Deck 3: The Balance Sheet and Financial Disclosures

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/112

العب

ملء الشاشة (f)

Deck 3: The Balance Sheet and Financial Disclosures

1

The balance sheet reports:

A)Net income at a point in time.

B)Cash flows for a period of time.

C)Assets and equities at a point in time.

D)Assets and liabilities for a period of time.

A)Net income at a point in time.

B)Cash flows for a period of time.

C)Assets and equities at a point in time.

D)Assets and liabilities for a period of time.

C

2

Segment reporting requires disclosure of each customer that accounts for more than 5% of total enterprise revenue.

False

3

Operational assets include property, plant, equipment and inventories.

False

4

The compensation of top executives is disclosed in the proxy statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

5

Intangible assets usually are reported in the balance sheet as current assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

6

The balance of net receivables represents the amount expected to be collected.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

7

A company's market value is generally less than its book value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

8

Accrued salaries and wages in a balance sheet represent salary and wages that have been earned by employees but not yet paid.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

9

Current assets include cash and all other assets expected to become cash or be consumed:

A)Within one year.

B)Within one operating cycle.

C)Within one year or one operating cycle, whichever is shorter.

D)Within one year or one operating cycle, whichever is longer.

A)Within one year.

B)Within one operating cycle.

C)Within one year or one operating cycle, whichever is shorter.

D)Within one year or one operating cycle, whichever is longer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

10

Horizontal analysis involves expressing each item in the financial statements as a percentage of an appropriate total, or base amount, within the same year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

11

Payment terms, interest rates, and other details of long-term liabilities usually are reported in disclosure notes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

12

Subsequent events are significant developments that take place after a firm's year-end, and after the financial statements are issued.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

13

The balance sheet reports a company's financial position at a point in time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

14

Prepaid expenses are classified as current assets if the services purchased are expected to expire within twelve months or the operating cycle, if that is longer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

15

The ultimate responsibility for the financial statements lies with the auditors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

16

Liquidity refers to the riskiness of a company with regard to the amount of liabilities in its capital structure.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

17

A payment on account has no effect on working capital but will increase the current ratio if it is already greater than 1.0.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

18

The criteria for determining which items comprise cash equivalents often is disclosed in the summary of significant accounting policies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

19

Illegal acts will only need to be disclosed if the impact of the act is material.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

20

All current assets are either cash or assets that will be converted into cash or consumed within twelve months or the operating cycle, if that is longer than one year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

21

What is the amount of working capital for Symphony?

A)$ 98.

B)$143.

C)$128.

D)$113.

A)$ 98.

B)$143.

C)$128.

D)$113.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

22

Cash equivalents would not include:

A)Cash not available for current operations.

B)Money market funds.

C)United States treasury bills.

D)Bank drafts.

A)Cash not available for current operations.

B)Money market funds.

C)United States treasury bills.

D)Bank drafts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

23

An asset that is not expected to be converted to cash or consumed within one year or the operating cycle is:

A)Goodwill.

B)Accounts receivable.

C)Inventory.

D)Supplies.

A)Goodwill.

B)Accounts receivable.

C)Inventory.

D)Supplies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

24

Which of the following accounts are closed at the end of the accounting period?

A)Allowance for uncollectibles.

B)Unearned revenue.

C)Retained earnings.

D)Income tax expense.

A)Allowance for uncollectibles.

B)Unearned revenue.

C)Retained earnings.

D)Income tax expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

25

Red Onion Restaurant classifies a six-month prepaid insurance policy as a current asset. Its rationale is based on:

A)Materiality.

B)Operating cycle.

C)Definition.

D)Liquidity.

A)Materiality.

B)Operating cycle.

C)Definition.

D)Liquidity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

26

Rent collected in advance is:

A)An asset account in the balance sheet.

B)A liability account in the balance sheet.

C)A shareholders' equity account in the balance sheet.

D)A temporary account, not in the balance sheet at all.

A)An asset account in the balance sheet.

B)A liability account in the balance sheet.

C)A shareholders' equity account in the balance sheet.

D)A temporary account, not in the balance sheet at all.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

27

Assets do not include:

A)Property, plant, and equipment.

B)Investments.

C)Paid-in capital.

D)Unexpired insurance.

A)Property, plant, and equipment.

B)Investments.

C)Paid-in capital.

D)Unexpired insurance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

28

New Oaks Winery requires two months to make wine, two years to age it, one month to bottle it, two months to sell it, and one month to collect the receivable. Its operating cycle is:

A)Twelve months.

B)Thirty months.

C)Six months.

D)Three months.

A)Twelve months.

B)Thirty months.

C)Six months.

D)Three months.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

29

What would Symphony report as total shareholders' equity?

A)$548.

B)$808.

C)$838.

D)$778.Total shareholders' equity: $485 + 15 + 48 120 + 380 = $808

A)$548.

B)$808.

C)$838.

D)$778.Total shareholders' equity: $485 + 15 + 48 120 + 380 = $808

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

30

Non-operating assets include:

A)Inventory held for sale.

B)Construction in progress.

C)Accounts receivable.

D)Land held for a possible future plant site.

A)Inventory held for sale.

B)Construction in progress.

C)Accounts receivable.

D)Land held for a possible future plant site.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

31

Which of the following is never a current liability account?

A)Accrued payroll

B)Dividends payable

C)Prepaid rent

D)Subscriptions collected in advance

A)Accrued payroll

B)Dividends payable

C)Prepaid rent

D)Subscriptions collected in advance

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

32

What would Symphony report as total current assets?

A)$823.

B)$838.

C)$843.

D)$1,696.Total current assets: ($680 20) + 34 + 50 + 30 + 16 + 5 + 20 + 8 = $823

A)$823.

B)$838.

C)$843.

D)$1,696.Total current assets: ($680 20) + 34 + 50 + 30 + 16 + 5 + 20 + 8 = $823

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

33

What would Symphony report as total assets?

A)$2,338.

B)$2,323.

C)$2,318.

D)$2,303.Total assets: ($680 20) + ($920 80) + 34 + 50 + 30 + 16 + 150 + 450 + 5 + 20 + 8 + 40 = $2,303

A)$2,338.

B)$2,323.

C)$2,318.

D)$2,303.Total assets: ($680 20) + ($920 80) + 34 + 50 + 30 + 16 + 150 + 450 + 5 + 20 + 8 + 40 = $2,303

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

34

Cash equivalents would include:

A)Highly liquid equity securities.

B)Accounts receivable from a financial institution.

C)A sinking fund for bonds that mature in three years.

D)Debt instruments with maturity dates of less than three months from the date of the purchase.

A)Highly liquid equity securities.

B)Accounts receivable from a financial institution.

C)A sinking fund for bonds that mature in three years.

D)Debt instruments with maturity dates of less than three months from the date of the purchase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

35

Notes payable:

A)Is a current liability account.

B)Usually has a debit balance.

C)Is a non-current liability account.

D)Cannot determine its classification without additional information.

A)Is a current liability account.

B)Usually has a debit balance.

C)Is a non-current liability account.

D)Cannot determine its classification without additional information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

36

Accrued expenses:

A)Are generally paid in services rather than cash.

B)Result from payment before services are received.

C)Result from services received before payment.

D)Are deferred charges to expense.

A)Are generally paid in services rather than cash.

B)Result from payment before services are received.

C)Result from services received before payment.

D)Are deferred charges to expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

37

The usual difference between accounts payable and notes payable is:

A)Legally enforceable debt.

B)Current-non-current classification.

C)Known payment terms.

D)Explicitly stated interest.

A)Legally enforceable debt.

B)Current-non-current classification.

C)Known payment terms.

D)Explicitly stated interest.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

38

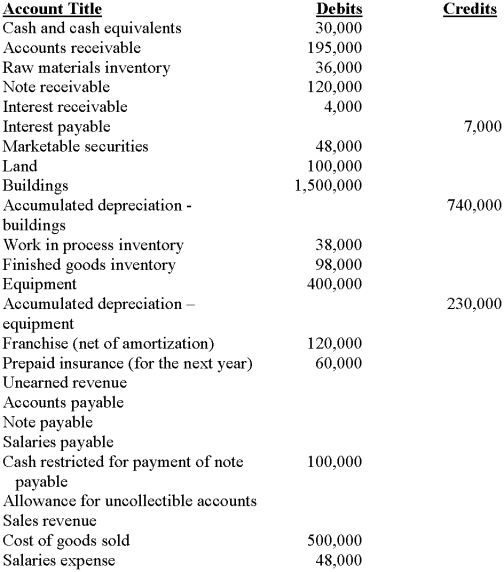

Janson Corporation Co.'s trial balance included the following account balances at December 31, 2009: What amount should be included in the current liability section of Janson's December 31, 2009, balance sheet?

A)$ 63,000.

B)$ 41,000.

C)$ 61,000.

D)$101,000.

A)$ 63,000.

B)$ 41,000.

C)$ 61,000.

D)$101,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

39

Janson Corporation Co.'s trial balance included the following account balances at December 31, 2009: Investments consist of treasury bills that were purchased in November and mature in January. Prepaid insurance is for the next two years. What amount should be included in the current asset section of Janson's December 31, 2009, balance sheet?

A)$ 88.000.

B)$ 85,000.

C)$ 55,000.

D)$135,000.

A)$ 88.000.

B)$ 85,000.

C)$ 55,000.

D)$135,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

40

Which is a shareholders' equity account on the balance sheet?

A)Accumulated depreciation.

B)Paid-in capital.

C)Dividends payable.

D)Marketable securities.

A)Accumulated depreciation.

B)Paid-in capital.

C)Dividends payable.

D)Marketable securities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

41

A subsequent event for an entity with a December 31, 2009, year-end would not include:

A)A change in the estimated useful lives of equipment in January 2010.

B)An issuance of bonds in January 2010.

C)An acquisition of another company in January 2010.

D)A major uncertainty at December 31, resolved in January 2010.

A)A change in the estimated useful lives of equipment in January 2010.

B)An issuance of bonds in January 2010.

C)An acquisition of another company in January 2010.

D)A major uncertainty at December 31, resolved in January 2010.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

42

The quick ratio is:

A)The liquidity ratio divided by the equity ratio.

B)Current assets minus inventory divided by current liabilities minus accounts payable.

C)Current assets minus inventory and prepaid items divided by current liabilities.

D)Cash divided by accounts payable.

A)The liquidity ratio divided by the equity ratio.

B)Current assets minus inventory divided by current liabilities minus accounts payable.

C)Current assets minus inventory and prepaid items divided by current liabilities.

D)Cash divided by accounts payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

43

The Management Discussion and Analysis section of the annual report can best be described as:

A)Frank but objective.

B)Independent but precise.

C)Legalistic and lengthy.

D)Biased but informative.

A)Frank but objective.

B)Independent but precise.

C)Legalistic and lengthy.

D)Biased but informative.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

44

Which of the following is not a required disclosure for related party transactions?

A)The nature of the relationship.

B)A description of the transactions.

C)The amounts due from or to related parties.

D)The impact of the transactions on current year's income.

A)The nature of the relationship.

B)A description of the transactions.

C)The amounts due from or to related parties.

D)The impact of the transactions on current year's income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

45

Liquidity refers to:

A)The amount of cash on hand at a given time.

B)The readiness of an asset to be converted to cash.

C)The period of time until cash is used and refinancing becomes necessary.

D)Financial leverage.

A)The amount of cash on hand at a given time.

B)The readiness of an asset to be converted to cash.

C)The period of time until cash is used and refinancing becomes necessary.

D)Financial leverage.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

46

Working capital is equal to:

A)Current assets.

B)Current liabilities.

C)Current assets plus current liabilities.

D)Current assets minus current liabilities.

A)Current assets.

B)Current liabilities.

C)Current assets plus current liabilities.

D)Current assets minus current liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

47

An exception that is so serious that an unqualified opinion is not justified would result in:

A)A disclaimer.

B)An unqualified opinion.

C)An adverse opinion.

D)A consistency exception.

A)A disclaimer.

B)An unqualified opinion.

C)An adverse opinion.

D)A consistency exception.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

48

Lack of long-term solvency refers to:

A)Risk of non-payment relative to liabilities in the capital structure.

B)The length of time before long-term debt becomes due.

C)The ability to refinance long-term debt when it becomes due.

D)Long-term assets.

A)Risk of non-payment relative to liabilities in the capital structure.

B)The length of time before long-term debt becomes due.

C)The ability to refinance long-term debt when it becomes due.

D)Long-term assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

49

When a company sells land for cash and recognizes a $25,000 gain:

A)Its acid-test ratio decreases.

B)Its current ratio decreases.

C)Its debt to equity ratio decreases.

D)Cannot determine from the given information.

A)Its acid-test ratio decreases.

B)Its current ratio decreases.

C)Its debt to equity ratio decreases.

D)Cannot determine from the given information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

50

Disclosure notes would not include:

A)Depreciation methods used and estimated useful life.

B)Definition of cash equivalents.

C)Details of pension plans.

D)Data to adjust the financial statements so that they are not misleading.

A)Depreciation methods used and estimated useful life.

B)Definition of cash equivalents.

C)Details of pension plans.

D)Data to adjust the financial statements so that they are not misleading.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

51

When a company accrues federal income taxes at the end of the accounting period:

A)Its acid-test ratio increases.

B)Its current ratio increases.

C)Its debt to equity ratio decreases.

D)Its debt to equity ratio increases.

A)Its acid-test ratio increases.

B)Its current ratio increases.

C)Its debt to equity ratio decreases.

D)Its debt to equity ratio increases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

52

The principal concern with accounting for related party transactions is:

A)The size of the transactions.

B)Differences between economic substance and legal form.

C)The absence of legally binding contracts.

D)The lack of accurate data to record transactions.

A)The size of the transactions.

B)Differences between economic substance and legal form.

C)The absence of legally binding contracts.

D)The lack of accurate data to record transactions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

53

Which of the following is not a financing ratio?

A)Time interest earned ratio.

B)The debt to equity ratio.

C)The current ratio.

D)All of these are financing ratios.

A)Time interest earned ratio.

B)The debt to equity ratio.

C)The current ratio.

D)All of these are financing ratios.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

54

An example of fraud would be:

A)Issuing a purchase order without first securing bids.

B)Buying raw materials from an affiliated company.

C)Knowingly classifying a material non-current receivable as a current receivable.

D)Forgetting to accrue salaries and wages payable.

A)Issuing a purchase order without first securing bids.

B)Buying raw materials from an affiliated company.

C)Knowingly classifying a material non-current receivable as a current receivable.

D)Forgetting to accrue salaries and wages payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

55

Assume a company's liquidity and financing ratios all are less than 1.0 before it purchases inventory on credit. When it makes the purchase:

A)Its current ratio decreases.

B)Its quick ratio decreases.

C)Its current ratio remains unchanged.

D)Its quick ratio remains unchanged.

A)Its current ratio decreases.

B)Its quick ratio decreases.

C)Its current ratio remains unchanged.

D)Its quick ratio remains unchanged.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

56

When a company pays its bill from a plumber for previous services on account:

A)Its debt to equity ratio always decreases.

B)Its acid-test ratio always remains unchanged.

C)Its current ratio always remains unchanged.

D)All of these are correct.

A)Its debt to equity ratio always decreases.

B)Its acid-test ratio always remains unchanged.

C)Its current ratio always remains unchanged.

D)All of these are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

57

The fourth paragraph of the audit report:

A)Provides the auditors' opinion on the fairness of the financial statements.

B)Provides the auditor's opinion on the effectiveness of internal control.

C)Describes the scope of the audit.

D)States management's responsibility for the financial statements.

A)Provides the auditors' opinion on the fairness of the financial statements.

B)Provides the auditor's opinion on the effectiveness of internal control.

C)Describes the scope of the audit.

D)States management's responsibility for the financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

58

An example of an error would be:

A)Purchasing inventory from a related party.

B)Counting an inventory item twice when taking a physical inventory.

C)Holding back invoices so that accounts payable are understated.

D)Receiving kickbacks in exchange for issuing a purchase order to a vender.

A)Purchasing inventory from a related party.

B)Counting an inventory item twice when taking a physical inventory.

C)Holding back invoices so that accounts payable are understated.

D)Receiving kickbacks in exchange for issuing a purchase order to a vender.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

59

The current ratio is given by:

A)Current assets divided by non-current assets.

B)Current assets divided by total assets.

C)Current assets divided by current liabilities.

D)Current assets divided by total liabilities.

A)Current assets divided by non-current assets.

B)Current assets divided by total assets.

C)Current assets divided by current liabilities.

D)Current assets divided by total liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

60

The acid-test ratio is also known as the:

A)Current ratio.

B)Debt equity ratio.

C)Times interest earned ratio.

D)Quick ratio.

A)Current ratio.

B)Debt equity ratio.

C)Times interest earned ratio.

D)Quick ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

61

Which of the following is not a required segment reporting disclosure according to International Accounting Standards?

A)Segment profit or loss.

B)Segment assets.

C)Segment liabilities.

D)All are required disclosures.

A)Segment profit or loss.

B)Segment assets.

C)Segment liabilities.

D)All are required disclosures.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

62

The acid-test ratio is:

A)0.25.

B)0.88.

C)1.17.

D)1.58.Acid test ratio: ($505 200 25)/$320 = .88

A)0.25.

B)0.88.

C)1.17.

D)1.58.Acid test ratio: ($505 200 25)/$320 = .88

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

63

Compute the debt-to-equity ratio for Marjoram Company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

64

Which of the following is not a required segment reporting disclosure according to U.S. GAAP?

A)Segment profit or loss.

B)Segment assets.

C)Segment liabilities.

D)General information about the operating segment.

A)Segment profit or loss.

B)Segment assets.

C)Segment liabilities.

D)General information about the operating segment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

65

HHF's long term debt-to-equity ratio equity is:

A)133.3%.

B)75%.

C)180%.

D)0%.Long Term Debt-to-equity ratio: $360/$480 = 75%

A)133.3%.

B)75%.

C)180%.

D)0%.Long Term Debt-to-equity ratio: $360/$480 = 75%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

66

Compute the acid-test ratio for Marjoram Company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

67

Compute the times interest earned ratio for Marjoram Company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

68

HHF's debt-to-equity ratio is:

A)0.75.

B)1.13.

C)0.53.

D)1.80.Debt-to-equity ratio: $540/$480 = 1.13

A)0.75.

B)1.13.

C)0.53.

D)1.80.Debt-to-equity ratio: $540/$480 = 1.13

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

69

The current ratio is:

A)1.98.

B)1.58.

C)1.17.

D)0.66.Current ratio: $505/$320 = 1.58

A)1.98.

B)1.58.

C)1.17.

D)0.66.Current ratio: $505/$320 = 1.58

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

70

Working capital is:

A)$505.

B)$265.

C)$185.

D)$75.Working capital: $505 320 = 185

A)$505.

B)$265.

C)$185.

D)$75.Working capital: $505 320 = 185

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

71

Compute the current ratio for Marjoram Company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

72

Which of the following is not a characteristic that defines a reportable operating segment according to U.S. GAAP?

A)Operating results are regularly reviewed by the enterprise's chief operating officer.

B)Discrete financial information is available.

C)Engages in business activities from which it may earn revenues and incur expenses.

D)Represents more than 20% of total company revenues, assets, or net income.

A)Operating results are regularly reviewed by the enterprise's chief operating officer.

B)Discrete financial information is available.

C)Engages in business activities from which it may earn revenues and incur expenses.

D)Represents more than 20% of total company revenues, assets, or net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

73

Compute the return on shareholders' equity ratio for Marjoram Company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

74

HHF's times interest earned ratio is:

A)3.47.

B)1.73.

C)2.47.

D)10.0.Times interest earned ratio:125/$36 = 3.47

A)3.47.

B)1.73.

C)2.47.

D)10.0.Times interest earned ratio:125/$36 = 3.47

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

75

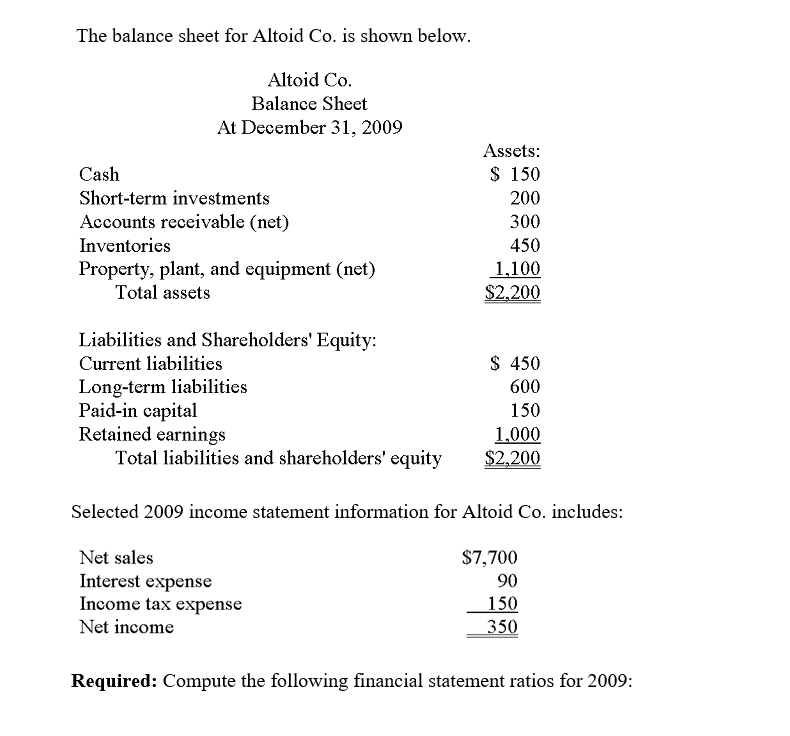

Presented below is a partial trial balance for the Messenger Corporation at December 31, 2009.

Additional information:

1. The note receivable, along with any accrued interest, is due on November 1, 2010.

2. The note payable is due in 2014. Interest is payable annually.

3. The marketable securities consist of equity securities of other corporations. Management does not intend to sell any of the securities in the next year.

4. Unearned revenue will be earned equally over the next eighteen months.

Required:

Determine the company's working capital (current assets minus current liabilities) at December 31, 2009.

Additional information:

1. The note receivable, along with any accrued interest, is due on November 1, 2010.

2. The note payable is due in 2014. Interest is payable annually.

3. The marketable securities consist of equity securities of other corporations. Management does not intend to sell any of the securities in the next year.

4. Unearned revenue will be earned equally over the next eighteen months.

Required:

Determine the company's working capital (current assets minus current liabilities) at December 31, 2009.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

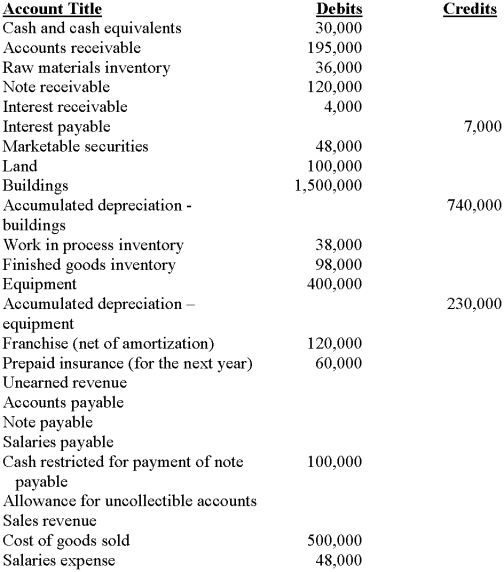

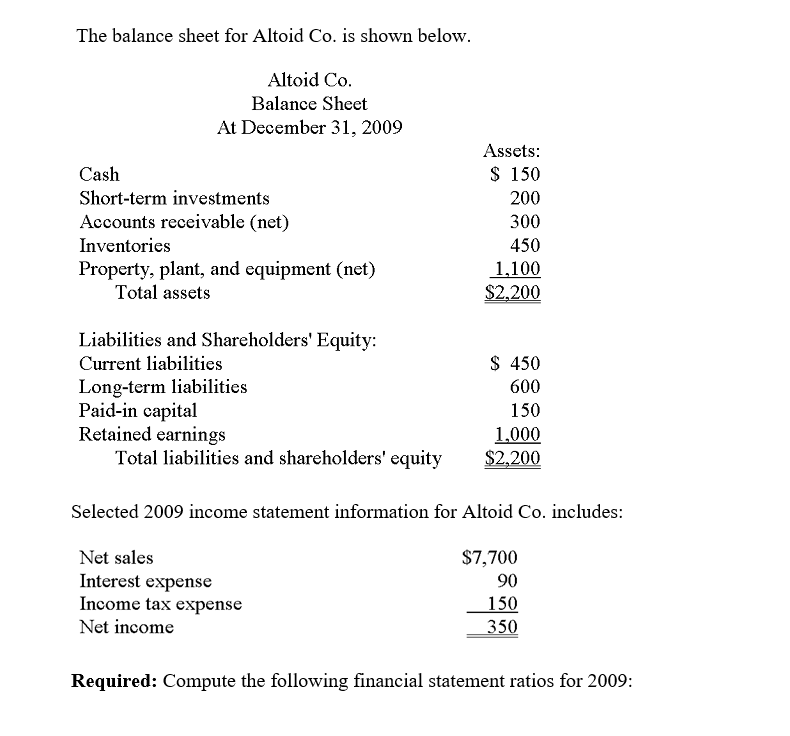

76

-Altoid Co.'s acid-test ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

77

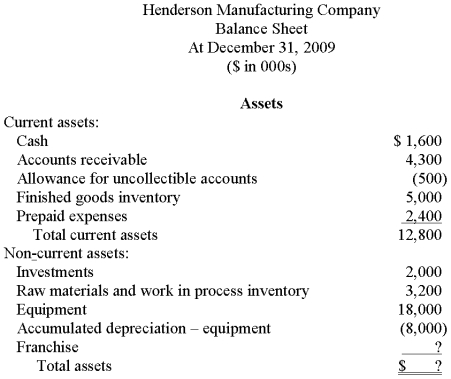

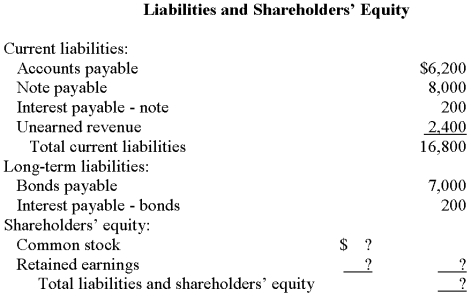

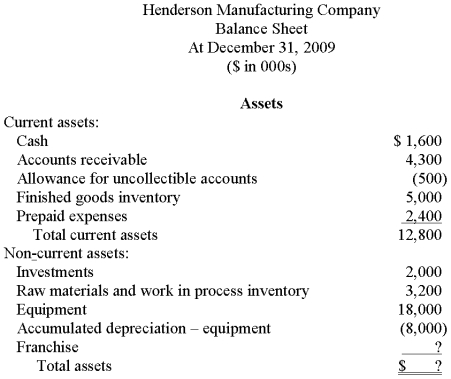

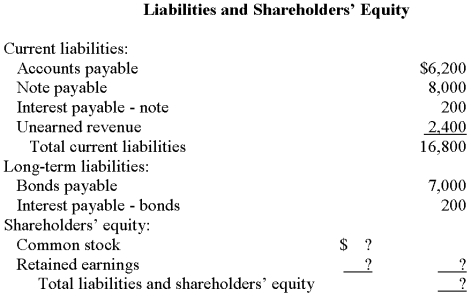

As controller for Sanderson, you are attempting to reconstruct and revise the following balance sheet prepared by a staff accountant.

Additional information ($ in 000s):

Additional information ($ in 000s):

1. Certain records that included the account balances for the franchise and shareholders' equity items were lost. However, a complete, preliminary balance sheet prepared before the records were lost showed a debt to equity ratio of 1.5. That is, total liabilities are 150% of total shareholders' equity. Retained earnings at the beginning of the year was $4,300. Net income for 2009 was $2,500 and $800 in cash dividends were declared and paid to shareholders.

2. The investments represent treasury bills purchased in December that mature in January.

3. Interest on both the note and the bonds is payable annually.

4. The note payable is due in annual installments of $800 each.

5. Unearned revenue will be earned equally over the next eighteen months.

6. The common stock represents 500,000 shares of no par stock authorized, 300,000 shares issued and outstanding.

Required:

Prepare a complete, corrected, classified balance sheet.

Additional information ($ in 000s):

Additional information ($ in 000s):1. Certain records that included the account balances for the franchise and shareholders' equity items were lost. However, a complete, preliminary balance sheet prepared before the records were lost showed a debt to equity ratio of 1.5. That is, total liabilities are 150% of total shareholders' equity. Retained earnings at the beginning of the year was $4,300. Net income for 2009 was $2,500 and $800 in cash dividends were declared and paid to shareholders.

2. The investments represent treasury bills purchased in December that mature in January.

3. Interest on both the note and the bonds is payable annually.

4. The note payable is due in annual installments of $800 each.

5. Unearned revenue will be earned equally over the next eighteen months.

6. The common stock represents 500,000 shares of no par stock authorized, 300,000 shares issued and outstanding.

Required:

Prepare a complete, corrected, classified balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

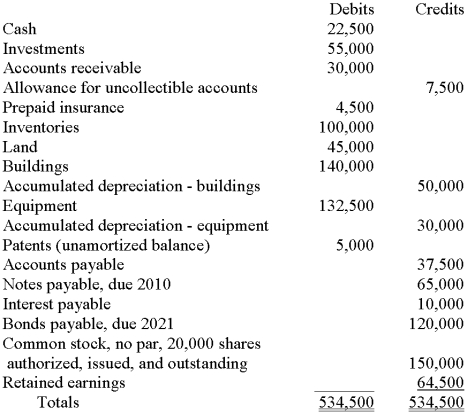

78

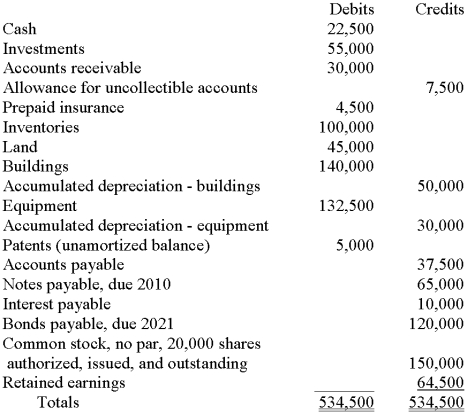

The December 31, 2009, post-closing trial balance ($ in thousands) for Libby Corporation is presented below:

Required: Prepare a classified balance sheet for Libby Corporation at December 31, 2009.

Required: Prepare a classified balance sheet for Libby Corporation at December 31, 2009.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

79

-Altoid Co.'s current ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

80

Quick assets total:

A)$60.

B)$230.

C)$280.

D)$305.Quick assets: $505 200 25 = 280

A)$60.

B)$230.

C)$280.

D)$305.Quick assets: $505 200 25 = 280

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck