Deck 8: Inventories: Measurement

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/182

العب

ملء الشاشة (f)

Deck 8: Inventories: Measurement

1

During periods of falling prices, LIFO ending inventory will be less than FIFO ending inventory.

False

2

Physical counts of inventory are never made with perpetual inventory systems.

False

3

Inventory costing methods are merely means by which costs are allocated between ending inventory and cost of goods sold.

True

4

In a perpetual inventory system, the cost of purchases is debited to:

A) Purchases.

B) Cost of goods sold.

C) Inventory.

D) Accounts payable.

A) Purchases.

B) Cost of goods sold.

C) Inventory.

D) Accounts payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

5

The main difference between perpetual and periodic inventory systems is the timing of the allocation of costs between inventory and cost of goods sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

6

Cost of goods on consignment is included in the consignee's inventory until sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

7

The gross profit ratio is calculated by dividing gross profit by average inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

8

In a perpetual inventory system, which of the following is recorded at the time of the sale?

A) Sales revenue only.

B) Both sales revenue and cost of goods sold.

C) Cost of goods sold only.

D) Neither sales revenue or cost of goods sold.

A) Sales revenue only.

B) Both sales revenue and cost of goods sold.

C) Cost of goods sold only.

D) Neither sales revenue or cost of goods sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

9

A company that prepares its financial statements according to International Financial Reporting Standards (IFRS) can use all of the same inventory valuation methods as a company that prepares its statements under U.S. GAAP.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

10

LIFO periodic and LIFO perpetual always produce the same dollar amounts for ending inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

11

The choice of cost flow assumption (FIFO, LIFO, or average) does not depend on the actual physical flow of the product.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

12

Shipping charges on outgoing goods are included in either cost of goods sold or selling expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

13

In a perpetual inventory system, the cost of inventory sold is:

A) Debited to accounts receivable.

B) Credited to cost of goods sold.

C) Debited to cost of goods sold.

D) Not recorded at the time goods are sold.

A) Debited to accounts receivable.

B) Credited to cost of goods sold.

C) Debited to cost of goods sold.

D) Not recorded at the time goods are sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

14

Net purchases are reduced for discounts taken whether the net method is used or the gross method is used.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

15

Unit LIFO is more costly to implement than dollar-value LIFO.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

16

Dollar-value LIFO eliminates the risk of LIFO liquidations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

17

In a periodic inventory system, the cost of purchases is debited to:

A) Purchases.

B) Cost of goods sold.

C) Inventory.

D) Accounts payable.

A) Purchases.

B) Cost of goods sold.

C) Inventory.

D) Accounts payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

18

FIFO periodic and FIFO perpetual always produce the same dollar amounts for cost of goods sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

19

LIFO usually provides a better match of revenue and expense than does FIFO.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

20

LIFO liquidation profits occur when inventory quantity declines and costs are rising.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

21

Ending inventory is equal to the cost of items on hand plus:

A) Items in transit sold f.o.b. shipping point.

B) Purchases in transit f.o.b. destination.

C) Items in transit sold f.o.b. destination.

D) None of these answer choices is correct.

A) Items in transit sold f.o.b. shipping point.

B) Purchases in transit f.o.b. destination.

C) Items in transit sold f.o.b. destination.

D) None of these answer choices is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

22

In a periodic inventory system, the cost of inventories sold is:

A) Debited to accounts receivable.

B) Credited to cost of goods sold.

C) Debited to cost of goods sold.

D) Not recorded at the time goods are sold.

A) Debited to accounts receivable.

B) Credited to cost of goods sold.

C) Debited to cost of goods sold.

D) Not recorded at the time goods are sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

23

Cinnamon Buns Co. (CBC) started 2018 with $52,000 of merchandise on hand. During 2018, $280,000 in merchandise was purchased on account with credit terms of 2/10, n/30. All discounts were taken. Purchases were all made f.o.b. shipping point. CBC paid freight charges of $9,000. Merchandise with an invoice amount of $4,000 was returned for credit. Cost of goods sold for the year was $316,000. CBC uses a perpetual inventory system.

-What is cost of goods available for sale, assuming CBC uses the gross method?

A) $312,480.

B) $326,000.

C) $331,480.

D) $337,000.

-What is cost of goods available for sale, assuming CBC uses the gross method?

A) $312,480.

B) $326,000.

C) $331,480.

D) $337,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

24

Purchases equal the invoice amount:

A) Plus freight-in, plus discounts lost.

B) Less purchase returns, plus purchase allowances.

C) Plus freight-in, less purchase discounts.

D) Plus discounts, less purchase returns.

A) Plus freight-in, plus discounts lost.

B) Less purchase returns, plus purchase allowances.

C) Plus freight-in, less purchase discounts.

D) Plus discounts, less purchase returns.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

25

Cinnamon Buns Co. (CBC) started 2018 with $52,000 of merchandise on hand. During 2018, $280,000 in merchandise was purchased on account with credit terms of 2/10, n/30. All discounts were taken. Purchases were all made f.o.b. shipping point. CBC paid freight charges of $9,000. Merchandise with an invoice amount of $4,000 was returned for credit. Cost of goods sold for the year was $316,000. CBC uses a perpetual inventory system. Assume instead that (a) freight costs were paid by the vendor, (b) no discounts were taken, and (c) the merchandise on hand at the beginning of 2018 was determined by a physical count that failed to realize that $10,000 of merchandise was being held on consignment for Frosting R Us Inc.

-What is cost of goods available for sale, assuming CBC uses the gross method to record purchase discounts?

A) $318,000.

B) $327,000.

C) $321,480.

D) $337,000.

-What is cost of goods available for sale, assuming CBC uses the gross method to record purchase discounts?

A) $318,000.

B) $327,000.

C) $321,480.

D) $337,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

26

The Constance Corporation's inventory at December 31, 2018, was $125,000 (at cost) based on a physical count of inventory on hand, before any necessary adjustment for the following: Merchandise costing $15,000, shipped f.o.b. shipping point from a vendor on December 27, 2019, was received by Constance on January 5, 2019.

Merchandise costing $45,000 was shipped to a customer f.o.b. shipping point on December 28, 2018, arrived at the customer's location on January 6, 2019.

Merchandise costing $21,000 was being held on hand for Jess Company on consignment.

Estimated sales returns are 10% of annual sales. Sales revenue was $550,000 with a gross profit ratio of 25%.

What amount should Constance Corporation report as inventory in its December 31, 2018, balance sheet?

A) $160,250.

B) $145,250.

C) $187,250.

D) $190,250.

Merchandise costing $45,000 was shipped to a customer f.o.b. shipping point on December 28, 2018, arrived at the customer's location on January 6, 2019.

Merchandise costing $21,000 was being held on hand for Jess Company on consignment.

Estimated sales returns are 10% of annual sales. Sales revenue was $550,000 with a gross profit ratio of 25%.

What amount should Constance Corporation report as inventory in its December 31, 2018, balance sheet?

A) $160,250.

B) $145,250.

C) $187,250.

D) $190,250.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

27

Inventory does not include:

A) Materials used in the production of goods to be sold.

B) Assets intended to be sold in the normal course of business.

C) The cost of office equipment.

D) Assets currently in production for normal sales.

A) Materials used in the production of goods to be sold.

B) Assets intended to be sold in the normal course of business.

C) The cost of office equipment.

D) Assets currently in production for normal sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

28

Cost of goods sold is given by:

A) Beginning inventory − net purchases + ending inventory.

B) Beginning inventory + accounts payable − net purchases.

C) Net purchases + ending inventory − beginning inventory.

D) Net Purchases + beginning inventory − ending inventory.

A) Beginning inventory − net purchases + ending inventory.

B) Beginning inventory + accounts payable − net purchases.

C) Net purchases + ending inventory − beginning inventory.

D) Net Purchases + beginning inventory − ending inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

29

Northwest Fur Co. started 2018 with $94,000 of merchandise inventory on hand. During 2018, $400,000 in merchandise was purchased on account with credit terms of 1/15, n/45. All discounts were taken. Purchases were all made f.o.b. shipping point. Northwest paid freight charges of $7,500. Merchandise with an invoice amount of $5,000 was returned for credit. Cost of goods sold for the year was $380,000. Northwest uses a perpetual inventory system.

-Assuming Northwest uses the gross method to record purchases, what is the cost of goods available for sale?

A) $492,500.

B) $496,500.

C) $490,500.

D) $492,550.

-Assuming Northwest uses the gross method to record purchases, what is the cost of goods available for sale?

A) $492,500.

B) $496,500.

C) $490,500.

D) $492,550.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

30

Under the net method, purchase discounts lost are:

A) Included in purchases.

B) Added to accounts payable.

C) Included in interest expense.

D) Deducted from discount income.

A) Included in purchases.

B) Added to accounts payable.

C) Included in interest expense.

D) Deducted from discount income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

31

A company's estimate of merchandise that will be returned by customers should be:

A) Included in inventory at an amount equal to the selling price of the merchandise.

B) Included in inventory at an amount equal to the cost of the merchandise.

C) Excluded from inventory but deducted from sales revenue and accounts receivable.

D) None of these answer choices are correct.

A) Included in inventory at an amount equal to the selling price of the merchandise.

B) Included in inventory at an amount equal to the cost of the merchandise.

C) Excluded from inventory but deducted from sales revenue and accounts receivable.

D) None of these answer choices are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

32

Cinnamon Buns Co. (CBC) started 2018 with $52,000 of merchandise on hand. During 2018, $280,000 in merchandise was purchased on account with credit terms of 2/10, n/30. All discounts were taken. Purchases were all made f.o.b. shipping point. CBC paid freight charges of $9,000. Merchandise with an invoice amount of $4,000 was returned for credit. Cost of goods sold for the year was $316,000. CBC uses a perpetual inventory system.

- Assuming CBC uses the gross method to record purchases, ending inventory would be:

A) $6,480.

B) $15,400.

C) $15,480.

D) $21,000.

- Assuming CBC uses the gross method to record purchases, ending inventory would be:

A) $6,480.

B) $15,400.

C) $15,480.

D) $21,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

33

The inventory method that will always produce the same amount for cost of goods sold in a periodic inventory system as in a perpetual inventory system would be:

A) FIFO.

B) LIFO.

C) Weighted average.

D) None of these answer choices are correct.

A) FIFO.

B) LIFO.

C) Weighted average.

D) None of these answer choices are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

34

Alison's dress shop buys dresses from McGuire Manufacturing. Alison purchased dresses from McGuire on July 17 and received an invoice with a list price amount of $6,000 and payment terms of 2/10, n/30. Alison uses the net method to record purchases. Alison should record the purchase at:

A) $5,940.

B) $5,880.

C) $6,000.

D) $6,120.

A) $5,940.

B) $5,880.

C) $6,000.

D) $6,120.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

35

One difference between periodic and perpetual inventory systems is:

A) Cost of goods sold is not recorded under a perpetual system until the end of the period.

B) Cost of goods sold is not recorded under a periodic system until the end of the period.

C) Cost of goods sold is always significantly higher under a perpetual system.

D) Cost of goods sold is always significantly higher under a periodic system.

A) Cost of goods sold is not recorded under a perpetual system until the end of the period.

B) Cost of goods sold is not recorded under a periodic system until the end of the period.

C) Cost of goods sold is always significantly higher under a perpetual system.

D) Cost of goods sold is always significantly higher under a periodic system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

36

Using the gross method, purchase discounts lost are:

A) Included in purchases.

B) Added to accounts payable.

C) Included in interest expense.

D) Deducted from discount income.

A) Included in purchases.

B) Added to accounts payable.

C) Included in interest expense.

D) Deducted from discount income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

37

Northwest Fur Co. started 2018 with $94,000 of merchandise inventory on hand. During 2018, $400,000 in merchandise was purchased on account with credit terms of 1/15, n/45. All discounts were taken. Purchases were all made f.o.b. shipping point. Northwest paid freight charges of $7,500. Merchandise with an invoice amount of $5,000 was returned for credit. Cost of goods sold for the year was $380,000. Northwest uses a perpetual inventory system.

-What is ending inventory assuming Northwest uses the gross method to record purchases?

A) $112,490.

B) $112,550.

C) $116,500.

D) $120,300.

-What is ending inventory assuming Northwest uses the gross method to record purchases?

A) $112,490.

B) $112,550.

C) $116,500.

D) $120,300.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

38

The largest expense on a retailer's income statement is typically:

A) Salaries and wages.

B) Cost of goods sold.

C) Income tax expense.

D) Depreciation expense.

A) Salaries and wages.

B) Cost of goods sold.

C) Income tax expense.

D) Depreciation expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

39

Under the gross method, purchase discounts taken are:

A) Deducted from interest expense.

B) Added to net purchases.

C) Added to interest income.

D) Deducted from purchases.

A) Deducted from interest expense.

B) Added to net purchases.

C) Added to interest income.

D) Deducted from purchases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

40

The Mateo Corporation's inventory at December 31, 2018, was $325,000 based on a physical count priced at cost, and before any necessary adjustment for the following:

Merchandise costing $30,000, shipped f.o.b. shipping point from a vendor on December 30, 2018, was received on January 5, 2019.

Merchandise costing $22,000, shipped f.o.b. destination from a vendor on December 28, 2018, was received on January 3, 2019.

Merchandise costing $38,000 was shipped to a customer f.o.b. destination on December 28, arrived at the customer's location on January 6, 2019.

Merchandise costing $12,000 was being held on consignment by Traynor Company.

What amount should Mateo Corporation report as inventory in its December 31, 2018, balance sheet?

A) $367,000.

B) $427,000.

C) $405,000.

D) $325,000.

Merchandise costing $30,000, shipped f.o.b. shipping point from a vendor on December 30, 2018, was received on January 5, 2019.

Merchandise costing $22,000, shipped f.o.b. destination from a vendor on December 28, 2018, was received on January 3, 2019.

Merchandise costing $38,000 was shipped to a customer f.o.b. destination on December 28, arrived at the customer's location on January 6, 2019.

Merchandise costing $12,000 was being held on consignment by Traynor Company.

What amount should Mateo Corporation report as inventory in its December 31, 2018, balance sheet?

A) $367,000.

B) $427,000.

C) $405,000.

D) $325,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

41

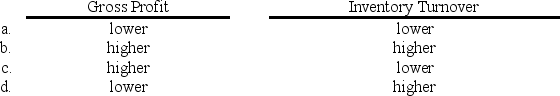

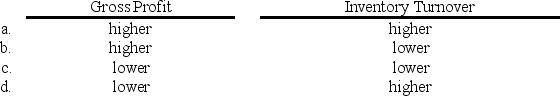

Company A is identical to Company B in every regard except that Company A uses FIFO and Company B uses LIFO. In an extended period of rising inventory costs, Company A's gross profit and inventory turnover ratio, compared to Company B's, would be:

A) Option A

B) Option B

C) Option C

D) Option D

A) Option A

B) Option B

C) Option C

D) Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

42

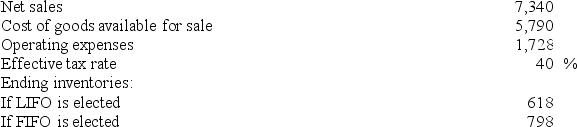

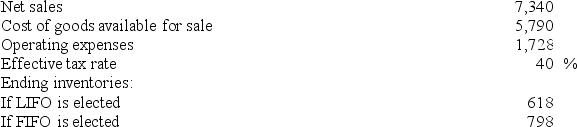

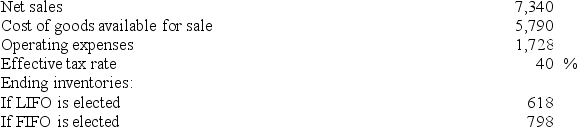

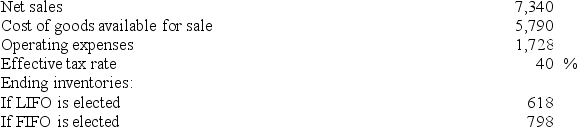

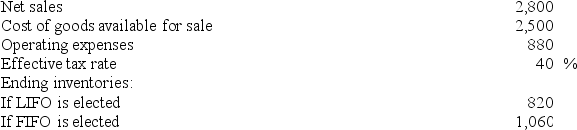

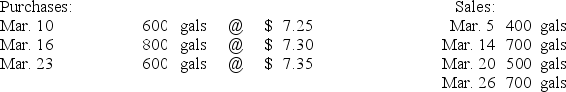

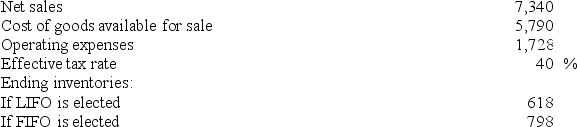

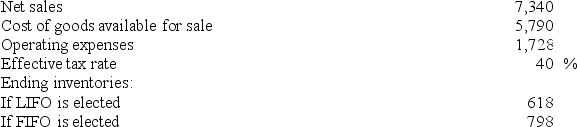

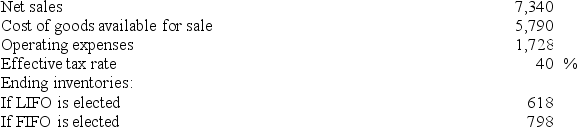

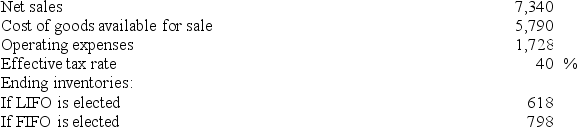

Nueva Company reported the following pretax data for its first year of operations.

-What is Nueva's net income if it elects FIFO?

A) $440.

B) $264.

C) $620.

D) $372.

-What is Nueva's net income if it elects FIFO?

A) $440.

B) $264.

C) $620.

D) $372.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

43

During periods when costs are rising and inventory quantities are stable, ending inventory will be:

A) Higher under LIFO than FIFO.

B) Lower under average cost than LIFO.

C) Higher under average cost than FIFO.

D) Higher under FIFO than LIFO.

A) Higher under LIFO than FIFO.

B) Lower under average cost than LIFO.

C) Higher under average cost than FIFO.

D) Higher under FIFO than LIFO.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

44

The use of LIFO during a long inflationary period can result in:

A) A net increase in income tax expense.

B) An inflated balance sheet.

C) Significant cash flow advantages over FIFO.

D) A reduction in inventory turnover over FIFO.

A) A net increase in income tax expense.

B) An inflated balance sheet.

C) Significant cash flow advantages over FIFO.

D) A reduction in inventory turnover over FIFO.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

45

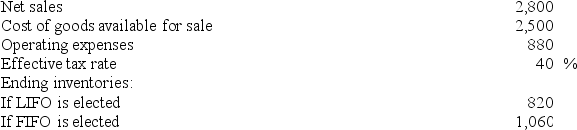

Nueva Company reported the following pretax data for its first year of operations.

- What is Nueva's gross profit ratio (rounded) if it elects FIFO?

A) 30%.

B) 32%.

C) 10.7%.

D) 60%.

- What is Nueva's gross profit ratio (rounded) if it elects FIFO?

A) 30%.

B) 32%.

C) 10.7%.

D) 60%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

46

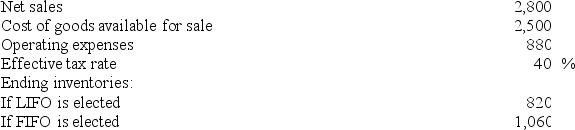

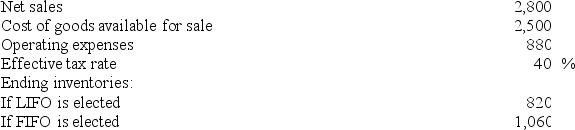

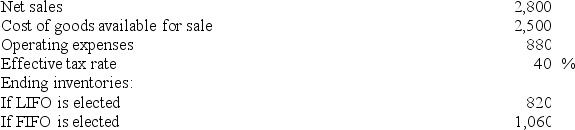

Nu Company reported the following pretax data for its first year of operations.

-What is Nu's net income if it elects LIFO?

A) $288.

B) $144.

C) $240.

D) $480.

-What is Nu's net income if it elects LIFO?

A) $288.

B) $144.

C) $240.

D) $480.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

47

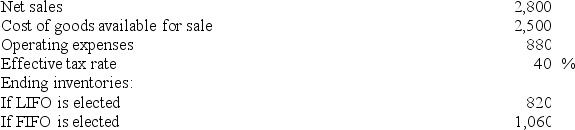

Nu Company reported the following pretax data for its first year of operations.

- What is Nu's gross profit ratio if it elects LIFO?

A) 80%.

B) 49%.

C) 40%.

D) 5%.

- What is Nu's gross profit ratio if it elects LIFO?

A) 80%.

B) 49%.

C) 40%.

D) 5%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

48

Nu Company reported the following pretax data for its first year of operations.

- What is Nu's net income if it elects FIFO?

A) $480.

B) $288.

C) $1,360.

D) $144.

- What is Nu's net income if it elects FIFO?

A) $480.

B) $288.

C) $1,360.

D) $144.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

49

During periods when costs are rising and inventory quantities are stable, cost of goods sold will be:

A) Higher under FIFO than LIFO.

B) Higher under FIFO than average cost.

C) Lower under average cost than LIFO.

D) Lower under LIFO than FIFO.

A) Higher under FIFO than LIFO.

B) Higher under FIFO than average cost.

C) Lower under average cost than LIFO.

D) Lower under LIFO than FIFO.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

50

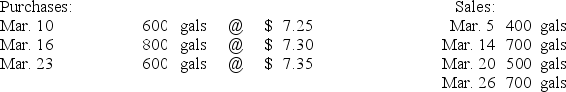

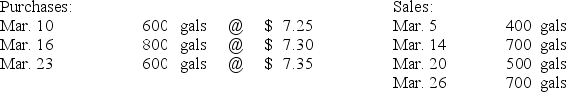

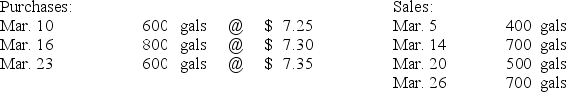

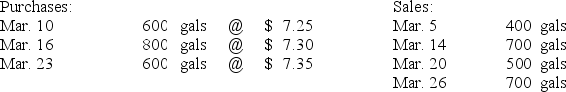

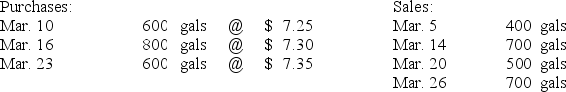

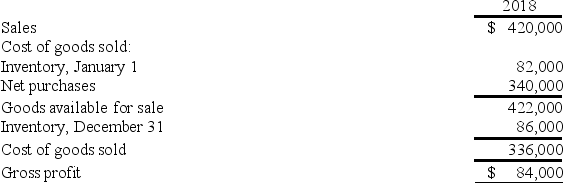

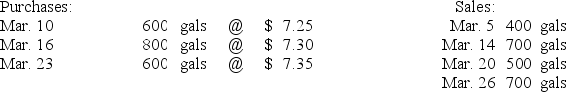

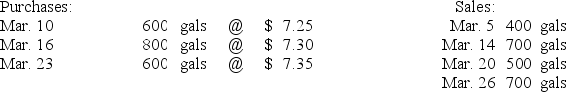

Inventory records for Herb's Chemicals revealed the following: March 1, 2018, inventory: 1,000 gallons @ $7.20 = $7,200

- Ending inventory assuming LIFO in a periodic inventory system would be:

A) $5,040.

B) $5,055.

C) $5,075.

D) $5,135.

- Ending inventory assuming LIFO in a periodic inventory system would be:

A) $5,040.

B) $5,055.

C) $5,075.

D) $5,135.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

51

Fulbright Corp. uses the periodic inventory system. During its first year of operations, Fulbright made the following purchases (listed in chronological order of acquisition): 40 units at $100

70 units at $80

170 units at $60

Sales for the year totaled 270 units, leaving 10 units on hand at the end of the year.

-

Ending inventory using the FIFO method is:

A) $650.

B) $1,000.

C) $707.

D) $600.

70 units at $80

170 units at $60

Sales for the year totaled 270 units, leaving 10 units on hand at the end of the year.

-

Ending inventory using the FIFO method is:

A) $650.

B) $1,000.

C) $707.

D) $600.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

52

In a period when costs are rising and inventory quantities are stable, the inventory method that would result in the highest ending inventory is:

A) Weighted average.

B) Moving average.

C) FIFO.

D) LIFO.

A) Weighted average.

B) Moving average.

C) FIFO.

D) LIFO.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

53

In a perpetual average cost system:

A) A new weighted-average unit cost is calculated each time additional units are purchased.

B) The cost allocated to ending inventory is generally the same as it would be in a periodic inventory system.

C) The moving-average unit cost is determined following each sale.

D) The average is determined by dividing the total number of units sold by the cost of units purchased during the period.

A) A new weighted-average unit cost is calculated each time additional units are purchased.

B) The cost allocated to ending inventory is generally the same as it would be in a periodic inventory system.

C) The moving-average unit cost is determined following each sale.

D) The average is determined by dividing the total number of units sold by the cost of units purchased during the period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

54

Which of the following is false regarding the FIFO inventory method?

A) FIFO under a perpetual inventory system results in the same cost of goods sold as FIFO under a periodic inventory system.

B) A company can choose to account for the flow of inventory using the FIFO method even if this doesn't match the actual flow of its inventory.

C) Perishable goods often follow an actual physical flow that is consistent with the FIFO method assumptions.

D) All of the other answer choices are true.

A) FIFO under a perpetual inventory system results in the same cost of goods sold as FIFO under a periodic inventory system.

B) A company can choose to account for the flow of inventory using the FIFO method even if this doesn't match the actual flow of its inventory.

C) Perishable goods often follow an actual physical flow that is consistent with the FIFO method assumptions.

D) All of the other answer choices are true.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

55

Nueva Company reported the following pretax data for its first year of operations.

- What is Nueva's net income if it elects LIFO?

A) $440.

B) $264.

C) $620.

D) $372.

- What is Nueva's net income if it elects LIFO?

A) $440.

B) $264.

C) $620.

D) $372.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

56

Nueva Company reported the following pretax data for its first year of operations.

-How much more will Nueva report in income tax if it elects FIFO instead of LIFO?

A) $108.

B) $176.

C) $248.

D) $72.

-How much more will Nueva report in income tax if it elects FIFO instead of LIFO?

A) $108.

B) $176.

C) $248.

D) $72.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

57

Fulbright Corp. uses the periodic inventory system. During its first year of operations, Fulbright made the following purchases (listed in chronological order of acquisition):

40 units at $100

70 units at $80

170 units at $60

Sales for the year totaled 270 units, leaving 10 units on hand at the end of the year.

-

Ending inventory using the LIFO method is:

A) $650.

B) $1,000.

C) $707.

D) $600.

40 units at $100

70 units at $80

170 units at $60

Sales for the year totaled 270 units, leaving 10 units on hand at the end of the year.

-

Ending inventory using the LIFO method is:

A) $650.

B) $1,000.

C) $707.

D) $600.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

58

Fulbright Corp. uses the periodic inventory system. During its first year of operations, Fulbright made the following purchases (listed in chronological order of acquisition): 40 units at $100

70 units at $80

170 units at $60

Sales for the year totaled 270 units, leaving 10 units on hand at the end of the year.

-

In comparing the ending inventory balances of FIFO and LIFO, the ending inventory value under FIFO less the ending inventory balance under LIFO results in a difference of:

A) $400.

B) $(400).

C) $0.

D) $50.

70 units at $80

170 units at $60

Sales for the year totaled 270 units, leaving 10 units on hand at the end of the year.

-

In comparing the ending inventory balances of FIFO and LIFO, the ending inventory value under FIFO less the ending inventory balance under LIFO results in a difference of:

A) $400.

B) $(400).

C) $0.

D) $50.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

59

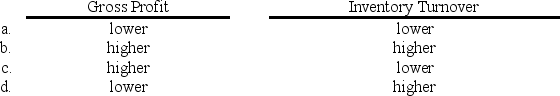

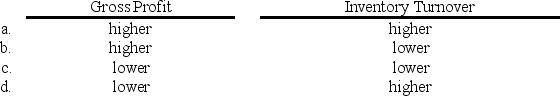

Company C is identical to Company D in every respect except that Company C uses LIFO and Company D uses average costs. In an extended period of rising inventory costs, Company C's gross profit and inventory turnover ratio, compared to Company D's, would be:

A) Option A

B) Option B

C) Option C

D) Option D

A) Option A

B) Option B

C) Option C

D) Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

60

Fulbright Corp. uses the periodic inventory system. During its first year of operations, Fulbright made the following purchases (listed in chronological order of acquisition): 40 units at $100

70 units at $80

170 units at $60

Sales for the year totaled 270 units, leaving 10 units on hand at the end of the year.

-

Ending inventory using the LIFO method is:

A) $650.

B) $1,000.

C) $707.

D) $600.

70 units at $80

170 units at $60

Sales for the year totaled 270 units, leaving 10 units on hand at the end of the year.

-

Ending inventory using the LIFO method is:

A) $650.

B) $1,000.

C) $707.

D) $600.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

61

The LIFO Conformity Rule states that if LIFO is used for:

A) One class of inventory, it must be used for all classes of inventory.

B) Tax purposes, it must be used for financial reporting.

C) One company in an affiliated group, it must be used by all companies in an affiliated group.

D) Domestic companies, it must be used by foreign partners.

A) One class of inventory, it must be used for all classes of inventory.

B) Tax purposes, it must be used for financial reporting.

C) One company in an affiliated group, it must be used by all companies in an affiliated group.

D) Domestic companies, it must be used by foreign partners.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

62

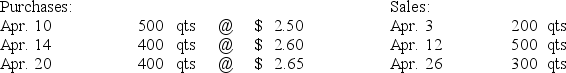

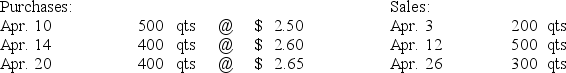

Texas Petrochemical reported the following April activity for its VC-30 lubricant, which had a balance of 300 qts. @ $2.40 on April 1.  The ending inventory assuming LIFO and a periodic inventory system is:

The ending inventory assuming LIFO and a periodic inventory system is:

A) $1,580.

B) $1,510.

C) $1,575.

D) $1,470.

The ending inventory assuming LIFO and a periodic inventory system is:

The ending inventory assuming LIFO and a periodic inventory system is:A) $1,580.

B) $1,510.

C) $1,575.

D) $1,470.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

63

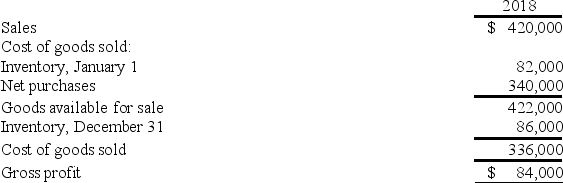

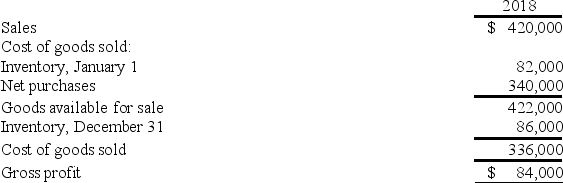

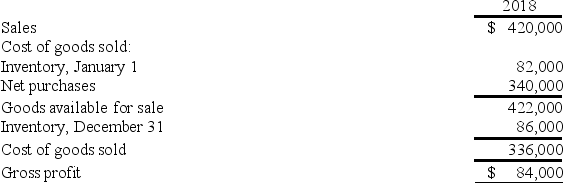

Thompson TV and Appliance reported the following in its 2018 financial statements:

-Thompson's 2018 gross profit ratio is:

A) 25%.

B) 19%.

C) 20%.

D) None of these answer choices are correct.

-Thompson's 2018 gross profit ratio is:

A) 25%.

B) 19%.

C) 20%.

D) None of these answer choices are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

64

Inventory records for Herb's Chemicals revealed the following: March 1, 2018, inventory: 1,000 gallons @ $7.20 = $7,200

- The ending inventory under a periodic inventory system assuming average cost (rounding unit cost to three decimal places) is:

A) $5,087.

B) $5,107.

C) $5,077.

D) $5,005.

- The ending inventory under a periodic inventory system assuming average cost (rounding unit cost to three decimal places) is:

A) $5,087.

B) $5,107.

C) $5,077.

D) $5,005.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

65

TNM Inc. uses LIFO and was founded in on January 1, 2017. At the end of 2017, TNM disclosed that the LIFO reserve was $1 million, indicating that the ending inventory balance would have been $1 million higher under FIFO. At the end of 2018, the LIFO reserve decreased to $0.5 million and inventory balances were relatively stable compared to 2017. Which of the following is true regarding TNM's costs?

A) Costs have been increasing since TNM was founded because the LIFO reserve is greater than zero.

B) Costs have been decreasing since TNM was founded because the LIFO reserve is greater than zero.

C) Costs were increasing in 2018, but decreasing in 2017.

D) Costs were decreasing in 2018, but increasing in 2017.

A) Costs have been increasing since TNM was founded because the LIFO reserve is greater than zero.

B) Costs have been decreasing since TNM was founded because the LIFO reserve is greater than zero.

C) Costs were increasing in 2018, but decreasing in 2017.

D) Costs were decreasing in 2018, but increasing in 2017.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

66

Inventory records for Herb's Chemicals revealed the following: March 1, 2018, inventory: 1,000 gallons @ $7.20 = $7,200

-The ending inventory assuming FIFO is:

A) $5,140.

B) $5,080.

C) $5,060.

D) $5,050.

-The ending inventory assuming FIFO is:

A) $5,140.

B) $5,080.

C) $5,060.

D) $5,050.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

67

Which of the following statements is/are true?

A) In a period of rising costs and stable inventory levels, using the LIFO method leads to a lower taxable income and higher net income compared to the FIFO method.

B) In a period of rising costs and stable inventory levels, using the FIFO method leads to a higher taxable income and higher net income compared to the LIFO method.

C) In a period of falling costs and stable inventory levels, cost of goods sold is the same under LIFO and FIFO.

D) All of the other answer choices are true.

A) In a period of rising costs and stable inventory levels, using the LIFO method leads to a lower taxable income and higher net income compared to the FIFO method.

B) In a period of rising costs and stable inventory levels, using the FIFO method leads to a higher taxable income and higher net income compared to the LIFO method.

C) In a period of falling costs and stable inventory levels, cost of goods sold is the same under LIFO and FIFO.

D) All of the other answer choices are true.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

68

In periods when costs are rising, LIFO liquidations:

A) Can't occur.

B) Are used to reduce tax liabilities.

C) Are a source of off-balance-sheet financing.

D) Distort the net income.

A) Can't occur.

B) Are used to reduce tax liabilities.

C) Are a source of off-balance-sheet financing.

D) Distort the net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

69

In a period when costs are falling and inventory quantities are stable, the lowest taxable income would be reported by using the inventory method of:

A) Weighted average.

B) LIFO.

C) Moving average.

D) FIFO.

A) Weighted average.

B) LIFO.

C) Moving average.

D) FIFO.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

70

Thompson TV and Appliance reported the following in its 2018 financial statements:

-Thompson's 2018 inventory turnover ratio is:

A) 3.91.

B) 4.00.

C) 4.88.

D) 5.00.

-Thompson's 2018 inventory turnover ratio is:

A) 3.91.

B) 4.00.

C) 4.88.

D) 5.00.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

71

If a company uses LIFO, a LIFO liquidation causes a company's income taxes to increase:

A) When inventory purchase costs are rising.

B) When inventory purchase costs are declining.

C) Whether inventory purchase costs are declining or rising.

D) LIFO liquidations have no effect on a company's income taxes.

A) When inventory purchase costs are rising.

B) When inventory purchase costs are declining.

C) Whether inventory purchase costs are declining or rising.

D) LIFO liquidations have no effect on a company's income taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

72

The primary reason for the popularity of LIFO is that it:

A) Provides better matching of physical flow and cost flow.

B) Saves income taxes currently.

C) Simplifies recordkeeping.

D) Provides a permanent reduction of income taxes.

A) Provides better matching of physical flow and cost flow.

B) Saves income taxes currently.

C) Simplifies recordkeeping.

D) Provides a permanent reduction of income taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

73

During 2018, WW Inc. reduced its LIFO eligible inventory quantities due to a problem with its major supplier. The effect of this liquidation was to increase its cost of goods sold by approximately $50 million. WW has a 40% income tax rate. If WW had not experienced these supplier problems and the resulting liquidation:

A) Its 2018 net income would have been $30 million lower because inventory purchase prices were rising.

B) Its 2018 net income would have been $30 million lower because inventory purchase prices were declining.

C) Its 2018 net income would have been $30 million higher because inventory purchase prices were rising.

D) Its 2018 net income would have been $30 million higher because inventory purchase prices were declining.

A) Its 2018 net income would have been $30 million lower because inventory purchase prices were rising.

B) Its 2018 net income would have been $30 million lower because inventory purchase prices were declining.

C) Its 2018 net income would have been $30 million higher because inventory purchase prices were rising.

D) Its 2018 net income would have been $30 million higher because inventory purchase prices were declining.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

74

Inventory records for Herb's Chemicals revealed the following: March 1, 2018, inventory: 1,000 gallons @ $7.20 = $7,200

-Ending inventory assuming LIFO in a perpetual inventory system would be:

A) $4,960.

B) $5,060.

C) $5,080.

D) $5,140.

-Ending inventory assuming LIFO in a perpetual inventory system would be:

A) $4,960.

B) $5,060.

C) $5,080.

D) $5,140.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

75

CMN Inc. uses LIFO and has experienced increasing costs since its founding. CMN disclosed that the LIFO reserve (also known as the LIFO allowance) at the end of 2018 was $3 million. The balance sheet showed ending inventory of $17 million at the end of 2018. What would the ending inventory have been if CMN had always used FIFO?

A) $20 million.

B) $17 million.

C) $14 million.

D) None of these answer choices are correct.

A) $20 million.

B) $17 million.

C) $14 million.

D) None of these answer choices are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

76

The use of LIFO in accounting for a firm's inventory:

A) Usually matches the physical flow of goods through the business.

B) Is usually used for internal management purposes.

C) Usually provides a better match of expenses with revenues.

D) None of these answer choices are correct.

A) Usually matches the physical flow of goods through the business.

B) Is usually used for internal management purposes.

C) Usually provides a better match of expenses with revenues.

D) None of these answer choices are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

77

HH Company uses LIFO. HH disclosed that if FIFO had been used, inventory at the end of 2018 would have been $20 million lower than the difference between LIFO and FIFO at the end of 2017. Assuming HH has a 30% income tax rate:

A) Its reported cost of goods for 2018 would have been $14 million less if it had used FIFO rather than LIFO for its financial statements.

B) Its reported cost of goods for 2018 would have been $20 million less if it had used FIFO rather than LIFO for its financial statements.

C) Its reported cost of goods sold for 2018 would have been $14 million higher if it had used FIFO rather than LIFO for its financial statements.

D) Its reported cost of goods sold for 2018 would have been $20 million higher if it had used FIFO rather than LIFO for its financial statements.

A) Its reported cost of goods for 2018 would have been $14 million less if it had used FIFO rather than LIFO for its financial statements.

B) Its reported cost of goods for 2018 would have been $20 million less if it had used FIFO rather than LIFO for its financial statements.

C) Its reported cost of goods sold for 2018 would have been $14 million higher if it had used FIFO rather than LIFO for its financial statements.

D) Its reported cost of goods sold for 2018 would have been $20 million higher if it had used FIFO rather than LIFO for its financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

78

Robertson Corporation's inventory balance was $22,000 at the beginning of the year and $20,000 at the end. The inventory turnover ratio for the year was 6.0 and the gross profit ratio 40%. What were net sales for the year?

A) $126,000.

B) $200,000.

C) $120,000.

D) $210,000.

A) $126,000.

B) $200,000.

C) $120,000.

D) $210,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

79

When reported in financial statements, a LIFO allowance account usually:

A) Is shown in the firm's income statement.

B) Is added to LIFO cost to indicate what the inventory would cost on a FIFO basis.

C) Indicates the effect on income if LIFO were not used.

D) Shows the current rate of inflation for that asset.

A) Is shown in the firm's income statement.

B) Is added to LIFO cost to indicate what the inventory would cost on a FIFO basis.

C) Indicates the effect on income if LIFO were not used.

D) Shows the current rate of inflation for that asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck

80

GG Inc. uses LIFO. GG disclosed that if FIFO had been used, inventory at the end of 2018 would have been $15 million higher than the difference between LIFO and FIFO at the end of 2017. Assuming GG has a 40% income tax rate:

A) Its reported cost of goods sold for 2018 would have been $9 million higher if it had used FIFO rather than LIFO for its financial statements.

B) Its reported cost of goods sold for 2018 would have been $15 million higher if it had used FIFO rather than LIFO for its financial statements.

C) Its reported net income for 2018 would have been $9 million higher if it had used FIFO rather than LIFO for its financial statements.

D) Its reported net income for 2018 would have been $15 million higher if it had used FIFO rather than LIFO for its financial statements.

A) Its reported cost of goods sold for 2018 would have been $9 million higher if it had used FIFO rather than LIFO for its financial statements.

B) Its reported cost of goods sold for 2018 would have been $15 million higher if it had used FIFO rather than LIFO for its financial statements.

C) Its reported net income for 2018 would have been $9 million higher if it had used FIFO rather than LIFO for its financial statements.

D) Its reported net income for 2018 would have been $15 million higher if it had used FIFO rather than LIFO for its financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 182 في هذه المجموعة.

فتح الحزمة

k this deck