Deck 20: Accounting Changes and Error Corrections

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/150

العب

ملء الشاشة (f)

Deck 20: Accounting Changes and Error Corrections

1

Which of the following is not one of the approaches for reporting accounting changes?

A) The change approach.

B) The retrospective approach.

C) The prospective approach.

D) All of these answer choices are approaches for reporting accounting changes.

A) The change approach.

B) The retrospective approach.

C) The prospective approach.

D) All of these answer choices are approaches for reporting accounting changes.

A

2

When a change in accounting principle is reported, what is sometimes sacrificed?

A) Relevance.

B) Consistency.

C) Conservatism.

D) Representational faithfulness.

A) Relevance.

B) Consistency.

C) Conservatism.

D) Representational faithfulness.

B

3

Error corrections require restatement of all the affected prior year financial statements reported in comparative financial statements.

True

4

All changes in estimate are accounted for retrospectively.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

5

A change in accounting estimate and a change in reporting entity are types of changes in accounting principle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

6

A change in reporting entity requires note disclosure in all subsequent financial statements prepared for the new entity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

7

A change in reporting entity and a material error correction are both reported prospectively.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

8

When an accounting change is reported under the retrospective approach, prior years' financial statements are:

A) Revised to reflect the use of the new principle.

B) Reported as previously prepared.

C) Left unchanged.

D) Adjusted using prior period adjustment procedures.

A) Revised to reflect the use of the new principle.

B) Reported as previously prepared.

C) Left unchanged.

D) Adjusted using prior period adjustment procedures.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

9

Which of the following changes would not be accounted for using the prospective approach?

A) A change to LIFO from average costing for inventories.

B) A change from application of the LCNRV rule from individual item costing to an aggregate costing approach.

C) A change from straight-line to double-declining balance depreciation.

D) A change from double-declining balance to straight-line depreciation.

A) A change to LIFO from average costing for inventories.

B) A change from application of the LCNRV rule from individual item costing to an aggregate costing approach.

C) A change from straight-line to double-declining balance depreciation.

D) A change from double-declining balance to straight-line depreciation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

10

How many acceptable approaches are there for changes in accounting principles?

A) One.

B) Two.

C) Three.

D) Four.

A) One.

B) Two.

C) Three.

D) Four.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

11

Prior years' financial statements are restated when the prospective approach is used.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

12

Accounting changes occur for which of the following reasons?

A) Management is being fair and consistent in financial reporting.

B) Management compensation is affected.

C) Debt agreements are impacted.

D) All of these answer choices are correct.

A) Management is being fair and consistent in financial reporting.

B) Management compensation is affected.

C) Debt agreements are impacted.

D) All of these answer choices are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

13

Most changes in accounting principle require a disclosure justifying the change in the first set of financial statements that the change is made.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

14

A change to the LIFO method of valuing inventory usually requires use of the retrospective method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

15

Which of the following changes is not usually accounted for retrospectively?

A) Change from expensing extraordinary repairs to capitalizing the expenditures.

B) Change from FIFO to LIFO.

C) Change in the composition of firms reporting on a consolidated basis.

D) Change from LIFO to FIFO.

A) Change from expensing extraordinary repairs to capitalizing the expenditures.

B) Change from FIFO to LIFO.

C) Change in the composition of firms reporting on a consolidated basis.

D) Change from LIFO to FIFO.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

16

An accounting change that is reported by the prospective approach is reflected in the financial statements of:

A) Prior years only.

B) Prior years plus the current year.

C) The current year only.

D) Current and future years.

A) Prior years only.

B) Prior years plus the current year.

C) The current year only.

D) Current and future years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

17

Regardless of the type of accounting change that occurs, the most important responsibility is:

A) To properly determine the tax effect.

B) To communicate that a change has occurred.

C) To compute the correct amount of the change.

D) None of these answer choices are correct.

A) To properly determine the tax effect.

B) To communicate that a change has occurred.

C) To compute the correct amount of the change.

D) None of these answer choices are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

18

All changes reported using the retrospective approach require cumulative effect adjustments of the change.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

19

Most, but not all, changes in accounting principle are reported using the retrospective approach.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

20

Retrospective restatement usually is not used for a:

A) Change in accounting estimate.

B) Change in accounting principle.

C) Change in entity.

D) Correction of error.

A) Change in accounting estimate.

B) Change in accounting principle.

C) Change in entity.

D) Correction of error.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

21

Which of the following accounting changes should not be accounted for prospectively?

A) The correction of an error.

B) A change from declining balance to straight-line depreciation.

C) A change from straight-line to declining balance depreciation.

D) A change in the expected salvage value of a depreciable asset.

A) The correction of an error.

B) A change from declining balance to straight-line depreciation.

C) A change from straight-line to declining balance depreciation.

D) A change in the expected salvage value of a depreciable asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

22

Which of the accounting changes listed below is more associated with financial statements prepared in accordance with U.S. GAAP than with International Financial Reporting Standards (IFRS)?

A) Change in estimated useful life of depreciable assets.

B) Change from the FIFO method of costing inventories to the LIFO method.

C) Change in depreciation method.

D) Change in reporting entity.

A) Change in estimated useful life of depreciable assets.

B) Change from the FIFO method of costing inventories to the LIFO method.

C) Change in depreciation method.

D) Change in reporting entity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

23

Companies should report the cumulative effect of an accounting change in the income statement:

A) In the quarter in which the change is made.

B) In the annual financial statements only.

C) In the first quarter of the fiscal year in which the change is made.

D) Never.

A) In the quarter in which the change is made.

B) In the annual financial statements only.

C) In the first quarter of the fiscal year in which the change is made.

D) Never.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

24

Which of the following would not be accounted for using the prospective approach?

A) A change to LIFO from FIFO for inventory costing.

B) A change in price indexes used under the LIFO method of inventory costing.

C) A change in estimate.

D) A change from the cash basis to accrual accounting.

A) A change to LIFO from FIFO for inventory costing.

B) A change in price indexes used under the LIFO method of inventory costing.

C) A change in estimate.

D) A change from the cash basis to accrual accounting.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

25

Disclosure notes related to a change in accounting principle under the retrospective approach should include:

A) The effect of the change on executive compensation.

B) The auditor's approval of the change.

C) The SEC's permission to change.

D) Justification for the change.

A) The effect of the change on executive compensation.

B) The auditor's approval of the change.

C) The SEC's permission to change.

D) Justification for the change.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

26

During 2018, Hoffman Co. decides to use FIFO to account for its inventory transactions. Previously, it had used LIFO.

A) Hoffman is not required to make any accounting adjustments.

B) Hoffman has made a change in accounting principle requiring retrospective adjustment.

C) Hoffman has made a change in accounting principle requiring prospective application.

D) Hoffman needs to correct an accounting error.

A) Hoffman is not required to make any accounting adjustments.

B) Hoffman has made a change in accounting principle requiring retrospective adjustment.

C) Hoffman has made a change in accounting principle requiring prospective application.

D) Hoffman needs to correct an accounting error.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

27

Which of the accounting changes listed below is more associated with financial statements prepared in accordance with U.S. GAAP than with International Financial Reporting Standards (IFRS)?

A) Change in reporting entity.

B) Change to the LIFO method from the FIFO method.

C) Change in accounting estimate.

D) Change in depreciation methods.

A) Change in reporting entity.

B) Change to the LIFO method from the FIFO method.

C) Change in accounting estimate.

D) Change in depreciation methods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

28

If a change is made from straight-line to units-of-production depreciation, one should record the effects by a journal entry including:

A) A credit to deferred tax liability.

B) A credit to accumulated depreciation.

C) A debit to depreciation expense.

D) No journal entry is required.

A) A credit to deferred tax liability.

B) A credit to accumulated depreciation.

C) A debit to depreciation expense.

D) No journal entry is required.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

29

Which of the following changes should be accounted for using the retrospective approach?

A) A change in the estimated life of a depreciable asset.

B) A change from straight-line to declining balance depreciation.

C) A change to the LIFO method of costing inventories.

D) A change in accounting for long-term construction contracts by recognizing revenue over time rather than when the contract is completed.

A) A change in the estimated life of a depreciable asset.

B) A change from straight-line to declining balance depreciation.

C) A change to the LIFO method of costing inventories.

D) A change in accounting for long-term construction contracts by recognizing revenue over time rather than when the contract is completed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

30

On January 2, 2018, Tobias Company began using straight-line depreciation for a certain class of assets. In the past, the company had used double-declining-balance depreciation for these assets. As of January 2, 2018, the amount of the change in accumulated depreciation is $40,000. The appropriate tax rate is 40%. The separately reported change in 2018 earnings is:

A) An increase of $40,000.

B) A decrease of $40,000.

C) An increase of $24,000.

D) None of these answer choices are correct.

A) An increase of $40,000.

B) A decrease of $40,000.

C) An increase of $24,000.

D) None of these answer choices are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

31

Which of the following is not an example of a change in accounting principle?

A) A change in the useful life of a depreciable asset.

B) A change from LIFO to FIFO for inventory costing.

C) A change to the full costing method in the extractive industries.

D) A change to the equity method of accounting for investments.

A) A change in the useful life of a depreciable asset.

B) A change from LIFO to FIFO for inventory costing.

C) A change to the full costing method in the extractive industries.

D) A change to the equity method of accounting for investments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

32

A change that uses the prospective approach is accounted for by:

A) Implementing it in the current year.

B) Reporting pro forma data.

C) Retrospective restatement of all prior financial statements in a comparative annual report.

D) Giving current recognition of the past effect of the change.

A) Implementing it in the current year.

B) Reporting pro forma data.

C) Retrospective restatement of all prior financial statements in a comparative annual report.

D) Giving current recognition of the past effect of the change.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

33

Which of the following would not be accounted for using the retrospective approach?

A) A change from LIFO to FIFO inventory costing.

B) A change in accounting for long-term construction contracts by recognizing revenue over time rather than when the contract is completed.

C) A change in depreciation methods.

D) A change from the equity method of accounting for investments.

A) A change from LIFO to FIFO inventory costing.

B) A change in accounting for long-term construction contracts by recognizing revenue over time rather than when the contract is completed.

C) A change in depreciation methods.

D) A change from the equity method of accounting for investments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

34

Prior years' financial statements are restated under the:

A) Current approach.

B) Prospective approach.

C) Retrospective approach.

D) None of these answer choices are correct.

A) Current approach.

B) Prospective approach.

C) Retrospective approach.

D) None of these answer choices are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

35

Which of the following is an example of a change in accounting principle?

A) A change in inventory costing methods.

B) A change in the estimated useful life of a depreciable asset.

C) A change in the actuarial life expectancies of employees under a pension plan.

D) Consolidating a new subsidiary.

A) A change in inventory costing methods.

B) A change in the estimated useful life of a depreciable asset.

C) A change in the actuarial life expectancies of employees under a pension plan.

D) Consolidating a new subsidiary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

36

The cumulative effect of most changes in accounting principle is reported:

A) In the income statement between income from continuing operations and net income.

B) In the income statement after income and before income tax.

C) In the income statement before income from continuing operations.

D) In the balance sheet accounts affected.

A) In the income statement between income from continuing operations and net income.

B) In the income statement after income and before income tax.

C) In the income statement before income from continuing operations.

D) In the balance sheet accounts affected.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

37

JFS Co. changed from straight-line to double-declining-balance depreciation. The journal entry to record the change includes:

A) A credit to accumulated depreciation.

B) A debit to accumulated depreciation.

C) A debit to a depreciable asset.

D) The change does not require a journal entry.

A) A credit to accumulated depreciation.

B) A debit to accumulated depreciation.

C) A debit to a depreciable asset.

D) The change does not require a journal entry.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

38

National Hoopla Company switches from sum-of-the-years' digits depreciation to straight-line depreciation. As a result:

A) Current income tax payable increases.

B) The cumulative effect decreases current period earnings.

C) Prior periods' financial statements are restated.

D) None of these answer choices are correct.

A) Current income tax payable increases.

B) The cumulative effect decreases current period earnings.

C) Prior periods' financial statements are restated.

D) None of these answer choices are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

39

When an accounting change is reported under the retrospective approach, account balances in the general ledger:

A) Are not adjusted.

B) Are closed out and then updated.

C) Are adjusted net of the tax effect.

D) Are adjusted to what they would have been had the new method been used in previous years.

A) Are not adjusted.

B) Are closed out and then updated.

C) Are adjusted net of the tax effect.

D) Are adjusted to what they would have been had the new method been used in previous years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

40

When the retrospective approach is used for a change to the FIFO method, which of the following accounts is usually not adjusted?

A) Deferred Income Taxes.

B) Inventory.

C) Retained Earnings.

D) All of these answer choices are usually adjusted.

A) Deferred Income Taxes.

B) Inventory.

C) Retained Earnings.

D) All of these answer choices are usually adjusted.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

41

Which of the following is accounted for prospectively?

A) Changes from the weighted-average method of inventory costing to FIFO.

B) Change in reporting entity.

C) Change in the percentage used to determine warranty expense.

D) Correction of an error.

A) Changes from the weighted-average method of inventory costing to FIFO.

B) Change in reporting entity.

C) Change in the percentage used to determine warranty expense.

D) Correction of an error.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

42

FIFA Footballs acquired a patent in 2015 at a cost of $150 million and amortizes the patent on a straight-line basis. During 2018 management decided that the benefits from the patent would be received over a total period of 8 years rather than the 20-year legal life being used to amortize the cost. FIFA's 2018 financial statements should include:

A) A patent balance of $150 million.

B) A patent balance of $102 million.

C) Patent amortization expense of $15 million.

D) Patent amortization expense of $7.5 million.

A) A patent balance of $150 million.

B) A patent balance of $102 million.

C) Patent amortization expense of $15 million.

D) Patent amortization expense of $7.5 million.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

43

Which of the following changes should be accounted for using the retrospective approach?

A) A change in the estimated useful life of a depreciable asset.

B) A change from straight-line to declining balance depreciation.

C) A change in accounting for long-term construction contracts by recognizing revenue over time rather than when the contract is completed.

D) A change to LIFO method of costing inventories.

A) A change in the estimated useful life of a depreciable asset.

B) A change from straight-line to declining balance depreciation.

C) A change in accounting for long-term construction contracts by recognizing revenue over time rather than when the contract is completed.

D) A change to LIFO method of costing inventories.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

44

For 2017, P Co. estimated its two-year equipment warranty costs based on $23 per unit sold in 2017. Experience during 2018 indicated that the estimate should have been based on $25 per unit. The effect of this $2 difference from the estimate is reported:

A) In 2018 income from continuing operations.

B) As an accounting change, net of tax, below 2018 income from continuing operations.

C) As an accounting change requiring 2017 financial statements to be restated.

D) As a correction of an error requiring 2017 financial statements to be restated.

A) In 2018 income from continuing operations.

B) As an accounting change, net of tax, below 2018 income from continuing operations.

C) As an accounting change requiring 2017 financial statements to be restated.

D) As a correction of an error requiring 2017 financial statements to be restated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

45

La Casita Restaurants changed from the FIFO method of inventory costing to the weighted average method during 2018. When reported in the 2018 comparative financial statements, the 2017 inventory amount will be:

A) Increased.

B) Decreased.

C) Increased or decreased, depending on how prices changed.

D) Unaffected.

A) Increased.

B) Decreased.

C) Increased or decreased, depending on how prices changed.

D) Unaffected.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

46

Orange Corp. constructed a machine at a total cost of $70 million. Construction was completed at the end of 2014 and the machine was placed in service at the beginning of 2015. The machine was being depreciated over a 10-year life using the sum-of-the-years'-digits method. The residual value is expected to be $4 million. At the beginning of 2018, Orange decided to change to the straight-line method. Ignoring income taxes, what will be Orange's depreciation expense for 2018?

A) $4.8 million.

B) $5.4 million.

C) $6.6 million.

D) $9.4 million.

A) $4.8 million.

B) $5.4 million.

C) $6.6 million.

D) $9.4 million.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

47

The prospective approach usually is required for:

A) A change in accounting principle.

B) A change in reporting entity.

C) A change in estimate.

D) A correction of an error.

A) A change in accounting principle.

B) A change in reporting entity.

C) A change in estimate.

D) A correction of an error.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

48

Which of the following changes in inventory costing usually should not be reported by revising the financial statements of prior periods?

A) The weighted-average method to the LIFO method.

B) The weighted-average method to the FIFO method.

C) FIFO method to the weighted-average method.

D) LIFO method to the weighted-average method.

A) The weighted-average method to the LIFO method.

B) The weighted-average method to the FIFO method.

C) FIFO method to the weighted-average method.

D) LIFO method to the weighted-average method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

49

Which of the following is not a change in accounting principle that usually is accounted for by retrospectively revising prior financial statements?

A) Change from FIFO to the average method of inventory costing.

B) Change from SYD to DDB depreciation.

C) Change from the average method of inventory costing to FIFO.

D) Change from the LIFO to the FIFO method of inventory costing.

A) Change from FIFO to the average method of inventory costing.

B) Change from SYD to DDB depreciation.

C) Change from the average method of inventory costing to FIFO.

D) Change from the LIFO to the FIFO method of inventory costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

50

Blue Co. has a patent on a communication process. The company has amortized the patent on a straight-line basis since 2014, when it was acquired at a cost of $36 million at the beginning of that year. Due to rapid technological advances in the industry, management decided that the patent would benefit the company over a total of six years rather than the nine-year life being used to amortize its cost. The decision was made at the end of 2018 (before adjusting and closing entries). What is the appropriate patent amortization expense in 2018?

A) $4 million.

B) $5 million.

C) $10 million.

D) $20 million.

A) $4 million.

B) $5 million.

C) $10 million.

D) $20 million.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

51

A change in the residual value of equipment is accounted for:

A) As a prior period adjustment.

B) Prospectively.

C) Retrospectively.

D) None of these answer choices are correct.

A) As a prior period adjustment.

B) Prospectively.

C) Retrospectively.

D) None of these answer choices are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

52

Red Corp. constructed a machine at a total cost of $70 million. Construction was completed at the end of 2014 and the machine was placed in service at the beginning of 2015. The machine was being depreciated over a 10-year life using the straight-line method. The residual value is expected to be $4 million. At the beginning of 2018, Red decided to change to the sum-of-the-years'-digits method. Ignoring income taxes, what will be Red's depreciation expense for 2018?

A) $4.80 million.

B) $5.40 million.

C) $6.60 million.

D) $11.55 million.

A) $4.80 million.

B) $5.40 million.

C) $6.60 million.

D) $11.55 million.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

53

Venice Company purchased a gondola for $440,000 (no residual value) at the beginning of 2015. The gondola was being depreciated over a 10-year life using the sum-of-the-years'-digits method. At the beginning of 2018, it was decided to change to straight-line. Ignoring taxes, the 2018 adjusting entry will include a debit to depreciation expense of:

A) $76,000

B) $44,000

C) $32,000

D) $22,000

A) $76,000

B) $44,000

C) $32,000

D) $22,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

54

Which of the following is not a change in estimate?

A) A change in the useful life of a depreciable asset.

B) A change in the mortality rate used for pension computations.

C) A change from the cost to the equity method in accounting for investments.

D) A change in the warranty expense percentage.

A) A change in the useful life of a depreciable asset.

B) A change in the mortality rate used for pension computations.

C) A change from the cost to the equity method in accounting for investments.

D) A change in the warranty expense percentage.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

55

Gore Inc. recorded a liability in 2018 for probable litigation losses of $2 million. Ultimately, $5 million in legitimate warranty claims were filed by Gore's customers.

A) Gore has made a change in accounting principle, requiring retrospective adjustment.

B) Gore needs to correct an accounting error.

C) Gore is required to adjust a change in accounting estimate prospectively.

D) Gore is not required to make any accounting adjustments.

A) Gore has made a change in accounting principle, requiring retrospective adjustment.

B) Gore needs to correct an accounting error.

C) Gore is required to adjust a change in accounting estimate prospectively.

D) Gore is not required to make any accounting adjustments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

56

Mobic Inc. acquired some manufacturing equipment in January 2015 for $400,000 and depreciated it $40,000 each year for three years on a straight-line basis. During 2018, the manufacturer announced a new technology for this type of equipment that will make the old models obsolete by the end of 2021. As a result, Mobic will plan to replace the equipment at that time, effectively reducing the asset's life from ten to seven years. In its financial statements for 2018, Mobic should:

A) Charge $280,000 in depreciation expense.

B) Report the book value of the equipment in its December 31,2018 balance sheet at $210,000.

C) Make an adjustment to retained earnings for the error in measuring depreciation during 2015-2017.

D) None of these answer choices are correct.

A) Charge $280,000 in depreciation expense.

B) Report the book value of the equipment in its December 31,2018 balance sheet at $210,000.

C) Make an adjustment to retained earnings for the error in measuring depreciation during 2015-2017.

D) None of these answer choices are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

57

B Company switched from the sum-of-the-years-digits depreciation method to straight-line depreciation in 2018. The change affects machinery purchased at the beginning of 2016 at a cost of $72,000. The machinery has an estimated life of five years and an estimated residual value of $3,600. What is B's 2018 depreciation expense?

A) $9,120.

B) $13,680.

C) $15,840.

D) $19,200.

A) $9,120.

B) $13,680.

C) $15,840.

D) $19,200.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

58

Which of the following is a change in estimate?

A) A change from the full costing method in the extractive industries.

B) A change from recognizing construction contract revenue over time to recognizing revenue at a point in time.

C) Consolidating a subsidiary for the first time.

D) A change in the termination rate of employees under a pension plan.

A) A change from the full costing method in the extractive industries.

B) A change from recognizing construction contract revenue over time to recognizing revenue at a point in time.

C) Consolidating a subsidiary for the first time.

D) A change in the termination rate of employees under a pension plan.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

59

SkiPark Company purchased a gondola for $440,000 (no residual value) at the beginning of 2015. The gondola was being depreciated over a 10-year life using the double-declining method. At the beginning of 2018, it was decided to change to straight-line. An accompanying disclosure note would include each of the following except:

A) The effect of a change on any financial statement line items affected for all periods reported.

B) Justification that the change is preferable.

C) The cumulative effect of the change.

D) The effect of a change on per share amounts affected for all periods reported.

A) The effect of a change on any financial statement line items affected for all periods reported.

B) Justification that the change is preferable.

C) The cumulative effect of the change.

D) The effect of a change on per share amounts affected for all periods reported.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

60

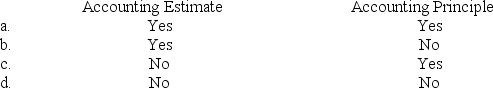

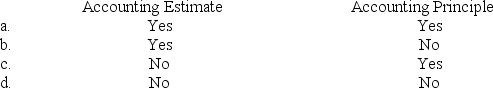

Retrospective restatement usually is appropriate for a change in:

A) Option A

B) Option B

C) Option C

D) Option D

A) Option A

B) Option B

C) Option C

D) Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

61

Berkshire Inc. uses a periodic inventory system. At the end of 2017, it missed counting some inventory items, resulting in an inventory understatement by $600,000. Assume that Berkshire has a 30% income tax rate and that this was the only error it made.

-What is the effect of the error on Berkshire's December 31,2018 balance sheet?

A) There are no errors in the December 31,2018 balance sheet.

B) Assets understated by $600,000 and shareholders' equity understated by $600,000.

C) Assets understated by $420,000 and shareholders' equity understated by $420,000.

D) Liabilities understated by $180,000 and shareholders' equity overstated by $420,000.

-What is the effect of the error on Berkshire's December 31,2018 balance sheet?

A) There are no errors in the December 31,2018 balance sheet.

B) Assets understated by $600,000 and shareholders' equity understated by $600,000.

C) Assets understated by $420,000 and shareholders' equity understated by $420,000.

D) Liabilities understated by $180,000 and shareholders' equity overstated by $420,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

62

Popeye Company purchased a machine for $300,000 on January 1, 2017. Popeye depreciates machines of this type by the straight-line method over a five-year period using no salvage value. Due to an error, no depreciation was taken on this machine in 2017. Popeye discovered the error in 2018. What amount should Popeye record as depreciation expense for 2018? The tax rate is 40%.

A) $120,000.

B) $60,000.

C) $36,000.

D) $72,000.

A) $120,000.

B) $60,000.

C) $36,000.

D) $72,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

63

Moonland Company's income statement contained the following errors: Ending inventory, December 31, 2018, understated by $6,000

Depreciation expense for 2018 overstated by $1,000

What is the effect of the errors on 2018 net income before taxes?

A) Overstated by $5,000.

B) Understated by $5,000.

C) Understated by $7,000.

D) Overstated by $7,000.

Depreciation expense for 2018 overstated by $1,000

What is the effect of the errors on 2018 net income before taxes?

A) Overstated by $5,000.

B) Understated by $5,000.

C) Understated by $7,000.

D) Overstated by $7,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

64

Goosen Company bought a copyright for $90,000 on January 1, 2015, at which time the copyright had an estimated useful life of 15 years. On January 5, 2018, the company determined that the copyright would expire at the end of 2021. How much should Goosen record retrospectively as the effect of change?

A) $0.

B) $12,000.

C) $8,000.

D) $14,400.

A) $0.

B) $12,000.

C) $8,000.

D) $14,400.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

65

Washburn Co. spent $10 million to purchase a new patented technology, debiting an intangible asset and crediting cash. Washburn uses SYD depreciation on its depreciable assets and plans to amortize the intangible asset on a straight-line basis. The appropriate accounting treatment is that:

A) Washburn is not required to make any accounting adjustments.

B) Washburn is required to adjust a change in accounting estimate prospectively.

C) Washburn has made a change in accounting principle, requiring retrospective adjustment.

D) Washburn needs to correct an accounting error.

A) Washburn is not required to make any accounting adjustments.

B) Washburn is required to adjust a change in accounting estimate prospectively.

C) Washburn has made a change in accounting principle, requiring retrospective adjustment.

D) Washburn needs to correct an accounting error.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

66

Which of the following is a change in reporting entity?

A) A change to the full cost method in the extractive industries.

B) Discontinuing a segment of operations.

C) A change from the cost to the equity method.

D) Consolidating a subsidiary not previously included in consolidated financial statements.

A) A change to the full cost method in the extractive industries.

B) Discontinuing a segment of operations.

C) A change from the cost to the equity method.

D) Consolidating a subsidiary not previously included in consolidated financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

67

C Co. reported a retained earnings balance of $200,000 at December 31, 2017. In September 2018, C determined that insurance premiums of $30,000 for the three-year period beginning January 1, 2017, had been paid and fully expensed in 2017. C has a 30% income tax rate. What amount should C report as adjusted beginning retained earnings in its 2018 statement of retained earnings?

A) $210,000.

B) $214,000.

C) $220,000.

D) $221,000.

A) $210,000.

B) $214,000.

C) $220,000.

D) $221,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

68

Cooper Inc. took physical inventory at the end of 2017. Purchases that were acquired FOB destination were in transit, so they were not included in the physical count.

A) Cooper needs to correct an accounting error.

B) Cooper has made a change in accounting principle, requiring retrospective adjustment.

C) Cooper is required to adjust a change in accounting estimate prospectively.

D) Cooper is not required to make any accounting adjustments.

A) Cooper needs to correct an accounting error.

B) Cooper has made a change in accounting principle, requiring retrospective adjustment.

C) Cooper is required to adjust a change in accounting estimate prospectively.

D) Cooper is not required to make any accounting adjustments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

69

In 2018, internal auditors discovered that Fay, Inc., had debited an expense account for the $700,000 cost of a machine purchased on January 1, 2015. The machine's useful life was expected to be five years with no residual value. Straight-line depreciation is used by Fay. The journal entry to correct the error will include a credit to accumulated depreciation of:

A) $140,000.

B) $280,000.

C) $420,000.

D) $700,000.

A) $140,000.

B) $280,000.

C) $420,000.

D) $700,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

70

Z Company acquired a subsidiary several years ago that was appropriately excluded from consolidation last year. This year Z has consolidated the subsidiary in its financial statements. This results in:

A) An accounting change that should be reported prospectively.

B) A correction of an error.

C) An accounting change that should be reported by restating the financial statements of all prior periods presented.

D) Neither an accounting change nor a correction of an error.

A) An accounting change that should be reported prospectively.

B) A correction of an error.

C) An accounting change that should be reported by restating the financial statements of all prior periods presented.

D) Neither an accounting change nor a correction of an error.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

71

In December 2018, Kojak Insurance Co. received $500,000 in premiums for a two-year property insurance policy. The company recorded the transaction by debiting cash and crediting insurance premium revenue for the full amount. An internal audit conducted in early 2019 flagged this transaction. The appropriate accounting treatment is that:

A) Kojak needs to correct an accounting error.

B) Kojak has made a change in accounting principle, requiring retrospective adjustment.

C) Kojak is required to adjust a change in accounting estimate prospectively.

D) Kojak is not required to make any accounting adjustments.

A) Kojak needs to correct an accounting error.

B) Kojak has made a change in accounting principle, requiring retrospective adjustment.

C) Kojak is required to adjust a change in accounting estimate prospectively.

D) Kojak is not required to make any accounting adjustments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

72

Which of the following is not a change in reporting entity?

A) Reporting using comparative financial statements for the first time.

B) Changing the companies that comprise a consolidated group.

C) Presenting consolidated financial statements for the first time.

D) All are changes in reporting entity.

A) Reporting using comparative financial statements for the first time.

B) Changing the companies that comprise a consolidated group.

C) Presenting consolidated financial statements for the first time.

D) All are changes in reporting entity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

73

Berkshire Inc. uses a periodic inventory system. At the end of 2017, it missed counting some inventory items, resulting in an inventory understatement by $600,000. Assume that Berkshire has a 30% income tax rate and that this was the only error it made. v

-If undetected, what is the effect of this error on Berkshire's December 31,2017 balance sheet?

A) Assets understated by $600,000 and shareholders' equity understated by $600,000.

B) Assets understated by $420,000 and shareholders' equity understated by $420,000.

C) Assets understated by $600,000, liabilities understated by $180,000, and shareholders' equity understated by $420,000.

D) None of these answer choices are correct.

-If undetected, what is the effect of this error on Berkshire's December 31,2017 balance sheet?

A) Assets understated by $600,000 and shareholders' equity understated by $600,000.

B) Assets understated by $420,000 and shareholders' equity understated by $420,000.

C) Assets understated by $600,000, liabilities understated by $180,000, and shareholders' equity understated by $420,000.

D) None of these answer choices are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

74

Prior to 2018, Trapper John Inc. used sum-of-the-years'-digits depreciation on its store equipment. Beginning in 2018, Trapper John decided to use straight-line depreciation for these assets. The equipment cost $3 million when it was purchased at the beginning of 2016, had an estimated useful life of five years and no estimated residual value. To account for the change in 2018, Trapper John:

A) Would retrospectively report $600,000 in depreciation expense annually for 2016 and 2017, and report $600,000 in depreciation expense for 2018.

B) Would adjust accumulated depreciation and retained earnings for the excess charges made in 2016 and 2017.

C) Would report depreciation expense of $400,000 in its 2018 income statement.

D) None of these answer choices is correct.

A) Would retrospectively report $600,000 in depreciation expense annually for 2016 and 2017, and report $600,000 in depreciation expense for 2018.

B) Would adjust accumulated depreciation and retained earnings for the excess charges made in 2016 and 2017.

C) Would report depreciation expense of $400,000 in its 2018 income statement.

D) None of these answer choices is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

75

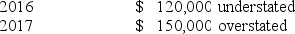

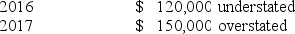

During 2018, P Company discovered that the ending inventories reported on its financial statements were incorrect by the following amounts:  P uses the periodic inventory system to ascertain year-end quantities that are converted to dollar amounts using the FIFO cost method. Prior to any adjustments for these errors and ignoring income taxes, P's retained earnings at January 1, 2018, would be:

P uses the periodic inventory system to ascertain year-end quantities that are converted to dollar amounts using the FIFO cost method. Prior to any adjustments for these errors and ignoring income taxes, P's retained earnings at January 1, 2018, would be:

A) Correct.

B) $30,000 overstated.

C) $150,000 overstated.

D) $270,000 overstated.

P uses the periodic inventory system to ascertain year-end quantities that are converted to dollar amounts using the FIFO cost method. Prior to any adjustments for these errors and ignoring income taxes, P's retained earnings at January 1, 2018, would be:

P uses the periodic inventory system to ascertain year-end quantities that are converted to dollar amounts using the FIFO cost method. Prior to any adjustments for these errors and ignoring income taxes, P's retained earnings at January 1, 2018, would be:A) Correct.

B) $30,000 overstated.

C) $150,000 overstated.

D) $270,000 overstated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

76

Lundholm Company purchased a machine for $100,000 on January 1, 2016. Lundholm depreciates machines of this type by the straight-line method over a 10-year period using no salvage value. Due to a change in sales patterns, on January 1, 2018, management determines the useful life of the machine to be a total of five years. What amount should Lundholm record for depreciation expense for 2018? The tax rate is 40%.

A) $20,000.

B) $16,000.

C) $17,778.

D) $26,667.

A) $20,000.

B) $16,000.

C) $17,778.

D) $26,667.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

77

An item that should be reported as a prior period adjustment is the:

A) Correction of an error in depreciation from last year.

B) Payment of taxes due to a tax audit of last year's tax return.

C) Payment of a previously recorded warranty expense.

D) Receipt of the proceeds of a note receivable that was due last year.

A) Correction of an error in depreciation from last year.

B) Payment of taxes due to a tax audit of last year's tax return.

C) Payment of a previously recorded warranty expense.

D) Receipt of the proceeds of a note receivable that was due last year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

78

Diversified Systems, Inc., reports consolidated financial statements this year in place of statements of individual companies reported in previous years. This results in:

A) An accounting change that should be reported prospectively.

B) An accounting change that should be reported by restating the financial statements of all prior periods presented.

C) A correction of an error.

D) Neither an accounting change nor a correction of an error.

A) An accounting change that should be reported prospectively.

B) An accounting change that should be reported by restating the financial statements of all prior periods presented.

C) A correction of an error.

D) Neither an accounting change nor a correction of an error.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

79

Hepburn Company bought a copyright for $90,000 on January 1, 2015, at which time the copyright had an estimated useful life of 15 years. On January 5, 2018, the company determined that the copyright would expire at the end of 2021. How much should Hepburn record as amortization expense for this copyright for 2018?

A) $14,400.

B) $7,200.

C) $8,000.

D) $18,000.

A) $14,400.

B) $7,200.

C) $8,000.

D) $18,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

80

Berkshire Inc. uses a periodic inventory system. At the end of 2017, it missed counting some inventory items, resulting in an inventory understatement by $600,000. Assume that Berkshire has a 30% income tax rate and that this was the only error it made.

- What is the effect of the error on Berkshire's 2018 income statement?

A) Net income is understated by $420,000.

B) Cost of goods sold is understated by $420,000.

C) There are no errors in the 2018 income statement.

D) None of these answer choices is correct.

- What is the effect of the error on Berkshire's 2018 income statement?

A) Net income is understated by $420,000.

B) Cost of goods sold is understated by $420,000.

C) There are no errors in the 2018 income statement.

D) None of these answer choices is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck