Deck 4: The Income Statement, Comprehensive Income, and the Statement of Cash Flows

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/178

العب

ملء الشاشة (f)

Deck 4: The Income Statement, Comprehensive Income, and the Statement of Cash Flows

1

A change in accounting principle that is implemented using the retrospective approach includes restating financial statements of all periods presented as if the new standard had been used in those periods.

True

2

Restructuring costs most often refer to costs associated with management's plans to materially change the scope of business operations or the manner in which they are conducted.

True

3

Material restructuring costs are reported as an element of income from continuing operations.

True

4

A change in accounting principle that is implemented using the modified retrospective approach includes implementing the change in the current period only and not adjusting for the cumulative effects on prior periods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

5

Interest expense typically is considered a temporary component of earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

6

The single-step format of the income statement first lists all the revenues and gains included in income from continuing operations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

7

Earnings quality refers to the ability of reported earnings (income) to predict future earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

8

Income from continuing operations consists only of those items expected to be permanent components of earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

9

Gains, but not losses, from discontinued operations must be separately reported in an income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

10

The multiple-step format of the income statement reports a series of intermediate subtotals such as gross profit, operating income, and income before taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

11

Intraperiod tax allocation is the process of associating income tax effects with the income statement components that create those effects.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

12

The single-step format of the income statement does not separately report nonoperating gains in the revenues section of the income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

13

Material errors in prior periods' income statements are corrected by making an adjustment to the beginning balance of the current period's retained earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

14

Income from continuing operations sometimes includes gains from nonoperating activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

15

Earnings per share disclosure is required only for income from continuing operations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

16

Comprehensive income is the total change in shareholders' equity that occurred during the period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

17

Changes in estimates are accounted for using the prospective approach.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

18

Comprehensive income reports an expanded version of income to include certain types of gains and losses not included in traditional income statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

19

The direct and indirect methods of reporting the statement of cash flows present different information for investing and financing activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

20

Income statements prepared according to both U.S. GAAP and International Financial Reporting Standards (IFRS) require the separate reporting of discontinued operations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

21

Earnings quality refers to:

A) the ability of management to budget for expenditures in the following year.

B) the ability of management to sell its inventory for a profit.

C) the ability of management to quickly collect cash from customers.

D) the ability of reported earnings to predict a company's future earnings.

A) the ability of management to budget for expenditures in the following year.

B) the ability of management to sell its inventory for a profit.

C) the ability of management to quickly collect cash from customers.

D) the ability of reported earnings to predict a company's future earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

22

Income smoothing refers to:

A) the ability of management to report an earnings amount in each period less than actual earnings.

B) the ability of management to use accruals to reduce the volatility of reported earnings over time.

C) the ability of management to maintain sales to its current customers for several years.

D) the ability of management to report an earnings amount in each period greater than actual earnings.

A) the ability of management to report an earnings amount in each period less than actual earnings.

B) the ability of management to use accruals to reduce the volatility of reported earnings over time.

C) the ability of management to maintain sales to its current customers for several years.

D) the ability of management to report an earnings amount in each period greater than actual earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

23

Most real-world income statements are presented using which format?

A) Income-step.

B) Single-step.

C) Magnitude-step.

D) Multiple-step.

A) Income-step.

B) Single-step.

C) Magnitude-step.

D) Multiple-step.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

24

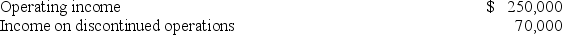

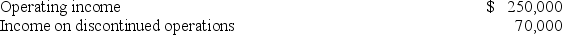

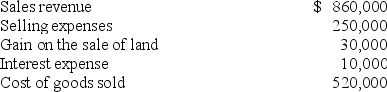

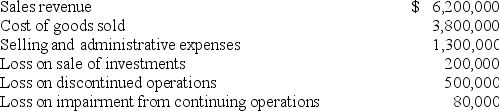

Freda's Florist reported the following before-tax income statement items for the year ended December 31, 2018:  All income statement items are subject to a 40% income tax rate. In its 2018 income statement, Freda's separately stated income tax expense and total income tax expense would be:

All income statement items are subject to a 40% income tax rate. In its 2018 income statement, Freda's separately stated income tax expense and total income tax expense would be:

A) $128,000 and $128,000, respectively.

B) $128,000 and $100,000, respectively.

C) $100,000 and $128,000, respectively.

D) $100,000 and $100,000, respectively.

All income statement items are subject to a 40% income tax rate. In its 2018 income statement, Freda's separately stated income tax expense and total income tax expense would be:

All income statement items are subject to a 40% income tax rate. In its 2018 income statement, Freda's separately stated income tax expense and total income tax expense would be:A) $128,000 and $128,000, respectively.

B) $128,000 and $100,000, respectively.

C) $100,000 and $128,000, respectively.

D) $100,000 and $100,000, respectively.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

25

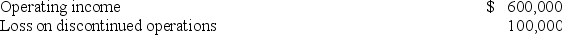

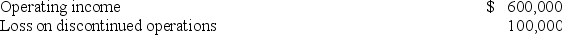

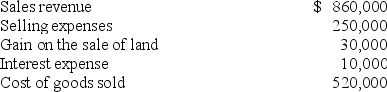

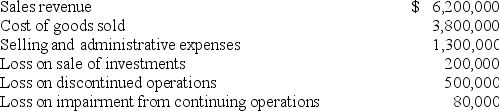

Provincial Inc. reported the following before-tax income statement items:  Provincial has a 30% income tax rate. Provincial would report the following amount of income tax expense as a separately stated line item in the income statement:

Provincial has a 30% income tax rate. Provincial would report the following amount of income tax expense as a separately stated line item in the income statement:

A) $198,000.

B) $180,000.

C) $168,000.

D) $150,000.

Provincial has a 30% income tax rate. Provincial would report the following amount of income tax expense as a separately stated line item in the income statement:

Provincial has a 30% income tax rate. Provincial would report the following amount of income tax expense as a separately stated line item in the income statement:A) $198,000.

B) $180,000.

C) $168,000.

D) $150,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

26

The difference between single-step and multiple-step income statements is primarily an issue of:

A) Consistency.

B) Presentation.

C) Measurement.

D) Valuation.

A) Consistency.

B) Presentation.

C) Measurement.

D) Valuation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

27

The decomposition of return on assets illustrates why some companies with low profit margins can be very profitable if their asset turnover is high.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

28

In a statement of cash flows prepared under International Financial Reporting Standards (IFRS), interest paid is most often classified as a financing cash flow.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

29

A primary advantage of the multiple-step format of the income statement over the single-step format is that the multiple-step format:

A) classifies expenses by function.

B) results in a higher amount of net income.

C) separately lists income tax expense.

D) lists revenues and expenses in order of their dollar amount.

A) classifies expenses by function.

B) results in a higher amount of net income.

C) separately lists income tax expense.

D) lists revenues and expenses in order of their dollar amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

30

A decrease in the receivables turnover ratio indicates a decrease in the time between credit sales and cash collection.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

31

Return on shareholders' equity is increased if a firm can maintain its return on assets but increase its leverage.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

32

International Financial Reporting Standards (IFRS) require a company to classify expenses in an income statement by function.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

33

Intraperiod income tax presentation is primarily a matter of:

A) Valuation.

B) Going concern.

C) Periodicity.

D) Allocation.

A) Valuation.

B) Going concern.

C) Periodicity.

D) Allocation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

34

The relationship between revenue from selling inventory and the cost of that inventory is measured as:

A) Net income.

B) Gross profit.

C) Income before taxes.

D) Operating income.

A) Net income.

B) Gross profit.

C) Income before taxes.

D) Operating income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

35

Financial statement users typically begin their assessment of permanent earnings with:

A) sales revenue.

B) income from continuing operations.

C) net income.

D) gross profit.

A) sales revenue.

B) income from continuing operations.

C) net income.

D) gross profit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

36

In a statement of cash flows prepared under International Financial Reporting Standards (IFRS), interest received is most often classified as an operating cash flow.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

37

Managers may engage in classification shifting by:

A) reporting sales to fictitious customers to inflate reported revenues.

B) reduce estimates of accrued expenses to inflate reported net income.

C) reporting operating expenses as nonoperating expenses to inflate reported operating income.

D) increasing estimates of accrued expenses to inflate reported net income.

A) reporting sales to fictitious customers to inflate reported revenues.

B) reduce estimates of accrued expenses to inflate reported net income.

C) reporting operating expenses as nonoperating expenses to inflate reported operating income.

D) increasing estimates of accrued expenses to inflate reported net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

38

Popson Inc. incurred a material loss that was unusual in character. This loss should be reported as:

A) a discontinued operation.

B) a line item between income from continuing operations and income from discontinued operations.

C) a line item within income from continuing operations.

D) a line item in the retained earnings statement.

A) a discontinued operation.

B) a line item between income from continuing operations and income from discontinued operations.

C) a line item within income from continuing operations.

D) a line item in the retained earnings statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

39

Which of the following profit amounts usually will be listed in both the single-step and multiple-step formats of the income statement?

A) Gross profit.

B) Operating income.

C) Income before taxes.

D) Net nonoperating income.

A) Gross profit.

B) Operating income.

C) Income before taxes.

D) Net nonoperating income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

40

A company could improve its return on assets by increasing its income or by increasing its total assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

41

Non-GAAP earnings:

A) could be considered management's view of permanent earnings.

B) are needed for the correction of errors.

C) are standardized under generally accepted accounting principles.

D) are useful to compare two different firms' performance.

A) could be considered management's view of permanent earnings.

B) are needed for the correction of errors.

C) are standardized under generally accepted accounting principles.

D) are useful to compare two different firms' performance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

42

Which of the following mostly likely would be classified as restructuring costs?

A) Advertising costs to sell a product recently developed by a company.

B) Severance pay for employee layoffs associated with facility closings.

C) Brokerage fees from the issuance of additional shares of stock.

D) Acquisition fees associated with the purchase of land and buildings.

A) Advertising costs to sell a product recently developed by a company.

B) Severance pay for employee layoffs associated with facility closings.

C) Brokerage fees from the issuance of additional shares of stock.

D) Acquisition fees associated with the purchase of land and buildings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

43

The principal benefit of separately reporting discontinued operations is to enhance:

A) predictive ability of future profitability.

B) consistency in reporting.

C) intraperiod continuity.

D) comprehensive reporting.

A) predictive ability of future profitability.

B) consistency in reporting.

C) intraperiod continuity.

D) comprehensive reporting.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

44

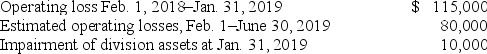

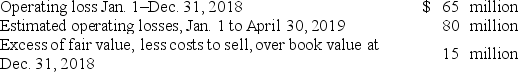

On August 1, 2018, Rocket Retailers adopted a plan to discontinue its catalog sales division, which qualifies as a separate component of the business according to GAAP regarding discontinued operations. The disposal of the division was expected to be concluded by June 30, 2019. On January 31, 2019, Rocket's fiscal year-end, the following information relative to the discontinued division was accumulated:  In its income statement for the year ended January 31, 2019, Rocket would report a before-tax loss on discontinued operations of:

In its income statement for the year ended January 31, 2019, Rocket would report a before-tax loss on discontinued operations of:

A) $(115,000).

B) $(195,000).

C) $(65,000).

D) $(125,000).

In its income statement for the year ended January 31, 2019, Rocket would report a before-tax loss on discontinued operations of:

In its income statement for the year ended January 31, 2019, Rocket would report a before-tax loss on discontinued operations of:A) $(115,000).

B) $(195,000).

C) $(65,000).

D) $(125,000).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

45

On May 1, Foxtrot Co. agreed to sell the assets of its Footwear Division to Albanese Inc. for $80 million. The sale was completed on December 31, 2018. The following additional facts pertain to the transaction:

• The Footwear Division qualifies as a component of the entity according to GAAP

Regarding discontinued operations.

• The book value of Footwear's assets totaled $48 million on the date of the sale.

• Footwear's operating income was a pre-tax loss of $10 million in 2018.

• Foxtrot's income tax rate is 40%.

-

In the income statement for the year ended December 31, 2018, Foxtrot Co. would report:

A) Income (loss) on its total operations for the year without separation.

B) Income (loss) on its continuing operation only.

C) Income (loss) from its continuing and discontinued operations separately.

D) Income and gains separately from losses.

• The Footwear Division qualifies as a component of the entity according to GAAP

Regarding discontinued operations.

• The book value of Footwear's assets totaled $48 million on the date of the sale.

• Footwear's operating income was a pre-tax loss of $10 million in 2018.

• Foxtrot's income tax rate is 40%.

-

In the income statement for the year ended December 31, 2018, Foxtrot Co. would report:

A) Income (loss) on its total operations for the year without separation.

B) Income (loss) on its continuing operation only.

C) Income (loss) from its continuing and discontinued operations separately.

D) Income and gains separately from losses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

46

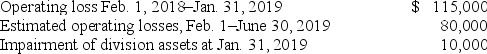

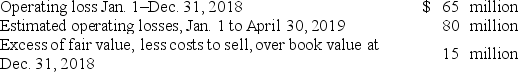

On November 1, 2018, Jamison Inc. adopted a plan to discontinue its barge division, which qualifies as a separate component of the business according to GAAP regarding discontinued operations. The disposal of the division was expected to be concluded by April 30, 2019. On December 31, 2018, the company's year-end, the following information relative to the discontinued division was accumulated:  In its income statement for the year ended December 31, 2018, Jamison would report a before-tax loss on discontinued operations of:

In its income statement for the year ended December 31, 2018, Jamison would report a before-tax loss on discontinued operations of:

A) $65 million.

B) $50 million.

C) $130 million.

D) $145 million.

In its income statement for the year ended December 31, 2018, Jamison would report a before-tax loss on discontinued operations of:

In its income statement for the year ended December 31, 2018, Jamison would report a before-tax loss on discontinued operations of:A) $65 million.

B) $50 million.

C) $130 million.

D) $145 million.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

47

The Claxton Company manufactures children's toys and also has a division that makes automobile parts. Due to a change in its strategic focus, the company sold the automobile parts division. The division qualifies as a component of the entity according to GAAP. How should Claxton report the sale in its 2018 income statement?

A) Report it as restructuring costs.

B) Report it as a discontinued operation.

C) Report the income or loss from operations of the division in discontinued operations.

D) Report it as a gain on sale of investments included in income from continuing operations.

A) Report it as restructuring costs.

B) Report it as a discontinued operation.

C) Report the income or loss from operations of the division in discontinued operations.

D) Report it as a gain on sale of investments included in income from continuing operations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

48

Temporary earnings are best characterized as:

A) earnings that do not have corresponding cash flows.

B) earnings from nonoperating activities.

C) earnings that do not conform to Generally Accepted Accounting Principles (GAAP).

D) earnings that arise from events that are not likely to recur in the foreseeable future.

A) earnings that do not have corresponding cash flows.

B) earnings from nonoperating activities.

C) earnings that do not conform to Generally Accepted Accounting Principles (GAAP).

D) earnings that arise from events that are not likely to recur in the foreseeable future.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

49

The distinction between operating and nonoperating income relates to:

A) continuity of income.

B) primary activities of the reporting entity.

C) consistency of income stream.

D) reliability of measurements.

A) continuity of income.

B) primary activities of the reporting entity.

C) consistency of income stream.

D) reliability of measurements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

50

On May 1, Foxtrot Co. agreed to sell the assets of its Footwear Division to Albanese Inc. for $80 million. The sale was completed on December 31, 2018. The following additional facts pertain to the transaction:

• The Footwear Division qualifies as a component of the entity according to GAAP

Regarding discontinued operations.

• The book value of Footwear's assets totaled $48 million on the date of the sale.

• Footwear's operating income was a pre-tax loss of $10 million in 2018.

• Foxtrot's income tax rate is 40%.

-

Suppose that the Footwear Division's assets had not been sold by December 31, 2018, but were considered held for sale. Assume that the fair value of these assets was $40 million at December 31, 2018. In the income statement for the year ended December 31, 2018, Foxtrot Co. would report discontinued operations of a:

A) $3 million loss.

B) $10 million loss.

C) $10.8 million loss.

D) $18 million loss.

• The Footwear Division qualifies as a component of the entity according to GAAP

Regarding discontinued operations.

• The book value of Footwear's assets totaled $48 million on the date of the sale.

• Footwear's operating income was a pre-tax loss of $10 million in 2018.

• Foxtrot's income tax rate is 40%.

-

Suppose that the Footwear Division's assets had not been sold by December 31, 2018, but were considered held for sale. Assume that the fair value of these assets was $40 million at December 31, 2018. In the income statement for the year ended December 31, 2018, Foxtrot Co. would report discontinued operations of a:

A) $3 million loss.

B) $10 million loss.

C) $10.8 million loss.

D) $18 million loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

51

A common component of income excluded from the calculation of non-GAAP earnings is:

A) Interest expense.

B) Income tax expense.

C) Cost of goods sold.

D) Restructuring costs.

A) Interest expense.

B) Income tax expense.

C) Cost of goods sold.

D) Restructuring costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

52

On May 1, Foxtrot Co. agreed to sell the assets of its Footwear Division to Albanese Inc. for $80 million. The sale was completed on December 31, 2018. The following additional facts pertain to the transaction:

• The Footwear Division qualifies as a component of the entity according to GAAP

Regarding discontinued operations.

• The book value of Footwear's assets totaled $48 million on the date of the sale.

• Footwear's operating income was a pre-tax loss of $10 million in 2018.

• Foxtrot's income tax rate is 40%.

-

In the income statement for the year ended December 31, 2018, Foxtrot Co. would report income from discontinued operations of:

A) $9.2 million.

B) $13.2 million.

C) $22 million.

D) $26 million.

• The Footwear Division qualifies as a component of the entity according to GAAP

Regarding discontinued operations.

• The book value of Footwear's assets totaled $48 million on the date of the sale.

• Footwear's operating income was a pre-tax loss of $10 million in 2018.

• Foxtrot's income tax rate is 40%.

-

In the income statement for the year ended December 31, 2018, Foxtrot Co. would report income from discontinued operations of:

A) $9.2 million.

B) $13.2 million.

C) $22 million.

D) $26 million.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

53

Restructuring costs typically can be defined as:

A) costs of external financing through issuance of debt or equity securities.

B) costs associated safeguarding a company's assets and ensuring accuracy of financial reporting.

C) costs associated with management's plans to materially change the scope of business operations or the manner in which they are conducted.

D) costs of expenditures made on capital projects and executive compensation.

A) costs of external financing through issuance of debt or equity securities.

B) costs associated safeguarding a company's assets and ensuring accuracy of financial reporting.

C) costs associated with management's plans to materially change the scope of business operations or the manner in which they are conducted.

D) costs of expenditures made on capital projects and executive compensation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

54

A company reports the following amounts at the end of the current year:  Under normal circumstances (ignoring tax effects), permanent earnings would be computed as:

Under normal circumstances (ignoring tax effects), permanent earnings would be computed as:

A) $90,000.

B) $110,000.

C) $80,000.

D) $50,000.

Under normal circumstances (ignoring tax effects), permanent earnings would be computed as:

Under normal circumstances (ignoring tax effects), permanent earnings would be computed as:A) $90,000.

B) $110,000.

C) $80,000.

D) $50,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

55

On October 28, 2018, Mercedes Company committed to a plan to sell a division that qualified as a component of the entity according to GAAP regarding discontinued operations and was properly classified as held for sale on December 31, 2018, the end of the company's fiscal year. The division's loss from operations for 2018 was $2,000,000. The division's book value and fair value less cost to sell on December 31 were $3,000,000 and $3,500,000, respectively. What before-tax amount(s) should Mercedes report as loss on discontinued operations in its 2018 income statement?

A) $2,000,000 loss.

B) $2,500,000 loss.

C) No loss would be reported.

D) $500,000 gain included in continuing operations and a $2,000,000 loss from discontinued operations.

A) $2,000,000 loss.

B) $2,500,000 loss.

C) No loss would be reported.

D) $500,000 gain included in continuing operations and a $2,000,000 loss from discontinued operations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

56

On October 28, 2018, Mercedes Company committed to a plan to sell a division that qualified as a component of the entity according to GAAP regarding discontinued operations and was properly classified as held for sale on December 31, 2018, the end of the company's fiscal year. The division's loss from operations for 2018 was $2,000,000. The division's book value and fair value less cost to sell on December 31 were $3,000,000 and $2,500,000, respectively. What before-tax amount(s) should Mercedes report as loss on discontinued operations in its 2018 income statement?

A) $2,000,000 loss.

B) $2,500,000 loss.

C) No loss would be reported.

D) $500,000 impairment loss included in continuing operations and a $2,000,000 loss from discontinued operations.

A) $2,000,000 loss.

B) $2,500,000 loss.

C) No loss would be reported.

D) $500,000 impairment loss included in continuing operations and a $2,000,000 loss from discontinued operations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

57

Howard Co.'s 2018 income from continuing operations before income taxes was $280,000. Howard Co. reported before-tax income on discontinued operations of $50,000. All tax items are subject to a 40% tax rate. In its income statement for 2018, Howard Co. would show the following line-item amounts for income tax expense and net income:

A) $112,000 and $198,000 respectively.

B) $92,000 and $230,000 respectively.

C) $132,000 and $330,000 respectively.

D) $79,000 and $198,000 respectively.

A) $112,000 and $198,000 respectively.

B) $92,000 and $230,000 respectively.

C) $132,000 and $330,000 respectively.

D) $79,000 and $198,000 respectively.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

58

On May 1, Foxtrot Co. agreed to sell the assets of its Footwear Division to Albanese Inc. for $80 million. The sale was completed on December 31, 2018. The following additional facts pertain to the transaction:

• The Footwear Division qualifies as a component of the entity according to GAAP

Regarding discontinued operations.

• The book value of Footwear's assets totaled $48 million on the date of the sale.

• Footwear's operating income was a pre-tax loss of $10 million in 2018.

• Foxtrot's income tax rate is 40%.

-

In the income statement for the year ended December 31, 2018, Foxtrot Co. would report:

A) All income taxes combined into one line item.

B) Income taxes separated for continuing and discontinued operations.

C) Income taxes reported for income and gains only.

D) None of these answer choices are correct.

• The Footwear Division qualifies as a component of the entity according to GAAP

Regarding discontinued operations.

• The book value of Footwear's assets totaled $48 million on the date of the sale.

• Footwear's operating income was a pre-tax loss of $10 million in 2018.

• Foxtrot's income tax rate is 40%.

-

In the income statement for the year ended December 31, 2018, Foxtrot Co. would report:

A) All income taxes combined into one line item.

B) Income taxes separated for continuing and discontinued operations.

C) Income taxes reported for income and gains only.

D) None of these answer choices are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

59

Major Co. reported 2018 income of $300,000 from continuing operations before income taxes and a before-tax loss on discontinued operations of $80,000. All income is subject to a 30% tax rate. In the income statement for the year ended December 31, 2018, Major Co. would show the following line-item amounts for income tax expense and net income:

A) $66,000 and $210,000 respectively.

B) $90,000 and $154,000 respectively.

C) $90,000 and $276,000 respectively.

D) $66,000 and $220,000 respectively.

A) $66,000 and $210,000 respectively.

B) $90,000 and $154,000 respectively.

C) $90,000 and $276,000 respectively.

D) $66,000 and $220,000 respectively.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

60

On May 1, Foxtrot Co. agreed to sell the assets of its Footwear Division to Albanese Inc. for $80 million. The sale was completed on December 31, 2018. The following additional facts pertain to the transaction:

• The Footwear Division qualifies as a component of the entity according to GAAP

Regarding discontinued operations.

• The book value of Footwear's assets totaled $48 million on the date of the sale.

• Footwear's operating income was a pre-tax loss of $10 million in 2018.

• Foxtrot's income tax rate is 40%.

-

Suppose that the Footwear Division's assets had not been sold by December 31, 2018, but were considered held for sale. Assume that the fair value of these assets was $80 million at December 31, 2018. In the income statement for the year ended December 31, 2018, Foxtrot Co., would report discontinued operations of a:

A) $6 million loss.

B) $10 million loss.

C) $13.2 million income.

D) None of these answer choices are correct.

• The Footwear Division qualifies as a component of the entity according to GAAP

Regarding discontinued operations.

• The book value of Footwear's assets totaled $48 million on the date of the sale.

• Footwear's operating income was a pre-tax loss of $10 million in 2018.

• Foxtrot's income tax rate is 40%.

-

Suppose that the Footwear Division's assets had not been sold by December 31, 2018, but were considered held for sale. Assume that the fair value of these assets was $80 million at December 31, 2018. In the income statement for the year ended December 31, 2018, Foxtrot Co., would report discontinued operations of a:

A) $6 million loss.

B) $10 million loss.

C) $13.2 million income.

D) None of these answer choices are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

61

Each of the following would be reported as items of other comprehensive income except:

A) foreign currency translation adjustments.

B) net unrealized holding gains on investments.

C) deferred gains from derivatives.

D) gains from the sale of equipment.

A) foreign currency translation adjustments.

B) net unrealized holding gains on investments.

C) deferred gains from derivatives.

D) gains from the sale of equipment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

62

A change in accounting principle that is implemented using the retrospective approach includes:

A) implementing the change in the current period only and not adjusting for the cumulative effects on prior periods.

B) applying the new standard to the adoption period only and recording the cumulative adjustment for prior periods to the beginning balance of retained earnings.

C) restating financial statements of all periods presented as if the new standard had been used in those periods.

D) not accounting for the change in the current period or prior periods.

A) implementing the change in the current period only and not adjusting for the cumulative effects on prior periods.

B) applying the new standard to the adoption period only and recording the cumulative adjustment for prior periods to the beginning balance of retained earnings.

C) restating financial statements of all periods presented as if the new standard had been used in those periods.

D) not accounting for the change in the current period or prior periods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

63

Comprehensive income is the change in equity from:

A) Owner transactions.

B) Nonowner transactions.

C) Owner or nonowner transactions.

D) Capital transactions.

A) Owner transactions.

B) Nonowner transactions.

C) Owner or nonowner transactions.

D) Capital transactions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

64

Which of the following is not true about EPS?

A) It must be reported by all corporations whose stock is publicly traded.

B) It must be reported separately for discontinued operations.

C) It must be reported on operating income.

D) None of these answer choices are correct.

A) It must be reported by all corporations whose stock is publicly traded.

B) It must be reported separately for discontinued operations.

C) It must be reported on operating income.

D) None of these answer choices are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

65

The statement of cash flows reports cash flows from the activities of:

A) operating, purchasing, and investing.

B) borrowing, paying, and investing.

C) financing, investing, and operating.

D) using, investing, and financing.

A) operating, purchasing, and investing.

B) borrowing, paying, and investing.

C) financing, investing, and operating.

D) using, investing, and financing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

66

In comparing the direct method with the indirect method of preparing the statement of cash flows:

A) only operating activities are presented differently.

B) only investing activities are presented differently.

C) only financing activities are presented differently.

D) all activities are presented differently.

A) only operating activities are presented differently.

B) only investing activities are presented differently.

C) only financing activities are presented differently.

D) all activities are presented differently.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

67

Changes in estimates are accounted for using which approach?

A) Prospective.

B) Retrospective.

C) Modified retrospective.

D) Modified prospective.

A) Prospective.

B) Retrospective.

C) Modified retrospective.

D) Modified prospective.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

68

Operating cash outflows would include:

A) Purchase of investments.

B) Purchase of equipment.

C) Payment of cash dividends.

D) Purchases of inventory.

A) Purchase of investments.

B) Purchase of equipment.

C) Payment of cash dividends.

D) Purchases of inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

69

For the statement of cash flows, short-term Treasury bills would be included as:

A) Operating activities.

B) Investing activities.

C) Financing activities.

D) Cash equivalents.

A) Operating activities.

B) Investing activities.

C) Financing activities.

D) Cash equivalents.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

70

The Maytag Corporation's income statement includes income from continuing operations and a loss on discontinued operations. Earnings per share information would be provided for:

A) net income only.

B) income from continuing operations and net income only.

C) income from continuing operations, loss on discontinued operations, and net income only.

D) none of these answer choices are correct.

A) net income only.

B) income from continuing operations and net income only.

C) income from continuing operations, loss on discontinued operations, and net income only.

D) none of these answer choices are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

71

A change in accounting principle that is implemented using the modified retrospective approach includes:

A) implementing the change in the current period only and not adjusting for the cumulative effects on prior periods.

B) applying the new standard to the adoption period only, and recording the cumulative adjustment for prior periods to the current period's beginning balance of retained earnings.

C) restating financial statements of all periods presented as if the new standard had been used in those periods.

D) not accounting for the change in the current period or prior periods.

A) implementing the change in the current period only and not adjusting for the cumulative effects on prior periods.

B) applying the new standard to the adoption period only, and recording the cumulative adjustment for prior periods to the current period's beginning balance of retained earnings.

C) restating financial statements of all periods presented as if the new standard had been used in those periods.

D) not accounting for the change in the current period or prior periods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

72

Reporting comprehensive income according to International Financial Reporting Standards (IFRS) can be accomplished by each of the following methods except:

A) in the statement of shareholders' equity.

B) a combined statement of income and comprehensive income.

C) in two separate statements.

D) the entity may choose either a combined statement of income and comprehensive income or two separate statements.

A) in the statement of shareholders' equity.

B) a combined statement of income and comprehensive income.

C) in two separate statements.

D) the entity may choose either a combined statement of income and comprehensive income or two separate statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

73

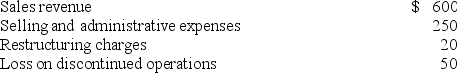

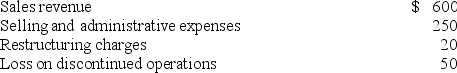

Misty Company reported the following before-tax items during the current year:

-Misty's effective tax rate is 40%. What is Misty's income from continuing operations?

A) $198.

B) $210.

C) $330.

D) $360.

-Misty's effective tax rate is 40%. What is Misty's income from continuing operations?

A) $198.

B) $210.

C) $330.

D) $360.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

74

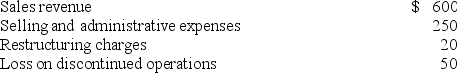

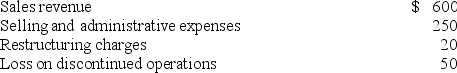

Cendant Corporation's results for the year ended December 31, 2018, include the following material items:  Cendant Corporation's income from continuing operations before income taxes for 2018 is:

Cendant Corporation's income from continuing operations before income taxes for 2018 is:

A) $900,000.

B) $880,000.

C) $820,000

D) $320,000.

Cendant Corporation's income from continuing operations before income taxes for 2018 is:

Cendant Corporation's income from continuing operations before income taxes for 2018 is:A) $900,000.

B) $880,000.

C) $820,000

D) $320,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

75

Operating cash flows would not include:

A) Interest received.

B) Interest paid.

C) Dividends paid.

D) Dividends received.

A) Interest received.

B) Interest paid.

C) Dividends paid.

D) Dividends received.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

76

Misty Company reported the following before-tax items during the current year:

-Misty's effective tax rate is 40%. What is Misty's net income for the current year?

A) $148.

B) $168.

C) $112.

D) None of these answer choices are correct.

-Misty's effective tax rate is 40%. What is Misty's net income for the current year?

A) $148.

B) $168.

C) $112.

D) None of these answer choices are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

77

When a material error is discovered in prior financial statements:

A) prior financial statements are restated to their correct amounts.

B) assets and liabilities in the current period are restated to their appropriate levels.

C) prior income effects are adjusted to the current period's beginning balance of retained earnings.

D) all of these answer choices are correct.

A) prior financial statements are restated to their correct amounts.

B) assets and liabilities in the current period are restated to their appropriate levels.

C) prior income effects are adjusted to the current period's beginning balance of retained earnings.

D) all of these answer choices are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

78

Reporting comprehensive income can be accomplished by each of the following methods except:

A) in the statement of shareholders' equity.

B) a single, continuous statement of comprehensive income.

C) in two separate, but consecutive statements.

D) all of these answer choices are acceptable methods.

A) in the statement of shareholders' equity.

B) a single, continuous statement of comprehensive income.

C) in two separate, but consecutive statements.

D) all of these answer choices are acceptable methods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

79

Change statements include a:

A) retained earnings statement, balance sheet, and cash flow statement.

B) balance sheet, cash flow statement, and income statement.

C) cash flow statement, income statement, and retained earnings statement.

D) retained earnings statement, balance sheet, and income statement.

A) retained earnings statement, balance sheet, and cash flow statement.

B) balance sheet, cash flow statement, and income statement.

C) cash flow statement, income statement, and retained earnings statement.

D) retained earnings statement, balance sheet, and income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

80

Reconciliation between net income and comprehensive income would include:

A) unrealized holding losses but not unrealized holding gains on investments.

B) unrealized holding gains but not unrealized holding losses on investments.

C) unrealized holding losses and unrealized holding gains on investments.

D) neither unrealized holding losses nor unrealized holding gains on investments.

A) unrealized holding losses but not unrealized holding gains on investments.

B) unrealized holding gains but not unrealized holding losses on investments.

C) unrealized holding losses and unrealized holding gains on investments.

D) neither unrealized holding losses nor unrealized holding gains on investments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck