Deck 6: Analyzing Operating Activities

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/83

العب

ملء الشاشة (f)

Deck 6: Analyzing Operating Activities

1

If a company that normally expenses advertising costs was to capitalize and amortize these costs over 3 years instead:

A) after the third year net income would always be higher if it is capitalized.

B) after the third year net income would always be lower if it is capitalized.

C) after the third year net income would be higher (if it is capitalized) only if advertising costs were increasing.

D) after the third year net income would be lower (if it is capitalized) only if advertising costs were increasing.

A) after the third year net income would always be higher if it is capitalized.

B) after the third year net income would always be lower if it is capitalized.

C) after the third year net income would be higher (if it is capitalized) only if advertising costs were increasing.

D) after the third year net income would be lower (if it is capitalized) only if advertising costs were increasing.

C

2

The following information was extracted from Smurm Corporation's 2006 annual report:

-Diluted earnings per share for 2006 was:

A) $3.52

B) $3.07

C) $2.00

D) $2.03

Tecktroniks Company reported in its annual report software refinement expenses of $12M, 15M and 18M for fiscal years 2005, 2006 and 2007, respectively. At the end of fiscal 2007, it had total assets of 140M. Net income was 20M for fiscal 2007, and it had a marginal tax rate of 35%.

-Diluted earnings per share for 2006 was:

A) $3.52

B) $3.07

C) $2.00

D) $2.03

Tecktroniks Company reported in its annual report software refinement expenses of $12M, 15M and 18M for fiscal years 2005, 2006 and 2007, respectively. At the end of fiscal 2007, it had total assets of 140M. Net income was 20M for fiscal 2007, and it had a marginal tax rate of 35%.

$3.07

3

The following information was extracted from Smurm Corporation's 2006 annual report:

-If software refinement had been capitalized each year and amortized over a three-year period beginning in the year the cost was incurred, total assets at the end of fiscal 2007 would have been:

A) $185M

B) $172M

C) $158M

D) $157M

-If software refinement had been capitalized each year and amortized over a three-year period beginning in the year the cost was incurred, total assets at the end of fiscal 2007 would have been:

A) $185M

B) $172M

C) $158M

D) $157M

$157M

4

If the software refinement had been capitalized and amortized over a three year period beginning in the year the cost was incurred, but was expensed for tax purposes, the deferred tax position at the end of fiscal 2005 would have been:

A) A deferred tax credit of $2.8M

B) A deferred tax credit of $3.5M

C) A deferred tax credit of $5.2M

D) A deferred tax debit of $4M

A) A deferred tax credit of $2.8M

B) A deferred tax credit of $3.5M

C) A deferred tax credit of $5.2M

D) A deferred tax debit of $4M

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

5

Compared with companies that expense costs, firms that capitalize costs can be expected to report:

A) higher asset levels and lower equity levels.

B) higher asset levels and higher equity levels.

C) lower asset levels and higher equity levels.

D) lower asset levels and lower equity levels.

A) higher asset levels and lower equity levels.

B) higher asset levels and higher equity levels.

C) lower asset levels and higher equity levels.

D) lower asset levels and lower equity levels.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

6

Which of the following is not a reason for economic income and accounting income to differ?

A) Transaction basis

B) The monetary assumption

C) Conservatism

D) Earnings management

A) Transaction basis

B) The monetary assumption

C) Conservatism

D) Earnings management

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

7

Which of the following combinations of accounting practices will lead to the highest reported earnings in an inflationary environment?

A) Choice A

B) Choice B

C) Choice C

D) Choice D

A) Choice A

B) Choice B

C) Choice C

D) Choice D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

8

The following information was extracted from Smurm Corporation's 2006 annual report:

-Basic earnings per share for 2006 was:

A) $3.50

B) $3.16

C) $3.08

D) $3.00

-Basic earnings per share for 2006 was:

A) $3.50

B) $3.16

C) $3.08

D) $3.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

9

Two growing firms are identical except that one firm capitalizes whereas the other firm expenses costs for long-lived resources over time. For these two firms, which of the following statements is generally true?

I) The expensing firm will show a more volatile pattern of reported income than capitalizing firm.

II) The expensing firm will show a less volatile pattern of return on assets than the capitalizing firm.

III) The expensing firm will show lower cash flows from operations than the capitalizing firm.

A) I only

B) II only

C) I and III only

D) II and III only

I) The expensing firm will show a more volatile pattern of reported income than capitalizing firm.

II) The expensing firm will show a less volatile pattern of return on assets than the capitalizing firm.

III) The expensing firm will show lower cash flows from operations than the capitalizing firm.

A) I only

B) II only

C) I and III only

D) II and III only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

10

The following information was extracted from Smurm Corporation's 2006 annual report:

-Using the treasury stock method, the options would result in how many extra shares being recognized in the diluted EPS calculation:

A) 500,000

B) 358,975

C) 333,333

D) 285,714

-Using the treasury stock method, the options would result in how many extra shares being recognized in the diluted EPS calculation:

A) 500,000

B) 358,975

C) 333,333

D) 285,714

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

11

Differences in taxable income and pretax accounting income that will not be offset by corresponding differences or "turn around" in future periods are called:

A) timing differences.

B) circular differences.

C) permanent differences.

D) reverse differences.

A) timing differences.

B) circular differences.

C) permanent differences.

D) reverse differences.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

12

According to FASB, initial franchise fees should be recognized as income when:

A) the franchiser has substantially performed or satisfied all material services and conditions.

B) the franchiser has collected the majority of fee in cash.

C) the franchisee shows the ability to pay the fee.

D) the franchiser bills the franchisee.

A) the franchiser has substantially performed or satisfied all material services and conditions.

B) the franchiser has collected the majority of fee in cash.

C) the franchisee shows the ability to pay the fee.

D) the franchiser bills the franchisee.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

13

Hurik Company reports the following Based upon this information which of the following is most correct:

A) Cost of goods sold is a permanent cost.

B) Cost of goods sold is an economic cost.

C) Cost of goods sold is a totally variable cost.

D) Cost of goods sold is a period expense.

A) Cost of goods sold is a permanent cost.

B) Cost of goods sold is an economic cost.

C) Cost of goods sold is a totally variable cost.

D) Cost of goods sold is a period expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

14

Which of the following are correct?

I) If a company uses straight-line depreciation for financial reporting purposes, it is very likely they have a deferred tax liability with respect to its depreciable assets.

II) Straight line depreciation yields an increasing rate of return on book value over the life of asset.

III) Straight line depreciation results in lower tax payments than accelerated depreciation methods over the life of an asset.

IV) If a company revises its estimate of the useful life of an asset upwards this will decrease annual depreciation expense.

A) I, II, III and IV

B) I, II and IV

C) I, II and III

D) I and IV

I) If a company uses straight-line depreciation for financial reporting purposes, it is very likely they have a deferred tax liability with respect to its depreciable assets.

II) Straight line depreciation yields an increasing rate of return on book value over the life of asset.

III) Straight line depreciation results in lower tax payments than accelerated depreciation methods over the life of an asset.

IV) If a company revises its estimate of the useful life of an asset upwards this will decrease annual depreciation expense.

A) I, II, III and IV

B) I, II and IV

C) I, II and III

D) I and IV

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

15

Brierton Company enters a contract at the beginning of year 1 to build a new federal courthouse for a price of $16 million. Brierton estimates that total cost of the project will be $12 million, and will take four years to complete.

-If Brierton used percentage-of-completion method to account for this project, what would they have reported as profit in year 2?

A) $ 0

B) $ 1.333M

C) $ 1.5M

D) $ 0.667M

-If Brierton used percentage-of-completion method to account for this project, what would they have reported as profit in year 2?

A) $ 0

B) $ 1.333M

C) $ 1.5M

D) $ 0.667M

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

16

Which of the following statements concerning deferred taxes is correct?

A) Deferred taxes will not be found in asset section of the balance sheet.

B) Deferred taxes arise from permanent differences in GAAP and tax accounting.

C) Deferred taxes will only decrease when a cash payment is made.

D) Deferred taxes arising from the depreciation of a specific asset will ultimately reduce to zero as the item is depreciated.

A) Deferred taxes will not be found in asset section of the balance sheet.

B) Deferred taxes arise from permanent differences in GAAP and tax accounting.

C) Deferred taxes will only decrease when a cash payment is made.

D) Deferred taxes arising from the depreciation of a specific asset will ultimately reduce to zero as the item is depreciated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

17

As a general rule, revenue is normally recognized when it is:

A) measurable and earned.

B) measurable and received.

C) realizable and earned.

D) realizable.

A) measurable and earned.

B) measurable and received.

C) realizable and earned.

D) realizable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

18

The following information was extracted from Smurm Corporation's 2006 annual report:

-If software refinement had been capitalized each year and amortized over a three year period beginning in the year the cost was incurred, net income for fiscal 2007 would have been:

A) $31.7M

B) $29.75M

C) $21.95M

D) $14.95M

-If software refinement had been capitalized each year and amortized over a three year period beginning in the year the cost was incurred, net income for fiscal 2007 would have been:

A) $31.7M

B) $29.75M

C) $21.95M

D) $14.95M

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

19

Which of the following measures of accounting income is typically reported in an income statement?

A) Net income

B) Comprehensive income

C) Continuing income

D) All of the above

A) Net income

B) Comprehensive income

C) Continuing income

D) All of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

20

Brierton Company enters a contract at the beginning of year 1 to build a new federal courthouse for a price of $16 million. Brierton estimates that total cost of the project will be $12 million, and will take four years to complete.

-If Brierton used cash accounting to account for this project, what would they have reported as profit (loss) in year 2?

A) $ 0

B) $ 1.333M

C) $ (2M)

D) $ (4M)

-If Brierton used cash accounting to account for this project, what would they have reported as profit (loss) in year 2?

A) $ 0

B) $ 1.333M

C) $ (2M)

D) $ (4M)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

21

The capitalization of interest cost during construction:

A) increases future net income.

B) decreases future depreciation expense.

C) increases net income during construction phase.

D) decreases assets during construction phase.

A) increases future net income.

B) decreases future depreciation expense.

C) increases net income during construction phase.

D) decreases assets during construction phase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

22

Exoil recorded an expense and corresponding liability to recognize potential losses relating to an oil spill in 2006 of $10 million. Its net income for the year was $200 million. It was not able to take a deduction for tax purposes until later years when it actually paid cash out in relation to this event. In 2006, with respect to this, Exoil would have:

A) recognized a deferred tax liability.

B) recognized a tax loss carryforward.

C) recognized a deferred tax asset.

D) recognized a deferred equity loss.

A) recognized a deferred tax liability.

B) recognized a tax loss carryforward.

C) recognized a deferred tax asset.

D) recognized a deferred equity loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

23

A company changes its depreciation method from an accelerated system to straight line. Which of the following would normally be true?

I) The change would be discussed in the auditor's letter.

II) The cumulative effect of the change would appear net of tax on the income statement.

III) The change would appear in cash flow from operations as a cash inflow.

IV) The change would be mentioned in the footnotes.

A) I, II, III and IV

B) I, II and III

C) II and IV

D) I, II and IV

I) The change would be discussed in the auditor's letter.

II) The cumulative effect of the change would appear net of tax on the income statement.

III) The change would appear in cash flow from operations as a cash inflow.

IV) The change would be mentioned in the footnotes.

A) I, II, III and IV

B) I, II and III

C) II and IV

D) I, II and IV

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

24

Which of the following is true with respect to extraordinary items?

I) Extraordinary items are recorded net of tax in income statement.

II) Extraordinary items, by definition, are probable and unusual in nature.

III) By definition, gains and losses from strikes are always extraordinary.

IV) By definition, gains and losses from sale of plant, property and equipment are never extraordinary.

A) I and IV

B) I, III and IV

C) II and IV

D) I, II and III

I) Extraordinary items are recorded net of tax in income statement.

II) Extraordinary items, by definition, are probable and unusual in nature.

III) By definition, gains and losses from strikes are always extraordinary.

IV) By definition, gains and losses from sale of plant, property and equipment are never extraordinary.

A) I and IV

B) I, III and IV

C) II and IV

D) I, II and III

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

25

Which of the following items is not included in the calculation of net income but is included in the calculation of comprehensive income?

A) Unrealized holding gain on available-for-sale marketable securities.

B) Unrealized holding gain on trading marketable securities.

C) Gain from early extinguishments of bonds.

D) Gain arising from sale of available-for-sale marketable securities.

A) Unrealized holding gain on available-for-sale marketable securities.

B) Unrealized holding gain on trading marketable securities.

C) Gain from early extinguishments of bonds.

D) Gain arising from sale of available-for-sale marketable securities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

26

Windsor Company has net temporary differences between tax and book accounting of $80 million, resulting in a deferred tax liability of $28 million. An increase in the tax rate would have the following impact on deferred taxes and net income:

A) Choice A

B) Choice B

C) Choice C

D) Choice D

A) Choice A

B) Choice B

C) Choice C

D) Choice D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

27

Which of the following would be considered an extraordinary item?

I) Write-down of receivables

II) Gains on disposal of a business segment

III) Loss of inventory resulting from a fire

IV) Loss resulting from a strike

A) I and IV

B) I, III and IV

C) III only

D) I, II and III

I) Write-down of receivables

II) Gains on disposal of a business segment

III) Loss of inventory resulting from a fire

IV) Loss resulting from a strike

A) I and IV

B) I, III and IV

C) III only

D) I, II and III

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

28

When comparing expensing or capitalizing (with straight-line depreciation) software, return on assets

A) will decrease over time using capitalization.

B) will increase over time using capitalization.

C) will be constant using expensing.

D) will initially be higher under expensing.

A) will decrease over time using capitalization.

B) will increase over time using capitalization.

C) will be constant using expensing.

D) will initially be higher under expensing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

29

Which of the following is not an extraordinary item?

I) Loss on abandonment of property

II) Gain on disposal of a business segment

III) Effect of a strike against a key supplier

IV) Write-down of deferred research and development costs

A) I and III

B) II and IV

C) I, II and III

D) I, II, III and IV

I) Loss on abandonment of property

II) Gain on disposal of a business segment

III) Effect of a strike against a key supplier

IV) Write-down of deferred research and development costs

A) I and III

B) II and IV

C) I, II and III

D) I, II, III and IV

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

30

What will be the basic EPS if average stock price during the year is $15 and treasury shares that can be purchased are 6000?

A) $3

B) $6

C) $5

D) $4.17

A) $3

B) $6

C) $5

D) $4.17

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

31

Which of the following statements are correct?

I) Tax loss carrybacks result in deferred tax assets.

II) Tax loss carryforwards result in deferred tax assets.

III) The tax valuation account is used to adjust deferred tax liabilities if it is "more likely than not" that they will not result in increased future taxes.

A) I only

B) II only

C) III only

D) I and II

I) Tax loss carrybacks result in deferred tax assets.

II) Tax loss carryforwards result in deferred tax assets.

III) The tax valuation account is used to adjust deferred tax liabilities if it is "more likely than not" that they will not result in increased future taxes.

A) I only

B) II only

C) III only

D) I and II

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

32

Which of the following statements is incorrect? Employee stock options

A) are not recorded as an expense when granted if they are at or out-of-the money under the intrinsic value method.

B) will not affect the share price of the company when exercised.

C) may reduce agency costs by more closely aligning interests of stockholders and managers.

D) may increase the risk propensity of managers.

A company's net income is $100,000, and its weighted-average shares outstanding are 20,000. During the year, the company issues 5,000 ESOs at an exercise price of $20.

A) are not recorded as an expense when granted if they are at or out-of-the money under the intrinsic value method.

B) will not affect the share price of the company when exercised.

C) may reduce agency costs by more closely aligning interests of stockholders and managers.

D) may increase the risk propensity of managers.

A company's net income is $100,000, and its weighted-average shares outstanding are 20,000. During the year, the company issues 5,000 ESOs at an exercise price of $20.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

33

Which of the following statements is true? Under GAAP, comprehensive income:

A) may be reported in addition to net income.

B) must be reported in addition to net income.

C) may be reported instead of net income.

D) must be reported instead of net income.

A) may be reported in addition to net income.

B) must be reported in addition to net income.

C) may be reported instead of net income.

D) must be reported instead of net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

34

If a company changes the useful life of its assets from 10 years to 12 years, this will be recorded as:

A) a non-recurring gain.

B) an extraordinary item.

C) a change in accounting principle.

D) None of the above

A) a non-recurring gain.

B) an extraordinary item.

C) a change in accounting principle.

D) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

35

Which of the following will cause the reported effective tax rate to differ from the federal statutory tax rate?

I) Foreign tax rates that are lower than federal statutory tax rate.

II) Tax-exempt income.

III) Different depreciation methods for tax and financial reporting purposes.

IV) Foreign tax rates that are higher than federal statutory tax rate.

A) I, II, and IV

B) I, II and III

C) I and II

D) III only

I) Foreign tax rates that are lower than federal statutory tax rate.

II) Tax-exempt income.

III) Different depreciation methods for tax and financial reporting purposes.

IV) Foreign tax rates that are higher than federal statutory tax rate.

A) I, II, and IV

B) I, II and III

C) I and II

D) III only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

36

Which of the following overall accounting concepts has a number of exceptions under GAAP?

A) Historical cost

B) Transaction basis

C) Conservatism

D) Accrual accounting

A) Historical cost

B) Transaction basis

C) Conservatism

D) Accrual accounting

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

37

What will be the basic EPS if average stock price during the year is $35 and treasury shares that can be purchased are 1000?

A) $3

B) $6

C) $5

D) $4.17

A) $3

B) $6

C) $5

D) $4.17

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

38

If a company estimates that its expected return on pension plan assets will increase to 9.5% from 9.0%, this would be considered:

A) an extraordinary gain.

B) a change in accounting principle.

C) a prior period adjustment.

D) a change in accounting estimate.

A) an extraordinary gain.

B) a change in accounting principle.

C) a prior period adjustment.

D) a change in accounting estimate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

39

What will be the diluted EPS if average stock price during the year is $15 and treasury shares that can be purchased are 6000?

A) $3

B) $5

C) $6

D) $4.17

A) $3

B) $5

C) $6

D) $4.17

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

40

What will be the diluted EPS if average stock price during the year is $35 and treasury shares that can be purchased are 1000?

A) $3

B) $5

C) $6

D) $4.17

A) $3

B) $5

C) $6

D) $4.17

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

41

Economic income and accounting income are always the same.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

42

Accounting changes are usually cosmetic and do not yield cash flow consequences.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

43

The matching principle in accounting prescribes that costs must be recognized in the same period when the related revenues are recognized.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

44

Revenue from sales where the buyer has the right of return can only be recognized after the return period has expired.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

45

A long term asset is said to be impaired when its fair value is below its book value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

46

Gains are earned inflows that arise from the company's ongoing business activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

47

Generally revenue should be recorded when it is probable and reasonably estimable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

48

For item to be considered extraordinary, it should be either unusual in nature or infrequent in occurrence.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

49

For item to be considered a special item, it should be either unusual in nature or infrequent in occurrence but not both.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

50

Revenues are earned inflows that arise from the company's ongoing business activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

51

A company that capitalizes costs, rather than expensing them will have a higher asset turnover.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

52

Comprehensive income is computed by adjusting net income for dirty surplus items.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

53

One difference between revenues and gains is that gains arise from transactions that are incidental to the operations of the business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

54

Smythe Corporation is in the real estate development business. If they sell a piece of land for $50,000 that they had previously purchased for $45,000, they should record a loss of $5,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

55

The intrinsic value approach ignores two types of costs:

A) Interest cost and opportunity cost

B) Opportunity cost and exercise cost

C) Interest cost and option cost

D) Carrying cost and interest cost

True / False Questions

A) Interest cost and opportunity cost

B) Opportunity cost and exercise cost

C) Interest cost and option cost

D) Carrying cost and interest cost

True / False Questions

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

56

Software costs may be capitalized once a company can show that the product is technologically feasible.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

57

Under current accounting standards, gains and losses relating to the extinguishment of debt must be both unusual and infrequent to be classified as an extraordinary item, and debt refinancing does not typically meet these criteria.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

58

For companies in an expansion phase, capitalizing interest may result in higher earnings over an extended period of time as the amount of interest amortization will not catch up with the amount of interest capitalized in the current period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

59

The capitalization of interest costs during construction increases future net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

60

If two firms are identical except that one firm uses percentage-of-completion accounting and the other uses completed contract accounting for revenue recognition, the cash flows of the firms will be identical.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

61

Housing Construction Company (HCC) has agreed to build a housing project for the city of New York. On January 1st, 2006 the company and the city agreed on the following terms, the construction should take no more than 3 years, HCC would be paid a total of $150 million for the project; the $150 million would be paid: 3 payments of $50 million each at the end of year 2006, 2007 and 2008. HCC expects contractions costs to be $50 million in year 2006, $50 million in year 2007, and $10 million in year 2008.

a. If HCC uses the completed contract method, what revenues and expenses would HCC recognize in year 2006, 2007, and 2008?

b. If HCC uses the percentage of completion method, what revenues and expenses would HCC recognize in year 2006, 2007, and 2008?

c. Show the balance on the construction-in-process account at the end of 2006, 2007, and 2008 (prior to the completion of the project) using both the completed contract and the percentage of completion methods?

a. If HCC uses the completed contract method, what revenues and expenses would HCC recognize in year 2006, 2007, and 2008?

b. If HCC uses the percentage of completion method, what revenues and expenses would HCC recognize in year 2006, 2007, and 2008?

c. Show the balance on the construction-in-process account at the end of 2006, 2007, and 2008 (prior to the completion of the project) using both the completed contract and the percentage of completion methods?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

62

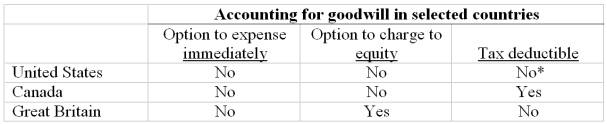

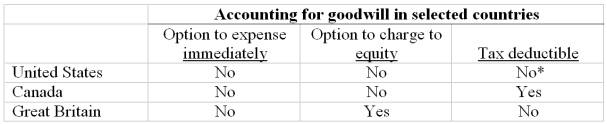

The table below shows the differences in accounting treatments for goodwill in three selected countries.

*Goodwill is tax deductible in the United States under limited circumstances, for the purposes of this question, assume it is not.

Given a company that has recognized significant acquisition goodwill, identify the country whose accounting and tax rules for goodwill would likely result in the highest valuation of the company. Justify and explain your answer.

*Goodwill is tax deductible in the United States under limited circumstances, for the purposes of this question, assume it is not.

Given a company that has recognized significant acquisition goodwill, identify the country whose accounting and tax rules for goodwill would likely result in the highest valuation of the company. Justify and explain your answer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

63

If revenue is recognized for financial reporting purposes but deferred for tax purposes this results in a deferred tax liability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

64

If an expense is recognized for financial reporting purposes but not allowed as a bona-fide deduction for tax purposes, this results in a deferred tax asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

65

A company that capitalizes rather than expenses software development costs, will have a less volatile net income, all other things equal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

66

Comprehensive income differs from net income in that it reflects certain unrealized holding gains and losses foreign currency translation adjustments, and minimum pension liability adjustments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

67

Deferred taxes arise due to temporary timing differences in recognizing items for tax and financial reporting purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

68

When a company disposes of a segment of its business, it must restate all prior year financial statements as if it had never owned that segment of the business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

69

R&D expenses for tangible assets that have alternative future uses qualify as deferred charges.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

70

If a company, operating in an inflationary environment, uses FIFO for tax purposes and weighted-average for financial reporting purposes, this will result in a deferred tax asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

71

Some items appear on a company's income statement but never appear on its tax return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

72

Extraordinary items are defined as those that are both unusual in nature and infrequent in occurrence. These items are disclosed, net of tax in the income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

73

In order to determine permanent income for the year being analyzed, it is necessary to consider special charges from other years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

74

Under long-term performance contracts-such as product warranty contracts and software maintenance contracts-revenues are often collected in advance and are recognized proportionally over the entire period of the contract.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

75

ESOs often are granted to managers in growth and innovative industries to induce more risk-taking.

Essay Questions

Essay Questions

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

76

Timing is one of the few revenue recognition issues that are seldom a concern in financial analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

77

If a company depreciates an asset at a faster rate for tax purposes than for financial reporting purposes this will give rise to a deferred tax liability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

78

Accounting errors are considered accounting changes and treated accordingly.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

79

Employee stock options (ESOs) usually constitute a wealth transfer from current shareholders to prospective shareholders (employees) and have no effect on total liabilities and shareholders' equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck

80

A deferred tax liability imposes an obligation on the business to pay taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 83 في هذه المجموعة.

فتح الحزمة

k this deck