Deck 17: Financing Land Development Projects Part Five Alternative Real Estate Financing and Investment Vehicles

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/31

العب

ملء الشاشة (f)

Deck 17: Financing Land Development Projects Part Five Alternative Real Estate Financing and Investment Vehicles

1

Usually,a lender does not require a developer to submit a schedule of estimated cash flows prior to approving a land development loan

False

2

It is illegal for the lender to hold back funds from the developer

False

3

The release price is the dollar amount of a loan that must be repaid when a lot is sold

True

4

The release schedule refers to a schedule of expiring leases for existing tenants

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

5

Which of the following is the MOST LIKELY sequence of events in the land development process?

A)Inspect site,perform feasibility analysis,implement marketing program,purchase land and begin construction of improvements

B)Inspect site,purchase land and begin construction of improvements,perform feasibility analysis,implement marketing program

C)Inspect site,perform feasibility analysis,purchase land and begin construction of improvements,implement marketing program

D)Purchase land,perform feasibility analysis,perform preliminary market study,begin construction of improvements,implement marketing program

A)Inspect site,perform feasibility analysis,implement marketing program,purchase land and begin construction of improvements

B)Inspect site,purchase land and begin construction of improvements,perform feasibility analysis,implement marketing program

C)Inspect site,perform feasibility analysis,purchase land and begin construction of improvements,implement marketing program

D)Purchase land,perform feasibility analysis,perform preliminary market study,begin construction of improvements,implement marketing program

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

6

An option contract does not preclude the landowner from selling the property to someone else after the expiration date

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

7

Option contracts are used to reserve a parcel of land so that it will not be sold to someone else,while the developer does preliminary analysis of the site

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

8

A developer must sell all of the lots in a development project and repay the entire development loan before any of the new property owners can receive a clear title

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

9

It is proper to include an estimate for developer profit as a cost of development when projecting net cash flows and evaluating whether a required rate of return will be met

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

10

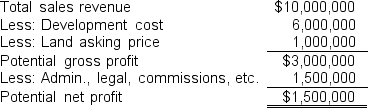

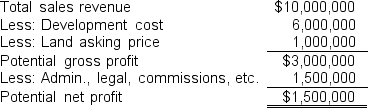

Consider the feasibility study shown in the table above.What is the return on total cost for the proposed project?

A)15.0%

B)17.6%

C)21.4%

D)150.0%

A)15.0%

B)17.6%

C)21.4%

D)150.0%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

11

It is common for a developer to hold back funds to be sure that subcontractors perform all work completely before making final payment

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

12

Generally,which of the following is FALSE regarding an option contract?

A)An option contract allows the developer to perform a preliminary market study and feasibility analysis

B)If the developer decides to purchase a property,the price of an option is applied towards the price of the property

C)If the developer decides not to purchase the property,the landowner will refund any money paid for the option

D)An option contract provides the developer with the assurance that a property will not be sold over the course of the option period

A)An option contract allows the developer to perform a preliminary market study and feasibility analysis

B)If the developer decides to purchase a property,the price of an option is applied towards the price of the property

C)If the developer decides not to purchase the property,the landowner will refund any money paid for the option

D)An option contract provides the developer with the assurance that a property will not be sold over the course of the option period

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

13

The land development industry is best characterized by which of the following statements?

A)The land development industry is dominated by relatively few national competitors

B)The land development industry is highly fragmented,localized,and extremely competitive

C)Land development and project development are synonymous

D)The production technologies and market risks involved in land development are essentially the same as those in project development

A)The land development industry is dominated by relatively few national competitors

B)The land development industry is highly fragmented,localized,and extremely competitive

C)Land development and project development are synonymous

D)The production technologies and market risks involved in land development are essentially the same as those in project development

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

14

By using an option contract,a developer may profit from an appreciation in the property's value over the option period

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

15

Lenders typically insist on a loan repayment rate that equal to the rate for which parcels are expected to sell

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

16

In most instances,a developer's repayment rate is set so that the development loan will be repaid at the exact point that 100% of total project revenue is realized

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

17

Refer to the information in the previous question.You have been advised that sales revenues may be 10 percent lower and/or development costs may be 10 percent higher.Performing a sensitivity analysis,you conclude:

A)A 10 percent decrease in sales revenues would have a bigger impact on returns than a 10 percent increase in development costs

B)A 10 percent increase in development costs would have a bigger impact on returns than a 10 percent decrease in sales revenues

C)A 10 percent increase in development costs and a 10 percent decrease in sales revenues would have opposite impacts on returns,canceling each other out and having no impact on returns

D)Both factors would have such a small impact,that there is no reason to be concerned about either a 10 percent increase in development costs or a 10 percent decrease in sales revenues

A)A 10 percent decrease in sales revenues would have a bigger impact on returns than a 10 percent increase in development costs

B)A 10 percent increase in development costs would have a bigger impact on returns than a 10 percent decrease in sales revenues

C)A 10 percent increase in development costs and a 10 percent decrease in sales revenues would have opposite impacts on returns,canceling each other out and having no impact on returns

D)Both factors would have such a small impact,that there is no reason to be concerned about either a 10 percent increase in development costs or a 10 percent decrease in sales revenues

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

18

In order to obtain a land development loan,the developer is required usually to purchase title insurance

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

19

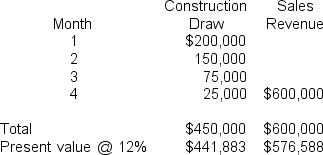

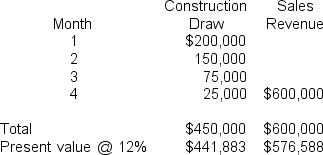

Consider the table above,which summarizes monthly construction draws and sales revenues.What is the percent of lot sales revenue that needs to be used to repay the loan?

A)4.0%

B)75.0%

C)76.6%

D)33.3%

A)4.0%

B)75.0%

C)76.6%

D)33.3%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

20

A feasibility study analyzes whether a tract can be purchased and developed profitably

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

21

An analysis of whether land can be purchased and developed profitably is known as:

A)Financial analysis

B)Feasibility study

C)Turnkey study

D)Project profitability

A)Financial analysis

B)Feasibility study

C)Turnkey study

D)Project profitability

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

22

When financing land development,the lender generally requires the developer to submit which of the following?

A)A detailed breakdown of project cost

B)Required zoning changes

C)Bank references for the general contractor to be used on the project

D)All of the above

A)A detailed breakdown of project cost

B)Required zoning changes

C)Bank references for the general contractor to be used on the project

D)All of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

23

Generally,which of the following is FALSE regarding interest rate risk management techniques?

A)Borrowers can protect themselves from upward movements in interest rates by using interest rate caps

B)Borrowers can protect themselves from upward movements in interest rates by using interest rate futures contracts

C)Borrowers can benefit from downward movements in interest rates by using interest rate caps

D)Borrowers can benefit from downward movements in interest rates by using interest rate futures contracts

A)Borrowers can protect themselves from upward movements in interest rates by using interest rate caps

B)Borrowers can protect themselves from upward movements in interest rates by using interest rate futures contracts

C)Borrowers can benefit from downward movements in interest rates by using interest rate caps

D)Borrowers can benefit from downward movements in interest rates by using interest rate futures contracts

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

24

A transaction in which two firms trade individual financing advantages to produce more favorable borrowing terms for each is know as an:

A)Interest rate swap

B)Sequential short hedge

C)Cross hedge

D)All of the above

A)Interest rate swap

B)Sequential short hedge

C)Cross hedge

D)All of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

25

The amount to be paid to the lender from each lot sale is included in the:

A)Release schedule

B)Development agreement

C)Cost breakdowns

D)Subcontracts

A)Release schedule

B)Development agreement

C)Cost breakdowns

D)Subcontracts

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

26

Which of the following costs should NOT be included in a net present value analysis of a land development project?

A)Land purchase price

B)Property tax

C)General overhead such as personnel costs

D)Developer's profit

A)Land purchase price

B)Property tax

C)General overhead such as personnel costs

D)Developer's profit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

27

Which of the following might impact the density of housing in a land development project?

A)The price paid for the land by the developer

B)The terrain of the land

C)The target market's preferences regarding density

D)All of the above

A)The price paid for the land by the developer

B)The terrain of the land

C)The target market's preferences regarding density

D)All of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

28

Each parcel of land in a new development is selling for $15,000 and the total project revenue is estimated to be $5,000,000.The project lender has stated that the loan should be paid off when 80% of the total project revenue has been earned.The total loan amount is $3,500,000.What is the release price for each parcel?

A)$8,400

B)$13,215

C)$18,750

D)None of the above

A)$8,400

B)$13,215

C)$18,750

D)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

29

Which of the following was NOT stated as contributing to the complication of estimating amount of interest carry?

A)The loan is drawn and interest is calculated on drawn amount

B)Revenue from each type of site varies

C)The rate of repayment of a loan depends on when the parcel is sold

D)Development loan interest rates are usually fixed while market rates fluctuate

A)The loan is drawn and interest is calculated on drawn amount

B)Revenue from each type of site varies

C)The rate of repayment of a loan depends on when the parcel is sold

D)Development loan interest rates are usually fixed while market rates fluctuate

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

30

A futures instrument,such as a T-bill,can be used to hedge a cash or a spot instrument such as the prime rate,where the two instruments are not perfectly correlated.What type of hedge is this referred to as?

A)A perfect hedge

B)A straight hedge

C)A cross hedge

D)None of the above

A)A perfect hedge

B)A straight hedge

C)A cross hedge

D)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

31

Which of the following is FALSE regarding the release price?

A)It is usually calculated to pay off the loan when the last lot is sold

B)It is usually calculated to pay off the loan before the last lot is sold

C)Increasing the release price usually lowers the lender's risk

D)Increasing the release price is likely to lower the investor's initial cash flow

A)It is usually calculated to pay off the loan when the last lot is sold

B)It is usually calculated to pay off the loan before the last lot is sold

C)Increasing the release price usually lowers the lender's risk

D)Increasing the release price is likely to lower the investor's initial cash flow

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck