Deck 10: Cash and Financial Investments

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/63

العب

ملء الشاشة (f)

Deck 10: Cash and Financial Investments

1

By preparing a four-column bank reconciliation ("proof of cash") at year-end, an auditor will generally be able to detect:

A) An unrecorded deposit made at the bank at the end of the month.

B) A second payment of an account payable which had already been paid in full two months earlier.

C) An embezzlement of cash receipts not recorded in the cash receipts journal before they had been deposited into the bank.

D) A receivable collected that had previously been written off as uncollectible.

A) An unrecorded deposit made at the bank at the end of the month.

B) A second payment of an account payable which had already been paid in full two months earlier.

C) An embezzlement of cash receipts not recorded in the cash receipts journal before they had been deposited into the bank.

D) A receivable collected that had previously been written off as uncollectible.

A

2

Signed checks should be returned to the cash disbursements clerk for mailing.

False

3

Your client left the cash receipts journal open after year-end for an extra day and included January 1 cash receipts in the 12/31/XX totals. All of those cash receipts were due to cash sales. Assuming the client uses a periodic inventory system with a 12/31/XX count of the physical inventory, which of the following is most likely to be true relating to the year XX financial statements?

A) Sales are understated.

B) Accounts receivable are understated.

C) Inventory is overstated.

D) Net income is overstated.

A) Sales are understated.

B) Accounts receivable are understated.

C) Inventory is overstated.

D) Net income is overstated.

D

4

Which of the following is correct concerning "window dressing" for cash?

A) A segregation of duties within the cash function effectively eliminates its occurrence.

B) It generally involves manipulation of inventory.

C) It is illegal, and an audit is designed to provide reasonable assurance of its detection.

D) Many forms of it require no action by the auditors.

A) A segregation of duties within the cash function effectively eliminates its occurrence.

B) It generally involves manipulation of inventory.

C) It is illegal, and an audit is designed to provide reasonable assurance of its detection.

D) Many forms of it require no action by the auditors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

5

Confirmations for cash balances should be mailed only to the financial institutions with which the client has a cash balance at year-end.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

6

An internal control questionnaire indicates that an approved receiving report is required to accompany every check request for payment of merchandise. Which of the following procedures provides the best evidence on operating effectiveness?

A) Select and examine receiving reports and test whether the related canceled checks are dated no earlier than the receiving reports.

B) Select and examine receiving reports and test whether the related canceled checks are dated no later than the receiving reports.

C) Select and examine canceled checks and test whether the related receiving reports are dated no earlier than the checks.

D) Select and examine canceled checks and test whether the related receiving reports are dated no later than the checks.

A) Select and examine receiving reports and test whether the related canceled checks are dated no earlier than the receiving reports.

B) Select and examine receiving reports and test whether the related canceled checks are dated no later than the receiving reports.

C) Select and examine canceled checks and test whether the related receiving reports are dated no earlier than the checks.

D) Select and examine canceled checks and test whether the related receiving reports are dated no later than the checks.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

7

Mailroom personnel of a company should prepare a control listing of incoming cash receipts and deposit them intact daily.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

8

Verification of cash and other liquid assets on the same date may prevent substitution of one form of asset for another.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

9

A compensating balance agreement always requires that cash be reclassified as a noncurrent asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

10

An auditor's analytical procedures have revealed that the accounts receivable of a client have doubled since the end of the prior year. However, the allowance for doubtful accounts, as a percentage of accounts receivable remained about the same. Which of the following client explanations most likely would satisfy the auditor?

A) Credit standards were liberalized in the current year.

B) Twice as many accounts receivable were written off in the prior year as compared to this year.

C) A greater percentage of accounts were currently listed in the "more than 90 days overdue" category than in the prior year.

D) The client opened a second retail outlet in the current year and its credit sales approximately equaled the older, established outlet.

A) Credit standards were liberalized in the current year.

B) Twice as many accounts receivable were written off in the prior year as compared to this year.

C) A greater percentage of accounts were currently listed in the "more than 90 days overdue" category than in the prior year.

D) The client opened a second retail outlet in the current year and its credit sales approximately equaled the older, established outlet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

11

Control over the receipt of cash sales is best achieved when two or more employees participate in each transaction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

12

By preparing a four-column bank reconciliation ("proof of cash") at year-end, an auditor will generally not be able to detect:

A) An unrecorded deposit made at the bank at the end of the month.

B) A second payment of an account payable which had already been paid in full two months earlier.

C) An unrecorded check cashed during that month.

D) A bank charge during the month not recorded on the books.

A) An unrecorded deposit made at the bank at the end of the month.

B) A second payment of an account payable which had already been paid in full two months earlier.

C) An unrecorded check cashed during that month.

D) A bank charge during the month not recorded on the books.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

13

Which procedure is an auditor most likely to use to detect a check outstanding at year-end that was not recorded as outstanding on the year-end bank reconciliation?

A) Prepare a bank transfer schedule using the client's cash receipts and cash disbursements journal.

B) Receive a cutoff statement directly from the client's bank.

C) Prepare a four column bank reconciliation using the year-end bank statement.

D) Confirm the year-end balance using the standard form to confirm account balance information with financial institutions.

A) Prepare a bank transfer schedule using the client's cash receipts and cash disbursements journal.

B) Receive a cutoff statement directly from the client's bank.

C) Prepare a four column bank reconciliation using the year-end bank statement.

D) Confirm the year-end balance using the standard form to confirm account balance information with financial institutions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

14

An auditor may obtain information on the December 31 month-end balance per bank in which of the following?

A) Option A

B) Option B

C) Option C

D) Option D

A) Option A

B) Option B

C) Option C

D) Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

15

Kiting would least likely be detected by:

A) Analyzing details of large cash deposits around year-end.

B) Comparing customer remittance advices with recorded disbursements in the cash disbursements journal.

C) Preparing a four-column bank reconciliation for all major cash accounts.

D) Preparing a schedule of interbank transfers by using the client's records and bank statements around year-end.

A) Analyzing details of large cash deposits around year-end.

B) Comparing customer remittance advices with recorded disbursements in the cash disbursements journal.

C) Preparing a four-column bank reconciliation for all major cash accounts.

D) Preparing a schedule of interbank transfers by using the client's records and bank statements around year-end.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

16

A proof of cash is an audit procedure that is performed on almost every engagement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

17

The auditors should count small petty cash funds at year-end to make sure that balance is not understated on the financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

18

For investments in securities accounted for by the equity method, the auditors are primarily concerned with verifying the fair value of the investments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

19

An auditor may obtain information on the December 31 month-end balance per bank in which of the following?

A) Option A

B) Option B

C) Option C

D) Option D

A) Option A

B) Option B

C) Option C

D) Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

20

Lapping of accounts receivable by an employee is not possible when there is adequate segregation of duties with respect to cash disbursements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

21

Which of the following is not a control that generally is established over cash receipts?

A) To prevent abstraction of cash, a control listing of cash receipts should be prepared by mailroom personnel.

B) To insure accurate posting, the accounts receivable clerk should post the customers' receipts from customers' checks.

C) To insure accuracy of the accounts receivable records, the records should be reconciled monthly to the accounts receivable controlling account.

D) To prevent theft of cash, receipts should be deposited daily.

A) To prevent abstraction of cash, a control listing of cash receipts should be prepared by mailroom personnel.

B) To insure accurate posting, the accounts receivable clerk should post the customers' receipts from customers' checks.

C) To insure accuracy of the accounts receivable records, the records should be reconciled monthly to the accounts receivable controlling account.

D) To prevent theft of cash, receipts should be deposited daily.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

22

A practical and effective audit procedure for the detection of lapping is:

A) Preparing an interbank transfer schedule.

B) Comparing recorded cash receipts in detail against items making up the bank deposit as shown on duplicate deposit slips validated by the bank.

C) Tracing recorded cash receipts to postings in customers' ledger cards.

D) Preparing a proof of cash.

A) Preparing an interbank transfer schedule.

B) Comparing recorded cash receipts in detail against items making up the bank deposit as shown on duplicate deposit slips validated by the bank.

C) Tracing recorded cash receipts to postings in customers' ledger cards.

D) Preparing a proof of cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

23

Jones was engaged to audit the financial statements of Gamma Corporation for the year ended June 30, 200X. Having completed an examination of the investment securities, which of the following is the best method of verifying the accuracy of recorded dividend income?

A) Tracing recorded dividend income to cash receipts records and validated deposit slips.

B) Utilizing analytical techniques and statistical sampling.

C) Comparing recorded dividends with amounts appearing on federal information form 1099s.

D) Comparing recorded dividends with a standard financial reporting service's record of dividends.

A) Tracing recorded dividend income to cash receipts records and validated deposit slips.

B) Utilizing analytical techniques and statistical sampling.

C) Comparing recorded dividends with amounts appearing on federal information form 1099s.

D) Comparing recorded dividends with a standard financial reporting service's record of dividends.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

24

Which of the following manipulations of cash transactions would overstate the cash balance on the financial statements?

A) Understatement of outstanding checks.

B) Overstatement of outstanding checks.

C) Understatement of deposits in transit.

D) Overstatement of bank services charges.

A) Understatement of outstanding checks.

B) Overstatement of outstanding checks.

C) Understatement of deposits in transit.

D) Overstatement of bank services charges.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

25

By preparing a four-column bank reconciliation ("proof of cash") for the last month of the year, an auditor will generally be able to detect:

A) An unrecorded check written at the beginning of the month which was cashed during the period covered by the reconciliation.

B) A cash sale which was not recorded on the books and was stolen by a bookkeeper.

C) An embezzlement of unrecorded cash receipts on receivables before they had been deposited into the bank.

D) A credit sale which has been recorded twice in the sales journal.

A) An unrecorded check written at the beginning of the month which was cashed during the period covered by the reconciliation.

B) A cash sale which was not recorded on the books and was stolen by a bookkeeper.

C) An embezzlement of unrecorded cash receipts on receivables before they had been deposited into the bank.

D) A credit sale which has been recorded twice in the sales journal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

26

Internal control over marketable securities is enhanced when:

A) Securities are held by the cashier.

B) Securities are registered in the name of the custodian.

C) Detailed records of securities are maintained by the custodian of the securities.

D) Securities are held under joint control of two or more officials.

A) Securities are held by the cashier.

B) Securities are registered in the name of the custodian.

C) Detailed records of securities are maintained by the custodian of the securities.

D) Securities are held under joint control of two or more officials.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

27

In a manufacturing company which one of the following audit procedures would give the least assurance of the existence of the assets in the general ledger balance of investment in stocks and bonds at the audit date?

A) Confirmation from the broker.

B) Inspection of year-end brokers' statements.

C) Vouching all changes during the year to brokers' advises and statements.

D) Examination of paid checks issued in payment of securities purchased.

A) Confirmation from the broker.

B) Inspection of year-end brokers' statements.

C) Vouching all changes during the year to brokers' advises and statements.

D) Examination of paid checks issued in payment of securities purchased.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

28

The auditors use a bank cutoff statement to compare:

A) Deposits in transit on the year-end cash general ledger account to deposits in the cash receipts journal.

B) Checks dated prior to year-end to the outstanding checks listed on the year-end bank reconciliation.

C) Deposits listed on the cutoff statement to disbursements in the cash disbursements journal.

D) Checks dated subsequent to year-end to the outstanding checks listed on the year-end bank statement.

A) Deposits in transit on the year-end cash general ledger account to deposits in the cash receipts journal.

B) Checks dated prior to year-end to the outstanding checks listed on the year-end bank reconciliation.

C) Deposits listed on the cutoff statement to disbursements in the cash disbursements journal.

D) Checks dated subsequent to year-end to the outstanding checks listed on the year-end bank statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

29

Which of the following is not confirmed on the standard confirmation form used for cash balances at financial institutions?

A) Cash checking account balances.

B) Cash savings account balances.

C) Loans payable.

D) Securities held for the client by the financial institution.

A) Cash checking account balances.

B) Cash savings account balances.

C) Loans payable.

D) Securities held for the client by the financial institution.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

30

The auditors compare information on canceled checks with information contained in the cash disbursement journal. The objective of this test is to determine that:

A) Recorded cash disbursement transactions are properly authorized.

B) Proper cash purchase discounts have been recorded.

C) Cash disbursements are for goods and services actually received.

D) No discrepancies exist between the data on the checks and the data in the journal.

A) Recorded cash disbursement transactions are properly authorized.

B) Proper cash purchase discounts have been recorded.

C) Cash disbursements are for goods and services actually received.

D) No discrepancies exist between the data on the checks and the data in the journal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

31

Which of the following is not a control over cash disbursements?

A) Disbursements should be made by check.

B) A check protecting machine should be used.

C) Documents supporting the payment of a disbursement should be canceled by the person preparing the check to prevent reuse.

D) Voided checks should be defaced and filed with paid checks.

A) Disbursements should be made by check.

B) A check protecting machine should be used.

C) Documents supporting the payment of a disbursement should be canceled by the person preparing the check to prevent reuse.

D) Voided checks should be defaced and filed with paid checks.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

32

Which of the following controls would be most likely to reduce the risk of diversion of customer receipts by a company's employees?

A) A bank lockbox system.

B) Approval of all disbursements by an individual independent of cash receipts.

C) Monthly bank cutoff statements.

D) Prenumbered remittance advices.

A) A bank lockbox system.

B) Approval of all disbursements by an individual independent of cash receipts.

C) Monthly bank cutoff statements.

D) Prenumbered remittance advices.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

33

Which of the following is not a control that generally is established over cash transactions?

A) Separating cash handling from recordkeeping.

B) Centralizing the receipt of cash.

C) Depositing each day's receipts intact.

D) Obtaining a receipt for every disbursement.

A) Separating cash handling from recordkeeping.

B) Centralizing the receipt of cash.

C) Depositing each day's receipts intact.

D) Obtaining a receipt for every disbursement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

34

The Standard Form to Confirm Account Balances with Financial Institutions includes information on all of the following except:

A) Date due of a direct liability.

B) The principal amount paid on a direct liability.

C) Description of collateral for a direct liability.

D) The interest rate of a direct liability.

A) Date due of a direct liability.

B) The principal amount paid on a direct liability.

C) Description of collateral for a direct liability.

D) The interest rate of a direct liability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

35

Which of the following is the best audit procedure for the detection of lapping?

A) Comparison of postings of cash receipts to accounts with the details of cash deposits.

B) Confirmation of the cash balance.

C) Reconciliation of the cash account balances.

D) Preparing a proof of cash.

A) Comparison of postings of cash receipts to accounts with the details of cash deposits.

B) Confirmation of the cash balance.

C) Reconciliation of the cash account balances.

D) Preparing a proof of cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

36

The auditors' count of the client's cash should be coordinated to coincide with the:

A) Consideration of the internal controls with respect to cash.

B) Close of business on the balance sheet date.

C) Count of investment securities.

D) Count of inventories.

A) Consideration of the internal controls with respect to cash.

B) Close of business on the balance sheet date.

C) Count of investment securities.

D) Count of inventories.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

37

Which of the following is not a universal rule for achieving internal control over cash?

A) Separate recordkeeping from accounting for cash to the extent possible.

B) Deposit each day's cash receipts intact.

C) Separate cash handling from recordkeeping.

D) Have monthly bank reconciliations prepared by employees not responsible for the issuance of checks.

A) Separate recordkeeping from accounting for cash to the extent possible.

B) Deposit each day's cash receipts intact.

C) Separate cash handling from recordkeeping.

D) Have monthly bank reconciliations prepared by employees not responsible for the issuance of checks.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

38

Which of the following statements is not correct?

A) Cash is important to the audit process because of its vulnerability to misappropriation, despite the fact that the balance at the balance sheet date may be immaterial.

B) Payroll cash account balances kept on an imprest basis are more easily controlled than others not so kept.

C) Confirmation of cash should only be performed as of the balance statement date because the auditor expresses an opinion as of that date.

D) Reviewing interbank transfers is important to the auditor because of the possibility that the client may be engaged in kiting.

A) Cash is important to the audit process because of its vulnerability to misappropriation, despite the fact that the balance at the balance sheet date may be immaterial.

B) Payroll cash account balances kept on an imprest basis are more easily controlled than others not so kept.

C) Confirmation of cash should only be performed as of the balance statement date because the auditor expresses an opinion as of that date.

D) Reviewing interbank transfers is important to the auditor because of the possibility that the client may be engaged in kiting.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

39

The auditors should insist that a representative of the client be present during the physical examination of securities in order to:

A) Lend authority of the auditor's directives.

B) Detect forged securities.

C) Coordinate the return of all securities to proper locations.

D) Acknowledge the receipt of securities returned.

A) Lend authority of the auditor's directives.

B) Detect forged securities.

C) Coordinate the return of all securities to proper locations.

D) Acknowledge the receipt of securities returned.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

40

In October, three months before year-end, the bookkeeper erroneously recorded the receipt of a one year bank loan with a debit to cash and a credit to miscellaneous revenue. The most effective method for detecting this type of error is:

A) Foot the cash receipts journal for October.

B) Send a bank confirmation as of year-end.

C) Prepare a bank reconciliation as of year-end.

D) Prepare a bank transfer schedule as of year-end.

A) Foot the cash receipts journal for October.

B) Send a bank confirmation as of year-end.

C) Prepare a bank reconciliation as of year-end.

D) Prepare a bank transfer schedule as of year-end.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

41

Contact with banks for the purpose of opening company bank accounts should normally be the responsibility of the corporate:

A) Board of Directors.

B) Treasurer.

C) Controller.

D) Executive Committee.

A) Board of Directors.

B) Treasurer.

C) Controller.

D) Executive Committee.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

42

The Parmalat fraud case involved:

A) A fraudulent cash confirmation.

B) Kiting of funds between banks in India and banks in Pakistan.

C) A bank reconciliation performed by the client that systematically understated cash.

D) Major unrecorded disbursements for equipment.

A) A fraudulent cash confirmation.

B) Kiting of funds between banks in India and banks in Pakistan.

C) A bank reconciliation performed by the client that systematically understated cash.

D) Major unrecorded disbursements for equipment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

43

As one of the year-end audit procedures, the auditor instructed the client's personnel to prepare a confirmation request for a bank account that had been closed during the year. After the client's treasurer has signed the request, it was mailed by the assistant treasurer. What is the major flaw in this audit procedure?

A) The confirmation request was signed by the treasurer.

B) Sending the request was meaningless because the account was closed before the year-end.

C) The request was mailed by the assistant treasurer.

D) The CPA did not sign the confirmation request before it was mailed.

A) The confirmation request was signed by the treasurer.

B) Sending the request was meaningless because the account was closed before the year-end.

C) The request was mailed by the assistant treasurer.

D) The CPA did not sign the confirmation request before it was mailed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

44

Which of the following is one of the better auditing techniques that might be used by an auditor to detect kiting?

A) Review composition of authenticated deposit slips.

B) Review subsequent bank statements and canceled checks received directly from the banks.

C) Prepare a schedule of bank transfers.

D) Prepare year-end bank reconciliations.

A) Review composition of authenticated deposit slips.

B) Review subsequent bank statements and canceled checks received directly from the banks.

C) Prepare a schedule of bank transfers.

D) Prepare year-end bank reconciliations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

45

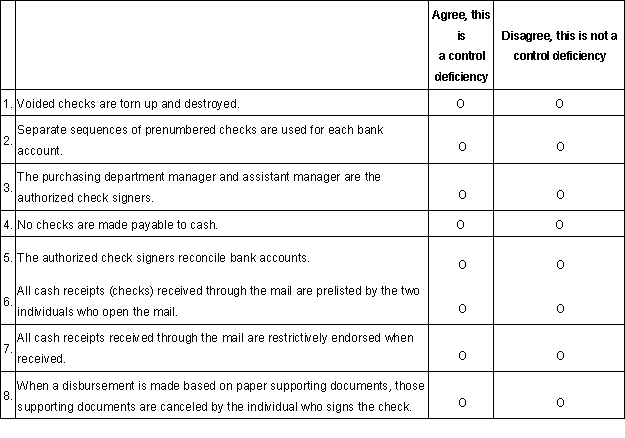

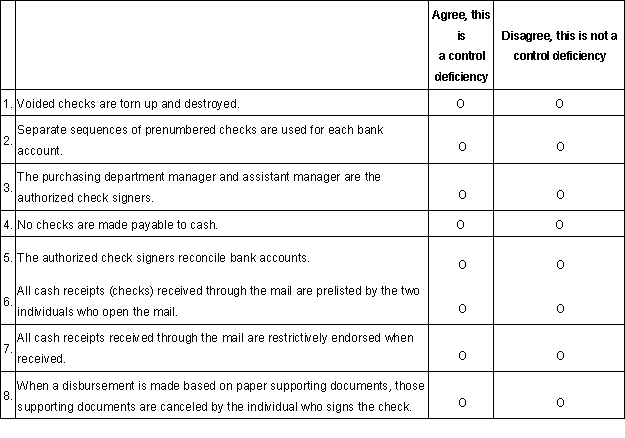

You are working on the Bemco audit. Assume that each of the four sections of this question are unrelated. Bill Wedman, another staff member, has given you the following list of what he refers to as "internal control deficiencies" and has asked you to review each point and make sure that you agree that each is an internal control deficiency.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

46

Properly designed internal control will permit the same employee to:

A) Receive and deposit checks, and also approve write-offs of customer accounts.

B) Approve vouchers for payment, and also receive and deposit cash.

C) Reconcile the bank statements, and also receive and deposit cash.

D) Sign checks, and also cancel supporting documents.

A) Receive and deposit checks, and also approve write-offs of customer accounts.

B) Approve vouchers for payment, and also receive and deposit cash.

C) Reconcile the bank statements, and also receive and deposit cash.

D) Sign checks, and also cancel supporting documents.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

47

Which one of the following would the auditor consider to be an incompatible operation if the cashier receives remittances from the mailroom?

A) The cashier prepares the daily deposit.

B) The cashier makes the daily deposit at a local bank.

C) The cashier posts the receipts to the accounts receivable subsidiary ledger.

D) The cashier endorses the checks.

A) The cashier prepares the daily deposit.

B) The cashier makes the daily deposit at a local bank.

C) The cashier posts the receipts to the accounts receivable subsidiary ledger.

D) The cashier endorses the checks.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

48

An auditor compares annual revenues and expenses with similar amounts from the prior year and investigates all changes exceeding 10%. This procedure most likely could indicate that:

A) Fourth quarter payroll taxes were properly accrued and recorded, but were not paid until early in the subsequent year.

B) Unrealized gains from increases in the value of available-for-sale securities were recorded in the income account for trading securities.

C) The annual provision for uncollectible accounts expense was inadequate because of worsening economic conditions.

D) Notice of an increase in property tax rates was received by management, but was not recorded until early in the subsequent year.

A) Fourth quarter payroll taxes were properly accrued and recorded, but were not paid until early in the subsequent year.

B) Unrealized gains from increases in the value of available-for-sale securities were recorded in the income account for trading securities.

C) The annual provision for uncollectible accounts expense was inadequate because of worsening economic conditions.

D) Notice of an increase in property tax rates was received by management, but was not recorded until early in the subsequent year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

49

For purposes of an audit of financial statements, electronic confirmation of cash balances:

A) Is acceptable when properly controlled.

B) Is acceptable, but only when combined with a non-electronic approach.

C) Is only acceptable for immaterial accounts.

D) Is not acceptable.

A) Is acceptable when properly controlled.

B) Is acceptable, but only when combined with a non-electronic approach.

C) Is only acceptable for immaterial accounts.

D) Is not acceptable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

50

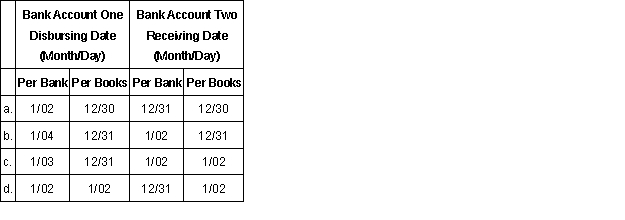

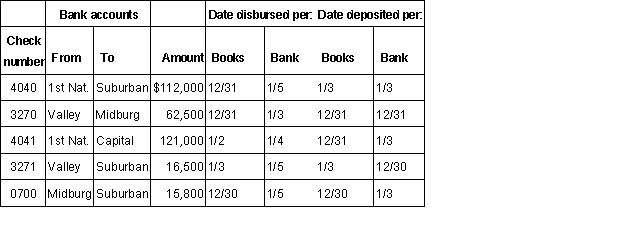

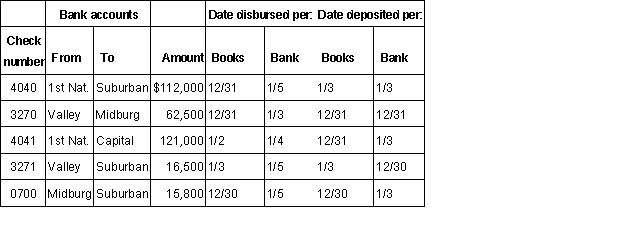

Listed below are four interbank cash transfers, indicated by the letters a, b, c and d, of a client for late December 20X1, and early January 20X2. Your answer choice for the next two questions should be selected from this list.  For each of transfers a through d indicate whether cash is understated, unaffected, or overstated by the transfer and provide a brief example of what could cause the situation in which cash is either understated or overstated.

For each of transfers a through d indicate whether cash is understated, unaffected, or overstated by the transfer and provide a brief example of what could cause the situation in which cash is either understated or overstated.

For each of transfers a through d indicate whether cash is understated, unaffected, or overstated by the transfer and provide a brief example of what could cause the situation in which cash is either understated or overstated.

For each of transfers a through d indicate whether cash is understated, unaffected, or overstated by the transfer and provide a brief example of what could cause the situation in which cash is either understated or overstated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

51

Since financial investments are assets with a high degree of inherent risk, companies must establish effective internal control over their investments.

a. Describe the functions that should be segregated to provide good internal control over financial investments.

b. Describe two other internal control policies that should be established for financial investments.

a. Describe the functions that should be segregated to provide good internal control over financial investments.

b. Describe two other internal control policies that should be established for financial investments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

52

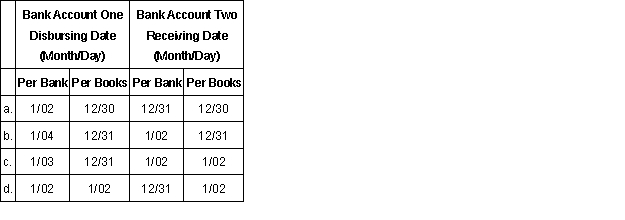

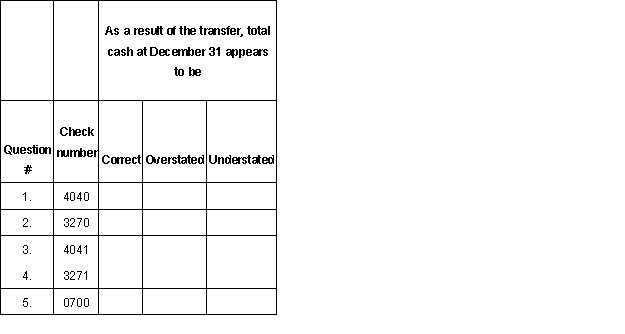

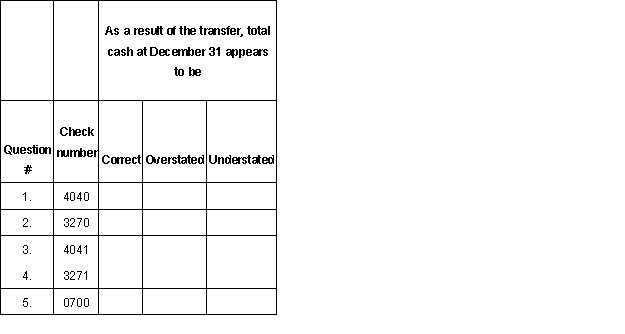

Flemco has made a series of transfers between bank accounts near year-end, some through inter-bank wired transfers and some through checks. You have audited the wired transfers and agree that they have been properly stated and now have the following schedule of transfers between cash accounts made using checks. You may assume that dates per bank are correct, and that dates per books are the dates the transactions were recorded in the books.  Analyze each of the above transfers and determine whether you believe each causes total cash to most likely be correct, overstated, or understated as of year-end.

Analyze each of the above transfers and determine whether you believe each causes total cash to most likely be correct, overstated, or understated as of year-end.

Analyze each of the above transfers and determine whether you believe each causes total cash to most likely be correct, overstated, or understated as of year-end.

Analyze each of the above transfers and determine whether you believe each causes total cash to most likely be correct, overstated, or understated as of year-end.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

53

To gather evidence regarding the balance per bank in a bank reconciliation, an auditor could examine all of the following except:

A) Cutoff bank statement.

B) Year-end bank statement.

C) Bank confirmation.

D) General ledger.

A) Cutoff bank statement.

B) Year-end bank statement.

C) Bank confirmation.

D) General ledger.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

54

A company's decision to use the fair value option for valuation of marketable securities is most likely to affect which of the following assertions the most?

A) Completeness.

B) Existence.

C) Fairness.

D) Presentation and Disclosure.

A) Completeness.

B) Existence.

C) Fairness.

D) Presentation and Disclosure.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

55

When a client engages in transactions involving derivatives, the auditor should:

A) Develop an understanding of the economic substance of each derivative.

B) Confirm with the client's broker whether the derivatives are for trading purposes.

C) Notify the audit committee about the risks involved in derivative transactions.

D) Add an explanatory paragraph to the auditor's report describing the risks associated with each derivative.

A) Develop an understanding of the economic substance of each derivative.

B) Confirm with the client's broker whether the derivatives are for trading purposes.

C) Notify the audit committee about the risks involved in derivative transactions.

D) Add an explanatory paragraph to the auditor's report describing the risks associated with each derivative.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

56

Which of the following is correct relating to kiting?

A) It is ordinarily used to understate cash.

B) It is more difficult to accomplish in an electronic environment as contrasted to a non-electronic environment.

C) It is a lapping approach performed using receivable accounts.

D) It is seldom, if ever, used.

A) It is ordinarily used to understate cash.

B) It is more difficult to accomplish in an electronic environment as contrasted to a non-electronic environment.

C) It is a lapping approach performed using receivable accounts.

D) It is seldom, if ever, used.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

57

On receiving the bank cutoff statement, the auditor should trace:

A) Deposits in transit on the year-end bank reconciliation to deposits in the cash receipts journal.

B) Checks dated prior to year-end to the outstanding checks listed on the year-end bank reconciliation.

C) Deposits listed on the cutoff statement to deposits in the cash receipts journal.

D) Checks dated subsequent to year-end to the outstanding checks listed on the year-end bank reconciliation.

A) Deposits in transit on the year-end bank reconciliation to deposits in the cash receipts journal.

B) Checks dated prior to year-end to the outstanding checks listed on the year-end bank reconciliation.

C) Deposits listed on the cutoff statement to deposits in the cash receipts journal.

D) Checks dated subsequent to year-end to the outstanding checks listed on the year-end bank reconciliation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

57

Agree. Voided checks should be so marked (defaced) and retained so as to allow one to know that they have been voided and are not outstanding.

2. Disagree. One expects separate sequences of numbers of the various accounts, as one overall sequence for various bank accounts is, at best, unwieldy; establishing control over each sequence is generally adequate.

3. Agree. Since the purchasing department employees approve purchases they should not also sign checks.

4. Disagree. Checks should not be made payable to cash as they may be cashed by anyone-properly or improperly.

5. Agree. The authorized signers disburse funds and effective oversight of those disbursements requires account reconciliation by another individual.

6. Disagree. Cash receipts should be so prelisted.

7. Disagree. A policy of restrictively endorsing such receipts (e.g., endorsing the checks as "pay only to Bemco") is a control, not a control deficiency.

8. Disagree. The person signing the check should be the person who perforates (defaces) the checks so as to eliminate the possibility of that support being used again to improperly support another disbursement.

2. Disagree. One expects separate sequences of numbers of the various accounts, as one overall sequence for various bank accounts is, at best, unwieldy; establishing control over each sequence is generally adequate.

3. Agree. Since the purchasing department employees approve purchases they should not also sign checks.

4. Disagree. Checks should not be made payable to cash as they may be cashed by anyone-properly or improperly.

5. Agree. The authorized signers disburse funds and effective oversight of those disbursements requires account reconciliation by another individual.

6. Disagree. Cash receipts should be so prelisted.

7. Disagree. A policy of restrictively endorsing such receipts (e.g., endorsing the checks as "pay only to Bemco") is a control, not a control deficiency.

8. Disagree. The person signing the check should be the person who perforates (defaces) the checks so as to eliminate the possibility of that support being used again to improperly support another disbursement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

58

Banks may process electronic "substitute checks" in place of customer written hard copy checks due to the:

A) Check Clearing for the 21st Century Act.

B) Public Company Accounting Oversight Board's Standard No. 2.

C) Foreign Corrupt Practices Act.

D) Sarbanes-Oxley Act.

A) Check Clearing for the 21st Century Act.

B) Public Company Accounting Oversight Board's Standard No. 2.

C) Foreign Corrupt Practices Act.

D) Sarbanes-Oxley Act.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

59

In the audit of a client's financial statements, the auditors must be concerned with the possibility that client personnel might be engaged in kiting or lapping.

a. Define lapping and describe an audit procedure that might detect lapping.

b. Define kiting and describe an audit procedure that might detect kiting.

a. Define lapping and describe an audit procedure that might detect lapping.

b. Define kiting and describe an audit procedure that might detect kiting.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

59

Understated. The entry is recorded as having been disbursed on December 31, yet it is not recorded as a deposit on the books until January 3. Accordingly, the cash is recorded in neither account as of year-end.

2. Correct. An example here is a check written in the Valley account on December 31, and deposited on that same day in the Midburg bank account. Valley bank will not record it as a disbursement until it is presented for payment several days later.

3. Overstated. Because the entry is recorded as deposited on the books on 12/31, but not recorded as a cash disbursement in the books until January 2, at December 31 the cash is recorded on the books in both accounts.

4. Overstated. The cash is recorded as a deposit per the bank on 12/30, but the receipt and disbursement is not recorded until January 3 on the books. In essence, this type of treatment may be used to hide a shortage in cash (perhaps due to embezzlement of cash).

5. Correct. An example here is recording a transfer, and processing this transfer through the mail-accordingly, both banks receive the information later.

2. Correct. An example here is a check written in the Valley account on December 31, and deposited on that same day in the Midburg bank account. Valley bank will not record it as a disbursement until it is presented for payment several days later.

3. Overstated. Because the entry is recorded as deposited on the books on 12/31, but not recorded as a cash disbursement in the books until January 2, at December 31 the cash is recorded on the books in both accounts.

4. Overstated. The cash is recorded as a deposit per the bank on 12/30, but the receipt and disbursement is not recorded until January 3 on the books. In essence, this type of treatment may be used to hide a shortage in cash (perhaps due to embezzlement of cash).

5. Correct. An example here is recording a transfer, and processing this transfer through the mail-accordingly, both banks receive the information later.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

60

Which of the following procedures in the cash disbursements cycle should not be performed by the accounts payable department?

A) Comparing the vendor's invoice with the receiving report.

B) Canceling supporting documentation after payment.

C) Verifying the mathematical accuracy of the vendor's invoice.

D) Preparing the check for signature by an authorized person.

A) Comparing the vendor's invoice with the receiving report.

B) Canceling supporting documentation after payment.

C) Verifying the mathematical accuracy of the vendor's invoice.

D) Preparing the check for signature by an authorized person.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

61

In many financial statements audits, auditing financial investments involves complex tasks requiring specialized skill and knowledge.

a. List three audit tasks related to the audit of financial investments that may require specialized skill or knowledge.

b. Define the term "financial derivative."

c. List the two general purposes why a client might acquire a financial derivative.

a. List three audit tasks related to the audit of financial investments that may require specialized skill or knowledge.

b. Define the term "financial derivative."

c. List the two general purposes why a client might acquire a financial derivative.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck