Deck 6: Intercompany Inventory and Land Profits

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/64

العب

ملء الشاشة (f)

Deck 6: Intercompany Inventory and Land Profits

1

What is the after-tax dollar value of X's realized profits during the year on its sales to Y?

A) $2,000.

B) $1,000.

C) $600.

D)$400.

A) $2,000.

B) $1,000.

C) $600.

D)$400.

C

2

Intercompany profits on sales of inventory are only realized:

A) once the seller receives payment for the sale.

B) once the inventory has been sold to outsiders.

C) when the inventory has been received by the purchaser.

D)when the inventory has been shipped to the purchaser.

A) once the seller receives payment for the sale.

B) once the inventory has been sold to outsiders.

C) when the inventory has been received by the purchaser.

D)when the inventory has been shipped to the purchaser.

B

3

What would be the amount of other revenue appearing on Kho Inc.'s consolidated income statement for the year ended December 31, 2018?

A) $410,000.

B) $415,000.

C) $444,000.

D)$460,000.

A) $410,000.

B) $415,000.

C) $444,000.

D)$460,000.

B

4

Assume that Y Inc. reported an after-tax net income of $20,000 in 2018, what would be Y's adjusted net income for the year?

A) $202,400.

B) $20,000.

C) $19,840.

D)$19,760.

A) $202,400.

B) $20,000.

C) $19,840.

D)$19,760.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

5

Which of the following theories does NOT acknowledge the existence of a non-controlling interest in the consolidated financial statements?

A) The Ownership Theory.

B) The Entity Theory.

C) The Proprietary Theory.

D)The Parent Company Theory.

A) The Ownership Theory.

B) The Entity Theory.

C) The Proprietary Theory.

D)The Parent Company Theory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

6

What is the after-tax dollar value of Y's unrealized profits during the year on its sales to X?

A) $240.

B) $360.

C) $400.

D)$500.

A) $240.

B) $360.

C) $400.

D)$500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

7

What is the after-tax dollar value of Y's realized profits during the year on its sales to X?

A) $240.

B) $360.

C) $400.

D)$500.

A) $240.

B) $360.

C) $400.

D)$500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

8

When are profits from intercompany land sales realized?

A) They are realized only when sold to outsiders.

B) They are realized once legal ownership of the land has been transferred.

C) They are realized when consideration has been received for the land.

D)They are realized when an agreement is signed with respect to ownership of the land.

A) They are realized only when sold to outsiders.

B) They are realized once legal ownership of the land has been transferred.

C) They are realized when consideration has been received for the land.

D)They are realized when an agreement is signed with respect to ownership of the land.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

9

Assuming that X Inc. used the equity method, what adjustment would have to be made to the investment in Y account to adjust for any unrealized profits on Y's sales to X?

A) No adjustment would be required.

B) The account would have to be reduced by $240.

C) The account would have to be reduced by $192.

D)The account would have to be reduced by $48.

A) No adjustment would be required.

B) The account would have to be reduced by $240.

C) The account would have to be reduced by $192.

D)The account would have to be reduced by $48.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

10

What amount of sales revenue would appear on Kho Inc.'s consolidated income statement for the year ended December 31, 2018?

A) $1,210,000.

B) $1,276,000.

C) $1,340,000.

D)$1,400,000.

A) $1,210,000.

B) $1,276,000.

C) $1,340,000.

D)$1,400,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

11

What is the after-tax dollar value of X's unrealized profits during the year on its sales to Y?

A) $2,000.

B) $1,000.

C) $600.

D)$400.

A) $2,000.

B) $1,000.

C) $600.

D)$400.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

12

What would be the journal entry to eliminate any unrealized profits from the consolidated financial statements during the year?

A)

B)

C)

A)

B)

C)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

13

What effect (if any) would Y's unrealized profits on its sales to X have on the non-controlling interest account on the consolidated balance sheet?

A) There would be no effect.

B) There would be an increase to the non-controlling interest account for the amount of $30.

C) There would be a decrease to the non-controlling interest account for the amount of $48.

D)There would be an increase to the non-controlling interest account for the amount of $48.

A) There would be no effect.

B) There would be an increase to the non-controlling interest account for the amount of $30.

C) There would be a decrease to the non-controlling interest account for the amount of $48.

D)There would be an increase to the non-controlling interest account for the amount of $48.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

14

Which of the following statements best describes the required accounting treatment with respect to income taxes on unrealized intercompany profits?

A) These taxes can be ignored since an increase in income tax expense for one company is offset by an equivalent reduction in Income Tax expense for the other.

B) They would be recognized as assets for the purchasing entity and liabilities for the selling entity.

C) They would be recognized as assets for the selling entity.

D)They would be charged to retained earnings during the preparation of Financial Statements.

A) These taxes can be ignored since an increase in income tax expense for one company is offset by an equivalent reduction in Income Tax expense for the other.

B) They would be recognized as assets for the purchasing entity and liabilities for the selling entity.

C) They would be recognized as assets for the selling entity.

D)They would be charged to retained earnings during the preparation of Financial Statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

15

What would be the journal entry to record the dividends received by Kho Inc. during the year?

A)

B)

C)

A)

B)

C)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

16

How would any management fees charged by a Parent Company to its Subsidiary be accounted for during the consolidation process?

A) The Parent Company would only record its pro rata share of any management revenues.

B) The Parent Company's profit on the rendering of management services would be charged to retained earnings.

C) Both the Parent's management fees and the subsidiary's related expense would be eliminated when preparing Consolidated Financial Statements.

D)No special accounting treatment is required, since this would have no effect on Consolidated Net Income.

A) The Parent Company would only record its pro rata share of any management revenues.

B) The Parent Company's profit on the rendering of management services would be charged to retained earnings.

C) Both the Parent's management fees and the subsidiary's related expense would be eliminated when preparing Consolidated Financial Statements.

D)No special accounting treatment is required, since this would have no effect on Consolidated Net Income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

17

Under which of the following Consolidation Theories would the elimination of only the Parent's share of any intercompany profits be required for the preparation of consolidated financial statements?

A) The Ownership Theory.

B) The Entity Theory.

C) The Proprietary Theory.

D)The Parent Company Theory.

A) The Ownership Theory.

B) The Entity Theory.

C) The Proprietary Theory.

D)The Parent Company Theory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

18

If a parent company borrows money from its subsidiary, what effect (if any) will this have on the non-controlling interest?

A) This would have no effect on the non-controlling interest.

B) The subsidiary would book its pro-rata share of any interest revenue.

C) The non-controlling interest balance would be reduced by the amount of the loan.

D)The subsidiary would record any interest revenue as an extraordinary gain.

A) This would have no effect on the non-controlling interest.

B) The subsidiary would book its pro-rata share of any interest revenue.

C) The non-controlling interest balance would be reduced by the amount of the loan.

D)The subsidiary would record any interest revenue as an extraordinary gain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

19

What is the amount of goodwill arising from this business combination?

A) $(180,000).

B) $120,000.

C) $168,000.

D)$186,667.

A) $(180,000).

B) $120,000.

C) $168,000.

D)$186,667.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

20

Under which of the following theories is the elimination of ALL intercompany profits called for?

A) The Ownership Theory.

B) The Entity Theory.

C) The Proprietary Theory.

D)The Parent Company Theory.

A) The Ownership Theory.

B) The Entity Theory.

C) The Proprietary Theory.

D)The Parent Company Theory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

21

Excluding any goodwill impairment losses, what would be the amount of the acquisition differential amortization for 2018?

A) $2,000.

B) $2,700.

C) $3,000.

D)$4,000.

A) $2,000.

B) $2,700.

C) $3,000.

D)$4,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

22

Where would be the amortization of the acquisition differential reflected on Kho's consolidated income statement?

A) It would be reflected through non-controlling interest in earnings.

B) It would be reflected through other expenses.

C) It would be reflected through cost of sales.

D)It would be reflected as a reduction of sales.

A) It would be reflected through non-controlling interest in earnings.

B) It would be reflected through other expenses.

C) It would be reflected through cost of sales.

D)It would be reflected as a reduction of sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

23

What would be the balance in the investment in MARS account at December 31, 2019?

A) $348,000.

B) $330,000.

C) $375,850.

D)$400,000.

A) $348,000.

B) $330,000.

C) $375,850.

D)$400,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

24

What would be the balance in the investment in MARS account at December 31, 2018?

A) $318,000.

B) $330,000.

C) $358,300.

D)$400,000.

A) $318,000.

B) $330,000.

C) $358,300.

D)$400,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

25

What would be the change in the non-controlling interest account for 2018?

A) Non-controlling interest would decrease by $27,800.

B) Non-controlling interest would decrease by $18,000.

C) Non-controlling interest would increase by $18,000.

D)Non-controlling interest would increase by $27,800.

A) Non-controlling interest would decrease by $27,800.

B) Non-controlling interest would decrease by $18,000.

C) Non-controlling interest would increase by $18,000.

D)Non-controlling interest would increase by $27,800.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

26

What would be the amount of the acquisition differential amortized during 2018?

A) $78,000.

B) $80,000.

C) $82,000.

D)$120,000.

A) $78,000.

B) $80,000.

C) $82,000.

D)$120,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

27

What would be the non-controlling interest amount appearing on Kho's consolidated statement of financial position on the date of acquisition?

A) $29,936.

B) $30,000.

C) $66,667.

D)$120,000.

A) $29,936.

B) $30,000.

C) $66,667.

D)$120,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

28

What would be the amount appearing on the December 31, 2018 consolidated statement of financial position for bonds payable?

A) $216,000.

B) $234,400.

C) $236,000.

D)$240,000.

A) $216,000.

B) $234,400.

C) $236,000.

D)$240,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

29

Ignoring taxes, what is the total amount of unrealized profits in inventory at the end of 2018?

A) Nil.

B) $6,000.

C) $7,800.

D)$8,000.

A) Nil.

B) $6,000.

C) $7,800.

D)$8,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

30

Consolidated net income attributable to the shareholders of the parent for 2018 would be:

A) $12,500.

B) $33,300.

C) $36,300.

D)$53,200.

A) $12,500.

B) $33,300.

C) $36,300.

D)$53,200.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

31

What would be the amount of the acquisition differential amortized during 2019?

A) $2,000.

B) $40,000.

C) $78,000.

D)$82,000.

A) $2,000.

B) $40,000.

C) $78,000.

D)$82,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

32

Ignoring taxes, what is the total amount of unrealized profits in inventory at the start of 2018?

A) Nil.

B) $5,000.

C) $6,000.

D)$6,200.

A) Nil.

B) $5,000.

C) $6,000.

D)$6,200.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

33

Consolidated net income attributable to the shareholders of the parent for 2019 would be:

A) $58,000.

B) $56,000.

C) $65,550.

D)$69,150.

A) $58,000.

B) $56,000.

C) $65,550.

D)$69,150.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

34

Assuming once again that LEO uses the equity method to account for its investment in MARS, what would be the NET increase to the investment in MARS account during 2019?

A) $16,000.

B) $16,800.

C) $17,550.

D)$20,000.

A) $16,000.

B) $16,800.

C) $17,550.

D)$20,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

35

What effect (if any) would the unrealized profits in beginning inventory have on income tax expense for 2018?

A) They would cause a $1,240 reduction in income tax expense.

B) They would cause a $1,200 reduction in income tax expense.

C) They would cause a $1,200 increase in income tax expense.

D)They would cause a $1,240 increase in income tax expense.

A) They would cause a $1,240 reduction in income tax expense.

B) They would cause a $1,200 reduction in income tax expense.

C) They would cause a $1,200 increase in income tax expense.

D)They would cause a $1,240 increase in income tax expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

36

Assuming that LEO uses the equity method to account for its investment in MARS, what would be the NET increase/decrease to the investment in MARS account during 2018?

A) $(49,200).

B) $(41,700).

C) $12,000.

D)$43,200.

A) $(49,200).

B) $(41,700).

C) $12,000.

D)$43,200.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

37

What would be the amount appearing on the December 31, 2018 consolidated statement of financial position for trademarks?

A) $200,000.

B) $236,000.

C) $240,000.

D)$245,000.

A) $200,000.

B) $236,000.

C) $240,000.

D)$245,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

38

What would be the change in the non-controlling interest account for 2019?

A) Non-controlling interest would increase by $14,200.

B) Non-controlling interest would increase by $16,800.

C) Non-controlling interest would decrease by $45,000.

D)Non-controlling interest would increase by $48,000.

A) Non-controlling interest would increase by $14,200.

B) Non-controlling interest would increase by $16,800.

C) Non-controlling interest would decrease by $45,000.

D)Non-controlling interest would increase by $48,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

39

What would be the non-controlling interest amount appearing on Kho's consolidated statement of financial position at the end of 2018?

A) $29,936.

B) $55,840.

C) $57,400.

D)$74,907.

A) $29,936.

B) $55,840.

C) $57,400.

D)$74,907.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

40

What effect (if any) would the unrealized profits in ending inventory have on income tax expense for 2018?

A) They would cause a $1,600 reduction in income tax expense.

B) They would cause a $1,200 reduction in income tax expense.

C) They would cause a $1,200 increase in income tax expense.

D)They would cause a $1,600 increase in income tax expense.

A) They would cause a $1,600 reduction in income tax expense.

B) They would cause a $1,200 reduction in income tax expense.

C) They would cause a $1,200 increase in income tax expense.

D)They would cause a $1,600 increase in income tax expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

41

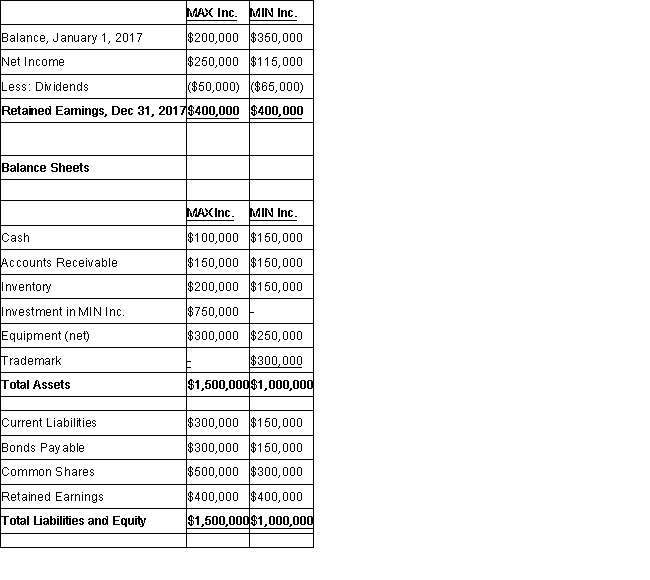

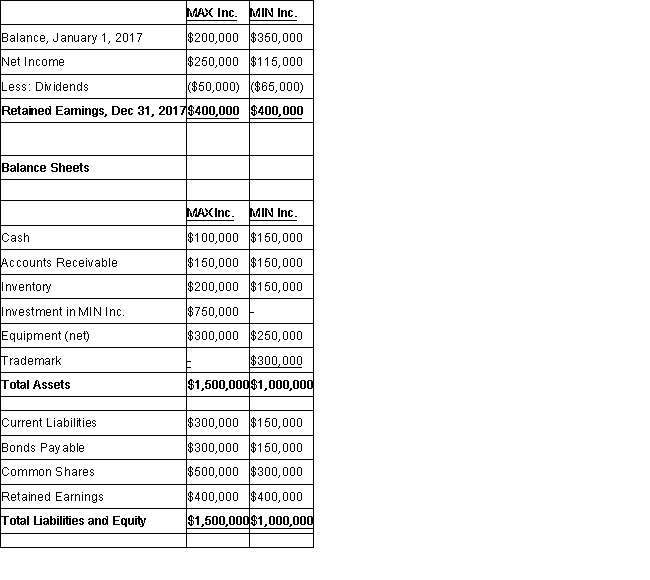

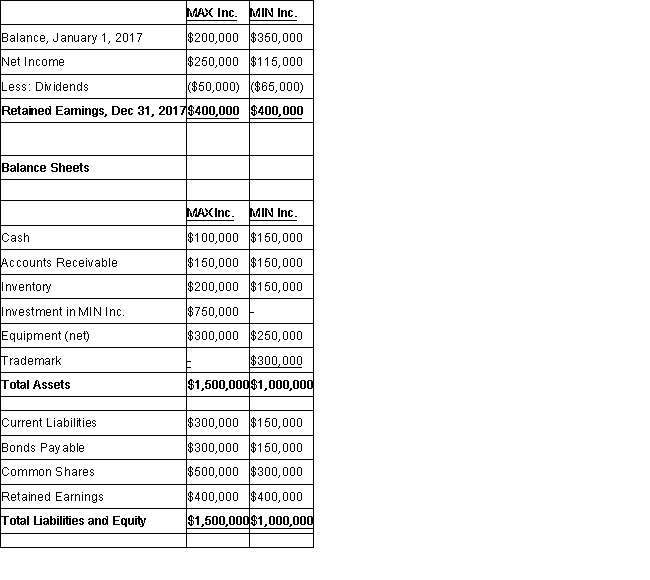

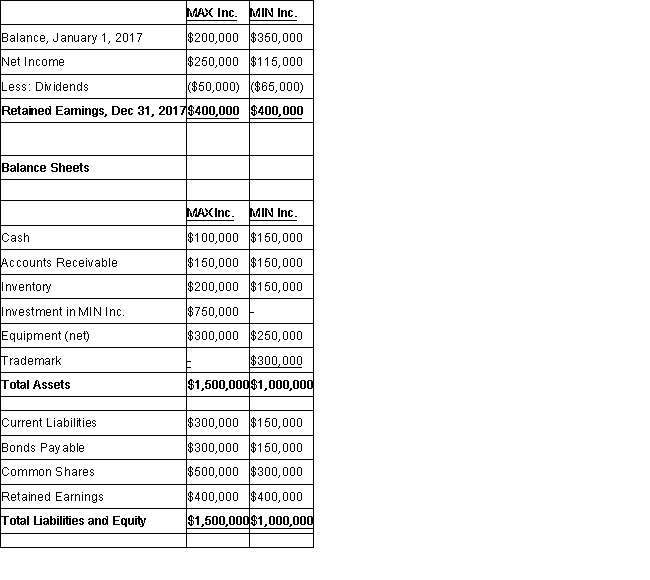

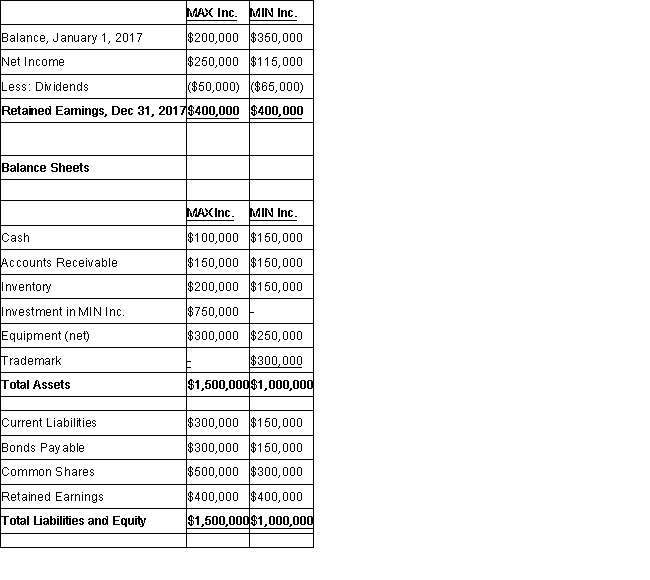

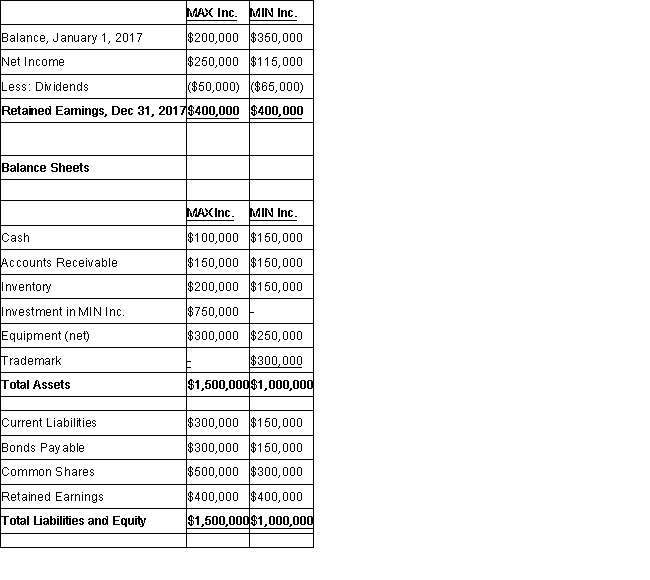

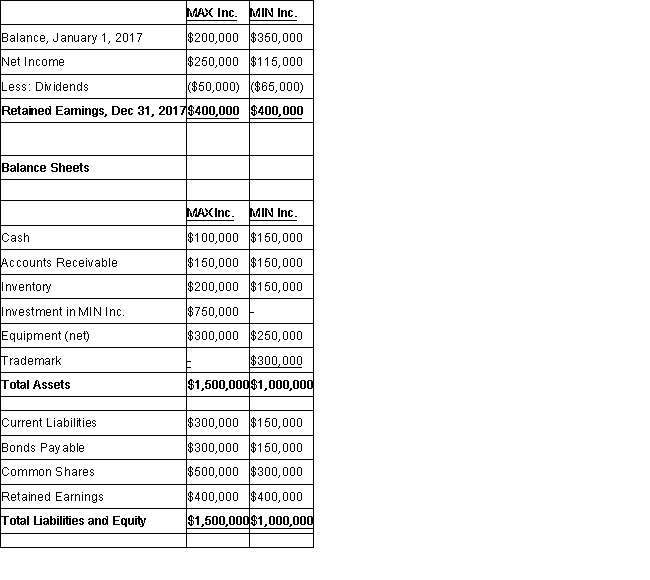

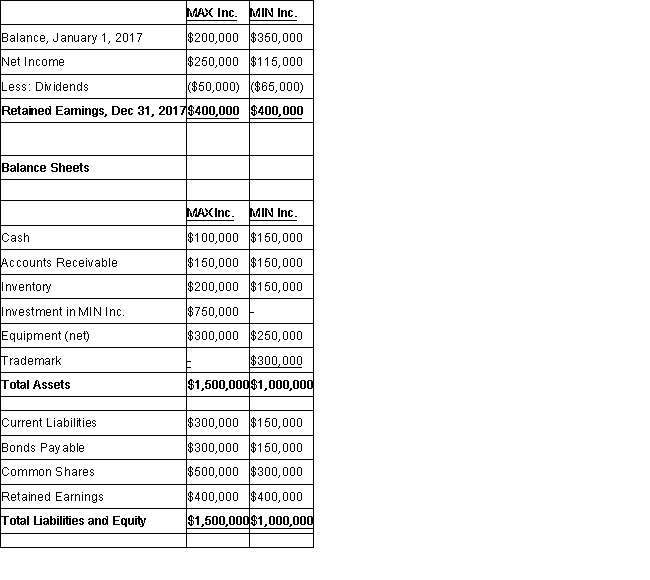

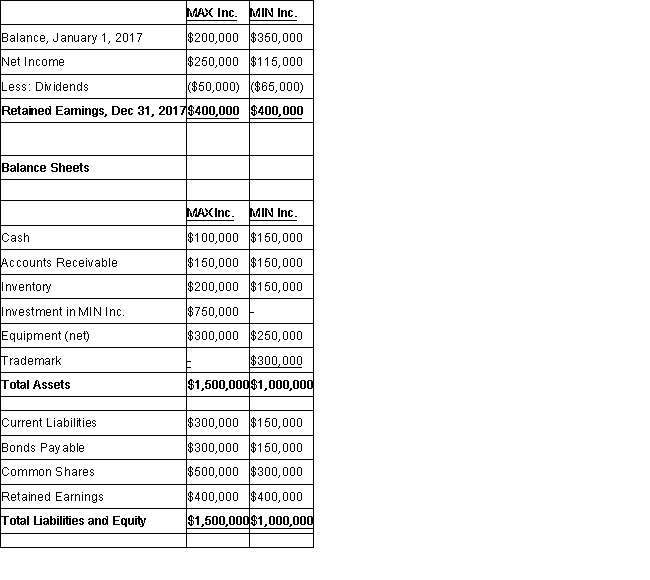

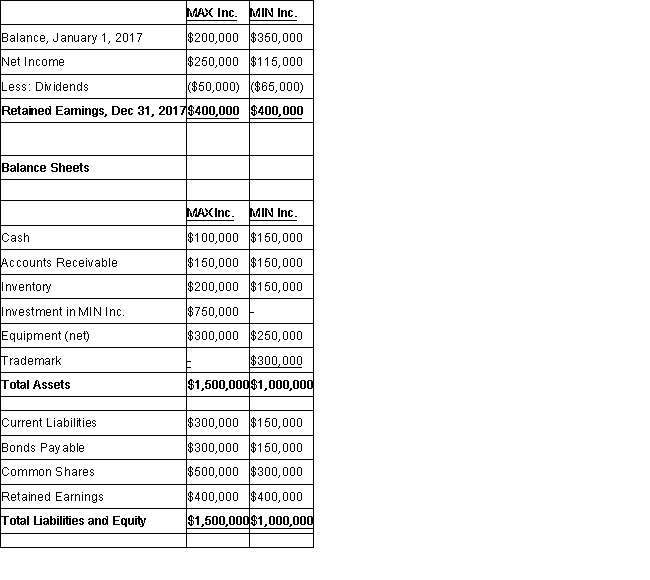

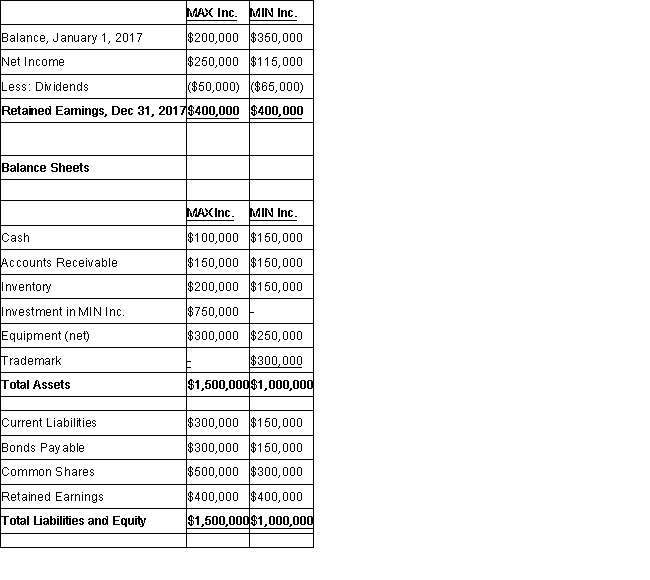

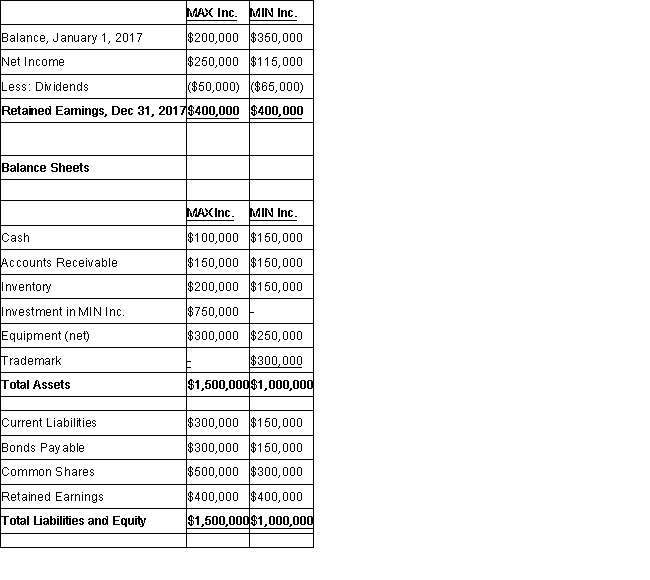

MAX Inc. purchased 80% of the voting shares of MIN Inc for $750,000 on January 1, 2015. On that date, MAX's common shares and retained earnings were valued at $300,000 and $150,000 respectively. Unless otherwise stated, assume that MAX uses the cost method to account for its investment in MIN Inc.

MIN's fair values approximated its carrying values with the following exceptions:

MIN's trademark had a fair value which was $80,000 higher than its carrying value.

MIN's bonds payable had a fair value which was $30,000 higher than their carrying value.

The trademark had a useful life of exactly twenty years remaining from the date of acquisition. The bonds payable mature on January 1, 2035. Both companies use straight line amortization exclusively.

The financial statements of both companies for the year ended December 31, 2017 are shown below:

Income Statements Retained Earnings Statements

Other Information:

Other Information:

A goodwill impairment test conducted during August 2017 revealed that the Min's goodwill amount on the date of acquisition had been impaired by $5,000.

During 2016, Max sold $60,000 worth of Inventory to Min, 80% of which was sold to outsiders during the year. During 2017, Max sold inventory to Min for $80,000. 75% of this inventory was resold by Min to outside parties during that year.

During 2016, Min sold $40,000 worth of Inventory to Max, 80% of which was sold to outsiders during the year. During 2017, Min sold inventory to Max for $50,000. 80% of this inventory was resold by Max to outside parties during that year.

All intercompany sales as well as sales to outsiders are priced 25% above cost. The effective tax rate for both companies is 50%.

-Calculate the non-controlling interest (Balance Sheet) as at December 31, 2017.

MIN's fair values approximated its carrying values with the following exceptions:

MIN's trademark had a fair value which was $80,000 higher than its carrying value.

MIN's bonds payable had a fair value which was $30,000 higher than their carrying value.

The trademark had a useful life of exactly twenty years remaining from the date of acquisition. The bonds payable mature on January 1, 2035. Both companies use straight line amortization exclusively.

The financial statements of both companies for the year ended December 31, 2017 are shown below:

Income Statements Retained Earnings Statements

Other Information:

Other Information:A goodwill impairment test conducted during August 2017 revealed that the Min's goodwill amount on the date of acquisition had been impaired by $5,000.

During 2016, Max sold $60,000 worth of Inventory to Min, 80% of which was sold to outsiders during the year. During 2017, Max sold inventory to Min for $80,000. 75% of this inventory was resold by Min to outside parties during that year.

During 2016, Min sold $40,000 worth of Inventory to Max, 80% of which was sold to outsiders during the year. During 2017, Min sold inventory to Max for $50,000. 80% of this inventory was resold by Max to outside parties during that year.

All intercompany sales as well as sales to outsiders are priced 25% above cost. The effective tax rate for both companies is 50%.

-Calculate the non-controlling interest (Balance Sheet) as at December 31, 2017.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

42

What effect will the adjustment for the realization of the intercompany gain (in the preparation of the consolidated income statement) have on the non-controlling interest in income for 2017?

A) It will have no effect on the non-controlling interest in income.

B) It will decrease the non-controlling interest in income by $24,000.

C) It will increase the non-controlling interest in income by $24,000.

D)It will increase the non-controlling interest in income by $30,000.

A) It will have no effect on the non-controlling interest in income.

B) It will decrease the non-controlling interest in income by $24,000.

C) It will increase the non-controlling interest in income by $24,000.

D)It will increase the non-controlling interest in income by $30,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

43

MAX Inc. purchased 80% of the voting shares of MIN Inc for $750,000 on January 1, 2015. On that date, MAX's common shares and retained earnings were valued at $300,000 and $150,000 respectively. Unless otherwise stated, assume that MAX uses the cost method to account for its investment in MIN Inc.

MIN's fair values approximated its carrying values with the following exceptions:

MIN's trademark had a fair value which was $80,000 higher than its carrying value.

MIN's bonds payable had a fair value which was $30,000 higher than their carrying value.

The trademark had a useful life of exactly twenty years remaining from the date of acquisition. The bonds payable mature on January 1, 2035. Both companies use straight line amortization exclusively.

The financial statements of both companies for the year ended December 31, 2017 are shown below:

Income Statements Retained Earnings Statements

Other Information:

Other Information:

A goodwill impairment test conducted during August 2017 revealed that the Min's goodwill amount on the date of acquisition had been impaired by $5,000.

During 2016, Max sold $60,000 worth of Inventory to Min, 80% of which was sold to outsiders during the year. During 2017, Max sold inventory to Min for $80,000. 75% of this inventory was resold by Min to outside parties during that year.

During 2016, Min sold $40,000 worth of Inventory to Max, 80% of which was sold to outsiders during the year. During 2017, Min sold inventory to Max for $50,000. 80% of this inventory was resold by Max to outside parties during that year.

All intercompany sales as well as sales to outsiders are priced 25% above cost. The effective tax rate for both companies is 50%.

-Compute MAX's Consolidated Net Income for 2017.

MIN's fair values approximated its carrying values with the following exceptions:

MIN's trademark had a fair value which was $80,000 higher than its carrying value.

MIN's bonds payable had a fair value which was $30,000 higher than their carrying value.

The trademark had a useful life of exactly twenty years remaining from the date of acquisition. The bonds payable mature on January 1, 2035. Both companies use straight line amortization exclusively.

The financial statements of both companies for the year ended December 31, 2017 are shown below:

Income Statements Retained Earnings Statements

Other Information:

Other Information:A goodwill impairment test conducted during August 2017 revealed that the Min's goodwill amount on the date of acquisition had been impaired by $5,000.

During 2016, Max sold $60,000 worth of Inventory to Min, 80% of which was sold to outsiders during the year. During 2017, Max sold inventory to Min for $80,000. 75% of this inventory was resold by Min to outside parties during that year.

During 2016, Min sold $40,000 worth of Inventory to Max, 80% of which was sold to outsiders during the year. During 2017, Min sold inventory to Max for $50,000. 80% of this inventory was resold by Max to outside parties during that year.

All intercompany sales as well as sales to outsiders are priced 25% above cost. The effective tax rate for both companies is 50%.

-Compute MAX's Consolidated Net Income for 2017.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

44

Prepare a schedule showing the realized and unrealized profits for P Inc. for 2017 and 2018. Your schedule should include both pre-tax and after-tax amounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

45

What amount will appear on the "Gain on sale of land" line in Parent Company's consolidated income statement for the year ended December 31, 2015?

A) $0.

B) $96,000.

C) $120,000.

D)$240,000.

A) $0.

B) $96,000.

C) $120,000.

D)$240,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

46

Prepare a schedule showing the realized and unrealized profits for Q Inc. for 2017 and 2018. Your schedule should include both pre-tax and after-tax amounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

47

What would be the balance in the non-controlling interest account on the date of acquisition?

A) $266,667.

B) $397,000.

C) $400,000.

D)$403,000.

A) $266,667.

B) $397,000.

C) $400,000.

D)$403,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

48

MAX Inc. purchased 80% of the voting shares of MIN Inc for $750,000 on January 1, 2015. On that date, MAX's common shares and retained earnings were valued at $300,000 and $150,000 respectively. Unless otherwise stated, assume that MAX uses the cost method to account for its investment in MIN Inc.

MIN's fair values approximated its carrying values with the following exceptions:

MIN's trademark had a fair value which was $80,000 higher than its carrying value.

MIN's bonds payable had a fair value which was $30,000 higher than their carrying value.

The trademark had a useful life of exactly twenty years remaining from the date of acquisition. The bonds payable mature on January 1, 2035. Both companies use straight line amortization exclusively.

The financial statements of both companies for the year ended December 31, 2017 are shown below:

Income Statements Retained Earnings Statements

Other Information:

Other Information:

A goodwill impairment test conducted during August 2017 revealed that the Min's goodwill amount on the date of acquisition had been impaired by $5,000.

During 2016, Max sold $60,000 worth of Inventory to Min, 80% of which was sold to outsiders during the year. During 2017, Max sold inventory to Min for $80,000. 75% of this inventory was resold by Min to outside parties during that year.

During 2016, Min sold $40,000 worth of Inventory to Max, 80% of which was sold to outsiders during the year. During 2017, Min sold inventory to Max for $50,000. 80% of this inventory was resold by Max to outside parties during that year.

All intercompany sales as well as sales to outsiders are priced 25% above cost. The effective tax rate for both companies is 50%.

-Prepare MAX's Consolidated Statement of Financial Position as at December 31, 2017.

MIN's fair values approximated its carrying values with the following exceptions:

MIN's trademark had a fair value which was $80,000 higher than its carrying value.

MIN's bonds payable had a fair value which was $30,000 higher than their carrying value.

The trademark had a useful life of exactly twenty years remaining from the date of acquisition. The bonds payable mature on January 1, 2035. Both companies use straight line amortization exclusively.

The financial statements of both companies for the year ended December 31, 2017 are shown below:

Income Statements Retained Earnings Statements

Other Information:

Other Information:A goodwill impairment test conducted during August 2017 revealed that the Min's goodwill amount on the date of acquisition had been impaired by $5,000.

During 2016, Max sold $60,000 worth of Inventory to Min, 80% of which was sold to outsiders during the year. During 2017, Max sold inventory to Min for $80,000. 75% of this inventory was resold by Min to outside parties during that year.

During 2016, Min sold $40,000 worth of Inventory to Max, 80% of which was sold to outsiders during the year. During 2017, Min sold inventory to Max for $50,000. 80% of this inventory was resold by Max to outside parties during that year.

All intercompany sales as well as sales to outsiders are priced 25% above cost. The effective tax rate for both companies is 50%.

-Prepare MAX's Consolidated Statement of Financial Position as at December 31, 2017.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

49

What amount will appear on the "Gain on sale of land" line in Parent Company's consolidated income statement for the year ended December 31, 2017?

A) $0.

B) $93,000.

C) $124,000.

D)$155,000.

A) $0.

B) $93,000.

C) $124,000.

D)$155,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

50

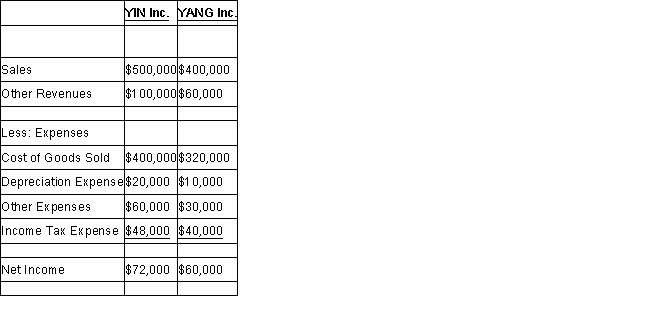

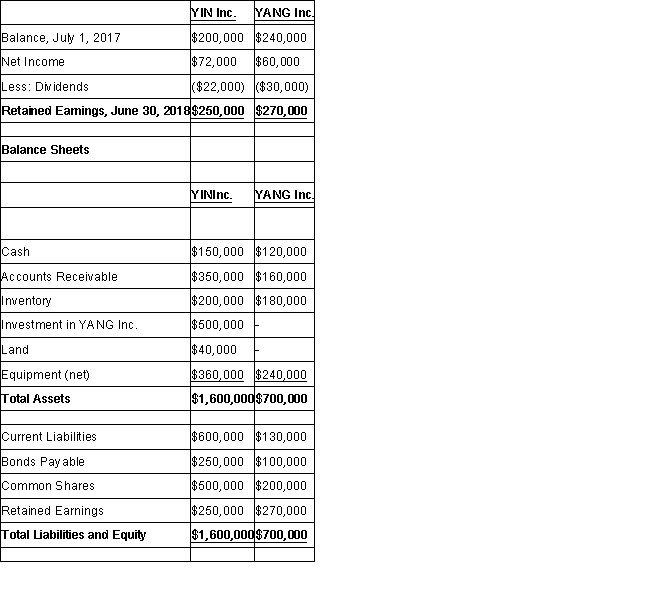

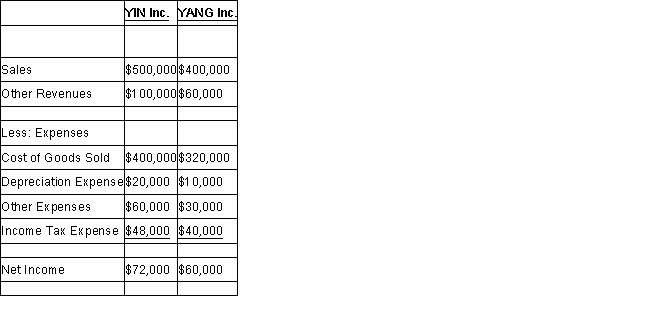

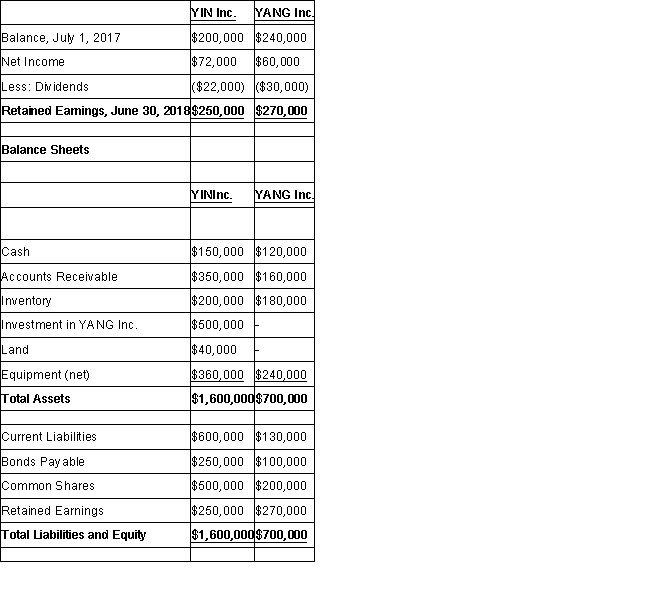

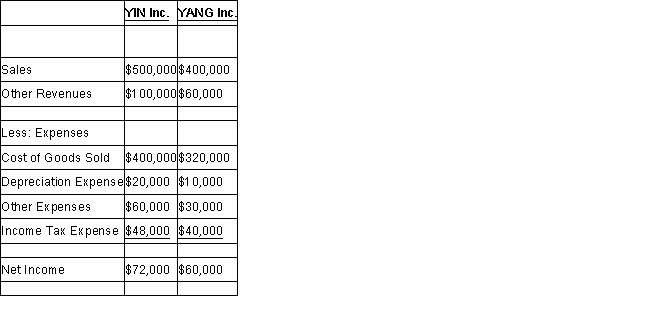

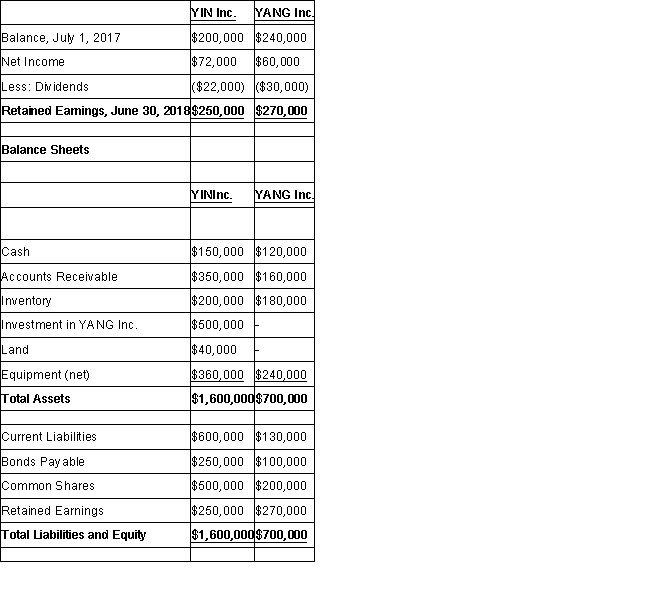

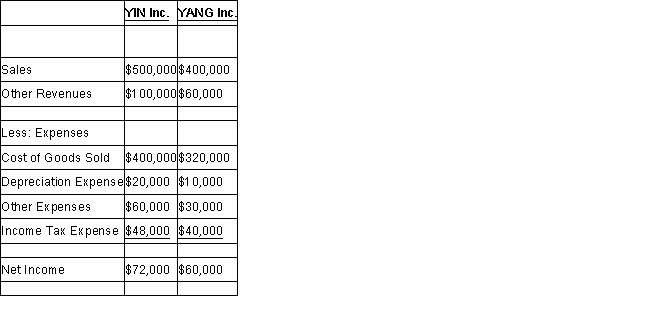

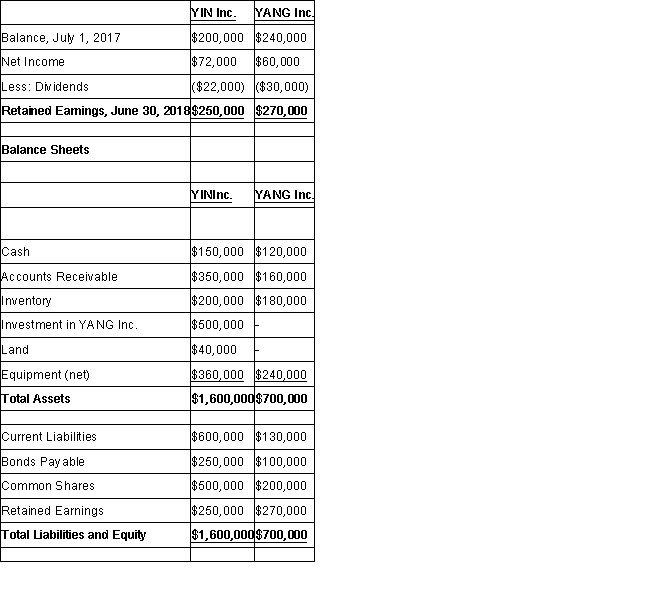

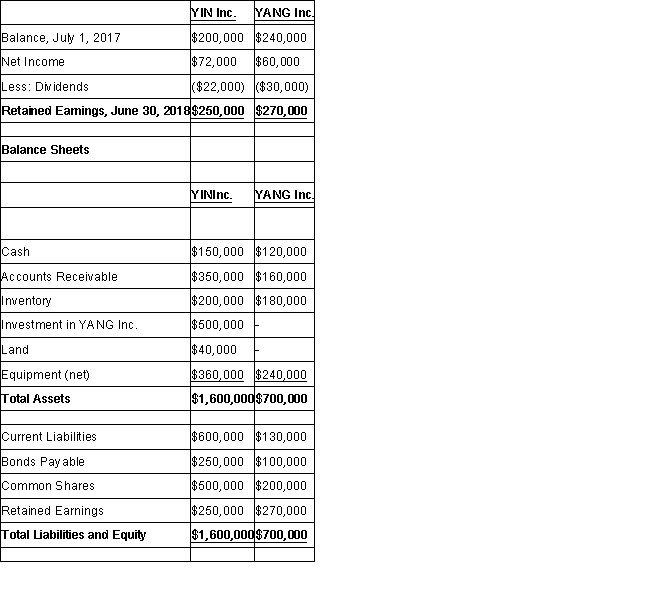

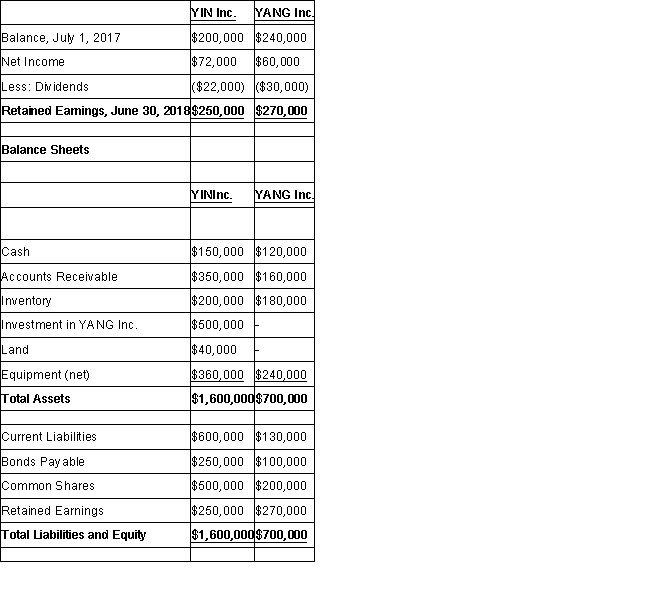

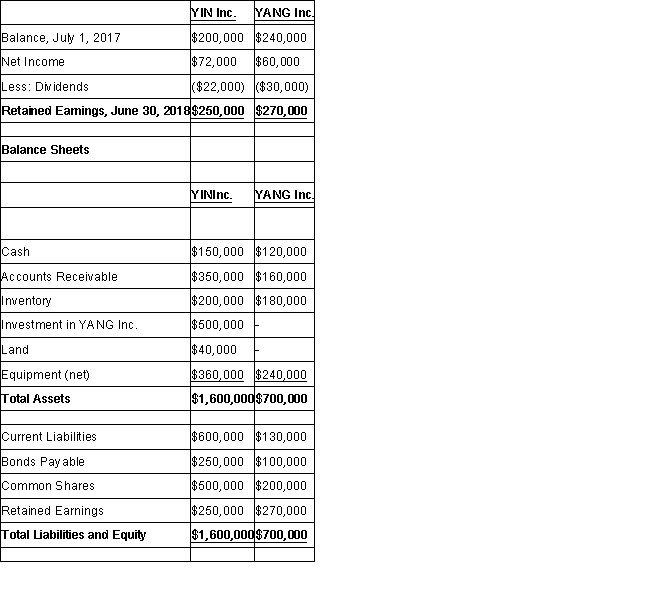

YIN Inc. purchased 75% of the voting shares of YANG Inc for $500,000 on July 1, 2015. On that date, YANG Inc.'s Common Shares and Retained Earnings were valued at $200,000 and $100,000 respectively. Unless otherwise stated, assume that YIN uses the cost method to account for its investment in YANG Inc.

YANG's fair values approximated its carrying values with the following exception:

YANG's bonds payable had a fair value which was $50,000 higher than their carrying value.

The bonds payable mature on July 1, 2025. Both companies use straight line amortization exclusively.

The Financial Statements of both companies for the Year ended June 30, 2018 are shown below:

Income Statements Retained Earnings Statements

Retained Earnings Statements

Other Information:

Other Information:

During August of 2016, YIN sold $60,000 worth of Inventory to YANG, 80% of which was sold to outsiders during the year. During October of 2017, YIN sold inventory to YANG for $90,000. two-thirds of this inventory was resold by YANG to outside parties later that year.

During September of 2016, YANG sold $90,000 worth of inventory to YIN, 50% of which was sold to outsiders during the year. During April of 2018, Yang sold inventory to YIN for $120,000. 80% of this inventory was resold by YANG to outside parties in May.

During May of 2018, YANG sold a plot of Land to YIN for $40,000. The land was recorded at cost of $24,000 on YANG's book prior to the sale. YIN has not yet sold the land.

All intercompany sales as well as sales to outsiders are priced 50% above cost. The effective tax rate for both companies is 40%.

Compute YIN's Goodwill at the date of acquisition.

YANG's fair values approximated its carrying values with the following exception:

YANG's bonds payable had a fair value which was $50,000 higher than their carrying value.

The bonds payable mature on July 1, 2025. Both companies use straight line amortization exclusively.

The Financial Statements of both companies for the Year ended June 30, 2018 are shown below:

Income Statements

Retained Earnings Statements

Retained Earnings Statements Other Information:

Other Information:During August of 2016, YIN sold $60,000 worth of Inventory to YANG, 80% of which was sold to outsiders during the year. During October of 2017, YIN sold inventory to YANG for $90,000. two-thirds of this inventory was resold by YANG to outside parties later that year.

During September of 2016, YANG sold $90,000 worth of inventory to YIN, 50% of which was sold to outsiders during the year. During April of 2018, Yang sold inventory to YIN for $120,000. 80% of this inventory was resold by YANG to outside parties in May.

During May of 2018, YANG sold a plot of Land to YIN for $40,000. The land was recorded at cost of $24,000 on YANG's book prior to the sale. YIN has not yet sold the land.

All intercompany sales as well as sales to outsiders are priced 50% above cost. The effective tax rate for both companies is 40%.

Compute YIN's Goodwill at the date of acquisition.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

51

MAX Inc. purchased 80% of the voting shares of MIN Inc for $750,000 on January 1, 2015. On that date, MAX's common shares and retained earnings were valued at $300,000 and $150,000 respectively. Unless otherwise stated, assume that MAX uses the cost method to account for its investment in MIN Inc.

MIN's fair values approximated its carrying values with the following exceptions:

MIN's trademark had a fair value which was $80,000 higher than its carrying value.

MIN's bonds payable had a fair value which was $30,000 higher than their carrying value.

The trademark had a useful life of exactly twenty years remaining from the date of acquisition. The bonds payable mature on January 1, 2035. Both companies use straight line amortization exclusively.

The financial statements of both companies for the year ended December 31, 2017 are shown below:

Income Statements Retained Earnings Statements

Other Information:

Other Information:

A goodwill impairment test conducted during August 2017 revealed that the Min's goodwill amount on the date of acquisition had been impaired by $5,000.

During 2016, Max sold $60,000 worth of Inventory to Min, 80% of which was sold to outsiders during the year. During 2017, Max sold inventory to Min for $80,000. 75% of this inventory was resold by Min to outside parties during that year.

During 2016, Min sold $40,000 worth of Inventory to Max, 80% of which was sold to outsiders during the year. During 2017, Min sold inventory to Max for $50,000. 80% of this inventory was resold by Max to outside parties during that year.

All intercompany sales as well as sales to outsiders are priced 25% above cost. The effective tax rate for both companies is 50%.

-Compute MAX's Goodwill at the date of acquisition.

MIN's fair values approximated its carrying values with the following exceptions:

MIN's trademark had a fair value which was $80,000 higher than its carrying value.

MIN's bonds payable had a fair value which was $30,000 higher than their carrying value.

The trademark had a useful life of exactly twenty years remaining from the date of acquisition. The bonds payable mature on January 1, 2035. Both companies use straight line amortization exclusively.

The financial statements of both companies for the year ended December 31, 2017 are shown below:

Income Statements Retained Earnings Statements

Other Information:

Other Information:A goodwill impairment test conducted during August 2017 revealed that the Min's goodwill amount on the date of acquisition had been impaired by $5,000.

During 2016, Max sold $60,000 worth of Inventory to Min, 80% of which was sold to outsiders during the year. During 2017, Max sold inventory to Min for $80,000. 75% of this inventory was resold by Min to outside parties during that year.

During 2016, Min sold $40,000 worth of Inventory to Max, 80% of which was sold to outsiders during the year. During 2017, Min sold inventory to Max for $50,000. 80% of this inventory was resold by Max to outside parties during that year.

All intercompany sales as well as sales to outsiders are priced 25% above cost. The effective tax rate for both companies is 50%.

-Compute MAX's Goodwill at the date of acquisition.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

52

The amount of goodwill arising from this combination would be:

A) $120,000.

B) $130,000.

C) $200,000.

D)$296,667.

A) $120,000.

B) $130,000.

C) $200,000.

D)$296,667.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

53

In your own words, explain what effect (if any) these intercompany transactions would have on non-controlling interest.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

54

MAX Inc. purchased 80% of the voting shares of MIN Inc for $750,000 on January 1, 2015. On that date, MAX's common shares and retained earnings were valued at $300,000 and $150,000 respectively. Unless otherwise stated, assume that MAX uses the cost method to account for its investment in MIN Inc.

MIN's fair values approximated its carrying values with the following exceptions:

MIN's trademark had a fair value which was $80,000 higher than its carrying value.

MIN's bonds payable had a fair value which was $30,000 higher than their carrying value.

The trademark had a useful life of exactly twenty years remaining from the date of acquisition. The bonds payable mature on January 1, 2035. Both companies use straight line amortization exclusively.

The financial statements of both companies for the year ended December 31, 2017 are shown below:

Income Statements Retained Earnings Statements

Other Information:

Other Information:

A goodwill impairment test conducted during August 2017 revealed that the Min's goodwill amount on the date of acquisition had been impaired by $5,000.

During 2016, Max sold $60,000 worth of Inventory to Min, 80% of which was sold to outsiders during the year. During 2017, Max sold inventory to Min for $80,000. 75% of this inventory was resold by Min to outside parties during that year.

During 2016, Min sold $40,000 worth of Inventory to Max, 80% of which was sold to outsiders during the year. During 2017, Min sold inventory to Max for $50,000. 80% of this inventory was resold by Max to outside parties during that year.

All intercompany sales as well as sales to outsiders are priced 25% above cost. The effective tax rate for both companies is 50%.

-Calculate Consolidated Retained Earnings as at December 31, 2017.

MIN's fair values approximated its carrying values with the following exceptions:

MIN's trademark had a fair value which was $80,000 higher than its carrying value.

MIN's bonds payable had a fair value which was $30,000 higher than their carrying value.

The trademark had a useful life of exactly twenty years remaining from the date of acquisition. The bonds payable mature on January 1, 2035. Both companies use straight line amortization exclusively.

The financial statements of both companies for the year ended December 31, 2017 are shown below:

Income Statements Retained Earnings Statements

Other Information:

Other Information:A goodwill impairment test conducted during August 2017 revealed that the Min's goodwill amount on the date of acquisition had been impaired by $5,000.

During 2016, Max sold $60,000 worth of Inventory to Min, 80% of which was sold to outsiders during the year. During 2017, Max sold inventory to Min for $80,000. 75% of this inventory was resold by Min to outside parties during that year.

During 2016, Min sold $40,000 worth of Inventory to Max, 80% of which was sold to outsiders during the year. During 2017, Min sold inventory to Max for $50,000. 80% of this inventory was resold by Max to outside parties during that year.

All intercompany sales as well as sales to outsiders are priced 25% above cost. The effective tax rate for both companies is 50%.

-Calculate Consolidated Retained Earnings as at December 31, 2017.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

55

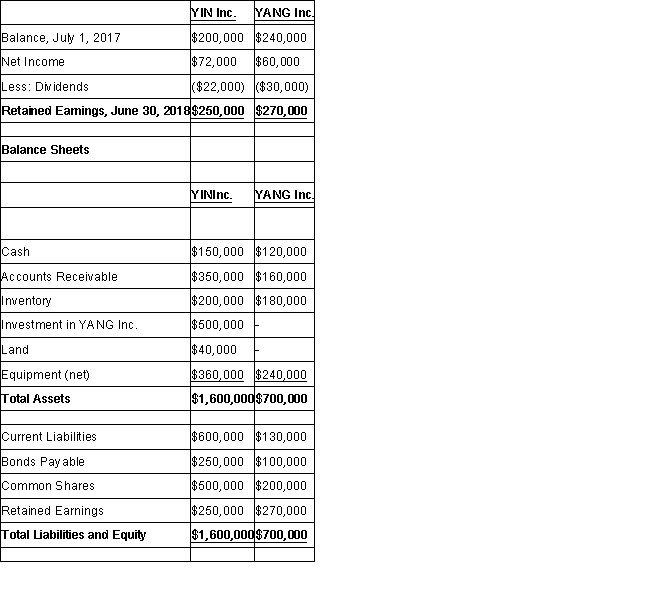

YIN Inc. purchased 75% of the voting shares of YANG Inc for $500,000 on July 1, 2015. On that date, YANG Inc.'s Common Shares and Retained Earnings were valued at $200,000 and $100,000 respectively. Unless otherwise stated, assume that YIN uses the cost method to account for its investment in YANG Inc.

YANG's fair values approximated its carrying values with the following exception:

YANG's bonds payable had a fair value which was $50,000 higher than their carrying value.

The bonds payable mature on July 1, 2025. Both companies use straight line amortization exclusively.

The Financial Statements of both companies for the Year ended June 30, 2018 are shown below:

Income Statements Retained Earnings Statements

Retained Earnings Statements

Other Information:

Other Information:

During August of 2016, YIN sold $60,000 worth of Inventory to YANG, 80% of which was sold to outsiders during the year. During October of 2017, YIN sold inventory to YANG for $90,000. two-thirds of this inventory was resold by YANG to outside parties later that year.

During September of 2016, YANG sold $90,000 worth of inventory to YIN, 50% of which was sold to outsiders during the year. During April of 2018, Yang sold inventory to YIN for $120,000. 80% of this inventory was resold by YANG to outside parties in May.

During May of 2018, YANG sold a plot of Land to YIN for $40,000. The land was recorded at cost of $24,000 on YANG's book prior to the sale. YIN has not yet sold the land.

All intercompany sales as well as sales to outsiders are priced 50% above cost. The effective tax rate for both companies is 40%.

Prepare a schedule of realized and unrealized profits for the fiscal year ended June 30, 2018 for both companies. Show your figures before and after tax.

YANG's fair values approximated its carrying values with the following exception:

YANG's bonds payable had a fair value which was $50,000 higher than their carrying value.

The bonds payable mature on July 1, 2025. Both companies use straight line amortization exclusively.

The Financial Statements of both companies for the Year ended June 30, 2018 are shown below:

Income Statements

Retained Earnings Statements

Retained Earnings Statements Other Information:

Other Information:During August of 2016, YIN sold $60,000 worth of Inventory to YANG, 80% of which was sold to outsiders during the year. During October of 2017, YIN sold inventory to YANG for $90,000. two-thirds of this inventory was resold by YANG to outside parties later that year.

During September of 2016, YANG sold $90,000 worth of inventory to YIN, 50% of which was sold to outsiders during the year. During April of 2018, Yang sold inventory to YIN for $120,000. 80% of this inventory was resold by YANG to outside parties in May.

During May of 2018, YANG sold a plot of Land to YIN for $40,000. The land was recorded at cost of $24,000 on YANG's book prior to the sale. YIN has not yet sold the land.

All intercompany sales as well as sales to outsiders are priced 50% above cost. The effective tax rate for both companies is 40%.

Prepare a schedule of realized and unrealized profits for the fiscal year ended June 30, 2018 for both companies. Show your figures before and after tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

56

On December 31, 2015, the land account balance in the books of Parent Company is $300,000 and in the books of the subsidiary is $300,000. No acquisition differential was allocated to land. What will be the amount of land in the consolidated balance sheet at December 31, 2015?

A) $480,000.

B) $504,000.

C) $510,000.

D)$600,000.

A) $480,000.

B) $504,000.

C) $510,000.

D)$600,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

57

MAX Inc. purchased 80% of the voting shares of MIN Inc for $750,000 on January 1, 2015. On that date, MAX's common shares and retained earnings were valued at $300,000 and $150,000 respectively. Unless otherwise stated, assume that MAX uses the cost method to account for its investment in MIN Inc.

MIN's fair values approximated its carrying values with the following exceptions:

MIN's trademark had a fair value which was $80,000 higher than its carrying value.

MIN's bonds payable had a fair value which was $30,000 higher than their carrying value.

The trademark had a useful life of exactly twenty years remaining from the date of acquisition. The bonds payable mature on January 1, 2035. Both companies use straight line amortization exclusively.

The financial statements of both companies for the year ended December 31, 2017 are shown below:

Income Statements Retained Earnings Statements

Other Information:

Other Information:

A goodwill impairment test conducted during August 2017 revealed that the Min's goodwill amount on the date of acquisition had been impaired by $5,000.

During 2016, Max sold $60,000 worth of Inventory to Min, 80% of which was sold to outsiders during the year. During 2017, Max sold inventory to Min for $80,000. 75% of this inventory was resold by Min to outside parties during that year.

During 2016, Min sold $40,000 worth of Inventory to Max, 80% of which was sold to outsiders during the year. During 2017, Min sold inventory to Max for $50,000. 80% of this inventory was resold by Max to outside parties during that year.

All intercompany sales as well as sales to outsiders are priced 25% above cost. The effective tax rate for both companies is 50%.

-Prepare a schedule of Realized and Unrealized Profits for 2017 for both companies. Show your figures before and after tax.

MIN's fair values approximated its carrying values with the following exceptions:

MIN's trademark had a fair value which was $80,000 higher than its carrying value.

MIN's bonds payable had a fair value which was $30,000 higher than their carrying value.

The trademark had a useful life of exactly twenty years remaining from the date of acquisition. The bonds payable mature on January 1, 2035. Both companies use straight line amortization exclusively.

The financial statements of both companies for the year ended December 31, 2017 are shown below:

Income Statements Retained Earnings Statements

Other Information:

Other Information:A goodwill impairment test conducted during August 2017 revealed that the Min's goodwill amount on the date of acquisition had been impaired by $5,000.

During 2016, Max sold $60,000 worth of Inventory to Min, 80% of which was sold to outsiders during the year. During 2017, Max sold inventory to Min for $80,000. 75% of this inventory was resold by Min to outside parties during that year.

During 2016, Min sold $40,000 worth of Inventory to Max, 80% of which was sold to outsiders during the year. During 2017, Min sold inventory to Max for $50,000. 80% of this inventory was resold by Max to outside parties during that year.

All intercompany sales as well as sales to outsiders are priced 25% above cost. The effective tax rate for both companies is 50%.

-Prepare a schedule of Realized and Unrealized Profits for 2017 for both companies. Show your figures before and after tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

58

On December 31, 2016, the land account balance in the books of Parent Company is $300,000 and in the books of the subsidiary is $340,000. No acquisition differential was allocated to land. What will be the amount of land in the consolidated balance sheet at December 31, 2016?

A) $520,000.

B) $544,000.

C) $550,000.

D)$640,000.

A) $520,000.

B) $544,000.

C) $550,000.

D)$640,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

59

What effect will the elimination of the unrealized intercompany gain (in the preparation of the consolidated income statement) have on consolidated income tax expense for 2015?

A) It will have no effect.

B) It will reduce income tax expense by $24,000.

C) It will reduce income tax expense by $18,000.

D)It will increase income tax expense by $24,000.

A) It will have no effect.

B) It will reduce income tax expense by $24,000.

C) It will reduce income tax expense by $18,000.

D)It will increase income tax expense by $24,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

60

What effect will the adjustment for the realization of the intercompany gain (in the preparation of the consolidated income statement) have on consolidated income tax expense for 2017?

A) It will have no effect.

B) It will reduce income tax expense by $24,000.

C) It will reduce income tax expense by $18,000.

D)It will increase income tax expense by $24,000.

A) It will have no effect.

B) It will reduce income tax expense by $24,000.

C) It will reduce income tax expense by $18,000.

D)It will increase income tax expense by $24,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

61

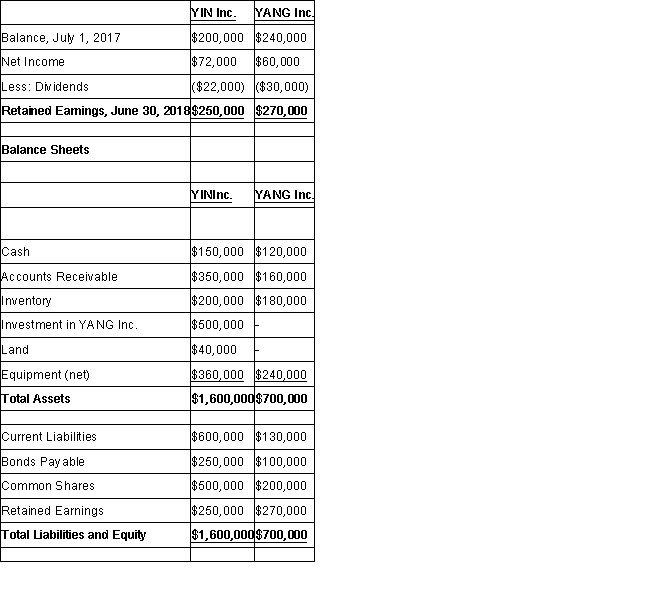

YIN Inc. purchased 75% of the voting shares of YANG Inc for $500,000 on July 1, 2015. On that date, YANG Inc.'s Common Shares and Retained Earnings were valued at $200,000 and $100,000 respectively. Unless otherwise stated, assume that YIN uses the cost method to account for its investment in YANG Inc.

YANG's fair values approximated its carrying values with the following exception:

YANG's bonds payable had a fair value which was $50,000 higher than their carrying value.

The bonds payable mature on July 1, 2025. Both companies use straight line amortization exclusively.

The Financial Statements of both companies for the Year ended June 30, 2018 are shown below:

Income Statements Retained Earnings Statements

Other Information:

Other Information:

During August of 2016, YIN sold $60,000 worth of Inventory to YANG, 80% of which was sold to outsiders during the year. During October of 2017, YIN sold inventory to YANG for $90,000. two-thirds of this inventory was resold by YANG to outside parties later that year.

During September of 2016, YANG sold $90,000 worth of inventory to YIN, 50% of which was sold to outsiders during the year. During April of 2018, Yang sold inventory to YIN for $120,000. 80% of this inventory was resold by YANG to outside parties in May.

During May of 2018, YANG sold a plot of Land to YIN for $40,000. The land was recorded at cost of $24,000 on YANG's book prior to the sale. YIN has not yet sold the land.

All intercompany sales as well as sales to outsiders are priced 50% above cost. The effective tax rate for both companies is 40%.

-Assuming that YIN Inc uses the equity method to account for its investment in YANG, compute the balance in its investment in YANG account at June 30, 2018.

YANG's fair values approximated its carrying values with the following exception:

YANG's bonds payable had a fair value which was $50,000 higher than their carrying value.

The bonds payable mature on July 1, 2025. Both companies use straight line amortization exclusively.

The Financial Statements of both companies for the Year ended June 30, 2018 are shown below:

Income Statements Retained Earnings Statements

Other Information:

Other Information:During August of 2016, YIN sold $60,000 worth of Inventory to YANG, 80% of which was sold to outsiders during the year. During October of 2017, YIN sold inventory to YANG for $90,000. two-thirds of this inventory was resold by YANG to outside parties later that year.

During September of 2016, YANG sold $90,000 worth of inventory to YIN, 50% of which was sold to outsiders during the year. During April of 2018, Yang sold inventory to YIN for $120,000. 80% of this inventory was resold by YANG to outside parties in May.

During May of 2018, YANG sold a plot of Land to YIN for $40,000. The land was recorded at cost of $24,000 on YANG's book prior to the sale. YIN has not yet sold the land.

All intercompany sales as well as sales to outsiders are priced 50% above cost. The effective tax rate for both companies is 40%.

-Assuming that YIN Inc uses the equity method to account for its investment in YANG, compute the balance in its investment in YANG account at June 30, 2018.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

62

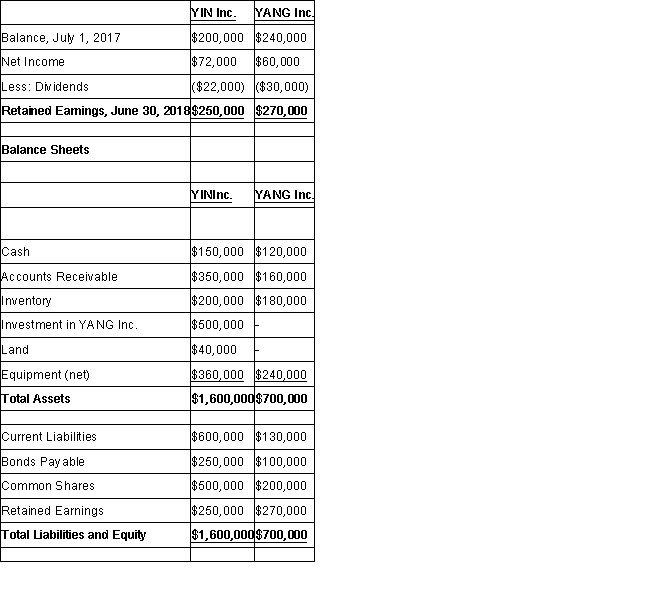

YIN Inc. purchased 75% of the voting shares of YANG Inc for $500,000 on July 1, 2015. On that date, YANG Inc.'s Common Shares and Retained Earnings were valued at $200,000 and $100,000 respectively. Unless otherwise stated, assume that YIN uses the cost method to account for its investment in YANG Inc.

YANG's fair values approximated its carrying values with the following exception:

YANG's bonds payable had a fair value which was $50,000 higher than their carrying value.

The bonds payable mature on July 1, 2025. Both companies use straight line amortization exclusively.

The Financial Statements of both companies for the Year ended June 30, 2018 are shown below:

Income Statements Retained Earnings Statements

Other Information:

Other Information:

During August of 2016, YIN sold $60,000 worth of Inventory to YANG, 80% of which was sold to outsiders during the year. During October of 2017, YIN sold inventory to YANG for $90,000. two-thirds of this inventory was resold by YANG to outside parties later that year.

During September of 2016, YANG sold $90,000 worth of inventory to YIN, 50% of which was sold to outsiders during the year. During April of 2018, Yang sold inventory to YIN for $120,000. 80% of this inventory was resold by YANG to outside parties in May.

During May of 2018, YANG sold a plot of Land to YIN for $40,000. The land was recorded at cost of $24,000 on YANG's book prior to the sale. YIN has not yet sold the land.

All intercompany sales as well as sales to outsiders are priced 50% above cost. The effective tax rate for both companies is 40%.

-Prepare YIN's Consolidated Income Statement for the Year ended June 30, 2018. Show the allocation of the income between the controlling and non-controlling interests.

YANG's fair values approximated its carrying values with the following exception:

YANG's bonds payable had a fair value which was $50,000 higher than their carrying value.

The bonds payable mature on July 1, 2025. Both companies use straight line amortization exclusively.

The Financial Statements of both companies for the Year ended June 30, 2018 are shown below:

Income Statements Retained Earnings Statements

Other Information:

Other Information:During August of 2016, YIN sold $60,000 worth of Inventory to YANG, 80% of which was sold to outsiders during the year. During October of 2017, YIN sold inventory to YANG for $90,000. two-thirds of this inventory was resold by YANG to outside parties later that year.

During September of 2016, YANG sold $90,000 worth of inventory to YIN, 50% of which was sold to outsiders during the year. During April of 2018, Yang sold inventory to YIN for $120,000. 80% of this inventory was resold by YANG to outside parties in May.

During May of 2018, YANG sold a plot of Land to YIN for $40,000. The land was recorded at cost of $24,000 on YANG's book prior to the sale. YIN has not yet sold the land.

All intercompany sales as well as sales to outsiders are priced 50% above cost. The effective tax rate for both companies is 40%.

-Prepare YIN's Consolidated Income Statement for the Year ended June 30, 2018. Show the allocation of the income between the controlling and non-controlling interests.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

63

YIN Inc. purchased 75% of the voting shares of YANG Inc for $500,000 on July 1, 2015. On that date, YANG Inc.'s Common Shares and Retained Earnings were valued at $200,000 and $100,000 respectively. Unless otherwise stated, assume that YIN uses the cost method to account for its investment in YANG Inc.

YANG's fair values approximated its carrying values with the following exception:

YANG's bonds payable had a fair value which was $50,000 higher than their carrying value.

The bonds payable mature on July 1, 2025. Both companies use straight line amortization exclusively.

The Financial Statements of both companies for the Year ended June 30, 2018 are shown below:

Income Statements Retained Earnings Statements

Other Information:

Other Information:

During August of 2016, YIN sold $60,000 worth of Inventory to YANG, 80% of which was sold to outsiders during the year. During October of 2017, YIN sold inventory to YANG for $90,000. two-thirds of this inventory was resold by YANG to outside parties later that year.

During September of 2016, YANG sold $90,000 worth of inventory to YIN, 50% of which was sold to outsiders during the year. During April of 2018, Yang sold inventory to YIN for $120,000. 80% of this inventory was resold by YANG to outside parties in May.

During May of 2018, YANG sold a plot of Land to YIN for $40,000. The land was recorded at cost of $24,000 on YANG's book prior to the sale. YIN has not yet sold the land.

All intercompany sales as well as sales to outsiders are priced 50% above cost. The effective tax rate for both companies is 40%.

-Calculate the non-controlling interest (Balance Sheet) as at June 30, 2018.

YANG's fair values approximated its carrying values with the following exception:

YANG's bonds payable had a fair value which was $50,000 higher than their carrying value.

The bonds payable mature on July 1, 2025. Both companies use straight line amortization exclusively.

The Financial Statements of both companies for the Year ended June 30, 2018 are shown below:

Income Statements Retained Earnings Statements

Other Information:

Other Information:During August of 2016, YIN sold $60,000 worth of Inventory to YANG, 80% of which was sold to outsiders during the year. During October of 2017, YIN sold inventory to YANG for $90,000. two-thirds of this inventory was resold by YANG to outside parties later that year.

During September of 2016, YANG sold $90,000 worth of inventory to YIN, 50% of which was sold to outsiders during the year. During April of 2018, Yang sold inventory to YIN for $120,000. 80% of this inventory was resold by YANG to outside parties in May.

During May of 2018, YANG sold a plot of Land to YIN for $40,000. The land was recorded at cost of $24,000 on YANG's book prior to the sale. YIN has not yet sold the land.

All intercompany sales as well as sales to outsiders are priced 50% above cost. The effective tax rate for both companies is 40%.

-Calculate the non-controlling interest (Balance Sheet) as at June 30, 2018.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

64

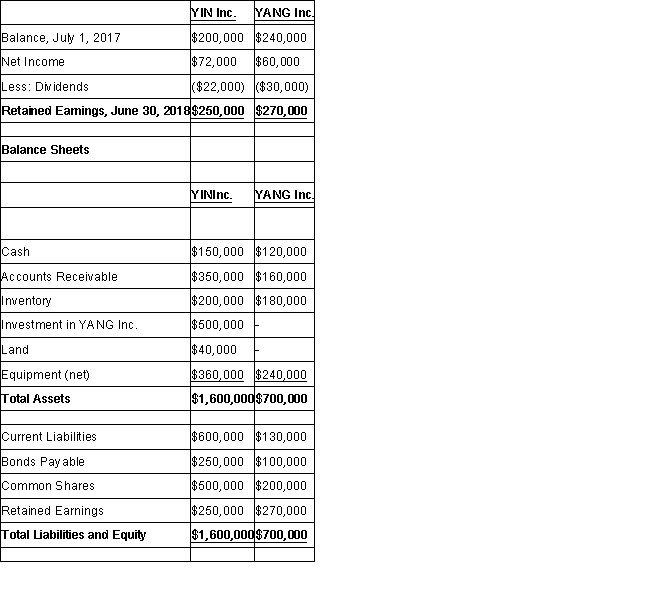

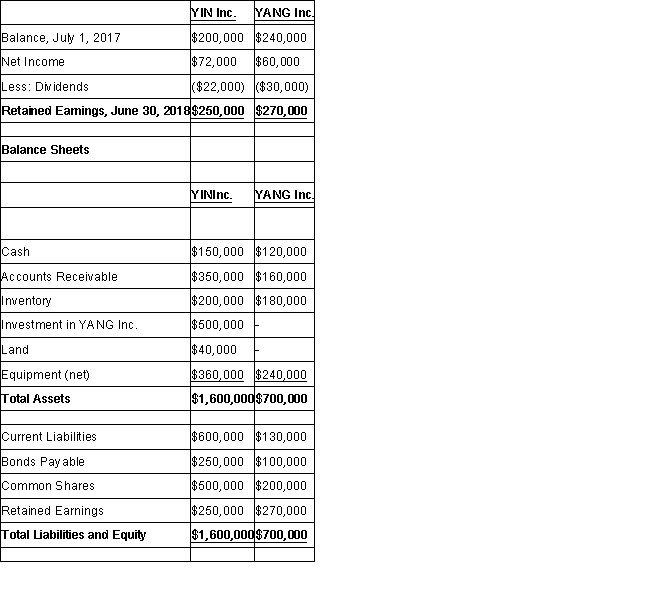

YIN Inc. purchased 75% of the voting shares of YANG Inc for $500,000 on July 1, 2015. On that date, YANG Inc.'s Common Shares and Retained Earnings were valued at $200,000 and $100,000 respectively. Unless otherwise stated, assume that YIN uses the cost method to account for its investment in YANG Inc.

YANG's fair values approximated its carrying values with the following exception:

YANG's bonds payable had a fair value which was $50,000 higher than their carrying value.

The bonds payable mature on July 1, 2025. Both companies use straight line amortization exclusively.

The Financial Statements of both companies for the Year ended June 30, 2018 are shown below:

Income Statements Retained Earnings Statements

Other Information:

Other Information:

During August of 2016, YIN sold $60,000 worth of Inventory to YANG, 80% of which was sold to outsiders during the year. During October of 2017, YIN sold inventory to YANG for $90,000. two-thirds of this inventory was resold by YANG to outside parties later that year.

During September of 2016, YANG sold $90,000 worth of inventory to YIN, 50% of which was sold to outsiders during the year. During April of 2018, Yang sold inventory to YIN for $120,000. 80% of this inventory was resold by YANG to outside parties in May.

During May of 2018, YANG sold a plot of Land to YIN for $40,000. The land was recorded at cost of $24,000 on YANG's book prior to the sale. YIN has not yet sold the land.

All intercompany sales as well as sales to outsiders are priced 50% above cost. The effective tax rate for both companies is 40%.

-Calculate Consolidated Retained Earnings as at June 30, 2018.

YANG's fair values approximated its carrying values with the following exception:

YANG's bonds payable had a fair value which was $50,000 higher than their carrying value.

The bonds payable mature on July 1, 2025. Both companies use straight line amortization exclusively.

The Financial Statements of both companies for the Year ended June 30, 2018 are shown below:

Income Statements Retained Earnings Statements

Other Information:

Other Information:During August of 2016, YIN sold $60,000 worth of Inventory to YANG, 80% of which was sold to outsiders during the year. During October of 2017, YIN sold inventory to YANG for $90,000. two-thirds of this inventory was resold by YANG to outside parties later that year.

During September of 2016, YANG sold $90,000 worth of inventory to YIN, 50% of which was sold to outsiders during the year. During April of 2018, Yang sold inventory to YIN for $120,000. 80% of this inventory was resold by YANG to outside parties in May.

During May of 2018, YANG sold a plot of Land to YIN for $40,000. The land was recorded at cost of $24,000 on YANG's book prior to the sale. YIN has not yet sold the land.

All intercompany sales as well as sales to outsiders are priced 50% above cost. The effective tax rate for both companies is 40%.

-Calculate Consolidated Retained Earnings as at June 30, 2018.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck