Deck 7: A Intercompany Profits in Depreciable Assets B Intercompany Bondholdings

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/65

العب

ملء الشاشة (f)

Deck 7: A Intercompany Profits in Depreciable Assets B Intercompany Bondholdings

1

What was the pre-tax gain or loss to Duff Inc. on the intercompany sale of the bonds?

A) $20,000 loss.

B) $10,000 loss.

C) Nil.

D)$10,000 gain.

A) $20,000 loss.

B) $10,000 loss.

C) Nil.

D)$10,000 gain.

B

2

What is the amount of the amortization of the acquisition differential during 2019?

A) $7,200.

B) $8,800.

C) $10,000.

D)$80,000.

A) $7,200.

B) $8,800.

C) $10,000.

D)$80,000.

B

3

What was the pre-tax gain or loss to Paddy Inc. on the intercompany purchase of the bonds?

A) $20,000 loss.

B) Nil.

C) $20,000 gain.

D)$40,000 loss.

A) $20,000 loss.

B) Nil.

C) $20,000 gain.

D)$40,000 loss.

C

4

What is the total amount of unrealized profit (after-tax) remaining at the end of 2018?

A) $1,000.

B) $2,000.

C) $9,000.

D)$10,000.

A) $1,000.

B) $2,000.

C) $9,000.

D)$10,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

5

What amount would be shown on Duff's 2017 Consolidated Statement of Financial Position under bonds payable?

A) $110,000.

B) $111,000.

C) $112,000.

D)$220,000.

A) $110,000.

B) $111,000.

C) $112,000.

D)$220,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

6

The amount of non-controlling interest in Jay's 2019 Consolidated Net Income would be:

A) Nil.

B) $1,458.

C) $1,800.

D)$1,818.

A) Nil.

B) $1,458.

C) $1,800.

D)$1,818.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

7

What would be the journal entry to record the dividends declared by King Corp during the year?

A)

B)

C)

D)No entry.

A)

B)

C)

D)No entry.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

8

What is the balance in the Investment in Stempy account at the end of 2019?

A) $300,000.

B) $350,000.

C) $444,960.

D)$469,000.

A) $300,000.

B) $350,000.

C) $444,960.

D)$469,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

9

What would be the pre-tax gain or loss to the combined entity on the intercompany sale of the bonds?

A) $20,000 loss.

B) $10,000 loss.

C) Nil.

D)$10,000 gain.

A) $20,000 loss.

B) $10,000 loss.

C) Nil.

D)$10,000 gain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

10

What is the total amount of unrealized profit (after-tax) remaining at the end of 2019?

A) Nil.

B) $26,000.

C) $27,000.

D)$30,000.

A) Nil.

B) $26,000.

C) $27,000.

D)$30,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

11

How much intercompany (after-tax) profit was realized during 2019 on Stempy's 2019 sale of assets to Rin?

A) Nil.

B) $1,000.

C) $2,000.

D)$10,000.

A) Nil.

B) $1,000.

C) $2,000.

D)$10,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

12

How much intercompany (after-tax) profit was realized during 2019 from Rin's 2018 sale of assets to Stempy?

A) Nil.

B) $1,000.

C) $2,000.

D)$10,000.

A) Nil.

B) $1,000.

C) $2,000.

D)$10,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

13

The controlling interest (attributable to the shareholders of Jay) in Jay's 2019 Consolidated Net Income would be:

A) $30,000.

B) $35,832.

C) $36,000.

D)$37,200.

A) $30,000.

B) $35,832.

C) $36,000.

D)$37,200.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

14

What amount of interest expense, excluding amortization of the bond discount, (if any) would have to be eliminated in 2017 as a result of the intercompany sale of the bonds?

A) None.

B) $12,000.

C) $12,200.

D)$14,400.

A) None.

B) $12,000.

C) $12,200.

D)$14,400.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

15

The amount of income tax expense appearing on Jay's 2019 Consolidated Income Statement would be:

A) $24,860.

B) $25,040.

C) $26,000.

D)$34,880.

A) $24,860.

B) $25,040.

C) $26,000.

D)$34,880.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

16

The amount of Miscellaneous Revenues/Expense appearing on Jay's 2019 Consolidated Income Statement would be:

A) $47,000.

B) $47,600.

C) $50,000.

D)$53,000.

A) $47,000.

B) $47,600.

C) $50,000.

D)$53,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

17

The amount of goodwill arising from this business combination is:

A) Nil.

B) $72,000.

C) $130,000.

D)$220,000.

A) Nil.

B) $72,000.

C) $130,000.

D)$220,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

18

The amount of gross profit appearing on Jay's 2019 Consolidated Income Statement would be:

A) $147,000.

B) $147,600.

C) $150,000.

D)$153,000.

A) $147,000.

B) $147,600.

C) $150,000.

D)$153,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

19

The amount of depreciation expense appearing on Jay's 2019 Consolidated Income Statement would be:

A) $15,000.

B) $34,850.

C) $34,880.

D)$35,000.

A) $15,000.

B) $34,850.

C) $34,880.

D)$35,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

20

The amount of deferred taxes appearing on Jay's 2019 Consolidated Statement of Financial Position would be:

A) Nil.

B) $1,000.

C) $1,140.

D)$2,550.

A) Nil.

B) $1,000.

C) $1,140.

D)$2,550.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

21

What effect would the intercompany bond sale have on Won?

A) Won would record a loss $14,000.

B) Won would record a loss of $10,000.

C) Won would record a gain of $4,000.

D)Won would record a gain of $10,000.

A) Won would record a loss $14,000.

B) Won would record a loss of $10,000.

C) Won would record a gain of $4,000.

D)Won would record a gain of $10,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

22

What is the amount of unamortized acquisition differential (excluding unimpaired goodwill) on December 31, 2018?

A) $4,000.

B) $5,000.

C) $8,000.

D)$10,000.

A) $4,000.

B) $5,000.

C) $8,000.

D)$10,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

23

What would be the non-controlling Interest amount appearing on King's Consolidated Statement of Financial Position at January 1, 2018?

A) $100,000.

B) $101,800.

C) $125,000.

D)$185,000.

A) $100,000.

B) $101,800.

C) $125,000.

D)$185,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

24

What is the total amount of unrealized pre-tax profits in inventory at the start of 2019?

A) Nil.

B) $2,000.

C) $5,000.

D)$8,000.

A) Nil.

B) $2,000.

C) $5,000.

D)$8,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

25

What would be the amount appearing on the December 31, 2018 Consolidated Statement of Financial Position for land?

A) $15,000.

B) $17,000.

C) $21,000.

D)$25,000.

A) $15,000.

B) $17,000.

C) $21,000.

D)$25,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

26

What would be the amount appearing on the December 31, 2018 Consolidated Statement of Financial Position for deferred income taxes?

A) Nil.

B) $10,000.

C) $11,200.

D)$12,000.

A) Nil.

B) $10,000.

C) $11,200.

D)$12,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

27

What would be the amount of other revenue appearing on King's Consolidated Income Statement for the year ended December 31, 2018?

A) $359,600.

B) $399,600.

C) $410,000.

D)$420,000.

A) $359,600.

B) $399,600.

C) $410,000.

D)$420,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

28

What would be the carrying value of the bonds payable appearing on Ting's December 31, 2019 Consolidated Statement of Financial Position?

A) $64,500.

B) $65,000.

C) $65,500.

D)$131,000.

A) $64,500.

B) $65,000.

C) $65,500.

D)$131,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

29

What would be the amount of consolidated patents appearing on King's Consolidated Statement of Financial Position as at December 31, 2018?

A) $8,000.

B) $10,000.

C) $12,000.

D)$15,000.

A) $8,000.

B) $10,000.

C) $12,000.

D)$15,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

30

The amount of goodwill appearing on King's December 31, 2018 Consolidated Statement of Financial Position would be:

A) Nil.

B) $126,000.

C) $224,000.

D)$240,000.

A) Nil.

B) $126,000.

C) $224,000.

D)$240,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

31

What would be the non-controlling interest amount in King's Consolidated Net Income for 2018?

A) $8,240.

B) $10,000.

C) $11,600.

D)$15,000.

A) $8,240.

B) $10,000.

C) $11,600.

D)$15,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

32

Ignoring income taxes and any minority interest effects, what is the amount of profit realized during 2018 from the intercompany sale of equipment?

A) Nil.

B) $4,000.

C) $5,000.

D)$8,000.

A) Nil.

B) $4,000.

C) $5,000.

D)$8,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

33

What is the total amount of pre-tax profit from intercompany inventory sales that was realized during 2018?

A) $2,000.

B) $5,000.

C) $7,000.

D)$10,000.

A) $2,000.

B) $5,000.

C) $7,000.

D)$10,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

34

What would be the amount appearing on the December 31, 2018 Consolidated Income Statement for cost of goods sold?

A) $640,000.

B) $593,000.

C) $590,000.

D)$400,000.

A) $640,000.

B) $593,000.

C) $590,000.

D)$400,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

35

The amount of goodwill arising from this business combination is:

A) $300,000.

B) $500,000.

C) $530,000.

D)$1,010,000.

A) $300,000.

B) $500,000.

C) $530,000.

D)$1,010,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

36

What effect would the intercompany bond sale have on Ting's December 31, 2019 Consolidated Income Statement?

A) Ting would record a loss of $15,000.

B) Ting would record a loss of $10,000.

C) Ting would record a gain of $5,000.

D)Ting would record a gain of $15,000.

A) Ting would record a loss of $15,000.

B) Ting would record a loss of $10,000.

C) Ting would record a gain of $5,000.

D)Ting would record a gain of $15,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

37

What effect would the intercompany bond sale have on Ting?

A) Ting would record a loss $5,000.

B) Ting would record a loss of $4,000.

C) Ting would record a gain of $14,000.

D)Ting would record a gain of $15,000.

A) Ting would record a loss $5,000.

B) Ting would record a loss of $4,000.

C) Ting would record a gain of $14,000.

D)Ting would record a gain of $15,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

38

What would be the amount appearing on the December 31, 2018 Consolidated Statement of Financial Position for inventories?

A) $295,000.

B) $296,000.

C) $297,000.

D)$300,000.

A) $295,000.

B) $296,000.

C) $297,000.

D)$300,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

39

Ignoring income taxes and any minority interest effects, what is the amount of unrealized profit remaining from the intercompany sale of equipment at December 31, 2018?

A) Nil.

B) $10,000.

C) $15,000.

D)$20,000.

A) Nil.

B) $10,000.

C) $15,000.

D)$20,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

40

What amount of sales revenue would appear on King's Consolidated Income Statement for the year ended December 31, 2018?

A) $750,000.

B) $790,000.

C) $800,000.

D)$810,000.

A) $750,000.

B) $790,000.

C) $800,000.

D)$810,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

41

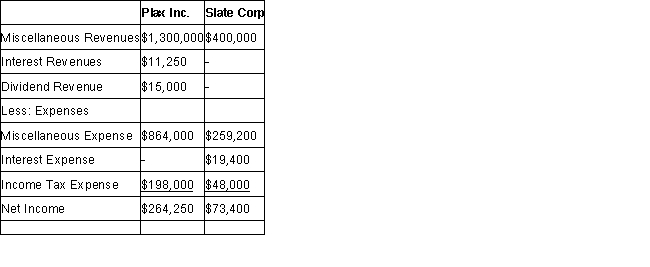

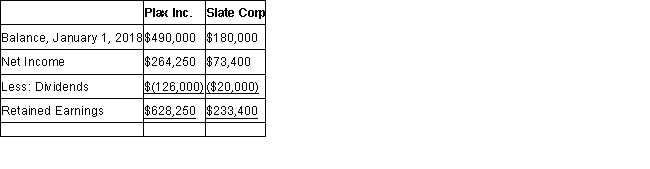

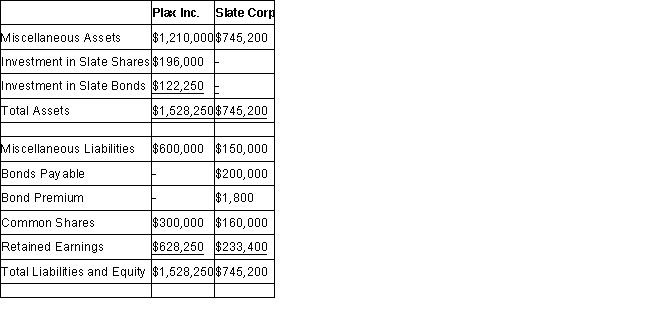

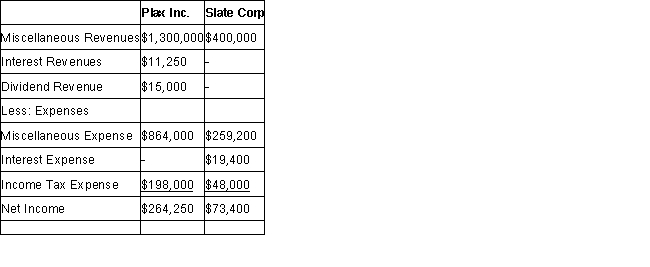

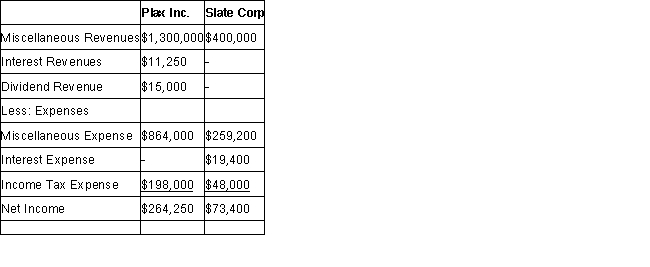

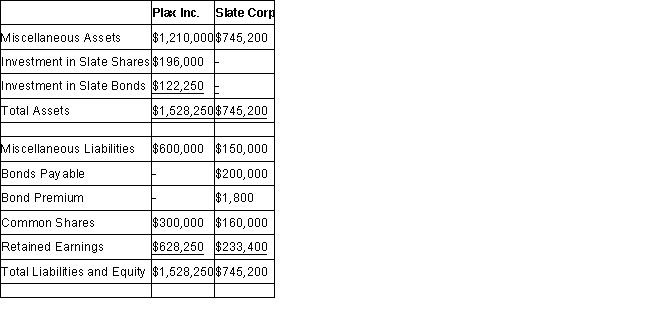

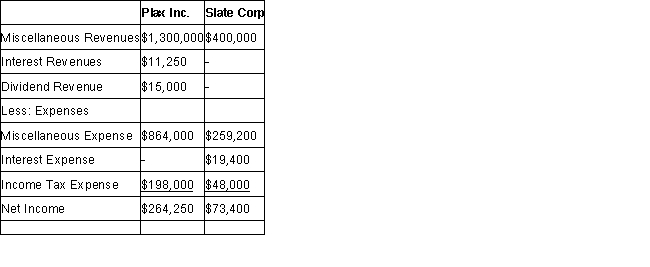

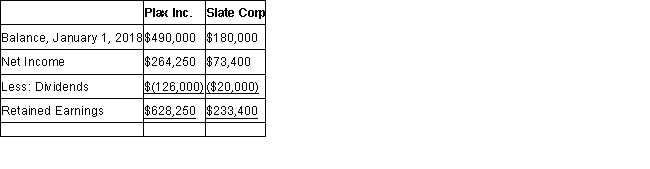

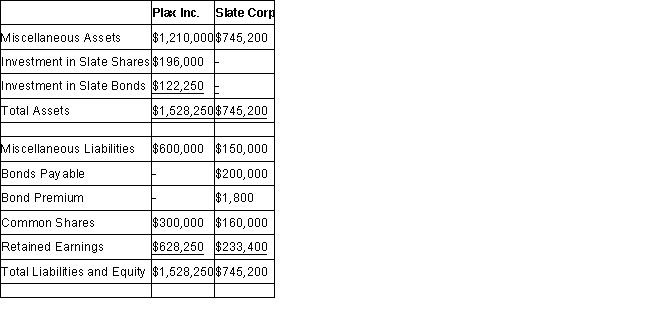

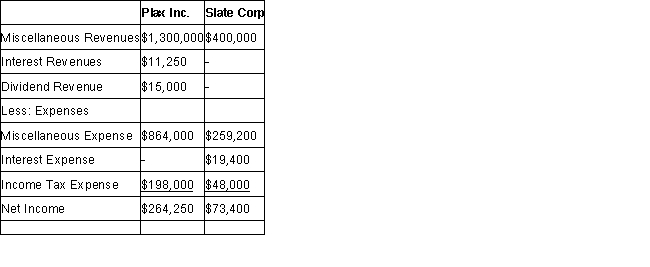

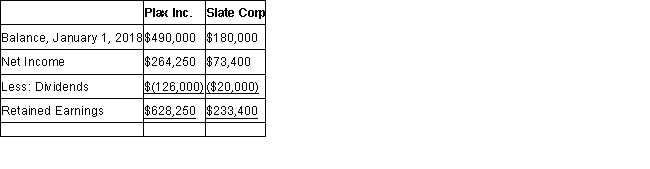

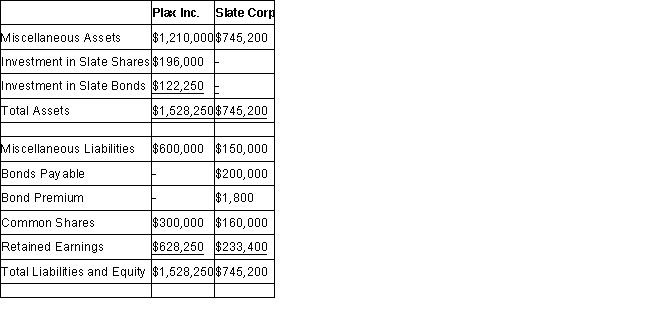

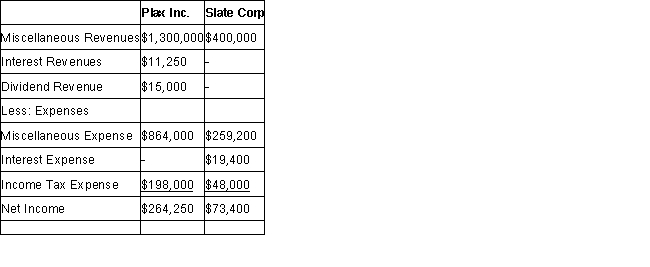

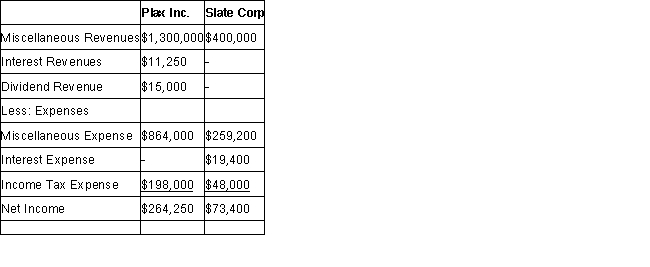

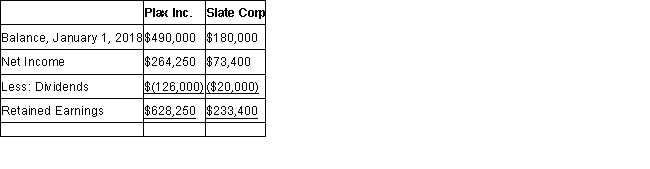

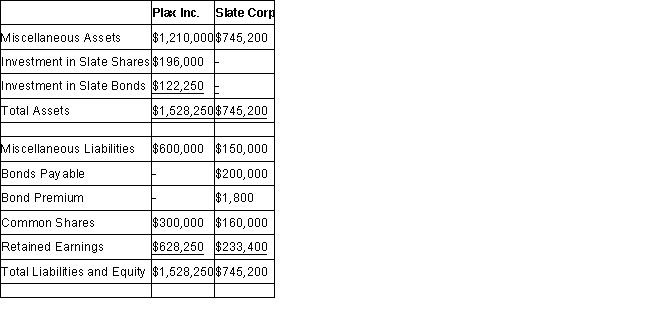

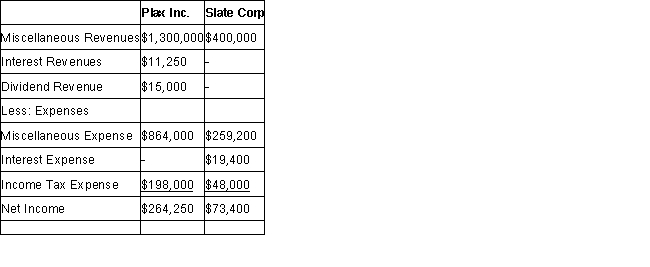

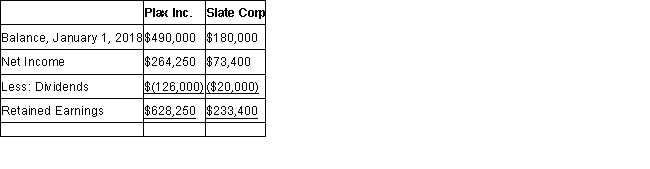

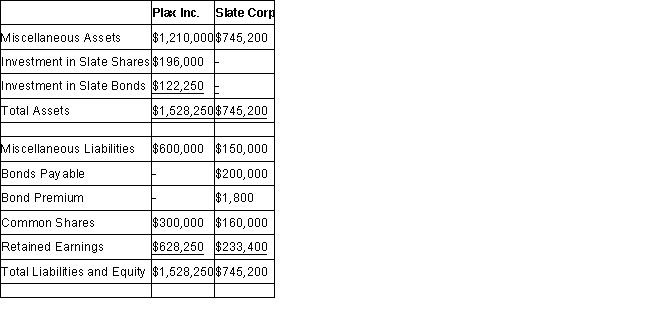

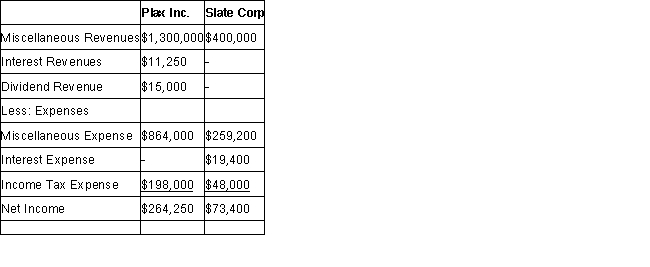

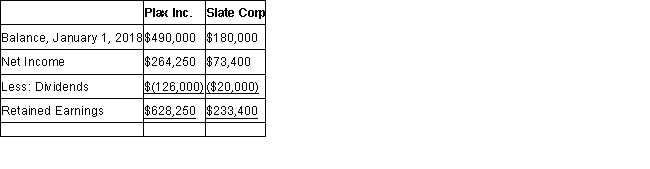

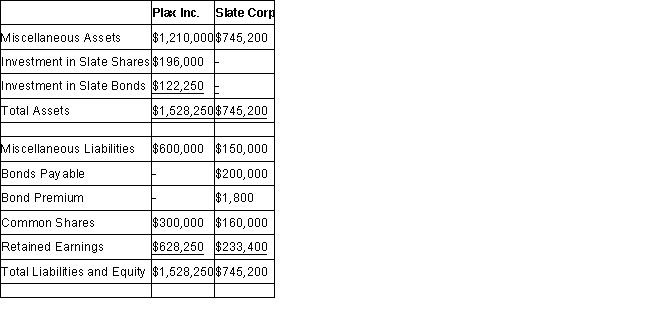

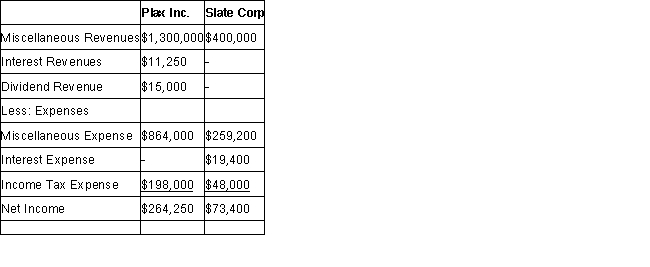

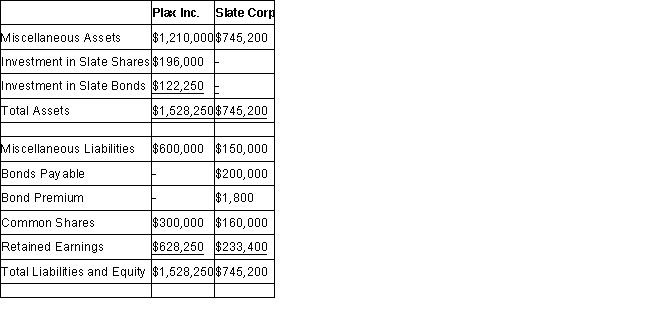

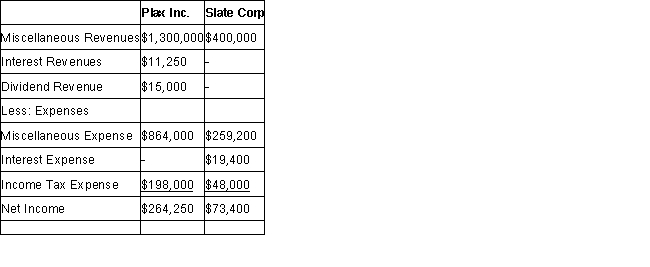

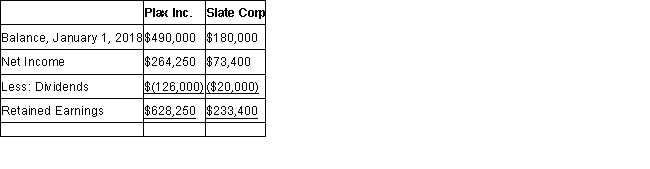

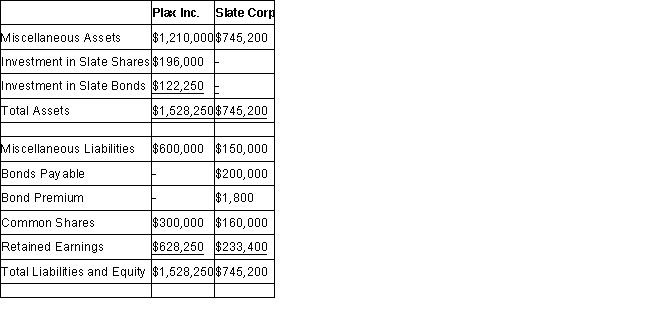

The financial statements of Plax Inc. and Slate Corp for the year ended December 31, 2018 are shown below:

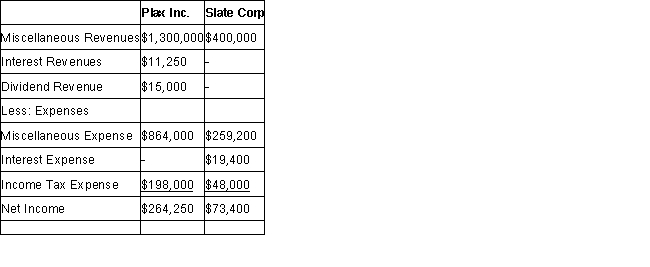

Income Statements Retained Earnings Statements

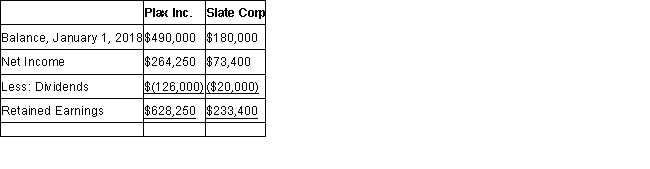

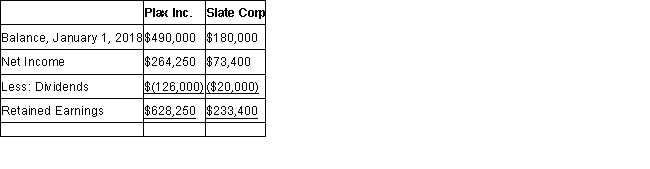

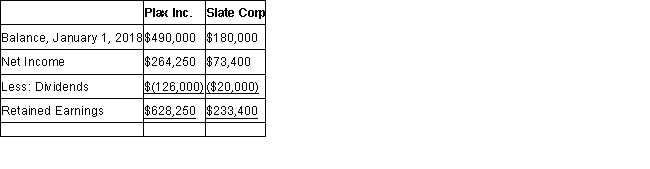

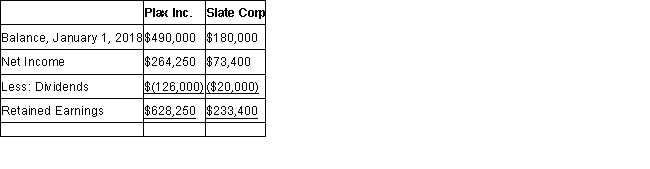

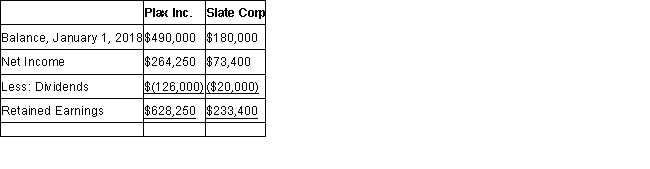

Retained Earnings Statements

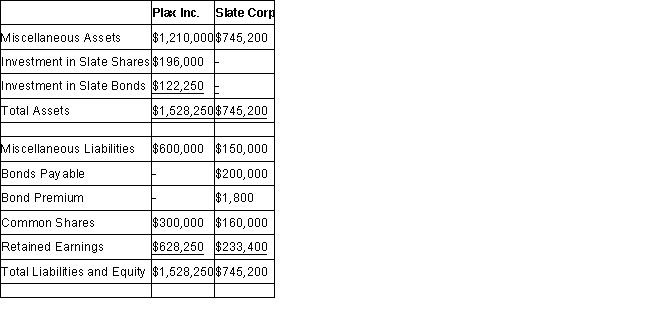

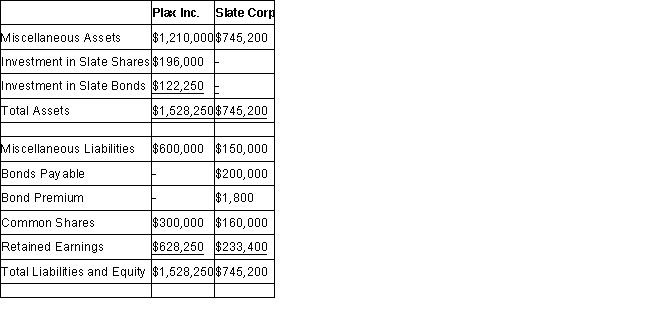

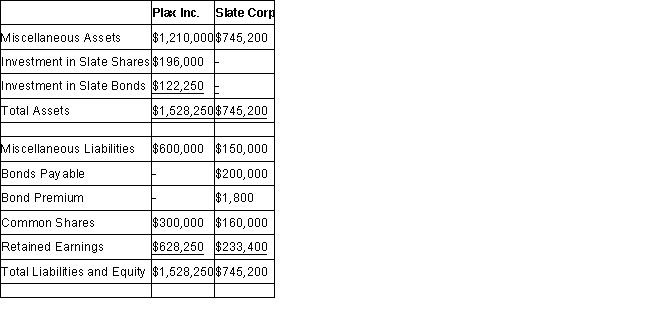

Balance Sheets

Balance Sheets

Other Information:

Other Information:

> Plax acquired 75% of Slate on January 1, 2014 for $196,000, when Slate's retained earnings was $80,000 and the acquisition differential was attributable entirely to goodwill. There were impairment losses to the goodwill of $6,400 and $1,600 in 2015 and 2018 respectively.

> Plax uses the cost method to account for its investment.

> Slate has 10% par value bonds outstanding in the amount of $200,000 which mature on December 31, 2021. The bonds were issued at a premium. On January 1, 2018 the unamortized premium amounted to $2,400 Slate uses the straight line method to amortize the premium.

> On January 1, 2018, Plax acquired $120,000 face value of Slate's bonds for $123,000 Plax also uses the straight line method to amortize any bond premium or discount.

> Both companies are subject to a 40% tax rate.

> Gains and losses from intercompany bond holdings are to be allocated to the two companies when consolidated financial statements are prepared.

Prepare a detailed calculation of consolidated retained earnings as at January 1, 2018. Do not prepare a Statement of Retained Earnings for this requirement.

Income Statements

Retained Earnings Statements

Retained Earnings Statements Balance Sheets

Balance Sheets Other Information:

Other Information:> Plax acquired 75% of Slate on January 1, 2014 for $196,000, when Slate's retained earnings was $80,000 and the acquisition differential was attributable entirely to goodwill. There were impairment losses to the goodwill of $6,400 and $1,600 in 2015 and 2018 respectively.

> Plax uses the cost method to account for its investment.

> Slate has 10% par value bonds outstanding in the amount of $200,000 which mature on December 31, 2021. The bonds were issued at a premium. On January 1, 2018 the unamortized premium amounted to $2,400 Slate uses the straight line method to amortize the premium.

> On January 1, 2018, Plax acquired $120,000 face value of Slate's bonds for $123,000 Plax also uses the straight line method to amortize any bond premium or discount.

> Both companies are subject to a 40% tax rate.

> Gains and losses from intercompany bond holdings are to be allocated to the two companies when consolidated financial statements are prepared.

Prepare a detailed calculation of consolidated retained earnings as at January 1, 2018. Do not prepare a Statement of Retained Earnings for this requirement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

42

What would be the amount of consolidated patents appearing on Ting's Consolidated Statement of Financial Position as at December 31, 2019?

A) $14,000.

B) $15,000.

C) $16,000.

D)$18,000.

A) $14,000.

B) $15,000.

C) $16,000.

D)$18,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

43

What would be the non-controlling interest amount appearing on Ting's Consolidated Statement of Financial Position on January 1, 2019?

A) $298,300.

B) $375,000.

C) $450,000.

D)$500,000.

A) $298,300.

B) $375,000.

C) $450,000.

D)$500,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

44

The financial statements of Plax Inc. and Slate Corp for the year ended December 31, 2018 are shown below:

Income Statements Retained Earnings Statements

Retained Earnings Statements

Balance Sheets

Balance Sheets

Other Information:

Other Information:

> Plax acquired 75% of Slate on January 1, 2014 for $196,000, when Slate's retained earnings was $80,000 and the acquisition differential was attributable entirely to goodwill. There were impairment losses to the goodwill of $6,400 and $1,600 in 2015 and 2018 respectively.

> Plax uses the cost method to account for its investment.

> Slate has 10% par value bonds outstanding in the amount of $200,000 which mature on December 31, 2021. The bonds were issued at a premium. On January 1, 2018 the unamortized premium amounted to $2,400 Slate uses the straight line method to amortize the premium.

> On January 1, 2018, Plax acquired $120,000 face value of Slate's bonds for $123,000 Plax also uses the straight line method to amortize any bond premium or discount.

> Both companies are subject to a 40% tax rate.

> Gains and losses from intercompany bond holdings are to be allocated to the two companies when consolidated financial statements are prepared.

Calculate the goodwill as at December 31, 2018.

Income Statements

Retained Earnings Statements

Retained Earnings Statements Balance Sheets

Balance Sheets Other Information:

Other Information:> Plax acquired 75% of Slate on January 1, 2014 for $196,000, when Slate's retained earnings was $80,000 and the acquisition differential was attributable entirely to goodwill. There were impairment losses to the goodwill of $6,400 and $1,600 in 2015 and 2018 respectively.

> Plax uses the cost method to account for its investment.

> Slate has 10% par value bonds outstanding in the amount of $200,000 which mature on December 31, 2021. The bonds were issued at a premium. On January 1, 2018 the unamortized premium amounted to $2,400 Slate uses the straight line method to amortize the premium.

> On January 1, 2018, Plax acquired $120,000 face value of Slate's bonds for $123,000 Plax also uses the straight line method to amortize any bond premium or discount.

> Both companies are subject to a 40% tax rate.

> Gains and losses from intercompany bond holdings are to be allocated to the two companies when consolidated financial statements are prepared.

Calculate the goodwill as at December 31, 2018.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

45

What would be the amount appearing on the December 31, 2019 Consolidated Statement of Financial Position for deferred income taxes?

A) $600.

B) $900.

C) $1,200.

D)$2,600.

A) $600.

B) $900.

C) $1,200.

D)$2,600.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

46

What would be the amount of other revenue appearing on Ting's Consolidated Income Statement for the Year ended December 31, 2019?

A) $840,000.

B) $820,000.

C) $815,000.

D)$788,000.

A) $840,000.

B) $820,000.

C) $815,000.

D)$788,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

47

Compute the goodwill on the acquisition date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

48

Ignoring income taxes, what is the amount of profit/(loss) realized during 2019 from the intercompany sale of equipment?

A) $4,000 loss.

B) $2,800 gain.

C) $4,000 gain.

D)$20,000 gain.

A) $4,000 loss.

B) $2,800 gain.

C) $4,000 gain.

D)$20,000 gain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

49

Prepare a Schedule of Realized and Unrealized Profits for 2018 and 2019 for both companies. Show your figures before and after tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

50

Ignoring taxes, what is the total amount of unrealized profits in inventory at the end of 2019?

A) $2,500.

B) $3,000.

C) $5,000.

D)$20,000.

A) $2,500.

B) $3,000.

C) $5,000.

D)$20,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

51

What is the amount of unamortized acquisition differential (excluding unimpaired goodwill) on December 31, 2019?

A) $4,000.

B) $8,000.

C) $16,000.

D)$26,000.

A) $4,000.

B) $8,000.

C) $16,000.

D)$26,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

52

What is the total amount of pre-tax profit from intercompany inventory sales that was realized during 2019?

A) $2,500.

B) $6,200.

C) $20,200.

D)$22,500.

A) $2,500.

B) $6,200.

C) $20,200.

D)$22,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

53

The financial statements of Plax Inc. and Slate Corp for the year ended December 31, 2018 are shown below:

Income Statements Retained Earnings Statements

Retained Earnings Statements

Balance Sheets

Balance Sheets

Other Information:

Other Information:

> Plax acquired 75% of Slate on January 1, 2014 for $196,000, when Slate's retained earnings was $80,000 and the acquisition differential was attributable entirely to goodwill. There were impairment losses to the goodwill of $6,400 and $1,600 in 2015 and 2018 respectively.

> Plax uses the cost method to account for its investment.

> Slate has 10% par value bonds outstanding in the amount of $200,000 which mature on December 31, 2021. The bonds were issued at a premium. On January 1, 2018 the unamortized premium amounted to $2,400 Slate uses the straight line method to amortize the premium.

> On January 1, 2018, Plax acquired $120,000 face value of Slate's bonds for $123,000 Plax also uses the straight line method to amortize any bond premium or discount.

> Both companies are subject to a 40% tax rate.

> Gains and losses from intercompany bond holdings are to be allocated to the two companies when consolidated financial statements are prepared.

Prepare a summary of intercompany interest revenues and expenses.

Income Statements

Retained Earnings Statements

Retained Earnings Statements Balance Sheets

Balance Sheets Other Information:

Other Information:> Plax acquired 75% of Slate on January 1, 2014 for $196,000, when Slate's retained earnings was $80,000 and the acquisition differential was attributable entirely to goodwill. There were impairment losses to the goodwill of $6,400 and $1,600 in 2015 and 2018 respectively.

> Plax uses the cost method to account for its investment.

> Slate has 10% par value bonds outstanding in the amount of $200,000 which mature on December 31, 2021. The bonds were issued at a premium. On January 1, 2018 the unamortized premium amounted to $2,400 Slate uses the straight line method to amortize the premium.

> On January 1, 2018, Plax acquired $120,000 face value of Slate's bonds for $123,000 Plax also uses the straight line method to amortize any bond premium or discount.

> Both companies are subject to a 40% tax rate.

> Gains and losses from intercompany bond holdings are to be allocated to the two companies when consolidated financial statements are prepared.

Prepare a summary of intercompany interest revenues and expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

54

Compute the amount of income tax that would be deferred as at December 31, 2019.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

55

The financial statements of Plax Inc. and Slate Corp for the year ended December 31, 2018 are shown below:

Income Statements Retained Earnings Statements

Retained Earnings Statements

Balance Sheets

Balance Sheets

Other Information:

Other Information:

> Plax acquired 75% of Slate on January 1, 2014 for $196,000, when Slate's retained earnings was $80,000 and the acquisition differential was attributable entirely to goodwill. There were impairment losses to the goodwill of $6,400 and $1,600 in 2015 and 2018 respectively.

> Plax uses the cost method to account for its investment.

> Slate has 10% par value bonds outstanding in the amount of $200,000 which mature on December 31, 2021. The bonds were issued at a premium. On January 1, 2018 the unamortized premium amounted to $2,400 Slate uses the straight line method to amortize the premium.

> On January 1, 2018, Plax acquired $120,000 face value of Slate's bonds for $123,000 Plax also uses the straight line method to amortize any bond premium or discount.

> Both companies are subject to a 40% tax rate.

> Gains and losses from intercompany bond holdings are to be allocated to the two companies when consolidated financial statements are prepared.

Prepare a detailed calculation of consolidated net income. Do not prepare an income statement for this requirement.

Income Statements

Retained Earnings Statements

Retained Earnings Statements Balance Sheets

Balance Sheets Other Information:

Other Information:> Plax acquired 75% of Slate on January 1, 2014 for $196,000, when Slate's retained earnings was $80,000 and the acquisition differential was attributable entirely to goodwill. There were impairment losses to the goodwill of $6,400 and $1,600 in 2015 and 2018 respectively.

> Plax uses the cost method to account for its investment.

> Slate has 10% par value bonds outstanding in the amount of $200,000 which mature on December 31, 2021. The bonds were issued at a premium. On January 1, 2018 the unamortized premium amounted to $2,400 Slate uses the straight line method to amortize the premium.

> On January 1, 2018, Plax acquired $120,000 face value of Slate's bonds for $123,000 Plax also uses the straight line method to amortize any bond premium or discount.

> Both companies are subject to a 40% tax rate.

> Gains and losses from intercompany bond holdings are to be allocated to the two companies when consolidated financial statements are prepared.

Prepare a detailed calculation of consolidated net income. Do not prepare an income statement for this requirement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

56

What amount of sales revenue would appear on Ting's Consolidated Income Statement for the year ended December 31, 2019?

A) $1,450,000.

B) $1,480,000.

C) $1,570,000.

D)$1,600,000.

A) $1,450,000.

B) $1,480,000.

C) $1,570,000.

D)$1,600,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

57

Ignoring income taxes, what is the amount of unrealized profit/(loss) remaining from the intercompany sale of equipment at December 31, 2019?

A) $16,000 loss.

B) $12,000 gain.

C) $12,500 gain.

D)$16,000 gain.

A) $16,000 loss.

B) $12,000 gain.

C) $12,500 gain.

D)$16,000 gain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

58

Compute the balance in Hot's Investment in Cold account as at December 31, 2019.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

59

The financial statements of Plax Inc. and Slate Corp for the year ended December 31, 2018 are shown below:

Income Statements Retained Earnings Statements

Retained Earnings Statements

Balance Sheets

Balance Sheets

Other Information:

Other Information:

> Plax acquired 75% of Slate on January 1, 2014 for $196,000, when Slate's retained earnings was $80,000 and the acquisition differential was attributable entirely to goodwill. There were impairment losses to the goodwill of $6,400 and $1,600 in 2015 and 2018 respectively.

> Plax uses the cost method to account for its investment.

> Slate has 10% par value bonds outstanding in the amount of $200,000 which mature on December 31, 2021. The bonds were issued at a premium. On January 1, 2018 the unamortized premium amounted to $2,400 Slate uses the straight line method to amortize the premium.

> On January 1, 2018, Plax acquired $120,000 face value of Slate's bonds for $123,000 Plax also uses the straight line method to amortize any bond premium or discount.

> Both companies are subject to a 40% tax rate.

> Gains and losses from intercompany bond holdings are to be allocated to the two companies when consolidated financial statements are prepared.

Prepare a summary of intercompany bond transactions. Be sure to show the gain or loss for each company as well as the effect on the consolidated entity.

Income Statements

Retained Earnings Statements

Retained Earnings Statements Balance Sheets

Balance Sheets Other Information:

Other Information:> Plax acquired 75% of Slate on January 1, 2014 for $196,000, when Slate's retained earnings was $80,000 and the acquisition differential was attributable entirely to goodwill. There were impairment losses to the goodwill of $6,400 and $1,600 in 2015 and 2018 respectively.

> Plax uses the cost method to account for its investment.

> Slate has 10% par value bonds outstanding in the amount of $200,000 which mature on December 31, 2021. The bonds were issued at a premium. On January 1, 2018 the unamortized premium amounted to $2,400 Slate uses the straight line method to amortize the premium.

> On January 1, 2018, Plax acquired $120,000 face value of Slate's bonds for $123,000 Plax also uses the straight line method to amortize any bond premium or discount.

> Both companies are subject to a 40% tax rate.

> Gains and losses from intercompany bond holdings are to be allocated to the two companies when consolidated financial statements are prepared.

Prepare a summary of intercompany bond transactions. Be sure to show the gain or loss for each company as well as the effect on the consolidated entity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

60

The financial statements of Plax Inc. and Slate Corp for the year ended December 31, 2018 are shown below:

Income Statements Retained Earnings Statements

Retained Earnings Statements

Balance Sheets

Balance Sheets

Other Information:

Other Information:

> Plax acquired 75% of Slate on January 1, 2014 for $196,000, when Slate's retained earnings was $80,000 and the acquisition differential was attributable entirely to goodwill. There were impairment losses to the goodwill of $6,400 and $1,600 in 2015 and 2018 respectively.

> Plax uses the cost method to account for its investment.

> Slate has 10% par value bonds outstanding in the amount of $200,000 which mature on December 31, 2021. The bonds were issued at a premium. On January 1, 2018 the unamortized premium amounted to $2,400 Slate uses the straight line method to amortize the premium.

> On January 1, 2018, Plax acquired $120,000 face value of Slate's bonds for $123,000 Plax also uses the straight line method to amortize any bond premium or discount.

> Both companies are subject to a 40% tax rate.

> Gains and losses from intercompany bond holdings are to be allocated to the two companies when consolidated financial statements are prepared.

Prepare Plax's Consolidated Income Statement for the year ended December 31, 2018. Show the allocation of consolidated net income between the controlling and non-controlling shareholders.

Income Statements

Retained Earnings Statements

Retained Earnings Statements Balance Sheets

Balance Sheets Other Information:

Other Information:> Plax acquired 75% of Slate on January 1, 2014 for $196,000, when Slate's retained earnings was $80,000 and the acquisition differential was attributable entirely to goodwill. There were impairment losses to the goodwill of $6,400 and $1,600 in 2015 and 2018 respectively.

> Plax uses the cost method to account for its investment.

> Slate has 10% par value bonds outstanding in the amount of $200,000 which mature on December 31, 2021. The bonds were issued at a premium. On January 1, 2018 the unamortized premium amounted to $2,400 Slate uses the straight line method to amortize the premium.

> On January 1, 2018, Plax acquired $120,000 face value of Slate's bonds for $123,000 Plax also uses the straight line method to amortize any bond premium or discount.

> Both companies are subject to a 40% tax rate.

> Gains and losses from intercompany bond holdings are to be allocated to the two companies when consolidated financial statements are prepared.

Prepare Plax's Consolidated Income Statement for the year ended December 31, 2018. Show the allocation of consolidated net income between the controlling and non-controlling shareholders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

61

The financial statements of Plax Inc. and Slate Corp for the year ended December 31, 2018 are shown below:

Income Statements Retained Earnings Statements

Balance Sheets

Other Information:

> Plax acquired 75% of Slate on January 1, 2014 for $196,000, when Slate's retained earnings was $80,000 and the acquisition differential was attributable entirely to goodwill. There were impairment losses to the goodwill of $6,400 and $1,600 in 2015 and 2018 respectively.

> Plax uses the cost method to account for its investment.

> Slate has 10% par value bonds outstanding in the amount of $200,000 which mature on December 31, 2021. The bonds were issued at a premium. On January 1, 2018 the unamortized premium amounted to $2,400 Slate uses the straight line method to amortize the premium.

> On January 1, 2018, Plax acquired $120,000 face value of Slate's bonds for $123,000 Plax also uses the straight line method to amortize any bond premium or discount.

> Both companies are subject to a 40% tax rate.

> Gains and losses from intercompany bond holdings are to be allocated to the two companies when consolidated financial statements are prepared.

-Prepare a Statement of Consolidated Retained Earnings for the year ended December 31, 2018 for Plax Inc.

Income Statements Retained Earnings Statements

Balance Sheets

Other Information:

> Plax acquired 75% of Slate on January 1, 2014 for $196,000, when Slate's retained earnings was $80,000 and the acquisition differential was attributable entirely to goodwill. There were impairment losses to the goodwill of $6,400 and $1,600 in 2015 and 2018 respectively.

> Plax uses the cost method to account for its investment.

> Slate has 10% par value bonds outstanding in the amount of $200,000 which mature on December 31, 2021. The bonds were issued at a premium. On January 1, 2018 the unamortized premium amounted to $2,400 Slate uses the straight line method to amortize the premium.

> On January 1, 2018, Plax acquired $120,000 face value of Slate's bonds for $123,000 Plax also uses the straight line method to amortize any bond premium or discount.

> Both companies are subject to a 40% tax rate.

> Gains and losses from intercompany bond holdings are to be allocated to the two companies when consolidated financial statements are prepared.

-Prepare a Statement of Consolidated Retained Earnings for the year ended December 31, 2018 for Plax Inc.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

62

The financial statements of Plax Inc. and Slate Corp for the year ended December 31, 2018 are shown below:

Income Statements Retained Earnings Statements

Balance Sheets

Other Information:

> Plax acquired 75% of Slate on January 1, 2014 for $196,000, when Slate's retained earnings was $80,000 and the acquisition differential was attributable entirely to goodwill. There were impairment losses to the goodwill of $6,400 and $1,600 in 2015 and 2018 respectively.

> Plax uses the cost method to account for its investment.

> Slate has 10% par value bonds outstanding in the amount of $200,000 which mature on December 31, 2021. The bonds were issued at a premium. On January 1, 2018 the unamortized premium amounted to $2,400 Slate uses the straight line method to amortize the premium.

> On January 1, 2018, Plax acquired $120,000 face value of Slate's bonds for $123,000 Plax also uses the straight line method to amortize any bond premium or discount.

> Both companies are subject to a 40% tax rate.

> Gains and losses from intercompany bond holdings are to be allocated to the two companies when consolidated financial statements are prepared.

-Prepare Plax's Consolidated Statement of Financial Position as at December 31, 2018.

Income Statements Retained Earnings Statements

Balance Sheets

Other Information:

> Plax acquired 75% of Slate on January 1, 2014 for $196,000, when Slate's retained earnings was $80,000 and the acquisition differential was attributable entirely to goodwill. There were impairment losses to the goodwill of $6,400 and $1,600 in 2015 and 2018 respectively.

> Plax uses the cost method to account for its investment.

> Slate has 10% par value bonds outstanding in the amount of $200,000 which mature on December 31, 2021. The bonds were issued at a premium. On January 1, 2018 the unamortized premium amounted to $2,400 Slate uses the straight line method to amortize the premium.

> On January 1, 2018, Plax acquired $120,000 face value of Slate's bonds for $123,000 Plax also uses the straight line method to amortize any bond premium or discount.

> Both companies are subject to a 40% tax rate.

> Gains and losses from intercompany bond holdings are to be allocated to the two companies when consolidated financial statements are prepared.

-Prepare Plax's Consolidated Statement of Financial Position as at December 31, 2018.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

63

The financial statements of Plax Inc. and Slate Corp for the year ended December 31, 2018 are shown below:

Income Statements Retained Earnings Statements

Balance Sheets

Other Information:

> Plax acquired 75% of Slate on January 1, 2014 for $196,000, when Slate's retained earnings was $80,000 and the acquisition differential was attributable entirely to goodwill. There were impairment losses to the goodwill of $6,400 and $1,600 in 2015 and 2018 respectively.

> Plax uses the cost method to account for its investment.

> Slate has 10% par value bonds outstanding in the amount of $200,000 which mature on December 31, 2021. The bonds were issued at a premium. On January 1, 2018 the unamortized premium amounted to $2,400 Slate uses the straight line method to amortize the premium.

> On January 1, 2018, Plax acquired $120,000 face value of Slate's bonds for $123,000 Plax also uses the straight line method to amortize any bond premium or discount.

> Both companies are subject to a 40% tax rate.

> Gains and losses from intercompany bond holdings are to be allocated to the two companies when consolidated financial statements are prepared.

-Prepare a Calculation of Non-Controlling Interest as at December 31, 2018 for Plax Inc.

Income Statements Retained Earnings Statements

Balance Sheets

Other Information:

> Plax acquired 75% of Slate on January 1, 2014 for $196,000, when Slate's retained earnings was $80,000 and the acquisition differential was attributable entirely to goodwill. There were impairment losses to the goodwill of $6,400 and $1,600 in 2015 and 2018 respectively.

> Plax uses the cost method to account for its investment.

> Slate has 10% par value bonds outstanding in the amount of $200,000 which mature on December 31, 2021. The bonds were issued at a premium. On January 1, 2018 the unamortized premium amounted to $2,400 Slate uses the straight line method to amortize the premium.

> On January 1, 2018, Plax acquired $120,000 face value of Slate's bonds for $123,000 Plax also uses the straight line method to amortize any bond premium or discount.

> Both companies are subject to a 40% tax rate.

> Gains and losses from intercompany bond holdings are to be allocated to the two companies when consolidated financial statements are prepared.

-Prepare a Calculation of Non-Controlling Interest as at December 31, 2018 for Plax Inc.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

64

The financial statements of Plax Inc. and Slate Corp for the year ended December 31, 2018 are shown below:

Income Statements Retained Earnings Statements

Balance Sheets

Other Information:

> Plax acquired 75% of Slate on January 1, 2014 for $196,000, when Slate's retained earnings was $80,000 and the acquisition differential was attributable entirely to goodwill. There were impairment losses to the goodwill of $6,400 and $1,600 in 2015 and 2018 respectively.

> Plax uses the cost method to account for its investment.

> Slate has 10% par value bonds outstanding in the amount of $200,000 which mature on December 31, 2021. The bonds were issued at a premium. On January 1, 2018 the unamortized premium amounted to $2,400 Slate uses the straight line method to amortize the premium.

> On January 1, 2018, Plax acquired $120,000 face value of Slate's bonds for $123,000 Plax also uses the straight line method to amortize any bond premium or discount.

> Both companies are subject to a 40% tax rate.

> Gains and losses from intercompany bond holdings are to be allocated to the two companies when consolidated financial statements are prepared.

-Assuming that Plax uses the equity method, prepare a computation showing the balance in Plax's investment in Slate account on December 31, 2018.

Income Statements Retained Earnings Statements

Balance Sheets

Other Information:

> Plax acquired 75% of Slate on January 1, 2014 for $196,000, when Slate's retained earnings was $80,000 and the acquisition differential was attributable entirely to goodwill. There were impairment losses to the goodwill of $6,400 and $1,600 in 2015 and 2018 respectively.

> Plax uses the cost method to account for its investment.

> Slate has 10% par value bonds outstanding in the amount of $200,000 which mature on December 31, 2021. The bonds were issued at a premium. On January 1, 2018 the unamortized premium amounted to $2,400 Slate uses the straight line method to amortize the premium.

> On January 1, 2018, Plax acquired $120,000 face value of Slate's bonds for $123,000 Plax also uses the straight line method to amortize any bond premium or discount.

> Both companies are subject to a 40% tax rate.

> Gains and losses from intercompany bond holdings are to be allocated to the two companies when consolidated financial statements are prepared.

-Assuming that Plax uses the equity method, prepare a computation showing the balance in Plax's investment in Slate account on December 31, 2018.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

65

The financial statements of Plax Inc. and Slate Corp for the year ended December 31, 2018 are shown below:

Income Statements Retained Earnings Statements

Balance Sheets

Other Information:

> Plax acquired 75% of Slate on January 1, 2014 for $196,000, when Slate's retained earnings was $80,000 and the acquisition differential was attributable entirely to goodwill. There were impairment losses to the goodwill of $6,400 and $1,600 in 2015 and 2018 respectively.

> Plax uses the cost method to account for its investment.

> Slate has 10% par value bonds outstanding in the amount of $200,000 which mature on December 31, 2021. The bonds were issued at a premium. On January 1, 2018 the unamortized premium amounted to $2,400 Slate uses the straight line method to amortize the premium.

> On January 1, 2018, Plax acquired $120,000 face value of Slate's bonds for $123,000 Plax also uses the straight line method to amortize any bond premium or discount.

> Both companies are subject to a 40% tax rate.

> Gains and losses from intercompany bond holdings are to be allocated to the two companies when consolidated financial statements are prepared.

-Prepare a detailed calculation of consolidated retained earnings as at December 31, 2018. Do not prepare a Statement of Retained Earnings for this requirement.

Income Statements Retained Earnings Statements

Balance Sheets

Other Information:

> Plax acquired 75% of Slate on January 1, 2014 for $196,000, when Slate's retained earnings was $80,000 and the acquisition differential was attributable entirely to goodwill. There were impairment losses to the goodwill of $6,400 and $1,600 in 2015 and 2018 respectively.

> Plax uses the cost method to account for its investment.

> Slate has 10% par value bonds outstanding in the amount of $200,000 which mature on December 31, 2021. The bonds were issued at a premium. On January 1, 2018 the unamortized premium amounted to $2,400 Slate uses the straight line method to amortize the premium.

> On January 1, 2018, Plax acquired $120,000 face value of Slate's bonds for $123,000 Plax also uses the straight line method to amortize any bond premium or discount.

> Both companies are subject to a 40% tax rate.

> Gains and losses from intercompany bond holdings are to be allocated to the two companies when consolidated financial statements are prepared.

-Prepare a detailed calculation of consolidated retained earnings as at December 31, 2018. Do not prepare a Statement of Retained Earnings for this requirement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck