Deck 14: Fiscal Policy

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

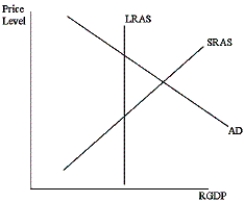

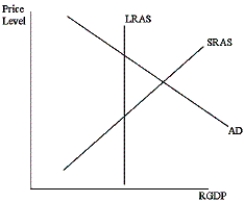

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

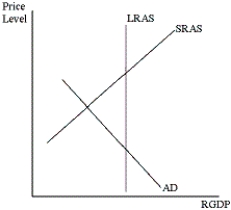

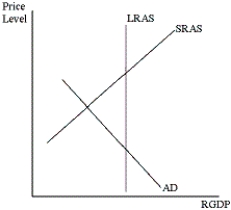

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/123

العب

ملء الشاشة (f)

Deck 14: Fiscal Policy

1

The issuance of debt involves some intergenerational transfer of income; long after the debt is issued, a new generation of taxpayers must make interest payments on the debt.

True

2

Supply-side economists encourage government to reduce taxes, deregulate, and increase spending on research and development because they think that these types of policies lead to greater long-run economic growth.

True

3

A policy of a tax cut combined with increases in government purchases would shift the aggregate demand curve to the left.

False

4

If inflation was the most significant issue in the economy, an appropriate fiscal policy response would be to decrease taxation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

5

If government purchases exceed tax revenue, there is a budget deficit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

6

The larger the marginal propensity to consume, the larger the multiplier effect.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

7

Supply-side economists believe that fiscal policy works only on the supply side of the economy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

8

Robert lost his job during the last recession and his yearly income fell by 15 percent.As a result of the action of automatic stabilizers, his disposable income fell by less than 15 percent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

9

The effect of a tax multiplier on aggregate demand is larger than that of the government spending multiplier.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

10

Supply-siders are generally critical of government intervention and regulation, since they believe regulations can be costly impediments to economic growth.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

11

Fiscal policy is a plan for taxing and spending that is designed to steer the economy in some desired direction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

12

Which of the following would be an example or result of expansionary fiscal policy in action?

A)an increase in taxation

B)a decrease in government purchases

C)a budget deficit

D)a decrease in transfer payments

E)a budget surplus

A)an increase in taxation

B)a decrease in government purchases

C)a budget deficit

D)a decrease in transfer payments

E)a budget surplus

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

13

An investment tax credit, which would lower taxes for firms that invested in new capital equipment, would shift the long-run aggregate supply curve to the right over time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

14

The government's fiscal policy is its plan to regulate aggregate demand by manipulating:

A)the money supply.

B)taxation and spending.

C)the treasury.

D)the energy department.

A)the money supply.

B)taxation and spending.

C)the treasury.

D)the energy department.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

15

Running a federal budget deficit would tend to increase real output in the short run, but running persistent large federal budget deficits could result in reducing real output in the long run, other things being equal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

16

Historically, the largest budget deficits and a growing government debt occur during war years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

17

If the government cuts taxes, total spending will fall and AD will shift to the left.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

18

If the MPC is 2/3, 2/3 of the effect of an increase in government purchases on aggregate demand will come from increased consumption.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

19

In general, the multiplier effect applies to changes in government spending but not to changes in taxation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

20

The crowding-out effect states that as the government borrows to pay for a deficit, and it drives up the interest rates, which crowds out private spending and investment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

21

Which of the following combinations of changes would have a contractionary effect on aggregate demand?

A)An increase in government purchases and an increase in transfer payments.

B)An increase in taxes and an increase in transfer payments.

C)A decrease in taxes and an increase in transfer payments.

D)An increase in taxes and a decrease in government purchases.

A)An increase in government purchases and an increase in transfer payments.

B)An increase in taxes and an increase in transfer payments.

C)A decrease in taxes and an increase in transfer payments.

D)An increase in taxes and a decrease in government purchases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

22

The main components of spending, which can cause changes in aggregate demand, are:

A)consumption, investment, government purchases, and net exports.

B)consumption, investment, government purchases, and imports.

C)investment, savings, replacement of depreciated equipment, and spending.

D)consumption, savings, government purchases, and exports.

A)consumption, investment, government purchases, and net exports.

B)consumption, investment, government purchases, and imports.

C)investment, savings, replacement of depreciated equipment, and spending.

D)consumption, savings, government purchases, and exports.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

23

A cut in taxes, combined with an increase in transfer payments, would:

A)increase AD.

B)decrease AD.

C)leave AD unchanged.

D)have an indeterminate effect on AD.

A)increase AD.

B)decrease AD.

C)leave AD unchanged.

D)have an indeterminate effect on AD.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

24

A contractionary fiscal policy is implemented in order to:

A)increase a budget deficit.

B)reduce a budget surplus.

C)create or expand a budget surplus.

D)increase government purchases.

A)increase a budget deficit.

B)reduce a budget surplus.

C)create or expand a budget surplus.

D)increase government purchases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

25

Assume that the government is considering plans to increase aggregate demand in order to reduce unemployment.Which of the following would be effective?

A)Increase government purchases of goods and services.

B)Decrease taxes.

C)Increase transfer payments.

D)Any of the above.

A)Increase government purchases of goods and services.

B)Decrease taxes.

C)Increase transfer payments.

D)Any of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

26

Contractionary fiscal policy consists of:

A)increased government purchases, increased taxes, increased transfer payments.

B)decreased government purchases, decreased taxes, decreased transfer payments.

C)decreased government purchases, increased taxes, decreased transfer payments.

D)increased government purchases, decreased taxes, increased transfer payments.

A)increased government purchases, increased taxes, increased transfer payments.

B)decreased government purchases, decreased taxes, decreased transfer payments.

C)decreased government purchases, increased taxes, decreased transfer payments.

D)increased government purchases, decreased taxes, increased transfer payments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

27

The largest single source of revenue for the federal government is the:

A)corporate income tax.

B)federal excise tax.

C)personal income tax.

D)Social Security tax.

A)corporate income tax.

B)federal excise tax.

C)personal income tax.

D)Social Security tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

28

How does a change in taxes primarily affect aggregate demand?

A)A tax change alters exports and net exports.

B)A tax change alters investment by an equal and opposite amount.

C)A tax change alters disposable income and consumption spending.

D)A tax change alters government purchases by an equal amount.

E)A tax change alters saving by an equal amount.

A)A tax change alters exports and net exports.

B)A tax change alters investment by an equal and opposite amount.

C)A tax change alters disposable income and consumption spending.

D)A tax change alters government purchases by an equal amount.

E)A tax change alters saving by an equal amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

29

Expansionary fiscal policy consists of:

A)increased government purchases, increased taxes, increased transfer payments.

B)decreased government purchases, decreased taxes, decreased transfer payments.

C)increased government purchases, increased taxes, decreased transfer payments.

D)increased government purchases, decreased taxes, increased transfer payments.

A)increased government purchases, increased taxes, increased transfer payments.

B)decreased government purchases, decreased taxes, decreased transfer payments.

C)increased government purchases, increased taxes, decreased transfer payments.

D)increased government purchases, decreased taxes, increased transfer payments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

30

If the government sought to end a recession, which of the following would be an appropriate policy?

A)Increase taxes.

B)Decrease government purchases.

C)Decrease transfer payments.

D)Decrease taxes and increase transfer payments.

E)Increase taxes and decrease transfer payments.

A)Increase taxes.

B)Decrease government purchases.

C)Decrease transfer payments.

D)Decrease taxes and increase transfer payments.

E)Increase taxes and decrease transfer payments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

31

If government policy makers were worried about the inflationary potential of the economy, which of the following would be a correct fiscal policy change?

A)Decrease consumption taxes.

B)Decrease government purchases of goods and services.

C)Increase transfer payments.

D)Increase the budget deficit.

E)None of the above.

A)Decrease consumption taxes.

B)Decrease government purchases of goods and services.

C)Increase transfer payments.

D)Increase the budget deficit.

E)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

32

Expansionary fiscal policy will result in a ____ price level and ____ employment in the short run.

A)higher; higher.

B)higher; lower.

C)lower; higher.

D)lower; lower.

A)higher; higher.

B)higher; lower.

C)lower; higher.

D)lower; lower.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

33

If government policy makers were worried about the inflationary potential of the economy, which of the following would not be a correct fiscal policy change?

A)Increase consumption taxes.

B)Increase government purchases of goods and services.

C)Reduce transfer payments.

D)Increase the budget deficit.

A)Increase consumption taxes.

B)Increase government purchases of goods and services.

C)Reduce transfer payments.

D)Increase the budget deficit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

34

Which of the following measures is associated with an expansionary fiscal policy?

A)lowering transfer payments

B)lowering taxes

C)lowering government purchases

D)decreasing investments

A)lowering transfer payments

B)lowering taxes

C)lowering government purchases

D)decreasing investments

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

35

Which of the following is an appropriate fiscal policy response to high inflation?

A)increase interest rates

B)increase government purchases

C)increase transfer payments

D)none of the above

A)increase interest rates

B)increase government purchases

C)increase transfer payments

D)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

36

If unemployment is the most significant problem in the economy, which of the following actions would be an appropriate fiscal policy response?

A)decrease taxes

B)decrease transfer payments

C)increase government purchases

D)all of the above

E)both A and C above

A)decrease taxes

B)decrease transfer payments

C)increase government purchases

D)all of the above

E)both A and C above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

37

An increase in transfer payments combined with a decrease in government purchases would:

A)increase AD.

B)decrease AD.

C)leave AD unchanged.

D)have an indeterminate effect on AD.

A)increase AD.

B)decrease AD.

C)leave AD unchanged.

D)have an indeterminate effect on AD.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

38

You are a member of Congress when the economy is in a recession.If your goal is to achieve a fully employed labor force, which of the following fiscal policy scenarios should you follow?

A)Eliminate a federal budget deficit or add to a federal budget surplus.

B)Raise government purchases, reduce taxes, and/or increase transfer payments.

C)Decrease government purchases, increase taxes, and/or cut transfer payments.

D)Raise government purchases, raise taxes by more than the increase in government purchases, and decrease transfer payments.

A)Eliminate a federal budget deficit or add to a federal budget surplus.

B)Raise government purchases, reduce taxes, and/or increase transfer payments.

C)Decrease government purchases, increase taxes, and/or cut transfer payments.

D)Raise government purchases, raise taxes by more than the increase in government purchases, and decrease transfer payments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

39

An increase in government purchases combined with an increase in taxes would:

A)increase AD.

B)decrease AD.

C)leave AD unchanged.

D)have an indeterminate effect on AD.

A)increase AD.

B)decrease AD.

C)leave AD unchanged.

D)have an indeterminate effect on AD.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

40

Budget surpluses exist when:

A)government spending exceeds its tax revenues.

B)government tax revenues exceed its spending.

C)government spending equals its tax revenues.

D)expansionary fiscal policies increase real GDP and the price level.

A)government spending exceeds its tax revenues.

B)government tax revenues exceed its spending.

C)government spending equals its tax revenues.

D)expansionary fiscal policies increase real GDP and the price level.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

41

If the marginal propensity to consume is 0.8, the marginal propensity to save is:

A)0.8

B)0.4

C)0.2

D)0.3

E)Data insufficient

A)0.8

B)0.4

C)0.2

D)0.3

E)Data insufficient

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

42

A decrease in transfer payments will have a smaller effect on aggregate demand the:

A)larger the marginal propensity to consume.

B)larger the average propensity to consume.

C)larger the marginal propensity to save.

D)larger the average propensity to save.

A)larger the marginal propensity to consume.

B)larger the average propensity to consume.

C)larger the marginal propensity to save.

D)larger the average propensity to save.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

43

A combination of an increase in investment and a decrease in exports would:

A)increase AD.

B)decrease AD.

C)leave AD unchanged.

D)have an indeterminate effect on AD.

A)increase AD.

B)decrease AD.

C)leave AD unchanged.

D)have an indeterminate effect on AD.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

44

What is the impact of a $10 billion tax cut on consumer spending, if MPC is equal to 0.8?

A)$50 billion

B)$40 billion

C)$10 billion

D)$20 billion

A)$50 billion

B)$40 billion

C)$10 billion

D)$20 billion

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

45

The federal government buys $10 million worth of aircraft engines from General Motors.If the MPC is .80 what will be the impact on aggregate demand, other things being equal?

A)Aggregate demand will increase $8 million.

B)Aggregate demand will increase $10 million.

C)Aggregate demand will increase $12.5 million.

D)Aggregate demand will increase $18 million.

E)Aggregate demand will increase $50 million.

A)Aggregate demand will increase $8 million.

B)Aggregate demand will increase $10 million.

C)Aggregate demand will increase $12.5 million.

D)Aggregate demand will increase $18 million.

E)Aggregate demand will increase $50 million.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

46

If MPC = 0.8, a $200 billion increase in government purchases would have what size effect on the "first round" of induced added consumption?

A)$80 billion

B)$160 billion

C)$200 billion

D)$800 billion

A)$80 billion

B)$160 billion

C)$200 billion

D)$800 billion

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

47

If MPC = 0.8, a $200 billion increase in government purchases would have what size effect on the "first round" of induced added consumption, and what total effect on AD?

A)increase "first round" consumption by $80 billion; increase AD by $400 billion

B)increase "first round" consumption by $160 billion; increase AD by $1 trillion

C)increase "first round" consumption by $200 billion; increase AD by $1 trillion

D)increase "first round" consumption by $800 billion; increase AD by $4 trillion

A)increase "first round" consumption by $80 billion; increase AD by $400 billion

B)increase "first round" consumption by $160 billion; increase AD by $1 trillion

C)increase "first round" consumption by $200 billion; increase AD by $1 trillion

D)increase "first round" consumption by $800 billion; increase AD by $4 trillion

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

48

A decrease in net taxes (taxes minus transfer payments) would do which of the following in the short run?

A)decrease any budget deficit or increase any budget surplus

B)reduce the price level

C)reduce unemployment

D)reduce consumption purchases

E)All of the above.

A)decrease any budget deficit or increase any budget surplus

B)reduce the price level

C)reduce unemployment

D)reduce consumption purchases

E)All of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

49

Based on the situation depicted in the graph below, which of the following would be an appropriate fiscal policy response?

A)increase taxes

B)decrease taxes

C)decrease government purchases

D)both A and C above

E)all of the above

A)increase taxes

B)decrease taxes

C)decrease government purchases

D)both A and C above

E)all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

50

Assume that there is a $20 billion increase in government purchases.If MPC = 0.8, the sum of the indirect effect on aggregate demand through induced additional consumption purchases is equal to:

A)$50 billion.

B)$10 billion.

C)$40 billion.

D)$20 billion.

A)$50 billion.

B)$10 billion.

C)$40 billion.

D)$20 billion.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

51

Among the following MPC values, which one would have the highest multiplier effect?

A)1/3

B)2/3

C)3/4

D)2/5

A)1/3

B)2/3

C)3/4

D)2/5

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

52

If Melanie had $200,000 of income and spent $180,000 on consumption in 2003 and had $300,000 of income and spent $240,000 on consumption in 2004:

A)her APC in 2003 was 0.8.

B)her APC in 2004 was 0.9.

C)her MPC was 0.6.

D)her MPC was 0.8.

E)her MPC was 0.9.

A)her APC in 2003 was 0.8.

B)her APC in 2004 was 0.9.

C)her MPC was 0.6.

D)her MPC was 0.8.

E)her MPC was 0.9.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

53

Each additional round of the multiplier process will tend to be larger:

A)the smaller the MPC.

B)the greater the rate of income taxation.

C)the less people save from increases in their incomes.

D)the larger the fraction of each dollar of domestic income spent on imported goods.

E)in each of the above cases.

A)the smaller the MPC.

B)the greater the rate of income taxation.

C)the less people save from increases in their incomes.

D)the larger the fraction of each dollar of domestic income spent on imported goods.

E)in each of the above cases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

54

To achieve a $500 billion increase in AD, if the MPC is 0.8, what increase in government purchases would be called for?

A)$625 billion

B)$500 billion

C)$400 billion

D)$100 billion

A)$625 billion

B)$500 billion

C)$400 billion

D)$100 billion

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

55

A combination of an increase in investment and a decrease in imports would:

A)increase AD.

B)decrease AD.

C)leave AD unchanged.

D)have an indeterminate effect on AD.

A)increase AD.

B)decrease AD.

C)leave AD unchanged.

D)have an indeterminate effect on AD.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

56

If government increases its purchases by $20 billion and the MPC = 0.9, the resulting increase in the consumption component of AD is:

A)$2 billion.

B)$18 billion.

C)$180 billion.

D)$200 billion.

A)$2 billion.

B)$18 billion.

C)$180 billion.

D)$200 billion.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

57

A decrease in taxes will do which of the following in the long run?

A)decrease unemployment

B)increase real output

C)decrease the price level

D)None of the above.

A)decrease unemployment

B)increase real output

C)decrease the price level

D)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

58

Based on the situation depicted in the graph below, which of the following would be an appropriate fiscal policy response?

A)increase taxes

B)decrease taxes

C)decrease government purchases

D)all of the above

E)both A and C above

A)increase taxes

B)decrease taxes

C)decrease government purchases

D)all of the above

E)both A and C above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

59

An increase in taxes will do which of the following in the long run?

A)increase unemployment

B)decrease the price level

C)decrease real output

D)None of the above.

A)increase unemployment

B)decrease the price level

C)decrease real output

D)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

60

A decrease in transfer payments would not do which of the following in the short run?

A)decrease any budget deficit or increase any budget surplus

B)reduce the price level

C)reduce unemployment

D)reduce consumption purchases

A)decrease any budget deficit or increase any budget surplus

B)reduce the price level

C)reduce unemployment

D)reduce consumption purchases

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

61

Obama economists believe that the multiplier for government purchases is:

A)equal to zero.

B)less than 1.

C)equal to one.

D)greater than one.

A)equal to zero.

B)less than 1.

C)equal to one.

D)greater than one.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

62

If MPC = 0.75, a $40 billion decrease in government purchases would have what size effect on the "first round" of induced added consumption?

A)$30 billion

B)$40 billion

C)$120 billion

D)$160 billion

A)$30 billion

B)$40 billion

C)$120 billion

D)$160 billion

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

63

The extent of the multiplier effect visible within a short time will be ____ the total effect indicated by the multiplier formula.

A)significantly higher than

B)equal to

C)less than

D)slightly higher than

A)significantly higher than

B)equal to

C)less than

D)slightly higher than

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

64

If the government decides to spend an extra $4 billion on fighter jets that they would otherwise have spent on computers, and the MPC = 0.75, what is the effect on AD?

A)AD increases by $20 billion.

B)AD increases by $16 billion.

C)AD increases by $4 billion.

D)AD does not change.

A)AD increases by $20 billion.

B)AD increases by $16 billion.

C)AD increases by $4 billion.

D)AD does not change.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

65

If investment decreases by $20 billion and the MPC = 0.8, the resulting decrease in the consumption component of AD is:

A)$16 billion.

B)$4 billion.

C)$100 billion.

D)$80 billion.

A)$16 billion.

B)$4 billion.

C)$100 billion.

D)$80 billion.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

66

If MPC = 0.75, a $40 billion decrease in government purchases would have what size effect on the "first round" of changed consumption, and what effect on AD?

A)reduce "first round" consumption by $160 billion; reduce AD by $640 billion

B)reduce consumption by $120 billion; reduce AD by $480 billion

C)reduce consumption by $40 billion; reduce AD by $160 billion

D)reduce consumption by $30 billion; reduce AD by $160 billion

A)reduce "first round" consumption by $160 billion; reduce AD by $640 billion

B)reduce consumption by $120 billion; reduce AD by $480 billion

C)reduce consumption by $40 billion; reduce AD by $160 billion

D)reduce consumption by $30 billion; reduce AD by $160 billion

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

67

A $100 billion decrease in government purchases would:

A)increase AD by $500 billion if MPC = 0.8.

B)decrease AD by $300 billion if MPC = 2/3.

C)increase AD by $200 billion if MPC = 0.5.

D)decrease AD by $40 billion if MPC = 0.4.

A)increase AD by $500 billion if MPC = 0.8.

B)decrease AD by $300 billion if MPC = 2/3.

C)increase AD by $200 billion if MPC = 0.5.

D)decrease AD by $40 billion if MPC = 0.4.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

68

If MPC = 0.75, a $40 billion decrease in government purchases would have what size effect on the "first round" of induced added consumption?

A)It would increase first round consumption by $30 billion.

B)It would increase first round consumption by $40 billion.

C)It would increase first round consumption by $120 billion.

D)It would increase first round consumption by $160 billion.

E)None of the above; the first round effect would be a decrease in consumption.

A)It would increase first round consumption by $30 billion.

B)It would increase first round consumption by $40 billion.

C)It would increase first round consumption by $120 billion.

D)It would increase first round consumption by $160 billion.

E)None of the above; the first round effect would be a decrease in consumption.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

69

The multiplier effect would lead to higher price levels and no increases in employment and RGDP if:

A)all resources are fully employed.

B)resources are under-utilized.

C)resources are idle.

D)unemployment is high.

A)all resources are fully employed.

B)resources are under-utilized.

C)resources are idle.

D)unemployment is high.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

70

Supply-side advocates believe that when taxes and regulations are too burdensome, people will:

A)save less.

B)work less.

C)provide less investment capital.

D)do all of the above.

A)save less.

B)work less.

C)provide less investment capital.

D)do all of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

71

A decrease in transfer payments or an increase in taxes would ____ disposable income of households and thus ____ in consumption purchases.

A)increase; increase.

B)increase; decrease.

C)decrease; increase.

D)decrease; decrease.

A)increase; increase.

B)increase; decrease.

C)decrease; increase.

D)decrease; decrease.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

72

The multiplier will be smaller, other things being equal:

A)the smaller the fraction of each dollar earned that goes to taxes.

B)the smaller the fraction of each dollar of disposable income that is spent on imports.

C)the smaller the fraction of each dollar of disposable income that goes to saving.

D)All of the above are true.

E)None of the above are true.

A)the smaller the fraction of each dollar earned that goes to taxes.

B)the smaller the fraction of each dollar of disposable income that is spent on imports.

C)the smaller the fraction of each dollar of disposable income that goes to saving.

D)All of the above are true.

E)None of the above are true.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

73

The multiplier will be smaller, other things being equal:

A)the smaller the fraction of each dollar earned that goes to taxes.

B)the larger the fraction of each dollar of disposable income that is spent on imports.

C)the smaller the fraction of each dollar of disposable income that goes to saving.

D)All of these answers are true.

A)the smaller the fraction of each dollar earned that goes to taxes.

B)the larger the fraction of each dollar of disposable income that is spent on imports.

C)the smaller the fraction of each dollar of disposable income that goes to saving.

D)All of these answers are true.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

74

The multiplier will be greater, other things being equal:

A)the smaller the fraction of each dollar earned that goes to taxes.

B)the smaller the fraction of each dollar of disposable income that is spent on imports.

C)the smaller the fraction of each dollar of disposable income that goes to saving.

D)All of these answers are true.

A)the smaller the fraction of each dollar earned that goes to taxes.

B)the smaller the fraction of each dollar of disposable income that is spent on imports.

C)the smaller the fraction of each dollar of disposable income that goes to saving.

D)All of these answers are true.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

75

Which of the following is true?

A)Tax multiplier is smaller than the government spending multiplier.

B)The government cannot stimulate consumer spending through tax cuts.

C)The effect of a government spending multiplier on aggregate demand is indirect.

D)The effect of a tax multiplier on aggregate demand is direct.

A)Tax multiplier is smaller than the government spending multiplier.

B)The government cannot stimulate consumer spending through tax cuts.

C)The effect of a government spending multiplier on aggregate demand is indirect.

D)The effect of a tax multiplier on aggregate demand is direct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

76

To achieve a $500 billion decrease in AD, if the MPC is 0.8, what decrease in government purchases would be called for?

A)$100 billion

B)$400 billion

C)$500 billion

D)$625 billion

A)$100 billion

B)$400 billion

C)$500 billion

D)$625 billion

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

77

If the government decides to spend an extra $5 billion on fighter jets that they would otherwise have spent on road construction, and the MPC = 0.75, what is the effect on AD?

A)It has no effect.

B)It increases by $5 billion.

C)It increases by $15 billion.

D)It increases by $20 billion.

A)It has no effect.

B)It increases by $5 billion.

C)It increases by $15 billion.

D)It increases by $20 billion.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

78

Economists agree that the multiplier is close to zero when:

A)inflation is very low.

B)the economy is at or near full employment.

C)the national debt is relatively small.

D)"shovel-ready" projects exist.

A)inflation is very low.

B)the economy is at or near full employment.

C)the national debt is relatively small.

D)"shovel-ready" projects exist.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

79

Supply-side economics stress that:

A)aggregate demand is the major determinant of real output.

B)higher tax rates discourage people from working and investing as much as they would at lower tax rates.

C)an increase in government expenditures and tax rates will cause real income to rise.

D)expansionary monetary policy will cause real output to expand without accelerating inflation.

A)aggregate demand is the major determinant of real output.

B)higher tax rates discourage people from working and investing as much as they would at lower tax rates.

C)an increase in government expenditures and tax rates will cause real income to rise.

D)expansionary monetary policy will cause real output to expand without accelerating inflation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

80

If net exports increase by $10 billion and the MPC = 0.6, the resulting increase in the consumption component of AD is:

A)$25 billion.

B)$15 billion.

C)$6 billion.

D)$4 billion.

A)$25 billion.

B)$15 billion.

C)$6 billion.

D)$4 billion.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck