Deck 11: Cost Behavior, Operating Leverage, and Profitability Analysis

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/202

العب

ملء الشاشة (f)

Deck 11: Cost Behavior, Operating Leverage, and Profitability Analysis

1

Quick Change and Fast Change are competing oil change businesses. Both companies have 5,000 customers. The price of an oil change at both companies is $20. Quick Change pays its employees on a salary basis, and its salary expense is $40,000. Fast Change pays its employees $8 per customer served. Suppose Quick Change is able to lure 1,000 customers from Fast Change by lowering its price to $18 per vehicle. Thus, Quick Change will have 6,000 customers and Fast Change will have only 4,000 customers.

Select the correct statement from the following.

A) Quick Change's profit will increase while Fast Change's profit will fall.

B) Fast Change's profit will fall but it will still earn a higher profit than Quick Change.

C) Profits will decline for both Quick Change and Fast Change.

D) Quick Change's profit will remain the same while Fast Change's profit will decrease.

Select the correct statement from the following.

A) Quick Change's profit will increase while Fast Change's profit will fall.

B) Fast Change's profit will fall but it will still earn a higher profit than Quick Change.

C) Profits will decline for both Quick Change and Fast Change.

D) Quick Change's profit will remain the same while Fast Change's profit will decrease.

A

2

Rock Creek Bottling Company pays its production manager a salary of $6,000 per month. Salespersons are paid strictly on commission, at $1.50 for each case of product sold.

For Rock Creek Bottling Company, the production manager's salary is an example of:

A) a variable cost.

B) a mixed cost.

C) a fixed cost.

D) none of these

For Rock Creek Bottling Company, the production manager's salary is an example of:

A) a variable cost.

B) a mixed cost.

C) a fixed cost.

D) none of these

C

3

Hard Nails and Bright Nails are competing nail salons. Both companies have the same number of customers. Both charge the same price for a manicure. The only difference is that Hard Nails pays its manicurists on a salary basis (i.e., a fixed cost structure) while Bright Nails pays its manicurists on the basis of the number of customers they serve (i.e., a variable cost structure). Both companies currently make the same amount of net income. If sales of both salons increase by an equal amount, Hard Nails:

A) will earn a higher profit than Bright Nails.

B) will earn a lower profit than Bright Nails.

C) will earn the same amount of profit as Bright Nails.

D) The answer cannot be determined from the information provided.

A) will earn a higher profit than Bright Nails.

B) will earn a lower profit than Bright Nails.

C) will earn the same amount of profit as Bright Nails.

D) The answer cannot be determined from the information provided.

A

4

Rock Creek Bottling Company pays its production manager a salary of $6,000 per month. Salespersons are paid strictly on commission, at $1.50 for each case of product sold.

For Rock Creek Bottling Company, the salespersons' commissions are an example of:

A) a fixed cost.

B) a variable cost.

C) a mixed cost.

D) none of these

For Rock Creek Bottling Company, the salespersons' commissions are an example of:

A) a fixed cost.

B) a variable cost.

C) a mixed cost.

D) none of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

5

Fixed cost per unit:

A) decreases as production volume decreases.

B) is not affected by changes in the production volume.

C) decreases as production volume increases.

D) increases as production volume increases.

A) decreases as production volume decreases.

B) is not affected by changes in the production volume.

C) decreases as production volume increases.

D) increases as production volume increases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

6

Wu Company incurred $40,000 of fixed cost and $50,000 of variable cost when 4,000 units of product were made and sold.

If the company's volume increases to 5,000 units, the company's total costs will be:

A) $100,000

B) $90,000

C) $102,500

D) $80,000

If the company's volume increases to 5,000 units, the company's total costs will be:

A) $100,000

B) $90,000

C) $102,500

D) $80,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

7

Java Joe operates a chain of coffee shops. The company pays rent of $20,000 per year for each shop. Supplies (napkins, bags and condiments) are purchased as needed. The manager of each shop is paid a salary of $3,000 per month, and all other employees are paid on an hourly basis. Relative to the number of customers for a shop, the cost of supplies is which kind of cost?

A) Fixed cost

B) Variable cost

C) Mixed cost

D) Relevant cost

A) Fixed cost

B) Variable cost

C) Mixed cost

D) Relevant cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

8

Select the correct statement regarding fixed costs.

A) Because they do not change, fixed costs should be ignored in decision making.

B) The fixed cost per unit decreases when volume increases.

C) The fixed cost per unit increases when volume increases.

D) The fixed cost per unit does not change when volume decreases.

A) Because they do not change, fixed costs should be ignored in decision making.

B) The fixed cost per unit decreases when volume increases.

C) The fixed cost per unit increases when volume increases.

D) The fixed cost per unit does not change when volume decreases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

9

Wu Company incurred $40,000 of fixed cost and $50,000 of variable cost when 4,000 units of product were made and sold.

If the company's volume doubles, the company's total cost will:

A) stay the same.

B) double as well.

C) increase but will not double.

D) decrease.

If the company's volume doubles, the company's total cost will:

A) stay the same.

B) double as well.

C) increase but will not double.

D) decrease.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

10

Based on the following cost data, items labeled (a) and (b) in the table below are which of the following amounts, respectively?

A) (a) = $3.00; (b) = $3.00

B) (a) = $5.00; (b) = $4.00

C) (a) = $2.50; (b) = $2.00

D) (a) = $5.00; (b) = $2.00

A) (a) = $3.00; (b) = $3.00

B) (a) = $5.00; (b) = $4.00

C) (a) = $2.50; (b) = $2.00

D) (a) = $5.00; (b) = $2.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

11

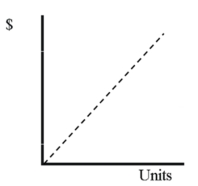

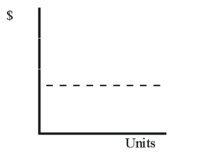

In the graph below, which depicts the relationship between units produced and total cost, the dotted line depicts which type of total cost?

A) Variable cost

B) Fixed cost

C) Mixed cost

D) None of these

A) Variable cost

B) Fixed cost

C) Mixed cost

D) None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

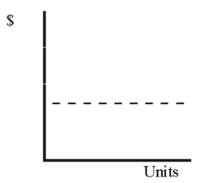

12

Two different costs incurred by Ruiz Company exhibit the following behavior pattern per unit: Cost #1 and Cost #2 exhibit which of the following cost behavior patterns, respectively?

A) Fixed/Variable

B) Variable/Variable

C) Fixed/Fixed

D) Variable/Fixed

A) Fixed/Variable

B) Variable/Variable

C) Fixed/Fixed

D) Variable/Fixed

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

13

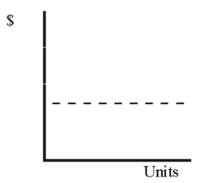

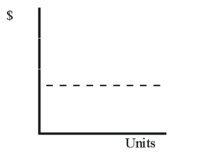

In the graph below, which depicts the relationship between units produced and unit cost, the dotted line depicts which type of cost per unit?

A) Variable cost

B) Fixed cost

C) Mixed cost

D) None of these

A) Variable cost

B) Fixed cost

C) Mixed cost

D) None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

14

Wu Company incurred $40,000 of fixed cost and $50,000 of variable cost when 4,000 units of product were made and sold.

If the company's volume increases to 5,000 units, the total cost per unit will be:

A) $18.00.

B) $20.00.

C) $20.50.

D) $22.50.

If the company's volume increases to 5,000 units, the total cost per unit will be:

A) $18.00.

B) $20.00.

C) $20.50.

D) $22.50.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

15

Larry's Lawn Care incurs significant gasoline costs. This cost would be classified as a variable cost if the total gasoline cost:

A) varies inversely with the number of hours the lawn equipment is operated.

B) is not affected by the number of hours the lawn equipment is operated.

C) increases in direct proportion to the number of hours the lawn equipment is operated.

D) none of these.

A) varies inversely with the number of hours the lawn equipment is operated.

B) is not affected by the number of hours the lawn equipment is operated.

C) increases in direct proportion to the number of hours the lawn equipment is operated.

D) none of these.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

16

Pickard Company pays its sales staff a base salary of $4,500 a month plus a $3.00 commission for each product sold. If a salesperson sells 800 units of product in January, the employee would be paid:

A) $6,900

B) $4,500

C) $2,300

D) $2,700

A) $6,900

B) $4,500

C) $2,300

D) $2,700

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

17

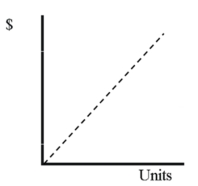

In the graph below, which depicts the relationship between units produced and total cost, the dotted line depicts which type of total cost?

A) Variable cost

B) Fixed cost

C) Mixed cost

D) None of these

A) Variable cost

B) Fixed cost

C) Mixed cost

D) None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

18

Select the correct statement regarding fixed costs.

A) There is a contradiction between the term "fixed cost per unit" and the behavior pattern implied by the term.

B) Fixed cost per unit is not fixed.

C) Total fixed cost remains constant when volume changes.

D) All of these are correct statements.

A) There is a contradiction between the term "fixed cost per unit" and the behavior pattern implied by the term.

B) Fixed cost per unit is not fixed.

C) Total fixed cost remains constant when volume changes.

D) All of these are correct statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

19

Based on the following cost data, what conclusions can you make about Product A and Product B?

A) Product A is a fixed cost and Product B is a variable cost.

B) Product A is a variable cost and Product B is a fixed cost.

C) Product A and Product B are both variable costs.

D) Product A and Product B are both mixed costs.

A) Product A is a fixed cost and Product B is a variable cost.

B) Product A is a variable cost and Product B is a fixed cost.

C) Product A and Product B are both variable costs.

D) Product A and Product B are both mixed costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

20

Wu Company incurred $40,000 of fixed cost and $50,000 of variable cost when 4,000 units of product were made and sold.

If the company's volume doubles, the total cost per unit will:

A) stay the same.

B) decrease.

C) double as well.

D) increase but will not double.

If the company's volume doubles, the total cost per unit will:

A) stay the same.

B) decrease.

C) double as well.

D) increase but will not double.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

21

Select the correct statement from the following.

A) A fixed cost structure offers less risk (i.e., less earnings volatility) and higher opportunity for profitability than does a variable cost structure.

B) A variable cost structure offers less risk and higher opportunity for profitability than does a fixed cost structure.

C) A fixed cost structure offers greater risk but higher opportunity for profitability than does a variable cost structure.

D) A variable cost structure offers greater risk but higher opportunity for profitability than does a fixed cost structure.

A) A fixed cost structure offers less risk (i.e., less earnings volatility) and higher opportunity for profitability than does a variable cost structure.

B) A variable cost structure offers less risk and higher opportunity for profitability than does a fixed cost structure.

C) A fixed cost structure offers greater risk but higher opportunity for profitability than does a variable cost structure.

D) A variable cost structure offers greater risk but higher opportunity for profitability than does a fixed cost structure.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

22

Operating leverage exists when:

A) a company utilizes debt to finance its assets.

B) management buys enough of the company's shares of stock to take control of the corporation.

C) the organization makes purchases on credit instead of paying cash.

D) small percentage changes in revenue produce large percentage changes in profit.

A) a company utilizes debt to finance its assets.

B) management buys enough of the company's shares of stock to take control of the corporation.

C) the organization makes purchases on credit instead of paying cash.

D) small percentage changes in revenue produce large percentage changes in profit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

23

Select the incorrect statement regarding the relationship between cost behavior and profits.

A) A pure variable cost structure offers higher potential rewards.

B) A pure fixed cost structure offers more security if volume expectations are not achieved.

C) In a pure variable cost structure, when revenue increases by $1, so do profits.

D) In a pure fixed cost structure, the unit selling price and unit contribution margin are equal.

A) A pure variable cost structure offers higher potential rewards.

B) A pure fixed cost structure offers more security if volume expectations are not achieved.

C) In a pure variable cost structure, when revenue increases by $1, so do profits.

D) In a pure fixed cost structure, the unit selling price and unit contribution margin are equal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

24

The following income statement is provided for Ramirez Company in 2013:

What amount was the company's contribution margin?

A) $50,000

B) $22,000

C) $52,000

D) $60,000

What amount was the company's contribution margin?

A) $50,000

B) $22,000

C) $52,000

D) $60,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

25

Which of the following items would not be found on a contribution format income statement?

A) Fixed cost

B) Variable cost

C) Gross margin

D) Net income

A) Fixed cost

B) Variable cost

C) Gross margin

D) Net income

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

26

Cool Runnings operates a chain of frozen yogurt shops. The company pays $5,000 of rent expense per month for each shop. The managers of each shop are paid a salary of $3,000 per month and all other employees are paid on an hourly basis. Relative to the number of shops, the cost of rent is which kind of cost?

A) Variable cost

B) Fixed cost

C) Mixed cost

D) Opportunity cost

A) Variable cost

B) Fixed cost

C) Mixed cost

D) Opportunity cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

27

In order to prepare a contribution format income statement:

A) costs must be separated into manufacturing and selling, general, and administrative costs.

B) costs must be separated into cost of goods sold and operating expenses.

C) costs must be separated into variable and fixed costs.

D) costs must be separated into mixed, variable and fixed costs.

A) costs must be separated into manufacturing and selling, general, and administrative costs.

B) costs must be separated into cost of goods sold and operating expenses.

C) costs must be separated into variable and fixed costs.

D) costs must be separated into mixed, variable and fixed costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

28

Based on the income statements shown below, which division has the cost structure with the highest operating leverage?

A) Bottled Water.

B) Fruit Juices.

C) Soft Drinks.

D) The three divisions have identical operating leverage.

A) Bottled Water.

B) Fruit Juices.

C) Soft Drinks.

D) The three divisions have identical operating leverage.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

29

The excess of a product's selling price over its variable costs is referred to as:

A) gross profit

B) gross margin

C) contribution margin

D) manufacturing margin

A) gross profit

B) gross margin

C) contribution margin

D) manufacturing margin

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

30

Select the incorrect statement regarding cost structures.

A) Highly leveraged companies will experience greater profits than companies less leveraged when sales increase.

B) The more variable cost, the higher the fluctuation in income as sales fluctuate.

C) When sales change, the amount of the corresponding change in income is affected by the company's cost structure.

D) Faced with significant uncertainty about future revenues, a low leverage cost structure is preferable to a high leverage cost structure.

A) Highly leveraged companies will experience greater profits than companies less leveraged when sales increase.

B) The more variable cost, the higher the fluctuation in income as sales fluctuate.

C) When sales change, the amount of the corresponding change in income is affected by the company's cost structure.

D) Faced with significant uncertainty about future revenues, a low leverage cost structure is preferable to a high leverage cost structure.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

31

Select from the following the incorrect statement regarding contribution margin.

A) Sales - fixed costs = contribution margin

B) Net income + total fixed costs = contribution margin

C) At the breakeven point (where the company has neither profit nor loss), total fixed costs = total contribution margin

D) Total sales revenue times the contribution margin percentage = total contribution margin

A) Sales - fixed costs = contribution margin

B) Net income + total fixed costs = contribution margin

C) At the breakeven point (where the company has neither profit nor loss), total fixed costs = total contribution margin

D) Total sales revenue times the contribution margin percentage = total contribution margin

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

32

The manager of Kenton Company stated that 45% of its total costs were fixed. The manager was describing the company's:

A) operating leverage.

B) contribution margin.

C) cost structure.

D) cost averaging.

A) operating leverage.

B) contribution margin.

C) cost structure.

D) cost averaging.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

33

The activity director for City Recreation is planning an activity. She is considering alternative ways to set up the activity's cost structure. Select the incorrect statement from the following.

A) If the director expects a low turnout, she should use a fixed cost structure.

B) If the director expects a large turnout, she should attempt to convert variable costs into fixed costs.

C) If the director shifts the cost structure from fixed to variable, the level of risk decreases.

D) If the director shifts the cost structure from fixed to variable, the potential for profits will be reduced.

A) If the director expects a low turnout, she should use a fixed cost structure.

B) If the director expects a large turnout, she should attempt to convert variable costs into fixed costs.

C) If the director shifts the cost structure from fixed to variable, the level of risk decreases.

D) If the director shifts the cost structure from fixed to variable, the potential for profits will be reduced.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

34

Companies A and B are in the same industry and are identical except for cost structure. At a volume of 50,000 units, the companies have equal net incomes. At 60,000 units, Company A's net income would be substantially higher than B's. Based on this information:

A) Company A's cost structure has more variable costs than B's.

B) Company A's cost structure has higher fixed costs than B's.

C) Company B's cost structure has higher fixed costs than A's.

D) At a volume of 50,000 units, Company A's magnitude of operating leverage was lower than B's.

A) Company A's cost structure has more variable costs than B's.

B) Company A's cost structure has higher fixed costs than B's.

C) Company B's cost structure has higher fixed costs than A's.

D) At a volume of 50,000 units, Company A's magnitude of operating leverage was lower than B's.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

35

Executive management at Ballard Books is very optimistic about the chain's ability to achieve significant increases in sales in each of the next five years. The company will most benefit if management creates a:

A) low leverage cost structure.

B) medium leverage cost structure.

C) high leverage cost structure.

D) no leverage cost structure.

A) low leverage cost structure.

B) medium leverage cost structure.

C) high leverage cost structure.

D) no leverage cost structure.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

36

For the last two years BRC Company had net income as follows:

What was the percentage change in income from 2012 to 2013?

A) 20% increase

B) 20% decrease

C) 25% increase

D) 25% decrease

What was the percentage change in income from 2012 to 2013?

A) 20% increase

B) 20% decrease

C) 25% increase

D) 25% decrease

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

37

Which of the following equations can be used to compute a firm's magnitude of operating leverage?

A) Net income/sales

B) Fixed costs/contribution margin

C) Contribution margin/net income

D) Net income/contribution margin

A) Net income/sales

B) Fixed costs/contribution margin

C) Contribution margin/net income

D) Net income/contribution margin

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

38

The following information is provided for Southall Company: What is this company's contribution margin?

A) $30,000

B) $17,500

C) $45,000

D) $67,500

A) $30,000

B) $17,500

C) $45,000

D) $67,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

39

Select the incorrect statement regarding the contribution margin income statement.

A) The contribution margin approach for the income statement is unacceptable for external reporting.

B) Contribution margin represents the amount available to cover product costs and thereafter to provide profit.

C) The contribution margin approach requires that all costs be classified as fixed or variable.

D) Assuming no change in fixed costs, a $1 increase in contribution margin will result in a $1 increase in profit.

A) The contribution margin approach for the income statement is unacceptable for external reporting.

B) Contribution margin represents the amount available to cover product costs and thereafter to provide profit.

C) The contribution margin approach requires that all costs be classified as fixed or variable.

D) Assuming no change in fixed costs, a $1 increase in contribution margin will result in a $1 increase in profit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

40

The following income statements are provided for two companies operating in the same industry

Assuming sales increase by $1,000, select the correct statement from the following:

A) Felix's net income will be more than Jinx's.

B) Both companies will experience an increase in profit.

C) Felix's net income will increase by $250.

D) Jinx's net income will increase by 6%.

Assuming sales increase by $1,000, select the correct statement from the following:

A) Felix's net income will be more than Jinx's.

B) Both companies will experience an increase in profit.

C) Felix's net income will increase by $250.

D) Jinx's net income will increase by 6%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

41

Craft, Inc. normally produces between 120,000 and 150,000 units each year. Producing more than 150,000 units alters the company's cost structure. For example, fixed costs increase because more space must be rented, and additional supervisors must be hired. The production range between 120,000 and 150,000 is called the:

A) differential range.

B) median range.

C) relevant range.

D) leverage range.

A) differential range.

B) median range.

C) relevant range.

D) leverage range.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

42

Southern Food Service operates six restaurants in the Atlanta area. The company pays rent of $20,000 per year for each shop. The managers of each shop are paid a salary of $4,200 per month and all other employees are paid on an hourly basis. Relative to the number of hours worked, total compensation cost for a particular shop is which kind of cost?

A) Mixed cost

B) Fixed cost

C) Variable cost

D) None of these

A) Mixed cost

B) Fixed cost

C) Variable cost

D) None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

43

Based on the income statements of the three following retail businesses, which company has the highest operating leverage?

A) Alpha Company

B) Beta Company

C) Gamma Company

D) They all have same operating leverage

A) Alpha Company

B) Beta Company

C) Gamma Company

D) They all have same operating leverage

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

44

Which of the following costs typically include both fixed and variable components?

A) Direct materials

B) Direct labor

C) Factory overhead

D) None of these

A) Direct materials

B) Direct labor

C) Factory overhead

D) None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

45

Yankee Tours provide seven-day guided tours along the New England coast. The company pays its guides a total of $100,000 per year. The average cost of supplies, lodging and food per customer is $500. The company expects a total of 500 customers during the period January - June, and a total of 1,500 customers from July through December. Yankee wants to earn $100 income per customer. For promotional reasons the company desires to charge the same price throughout the year. Based on this information, what is the correct price per customer? (round to nearest dollar)

A) $450

B) $500

C) $650

D) $700

A) $450

B) $500

C) $650

D) $700

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

46

Wham Company sells electronic squirrel repellants for $60. Variable costs are 60% of sales and total fixed costs are $40,000. What is the firm's magnitude of operating leverage if 2,000 units are sold?

A) 0.17

B) 6.0

C) 2.25

D) none of these

A) 0.17

B) 6.0

C) 2.25

D) none of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

47

What are the expected average quarterly costs of running a consulting practice if fixed costs are expected to be $4,000 a month and variable costs are expected to be $100 per client for each quarter? Expected number of clients for the year are:

A) $12,500

B) $24,500

C) $16,500

D) $19,500

A) $12,500

B) $24,500

C) $16,500

D) $19,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

48

Select the incorrect statement regarding the relevant range of volume.

A) Total fixed costs are expected to remain constant.

B) Total variable costs are expected to vary in direct proportion with changes in volume.

C) Variable cost per unit is expected to remain constant.

D) Total cost per unit is expected to remain constant.

A) Total fixed costs are expected to remain constant.

B) Total variable costs are expected to vary in direct proportion with changes in volume.

C) Variable cost per unit is expected to remain constant.

D) Total cost per unit is expected to remain constant.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

49

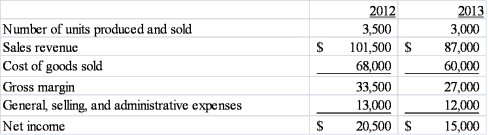

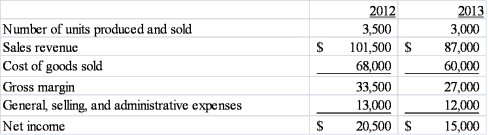

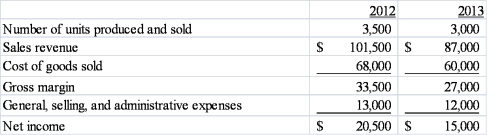

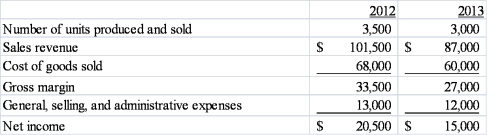

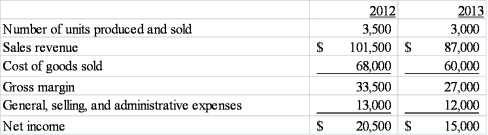

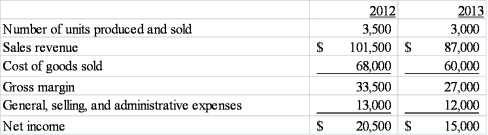

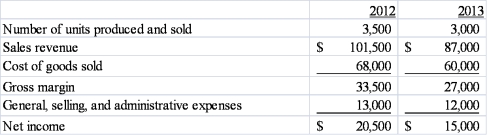

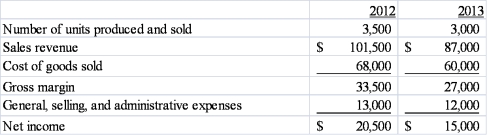

The following income statements are provided for Li Company's last two years of operation:  Assuming that cost behavior did not change over the two year period, what is the amount of the company's variable cost of goods sold per unit?

Assuming that cost behavior did not change over the two year period, what is the amount of the company's variable cost of goods sold per unit?

A) $12.00 per unit

B) $16.00 per unit

C) 22.00 per unit

D) none of these

Assuming that cost behavior did not change over the two year period, what is the amount of the company's variable cost of goods sold per unit?

Assuming that cost behavior did not change over the two year period, what is the amount of the company's variable cost of goods sold per unit?A) $12.00 per unit

B) $16.00 per unit

C) 22.00 per unit

D) none of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

50

The magnitude of operating leverage for Forbes Corporation is 1.8 when sales are $200,000 and net income is $24,000. If sales increase by 5%, what is net income expected to be?

A) $25,200

B) $26,160

C) $24,667

D) $43,200

A) $25,200

B) $26,160

C) $24,667

D) $43,200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

51

A cost that contains both fixed and variable elements is referred to as a:

A) mixed cost.

B) hybrid cost.

C) relevant cost.

D) nonvariable cost.

A) mixed cost.

B) hybrid cost.

C) relevant cost.

D) nonvariable cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

52

Production in 2013 for California Manufacturing, a producer of high security bank vaults, was at its highest point in the month of June when 80 units were produced at a total cost of $800,000. The lowest point in production was in January when only 20 units were produced at a cost of $440,000. The company is preparing a budget for 2013 and needs to project expected fixed cost for the budget year. Using the high/low method, the projected amount of fixed cost per month is:

A) $120,000

B) $320,000

C) $480,000

D) $360,000

A) $120,000

B) $320,000

C) $480,000

D) $360,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

53

The following information is given regarding driving lessons provided by Arrive Alive Company over several spans of time: Select the incorrect statement from the following.

A) The average cost per lesson over the five-year period was $9.24.

B) Based on the most current information, the cost per lesson was $12.00.

C) The average cost based on the total five-year period is probably the most appropriate cost for pricing purposes.

D) The selection of the most appropriate time span for calculating the average cost often requires considerable judgment.

A) The average cost per lesson over the five-year period was $9.24.

B) Based on the most current information, the cost per lesson was $12.00.

C) The average cost based on the total five-year period is probably the most appropriate cost for pricing purposes.

D) The selection of the most appropriate time span for calculating the average cost often requires considerable judgment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

54

The magnitude of operating leverage for Blue Ridge Corporation is 3.5 when sales are $200,000 and net income is $36,000. If sales decrease by 6%, net income is expected to decrease by what amount?

A) $2,160

B) $7,560

C) $3,420

D) $1,260

A) $2,160

B) $7,560

C) $3,420

D) $1,260

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

55

Mug Shots operates a chain of coffee shops. The company pays rent of $15,000 per year for each shop. Supplies (napkins, bags and condiments) are purchased as needed. The managers of each shop are paid a salary of $2,500 per month and all other employees are paid on an hourly basis. The cost of rent relative to the number of customers in a particular shop and relative to the number of customers in the entire chain of shops is which kind of cost, respectively?

A) Variable cost/fixed cost

B) Fixed cost/fixed cost

C) Fixed cost/variable cost

D) Variable cost/variable cost

A) Variable cost/fixed cost

B) Fixed cost/fixed cost

C) Fixed cost/variable cost

D) Variable cost/variable cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

56

Select the incorrect statement regarding the use of average unit costs.

A) Average costs should be calculated for a sufficiently long time period to capture seasonal fluctuations in costs.

B) Average costs are often more relevant for decision making than are actual costs.

C) Average cost information can help managers evaluate performance of the company or departments in the company.

D) Cost averaging should be used only for fixed costs, and not for variable costs.

A) Average costs should be calculated for a sufficiently long time period to capture seasonal fluctuations in costs.

B) Average costs are often more relevant for decision making than are actual costs.

C) Average cost information can help managers evaluate performance of the company or departments in the company.

D) Cost averaging should be used only for fixed costs, and not for variable costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

57

The magnitude of operating leverage for Perkins Corporation is 4.5 when sales are $100,000. If sales increase to $110,000, profits would be expected to increase by what percent?

A) 4.5%

B) 14.5%

C) 45%

D) 10%

A) 4.5%

B) 14.5%

C) 45%

D) 10%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

58

The following income statement is provided for Vargas, Inc.

What is this company's magnitude of operating leverage?

A) 3.07

B) 0.33

C) 3.00

D) 1.67

What is this company's magnitude of operating leverage?

A) 3.07

B) 0.33

C) 3.00

D) 1.67

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

59

The following income statement is provided for Grant, Inc. What is this company's magnitude of operating leverage?

A) 0.33

B) 1.31

C) 2.00

D) 3.00

A) 0.33

B) 1.31

C) 2.00

D) 3.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

60

Whether a cost behaves as a fixed cost or as a variable cost depends upon the:

A) presence of fixed costs.

B) cost structure of the company.

C) industry.

D) activity base used.

A) presence of fixed costs.

B) cost structure of the company.

C) industry.

D) activity base used.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

61

Based on the following operating data, the operating leverage is:

A) 0.18

B) 5.50

C) 1.22

D) 12.5

A) 0.18

B) 5.50

C) 1.22

D) 12.5

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

62

Frazier Company sells women's ski jackets. The average sales price is $275 and the variable cost per jacket is $175. Fixed Costs are $1,350,000. If Frazier sells 15,000 jackets, the contribution margin will be:

A) $2,775,000

B) $1,500,000

C) $2,250,000

D) $150,000

A) $2,775,000

B) $1,500,000

C) $2,250,000

D) $150,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

63

All of the following would be considered a fixed cost for a bottled water company except:

A) Rent on warehouse facility

B) Depreciation on its manufacturing equipment

C) Hourly wages for machine operators

D) Property taxes on its factory building

A) Rent on warehouse facility

B) Depreciation on its manufacturing equipment

C) Hourly wages for machine operators

D) Property taxes on its factory building

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

64

The following income statement was produced when volume of sales was at 400 units. If volume reaches 500 units, net income will be:

A) $625

B) $1,800

C) $700

D) None of these

A) $625

B) $1,800

C) $700

D) None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

65

Select the incorrect break-even equation from the following.

A) Total contribution margin = total variable costs

B) Total contribution margin = total fixed costs

C) Total fixed costs/contribution margin ratio = break-even sales in dollars

D) Total revenue = total costs

A) Total contribution margin = total variable costs

B) Total contribution margin = total fixed costs

C) Total fixed costs/contribution margin ratio = break-even sales in dollars

D) Total revenue = total costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

66

Taste of the Town, Inc. operates a gourmet sandwich shop. The company orders bread, cold cuts, and produce several times a week. If the cost of these items remains constant per customer served, the cost is said to be:

A) Variable

B) Fixed

C) Opportunity

D) Mixed

A) Variable

B) Fixed

C) Opportunity

D) Mixed

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

67

Carson Corporation's sales increase from $500,000 to $600,000 in the current year. What is the percentage change in sales?

A) 20%

B) 25%

C) 22%

D) 16.7%

A) 20%

B) 25%

C) 22%

D) 16.7%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

68

Pierce Company's break-even point is 12,000 units. Its product sells for $25 and has a $10 variable cost per unit. What is the company's total fixed cost amount?

A) $250,000

B) $180,000

C) $120,000

D) Fixed costs cannot be computed with the information provided.

A) $250,000

B) $180,000

C) $120,000

D) Fixed costs cannot be computed with the information provided.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

69

Which characteristic is true of the scatter graph method, high-low method, and regression analysis?

A) All methods will produce the same estimate of variable and fixed costs.

B) All methods use historic data to estimate variable and fixed costs.

C) All methods use only two data points in analyzing a mixed cost.

D) None of these is true.

A) All methods will produce the same estimate of variable and fixed costs.

B) All methods use historic data to estimate variable and fixed costs.

C) All methods use only two data points in analyzing a mixed cost.

D) None of these is true.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

70

Select the incorrect statement regarding fixed and variable costs.

A) Fixed cost per unit remains constant as the number of units increases.

B) Total variable cost is represented by a straight line sloping upward from the origin when total variable cost is graphed versus number of units.

C) The concept of relevant range applies to both fixed costs and variable costs.

D) The terms "fixed" and "variable" refer to the behavior of total cost.

A) Fixed cost per unit remains constant as the number of units increases.

B) Total variable cost is represented by a straight line sloping upward from the origin when total variable cost is graphed versus number of units.

C) The concept of relevant range applies to both fixed costs and variable costs.

D) The terms "fixed" and "variable" refer to the behavior of total cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

71

Mark Company, Inc. sells electronics. The company generated sales of $45,000. Contribution margin is $20,000 and net income is $4,000. Based on this information, the magnitude of operating leverage is:

A) 2.25 times

B) 11.25 times

C) 5 times

D) 6.25 times

A) 2.25 times

B) 11.25 times

C) 5 times

D) 6.25 times

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

72

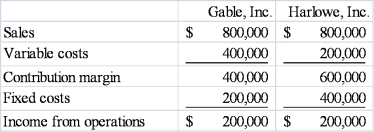

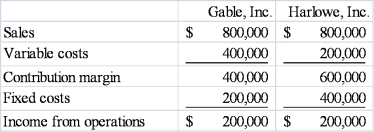

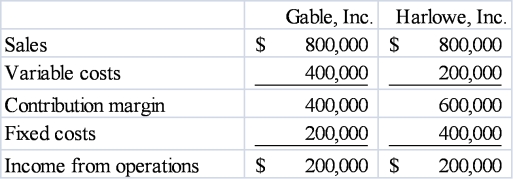

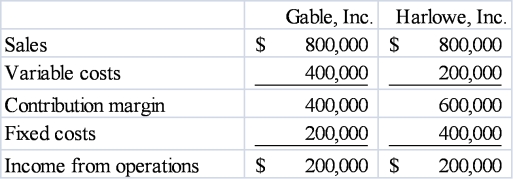

The following information is for Gable, Inc. and Harlowe, Inc. for the recent year.  What total amount of net income will Harlowe, Inc. earn if it experiences a 10 percent increase in revenue?

What total amount of net income will Harlowe, Inc. earn if it experiences a 10 percent increase in revenue?

A) $180, 000

B) $80,000

C) $260,000

D) $20,000

What total amount of net income will Harlowe, Inc. earn if it experiences a 10 percent increase in revenue?

What total amount of net income will Harlowe, Inc. earn if it experiences a 10 percent increase in revenue?A) $180, 000

B) $80,000

C) $260,000

D) $20,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

73

The following information is for Gable, Inc. and Harlowe, Inc. for the recent year.  Based on the above data, which company has a higher operating leverage?

Based on the above data, which company has a higher operating leverage?

A) Gable, Inc.

B) Harlowe, Inc.

C) Operating leverage is the same for both companies

D) Cannot be determined

Based on the above data, which company has a higher operating leverage?

Based on the above data, which company has a higher operating leverage?A) Gable, Inc.

B) Harlowe, Inc.

C) Operating leverage is the same for both companies

D) Cannot be determined

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

74

The results below represent what form of cost behavior?

A) Fixed Cost

B) Variable Cost

C) Mixed Cost

D) Opportunity Cost

A) Fixed Cost

B) Variable Cost

C) Mixed Cost

D) Opportunity Cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

75

The following income statements are provided for Li Company's last two years of operation:  Assuming that cost behavior did not change over the two year period, what is the annual amount of the company's fixed manufacturing overhead?

Assuming that cost behavior did not change over the two year period, what is the annual amount of the company's fixed manufacturing overhead?

A) $12,000

B) $24,000

C) $26,000

D) none of these

Assuming that cost behavior did not change over the two year period, what is the annual amount of the company's fixed manufacturing overhead?

Assuming that cost behavior did not change over the two year period, what is the annual amount of the company's fixed manufacturing overhead?A) $12,000

B) $24,000

C) $26,000

D) none of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

76

Jarvis Company produces a product that has a selling price of $20.00 and a variable cost of $15.00 per unit. The company's fixed costs are $50,000. What is the break-even point measured in sales dollars?

A) $150,000

B) $200,000

C) $62,500

D) $100,000

A) $150,000

B) $200,000

C) $62,500

D) $100,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

77

Martin Company currently produces and sells 40,000 units of product at a selling price of $12. The product has variable costs of $6 per unit and fixed costs of $150,000. The company currently earns a total contribution margin of:

A) $280,000

B) $200,000

C) $240,000

D) $90,000

A) $280,000

B) $200,000

C) $240,000

D) $90,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

78

The following information is for Companies M and N for the most recent year: Based on this information, select the incorrect statement:

A) M's magnitude of operating leverage was lower than N's.

B) N would suffer more than M from an equal drop in sales revenue.

C) M's cost structure carries greater risk and greater potential for profit.

D) If N's sales increased by 20%, its net income would increase by 40%.

A) M's magnitude of operating leverage was lower than N's.

B) N would suffer more than M from an equal drop in sales revenue.

C) M's cost structure carries greater risk and greater potential for profit.

D) If N's sales increased by 20%, its net income would increase by 40%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

79

The following income statements are provided for Li Company's last two years of operation:  Assuming that cost behavior did not change over the two year period, what is Li Company's contribution margin in 2013?

Assuming that cost behavior did not change over the two year period, what is Li Company's contribution margin in 2013?

A) $33,000

B) $32,000

C) $39,000

D) $69,000

Assuming that cost behavior did not change over the two year period, what is Li Company's contribution margin in 2013?

Assuming that cost behavior did not change over the two year period, what is Li Company's contribution margin in 2013?A) $33,000

B) $32,000

C) $39,000

D) $69,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

80

The following income statements are provided for Li Company's last two years of operation:  Assuming that cost behavior did not change over the two year period, what is the company's annual fixed general, selling, and administrative cost?

Assuming that cost behavior did not change over the two year period, what is the company's annual fixed general, selling, and administrative cost?

A) $6,500

B) $6,000

C) $3,000

D) $2,500

Assuming that cost behavior did not change over the two year period, what is the company's annual fixed general, selling, and administrative cost?

Assuming that cost behavior did not change over the two year period, what is the company's annual fixed general, selling, and administrative cost?A) $6,500

B) $6,000

C) $3,000

D) $2,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck