Deck 20: Corporations: Formation and Capital Stock Transactions

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/81

العب

ملء الشاشة (f)

Deck 20: Corporations: Formation and Capital Stock Transactions

1

Preferred Stock is shown in the Stockholders' Equity section of the balance sheet.

True

2

When common stock is issued, the par value, or stated value, of the shares issued is recorded in the Common Stock account.

True

3

A separate Common Stock account is kept in the general ledger for each common stockholder of a corporation.

False

4

Subscriptions Receivable is the control account for the subscribers' ledger.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

5

The entry to record a subscription for 100 shares of common stock at par value would consist of a debit to Subscriptions Receivable-Common and a credit to Common Stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

6

Callable preferred stock is the stock of another firm that a corporation has purchased as an investment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

7

Before dividends can be paid, they must be declared and voted upon by the shareholders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

8

Stock is issued to investors at the time they sign the stock subscription contract.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

9

The stockholders of a corporation are agents of the corporation empowered to act for the firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

10

Stock that carries special privileges or rights is called ____________________ stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

11

The stockholders' ledger for a class of stock is a subsidiary ledger, and the total shares shown must agree with the number of shares in the capital stock account for that class.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

12

The ability to convert preferred stock to common stock can make the preferred stock less attractive to investors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

13

Stockholders are the ____________________ of a corporation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

14

When shares of a corporation's stock are transferred from one investor to another, an entry is recorded in the capital stock transfer journal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

15

Stocks may have a(n) ___________________, or stated, value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

16

In respect to corporate debt, stockholders have ____________________ liability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

17

Organization costs are carried indefinitely as an intangible asset in the records of the corporation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

18

The conversion ratio is the number of shares of common stock for which a share of convertible preferred stock may be exchanged.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

19

If the issuing corporation retains the right to repurchase the shares of preferred stock from the stockholders at a specified price, the preferred stock is ___________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

20

The amount received in excess of the par value of preferred stock issued is recorded in an account called Paid-in Capital in Excess of Par Value-Preferred Stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

21

Subchapter S corporations

A) have the disadvantage of double taxation.

B) require that shareholders report their share of profits on their partnership tax returns.

C) have the advantage that shareholders can take part in policy and operating decisions.

D) are entities formed as corporations but are treated essentially as a partnership so the corporation pays no income tax.

A) have the disadvantage of double taxation.

B) require that shareholders report their share of profits on their partnership tax returns.

C) have the advantage that shareholders can take part in policy and operating decisions.

D) are entities formed as corporations but are treated essentially as a partnership so the corporation pays no income tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

22

Which of the following statements is correct?

A) Market value is the figure selected by the organizers of the corporation to be assigned to each share of stock for accounting purposes.

B) If there is only one class of stock, the stock is called preferred stock.

C) The authorized capital stock is the number of shares that have been issued and are still in the hands of stockholders.

D) In the event of liquidation, preferred stockholders have a claim on assets before that of common stockholders.

A) Market value is the figure selected by the organizers of the corporation to be assigned to each share of stock for accounting purposes.

B) If there is only one class of stock, the stock is called preferred stock.

C) The authorized capital stock is the number of shares that have been issued and are still in the hands of stockholders.

D) In the event of liquidation, preferred stockholders have a claim on assets before that of common stockholders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

23

Ari Hightower owns 200 shares of preferred stock that is convertible into common stock at the rate of 3 shares for every share surrendered. If she surrenders all her preferred stock, she will have _____________________ shares of common stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

24

A corporation is owned by

A) the individual who started the company.

B) its board of directors.

C) the president of the corporation.

D) its stockholders.

A) the individual who started the company.

B) its board of directors.

C) the president of the corporation.

D) its stockholders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

25

The holder of a share of 12 percent, $100 par-value preferred stock would receive a dividend of ____________________ per share before any dividend was paid to common stockholders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

26

Which of the following statements is correct?

A) Shareholders have personal liability for a corporation's debts.

B) Shareholders must obtain the consent of other shareholders to sell their shares or buy more shares.

C) Limited liability partnership (LLP) partners have liability for their own actions and the actions of those under their control or supervision.

D) Shareholders are legally prohibited from acting as an officer or employee of a corporation.

A) Shareholders have personal liability for a corporation's debts.

B) Shareholders must obtain the consent of other shareholders to sell their shares or buy more shares.

C) Limited liability partnership (LLP) partners have liability for their own actions and the actions of those under their control or supervision.

D) Shareholders are legally prohibited from acting as an officer or employee of a corporation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

27

Profits in the form of ____________________ are paid to the stockholders of a corporation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

28

If a corporation sells 400 shares of 12 percent, $100 par-value preferred stock for $105 a share, the entry to record the transaction will include a credit of ____________________ to the Preferred Stock account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

29

The stockholders of a corporation

A) have no personal liability for the debts of the corporation.

B) are agents of the corporation empowered to act for the firm.

C) cannot sell their share of stock without obtaining the agreement of other stockholders.

D) will receive a dividend each year.

A) have no personal liability for the debts of the corporation.

B) are agents of the corporation empowered to act for the firm.

C) cannot sell their share of stock without obtaining the agreement of other stockholders.

D) will receive a dividend each year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

30

If only one class of stock is issued by a corporation, it is referred to as

A) preferred stock.

B) company stock.

C) treasury stock.

D) common stock.

A) preferred stock.

B) company stock.

C) treasury stock.

D) common stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

31

The balance of the Preferred Stock account represents the ____________________ value of the shares issued.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

32

If preferred stock is ____________________, its owners must receive the stated dividends for both the current year and any prior years in which the stated dividend was not paid before the common stockholders can receive any dividend.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

33

Common stockholders will receive a dividend

A) in every year that the corporation is profitable.

B) in every year that the board of directors declares a dividend.

C) every year, whether the corporation is profitable or not.

D) every year that profits exceed a stated amount.

A) in every year that the corporation is profitable.

B) in every year that the board of directors declares a dividend.

C) every year, whether the corporation is profitable or not.

D) every year that profits exceed a stated amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

34

A person who signs a(n) ____________________ contract agrees to purchase stock and pay for the shares at a later date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

35

Which of the following statements is correct?

A) The owners of preferred stock are the only stockholders who have the right to vote.

B) All stockholders are guaranteed the right to receive annual dividends.

C) The issuing corporation may retain the right to repurchase shares of preferred stock from the stockholders at a specific price.

D) In a liquidation, common shareholders are paid before preferred shareholders.

A) The owners of preferred stock are the only stockholders who have the right to vote.

B) All stockholders are guaranteed the right to receive annual dividends.

C) The issuing corporation may retain the right to repurchase shares of preferred stock from the stockholders at a specific price.

D) In a liquidation, common shareholders are paid before preferred shareholders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

36

When the issuing corporation retains the right to repurchase shares of preferred stock at a specified price, the preferred stock is said to be

A) convertible.

B) callable.

C) participating.

D) nonparticipating.

A) convertible.

B) callable.

C) participating.

D) nonparticipating.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

37

The ___________________ accounts for all stock issued by a corporation and receives all cancelled and newly issued stock certificates from the transfer agent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

38

The Common Stock Subscribed account has a(n) ____________________ balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

39

The amount paid for stock in excess of par value is called a(n) ___________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

40

One disadvantage of a corporation is

A) limited liability.

B) continuous existence.

C) double taxation.

D) transferability of ownership rights.

A) limited liability.

B) continuous existence.

C) double taxation.

D) transferability of ownership rights.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

41

An investor agrees to pay a preferred stock subscription in two monthly installments. Each collection will include a debit to Cash and a credit to

A) Preferred Stock.

B) Preferred Stock Subscribed.

C) Subscriptions Receivable-Preferred.

D) Common Stock Subscribed.

A) Preferred Stock.

B) Preferred Stock Subscribed.

C) Subscriptions Receivable-Preferred.

D) Common Stock Subscribed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

42

Organization costs should be

A) treated as an operating expense when incurred.

B) debited to an intangible asset account when incurred and systematically charged to expense over a period of up to 40 years.

C) debited to an intangible asset account when incurred and carried at the original amount until the business ceases operations.

D) debited to an intangible asset account when incurred and carried at the original amount until the business begins to earn a profit.

A) treated as an operating expense when incurred.

B) debited to an intangible asset account when incurred and systematically charged to expense over a period of up to 40 years.

C) debited to an intangible asset account when incurred and carried at the original amount until the business ceases operations.

D) debited to an intangible asset account when incurred and carried at the original amount until the business begins to earn a profit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

43

The entry to record the issuance of 500 shares of $10 par-value common stock for $14 a share consists of a debit to Cash for $7,000 and a credit to Common Stock for

A) $5,000 and a credit to Treasury Stock for $2,000.

B) $5,000 and a credit to Paid-in Capital in Excess of Par Value-Common Stock for $2,000.

C) $5,000 and a credit to Gain on Sale of Common Stock for $2,000.

D) $7,000.

A) $5,000 and a credit to Treasury Stock for $2,000.

B) $5,000 and a credit to Paid-in Capital in Excess of Par Value-Common Stock for $2,000.

C) $5,000 and a credit to Gain on Sale of Common Stock for $2,000.

D) $7,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

44

The Paid-in Capital in Excess of Par Value-Preferred Stock account would be shown in the

A) Assets section of the balance sheet.

B) Stockholders' Equity section of the balance sheet.

C) Revenue section of the income statement.

D) Expense section of the income statement.

A) Assets section of the balance sheet.

B) Stockholders' Equity section of the balance sheet.

C) Revenue section of the income statement.

D) Expense section of the income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

45

A corporation has 10,000 shares of 6 percent, $50 par-value cumulative preferred stock and 50,000 shares of $4 par-value common stock outstanding. Last year, no dividends were paid. This year, the board of directors decided to pay a dividend of $80,000. The common stockholders will receive a dividend of

A) $0.40 a share.

B) $1.00 a share.

C) $1.60 a share.

D) $2.00 a share.

A) $0.40 a share.

B) $1.00 a share.

C) $1.60 a share.

D) $2.00 a share.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

46

A corporation has 4,000 shares of 5 percent, $100 par-value preferred stock and 50,000 shares of $2 par-value common stock outstanding. If the board of the directors decides to distribute dividends totaling $100,000, the common stockholders will receive a dividend of

A) $1.00 a share.

B) $1.60 a share.

C) $2.00 a share.

D) $2.40 a share.

A) $1.00 a share.

B) $1.60 a share.

C) $2.00 a share.

D) $2.40 a share.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

47

The entry to record the issuance of 1000 shares of $2 stated-value common stock for $10 a share consists of a debit to Cash for $10,000 and a credit to Common Stock for

A) $10,000.

B) $2,000 and a credit to Paid-in Capital in Excess of Par Value-Common Stock for $8,000.

C) $2,000 and a credit to Paid-in Capital in Excess of Stated Value-Common Stock for $8,000.

D) $2,000 and a credit to Gain On Sale of Common Stock for $8,000.

A) $10,000.

B) $2,000 and a credit to Paid-in Capital in Excess of Par Value-Common Stock for $8,000.

C) $2,000 and a credit to Paid-in Capital in Excess of Stated Value-Common Stock for $8,000.

D) $2,000 and a credit to Gain On Sale of Common Stock for $8,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

48

A corporation received a subscription for 200 shares of 10 percent, $100 par-value preferred stock at $103 a share. The entry to record this transaction consists of a debit to Subscriptions Receivable-Preferred for $20,600 and a credit to

A) Preferred Stock for $20,000 and a credit to Retained Earnings for $600.

B) Preferred Stock Subscribed for $20,000 and a credit to Gain on Sale of Preferred Stock for $600.

C) Preferred Stock Subscribed for $20,000 and a credit to Paid-in Capital in Excess of Par Value-Preferred Stock for $600.

D) Preferred Stock Subscribed for $20,600.

A) Preferred Stock for $20,000 and a credit to Retained Earnings for $600.

B) Preferred Stock Subscribed for $20,000 and a credit to Gain on Sale of Preferred Stock for $600.

C) Preferred Stock Subscribed for $20,000 and a credit to Paid-in Capital in Excess of Par Value-Preferred Stock for $600.

D) Preferred Stock Subscribed for $20,600.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

49

A corporation has 1,000 shares of 10 percent, $50 par-value preferred stock and 10,000 shares of $5 par-value common stock outstanding. If the board of the directors decides to distribute dividends totaling $40,000, the common stockholders will receive a dividend of

A) $5.00 a share.

B) $4.00 a share.

C) $3.50 a share.

D) $3.75 a share.

A) $5.00 a share.

B) $4.00 a share.

C) $3.50 a share.

D) $3.75 a share.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

50

The entry to record the issuance of 1,000 shares of $10 par-value common stock for $14 a share consists of a debit to Cash for $14,000 and a credit to Common Stock for

A) $14,000.

B) $10,000 and a credit to Gain on Sale of Common Stock for $4,000.

C) $10,000 and a credit to Paid-in Capital in Excess of Par Value-Common Stock for $4,000.

D) $10,000 and a credit to Treasury Stock for $4,000.

A) $14,000.

B) $10,000 and a credit to Gain on Sale of Common Stock for $4,000.

C) $10,000 and a credit to Paid-in Capital in Excess of Par Value-Common Stock for $4,000.

D) $10,000 and a credit to Treasury Stock for $4,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

51

A corporation received a subscription for 100 shares of 10 percent, $100 par-value preferred stock at $103 a share. The entry to record this transaction consists of a debit to Subscriptions Receivable-Preferred for $10,300 and a credit to

A) Preferred Stock Subscribed for $10,300.

B) Preferred Stock Subscribed for $10,000 and a credit to Gain on Sale of Preferred Stock for $300.

C) Preferred Stock for $10,000 and a credit to Retained Earnings for $300.

D) Preferred Stock Subscribed for $10,000 and a credit to Paid-in Capital in Excess of Par Value-Preferred Stock for $300.

A) Preferred Stock Subscribed for $10,300.

B) Preferred Stock Subscribed for $10,000 and a credit to Gain on Sale of Preferred Stock for $300.

C) Preferred Stock for $10,000 and a credit to Retained Earnings for $300.

D) Preferred Stock Subscribed for $10,000 and a credit to Paid-in Capital in Excess of Par Value-Preferred Stock for $300.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

52

Santorini Corporation has outstanding 300,000 shares of $70 par-value preferred stock, issued at an average price of $84 a share. The preferred stock is convertible into common stock at the rate of four shares of common stock for each share of preferred stock. Maryann Miller owns 880 shares of the preferred stock. During the current year she decides to convert 220 shares into common stock. How many shares of common stock will she receive?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

53

A corporation has 10,000 shares of 6 percent, $50 par-value noncumulative preferred stock and 50,000 shares of $4 par-value common stock outstanding. Last year, no dividends were paid. This year, the board of directors decided to pay a dividend of $80,000. The common stockholders will receive a dividend of

A) $0.40 a share.

B) $1.00 a share.

C) $1.60 a share.

D) $2.00 a share.

A) $0.40 a share.

B) $1.00 a share.

C) $1.60 a share.

D) $2.00 a share.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

54

A corporation received a subscription for 1,000 shares of 10 percent, $100 par-value preferred stock at $103 a share. The entry to record this transaction consists of a debit to Subscriptions Receivable-Preferred for $103,000 and a credit to

A) Preferred Stock for $100,000 and a credit to Retained Earnings for $3,000.

B) Preferred Stock Subscribed for $100,300.

C) Preferred Stock Subscribed for $100,000 and a credit to Paid-in Capital in Excess of Par Value-Preferred Stock for $3,000.

D) Preferred Stock Subscribed for $100,000 and a credit to Gain on Sale of Preferred Stock for $3,000.

A) Preferred Stock for $100,000 and a credit to Retained Earnings for $3,000.

B) Preferred Stock Subscribed for $100,300.

C) Preferred Stock Subscribed for $100,000 and a credit to Paid-in Capital in Excess of Par Value-Preferred Stock for $3,000.

D) Preferred Stock Subscribed for $100,000 and a credit to Gain on Sale of Preferred Stock for $3,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

55

The Preferred Stock account is shown in the

A) Assets section of the balance sheet.

B) Current Liabilities section of the balance sheet.

C) Long-Term Liabilities section of the balance sheet.

D) Stockholders' Equity section of the balance sheet.

A) Assets section of the balance sheet.

B) Current Liabilities section of the balance sheet.

C) Long-Term Liabilities section of the balance sheet.

D) Stockholders' Equity section of the balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

56

Participating preferred stockholders

A) receive dividends only after common stockholders have been paid dividends.

B) receive preference dividend amounts as well as a share of other dividends paid.

C) receive cumulative dividends if dividends are passed in previous years.

D) give up their voting rights in exchange for dividend preferences.

A) receive dividends only after common stockholders have been paid dividends.

B) receive preference dividend amounts as well as a share of other dividends paid.

C) receive cumulative dividends if dividends are passed in previous years.

D) give up their voting rights in exchange for dividend preferences.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

57

The entry to record the issuance of 2,000 shares of $10 par-value common stock for $14 a share consists of a debit to Cash for $28,000 and a credit to Common Stock for

A) $28,000.

B) $20,000 and a credit to Gain on Sale of Common Stock for $8,000.

C) $20,000 and a credit to Treasury Stock for $8,000.

D) $20,000 and a credit to Paid-in Capital in Excess of Par Value-Common Stock for $8,000.

A) $28,000.

B) $20,000 and a credit to Gain on Sale of Common Stock for $8,000.

C) $20,000 and a credit to Treasury Stock for $8,000.

D) $20,000 and a credit to Paid-in Capital in Excess of Par Value-Common Stock for $8,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

58

The transfer of stock between shareholders is

A) recorded in the general journal.

B) recorded in the capital stock transfer journal.

C) recorded in the minute book.

D) not recorded by the corporation.

A) recorded in the general journal.

B) recorded in the capital stock transfer journal.

C) recorded in the minute book.

D) not recorded by the corporation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

59

A corporation has 2,000 shares of 10 percent, $50 par-value preferred stock and 20,000 shares of $5 par-value common stock outstanding. If the board of the directors decides to distribute dividends totaling $80,000, the common stockholders will receive a dividend of

A) $3.50 a share.

B) $7.50 a share.

C) $8.00 a share.

D) $10.00 a share.

A) $3.50 a share.

B) $7.50 a share.

C) $8.00 a share.

D) $10.00 a share.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

60

Which of the following statements is not correct?

A) The Paid-in Capital in Excess of Par Value-Common Stock account appears in the Stockholders' Equity section of the balance sheet.

B) The Subscriptions Receivable account is shown in the Stockholders' Equity section of the balance sheet.

C) The balance of the Common Stock account appears in the Stockholders' Equity section of the balance sheet.

D) The balance of the Preferred Stock account appears in the Stockholders' Equity section of the balance sheet.

A) The Paid-in Capital in Excess of Par Value-Common Stock account appears in the Stockholders' Equity section of the balance sheet.

B) The Subscriptions Receivable account is shown in the Stockholders' Equity section of the balance sheet.

C) The balance of the Common Stock account appears in the Stockholders' Equity section of the balance sheet.

D) The balance of the Preferred Stock account appears in the Stockholders' Equity section of the balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

61

The Northwest Corporation has outstanding 20,000 shares of 12 percent, $50 par-value, noncumulative, nonparticipating preferred stock and 80,000 shares of $10 par-value common stock. The board of directors voted to distribute $60,000 as dividends in 2013, $140,000 in 2014, and $200,000 in 2012.

Compute the following:

1. Amount paid on each share of preferred stock in 2013.

2. Amount paid on each share of common stock in 2013.

3. Amount paid on each share of preferred stock in 2014.

4. Amount paid on each share of common stock in 2014.

5. Amount paid on each share of preferred stock in 2012.

6. Amount paid on each share of common stock in 2012.

Compute the following:

1. Amount paid on each share of preferred stock in 2013.

2. Amount paid on each share of common stock in 2013.

3. Amount paid on each share of preferred stock in 2014.

4. Amount paid on each share of common stock in 2014.

5. Amount paid on each share of preferred stock in 2012.

6. Amount paid on each share of common stock in 2012.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

62

The Odegard Corporation has outstanding 50,000 shares of 6 percent, $100 par-value, noncumulative, nonparticipating preferred stock and 100,000 shares of $2 par-value common stock, sold at an average price of $20 per share. The board of directors voted to distribute $200,000 as dividends in 2013, $400,000 in 2014, and $450,000 in 2012.

Compute the following:

1. Total dividend paid to preferred stockholders in 2013.

2. Total dividend paid to common stockholders in 2013.

3. Total dividend paid to preferred stockholders in 2014.

4. Total dividend paid to common stockholders in 2014.

5. Total dividend paid to preferred stockholders in 2012.

6. Total dividend paid to common stockholders in 2012.

Compute the following:

1. Total dividend paid to preferred stockholders in 2013.

2. Total dividend paid to common stockholders in 2013.

3. Total dividend paid to preferred stockholders in 2014.

4. Total dividend paid to common stockholders in 2014.

5. Total dividend paid to preferred stockholders in 2012.

6. Total dividend paid to common stockholders in 2012.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

63

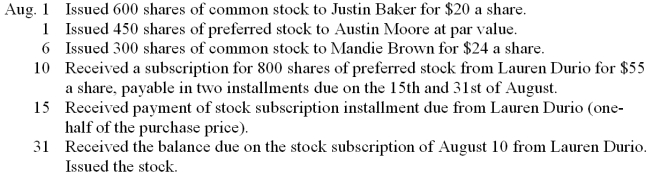

The Mayfair Corporation was organized on August 1, 2013. The firm is authorized to issue 80,000 shares of no-par-value common stock with a stated value of $20 per share and 20,000 shares of $50 par-value, 12 percent preferred stock. Record the selected transactions on page 1 of a general journal. Omit descriptions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

64

Contreras Corporation issued 10,000 shares of its no-par-value common stock (stated value, $3) for cash at $30 a share. Record the issuance of the stock on page 1 of a general journal. Omit the description.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

65

McDougall Corporation issued 40,000 shares of its $2 par-value common stock for cash at $20 a share. Record the issuance of the stock on page 1 of a general journal. Omit the description.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

66

Rukshad Patel, the owner of a sole proprietorship, is planning to incorporate her business. Her capital account has a balance of $200,000 after revaluation of the assets. Her cash account totals $60,000. She will receive 10 percent, $10 par-value preferred stock with a total par value equal to the cash transferred. The balance of her capital is to be exchanged for shares of $2 par-value common stock with a total par value equal to the remaining capital. How many shares of preferred stock should be issued to Patel? How many shares of common stock should be issued to Patel?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

67

The Gibbs Corporation has outstanding 20,000 shares of 10 percent, $50 par-value, cumulative, nonparticipating preferred stock and 80,000 shares of $10 par-value common stock. The board of directors voted to distribute $80,000 as dividends in 2013, $110,000 in 2014, and $130,000 in 2012.

Compute the following:

1. Total dividend paid to preferred stockholders in 2013.

2. Total dividend paid to common stockholders in 2013.

3. Total dividend paid to preferred stockholders in 2014.

4. Total dividend paid to common stockholders in 2014.

5. Total dividend paid to preferred stockholders in 2012.

6. Total dividend paid to common stockholders in 2012.

Compute the following:

1. Total dividend paid to preferred stockholders in 2013.

2. Total dividend paid to common stockholders in 2013.

3. Total dividend paid to preferred stockholders in 2014.

4. Total dividend paid to common stockholders in 2014.

5. Total dividend paid to preferred stockholders in 2012.

6. Total dividend paid to common stockholders in 2012.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

68

The Southeast Corporation has outstanding 40,000 shares of 12 percent, $50 par-value, noncumulative, nonparticipating preferred stock and 160,000 shares of $10 par-value common stock. The board of directors voted to distribute $240,000 as dividends in 2013, $280,000 in 2014, and $520,000 in 2012.

Compute the following:

1. Amount paid on each share of preferred stock in 2013.

2. Amount paid on each share of common stock in 2013.

3. Amount paid on each share of preferred stock in 2014.

4. Amount paid on each share of common stock in 2014.

5. Amount paid on each share of preferred stock in 2012.

6. Amount paid on each share of common stock in 2012.

Compute the following:

1. Amount paid on each share of preferred stock in 2013.

2. Amount paid on each share of common stock in 2013.

3. Amount paid on each share of preferred stock in 2014.

4. Amount paid on each share of common stock in 2014.

5. Amount paid on each share of preferred stock in 2012.

6. Amount paid on each share of common stock in 2012.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

69

Turque Corporation issued 4,000 shares of its no-par-value common stock (stated value, $20) for cash at $22 a share. Record the issuance of the stock on page 1 of a general journal. Omit the description.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

70

Corning Corporation issued 1,000 shares of its $5 par-value common stock for cash at $13 a share. Record the issuance of the stock on page 1 of a general journal. Omit the description.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

71

Elsinore Corporation has outstanding 200,000 shares of $100 par-value preferred stock, issued at an average price of $110 a share. The preferred stock is convertible into common stock at the rate of five shares of common stock for each share of preferred stock. Louis Reynault owns 500 shares of the preferred stock. During the current year he decides to convert 225 shares into common stock. How many shares of common stock will he receive?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

72

Venti Corporation has outstanding 100,000 shares of $50 par-value preferred stock, issued at an average price of $74 a share. The preferred stock is convertible into common stock at the rate of two shares of common stock for each share of preferred stock. Martin Spellman owns 100 shares of the preferred stock. During the current year he decides to convert 50 shares into common stock. How many shares of common stock will she receive?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

73

Cary Company, a newly organized corporation, received a bill from its lawyers for $7,500 for time spent in organizing the company.

1. How should these costs be treated for federal income tax purposes?

2. How should they be treated in the company's financial statements?

1. How should these costs be treated for federal income tax purposes?

2. How should they be treated in the company's financial statements?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

74

Robert Schuler, the owner of a sole proprietorship, is planning to incorporate his business. His capital account has a balance of $100,000 after revaluation of the assets. His cash account totals $30,000. He will receive 10 percent, $10 par-value preferred stock with a total par value equal to the cash transferred. The balance of his capital is to be exchanged for shares of $20 par-value common stock with a total par value equal to the remaining capital. How many shares of preferred stock should be issued to Schuler? How many shares of common stock should be issued to Schuler?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

75

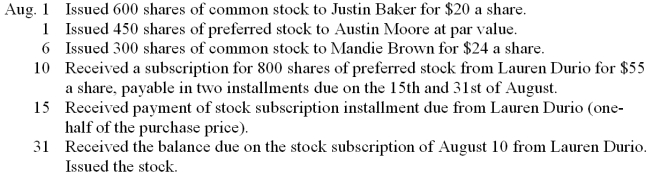

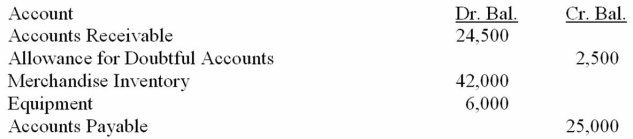

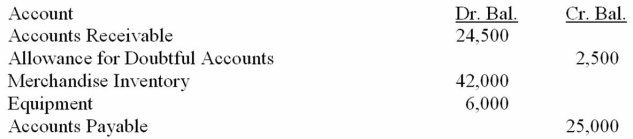

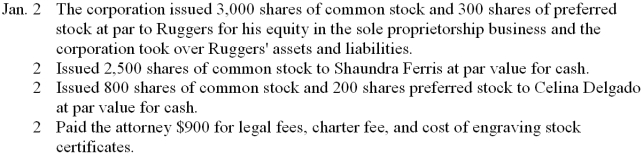

The Ventura Corporation, a new corporation, took over the assets and liabilities of the Jeremy Ruggers Company on January 2, 2013. The assets and liabilities assumed, after appropriate revaluation by Ruggers Company, are shown below.  The Ventura Corporation is authorized to issue 100,000 shares of $10 par-value common stock and 50,000 shares of 12 percent, $50 par-value preferred stock. Record the following transactions on page 1 of a general journal. Omit descriptions. Prepare the opening balance sheet for the corporation on January 2, 2013.

The Ventura Corporation is authorized to issue 100,000 shares of $10 par-value common stock and 50,000 shares of 12 percent, $50 par-value preferred stock. Record the following transactions on page 1 of a general journal. Omit descriptions. Prepare the opening balance sheet for the corporation on January 2, 2013.

The Ventura Corporation is authorized to issue 100,000 shares of $10 par-value common stock and 50,000 shares of 12 percent, $50 par-value preferred stock. Record the following transactions on page 1 of a general journal. Omit descriptions. Prepare the opening balance sheet for the corporation on January 2, 2013.

The Ventura Corporation is authorized to issue 100,000 shares of $10 par-value common stock and 50,000 shares of 12 percent, $50 par-value preferred stock. Record the following transactions on page 1 of a general journal. Omit descriptions. Prepare the opening balance sheet for the corporation on January 2, 2013.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

76

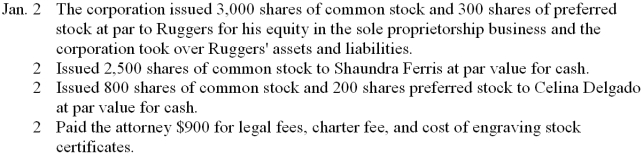

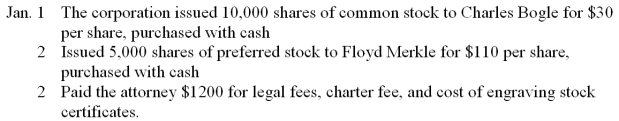

The Lompoc Corporation is authorized to issue 500,000 shares of $4 par-value common stock and 100,000 shares of 6 percent, $100 par-value preferred stock. Record the following transactions on page 1 of a general journal. Omit descriptions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

77

The Haines Corporation has outstanding 50,000 shares of 6 percent, $100 par-value, cumulative, nonparticipating preferred stock and 100,000 shares of $2 par-value common stock, sold at an average price of $20 per share. The board of directors voted to distribute $200,000 as dividends in 2013, $400,000 in 2014, and $450,000 in 2012.

Compute the following:

1. Total dividend paid to preferred stockholders in 2013.

2. Total dividend paid to common stockholders in 2013.

3. Total dividend paid to preferred stockholders in 2014.

4. Total dividend paid to common stockholders in 2014.

5. Total dividend paid to preferred stockholders in 2012.

6. Total dividend paid to common stockholders in 2012.

Compute the following:

1. Total dividend paid to preferred stockholders in 2013.

2. Total dividend paid to common stockholders in 2013.

3. Total dividend paid to preferred stockholders in 2014.

4. Total dividend paid to common stockholders in 2014.

5. Total dividend paid to preferred stockholders in 2012.

6. Total dividend paid to common stockholders in 2012.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

78

On July 1, 2013, Abbott Corporation received a subscription from Brad Jones for 1,200 shares of its $1 par-value common stock at a price of $20 a share. Jones made a payment of $10 per share on the stock at the time of the subscription. Record the receipt of the subscription and the cash payment on page 1 of a general journal. Then, using the same page of the general journal, record the payment of the balance of Jones' subscription and issuance of the stock on August 1, 2013. Omit the descriptions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

79

Chicagoland Landscape Company, a newly organized corporation, received a bill from its lawyers for $10,000 for time spent in organizing the company.

1. How should these costs be treated in the company's accounting records? Why?

2. How should they be treated for federal income tax purposes?

1. How should these costs be treated in the company's accounting records? Why?

2. How should they be treated for federal income tax purposes?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

80

The Maynard Corporation has outstanding 10,000 shares of 10 percent, $50 par-value, cumulative, nonparticipating preferred stock and 80,000 shares of $10 par-value common stock. The board of directors voted to distribute $40,000 as dividends in 2013, $55,000 in 2014, and $65,000 in 2012.

Compute the following:

1. Total dividend paid to preferred stockholders in 2013.

2. Total dividend paid to common stockholders in 2013.

3. Total dividend paid to preferred stockholders in 2014.

4. Total dividend paid to common stockholders in 2014.

5. Total dividend paid to preferred stockholders in 2012.

6. Total dividend paid to common stockholders in 2012.

Compute the following:

1. Total dividend paid to preferred stockholders in 2013.

2. Total dividend paid to common stockholders in 2013.

3. Total dividend paid to preferred stockholders in 2014.

4. Total dividend paid to common stockholders in 2014.

5. Total dividend paid to preferred stockholders in 2012.

6. Total dividend paid to common stockholders in 2012.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck