Deck 29: Controlling Manufacturing Costs: Standard Costs

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

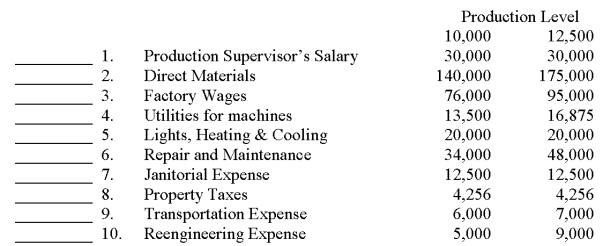

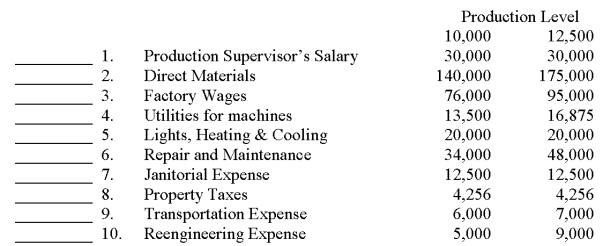

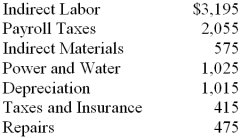

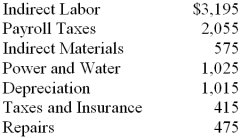

سؤال

سؤال

سؤال

سؤال

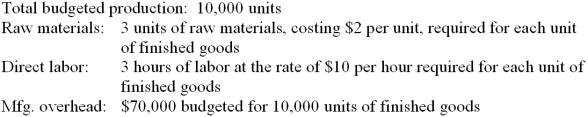

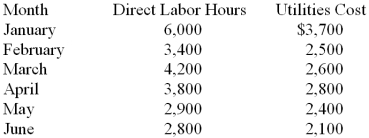

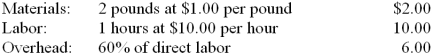

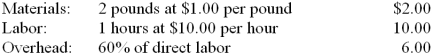

سؤال

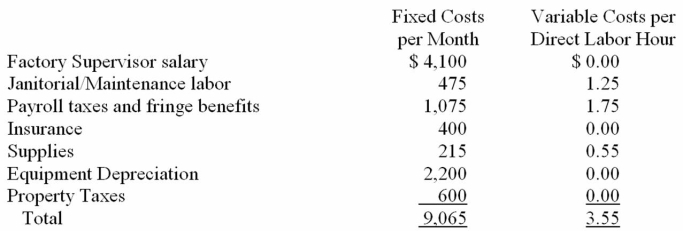

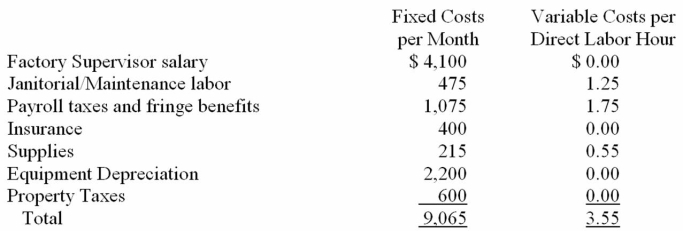

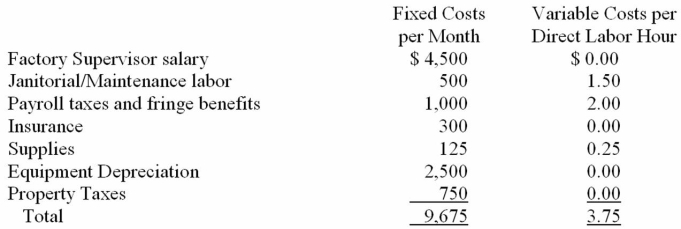

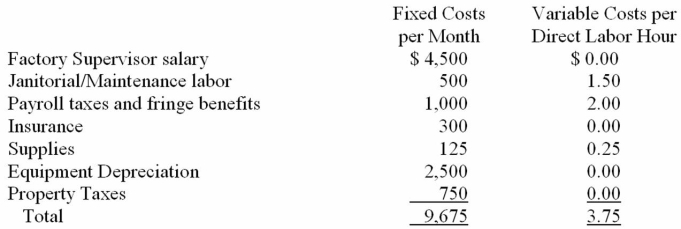

سؤال

سؤال

سؤال

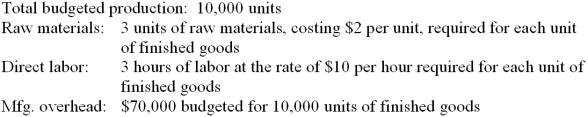

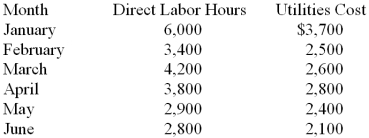

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

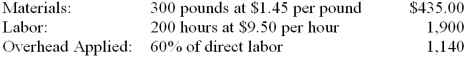

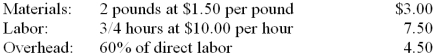

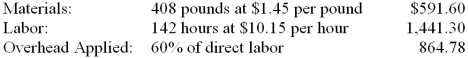

سؤال

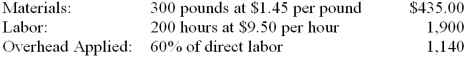

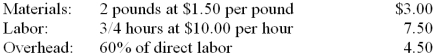

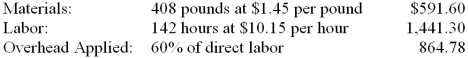

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/89

العب

ملء الشاشة (f)

Deck 29: Controlling Manufacturing Costs: Standard Costs

1

Semi-variable costs are sometimes called mixed costs.

True

2

The controllable overhead variance compares the actual overhead costs incurred with what the costs should have been for the units produced.

True

3

The purchasing department can determine the standard quantity per unit of each type of raw material required to manufacture a product.

False

4

If a price variance for materials is unfavorable, the quantity variance for materials also must be unfavorable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

5

Direct materials and direct labor are examples of costs that tend to vary directly with the volume of output.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

6

A price variance for an item is the difference between its actual price and its standard price multiplied by the standard quantity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

7

As the volume of output decreases, the fixed cost per unit of output increases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

8

The cost per unit of direct materials changes as output changes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

9

Standard costs reflect what costs should be for the units of product manufactured during the period under the normal efficient operating conditions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

10

A flexible budget shows budgeted costs at several different levels of activity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

11

The high-low point method results can be misleading if the months used are the highest and lowest production levels of the year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

12

In order to analyze the differences between actual costs and standard costs, it is necessary to identify the fixed and variable components of semi-variable costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

13

A budget performance report compares actual costs for a period with the budgeted costs for that period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

14

A key purpose of a manufacturing cost budget is to provide a basis for measuring performance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

15

If the standard cost for an item exceeds the actual cost, the variance is favorable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

16

Usually, a well-run manufacturing company prepares only annual manufacturing cost budgets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

17

The setting of standard wage rates is usually a function of the personnel department.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

18

A fixed budget includes only fixed manufacturing costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

19

If the predetermined overhead application rate is a percentage of labor cost, then a favorable labor time variance will be accompanied by a favorable manufacturing overhead variance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

20

Semi-variable costs vary in direct proportion to the volume of activity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

21

Costs that reflect what costs should be for the units of product manufactured during the period under normal efficient operating conditions are called ____________________ costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

22

Costs that do not vary in total during a period even though the volume of manufacturing activity changes are called ____________________ costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

23

The labor time (efficiency) variance and the labor ____________________ variance together make up the total labor variance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

24

As the volume of output increases, the ____________________ cost per unit of output decreases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

25

Costs that vary in some degree with the volume of activity, but not in direct proportion to it are called ____________________ costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

26

The difference between the actual cost of an item and its standard cost is called a(n) ___________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

27

Costs that tend to change in total directly with the volume of manufacturing activity are called ____________________ costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

28

A budget that shows expected costs at only one level of production activity is called a(n) ____________________ budget.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

29

Which of the following costs are generally semi-variable?

A) clerical salaries

B) depreciation

C) repairs and maintenance

D) property taxes

A) clerical salaries

B) depreciation

C) repairs and maintenance

D) property taxes

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

30

If the actual cost of an item is lower than the standard cost, a(n) ____________________ price variance will be recognized.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

31

Use the high-low point method to determine total fixed cost:

A) $20,000.

B) $28,000.

C) $16,000.

D) $24,000.

A) $20,000.

B) $28,000.

C) $16,000.

D) $24,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

32

The ____________________ cost per unit does not change as output changes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

33

A simple method used to analyze the fixed and variable components in semivariable costs is called the ____________________ point method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

34

A budget that shows expected costs at more than one level of activity is called a(n) ____________________ budget.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

35

The range of activity at which the factory is likely to operate is referred to as the ____________________ range of activity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

36

Use the high-low point method to determine variable cost per unit:

A) $0.60 per unit.

B) $0.80 per unit.

C) $1.00 per unit.

D) $1.20 per unit.

A) $0.60 per unit.

B) $0.80 per unit.

C) $1.00 per unit.

D) $1.20 per unit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

37

The quantity variance for an item is the difference between its actual quantity and its standard quantity, multiplied by the ____________________ cost of the item.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

38

Deducting the total variable cost from the total cost results in

A) overhead.

B) fixed cost.

C) manufacturing cost.

D) semivariable cost.

A) overhead.

B) fixed cost.

C) manufacturing cost.

D) semivariable cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

39

The price variance for an item is the difference between its actual price and its standard price, multiplied by the ____________________ quantity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

40

To separate the semi-variable costs into their fixed and variable components, one can use which of the following methods?

A) labor variance method

B) material variance method

C) relevant range of activity method

D) high-low point method

A) labor variance method

B) material variance method

C) relevant range of activity method

D) high-low point method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

41

The quantity variance for an item is the difference between its actual quantity and its standard quantity multiplied by

A) the standard cost of the item.

B) the actual cost of the item.

C) the price variance.

D) the budgeted amount for the item.

A) the standard cost of the item.

B) the actual cost of the item.

C) the price variance.

D) the budgeted amount for the item.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

42

The materials price variance for an item is the difference between its actual price and its standard cost

A) multiplied by the actual quantity used.

B) multiplied by the standard quantity allowed.

C) multiplied by the difference between the actual quantity and the standard quantity.

D) divided by the actual quantity.

A) multiplied by the actual quantity used.

B) multiplied by the standard quantity allowed.

C) multiplied by the difference between the actual quantity and the standard quantity.

D) divided by the actual quantity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

43

As the level of activity increases, the variable cost per unit of activity

A) increases.

B) decreases.

C) does not change.

D) may increase or decrease.

A) increases.

B) decreases.

C) does not change.

D) may increase or decrease.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

44

In a factory, the total variable costs are $600 if 500 units are produced. If 400 units are produced, the total variable costs would be

A) $480.

B) $600.

C) $120.

D) $333. (600/500) x 400.

A) $480.

B) $600.

C) $120.

D) $333. (600/500) x 400.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

45

The salary of the factory supervisor is a good example of

A) a variable cost.

B) a fixed cost.

C) a semi-variable cost.

D) a standard cost.

A) a variable cost.

B) a fixed cost.

C) a semi-variable cost.

D) a standard cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

46

Use the high-low point method to determine total costs if 16,000 units are produced.

A) $20,000

B) $22,800

C) $30,000

D) $32,800

A) $20,000

B) $22,800

C) $30,000

D) $32,800

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

47

In a factory, the fixed costs are $6,000 when 600 units are produced. If 900 units are produced, the fixed costs per unit would be

A) $10.00.

B) $9.00.

C) $7.50.

D) $6.67. 6,000/900.

A) $10.00.

B) $9.00.

C) $7.50.

D) $6.67. 6,000/900.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

48

As the level of activity increases, the total fixed costs for the period

A) increase.

B) decrease.

C) may increase or decrease.

D) do not change.

A) increase.

B) decrease.

C) may increase or decrease.

D) do not change.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

49

In a factory, the fixed costs per unit are $45 when 400 units are produced. If 450 units are produced, the fixed costs per unit would be

A) $45.00.

B) $40.00.

C) $10.00.

D) $50.63. (45 x 400)/450.

A) $45.00.

B) $40.00.

C) $10.00.

D) $50.63. (45 x 400)/450.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

50

In a factory, the total variable costs are $600 if 500 units are produced. If 800 units are produced, the variable cost per unit would be

A) $1.20

B) $1.11

C) $1.00

D) $0.75 600/500.

A) $1.20

B) $1.11

C) $1.00

D) $0.75 600/500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

51

As the level of activity increases, the total variable costs for the period

A) increase.

B) decrease.

C) do not change.

D) may increase or decrease.

A) increase.

B) decrease.

C) do not change.

D) may increase or decrease.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

52

A fixed budget is a meaningful way to evaluate manufacturing performance if the activity level used for the budget is

A) similar to actual.

B) less than actual.

C) more than actual.

D) a reasonable/logical activity measure.

A) similar to actual.

B) less than actual.

C) more than actual.

D) a reasonable/logical activity measure.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

53

The labor standard for a product was five hours at a wage rate of $8 per hour. The firm produced 900 units of the item. Labor costs totaled $35,250 and 4,700 hours of labor were used. An analysis of labor costs would indicate

A) a $750 favorable labor time variance.

B) a $1,600 unfavorable labor time variance.

C) a $750 unfavorable labor rate variance.

D) a $1,600 favorable labor rate variance.

A) a $750 favorable labor time variance.

B) a $1,600 unfavorable labor time variance.

C) a $750 unfavorable labor rate variance.

D) a $1,600 favorable labor rate variance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

54

Costs that reflect what costs should be for the units of product manufactured during the period under normal efficient operating conditions are known as

A) variable costs.

B) fixed costs.

C) standard costs.

D) semi-variable costs.

A) variable costs.

B) fixed costs.

C) standard costs.

D) semi-variable costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

55

An unfavorable price variance for materials means that

A) the actual cost of the materials was more than the budgeted amount.

B) more materials were used in production than anticipated.

C) more labor hours were required to work with the materials than expected.

D) the actual cost of the materials was more than the standard cost.

A) the actual cost of the materials was more than the budgeted amount.

B) more materials were used in production than anticipated.

C) more labor hours were required to work with the materials than expected.

D) the actual cost of the materials was more than the standard cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

56

A budget prepared using several differing levels of activity is a

A) fixed budget.

B) flexible budget.

C) manufacturing cost budget.

D) budget performance report.

A) fixed budget.

B) flexible budget.

C) manufacturing cost budget.

D) budget performance report.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

57

As the level of activity increases, the fixed cost per unit of activity

A) increases.

B) decreases.

C) does not change.

D) may increase or decrease.

A) increases.

B) decreases.

C) does not change.

D) may increase or decrease.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

58

The cost of utilities consumed in the factory is a good example of

A) a variable cost.

B) a fixed cost.

C) a semi-variable cost.

D) a standard cost.

A) a variable cost.

B) a fixed cost.

C) a semi-variable cost.

D) a standard cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

59

The standard quantity of materials for a product was 40 pounds per unit at the standard price of $2.00 per pound. The actual price per pound of materials was $1.50, and the actual quantity used was 44 pounds. An analysis would indicate

A) a $20.00 favorable price variance.

B) a $22.00 favorable price variance.

C) a $6.00 unfavorable quantity variance.

D) a $18.00 favorable price variance. (1.50 - 2.00) x 44 = 22.00 favorable.

A) a $20.00 favorable price variance.

B) a $22.00 favorable price variance.

C) a $6.00 unfavorable quantity variance.

D) a $18.00 favorable price variance. (1.50 - 2.00) x 44 = 22.00 favorable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

60

Direct factory labor is usually considered to be

A) a variable cost.

B) a fixed cost.

C) a semi-variable cost.

D) a mixed cost.

A) a variable cost.

B) a fixed cost.

C) a semi-variable cost.

D) a mixed cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

61

Determine the cost behavior for each of the following items as Fixed (F), Variable (V), or Semi-variable (S).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

62

Prepare a budget for manufacturing costs for Anasta Manufacturing for the month of April 2013 from the following information. Direct materials are estimated to be $600,000 for the year and direct labor is estimated to be $108,000. The direct labor per hour average is $16 and the budgeted level of direct labor activity for the month is 1,100 hours.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

63

Efficiency and cost control can be evaluated by comparing actual overhead costs with the budget for the actual level of operations with the

A) flexible budget.

B) fixed budget.

C) budget performance report.

D) manufacturing cost budget.

A) flexible budget.

B) fixed budget.

C) budget performance report.

D) manufacturing cost budget.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

64

The standard quantity of materials for a product was 40 pounds per unit at the standard price of $2.00 per pound. The actual price per pound of materials was $1.50, and the actual quantity used was 44 pounds. An analysis would indicate

A) a $20.00 favorable price variance.

B) a $8.00 favorable quantity variance.

C) a $6.00 unfavorable quantity variance.

D) a $8.00 unfavorable quantity variance. (44 - 40) x 2.00 = 8 unfavorable.

A) a $20.00 favorable price variance.

B) a $8.00 favorable quantity variance.

C) a $6.00 unfavorable quantity variance.

D) a $8.00 unfavorable quantity variance. (44 - 40) x 2.00 = 8 unfavorable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

65

The company's accountant developed the data given below for Product X for the year 2013. Use this information to compute the answers to the questions that follow.  1. What is the standard cost per unit of product for materials?

1. What is the standard cost per unit of product for materials?

2. What is the standard cost per unit of product for labor?

3. What is the standard cost per unit of product for overhead?

4. What is the total standard cost per unit of product?

1. What is the standard cost per unit of product for materials?

1. What is the standard cost per unit of product for materials?2. What is the standard cost per unit of product for labor?

3. What is the standard cost per unit of product for overhead?

4. What is the total standard cost per unit of product?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

66

Kenwood Company's manufacturing overhead costs for the assembly department are given below.

Using the information provided, prepare a flexible budget for the department for the month of May 2013, assuming that the expected production is for 2,000 direct labor hours. The flexible budget should show costs for production levels of 90 percent and 110 percent of the expected production level of 2,000 hours.

Using the information provided, prepare a flexible budget for the department for the month of May 2013, assuming that the expected production is for 2,000 direct labor hours. The flexible budget should show costs for production levels of 90 percent and 110 percent of the expected production level of 2,000 hours.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

67

Standard quantity is usually determined by the

A) purchasing department.

B) engineers.

C) company accountant.

D) shop foreman.

A) purchasing department.

B) engineers.

C) company accountant.

D) shop foreman.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

68

One element that is NOT part of the standard cost is

A) shipping.

B) labor.

C) materials.

D) machine maintenance.

A) shipping.

B) labor.

C) materials.

D) machine maintenance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

69

Vista Company's records show the following information for the first six months of 2013.  1. What are the variable costs per hour using the high-low point method?

1. What are the variable costs per hour using the high-low point method?

2. What are the fixed costs per month using the high-low point method?

1. What are the variable costs per hour using the high-low point method?

1. What are the variable costs per hour using the high-low point method?2. What are the fixed costs per month using the high-low point method?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

70

Kenwood Company's manufacturing overhead costs for the assembly department are given below.

Using the information provided prepare a departmental monthly overhead performance report comparing actual costs with the budget allowance for the number of hours worked. Assume that during the month of May actual production was 1,900 hours. Actual costs for the month were as follows:

Using the information provided prepare a departmental monthly overhead performance report comparing actual costs with the budget allowance for the number of hours worked. Assume that during the month of May actual production was 1,900 hours. Actual costs for the month were as follows:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

71

Complete the flexible budget of manufacturing costs for Lansome Industries for September 2013. Overhead is based on direct labor hours.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

72

The difference between the total standard cost and the total actual cost is the

A) standard cost card amount.

B) labor rate variance.

C) materials price variance.

D) cost variance.

A) standard cost card amount.

B) labor rate variance.

C) materials price variance.

D) cost variance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

73

An analysis would indicate

A) a $5,000 unfavorable materials quantity variance

B) a $7,600 favorable materials quantity variance.

C) a $2,600 favorable materials quantity variance.

D) a $7,600 unfavorable materials quantity variance. (actual quantity - standard quantity) x standard price = (13,000 - (4,000 x 3)) x 5 = 5,000 unfavorable.

A) a $5,000 unfavorable materials quantity variance

B) a $7,600 favorable materials quantity variance.

C) a $2,600 favorable materials quantity variance.

D) a $7,600 unfavorable materials quantity variance. (actual quantity - standard quantity) x standard price = (13,000 - (4,000 x 3)) x 5 = 5,000 unfavorable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

74

Prepare a budget for manufacturing costs for Nacelle Manufacturing for the month of July 2013 from the following information. Direct materials are estimated to be $480,000 for the year and direct labor is estimated to be $96,000. The direct labor per hour average is $13 and the budgeted level of activity for the month is 1,200 hours.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

75

The three classifications for manufacturing costs are fixed, variable, and semivariable. Explain what each is and how they relate to production.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

76

An analysis would indicate

A) a $900 unfavorable labor efficiency variance.

B) a $900 favorable labor efficiency variance.

C) a $4,800 unfavorable labor efficiency variance.

D) a $4,800 favorable labor efficiency variance. (actual hours - standard hours) x standard rate

= (3,600 - 4,000) x 12 = 4,800 favorable.

A) a $900 unfavorable labor efficiency variance.

B) a $900 favorable labor efficiency variance.

C) a $4,800 unfavorable labor efficiency variance.

D) a $4,800 favorable labor efficiency variance. (actual hours - standard hours) x standard rate

= (3,600 - 4,000) x 12 = 4,800 favorable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

77

An analysis would indicate

A) a $900 unfavorable labor rate variance.

B) a $900 favorable labor rate variance.

C) a $4,800 unfavorable labor rate variance.

D) a $4,80 favorable labor rate variance. (actual rate - standard rate) x actual hours= (11.75 - 12) x 3,600 = 900 favorable.

A) a $900 unfavorable labor rate variance.

B) a $900 favorable labor rate variance.

C) a $4,800 unfavorable labor rate variance.

D) a $4,80 favorable labor rate variance. (actual rate - standard rate) x actual hours= (11.75 - 12) x 3,600 = 900 favorable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

78

The standard costs for a unit of product are shown below.  During June, Job N-5 for 100 units was completed. The actual costs of the job are shown below.

During June, Job N-5 for 100 units was completed. The actual costs of the job are shown below.  1. What is the total cost variance between actual cost and standard cost?

1. What is the total cost variance between actual cost and standard cost?

2. What is the total material variance?

3. What is the material quantity variance?

4. What is the material price variance?

During June, Job N-5 for 100 units was completed. The actual costs of the job are shown below.

During June, Job N-5 for 100 units was completed. The actual costs of the job are shown below.  1. What is the total cost variance between actual cost and standard cost?

1. What is the total cost variance between actual cost and standard cost?2. What is the total material variance?

3. What is the material quantity variance?

4. What is the material price variance?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

79

The standard costs for a unit of product are shown below.  During July, Job N-5 for 200 units was completed. The actual costs of the job are shown below.

During July, Job N-5 for 200 units was completed. The actual costs of the job are shown below.  1. What is the total cost variance between actual cost and standard cost?

1. What is the total cost variance between actual cost and standard cost?

2. What is the total material variance?

3. What is the material quantity variance?

4. What is the material price variance?

During July, Job N-5 for 200 units was completed. The actual costs of the job are shown below.

During July, Job N-5 for 200 units was completed. The actual costs of the job are shown below.  1. What is the total cost variance between actual cost and standard cost?

1. What is the total cost variance between actual cost and standard cost?2. What is the total material variance?

3. What is the material quantity variance?

4. What is the material price variance?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

80

The flexible budget usually shows

A) only fixed costs.

B) only variable costs.

C) fixed and variable costs together.

D) fixed and variable costs separately.

A) only fixed costs.

B) only variable costs.

C) fixed and variable costs together.

D) fixed and variable costs separately.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck