Deck 12: Financial Statement Analysis

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/144

العب

ملء الشاشة (f)

Deck 12: Financial Statement Analysis

1

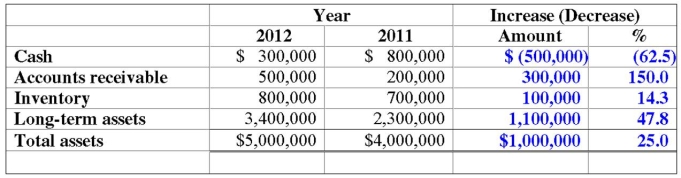

The following is an example of:

A) Vertical analysis.

B) Horizontal analysis.

C) Diagonal analysis.

D) Both vertical and horizontal analysis.

A) Vertical analysis.

B) Horizontal analysis.

C) Diagonal analysis.

D) Both vertical and horizontal analysis.

B

2

Which of the following ratios is most useful in evaluating liquidity?

A) Return on assets.

B) Return on equity.

C) Debt to equity ratio.

D) Current ratio.

A) Return on assets.

B) Return on equity.

C) Debt to equity ratio.

D) Current ratio.

D

3

Which of the following is a sign that a company cannot quickly turn its receivables into cash?

A) A high receivables turnover ratio.

B) A low receivables turnover ratio.

C) A low average collection period.

D) Both a high receivables turnover ratio and a low average collection period.

A) A high receivables turnover ratio.

B) A low receivables turnover ratio.

C) A low average collection period.

D) Both a high receivables turnover ratio and a low average collection period.

B

4

Which of the following is an example of horizontal analysis?

A) Comparing COGS with sales.

B) Comparing net income across companies.

C) Comparing debt with equity.

D) Comparing the growth in sales over time.

A) Comparing COGS with sales.

B) Comparing net income across companies.

C) Comparing debt with equity.

D) Comparing the growth in sales over time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

5

Which of the following ratios is most useful in evaluating solvency?

A) Debt to equity ratio.

B) Current ratio.

C) Receivables turnover ratio.

D) Inventory turnover ratio.

A) Debt to equity ratio.

B) Current ratio.

C) Receivables turnover ratio.

D) Inventory turnover ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

6

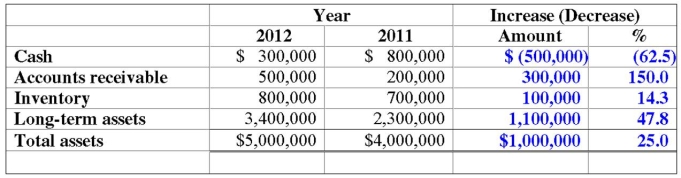

The following is an example of:

A) Vertical analysis.

B) Horizontal analysis.

C) Diagonal analysis.

D) Both vertical and horizontal analysis.

A) Vertical analysis.

B) Horizontal analysis.

C) Diagonal analysis.

D) Both vertical and horizontal analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

7

Horizontal analysis examines trends in a company:

A) Over time.

B) Between income statement accounts in the same year.

C) Between balance sheet accounts in the same year.

D) Between income statement and balance sheet accounts in the same year.

A) Over time.

B) Between income statement accounts in the same year.

C) Between balance sheet accounts in the same year.

D) Between income statement and balance sheet accounts in the same year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

8

Which of the following is an example of vertical analysis?

A) Comparing gross profit across companies.

B) Comparing income statement items as a percentage of sales.

C) Comparing debt with industry averages.

D) Comparing the change in sales over time.

A) Comparing gross profit across companies.

B) Comparing income statement items as a percentage of sales.

C) Comparing debt with industry averages.

D) Comparing the change in sales over time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

9

When using vertical analysis, we express income statement accounts as a percentage of:

A) Net income.

B) Gross profit.

C) Sales.

D) Total assets.

A) Net income.

B) Gross profit.

C) Sales.

D) Total assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

10

Comparing operating expenses as a percentage of sales is an example of:

A) Vertical analysis.

B) Horizontal analysis.

C) Diagonal analysis.

D) Both vertical and horizontal analysis.

A) Vertical analysis.

B) Horizontal analysis.

C) Diagonal analysis.

D) Both vertical and horizontal analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

11

The current ratio is calculated as:

A) Current assets divided by noncurrent assets.

B) Current assets divided by current liabilities.

C) Current liabilities divided by noncurrent liabilities.

D) Current liabilities divided by current assets.

A) Current assets divided by noncurrent assets.

B) Current assets divided by current liabilities.

C) Current liabilities divided by noncurrent liabilities.

D) Current liabilities divided by current assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

12

When using vertical analysis, we express balance sheet accounts as a percentage of:

A) Sales.

B) Total assets.

C) Total liabilities.

D) Total stockholders' equity.

A) Sales.

B) Total assets.

C) Total liabilities.

D) Total stockholders' equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

13

Comparing changes in net income for one company over time is an example of:

A) Vertical analysis.

B) Horizontal analysis.

C) Diagonal analysis.

D) Both vertical and horizontal analysis.

A) Vertical analysis.

B) Horizontal analysis.

C) Diagonal analysis.

D) Both vertical and horizontal analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

14

Which of the following is an example of horizontal analysis?

A) Comparing gross profit across companies.

B) Comparing gross profit with operating expenses.

C) Comparing assets with equity.

D) Comparing the change in sales over time.

A) Comparing gross profit across companies.

B) Comparing gross profit with operating expenses.

C) Comparing assets with equity.

D) Comparing the change in sales over time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

15

Which of the following is a sign that a company can quickly turn its receivables into cash?

A) A low receivables turnover ratio.

B) A high receivables turnover ratio.

C) A high average collection period.

D) Both a low receivables turnover ratio and a high average collection period.

A) A low receivables turnover ratio.

B) A high receivables turnover ratio.

C) A high average collection period.

D) Both a low receivables turnover ratio and a high average collection period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

16

Which of the following is a positive sign that a company is selling its inventory quickly?

A) A low inventory turnover ratio.

B) A high inventory turnover ratio.

C) A low average days in inventory.

D) Both a high inventory turnover ratio and a low average days in inventory.

A) A low inventory turnover ratio.

B) A high inventory turnover ratio.

C) A low average days in inventory.

D) Both a high inventory turnover ratio and a low average days in inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

17

Which of the following is a negative sign that a company is not selling its inventory quickly?

A) A low inventory turnover ratio.

B) A high inventory turnover ratio.

C) A low average days in inventory.

D) Both a high inventory turnover ratio and a low average days in inventory.

A) A low inventory turnover ratio.

B) A high inventory turnover ratio.

C) A low average days in inventory.

D) Both a high inventory turnover ratio and a low average days in inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

18

Which of the following is not a common type of comparison in accounting?

A) Comparisons of sales growth between companies.

B) Comparisons of earnings per share between companies.

C) Comparisons over time.

D) Comparisons to industry.

A) Comparisons of sales growth between companies.

B) Comparisons of earnings per share between companies.

C) Comparisons over time.

D) Comparisons to industry.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

19

The acid-test ratio is most similar to the:

A) Current ratio.

B) Debt to equity ratio.

C) Times interest earned ratio.

D) Inventory turnover ratio.

A) Current ratio.

B) Debt to equity ratio.

C) Times interest earned ratio.

D) Inventory turnover ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

20

Which of the following is correct?

A) Receivables turnover ratio depicts the company's frequency of cash collections.

B) Inventory turnover ratio can be used to assess the company's frequency of selling inventory.

C) Current ratio reflects the company's ability to pay current debt.

D) All of the other options are correct.

A) Receivables turnover ratio depicts the company's frequency of cash collections.

B) Inventory turnover ratio can be used to assess the company's frequency of selling inventory.

C) Current ratio reflects the company's ability to pay current debt.

D) All of the other options are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

21

Stealth Company's 2013 debt to equity ratio is:

A) 77.1%.

B) 80.0%.

C) 40.0%.

D) 60.0%.

A) 77.1%.

B) 80.0%.

C) 40.0%.

D) 60.0%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

22

Assuming a current ratio of 1.0 and an acid-test ratio of 0.75, how will the purchase of inventory with cash affect each ratio?

A) Increase the current ratio and increase the acid-test ratio.

B) No change to the current ratio and decrease the acid-test ratio.

C) Decrease the current ratio and decrease the acid-test ratio.

D) Increase the current ratio and decrease the acid-test ratio.

A) Increase the current ratio and increase the acid-test ratio.

B) No change to the current ratio and decrease the acid-test ratio.

C) Decrease the current ratio and decrease the acid-test ratio.

D) Increase the current ratio and decrease the acid-test ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

23

When a company sells land for cash and makes a $25,000 gain:

A) Its acid-test ratio decreases.

B) Its current ratio decreases.

C) Its debt to equity ratio decreases.

D) Cannot determine from the given information.

A) Its acid-test ratio decreases.

B) Its current ratio decreases.

C) Its debt to equity ratio decreases.

D) Cannot determine from the given information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

24

Stealth Company's 2013 average days in inventory is:

A) 60.5 days.

B) 92.2 days.

C) 100.8 days.

D) 89.7 days.

A) 60.5 days.

B) 92.2 days.

C) 100.8 days.

D) 89.7 days.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

25

Assuming a current ratio of 1.0, how will the purchase of inventory with cash affect the ratio?

A) Increase the current ratio.

B) No change to the current ratio.

C) Decrease the current ratio.

D) Could either increase or decrease the current ratio.

A) Increase the current ratio.

B) No change to the current ratio.

C) Decrease the current ratio.

D) Could either increase or decrease the current ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

26

TPX Company's 2013 receivables turnover ratio is:

A) 5.3 times.

B) 5.6 times.

C) 5.0 times.

D) 0.2 times.

A) 5.3 times.

B) 5.6 times.

C) 5.0 times.

D) 0.2 times.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

27

Stealth Company's 2013 receivables turnover ratio is:

A) 2.85.

B) 4.70.

C) 5.00.

D) 10.63.

A) 2.85.

B) 4.70.

C) 5.00.

D) 10.63.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

28

Stealth Company's 2013 inventory turnover is:

A) 3.62 times.

B) 3.96 times.

C) 4.07 times.

D) 6.03 times.

A) 3.62 times.

B) 3.96 times.

C) 4.07 times.

D) 6.03 times.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

29

Which of the following is not a solvency ratio?

A) Time interest earned ratio.

B) The debt to equity ratio.

C) The current ratio.

D) All of the other options are solvency ratios.

A) Time interest earned ratio.

B) The debt to equity ratio.

C) The current ratio.

D) All of the other options are solvency ratios.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

30

Assume a company's current ratio and acid-test ratio are less than 1.0 before it purchases inventory on credit. When it makes the purchase:

A) Its current ratio decreases.

B) Its acid-test ratio decreases.

C) Its current ratio remains unchanged.

D) Its acid-test ratio remains unchanged.

A) Its current ratio decreases.

B) Its acid-test ratio decreases.

C) Its current ratio remains unchanged.

D) Its acid-test ratio remains unchanged.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

31

TPX Company's 2013 average collection period is:

A) 69 days.

B) 65 days.

C) 73 days.

D) 1,825 days.

A) 69 days.

B) 65 days.

C) 73 days.

D) 1,825 days.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

32

The debt to equity ratio is:

A) 0.33.

B) 0.77.

C) 1.17.

D) 1.30.

A) 0.33.

B) 0.77.

C) 1.17.

D) 1.30.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

33

HHF's times interest earned ratio is:

A) 3.47.

B) 1.72.

C) 2.47.

D) 10.0.

A) 3.47.

B) 1.72.

C) 2.47.

D) 10.0.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

34

Assuming an acid-test ratio of 1.0, how will the purchase of inventory with cash affect the ratio?

A) Increase the acid-test ratio.

B) No change to the acid-test ratio.

C) Decrease the acid-test ratio.

D) Could either increase or decrease the acid-test ratio.

A) Increase the acid-test ratio.

B) No change to the acid-test ratio.

C) Decrease the acid-test ratio.

D) Could either increase or decrease the acid-test ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

35

HHF's debt to equity ratio is:

A) 0.75.

B) 1.13.

C) 0.38.

D) 1.80.

A) 0.75.

B) 1.13.

C) 0.38.

D) 1.80.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

36

Stealth Company's 2013 average collection period is:

A) 73 days.

B) 104 days.

C) 109 days.

D) 128 days.

A) 73 days.

B) 104 days.

C) 109 days.

D) 128 days.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

37

The acid-test ratio is:

A) 0.25.

B) 0.88.

C) 1.17.

D) 1.58.

A) 0.25.

B) 0.88.

C) 1.17.

D) 1.58.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

38

When a company pays a bill from a plumber for previous services on account:

A) Its debt to equity ratio decreases.

B) Its acid-test ratio always remains unchanged.

C) Its current ratio always remains unchanged.

D) All of the other options are correct.

A) Its debt to equity ratio decreases.

B) Its acid-test ratio always remains unchanged.

C) Its current ratio always remains unchanged.

D) All of the other options are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

39

The current ratio is:

A) 1.98.

B) 1.58.

C) 1.17.

D) 0.66.

A) 1.98.

B) 1.58.

C) 1.17.

D) 0.66.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

40

The acid-test ratio is:

A) The liquidity ratio divided by the equity ratio.

B) Current assets minus inventory divided by current liabilities minus accounts payable.

C) Cash, net receivables, and current investments divided by current liabilities.

D) Cash divided by accounts payable.

A) The liquidity ratio divided by the equity ratio.

B) Current assets minus inventory divided by current liabilities minus accounts payable.

C) Cash, net receivables, and current investments divided by current liabilities.

D) Cash divided by accounts payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

41

TPX Company's 2013 return on assets is:

A) 48.2%.

B) 9.3%.

C) 8.8%.

D) 9.0%.

A) 48.2%.

B) 9.3%.

C) 8.8%.

D) 9.0%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

42

TPX Company's 2013 asset turnover is:

A) 3.7 times.

B) 2.8 times.

C) 2.2 times.

D) 0.5 times.

A) 3.7 times.

B) 2.8 times.

C) 2.2 times.

D) 0.5 times.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

43

Stealth Company's 2013 return on assets is:

A) 7.1%.

B) 7.8%.

C) 13.5%.

D) 44.7%.

A) 7.1%.

B) 7.8%.

C) 13.5%.

D) 44.7%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

44

Nerf Mania reports net income of $500,000, net sales of $4,000,000, and average assets of $2,000,000. The asset turnover is:

A) 0.25 times.

B) 0.5 times.

C) 2 times.

D) 8 times.

A) 0.25 times.

B) 0.5 times.

C) 2 times.

D) 8 times.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

45

Stealth Company's 2013 gross profit ratio is:

A) 77.1%.

B) 80.0%.

C) 40.0%.

D) 60.0%.

A) 77.1%.

B) 80.0%.

C) 40.0%.

D) 60.0%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

46

TPX Company's 2013 inventory turnover is:

A) 3.0 times.

B) 5.2 times.

C) 3.3 times.

D) 3.6 times.

A) 3.0 times.

B) 5.2 times.

C) 3.3 times.

D) 3.6 times.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

47

Richard's Sporting Goods reports net income of $100,000, net sales of $500,000, and average assets of $1,000,000. The return on assets is:

A) 10%.

B) 20%.

C) 50%.

D) 5 times.

A) 10%.

B) 20%.

C) 50%.

D) 5 times.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

48

TPX Company's 2013 gross profit ratio is:

A) 57.5%.

B) 36.5%.

C) 63.5%.

D) 60.0%.

A) 57.5%.

B) 36.5%.

C) 63.5%.

D) 60.0%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

49

Richard's Sporting Goods reports net income of $100,000, net sales of $500,000, and average assets of $1,000,000. The profit margin is:

A) 10%.

B) 20%.

C) 50%.

D) 5 times.

A) 10%.

B) 20%.

C) 50%.

D) 5 times.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

50

Stealth Company's 2013 profit margin is:

A) 17.1%.

B) 13.5%.

C) 7.6%.

D) 4.5%.

A) 17.1%.

B) 13.5%.

C) 7.6%.

D) 4.5%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

51

Stealth Company's 2013 asset turnover is:

A) 3.7 times.

B) 2.8 times.

C) 2.2 times.

D) 0.5 times.

A) 3.7 times.

B) 2.8 times.

C) 2.2 times.

D) 0.5 times.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

52

TPX Company's 2013 profit margin is:

A) 18.8%.

B) 9.0%.

C) 19.4%.

D) 15.1%.

A) 18.8%.

B) 9.0%.

C) 19.4%.

D) 15.1%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

53

Given the information below, what is the company's gross profit?

A) $250,000.

B) $70,000.

C) $220,000.

D) $50,000.

A) $250,000.

B) $70,000.

C) $220,000.

D) $50,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

54

TPX Company's 2013 debt to equity ratio is:

A) 50.0%.

B) 60.0%.

C) 70.0%.

D) 80.0%.

A) 50.0%.

B) 60.0%.

C) 70.0%.

D) 80.0%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

55

Stealth Company's 2013 return on equity is:

A) 17.1%.

B) 14.0%.

C) 12.6%.

D) 7.1%.

A) 17.1%.

B) 14.0%.

C) 12.6%.

D) 7.1%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

56

Nerf Mania reports net income of $500,000, net sales of $4,000,000, and average assets of $2,000,000. The return on assets is:

A) 200%.

B) 25%.

C) 50%.

D) 12.5%.

A) 200%.

B) 25%.

C) 50%.

D) 12.5%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

57

Return on assets equals:

A) Gross profit ratio x Inventory turnover.

B) Profit margin x Inventory turnover.

C) Gross profit ratio x Asset turnover.

D) Profit margin x Asset turnover.

A) Gross profit ratio x Inventory turnover.

B) Profit margin x Inventory turnover.

C) Gross profit ratio x Asset turnover.

D) Profit margin x Asset turnover.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

58

TPX Company's 2013 return on equity is:

A) 16.7%.

B) 15.0%.

C) 15.8%.

D) 21.4%.

A) 16.7%.

B) 15.0%.

C) 15.8%.

D) 21.4%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

59

Nerf Mania reports net income of $500,000, net sales of $4,000,000, and average assets of $2,000,000. The profit margin is:

A) 12.5%.

B) 25%.

C) 50%.

D) 8 times.

A) 12.5%.

B) 25%.

C) 50%.

D) 8 times.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

60

TPX Company's 2013 average days in inventory is:

A) 121.7 days.

B) 70.2 days.

C) 110.6 days.

D) 101.4 days.

A) 121.7 days.

B) 70.2 days.

C) 110.6 days.

D) 101.4 days.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

61

We use vertical analysis for income statement accounts, but not balance sheet accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

62

Vertical analysis expresses each item in a financial statement as a percentage of the same base amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

63

The financial statements of a firm that uses more aggressive accounting practices would be likely to report:

A) Higher profitability.

B) Higher dividends.

C) Higher liabilities.

D) Fewer total assets.

A) Higher profitability.

B) Higher dividends.

C) Higher liabilities.

D) Fewer total assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

64

Which of the following is NOT an example of applying conservatism in accounting?

A) Recording contingent losses that are probable.

B) Expensing all research and development costs are they are incurred.

C) Using the lower-of-cost-or-market rules for inventory accounting.

D) Increasing the useful life used in calculating depreciation.

A) Recording contingent losses that are probable.

B) Expensing all research and development costs are they are incurred.

C) Using the lower-of-cost-or-market rules for inventory accounting.

D) Increasing the useful life used in calculating depreciation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

65

For vertical analysis, we express each balance sheet item as a percentage of sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

66

Which of the following items is most likely to be reported as an extraordinary loss?

A) Losses due to the write-down of inventory.

B) Losses on the sale of long-term assets.

C) Losses due to business restructuring.

D) Uninsured losses from a natural disaster.

A) Losses due to the write-down of inventory.

B) Losses on the sale of long-term assets.

C) Losses due to business restructuring.

D) Uninsured losses from a natural disaster.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

67

Which of the following is an aggressive accounting practice?

A) Change from straight-line to double-declining balance depreciation.

B) Record sales revenue before it is actually earned.

C) Adjust the allowance for uncollectible accounts to a larger amount.

D) Record inventory at lower of cost or market rather than at cost.

A) Change from straight-line to double-declining balance depreciation.

B) Record sales revenue before it is actually earned.

C) Adjust the allowance for uncollectible accounts to a larger amount.

D) Record inventory at lower of cost or market rather than at cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

68

Extraordinary items:

A) Include very large gains or losses from ordinary business activities.

B) Are items that are both unusual in nature and occur infrequently.

C) Are shown on the income statement before the tax effect.

D) Include the write-down of obsolete inventories.

A) Include very large gains or losses from ordinary business activities.

B) Are items that are both unusual in nature and occur infrequently.

C) Are shown on the income statement before the tax effect.

D) Include the write-down of obsolete inventories.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

69

An extraordinary item must meet which of the following criteria?

A) Unusual in nature.

B) Infrequent in occurrence.

C) Unusual in nature and infrequent in occurrence.

D) Unusual in nature or infrequent in occurrence.

A) Unusual in nature.

B) Infrequent in occurrence.

C) Unusual in nature and infrequent in occurrence.

D) Unusual in nature or infrequent in occurrence.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

70

Which of the following is an aggressive accounting practice?

A) The use of a shorter service life for depreciation.

B) Waiting to record a litigation loss.

C) Adjust the allowance for uncollectible accounts to a larger amount.

D) The write-down of overvalued inventory.

A) The use of a shorter service life for depreciation.

B) Waiting to record a litigation loss.

C) Adjust the allowance for uncollectible accounts to a larger amount.

D) The write-down of overvalued inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

71

We use vertical analysis to express each income statement item as a percentage of sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

72

Popson Inc. incurred a material loss which was not unusual in character, but was clearly an infrequent occurrence. This loss should be reported as:

A) An extraordinary loss.

B) A loss from discontinued operations.

C) Other revenues and expenses.

D) A separate line item in retained earnings.

A) An extraordinary loss.

B) A loss from discontinued operations.

C) Other revenues and expenses.

D) A separate line item in retained earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

73

Which of the following is a conservative accounting practice?

A) Change from double-declining balance to straight-line depreciation.

B) Record sales revenue before it is actually earned.

C) Adjust the allowance for uncollectible accounts to a larger amount.

D) Record inventory at market rather than lower of cost or market.

A) Change from double-declining balance to straight-line depreciation.

B) Record sales revenue before it is actually earned.

C) Adjust the allowance for uncollectible accounts to a larger amount.

D) Record inventory at market rather than lower of cost or market.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

74

Richard's Sporting Goods reports net income of $100,000, net sales of $500,000, and average assets of $1,000,000. The asset turnover is:

A) 0.1 times.

B) 0.5 times.

C) 2 times.

D) 5 times.

A) 0.1 times.

B) 0.5 times.

C) 2 times.

D) 5 times.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

75

The sale or disposal of a significant component of a company's operations is referred to as:

A) A discontinued operation.

B) An extraordinary item.

C) Other revenues and expenses.

D) Gain or loss on sale of assets.

A) A discontinued operation.

B) An extraordinary item.

C) Other revenues and expenses.

D) Gain or loss on sale of assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

76

Vertical analysis calculates the amount and percentage change of an account over time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

77

Which of the following is a conservative accounting practice?

A) The use of a longer service life for depreciation.

B) Waiting to record a litigation loss.

C) Adjust the allowance for uncollectible accounts to a smaller amount.

D) The write-down of overvalued inventory.

A) The use of a longer service life for depreciation.

B) Waiting to record a litigation loss.

C) Adjust the allowance for uncollectible accounts to a smaller amount.

D) The write-down of overvalued inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

78

A discontinued operation refers to:

A) The sale or disposal of a significant component of a company's operations.

B) Discontinued inventory items.

C) Inventory items that have been completed and sold.

D) The sale of most long-term assets.

A) The sale or disposal of a significant component of a company's operations.

B) Discontinued inventory items.

C) Inventory items that have been completed and sold.

D) The sale of most long-term assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

79

What is the correct order to present the following items on the income statement?

A) Other revenues and expenses, income tax expense, discontinued operations, extraordinary items.

B) Other revenues and expenses, income tax expense, extraordinary items, discontinued operations.

C) Discontinued operations, extraordinary items, other revenues and expenses, income tax expense.

D) Discontinued operations, extraordinary items, income tax expense, other revenues and expenses.

A) Other revenues and expenses, income tax expense, discontinued operations, extraordinary items.

B) Other revenues and expenses, income tax expense, extraordinary items, discontinued operations.

C) Discontinued operations, extraordinary items, other revenues and expenses, income tax expense.

D) Discontinued operations, extraordinary items, income tax expense, other revenues and expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

80

We can use ratios to help evaluate a firm's performance and financial position.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck