Deck 4: Cash and Internal Controls

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/178

العب

ملء الشاشة (f)

Deck 4: Cash and Internal Controls

1

The act of collusion refers to:

A) Top management and lower-level employees working together to share information necessary for effective internal controls.

B) Two or more people acting in coordination to circumvent internal controls.

C) Management working with an auditor to prevent occupational fraud.

D) Middle-level managers taking full responsibility for effective internal controls.

A) Top management and lower-level employees working together to share information necessary for effective internal controls.

B) Two or more people acting in coordination to circumvent internal controls.

C) Management working with an auditor to prevent occupational fraud.

D) Middle-level managers taking full responsibility for effective internal controls.

B

2

Which of the following is an example of detective controls?

A) Separation of duties.

B) Physical controls.

C) Proper authorization.

D) Reconciliations.

A) Separation of duties.

B) Physical controls.

C) Proper authorization.

D) Reconciliations.

D

3

What key piece of legislation was passed in response to corporate accounting scandals by Enron, WorldCom, and others?

A) Sarbanes-Oxley Act.

B) 1933 Securities Act.

C) 1934 Securities Exchange Act.

D) Regulation Fair Disclosure.

A) Sarbanes-Oxley Act.

B) 1933 Securities Act.

C) 1934 Securities Exchange Act.

D) Regulation Fair Disclosure.

A

4

Which of the following is NOT a design feature of effective internal controls?

A) Allow greater reliance by investors on reported financial statements.

B) Prevent fraudulent or errant financial reporting.

C) Ensure the company's price advantage over competitors.

D) Prevent misuse of company funds by employees.

A) Allow greater reliance by investors on reported financial statements.

B) Prevent fraudulent or errant financial reporting.

C) Ensure the company's price advantage over competitors.

D) Prevent misuse of company funds by employees.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

5

Giving only management the right to make purchases over a certain amount is an example of which preventive control?

A) Separation of duties.

B) Physical controls.

C) Proper authorization.

D) Employee management.

A) Separation of duties.

B) Physical controls.

C) Proper authorization.

D) Employee management.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

6

Occupational fraud:

A) Is the use of one's occupation for personal enrichment through the deliberate misuse or misapplication of the employing organization's resources.

B) Occurs in only a few organizations and generally involves minor amounts.

C) Will be prevented when companies employ an auditor.

D) Is committed only by lower-level employees.

A) Is the use of one's occupation for personal enrichment through the deliberate misuse or misapplication of the employing organization's resources.

B) Occurs in only a few organizations and generally involves minor amounts.

C) Will be prevented when companies employ an auditor.

D) Is committed only by lower-level employees.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

7

Separation of duties refers to:

A) Making each manager personally responsible for his/her department.

B) Keeping functions across different departments separate.

C) Preventing top management and lower-level employees from interacting.

D) Individuals who have physical responsibility for assets should not also have access to accounting records.

A) Making each manager personally responsible for his/her department.

B) Keeping functions across different departments separate.

C) Preventing top management and lower-level employees from interacting.

D) Individuals who have physical responsibility for assets should not also have access to accounting records.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

8

A framework for designing an internal control system is provided by the:

A) Committee of Sponsoring Organizations.

B) Financial Accounting Standards Board.

C) Securities and Exchange Commission.

D) International Accounting Standards Board.

A) Committee of Sponsoring Organizations.

B) Financial Accounting Standards Board.

C) Securities and Exchange Commission.

D) International Accounting Standards Board.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

9

Which of the following is not an example of preventive controls?

A) Separation of duties.

B) Physical controls.

C) Proper authorization.

D) Reconciliations.

A) Separation of duties.

B) Physical controls.

C) Proper authorization.

D) Reconciliations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

10

What is the concept behind separation of duties in establishing internal controls?

A) The company's financial accountant should not share information with the company's tax accountant.

B) Duties of middle-level managers should be clearly separated from those of top executives.

C) Employee fraud is less likely to occur when access to assets and access to accounting records are separated.

D) The external auditors of the company should have no contact with managers while the audit is taking place.

A) The company's financial accountant should not share information with the company's tax accountant.

B) Duties of middle-level managers should be clearly separated from those of top executives.

C) Employee fraud is less likely to occur when access to assets and access to accounting records are separated.

D) The external auditors of the company should have no contact with managers while the audit is taking place.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

11

Which of the following best describes the goal of internal controls?

A) Ensuring the business is profitable.

B) Enhancing the health of employees.

C) Improving the accuracy and the reliability of financial information.

D) Ensuring the compliance with tax regulations.

A) Ensuring the business is profitable.

B) Enhancing the health of employees.

C) Improving the accuracy and the reliability of financial information.

D) Ensuring the compliance with tax regulations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

12

The components of internal control do not directly include:

A) Risk assessment.

B) Inflation adjustment.

C) Monitoring.

D) Control activities.

A) Risk assessment.

B) Inflation adjustment.

C) Monitoring.

D) Control activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

13

The Sarbanes-Oxley Act (SOX) mandates which of the following?

A) Increased regulations related to auditor-client relations.

B) Increased regulations related to internal control.

C) Increased regulations related to corporate executive accountability.

D) All of the above.

A) Increased regulations related to auditor-client relations.

B) Increased regulations related to internal control.

C) Increased regulations related to corporate executive accountability.

D) All of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

14

Which employees are the ones who must take final responsibility for the establishment and success of internal controls?

A) Top executives.

B) Mid-level managers.

C) Lower-level employees.

D) All employees.

A) Top executives.

B) Mid-level managers.

C) Lower-level employees.

D) All employees.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

15

Under the provisions of the Sarbanes-Oxley Act, auditors must do which of the following?

A) Provide nonaudit services for their clients.

B) Audit public companies whose chief executives worked for the audit firm in the preceding year.

C) Be hired by company management.

D) Maintain working papers for at least seven years following an audit.

A) Provide nonaudit services for their clients.

B) Audit public companies whose chief executives worked for the audit firm in the preceding year.

C) Be hired by company management.

D) Maintain working papers for at least seven years following an audit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

16

Fraudulent reporting by management could include:

A) Fictitious revenues from a fake customer.

B) Improper asset valuation.

C) Mismatching revenues and expenses.

D) All of the above.

A) Fictitious revenues from a fake customer.

B) Improper asset valuation.

C) Mismatching revenues and expenses.

D) All of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

17

Under the provisions of the Sarbanes-Oxley Act, corporate executives:

A) Have limited responsibility for financial statements.

B) Must personally prepare the company's financial statements.

C) Must personally certify the company's financial statements.

D) Are not allowed to view the company's financial statements.

A) Have limited responsibility for financial statements.

B) Must personally prepare the company's financial statements.

C) Must personally certify the company's financial statements.

D) Are not allowed to view the company's financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

18

Keeping supplies in a locked room with access allowed only to authorized personnel is an example of which preventive control?

A) Separation of duties.

B) Physical controls.

C) Proper authorization.

D) Employee management.

A) Separation of duties.

B) Physical controls.

C) Proper authorization.

D) Employee management.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

19

Which employees have an impact on the operation and effectiveness of internal controls?

A) Upper management.

B) Mid-level managers.

C) Lower-level employees.

D) All employees.

A) Upper management.

B) Mid-level managers.

C) Lower-level employees.

D) All employees.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

20

Which of the following does not represent a major provision of the Sarbanes-Oxley Act?

A) Nonaudit services.

B) Quarterly financial statements.

C) Auditor rotation.

D) Corporate executive accountability.

A) Nonaudit services.

B) Quarterly financial statements.

C) Auditor rotation.

D) Corporate executive accountability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

21

Which of the following would NOT represent good controls over cash receipts?

A) Record all cash receipts as soon as possible.

B) The employee that receives cash and checks should also deposit them in the bank.

C) Open mail each day and make a list of checks received with the amount and payer's name.

D) Verify cash receipts by comparing the bank deposit slip with the accounting records.

A) Record all cash receipts as soon as possible.

B) The employee that receives cash and checks should also deposit them in the bank.

C) Open mail each day and make a list of checks received with the amount and payer's name.

D) Verify cash receipts by comparing the bank deposit slip with the accounting records.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

22

Which of the following would NOT represent good controls over cash disbursements?

A) Make all disbursements, other than very small ones, by check, debit card, or credit card.

B) Require only one signature for checks, especially larger ones.

C) Authorize all expenditures before purchase and verify the accuracy of the purchase itself.

D) The employee who authorizes payment should not also be the employee who prepares the check.

A) Make all disbursements, other than very small ones, by check, debit card, or credit card.

B) Require only one signature for checks, especially larger ones.

C) Authorize all expenditures before purchase and verify the accuracy of the purchase itself.

D) The employee who authorizes payment should not also be the employee who prepares the check.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

23

Which of the following is NOT a reason why a bank reconciliation is necessary?

A) The company has transactions that the bank has not recorded.

B) Petty cash has a low balance.

C) The bank has transactions that the company has not recorded.

D) Reconciliations provide a control over cash.

A) The company has transactions that the bank has not recorded.

B) Petty cash has a low balance.

C) The bank has transactions that the company has not recorded.

D) Reconciliations provide a control over cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

24

Which of the following is correct with respect to a bank reconciliation?

A) Subtract interest earned from the bank's balance.

B) Add service charge to the company's balance.

C) Subtract NSF checks from the company's balance.

D) Add deposits outstanding to the company's balance.

A) Subtract interest earned from the bank's balance.

B) Add service charge to the company's balance.

C) Subtract NSF checks from the company's balance.

D) Add deposits outstanding to the company's balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

25

Which of the following would NOT represent good controls over cash disbursements?

A) Periodically check amounts shown in the debit card and credit card statements against purchase receipts.

B) The employee verifying the accuracy of the debit card and credit card statements should not also be the employee responsible for actual purchases.

C) Set maximum purchase limits on debit cards and credit cards.

D) Employees responsible for making cash disbursements should also be in charge of cash receipts.

A) Periodically check amounts shown in the debit card and credit card statements against purchase receipts.

B) The employee verifying the accuracy of the debit card and credit card statements should not also be the employee responsible for actual purchases.

C) Set maximum purchase limits on debit cards and credit cards.

D) Employees responsible for making cash disbursements should also be in charge of cash receipts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

26

Which of the following would not be considered good internal control for cash receipts?

A) Allowing customers to pay with a debit card.

B) Requiring the employee receiving cash from customers to also deposit the cash into the company's bank account.

C) Recording cash receipts as soon as they are recorded.

D) Allowing customers to pay with a credit card.

A) Allowing customers to pay with a debit card.

B) Requiring the employee receiving cash from customers to also deposit the cash into the company's bank account.

C) Recording cash receipts as soon as they are recorded.

D) Allowing customers to pay with a credit card.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

27

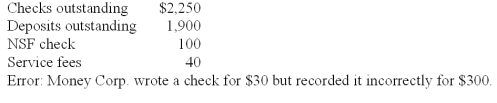

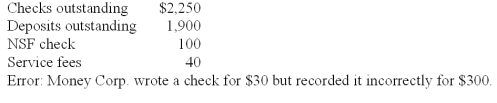

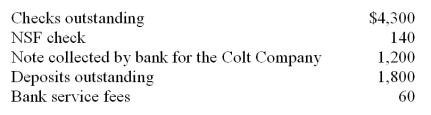

On May 31, Money Corporation's Cash account showed a balance of $10,000 before the bank reconciliation was prepared. After examining the May bank statement and items included with it, the company's accountant found the following items:  What is the amount of cash that should be reported in the company's balance sheet as of May 31?

What is the amount of cash that should be reported in the company's balance sheet as of May 31?

A) $9,860.

B) $9,650.

C) $10,130.

D) $10,410.

What is the amount of cash that should be reported in the company's balance sheet as of May 31?

What is the amount of cash that should be reported in the company's balance sheet as of May 31?A) $9,860.

B) $9,650.

C) $10,130.

D) $10,410.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

28

Having management periodically determine whether the amount of physical assets of the company match the accounting records is an example of which detective control?

A) Separation of duties.

B) Reconciliations.

C) Performance reviews.

D) Employee management.

A) Separation of duties.

B) Reconciliations.

C) Performance reviews.

D) Employee management.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

29

Cash may not include:

A) Foreign currency.

B) Money orders.

C) Accounts receivable.

D) Undeposited customer checks.

A) Foreign currency.

B) Money orders.

C) Accounts receivable.

D) Undeposited customer checks.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

30

Which of the following would NOT be recorded as a cash sale?

A) Customer who pays with a check.

B) Customer who pays with a debit card.

C) Customer who pays with a credit card.

D) A customers who buys on account.

A) Customer who pays with a check.

B) Customer who pays with a debit card.

C) Customer who pays with a credit card.

D) A customers who buys on account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

31

Which of the following would NOT need to be accounted for in a bank reconciliation?

A) Deposits outstanding recorded by the company but not the bank.

B) Interest earned recorded by the bank but not the company.

C) NSF checks recorded by the bank but not by the company.

D) Checks written by the company and recorded by the bank.

A) Deposits outstanding recorded by the company but not the bank.

B) Interest earned recorded by the bank but not the company.

C) NSF checks recorded by the bank but not by the company.

D) Checks written by the company and recorded by the bank.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

32

The following information was taken from the bank reconciliation for Mooner Sooner Inc. at the end of 2012: Bank balance: $8,000

Checks outstanding: $5,800

Note collected by the bank: $1,500

Service fee: $20

Deposits outstanding: $4,000

NSF check (bad check) returned for $300

What is the correct cash balance that should be reported in Mooner Sooner's balance sheet at the end of 2012?

A) $10,200.

B) $7,400.

C) $6,200.

D) $6,160.

Checks outstanding: $5,800

Note collected by the bank: $1,500

Service fee: $20

Deposits outstanding: $4,000

NSF check (bad check) returned for $300

What is the correct cash balance that should be reported in Mooner Sooner's balance sheet at the end of 2012?

A) $10,200.

B) $7,400.

C) $6,200.

D) $6,160.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

33

Cash transactions that have been recorded by the company but not the bank include:

A) NSF checks.

B) Interest earned.

C) Service fees.

D) Deposits outstanding.

A) NSF checks.

B) Interest earned.

C) Service fees.

D) Deposits outstanding.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

34

Checking actual outcome of individuals or processes against their expected outcome is an example of which detective control?

A) Separation of duties.

B) Reconciliations.

C) Performance reviews.

D) Employee management.

A) Separation of duties.

B) Reconciliations.

C) Performance reviews.

D) Employee management.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

35

Providing employees with appropriate guidance to ensure they have the knowledge necessary to carry out their job duties is an example of which preventive control?

A) Separation of duties.

B) Physical controls.

C) Proper authorization.

D) Employee management.

A) Separation of duties.

B) Physical controls.

C) Proper authorization.

D) Employee management.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

36

Common examples of cash equivalents include all of the following except:

A) Money market funds.

B) Treasury bills.

C) Certificates of deposit.

D) Accounts receivable.

A) Money market funds.

B) Treasury bills.

C) Certificates of deposit.

D) Accounts receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

37

McGregor Company allows customers to pay with credit cards. The credit card company charges McGregor 3% of the sale. When a customer uses a credit card to pay McGregor $200 for services provided, McGregor would:

A) Debit Cash for $200.

B) Credit Service Revenue for $194.

C) Debit Service Fee Expense for $6.

D) Credit Service Revenue for $206.

A) Debit Cash for $200.

B) Credit Service Revenue for $194.

C) Debit Service Fee Expense for $6.

D) Credit Service Revenue for $206.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

38

Which of the following is considered cash for financial reporting purposes?

A) Accounts receivable.

B) Investments with maturity dates greater than three months.

C) Checks received from customers.

D) Accounts payable.

A) Accounts receivable.

B) Investments with maturity dates greater than three months.

C) Checks received from customers.

D) Accounts payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

39

Cash transactions recorded by the bank but not yet recorded by the company include all of the following except

A) Service fees.

B) Interest earned.

C) Checks outstanding.

D) NSF checks.

A) Service fees.

B) Interest earned.

C) Checks outstanding.

D) NSF checks.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

40

A customer purchased a $2,000 item at ApplianceWorld, paying with a credit card. ApplianceWorld is charged a 2% fee by the credit card company. When recording this sale, ApplianceWorld would:

A) Debit Accounts Receivable for $2,000.

B) Credit Sales Revenue for $2,000.

C) Credit Sales Revenue for $1,960.

D) Credit Unearned Revenue for $2,000.

A) Debit Accounts Receivable for $2,000.

B) Credit Sales Revenue for $2,000.

C) Credit Sales Revenue for $1,960.

D) Credit Unearned Revenue for $2,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

41

When preparing a bank reconciliation, a deposit outstanding would be:

A) Added to the company's cash balance.

B) Added to the bank's cash balance.

C) Subtracted from the company's cash balance.

D) Subtracted from the bank's cash balance.

A) Added to the company's cash balance.

B) Added to the bank's cash balance.

C) Subtracted from the company's cash balance.

D) Subtracted from the bank's cash balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

42

The following data were obtained from the bank statement and from the process of reconciling it: Bank service charges = $20

Deposit outstanding = $150

Interest earned on the bank account = $10

Checks outstanding = $400

Which items should be deducted from and added to the bank balance in completing the reconciliation?

A) Deduct checks outstanding; add service charges and deposit outstanding.

B) Deduct interest earned; add deposit outstanding.

C) Deduct checks outstanding; add deposit outstanding.

D) Deduct deposit outstanding; add checks outstanding.

Deposit outstanding = $150

Interest earned on the bank account = $10

Checks outstanding = $400

Which items should be deducted from and added to the bank balance in completing the reconciliation?

A) Deduct checks outstanding; add service charges and deposit outstanding.

B) Deduct interest earned; add deposit outstanding.

C) Deduct checks outstanding; add deposit outstanding.

D) Deduct deposit outstanding; add checks outstanding.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

43

The statement of cash flows reports cash flows from the activities of:

A) Operating, purchasing, and investing.

B) Borrowing, paying, and investing.

C) Financing, investing, and operating.

D) Using, investing, and financing.

A) Operating, purchasing, and investing.

B) Borrowing, paying, and investing.

C) Financing, investing, and operating.

D) Using, investing, and financing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

44

Which of the following is NOT involved in the replenishment of the petty cash fund?

A) Transactions related to vouchers will be recorded.

B) Management will verify that the total of all vouchers equals the amount of cash missing from the petty cash fund.

C) Weekly payroll checks will be recorded.

D) Management will withdraw cash from the bank and place it in the petty cash fund.

A) Transactions related to vouchers will be recorded.

B) Management will verify that the total of all vouchers equals the amount of cash missing from the petty cash fund.

C) Weekly payroll checks will be recorded.

D) Management will withdraw cash from the bank and place it in the petty cash fund.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

45

After preparing a bank reconciliation, a check outstanding for the payment of advertising would be recorded with:

A) A debit to Advertising Expense.

B) A debit to Cash.

C) A credit to Advertising Expense.

D) No entry is needed.

A) A debit to Advertising Expense.

B) A debit to Cash.

C) A credit to Advertising Expense.

D) No entry is needed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

46

Cash flows from investing activities do not include:

A) Borrowing.

B) The purchase of equipment.

C) The sale of land.

D) The purchase of a building.

A) Borrowing.

B) The purchase of equipment.

C) The sale of land.

D) The purchase of a building.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

47

At the time a $400 petty cash fund is being replenished, the company's accountant finds vouchers totaling $350 and petty cash of $50. The vouchers include: postage, $100; business lunches, $150; delivery fees, $75; and office supplies, $25. Which of the following is not recorded when recognizing expenditures from the petty cash fund?

A) Debit Postage Expense, $100.

B) Debit Supplies, $25.

C) Credit Petty Cash, $350.

D) Debit Petty Cash, $350.

A) Debit Postage Expense, $100.

B) Debit Supplies, $25.

C) Credit Petty Cash, $350.

D) Debit Petty Cash, $350.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

48

Cash flows from investing do not include cash flows from:

A) Lending.

B) The sale of equipment.

C) Borrowing.

D) The purchase of a building.

A) Lending.

B) The sale of equipment.

C) Borrowing.

D) The purchase of a building.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

49

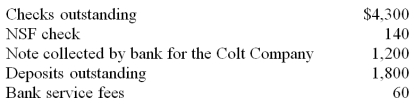

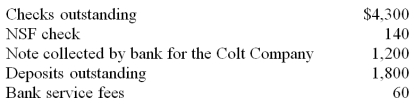

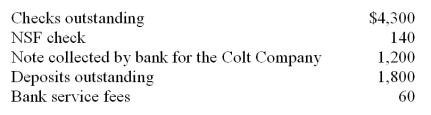

The balance shown in the August bank statement of Colt Company was $23,200. After examining the August bank statement and items included with it, the company's accountant found:  What is the amount of cash that should be reported in the balance sheet as of August 31?

What is the amount of cash that should be reported in the balance sheet as of August 31?

A) $20,700.

B) $17,200.

C) $18,700.

D) $22,200.

What is the amount of cash that should be reported in the balance sheet as of August 31?

What is the amount of cash that should be reported in the balance sheet as of August 31?A) $20,700.

B) $17,200.

C) $18,700.

D) $22,200.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

50

After preparing the bank reconciliation, an NSF check would result in which of the following when recording the adjustment to the company's cash balance?

A) Debit to Service Fee Expense.

B) Credit to Accounts Payable.

C) Credit to Service Revenue.

D) Debit to Accounts Receivable.

A) Debit to Service Fee Expense.

B) Credit to Accounts Payable.

C) Credit to Service Revenue.

D) Debit to Accounts Receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

51

Which of the following is NOT correct regarding the reporting of cash?

A) Cash is reported in both the balance sheet and the statement of cash flows.

B) Cash flows from buying and selling investments and long-term productive assets are called operating cash flows.

C) Cash flows from transactions with stockholders and creditors are called financing cash flows.

D) Net cash flows reported in the statement of cash flows should equal the change in cash reported in the balance sheet.

A) Cash is reported in both the balance sheet and the statement of cash flows.

B) Cash flows from buying and selling investments and long-term productive assets are called operating cash flows.

C) Cash flows from transactions with stockholders and creditors are called financing cash flows.

D) Net cash flows reported in the statement of cash flows should equal the change in cash reported in the balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

52

Cash flows from financing activities include:

A) Lending.

B) Salaries paid.

C) The sale of land.

D) Dividends paid.

A) Lending.

B) Salaries paid.

C) The sale of land.

D) Dividends paid.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

53

Investing cash flows would include which of the following?

A) Payment of cash dividends to stockholders.

B) Purchase of office supplies with cash.

C) Purchase of a building with cash.

D) Cash sales to customers.

A) Payment of cash dividends to stockholders.

B) Purchase of office supplies with cash.

C) Purchase of a building with cash.

D) Cash sales to customers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

54

Operating cash flows would exclude:

A) Payment of employee salaries.

B) Receipt of cash from customers.

C) Payment of dividends.

D) Payment for advertising.

A) Payment of employee salaries.

B) Receipt of cash from customers.

C) Payment of dividends.

D) Payment for advertising.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

55

After preparing a bank reconciliation, the collection of a note by the bank on a company's behalf would be recorded with:

A) A credit to Notes Receivable.

B) A credit to Cash.

C) A debit to Notes Receivable.

D) A credit to Accounts Receivable.

A) A credit to Notes Receivable.

B) A credit to Cash.

C) A debit to Notes Receivable.

D) A credit to Accounts Receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

56

A company's cash balance is reported in which two financial statements?

A) Income statement and statement of cash flows.

B) Balance sheet and statement of cash flows.

C) Income statement and balance sheet.

D) Balance sheet and statement of stockholders' equity.

A) Income statement and statement of cash flows.

B) Balance sheet and statement of cash flows.

C) Income statement and balance sheet.

D) Balance sheet and statement of stockholders' equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

57

A minor amount of cash kept on hand to pay for small purchases is referred to as a:

A) Petty cash fund.

B) Cash receipts fund.

C) Cash payments fund.

D) Cookie jar fund.

A) Petty cash fund.

B) Cash receipts fund.

C) Cash payments fund.

D) Cookie jar fund.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

58

After preparing a bank reconciliation, the service fee charged by the bank would be recorded with:

A) A credit to Service Fees Expense.

B) A debit to Cash.

C) A credit to Service Fees Revenue.

D) A debit to Service Fees Expense.

A) A credit to Service Fees Expense.

B) A debit to Cash.

C) A credit to Service Fees Revenue.

D) A debit to Service Fees Expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

59

Which of the following is correct regarding a petty cash fund?

A) Petty cash fund represents cash on hand at the business for quick access.

B) Petty cash fund is used for minor purposes.

C) When cash from this fund is taken out, it should be replaced with a voucher.

D) All of the above are correct.

A) Petty cash fund represents cash on hand at the business for quick access.

B) Petty cash fund is used for minor purposes.

C) When cash from this fund is taken out, it should be replaced with a voucher.

D) All of the above are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

60

The balance in the Colt Company's Cash account on August 31 was $19,700, before the bank reconciliation was prepared. After examining the August bank statement and items included with it, the company's accountant found:  What is the amount of cash that should be reported in the balance sheet as of August 31?

What is the amount of cash that should be reported in the balance sheet as of August 31?

A) $20,700.

B) $17,200.

C) $18,700.

D) $22,200.

What is the amount of cash that should be reported in the balance sheet as of August 31?

What is the amount of cash that should be reported in the balance sheet as of August 31?A) $20,700.

B) $17,200.

C) $18,700.

D) $22,200.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

61

A framework for designing an internal control system is provided by the Financial Accounting Standards Board (FASB).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

62

In response to corporate accounting scandals and to public outrage over seemingly widespread unethical behavior of top executives, Congress passed the Sarbanes-Oxley Act.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

63

Issuing common stock for cash is considered a(n):

A) Operating cash flow.

B) Investing cash flow.

C) Financing cash flow.

D) Not a cash flow.

A) Operating cash flow.

B) Investing cash flow.

C) Financing cash flow.

D) Not a cash flow.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

64

Providing services to customers on account is considered a(n):

A) Operating cash flow.

B) Investing cash flow.

C) Financing cash flow.

D) Not a cash flow.

A) Operating cash flow.

B) Investing cash flow.

C) Financing cash flow.

D) Not a cash flow.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

65

The Public Company Accounting Oversight Board (PCAOB) has the authority to establish standards dealing with auditing, quality control, ethics, independence, and other activities relating to the preparation of audited financial reports.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

66

Managers of the company act as stewards or caretakers of the company's assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

67

The Sarbanes-Oxley Act is also known as Generally Accepted Accounting Principles.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

68

Separation of duties refers to auditors not being allowed to perform both audit and nonaudit services for the same client.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

69

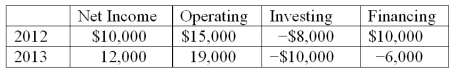

Terastar Corp. reports the following amounts for 2012 and 2013: What is the amount of Terastar's free cash flows for 2013?

A) $3,000.

B) $13,000.

C) $9,000.

D) $7,000.

A) $3,000.

B) $13,000.

C) $9,000.

D) $7,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

70

Section 404 of the Sarbanes-Oxley Act requires that a company's management document and assess the effectiveness of all internal control processes that could affect financial reporting.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

71

The control environment refers to the overall top-to-bottom attitude of the company with respect to internal controls.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

72

Auditors of public companies can perform the full range of audit and nonaudit consulting services for their audit clients.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

73

One benefit of internal control is greater reliance by investors on reported financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

74

Payment of dividends to stockholders is considered a(n):

A) Operating cash flow.

B) Investing cash flow.

C) Financing cash flow.

D) Not a cash flow.

A) Operating cash flow.

B) Investing cash flow.

C) Financing cash flow.

D) Not a cash flow.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

75

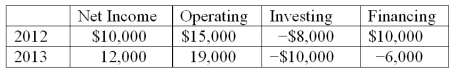

Terastar Corp. reports the following amounts for 2012 and 2013.  What is the trend in free cash flows relative to net income?

What is the trend in free cash flows relative to net income?

A) Both are increasing.

B) Net income is trending upward and free cash flows are trending downward.

C) Both are decreasing.

D) Net income is trending downward and free cash flows are trending upward.

What is the trend in free cash flows relative to net income?

What is the trend in free cash flows relative to net income?A) Both are increasing.

B) Net income is trending upward and free cash flows are trending downward.

C) Both are decreasing.

D) Net income is trending downward and free cash flows are trending upward.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

76

An example of separation of duties would be not allowing an employee who receives cash to also be responsible for depositing that cash in the bank account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

77

The internal control component of information and communication relates to the effectiveness of accurately measuring and communicating business transactions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

78

Internal control is a company's plan to (1) improve the accuracy and reliability of accounting information and (2) safeguard the company's assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

79

Common types of financial statement fraud include creating fictitious revenues from a fake customer, improperly valuing assets, and mismatching revenues and expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck

80

Risk assessment procedures include periodic reviews of internal controls, assessing management's oversight of the internal control, developing solutions to known cases of internal control failures, and determining whether each division or operation within a company is meeting its objectives.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 178 في هذه المجموعة.

فتح الحزمة

k this deck