Deck 6: Variable Costing and Segment Reporting: Tools for Management

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

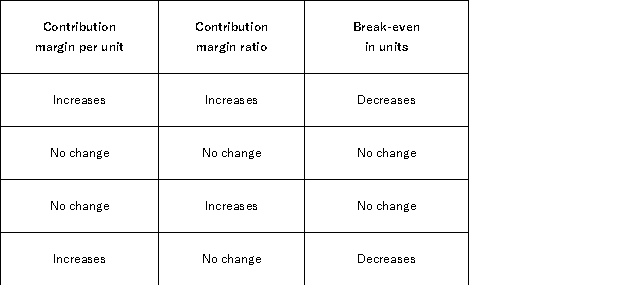

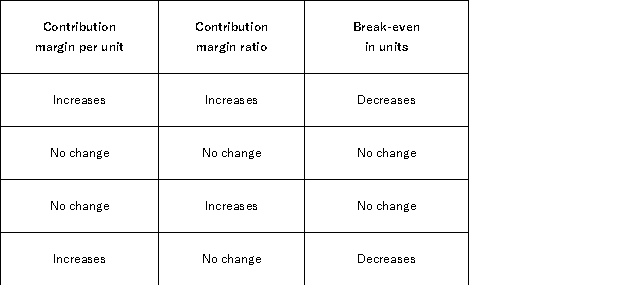

سؤال

سؤال

سؤال

سؤال

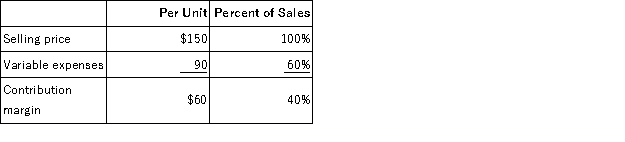

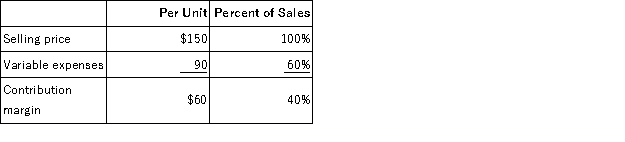

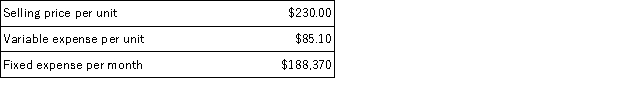

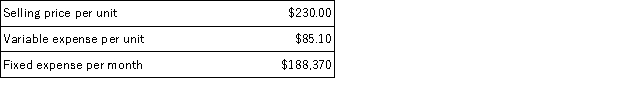

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

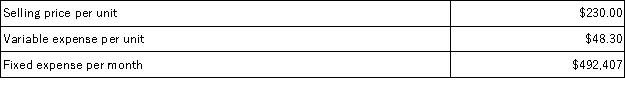

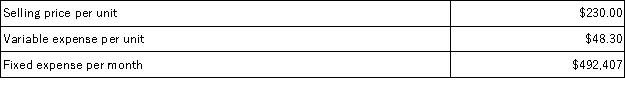

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

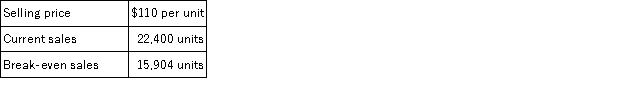

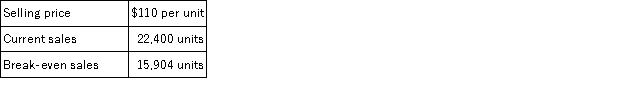

سؤال

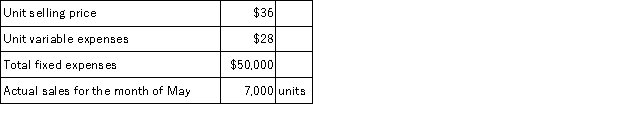

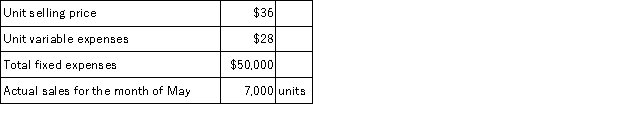

سؤال

سؤال

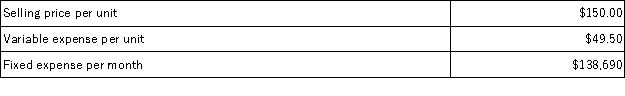

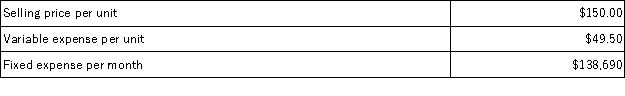

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/187

العب

ملء الشاشة (f)

Deck 6: Variable Costing and Segment Reporting: Tools for Management

1

The impact on net operating income of a given dollar change in sales can be computed by multiplying the contribution margin by the dollar change in sales.

False

2

At the break-even point, the total contribution margin and fixed expenses are equal.

True

3

If two companies produce the same product and have the same total sales and same total expenses, operating leverage will be higher in the company with a higher proportion of fixed expenses in its cost structure.

True

4

All other things the same, an increase in total fixed expenses will increase the break-even point.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 187 في هذه المجموعة.

فتح الحزمة

k this deck

5

Reynold Enterprises sells a single product for $25. The variable expense per unit is $15 and the fixed expense per unit is $5 at the current level of sales. The company's net operating income will increase by $10 if one more unit is sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 187 في هذه المجموعة.

فتح الحزمة

k this deck

6

Incremental analysis is generally the most complicated and least direct approach to decision making.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 187 في هذه المجموعة.

فتح الحزمة

k this deck

7

One assumption in CVP analysis is that the number of units produced and sold does not change.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 187 في هذه المجموعة.

فتح الحزمة

k this deck

8

For a capital intensive, automated company the break-even point will tend to be higher and the margin of safety will be lower than for a less capital intensive company with the same sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 187 في هذه المجموعة.

فتح الحزمة

k this deck

9

On a cost-volume-profit graph, the revenue line will be shown below the total expense line for any activity level above the break-even point.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 187 في هذه المجموعة.

فتح الحزمة

k this deck

10

All other things the same, a reduction in the variable expense per unit will decrease the break-even point.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 187 في هذه المجموعة.

فتح الحزمة

k this deck

11

All other things the same, an increase in variable expense per unit will reduce the break-even point.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 187 في هذه المجموعة.

فتح الحزمة

k this deck

12

The degree of operating leverage in a company is largest at the break-even point and decreases as sales rise.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 187 في هذه المجموعة.

فتح الحزمة

k this deck

13

The unit sales volume necessary to reach a target profit is determined by dividing the sum of the fixed expenses and the target profit by the contribution margin per unit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 187 في هذه المجموعة.

فتح الحزمة

k this deck

14

As total sales increase beyond the break-even point, the degree of operating leverage will decrease.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 187 في هذه المجموعة.

فتح الحزمة

k this deck

15

If sales volume decreases, and all other factors remain unchanged, the contribution margin ratio will decrease.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 187 في هذه المجموعة.

فتح الحزمة

k this deck

16

One way to compute the total contribution margin is to deduct total fixed expenses from net operating income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 187 في هذه المجموعة.

فتح الحزمة

k this deck

17

The margin of safety in dollars equals the excess of actual sales over budgeted sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 187 في هذه المجموعة.

فتح الحزمة

k this deck

18

All other things the same, in periods of increasing sales, net operating income will tend to increase more rapidly in a company with high fixed costs and low variable costs than in a company with high variable costs and low fixed costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 187 في هذه المجموعة.

فتح الحزمة

k this deck

19

In two companies making the same product and with the same total sales and total expenses, the contribution margin ratio will be higher in the company with a higher proportion of fixed expenses in its cost structure.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 187 في هذه المجموعة.

فتح الحزمة

k this deck

20

All other things the same, if the fixed expenses increase in a company then one would expect the margin of safety to increase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 187 في هذه المجموعة.

فتح الحزمة

k this deck

21

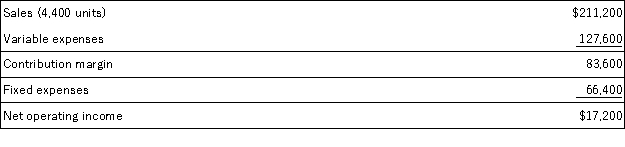

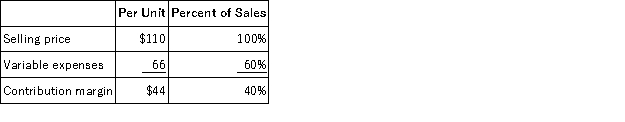

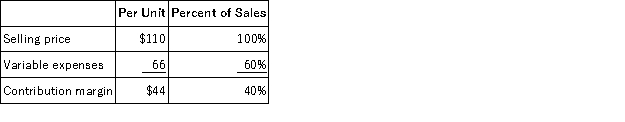

Ofarrell Corporation, a company that produces and sells a single product, has provided its contribution format income statement for March.  If the company sells 5,400 units, its net operating income should be closest to:

If the company sells 5,400 units, its net operating income should be closest to:

A)$19,008

B)$17,600

C)$24,000

D)$34,000

If the company sells 5,400 units, its net operating income should be closest to:

If the company sells 5,400 units, its net operating income should be closest to:A)$19,008

B)$17,600

C)$24,000

D)$34,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 187 في هذه المجموعة.

فتح الحزمة

k this deck

22

The overall contribution margin ratio for a company producing three products may be obtained by adding the contribution margin ratios for the three products and dividing the total by three.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 187 في هذه المجموعة.

فتح الحزمة

k this deck

23

At a break-even point of 800 units sold, White Corporation's variable expenses are $8,000 and its fixed expenses are $4,000. What will the Corporation's net operating income be at a volume of 801 units?

A)$15

B)$10

C)$5

D)$20

A)$15

B)$10

C)$5

D)$20

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 187 في هذه المجموعة.

فتح الحزمة

k this deck

24

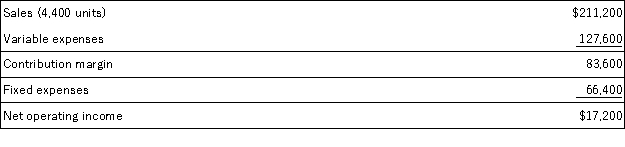

Lepage Corporation has provided its contribution format income statement for January. The company produces and sells a single product.  If the company sells 4,700 units, its total contribution margin should be closest to:

If the company sells 4,700 units, its total contribution margin should be closest to:

A)$83,600

B)$18,373

C)$89,300

D)$98,000

If the company sells 4,700 units, its total contribution margin should be closest to:

If the company sells 4,700 units, its total contribution margin should be closest to:A)$83,600

B)$18,373

C)$89,300

D)$98,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 187 في هذه المجموعة.

فتح الحزمة

k this deck

25

Maack Corporation's contribution margin ratio is 16% and its fixed monthly expenses are $44,000. If the company's sales for a month are $299,000, what is the best estimate of the company's net operating income? Assume that the fixed monthly expenses do not change.

A)$207,160

B)$3,840

C)$255,000

D)$47,840

A)$207,160

B)$3,840

C)$255,000

D)$47,840

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 187 في هذه المجموعة.

فتح الحزمة

k this deck

26

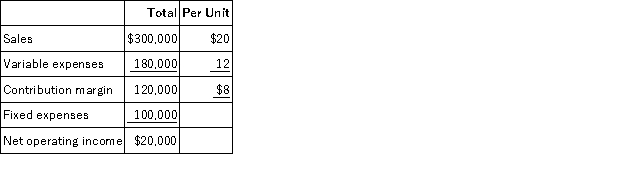

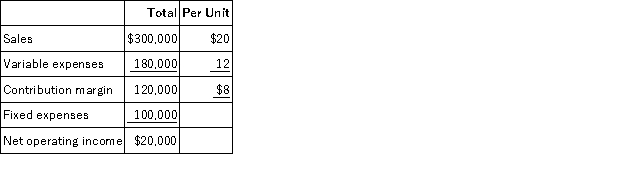

Spartan Systems reported total sales of $300,000, at a price of $20 and per unit variable expenses of $12, for the sales of their single product.  What is the amount of contribution margin if sales volume increases by 30%?

What is the amount of contribution margin if sales volume increases by 30%?

A)$19,500

B)$15,000

C)$156,000

D)$120,000

What is the amount of contribution margin if sales volume increases by 30%?

What is the amount of contribution margin if sales volume increases by 30%?A)$19,500

B)$15,000

C)$156,000

D)$120,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 187 في هذه المجموعة.

فتح الحزمة

k this deck

27

Assume a company sells a single product. If Q equals the level of output, P is the selling price per unit, V is the variable expense per unit, and F is the fixed expense, then the break-even point in sales dollars is:

A)F/(P-V).

B)F/[Q(P-V)].

C)F/[Q(P-V)/P].

D)F/[(P-V)/P].

A)F/(P-V).

B)F/[Q(P-V)].

C)F/[Q(P-V)/P].

D)F/[(P-V)/P].

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 187 في هذه المجموعة.

فتح الحزمة

k this deck

28

Bowe Corporation's fixed monthly expenses are $21,000 and its contribution margin ratio is 61%. Assuming that the fixed monthly expenses do not change, what is the best estimate of the company's net operating income in a month when sales are $74,000?

A)$7,860

B)$45,140

C)$24,140

D)$53,000

A)$7,860

B)$45,140

C)$24,140

D)$53,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 187 في هذه المجموعة.

فتح الحزمة

k this deck

29

Bolding Inc.'s contribution margin ratio is 61% and its fixed monthly expenses are $42,000. Assuming that the fixed monthly expenses do not change, what is the best estimate of the company's net operating income in a month when sales are $126,000?

A)$76,860

B)$7,140

C)$34,860

D)$84,000

A)$76,860

B)$7,140

C)$34,860

D)$84,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 187 في هذه المجموعة.

فتح الحزمة

k this deck

30

The margin of safety is:

A)the excess of budgeted or actual sales over budgeted or actual variable expenses.

B)the excess of budgeted or actual sales over budgeted or actual fixed expenses.

C)the excess of budgeted or actual sales over the break-even volume of sales.

D)the excess of budgeted net operating income over actual net operating income.

A)the excess of budgeted or actual sales over budgeted or actual variable expenses.

B)the excess of budgeted or actual sales over budgeted or actual fixed expenses.

C)the excess of budgeted or actual sales over the break-even volume of sales.

D)the excess of budgeted net operating income over actual net operating income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 187 في هذه المجموعة.

فتح الحزمة

k this deck

31

Which of the following is NOT a correct definition of the break-even point?

A)the point where total sales equals total expenses.

B)the point where total profit equals total fixed expenses.

C)the point where total contribution margin equals total fixed expenses.

D)the point where total profit equals zero.

A)the point where total sales equals total expenses.

B)the point where total profit equals total fixed expenses.

C)the point where total contribution margin equals total fixed expenses.

D)the point where total profit equals zero.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 187 في هذه المجموعة.

فتح الحزمة

k this deck

32

Florek Inc. produces and sells a single product. The company has provided its contribution format income statement for March.  If the company sells 5,900 units, its net operating income should be closest to:

If the company sells 5,900 units, its net operating income should be closest to:

A)$14,000

B)$10,600

C)$18,600

D)$10,972

If the company sells 5,900 units, its net operating income should be closest to:

If the company sells 5,900 units, its net operating income should be closest to:A)$14,000

B)$10,600

C)$18,600

D)$10,972

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 187 في هذه المجموعة.

فتح الحزمة

k this deck

33

The records of the Dodge Corporation show the following results for the most recent year:  Given these data, the unit contribution margin was:

Given these data, the unit contribution margin was:

A)$16

B)$4

C)$2

D)$6

Given these data, the unit contribution margin was:

Given these data, the unit contribution margin was:A)$16

B)$4

C)$2

D)$6

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 187 في هذه المجموعة.

فتح الحزمة

k this deck

34

Brees Inc., a company that produces and sells a single product, has provided its contribution format income statement for April.  If the company sells 5,800 units, its total contribution margin should be closest to:

If the company sells 5,800 units, its total contribution margin should be closest to:

A)$55,800

B)$52,200

C)$6,642

D)$47,000

If the company sells 5,800 units, its total contribution margin should be closest to:

If the company sells 5,800 units, its total contribution margin should be closest to:A)$55,800

B)$52,200

C)$6,642

D)$47,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 187 في هذه المجموعة.

فتح الحزمة

k this deck

35

Contribution margin is the amount remaining after:

A)variable expenses have been deducted from sales revenue.

B)fixed expenses have been deducted from sales revenue.

C)fixed expenses have been deducted from variable expenses.

D)cost of goods sold has been deducted from sales revenues.

A)variable expenses have been deducted from sales revenue.

B)fixed expenses have been deducted from sales revenue.

C)fixed expenses have been deducted from variable expenses.

D)cost of goods sold has been deducted from sales revenues.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 187 في هذه المجموعة.

فتح الحزمة

k this deck

36

If Q equals the level of output, P is the selling price per unit, V is the variable expense per unit, and F is the fixed expense, then the degree of operating leverage is equal to:

A)Q/(P-V).

B)F/(P-V).

C)F/[(P-V)/P].

D)[(P-V)Q]/[(P-V)Q - F].

A)Q/(P-V).

B)F/(P-V).

C)F/[(P-V)/P].

D)[(P-V)Q]/[(P-V)Q - F].

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 187 في هذه المجموعة.

فتح الحزمة

k this deck

37

The break-even in units sold will decrease if there is an increase in:

A)unit sales volume.

B)total fixed expenses.

C)unit variable expenses.

D)selling price.

A)unit sales volume.

B)total fixed expenses.

C)unit variable expenses.

D)selling price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 187 في هذه المجموعة.

فتح الحزمة

k this deck

38

Garth Corporation sells a single product. If the selling price per unit and the variable expense per unit both increase by 10% and fixed expenses do not change, then:

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 187 في هذه المجموعة.

فتح الحزمة

k this deck

39

The contribution margin ratio is equal to:

A)Total manufacturing expenses/Sales.

B)(Sales - Variable expenses)/Sales.

C)1 - (Gross Margin/Sales).

D)1 - (Contribution Margin/Sales).

A)Total manufacturing expenses/Sales.

B)(Sales - Variable expenses)/Sales.

C)1 - (Gross Margin/Sales).

D)1 - (Contribution Margin/Sales).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 187 في هذه المجموعة.

فتح الحزمة

k this deck

40

If a company decreases the variable expense per unit while increasing the total fixed expenses, the total expense line relative to its previous position will:

A)shift downward and have a steeper slope.

B)shift downward and have a flatter slope.

C)shift upward and have a flatter slope.

D)shift upward and have a steeper slope.

A)shift downward and have a steeper slope.

B)shift downward and have a flatter slope.

C)shift upward and have a flatter slope.

D)shift upward and have a steeper slope.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 187 في هذه المجموعة.

فتح الحزمة

k this deck

41

Steeler Corporation is planning to sell 100,000 units for $2.00 per unit and will break even at this level of sales. Fixed expenses will be $75,000. What are the company's variable expenses per unit?

A)$0.75

B)$1.00

C)$1.25

D)$1.10

A)$0.75

B)$1.00

C)$1.25

D)$1.10

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 187 في هذه المجموعة.

فتح الحزمة

k this deck

42

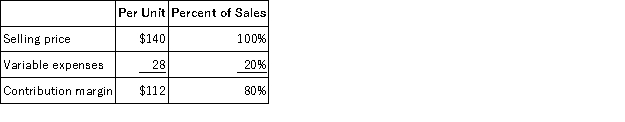

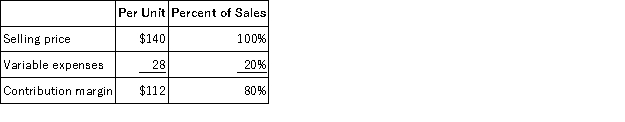

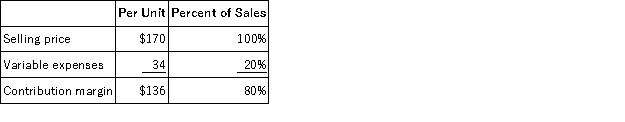

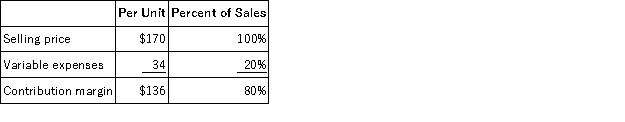

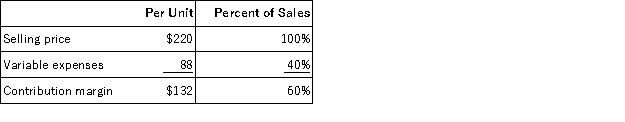

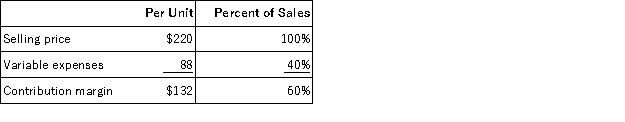

Data concerning Wythe Corporation's single product appear below:  Fixed expenses are $106,000 per month. The company is currently selling 2,000 units per month. The marketing manager would like to cut the selling price by $15 and increase the advertising budget by $5,000 per month. The marketing manager predicts that these two changes would increase monthly sales by 800 units. What should be the overall effect on the company's monthly net operating income of this change?

Fixed expenses are $106,000 per month. The company is currently selling 2,000 units per month. The marketing manager would like to cut the selling price by $15 and increase the advertising budget by $5,000 per month. The marketing manager predicts that these two changes would increase monthly sales by 800 units. What should be the overall effect on the company's monthly net operating income of this change?

A)increase of $31,000

B)decrease of $31,000

C)increase of $103,000

D)increase of $1,000

Fixed expenses are $106,000 per month. The company is currently selling 2,000 units per month. The marketing manager would like to cut the selling price by $15 and increase the advertising budget by $5,000 per month. The marketing manager predicts that these two changes would increase monthly sales by 800 units. What should be the overall effect on the company's monthly net operating income of this change?

Fixed expenses are $106,000 per month. The company is currently selling 2,000 units per month. The marketing manager would like to cut the selling price by $15 and increase the advertising budget by $5,000 per month. The marketing manager predicts that these two changes would increase monthly sales by 800 units. What should be the overall effect on the company's monthly net operating income of this change?A)increase of $31,000

B)decrease of $31,000

C)increase of $103,000

D)increase of $1,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 187 في هذه المجموعة.

فتح الحزمة

k this deck

43

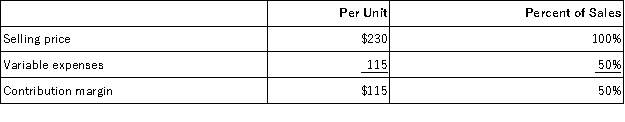

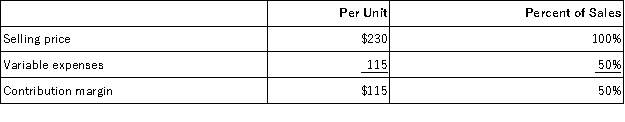

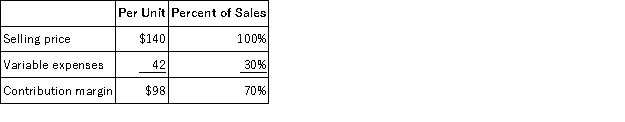

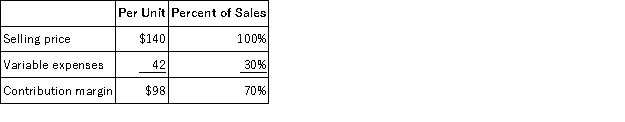

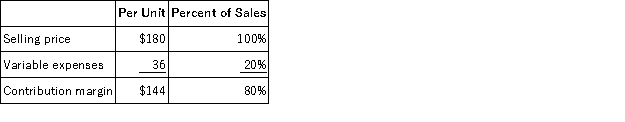

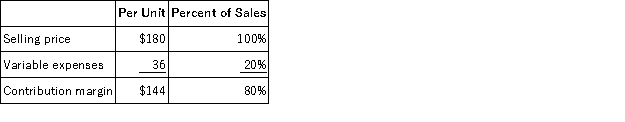

Dybala Corporation produces and sells a single product. Data concerning that product appear below:  The company is currently selling 5,000 units per month. Fixed expenses are $173,000 per month. The marketing manager believes that a $6,000 increase in the monthly advertising budget would result in a 170 unit increase in monthly sales. What should be the overall effect on the company's monthly net operating income of this change?

The company is currently selling 5,000 units per month. Fixed expenses are $173,000 per month. The marketing manager believes that a $6,000 increase in the monthly advertising budget would result in a 170 unit increase in monthly sales. What should be the overall effect on the company's monthly net operating income of this change?

A)increase of $1,480

B)decrease of $6,000

C)increase of $7,480

D)decrease of $1,480

The company is currently selling 5,000 units per month. Fixed expenses are $173,000 per month. The marketing manager believes that a $6,000 increase in the monthly advertising budget would result in a 170 unit increase in monthly sales. What should be the overall effect on the company's monthly net operating income of this change?

The company is currently selling 5,000 units per month. Fixed expenses are $173,000 per month. The marketing manager believes that a $6,000 increase in the monthly advertising budget would result in a 170 unit increase in monthly sales. What should be the overall effect on the company's monthly net operating income of this change?A)increase of $1,480

B)decrease of $6,000

C)increase of $7,480

D)decrease of $1,480

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 187 في هذه المجموعة.

فتح الحزمة

k this deck

44

Minist Corporation sells a single product for $15 per unit. Last year, the company's sales revenue was $225,000 and its net operating income was $18,000. If fixed expenses totaled $72,000 for the year, the break-even point in unit sales was:

A)15,000

B)9,900

C)14,100

D)12,000

A)15,000

B)9,900

C)14,100

D)12,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 187 في هذه المجموعة.

فتح الحزمة

k this deck

45

Data concerning Massing Corporation's single product appear below:  The company is currently selling 9,000 units per month. Fixed expenses are $837,000 per month. The marketing manager believes that a $16,000 increase in the monthly advertising budget would result in a 150 unit increase in monthly sales. What should be the overall effect on the company's monthly net operating income of this change?

The company is currently selling 9,000 units per month. Fixed expenses are $837,000 per month. The marketing manager believes that a $16,000 increase in the monthly advertising budget would result in a 150 unit increase in monthly sales. What should be the overall effect on the company's monthly net operating income of this change?

A)increase of $1,250

B)decrease of $16,000

C)decrease of $1,250

D)increase of $17,250

The company is currently selling 9,000 units per month. Fixed expenses are $837,000 per month. The marketing manager believes that a $16,000 increase in the monthly advertising budget would result in a 150 unit increase in monthly sales. What should be the overall effect on the company's monthly net operating income of this change?

The company is currently selling 9,000 units per month. Fixed expenses are $837,000 per month. The marketing manager believes that a $16,000 increase in the monthly advertising budget would result in a 150 unit increase in monthly sales. What should be the overall effect on the company's monthly net operating income of this change?A)increase of $1,250

B)decrease of $16,000

C)decrease of $1,250

D)increase of $17,250

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 187 في هذه المجموعة.

فتح الحزمة

k this deck

46

Data concerning Hinkson Corporation's single product appear below:  Fixed expenses are $720,000 per month. The company is currently selling 8,000 units per month. The marketing manager would like to introduce sales commissions as an incentive for the sales staff. The marketing manager has proposed a commission of $9 per unit. In exchange, the sales staff would accept a decrease in their salaries of $60,000 per month. (This is the company's savings for the entire sales staff.) The marketing manager predicts that introducing this sales incentive would increase monthly sales by 100 units. What should be the overall effect on the company's monthly net operating income of this change?

Fixed expenses are $720,000 per month. The company is currently selling 8,000 units per month. The marketing manager would like to introduce sales commissions as an incentive for the sales staff. The marketing manager has proposed a commission of $9 per unit. In exchange, the sales staff would accept a decrease in their salaries of $60,000 per month. (This is the company's savings for the entire sales staff.) The marketing manager predicts that introducing this sales incentive would increase monthly sales by 100 units. What should be the overall effect on the company's monthly net operating income of this change?

A)increase of $59,100

B)decrease of $121,700

C)increase of $894,300

D)decrease of $1,700

Fixed expenses are $720,000 per month. The company is currently selling 8,000 units per month. The marketing manager would like to introduce sales commissions as an incentive for the sales staff. The marketing manager has proposed a commission of $9 per unit. In exchange, the sales staff would accept a decrease in their salaries of $60,000 per month. (This is the company's savings for the entire sales staff.) The marketing manager predicts that introducing this sales incentive would increase monthly sales by 100 units. What should be the overall effect on the company's monthly net operating income of this change?

Fixed expenses are $720,000 per month. The company is currently selling 8,000 units per month. The marketing manager would like to introduce sales commissions as an incentive for the sales staff. The marketing manager has proposed a commission of $9 per unit. In exchange, the sales staff would accept a decrease in their salaries of $60,000 per month. (This is the company's savings for the entire sales staff.) The marketing manager predicts that introducing this sales incentive would increase monthly sales by 100 units. What should be the overall effect on the company's monthly net operating income of this change?A)increase of $59,100

B)decrease of $121,700

C)increase of $894,300

D)decrease of $1,700

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 187 في هذه المجموعة.

فتح الحزمة

k this deck

47

Hartung Corporation produces and sells a single product. Data concerning that product appear below:  Fixed expenses are $147,000 per month. The company is currently selling 2,000 units per month. The marketing manager would like to introduce sales commissions as an incentive for the sales staff. The marketing manager has proposed a commission of $13 per unit. In exchange, the sales staff would accept a decrease in their salaries of $22,000 per month. (This is the company's savings for the entire sales staff.) The marketing manager predicts that introducing this sales incentive would increase monthly sales by 400 units. What should be the overall effect on the company's monthly net operating income of this change?

Fixed expenses are $147,000 per month. The company is currently selling 2,000 units per month. The marketing manager would like to introduce sales commissions as an incentive for the sales staff. The marketing manager has proposed a commission of $13 per unit. In exchange, the sales staff would accept a decrease in their salaries of $22,000 per month. (This is the company's savings for the entire sales staff.) The marketing manager predicts that introducing this sales incentive would increase monthly sales by 400 units. What should be the overall effect on the company's monthly net operating income of this change?

A)increase of $16,800

B)increase of $226,000

C)increase of $30,000

D)decrease of $14,000

Fixed expenses are $147,000 per month. The company is currently selling 2,000 units per month. The marketing manager would like to introduce sales commissions as an incentive for the sales staff. The marketing manager has proposed a commission of $13 per unit. In exchange, the sales staff would accept a decrease in their salaries of $22,000 per month. (This is the company's savings for the entire sales staff.) The marketing manager predicts that introducing this sales incentive would increase monthly sales by 400 units. What should be the overall effect on the company's monthly net operating income of this change?

Fixed expenses are $147,000 per month. The company is currently selling 2,000 units per month. The marketing manager would like to introduce sales commissions as an incentive for the sales staff. The marketing manager has proposed a commission of $13 per unit. In exchange, the sales staff would accept a decrease in their salaries of $22,000 per month. (This is the company's savings for the entire sales staff.) The marketing manager predicts that introducing this sales incentive would increase monthly sales by 400 units. What should be the overall effect on the company's monthly net operating income of this change?A)increase of $16,800

B)increase of $226,000

C)increase of $30,000

D)decrease of $14,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 187 في هذه المجموعة.

فتح الحزمة

k this deck

48

Holdt Inc. produces and sells a single product. The selling price of the product is $230.00 per unit and its variable cost is $66.70 per unit. The fixed expense is $212,290 per month. The break-even in monthly unit sales is closest to:

A)1,300

B)3,183

C)1,802

D)923

A)1,300

B)3,183

C)1,802

D)923

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 187 في هذه المجموعة.

فتح الحزمة

k this deck

49

Darwin Inc. sells a particular textbook for $20. Variable expenses are $14 per book. At the current volume of 50,000 books sold per year the company is just breaking even. Given these data, the annual fixed expenses associated with the textbook total:

A)$300,000

B)$1,000,000

C)$1,300,000

D)$700,000

A)$300,000

B)$1,000,000

C)$1,300,000

D)$700,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 187 في هذه المجموعة.

فتح الحزمة

k this deck

50

Arthur Corporation has a margin of safety percentage of 25% based on its actual sales. The break-even point is $300,000 and the variable expenses are 45% of sales. Given this information, the actual profit is:

A)$75,000

B)$55,000

C)$15,000

D)$41,250

A)$75,000

B)$55,000

C)$15,000

D)$41,250

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 187 في هذه المجموعة.

فتح الحزمة

k this deck

51

The Clyde Corporation's variable expenses are 35% of sales. Clyde Corporation is contemplating an advertising campaign that will cost $25,000. If sales increase by $75,000, the company's net operating income will increase by:

A)$26,250

B)$23,750

C)$1,250

D)$65,000

A)$26,250

B)$23,750

C)$1,250

D)$65,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 187 في هذه المجموعة.

فتح الحزمة

k this deck

52

Carlton Corporation sells a single product at a selling price of $40 per unit. Variable expenses are $22 per unit and fixed expenses are $82,800. Carlton's break-even point is:

A)4,600 units

B)3,764 units

C)5,000 units

D)2,070 units

A)4,600 units

B)3,764 units

C)5,000 units

D)2,070 units

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 187 في هذه المجموعة.

فتح الحزمة

k this deck

53

Data concerning Bunck Corporation's single product appear below:  Fixed expenses are $202,000 per month. The company is currently selling 2,000 units per month. Management is considering using a new component that would increase the unit variable cost by $18. Since the new component would increase the features of the company's product, the marketing manager predicts that monthly sales would increase by 400 units. What should be the overall effect on the company's monthly net operating income of this change?

Fixed expenses are $202,000 per month. The company is currently selling 2,000 units per month. Management is considering using a new component that would increase the unit variable cost by $18. Since the new component would increase the features of the company's product, the marketing manager predicts that monthly sales would increase by 400 units. What should be the overall effect on the company's monthly net operating income of this change?

A)decrease of $47,200

B)decrease of $11,200

C)increase of $47,200

D)increase of $11,200

Fixed expenses are $202,000 per month. The company is currently selling 2,000 units per month. Management is considering using a new component that would increase the unit variable cost by $18. Since the new component would increase the features of the company's product, the marketing manager predicts that monthly sales would increase by 400 units. What should be the overall effect on the company's monthly net operating income of this change?

Fixed expenses are $202,000 per month. The company is currently selling 2,000 units per month. Management is considering using a new component that would increase the unit variable cost by $18. Since the new component would increase the features of the company's product, the marketing manager predicts that monthly sales would increase by 400 units. What should be the overall effect on the company's monthly net operating income of this change?A)decrease of $47,200

B)decrease of $11,200

C)increase of $47,200

D)increase of $11,200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 187 في هذه المجموعة.

فتح الحزمة

k this deck

54

Salley Corporation produces and sells a single product. Data concerning that product appear below:  Fixed expenses are $1,133,000 per month. The company is currently selling 9,000 units per month. Management is considering using a new component that would increase the unit variable cost by $7. Since the new component would increase the features of the company's product, the marketing manager predicts that monthly sales would increase by 500 units. What should be the overall effect on the company's monthly net operating income of this change?

Fixed expenses are $1,133,000 per month. The company is currently selling 9,000 units per month. Management is considering using a new component that would increase the unit variable cost by $7. Since the new component would increase the features of the company's product, the marketing manager predicts that monthly sales would increase by 500 units. What should be the overall effect on the company's monthly net operating income of this change?

A)decrease of $68,500

B)decrease of $5,500

C)increase of $68,500

D)increase of $5,500

Fixed expenses are $1,133,000 per month. The company is currently selling 9,000 units per month. Management is considering using a new component that would increase the unit variable cost by $7. Since the new component would increase the features of the company's product, the marketing manager predicts that monthly sales would increase by 500 units. What should be the overall effect on the company's monthly net operating income of this change?

Fixed expenses are $1,133,000 per month. The company is currently selling 9,000 units per month. Management is considering using a new component that would increase the unit variable cost by $7. Since the new component would increase the features of the company's product, the marketing manager predicts that monthly sales would increase by 500 units. What should be the overall effect on the company's monthly net operating income of this change?A)decrease of $68,500

B)decrease of $5,500

C)increase of $68,500

D)increase of $5,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 187 في هذه المجموعة.

فتح الحزمة

k this deck

55

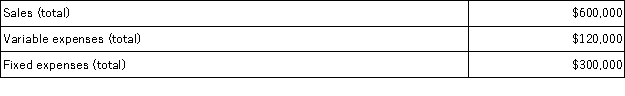

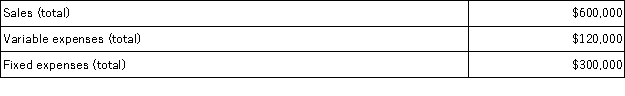

Garcia Veterinary Clinic expects the following operating results next year:  What is Garcia's break-even point next year in sales dollars?

What is Garcia's break-even point next year in sales dollars?

A)$240,000

B)$375,000

C)$400,000

D)$420,000

What is Garcia's break-even point next year in sales dollars?

What is Garcia's break-even point next year in sales dollars?A)$240,000

B)$375,000

C)$400,000

D)$420,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 187 في هذه المجموعة.

فتح الحزمة

k this deck

56

Solen Corporation's break-even-point in sales is $900,000, and its variable expenses are 75% of sales. If the company lost $32,000 last year, sales must have amounted to:

A)$868,000

B)$804,000

C)$772,000

D)$628,000

A)$868,000

B)$804,000

C)$772,000

D)$628,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 187 في هذه المجموعة.

فتح الحزمة

k this deck

57

Lore Corporation has provided the following information:  Lore's break-even point in dollar sales is:

Lore's break-even point in dollar sales is:

A)$50,000

B)$10,000

C)$12,500

D)$40,000

Lore's break-even point in dollar sales is:

Lore's break-even point in dollar sales is:A)$50,000

B)$10,000

C)$12,500

D)$40,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 187 في هذه المجموعة.

فتح الحزمة

k this deck

58

Joly Corporation produces and sells a single product. Data concerning that product appear below:  Fixed expenses are $511,000 per month. The company is currently selling 5,000 units per month. The marketing manager would like to cut the selling price by $16 and increase the advertising budget by $33,000 per month. The marketing manager predicts that these two changes would increase monthly sales by 800 units. What should be the overall effect on the company's monthly net operating income of this change?

Fixed expenses are $511,000 per month. The company is currently selling 5,000 units per month. The marketing manager would like to cut the selling price by $16 and increase the advertising budget by $33,000 per month. The marketing manager predicts that these two changes would increase monthly sales by 800 units. What should be the overall effect on the company's monthly net operating income of this change?

A)decrease of $59,800

B)increase of $59,800

C)increase of $130,200

D)decrease of $20,200

Fixed expenses are $511,000 per month. The company is currently selling 5,000 units per month. The marketing manager would like to cut the selling price by $16 and increase the advertising budget by $33,000 per month. The marketing manager predicts that these two changes would increase monthly sales by 800 units. What should be the overall effect on the company's monthly net operating income of this change?

Fixed expenses are $511,000 per month. The company is currently selling 5,000 units per month. The marketing manager would like to cut the selling price by $16 and increase the advertising budget by $33,000 per month. The marketing manager predicts that these two changes would increase monthly sales by 800 units. What should be the overall effect on the company's monthly net operating income of this change?A)decrease of $59,800

B)increase of $59,800

C)increase of $130,200

D)decrease of $20,200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 187 في هذه المجموعة.

فتح الحزمة

k this deck

59

Last year Easton Corporation reported sales of $720,000, a contribution margin ratio of 30% and a net loss of $24,000. Based on this information, the break-even point was:

A)$640,000

B)$880,000

C)$744,000

D)$800,000

A)$640,000

B)$880,000

C)$744,000

D)$800,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 187 في هذه المجموعة.

فتح الحزمة

k this deck

60

Fost Corporation's contribution margin ratio is 20%. If the degree of operating leverage is 15 at the $225,000 sales level, net operating income at the $225,000 sales level must equal:

A)$2,250

B)$6,750

C)$3,000

D)$5,063

A)$2,250

B)$6,750

C)$3,000

D)$5,063

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 187 في هذه المجموعة.

فتح الحزمة

k this deck

61

Blane Corporation produces and sells a single product. Data concerning that product appear below:  The break-even in monthly unit sales is closest to:

The break-even in monthly unit sales is closest to:

A)4,401

B)2,360

C)3,470

D)7,374

The break-even in monthly unit sales is closest to:

The break-even in monthly unit sales is closest to:A)4,401

B)2,360

C)3,470

D)7,374

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 187 في هذه المجموعة.

فتح الحزمة

k this deck

62

The Breiden Corporation sells rodaks for $6.00 per unit. Fixed expenses total $37,500 per month and variable expenses are $2.00 per unit. The number of units that must be sold each month to realize a profit of 15% of sales is closest to:

A)9,375 units

B)11,029 units

C)12,097 units

D)9,740 units

A)9,375 units

B)11,029 units

C)12,097 units

D)9,740 units

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 187 في هذه المجموعة.

فتح الحزمة

k this deck

63

Wyly Inc. produces and sells a single product. The selling price of the product is $170.00 per unit and its variable cost is $62.90 per unit. The fixed expense is $356,643 per month. The break-even in monthly dollar sales is closest to:

A)$963,900

B)$628,881

C)$566,100

D)$356,643

A)$963,900

B)$628,881

C)$566,100

D)$356,643

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 187 في هذه المجموعة.

فتح الحزمة

k this deck

64

Data concerning Nazario Corporation's single product appear below:  The break-even in monthly unit sales is closest to:

The break-even in monthly unit sales is closest to:

A)819

B)2,214

C)1,300

D)1,444

The break-even in monthly unit sales is closest to:

The break-even in monthly unit sales is closest to:A)819

B)2,214

C)1,300

D)1,444

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 187 في هذه المجموعة.

فتح الحزمة

k this deck

65

Havely International Corporation's only product sells for $200.00 per unit and its variable expense is $70.00. The company's monthly fixed expense is $390,000 per month. The unit sales to attain the company's monthly target profit of $10,000 is closest to:

A)5,714

B)3,077

C)3,597

D)2,000

A)5,714

B)3,077

C)3,597

D)2,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 187 في هذه المجموعة.

فتح الحزمة

k this deck

66

Sales in North Corporation increased from $60,000 per year to $63,000 per year while net operating income increased from $10,000 to $12,000. Given this data, the company's degree of operating leverage must have been:

A)4.0

B)1.5

C)5.0

D)21.0

A)4.0

B)1.5

C)5.0

D)21.0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 187 في هذه المجموعة.

فتح الحزمة

k this deck

67

A product sells for $10 per unit and has variable expenses of $6 per unit. Fixed expenses total $45,000 per month. How many units of the product must be sold each month to yield a monthly profit of $15,000?

A)6,000 units

B)3,750 units

C)15,000 units

D)10,000 units

A)6,000 units

B)3,750 units

C)15,000 units

D)10,000 units

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 187 في هذه المجموعة.

فتح الحزمة

k this deck

68

Malley Corporation has provided the following data concerning its only product:  What is the margin of safety in dollars?

What is the margin of safety in dollars?

A)$1,390,000

B)$562,950

C)$2,085,000

D)$1,522,050

What is the margin of safety in dollars?

What is the margin of safety in dollars?A)$1,390,000

B)$562,950

C)$2,085,000

D)$1,522,050

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 187 في هذه المجموعة.

فتح الحزمة

k this deck

69

Preyer Corporation produces and sells a single product. Data concerning that product appear below:  The break-even in monthly dollar sales is closest to:

The break-even in monthly dollar sales is closest to:

A)$2,344,795

B)$492,407

C)$623,300

D)$1,153,501

The break-even in monthly dollar sales is closest to:

The break-even in monthly dollar sales is closest to:A)$2,344,795

B)$492,407

C)$623,300

D)$1,153,501

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 187 في هذه المجموعة.

فتح الحزمة

k this deck

70

Moonen Corporation produces and sells a single product whose contribution margin ratio is 57%. The company's monthly fixed expense is $487,350 and the company's monthly target profit is $10,000. The dollar sales to attain that target profit is closest to:

A)$855,000

B)$277,790

C)$872,544

D)$283,490

A)$855,000

B)$277,790

C)$872,544

D)$283,490

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 187 في هذه المجموعة.

فتح الحزمة

k this deck

71

Morganti Corporation sells a product for $140 per unit. The product's current sales are 40,700 units and its break-even sales are 31,339 units. What is the margin of safety in dollars?

A)$3,798,667

B)$5,698,000

C)$4,387,460

D)$1,310,540

A)$3,798,667

B)$5,698,000

C)$4,387,460

D)$1,310,540

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 187 في هذه المجموعة.

فتح الحزمة

k this deck

72

Sanes Corporation produces and sells a single product. Data concerning that product appear below:  The unit sales to attain the company's monthly target profit of $19,000 is closest to:

The unit sales to attain the company's monthly target profit of $19,000 is closest to:

A)3,426

B)5,833

C)3,806

D)2,158

The unit sales to attain the company's monthly target profit of $19,000 is closest to:

The unit sales to attain the company's monthly target profit of $19,000 is closest to:A)3,426

B)5,833

C)3,806

D)2,158

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 187 في هذه المجموعة.

فتح الحزمة

k this deck

73

Frank Corporation manufacturers a single product that has a selling price of $20.00 per unit. Fixed expenses total $45,000 per year, and the company must sell 5,000 units to break even. If the company has a target profit of $13,500, sales in units must be:

A)6,000

B)5,750

C)6,500

D)7,925

A)6,000

B)5,750

C)6,500

D)7,925

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 187 في هذه المجموعة.

فتح الحزمة

k this deck

74

Chibu Corporation is a single product firm with the following cost formula for all of its costs for next year, where X is the number of units sold and Y is total cost: Y = $225,000 + $30X

Chibu sells its product for $120 per unit. What would Chibu's total sales dollars have to be next year in order to generate $270,000 of net operating income?

A)$618,750

B)$660,000

C)$1,080,000

D)$1,980,000

Chibu sells its product for $120 per unit. What would Chibu's total sales dollars have to be next year in order to generate $270,000 of net operating income?

A)$618,750

B)$660,000

C)$1,080,000

D)$1,980,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 187 في هذه المجموعة.

فتح الحزمة

k this deck

75

Renfrew Corporation has provided the following data concerning its only product:  The margin of safety as a percentage of sales is closest to:

The margin of safety as a percentage of sales is closest to:

A)29%

B)59%

C)71%

D)41%

The margin of safety as a percentage of sales is closest to:

The margin of safety as a percentage of sales is closest to:A)29%

B)59%

C)71%

D)41%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 187 في هذه المجموعة.

فتح الحزمة

k this deck

76

The following monthly data are available for the Wyatt Corporation and its only product:  The margin of safety for the company during May was:

The margin of safety for the company during May was:

A)$27,000

B)$56,000

C)$6,000

D)$106,000

The margin of safety for the company during May was:

The margin of safety for the company during May was:A)$27,000

B)$56,000

C)$6,000

D)$106,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 187 في هذه المجموعة.

فتح الحزمة

k this deck

77

Palomo Corporation sells a product for $170 per unit. The product's current sales are 35,200 units and its break-even sales are 25,344 units. The margin of safety as a percentage of sales is closest to:

A)72%

B)39%

C)28%

D)61%

A)72%

B)39%

C)28%

D)61%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 187 في هذه المجموعة.

فتح الحزمة

k this deck

78

Data concerning Wang Corporation's single product appear below:  The break-even in monthly dollar sales is closest to:

The break-even in monthly dollar sales is closest to:

A)$207,000

B)$255,321

C)$138,690

D)$420,273

The break-even in monthly dollar sales is closest to:

The break-even in monthly dollar sales is closest to:A)$207,000

B)$255,321

C)$138,690

D)$420,273

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 187 في هذه المجموعة.

فتح الحزمة

k this deck

79

The contribution margin ratio of Baginski Corporation's only product is 53%. The company's monthly fixed expense is $617,980 and the company's monthly target profit is $23,000. The dollar sales to attain that target profit is closest to:

A)$1,166,000

B)$1,209,396

C)$339,719

D)$327,529

A)$1,166,000

B)$1,209,396

C)$339,719

D)$327,529

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 187 في هذه المجموعة.

فتح الحزمة

k this deck

80

Data concerning Cutshall Enterprises Corporation's single product appear below:  The unit sales to attain the company's monthly target profit of $16,000 is closest to:

The unit sales to attain the company's monthly target profit of $16,000 is closest to:

A)3,872

B)2,320

C)4,834

D)4,462

The unit sales to attain the company's monthly target profit of $16,000 is closest to:

The unit sales to attain the company's monthly target profit of $16,000 is closest to:A)3,872

B)2,320

C)4,834

D)4,462

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 187 في هذه المجموعة.

فتح الحزمة

k this deck