Deck 2: Basic Cost Management Concepts

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/85

العب

ملء الشاشة (f)

Deck 2: Basic Cost Management Concepts

1

Yang Corporation recently computed total product costs of $567,000 and total period costs of $420,000, excluding $35,000 of sales commissions that were overlooked by the company's administrative assistant. On the basis of this information, Yang's income statement should reveal operating expenses of:

A) $35,000.

B) $420,000.

C) $455,000.

D) $567,000.

E) $602,000.

A) $35,000.

B) $420,000.

C) $455,000.

D) $567,000.

E) $602,000.

C

2

Which of the following is a product cost?

A) Glass in an automobile.

B) Advertising.

C) The salary of the vice president-finance.

D) Rent on a factory.

E) Advertising and rent on a factory.

A) Glass in an automobile.

B) Advertising.

C) The salary of the vice president-finance.

D) Rent on a factory.

E) Advertising and rent on a factory.

E

3

The accounting records of Reynolds Corporation revealed the following selected costs: Sales commissions, $65,000; plant supervision, $190,000; and administrative expenses, $185,000. Reynolds's period costs total:

A) $250,000.

B) $440,000.

C) $375,000.

D) $255,000.

E) $185,000.

A) $250,000.

B) $440,000.

C) $375,000.

D) $255,000.

E) $185,000.

A

4

Which of the following statements is true?

A) The word "cost" has the same meaning in all situations in which it is used.

B) Cost data, once classified and recorded for a specific application, are appropriate for use in any application.

C) Different cost concepts and classifications are used for different purposes.

D) All organizations incur the same types of costs.

E) Costs incurred in one year are always meaningful in the following year.

A) The word "cost" has the same meaning in all situations in which it is used.

B) Cost data, once classified and recorded for a specific application, are appropriate for use in any application.

C) Different cost concepts and classifications are used for different purposes.

D) All organizations incur the same types of costs.

E) Costs incurred in one year are always meaningful in the following year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

5

Which of the following inventories would a company ordinarily hold for sale?

A) Raw materials.

B) Work in process.

C) Finished goods.

D) Raw materials and finished goods.

E) Work in process and finished goods.

A) Raw materials.

B) Work in process.

C) Finished goods.

D) Raw materials and finished goods.

E) Work in process and finished goods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

6

Inventoriable costs are expensed when incurred.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

7

Which of the four items listed below is not a type of production process?

A) Batch.

B) Job Shop.

C) Continuous Flow.

D) Job Flow.

A) Batch.

B) Job Shop.

C) Continuous Flow.

D) Job Flow.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

8

Product costs are:

A) expensed when incurred.

B) inventoried.

C) treated in the same manner as period costs.

D) treated in the same manner as advertising costs.

E) subtracted from cost of goods sold.

A) expensed when incurred.

B) inventoried.

C) treated in the same manner as period costs.

D) treated in the same manner as advertising costs.

E) subtracted from cost of goods sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

9

The accounting records of Georgia Company revealed the following costs: direct materials used, $250,000; direct labor, $425,000; manufacturing overhead, $375,000; and selling and administrative expenses, $220,000. Georgia's product costs total:

A) $1,050,000.

B) $830,000.

C) $895,000.

D) $1,270,000.

E) None of the other answers are correct.

A) $1,050,000.

B) $830,000.

C) $895,000.

D) $1,270,000.

E) None of the other answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

10

Which of the following would not be classified as a product cost?

A) Direct materials.

B) Direct labor.

C) Indirect materials.

D) Insurance on a manufacturing plant.

E) Sales commissions.

A) Direct materials.

B) Direct labor.

C) Indirect materials.

D) Insurance on a manufacturing plant.

E) Sales commissions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

11

Which of the following is a period cost?

A) Direct material.

B) Advertising expense.

C) Indirect labor.

D) Miscellaneous supplies used in production activities.

E) Advertising expense and indirect labor.

A) Direct material.

B) Advertising expense.

C) Indirect labor.

D) Miscellaneous supplies used in production activities.

E) Advertising expense and indirect labor.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

12

Which of the following entities would most likely have raw materials, work in process, and finished goods?

A) Exxon Corporation.

B) Macy's Department Store.

C) Wendy's.

D) Southwest Airlines.

E) Columbia University.

A) Exxon Corporation.

B) Macy's Department Store.

C) Wendy's.

D) Southwest Airlines.

E) Columbia University.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

13

Finished goods inventory is ordinarily held for sale by a manufacturing company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

14

Costs that are expensed when incurred are called:

A) product costs.

B) direct costs.

C) inventoriable costs.

D) period costs.

E) indirect costs.

A) product costs.

B) direct costs.

C) inventoriable costs.

D) period costs.

E) indirect costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

15

Indirect labor is not a component of manufacturing overhead.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

16

A suitable cost driver for the amount of direct materials used is the number of direct labor hours worked.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

17

Which of the following inventories would a discount retailer such as Wal-Mart report as an asset?

A) Raw materials.

B) Work in process.

C) Finished goods.

D) Merchandise inventory.

E) All of the other answers are correct.

A) Raw materials.

B) Work in process.

C) Finished goods.

D) Merchandise inventory.

E) All of the other answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

18

The following equation-Beginning finished goods + cost of goods manufactured - ending finished goods-is used to calculate cost of goods sold during the period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

19

Which of the following is not a period cost?

A) Legal costs.

B) Public relations costs.

C) Sales commissions.

D) Wages of assembly-line workers.

E) The salary of a company's chief financial officer (CFO).

A) Legal costs.

B) Public relations costs.

C) Sales commissions.

D) Wages of assembly-line workers.

E) The salary of a company's chief financial officer (CFO).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

20

Selling and administrative expenses would likely appear on the balance sheet of:

A) The Gap.

B) Texas Instruments.

C) Turner Broadcasting System.

D) All of these firms.

E) None of these firms.

A) The Gap.

B) Texas Instruments.

C) Turner Broadcasting System.

D) All of these firms.

E) None of these firms.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

21

Carolina Plating Company reported a cost of goods manufactured of $520,000, with the firm's year-end balance sheet revealing work in process and finished goods of $70,000 and $134,000, respectively. If supplemental information disclosed raw materials used in production of $80,000, direct labor of $140,000, and manufacturing overhead of $240,000, the company's beginning work in process must have been:

A) $130,000.

B) $10,000.

C) $66,000.

D) $390,000.

E) None of the other answers are correct.

A) $130,000.

B) $10,000.

C) $66,000.

D) $390,000.

E) None of the other answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

22

In a manufacturing company, the cost of goods completed during the period would include which of the following elements?

A) Raw materials used.

B) Beginning finished goods inventory.

C) Marketing costs.

D) Depreciation of delivery trucks.

E) All of the other answers are correct.

A) Raw materials used.

B) Beginning finished goods inventory.

C) Marketing costs.

D) Depreciation of delivery trucks.

E) All of the other answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

23

Work-in-process inventory is composed of:

A) direct material and direct labor.

B) direct labor and manufacturing overhead.

C) direct material and manufacturing overhead.

D) direct material, direct labor, and manufacturing overhead.

E) direct material only.

A) direct material and direct labor.

B) direct labor and manufacturing overhead.

C) direct material and manufacturing overhead.

D) direct material, direct labor, and manufacturing overhead.

E) direct material only.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

24

Mideast Motors manufactures automobiles. Which of the following would not be classified as direct materials by the company?

A) Wheel lubricant.

B) Tires.

C) Interior leather.

D) CD player.

E) Sheet metal used in the automobile's body.

A) Wheel lubricant.

B) Tires.

C) Interior leather.

D) CD player.

E) Sheet metal used in the automobile's body.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

25

Which of the following costs is not a component of manufacturing overhead?

A) Indirect materials.

B) Factory utilities.

C) Factory equipment.

D) Indirect labor.

E) Property taxes on the manufacturing plant.

A) Indirect materials.

B) Factory utilities.

C) Factory equipment.

D) Indirect labor.

E) Property taxes on the manufacturing plant.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

26

Which of the following statements is true?

A) Product costs affect only the balance sheet.

B) Product costs affect only the income statement.

C) Period costs affect only the balance sheet.

D) Neither product costs nor period costs affect the Statement of Retained Earnings. This can also be a true statement if the period costs were prepaid (i.e., prepaid advertising, depreciation).

E) Product costs eventually affect both the balance sheet and the income statement.

A) Product costs affect only the balance sheet.

B) Product costs affect only the income statement.

C) Period costs affect only the balance sheet.

D) Neither product costs nor period costs affect the Statement of Retained Earnings. This can also be a true statement if the period costs were prepaid (i.e., prepaid advertising, depreciation).

E) Product costs eventually affect both the balance sheet and the income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

27

Conversion costs are:

A) direct material, direct labor, and manufacturing overhead.

B) direct material and direct labor.

C) direct labor and manufacturing overhead.

D) prime costs.

E) period costs.

A) direct material, direct labor, and manufacturing overhead.

B) direct material and direct labor.

C) direct labor and manufacturing overhead.

D) prime costs.

E) period costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

28

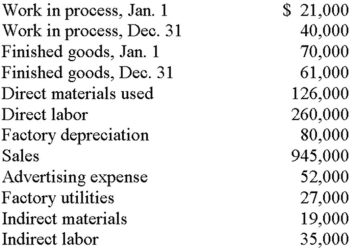

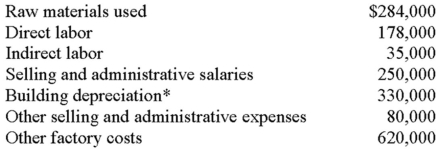

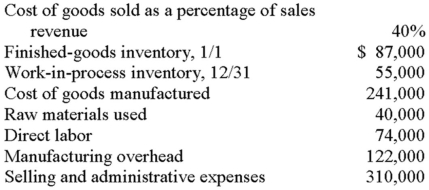

The accounting records of Bronco Company revealed the following information: Bronco's cost of goods manufactured is:

A) $519,000.

B) $522,000.

C) $568,000.

D) $571,000.

E) None of the other answers are correct.

A) $519,000.

B) $522,000.

C) $568,000.

D) $571,000.

E) None of the other answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

29

Prime costs are comprised of:

A) direct materials and manufacturing overhead.

B) direct labor and manufacturing overhead.

C) direct materials, direct labor, and manufacturing overhead.

D) direct materials and direct labor.

E) direct materials and indirect materials.

A) direct materials and manufacturing overhead.

B) direct labor and manufacturing overhead.

C) direct materials, direct labor, and manufacturing overhead.

D) direct materials and direct labor.

E) direct materials and indirect materials.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

30

Lake Appliance produces washers and dryers in an assembly-line process. Labor costs incurred during a recent period were: corporate executives, $500,000; assembly-line workers, $180,000; security guards, $45,000; and plant supervisor, $110,000. The total of Lake's direct labor cost was:

A) $110,000.

B) $180,000.

C) $155,000.

D) $235,000.

E) $735,000.

A) $110,000.

B) $180,000.

C) $155,000.

D) $235,000.

E) $735,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

31

Depreciation of factory equipment would be classified as:

A) operating cost.

B) "other" cost.

C) manufacturing overhead.

D) period cost.

E) administrative cost.

A) operating cost.

B) "other" cost.

C) manufacturing overhead.

D) period cost.

E) administrative cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

32

Which of the following equations is used to calculate cost of goods sold during the period?

A) Beginning finished goods + cost of goods manufactured + ending finished goods.

B) Beginning finished goods - ending finished goods.

C) Beginning finished goods + cost of goods manufactured.

D) Beginning finished goods + cost of goods manufactured - ending finished goods.

E) Beginning finished goods + ending finished goods - cost of goods manufactured.

A) Beginning finished goods + cost of goods manufactured + ending finished goods.

B) Beginning finished goods - ending finished goods.

C) Beginning finished goods + cost of goods manufactured.

D) Beginning finished goods + cost of goods manufactured - ending finished goods.

E) Beginning finished goods + ending finished goods - cost of goods manufactured.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

33

Holden Industries began July with a finished-goods inventory of $48,000. The finished-goods inventory at the end of July was $56,000 and the cost of goods sold during the month was $125,000. The cost of goods manufactured during July was:

A) $104,000.

B) $125,000.

C) $117,000.

D) $133,000.

E) None of the other answers are correct.

A) $104,000.

B) $125,000.

C) $117,000.

D) $133,000.

E) None of the other answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

34

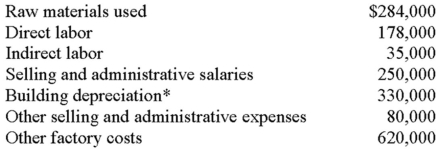

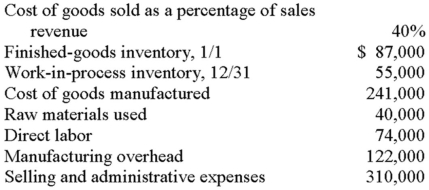

The accounting records of Brownwood Company revealed the following information: Brownwood's cost of goods sold is:

A) $721,000.

B) $730,000.

C) $778,000.

D) $787,000.

E) None of the other answers are correct.

A) $721,000.

B) $730,000.

C) $778,000.

D) $787,000.

E) None of the other answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

35

Which type of production process is ideal for a low production volume and one of a kind products?

A) Batch.

B) Continuous Flow.

C) Job Shop.

D) Assembly.

A) Batch.

B) Continuous Flow.

C) Job Shop.

D) Assembly.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

36

Which of the following statements is(are) correct?

A) Overtime premiums should be treated as a component of manufacturing overhead.

B) Overtime premiums should be treated as a component of direct labor.

C) Idle time should be treated as a component of direct labor.

D) Idle time should be accounted for as a special type of loss.

E) Overtime premiums should be treated as a component of direct labor and idle time should be treated as a component of direct labor.

A) Overtime premiums should be treated as a component of manufacturing overhead.

B) Overtime premiums should be treated as a component of direct labor.

C) Idle time should be treated as a component of direct labor.

D) Idle time should be accounted for as a special type of loss.

E) Overtime premiums should be treated as a component of direct labor and idle time should be treated as a component of direct labor.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

37

Which of the following employees of a commercial printer/publisher would be classified as direct labor?

A) Book binder.

B) Plant security guard.

C) Sales representative.

D) Plant supervisor.

E) Payroll supervisor.

A) Book binder.

B) Plant security guard.

C) Sales representative.

D) Plant supervisor.

E) Payroll supervisor.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

38

The accounting records of Dolphin Company revealed the following information: Dolphin's cost of goods sold is:

A) $508,000.

B) $529,000.

C) $531,000.

D) $553,000.

E) None of the other answers are correct.

A) $508,000.

B) $529,000.

C) $531,000.

D) $553,000.

E) None of the other answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

39

The accounting records of Diego Company revealed the following costs, among others: Costs that would be considered in the calculation of manufacturing overhead total:

A) $149,000.

B) $171,000.

C) $186,000.

D) $442,000.

E) None of the other answers are correct.

A) $149,000.

B) $171,000.

C) $186,000.

D) $442,000.

E) None of the other answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

40

Which of the following employees would not be classified as indirect labor?

A) Plant Custodian.

B) Salesperson.

C) Assembler of wooden furniture.

D) Plant security guard.

E) Salesperson and assembler of wooden furniture.

A) Plant Custodian.

B) Salesperson.

C) Assembler of wooden furniture.

D) Plant security guard.

E) Salesperson and assembler of wooden furniture.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

41

As activity increases, unit variable cost:

A) increases proportionately with activity.

B) decreases proportionately with activity.

C) remains constant.

D) increases by a fixed amount.

E) decreases by a fixed amount.

A) increases proportionately with activity.

B) decreases proportionately with activity.

C) remains constant.

D) increases by a fixed amount.

E) decreases by a fixed amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

42

Variable costs are costs that:

A) vary inversely with changes in activity.

B) vary directly with changes in activity.

C) remain constant as activity changes.

D) decrease on a per-unit basis as activity increases.

E) increase on a per-unit basis as activity increases.

A) vary inversely with changes in activity.

B) vary directly with changes in activity.

C) remain constant as activity changes.

D) decrease on a per-unit basis as activity increases.

E) increase on a per-unit basis as activity increases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

43

The true statement about cost behavior is that:

A) variable costs are constant on a per-unit basis and change in total as activity changes.

B) fixed costs are constant on a per-unit basis and change in total as activity changes.

C) fixed costs are constant on a per-unit basis and constant in total as activity changes.

D) variable costs change on a per-unit basis and change in total as activity changes.

E) variable costs are constant on a per-unit basis and are constant in total as activity changes.

A) variable costs are constant on a per-unit basis and change in total as activity changes.

B) fixed costs are constant on a per-unit basis and change in total as activity changes.

C) fixed costs are constant on a per-unit basis and constant in total as activity changes.

D) variable costs change on a per-unit basis and change in total as activity changes.

E) variable costs are constant on a per-unit basis and are constant in total as activity changes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

44

As activity decreases, unit variable cost:

A) increases proportionately with activity.

B) decreases proportionately with activity.

C) remains constant.

D) increases by a fixed amount.

E) decreases by a fixed amount.

A) increases proportionately with activity.

B) decreases proportionately with activity.

C) remains constant.

D) increases by a fixed amount.

E) decreases by a fixed amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

45

Which of the following would not be characterized as a cost object?

A) An automobile manufactured by General Motors.

B) The New York Fire Department.

C) A Burger King restaurant located in Cleveland, Ohio.

D) A Delta Airlines flight from Atlanta to Miami.

E) All of these are examples of cost objects.

A) An automobile manufactured by General Motors.

B) The New York Fire Department.

C) A Burger King restaurant located in Cleveland, Ohio.

D) A Delta Airlines flight from Atlanta to Miami.

E) All of these are examples of cost objects.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

46

Pumpkin Enterprises began operations on January 1, 20x1, with all of its activities conducted from a single facility. The company's accountant concluded that the year's building depreciation should be allocated as follows: selling activities, 20%; administrative activities, 35%; and manufacturing activities, 45%. If Pumpkin sold 60% of 20x1 production during that year, what percentage of the depreciation would appear (either directly or indirectly) on the 20x1 income statement?

A) 27%.

B) 45%.

C) 55%.

D) 82%.

E) 100%.

A) 27%.

B) 45%.

C) 55%.

D) 82%.

E) 100%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

47

The variable costs per unit are $6 when a company produces 12,000 units of product. What are the variable costs per unit when 14,000 units are produced?

A) $4.50.

B) $5.00.

C) $5.50.

D) $6.00.

E) None of the other answers are correct.

A) $4.50.

B) $5.00.

C) $5.50.

D) $6.00.

E) None of the other answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

48

Which of the following would likely be a suitable cost driver for the amount of direct materials used?

A) The number of units sold.

B) The number of direct labor hours worked.

C) The number of machine hours worked.

D) The number of units produced.

E) The number of employees working in the factory.

A) The number of units sold.

B) The number of direct labor hours worked.

C) The number of machine hours worked.

D) The number of units produced.

E) The number of employees working in the factory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

49

Fixed costs are costs that:

A) vary directly with changes in activity.

B) vary inversely with changes in activity.

C) remain constant on a per-unit basis.

D) remain constant as activity changes.

E) increase on a per-unit basis as activity increases.

A) vary directly with changes in activity.

B) vary inversely with changes in activity.

C) remain constant on a per-unit basis.

D) remain constant as activity changes.

E) increase on a per-unit basis as activity increases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

50

When 5,000 units are produced variable costs are $35 per unit and total costs are $200,000. What are the total costs when 8,000 units are produced?

A) $200,000.

B) $305,000.

C) $240,000.

D) None of the other answers are correct.

E) Total costs cannot be calculated based on the information presented.

A) $200,000.

B) $305,000.

C) $240,000.

D) None of the other answers are correct.

E) Total costs cannot be calculated based on the information presented.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

51

Baxter Company, which pays a 10% commission to its salespeople, reported sales revenues of $210,000 for the period just ended. If fixed and variable sales expenses totaled $56,000, what would these expenses total at sales of $168,000?

A) $16,800.

B) $35,000.

C) $44,800.

D) $51,800.

E) None of the other answers are correct.

A) $16,800.

B) $35,000.

C) $44,800.

D) $51,800.

E) None of the other answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

52

The fixed costs per unit are $10 when a company produces 10,000 units of product. What are the fixed costs per unit when 8,000 units are produced?

A) $12.50.

B) $10.00.

C) $8.00.

D) $6.50.

E) $5.50.

A) $12.50.

B) $10.00.

C) $8.00.

D) $6.50.

E) $5.50.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

53

Total costs are $180,000 when 10,000 units are produced; of this amount, variable costs are $64,000. What are the total costs when 13,000 units are produced?

A) $199,200.

B) $214,800.

C) $234,000.

D) None of the other answers are correct.

E) Total costs cannot be calculated based on the information presented.

A) $199,200.

B) $214,800.

C) $234,000.

D) None of the other answers are correct.

E) Total costs cannot be calculated based on the information presented.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

54

Which of the following is not an example of a variable cost?

A) Straight-line depreciation on a machine that has a five-year service life.

B) Wages of manufacturing workers whose pay is based on hours worked.

C) Tires used in the production of tractors.

D) Aluminum used to make patio furniture.

E) Commissions paid to sales personnel.

A) Straight-line depreciation on a machine that has a five-year service life.

B) Wages of manufacturing workers whose pay is based on hours worked.

C) Tires used in the production of tractors.

D) Aluminum used to make patio furniture.

E) Commissions paid to sales personnel.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

55

Which of the following is an example of a fixed cost?

A) Paper used in the manufacture of textbooks.

B) Property taxes paid by a firm to the City of Los Angeles.

C) The wages of part-time workers who are paid $8 per hour.

D) Gasoline consumed by salespersons' cars.

E) Surgical supplies used in a hospital's operating room.

A) Paper used in the manufacture of textbooks.

B) Property taxes paid by a firm to the City of Los Angeles.

C) The wages of part-time workers who are paid $8 per hour.

D) Gasoline consumed by salespersons' cars.

E) Surgical supplies used in a hospital's operating room.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

56

An employee accidentally overstated the year's advertising expense by $50,000. Which of the following correctly depicts the effect of this error?

A) Cost of goods manufactured will be overstated by $50,000.

B) Cost of goods sold will be overstated by $50,000.

C) Both cost of goods manufactured and cost of goods sold will be overstated by $50,000.

D) Cost of goods sold will be overstated by $50,000, and cost of goods manufactured will be understated by $50,000.

E) None of the other answers are correct.

A) Cost of goods manufactured will be overstated by $50,000.

B) Cost of goods sold will be overstated by $50,000.

C) Both cost of goods manufactured and cost of goods sold will be overstated by $50,000.

D) Cost of goods sold will be overstated by $50,000, and cost of goods manufactured will be understated by $50,000.

E) None of the other answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

57

Glass Industries reported the following data for the year just ended: sales revenue, $1,750,000; cost of goods sold, $980,000; cost of goods manufactured, $560,000; and selling and administrative expenses, $170,000. Glass' gross margin would be:

A) $940,000.

B) $1,190,000.

C) $1,020,000.

D) $380,000.

E) $770,000.

A) $940,000.

B) $1,190,000.

C) $1,020,000.

D) $380,000.

E) $770,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

58

The fixed cost per unit:

A) will increase as activity increases.

B) will increase as activity decreases.

C) will decrease as activity increases.

D) will remain constant.

E) will increase as activity decreases and will decrease as activity increases.

A) will increase as activity increases.

B) will increase as activity decreases.

C) will decrease as activity increases.

D) will remain constant.

E) will increase as activity decreases and will decrease as activity increases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

59

The true statement about cost behavior is that:

A) variable costs change on a per-unit basis and change in total as activity changes.

B) fixed costs are constant on a per-unit basis and change in total as activity changes.

C) fixed costs are constant on a per-unit basis and are constant in total as activity changes.

D) fixed costs change on a per-unit basis and are constant in total as activity changes.

E) variable costs are constant on a per-unit basis and are constant in total as activity changes.

A) variable costs change on a per-unit basis and change in total as activity changes.

B) fixed costs are constant on a per-unit basis and change in total as activity changes.

C) fixed costs are constant on a per-unit basis and are constant in total as activity changes.

D) fixed costs change on a per-unit basis and are constant in total as activity changes.

E) variable costs are constant on a per-unit basis and are constant in total as activity changes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

60

The choices below depict five costs of Benton Corporation and a possible driver for each cost. Which of these choices likely contains an inappropriate cost driver?

A) Gasoline consumed; number of miles driven.

B) Manufacturing overhead incurred in a heavily automated facility; direct labor hours.

C) Sales commissions; gross sales revenue.

D) Building maintenance cost; building square footage.

E) Human resources department cost; number of employees.

A) Gasoline consumed; number of miles driven.

B) Manufacturing overhead incurred in a heavily automated facility; direct labor hours.

C) Sales commissions; gross sales revenue.

D) Building maintenance cost; building square footage.

E) Human resources department cost; number of employees.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

61

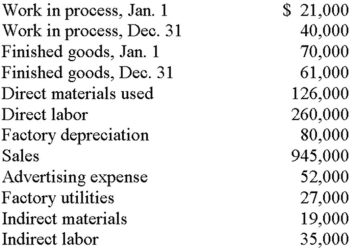

Parrish's Manufacturing had the following data for the period just ended:

Required:

A. Calculate Parrish's cost of goods manufactured.

B. Calculate Parrish's cost of goods sold.

Required:

A. Calculate Parrish's cost of goods manufactured.

B. Calculate Parrish's cost of goods sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

62

Which of the following would not be considered a direct cost with respect to the service department of a new car dealership?

A) Wages of repair technicians.

B) Property taxes paid by the dealership.

C) Repair parts consumed.

D) Salary of the department manager.

E) Depreciation on new equipment used to analyze engine problems.

A) Wages of repair technicians.

B) Property taxes paid by the dealership.

C) Repair parts consumed.

D) Salary of the department manager.

E) Depreciation on new equipment used to analyze engine problems.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

63

The tuition that will be paid next semester by a college student who pursues a degree is a(n):

A) sunk cost.

B) out-of-pocket cost.

C) indirect cost.

D) average cost.

E) marginal cost.

A) sunk cost.

B) out-of-pocket cost.

C) indirect cost.

D) average cost.

E) marginal cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

64

Which of the following costs should be ignored when choosing among alternatives?

A) Opportunity costs.

B) Sunk costs.

C) Out-of-pocket costs.

D) Differential costs.

E) None of the other answers are correct.

A) Opportunity costs.

B) Sunk costs.

C) Out-of-pocket costs.

D) Differential costs.

E) None of the other answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

65

The salary that is sacrificed by a college student who pursues a degree full time is a(n):

A) sunk cost.

B) out-of-pocket cost.

C) opportunity cost.

D) differential cost.

E) marginal cost.

A) sunk cost.

B) out-of-pocket cost.

C) opportunity cost.

D) differential cost.

E) marginal cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

66

Costs that can be easily traced to a specific department are called:

A) direct costs.

B) indirect costs.

C) product costs.

D) manufacturing costs.

E) processing costs.

A) direct costs.

B) indirect costs.

C) product costs.

D) manufacturing costs.

E) processing costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

67

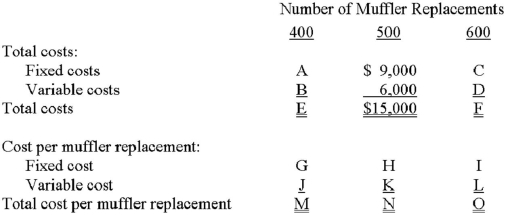

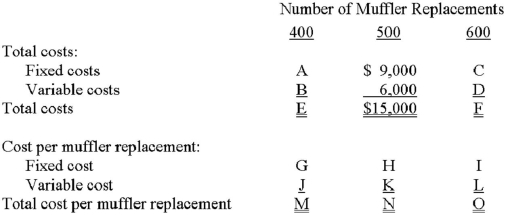

Aurora Muffler, Inc. operates an automobile service facility. The table below shows the cost incurred during a month when 500 mufflers were replaced.

Required:

Fill in the missing amounts, labeled A through O, in the table above.

Required:

Fill in the missing amounts, labeled A through O, in the table above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

68

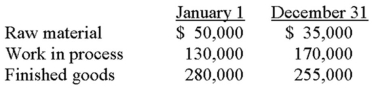

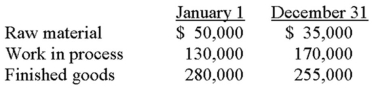

Hamilton Company had the following inventory balances at the beginning and end of the year:

During the year, the company purchased $100,000 of raw material and incurred $340,000 of direct labor costs. Other data: manufacturing overhead incurred, $450,000; sales, $1,560,000; selling and administrative expenses, $90,000; income tax rate, 30%.

Required:

A. Calculate cost of goods manufactured.

B. Calculate cost of goods sold.

C. Determine Hamilton's net income.

During the year, the company purchased $100,000 of raw material and incurred $340,000 of direct labor costs. Other data: manufacturing overhead incurred, $450,000; sales, $1,560,000; selling and administrative expenses, $90,000; income tax rate, 30%.

Required:

A. Calculate cost of goods manufactured.

B. Calculate cost of goods sold.

C. Determine Hamilton's net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

69

Wee Care is a nursery school for pre-kindergarten children. The school has determined that the following biweekly revenues and costs occur at different levels of enrollment: The average cost per student when 16 students enroll in the school is:

A) $100.

B) $125.

C) $175.

D) $300.

E) $400.

A) $100.

B) $125.

C) $175.

D) $300.

E) $400.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

70

If the total cost of alternative A is $50,000 and the total cost of alternative B is $34,000, then $16,000 is termed the:

A) opportunity cost.

B) average cost.

C) sunk cost.

D) out-of-pocket cost.

E) differential cost.

A) opportunity cost.

B) average cost.

C) sunk cost.

D) out-of-pocket cost.

E) differential cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

71

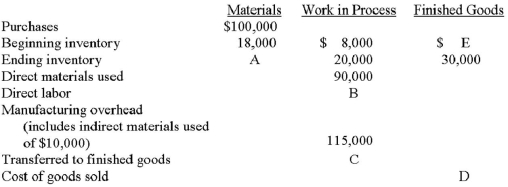

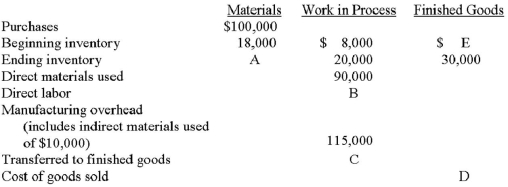

The Perez Company recorded the following transactions for February 20x1:

Sales were $560,000, with sales prices determined by adding a 40% markup to the firm's manufacturing cost. The total cost of direct materials used, direct labor, and manufacturing overhead during the month was $285,000.

Note: The materials account includes both direct materials and indirect materials.

Required:

Calculate the missing values.

Sales were $560,000, with sales prices determined by adding a 40% markup to the firm's manufacturing cost. The total cost of direct materials used, direct labor, and manufacturing overhead during the month was $285,000.

Note: The materials account includes both direct materials and indirect materials.

Required:

Calculate the missing values.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

72

Indirect costs:

A) can be traced to a cost object.

B) cannot be traced to a particular cost object.

C) are not important.

D) are always variable costs.

E) may be indirect with respect to Disney World but direct with respect to one of its major components, Epcot Center.

A) can be traced to a cost object.

B) cannot be traced to a particular cost object.

C) are not important.

D) are always variable costs.

E) may be indirect with respect to Disney World but direct with respect to one of its major components, Epcot Center.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

73

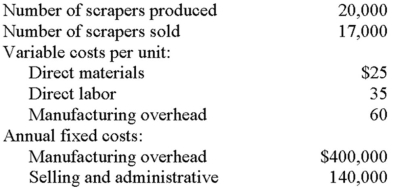

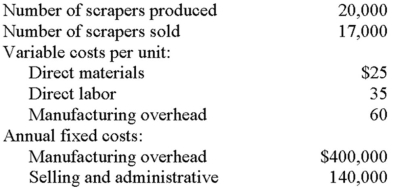

Xi Manufacturing, which began operations on January 1 of the current year, produces an industrial scraper that sells for $325 per unit. Information related to the current year's activities follows.

Xi carries its finished-goods inventory at the average unit cost of production. There was no work in process at year-end.

Required:

A. Compute the company's average unit cost of production.

B. Determine the cost of the December 31 finished-goods inventory.

C. Compute the company's cost of goods sold.

D. If next year's production increases to 23,000 units and general cost behavior patterns do not change, what is the likely effect on:

1. The direct-labor cost of $35 per unit? Why?

2. The fixed manufacturing overhead cost of $400,000? Why?

Xi carries its finished-goods inventory at the average unit cost of production. There was no work in process at year-end.

Required:

A. Compute the company's average unit cost of production.

B. Determine the cost of the December 31 finished-goods inventory.

C. Compute the company's cost of goods sold.

D. If next year's production increases to 23,000 units and general cost behavior patterns do not change, what is the likely effect on:

1. The direct-labor cost of $35 per unit? Why?

2. The fixed manufacturing overhead cost of $400,000? Why?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

74

Consider the following cost items:

1. Sales commissions earned by a company's sales force.

2. Raw materials purchased during the period.

3. Current year's depreciation on a firm's manufacturing facilities.

4. Year-end completed production of a carpet manufacturer.

5. The cost of products sold to customers of an apparel store.

6. Wages earned by machine operators in a manufacturing plant.

7. Income taxes incurred by an airline.

8. Marketing costs of an electronics manufacturer.

9. Indirect labor costs incurred by a manufacturer of office equipment.

Required:

A. Evaluate the costs just cited and determine whether the associated dollar amounts would appear on the firm's balance sheet, income statement, or schedule of cost of goods manufactured.

B. What major asset will normally be insignificant for service enterprises and relatively substantial for retailers, wholesalers, and manufacturers? Briefly discuss.

C. Briefly explain the similarity and difference between the merchandise inventory of a retailer and the finished-goods inventory of a manufacturer.

1. Sales commissions earned by a company's sales force.

2. Raw materials purchased during the period.

3. Current year's depreciation on a firm's manufacturing facilities.

4. Year-end completed production of a carpet manufacturer.

5. The cost of products sold to customers of an apparel store.

6. Wages earned by machine operators in a manufacturing plant.

7. Income taxes incurred by an airline.

8. Marketing costs of an electronics manufacturer.

9. Indirect labor costs incurred by a manufacturer of office equipment.

Required:

A. Evaluate the costs just cited and determine whether the associated dollar amounts would appear on the firm's balance sheet, income statement, or schedule of cost of goods manufactured.

B. What major asset will normally be insignificant for service enterprises and relatively substantial for retailers, wholesalers, and manufacturers? Briefly discuss.

C. Briefly explain the similarity and difference between the merchandise inventory of a retailer and the finished-goods inventory of a manufacturer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

75

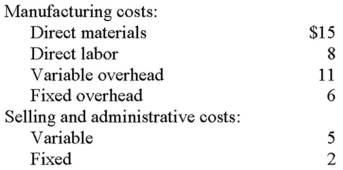

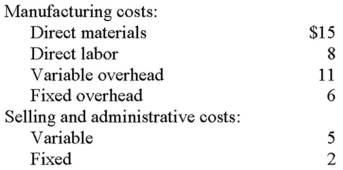

Giraldo Systems began business on January 1 of the current year, producing a single product that is popular with home builders. Demand was very strong, allowing the company to sell its entire manufacturing output of 80,000 units. The following unit costs were incurred:

Giraldo anticipates an increase in productive output to 100,000 units and sales of 95,000 units in the next accounting period. The company uses appropriate drivers to determine cost behavior and estimates.

Required:

A. Assuming that present cost behavior patterns continue, compute the total expected costs in the upcoming accounting period.

B. Ben Levy is about to prepare a graph that shows the unit cost behavior for variable selling and administrative cost. If the graph's horizontal axis is volume and the vertical axis is dollars, briefly describe what Levy's graph should look like.

C. Determine whether the following costs are variable or fixed in terms of behavior:

1. Yearly lease payments for a state-of-the-art cutting machine.

2. A fee paid to a consultant who provided advice about quality issues. The fee was based on the number of consulting hours provided.

3. Cost of an awards dinner for "star" salespeople.

Giraldo anticipates an increase in productive output to 100,000 units and sales of 95,000 units in the next accounting period. The company uses appropriate drivers to determine cost behavior and estimates.

Required:

A. Assuming that present cost behavior patterns continue, compute the total expected costs in the upcoming accounting period.

B. Ben Levy is about to prepare a graph that shows the unit cost behavior for variable selling and administrative cost. If the graph's horizontal axis is volume and the vertical axis is dollars, briefly describe what Levy's graph should look like.

C. Determine whether the following costs are variable or fixed in terms of behavior:

1. Yearly lease payments for a state-of-the-art cutting machine.

2. A fee paid to a consultant who provided advice about quality issues. The fee was based on the number of consulting hours provided.

3. Cost of an awards dinner for "star" salespeople.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

76

The following selected information was extracted from the 20x3 accounting records of Medina Products

*Seventy percent of the company's building was devoted to production activities; the remaining 30% was used for selling and administrative functions.

Medina's beginning and ending work-in-process inventories amounted to $306,000 and $245,000, respectively. The company's beginning and ending finished-goods inventories were $450,000 and $440,000, respectively.

Required:

A. Calculate Medina's manufacturing overhead for the year.

B. Calculate Medina's cost of goods manufactured.

C. Compute Medina's cost of goods sold.

*Seventy percent of the company's building was devoted to production activities; the remaining 30% was used for selling and administrative functions.

Medina's beginning and ending work-in-process inventories amounted to $306,000 and $245,000, respectively. The company's beginning and ending finished-goods inventories were $450,000 and $440,000, respectively.

Required:

A. Calculate Medina's manufacturing overhead for the year.

B. Calculate Medina's cost of goods manufactured.

C. Compute Medina's cost of goods sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

77

Heathrow Corporation sold 12,500 units of its single product during the year, reporting a cost of good sold that totaled $250,000. A review of the company's accounting records disclosed the following information:

Heathrow is subject to a 30% income tax rate.

Required:

A. Determine the selling price per unit.

B. Management established a goal at the beginning of the year to reduce the company's investment in finished-goods inventory and work-in-process inventory.

1. Analyze cost of goods sold and determine if management's goal was achieved with respect to finished-goods inventory. Show computations.

2. Analyze the firm's manufacturing costs and determine if management's goal was achieved with respect to work-in-process inventory. Show computations.

C. Is the company profitable? Show calculations.

Heathrow is subject to a 30% income tax rate.

Required:

A. Determine the selling price per unit.

B. Management established a goal at the beginning of the year to reduce the company's investment in finished-goods inventory and work-in-process inventory.

1. Analyze cost of goods sold and determine if management's goal was achieved with respect to finished-goods inventory. Show computations.

2. Analyze the firm's manufacturing costs and determine if management's goal was achieved with respect to work-in-process inventory. Show computations.

C. Is the company profitable? Show calculations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

78

Wee Care is a nursery school for pre-kindergarten children. The school has determined that the following biweekly revenues and costs occur at different levels of enrollment: The marginal cost when the twenty-first student enrolls in the school is:

A) $55.

B) $155.

C) $300.

D) $3,045.

E) $3,255.

A) $55.

B) $155.

C) $300.

D) $3,045.

E) $3,255.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

79

Madi and Sohn Corporation has a single facility that it uses for manufacturing, sales, and administrative activities. Should the company's building depreciation charge be expensed in its entirety or is a different accounting procedure appropriate? Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

80

The costs that follow all have applicability for a manufacturing enterprise. Which of the choices listed correctly denotes the costs' applicability for a service provider?

A) Choice A

B) Choice B

C) Choice C

D) Choice D

E) Choice E

A) Choice A

B) Choice B

C) Choice C

D) Choice D

E) Choice E

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck