Deck 17: Allocation of Support Activity Costs and Joint Costs

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

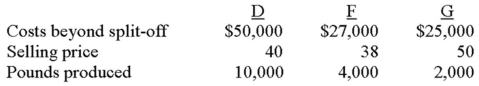

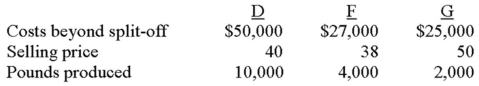

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

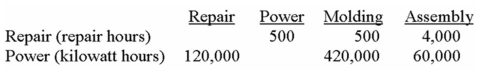

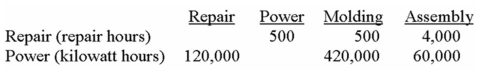

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/81

العب

ملء الشاشة (f)

Deck 17: Allocation of Support Activity Costs and Joint Costs

1

The Hearts and Hands Clinic has two service departments (Human Resources and Information Systems) and two "production" departments (In-patient Treatment and Out-patient Treatment). The service departments service the "production" departments as well as each other, and studies have shown that Information Systems provides the greater amount of service. Which of the following allocations would not occur if Hearts uses the step-down method of cost allocation?

A) Information Systems cost would be allocated to Human Resources.

B) Human Resources cost would be allocated to Information Systems.

C) Human Resources cost would be allocated to In-patient Treatment.

D) In-patient Treatment cost would be allocated to Out-patient Treatment.

E) Both Human Resources cost would be allocated to Information Systems and In-patient Treatment cost would be allocated to Out-patient Treatment.

A) Information Systems cost would be allocated to Human Resources.

B) Human Resources cost would be allocated to Information Systems.

C) Human Resources cost would be allocated to In-patient Treatment.

D) In-patient Treatment cost would be allocated to Out-patient Treatment.

E) Both Human Resources cost would be allocated to Information Systems and In-patient Treatment cost would be allocated to Out-patient Treatment.

E

2

Which of the following methods fully recognizes the fact that some service departments provide service to other service departments?

A) Direct method.

B) Indirect method.

C) Step-down method.

D) Reciprocal method.

E) Dual-cost allocation method.

A) Direct method.

B) Indirect method.

C) Step-down method.

D) Reciprocal method.

E) Dual-cost allocation method.

D

3

Consider the following statements about service department costs:

I) The costs of the Human Resources Department in a manufacturing organization must be allocated to production departments in order to achieve a correct costing of inventory.

II) The allocation of service department costs requires that an organization select both an allocation base and an allocation method.

III) Service department cost allocations are more relevant for firms involved in service industries (e.g., repair, health care) than for those involved with manufacturing.

Which of the above statements is (are) correct?

A) I only.

B) II only.

C) I and II.

D) II and III.

E) I, II, and III.

I) The costs of the Human Resources Department in a manufacturing organization must be allocated to production departments in order to achieve a correct costing of inventory.

II) The allocation of service department costs requires that an organization select both an allocation base and an allocation method.

III) Service department cost allocations are more relevant for firms involved in service industries (e.g., repair, health care) than for those involved with manufacturing.

Which of the above statements is (are) correct?

A) I only.

B) II only.

C) I and II.

D) II and III.

E) I, II, and III.

C

4

When allocating service department costs, companies should use actual costs rather than budgeted costs, and separate rates for variable and fixed costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

5

Eastside Hospital has two service departments (Patient Records and Accounting) and two "production" departments (Internal Medicine and Surgery). It uses the reciprocal-services method of cost allocation and should allocate Internal Medicine cost to Surgery.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

6

Dunwoody Corporation has two service departments (Maintenance and Human Resources) and three production departments (Machining, Assembly, and Finishing). The two service departments service the production departments as well as each other, and studies have shown that Maintenance provides the greater amount of service. On the basis of this information, which of the following cost allocations would likely occur under the step-down method?

A) Machining cost would be allocated to Assembly.

B) Maintenance cost would be allocated to Finishing.

C) Maintenance cost would be allocated to Human Resources.

D) Human Resources cost would be allocated to Maintenance.

E) Both maintenance cost would be allocated to Finishing and maintenance cost would be allocated to Human Resources.

A) Machining cost would be allocated to Assembly.

B) Maintenance cost would be allocated to Finishing.

C) Maintenance cost would be allocated to Human Resources.

D) Human Resources cost would be allocated to Maintenance.

E) Both maintenance cost would be allocated to Finishing and maintenance cost would be allocated to Human Resources.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

7

Which of the following methods recognizes some (but not all) of the services that occur between service departments?

A) Direct method.

B) Step-down method.

C) Indirect method.

D) Reciprocal method.

E) Dual-cost allocation method.

A) Direct method.

B) Step-down method.

C) Indirect method.

D) Reciprocal method.

E) Dual-cost allocation method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

8

Which of the following would be considered a service department for an airline?

A) Maintenance.

B) Information Systems.

C) Purchasing.

D) Flight Catering.

E) All of the other answers are correct.

A) Maintenance.

B) Information Systems.

C) Purchasing.

D) Flight Catering.

E) All of the other answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

9

Consider the following statements about the step-down method of service department cost allocation:

I) Under the step-down method, all service department costs are eventually allocated to production departments.

II) The order in which service department costs are allocated is important.

III) After a service department's costs have been allocated to other departments, no costs are re-circulated back to that service department.

Which of the above statements is (are) correct?

A) I only.

B) II only.

C) I and II.

D) I and III.

E) I, II, and III.

I) Under the step-down method, all service department costs are eventually allocated to production departments.

II) The order in which service department costs are allocated is important.

III) After a service department's costs have been allocated to other departments, no costs are re-circulated back to that service department.

Which of the above statements is (are) correct?

A) I only.

B) II only.

C) I and II.

D) I and III.

E) I, II, and III.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

10

Which of the following methods ignores the fact that some service departments provide service to other service departments?

A) Direct method.

B) Indirect method.

C) Step-down method.

D) Reciprocal method.

E) Dual-cost allocation method.

A) Direct method.

B) Indirect method.

C) Step-down method.

D) Reciprocal method.

E) Dual-cost allocation method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

11

The Montrose Clinic has two service departments (Human Resources and Information Resources) and two "production" departments (In-patient Treatment and Out-patient Treatment). The service departments service the "production" departments as well as each other, and studies have shown that Information Resources provides the greater amount of service. Which of the following allocations would occur if Montrose uses the direct method of cost allocation?

A) Information Resources cost would be allocated to In-patient Treatment.

B) Information Resources cost would be allocated to Human Resources.

C) Human Resources cost would be allocated to Information Resources.

D) In-patient Treatment cost would be allocated to Out-patient Treatment.

E) Out-patient Treatment cost would be allocated to Information Resources.

A) Information Resources cost would be allocated to In-patient Treatment.

B) Information Resources cost would be allocated to Human Resources.

C) Human Resources cost would be allocated to Information Resources.

D) In-patient Treatment cost would be allocated to Out-patient Treatment.

E) Out-patient Treatment cost would be allocated to Information Resources.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

12

When the step-down method is used, the service department whose costs are allocated first is often the department that:

A) obtains the highest yield.

B) has the lowest cost.

C) is the newest.

D) serves the greatest number of other service departments.

E) serves the fewest other service departments.

A) obtains the highest yield.

B) has the lowest cost.

C) is the newest.

D) serves the greatest number of other service departments.

E) serves the fewest other service departments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

13

Which of the following methods recognizes the fact that fixed and variable service department costs should be allocated separately?

A) Direct method.

B) Indirect method.

C) Step-down method.

D) Reciprocal method.

E) Dual-cost allocation method.

A) Direct method.

B) Indirect method.

C) Step-down method.

D) Reciprocal method.

E) Dual-cost allocation method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

14

The Metropolitan Clinic has two service departments (S1 and S2) and two "production" departments (P1 and P2). The service departments service the "production" departments as well as each other, and studies have shown that S2 provides the greater amount of service. Which of the following choices correctly denotes an allocation that would not occur under (1) the direct method and (2) the step-down method of cost allocation?

A.

B.

C.

D.

E.

A) Choice A

B) Choice B

C) Choice C

D) Choice D

E) Choice E

A.

B.

C.

D.

E.

A) Choice A

B) Choice B

C) Choice C

D) Choice D

E) Choice E

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

15

A company that uses activity-based costing would likely allocate costs from activity-cost pools to products and services.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

16

Trackings Corporation has two service departments (Maintenance and Human Resources) and three production departments (Machining, Assembly, and Finishing). Maintenance is the larger service department and Assembly is the largest production department. The two service departments service each other as well as the three producing departments. On the basis of this information, which of the following cost allocations would not occur under the direct method?

A) Machining cost would be allocated to Assembly.

B) Maintenance cost would be allocated to Finishing.

C) Maintenance cost would be allocated to Human Resources.

D) Human Resources cost would be allocated to Finishing.

E) Both machining cost would be allocated to Assembly and maintenance cost would be allocated to Human Resources.

A) Machining cost would be allocated to Assembly.

B) Maintenance cost would be allocated to Finishing.

C) Maintenance cost would be allocated to Human Resources.

D) Human Resources cost would be allocated to Finishing.

E) Both machining cost would be allocated to Assembly and maintenance cost would be allocated to Human Resources.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

17

The Gross Margin at Split-Off method should be selected if a company terminates all processing at the split-off point and desires to use a cost-allocation approach that considers the "revenue-producing ability" of each product.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

18

Which of the following would not be considered a service department in a hospital?

A) Security.

B) Cardiac Care.

C) Patient Records.

D) Accounting.

E) Human Resources.

A) Security.

B) Cardiac Care.

C) Patient Records.

D) Accounting.

E) Human Resources.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

19

Consider the following statements about the direct method of service department cost allocation:

I) Under the direct method, all service department costs are eventually allocated to production departments.

II) The order in which service department costs are allocated to production departments is important.

III) Once a service department's costs have been allocated, no costs are re-circulated back to that department.

Which of the above statements is (are) correct?

A) I only.

B) II only.

C) I and II.

D) I and III.

E) I, II, and III.

I) Under the direct method, all service department costs are eventually allocated to production departments.

II) The order in which service department costs are allocated to production departments is important.

III) Once a service department's costs have been allocated, no costs are re-circulated back to that department.

Which of the above statements is (are) correct?

A) I only.

B) II only.

C) I and II.

D) I and III.

E) I, II, and III.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

20

The direct method ignores the fact that some service departments provide service to other service departments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

21

Hreck, Inc. has two service departments (Human Resources and Building Maintenance) and two production departments (Machining and Assembly). The company allocates Building Maintenance cost on the basis of square footage and believes that Building Maintenance provides more service than Human Resources. The square footage occupied by each department follows. Assuming use of the direct method, over how many square feet would the Building Maintenance cost be allocated (i.e., spread)?

A) 18,000.

B) 48,000.

C) 55,000.

D) 66,000.

E) More information is needed to judge.

A) 18,000.

B) 48,000.

C) 55,000.

D) 66,000.

E) More information is needed to judge.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

22

Martina, Inc. has two service departments (Human Resources and Building Maintenance) and two production departments (Machining and Assembly). The company allocates Building Maintenance cost on the basis of square footage and believes that Building Maintenance provides more service than Human Resources. The square footage occupied by each department follows. Assuming use of the step-down method, over how many square feet would the Building Maintenance cost be allocated (i.e., spread)?

A) 19,000.

B) 44,000.

C) 50,000.

D) 63,000.

E) More information is needed to judge.

A) 19,000.

B) 44,000.

C) 50,000.

D) 63,000.

E) More information is needed to judge.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

23

Harvest Corporation has two service departments (S1 and S2) and two production departments (P1 and P2), and uses the step-down method of cost allocation. Management has determined that S1 provides more service to the firm than S2, and has decided that the number of employees is the best allocation base to use for S1. The following data are available: Which of the following statements is (are) true if S1 and S2 have respective operating costs of $280,000 and $350,000?

A) S2 should allocate a portion of its $350,000 cost to S1.

B) S1's cost should be allocated (i.e., spread) over 140 employees.

C) S1's cost should be allocated (i.e., spread) over 150 employees.

D) S2 should allocate a total of $390,000 to P1 and P2.

E) Both S1's cost should be allocated (i.e., spread) over 140 employees and S2 should allocate a total of $390,000 to P1 and P2.

A) S2 should allocate a portion of its $350,000 cost to S1.

B) S1's cost should be allocated (i.e., spread) over 140 employees.

C) S1's cost should be allocated (i.e., spread) over 150 employees.

D) S2 should allocate a total of $390,000 to P1 and P2.

E) Both S1's cost should be allocated (i.e., spread) over 140 employees and S2 should allocate a total of $390,000 to P1 and P2.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

24

Apex Metallurgy, Inc. has two service departments (Human Resources and Building Maintenance) and two production departments (Machining and Assembly). The company allocates Building Maintenance cost on the basis of square footage and Human Resources cost on the basis of employees. It believes that Building Maintenance provides more service than Human Resources. The square footage and employees in each department follow. Assuming use of the step-down method, which of the following choices correctly denotes the number of square feet and employees over which the Building Maintenance cost and Human Resources cost would be allocated (i.e., spread)?

A.

B.

C.

D.

E.

A) Choice A

B) Choice B

C) Choice C

D) Choice D

E) Choice E

A.

B.

C.

D.

E.

A) Choice A

B) Choice B

C) Choice C

D) Choice D

E) Choice E

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

25

Which of the following methods would be of little use when allocating service department costs to production departments?

A) The direct method.

B) The reciprocal method.

C) The step-down method.

D) The net-realizable-value method.

E) The dual-cost allocation method.

A) The direct method.

B) The reciprocal method.

C) The step-down method.

D) The net-realizable-value method.

E) The dual-cost allocation method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

26

The Dopler Manufacturing Company has two production departments (Assembly and Finishing) and two service departments (Human Resources and Janitorial). The projected usage of the two service departments is as follows: The budgeted costs in the service departments are: Human Resources, $90,000 and Janitorial, $50,000.

Using the step-down method and assuming the Human Resources Department is allocated first, the amount of Human Resources cost allocated to the Assembly Department is:

A) $21,053.

B) $28,947.

C) $54,000.

D) $60,000.

E) $78,842.

Using the step-down method and assuming the Human Resources Department is allocated first, the amount of Human Resources cost allocated to the Assembly Department is:

A) $21,053.

B) $28,947.

C) $54,000.

D) $60,000.

E) $78,842.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

27

Seymore Company has two service departments (Cafeteria and Human Resources) and two production departments (Machining and Assembly). The number of employees in each department follows. Seymore uses the step-down method of cost allocation and allocates cost on the basis of employees. Human Resources cost amounts to $1,200,000, and the department provides more service to the firm than Cafeteria. How much Human Resources cost would be allocated to Cafeteria?

A) $88,888.

B) $28,572.

C) $44,444.

D) $0.

E) None of the other answers are correct.

A) $88,888.

B) $28,572.

C) $44,444.

D) $0.

E) None of the other answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

28

Visions, Inc. has two service departments (Human Resources and Building Maintenance) and two production departments (Machining and Assembly). The company allocates Building Maintenance cost on the basis of square footage and believes that Building Maintenance provides more service than Human Resources. The square footage occupied by each department follows. Over how many square feet would the Building Maintenance cost be allocated (i.e., spread) with the direct method and the step-down method?

A.

B.

C.

D.

E.

A) Choice A

B) Choice B

C) Choice C

D) Choice D

E) Choice E

A.

B.

C.

D.

E.

A) Choice A

B) Choice B

C) Choice C

D) Choice D

E) Choice E

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

29

The Dollar Store has a Human Resources Department and a Janitorial Department that provide service to three sales departments. The Human Resources Department cost is allocated on the basis of employees, and the Janitorial Department cost is allocated on the basis of space. The following information is available:

Using the direct method, the amount of Janitorial Department cost allocated to Sales Department no. 2 is:

A) $8,571.

B) $8,654.

C) $9,000.

D) $10,350.

E) $14,210.

Using the direct method, the amount of Janitorial Department cost allocated to Sales Department no. 2 is:

A) $8,571.

B) $8,654.

C) $9,000.

D) $10,350.

E) $14,210.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

30

Pederson Company has two service departments (Cafeteria and Human Resources) and two production departments (Machining and Assembly). The number of employees in each department follows. Pederson uses the direct method of cost allocation and allocates cost on the basis of employees. If Human Resources cost amounts to $1,800,000, how much of the department's cost would be allocated to Assembly?

A) $900,000.

B) $720,000.

C) $1,080,000.

D) $1,200,000.

E) None of the other answers are correct.

A) $900,000.

B) $720,000.

C) $1,080,000.

D) $1,200,000.

E) None of the other answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

31

The Dopler Manufacturing Company has two production departments (Assembly and Finishing) and two service departments (Human Resources and Janitorial). The projected usage of the two service departments is as follows: The budgeted costs in the service departments are: Human Resources, $90,000 and Janitorial, $50,000.

Using the direct method, the amount of Janitorial Department cost allocated to the Finishing Department is:

A) $21,053.

B) $24,843.

C) $25,000.

D) $28,947.

E) $34,157.

Using the direct method, the amount of Janitorial Department cost allocated to the Finishing Department is:

A) $21,053.

B) $24,843.

C) $25,000.

D) $28,947.

E) $34,157.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

32

Seymore Company has two service departments (Cafeteria and Human Resources) and two production departments (Machining and Assembly). The number of employees in each department follows. Seymore uses the step-down method of cost allocation and allocates cost on the basis of employees. Human Resources cost amounts to $1,200,000, and the department provides more service to the firm than Cafeteria. How much Human Resources cost would be allocated to Machining?

A) $0.

B) $428,572.

C) $444,444.

D) $480,000.

E) None of the other answers are correct.

A) $0.

B) $428,572.

C) $444,444.

D) $480,000.

E) None of the other answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

33

Hreck, Inc. has two service departments (Human Resources and Building Maintenance) and two production departments (Machining and Assembly). The company allocates Building Maintenance cost on the basis of square footage and believes that Building Maintenance provides more service than Human Resources. The square footage occupied by each department follows. Assuming use of the step-down method, over how many square feet would the Building Maintenance cost be allocated (i.e., spread)?

A) 18,000.

B) 48,000.

C) 55,000.

D) 66,000.

E) More information is needed to judge.

A) 18,000.

B) 48,000.

C) 55,000.

D) 66,000.

E) More information is needed to judge.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

34

The Dollar Store has a Human Resources Department and a Janitorial Department that provide service to three sales departments. The Human Resources Department cost is allocated on the basis of employees, and the Janitorial Department cost is allocated on the basis of space. The following information is available:

Using the step-down method and assuming the Human Resources Department is allocated first, the amount of Janitorial cost allocated to Sales Department no. 2 is:

A) $8,571.

B) $9,000.

C) $9,857.

D) $10,247.

E) $10,350.

Using the step-down method and assuming the Human Resources Department is allocated first, the amount of Janitorial cost allocated to Sales Department no. 2 is:

A) $8,571.

B) $9,000.

C) $9,857.

D) $10,247.

E) $10,350.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

35

The Dollar Store has a Human Resources Department and a Janitorial Department that provide service to three sales departments. The Human Resources Department cost is allocated on the basis of employees, and the Janitorial Department cost is allocated on the basis of space. The following information is available:

Using the step-down method and assuming that the Human Resources Department is allocated first, the amount of Human Resources cost allocated to Sales Department no. 3 is:

A) $12,000.

B) $12,857.

C) $13,500.

D) $15,000.

E) $22,500.

Using the step-down method and assuming that the Human Resources Department is allocated first, the amount of Human Resources cost allocated to Sales Department no. 3 is:

A) $12,000.

B) $12,857.

C) $13,500.

D) $15,000.

E) $22,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

36

Martina, Inc. has two service departments (Human Resources and Building Maintenance) and two production departments (Machining and Assembly). The company allocates Building Maintenance cost on the basis of square footage and believes that Building Maintenance provides more service than Human Resources. The square footage occupied by each department follows. Assuming use of the direct method, over how many square feet would the Building Maintenance cost be allocated (i.e., spread)?

A) 19,000.

B) 44,000.

C) 50,000.

D) 63,000.

E) More information is needed to judge.

A) 19,000.

B) 44,000.

C) 50,000.

D) 63,000.

E) More information is needed to judge.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

37

Ricardo Corporation has two service departments (Maintenance and Human Resources) and three production departments (Machining, Assembly, and Finishing). The two service departments service each other, and studies have shown that Maintenance provides the greater amount of service. Given the various cost allocation methods, which of the following choices correctly denotes whether Maintenance cost would be allocated to Human Resources?

A) Choice A

B) Choice B

C) Choice C

D) Choice D

E) Choice E

A) Choice A

B) Choice B

C) Choice C

D) Choice D

E) Choice E

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

38

Which of the following methods accounts for 100% of the services that occur between service departments?

A) Direct method.

B) Indirect method.

C) Reciprocal method.

D) Step-down method.

E) Dual-cost allocation method.

A) Direct method.

B) Indirect method.

C) Reciprocal method.

D) Step-down method.

E) Dual-cost allocation method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

39

Pederson Company has two service departments (Cafeteria and Human Resources) and two production departments (Machining and Assembly). The number of employees in each department follows. Pederson uses the direct method of cost allocation and allocates cost on the basis of employees. If Human Resources cost amounts to $1,800,000, how much of the department's cost would be allocated to Machining?

A) $600,000.

B) $720,000.

C) $900,000.

D) $1,200,000.

E) None of the other answers are correct.

A) $600,000.

B) $720,000.

C) $900,000.

D) $1,200,000.

E) None of the other answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

40

Seymore Company has two service departments (Cafeteria and Human Resources) and two production departments (Machining and Assembly). The number of employees in each department follows. Seymore uses the step-down method of cost allocation and allocates cost on the basis of employees. Human Resources cost amounts to $1,200,000, and the department provides more service to the firm than Cafeteria. How much Human Resources cost would be allocated to Assembly?

A) $0.

B) $480,572.

C) $444,444.

D) $666,666.

E) None of the other answers are correct.

A) $0.

B) $480,572.

C) $444,444.

D) $666,666.

E) None of the other answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

41

Nash Corporation allocates administrative costs on the basis of staff hours. Short-run monthly usage and anticipated long-run monthly usage of staff hours for Operating Departments 1 and 2 follow. Variable and fixed administrative costs total $180,000 and $400,000, respectively. If Nash uses dual-cost accounting procedures, the total amount of administrative cost to allocate to Department 2 would be:

A) $301,600.

B) $307,000.

C) $313,600.

D) $319,000.

E) None of the other answers are correct.

A) $301,600.

B) $307,000.

C) $313,600.

D) $319,000.

E) None of the other answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

42

Garage Specialty Corporation manufactures joint products P and Q. During a recent period, joint costs amounted to $80,000 in the production of 20,000 gallons of P and 60,000 gallons of Q. Garage can sell P and Q at split-off for $2.20 per gallon and $2.60 per gallon, respectively. Alternatively, both products can be processed beyond the split-off point, as follows: The joint cost allocated to P under the relative-sales-value method would be:

A) $17,600.

B) $16,400.

C) $24,000.

D) $25,600.

E) None of the other answers are correct.

A) $17,600.

B) $16,400.

C) $24,000.

D) $25,600.

E) None of the other answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

43

Consider the following statements about dual-cost allocation:

I) Dual-cost allocation prevents a change in the short-run activity of one department from affecting the cost allocated to another department.

II) Dual-cost allocations create an incentive for user department managers to understate their expected long-run service needs.

III) Dual-cost allocations are generally preferred over lump-sum allocations, or those that combine variable and fixed costs together.

Which of the above statements is (are) true?

A) I only.

B) III only.

C) I and II.

D) II and III.

E) I, II, and III.

I) Dual-cost allocation prevents a change in the short-run activity of one department from affecting the cost allocated to another department.

II) Dual-cost allocations create an incentive for user department managers to understate their expected long-run service needs.

III) Dual-cost allocations are generally preferred over lump-sum allocations, or those that combine variable and fixed costs together.

Which of the above statements is (are) true?

A) I only.

B) III only.

C) I and II.

D) II and III.

E) I, II, and III.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

44

Which of the following methods should be selected if a company terminates all processing at the split-off point and desires to use a cost-allocation approach that considers the "revenue-producing ability" of each product?

A) Gross margin at split-off method.

B) Reciprocal-accounting method.

C) Relative-sales-value method.

D) Physical-units method.

E) Net-realizable-value method.

A) Gross margin at split-off method.

B) Reciprocal-accounting method.

C) Relative-sales-value method.

D) Physical-units method.

E) Net-realizable-value method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

45

The joint-cost allocation method that recognizes the revenues at split-off but does not consider any further processing costs is the:

A) relative-sales-value method.

B) net-realizable-value method.

C) physical-units method.

D) reciprocal-accounting method.

E) gross margin at split-off method.

A) relative-sales-value method.

B) net-realizable-value method.

C) physical-units method.

D) reciprocal-accounting method.

E) gross margin at split-off method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

46

Garage Specialty Corporation manufactures joint products P and Q. During a recent period, joint costs amounted to $80,000 in the production of 20,000 gallons of P and 60,000 gallons of Q. Garage can sell P and Q at split-off for $2.20 per gallon and $2.60 per gallon, respectively. Alternatively, both products can be processed beyond the split-off point, as follows:

The joint cost allocated to Q under the relative-sales-value method would be:

A) $40,000.

B) $62,400.

C) $64,000.

D) $65,600.

E) None of the other answers are correct.

The joint cost allocated to Q under the relative-sales-value method would be:

A) $40,000.

B) $62,400.

C) $64,000.

D) $65,600.

E) None of the other answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

47

A company that uses activity-based costing would likely allocate costs from:

A) service departments to production departments.

B) service departments to products and services.

C) service departments to production departments and then to products and services.

D) activity-cost pools to production departments.

E) activity-cost pools to products and services.

A) service departments to production departments.

B) service departments to products and services.

C) service departments to production departments and then to products and services.

D) activity-cost pools to production departments.

E) activity-cost pools to products and services.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

48

The point in a joint production process where each individual product becomes separately identifiable is commonly called the:

A) decision point.

B) separation point.

C) individual product point.

D) split-off point.

E) joint product point.

A) decision point.

B) separation point.

C) individual product point.

D) split-off point.

E) joint product point.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

49

Gandolf Corporation allocates administrative costs on the basis of staff hours. Short-run monthly usage and anticipated long-run monthly usage of staff hours for Operating Departments 1 and 2 follow. If Gandolf uses dual-cost accounting procedures and variable administrative costs total $200,000, the amount of variable administrative cost to allocate to Department 1 would be:

A) $80,000.

B) $85,000.

C) $90,000.

D) $100,000.

E) None of the other answers are correct.

A) $80,000.

B) $85,000.

C) $90,000.

D) $100,000.

E) None of the other answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

50

Christiansen Corporation manufactures joint products W and X. During a recent period, joint costs amounted to $300,000 in the production of 20,000 gallons of W and 60,000 gallons of X. Both products will be processed beyond the split-off point, giving rise to the following data:

The joint cost allocated to X under the net-realizable-value method would be:

A) $210,000.

B) $180,000.

C) $184,000.

D) $190,000.

E) None of the other answers are correct.

The joint cost allocated to X under the net-realizable-value method would be:

A) $210,000.

B) $180,000.

C) $184,000.

D) $190,000.

E) None of the other answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

51

Isthmus Corporation uses the physical-units method to allocate costs among its three joint products: X, Y, and Z. The following data are available for the period just ended:

Joint processing cost: $800,000

Total production: 150,000 pounds

Share of joint cost allocated to X: $160,000

Share of joint cost allocated to Y: $400,000

Which of the following statements is true?

A) The company would have relied on the sales value of each product when allocating joint costs to X, Y, and Z.

B) Ithaca produced 30,000 pounds of Z during the period.

C) Ithaca produced 45,000 pounds of Z during the period.

D) Ithaca produced 105,000 pounds of Z during the period.

E) Based on the data presented, it is not possible to determine Ithaca's production of Z during the period.

Joint processing cost: $800,000

Total production: 150,000 pounds

Share of joint cost allocated to X: $160,000

Share of joint cost allocated to Y: $400,000

Which of the following statements is true?

A) The company would have relied on the sales value of each product when allocating joint costs to X, Y, and Z.

B) Ithaca produced 30,000 pounds of Z during the period.

C) Ithaca produced 45,000 pounds of Z during the period.

D) Ithaca produced 105,000 pounds of Z during the period.

E) Based on the data presented, it is not possible to determine Ithaca's production of Z during the period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

52

Zena Company manufactures two products (A and B) from a joint process that cost $200,000 for the year just ended. Each product may be sold at the split-off point or processed further. Additional processing requires no special facilities, and production costs of further processing are entirely variable and traceable to the products involved. Further information follows.

If the joint costs are allocated based on the physical-units method, the amount of joint cost assigned to product A would be:

A) $80,000.

B) $100,000.

C) $104,000.

D) $120,000.

E) None of the other answers are correct.

If the joint costs are allocated based on the physical-units method, the amount of joint cost assigned to product A would be:

A) $80,000.

B) $100,000.

C) $104,000.

D) $120,000.

E) None of the other answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

53

The process of allocating fixed and variable costs separately is called:

A) the separate allocation procedure (SAP).

B) diverse allocation.

C) reciprocal-cost allocation.

D) common-cost allocation.

E) dual-cost allocation.

A) the separate allocation procedure (SAP).

B) diverse allocation.

C) reciprocal-cost allocation.

D) common-cost allocation.

E) dual-cost allocation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

54

Under dual-cost allocation, fixed costs are allocated on the basis of a user department's:

A) long-run usage of a service department's output.

B) short-run usage of a service department's output.

C) long-run usage and short-run usage of a service department's output.

D) neither long-run usage nor short-run usage of a service department's output.

E) either long-run usage or short-run usage of a service department's output.

A) long-run usage of a service department's output.

B) short-run usage of a service department's output.

C) long-run usage and short-run usage of a service department's output.

D) neither long-run usage nor short-run usage of a service department's output.

E) either long-run usage or short-run usage of a service department's output.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

55

Christiansen Corporation manufactures joint products W and X. During a recent period, joint costs amounted to $300,000 in the production of 20,000 gallons of W and 60,000 gallons of X. Both products will be processed beyond the split-off point, giving rise to the following data: The joint cost allocated to W under the net-realizable-value method would be:

A) $75,000.

B) $80,000.

C) $84,000.

D) $90,000.

E) None of the other answers are correct.

A) $75,000.

B) $80,000.

C) $84,000.

D) $90,000.

E) None of the other answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

56

Which of the following choices correctly denotes the data needed to allocate joint costs under the relative-sales-value method?

A) Choice A

B) Choice B

C) Choice C

D) Choice D

E) Choice E

A) Choice A

B) Choice B

C) Choice C

D) Choice D

E) Choice E

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

57

When allocating joint costs, Weinberg calculates the final sales value of the various products manufactured and subtracts appropriate separable costs. The company is using the:

A) gross margin at split-off method.

B) reciprocal-accounting method.

C) relative-sales-value method.

D) physical-units method.

E) net-realizable-value method.

A) gross margin at split-off method.

B) reciprocal-accounting method.

C) relative-sales-value method.

D) physical-units method.

E) net-realizable-value method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

58

The Dopler Manufacturing Company has two production departments (Assembly and Finishing) and two service departments (Human Resources and Janitorial). The projected usage of the two service departments is as follows: The budgeted costs in the service departments are: Human Resources, $90,000 and Janitorial, $50,000.

Using the step-down method and assuming the Human Resources Department is allocated first, the total amount of service department cost allocated to the Finishing Department is:

A) $58,947.

B) $61,158.

C) $74,000.

D) $78,842.

E) $81,053.

Using the step-down method and assuming the Human Resources Department is allocated first, the total amount of service department cost allocated to the Finishing Department is:

A) $58,947.

B) $61,158.

C) $74,000.

D) $78,842.

E) $81,053.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

59

When allocating service department costs, companies should use:

A) actual costs rather than budgeted costs, and separate rates for variable and fixed costs.

B) budgeted costs rather than actual costs, and separate rates for variable and fixed costs.

C) budgeted costs rather than actual costs, and a rate that combines variable and fixed costs.

D) actual costs rather than budgeted costs, and a rate that combines variable and fixed costs.

E) a rate that is based on matrix theory.

A) actual costs rather than budgeted costs, and separate rates for variable and fixed costs.

B) budgeted costs rather than actual costs, and separate rates for variable and fixed costs.

C) budgeted costs rather than actual costs, and a rate that combines variable and fixed costs.

D) actual costs rather than budgeted costs, and a rate that combines variable and fixed costs.

E) a rate that is based on matrix theory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

60

Romano Corporation allocates administrative costs on the basis of staff hours. Short-run monthly usage and anticipated long-run monthly usage of staff hours for Operating Departments 1 and 2 follow. If Romano uses dual-cost accounting procedures and fixed administrative costs total $1,000,000, the amount of fixed administrative cost to allocate to Department 1 would be:

A) $400,000.

B) $450,000.

C) $500,000.

D) $850,000.

E) None of the other answers are correct.

A) $400,000.

B) $450,000.

C) $500,000.

D) $850,000.

E) None of the other answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

61

Rocky Mountain Company produces two products (X and Y) from a joint process. Each product may be sold at the split-off point or processed further. Additional processing requires no special facilities, and production costs of further processing are entirely variable and traceable to the products involved. Joint manufacturing costs for the year were $60,000. Sales values and costs were as follows:

If the joint production costs are allocated based on the relative-sales-value method, the amount of joint cost assigned to product X would be:

A) $20,000.

B) $27,000.

C) $33,000.

D) $40,000.

E) None of the other answers are correct.

If the joint production costs are allocated based on the relative-sales-value method, the amount of joint cost assigned to product X would be:

A) $20,000.

B) $27,000.

C) $33,000.

D) $40,000.

E) None of the other answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

62

Haggins Corporation manufactures two chemicals (Flextra and Hydro) in a joint process. Data from a recent month follow.

Direct materials used: $360,000

Direct labor: $150,000

Manufacturing overhead: $690,000

Manufacturing output:

Flextra: 40,000 gallons

Hydro: 120,000 gallons

Flextra sells for $15 per gallon and Hydro sells for $20 per gallon.

Required:

A. Compute the total joint costs to be allocated to Flextra and Hydro.

B. Compute the joint costs that would be allocated to Flextra by using the physical-units method.

C. Compute the joint costs that would be allocated to Hydro by using the relative-sales-value method.

D. Assume that Hydro can be converted into a more refined product, Hydro-R, in a totally separable process at an additional cost of $4 per gallon. If the refined product can be sold in the marketplace for $26 per gallon, compute the net realizable value of Hydro-R.

Direct materials used: $360,000

Direct labor: $150,000

Manufacturing overhead: $690,000

Manufacturing output:

Flextra: 40,000 gallons

Hydro: 120,000 gallons

Flextra sells for $15 per gallon and Hydro sells for $20 per gallon.

Required:

A. Compute the total joint costs to be allocated to Flextra and Hydro.

B. Compute the joint costs that would be allocated to Flextra by using the physical-units method.

C. Compute the joint costs that would be allocated to Hydro by using the relative-sales-value method.

D. Assume that Hydro can be converted into a more refined product, Hydro-R, in a totally separable process at an additional cost of $4 per gallon. If the refined product can be sold in the marketplace for $26 per gallon, compute the net realizable value of Hydro-R.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

63

Mercury Corporation allocates joint costs by using the net-realizable-value method. In the company's Michigan plant, products D and E emerge from a joint process that costs $250,000. E is then processed at a cost of $220,000 into products F and

A. Allocate the $220,000 processing cost between products F and

B. From a profitability perspective, should product E be processed into products F and G? Show your calculations.

C. Assume that the net realizable value associated with E is zero. How would you allocate the joint cost of $250,000?

G.

G. Data pertaining to D, F, and G follow. Required:

Required:

A. Allocate the $220,000 processing cost between products F and

B. From a profitability perspective, should product E be processed into products F and G? Show your calculations.

C. Assume that the net realizable value associated with E is zero. How would you allocate the joint cost of $250,000?

G.

G. Data pertaining to D, F, and G follow.

Required:

Required:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

64

Consider the following statements about joint product cost allocation:

I) Joint product cost is allocated because it is necessary for inventory valuation.

II) Joint product cost is allocated because it is necessary for making economic decisions about individual products (e.g., sell at split-off or process further).

III) Joint cost may be allocated to products by using several different methods.

Which of the above statements is (are) correct?

A) I only.

B) III only.

C) I and II.

D) I and III.

E) I, II, and III.

I) Joint product cost is allocated because it is necessary for inventory valuation.

II) Joint product cost is allocated because it is necessary for making economic decisions about individual products (e.g., sell at split-off or process further).

III) Joint cost may be allocated to products by using several different methods.

Which of the above statements is (are) correct?

A) I only.

B) III only.

C) I and II.

D) I and III.

E) I, II, and III.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

65

Suppose that one hog yields 250 pounds of ham, 200 pounds of chops, and 50 pounds of miscellaneous items. The sales value of ham is $1.80 per pound; chops, $2.50 per pound; and miscellaneous items, $1.00 per pound. The hog costs $670, and processing costs are $30.

Required:

A. Determine the proper allocation of joint costs to the three products by using the physical-units method.

B. Repeat part "B" by using the relative-sales-value method.

Required:

A. Determine the proper allocation of joint costs to the three products by using the physical-units method.

B. Repeat part "B" by using the relative-sales-value method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

66

Consider the following independent cases that relate to service department cost allocations:

Case A: Strickland Company has two service departments [Human Resources (H/R) and Information Systems] and two production departments (Machining and Assembly). Human Resource cost is allocated by using the direct method based on the number of personnel in each department. For the period just ended, there were 189 employees in Machining, and Machining received $90,000 of H/R's overhead of $200,000. How many employees are in the Assembly Department?

Case B: Walter Burke, controller of Alexander Enterprises, wants service department managers to be aware that their use of other service departments costs the firm a substantial amount of money. Would Burke prefer the direct method or the step-down method of cost allocation? Why?

Case C: Lockwood Company has four service departments (S1, S2, S3, and S4) and two production departments (P1 and P2). The costs of S1 are allocated first, followed in order by the costs of S2, S3, and S4. Lockwood uses the step-down method, and the costs of S2 are allocated based on the number of computer hours used. Computer hours logged during the period were as follows: S1, 4,600; S2, 7,100; S3, 10,400; S4, 17,600; P1, 37,000; and P2, 48,600. Over how many hours would S2's cost be allocated?

Case D: A recently hired staff accountant noted that given the nature of the allocations, the total cost allocated to production departments is typically less under the step-down method than under the direct method. Do you agree with the accountant? Why?

Required:

Answer the questions that are raised in Cases A, B, C, and

D.

Case A: Strickland Company has two service departments [Human Resources (H/R) and Information Systems] and two production departments (Machining and Assembly). Human Resource cost is allocated by using the direct method based on the number of personnel in each department. For the period just ended, there were 189 employees in Machining, and Machining received $90,000 of H/R's overhead of $200,000. How many employees are in the Assembly Department?

Case B: Walter Burke, controller of Alexander Enterprises, wants service department managers to be aware that their use of other service departments costs the firm a substantial amount of money. Would Burke prefer the direct method or the step-down method of cost allocation? Why?

Case C: Lockwood Company has four service departments (S1, S2, S3, and S4) and two production departments (P1 and P2). The costs of S1 are allocated first, followed in order by the costs of S2, S3, and S4. Lockwood uses the step-down method, and the costs of S2 are allocated based on the number of computer hours used. Computer hours logged during the period were as follows: S1, 4,600; S2, 7,100; S3, 10,400; S4, 17,600; P1, 37,000; and P2, 48,600. Over how many hours would S2's cost be allocated?

Case D: A recently hired staff accountant noted that given the nature of the allocations, the total cost allocated to production departments is typically less under the step-down method than under the direct method. Do you agree with the accountant? Why?

Required:

Answer the questions that are raised in Cases A, B, C, and

D.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

67

Westside Hospital has two service departments (Patient Records and Accounting) and two "production" departments (Internal Medicine and Surgery). Which of the following allocations would not take place under the reciprocal-services method of cost allocation?

A) Allocation of Accounting cost to Patient Records.

B) Allocation of Patient Records cost to Internal Medicine.

C) Allocation of Surgery cost to Accounting.

D) Allocation of Internal Medicine cost to Surgery.

E) Both Allocation of Surgery cost to Accounting and Allocation of Internal Medicine cost to Surgery.

A) Allocation of Accounting cost to Patient Records.

B) Allocation of Patient Records cost to Internal Medicine.

C) Allocation of Surgery cost to Accounting.

D) Allocation of Internal Medicine cost to Surgery.

E) Both Allocation of Surgery cost to Accounting and Allocation of Internal Medicine cost to Surgery.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

68

Rocky Mountain Company produces two products (X and Y) from a joint process. Each product may be sold at the split-off point or processed further. Additional processing requires no special facilities, and production costs of further processing are entirely variable and traceable to the products involved. Joint manufacturing costs for the year were $60,000. Sales values and costs were as follows:

If the joint production costs are allocated based on the net-realizable-value method, the amount of joint cost assigned to product Y would be:

A) $20,000.

B) $27,000.

C) $33,000.

D) $40,000.

E) None of the other answers are correct.

If the joint production costs are allocated based on the net-realizable-value method, the amount of joint cost assigned to product Y would be:

A) $20,000.

B) $27,000.

C) $33,000.

D) $40,000.

E) None of the other answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

69

Which of the following statements about joint-cost allocation is false?

A) Joint-cost allocation is useful in deciding whether to further process a product after split-off.

B) Joint-cost allocation is useful in making a profit determination about individual joint products.

C) Joint-cost allocation is helpful in inventory valuation.

D) Joint-cost allocation can be based on the number of units produced.

E) Joint-cost allocation can be accomplished by using several different methods that focus on sales value and product "worth."

A) Joint-cost allocation is useful in deciding whether to further process a product after split-off.

B) Joint-cost allocation is useful in making a profit determination about individual joint products.

C) Joint-cost allocation is helpful in inventory valuation.

D) Joint-cost allocation can be based on the number of units produced.

E) Joint-cost allocation can be accomplished by using several different methods that focus on sales value and product "worth."

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

70

Companies are free to use the direct, step-down, and reciprocal allocation methods when dealing with service-department costs.

Required:

A. How does the direct method work? What is its chief limitation?

B. Is the step-down method an improvement over the direct method? Explain.

C. Which of the three methods is the most correct from a conceptual viewpoint? Why?

Required:

A. How does the direct method work? What is its chief limitation?

B. Is the step-down method an improvement over the direct method? Explain.

C. Which of the three methods is the most correct from a conceptual viewpoint? Why?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

71

Holbrook Corporation is developing departmental overhead rates based on direct labor hours for its two production departments, Molding and Assembly. The Molding Department worked 20,000 hours during the period just ended, and the Assembly Department worked 40,000 hours. The overhead costs incurred by Molding and Assembly were $151,250 and $440,750, respectively.

Two service departments, Repair and Power, directly support the two production departments. These service departments have costs of $90,000 and $250,000, respectively. The following schedule reflects the use of Repair and Power's output by the various departments:

Required:

A. Allocate the company's service department costs to production departments by using the direct method.

B. Calculate the overhead application rates of the production departments. Hint: Consider both directly traceable and allocated overhead when deriving your answer.

C. Allocate the company's service department costs to production departments by using the step-down method. Begin with the Power Department, and round calculations to the nearest dollar.

Two service departments, Repair and Power, directly support the two production departments. These service departments have costs of $90,000 and $250,000, respectively. The following schedule reflects the use of Repair and Power's output by the various departments:

Required:

A. Allocate the company's service department costs to production departments by using the direct method.

B. Calculate the overhead application rates of the production departments. Hint: Consider both directly traceable and allocated overhead when deriving your answer.

C. Allocate the company's service department costs to production departments by using the step-down method. Begin with the Power Department, and round calculations to the nearest dollar.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

72

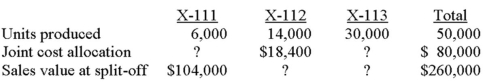

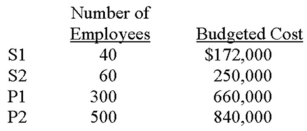

Barry Chemical Company manufactures X-111, X-112, and X-113 from a joint process. The following information is available for the period just ended:

Required:

A. Does Barry allocate joint costs by using the physical-units method? Explain.

B. Assume that Barry does not use the physical-units method but instead allocates joint costs by using the relative-sales-value method. Find the four unknowns in the preceding table.

Required:

A. Does Barry allocate joint costs by using the physical-units method? Explain.

B. Assume that Barry does not use the physical-units method but instead allocates joint costs by using the relative-sales-value method. Find the four unknowns in the preceding table.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

73

Douglas Company, a new firm, manufactures two products, J and K, in a common process. The joint costs amount to $80,000 per batch of finished goods. Each batch results in 20,000 liters of output, of which 80% are J and 20% are K.

The two products are processed beyond the split-off point, with Douglas incurring the following separable costs: J, $2 per liter; K, $5 per liter. After the additional processing, the selling price of J is $12 per liter, and the selling price of K is $15 per liter.

Required:

A. Determine the proper allocation of joint costs if the company uses the net-realizable-value method.

B. Assume that Douglas sold all of its production of K during the current accounting period. Compute K's sales revenue, cost of goods sold, and gross margin.

C. Is the firm's cost-of-goods-sold figure influenced by the choice of a joint-cost allocation method? Briefly explain.

The two products are processed beyond the split-off point, with Douglas incurring the following separable costs: J, $2 per liter; K, $5 per liter. After the additional processing, the selling price of J is $12 per liter, and the selling price of K is $15 per liter.

Required:

A. Determine the proper allocation of joint costs if the company uses the net-realizable-value method.

B. Assume that Douglas sold all of its production of K during the current accounting period. Compute K's sales revenue, cost of goods sold, and gross margin.

C. Is the firm's cost-of-goods-sold figure influenced by the choice of a joint-cost allocation method? Briefly explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

74

Ojai Chemical manufactures two industrial chemicals in a joint process. In October, $200,000 of direct materials were processed at a cost of $300,000, resulting in 16,000 pounds of Pentex and 4,000 pounds of Glaxco. Pentex sells for $35 per pound and Glaxco sells for $60 per pound. Management generally processes each of these chemicals further in separable processes to manufacture more refined products. Pentex is processed separately at a cost of $7.50 per pound, with the resulting product, Pentex-R, selling for $45 per pound. Glaxco is processed separately at a cost of $10 per pound, and the resulting product, Glaxco-R, sells for $100 per pound.

Required:

A. Compute the company's total joint production costs.

B. Assuming that total joint production costs amounted to $500,000, allocate these costs by using:

1. The physical-units method.

2. The relative-sales-value method.

3. The net-realizable-value method.

Required:

A. Compute the company's total joint production costs.

B. Assuming that total joint production costs amounted to $500,000, allocate these costs by using:

1. The physical-units method.

2. The relative-sales-value method.

3. The net-realizable-value method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

75

Rocky Mountain Company produces two products (X and Y) from a joint process. Each product may be sold at the split-off point or processed further. Additional processing requires no special facilities, and production costs of further processing are entirely variable and traceable to the products involved. Joint manufacturing costs for the year were $60,000. Sales values and costs were as follows:

If the joint production costs are allocated based on the physical-units method, the amount of joint cost assigned to product X would be:

A) $20,000.

B) $24,000.

C) $30,000.

D) $36,000.

E) $40,000.

If the joint production costs are allocated based on the physical-units method, the amount of joint cost assigned to product X would be:

A) $20,000.

B) $24,000.

C) $30,000.

D) $36,000.

E) $40,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

76

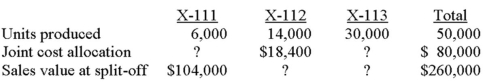

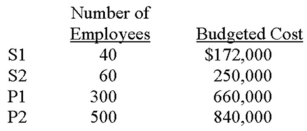

Ovation Corporation has two service departments (S1 and S2) and two production departments (P1 and P2). S1 and S2 both use the number of employees as an allocation base. The following data are available:

Required:

A. Assuming use of the direct method:

1. Over how many employees would S1's budgeted cost be allocated?

2. How much of S2's cost would be allocated to P1?

3. How much of P1's cost would be allocated to S1?

B. Assuming use of the step-down method:

1. How much of S1's cost would be allocated to S2? Ovation allocates S1's costs prior to allocating those of S2.

2. How much of S2's total cost would be allocated to P2?

3. How much of S2's total cost would be allocated to S1?

Required:

A. Assuming use of the direct method:

1. Over how many employees would S1's budgeted cost be allocated?

2. How much of S2's cost would be allocated to P1?

3. How much of P1's cost would be allocated to S1?

B. Assuming use of the step-down method:

1. How much of S1's cost would be allocated to S2? Ovation allocates S1's costs prior to allocating those of S2.

2. How much of S2's total cost would be allocated to P2?

3. How much of S2's total cost would be allocated to S1?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

77

Eastside Hospital has two service departments (Patient Records and Accounting) and two "production" departments (Internal Medicine and Surgery). Which of the following allocations would likely take place under the reciprocal-services method of cost allocation?

A) Allocation of Accounting cost to Patient Records.

B) Allocation of Patient Records cost to Internal Medicine.

C) Allocation of Surgery cost to Accounting.

D) Allocation of Internal Medicine cost to Surgery.

E) Both Allocation of Accounting cost to Patient Records and Allocation of Patient Records cost to Internal Medicine.

A) Allocation of Accounting cost to Patient Records.

B) Allocation of Patient Records cost to Internal Medicine.

C) Allocation of Surgery cost to Accounting.

D) Allocation of Internal Medicine cost to Surgery.

E) Both Allocation of Accounting cost to Patient Records and Allocation of Patient Records cost to Internal Medicine.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

78

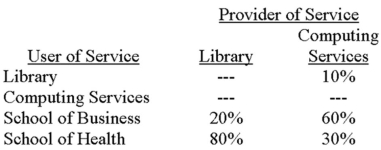

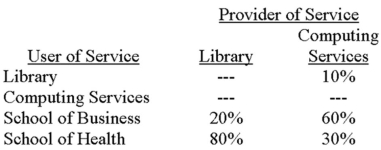

Western Kentucky State College has two service departments, the Library and Computing Services, that assist the School of Business and the School of Health. Budgeted costs of the Library and Computing Services are $800,000 and $1,800,000, respectively. Usage of the service departments' output during the year is anticipated to be:

Required:

A. Use the direct method to allocate the costs of the Library and Computing Services to the School of Business and the School of Health.

B. Repeat requirement "A" using the step-down method. Western allocates the cost of Computing Services first.

Required:

A. Use the direct method to allocate the costs of the Library and Computing Services to the School of Business and the School of Health.

B. Repeat requirement "A" using the step-down method. Western allocates the cost of Computing Services first.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

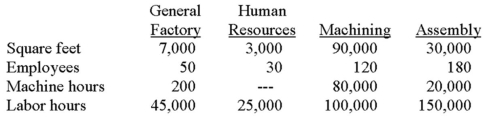

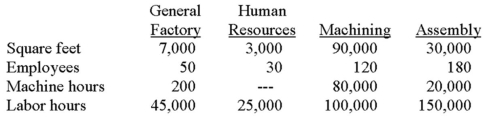

79

Madrid has two service departments (General Factory and Human Resources) and two production departments (Machining and Assembly). The company uses the direct method of service-department cost allocation, allocating General Factory cost on the basis of square feet and Human Resources cost on the basis of employees. Budgeted allocation-base and operating data for the four departments follow.

Additional information:

• Budgeted costs of General Factory and Human Resources respectively amount to $1,560,000 and $950,000.

• The anticipated overhead costs incurred directly in the Machining and Assembly Departments respectively total $3,650,000 and $2,340,000.

• The manufacturing overhead application bases used by Madrid's production departments are: Machining, machine hours; Assembly, labor hours.

• Company policy holds that a department's overhead application rate is based on a department's own overhead plus an allocated share of service-department cost.

Required:

A. Allocate the company's service-department costs to the producing departments.

B. Compute the overhead application rates for Machining and Assembly.

Additional information:

• Budgeted costs of General Factory and Human Resources respectively amount to $1,560,000 and $950,000.

• The anticipated overhead costs incurred directly in the Machining and Assembly Departments respectively total $3,650,000 and $2,340,000.

• The manufacturing overhead application bases used by Madrid's production departments are: Machining, machine hours; Assembly, labor hours.

• Company policy holds that a department's overhead application rate is based on a department's own overhead plus an allocated share of service-department cost.

Required:

A. Allocate the company's service-department costs to the producing departments.

B. Compute the overhead application rates for Machining and Assembly.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

80

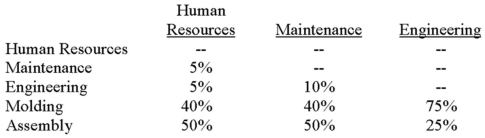

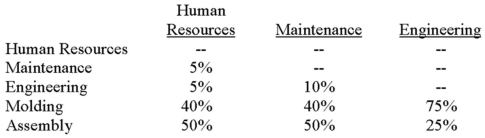

Detroit Electronics, Inc. manufactures gauges for automobile dashboards. The company has two production departments, Molding and Assembly. There are three service departments: Human Resources, Maintenance, and Engineering. Usage of services by the various departments follows.

The budgeted costs in Detroit's service departments are: Human Resources, $180,000; Maintenance, $270,000; and Engineering, $200,000. The company rounds all calculations to the nearest dollar.

Required:

A. Use the direct method to allocate Detroit's service department costs to the production departments.

B. Determine the proper departmental sequence to use in allocating the company's service costs by the step-down method.

C. Ignoring your answer in part "B," assume that Human Resources costs are allocated first, Maintenance costs second, and Engineering costs third. Use the step-down method to allocate Detroit's service department costs.

The budgeted costs in Detroit's service departments are: Human Resources, $180,000; Maintenance, $270,000; and Engineering, $200,000. The company rounds all calculations to the nearest dollar.

Required:

A. Use the direct method to allocate Detroit's service department costs to the production departments.

B. Determine the proper departmental sequence to use in allocating the company's service costs by the step-down method.

C. Ignoring your answer in part "B," assume that Human Resources costs are allocated first, Maintenance costs second, and Engineering costs third. Use the step-down method to allocate Detroit's service department costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck