Deck 22: Pricing Products and Services

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/67

العب

ملء الشاشة (f)

Deck 22: Pricing Products and Services

1

Holding all other things constant, an increase in the company's required ROI will affect:

A)the markup under the absorption costing approach to cost-plus pricing.

B)the markup used to compute the profit-maximizing price.

C)both the markup under the absorption costing approach to cost-plus pricing and the markup used to compute profit-maximizing price.

D)neither the markup under the absorption costing approach to cost-plus pricing nor the markup used to compute profit-maximizing price.

A)the markup under the absorption costing approach to cost-plus pricing.

B)the markup used to compute the profit-maximizing price.

C)both the markup under the absorption costing approach to cost-plus pricing and the markup used to compute profit-maximizing price.

D)neither the markup under the absorption costing approach to cost-plus pricing nor the markup used to compute profit-maximizing price.

A

2

The price elasticity of demand can be estimated using the formula ln(1 + %change in selling price)/ln(1 + %change in quantity sold).

False

3

Demand for a product is said to be inelastic if a change in price has a substantial effect on the number of units sold.

False

4

Cost-plus pricing is so named because all costs--production, selling, and administrative--are included in the cost base from which a target selling price is derived.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

5

Salt is an example of a product whose demand is price inelastic.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

6

Holding all other things constant, if the price elasticity of demand increases (i.e., becomes more negative), then the markup under absorption costing will:

A)increase.

B)decrease.

C)remain the same.

D)The effect cannot be determined.

A)increase.

B)decrease.

C)remain the same.

D)The effect cannot be determined.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

7

Target costing is primarily used when developing a new product.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

8

Assume that the price elasticity of demand is less than -1 (for example, -1.5). As the absolute value of the price elasticity of demand increases, the profit-maximizing price decreases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

9

Gasoline is a product whose demand is elastic.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

10

Holding all other things constant, an increase in variable selling costs will affect:

A)the markup under the absorption costing approach to cost-plus pricing.

B)the markup used to compute the profit-maximizing price.

C)both the markup under the absorption costing approach to cost-plus pricing and the markup used to compute profit-maximizing price.

D)neither the markup under the absorption costing approach to cost-plus pricing nor the markup used to compute profit-maximizing price.

A)the markup under the absorption costing approach to cost-plus pricing.

B)the markup used to compute the profit-maximizing price.

C)both the markup under the absorption costing approach to cost-plus pricing and the markup used to compute profit-maximizing price.

D)neither the markup under the absorption costing approach to cost-plus pricing nor the markup used to compute profit-maximizing price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

11

In the absorption approach to cost-plus pricing, which costs below are included in the cost base?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

12

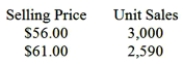

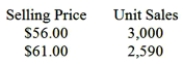

Hanvold Company recently changed the selling price of one of its products. Data concerning sales for comparable periods before and after the price change are presented below. The product's price elasticity of demand as defined in the text is closest to:

A)-3.14

B)-3.55

C)-4.72

D)-2.90

A)-3.14

B)-3.55

C)-4.72

D)-2.90

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

13

Gorry Company's management has found that every 7% increase in the selling price of one of the company's products leads to a 11% decrease in the product's total unit sales. The product's absorption costing unit product cost is $13.00. The variable production cost of the product is $4.00 per unit and the variable selling and administrative cost is $5.40 per unit. According to the formula in the text, the product's profit-maximizing price is closest to:

A)$22.41

B)$31.00

C)$23.60

D)$20.06

A)$22.41

B)$31.00

C)$23.60

D)$20.06

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

14

Holding all other things constant, an increase in fixed selling costs will affect:

A)the selling price under the absorption costing approach to cost-plus pricing.

B)the profit-maximizing price.

C)both the selling price under the absorption costing approach to cost-plus pricing and the profit-maximizing price.

D)neither the selling price under the absorption costing approach to cost-plus pricing nor the profit-maximizing price.

A)the selling price under the absorption costing approach to cost-plus pricing.

B)the profit-maximizing price.

C)both the selling price under the absorption costing approach to cost-plus pricing and the profit-maximizing price.

D)neither the selling price under the absorption costing approach to cost-plus pricing nor the profit-maximizing price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

15

The absorption costing approach to cost-plus pricing provides assurance that the company's required rate of return will be realized even if unit sales are less than forecasted.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

16

Which of the following methods would probably be the most beneficial to a company that has little or no control over the price that it can charge for its product or service?

A)cost-plus pricing, absorption approach

B)cost-plus pricing, contribution approach

C)time and material pricing

D)target costing

A)cost-plus pricing, absorption approach

B)cost-plus pricing, contribution approach

C)time and material pricing

D)target costing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

17

If a company sells a product for less than its budgeted unit product cost under absorption costing, then the company will lose money.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

18

The markup over cost under the absorption costing approach would increase if the unit product cost increases, holding everything else constant.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

19

Holding all other things constant, an increase in variable production costs will affect:

A)the selling price under the absorption costing approach to cost-plus pricing.

B)the profit-maximizing price.

C)both the selling price under the absorption costing approach to cost-plus pricing and the profit-maximizing price.

D)neither the selling price under the absorption costing approach to cost-plus pricing nor the profit-maximizing price.

A)the selling price under the absorption costing approach to cost-plus pricing.

B)the profit-maximizing price.

C)both the selling price under the absorption costing approach to cost-plus pricing and the profit-maximizing price.

D)neither the selling price under the absorption costing approach to cost-plus pricing nor the profit-maximizing price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

20

Demand for a product is said to be inelastic if a change in price has little effect on the number of units sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

21

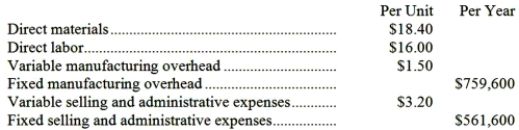

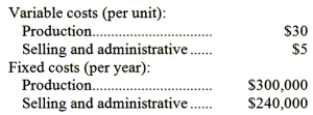

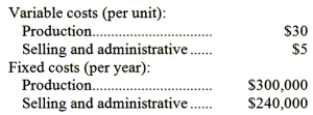

Kirsch, Inc., manufactures a product with the following costs:  The company uses the absorption costing approach to cost-plus pricing described in the text. The pricing calculations are based on budgeted production and sales of 41,000 units per year. The company has invested $540,000 in this product and expects a return on investment of 13%.

The company uses the absorption costing approach to cost-plus pricing described in the text. The pricing calculations are based on budgeted production and sales of 41,000 units per year. The company has invested $540,000 in this product and expects a return on investment of 13%.

The selling price based on the absorption costing approach would be closest to:

A)$95.43

B)$72.31

C)$41.50

D)$70.60

The company uses the absorption costing approach to cost-plus pricing described in the text. The pricing calculations are based on budgeted production and sales of 41,000 units per year. The company has invested $540,000 in this product and expects a return on investment of 13%.

The company uses the absorption costing approach to cost-plus pricing described in the text. The pricing calculations are based on budgeted production and sales of 41,000 units per year. The company has invested $540,000 in this product and expects a return on investment of 13%.The selling price based on the absorption costing approach would be closest to:

A)$95.43

B)$72.31

C)$41.50

D)$70.60

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

22

Coan Company recently changed the selling price of one of its products. Data concerning sales for comparable periods before and after the price change are presented below.

The product's variable cost is $21.40 per unit.

-The product's profit-maximizing price according to the formula in the text is closest to:

A)$30.08

B)$70.54

C)$29.43

D)$32.55

The product's variable cost is $21.40 per unit.

-The product's profit-maximizing price according to the formula in the text is closest to:

A)$30.08

B)$70.54

C)$29.43

D)$32.55

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

23

A new product, an automated crepe maker, is being introduced at Laguna Corporation. At a selling price of $52 per unit, management projects sales of 90,000 units. Launching the crepe maker as a new product would require an investment of $200,000. The desired return on investment is 15%. The target cost per crepe maker is closest to:

A)$59.80

B)$52.00

C)$59.42

D)$51.67

A)$59.80

B)$52.00

C)$59.42

D)$51.67

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

24

Inkeo Company recently changed the selling price of one of its products. Data concerning sales for comparable periods before and after the price change are presented below. The product's variable cost is $12.70 per unit. According to the formula in the text, the product's profit-maximizing price is closest to:

A)$28.87

B)$28.53

C)$15.91

D)$29.91

A)$28.87

B)$28.53

C)$15.91

D)$29.91

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

25

Mahboud, Inc., uses the absorption costing approach to cost-plus pricing described in the text to set prices for its products. Based on budgeted sales of 64,000 units next year, the unit product cost of a particular product is $84.20. The company's selling and administrative expenses for this product are budgeted to be $1,292,800 in total for the year. The company has invested $560,000 in this product and expects a return on investment of 13%. The selling price for this product based on the absorption costing approach would be closest to:

A)$95.15

B)$130.86

C)$104.40

D)$105.54

A)$95.15

B)$130.86

C)$104.40

D)$105.54

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

26

Marvel Company estimates that the following costs and activity would be associated with the manufacture and sale of one unit of product Y:

If the company uses the absorption costing approach to cost-plus pricing described in the text and desires a 15% rate of return on investment (ROI), the required markup on absorption cost for product Y would be:

A)12%

B)15%

C)26%

D)38%

If the company uses the absorption costing approach to cost-plus pricing described in the text and desires a 15% rate of return on investment (ROI), the required markup on absorption cost for product Y would be:

A)12%

B)15%

C)26%

D)38%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

27

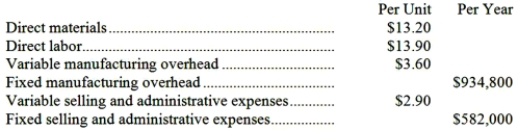

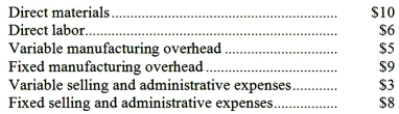

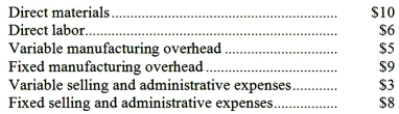

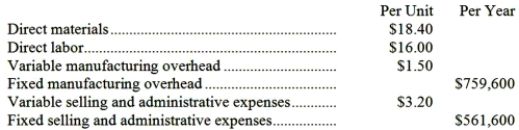

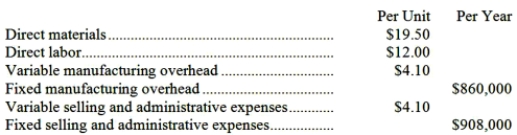

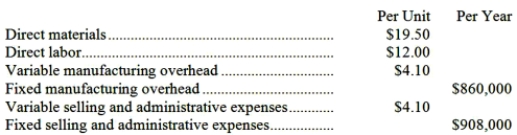

Jaber Corporation makes a product with the following costs:  The company uses the absorption costing approach to cost-plus pricing described in the text. The pricing calculations are based on budgeted production and sales of 52,000 units per year. The company has invested $200,000 in this product and expects a return on investment of 9%.

The company uses the absorption costing approach to cost-plus pricing described in the text. The pricing calculations are based on budgeted production and sales of 52,000 units per year. The company has invested $200,000 in this product and expects a return on investment of 9%.

The markup on absorption cost would be closest to:

A)37.7%

B)9.0%

C)110.8%

D)37.1%

The company uses the absorption costing approach to cost-plus pricing described in the text. The pricing calculations are based on budgeted production and sales of 52,000 units per year. The company has invested $200,000 in this product and expects a return on investment of 9%.

The company uses the absorption costing approach to cost-plus pricing described in the text. The pricing calculations are based on budgeted production and sales of 52,000 units per year. The company has invested $200,000 in this product and expects a return on investment of 9%.The markup on absorption cost would be closest to:

A)37.7%

B)9.0%

C)110.8%

D)37.1%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

28

Delsey Company manufactures product A which has a selling price of $48 per unit. Unit costs associated with the manufacture and sale of product A follow (based on 30,000 units manufactured and sold each year):  The company uses the absorption costing approach to cost-plus pricing described in the text. The percentage markup being used to determine the selling price for product A is closest to:

The company uses the absorption costing approach to cost-plus pricing described in the text. The percentage markup being used to determine the selling price for product A is closest to:

A)100.0%

B)37.5%

C)60.0%

D)40.0%

The company uses the absorption costing approach to cost-plus pricing described in the text. The percentage markup being used to determine the selling price for product A is closest to:

The company uses the absorption costing approach to cost-plus pricing described in the text. The percentage markup being used to determine the selling price for product A is closest to:A)100.0%

B)37.5%

C)60.0%

D)40.0%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

29

Lafave Corporation uses the absorption costing approach to cost-plus pricing described in the text to set prices for its products. Based on budgeted sales of 79,000 units next year, the unit product cost of a particular product is $50.80. The company's selling and administrative expenses for this product are budgeted to be $1,896,000 in total for the year. The company has invested $260,000 in this product and expects a return on investment of 15%. The markup on absorption cost for this product would be closest to:

A)62.2%

B)15.0%

C)47.2%

D)48.2%

A)62.2%

B)15.0%

C)47.2%

D)48.2%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

30

Perin Corporation would like to use target costing for a new product it is considering introducing. At a selling price of $25 per unit, management projects sales of 30,000 units. The new product would require an investment of $500,000. The desired return on investment is 11%. The target cost per unit is closest to:

A)$23.17

B)$25.00

C)$25.72

D)$27.75

A)$23.17

B)$25.00

C)$25.72

D)$27.75

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

31

The following information is available on Bruder Inc.'s Product A:

The company uses the absorption costing approach to cost-plus pricing described in the text. Based on these data, the total selling and administrative expenses each year are:

A)$240,000

B)$300,000

C)$140,000

D)$200,000

The company uses the absorption costing approach to cost-plus pricing described in the text. Based on these data, the total selling and administrative expenses each year are:

A)$240,000

B)$300,000

C)$140,000

D)$200,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

32

The product's price elasticity of demand as defined in the text is closest to:

A)-1.06

B)-1.96

C)-1.51

D)-1.81

A)-1.06

B)-1.96

C)-1.51

D)-1.81

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

33

Epperson Company's management believes that every 3% decrease in the selling price of one of the company's products leads to an 8% increase in the product's total unit sales. The product's price elasticity of demand as defined in the text is closest to:

A)-2.82

B)-2.98

C)-2.53

D)-2.03

A)-2.82

B)-2.98

C)-2.53

D)-2.03

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

34

Finnie Company's management believes that every 5% increase in the selling price of one of the company's products results in a 13% decrease in the product's total unit sales. The variable production cost of this product is $23.10 per unit and the variable selling and administrative cost is $5.40 per unit. The product's profit-maximizing price according to the formula in the text is closest to:

A)$32.03

B)$47.48

C)$43.87

D)$33.63

A)$32.03

B)$47.48

C)$43.87

D)$33.63

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

35

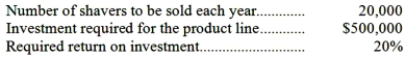

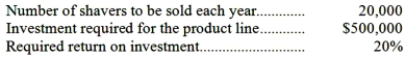

Penrod Company wants to manufacture and sell a new electric shaver. To compete effectively, the shaver would have to be priced at no more than $40 per unit. The following additional information is available:  The target cost per shaver would be:

The target cost per shaver would be:

A)$25

B)$45

C)$35

D)$40

The target cost per shaver would be:

The target cost per shaver would be:A)$25

B)$45

C)$35

D)$40

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

36

If every 10% increase in price leads to a 12% decrease in quantity sold, the profit-maximizing price is closest to:

A)$56.40

B)$130.10

C)$144.16

D)$134.03

A)$56.40

B)$130.10

C)$144.16

D)$134.03

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

37

Coan Company recently changed the selling price of one of its products. Data concerning sales for comparable periods before and after the price change are presented below.

The product's variable cost is $21.40 per unit.

-The product's price elasticity of demand as defined in the text is closest to:

A)-3.46

B)-3.67

C)-2.92

D)-1.44

The product's variable cost is $21.40 per unit.

-The product's price elasticity of demand as defined in the text is closest to:

A)-3.46

B)-3.67

C)-2.92

D)-1.44

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

38

The markup on absorption cost is closest to:

A)25.7%

B)13.0%

C)24.2%

D)72.4%

A)25.7%

B)13.0%

C)24.2%

D)72.4%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

39

The selling price based on the absorption costing approach is closest to:

A)$70.88

B)$41.60

C)$56.40

D)$57.06

A)$70.88

B)$41.60

C)$56.40

D)$57.06

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

40

The management of Kozloff Corporation is considering introducing a new product--a compact barbecue. At a selling price of $74 per unit, management projects sales of 80,000 units. Launching the barbecue as a new product would require an investment of $800,000. The desired return on investment is 14%. The target cost per barbecue is closest to:

A)$72.60

B)$82.76

C)$84.36

D)$74.00

A)$72.60

B)$82.76

C)$84.36

D)$74.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

41

The target cost per lawn blower is closest to:

A)$28.20

B)$23.50

C)$33.60

D)$28.00

A)$28.20

B)$23.50

C)$33.60

D)$28.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

42

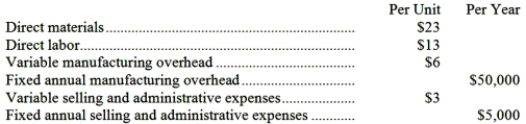

Qudsi Company makes a product that has the following costs:  The company uses the absorption costing approach to cost-plus pricing as described in the text. The pricing calculations are based on budgeted production and sales of 36,000 units per year.

The company uses the absorption costing approach to cost-plus pricing as described in the text. The pricing calculations are based on budgeted production and sales of 36,000 units per year.

The company has invested $580,000 in this product and expects a return on investment of 12%.

Required:

a. Compute the markup on absorption cost.

b. Compute the selling price of the product using the absorption costing approach.

c. Assume that every 10% increase in price leads to a 13% decrease in quantity sold. Assuming no change in cost structure and that direct labor is a variable cost, compute the profit-maximizing price.

The company uses the absorption costing approach to cost-plus pricing as described in the text. The pricing calculations are based on budgeted production and sales of 36,000 units per year.

The company uses the absorption costing approach to cost-plus pricing as described in the text. The pricing calculations are based on budgeted production and sales of 36,000 units per year.The company has invested $580,000 in this product and expects a return on investment of 12%.

Required:

a. Compute the markup on absorption cost.

b. Compute the selling price of the product using the absorption costing approach.

c. Assume that every 10% increase in price leads to a 13% decrease in quantity sold. Assuming no change in cost structure and that direct labor is a variable cost, compute the profit-maximizing price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

43

The desired profit according to the target costing calculations is:

A)$1,120,000

B)$224,000

C)$940,000

D)$180,000

A)$1,120,000

B)$224,000

C)$940,000

D)$180,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

44

Werry Company is about to introduce a new product. It is expected that the following costs would be incurred when 25,000 units are produced and sold in a year:

Werry Company uses the absorption costing approach to cost-plus pricing as described in the text.

-Assume that Werry Company has not yet determined a markup to use on the new product. The new product would require an investment of $800,000. The company requires a 20% rate of return on investment on all new products. The markup under the absorption costing approach would be closest to:

A)62.0%

B)80.0%

C)35.0%

D)24.6%

Werry Company uses the absorption costing approach to cost-plus pricing as described in the text.

-Assume that Werry Company has not yet determined a markup to use on the new product. The new product would require an investment of $800,000. The company requires a 20% rate of return on investment on all new products. The markup under the absorption costing approach would be closest to:

A)62.0%

B)80.0%

C)35.0%

D)24.6%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

45

The unit target selling price using the absorption costing approach is closest to:

A)$77

B)$116

C)$70

D)$96

A)$77

B)$116

C)$70

D)$96

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

46

The management of Heimrich Corporation would like to set the selling price on a new product using the absorption costing approach to cost-plus pricing. The company's accounting department has supplied the following estimates for the new product:  Management plans to produce and sell 5,000 units of the new product annually. The new product would require an investment of $420,000 and has a required return on investment of 20%.

Management plans to produce and sell 5,000 units of the new product annually. The new product would require an investment of $420,000 and has a required return on investment of 20%.

Required:

a. Determine the unit product cost for the new product.

b. Determine the markup percentage on absorption cost for the new product.

c. Determine the target selling price for the new product using the absorption costing approach.

Management plans to produce and sell 5,000 units of the new product annually. The new product would require an investment of $420,000 and has a required return on investment of 20%.

Management plans to produce and sell 5,000 units of the new product annually. The new product would require an investment of $420,000 and has a required return on investment of 20%.Required:

a. Determine the unit product cost for the new product.

b. Determine the markup percentage on absorption cost for the new product.

c. Determine the target selling price for the new product using the absorption costing approach.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

47

Werry Company is about to introduce a new product. It is expected that the following costs would be incurred when 25,000 units are produced and sold in a year:

Werry Company uses the absorption costing approach to cost-plus pricing as described in the text.

-Assume that the company uses a markup of 90% in order to determine selling prices. The selling price under the absorption costing approach would be:

A)$45.60

B)$38.00

C)$41.80

D)$49.40

Werry Company uses the absorption costing approach to cost-plus pricing as described in the text.

-Assume that the company uses a markup of 90% in order to determine selling prices. The selling price under the absorption costing approach would be:

A)$45.60

B)$38.00

C)$41.80

D)$49.40

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

48

The target cost per unit is closest to:

A)$22.00

B)$23.81

C)$21.45

D)$24.42

A)$22.00

B)$23.81

C)$21.45

D)$24.42

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

49

Pasta Corporation recently changed the selling price of one of its products. Data concerning sales for comparable periods before and after the price change are presented below.  The product's variable cost is $15.90 per unit.

The product's variable cost is $15.90 per unit.

Required:

a Compute the product's price elasticity of demand as defined in the text.

b. Compute the product's profit-maximizing price according to the formula in the text.

The product's variable cost is $15.90 per unit.

The product's variable cost is $15.90 per unit.Required:

a Compute the product's price elasticity of demand as defined in the text.

b. Compute the product's profit-maximizing price according to the formula in the text.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

50

The absorption costing unit product cost is:

A)$57

B)$64

C)$77

D)$53

A)$57

B)$64

C)$77

D)$53

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

51

Nicklos Corporation's marketing manager believes that every 7% decrease in the selling price of one of the company's products would lead to a 10% increase in the product's total unit sales. The product's absorption costing unit product cost is $18.60. The variable production cost is $7.60 per unit and the variable selling and administrative cost is $4.90.

Required:

a. Compute the product's price elasticity of demand as defined in the text.

b. Compute the product's profit-maximizing price according to the formula in the text.

Required:

a. Compute the product's price elasticity of demand as defined in the text.

b. Compute the product's profit-maximizing price according to the formula in the text.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

52

The product's price elasticity of demand as defined in the text is closest to:

A)-3.01

B)-2.07

C)-1.89

D)-2.59

A)-3.01

B)-2.07

C)-1.89

D)-2.59

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

53

Okano Company's management believes that every 5% increase in the selling price of one of the company's products would lead to a 7% decrease in the product's total unit sales. The variable cost per unit of this product is $47.00.

Required:

a. Compute the product's price elasticity of demand as defined in the text.

b. Compute the product's profit-maximizing price according to the formula in the text.

Required:

a. Compute the product's price elasticity of demand as defined in the text.

b. Compute the product's profit-maximizing price according to the formula in the text.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

54

The product's profit-maximizing price according to the formula in the text is closest to:

A)$12.96

B)$4.42

C)$17.37

D)$31.51

A)$12.96

B)$4.42

C)$17.37

D)$31.51

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

55

The product's profit-maximizing price according to the formula in the text is closest to:

A)$37.39

B)$31.44

C)$40.88

D)$28.91

A)$37.39

B)$31.44

C)$40.88

D)$28.91

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

56

The desired profit according to the target costing calculations is:

A)$33,000

B)$145,200

C)$1,287,000

D)$1,320,000

A)$33,000

B)$145,200

C)$1,287,000

D)$1,320,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

57

The selling price based on the absorption costing approach for this product would be closest to:

A)$27.59

B)$50.22

C)$48.40

D)$100.46

A)$27.59

B)$50.22

C)$48.40

D)$100.46

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

58

The markup on absorption cost for this product would be closest to:

A)100.0%

B)14.0%

C)114.0%

D)107.5%

A)100.0%

B)14.0%

C)114.0%

D)107.5%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

59

Werry Company is about to introduce a new product. It is expected that the following costs would be incurred when 25,000 units are produced and sold in a year:

Werry Company uses the absorption costing approach to cost-plus pricing as described in the text.

-After introducing the product at a markup of 90%, the company finds that it has excess capacity. A foreign dealer has offered to purchase 4,000 units of the product at a special price of $32 per unit. This sale would not disturb regular business. If the special price is accepted on the 4,000 units, the effect on total profits for the year will be a:

A)56,000 increase

B)76,800 increase

C)16,000 increase

D)48,000 increase

Werry Company uses the absorption costing approach to cost-plus pricing as described in the text.

-After introducing the product at a markup of 90%, the company finds that it has excess capacity. A foreign dealer has offered to purchase 4,000 units of the product at a special price of $32 per unit. This sale would not disturb regular business. If the special price is accepted on the 4,000 units, the effect on total profits for the year will be a:

A)56,000 increase

B)76,800 increase

C)16,000 increase

D)48,000 increase

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

60

To the nearest whole percent, the markup percentage on absorption cost is:

A)10%

B)30%

C)50%

D)20%

A)10%

B)30%

C)50%

D)20%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

61

Rizer Corporation manufactures a product that has the following costs:  The company uses the absorption costing approach to cost-plus pricing as described in the text. The pricing calculations are based on budgeted production and sales of 40,000 units per year.

The company uses the absorption costing approach to cost-plus pricing as described in the text. The pricing calculations are based on budgeted production and sales of 40,000 units per year.

The company has invested $200,000 in this product and expects a return on investment of 15%.

Required:

a. Compute the markup on absorption cost.

b. Compute the selling price of the product using the absorption costing approach.

The company uses the absorption costing approach to cost-plus pricing as described in the text. The pricing calculations are based on budgeted production and sales of 40,000 units per year.

The company uses the absorption costing approach to cost-plus pricing as described in the text. The pricing calculations are based on budgeted production and sales of 40,000 units per year.The company has invested $200,000 in this product and expects a return on investment of 15%.

Required:

a. Compute the markup on absorption cost.

b. Compute the selling price of the product using the absorption costing approach.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

62

Kupperson, Inc. is considering adding an inline roller skate to its product line. Management believes that in order to be competitive, the skate cannot be priced above $65 per pair. The company requires a minimum return of 25% on its investments. Launching the new product would require an investment of $4,000,000. Sales are expected to be 50,000 pairs of skates per year.

Required:

Compute the target cost of a pair of skates.

Required:

Compute the target cost of a pair of skates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

63

The management of Mendoza, Inc., is considering a new product that would have a selling price of $98 per unit and projected sales of 40,000 units. The new product would require an investment of $600,000. The desired return on investment is 10%.

Required:

Determine the target cost per unit for the new product.

Required:

Determine the target cost per unit for the new product.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

64

Management of Fabiano Corporation is considering a new product, an outdoor speaker that would have a selling price of $43 per unit and projected sales of 20,000 units. Launching the new product would require an investment of $600,000. The desired return on investment is 14%.

Required:

Determine the target cost per unit for the outdoor speaker.

Required:

Determine the target cost per unit for the outdoor speaker.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

65

Guzzetta Corporation would like to use target costing for a new product that is under consideration. At a selling price of $70 per unit, management projects sales of 40,000 units. The new product would require an investment of $700,000. The desired return on investment is 17%.

Required:

Determine the target cost per unit for the new product.

Required:

Determine the target cost per unit for the new product.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

66

Madonia Corporation is introducing a new product whose direct materials cost is $37 per unit, direct labor cost is $19 per unit, variable manufacturing overhead is $6 per unit, and variable selling and administrative expense is $4 per unit. The annual fixed manufacturing overhead associated with the product is $91,000 and its annual fixed selling and administrative expense is $42,000. Management plans to produce and sell 7,000 units of the new product annually. The new product would require an investment of $595,000 and has a required return on investment of 20%. Management would like to set the selling price on a new product using the absorption costing approach to cost-plus pricing.

Required:

a. Determine the unit product cost for the new product.

b. Determine the markup percentage on absorption cost for the new product.

c. Determine the target selling price for the new product using the absorption costing approach.

Required:

a. Determine the unit product cost for the new product.

b. Determine the markup percentage on absorption cost for the new product.

c. Determine the target selling price for the new product using the absorption costing approach.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

67

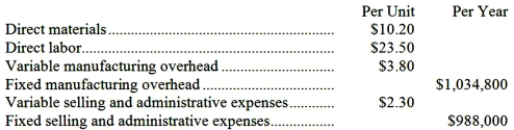

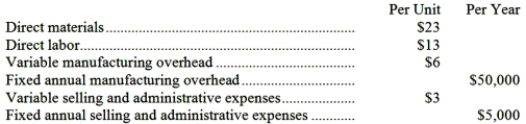

Mercer Company estimates that an investment of $800,000 would be necessary in order to produce and sell 40,000 units of Product A each year. Costs associated with the new product would be:  The company requires a 20% rate of return on the investment on all products.

The company requires a 20% rate of return on the investment on all products.

Required:

a. Compute the markup that would be used under the absorption costing approach to cost-plus pricing as described in the text.

b. Compute the selling price under the absorption costing approach to cost-plus pricing as described in the text.

The company requires a 20% rate of return on the investment on all products.

The company requires a 20% rate of return on the investment on all products.Required:

a. Compute the markup that would be used under the absorption costing approach to cost-plus pricing as described in the text.

b. Compute the selling price under the absorption costing approach to cost-plus pricing as described in the text.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck