Deck 9: Operating Activities

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/69

العب

ملء الشاشة (f)

Deck 9: Operating Activities

1

All of the following are considered by analysts when assessing the quality of accounting except:

A) Price variation and the speed at which inventory turns over

B) Any liquidation of FIFO inventory layers

C) Any physical deterioration or obsolescence of inventory

D) The inventory cost-flow assumption chosen by management

A) Price variation and the speed at which inventory turns over

B) Any liquidation of FIFO inventory layers

C) Any physical deterioration or obsolescence of inventory

D) The inventory cost-flow assumption chosen by management

B

2

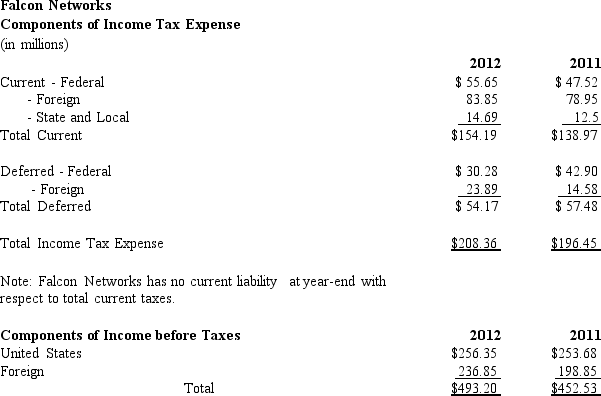

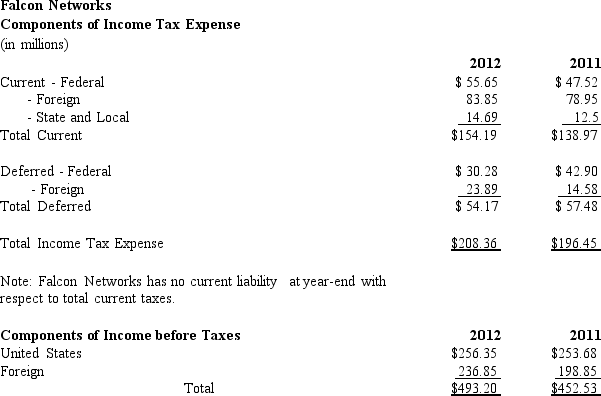

Falcon Networks

Falcon Networks is a leading semiconductor company with operations in 17 different countries.Information about the company's taxes appears below:

Based on the information provided by Falcon Networks how much cash did income taxes use during 2012?

A) $154.19 million

B) $54.17 million

C) $208.36 million

D) $284.84 million

Falcon Networks is a leading semiconductor company with operations in 17 different countries.Information about the company's taxes appears below:

Based on the information provided by Falcon Networks how much cash did income taxes use during 2012?

A) $154.19 million

B) $54.17 million

C) $208.36 million

D) $284.84 million

A

3

Analysts concerns with postretirement benefits include all of the following except:

A) Should the underfunded postretirement benefit obligation be added to liabilities in assessing risk?

B) How reasonable are the firms' assumptions regarding health care cost increases?

C) Is the postretirement benefit fund adequately paying benefits?

D) Is the postretirement benefit fund generating returns consistent with the expected rate of return?

A) Should the underfunded postretirement benefit obligation be added to liabilities in assessing risk?

B) How reasonable are the firms' assumptions regarding health care cost increases?

C) Is the postretirement benefit fund adequately paying benefits?

D) Is the postretirement benefit fund generating returns consistent with the expected rate of return?

C

4

All of the following are conditions for revenue recognition outlined by SAB 104 except:

A) There is pervasive evidence that an arrangement exists.

B) Delivery has occurred or services have been performed.

C) The seller's price to the buyer can be variable.

D) Collectability is reasonably assured.

A) There is pervasive evidence that an arrangement exists.

B) Delivery has occurred or services have been performed.

C) The seller's price to the buyer can be variable.

D) Collectability is reasonably assured.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

5

The accumulated benefit obligation measures:

A) the pension obligation on the basis of the plan formula applied to years of service to date and based on existing salary levels.

B) an estimated total benefit at retirement and then computes the level cost that will be sufficient,together with interest expected to accumulate at the assumed rate,to provide the total benefits at retirement.

C) the pension obligation on the basis of the plan formula applied to years of service to date and based on future salary levels.

D) the shortest possible period for funding to maximize the tax deduction.

A) the pension obligation on the basis of the plan formula applied to years of service to date and based on existing salary levels.

B) an estimated total benefit at retirement and then computes the level cost that will be sufficient,together with interest expected to accumulate at the assumed rate,to provide the total benefits at retirement.

C) the pension obligation on the basis of the plan formula applied to years of service to date and based on future salary levels.

D) the shortest possible period for funding to maximize the tax deduction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

6

A minimum liability for pension expense is reported when:

A) the projected benefit obligation exceeds the fair value of pension plan assets.

B) the pension expense reported for the period is greater than the funding amount for the same period.

C) the accumulated benefit obligation exceeds the fair value of pension plan assets.

D) vested benefits exceed the fair value of pension plan assets.

A) the projected benefit obligation exceeds the fair value of pension plan assets.

B) the pension expense reported for the period is greater than the funding amount for the same period.

C) the accumulated benefit obligation exceeds the fair value of pension plan assets.

D) vested benefits exceed the fair value of pension plan assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

7

Using the information provided by Falcon Networks,determine the foreign effective tax rate for 2012.

A) 33.52%

B) 35.00%

C) 42.25%

D) 45.49%

A) 33.52%

B) 35.00%

C) 42.25%

D) 45.49%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

8

Using the information provided by Falcon Networks determine the combined effective tax rate for 2012.

A) 33.52%

B) 35.00%

C) 42.25%

D) 45.49%

A) 33.52%

B) 35.00%

C) 42.25%

D) 45.49%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

9

To calculate a company's average tax rate an analyst would:

A) Divide income tax payable by income before taxes

B) Divide income tax expense by income before taxes

C) Multiply the statutory income tax rate by income before tax

D) Average a firm's Federal,State,Local and Foreign tax rates.

A) Divide income tax payable by income before taxes

B) Divide income tax expense by income before taxes

C) Multiply the statutory income tax rate by income before tax

D) Average a firm's Federal,State,Local and Foreign tax rates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

10

Which of the following accounts would not be considered a reserve account?

A) Allowance for Doubtful Accounts

B) Estimated Warranty Liability

C) Prepaid Expense

D) Accumulated Depreciation

A) Allowance for Doubtful Accounts

B) Estimated Warranty Liability

C) Prepaid Expense

D) Accumulated Depreciation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

11

Which of the following calculations is used to determine the amount of the liability reported on the balance sheet for underfunding?

A) Plan assets less projected benefit obligation.

B) Projected benefit obligation less plan assets.

C) Plan assets less accumulated benefit obligation.

D) Accumulated benefit obligation less plan assets.

A) Plan assets less projected benefit obligation.

B) Projected benefit obligation less plan assets.

C) Plan assets less accumulated benefit obligation.

D) Accumulated benefit obligation less plan assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

12

The projected benefit obligation measures:

A) the pension obligation on the basis of the plan formula applied to years of service to date and based on existing salary levels.

B) an estimated total benefit at retirement and then computes the level cost that will be sufficient,together with interest expected to accumulate at the assumed rate,to provide the total benefits at retirement.

C) the pension obligation on the basis of the plan formula applied to years of service to date and based on future salary levels.

D) the shortest possible period for funding to maximize the tax deduction.

A) the pension obligation on the basis of the plan formula applied to years of service to date and based on existing salary levels.

B) an estimated total benefit at retirement and then computes the level cost that will be sufficient,together with interest expected to accumulate at the assumed rate,to provide the total benefits at retirement.

C) the pension obligation on the basis of the plan formula applied to years of service to date and based on future salary levels.

D) the shortest possible period for funding to maximize the tax deduction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

13

The major difference between accounting for pensions and the accounting for other postretirement benefits is that firms:

A) do not need to report an excess of the accumulated benefits obligations over assets in a postretirement benefits fund as a liability on the balance sheet.

B) do not need to disclose any estimates used in calculating projected benefits.

C) postretirement benefits are normally not material for most companies and do not need to be disclosed.

D) do not need to set aside funds for future postretirement benefits as they do for pension benefits.

A) do not need to report an excess of the accumulated benefits obligations over assets in a postretirement benefits fund as a liability on the balance sheet.

B) do not need to disclose any estimates used in calculating projected benefits.

C) postretirement benefits are normally not material for most companies and do not need to be disclosed.

D) do not need to set aside funds for future postretirement benefits as they do for pension benefits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

14

Which of the following statements best describes the difference between U.S.GAAP and IFRS with respect to revenue recognition?

A) IFRS has a substantial amount of industry specific guidance for revenue recognition.

B) IFRS revenue recognition is not consistent with U.S.GAAP in principle.

C) There are subtle differences in the wording of U.S.GAAP as compared with IFRS.

D) IFRS has four criteria and U.S.GAAP has five conditions for revenue recognition.

A) IFRS has a substantial amount of industry specific guidance for revenue recognition.

B) IFRS revenue recognition is not consistent with U.S.GAAP in principle.

C) There are subtle differences in the wording of U.S.GAAP as compared with IFRS.

D) IFRS has four criteria and U.S.GAAP has five conditions for revenue recognition.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

15

All of the following conditions signal that revenue recognition may have been recorded too early except:

A) large and volatile amounts of uncollectible accounts receivable.

B) a decrease in the number of days accounts receivable are outstanding.

C) unusually large amounts of returned goods.

D) excessive warranty expenditures.

A) large and volatile amounts of uncollectible accounts receivable.

B) a decrease in the number of days accounts receivable are outstanding.

C) unusually large amounts of returned goods.

D) excessive warranty expenditures.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

16

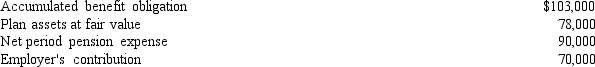

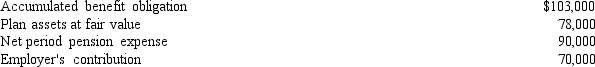

Gorilla,Corp.implemented a defined-benefit pension plan for its employees on January 2,2012.The following data are provided for year 2012,as of December 31:  What amount should Gorilla record as additional minimum pension liability at December 31,2012?

What amount should Gorilla record as additional minimum pension liability at December 31,2012?

A) $0

B) $5,000

C) $20,000

D) $45,000

What amount should Gorilla record as additional minimum pension liability at December 31,2012?

What amount should Gorilla record as additional minimum pension liability at December 31,2012?A) $0

B) $5,000

C) $20,000

D) $45,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

17

Which of the following will most likely help identify an increasing proportion of uncollectible sales?

A) accounts receivable turnover

B) the ratio of bad debt expense to sales

C) the ratio of sales returns to sales

D) the ratio of cost of sales to sales

A) accounts receivable turnover

B) the ratio of bad debt expense to sales

C) the ratio of sales returns to sales

D) the ratio of cost of sales to sales

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

18

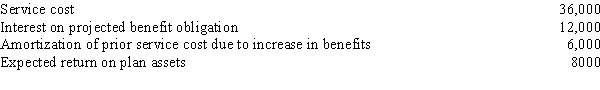

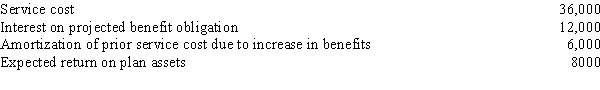

Presented below is pension information related to Roberts Corp.for the year 2012:  The amount of pension expense to be reported for 2012 is:

The amount of pension expense to be reported for 2012 is:

A) $46,000

B) $48,000

C) $54,000

D) $40,000

The amount of pension expense to be reported for 2012 is:

The amount of pension expense to be reported for 2012 is:A) $46,000

B) $48,000

C) $54,000

D) $40,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

19

Using the information provided by Falcon Networks,determine the federal effective tax rate for 2012.

A) 33.52%

B) 35.00%

C) 42.25%

D) 45.49%

A) 33.52%

B) 35.00%

C) 42.25%

D) 45.49%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

20

All of the following are true regarding accrual accounting except:

A) Accrual basis measures operating success by the extent to which accomplishments exceed efforts.

B) Accrual basis measures operating success by the extent to which revenues exceed expenses.

C) Accrual basis reports operating activities in terms of their success in generating value.

D) Accrual basis for the recognition of expenses is not required under IFRS.

A) Accrual basis measures operating success by the extent to which accomplishments exceed efforts.

B) Accrual basis measures operating success by the extent to which revenues exceed expenses.

C) Accrual basis reports operating activities in terms of their success in generating value.

D) Accrual basis for the recognition of expenses is not required under IFRS.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

21

All of the following are most likely to change the FMV of pension plan assets during a given period except:

A) Employer cash payments are made to the plan trustee.

B) Changes in Internal Revenue Service regulations for future tax deductible amounts of contributions.

C) Actual returns on invested plan assets.

D) Retirement benefits paid.

A) Employer cash payments are made to the plan trustee.

B) Changes in Internal Revenue Service regulations for future tax deductible amounts of contributions.

C) Actual returns on invested plan assets.

D) Retirement benefits paid.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

22

All of the following are events that can change the projected benefit obligation (PBO)during a period except:

A) The payment of retirement benefits.

B) Amendments to the pension plan agreement

C) The interest accumulated on the liability.

D) All of these can change the PBO.

A) The payment of retirement benefits.

B) Amendments to the pension plan agreement

C) The interest accumulated on the liability.

D) All of these can change the PBO.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

23

Dividing a company's income tax expense by its book income before income taxes provides the company's ___________________________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

24

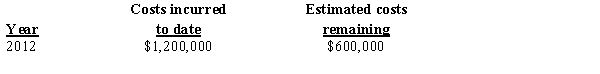

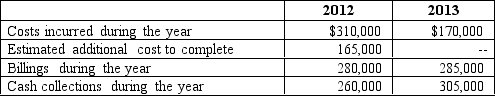

Playtime Corporation

Assume that Playtime Corp.has agreed to construct a new playground for Surrey County for $2,450,000.Construction of the new playground will begin on March 17,2012 and is expected to be completed in August 2013.At the signing of the contract Playtime Corp.estimates that it will cost $1,750,000 to build the playground.

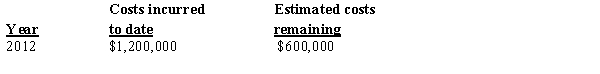

At the end of 2012 Playtime provided the following information about the project: What percentage is the playground complete?

What percentage is the playground complete?

A) 62.5%

B) 66.7%

C) 55.6%

D) 50.0%

Assume that Playtime Corp.has agreed to construct a new playground for Surrey County for $2,450,000.Construction of the new playground will begin on March 17,2012 and is expected to be completed in August 2013.At the signing of the contract Playtime Corp.estimates that it will cost $1,750,000 to build the playground.

At the end of 2012 Playtime provided the following information about the project:

What percentage is the playground complete?

What percentage is the playground complete?A) 62.5%

B) 66.7%

C) 55.6%

D) 50.0%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

25

Deferred tax liabilities result in future tax ____________________ when temporary differences reverse.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

26

An inventory pricing procedure in which the current costs have a direct impact on the inventory is:

A) FIFO

B) LIFO

C) Base stock

D) Weighted-average

A) FIFO

B) LIFO

C) Base stock

D) Weighted-average

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

27

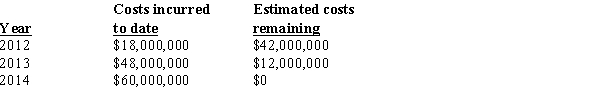

Upton Company has consistently used the percentage-of- method of recognizing income.In 2010,Upton started on an $18,000,000 construction contract that was completed in 2012.The following information was taken from Upton's 2010 accounting records:  What amount of revenue should Upton recognize on the contract in 2010?

What amount of revenue should Upton recognize on the contract in 2010?

A) $6,000,000

B) $5,400,000

C) $9,000,000

D) $0

What amount of revenue should Upton recognize on the contract in 2010?

What amount of revenue should Upton recognize on the contract in 2010?A) $6,000,000

B) $5,400,000

C) $9,000,000

D) $0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

28

Under the completed contract method:

A) revenue and cost are recognized during the production cycle,but gross profit recognition is deferred until the contract is completed.

B) revenue,cost,and gross profit are recognized during the production cycle.

C) revenue,cost,and gross profit are recognized at the time the contract is completed.

D) None of these are correct.

A) revenue and cost are recognized during the production cycle,but gross profit recognition is deferred until the contract is completed.

B) revenue,cost,and gross profit are recognized during the production cycle.

C) revenue,cost,and gross profit are recognized at the time the contract is completed.

D) None of these are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

29

Regarding actuarial assumptions,firms must disclose in notes to the financial statements all of the following except:

A) the discount rate used to compute the pension benefit obligation.

B) the expected rate of return on pension investments.

C) estimates of the number of retirees over the future 10 years.

D) the rate of compensation increase.

A) the discount rate used to compute the pension benefit obligation.

B) the expected rate of return on pension investments.

C) estimates of the number of retirees over the future 10 years.

D) the rate of compensation increase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

30

If the portions of the firm's foreign operations in higher-tax-rate countries grew more rapidly than foreign operations in lower-tax-rate countries,the company may seek out more tax effective ways of operating abroad through all of the following means except:

A) Assess whether transfer prices or cost allocations can be adjusted to shift income

From high-tax-rate to low-tax-rate jurisdictions.

B) Shift from domestic to foreign borrowing to increase deductions for interest against

Foreign-source income.

C) Shift from debt to equity financing of foreign operations to increase interest deductions

Against foreign-source income.

D) Shift some operations,like marketing,to the United States where the average tax rate is lower.

A) Assess whether transfer prices or cost allocations can be adjusted to shift income

From high-tax-rate to low-tax-rate jurisdictions.

B) Shift from domestic to foreign borrowing to increase deductions for interest against

Foreign-source income.

C) Shift from debt to equity financing of foreign operations to increase interest deductions

Against foreign-source income.

D) Shift some operations,like marketing,to the United States where the average tax rate is lower.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

31

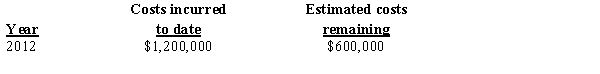

Playtime Corporation

Assume that Playtime Corp.has agreed to construct a new playground for Surrey County for $2,450,000.Construction of the new playground will begin on March 17,2012 and is expected to be completed in August 2013.At the signing of the contract Playtime Corp.estimates that it will cost $1,750,000 to build the playground.

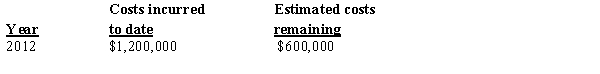

At the end of 2012 Playtime provided the following information about the project: If Playtime uses the percentage of to recognize revenue on the long-term contract,how much gross margin should Playtime recognize in 2012?

If Playtime uses the percentage of to recognize revenue on the long-term contract,how much gross margin should Playtime recognize in 2012?

A) $389,200

B) $278,000

C) $556,000

D) $433,550

Assume that Playtime Corp.has agreed to construct a new playground for Surrey County for $2,450,000.Construction of the new playground will begin on March 17,2012 and is expected to be completed in August 2013.At the signing of the contract Playtime Corp.estimates that it will cost $1,750,000 to build the playground.

At the end of 2012 Playtime provided the following information about the project:

If Playtime uses the percentage of to recognize revenue on the long-term contract,how much gross margin should Playtime recognize in 2012?

If Playtime uses the percentage of to recognize revenue on the long-term contract,how much gross margin should Playtime recognize in 2012?A) $389,200

B) $278,000

C) $556,000

D) $433,550

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

32

Which of the following is not a disclosure for derivatives required under SFAS No.133?

A) Firms must describe their risk management strategy and how particular derivatives

Help accomplish their hedging objectives.

B) For fair value and cash flow hedges,firms must disclose the net gain or loss recognized

In earnings resulting from the hedges' ineffectiveness and the line item on the income statement that includes this net gain or loss.

C) For cash flow hedges,firms must describe the transactions or events that will result

In reclassifying gains and losses from other comprehensive income to net income

And the estimated amount of such reclassifications during the next 12 months.

D) The specifics of a model that simulates with a 95 percent or other confidence level the minimum,maximum,or average amount of loss that a firm would incur.

A) Firms must describe their risk management strategy and how particular derivatives

Help accomplish their hedging objectives.

B) For fair value and cash flow hedges,firms must disclose the net gain or loss recognized

In earnings resulting from the hedges' ineffectiveness and the line item on the income statement that includes this net gain or loss.

C) For cash flow hedges,firms must describe the transactions or events that will result

In reclassifying gains and losses from other comprehensive income to net income

And the estimated amount of such reclassifications during the next 12 months.

D) The specifics of a model that simulates with a 95 percent or other confidence level the minimum,maximum,or average amount of loss that a firm would incur.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

33

The _____________________________________________ is equal to the actuarial present value of amounts that the employer expects to pay to retired employees,based on the employees' service to date and using expected future salary amounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

34

Typical U.S.GAAP disclosures for deferred income taxes include all of the following except:

A) Components of income tax expense

B) Components of income before taxes

C) Reconciliation of income taxes at statutory rate with income tax expense

D) Components of permanent tax differences

A) Components of income tax expense

B) Components of income before taxes

C) Reconciliation of income taxes at statutory rate with income tax expense

D) Components of permanent tax differences

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

35

A typical defined benefit pension plan formula includes all of the following except:

A) the number of years of employee service

B) the fair market value of pension plan assets

C) a credit for each year of annual service

D) the final salary at retirement date

A) the number of years of employee service

B) the fair market value of pension plan assets

C) a credit for each year of annual service

D) the final salary at retirement date

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

36

Which of the following is not part of the balance sheet approach when computing income tax expense?

A) Identifying at each balance sheet date all differences between the book basis of assets,liabilities,and tax loss carryforwards

B) Eliminating permanent differences between book and tax basis.

C) Eliminating deferred tax assets.

D) Assessing the likelihood that the firm will realize the benefits of deferred tax assets in

The future.

A) Identifying at each balance sheet date all differences between the book basis of assets,liabilities,and tax loss carryforwards

B) Eliminating permanent differences between book and tax basis.

C) Eliminating deferred tax assets.

D) Assessing the likelihood that the firm will realize the benefits of deferred tax assets in

The future.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

37

Which of the following would not be suggestive of a company recognizing sales too early?

A) large and volatile amounts of uncollectible accounts receivable

B) excessive warranty expenditures

C) large growth in accounts receivable

D) unusually large amount of returned goods

A) large and volatile amounts of uncollectible accounts receivable

B) excessive warranty expenditures

C) large growth in accounts receivable

D) unusually large amount of returned goods

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

38

Deferred tax assets result in future tax ____________________ when temporary differences reverse.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

39

When input prices are increasing,companies that use the LIFO method of accounting for inventory will report:

A) Lower cost of goods sold amounts in comparison to the FIFO method

B) Higher sales amounts in comparison to the FIFO method

C) Higher ending inventory amounts in comparison to the FIFO method

D) Lower gross profit margins in comparison to the FIFO method

A) Lower cost of goods sold amounts in comparison to the FIFO method

B) Higher sales amounts in comparison to the FIFO method

C) Higher ending inventory amounts in comparison to the FIFO method

D) Lower gross profit margins in comparison to the FIFO method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

40

A LIFO liquidation during periods when prices are increasing results in a company:

A) recording a large inventory write down.

B) recording higher earnings than it would have if it had used FIFO.

C) recording lower earnings than it would have if it had used FIFO.

D) having operational s,but no financial statement effects.

A) recording a large inventory write down.

B) recording higher earnings than it would have if it had used FIFO.

C) recording lower earnings than it would have if it had used FIFO.

D) having operational s,but no financial statement effects.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

41

A company that uses FIFO will find that its ___________________________________ account tends to be somewhat out of date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

42

A contractor would not use ________________________________________ method of income recognition when there is substantial uncertainty regarding the total costs it will incur in completing the project.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

43

Income tax expense consists of two components,the ____________________ portion and the ____________________ portion.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

44

U.S.GAAP requires firms to report the assets and liabilities of defined benefit plans _______________________________________________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

45

Recording municipal bond interest received in the general ledger will generate a(n)_________________ difference

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

46

A company that uses LIFO will find that its ______________________________ account will be somewhat out of date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

47

Assume that Madison Corp.has agreed to construct a new basketball arena for Gator Town for $70 million dollars.Construction of the new arena begins in July,2012 and is expected to be completed in March 2009.At the signing of the contract Madison Corp.estimates that the new arena will cost $60 million dollars to build.Given the following cost and building schedule determine the cumulative degree of and how much revenue and gross margin Madison Corp.should recognize in years 2012,2013 and 2014.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

48

___________________________________ is primarily a question of timing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

49

____________________ differences result from including revenues and expenses in income before taxes in a different period than those items affect taxable income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

50

One sign that a company may be recognizing sales too early is that it has unusually large amounts of ______________________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

51

Companies that engage in long-term contracts can recognize income using either the _____________________________________________ method or the ________________________________________ method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

52

The difference between the economic resources received from customers and the economic resources paid to suppliers,employees and other providers of goods and services is called ____________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

53

A company may try to paint a favorable picture of itself by accelerating the timing of revenues or estimating the collectible amounts too aggressively.In these cases the quality of accounting information declines because it does not represent the company's true economic condition and may not be sustainable.List four conditions that might suggest that a company is recognizing revenues too early?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

54

Under the accrual method of accounting,when a firm has substantially completed its value-adding activities it should recognize ____________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

55

The statement of cash flows allows the accountant to agree the net cash provided to the _________________________ general ledger

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

56

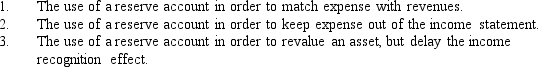

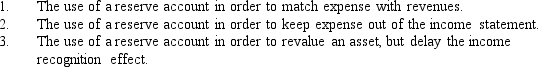

Accountants use reserve accounts for various reasons,for each of the scenarios below describe a specific account example that matches the scenario.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

57

Although LIFO generally provides higher quality earnings measures,FIFO generally provides higher _____________________________________________ measures.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

58

Differences between income before taxes and taxable income are either ____________________ or ____________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

59

The process of allocating the historical cost of certain assets to the periods of their use in a reasonably systematic manner is referred to as ____________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

60

A company that uses LIFO will experience a(n)______________________________ during a period it sells more units than it purchases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

61

What are the four disclosures required by U.S.GAAP relating to income taxes?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

62

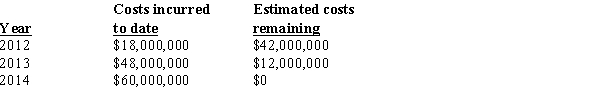

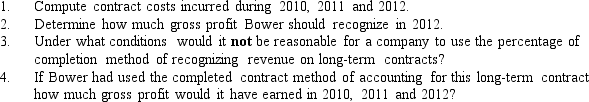

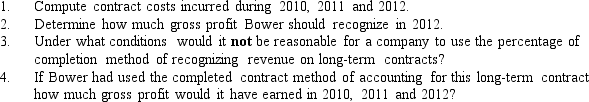

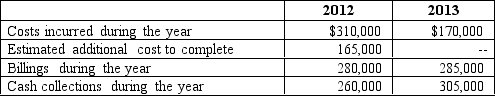

Bower Construction Comp.has consistently used the percentage-of- method for recognizing revenue on its long-term contracts.During 2010 Bower entered into a fixed-price contract to construct an office building for $8,000,000.Information relating to the contract is as follows:  Required (Show Calculations):

Required (Show Calculations):

Required (Show Calculations):

Required (Show Calculations):

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

63

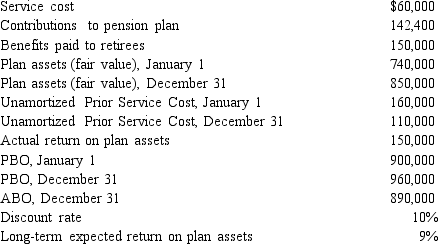

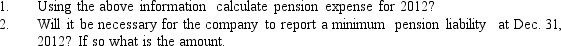

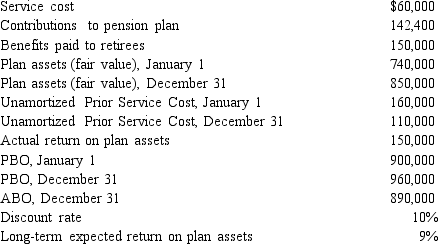

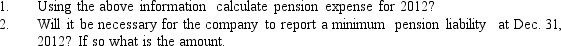

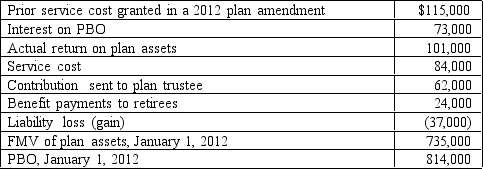

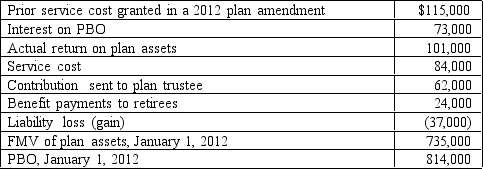

The following information is related to the defined benefit pension plan of Xavier Company for 2012:

Required:

Required:

Required:

Required:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

64

Magnum Construction contracted to construct a factory building for $545,000.The company started during 2012 and was completed in 2013.Information relating to the contract is as follows:

Required:

Required:

Record the preceding transactions in Magnum's books under completed-contract and the percentage of methods.Determine amounts that will be reported on the balance sheet at the end of 2012.

Required:

Required:Record the preceding transactions in Magnum's books under completed-contract and the percentage of methods.Determine amounts that will be reported on the balance sheet at the end of 2012.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

65

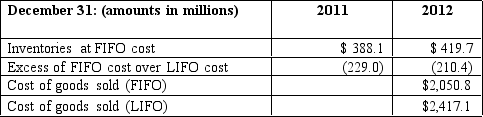

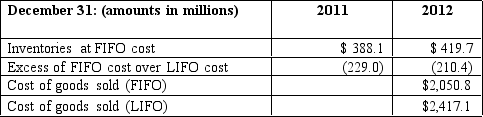

A large manufacturer recently changed its cost-flow assumption method for inventories at the beginning of 2012.The manufacturer has been in operation for almost 40 years,and for the last decade,it has reported moderate growth in revenues.The firm changed from the LIFO method to the FIFO method and reported the following information:

Calculate the inventory turnover ratio for 2012 using the LIFO and FIFO cost-flow assumption methods.Explain why the costs assigned to inventory under LIFO at the end of 2011 and 2012 are so much less than they are under FIFO.

Calculate the inventory turnover ratio for 2012 using the LIFO and FIFO cost-flow assumption methods.Explain why the costs assigned to inventory under LIFO at the end of 2011 and 2012 are so much less than they are under FIFO.

Calculate the inventory turnover ratio for 2012 using the LIFO and FIFO cost-flow assumption methods.Explain why the costs assigned to inventory under LIFO at the end of 2011 and 2012 are so much less than they are under FIFO.

Calculate the inventory turnover ratio for 2012 using the LIFO and FIFO cost-flow assumption methods.Explain why the costs assigned to inventory under LIFO at the end of 2011 and 2012 are so much less than they are under FIFO.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

66

Explain the difference between a temporary and a permanent timing difference for income tax purposes"

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

67

Under U.S.GAAP,application of the LIFO and FIFO inventory methods result in differences in the balance sheet,income statement and cash flow statement.Compare and contrast the effect of the two methods on each financial statement and determine the advantages and disadvantages of each method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

68

What are the five steps to apply the core principles of revenue recognition?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

69

Given the following information,compute December 31,2012 projected benefit obligation (PBO)and fair market value (FMV)of plan assets for Eagan Company.

What amount of asset or liability will be reported on the balance sheet at December 31,2012?

What amount of asset or liability will be reported on the balance sheet at December 31,2012?

What amount of asset or liability will be reported on the balance sheet at December 31,2012?

What amount of asset or liability will be reported on the balance sheet at December 31,2012?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck