Deck 3: Income Flows Versus Cash Flows: Understanding the Statement of Cash Flows

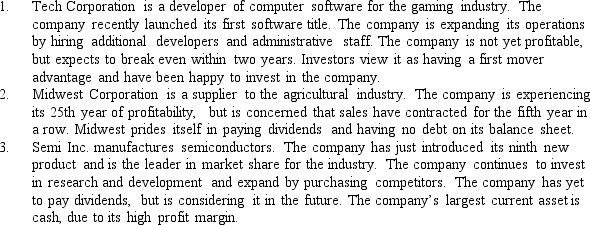

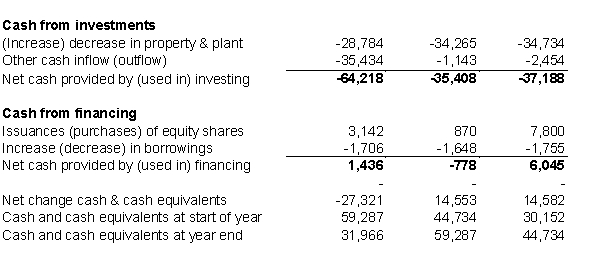

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

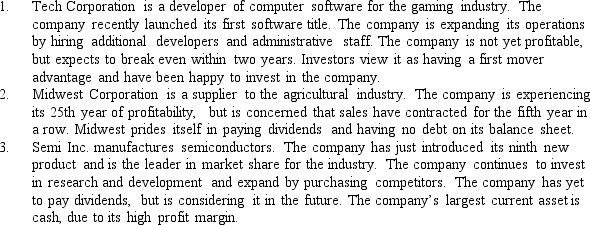

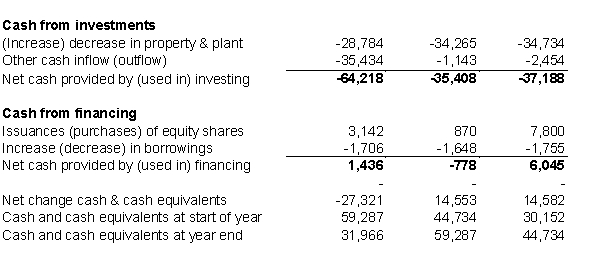

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/81

العب

ملء الشاشة (f)

Deck 3: Income Flows Versus Cash Flows: Understanding the Statement of Cash Flows

1

An example of an item that is deducted from net income when preparing the operating activities section of the statement of cash using the indirect method is:

A) depreciation expense.

B) compensation expense related to stock option plans.

C) income from an investment accounted for using the equity method.

D) unrealized losses on trading investments

A) depreciation expense.

B) compensation expense related to stock option plans.

C) income from an investment accounted for using the equity method.

D) unrealized losses on trading investments

C

2

In a statement of cash flows,interest received from sources other than a company's investments would be classified as cash inflows from:

A) lending activities.

B) operating activities.

C) investing activities.

D) financing activities.

A) lending activities.

B) operating activities.

C) investing activities.

D) financing activities.

B

3

When preparing the statement of cash flows using the indirect method,an increase in accounts payable would appear as:

A) a decrease in the operating activities section

B) an increase in the operating activities section

C) a use of cash in the investing activities section

D) a source of cash in the investing activities section

A) a decrease in the operating activities section

B) an increase in the operating activities section

C) a use of cash in the investing activities section

D) a source of cash in the investing activities section

B

4

Toro Company recognized $655,000 of cost of goods sold in 2010,in addition its implementation of a just-in-time inventory system allowed it to reduce its inventory from $325,000 at the beginning of the year to $230,000 at the end of 2010.How much cash did Toro spend for inventory in 2010?

A) $655,000

B) $980,000

C) $560,000

D) $620,000

A) $655,000

B) $980,000

C) $560,000

D) $620,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

5

Free cash flows to all debt and common equity shareholders represents the excess of cash flows from:

A) operating activities over cash flows for financing activities

B) investing over cash flows for operating activities

C) investing over cash flows for financing activities

D) operating activities over cash flows for investing activities

A) operating activities over cash flows for financing activities

B) investing over cash flows for operating activities

C) investing over cash flows for financing activities

D) operating activities over cash flows for investing activities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

6

Fizzzle Inc.sold a piece of equipment during the period for $230,000 and recorded a gain of $45,000 on the sale.How should this gain be treated when preparing the operating activities section of the statement of cash flows using the indirect method?

A) A sale of equipment is an investing activity;the transaction will not affect the operating activities section.

B) The gain is added back to net income in the operating activities section.

C) The gain is subtracted from net income in the operating activities section.

D) The entire sales price is subtracted from net income in the operating activities section.

A) A sale of equipment is an investing activity;the transaction will not affect the operating activities section.

B) The gain is added back to net income in the operating activities section.

C) The gain is subtracted from net income in the operating activities section.

D) The entire sales price is subtracted from net income in the operating activities section.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

7

Which of the following is not one of the reasons why net income differs from cash flows from operations under the indirect method of calculating cash flows?

A) non-cash items,such as depreciation and amortization

B) changes in working capital accounts

C) gains and losses related to the sale of plant,property and equipment

D) sale or repurchase of capital stock

A) non-cash items,such as depreciation and amortization

B) changes in working capital accounts

C) gains and losses related to the sale of plant,property and equipment

D) sale or repurchase of capital stock

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

8

Normally,cash flows from operations will peak during which phase of the product life cycle?

A) Introduction

B) Growth

C) Maturity

D) Decline

A) Introduction

B) Growth

C) Maturity

D) Decline

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

9

Outback Corp.recorded sales of $1,300,000 in 2010,in addition the company's accounts receivable balance grew from $120,000 at the beginning of 2010 to $165,000 at the end of 2010.How much cash did Outback collect from customers in 2010?

A) $1,300,000

B) $1,345,000

C) $1,255,000

D) $1,135,000

A) $1,300,000

B) $1,345,000

C) $1,255,000

D) $1,135,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

10

If a firm is growing and expanding its accounts receivable and inventories faster than its current operating liabilities its cash flow from operation will normally be:

A) greater than net income

B) less than net income

C) greater than the change in working capital from operations

D) greater than the change in cash

A) greater than net income

B) less than net income

C) greater than the change in working capital from operations

D) greater than the change in cash

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

11

When preparing the statement of cash flows using the indirect method,the payment of dividends would appear as:

A) a decrease in the operating activities section

B) an increase in the operating activities section

C) a use of cash in the financing activities section

D) a source of cash in the financing activities section

A) a decrease in the operating activities section

B) an increase in the operating activities section

C) a use of cash in the financing activities section

D) a source of cash in the financing activities section

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

12

Which of the following is an adjustment that would need to be made to net income when calculating cash flows from operations under the indirect method?

A) Subtract amortization expense

B) subtract gain on sale of subsidiary

C) add an increase in accounts receivable

D) add a decrease in accounts payable

A) Subtract amortization expense

B) subtract gain on sale of subsidiary

C) add an increase in accounts receivable

D) add a decrease in accounts payable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

13

Normally,cash flows from investing activities will start providing cash during which phase of the product life cycle?

A) Introduction

B) Growth

C) Maturity

D) Decline

A) Introduction

B) Growth

C) Maturity

D) Decline

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

14

Firms with short operating cycles will experience less of a lag between the creation and delivery of their products and the collection of cash from customers because:

A) their cash flow from operations will be much greater than their working capital from operations.

B) their cash flow from operations will not differ much from their working capital from operations.

C) their cash flow from operations will be much less than their working capital from operations.

D) there will be no relation between their cash flow from operations and working capital from operations.

A) their cash flow from operations will be much greater than their working capital from operations.

B) their cash flow from operations will not differ much from their working capital from operations.

C) their cash flow from operations will be much less than their working capital from operations.

D) there will be no relation between their cash flow from operations and working capital from operations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

15

When preparing the statement of cash flows using the indirect method,an increase in inventories would appear as:

A) a decrease in the operating activities section

B) an increase in the operating activities section

C) a use of cash in the investing activities section

D) a source of cash in the investing activities section

A) a decrease in the operating activities section

B) an increase in the operating activities section

C) a use of cash in the investing activities section

D) a source of cash in the investing activities section

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

16

Which of the following is the correct formula for calculating cash collections from customers?

A) sales for the period plus accounts receivable at the beginning of the period

B) sales for the period plus accounts receivable at the beginning of the period minus accounts receivable at the end of the period

C) sales for the period plus accounts receivable at the end of the period

D) sales for the period plus accounts receivable at the end of the period minus accounts receivable at the beginning of the period

A) sales for the period plus accounts receivable at the beginning of the period

B) sales for the period plus accounts receivable at the beginning of the period minus accounts receivable at the end of the period

C) sales for the period plus accounts receivable at the end of the period

D) sales for the period plus accounts receivable at the end of the period minus accounts receivable at the beginning of the period

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

17

Normally,cash flows from financing will start using cash during which phase of the product life cycle?

A) Introduction

B) Growth

C) Maturity

D) Decline

A) Introduction

B) Growth

C) Maturity

D) Decline

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

18

When preparing the statement of cash flows using the indirect method,the sale of marketable securities would appear as:

A) a use of cash in the investing activities section

B) a source of cash in the investing activities section

C) a use of cash in the financing activities section

D) a source of cash in the financing activities section

A) a use of cash in the investing activities section

B) a source of cash in the investing activities section

C) a use of cash in the financing activities section

D) a source of cash in the financing activities section

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

19

A company in the growth phase of its product life cycle will normally have which of the following patterns of cash flows?

A) Negative cash flows from operations,negative cash flows from investing and positive cash flows from financing.

B) Negative or positive cash flows from operations,negative cash flows from investing and positive cash flows from financing.

C) Positive cash flows from operations,positive cash flows from investing and positive cash flows from financing.

D) Negative or positive cash flows from operations,negative cash flows from investing and negative cash flows from financing.

A) Negative cash flows from operations,negative cash flows from investing and positive cash flows from financing.

B) Negative or positive cash flows from operations,negative cash flows from investing and positive cash flows from financing.

C) Positive cash flows from operations,positive cash flows from investing and positive cash flows from financing.

D) Negative or positive cash flows from operations,negative cash flows from investing and negative cash flows from financing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

20

One rationale for the statement of cash flows is to:

A) ensure that the cash account balances at year-end.

B) reconcile differences between net income and cash receipts and disbursements.

C) calculate the company's free cash flow.

D) examine the cash effects of income from discontinued operations,extraordinary items and changes in accounting principles.

A) ensure that the cash account balances at year-end.

B) reconcile differences between net income and cash receipts and disbursements.

C) calculate the company's free cash flow.

D) examine the cash effects of income from discontinued operations,extraordinary items and changes in accounting principles.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

21

Tinker Company reported sales revenue of $500,000 and total expenses of $450,000 (including depreciation)for the year ended December 31,2010.During 2010,accounts receivable decreased by $5,000,merchandise inventory increased by $4,000,accounts payable increased by $6,000,and depreciation expense of $10,000 was recorded.Assuming no other data is needed and using the indirect method,the net cash inflow from operating activities for 2010 was:

A) $60,000

B) $67,000

C) $44,000

D) $51,000

A) $60,000

B) $67,000

C) $44,000

D) $51,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

22

Which of the following transactions would not create a cash flow?

A) Payment of a cash dividend.

B) The company purchased some of its own stock from a stockholder.

C) Amortization of patent for the period.

D) Sale of equipment at book value (i.e.no gain or loss).

A) Payment of a cash dividend.

B) The company purchased some of its own stock from a stockholder.

C) Amortization of patent for the period.

D) Sale of equipment at book value (i.e.no gain or loss).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

23

Which of the following statements about the statement of cash flows is correct?

A) A purchase of equipment is classified as a cash inflow from investing activities.

B) Cash dividends paid are classified as cash flows from operating activities.

C) Cash dividends received on stock investments are classified as cash flows from operating activities.

D) A company with a net loss on the income statement will always have a net cash outflow from operating activities.

A) A purchase of equipment is classified as a cash inflow from investing activities.

B) Cash dividends paid are classified as cash flows from operating activities.

C) Cash dividends received on stock investments are classified as cash flows from operating activities.

D) A company with a net loss on the income statement will always have a net cash outflow from operating activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

24

Academic research has found that market rates of return on common stock are the most highly correlated with:

A) net income.

B) cash flow from operations.

C) EBITDA.

D) cash flow from investing activities.

A) net income.

B) cash flow from operations.

C) EBITDA.

D) cash flow from investing activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

25

Which of the following companies would you expect to report significant amounts of cash provided by financing activities?

A) A yet-to-be-profitable biotechnology company.

B) A mature company operating in the oil refinery industry.

C) A profitable established company in the retail industry.

D) A large multinational pharmaceutical company.

A) A yet-to-be-profitable biotechnology company.

B) A mature company operating in the oil refinery industry.

C) A profitable established company in the retail industry.

D) A large multinational pharmaceutical company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

26

As products move through the maturity phase,companies invest to ___________ productive capacity.

A) increase

B) decrease

C) maintain

D) Not enough information to answer this question.

A) increase

B) decrease

C) maintain

D) Not enough information to answer this question.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

27

Kraco Corporation reported 2010 net income of $450,000,including the effects of depreciation expense of $60,000,and amortization expense on a patent of $10,000.Also,cash of $50,000 was borrowed on a 5-year note payable.Based on this data,total cash inflow from operating activities using the indirect method for 2010 was:

A) $570,000

B) $520,000

C) $470,000

D) $440,000

A) $570,000

B) $520,000

C) $470,000

D) $440,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

28

Which of the following would not be a cash flow from investing activities?

A) Sale of a patent.

B) Collection of interest revenue on a long-term note receivable.

C) Collection of principal of a note receivable.

D) Purchase of long-term investments.

A) Sale of a patent.

B) Collection of interest revenue on a long-term note receivable.

C) Collection of principal of a note receivable.

D) Purchase of long-term investments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

29

As a complement to the balance sheet and the income statement,the statement of cash flows is an informative statement for analysts for all the following reasons except:

A) The statement of cash flows provides information to assess the financial health of a firm.Analysts increasingly recognize that cash flows do not necessarily track income flows.A firm with a healthy income statement is not necessarily financially healthy,and vice versa.Cash requirements to service debt,for example,may outstrip the ability of operations to generate cash.

B) The existence of negative cash flows from operations can be eliminated by using this financial statement.

C) The statement of cash flows highlights accounting accruals,which can provide insight into the overall sustainability and quality of a firm's reported earnings.

D) Analysts who understand the types of information this statement presents and the kinds of interpretations that are appropriate find that the statement of cash flows reveals information about the economic characteristics of a firm's industry,its strategy,

And the stage in its life cycle.

A) The statement of cash flows provides information to assess the financial health of a firm.Analysts increasingly recognize that cash flows do not necessarily track income flows.A firm with a healthy income statement is not necessarily financially healthy,and vice versa.Cash requirements to service debt,for example,may outstrip the ability of operations to generate cash.

B) The existence of negative cash flows from operations can be eliminated by using this financial statement.

C) The statement of cash flows highlights accounting accruals,which can provide insight into the overall sustainability and quality of a firm's reported earnings.

D) Analysts who understand the types of information this statement presents and the kinds of interpretations that are appropriate find that the statement of cash flows reveals information about the economic characteristics of a firm's industry,its strategy,

And the stage in its life cycle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

30

The expense incurred by issuing stock options should be:

A) classified as a financing activity.

B) added back to net income in the operating activities section.

C) subtracted from net income in the operating activities section.

D) does not appear in the statement of cash flows.

A) classified as a financing activity.

B) added back to net income in the operating activities section.

C) subtracted from net income in the operating activities section.

D) does not appear in the statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

31

Norton Company reported total sales revenue of $55,000,total expenses of $45,000,and net income of $10,000 on its income statement for the year ended December 31,2010.During 2010,accounts receivable increased by $4,000,merchandise inventory increased by $6,000,accounts payable decreased by $2,000,and depreciation of $18,000 was recorded.Therefore,based only on this information,the net cash flow from operating activities using the indirect method for 2010 was:

A) $30,000

B) $10,000

C) $16,000

D) $19,000

A) $30,000

B) $10,000

C) $16,000

D) $19,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

32

Which of the following is a cash flow from operating activities?

A) Sale of long-term investments in common stock.

B) Purchase of merchandise for resale.

C) Payment of a note payable.

D) Sale of a piece of land no longer used in operations.

A) Sale of long-term investments in common stock.

B) Purchase of merchandise for resale.

C) Payment of a note payable.

D) Sale of a piece of land no longer used in operations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

33

Under the indirect method of preparing the statement of cash flows,add backs to net income include all of the following except:

A) depreciation expense

B) deferred tax expense

C) gains on sale of equipment

D) share-based compensation

A) depreciation expense

B) deferred tax expense

C) gains on sale of equipment

D) share-based compensation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

34

Adophus,Inc.'s 2010 income statement reported total revenues of $850,000 and total expenses (including $40,000 depreciation)of $720,000.The 2010 balance sheet reported the following: accounts receivable beginning balance of $50,000 and ending balance of $40,000;accounts payable beginning balance of $22,000 and ending balance of $28,000.Therefore,based only on this information and using the indirect method,the 2010 net cash inflow from operating activities was:

A) $126,000

B) $186,000

C) $166,000

D) $174,000

A) $126,000

B) $186,000

C) $166,000

D) $174,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

35

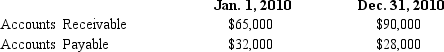

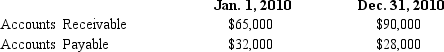

Lagos Corp.recorded sales of $345,000 in 2010.In addition,its accounts receivable and accounts payable balances at the beginning and end of 2010 were as follows:  How much cash did Lagos collect from customers in 2010?

How much cash did Lagos collect from customers in 2010?

A) $345,000

B) $320,000

C) $324,000

D) $316,000

How much cash did Lagos collect from customers in 2010?

How much cash did Lagos collect from customers in 2010?A) $345,000

B) $320,000

C) $324,000

D) $316,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

36

When net income is low relative to operating cash flows,we describe the firm as having recorded:

A) income-decreasing accruals.

B) income-increasing accruals.

C) income neutral accruals.

D) abnormal accruals.

A) income-decreasing accruals.

B) income-increasing accruals.

C) income neutral accruals.

D) abnormal accruals.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

37

A firm's cash flows will differ from net income each period for all of the following reasons except:

A) cash receipts from customers do not necessarily occur in the same period in which a firm recognizes revenues.

B) cash expenditures to employees,suppliers,and governments do not necessarily occur in the same period in which a firm recognizes expenses.

C) the company is sustaining losses each period.

D) cash inflows and outflows that pertain to investing and financing activities do not immediately flow through the income statement.

A) cash receipts from customers do not necessarily occur in the same period in which a firm recognizes revenues.

B) cash expenditures to employees,suppliers,and governments do not necessarily occur in the same period in which a firm recognizes expenses.

C) the company is sustaining losses each period.

D) cash inflows and outflows that pertain to investing and financing activities do not immediately flow through the income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

38

When net income is high relative to operating cash flows,we describe the firm as having recorded:

A) income-decreasing accruals.

B) income-increasing accruals.

C) income-neutral accruals.

D) abnormal accruals.

A) income-decreasing accruals.

B) income-increasing accruals.

C) income-neutral accruals.

D) abnormal accruals.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

39

A cash inflow from financing activities includes:

A) receipt of interest payments.

B) proceeds from selling equipment.

C) proceeds from issuance of bonds payable.

D) proceeds from selling investments in equity securities of another company.

A) receipt of interest payments.

B) proceeds from selling equipment.

C) proceeds from issuance of bonds payable.

D) proceeds from selling investments in equity securities of another company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

40

All of the following are firms that may experience a long lag between the expenditures of cash and the receipt of cash from customers,except:

A) restaurants

B) wineries

C) construction companies

D) aerospace manufacturers

A) restaurants

B) wineries

C) construction companies

D) aerospace manufacturers

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

41

Under the _________________________,firms begin with net income to calculate cash flow from operations for the period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

42

____________________ activities relate to the acquisition and sale of noncurrent assets,particularly property,plant and equipment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

43

Krenshaw Company reported total sales revenue of $80,000,total expenses of $72,000,and net income of $8,000 for the year ended December 31,2009.During 2009,accounts receivable increased by $3,000,merchandise inventory decreased by $2,000,accounts payable increased by $1,000,and $5,000 in depreciation expense was recorded.Assuming no other adjustments to net income are needed,the net cash inflow from operating activities using the indirect method was:

A) $19,000

B) $13,000

C) $10,000

D) $11,000

A) $19,000

B) $13,000

C) $10,000

D) $11,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

44

Lui Company's 2010 income statement reported total sales revenue of $350,000.The 2009-2010 comparative balance sheets showed that accounts receivable increased by $20,000.The 2010 "cash receipts from customers" would be:

A) $270,000

B) $250,000

C) $330,000

D) $40,000

A) $270,000

B) $250,000

C) $330,000

D) $40,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

45

Free cash flows to all debt and common equity shareholders represents the excess of cash flow from operations over cash flows from ___________________________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

46

The length of the operating cycle is another factor that may cause cash flow from operations to differ from __________________________________________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

47

Under the ______________________________ of preparing the statement of cash flow's operating activities section firms list the cash flows from selling goods and services and then subtract the cash outflows to providers of goods and services.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

48

Which of the following statements is true?

A) A cash dividend is an operating cash outflow.

B) Cash paid to repurchase treasury stock is an investing cash outflow.

C) Cash paid to acquire stock in another company is a financing outflow.

D) Purchase of a patent is an investing cash outflow.

A) A cash dividend is an operating cash outflow.

B) Cash paid to repurchase treasury stock is an investing cash outflow.

C) Cash paid to acquire stock in another company is a financing outflow.

D) Purchase of a patent is an investing cash outflow.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

49

Which statement is false regarding the preparation of the indirect method of the statement of cash flows?

A) An increase in merchandise inventory is subtracted from net income.

B) Depreciation expense is added to net income.

C) An increase in accounts receivable is added to net income.

D) An increase in accounts payable is added to net income.

A) An increase in merchandise inventory is subtracted from net income.

B) Depreciation expense is added to net income.

C) An increase in accounts receivable is added to net income.

D) An increase in accounts payable is added to net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

50

____________________ ___________________ equals current assets minus current liabilities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

51

The payment of dividends would be classified as ____________________ activities in the statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

52

Interest expense and interest revenue would be classified as ____________________ activities in the statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

53

Amortization of bond discount and premiums would be additions or subtractions from net income in the ___________________________ section of the statement of cash flows

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

54

The acquisition of new investments would be classified as ____________________ activities in the statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

55

The receipt of dividends from an investee would be classified as ____________________ activities in the statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

56

____________________ activities relate to the normal operations of the firm,selling goods and providing services.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

57

The period in which a firm commences the manufacture of its product to the time it receives cash is called the ______________________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

58

Cash flows from ____________________ activities will normally be negative during the introduction and growth phase of the product life cycle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

59

The financial statements for Warren Company show the following: Cost of goods sold $725,000

Based on this information,cash paid for merchandise was:

Based on this information,cash paid for merchandise was:

A) $736,000

B) $719,000

C) $731,000

D) $741,000

Based on this information,cash paid for merchandise was:

Based on this information,cash paid for merchandise was:A) $736,000

B) $719,000

C) $731,000

D) $741,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

60

Which of the following statements is false?

A) Purchase of equipment is an investing cash outflow.

B) Sale of equipment creates investing cash outflow equal to its selling price.

C) Purchase of short-term investments is an investing cash outflow.

D) Purchase of a patent is an investing cash outflow.

A) Purchase of equipment is an investing cash outflow.

B) Sale of equipment creates investing cash outflow equal to its selling price.

C) Purchase of short-term investments is an investing cash outflow.

D) Purchase of a patent is an investing cash outflow.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

61

The issuance of debt would be classified as a(n)____________________ activity in the statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

62

Discuss operating,investing,and financing cash flows in relation to the various stages of the product life cycle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

63

The receipt of cash when employees exercise stock options is a(n)____________________ activity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

64

Clarion Industries manufactures computer equipment and provides financing for purchases by its customers.Clarion reported sales and interest revenues of $79,500 million for 2010.The

balance sheet showed current and noncurrent receivables of $ 30,750 million at the beginning

of 2010 and $ 26,900 million at the end of 2010.Compute the amount of cash collected

from customers during 2010.

balance sheet showed current and noncurrent receivables of $ 30,750 million at the beginning

of 2010 and $ 26,900 million at the end of 2010.Compute the amount of cash collected

from customers during 2010.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

65

While preparing a statement of cash flows,you encountered the following transaction:

February 1,2011: Galvinize Corporation acquired a small office building in exchange for 5,000 shares of its own common stock;par value $10 per share;market value $15 per share.

A.Should this transaction be shown on the statement of cash flows?

B.Why or why not?

February 1,2011: Galvinize Corporation acquired a small office building in exchange for 5,000 shares of its own common stock;par value $10 per share;market value $15 per share.

A.Should this transaction be shown on the statement of cash flows?

B.Why or why not?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

66

Indicate if any of the events will be reported as a significant noncash transaction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

67

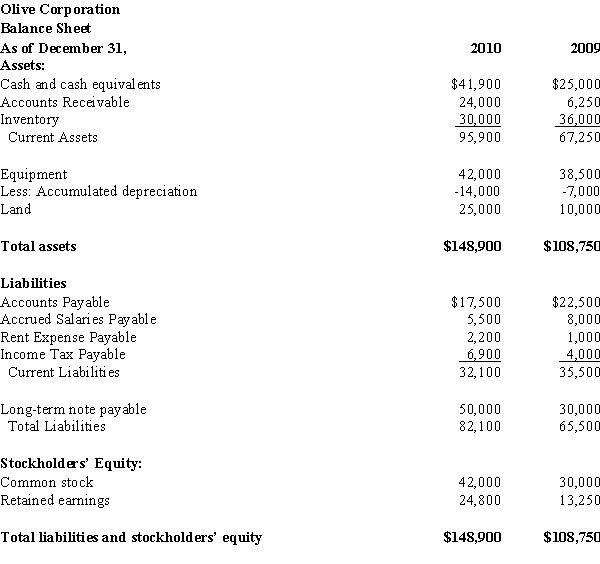

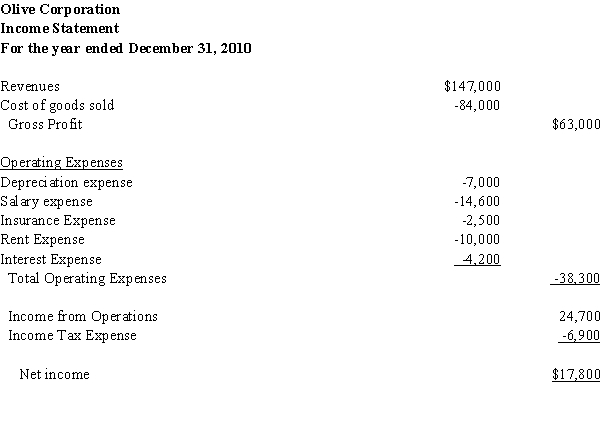

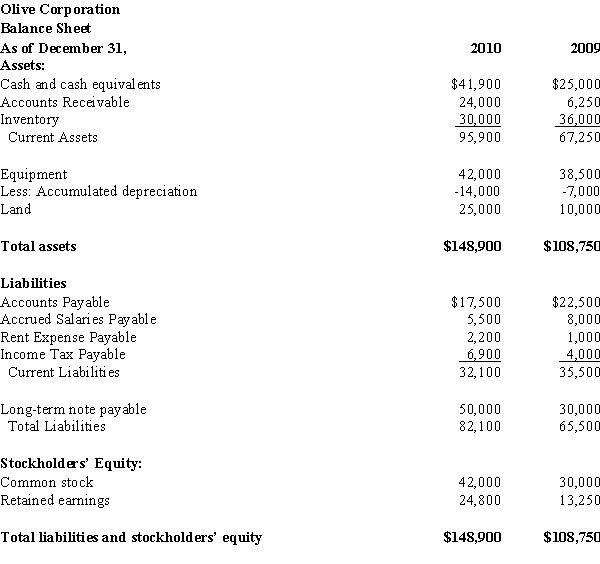

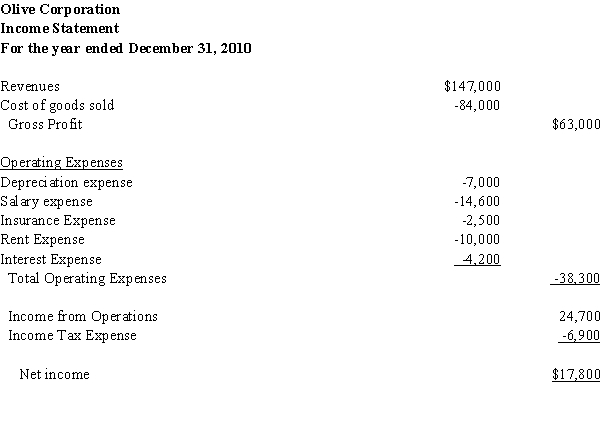

Olive Corporation manufactures food processing equipment.Use Olive Corporation's two most recent balance sheets and most recent income statement to prepare a statement of cash flows for 2010.The company paid dividends of $6,250 during 2010.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

68

For the following types of companies,discuss whether you think their cash flows from operations,investing,and financing will be positive (the activity provides cash)or negative (the activity uses cash).Provide support for your answer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

69

In 2010,Lamar Industries reported the following: Sales $700,000;Accounts receivable beginning of 2010 $450,000;Accounts receivable end of 2010 $369,200;Depreciation expense $55,400;Rent Expense $30,000.What is the net cash provided (used)by operating activities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

70

J.Jill is a women's clothing retailer.The company started as a mail order company and has expanded into mall department stores.The company now receives approximately half of its revenues from mail order and half from retail outlets.Over the time period 2010 to 2012,sales increased approximately 25%.

Discuss the relationship between net income,working capital from operations,and cash flow from operations,and between cash flows from operating,investing,and financing activities over the three-year period.

Discuss the relationship between net income,working capital from operations,and cash flow from operations,and between cash flows from operating,investing,and financing activities over the three-year period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

71

Discuss the correlations that have been found between net income,net income plus or minus Type 1 adjustments (i.e. ,adjustments to net income for revenues,expenses,gains,and losses that are recognized in income and are associated with changes in noncurrent assets,noncurrent liabilities,and shareholders' equity,but do not affect cash by the same amounts for the period),and cash flow from operations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

72

One factor that may cause cash flow from operations to differ from net income is the length of the ______________________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

73

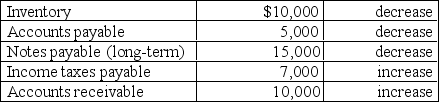

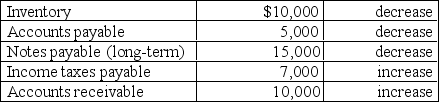

Bankers Company reported net income of $40,000,which included depreciation expense and depletion expense of $21,000 and $18,000,respectively.The following changes also occurred during 2010:

Required:

Required:

Calculate cash flows from operating activities.

Required:

Required:Calculate cash flows from operating activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

74

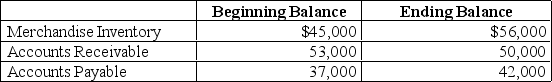

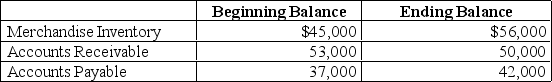

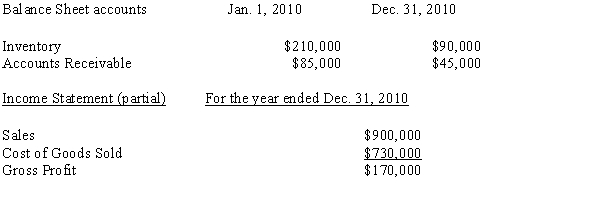

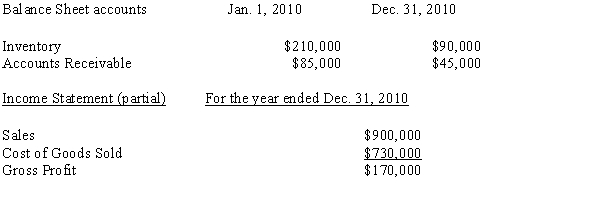

Selected financial statement information for Filmco appears below:  Calculate the amount of cash collected from customers and the amount of cash spent on inventory for 2010 by Filmco.

Calculate the amount of cash collected from customers and the amount of cash spent on inventory for 2010 by Filmco.

Calculate the amount of cash collected from customers and the amount of cash spent on inventory for 2010 by Filmco.

Calculate the amount of cash collected from customers and the amount of cash spent on inventory for 2010 by Filmco.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

75

Jarrett Company,home improvement retailer,reported cost of goods sold of $33,729 million for the fiscal year ended January 30,2010.It reported merchandise inventories of $9,611 million at the beginning of fiscal 2010 and $10,209 million at the end of fiscal 2010.It reported

accounts payable to suppliers of $5,713 million at the beginning of fiscal 2010 and $6,109

million at the end of fiscal 2010.Compute the amount of cash paid to merchandise suppliers

during fiscal 2010.

accounts payable to suppliers of $5,713 million at the beginning of fiscal 2010 and $6,109

million at the end of fiscal 2010.Compute the amount of cash paid to merchandise suppliers

during fiscal 2010.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

76

What is working capital from operations? Discuss what types of firms will have similar net income and working capital from operations? For which types of firms will net income and working capital from operations be significantly different?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

77

The calculation of cash flow from operations under the indirect method involves two types of adjustments.Discuss each type of adjustment and provide an example of each type of adjustment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

78

Cash flow from operations should include none of the cash flows associated with marketable securities if such transactions are viewed as ___________________________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

79

Cash collected from customers would appear in the operating activities section of a statement of cash flows prepared using the ____________________ method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

80

Krenzer,Inc. ,a financial company,reported income tax expense of $2,648 million for 2010,comprising $2,346 million of current taxes and $302 million of deferred taxes.The balance sheet showed income taxes payable of $222 million at the beginning of 2010 and $427 million at the end of 2010.Compute the amount of income taxes paid in cash during 2010.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck