Deck 2: Cost Concepts and Behavior

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/105

العب

ملء الشاشة (f)

Deck 2: Cost Concepts and Behavior

1

Variable marketing and administrative costs are included in determining full absorption costs.The two costs are included in full cost and not in determining full absorption costs.

False

2

If the cost of goods manufactured during the period exceeds the cost of goods sold,the ending balance of Finished Goods Inventory account increased.Cost of goods sold = cost of goods manufactured + beginning finished goods inventory - ending finished goods inventory.

True

3

An asset is a cost matched with revenues in a future accounting period.This statement is the definition of asset.

True

4

The three categories of product costs are direct materials,direct labor,and manufacturing overhead.This statement is the definition of product cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

5

The primary goal of the cost accounting system is to provide managers with information to prepare their annual financial statements.The primary goal is to provide managers with information for decision making.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

6

Accounting systems typically record opportunity costs as assets and treat them as intangible items on the financial statements.Opportunity costs are not reflected in the accounting system-they are what did not happen.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

7

Revenue minus cost of goods sold equals contribution margin.Revenue minus cost of goods sold equals gross margin.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

8

The cost of an item is the sacrifice of resources made to acquire it.This statement is the definition of cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

9

Period costs are those costs assigned to units of production in the period in which they are incurred.This statement describes product costs,not period costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

10

The first step in determining whether a cost is direct or indirect is to specify the cost allocation rule.This is the first step to define the cost object.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

11

Only direct costs can be classified as product costs;indirect costs are classified as period costs.Product costs can include both direct and indirect costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

12

The range within which fixed costs remain constant as volume of activity varies is known as the relevant range.This statement is the definition of a relevant range.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

13

Cost of goods sold plus the ending finished goods inventory minus the beginning finished goods inventory equals the cost of goods manufactured.This statement works backwards from cost of goods sold to cost of goods manufactured.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

14

Fixed costs per unit change inversely with changes in the volume of activity.Fixed costs per unit would vary inversely with the volume of activity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

15

Total work-in-process during the period is the sum of the beginning work-in-process inventory and the total manufacturing costs incurred during the period.This is the correct formula for total work-in-process.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

16

Total cost of goods purchased minus beginning merchandise inventory plus ending merchandise inventory equals cost of goods sold.Purchases plus beginning inventory minus ending inventory equals cost of goods sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

17

Cost of goods sold includes the actual costs of the goods sold and the cost of selling them to the customer.Cost of goods sold does not include selling costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

18

The term full cost refers to the cost of manufacturing and selling a unit of product and includes both fixed and variable costs.We need to distinguish between full cost (which includes selling costs)and full absorption cost (which does not include selling costs. )

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

19

Total variable costs change inversely with changes in the volume of activity.Total variable costs are linear and vary directly with changes in the volume of activity,fixed costs vary inversely.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

20

An expense is an expired cost matched with revenues in a specific accounting period.This statement is the definition of expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

21

Which of the following accounts would be a period cost rather than a product cost?

A)Depreciation on manufacturing machinery.

B)Maintenance on factory machines.

C)Production manager's salary.

D)Direct Labor.

E)Freight out.

A)Depreciation on manufacturing machinery.

B)Maintenance on factory machines.

C)Production manager's salary.

D)Direct Labor.

E)Freight out.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

22

Which of the following statements is (are)false? (1).In general,the term expense is used for managerial purposes,while the term cost refers to external financial reports.(2).An opportunity cost is the benefit forgone by selecting one alternative over another.

A)Only (1)is false.

B)Only (2)is false.

C)Both (1)and (2)are false.

D)Neither (1)nor (2)are false.

A)Only (1)is false.

B)Only (2)is false.

C)Both (1)and (2)are false.

D)Neither (1)nor (2)are false.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

23

Which of the following statements is (are)true? (1).An asset is a cost that will be matched with revenues in a future accounting period.(2).Opportunity costs are recorded as intangible assets in the current accounting period.

A)Only (1)is true.

B)Only (2)is true.

C)Both (1)and (2)are true.

D)Neither (1)nor (2)are true.

A)Only (1)is true.

B)Only (2)is true.

C)Both (1)and (2)are true.

D)Neither (1)nor (2)are true.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

24

Which of the following best distinguishes an opportunity cost from an outlay cost?

A)Opportunity costs are recorded,whereas outlay costs are not.

B)Outlay costs are speculative in nature,whereas opportunity costs are easily traceable to products.

C)Opportunity costs have very little utility in practical applications,whereas outlay costs are always relevant.

D)Opportunity costs are sacrifices from foregone alternative uses of resources,whereas outlay costs are cash outflows.

A)Opportunity costs are recorded,whereas outlay costs are not.

B)Outlay costs are speculative in nature,whereas opportunity costs are easily traceable to products.

C)Opportunity costs have very little utility in practical applications,whereas outlay costs are always relevant.

D)Opportunity costs are sacrifices from foregone alternative uses of resources,whereas outlay costs are cash outflows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

25

Marketing costs include all of the following except:

A)Advertising.

B)Shipping costs.

C)Sales commissions.

D)Legal and accounting fees.

A)Advertising.

B)Shipping costs.

C)Sales commissions.

D)Legal and accounting fees.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

26

The cost of the direct labor will be treated as an expense on the income statement when the resulting:

A)payroll costs are paid.

B)payroll costs are incurred.

C)products are completed.

D)products are solD.This solution supports the matching principle.

A)payroll costs are paid.

B)payroll costs are incurred.

C)products are completed.

D)products are solD.This solution supports the matching principle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

27

The amount of direct materials issued to production is found by

A)subtracting ending work in process from total work in process during the period.

B)adding beginning direct materials inventory and the delivered cost of direct materials.

C)subtracting ending direct materials from direct materials available for production.

D)adding delivered cost of materials,labor,and manufacturing overheaD.

A)subtracting ending work in process from total work in process during the period.

B)adding beginning direct materials inventory and the delivered cost of direct materials.

C)subtracting ending direct materials from direct materials available for production.

D)adding delivered cost of materials,labor,and manufacturing overheaD.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

28

For a manufacturing company,which of the following is an example of a period cost rather than a product cost?

A)Wages of salespersons.

B)Salaries of machine operators.

C)Insurance on factory equipment.

D)Depreciation of factory equipment.

A)Wages of salespersons.

B)Salaries of machine operators.

C)Insurance on factory equipment.

D)Depreciation of factory equipment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

29

A product cost is deducted from revenue when

A)the finished goods are sold.

B)the expenditure is incurred.

C)the production process takes place.

D)the production process is completeD.

A)the finished goods are sold.

B)the expenditure is incurred.

C)the production process takes place.

D)the production process is completeD.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

30

Classifying a cost as either direct or indirect depends upon

A)whether an expenditure is unavoidable because it cannot be changed regardless of any action taken.

B)whether the cost is expensed in the period in which it is incurred.

C)the behavior of the cost in response to volume changes.

D)the cost object to which the cost is being relateD.This is the definition for classifying a cost as either direct or indirect.

A)whether an expenditure is unavoidable because it cannot be changed regardless of any action taken.

B)whether the cost is expensed in the period in which it is incurred.

C)the behavior of the cost in response to volume changes.

D)the cost object to which the cost is being relateD.This is the definition for classifying a cost as either direct or indirect.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

31

The beginning Work-in-Process inventory plus the total of the manufacturing costs equals

A)total finished goods during the period.

B)cost of goods sold for the period.

C)total work-in-process during the period.

D)cost of goods manufactured for the perioD.Total work-in-process during the period is equal to the beginning Work-in-Process inventory plus the total of the manufacturing costs.

A)total finished goods during the period.

B)cost of goods sold for the period.

C)total work-in-process during the period.

D)cost of goods manufactured for the perioD.Total work-in-process during the period is equal to the beginning Work-in-Process inventory plus the total of the manufacturing costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

32

Which of the following costs is both a prime cost and a conversion cost?

A)direct materials

B)direct labor

C)manufacturing overhead

D)administrative costs

A)direct materials

B)direct labor

C)manufacturing overhead

D)administrative costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

33

The Work-in-Process Inventory of the Rapid Fabricating Corp.was $3,000 higher on December 31,2012 than it was on January 1,2012.This implies that in 2012

A)cost of goods manufactured was higher than cost of goods sold.

B)cost of goods manufactured was less than total manufacturing costs.

C)manufacturing costs were higher than cost of goods sold.

D)manufacturing costs were less than cost of goods manufactureD.

A)cost of goods manufactured was higher than cost of goods sold.

B)cost of goods manufactured was less than total manufacturing costs.

C)manufacturing costs were higher than cost of goods sold.

D)manufacturing costs were less than cost of goods manufactureD.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

34

Which of the following is not a product cost under full-absorption costing?

A)Direct materials used in the current period

B)Rent for the warehouse used to store direct materials

C)Salaries paid to the top management in the company

D)Vacation pay accrued for the production workers

A)Direct materials used in the current period

B)Rent for the warehouse used to store direct materials

C)Salaries paid to the top management in the company

D)Vacation pay accrued for the production workers

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

35

Direct labor would be part of the cost of the ending inventory for which of these accounts?

A)Work-in-Process.

B)Finished Goods.

C)Direct Materials and Work-in-Process.

D)Work-in-Process and Finished Goods.

A)Work-in-Process.

B)Finished Goods.

C)Direct Materials and Work-in-Process.

D)Work-in-Process and Finished Goods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

36

XYZ Company manufactures a single product.The product's prime costs consist of

A)direct material and direct labor.

B)direct material and factory overhead.

C)direct labor and factory overhead.

D)direct material,direct labor and factory overheaD.

A)direct material and direct labor.

B)direct material and factory overhead.

C)direct labor and factory overhead.

D)direct material,direct labor and factory overheaD.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

37

Inventoriable costs:

A)include only the prime costs of manufacturing a product.

B)include only the conversion costs of providing a service.

C)exclude fixed manufacturing costs.

D)are regarded as assets until the units are solD.

A)include only the prime costs of manufacturing a product.

B)include only the conversion costs of providing a service.

C)exclude fixed manufacturing costs.

D)are regarded as assets until the units are solD.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

38

A company which manufactures custom-made machinery routinely incurs sizable telephone costs in the process of taking sales orders from customers.Which of the following is a proper classification of this cost?

A)Product cost

B)Period cost

C)Conversion cost

D)Prime cost

A)Product cost

B)Period cost

C)Conversion cost

D)Prime cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

39

The beginning Finished Goods Inventory plus the cost of goods manufactured equals

A)ending finished goods inventory.

B)cost of goods sold for the period.

C)total work-in-process during the period.

D)total cost of goods manufactured for the perioD.

E)cost of goods available for sale for the period.

A)ending finished goods inventory.

B)cost of goods sold for the period.

C)total work-in-process during the period.

D)total cost of goods manufactured for the perioD.

E)cost of goods available for sale for the period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

40

The term "gross margin" for a manufacturing firm refers to the excess of sales over:

A)cost of goods sold,excluding fixed indirect manufacturing costs.

B)all variable costs,including variable marketing and administrative costs.

C)cost of goods sold,including fixed indirect manufacturing costs.

D)variable costs,excluding variable marketing and administrative costs.

A)cost of goods sold,excluding fixed indirect manufacturing costs.

B)all variable costs,including variable marketing and administrative costs.

C)cost of goods sold,including fixed indirect manufacturing costs.

D)variable costs,excluding variable marketing and administrative costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

41

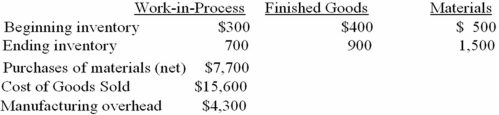

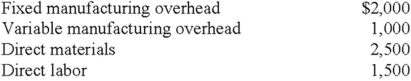

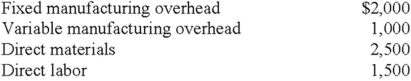

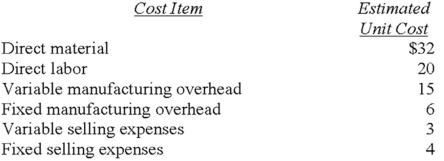

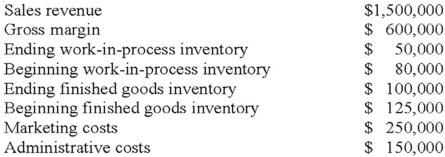

Seiler Company has the following information:  What was the cost of goods available for sale for the period?

What was the cost of goods available for sale for the period?

A)$16,800

B)$16,500

C)$16,100

D)$15,100

What was the cost of goods available for sale for the period?

What was the cost of goods available for sale for the period?A)$16,800

B)$16,500

C)$16,100

D)$15,100

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

42

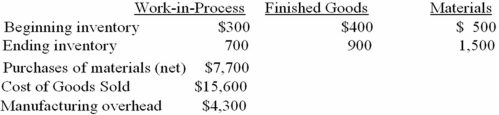

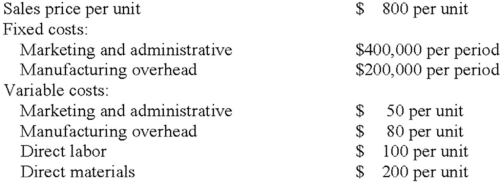

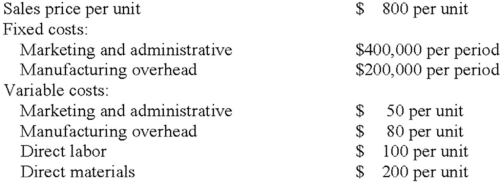

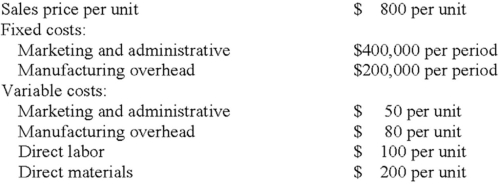

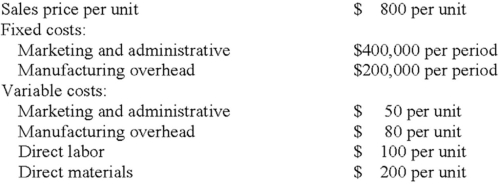

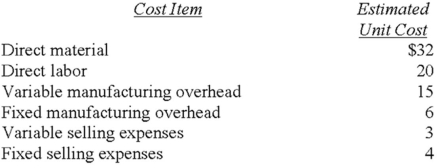

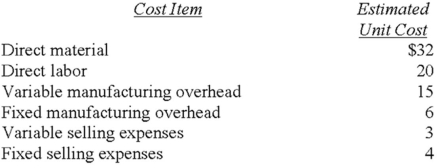

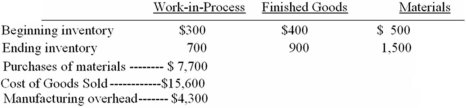

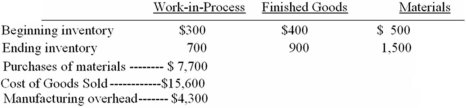

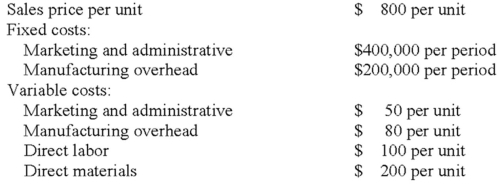

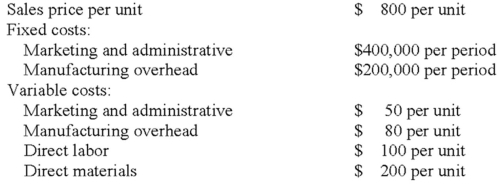

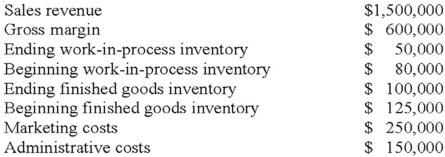

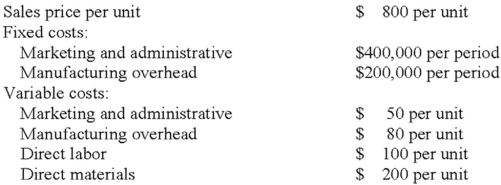

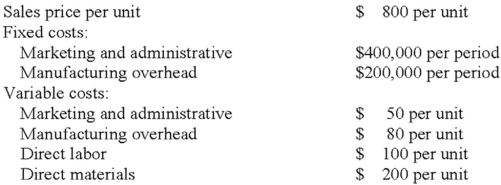

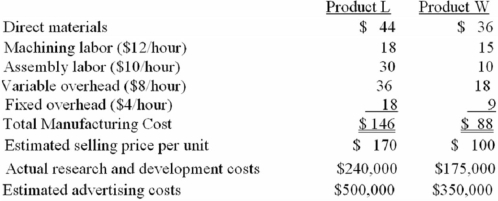

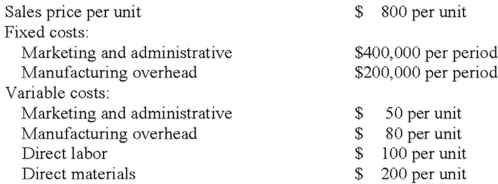

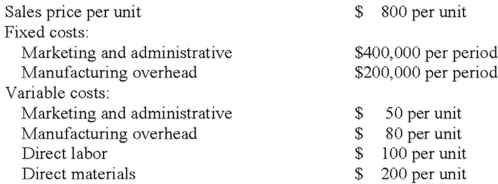

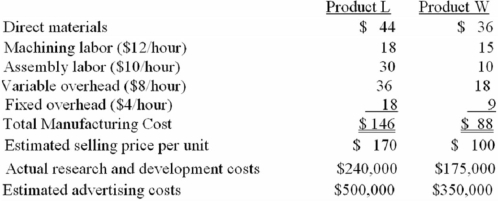

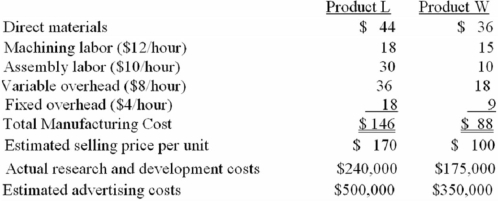

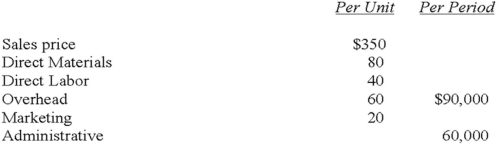

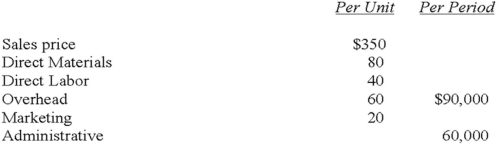

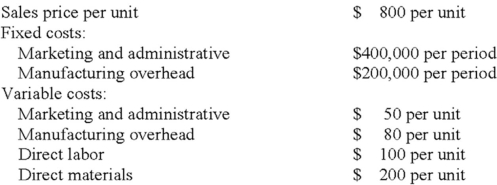

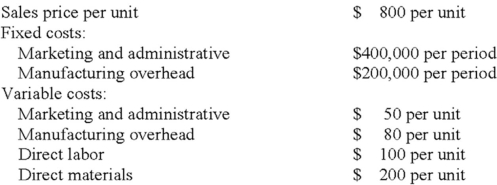

Laner Company has the following data for the production and sale of 2,000 units.  What is the full cost per unit of making and selling the product?

What is the full cost per unit of making and selling the product?

A)$430

B)$480

C)$530

D)$730

What is the full cost per unit of making and selling the product?

What is the full cost per unit of making and selling the product?A)$430

B)$480

C)$530

D)$730

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

43

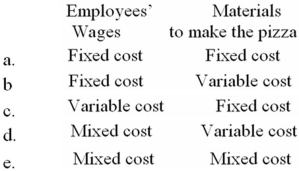

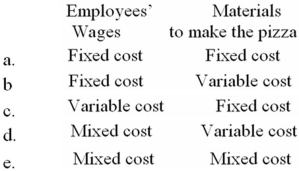

Pete's Pizza Place has four pizza makers and ten other employees who take orders from customers and perform other tasks.The four pizza makers and the other employees are paid an hourly wage.How would one classify (1)the wages paid to the pizza makers and other employees and (2)materials (e.g. ,cheeses,sauce,etc. )used to make the pizza? Assume the activity is the number of pizzas made.

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

44

A company had beginning inventories as follows: Direct Materials,$300;Work-in-Process,$500;Finished Goods,$700.It had ending inventories as follows: Direct Materials,$400;Work-in-Process,$600;Finished Goods,$800.Material Purchases (net including freight)were $1,400,Direct Labor $1,500,and Manufacturing Overhead $1,600.What is the Cost of Goods Sold for the period?

A)$4,100.

B)$4,200.

C)$4,300.

D)$4,400.

A)$4,100.

B)$4,200.

C)$4,300.

D)$4,400.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

45

How would miscellaneous supplies used in assembling a product be classified for a manufacturing company?

A)Fixed,period cost.

B)Fixed,product cost.

C)Variable,period cost.

D)Variable,product cost.

A)Fixed,period cost.

B)Fixed,product cost.

C)Variable,period cost.

D)Variable,product cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

46

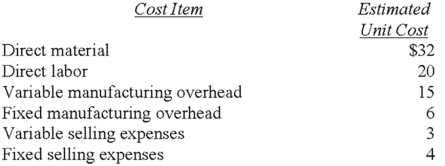

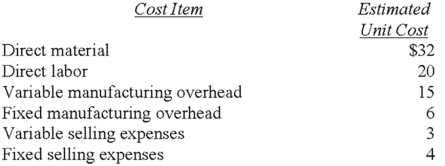

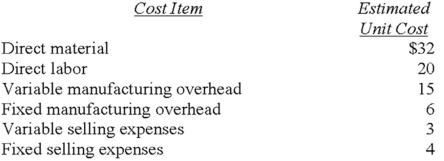

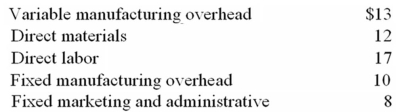

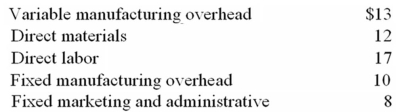

The estimated unit costs for a company to produce and sell a product at a level of 12,000 units per month are as follows:  What are the estimated prime costs per unit?

What are the estimated prime costs per unit?

A)$73

B)$32

C)$67

D)$52

What are the estimated prime costs per unit?

What are the estimated prime costs per unit?A)$73

B)$32

C)$67

D)$52

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

47

Laner Company has the following data for the production and sale of 2,000 units.  What is the total manufacturing cost per unit?

What is the total manufacturing cost per unit?

A)$380

B)$430

C)$480

D)$730

What is the total manufacturing cost per unit?

What is the total manufacturing cost per unit?A)$380

B)$430

C)$480

D)$730

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

48

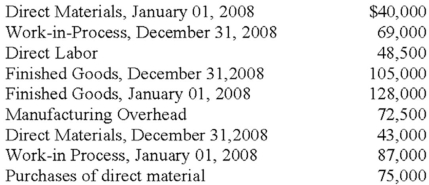

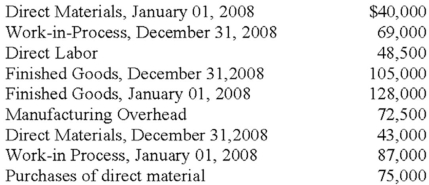

Compute the Cost of Goods Sold for 2008 using the following information:

A)$244,000

B)$234,000

C)$211,000

D)$198,000

A)$244,000

B)$234,000

C)$211,000

D)$198,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

49

Calculate the conversion costs from the following information:

A)$3,000

B)$4,000

C)$4,500

D)$5,000

A)$3,000

B)$4,000

C)$4,500

D)$5,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

50

Which of the following statements is (are)true? (1).The term full cost refers to the cost of manufacturing and selling a unit of product and includes both fixed and variable costs.(2).The fixed cost per unit is considered constant despite changes in volume of activity within the relevant range.

A)Only (1)is true.

B)Only (2)is true.

C)Both (1)and (2)are true.

D)Neither (1)nor (2)are true.

A)Only (1)is true.

B)Only (2)is true.

C)Both (1)and (2)are true.

D)Neither (1)nor (2)are true.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

51

The estimated unit costs for a company to produce and sell a product at a level of 12,000 units per month are as follows:  What are the estimated conversion costs per unit?

What are the estimated conversion costs per unit?

A)$35

B)$41

C)$44

D)$48

What are the estimated conversion costs per unit?

What are the estimated conversion costs per unit?A)$35

B)$41

C)$44

D)$48

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

52

The estimated unit costs for a company to produce and sell a product at a level of 12,000 units per month are as follows:  What are the estimated variable costs per unit?

What are the estimated variable costs per unit?

A)$70

B)$38

C)$67

D)$52

What are the estimated variable costs per unit?

What are the estimated variable costs per unit?A)$70

B)$38

C)$67

D)$52

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

53

How would a 5% sales commission paid to sales personnel be classified in a manufacturing company?

A)Fixed,period cost.

B)Fixed,product cost.

C)Variable,period cost.

D)Variable,product cost.

A)Fixed,period cost.

B)Fixed,product cost.

C)Variable,period cost.

D)Variable,product cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

54

Seiler Company has the following information:  What was the direct labor for the period?

What was the direct labor for the period?

A)$5,500.

B)$5,800.

C)$6,300.

D)$6,800.

What was the direct labor for the period?

What was the direct labor for the period?A)$5,500.

B)$5,800.

C)$6,300.

D)$6,800.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

55

Laner Company has the following data for the production and sale of 2,000 units.  What is the variable manufacturing cost per unit?

What is the variable manufacturing cost per unit?

A)$380

B)$430

C)$480

D)$730

What is the variable manufacturing cost per unit?

What is the variable manufacturing cost per unit?A)$380

B)$430

C)$480

D)$730

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

56

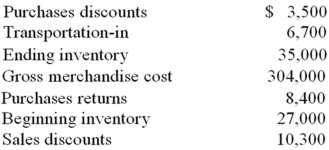

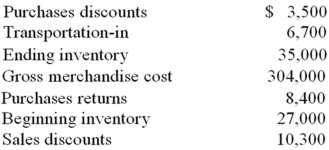

Given the following information for a retail company,what is the total cost of goods purchased for the period?

A)$298,800

B)$290,800

C)$282,100

D)$304,000

A)$298,800

B)$290,800

C)$282,100

D)$304,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

57

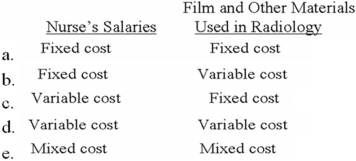

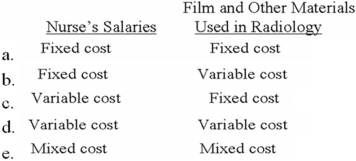

The student health center employs one doctor,three nurses,and several other employees.How would you classify (1)the nurses' salary and (2)film and other materials used in radiology to give X-rays to students? Assume the activity is the number of students visiting the health center.

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

58

During the year,a manufacturing company had the following operating results:  What is the cost of goods manufactured for the year?

What is the cost of goods manufactured for the year?

A)$1,011,000

B)$1,134,000

C)$1,033,000

D)$1,112,000

What is the cost of goods manufactured for the year?

What is the cost of goods manufactured for the year?A)$1,011,000

B)$1,134,000

C)$1,033,000

D)$1,112,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

59

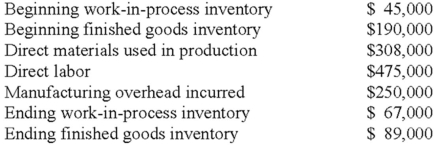

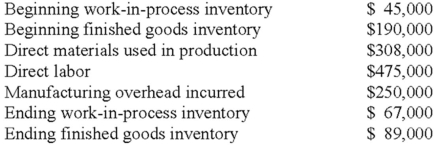

During April,the CJG Manufacturing Company had the following operating results:  What is the cost of goods manufactured for April?

What is the cost of goods manufactured for April?

A)$900,000

B)$875,000

C)$925,000

D)$905,000

What is the cost of goods manufactured for April?

What is the cost of goods manufactured for April?A)$900,000

B)$875,000

C)$925,000

D)$905,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

60

How would property taxes paid on a factory building be classified in a manufacturing company?

A)Fixed,period cost.

B)Fixed,product cost.

C)Variable,period cost.

D)Variable,product cost.

A)Fixed,period cost.

B)Fixed,product cost.

C)Variable,period cost.

D)Variable,product cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

61

Sarasota Company, (a merchandising Co. )has the following data pertaining to the year ended December 31,2006: (CPA adapted)  What is the cost of goods sold for the year?

What is the cost of goods sold for the year?

A)$385,000

B)$460,000

C)$485,000

D)$536,000

What is the cost of goods sold for the year?

What is the cost of goods sold for the year?A)$385,000

B)$460,000

C)$485,000

D)$536,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

62

Laner Company has the following data for the production and sale of 2,000 units.  What is the contribution margin per unit?

What is the contribution margin per unit?

A)$70

B)$320

C)$370

D)$430

What is the contribution margin per unit?

What is the contribution margin per unit?A)$70

B)$320

C)$370

D)$430

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

63

A ___________________ is any end to which a cost is assigned.

A)cost object

B)cost pool

C)cost allocation

D)opportunity cost

A)cost object

B)cost pool

C)cost allocation

D)opportunity cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

64

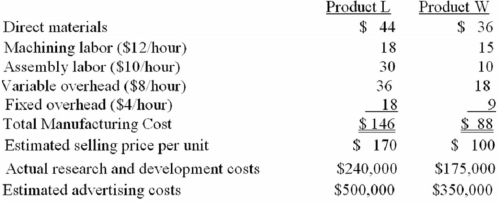

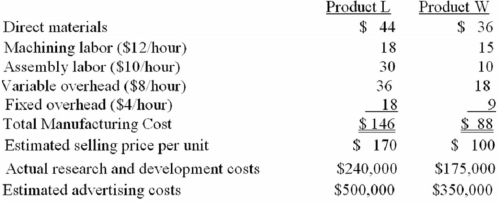

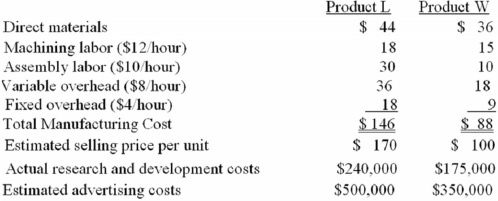

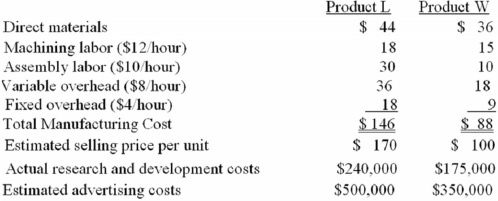

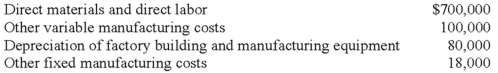

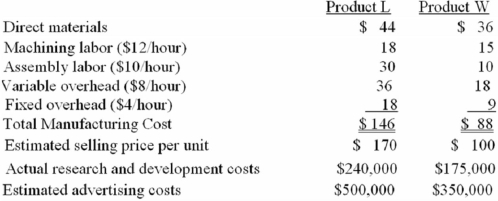

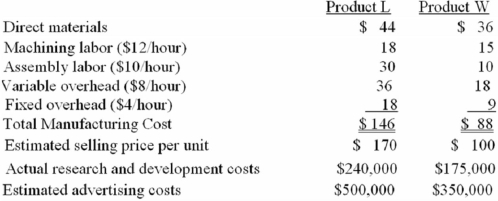

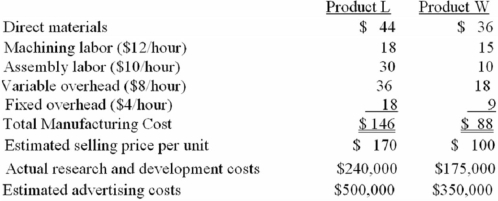

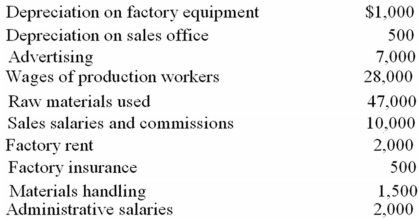

Makwa Industries has developed two new products but has only enough plant capacity to introduce one product during the current year.The following data will assist management in deciding which product should be selected.Makwa's fixed overhead includes rent and utilities,equipment depreciation,and supervisory salaries.Selling and administrative expenses are not allocated to individual products.  The difference between the $100 estimated selling price for Product W and its total cost of $88 represents

The difference between the $100 estimated selling price for Product W and its total cost of $88 represents

A)Contribution margin per unit.

B)Gross margin per unit.

C)Variable cost per unit.

D)Operating profit per unit.

The difference between the $100 estimated selling price for Product W and its total cost of $88 represents

The difference between the $100 estimated selling price for Product W and its total cost of $88 representsA)Contribution margin per unit.

B)Gross margin per unit.

C)Variable cost per unit.

D)Operating profit per unit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

65

Makwa Industries has developed two new products but has only enough plant capacity to introduce one product during the current year.The following data will assist management in deciding which product should be selected.Makwa's fixed overhead includes rent and utilities,equipment depreciation,and supervisory salaries.Selling and administrative expenses are not allocated to individual products.  Research and development costs for Makwa's two new products are

Research and development costs for Makwa's two new products are

A)Prime costs.

B)Conversion costs.

C)Opportunity costs.

D)Sunk costs.

Research and development costs for Makwa's two new products are

Research and development costs for Makwa's two new products areA)Prime costs.

B)Conversion costs.

C)Opportunity costs.

D)Sunk costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

66

The process of assigning indirect costs to products,services,people,business units,etc. ,is

A)cost object.

B)cost pool.

C)cost allocation.

D)opportunity cost.

A)cost object.

B)cost pool.

C)cost allocation.

D)opportunity cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

67

A cost allocation rule is the method or process used to assign the costs in the _________ to the ______________.

A)cost allocation;cost pool

B)cost pool;opportunity cost

C)cost object;cost pool

D)cost pool;cost object

A)cost allocation;cost pool

B)cost pool;opportunity cost

C)cost object;cost pool

D)cost pool;cost object

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

68

Which one of the following costs is classified as a period cost? (CIA adapted)

A)The wages of the workers on the shipping docks who load completed products onto outgoing trucks.

B)The wages of a worker paid for idle time resulting from a machine breakdown in the molding department.

C)The payments for employee (fringe)benefits paid on behalf of the workers in the manufacturing plant.

D)The wages paid to workers for reworking defective products that failed the quality inspection upon completion.

A)The wages of the workers on the shipping docks who load completed products onto outgoing trucks.

B)The wages of a worker paid for idle time resulting from a machine breakdown in the molding department.

C)The payments for employee (fringe)benefits paid on behalf of the workers in the manufacturing plant.

D)The wages paid to workers for reworking defective products that failed the quality inspection upon completion.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

69

An opportunity cost is

A)a cost that is charged against revenue in an accounting period.

B)the foregone benefit from the best alternative course of action.

C)the excess of operating revenues over operating costs.

D)the cost assigned to the products sold during the perioD.

A)a cost that is charged against revenue in an accounting period.

B)the foregone benefit from the best alternative course of action.

C)the excess of operating revenues over operating costs.

D)the cost assigned to the products sold during the perioD.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

70

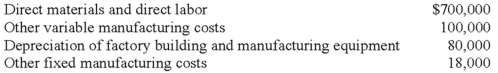

The Southeastern Company's manufacturing costs for the third quarter of 2008 were as follows: (CPA adapted)  What amount should be considered product costs for external reporting purposes?

What amount should be considered product costs for external reporting purposes?

A)$700,000

B)$800,000

C)$880,000

D)$898,000

What amount should be considered product costs for external reporting purposes?

What amount should be considered product costs for external reporting purposes?A)$700,000

B)$800,000

C)$880,000

D)$898,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

71

Under full absorption costing,which of the following are included in product costs?

A)Only direct materials and direct labor.

B)Only variable manufacturing costs.

C)Only conversion costs.

D)All fixed and variable manufacturing costs.

A)Only direct materials and direct labor.

B)Only variable manufacturing costs.

C)Only conversion costs.

D)All fixed and variable manufacturing costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

72

Makwa Industries has developed two new products but has only enough plant capacity to introduce one product during the current year.The following data will assist management in deciding which product should be selected.Makwa's fixed overhead includes rent and utilities,equipment depreciation,and supervisory salaries.Selling and administrative expenses are not allocated to individual products.  For Makwa's Product L,the costs for direct material,machining labor,and assembly labor represent

For Makwa's Product L,the costs for direct material,machining labor,and assembly labor represent

A)Conversion costs.

B)Period costs.

C)Prime costs.

D)Common costs.

For Makwa's Product L,the costs for direct material,machining labor,and assembly labor represent

For Makwa's Product L,the costs for direct material,machining labor,and assembly labor representA)Conversion costs.

B)Period costs.

C)Prime costs.

D)Common costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

73

Makwa Industries has developed two new products but has only enough plant capacity to introduce one product during the current year.The following data will assist management in deciding which product should be selected.Makwa's fixed overhead includes rent and utilities,equipment depreciation,and supervisory salaries.Selling and administrative expenses are not allocated to individual products.  The advertising costs for the product selected by Makwa will be

The advertising costs for the product selected by Makwa will be

A)Prime costs.

B)Conversion costs.

C)Period costs.

D)Opportunity costs.

The advertising costs for the product selected by Makwa will be

The advertising costs for the product selected by Makwa will beA)Prime costs.

B)Conversion costs.

C)Period costs.

D)Opportunity costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

74

Laner Company has the following data for the production and sale of 2,000 units.  What is the prime cost per unit?

What is the prime cost per unit?

A)$100

B)$280

C)$300

D)$480

What is the prime cost per unit?

What is the prime cost per unit?A)$100

B)$280

C)$300

D)$480

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

75

Makwa Industries has developed two new products but has only enough plant capacity to introduce one product during the current year.The following data will assist management in deciding which product should be selected.Makwa's fixed overhead includes rent and utilities,equipment depreciation,and supervisory salaries.Selling and administrative expenses are not allocated to individual products.  The total overhead cost of $27 for Makwa's Product W is a

The total overhead cost of $27 for Makwa's Product W is a

A)Sunk cost.

B)Opportunity cost.

C)Variable cost.

D)Mixed cost.

The total overhead cost of $27 for Makwa's Product W is a

The total overhead cost of $27 for Makwa's Product W is aA)Sunk cost.

B)Opportunity cost.

C)Variable cost.

D)Mixed cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

76

The difference between variable costs and fixed costs is (CMA adapted)

A)Unit variable costs fluctuate and unit fixed costs remain constant.

B)Unit variable costs are fixed over the relevant range and unit fixed costs are variable.

C)Total variable costs are constant over the relevant range,while fixed costs change in the long-term.

D)Total variable costs are variable over the relevant range but fixed in the long-term,while fixed costs never change.

A)Unit variable costs fluctuate and unit fixed costs remain constant.

B)Unit variable costs are fixed over the relevant range and unit fixed costs are variable.

C)Total variable costs are constant over the relevant range,while fixed costs change in the long-term.

D)Total variable costs are variable over the relevant range but fixed in the long-term,while fixed costs never change.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

77

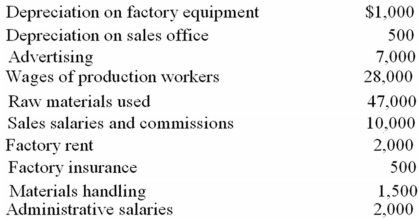

The following cost data for the month of May were taken from the records of the Paducah Manufacturing Company: (CIA adapted)  Based upon this information,the manufacturing cost incurred during the month was:

Based upon this information,the manufacturing cost incurred during the month was:

A)$78,500.

B)$80,000.

C)$80,500.

D)$83,000.

Based upon this information,the manufacturing cost incurred during the month was:

Based upon this information,the manufacturing cost incurred during the month was:A)$78,500.

B)$80,000.

C)$80,500.

D)$83,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

78

Waupun Company has the following unit costs:  What cost per unit would be used for product costing under full absorption costing?

What cost per unit would be used for product costing under full absorption costing?

A)$29

B)$42

C)$52

D)$60

What cost per unit would be used for product costing under full absorption costing?

What cost per unit would be used for product costing under full absorption costing?A)$29

B)$42

C)$52

D)$60

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

79

The following information was collected from the accounting records of the CJG 65 for 3,000 units:  What is CJG's total cost per unit?

What is CJG's total cost per unit?

A)$180.

B)$200.

C)$210.

D)$250.

What is CJG's total cost per unit?

What is CJG's total cost per unit?A)$180.

B)$200.

C)$210.

D)$250.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

80

Laner Company has the following data for the production and sale of 2,000 units.  What is the conversion cost per unit?

What is the conversion cost per unit?

A)$100

B)$180

C)$280

D)$380

What is the conversion cost per unit?

What is the conversion cost per unit?A)$100

B)$180

C)$280

D)$380

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck