Deck 3: Fundamentals of Cost-Volume-Profit Analysis

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/105

العب

ملء الشاشة (f)

Deck 3: Fundamentals of Cost-Volume-Profit Analysis

1

The contribution margin ratio is the contribution margin per unit divided by the selling price per unit.The statement made in the question is a definition of the contribution margin ratio.

True

2

An increase in the selling price per unit will decrease an organization's operating leverage,assuming sales unit volume doesn't change and there are no other changes in its cost structure.The operating leverage will decrease,even though the total cost structure does not change,because the fixed cost decline relative to selling price.

True

3

An increase in an organization's tax rate will cause an increase in its break-even point.Taxes have no impact on the break-even point because break even is calculated on before-tax profit.

False

4

An increase in an organization's fixed costs will result in a lower margin of safety,assuming all other costs and sales remain unchanged.This is due to an upward shift in the fixed and total cost curves relative to the revenue curve,driving the break-even point out;thereby,reducing the difference (margin of safety)between break-even and the point of actual performance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

5

The total contribution margin is the unit contribution margin multiplied by the number of units minus the fixed component of the total costs (TC).The total contribution margin is the unit contribution margin multiplied by the number of units.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

6

Profit is the unit contribution margin multiplied by the number of units minus the fixed component of the total costs (TC).Profit is TR minus TC,however at the unit contribution margin V (variable cost)has already been removed;therefore the above statement is true.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

7

If an organization's fixed costs are $2,400,tax rate is 40%,and contribution margin is $5,200,then its after-tax operating profits are $1,680.$5,200 - 2,400 = 2,800 - (2,800 × 40%)= $1,680.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

8

Both total revenues (TR)and total costs (TC)are likely to be affected by changes in the output.Fixed costs are not affected by changes in output,up to the point where capacity must be changed,thereby changing fixed costs as well.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

9

If the fixed costs are $2,400,targeted before-tax operating profit is $1,200,tax rate is 25%,selling price per unit is $2,and contribution margin ratio is 40%,then the sales volume is 9,000 units.(2,400 + 1,200)/(2 × 40%)= 4,500 units.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

10

The average selling price is $.60 per unit,the average variable cost is $.36 per unit,and the total fixed costs are $1,500.If operating profits of $900 are desired,a sales volume of 2,500 units is necessary.($1,500 + 900)/($0.60 - .36)= 10,000 units.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

11

The JK Manufacturing Company sells two products,J and K.J has a higher contribution margin ratio than K.If the product mix shifts towards K,the company's break-even point in total units (i.e. ,J plus K)will increase.The weighted-average contribution margin will be less when the sales mix shifts to the lower profit product.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

12

The break-even point in sales dollars is fixed costs divided by the contribution margin ratio.The statement made in the question is a definition of the break even.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

13

If the average selling price is $.60 per unit,the average variable cost is $.36 per unit,and the total fixed costs are $1,500,then sales of 15,000 units will result in operating profits of $3,600.($.60 - .36)× 15,000 - 1,500 = $2,100.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

14

Cost-volume-profit (CVP)analysis assumes that the production volume equals sales volume so that any changes in unit prices can be ignored.A basic assumption of cost-volume-profit analysis is that changes in inventory are ignored,or put another way,inventory is held constant.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

15

An organization's operating leverage is high when it has a low proportion of variable costs in its total costs.Low variable costs and higher fixed cost cause an organization's operating leverage to be high.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

16

Cost-volume-profit (CVP)analysis is more complicated for organizations with multiple products because typically each product has a different contribution margin ratio.Multiple products makes in necessary to develop a weighted-average contribution margin in order to calculate break even.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

17

The break-even point for an organization with a low operating leverage will be relatively higher than the break-even point for an organization with a high operating leverage.A low operating leverage has lower fixed costs and higher variable costs;therefore,the break-even point will be lower.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

18

Before-tax operating profits are equal to the after-tax operating profits divided by (1 - tax rate).After-tax profit = before-tax profit - before-tax profit × tax rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

19

In multi-product cost-volume-profit (CVP)analysis,the fixed product mix method and the weighted-average contribution margin method yield different break-even points.Both methods yield the same result.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

20

If the fixed costs are $2,400,targeted operating profits is $1,200,selling price per unit is $2,and the contribution margin ratio is 40%,then the required sales volume is 9,000 units.($2,400 + 1,200)/40% = $9,000;this is dollars,not units.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

21

If both the variable cost per unit and the selling price per unit decrease,the new contribution margin ratio in relation to the old contribution margin ratio will be:

A)Lower.

B)Higher.

C)Unchanged.

D)Cannot determine with the information given.

A)Lower.

B)Higher.

C)Unchanged.

D)Cannot determine with the information given.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

22

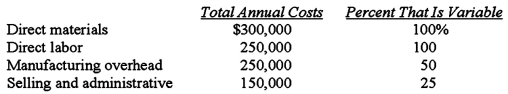

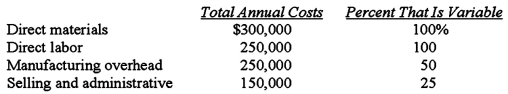

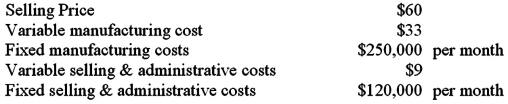

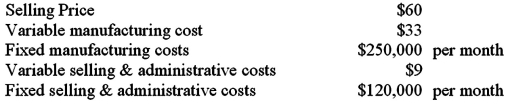

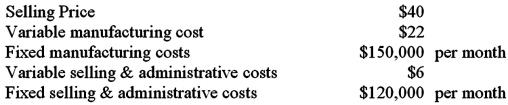

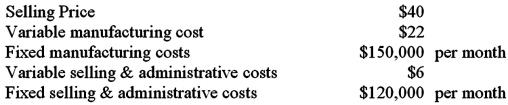

The following costs have been estimated based on sales of 30,000 units:  What selling price will yield a contribution margin of 40%?

What selling price will yield a contribution margin of 40%?

A)$59.38.

B)$43.75.

C)$39.58.

D)$33.25.

What selling price will yield a contribution margin of 40%?

What selling price will yield a contribution margin of 40%?A)$59.38.

B)$43.75.

C)$39.58.

D)$33.25.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

23

Which of the following changes to a company's contribution income statement will always lower the break-even point (either in units or in dollars)?

A)Sales price increases by 10%.

B)Sales price decreases by 5%.

C)Variable costs increase by 10% and fixed costs decrease by 5%.

D)Variable costs decrease by 5% and fixed costs increase by 10%.

A)Sales price increases by 10%.

B)Sales price decreases by 5%.

C)Variable costs increase by 10% and fixed costs decrease by 5%.

D)Variable costs decrease by 5% and fixed costs increase by 10%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

24

Cost-volume-profit (CVP)analysis is a simple but powerful tool to assist management make operating decisions.Which of the following does not represent a potential use of CVP analysis?

A)Ability to compute the break-even point.

B)Ability to determine optimal sales volumes.

C)Aids in evaluating tax planning alternatives.

D)Aids in determining optimal pricing policies.

A)Ability to compute the break-even point.

B)Ability to determine optimal sales volumes.

C)Aids in evaluating tax planning alternatives.

D)Aids in determining optimal pricing policies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

25

A decrease in the margin of safety would be caused by a(n):

A)increase in the total fixed costs.

B)increase in total revenue (sales).

C)decrease in the break-even point.

D)decrease in the variable cost per unit.

A)increase in the total fixed costs.

B)increase in total revenue (sales).

C)decrease in the break-even point.

D)decrease in the variable cost per unit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

26

JJ Motors Inc.employs 45 sales personnel to market its line of luxury automobiles.The average car sells for $23,000,and a 6 percent commission is paid to the salesperson.JJ Motors is considering a change to the commission arrangement where the company would pay each salesperson a salary of $2,000 per month plus a commission of 2 percent of the sales made by that salesperson.The amount of total monthly car sales at which JJ Motors would be indifferent as to which plan to select is:

A)$2,250,000.

B)$3,000,000.

C)$1,500,000.

D)$1,250,000.

A)$2,250,000.

B)$3,000,000.

C)$1,500,000.

D)$1,250,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

27

The Blue Company is currently selling its single product for $15.Variable costs are estimated to remain at 70% of the current selling price and fixed costs are estimated to be $4,800 per month.If Blue increases its selling price by 10%,its variable cost ratio will:

A)Not change.

B)Decrease.

C)Increase.

D)Cannot determine with the information given.

A)Not change.

B)Decrease.

C)Increase.

D)Cannot determine with the information given.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

28

XYZ Company's sales are $750,000 with operating profits of $130,000.If the contribution margin ratio is 40%,what did the fixed costs amount to?

A)$370,000.

B)$300,000.

C)$270,000.

D)$170,000.

A)$370,000.

B)$300,000.

C)$270,000.

D)$170,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

29

A company's break-even point will not be increased by:

A)an increase in total fixed costs.

B)a decrease in the selling price per unit.

C)an increase in the variable cost per unit.

D)a decrease in the contribution margin ratio.

E)an increase in the number of units produced and sold.

A)an increase in total fixed costs.

B)a decrease in the selling price per unit.

C)an increase in the variable cost per unit.

D)a decrease in the contribution margin ratio.

E)an increase in the number of units produced and sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

30

Fowler Manufacturing Company has a fixed cost of $225,000 for the production of tubes.Estimated sales are 150,000 units.A before tax profit of $125,000 is desired by the controller.If the tubes sell for $5 each,what unit contribution margin is required to attain the profit target?

A)$3.00.

B)$2.33.

C)$1.47.

D)$.90.

A)$3.00.

B)$2.33.

C)$1.47.

D)$.90.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

31

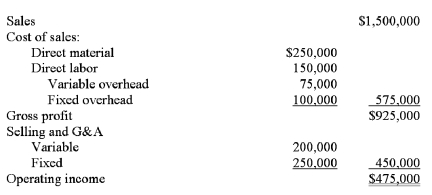

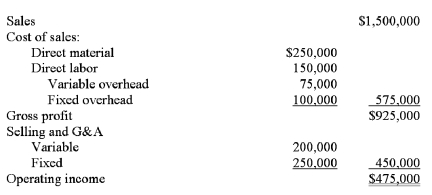

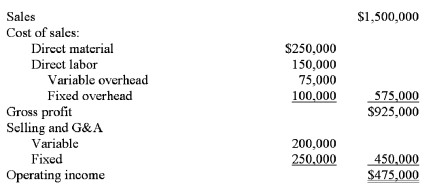

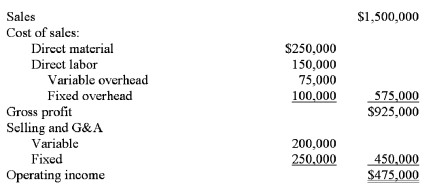

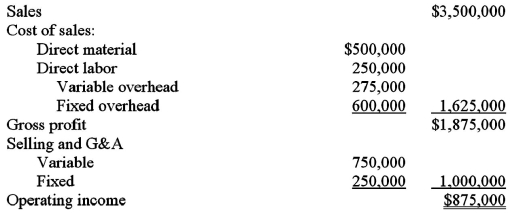

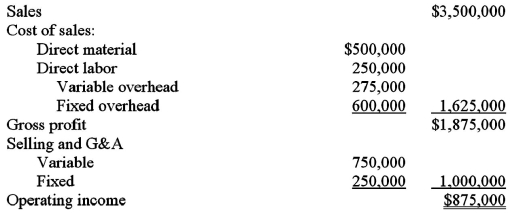

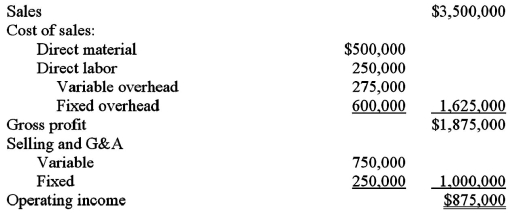

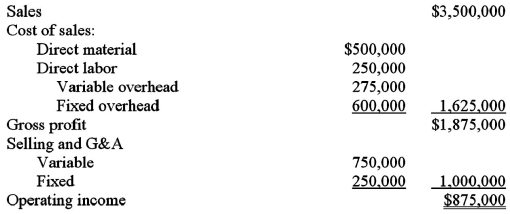

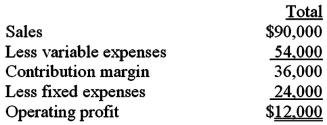

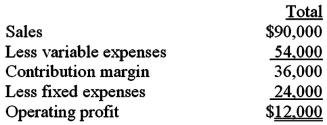

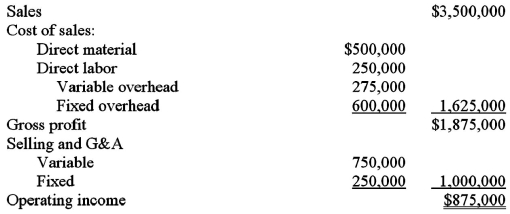

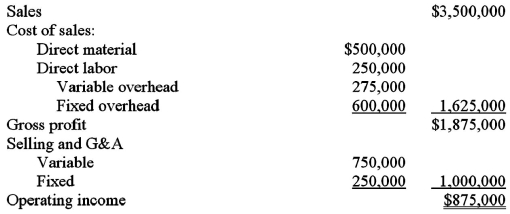

Barnes Corporation manufactures skateboards and is in the process of preparing next year's budget.The pro forma income statement for the current year is presented below.  The break-even point (rounded to the nearest dollar)for Barnes Corporation for the current year is:

The break-even point (rounded to the nearest dollar)for Barnes Corporation for the current year is:

A)$146,341.

B)$636,364.

C)$729,730.

D)$181,818.

The break-even point (rounded to the nearest dollar)for Barnes Corporation for the current year is:

The break-even point (rounded to the nearest dollar)for Barnes Corporation for the current year is:A)$146,341.

B)$636,364.

C)$729,730.

D)$181,818.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

32

Operating leverage refers to the extent to which an organization's cost structure is made up of:

A)differential costs.

B)opportunity costs.

C)fixed costs.

D)relevant costs.

A)differential costs.

B)opportunity costs.

C)fixed costs.

D)relevant costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

33

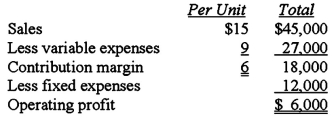

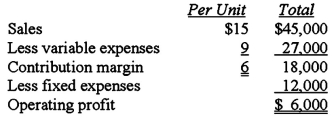

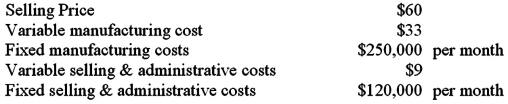

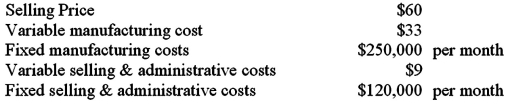

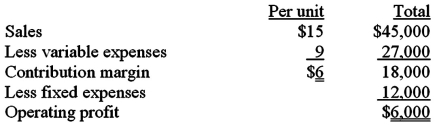

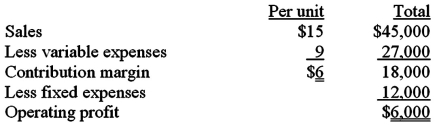

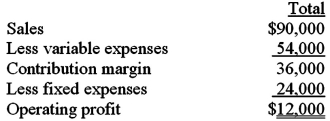

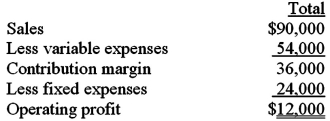

You have been provided with the following information:  If sales decrease by 500 units,how much will fixed costs have to be reduced by to maintain the current operating profit of $6,000?

If sales decrease by 500 units,how much will fixed costs have to be reduced by to maintain the current operating profit of $6,000?

A)$9,000.

B)$7,500.

C)$6,000.

D)$3,000.

If sales decrease by 500 units,how much will fixed costs have to be reduced by to maintain the current operating profit of $6,000?

If sales decrease by 500 units,how much will fixed costs have to be reduced by to maintain the current operating profit of $6,000?A)$9,000.

B)$7,500.

C)$6,000.

D)$3,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

34

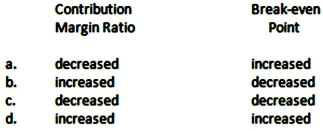

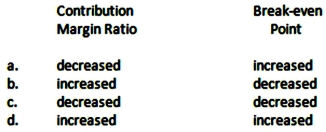

If the fixed costs for a product decrease and the variable costs (as a percentage of sales dollars)decrease,what will be the effect on the contribution margin ratio and the break-even point,respectively?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

35

Which of the following would not cause the break-even point to change?

A)Sales price increases.

B)Fixed cost decreases.

C)Sales volume decreases.

D)Variable costs per unit increases.

A)Sales price increases.

B)Fixed cost decreases.

C)Sales volume decreases.

D)Variable costs per unit increases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

36

Barnes Corporation manufactures skateboards and is in the process of preparing next year's budget.The pro forma income statement for the current year is presented below.  For the coming year,the management of Barnes Corporation anticipates a 10 percent increase in sales,a 12 percent increase in variable costs,and a $45,000 increase in fixed costs.The break-even point for next year would be:

For the coming year,the management of Barnes Corporation anticipates a 10 percent increase in sales,a 12 percent increase in variable costs,and a $45,000 increase in fixed costs.The break-even point for next year would be:

A)$729,027.

B)$862,103.

C)$214,018.

D)$474,000.

For the coming year,the management of Barnes Corporation anticipates a 10 percent increase in sales,a 12 percent increase in variable costs,and a $45,000 increase in fixed costs.The break-even point for next year would be:

For the coming year,the management of Barnes Corporation anticipates a 10 percent increase in sales,a 12 percent increase in variable costs,and a $45,000 increase in fixed costs.The break-even point for next year would be:A)$729,027.

B)$862,103.

C)$214,018.

D)$474,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

37

At a break-even point of 400 units,variable costs were $400 and fixed costs were $200.What will the 401st unit sold contribute to operating profits before income taxes?

A)$0.50.

B)$1.00.

C)$1.50.

D)$2.00.

A)$0.50.

B)$1.00.

C)$1.50.

D)$2.00.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

38

Cost A is a fixed cost,while B is a variable cost.During the current year,the volume of output has decreased.In terms of cost per unit of output,we would expect that:

A)cost A has remained unchanged.

B)cost B has decreased.

C)cost A has decreased.

D)cost B has remained unchangeD.Variable cost per unit has remained constant,while fixed cost in total remains unchanged but has increased on a per unit basis.

A)cost A has remained unchanged.

B)cost B has decreased.

C)cost A has decreased.

D)cost B has remained unchangeD.Variable cost per unit has remained constant,while fixed cost in total remains unchanged but has increased on a per unit basis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

39

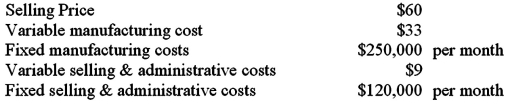

Given the following information:  What would expected net income be if the company experienced a 10 percent increase in fixed costs and a 10 percent increase in sales volume?

What would expected net income be if the company experienced a 10 percent increase in fixed costs and a 10 percent increase in sales volume?

A)$1,750.

B)$1,550.

C)$1,250.

D)$1,375.

What would expected net income be if the company experienced a 10 percent increase in fixed costs and a 10 percent increase in sales volume?

What would expected net income be if the company experienced a 10 percent increase in fixed costs and a 10 percent increase in sales volume?A)$1,750.

B)$1,550.

C)$1,250.

D)$1,375.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

40

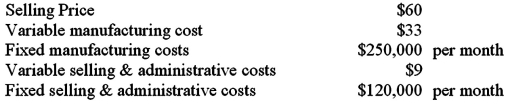

Given the following data:  If sales decrease by 500 units,by what percent would fixed costs have to be reduced by to maintain current net income?

If sales decrease by 500 units,by what percent would fixed costs have to be reduced by to maintain current net income?

A)50.0%.

B)33.3%.

C)25.0%.

D)16.7%.

If sales decrease by 500 units,by what percent would fixed costs have to be reduced by to maintain current net income?

If sales decrease by 500 units,by what percent would fixed costs have to be reduced by to maintain current net income?A)50.0%.

B)33.3%.

C)25.0%.

D)16.7%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

41

Donnelly Corporation manufactures and sells T-shirts imprinted with college names and slogans.Last year,the shirts sold for $7.50 each,and the variable cost to manufacture them was $2.25 per unit.The company needed to sell 20,000 shirts to break even.The after tax net income last year was $5,040.Donnelly's expectations for the coming year include the following: (CMA adapted) • The sales price of the T-shirts will be $9.• Variable cost to manufacture will increase by one-third.• Fixed costs will increase by 10%.• The income tax rate of 40% will be unchanged.Based on a $10 selling price per unit and if Donnelly Corporation wishes to earn $37,800 in after tax net income for the coming year,the company's sales volume in dollars must be:

A)$213,750.

B)$257,625.

C)$207,000.

D).$255,000.

A)$213,750.

B)$257,625.

C)$207,000.

D).$255,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

42

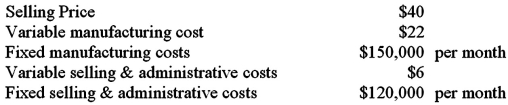

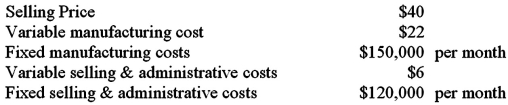

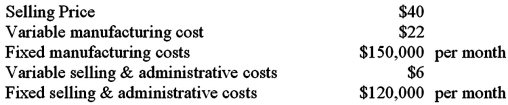

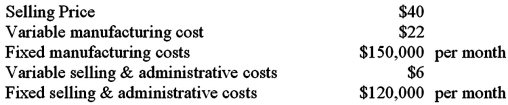

Sanfran has the following data:  How many units must Sanfran produce and sell in order to break even?

How many units must Sanfran produce and sell in order to break even?

A)8,333 units.

B)12,500 units.

C)15,000 units.

D)22,500 units.

How many units must Sanfran produce and sell in order to break even?

How many units must Sanfran produce and sell in order to break even?A)8,333 units.

B)12,500 units.

C)15,000 units.

D)22,500 units.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

43

Donnelly Corporation manufactures and sells T-shirts imprinted with college names and slogans.Last year,the shirts sold for $7.50 each,and the variable cost to manufacture them was $2.25 per unit.The company needed to sell 20,000 shirts to break even.The after tax net income last year was $5,040.Donnelly's expectations for the coming year include the following: (CMA adapted) • The sales price of the T-shirts will be $9.• Variable cost to manufacture will increase by one-third.• Fixed costs will increase by 10%.• The income tax rate of 40% will be unchanged.Based on a $10 selling price per unit,the number of T-shirts Donnelly Corporation must sell to break even in the coming year is:

A)17,000 units.

B)16,500 units.

C)20,000 units.

D)22,000 units.

A)17,000 units.

B)16,500 units.

C)20,000 units.

D)22,000 units.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

44

KR Sales had $1,200,000 in sales last month.The variable cost ratio was 60% and operating profits were $80,000.What sales volume does KR's need to yield a $200,000 operating profit?

A)$1,000,000.

B)$1,200,000.

C)$1,500,000.

D)$2,000,000.

A)$1,000,000.

B)$1,200,000.

C)$1,500,000.

D)$2,000,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

45

RedTail Manufacturing has the following data:  If RedTail has actual monthly sales of $1,500,000 and desires an operating profit of $50,000 per month,what is the margin of safety in sales dollars?

If RedTail has actual monthly sales of $1,500,000 and desires an operating profit of $50,000 per month,what is the margin of safety in sales dollars?

A)$100,000.

B)$266,667.

C)$50,000.

D)$1,130,000.

If RedTail has actual monthly sales of $1,500,000 and desires an operating profit of $50,000 per month,what is the margin of safety in sales dollars?

If RedTail has actual monthly sales of $1,500,000 and desires an operating profit of $50,000 per month,what is the margin of safety in sales dollars?A)$100,000.

B)$266,667.

C)$50,000.

D)$1,130,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

46

RedTail Manufacturing has the following data:  What dollar sales volume does RedTail need to break even?

What dollar sales volume does RedTail need to break even?

A)$822,222.

B)$833,333.

C)$900,000.

D)$1,233,333.

What dollar sales volume does RedTail need to break even?

What dollar sales volume does RedTail need to break even?A)$822,222.

B)$833,333.

C)$900,000.

D)$1,233,333.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

47

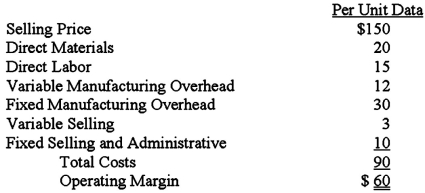

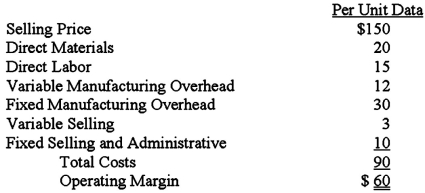

Kator Inc.manufactures industrial components.One of its products used as a subcomponent in auto manufacturing is KB-96.The selling price and cost per unit data for 9,000 units of KB-96 are as follows.  During the next year,sales of KB-96 are expected to be 10,000 units.All costs will remain the same except for fixed manufacturing overhead,which will increase by 20%,and material,which will increase by 10%.The selling price per unit for next year will be $160.Based on these data,Kator Inc.'s total contribution margin for next year will be: (CMA adapted)

During the next year,sales of KB-96 are expected to be 10,000 units.All costs will remain the same except for fixed manufacturing overhead,which will increase by 20%,and material,which will increase by 10%.The selling price per unit for next year will be $160.Based on these data,Kator Inc.'s total contribution margin for next year will be: (CMA adapted)

A)$882,000.

B)$980,000.

C)$972,000.

D)$1,080,000.

During the next year,sales of KB-96 are expected to be 10,000 units.All costs will remain the same except for fixed manufacturing overhead,which will increase by 20%,and material,which will increase by 10%.The selling price per unit for next year will be $160.Based on these data,Kator Inc.'s total contribution margin for next year will be: (CMA adapted)

During the next year,sales of KB-96 are expected to be 10,000 units.All costs will remain the same except for fixed manufacturing overhead,which will increase by 20%,and material,which will increase by 10%.The selling price per unit for next year will be $160.Based on these data,Kator Inc.'s total contribution margin for next year will be: (CMA adapted)A)$882,000.

B)$980,000.

C)$972,000.

D)$1,080,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

48

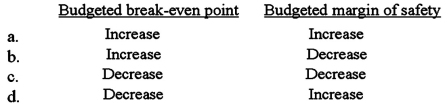

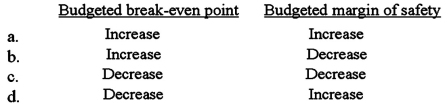

On January 1,2013,Lake Co.increased its direct labor wage rates.All other budgeted costs and revenues were unchanged.How did this increase affect Lake's budgeted break-even point and budgeted margin of safety? (CPA adapted)

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

49

Break-even analysis assumes that over the relevant range: (CPA adapted)

A)Total Fixed Costs are nonlinear.

B)Total Costs are unchanged.

C)Unit Variable Costs are unchanged.

D)Unit Revenues are nonlinear.

A)Total Fixed Costs are nonlinear.

B)Total Costs are unchanged.

C)Unit Variable Costs are unchanged.

D)Unit Revenues are nonlinear.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

50

The following information pertains to Syl Co.:  What is Syl's break-even point in sales dollars? (CPA adapted)

What is Syl's break-even point in sales dollars? (CPA adapted)

A)$200,000.

B)$160,000.

C)$50,000.

D)$40,000.

What is Syl's break-even point in sales dollars? (CPA adapted)

What is Syl's break-even point in sales dollars? (CPA adapted)A)$200,000.

B)$160,000.

C)$50,000.

D)$40,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

51

KR Sales had $1,200,000 in sales last month.The variable cost ratio was 60% and operating profits were $80,000.What is KR's break-even sales volume?

A)$800,000.

B)$1,000,000.

C)$1,200,000.

D)$2,000,000.

A)$800,000.

B)$1,000,000.

C)$1,200,000.

D)$2,000,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

52

Donnelly Corporation manufactures and sells T-shirts imprinted with college names and slogans.Last year,the shirts sold for $7.50 each,and the variable cost to manufacture them was $2.25 per unit.The company needed to sell 20,000 shirts to break even.The after tax net income last year was $5,040.Donnelly's expectations for the coming year include the following: (CMA adapted) • The sales price of the T-shirts will be $9.• Variable cost to manufacture will increase by one-third.• Fixed costs will increase by 10%.• The income tax rate of 40% will be unchanged.The selling price that would maintain the same contribution margin ratio as last year is:

A)$9.00.

B)$8.25.

C)$10.00.

D)$9.50.

A)$9.00.

B)$8.25.

C)$10.00.

D)$9.50.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

53

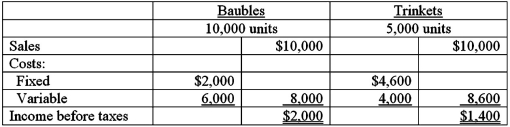

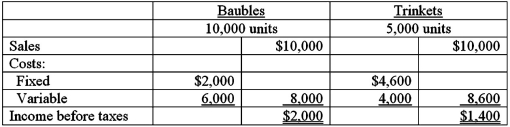

The Dooley Co.manufactures two products,Baubles and Trinkets.The following are projections for the coming year:  How many Baubles will be sold at the break-even point,assuming that the facilities are jointly used with the sales mix remaining constant?

How many Baubles will be sold at the break-even point,assuming that the facilities are jointly used with the sales mix remaining constant?

A)9,900.

B)8,800.

C)6,600.

D)5,000.

How many Baubles will be sold at the break-even point,assuming that the facilities are jointly used with the sales mix remaining constant?

How many Baubles will be sold at the break-even point,assuming that the facilities are jointly used with the sales mix remaining constant?A)9,900.

B)8,800.

C)6,600.

D)5,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

54

At the break-even point,the total contribution margin equals total: (CPA adapted)

A)Variable costs.

B)Sales.

C)Selling and administrative costs.

D)Fixed costs.

A)Variable costs.

B)Sales.

C)Selling and administrative costs.

D)Fixed costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

55

Sanfran has the following data:  How many units must Sanfran produce and sell in order to achieve a profit of $30,000 per month?

How many units must Sanfran produce and sell in order to achieve a profit of $30,000 per month?

A)10,000 units.

B)8,824 units.

C)25,000 units.

D)15,000 units.

How many units must Sanfran produce and sell in order to achieve a profit of $30,000 per month?

How many units must Sanfran produce and sell in order to achieve a profit of $30,000 per month?A)10,000 units.

B)8,824 units.

C)25,000 units.

D)15,000 units.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

56

Donnelly Corporation manufactures and sells T-shirts imprinted with college names and slogans.Last year,the shirts sold for $7.50 each,and the variable cost to manufacture them was $2.25 per unit.The company needed to sell 20,000 shirts to break even.The after tax net income last year was $5,040.Donnelly's expectations for the coming year include the following: (CMA adapted) • The sales price of the T-shirts will be $9.• Variable cost to manufacture will increase by one-third.• Fixed costs will increase by 10%.• The income tax rate of 40% will be unchanged.Sales for the coming year are expected to exceed last year's by 1,000 units.If this occurs,Donnelly's sales volume in the coming year will be:

A)22,600 units.

B)21,960 units.

C)23,400 units.

D)21,000 units.

A)22,600 units.

B)21,960 units.

C)23,400 units.

D)21,000 units.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

57

The following pertains to Clove Co.for the year ending December 31,2012:  Clove's margin of safety is: (CPA adapted)

Clove's margin of safety is: (CPA adapted)

A)$300,000.

B)$400,000.

C)$500,000.

D)$800,000.

Clove's margin of safety is: (CPA adapted)

Clove's margin of safety is: (CPA adapted)A)$300,000.

B)$400,000.

C)$500,000.

D)$800,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

58

RedTail Manufacturing has the following data:  What dollar sales volume does RedTail need to achieve a $50,000 operating profit per month?

What dollar sales volume does RedTail need to achieve a $50,000 operating profit per month?

A)$1,400,000.

B)$7,560,000.

C)$933,333.

D)$1,233,333.

What dollar sales volume does RedTail need to achieve a $50,000 operating profit per month?

What dollar sales volume does RedTail need to achieve a $50,000 operating profit per month?A)$1,400,000.

B)$7,560,000.

C)$933,333.

D)$1,233,333.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

59

Sanfran has the following data:  If Sanfran produces and sells 30,000 units,what is the margin of safety in units?

If Sanfran produces and sells 30,000 units,what is the margin of safety in units?

A)5,000 units.

B)7,500 units.

C)22,500 units.

D)30,000 units.

If Sanfran produces and sells 30,000 units,what is the margin of safety in units?

If Sanfran produces and sells 30,000 units,what is the margin of safety in units?A)5,000 units.

B)7,500 units.

C)22,500 units.

D)30,000 units.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

60

During 2012,Thor Lab supplied hospitals with a comprehensive diagnostic kit for $120.At a volume of 80,000 kits,Thor had fixed costs of $1,000,000 and a profit before income taxes of $200,000.Due to an adverse legal decision,Thor's 2013 liability insurance increased by $1,200,000 over 2012.Assuming the volume and other costs are unchanged,what should the 2013 price be if Thor is to make the same $200,000 profit before income taxes? (CPA adapted)

A)$122.50.

B)$135.00.

C)$152.50.

D)$240.00.

A)$122.50.

B)$135.00.

C)$152.50.

D)$240.00.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

61

Which of the following would not cause the break-even point to change?

A)Sales price increases.

B)Sales volume increases.

C)Fixed cost increases.

D)Variable costs per unit decreases.

A)Sales price increases.

B)Sales volume increases.

C)Fixed cost increases.

D)Variable costs per unit decreases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

62

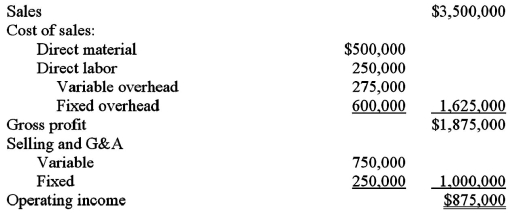

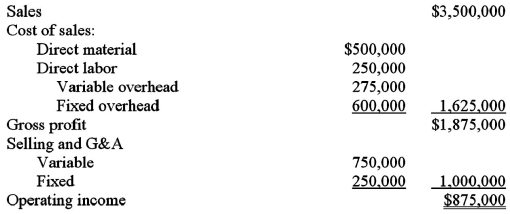

Misa Corporation manufactures circuit boards and is in the process of preparing next year's budget.The pro forma income statement for the current year is presented below.  The contribution margin ratio for the current year is:

The contribution margin ratio for the current year is:

A)53.6%.

B)49.3%.

C)46.4%.

D)25%.

The contribution margin ratio for the current year is:

The contribution margin ratio for the current year is:A)53.6%.

B)49.3%.

C)46.4%.

D)25%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

63

Misa Corporation manufactures circuit boards and is in the process of preparing next year's budget.The pro forma income statement for the current year is presented below.  For the coming year,the management of Misa Corporation anticipates a 5 percent decrease in sales,a 10 percent increase in variable costs,and a $45,000 increase in fixed costs.The break-even point for next year would be:

For the coming year,the management of Misa Corporation anticipates a 5 percent decrease in sales,a 10 percent increase in variable costs,and a $45,000 increase in fixed costs.The break-even point for next year would be:

A)$3,022,500.

B)$2,947,500.

C)$2,668,750.

D)$2,168,225.

For the coming year,the management of Misa Corporation anticipates a 5 percent decrease in sales,a 10 percent increase in variable costs,and a $45,000 increase in fixed costs.The break-even point for next year would be:

For the coming year,the management of Misa Corporation anticipates a 5 percent decrease in sales,a 10 percent increase in variable costs,and a $45,000 increase in fixed costs.The break-even point for next year would be:A)$3,022,500.

B)$2,947,500.

C)$2,668,750.

D)$2,168,225.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

64

Misa Corporation manufactures circuit boards and is in the process of preparing next year's budget.The pro forma income statement for the current year is presented below.  For the coming year,the management of Misa Corporation anticipates a 5 percent decrease in sales,a 10 percent increase in all variable costs,and a $45,000 increase in fixed costs.The operating profit for next year would be:

For the coming year,the management of Misa Corporation anticipates a 5 percent decrease in sales,a 10 percent increase in all variable costs,and a $45,000 increase in fixed costs.The operating profit for next year would be:

A)$477,500.

B)$492,500.

C)$552,500.

D)$831,250.

For the coming year,the management of Misa Corporation anticipates a 5 percent decrease in sales,a 10 percent increase in all variable costs,and a $45,000 increase in fixed costs.The operating profit for next year would be:

For the coming year,the management of Misa Corporation anticipates a 5 percent decrease in sales,a 10 percent increase in all variable costs,and a $45,000 increase in fixed costs.The operating profit for next year would be:A)$477,500.

B)$492,500.

C)$552,500.

D)$831,250.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

65

EM Sales had $2,200,000 in sales last month.The contribution margin ratio was 30% and operating profits were $180,000.What is EM's break-even sales volume?

A)$660,000.

B)$1,540,000.

C)$1,600,000.

D)$2,020,000.

A)$660,000.

B)$1,540,000.

C)$1,600,000.

D)$2,020,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

66

Acme Sales has two store locations.Store A has fixed costs of $125,000 per month and a variable cost ratio of 60%.Store B has fixed costs of $200,000 per month and a variable cost ratio of 30%.At what sales volume would the two stores have equal profits or losses?

A)$250,000.

B)$325,000.

C)$361,111.

D)Cannot determine with the information given.

A)$250,000.

B)$325,000.

C)$361,111.

D)Cannot determine with the information given.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

67

Which of the following would not cause the break-even point to change?

A)Variable costs per unit increases.

B)Fixed costs increases.

C)Product mix shifts towards the more expensive products.

D)Sales volume decreases.

A)Variable costs per unit increases.

B)Fixed costs increases.

C)Product mix shifts towards the more expensive products.

D)Sales volume decreases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

68

A company's break-even point will not be changed by:

A)a change in total fixed costs.

B)a change in the number of units produced and sold.

C)a change in the variable cost ratio.

D)a change in the contribution margin ratio.

A)a change in total fixed costs.

B)a change in the number of units produced and sold.

C)a change in the variable cost ratio.

D)a change in the contribution margin ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

69

Genco Sales has two store locations.Carslberg has fixed costs of $250,000 per month and a contribution margin ratio of 35%.Tuborg has fixed costs of $400,000 per month and a contribution margin ratio of 65%.At what sales volume would the two stores have equal profits or losses?

A)$500,000.

B)$650,000.

C)$1,300,000.

D)Cannot determine with the information given.

A)$500,000.

B)$650,000.

C)$1,300,000.

D)Cannot determine with the information given.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

70

You have been provided with the following information:  If sales increase by 10%,what level of fixed costs will yield a 20% increase in profits?

If sales increase by 10%,what level of fixed costs will yield a 20% increase in profits?

A)$14,400.

B)$19,200.

C)$25,200.

D)$26,400.

If sales increase by 10%,what level of fixed costs will yield a 20% increase in profits?

If sales increase by 10%,what level of fixed costs will yield a 20% increase in profits?A)$14,400.

B)$19,200.

C)$25,200.

D)$26,400.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

71

Acme Sales has two store locations.Store A has fixed costs of $125,000 per month and a variable cost ratio of 60%.Store B has fixed costs of $200,000 per month and a variable cost ratio of 30%.What is the break-even sales volume for Store B?

A)$666,667.

B)$325,000.

C)$285,714.

D)Cannot determine with the information given.

A)$666,667.

B)$325,000.

C)$285,714.

D)Cannot determine with the information given.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

72

You have been provided with the following information:  If unit sales decrease by 10%,how much will fixed costs have to be reduced by to maintain the current operating profit?

If unit sales decrease by 10%,how much will fixed costs have to be reduced by to maintain the current operating profit?

A)$12,000.

B)$4,500.

C)$6,000.

D)$1,800.

If unit sales decrease by 10%,how much will fixed costs have to be reduced by to maintain the current operating profit?

If unit sales decrease by 10%,how much will fixed costs have to be reduced by to maintain the current operating profit?A)$12,000.

B)$4,500.

C)$6,000.

D)$1,800.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

73

A company's break-even point will not be increased by:

A)an increase in the number of units produced and sold.

B)a decrease in the selling price per unit.

C)an increase in the variable cost per unit.

D)an increase in the variable cost ratio.

A)an increase in the number of units produced and sold.

B)a decrease in the selling price per unit.

C)an increase in the variable cost per unit.

D)an increase in the variable cost ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

74

You have been provided with the following information:  If sales decrease by 10%,what level of fixed costs will maintain the current operating profit?

If sales decrease by 10%,what level of fixed costs will maintain the current operating profit?

A)$12,000.

B)$20,400.

C)$21,600.

D)$24,000.

If sales decrease by 10%,what level of fixed costs will maintain the current operating profit?

If sales decrease by 10%,what level of fixed costs will maintain the current operating profit?A)$12,000.

B)$20,400.

C)$21,600.

D)$24,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

75

KR Sales had $1,200,000 in sales last month.The variable cost ratio was 60% and operating profits were $80,000.What is KR's margin of safety in sales dollars?

A)$200,000.

B)$300,000.

C)$500,000.

D)Cannot determine with the information given.

A)$200,000.

B)$300,000.

C)$500,000.

D)Cannot determine with the information given.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

76

Misa Corporation manufactures circuit boards and is in the process of preparing next year's budget.The pro forma income statement for the current year is presented below.  The break-even point (rounded to the nearest dollar)for Misa Corporation for the current year is:

The break-even point (rounded to the nearest dollar)for Misa Corporation for the current year is:

A)$2,625,000.

B)$1,865,672.

C)$1,724,138.

D)$2,155,172.

The break-even point (rounded to the nearest dollar)for Misa Corporation for the current year is:

The break-even point (rounded to the nearest dollar)for Misa Corporation for the current year is:A)$2,625,000.

B)$1,865,672.

C)$1,724,138.

D)$2,155,172.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

77

If both the variable cost per unit and the selling price per unit increase,the new contribution margin ratio in relation to the old contribution margin ratio will be:

A)Lower.

B)Higher.

C)Unchanged.

D)Cannot determine with the information given.

A)Lower.

B)Higher.

C)Unchanged.

D)Cannot determine with the information given.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

78

Acme Sales has two store locations.Store A has fixed costs of $125,000 per month and a variable cost ratio of 60%.Store B has fixed costs of $200,000 per month and a variable cost ratio of 30%.What is the break-even sales volume for Store A?

A)$208,333.

B)$312,500.

C)$325,000.

D)Cannot determine with the information given.

A)$208,333.

B)$312,500.

C)$325,000.

D)Cannot determine with the information given.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

79

A company's break-even point will not be changed by:

A)a change in total fixed costs.

B)a change in the selling price per unit.

C)a change in the variable cost per unit.

D)a change in the contribution margin ratio.

E)a change in the income tax rate.

A)a change in total fixed costs.

B)a change in the selling price per unit.

C)a change in the variable cost per unit.

D)a change in the contribution margin ratio.

E)a change in the income tax rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

80

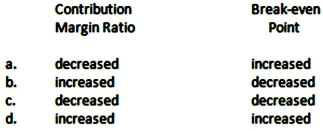

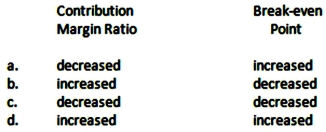

If the fixed costs for a product increase and the variable costs (as a percentage of sales dollars)increase,what will be the effect on the contribution margin ratio and the break-even point,respectively?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck