Deck 14: Business Unit Performance Measurement

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/76

العب

ملء الشاشة (f)

Deck 14: Business Unit Performance Measurement

1

Residual income is the difference between the divisional income and the cost of invested capital required to operate the division.This is the definition of residual income.

True

2

One problem associated with using accounting measures to evaluate divisional performance is the measures are based on historical information.Historical costs may not reflect current conditions.

True

3

Managerial myopia is the distortion in incentives that result from using accounting measures to evaluate performance.This is one definition of managerial myopia.

True

4

Treating research and development costs as an expense rather than a long-term asset may reduce a manager's inclination to participate in research and development activities.There would be a large impact on income in a single year rather than spreading it over many years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

5

It is not possible for a manager to accept an unacceptable project when his/her performance is evaluated using ROI.Since ROI is a ratio,a division with a lower than average ROI may choose a project that does not meet the corporate benchmarks.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

6

One advantage of using after-tax income as a performance measure of divisional results is it's a financial accounting measure that is also used to compute the organizational income.This makes it easier to understand and compare.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

7

Most organizations use residual income instead of return on investment (ROI)as a performance measure.ROI is much more common than residual income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

8

The use of residual income reduces,but does not eliminate,the suboptimization problem.Suboptimization may still exist since accounting income does not necessarily reflect economic performance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

9

A problem with ratio-based measures is that managers can make decisions that improve divisional income but lower total organizational income.This is the problem of suboptimization.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

10

Historical costs are based on the original costs to acquire a long-term asset,while current costs represent the costs to replace the long-term asset.These are the definitions of historical and current cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

11

One disadvantage of using after-tax income as a performance measure of divisional results is it's an absolute measure which makes it difficult to compare divisions of significantly different sizes.Larger divisions will naturally show larger income than a smaller division would.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

12

Economic value added (EVA)adjustments are made to both the after-tax income and the capital employed.Both income and capital are adjusted to eliminate accounting distortions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

13

In general,a division's investment base includes an allocated share of the corporate headquarters' assets.The goal is controllable investment,so corporate costs should not be allocated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

14

One problem with economic value added (EVA)adjustments is determining the appropriate life for expenditures that benefit multiple periods.There is uncertainty in how many years an expenditure will yield benefits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

15

Using net book values instead of gross book values to compute return on investment (ROI)might encourage an investment center manager to delay replacing inefficient assets until they are fully depreciated.Book value decreases as the asset ages.Replacing an asset replaces a lower net investment with a larger one.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

16

In general,it is better to have a higher return on investment (ROI)than a lower one.This implies that either income is higher or the assets are being used more efficiently.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

17

Divisional income statements do not have to follow generally accepted accounting principles (GAAP)because they are internal reports.GAAP is only required for external reports.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

18

Like return on investment (ROI),economic value added (EVA)adjustments fail to sufficiently address the sub-optimization problem.Both ROI and EVA are ratio-based measures,which gives rise to suboptimization.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

19

Current costs should not be used to compute either return on investment (ROI)or residual income because current costs are not generally accepted accounting principles (GAAP).GAAP is not a relevant concern for either ROI or residual income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

20

The profit margin ratio is computed by dividing after-tax operating income by sales.This is the definition of the profit margin ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

21

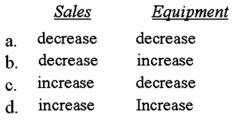

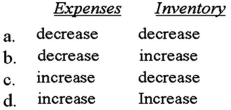

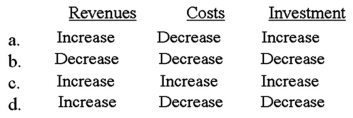

How will increases in the following items affect residual income?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

22

A division earning a profit will increase its return on investment (ROI)if it increases operating expenses and:

A)sales by the same dollar amount.

B)sales by the same percentage.

C)investment by the same dollar amount.

D)investment by the same percentage.

A)sales by the same dollar amount.

B)sales by the same percentage.

C)investment by the same dollar amount.

D)investment by the same percentage.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

23

Residual income is similar to the _________ notion of profit as being the amount left over after all costs,including the cost of the capital employed in the division,are subtracted.

A)accountant's

B)manager's

C)shareholder's

D)economist's

A)accountant's

B)manager's

C)shareholder's

D)economist's

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

24

Which of the following statements is (are)true? (A)Divisional income statements do not include allocated common costs.(B)The gross margin ratio is computed by dividing operating income by sales.

A)Only A is true.

B)Only B is true.

C)Both A and B are true.

D)Neither A nor B is true.

A)Only A is true.

B)Only B is true.

C)Both A and B are true.

D)Neither A nor B is true.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

25

Which of the following should not be used for the cost of capital to compute residual income?

A)Historical weighted average cost of capital.

B)Marginal after-tax cost of new equity capital.

C)Cost of debt and equity used to finance a project.

D)Return on investment (ROI).

A)Historical weighted average cost of capital.

B)Marginal after-tax cost of new equity capital.

C)Cost of debt and equity used to finance a project.

D)Return on investment (ROI).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

26

Which of the following items would not be an example of an economic value added (EVA)adjustment to eliminate accounting distortions?

A)Research & development costs.

B)Advertising expenditures.

C)Patent amortization.

D)Common stock.

A)Research & development costs.

B)Advertising expenditures.

C)Patent amortization.

D)Common stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

27

Which one of the following items would most likely not be incorporated into the calculation of a division's investment base when using the residual income approach for performance measurement and evaluation?

A)Land being held by the division as a potential site for a new plant and parking lot.

B)Division inventories when division management exercises control over the inventory levels.

C)Division accounts payable when division management exercises control over the amount of short-term credit utilized.

D)Division accounts receivable when division management exercises control over credit policy and credit terms.

A)Land being held by the division as a potential site for a new plant and parking lot.

B)Division inventories when division management exercises control over the inventory levels.

C)Division accounts payable when division management exercises control over the amount of short-term credit utilized.

D)Division accounts receivable when division management exercises control over credit policy and credit terms.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

28

Which of the following statements does not represent a limitation of using return on investment (ROI)for measuring and evaluating performance?

A)ROI uses accounting income which is based on historical costs.

B)ROI cannot be used to compare divisions of different sizes.

C)ROI has the potential to create goal congruence problems.

D)ROI fails to align some costs incurred in one period with the benefits received in another perioD.ROI can be used to compare different sized divisions-this is an advantage of ROI.

A)ROI uses accounting income which is based on historical costs.

B)ROI cannot be used to compare divisions of different sizes.

C)ROI has the potential to create goal congruence problems.

D)ROI fails to align some costs incurred in one period with the benefits received in another perioD.ROI can be used to compare different sized divisions-this is an advantage of ROI.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

29

Which of the following statement(s)is/are true? (A)If a division's return on investment (ROI)exceeds its cost of capital,then its residual income is positive.(B)If a division's cost of capital equals its return on investment (ROI),then its residual income is zero.

A)Only (A)is true.

B)Only (B)is true.

C)Both (A)and (B)are true.

D)Neither (A)and (B)is true.

A)Only (A)is true.

B)Only (B)is true.

C)Both (A)and (B)are true.

D)Neither (A)and (B)is true.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

30

The asset turnover is a measure (ratio)of an investment center's ability to:

A)earn profits.

B)generate sales.

C)control costs.

D)remain solvent.

A)earn profits.

B)generate sales.

C)control costs.

D)remain solvent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

31

A manager can always increase his/her return on investment (ROI)by:

A)reducing the asset turnover.

B)decreasing residual income.

C)increasing the operating profit margin.

D)expanding operating assets while holding sales and expenses constant.

A)reducing the asset turnover.

B)decreasing residual income.

C)increasing the operating profit margin.

D)expanding operating assets while holding sales and expenses constant.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

32

Return on investment (ROI)can be decomposed into the asset turnover and the:

A)gross margin ratio.

B)profit margin ratio.

C)operating margin ratio.

D)contribution margin ratio.

A)gross margin ratio.

B)profit margin ratio.

C)operating margin ratio.

D)contribution margin ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

33

Managerial performance can be measured in many different ways including return on investment (ROI)and residual income.A good reason for using residual income instead of ROI is that:

A)residual income can be computed without regard to identifying an investment base.

B)appropriate goal congruence behavior is more likely to occur when using residual income.

C)residual income is well accepted in many organizations and often used in the financial press.

D)ROI does not take into consideration both the investment turnover ratio and return-on-sales percentage.

A)residual income can be computed without regard to identifying an investment base.

B)appropriate goal congruence behavior is more likely to occur when using residual income.

C)residual income is well accepted in many organizations and often used in the financial press.

D)ROI does not take into consideration both the investment turnover ratio and return-on-sales percentage.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

34

The measure (ratio)that reflects the performance of a manager regarding sales and cost of goods sold,but not other operating costs and income taxes,is called the:

A)gross margin ratio.

B)profit margin ratio.

C)operating margin ratio.

D)contribution margin ratio.

A)gross margin ratio.

B)profit margin ratio.

C)operating margin ratio.

D)contribution margin ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

35

If a division is evaluated using return on investment (ROI)without regard to how assets are financed,the denominator in the ROI calculation will be:

A)current assets.

B)working capital.

C)total assets available.

D)total assets employeD.

A)current assets.

B)working capital.

C)total assets available.

D)total assets employeD.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

36

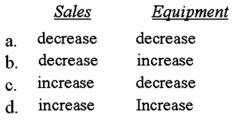

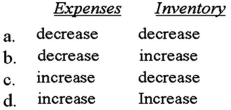

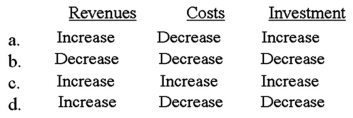

How will decreases in the following items affect return on investment (ROI)?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

37

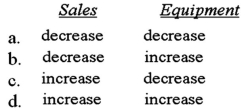

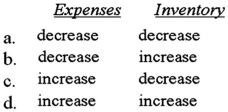

How will decreases in the following items affect residual income?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

38

Which of the following statement(s)is/are false? (A)Residual income can be used to compare divisions of different sizes.(B)Residual income can be used to compare divisions that are profit centers.

A)Only (A)is false.

B)Only (B)is false.

C)Both (A)and (B)are false.

D)Neither (A)and (B)is false.

A)Only (A)is false.

B)Only (B)is false.

C)Both (A)and (B)are false.

D)Neither (A)and (B)is false.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

39

After-tax income divided by sales is called the:

A)gross margin ratio.

B)profit margin ratio.

C)operating margin ratio.

D)contribution margin ratio.

A)gross margin ratio.

B)profit margin ratio.

C)operating margin ratio.

D)contribution margin ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

40

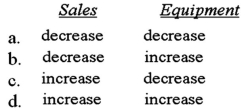

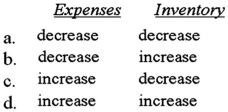

How will increases in the following items affect return on investment (ROI)?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

41

Which of the following statements regarding the use of historical costs and current costs to compute return on investment (ROI)is (are)true? (A)Historical costs are based on the original costs to acquire a long-term asset,while current costs represent the costs to replace the long-term asset.(B)For a specific multiple-period project,the return on investment (ROI)computed using current costs will generally be less than the ROI computed using historical costs.

A)Only (A)is true.

B)Only (B)is true.

C)Both (A)and (B)are true.

D)Neither (A)and (B)is true.

A)Only (A)is true.

B)Only (B)is true.

C)Both (A)and (B)are true.

D)Neither (A)and (B)is true.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

42

Using ending balances for the investment base in computing return on investment (ROI)might encourage managers to acquire assets:

A)early in the year and dispose of assets late in the year.

B)early in the year and dispose of assets early in the year.

C)late in the year and dispose of assets late in the year.

D)late in the year and dispose of assets early in the year.

A)early in the year and dispose of assets late in the year.

B)early in the year and dispose of assets early in the year.

C)late in the year and dispose of assets late in the year.

D)late in the year and dispose of assets early in the year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

43

Which of the following items would not require an adjustment to capital employed when using economic value added (EVA)?

A)Research & development costs.

B)Advertising expenditures.

C)Preferred stock.

D)Patents developeD.Stock does not require an adjustment to capital employed;the other three do because they are expensed under GAAP.

A)Research & development costs.

B)Advertising expenditures.

C)Preferred stock.

D)Patents developeD.Stock does not require an adjustment to capital employed;the other three do because they are expensed under GAAP.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

44

Welsh Corporation's return on investment (ROI)on some new equipment was 20% using beginning-of-year net book value.The gross book value of the equipment is $250,000.Accumulated depreciation at the beginning of the year was $10,000.This represents one-half year's straight-line depreciation.What is the annual before-tax cash flow from the new equipment?

A)$68,000.

B)$60,000.

C)$48,000.

D)$20,000.

A)$68,000.

B)$60,000.

C)$48,000.

D)$20,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

45

Using beginning balances for the investment base in computing return on investment (ROI)might encourage managers to acquire assets:

A)early in the year and dispose of assets late in the year.

B)early in the year and dispose of assets early in the year.

C)late in the year and dispose of assets late in the year.

D)late in the year and dispose of assets early in the year.

A)early in the year and dispose of assets late in the year.

B)early in the year and dispose of assets early in the year.

C)late in the year and dispose of assets late in the year.

D)late in the year and dispose of assets early in the year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

46

Rayburn Corporation purchased a new machine for $120,000.The machine has an estimated useful life of 10-years with no salvage value and a return on investment (ROI)of 15%.ROI is computed using annual cash flows and straight-line depreciation.What is the annual cash flow using the gross book value method?

A)$12,200.

B)$18,000.

C)$28,200.

D)$30,000.

A)$12,200.

B)$18,000.

C)$28,200.

D)$30,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

47

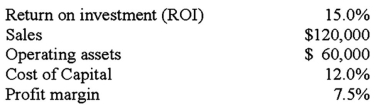

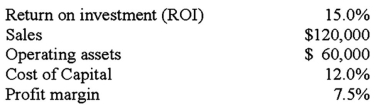

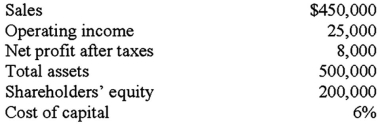

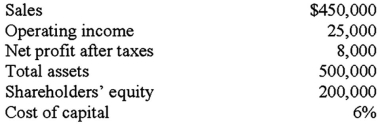

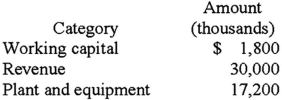

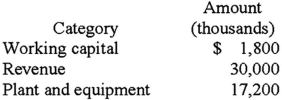

The following information is available for Company X:  What is Company X's return on investment (ROI)?

What is Company X's return on investment (ROI)?

A)6.0%.

B)10.0%.

C)15.0%.

D)24.0%.

What is Company X's return on investment (ROI)?

What is Company X's return on investment (ROI)?A)6.0%.

B)10.0%.

C)15.0%.

D)24.0%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

48

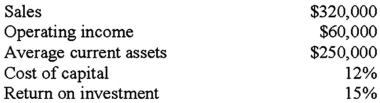

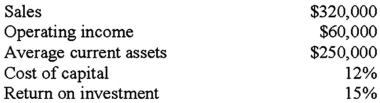

The following information has been gathered for the Green Division:  Compute the Green Division's residual income.

Compute the Green Division's residual income.

A)$1,800.

B)$2,700.

C)$3,600.

D)$5,400.

Compute the Green Division's residual income.

Compute the Green Division's residual income.A)$1,800.

B)$2,700.

C)$3,600.

D)$5,400.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

49

Use the following information to compute residual income:

A)$12,000.

B)$22,500.

C)$30,000.

D)$48,000.

A)$12,000.

B)$22,500.

C)$30,000.

D)$48,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

50

The FGH Company has an asset turnover of 3.0 times,using assets of $45,000.The company also has a return on investment (ROI)of 20%.What was the company's operating profit margin?

A)5.0%.

B)6.0%.

C)6.7%.

D)8.3%.

A)5.0%.

B)6.0%.

C)6.7%.

D)8.3%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

51

The FGH Company has an asset turnover of 3.0 times,using assets of $45,000.The company also has a return on investment (ROI)of 20%.If the residual income was $2,250,what was the company's cost of capital?

A)6.0%.

B)10.0%.

C)15.0%.

D)20.0%.

A)6.0%.

B)10.0%.

C)15.0%.

D)20.0%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

52

In 2012,Wishbone Corporation had an operating profit of $750,000 and a residual income of $300,000.If Wishbone's cost of capital is 15%,what is the amount of the invested capital?

A)$5,000,000.

B)$3,000,000.

C)$2,000,000.

D)$1,250,000.

A)$5,000,000.

B)$3,000,000.

C)$2,000,000.

D)$1,250,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

53

The Najacht Division of the Rassbach Company has a return on investment (ROI)of 12%,sales of $200,000,and an asset turnover of 2.0.What was Najacht's operating income?

A)$6,000.

B)$12,000.

C)$24,000.

D)$48,000.

A)$6,000.

B)$12,000.

C)$24,000.

D)$48,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

54

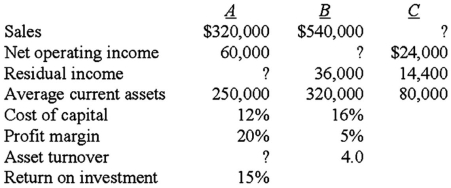

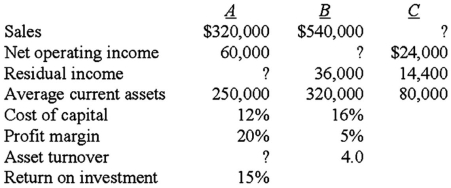

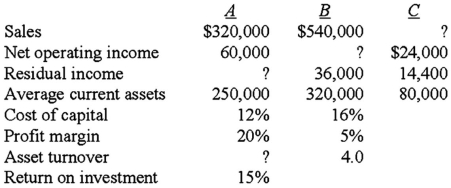

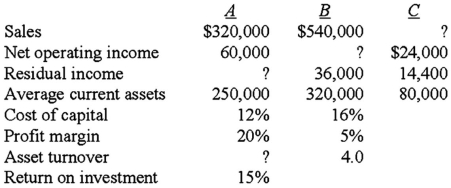

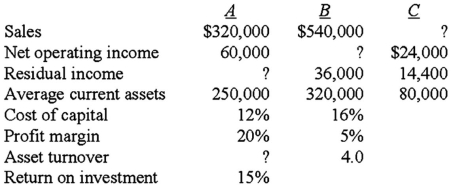

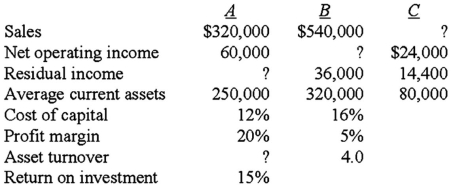

The ABC Company has three divisions: A Division,B Division,and C Division.  What was C Division's cost of capital last year?

What was C Division's cost of capital last year?

A)8%.

B)12%.

C)18%.

D)20%.

What was C Division's cost of capital last year?

What was C Division's cost of capital last year?A)8%.

B)12%.

C)18%.

D)20%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

55

Level return on investments (ROI)over the life of a long-term project is more likely when ROI is computed using:

A)historical costs and net book values.

B)historical costs and gross book values.

C)current costs and net book values.

D)current costs and gross book values.

A)historical costs and net book values.

B)historical costs and gross book values.

C)current costs and net book values.

D)current costs and gross book values.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

56

Economic value added (EVA)assumes that which of the following GAAP expenses would not result in an adjustment to either the income or the capital employed?

A)Research & development costs.

B)Use of process costing rather than job costing.

C)Advertising expenses.

D)Writeoff of goodwill.

A)Research & development costs.

B)Use of process costing rather than job costing.

C)Advertising expenses.

D)Writeoff of goodwill.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

57

The ABC Company has three divisions: A Division,B Division,and C Division.  What was B Division's return on investment (ROI)last year?

What was B Division's return on investment (ROI)last year?

A)16.00%.

B)20.00%.

C)24.00%.

D)33.75%.

What was B Division's return on investment (ROI)last year?

What was B Division's return on investment (ROI)last year?A)16.00%.

B)20.00%.

C)24.00%.

D)33.75%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

58

The ABC Company has three divisions: A Division,B Division,and C Division.  What was A Division's residual income last year?

What was A Division's residual income last year?

A)$12,000.

B)$22,500.

C)$30,000.

D)$48,000.

What was A Division's residual income last year?

What was A Division's residual income last year?A)$12,000.

B)$22,500.

C)$30,000.

D)$48,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

59

The following information is available for Company X:  What is Company X's residual income?

What is Company X's residual income?

A)$2,000.

B)$2,500.

C)$3,500.

D)$4,000.

What is Company X's residual income?

What is Company X's residual income?A)$2,000.

B)$2,500.

C)$3,500.

D)$4,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

60

Economic value added (EVA)is a concept that is closely related to residual income.EVA is computed by:

A)subtracting the adjusted total cost of capital from the adjusted after-tax income.

B)subtracting adjusted after-tax income from total divisional investment.

C)dividing adjusted after-tax income by adjusted divisional investment.

D)dividing adjusted after-tax income by adjusted total cost of capital.

A)subtracting the adjusted total cost of capital from the adjusted after-tax income.

B)subtracting adjusted after-tax income from total divisional investment.

C)dividing adjusted after-tax income by adjusted divisional investment.

D)dividing adjusted after-tax income by adjusted total cost of capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

61

The following information pertains to Quest Co.'s Gold Division for the current year: (CPA adapted)  Quest's return on investment was:

Quest's return on investment was:

A)10.00%.

B)13.33%.

C)27.50%.

D)30.00%.

Quest's return on investment was:

Quest's return on investment was:A)10.00%.

B)13.33%.

C)27.50%.

D)30.00%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

62

Which of the following will not result in an increase in the residual income,assuming other factors remain constant?

A)An increase in sales.

B)An increase in the minimum required rate of return.

C)A decrease in expenses.

D)A decrease in operating assets.

A)An increase in sales.

B)An increase in the minimum required rate of return.

C)A decrease in expenses.

D)A decrease in operating assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

63

Residual income is a better measure for performance evaluation of an investment center manager than return on investment (ROI)because: (CMA adapted)

A)the problems associated with measuring the asset base are eliminated.

B)desirable investment decisions will not be neglected by high return divisions.

C)only the gross book value of assets needs to be calculated.

D)returns do not increase as assets are depreciateD.

A)the problems associated with measuring the asset base are eliminated.

B)desirable investment decisions will not be neglected by high return divisions.

C)only the gross book value of assets needs to be calculated.

D)returns do not increase as assets are depreciateD.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

64

All other things the same,which of the following would increase residual income?

A)Increase in average operating assets.

B)Decrease in average operating assets.

C)Increase in minimum required return.

D)Decrease in net operating income.

A)Increase in average operating assets.

B)Decrease in average operating assets.

C)Increase in minimum required return.

D)Decrease in net operating income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

65

Residual income is a performance evaluation that is used in conjunction with,or instead of,return on investment (ROI).In many cases,residual income is preferred to ROI because: (CIA adapted)

A)residual income is a measure over time,while ROI represents the results for one period.

B)residual income concentrates on maximizing absolute dollars of income rather than a percentage return,as with ROI.

C)the imputed interest rate used in calculating residual income is more easily derived than the target rate that is compared to the calculated ROI.

D)average investment is employed with residual income while year-end investment is employed with ROI.

A)residual income is a measure over time,while ROI represents the results for one period.

B)residual income concentrates on maximizing absolute dollars of income rather than a percentage return,as with ROI.

C)the imputed interest rate used in calculating residual income is more easily derived than the target rate that is compared to the calculated ROI.

D)average investment is employed with residual income while year-end investment is employed with ROI.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

66

The following information pertains to Bala Co.for the year ended December 31: (CPA adapted)  Which of the following equations should be used to compute Bala's return on investment (ROI)?

Which of the following equations should be used to compute Bala's return on investment (ROI)?

A)(4/6)× (6/1)= ROI

B)(6/4)× (1/6)= ROI

C)(4/6)× (1/6)= ROI

D)(6/4)× (6/1)= ROI

Which of the following equations should be used to compute Bala's return on investment (ROI)?

Which of the following equations should be used to compute Bala's return on investment (ROI)?A)(4/6)× (6/1)= ROI

B)(6/4)× (1/6)= ROI

C)(4/6)× (1/6)= ROI

D)(6/4)× (6/1)= ROI

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

67

REB Service Co.is a computer service center.For the month of May,REB had the following operating statistics: (CMA adapted)  Based on the above information,which one of the following statements is correct? REB has a:

Based on the above information,which one of the following statements is correct? REB has a:

A)return on investment of 4%.

B)residual income of $(2,000).

C)return on investment of 5.6%.

D)residual income of $(22,000).

Based on the above information,which one of the following statements is correct? REB has a:

Based on the above information,which one of the following statements is correct? REB has a:A)return on investment of 4%.

B)residual income of $(2,000).

C)return on investment of 5.6%.

D)residual income of $(22,000).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

68

A firm earning a profit can increase its return on investment by: (CMA adapted)

A)increasing sales revenue and operating expenses by the same dollar amount.

B)decreasing sales revenues and operating expenses by the same percentage.

C)increasing investment and operating expenses by the same dollar amount.

D)increasing sales revenues and operating expenses by the same percentage.

A)increasing sales revenue and operating expenses by the same dollar amount.

B)decreasing sales revenues and operating expenses by the same percentage.

C)increasing investment and operating expenses by the same dollar amount.

D)increasing sales revenues and operating expenses by the same percentage.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

69

James Webb is the general manager of the Industrial Product Division,and his performance is measured using the residual income method.Webb is reviewing the following forecasted information for his division for next year: (CMA adapted)  If the cost of capital is 15% and Webb wants to achieve a residual income target of $2,000,000,what will costs have to be in order to achieve the target?

If the cost of capital is 15% and Webb wants to achieve a residual income target of $2,000,000,what will costs have to be in order to achieve the target?

A)$9,000,000.

B)$10,800,000.

C)$25,150,000.

D)$25,690,000.

If the cost of capital is 15% and Webb wants to achieve a residual income target of $2,000,000,what will costs have to be in order to achieve the target?

If the cost of capital is 15% and Webb wants to achieve a residual income target of $2,000,000,what will costs have to be in order to achieve the target?A)$9,000,000.

B)$10,800,000.

C)$25,150,000.

D)$25,690,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

70

A company purchased assets costing $200,000 which will be depreciated over 5-years using straight-line depreciation and no salvage value.The company also purchased land and other assets,which are not depreciable at a cost of $200,000.It is estimated that in 5-years,the value of these assets will be unchanged.Assume that annual cash profits are $80,000 and,for return on investment (ROI)calculations,the company uses end-of-year asset values.If sales each year average $840,000,what will be the asset turnover using gross book value?

A)3.0.

B)2.6.

C)2.1.

D)1.9.

A)3.0.

B)2.6.

C)2.1.

D)1.9.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

71

In computing the margin in a ROI analysis,which of the following is used?

A)Sales in the denominator.

B)Net operating income in the denominator.

C)Average operating assets in the denominator.

D)Residual income in the denominator.

A)Sales in the denominator.

B)Net operating income in the denominator.

C)Average operating assets in the denominator.

D)Residual income in the denominator.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

72

Residual income is a better measure for performance evaluation of an investment center manager than return on investment because: (CMA adapted)

A)the problems associated with measuring the asset base are eliminated.

B)desirable investment decisions will not be neglected by high-return divisions.

C)only the gross book value of assets needs to be calculated.

D)the arguments about the implicit cost of interest are eliminateD.Problems in measuring the asset base,gross versus net book values,and implicit cost of interest are present in both residual income and ROI.Residual income avoids the suboptimization problem with high return divisions.

A)the problems associated with measuring the asset base are eliminated.

B)desirable investment decisions will not be neglected by high-return divisions.

C)only the gross book value of assets needs to be calculated.

D)the arguments about the implicit cost of interest are eliminateD.Problems in measuring the asset base,gross versus net book values,and implicit cost of interest are present in both residual income and ROI.Residual income avoids the suboptimization problem with high return divisions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

73

Which one of the following items would most likely not be incorporated into the calculation of a division's investment base when using the residual income approach for performance measurement and evaluation? (CMA adapted)

A)Fixed assets employed in division operations.

B)Land being held by the division as a site for a new plant.

C)Division inventories when division management exercises control over the amount of short-term credit used.

D)Division accounts payable when division management exercises control over the amount of short-term credit useD.Land would be a strategic asset that is not controlled by the division manager.

A)Fixed assets employed in division operations.

B)Land being held by the division as a site for a new plant.

C)Division inventories when division management exercises control over the amount of short-term credit used.

D)Division accounts payable when division management exercises control over the amount of short-term credit useD.Land would be a strategic asset that is not controlled by the division manager.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

74

Residual income is a better measure for performance evaluation of an investment center manager than return on investment because: (CMA adapted)

A)the problems associated with measuring the asset base are eliminated.

B)desirable investment decisions will not be rejected by divisions that already have a high ROI.

C)only the gross book value of assets needs to be calculated.

D)returns do not increase as assets are depreciateD.Residual income indicates those situations with more than a threshold return that should be accepteD.

A)the problems associated with measuring the asset base are eliminated.

B)desirable investment decisions will not be rejected by divisions that already have a high ROI.

C)only the gross book value of assets needs to be calculated.

D)returns do not increase as assets are depreciateD.Residual income indicates those situations with more than a threshold return that should be accepteD.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

75

In determining the dollar amount to use for operating assets in the return on investment (ROI)calculation,companies will generally use either net book value or gross cost of the assets.Which of the following is an argument for the use of net book value rather than gross cost?

A)It is consistent with how assets are reported on the balance sheet.

B)It eliminates the depreciation method as a factor in ROI calculations.

C)It encourages the replacement of old,worn-out equipment.

D)All of the above.

A)It is consistent with how assets are reported on the balance sheet.

B)It eliminates the depreciation method as a factor in ROI calculations.

C)It encourages the replacement of old,worn-out equipment.

D)All of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

76

Return on investment (ROI)is a very popular measure employed to evaluate the performance of corporate segments because it incorporates all of the major ingredients of profitability (revenue,cost,investment)into a single measure.Under which one of the following combinations of actions regarding a segment's revenues,costs,and investment would a segment's ROI always increase? (CIA adapted)

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck