Deck 11: Service Department and Joint Cost Allocation

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/99

العب

ملء الشاشة (f)

Deck 11: Service Department and Joint Cost Allocation

1

The selection of an allocation base in the direct method is easier than the selection of an allocation base in the step method.The allocation base would remain constant across the three allocation methods.

False

2

The step method allocates some,but not all,service department costs to other service departments.In allocating service department costs,the majority of the services provided are usually allocated to the production departments.Once the costs of a service department have been allocated,it is considered "closed" and cannot be the recipient in future allocations.

True

3

One advantage of the step method is that all reciprocal services are recognized between service departments.In the step method,once the costs of a service department have been allocated,it is considered "closed" and cannot be the recipient in future allocations.

False

4

The estimated net realizable value at the split-off point is calculated by taking the sales value after further processing and deducting the additional processing costs.This is the definition of estimated net realizable value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

5

Since by-products have minor sales value,alternative methods of accounting for them will not have a material effect on the financial statements.The sales value is immaterial,so the alternate results would be immaterial.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

6

One reason to allocate service department costs to user departments is to encourage the user departments to monitor their use of the service department costs.Allocating service department costs makes manufacturing managers aware of the support costs required to complete their manufacturing efforts as well as provide better product costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

7

In deciding whether to outsource a service department or not,the cost of the service department should be estimated using the step method of allocation.The reciprocal method should be used as it is the most accurate method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

8

Joint products are outputs from common inputs and a common production process.This is the definition of joint products.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

9

With the reciprocal method,the total service department costs less the direct costs of the service department equals the cost allocated to the service department.Direct costs + costs allocated from other services = total cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

10

Joint costs are processing costs incurred after the split-off point in a common production process.Joint costs are the costs that are incurred prior to reaching the split-off point.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

11

In a sell-or-process-further decision,the common costs incurred prior to the spilt-off point are irrelevant.Common costs will be there whatever the end decision is.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

12

The human resource department in a manufacturing company would be considered a service department.Human resources would be considered a support department for the manufacturing activities of the firm,and therefore a service department.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

13

In a sell-or-process-further decision,the additional costs incurred after the split-off point are irrelevant.These additional costs are incremental and would be relevant.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

14

In general,it is better to use a product's market value at the split-off point than its estimated net realizable value in allocating joint costs.Actual market value is better than an estimate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

15

The physical quantities method of allocating joint costs is often used when the output sales prices are highly volatile.In this instance,there would not be reliable sales values;physical values would be preferred.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

16

The physical quantities method allocates joint costs so that each joint product has the same gross margin as a percentage of sales.Each product has the same cost per pound (or foot,or gallon,etc).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

17

One potential disadvantage of the reciprocal method is it could overstate the cost of running the organization's service departments.The reciprocal method is the most accurate method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

18

If a company's two joint products can be sold at the split-off point,there is no reason for allocating the joint costs to the products.Just because they can be sold,doesn't mean that they are all sold.Inventory valuation would still be necessary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

19

The direct method makes no cost allocations between or among service departments.All costs are allocated directly to the producing departments,as if service departments were not a user of services themselves.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

20

The estimated net realizable value for a product is its estimated selling price after processing the product beyond the split-off point.If the products require further processing before they are marketable,it could be necessary to estimate the net realizable value at the split-off point.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

21

For purposes of allocating joint costs to joint products,the estimated net realizable value at split-off is equal to:

A)final sales price reduced by cost to complete after split-off.

B)sales price less a normal profit margin at the point of sale.

C)separable product cost plus a normal profit margin.

D)total sales value less joint costs at point of split-off.

A)final sales price reduced by cost to complete after split-off.

B)sales price less a normal profit margin at the point of sale.

C)separable product cost plus a normal profit margin.

D)total sales value less joint costs at point of split-off.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

22

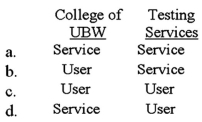

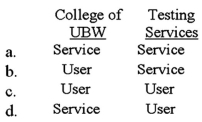

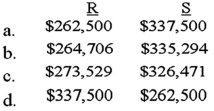

LaCrescent University has 20 departments.Two of its best departments are the (1)College of UBW (Underwater Basket Weaving)and (2)Testing Services.The College of UBW attempts to teach students the difficult,but useful,skill of weaving baskets underwater.Testing Services grades examinations for professors.How would these two departments be classified?

A)Option a

B)Option b

C)Option c

D)Option d

A)Option a

B)Option b

C)Option c

D)Option d

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

23

A management purpose for allocating joint costs of a processing center to the various products produced is to:

A)establish inventory values for unsold units.

B)record accurate cost of sales by-product line.

C)compute total processing cost variances by-product.

D)report correct standard product costs for comparative analysis.

A)establish inventory values for unsold units.

B)record accurate cost of sales by-product line.

C)compute total processing cost variances by-product.

D)report correct standard product costs for comparative analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

24

Which of the following cost items is not allocable as joint costs when a single manufacturing process produces several main products and several by-products?

A)Direct materials.

B)Variable overhead.

C)Direct labor.

D)Fixed overheaD.

E)Freight-out.

A)Direct materials.

B)Variable overhead.

C)Direct labor.

D)Fixed overheaD.

E)Freight-out.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

25

If two service departments service the same number of departments,which service department's costs should be allocated first when using the step method?

A)The service department that provides the most service to other service departments.

B)The service department that provides the most service to the user departments.

C)The service department with the least cost.

D)The service department that provides the least service to other service departments.

A)The service department that provides the most service to other service departments.

B)The service department that provides the most service to the user departments.

C)The service department with the least cost.

D)The service department that provides the least service to other service departments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

26

Service department costs are:

A)generally treated as period costs rather than product costs.

B)reported as selling and administrative expenses on the income statement.

C)eventually applied by the user departments to the units produced.

D)seldom found in manufacturing organizations.

A)generally treated as period costs rather than product costs.

B)reported as selling and administrative expenses on the income statement.

C)eventually applied by the user departments to the units produced.

D)seldom found in manufacturing organizations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

27

Which of the following service departments could logically use space occupied (square footage)to allocate its costs to user departments?

A)Material Handling.

B)Cafeteria.

C)Custodial Services.

D)Cost Accounting.

A)Material Handling.

B)Cafeteria.

C)Custodial Services.

D)Cost Accounting.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

28

Criteria for selecting allocation bases for service department allocations should not include:

A)direct,traceable benefits from the service.

B)the extent of facilities provided.

C)the ease of making an allocation.

D)sales dollars generated during the perioD.Revenues are never a good base for allocating service costs

A)direct,traceable benefits from the service.

B)the extent of facilities provided.

C)the ease of making an allocation.

D)sales dollars generated during the perioD.Revenues are never a good base for allocating service costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

29

Which of the following statements is (are)false regarding the direct method of allocating service department costs? (A)The selection of an allocation base in the direct method is easier than the selection of an allocation base in the step method.(B)Once an allocation is made from a service department using the direct method,no further allocations are made back to that department.

A)Only A is false.

B)Only B is false.

C)Neither A nor B is false.

D)Both A and B are false.

A)Only A is false.

B)Only B is false.

C)Neither A nor B is false.

D)Both A and B are false.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

30

Joint products and byproducts are produced simultaneously by a single process or series of processes and:

A)joint products are salable at the split-off point,but byproducts are not.

B)by-products are salable at the split-off point,but joint products are not.

C)the revenue from by-products may be recognized at the time of production.

D)all by-products must be allocated some portion of joint costs.

A)joint products are salable at the split-off point,but byproducts are not.

B)by-products are salable at the split-off point,but joint products are not.

C)the revenue from by-products may be recognized at the time of production.

D)all by-products must be allocated some portion of joint costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

31

Which of the following methods provides no data for service departments to monitor each other's costs?

A)Direct method.

B)Reciprocal method.

C)Step method.

D)All three methods,Direct,Reciprocal,and Step,provide data for monitoring costs.

A)Direct method.

B)Reciprocal method.

C)Step method.

D)All three methods,Direct,Reciprocal,and Step,provide data for monitoring costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

32

Which of the following best describes the objective of joint cost allocation?

A)Inventory valuation.

B)Pricing goods for sale.

C)Making decisions about levels of production.

D)Making decisions about raw materials requirements.

A)Inventory valuation.

B)Pricing goods for sale.

C)Making decisions about levels of production.

D)Making decisions about raw materials requirements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

33

Allocated joint costs are useful for:

A)setting the selling price of a product.

B)determining whether to continue producing an item.

C)controlling user department costs.

D)evaluating management by means of a responsibility reporting system.

E)determining inventory cost for accounting purposes.

A)setting the selling price of a product.

B)determining whether to continue producing an item.

C)controlling user department costs.

D)evaluating management by means of a responsibility reporting system.

E)determining inventory cost for accounting purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

34

Which of the following departments is not a service department in a typical manufacturing company?

A)Assembly.

B)Accounting.

C)Human resources.

D)Information processing.

A)Assembly.

B)Accounting.

C)Human resources.

D)Information processing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

35

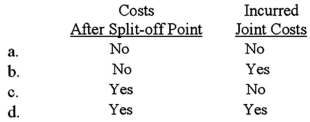

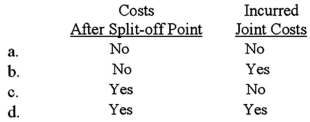

Net realizable value at the split-off point is used to allocate:

A)Option a

B)Option b

C)Option c

D)Option d

A)Option a

B)Option b

C)Option c

D)Option d

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

36

Which of the following is a weakness of the step method of service cost allocations?

A)Computations are more complex than the reciprocal method.

B)All interdepartmental services are ignored.

C)All intradepartmental services are ignored.

D)The order of service department allocation has to be determineD.Computations are easier than the reciprocal method and some services are ignored

A)Computations are more complex than the reciprocal method.

B)All interdepartmental services are ignored.

C)All intradepartmental services are ignored.

D)The order of service department allocation has to be determineD.Computations are easier than the reciprocal method and some services are ignored

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

37

The method of accounting for joint product costs that will produce the same gross margin percentage for all products is the:

A)replacement method.

B)physical quantities method.

C)net realizable value method.

D)units produced methoD.Under net realizable value,the cost allocated is a constant percentage of the sales value so each product will have the same gross margin percentage.

A)replacement method.

B)physical quantities method.

C)net realizable value method.

D)units produced methoD.Under net realizable value,the cost allocated is a constant percentage of the sales value so each product will have the same gross margin percentage.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

38

Which of the following statements is false?

A)The estimated net realizable value for a product is its estimated selling price after processing the product beyond the split-off point.

B)In general,it is better to use a product's market value at the split-off point than its estimated net realizable value.

C)The estimated net realizable value at the split-off point is calculated by taking the sales value after further processing and deducting the additional processing costs.

D)It is better to use the net realizable value method for allocating joint costs than the estimated net realizable value methoD.It is the final selling price minus the additional processing costs.

A)The estimated net realizable value for a product is its estimated selling price after processing the product beyond the split-off point.

B)In general,it is better to use a product's market value at the split-off point than its estimated net realizable value.

C)The estimated net realizable value at the split-off point is calculated by taking the sales value after further processing and deducting the additional processing costs.

D)It is better to use the net realizable value method for allocating joint costs than the estimated net realizable value methoD.It is the final selling price minus the additional processing costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

39

Which of the following is not a physical measure that can be used for allocating joint costs using the physical quantities method?

A)Tons of steel.

B)Ounces of gold.

C)Dollars of labor.

D)Feet of lumber.

A)Tons of steel.

B)Ounces of gold.

C)Dollars of labor.

D)Feet of lumber.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

40

Which of the following is the least practical reason for allocating service department costs to user departments?

A)To ascertain profitability of user departments.

B)To evaluate performance of managers and divisions.

C)To make user departments aware that services are costly.

D)To provide the best possible service to users.

A)To ascertain profitability of user departments.

B)To evaluate performance of managers and divisions.

C)To make user departments aware that services are costly.

D)To provide the best possible service to users.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

41

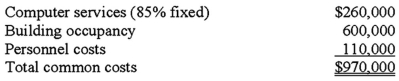

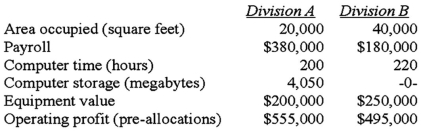

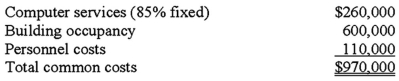

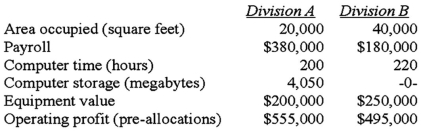

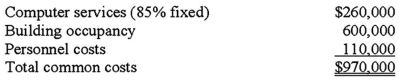

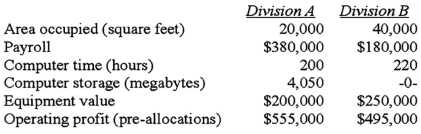

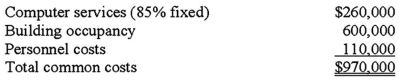

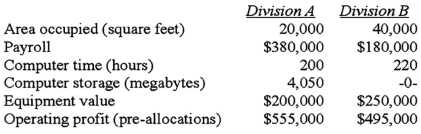

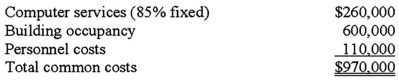

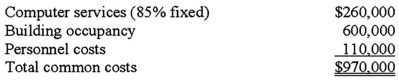

Cincinnati Million,Inc.operates two user divisions as separate cost objects.To determine the costs of each division,the company allocates common costs to the divisions.During the past month,the following common costs were incurred:  The following information is available concerning various activity measures and service usages by each of the divisions:

The following information is available concerning various activity measures and service usages by each of the divisions:  If all common costs are allocated using operating profit as the allocation basis,what is the total cost allocated to Division B?

If all common costs are allocated using operating profit as the allocation basis,what is the total cost allocated to Division B?

A)$457,286.

B)$512,714.

C)$555,000.

D)$1,087,576.

The following information is available concerning various activity measures and service usages by each of the divisions:

The following information is available concerning various activity measures and service usages by each of the divisions:  If all common costs are allocated using operating profit as the allocation basis,what is the total cost allocated to Division B?

If all common costs are allocated using operating profit as the allocation basis,what is the total cost allocated to Division B?A)$457,286.

B)$512,714.

C)$555,000.

D)$1,087,576.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

42

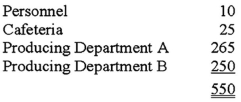

Cincinnati Million,Inc.operates two user divisions as separate cost objects.To determine the costs of each division,the company allocates common costs to the divisions.During the past month,the following common costs were incurred:  The following information is available concerning various activity measures and service usages by each of the divisions:

The following information is available concerning various activity measures and service usages by each of the divisions:  Using the most appropriate allocation basis,what is the personnel cost allocated to Division A?

Using the most appropriate allocation basis,what is the personnel cost allocated to Division A?

A)$58,143.

B)$74,643.

C)$76,463.

D)$110,000.

The following information is available concerning various activity measures and service usages by each of the divisions:

The following information is available concerning various activity measures and service usages by each of the divisions:  Using the most appropriate allocation basis,what is the personnel cost allocated to Division A?

Using the most appropriate allocation basis,what is the personnel cost allocated to Division A?A)$58,143.

B)$74,643.

C)$76,463.

D)$110,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

43

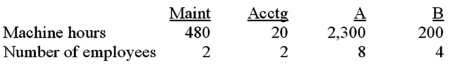

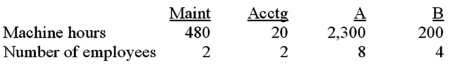

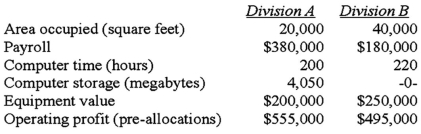

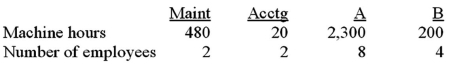

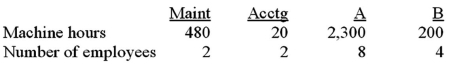

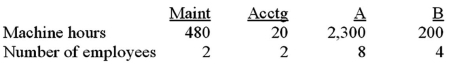

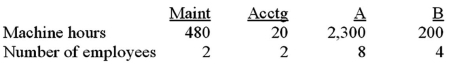

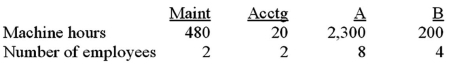

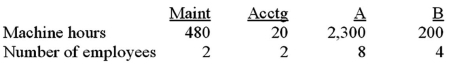

The RAH Manufacturing Company has two service departments: Maintenance and Accounting.The Maintenance Department's costs of $300,000 are allocated on the basis of machine hours.The Accounting Department's costs of $120,000 are allocated on the basis of the number of employees within a specific department.The direct departmental costs for A and B are $300,000 and $500,000,respectively.  What is the Maintenance Department's cost allocated to Department A using the direct method?

What is the Maintenance Department's cost allocated to Department A using the direct method?

A)$92,000.

B)$230,000.

C)$276,000.

D)$386,400.

What is the Maintenance Department's cost allocated to Department A using the direct method?

What is the Maintenance Department's cost allocated to Department A using the direct method?A)$92,000.

B)$230,000.

C)$276,000.

D)$386,400.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

44

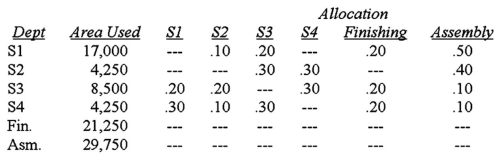

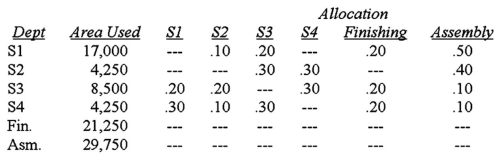

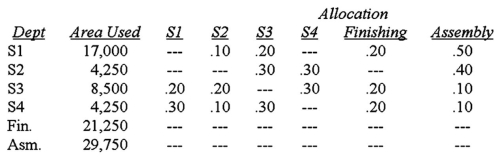

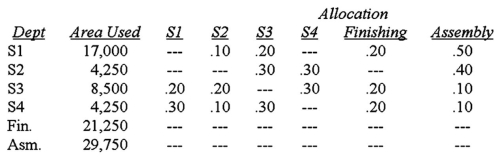

The Emery Construction Company occupies 85,000 square feet for construction of mobile homes.There are two manufacturing departments,finishing and assembly,and four service departments labeled S1,S2,S3,and S4.Information relevant to Emery is as follows:  Rent paid for the area used is $720,000.How much rent would be charged to S4 using the step method of allocation and a S3-S4-S1-S2 sequence for the allocations?

Rent paid for the area used is $720,000.How much rent would be charged to S4 using the step method of allocation and a S3-S4-S1-S2 sequence for the allocations?

A)$36,000.

B)$40,000.

C)$54,000.

D)$90,000.

Rent paid for the area used is $720,000.How much rent would be charged to S4 using the step method of allocation and a S3-S4-S1-S2 sequence for the allocations?

Rent paid for the area used is $720,000.How much rent would be charged to S4 using the step method of allocation and a S3-S4-S1-S2 sequence for the allocations?A)$36,000.

B)$40,000.

C)$54,000.

D)$90,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

45

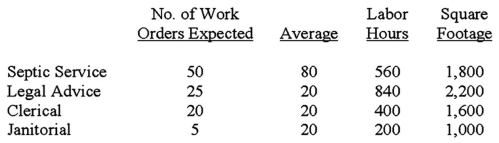

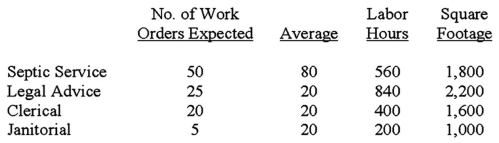

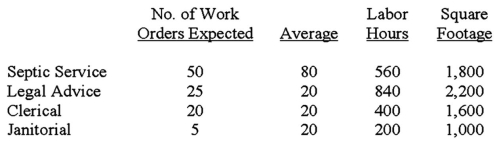

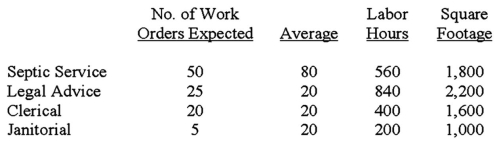

Harry Dishman owns and operates Harry's Septic Service and Legal Advice.Harry's two revenue generating (production)operations are supported by two service departments: Clerical and Janitorial.Costs in the service departments are allocated in the following order using the designated allocation bases: Clerical:

Variable cost: expected number of work orders processed

Fixed cost: long-run average number of work orders processed

Janitorial:

Variable cost: labor hours

Fixed cost: square footage of space occupied

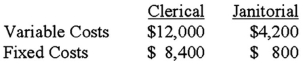

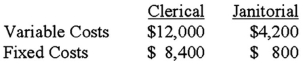

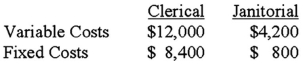

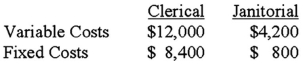

Average and expected activity levels for next month (June)are as follows: Expected costs in the service departments for June are as follows:

Expected costs in the service departments for June are as follows:  Under the direct method of allocation,what is the total amount of service cost allocated to the Legal Advice operation for June? (Round all calculations to the nearest whole dollar. )

Under the direct method of allocation,what is the total amount of service cost allocated to the Legal Advice operation for June? (Round all calculations to the nearest whole dollar. )

A)$6,231.

B)$7,720.

C)$8,640.

D)$9,330.

Variable cost: expected number of work orders processed

Fixed cost: long-run average number of work orders processed

Janitorial:

Variable cost: labor hours

Fixed cost: square footage of space occupied

Average and expected activity levels for next month (June)are as follows:

Expected costs in the service departments for June are as follows:

Expected costs in the service departments for June are as follows:  Under the direct method of allocation,what is the total amount of service cost allocated to the Legal Advice operation for June? (Round all calculations to the nearest whole dollar. )

Under the direct method of allocation,what is the total amount of service cost allocated to the Legal Advice operation for June? (Round all calculations to the nearest whole dollar. )A)$6,231.

B)$7,720.

C)$8,640.

D)$9,330.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

46

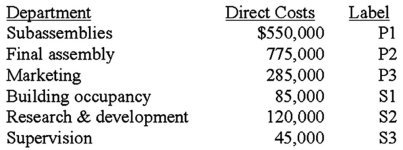

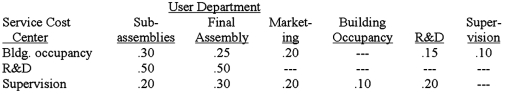

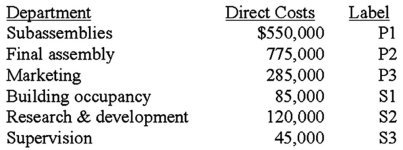

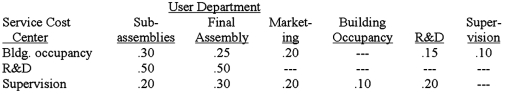

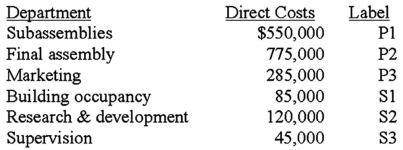

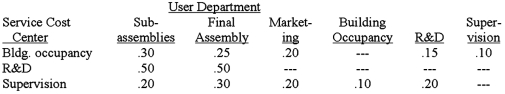

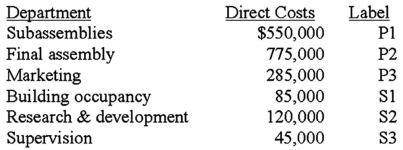

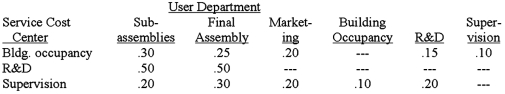

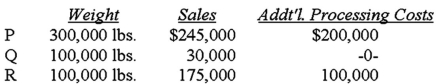

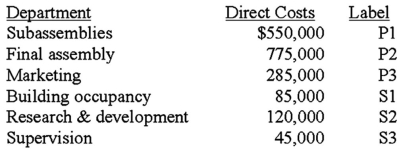

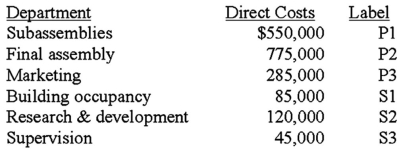

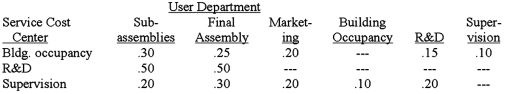

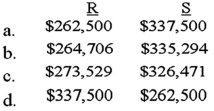

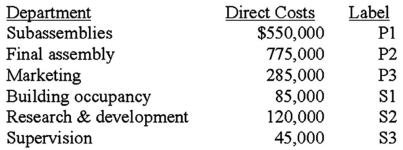

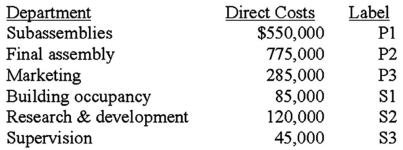

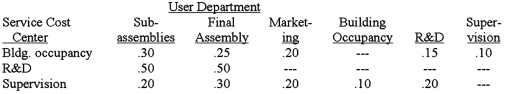

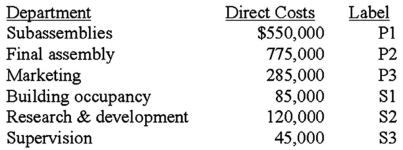

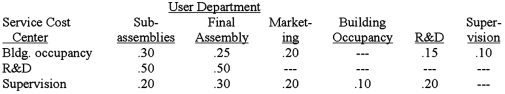

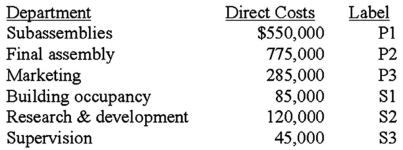

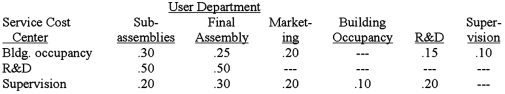

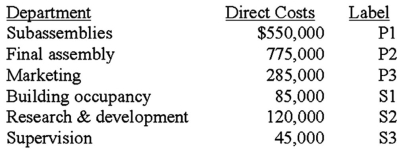

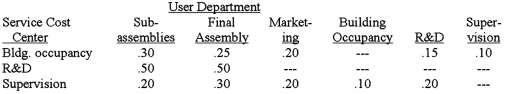

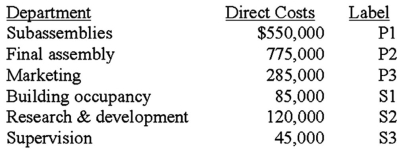

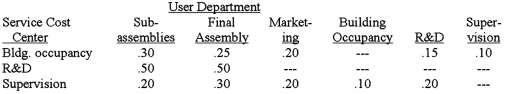

The following set up is a system of simultaneous linear equations to allocate costs using the reciprocal method.Matrix algebra is not required.The following costs were incurred in three operating departments and three service departments in Reality Company.  Use of services by other departments is as follows.

Use of services by other departments is as follows.  The equation for department P1 (subassemblies)is:

The equation for department P1 (subassemblies)is:

A)P1 = $550,000 + .25P2 + .20P3 + .15S2 + 10S3.

B)P1 = $550,000 + .30S1 + .50S2 + .20S3.

C)P1 = .30S1 + .50S2 + 20S3.

D)P1 = .30S1 + .50S.

Use of services by other departments is as follows.

Use of services by other departments is as follows.  The equation for department P1 (subassemblies)is:

The equation for department P1 (subassemblies)is:A)P1 = $550,000 + .25P2 + .20P3 + .15S2 + 10S3.

B)P1 = $550,000 + .30S1 + .50S2 + .20S3.

C)P1 = .30S1 + .50S2 + 20S3.

D)P1 = .30S1 + .50S.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

47

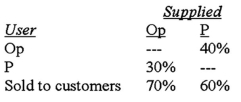

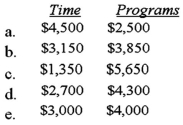

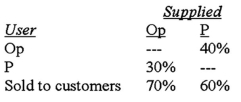

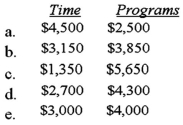

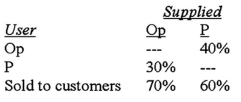

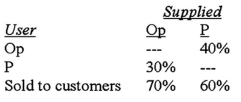

Computer Complex,Inc.has two main services: (1)time on a timeshared computer system,and (2)proprietary computer programs.Computer time is provided by the operation department (Op)and programs are written by the programming department (P) The percentage of each service used by each department for a typical period is:  In a typical period,the operation department (Op)spends $4,500 and the programming department (P)spends $2,500.Under the step method (Op first),what is the cost of the computer time and the computer programs for sale?

In a typical period,the operation department (Op)spends $4,500 and the programming department (P)spends $2,500.Under the step method (Op first),what is the cost of the computer time and the computer programs for sale?

A)Option a

B)Option b

C)Option c

D)Option d

In a typical period,the operation department (Op)spends $4,500 and the programming department (P)spends $2,500.Under the step method (Op first),what is the cost of the computer time and the computer programs for sale?

In a typical period,the operation department (Op)spends $4,500 and the programming department (P)spends $2,500.Under the step method (Op first),what is the cost of the computer time and the computer programs for sale?

A)Option a

B)Option b

C)Option c

D)Option d

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

48

Products with a relatively minor sales value are called:

A)scrap.

B)spoilage.

C)by-products.

D)main products.

A)scrap.

B)spoilage.

C)by-products.

D)main products.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

49

The characteristic that is most often used to distinguish a product as either a main product or a by-product is the amount of:

A)sales value of the products produced during the common production process.

B)direct manufacturing costs (e.g. ,materials)incurred before the split-off point.

C)physical measures in the products produced during the common production process.

D)time (i.e. ,labor)required to produce the products from start to finish.

A)sales value of the products produced during the common production process.

B)direct manufacturing costs (e.g. ,materials)incurred before the split-off point.

C)physical measures in the products produced during the common production process.

D)time (i.e. ,labor)required to produce the products from start to finish.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

50

Harry Dishman owns and operates Harry's Septic Service and Legal Advice.Harry's two revenue generating (production)operations are supported by two service departments: Clerical and Janitorial.Costs in the service departments are allocated in the following order using the designated allocation bases: Clerical:

Variable cost: expected number of work orders processed

Fixed cost: long-run average number of work orders processed

Janitorial:

Variable cost: labor hours

Fixed cost: square footage of space occupied

Average and expected activity levels for next month (June)are as follows: Expected costs in the service departments for June are as follows:

Expected costs in the service departments for June are as follows:  Under the step method of allocation,how much Clerical service cost should be allocated to the Septic Service operation for June? (Assume Clerical costs are allocated before Janitorial costs and round all calculations to the nearest whole dollar. )

Under the step method of allocation,how much Clerical service cost should be allocated to the Septic Service operation for June? (Assume Clerical costs are allocated before Janitorial costs and round all calculations to the nearest whole dollar. )

A)$12,689.

B)$13,100.

C)$13,620.

D)$15,596.

Variable cost: expected number of work orders processed

Fixed cost: long-run average number of work orders processed

Janitorial:

Variable cost: labor hours

Fixed cost: square footage of space occupied

Average and expected activity levels for next month (June)are as follows:

Expected costs in the service departments for June are as follows:

Expected costs in the service departments for June are as follows:  Under the step method of allocation,how much Clerical service cost should be allocated to the Septic Service operation for June? (Assume Clerical costs are allocated before Janitorial costs and round all calculations to the nearest whole dollar. )

Under the step method of allocation,how much Clerical service cost should be allocated to the Septic Service operation for June? (Assume Clerical costs are allocated before Janitorial costs and round all calculations to the nearest whole dollar. )A)$12,689.

B)$13,100.

C)$13,620.

D)$15,596.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

51

Product C is one of several joint products that come out of Department M.The joint costs incurred in Department M total $40,000.Product C can be sold at split-off or processed further and sold as a higher quality item.The decision to process further should be based on the:

A)assumption that the $40,000 is irrelevant.

B)allocation of the $40,000,using the net realizable value.

C)allocation of the $40,000,using a physical measures approach.

D)allocation of the $40,000,using the relative sales value at split-off methoD.The decision should not depend upon allocations.The joint cost is irrelevant.

A)assumption that the $40,000 is irrelevant.

B)allocation of the $40,000,using the net realizable value.

C)allocation of the $40,000,using a physical measures approach.

D)allocation of the $40,000,using the relative sales value at split-off methoD.The decision should not depend upon allocations.The joint cost is irrelevant.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

52

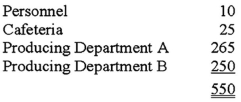

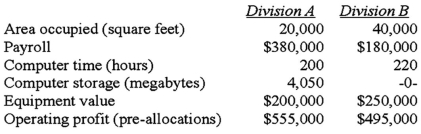

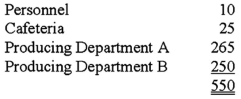

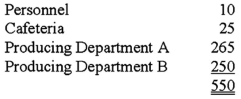

Castle Company has two service departments and two producing departments.The number of employees in each department is:  The department costs of the Personnel Department are allocated on a basis of the number of employees.If these costs are budgeted at $37,125 during a given period,the amount of cost allocated to Department B under the direct method would be:

The department costs of the Personnel Department are allocated on a basis of the number of employees.If these costs are budgeted at $37,125 during a given period,the amount of cost allocated to Department B under the direct method would be:

A)$0.

B)$17,187.50.

C)$16,875.00.

D)$18,021.84.

The department costs of the Personnel Department are allocated on a basis of the number of employees.If these costs are budgeted at $37,125 during a given period,the amount of cost allocated to Department B under the direct method would be:

The department costs of the Personnel Department are allocated on a basis of the number of employees.If these costs are budgeted at $37,125 during a given period,the amount of cost allocated to Department B under the direct method would be:A)$0.

B)$17,187.50.

C)$16,875.00.

D)$18,021.84.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

53

Cincinnati Million,Inc.operates two user divisions as separate cost objects.To determine the costs of each division,the company allocates common costs to the divisions.During the past month,the following common costs were incurred:  The following information is available concerning various activity measures and service usages by each of the divisions:

The following information is available concerning various activity measures and service usages by each of the divisions:  If common computer service costs are allocated using computer time as the allocation basis,what is the computer cost allocated to Division B?

If common computer service costs are allocated using computer time as the allocation basis,what is the computer cost allocated to Division B?

A)$136,190.

B)$137,647.

C)$144,444.

D)$173,333.

The following information is available concerning various activity measures and service usages by each of the divisions:

The following information is available concerning various activity measures and service usages by each of the divisions:  If common computer service costs are allocated using computer time as the allocation basis,what is the computer cost allocated to Division B?

If common computer service costs are allocated using computer time as the allocation basis,what is the computer cost allocated to Division B?A)$136,190.

B)$137,647.

C)$144,444.

D)$173,333.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

54

The RAH Manufacturing Company has two service departments: Maintenance and Accounting.The Maintenance Department's costs of $300,000 are allocated on the basis of machine hours.The Accounting Department's costs of $120,000 are allocated on the basis of the number of employees within a specific department.The direct departmental costs for A and B are $300,000 and $500,000,respectively.  What is the Maintenance Department's cost allocated to Department B using the step method and assuming the Maintenance Department's costs are allocated first?

What is the Maintenance Department's cost allocated to Department B using the step method and assuming the Maintenance Department's costs are allocated first?

A)$276,000.

B)$230,000.

C)$322,000.

D)$23,810.

What is the Maintenance Department's cost allocated to Department B using the step method and assuming the Maintenance Department's costs are allocated first?

What is the Maintenance Department's cost allocated to Department B using the step method and assuming the Maintenance Department's costs are allocated first?A)$276,000.

B)$230,000.

C)$322,000.

D)$23,810.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

55

The RAH Manufacturing Company has two service departments: Maintenance and Accounting.The Maintenance Department's costs of $300,000 are allocated on the basis of machine hours.The Accounting Department's costs of $120,000 are allocated on the basis of the number of employees within a specific department.The direct departmental costs for A and B are $300,000 and $500,000,respectively.  What is the cost of the Accounting Department's cost allocated to Department A using the step method and assuming the Maintenance Department's costs are allocated first?

What is the cost of the Accounting Department's cost allocated to Department A using the step method and assuming the Maintenance Department's costs are allocated first?

A)$81,333.

B)$81,587.

C)$80,000.

D)$68,571.

What is the cost of the Accounting Department's cost allocated to Department A using the step method and assuming the Maintenance Department's costs are allocated first?

What is the cost of the Accounting Department's cost allocated to Department A using the step method and assuming the Maintenance Department's costs are allocated first?A)$81,333.

B)$81,587.

C)$80,000.

D)$68,571.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

56

Computer Complex,Inc.has two main services: (1)time on a timeshared computer system,and (2)proprietary computer programs.Computer time is provided by the operation department (Op)and programs are written by the programming department (P) The percentage of each service used by each department for a typical period is:  In a typical period,the operation department (Op)spends $4,500 and the programming department (P)spends $2,500.Under the reciprocal method what is the algebraic solution to the cost allocation problem?

In a typical period,the operation department (Op)spends $4,500 and the programming department (P)spends $2,500.Under the reciprocal method what is the algebraic solution to the cost allocation problem?

A)Op = 4,500 + .40 P;P = 2,500 + .30 Op.

B)Op = 4,500 + .70 P;P = 2,500 + .60 Op.

C)Op = 2,500 + .40 P;P = 4,500 + .30 Op.

D)Op = 2,500 + .70 P;P = 4,500 + .60 Op.

In a typical period,the operation department (Op)spends $4,500 and the programming department (P)spends $2,500.Under the reciprocal method what is the algebraic solution to the cost allocation problem?

In a typical period,the operation department (Op)spends $4,500 and the programming department (P)spends $2,500.Under the reciprocal method what is the algebraic solution to the cost allocation problem?A)Op = 4,500 + .40 P;P = 2,500 + .30 Op.

B)Op = 4,500 + .70 P;P = 2,500 + .60 Op.

C)Op = 2,500 + .40 P;P = 4,500 + .30 Op.

D)Op = 2,500 + .70 P;P = 4,500 + .60 Op.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

57

The RAH Manufacturing Company has two service departments: Maintenance and Accounting.The Maintenance Department's costs of $300,000 are allocated on the basis of machine hours.The Accounting Department's costs of $120,000 are allocated on the basis of the number of employees within a specific department.The direct departmental costs for A and B are $300,000 and $500,000,respectively.  What is the Accounting Department's cost allocated to Department B using the direct method?

What is the Accounting Department's cost allocated to Department B using the direct method?

A)$40,000.

B)$80,000.

C)$20,000.

D)$10,000.

What is the Accounting Department's cost allocated to Department B using the direct method?

What is the Accounting Department's cost allocated to Department B using the direct method?A)$40,000.

B)$80,000.

C)$20,000.

D)$10,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

58

Castle Company has two service departments and two user departments.The number of employees in each department is:  The fixed costs of the Personnel Department are allocated on a basis of the number of employees.If these costs are budgeted at $37,125 during a given period,the amount of cost allocated to the Cafeteria under the step method would be:

The fixed costs of the Personnel Department are allocated on a basis of the number of employees.If these costs are budgeted at $37,125 during a given period,the amount of cost allocated to the Cafeteria under the step method would be:

A)$0.

B)$1,718.75.

C)$1,687.50.

D)$1,802.18.

The fixed costs of the Personnel Department are allocated on a basis of the number of employees.If these costs are budgeted at $37,125 during a given period,the amount of cost allocated to the Cafeteria under the step method would be:

The fixed costs of the Personnel Department are allocated on a basis of the number of employees.If these costs are budgeted at $37,125 during a given period,the amount of cost allocated to the Cafeteria under the step method would be:A)$0.

B)$1,718.75.

C)$1,687.50.

D)$1,802.18.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

59

The Emery Construction Company occupies 85,000 square feet for construction of mobile homes.There are two manufacturing departments,finishing and assembly,and four service departments labeled S1,S2,S3,and S4.Information relevant to Emery is as follows:  Rent paid for the area used is $720,000.How much rent is allocable to the assembly department using the direct method of allocation?

Rent paid for the area used is $720,000.How much rent is allocable to the assembly department using the direct method of allocation?

A)$420,000.

B)$332,500.

C)$300,000.

D)$252,000.

Rent paid for the area used is $720,000.How much rent is allocable to the assembly department using the direct method of allocation?

Rent paid for the area used is $720,000.How much rent is allocable to the assembly department using the direct method of allocation?A)$420,000.

B)$332,500.

C)$300,000.

D)$252,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

60

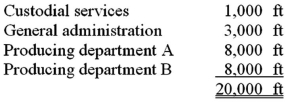

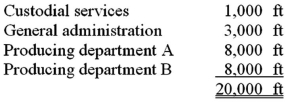

Bagley Company has two service departments and two producing departments.Square footage of space occupied by each department follows:  The department costs of Custodial Services are allocated on a basis of square footage of space.If Custodial Services costs are budgeted at $38,000,the amount of cost allocated to General Administration under the direct method would be:

The department costs of Custodial Services are allocated on a basis of square footage of space.If Custodial Services costs are budgeted at $38,000,the amount of cost allocated to General Administration under the direct method would be:

A)$0.

B)$7,125.

C)$6,000.

D)$5,700.

The department costs of Custodial Services are allocated on a basis of square footage of space.If Custodial Services costs are budgeted at $38,000,the amount of cost allocated to General Administration under the direct method would be:

The department costs of Custodial Services are allocated on a basis of square footage of space.If Custodial Services costs are budgeted at $38,000,the amount of cost allocated to General Administration under the direct method would be:A)$0.

B)$7,125.

C)$6,000.

D)$5,700.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

61

The following set up is a system of simultaneous linear equations to allocate costs using the reciprocal method.Matrix algebra is not required.The following costs were incurred in three operating departments and three service departments in Reality Company.  Use of services by other departments is as follows.

Use of services by other departments is as follows.  The equation for department S1 (building occupancy)is:

The equation for department S1 (building occupancy)is:

A)S1 = .10S3.

B)S1 = $85,000 + 1.00S3.

C)S1 = $85,000 + .10S3.

D)S1 = $85,000 + .90S2 + .10S3.

Use of services by other departments is as follows.

Use of services by other departments is as follows.  The equation for department S1 (building occupancy)is:

The equation for department S1 (building occupancy)is:A)S1 = .10S3.

B)S1 = $85,000 + 1.00S3.

C)S1 = $85,000 + .10S3.

D)S1 = $85,000 + .90S2 + .10S3.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

62

The Freed Company produces three products,X,Y,and Z from a single raw material input.Product Y can be sold at the split-off point for total revenues of $50,000 or it can be processed further at a total cost of $16,000 and then sold for $68,000.Product Y:

A)should be sold at the split-off point,rather than processed further.

B)would increase the company's overall net income by $18,000 if processed further and then sold.

C)would increase the company's overall net income by $68,000 if processed further and then sold.

D)would increase the company's overall net income by $2,000 if processed further and then solD.Process further: $68,000 - 16,000 = $52,000 vs.$50,000 sell now

A)should be sold at the split-off point,rather than processed further.

B)would increase the company's overall net income by $18,000 if processed further and then sold.

C)would increase the company's overall net income by $68,000 if processed further and then sold.

D)would increase the company's overall net income by $2,000 if processed further and then solD.Process further: $68,000 - 16,000 = $52,000 vs.$50,000 sell now

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

63

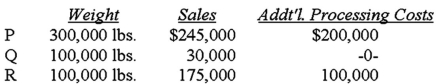

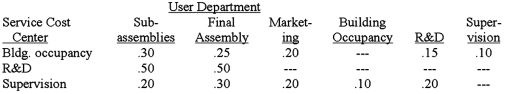

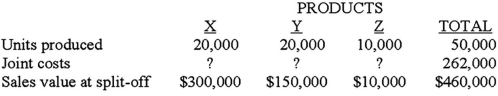

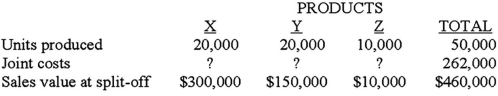

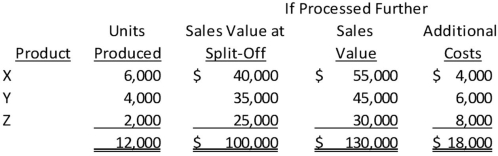

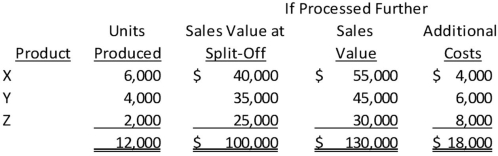

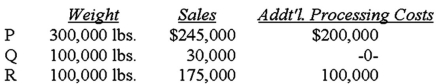

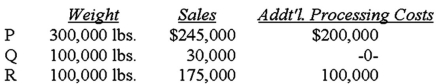

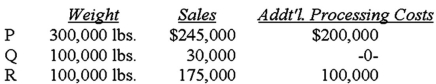

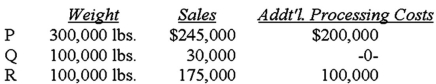

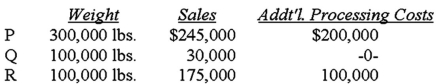

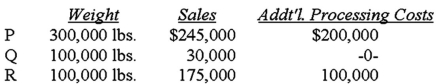

The Moody Company produced three joint products at a joint cost of $100,000.Two of these products were processed further.Production and sales were:  If joint costs are allocated based on relative weight of the outputs and all products are main products,how much of the joint costs would be allocated to product P?

If joint costs are allocated based on relative weight of the outputs and all products are main products,how much of the joint costs would be allocated to product P?

A)$43,750.

B)$50,000.

C)$60,000.

D)$62,500.

If joint costs are allocated based on relative weight of the outputs and all products are main products,how much of the joint costs would be allocated to product P?

If joint costs are allocated based on relative weight of the outputs and all products are main products,how much of the joint costs would be allocated to product P?A)$43,750.

B)$50,000.

C)$60,000.

D)$62,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

64

The following set up is a system of simultaneous linear equations to allocate costs using the reciprocal method.Matrix algebra is not required.The following costs were incurred in three operating departments and three service departments in Reality Company.  Use of services by other departments is as follows.

Use of services by other departments is as follows.  The equation for department S2 (research and development)is:

The equation for department S2 (research and development)is:

A)S2 = $120,000 + .15S1 + .65S2 + .20S3.

B)S2 = .15S1 + 20S3.

C)S2 = $120,000 + .15S1 + .20S3.

D)S2 = $120,000 + .40S1 + .60S3.

Use of services by other departments is as follows.

Use of services by other departments is as follows.  The equation for department S2 (research and development)is:

The equation for department S2 (research and development)is:A)S2 = $120,000 + .15S1 + .65S2 + .20S3.

B)S2 = .15S1 + 20S3.

C)S2 = $120,000 + .15S1 + .20S3.

D)S2 = $120,000 + .40S1 + .60S3.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

65

Lite Co.manufactures products X and Y from a joint process that also yields a by-product,Z.Revenue from sales of Z is treated as a reduction of joint costs.Additional information is as follows:  Joint costs were allocated using the net realizable value method at the split-off point.The joint costs allocated to product X were

Joint costs were allocated using the net realizable value method at the split-off point.The joint costs allocated to product X were

A)$75,000.

B)$100,800.

C)$150,000.

D)$168,000.

Joint costs were allocated using the net realizable value method at the split-off point.The joint costs allocated to product X were

Joint costs were allocated using the net realizable value method at the split-off point.The joint costs allocated to product X wereA)$75,000.

B)$100,800.

C)$150,000.

D)$168,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

66

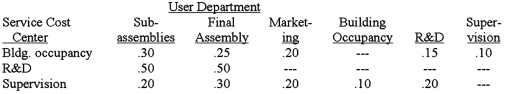

Zebra Manufacturing Company incurred a joint cost of $600,000 in the production of R and S in a joint process.Presently,1,800 of R and 1,400 of S are being produced each month.Management plans to decrease R's production by 300 units in order to increase the production of S by 500 units.Additionally,this change will require minor modifications,which will add $20,000 to the joint cost.This cost is entirely attributable to product S.What is the amount of the joint costs allocable to R and S before changes to existing production assuming Zebra allocates their joint costs according to the proportion of S and R produced?

A)Option a

B)Option b

C)Option c

D)Option d

A)Option a

B)Option b

C)Option c

D)Option d

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

67

The following set up is a system of simultaneous linear equations to allocate costs using the reciprocal method.Matrix algebra is not required.The following costs were incurred in three operating departments and three service departments in Reality Company.  Use of services by other departments is as follows.

Use of services by other departments is as follows.  The equation for department P2 (final assembly)is:

The equation for department P2 (final assembly)is:

A)P2 = .25S1 + .50S2 + .30S3.

B)P2 = $775,000 + .25P2 + .20P3 + .15S2 + .10S3.

C)P2 = $775,000 + .30S1 + .50S2 + .20S3.

D)P2 = $775,000 + .25S1 + .50S2 + .30S3.

Use of services by other departments is as follows.

Use of services by other departments is as follows.  The equation for department P2 (final assembly)is:

The equation for department P2 (final assembly)is:A)P2 = .25S1 + .50S2 + .30S3.

B)P2 = $775,000 + .25P2 + .20P3 + .15S2 + .10S3.

C)P2 = $775,000 + .30S1 + .50S2 + .20S3.

D)P2 = $775,000 + .25S1 + .50S2 + .30S3.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

68

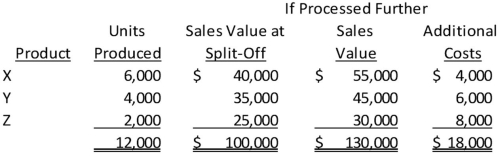

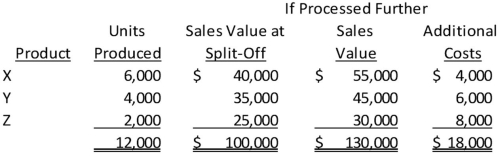

Vreeland,Inc. ,manufactures products X,Y,and Z from a common process.Joint costs were $60,000.Additional information is as follows:  Assuming that joint production costs are allocated using the physical quantities method (units produced),what were the costs allocated to Product X?

Assuming that joint production costs are allocated using the physical quantities method (units produced),what were the costs allocated to Product X?

A)$27,000.

B)$29,000.

C)$33,000.

D)$30,000.

Assuming that joint production costs are allocated using the physical quantities method (units produced),what were the costs allocated to Product X?

Assuming that joint production costs are allocated using the physical quantities method (units produced),what were the costs allocated to Product X?A)$27,000.

B)$29,000.

C)$33,000.

D)$30,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

69

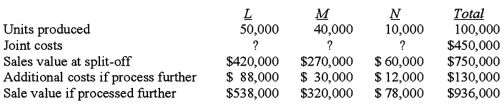

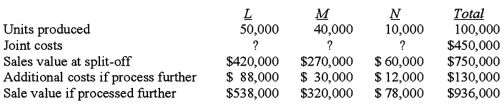

Anchorage Company manufactures three main products,L,M,and N,from a joint process.Additional information for June production activity follows:  Assuming that the 10,000 units of N were processed further and sold for $78,000,what was Anchorage's gross profit from this sale? Assume the physical quantities method of allocation is used.

Assuming that the 10,000 units of N were processed further and sold for $78,000,what was Anchorage's gross profit from this sale? Assume the physical quantities method of allocation is used.

A)$21,000.

B)$28,500.

C)$30,000.

D)$66,000.

Assuming that the 10,000 units of N were processed further and sold for $78,000,what was Anchorage's gross profit from this sale? Assume the physical quantities method of allocation is used.

Assuming that the 10,000 units of N were processed further and sold for $78,000,what was Anchorage's gross profit from this sale? Assume the physical quantities method of allocation is used.A)$21,000.

B)$28,500.

C)$30,000.

D)$66,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

70

Vreeland,Inc. ,manufactures products X,Y,and Z from a common process.Joint costs were $60,000.Additional information is as follows:  Assuming that joint product costs are allocated using the net realizable value method,what were the total costs assigned to Product Y?

Assuming that joint product costs are allocated using the net realizable value method,what were the total costs assigned to Product Y?

A)$26,000.

B)$26,796.

C)$27,000.

D)$28,286.

Assuming that joint product costs are allocated using the net realizable value method,what were the total costs assigned to Product Y?

Assuming that joint product costs are allocated using the net realizable value method,what were the total costs assigned to Product Y?A)$26,000.

B)$26,796.

C)$27,000.

D)$28,286.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

71

The Moody Company produced three joint products at a joint cost of $100,000.Two of these products were processed further.Production and sales were:  If the estimated net realizable value method is used and product Q is accounted for as a main product,how much of the joint costs would be allocated to product R?

If the estimated net realizable value method is used and product Q is accounted for as a main product,how much of the joint costs would be allocated to product R?

A)$38,889.

B)$41,667.

C)$50,000.

D)$62,500.

If the estimated net realizable value method is used and product Q is accounted for as a main product,how much of the joint costs would be allocated to product R?

If the estimated net realizable value method is used and product Q is accounted for as a main product,how much of the joint costs would be allocated to product R?A)$38,889.

B)$41,667.

C)$50,000.

D)$62,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

72

The Moody Company produced three joint products at a joint cost of $100,000.Two of these products were processed further.Production and sales were:  Assume Q is a by-product and Moody uses the cost reduction method of accounting for by-product cost.If estimated net realizable value is used,how much of the joint costs would be allocated to product R?

Assume Q is a by-product and Moody uses the cost reduction method of accounting for by-product cost.If estimated net realizable value is used,how much of the joint costs would be allocated to product R?

A)$38,889.

B)$43,750.

C)$50,000.

D)$62,500.

Assume Q is a by-product and Moody uses the cost reduction method of accounting for by-product cost.If estimated net realizable value is used,how much of the joint costs would be allocated to product R?

Assume Q is a by-product and Moody uses the cost reduction method of accounting for by-product cost.If estimated net realizable value is used,how much of the joint costs would be allocated to product R?A)$38,889.

B)$43,750.

C)$50,000.

D)$62,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

73

Because this allocation method recognizes that service departments often provide each other with inter-departmental service,it is theoretically considered to be the most accurate method for allocating service department costs to production departments.This method is: (CMA adapted)

A)direct method.

B)variable method.

C)linear method.

D)reciprocal methoD.

A)direct method.

B)variable method.

C)linear method.

D)reciprocal methoD.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

74

There are several methods for allocating service department costs to production departments.The method which recognizes service provided by one service department to another but does not recognize reciprocal interdepartmental service is called: (CMA adapted)

A)direct method.

B)variable method.

C)linear method.

D)reciprocal methoD.

E)step-down method.

A)direct method.

B)variable method.

C)linear method.

D)reciprocal methoD.

E)step-down method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

75

The following set up is a system of simultaneous linear equations to allocate costs using the reciprocal method.Matrix algebra is not required.The following costs were incurred in three operating departments and three service departments in Reality Company.  Use of services by other departments is as follows.

Use of services by other departments is as follows.  The equation for department P3 (marketing)is:

The equation for department P3 (marketing)is:

A)P3 = $285,000 + .20S1 + .20S3.

B)P3 = $285,000 + .20S1 + .60S2 + .20S3.

C)P3 = $285,000 + .20S1 + .20S2 + .60S3.

D)P3 = $285,000 + .50S1 + .50S3.

Use of services by other departments is as follows.

Use of services by other departments is as follows.  The equation for department P3 (marketing)is:

The equation for department P3 (marketing)is:A)P3 = $285,000 + .20S1 + .20S3.

B)P3 = $285,000 + .20S1 + .60S2 + .20S3.

C)P3 = $285,000 + .20S1 + .20S2 + .60S3.

D)P3 = $285,000 + .50S1 + .50S3.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

76

The Moody Company produced three joint products at a joint cost of $100,000.Two of these products were processed further.Production and sales were:  What is the net income of Moody Company if the estimated net realizable value method of joint cost allocation is used?

What is the net income of Moody Company if the estimated net realizable value method of joint cost allocation is used?

A)$20,000.

B)$50,000.

C)$150,000.

D)$350,000.

What is the net income of Moody Company if the estimated net realizable value method of joint cost allocation is used?

What is the net income of Moody Company if the estimated net realizable value method of joint cost allocation is used?A)$20,000.

B)$50,000.

C)$150,000.

D)$350,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

77

Raymer Corporation produced 3,660 units,consisting of three separate products,in a joint process for the year.The market for these products was so unstable that it was not practical to estimate the selling price of the products.A cost of $425,000 was incurred in the joint process.Product X's production was 80% of product Y's while product Z's production was 125% of product Y's.What is the amount of the joint cost allocable to product X assuming Raymer uses the physical quantities method of allocation?

A)$111,475.

B)$114,865.

C)$139,344.

D)$141,667.

A)$111,475.

B)$114,865.

C)$139,344.

D)$141,667.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

78

Products X,Y,and Z are produced from the same process at a cost of $5,200.Five thousand pounds of raw material yields 1,500 X,2,500 Y,and 1,000 Z.Selling prices are: X $2 per unit,Y $4 per unit,Z valueless.The ending inventory of X is 50 units.What is the value of the ending inventory if joint costs are allocated using net realizable value?

A)$21.67.

B)$31.20.

C)$40.00.

D)$42.00.

A)$21.67.

B)$31.20.

C)$40.00.

D)$42.00.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

79

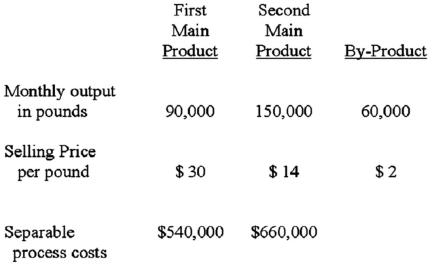

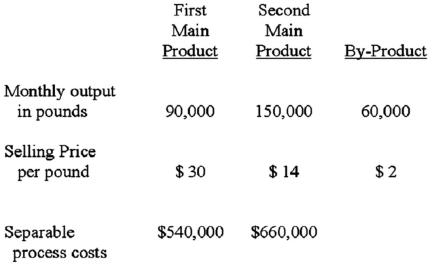

Lankip Company produces two main products and a by-product out of a joint process.The ratio of output quantities to input quantities of direct material used in the joint process remains consistent from month to month.Lankip has employed the physical-volume method to allocate joint production costs to the two main products.The net realizable value of the by-product is used to reduce the joint production costs before the joint costs are allocated to the main products.Data regarding Lankip's operations for the current month are presented in the chart below.During the month,Lankip incurred joint production costs of $2,520,000.The main products are not marketable at the split-off point and,thus,have to be processed further.  The amount of joint production cost that Lankip would allocate to the Second Main Product by using the physical quantities method to allocate joint production costs would be:

The amount of joint production cost that Lankip would allocate to the Second Main Product by using the physical quantities method to allocate joint production costs would be:

A)$1,200,000.

B)$1,260,000.

C)$1,500,000.

D)$1,575,000.

The amount of joint production cost that Lankip would allocate to the Second Main Product by using the physical quantities method to allocate joint production costs would be:

The amount of joint production cost that Lankip would allocate to the Second Main Product by using the physical quantities method to allocate joint production costs would be:A)$1,200,000.

B)$1,260,000.

C)$1,500,000.

D)$1,575,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

80

The following set up is a system of simultaneous linear equations to allocate costs using the reciprocal method.Matrix algebra is not required.The following costs were incurred in three operating departments and three service departments in Reality Company.  Use of services by other departments is as follows.

Use of services by other departments is as follows.  The equation for department S3 (supervision)is:

The equation for department S3 (supervision)is:

A)S3 = $45,000 + .90S1 + .10S2.

B)S3 = $45,000 + .10S1.

C)S3 = $45,000 + 1.00S1.

D)S3 = .10S1.

Use of services by other departments is as follows.

Use of services by other departments is as follows.  The equation for department S3 (supervision)is:

The equation for department S3 (supervision)is:A)S3 = $45,000 + .90S1 + .10S2.

B)S3 = $45,000 + .10S1.

C)S3 = $45,000 + 1.00S1.

D)S3 = .10S1.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck