Deck 13: Fiscal Policy

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

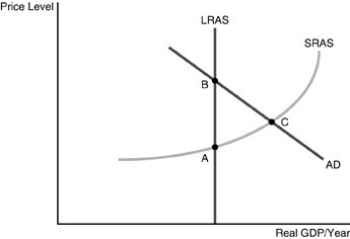

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/274

العب

ملء الشاشة (f)

Deck 13: Fiscal Policy

1

Which of the following fiscal policy actions would be appropriate if the economy is experiencing an recessionary gap?

A) a decrease in government spending

B) a decrease in taxes

C) an increase in interest rates

D) a decrease in the money supply

A) a decrease in government spending

B) a decrease in taxes

C) an increase in interest rates

D) a decrease in the money supply

B

2

Which of the following is NOT a fiscal policy action?

A) increasing government expenditures on military hardware

B) decreasing government spending on social welfare

C) decreasing the quantity of money in circulation

D) lowering income tax rates

A) increasing government expenditures on military hardware

B) decreasing government spending on social welfare

C) decreasing the quantity of money in circulation

D) lowering income tax rates

C

3

Fiscal policy to solve short-run economic problems supports the Keynesian notion of

A) there being no government role in the economy.

B) an active government role in the economy.

C) achieving a command and control economy.

D) the long-run nature of the economy.

A) there being no government role in the economy.

B) an active government role in the economy.

C) achieving a command and control economy.

D) the long-run nature of the economy.

B

4

Suppose the economy is experiencing an inflationary gap at the current level of GDP. Which of the following fiscal policy actions would be most appropriate given this gap?

A) decreasing interest rates

B) decreasing the money supply

C) increasing taxes

D) a simultaneous and equal increase in taxes and increase in government spending

A) decreasing interest rates

B) decreasing the money supply

C) increasing taxes

D) a simultaneous and equal increase in taxes and increase in government spending

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 274 في هذه المجموعة.

فتح الحزمة

k this deck

5

Which of the following is a discretionary fiscal policy action?

A) an increase in the amount of unemployment compensation because more people become unemployed

B) a progressive tax system that leads to an increase in income tax revenues from the rich

C) a deliberate tax increase when the economy experiences high inflation

D) an increase in Supplemental Security Income payments when more people become eligible for the benefits

A) an increase in the amount of unemployment compensation because more people become unemployed

B) a progressive tax system that leads to an increase in income tax revenues from the rich

C) a deliberate tax increase when the economy experiences high inflation

D) an increase in Supplemental Security Income payments when more people become eligible for the benefits

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 274 في هذه المجموعة.

فتح الحزمة

k this deck

6

Fiscal policy is defined as

A) the design of a tax system to transfer income from large corporations to the poor.

B) the use of Congressional power to pursue social and political goals.

C) the discretionary changing of government expenditures or taxes to achieve macroeconomic goals.

D) the use of the taxing power of the government to redistribute wealth in a socially acceptable manner.

A) the design of a tax system to transfer income from large corporations to the poor.

B) the use of Congressional power to pursue social and political goals.

C) the discretionary changing of government expenditures or taxes to achieve macroeconomic goals.

D) the use of the taxing power of the government to redistribute wealth in a socially acceptable manner.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 274 في هذه المجموعة.

فتح الحزمة

k this deck

7

When the government deliberately alters its level of spending and/or taxes in order to achieve specific national economic goals, it is exercising

A) monetary policy.

B) discretionary fiscal policy.

C) automatic government budgetary policy.

D) a laissez-faire policy.

A) monetary policy.

B) discretionary fiscal policy.

C) automatic government budgetary policy.

D) a laissez-faire policy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 274 في هذه المجموعة.

فتح الحزمة

k this deck

8

Typical goals for fiscal policy are

A) high employment and price stability.

B) high prices for consumers and low prices for businesses.

C) running high deficits and raising consumer prices.

D) increasing the money supply so the government can spend more.

A) high employment and price stability.

B) high prices for consumers and low prices for businesses.

C) running high deficits and raising consumer prices.

D) increasing the money supply so the government can spend more.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 274 في هذه المجموعة.

فتح الحزمة

k this deck

9

Fiscal policy is implemented by

A) the central bank.

B) local government units.

C) the Internal Revenue Service.

D) the federal government.

A) the central bank.

B) local government units.

C) the Internal Revenue Service.

D) the federal government.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 274 في هذه المجموعة.

فتح الحزمة

k this deck

10

Which of the following is an example of fiscal policy?

A) a reduction in the federal funds rate.

B) a reduction in the money supply.

C) a reduction in lump-sum taxes.

D) an increase in the government deficit due to more military spending in wartime.

A) a reduction in the federal funds rate.

B) a reduction in the money supply.

C) a reduction in lump-sum taxes.

D) an increase in the government deficit due to more military spending in wartime.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 274 في هذه المجموعة.

فتح الحزمة

k this deck

11

When television commentators refer to "tax and spend" policy, they are referring to

A) fiscal policy.

B) monetary policy.

C) command and control policy.

D) automatic stabilizers.

A) fiscal policy.

B) monetary policy.

C) command and control policy.

D) automatic stabilizers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 274 في هذه المجموعة.

فتح الحزمة

k this deck

12

Fiscal policy involves which of the following?

A) tax policy

B) interest rates

C) selling government bonds

D) all of the above

A) tax policy

B) interest rates

C) selling government bonds

D) all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 274 في هذه المجموعة.

فتح الحزمة

k this deck

13

Fiscal policy refers to the

A) manipulation of the money supply in order to increase the amount of cash that the government holds.

B) adjustment of government spending and taxes in order to achieve certain national economic goals.

C) adjustment of national income data to account for price level changes.

D) government policy that aims at raising the market prices of certain goods.

A) manipulation of the money supply in order to increase the amount of cash that the government holds.

B) adjustment of government spending and taxes in order to achieve certain national economic goals.

C) adjustment of national income data to account for price level changes.

D) government policy that aims at raising the market prices of certain goods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 274 في هذه المجموعة.

فتح الحزمة

k this deck

14

All the following actions represent fiscal policy EXCEPT

A) an increase in the money supply.

B) a decrease in government spending.

C) a reduction in individual income tax rates.

D) an increase in corporate income tax rates.

A) an increase in the money supply.

B) a decrease in government spending.

C) a reduction in individual income tax rates.

D) an increase in corporate income tax rates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 274 في هذه المجموعة.

فتح الحزمة

k this deck

15

A decrease in government spending would cause which of the following to happen?

A) The aggregate demand curve would shift to the left.

B) The aggregate demand curve would shift to the right.

C) The aggregate supply curve would shift to the right.

D) The aggregate supply curve would shift to the left.

A) The aggregate demand curve would shift to the left.

B) The aggregate demand curve would shift to the right.

C) The aggregate supply curve would shift to the right.

D) The aggregate supply curve would shift to the left.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 274 في هذه المجموعة.

فتح الحزمة

k this deck

16

Which of the following represents expansionary fiscal policy?

A) a reduction in government spending

B) a decrease in average individual income tax rates

C) an increase in corporate income tax rates

D) an increase in marginal individual income tax rates

A) a reduction in government spending

B) a decrease in average individual income tax rates

C) an increase in corporate income tax rates

D) an increase in marginal individual income tax rates

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 274 في هذه المجموعة.

فتح الحزمة

k this deck

17

Which of the following would shift the aggregate demand curve to the right?

A) an increase in government spending

B) an increase in taxes

C) an increase in interest rates

D) an increase in labor productivity

A) an increase in government spending

B) an increase in taxes

C) an increase in interest rates

D) an increase in labor productivity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 274 في هذه المجموعة.

فتح الحزمة

k this deck

18

According to traditional Keynesian economics, contractionary fiscal policy initiated by the federal government

A) is never appropriate.

B) is an appropriate way to prevent recessions and depressions.

C) is an appropriate way to slow down an over-heated economy.

D) will always fail due to crowding out effects.

A) is never appropriate.

B) is an appropriate way to prevent recessions and depressions.

C) is an appropriate way to slow down an over-heated economy.

D) will always fail due to crowding out effects.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 274 في هذه المجموعة.

فتح الحزمة

k this deck

19

Which of the following is an example of a discretionary fiscal policy action?

A) an increase in government spending to deal with a recession

B) a decrease in tax revenues as taxpayers' incomes decrease

C) increasing the minimum wage rate

D) raising regulations in the banking industry

A) an increase in government spending to deal with a recession

B) a decrease in tax revenues as taxpayers' incomes decrease

C) increasing the minimum wage rate

D) raising regulations in the banking industry

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 274 في هذه المجموعة.

فتح الحزمة

k this deck

20

Discretionary fiscal policy is

A) automatic changes in government expenditures and interest rates that achieve certain national economic goals.

B) deliberate changes in government expenditures or taxes in order to achieve certain national economic goals.

C) used to achieve full employment by changing monetary growth targets.

D) deliberate changes in government regulations in markets to achieve certain social goals.

A) automatic changes in government expenditures and interest rates that achieve certain national economic goals.

B) deliberate changes in government expenditures or taxes in order to achieve certain national economic goals.

C) used to achieve full employment by changing monetary growth targets.

D) deliberate changes in government regulations in markets to achieve certain social goals.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 274 في هذه المجموعة.

فتح الحزمة

k this deck

21

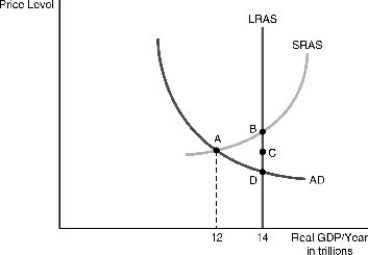

Refer to the above figure. Suppose the economy is at point A. By the proper use of fiscal policy, the government can

A) boost taxes to shift LRAS through point A.

B) cut income tax rates to get the economy to point B.

C) raise income tax rates to get the economy to point C.

D) reduce government spending to get the economy to point D.

A) boost taxes to shift LRAS through point A.

B) cut income tax rates to get the economy to point B.

C) raise income tax rates to get the economy to point C.

D) reduce government spending to get the economy to point D.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 274 في هذه المجموعة.

فتح الحزمة

k this deck

22

The discretionary change of government expenditures or taxes to achieve national economic goals is

A) crowding-out policy.

B) Ricardian-equivalence theorem.

C) supply-side economics.

D) fiscal policy.

A) crowding-out policy.

B) Ricardian-equivalence theorem.

C) supply-side economics.

D) fiscal policy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 274 في هذه المجموعة.

فتح الحزمة

k this deck

23

Which of the following actions could be undertaken if the government wants to reduce a recessionary gap?

A) Increase taxes and reduce government spending.

B) Reduce taxes and increase government spending.

C) Increase taxes and increase government spending.

D) Increase taxes more than the amount of reduction in government spending.

A) Increase taxes and reduce government spending.

B) Reduce taxes and increase government spending.

C) Increase taxes and increase government spending.

D) Increase taxes more than the amount of reduction in government spending.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 274 في هذه المجموعة.

فتح الحزمة

k this deck

24

Fiscal policy involves discretionary changes in

A) interest rates.

B) exchange rates.

C) lump-sum taxes.

D) the rate of growth of the money supply.

A) interest rates.

B) exchange rates.

C) lump-sum taxes.

D) the rate of growth of the money supply.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 274 في هذه المجموعة.

فتح الحزمة

k this deck

25

Refer to the above figure. Suppose the economy is operating at point A. There is a recessionary gap of ________, which can be closed by ________.

A) $3 trillion; increasing government spending by $1 trillion

B) $1 trillion; expansionary fiscal policy that shifts the short-run aggregate supply curve through point C

C) $2 trillion; expansionary fiscal policy that generates another $2 trillion in total spending

D) $2 trillion; an increase in government spending of $14 trillion

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 274 في هذه المجموعة.

فتح الحزمة

k this deck

26

According to traditional Keynesian analysis, fiscal policy operates by

A) informing business people about its plans for the economy so they will know how to adjust their behavior.

B) indirectly affecting aggregate demand through its effect on the money supply.

C) directly affecting aggregate demand.

D) directly affecting aggregate supply.

A) informing business people about its plans for the economy so they will know how to adjust their behavior.

B) indirectly affecting aggregate demand through its effect on the money supply.

C) directly affecting aggregate demand.

D) directly affecting aggregate supply.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 274 في هذه المجموعة.

فتح الحزمة

k this deck

27

Discretionary fiscal policy is best described as

A) a deliberate action to move the economy toward full employment and price stability more quickly than it might otherwise.

B) a deliberate attempt to improve the functioning of free markets.

C) an automatic change in income transfer payments to keep the economy at full employment.

D) the design of a tax system that automatically stabilizes economic activity over time.

A) a deliberate action to move the economy toward full employment and price stability more quickly than it might otherwise.

B) a deliberate attempt to improve the functioning of free markets.

C) an automatic change in income transfer payments to keep the economy at full employment.

D) the design of a tax system that automatically stabilizes economic activity over time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 274 في هذه المجموعة.

فتح الحزمة

k this deck

28

Which of the following actions could be undertaken if the government wants to close an inflationary gap?

A) Increase taxes and reduce government spending.

B) Reduce taxes and increase government spending.

C) Increase taxes and increase government spending.

D) Reduce taxes and reduce government spending.

A) Increase taxes and reduce government spending.

B) Reduce taxes and increase government spending.

C) Increase taxes and increase government spending.

D) Reduce taxes and reduce government spending.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 274 في هذه المجموعة.

فتح الحزمة

k this deck

29

Refer to the above figure. If the economy is currently operating at point C, then there is

A) deflation.

B) a recessionary gap.

C) an inflationary gap.

D) unemployment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 274 في هذه المجموعة.

فتح الحزمة

k this deck

30

If the economy is operating on the long-run aggregate supply curve, then expansionary fiscal policy will

A) generate higher prices in the short run, but will induce aggregate supply to increase in the long run.

B) generate an increase in real GDP and higher prices in both the short run and the long run.

C) generate an increase in real GDP without higher prices in the short run, but then real GDP will return to its long-run level, and the price level will increase.

D) generate an increase in real GDP and higher prices in the short run, but then real GDP will decrease to its long-run level, and the price level will increase some more.

A) generate higher prices in the short run, but will induce aggregate supply to increase in the long run.

B) generate an increase in real GDP and higher prices in both the short run and the long run.

C) generate an increase in real GDP without higher prices in the short run, but then real GDP will return to its long-run level, and the price level will increase.

D) generate an increase in real GDP and higher prices in the short run, but then real GDP will decrease to its long-run level, and the price level will increase some more.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 274 في هذه المجموعة.

فتح الحزمة

k this deck

31

Refer to the above figure. If the economy is currently at point C, then an increase in taxes will lead to

A) an increase in the price level and an increase in real GDP.

B) a decrease in real GDP and an increase in the price level.

C) a decrease in real GDP and a decrease in the price level.

D) a decrease in the price level and an increase in real GDP.

A) an increase in the price level and an increase in real GDP.

B) a decrease in real GDP and an increase in the price level.

C) a decrease in real GDP and a decrease in the price level.

D) a decrease in the price level and an increase in real GDP.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 274 في هذه المجموعة.

فتح الحزمة

k this deck

32

Keynes believed that the way to prevent recessions and depressions was to

A) reduce spending when there is a recessionary gap.

B) only change tax rates as a means of regulating the economy.

C) maximize the crowding out effect.

D) increase aggregate demand through expansionary fiscal policy.

A) reduce spending when there is a recessionary gap.

B) only change tax rates as a means of regulating the economy.

C) maximize the crowding out effect.

D) increase aggregate demand through expansionary fiscal policy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 274 في هذه المجموعة.

فتح الحزمة

k this deck

33

Other things being equal, an increase in taxes will

A) lead to a reduction in the long run aggregate supply curve as businesses enjoy greater profits.

B) influence the short run aggregate supply curve but not the aggregate demand curve.

C) lead to a corresponding reduction in interest rates increasing the crowding out effect.

D) cause a decrease in aggregate demand due to decreases in consumption, investment, or net exports.

A) lead to a reduction in the long run aggregate supply curve as businesses enjoy greater profits.

B) influence the short run aggregate supply curve but not the aggregate demand curve.

C) lead to a corresponding reduction in interest rates increasing the crowding out effect.

D) cause a decrease in aggregate demand due to decreases in consumption, investment, or net exports.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 274 في هذه المجموعة.

فتح الحزمة

k this deck

34

An example of fiscal policy is

A) an increase in government spending.

B) a reduction in investment spending by the private sector.

C) an increase in autonomous spending by consumers.

D) a cost-of-living adjustment in Social Security payments to the elderly.

A) an increase in government spending.

B) a reduction in investment spending by the private sector.

C) an increase in autonomous spending by consumers.

D) a cost-of-living adjustment in Social Security payments to the elderly.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 274 في هذه المجموعة.

فتح الحزمة

k this deck

35

Fiscal policy includes all of the following EXCEPT

A) changing taxes.

B) changing government spending.

C) policies that influence aggregate demand.

D) policies that influence the rate of growth of the money supply.

A) changing taxes.

B) changing government spending.

C) policies that influence aggregate demand.

D) policies that influence the rate of growth of the money supply.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 274 في هذه المجموعة.

فتح الحزمة

k this deck

36

Refer to the above figure. Suppose the U.S. economy is currently operating at point C. Which of the following actions would you recommend to the president of the United States?

A) Raise government spending to stimulate investment, consumption and net exports.

B) Increase government spending while holding taxes constant.

C) Engage in contractionary fiscal policy by raising income taxes.

D) Reduce the interest rate to stimulate investment minimizing the crowding out effect.

A) Raise government spending to stimulate investment, consumption and net exports.

B) Increase government spending while holding taxes constant.

C) Engage in contractionary fiscal policy by raising income taxes.

D) Reduce the interest rate to stimulate investment minimizing the crowding out effect.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 274 في هذه المجموعة.

فتح الحزمة

k this deck

37

To close an inflationary gap through fiscal policy, the government should

A) decrease government spending in order to increase aggregate supply.

B) decrease government spending in order to reduce aggregate demand.

C) reduce taxes in order to stimulate investment, and thus increase aggregate supply.

D) increase government spending and taxes in order to both increase aggregate demand and aggregate supply.

A) decrease government spending in order to increase aggregate supply.

B) decrease government spending in order to reduce aggregate demand.

C) reduce taxes in order to stimulate investment, and thus increase aggregate supply.

D) increase government spending and taxes in order to both increase aggregate demand and aggregate supply.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 274 في هذه المجموعة.

فتح الحزمة

k this deck

38

Suppose the government decreases lump-sum taxes. This causes

A) disposable income to increase, which causes consumption spending to decrease and aggregate demand to increase.

B) government spending to decrease, which causes aggregate demand to decrease.

C) consumption spending to decrease and spending on imports to increase. The effect on aggregate demand depends on whether domestic spending or spending on imports decreased the most.

D) disposable income to decrease, which causes aggregate supply to decrease.

A) disposable income to increase, which causes consumption spending to decrease and aggregate demand to increase.

B) government spending to decrease, which causes aggregate demand to decrease.

C) consumption spending to decrease and spending on imports to increase. The effect on aggregate demand depends on whether domestic spending or spending on imports decreased the most.

D) disposable income to decrease, which causes aggregate supply to decrease.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 274 في هذه المجموعة.

فتح الحزمة

k this deck

39

If the economy is experiencing a recessionary gap and the government wants to accelerate the adjustment to the long-run equilibrium, it should

A) reduce aggregate demand by cutting government spending or raising taxes.

B) increase aggregate demand by increasing government spending or cutting taxes.

C) increase aggregate supply by cutting government spending or raising taxes.

D) increase aggregate supply by increasing government spending or lowering taxes.

A) reduce aggregate demand by cutting government spending or raising taxes.

B) increase aggregate demand by increasing government spending or cutting taxes.

C) increase aggregate supply by cutting government spending or raising taxes.

D) increase aggregate supply by increasing government spending or lowering taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 274 في هذه المجموعة.

فتح الحزمة

k this deck

40

Refer to the above figure. Suppose that the economy was originally at point A, and then it reached point C by means of a fiscal policy action. Which of the following is correct?

A) Point C is a short-run equilibrium that could have been attained through a tax cut, but in the long run the economy will end up at point B.

B) Point C is both a short-run equilibrium and a long-run equilibrium that could have been attained through an increase in government spending.

C) Point C is a long-run equilibrium that could have been attained through a tax increase, although reaching this point first required a short-run equilibrium at point B.

D) Point C is a short-run equilibrium that could have been attained through a reduction in government spending, but in the long run the economy will end up at point B.

A) Point C is a short-run equilibrium that could have been attained through a tax cut, but in the long run the economy will end up at point B.

B) Point C is both a short-run equilibrium and a long-run equilibrium that could have been attained through an increase in government spending.

C) Point C is a long-run equilibrium that could have been attained through a tax increase, although reaching this point first required a short-run equilibrium at point B.

D) Point C is a short-run equilibrium that could have been attained through a reduction in government spending, but in the long run the economy will end up at point B.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 274 في هذه المجموعة.

فتح الحزمة

k this deck

41

Discretionary fiscal policy in the United States

A) is undertaken at the order of the Federal Reserve.

B) occurs automatically as the nation's level of GDP changes.

C) involves specific changes in taxes and government spending undertaken by Congress and the president.

D) involves secret advice given by the Council of Economic Advisers to the president.

A) is undertaken at the order of the Federal Reserve.

B) occurs automatically as the nation's level of GDP changes.

C) involves specific changes in taxes and government spending undertaken by Congress and the president.

D) involves secret advice given by the Council of Economic Advisers to the president.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 274 في هذه المجموعة.

فتح الحزمة

k this deck

42

The government will conduct expansionary fiscal policy if it attempts to

A) reduce the price level.

B) reduce real GDP.

C) shift the aggregate demand curve to the left.

D) reduce the level of unemployment.

A) reduce the price level.

B) reduce real GDP.

C) shift the aggregate demand curve to the left.

D) reduce the level of unemployment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 274 في هذه المجموعة.

فتح الحزمة

k this deck

43

Suppose the economy has a low level of employment. This would imply

A) that the government should engage in expansionary fiscal policy and increase the tax rate.

B) that the economy is operating to the left of the LRAS curve and that government spending could be increased to reduce unemployment.

C) that fiscal policy has been ineffective and should be abandoned.

D) that the economy is operating on the SRAS curve and that government spending could be decreased to reduce unemployment.

A) that the government should engage in expansionary fiscal policy and increase the tax rate.

B) that the economy is operating to the left of the LRAS curve and that government spending could be increased to reduce unemployment.

C) that fiscal policy has been ineffective and should be abandoned.

D) that the economy is operating on the SRAS curve and that government spending could be decreased to reduce unemployment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 274 في هذه المجموعة.

فتح الحزمة

k this deck

44

Which one of the following is TRUE about the effects of fiscal policy?

A) A decrease government spending will increase aggregate supply.

B) A tax change does not have any direct or indirect effects on aggregate demand.

C) An increase in government spending will increase aggregate demand.

D) An increase in government spending will reduce aggregate demand.

A) A decrease government spending will increase aggregate supply.

B) A tax change does not have any direct or indirect effects on aggregate demand.

C) An increase in government spending will increase aggregate demand.

D) An increase in government spending will reduce aggregate demand.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 274 في هذه المجموعة.

فتح الحزمة

k this deck

45

The changing of government expenditures to achieve national economic goals is

A) discretionary fiscal policy.

B) automatic fiscal policy.

C) budget deficit policy.

D) inflationary fiscal policy.

A) discretionary fiscal policy.

B) automatic fiscal policy.

C) budget deficit policy.

D) inflationary fiscal policy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 274 في هذه المجموعة.

فتح الحزمة

k this deck

46

Which of the following is NOT related to fiscal policy?

A) passage of a new regulation on a specific industry

B) decreasing marginal tax rates

C) reducing the budget deficit

D) increasing government expenditures

A) passage of a new regulation on a specific industry

B) decreasing marginal tax rates

C) reducing the budget deficit

D) increasing government expenditures

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 274 في هذه المجموعة.

فتح الحزمة

k this deck

47

An example of expansionary fiscal policy could be

A) to increase the nation's money supply.

B) to reduce tax rates.

C) to reduce government spending.

D) to reduce interest rates.

A) to increase the nation's money supply.

B) to reduce tax rates.

C) to reduce government spending.

D) to reduce interest rates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 274 في هذه المجموعة.

فتح الحزمة

k this deck

48

Fiscal policy involves the actions of

A) taxation and spending in an effort to address inflation and unemployment.

B) business regulation to increase economic efficiency.

C) changing interest rates to stimulate private savings.

D) changing the exchange rate to discourage imports.

A) taxation and spending in an effort to address inflation and unemployment.

B) business regulation to increase economic efficiency.

C) changing interest rates to stimulate private savings.

D) changing the exchange rate to discourage imports.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 274 في هذه المجموعة.

فتح الحزمة

k this deck

49

Which of the following fiscal policy actions would definitely cause an increase in the size of a recessionary gap?

A) cuts in government spending

B) cuts in taxes

C) increases in taxes and increases in government spending

D) cuts in taxes and increases in government spending

A) cuts in government spending

B) cuts in taxes

C) increases in taxes and increases in government spending

D) cuts in taxes and increases in government spending

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 274 في هذه المجموعة.

فتح الحزمة

k this deck

50

In the short run, if the government attempts to increase aggregate demand, it should

A) increase government spending and reduce taxes.

B) decrease government spending and increase taxes.

C) shift the long-run aggregate supply curve to the right.

D) shift the short-run aggregate supply curve to the right.

A) increase government spending and reduce taxes.

B) decrease government spending and increase taxes.

C) shift the long-run aggregate supply curve to the right.

D) shift the short-run aggregate supply curve to the right.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 274 في هذه المجموعة.

فتح الحزمة

k this deck

51

Suppose there currently is an inflationary gap. What could the government do to bring the overall price level down?

A) nothing

B) Increase income taxes.

C) Increase government spending.

D) Reduce the nation's aggregate supply.

A) nothing

B) Increase income taxes.

C) Increase government spending.

D) Reduce the nation's aggregate supply.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 274 في هذه المجموعة.

فتح الحزمة

k this deck

52

If there is a deliberate change in government taxes and spending, it is called

A) a recessionary gap.

B) an inflationary gap.

C) discretionary fiscal policy.

D) discretionary monetary policy.

A) a recessionary gap.

B) an inflationary gap.

C) discretionary fiscal policy.

D) discretionary monetary policy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 274 في هذه المجموعة.

فتح الحزمة

k this deck

53

In the short run, expansionary fiscal policy usually will

A) increase both real GDP and the price level.

B) increase real GDP and decrease the price level.

C) decrease the price level and increase real GDP.

D) decrease both real GDP and the price level.

A) increase both real GDP and the price level.

B) increase real GDP and decrease the price level.

C) decrease the price level and increase real GDP.

D) decrease both real GDP and the price level.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 274 في هذه المجموعة.

فتح الحزمة

k this deck

54

How might fiscal policy be used to correct a recessionary gap?

A) The exchange rate would be adjusted to encourage imports.

B) The exchange rate would be adjusted to discourage imports.

C) The interest rate would be adjusted to encourage saving.

D) Taxes would be cut to stimulate aggregate demand.

A) The exchange rate would be adjusted to encourage imports.

B) The exchange rate would be adjusted to discourage imports.

C) The interest rate would be adjusted to encourage saving.

D) Taxes would be cut to stimulate aggregate demand.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 274 في هذه المجموعة.

فتح الحزمة

k this deck

55

Which of the following fiscal policy actions would most likely cause a reduction in the size of an inflationary gap?

A) cuts in taxes and increases in government spending

B) increases in government spending

C) increases in taxes

D) cuts in taxes

A) cuts in taxes and increases in government spending

B) increases in government spending

C) increases in taxes

D) cuts in taxes

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 274 في هذه المجموعة.

فتح الحزمة

k this deck

56

How might fiscal policy be used to correct an inflationary gap?

A) The exchange rate would be adjusted to encourage imports.

B) The exchange rate would be adjusted to discourage imports.

C) Government spending would be adjusted to reduce consumer spending.

D) Business operations would be regulated by the government to become more efficient.

A) The exchange rate would be adjusted to encourage imports.

B) The exchange rate would be adjusted to discourage imports.

C) Government spending would be adjusted to reduce consumer spending.

D) Business operations would be regulated by the government to become more efficient.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 274 في هذه المجموعة.

فتح الحزمة

k this deck

57

Expansionary fiscal policy is used to

A) flight inflation.

B) fight recessions.

C) encourage private saving.

D) make businesses more efficient.

A) flight inflation.

B) fight recessions.

C) encourage private saving.

D) make businesses more efficient.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 274 في هذه المجموعة.

فتح الحزمة

k this deck

58

When the government cuts taxes,

A) the long-run aggregate supply curve shifts to the left.

B) the short-run aggregate supply curve shifts to the left.

C) the aggregate demand curve shifts to the left.

D) the aggregate demand curve shifts to the right.

A) the long-run aggregate supply curve shifts to the left.

B) the short-run aggregate supply curve shifts to the left.

C) the aggregate demand curve shifts to the left.

D) the aggregate demand curve shifts to the right.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 274 في هذه المجموعة.

فتح الحزمة

k this deck

59

Which of the following conditions describes an inflationary gap?

A) The short-run equilibrium level of real GDP is above the long-run level of real GDP.

B) The short-run equilibrium level of real GDP is below the long-run level of real GDP.

C) The actual interest rate is above the equilibrium interest rate.

D) The actual interest rate is below the equilibrium interest rate.

A) The short-run equilibrium level of real GDP is above the long-run level of real GDP.

B) The short-run equilibrium level of real GDP is below the long-run level of real GDP.

C) The actual interest rate is above the equilibrium interest rate.

D) The actual interest rate is below the equilibrium interest rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 274 في هذه المجموعة.

فتح الحزمة

k this deck

60

Contractionary fiscal policy will most likely

A) raise real GDP more than the increase in the price level.

B) raise real GDP.

C) lower the price level.

D) raise inflation.

A) raise real GDP more than the increase in the price level.

B) raise real GDP.

C) lower the price level.

D) raise inflation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 274 في هذه المجموعة.

فتح الحزمة

k this deck

61

Suppose the current level of real GDP is below the full-employment level of real GDP. Which of the following represents a fiscal policy action that could be implemented to reduce the size of this recessionary gap?

A) Increase government spending.

B) Decrease interest rates.

C) Increase the money supply.

D) all of the above

A) Increase government spending.

B) Decrease interest rates.

C) Increase the money supply.

D) all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 274 في هذه المجموعة.

فتح الحزمة

k this deck

62

Government spending conducted for the purpose of achieving full employment or price stability is an example of

A) monetary policy.

B) interest-rate policy.

C) exchange-rate policy.

D) fiscal policy.

A) monetary policy.

B) interest-rate policy.

C) exchange-rate policy.

D) fiscal policy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 274 في هذه المجموعة.

فتح الحزمة

k this deck

63

Which of the following statements about fiscal policy is TRUE?

A) Real Gross Domestic Product (GDP) can be increased above its long-run equilibrium only in the short run.

B) Real Gross Domestic Product (GDP) can never be increased above its long-run equilibrium, even for a brief period of time.

C) Government can shift the aggregate demand curve inward by increasing spending.

D) Government can shift the aggregate demand curve outward by reducing spending.

A) Real Gross Domestic Product (GDP) can be increased above its long-run equilibrium only in the short run.

B) Real Gross Domestic Product (GDP) can never be increased above its long-run equilibrium, even for a brief period of time.

C) Government can shift the aggregate demand curve inward by increasing spending.

D) Government can shift the aggregate demand curve outward by reducing spending.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 274 في هذه المجموعة.

فتح الحزمة

k this deck

64

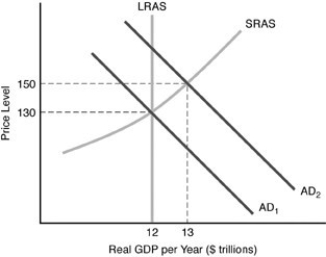

Refer to the above figure. If the relevant aggregate demand curve was AD2, the government could do all of the following to close the existing gap EXCEPT

A) increase government spending on roads.

B) reduce marginal tax rates.

C) reduce corporate taxes.

D) reduce defense spending.

A) increase government spending on roads.

B) reduce marginal tax rates.

C) reduce corporate taxes.

D) reduce defense spending.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 274 في هذه المجموعة.

فتح الحزمة

k this deck

65

Refer to the above figure. If the relevant aggregate demand curve is AD2, what is the current economic situation?

A) inflationary gap

B) recessionary gap

C) equilibrium

D) overemployment

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 274 في هذه المجموعة.

فتح الحزمة

k this deck

66

Refer to the above figure. Suppose the relevant aggregate demand curve is AD2. If the government wants to use fiscal policy to close the existing gap, it should

A) increase taxes.

B) decrease taxes.

C) increase the money supply.

D) increase government spending.

A) increase taxes.

B) decrease taxes.

C) increase the money supply.

D) increase government spending.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 274 في هذه المجموعة.

فتح الحزمة

k this deck

67

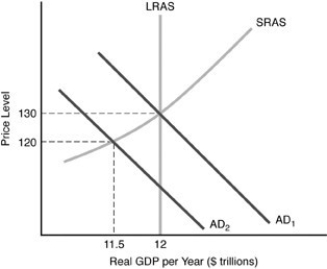

Refer to the above figure. If the relevant aggregate demand curve is AD2, what is the current economic situation?

A) inflationary gap

B) recessionary gap

C) equilibrium

D) overemployment

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 274 في هذه المجموعة.

فتح الحزمة

k this deck

68

The fiscal policy of the United States is

A) summarized in the budget of the U.S. federal government.

B) the sum of the budgets of each state and municipality.

C) published in the Federal Reserve Bank's Annual Report.

D) decided each year by the head of the U.S. Department of the Treasury.

A) summarized in the budget of the U.S. federal government.

B) the sum of the budgets of each state and municipality.

C) published in the Federal Reserve Bank's Annual Report.

D) decided each year by the head of the U.S. Department of the Treasury.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 274 في هذه المجموعة.

فتح الحزمة

k this deck

69

Which one of the following is an example of discretionary fiscal policy used to correct a recessionary gap?

A) a tax decrease passed into law by Congress

B) an increase in the money supply by the Federal Reserve

C) a decrease in government expenditures approved by Congress

D) an agreement among major banks to raise interest rates

A) a tax decrease passed into law by Congress

B) an increase in the money supply by the Federal Reserve

C) a decrease in government expenditures approved by Congress

D) an agreement among major banks to raise interest rates

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 274 في هذه المجموعة.

فتح الحزمة

k this deck

70

Discretionary fiscal policy

A) is the use of government spending and tax policies to influence economic growth and inflation.

B) is the use of regulation to influence economic growth and inflation.

C) is the purchase and sale of Treasury securities to influence economic growth and inflation.

D) is the use of the money supply to maintain stable prices.

A) is the use of government spending and tax policies to influence economic growth and inflation.

B) is the use of regulation to influence economic growth and inflation.

C) is the purchase and sale of Treasury securities to influence economic growth and inflation.

D) is the use of the money supply to maintain stable prices.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 274 في هذه المجموعة.

فتح الحزمة

k this deck

71

Refer to the above figure. If the current level of real GDP is $13 trillion, then the economy is experiencing

A) an inflationary gap.

B) a recessionary gap.

C) a deflationary gap.

D) a fiscal deficit gap.

A) an inflationary gap.

B) a recessionary gap.

C) a deflationary gap.

D) a fiscal deficit gap.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 274 في هذه المجموعة.

فتح الحزمة

k this deck

72

Suppose the government believes the economy is operating beyond the full-employment real GDP. What kind of fiscal policy could it pursue?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 274 في هذه المجموعة.

فتح الحزمة

k this deck

73

Explain how fiscal policy can correct a contractionary gap.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 274 في هذه المجموعة.

فتح الحزمة

k this deck

74

Refer to the above figure. Suppose the relevant aggregate demand curve is AD2. If the government wants to use discretionary fiscal policy to close the existing gap, it should

A) decrease taxes.

B) increase taxes.

C) increase the money supply.

D) decrease government spending.

A) decrease taxes.

B) increase taxes.

C) increase the money supply.

D) decrease government spending.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 274 في هذه المجموعة.

فتح الحزمة

k this deck

75

What is discretionary fiscal policy and what is its purpose?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 274 في هذه المجموعة.

فتح الحزمة

k this deck

76

When the current short-run equilibrium is to the right of the long-run aggregate supply, appropriate discretionary fiscal policy used to address this problem would be to

A) increase taxes.

B) decrease taxes.

C) increase government spending.

D) decrease the discount rate.

A) increase taxes.

B) decrease taxes.

C) increase government spending.

D) decrease the discount rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 274 في هذه المجموعة.

فتح الحزمة

k this deck

77

Which one of the following is an example of discretionary fiscal policy used to correct an inflationary gap?

A) a tax increase passed into law by Congress

B) decrease in the money supply by the Federal Reserve

C) an increase in government expenditures approved by Congress

D) an agreement among major banks to lower interest rates

A) a tax increase passed into law by Congress

B) decrease in the money supply by the Federal Reserve

C) an increase in government expenditures approved by Congress

D) an agreement among major banks to lower interest rates

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 274 في هذه المجموعة.

فتح الحزمة

k this deck

78

Tax policy conducted for the purpose of achieving full employment, price stability, or economic growth is an example of

A) monetary policy.

B) interest-rate policy.

C) exchange-rate policy.

D) discretionary fiscal policy.

A) monetary policy.

B) interest-rate policy.

C) exchange-rate policy.

D) discretionary fiscal policy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 274 في هذه المجموعة.

فتح الحزمة

k this deck

79

In 2009, Congress passed a bill that involved government spending increases and tax cuts with the purpose of stimulating the U.S. economy. This policy is an example of

A) an automatic stabilizer.

B) contractionary fiscal policy.

C) expansionary fiscal policy.

D) expansionary monetary policy.

A) an automatic stabilizer.

B) contractionary fiscal policy.

C) expansionary fiscal policy.

D) expansionary monetary policy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 274 في هذه المجموعة.

فتح الحزمة

k this deck

80

Refer to the above figure. If the relevant aggregate demand curve is AD1, then the economy is experiencing

A) an inflationary gap.

B) a recessionary gap.

C) a deflationary gap.

D) full employment.

A) an inflationary gap.

B) a recessionary gap.

C) a deflationary gap.

D) full employment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 274 في هذه المجموعة.

فتح الحزمة

k this deck