Deck 21: The Statement of Cash Flows Revisited

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/155

العب

ملء الشاشة (f)

Deck 21: The Statement of Cash Flows Revisited

1

Generally speaking, cash flows from operating activities include the elements of net income reported on a cash basis.

True

2

Which of the following never requires an outflow of cash?

A)Early extinguishment of debt.

B)Retirement of common stock.

C)Payment of dividends.

D)Amortization of patent.

A)Early extinguishment of debt.

B)Retirement of common stock.

C)Payment of dividends.

D)Amortization of patent.

D

3

When one enters a $50,000 credit entry to the Land account in a spreadsheet for the statement of cash flows, it represents a negative change in that account and probably is due to selling such assets.

True

4

The purchase of treasury stock is an investing cash outflow.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

5

Transactions that represent noncash investing and financing activities must be reported in the statement of cash flows or in disclosure notes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

6

A decrease in cash dividends payable means that dividends declared were less than dividends paid.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

7

Which of the following is not an inflow of cash?

A)Depletion.

B)Cash borrowed on a short-term note.

C)Sale of a computer.

D)Cash borrowed on a long-term note.

A)Depletion.

B)Cash borrowed on a short-term note.

C)Sale of a computer.

D)Cash borrowed on a long-term note.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

8

If the direct method is used to report cash flows from operating activities in the body of the statement of cash flows, a reconciliation of net income to net cash flows from operating activities also is required.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

9

Creditors and investors would generally find the statement of cash flows least useful for assessing the:

A)Ability to generate future cash flows.

B)Ability to pay dividends.

C)Financial position at a point in time.

D)Quality of earnings.

A)Ability to generate future cash flows.

B)Ability to pay dividends.

C)Financial position at a point in time.

D)Quality of earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

10

Which of the following financial statements is prepared as of a particular point in time rather than for a period of time?

A)Statement of cash flows.

B)Income statement.

C)Statement of shareholders' equity.

D)Balance sheet.

A)Statement of cash flows.

B)Income statement.

C)Statement of shareholders' equity.

D)Balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

11

How is the amortization of patents reported in a statement of cash flows that is prepared using the direct method?

A)Not reported.

B)An increase in cash flows from operating activities.

C)A decrease in cash flows from operating activities.

D)A decrease in cash flows from investing activities.

A)Not reported.

B)An increase in cash flows from operating activities.

C)A decrease in cash flows from operating activities.

D)A decrease in cash flows from investing activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

12

All of the following may qualify as cash equivalents except:

A)Money market accounts.

B)Certificates of deposit.

C)U.S.Treasury bills.

D)Newly issued corporate bonds.

A)Money market accounts.

B)Certificates of deposit.

C)U.S.Treasury bills.

D)Newly issued corporate bonds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

13

Interest payments on debt are classified as cash outflows from financing activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

14

When a transfer is made between cash and cash equivalents with no gain or loss, how is the transaction treated in the statement of cash flows?

A)It is included as an operating activity.

B)It is included as a noncash financing activity.

C)It is included as an investing activity.

D)It is not reported.

A)It is included as an operating activity.

B)It is included as a noncash financing activity.

C)It is included as an investing activity.

D)It is not reported.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

15

The primary objective of the statement of cash flows is to provide information about a company's:

A)Cash receipts and disbursements.

B)Noncash financing and investing activities.

C)Financial position.

D)Profitability.

A)Cash receipts and disbursements.

B)Noncash financing and investing activities.

C)Financial position.

D)Profitability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

16

Which one of the following financial statements does not report amounts primarily on an accrual basis?

A)Income statement.

B)Balance sheet.

C)Statement of cash flows.

D)Statement of shareholders' equity.

A)Income statement.

B)Balance sheet.

C)Statement of cash flows.

D)Statement of shareholders' equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

17

In using a spreadsheet to prepare the statement of cash flows, the summary entries duplicate the actual journal entries used to record the transactions during the year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

18

Which of the following is not required by generally accepted accounting principles?

A)Cash flow per share.

B)Earnings per share.

C)Statement of cash flows.

D)Disclosure notes.

A)Cash flow per share.

B)Earnings per share.

C)Statement of cash flows.

D)Disclosure notes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

19

Amounts held in cash equivalent investments must be reported separately from amounts held as cash in the statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

20

Cash paid for taxes and interest must be disclosed on the face of the statement or in the disclosure notes under both the direct and indirect methods of reporting cash flows from operating activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

21

When preparing a statement of cash flows using the direct method, accrual of payroll expense is:

A)Reported as an operating activity.

B)Reported as an investing activity.

C)Reported as a financing activity.

D)None of the above is correct.

A)Reported as an operating activity.

B)Reported as an investing activity.

C)Reported as a financing activity.

D)None of the above is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

22

Ludwig Company's prepaid rent was $9,000 at December 31, 2012, and $13,000 at December 31, 2013. Ludwig reported rent expense of $19,000 on the 2013 income statement. What amount would be reported in the statement of cash flows as rent paid using the direct method?

A)$15,000.

B)$19,000.

C)$23,000.

D)None of the above is correct.

A)$15,000.

B)$19,000.

C)$23,000.

D)None of the above is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

23

Which of the following is reported as an operating activity in the statement of cash flows?

A)The payment of dividends.

B)The sale of office equipment.

C)The payment of interest on long-term notes.

D)The issuance of a stock dividend.

A)The payment of dividends.

B)The sale of office equipment.

C)The payment of interest on long-term notes.

D)The issuance of a stock dividend.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

24

In a statement of cash flows in which operating activities are reported by the direct method, which of the following would increase reported cash flows from operating activities?

A)Gain on sale of equipment.

B)Interest revenue.

C)Gain on early extinguishment of bonds.

D)Proceeds from sale of lanD.The two gains are not cash flows.Proceeds from the sale of land are reported as a component of investing activities.

A)Gain on sale of equipment.

B)Interest revenue.

C)Gain on early extinguishment of bonds.

D)Proceeds from sale of lanD.The two gains are not cash flows.Proceeds from the sale of land are reported as a component of investing activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

25

On December 31, 2013, Wellstone Company reported net income of $70,000 and sales of $210,000. The company also reported beginning and ending accounts receivable at $20,000 and $25,000, respectively. Wellstone will report cash collected from customers in its 2013 statement of cash flows (direct method) in the amount of:

A)$215,000.

B)$285,000.

C)$135,000.

D)$205,000.

A)$215,000.

B)$285,000.

C)$135,000.

D)$205,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

26

Cash equivalents generally would not include short-term investments in:

A)Commercial paper.

B)Certificates of deposit.

C)Held-to-maturity securities.

D)Money market funds.

A)Commercial paper.

B)Certificates of deposit.

C)Held-to-maturity securities.

D)Money market funds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

27

A firm reported salary expense of $239,000 for the current year. The beginning and ending balances in salaries payable were $40,000 and $15,000, respectively. What was the amount of cash paid for salaries?

A)$214,000.

B)$289,000.

C)$264,000.

D)$239,000.

A)$214,000.

B)$289,000.

C)$264,000.

D)$239,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

28

Which of the following is reported as an operating activity in the statement of cash flows?

A)The purchase of long-lived assets.

B)The acquisition of treasury stock.

C)The retirement of bonds.

D)The payment of prepaid insurance.

A)The purchase of long-lived assets.

B)The acquisition of treasury stock.

C)The retirement of bonds.

D)The payment of prepaid insurance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

29

When a company purchases a security it considers a cash equivalent, the cash outflow is:

A)Reported as an operating activity.

B)Reported as an investing activity.

C)Reported as a financing activity.

D)Not reported on a statement of cash flows.

A)Reported as an operating activity.

B)Reported as an investing activity.

C)Reported as a financing activity.

D)Not reported on a statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

30

Cost of goods sold as reported in the income statement will be less than cash paid to suppliers if:

A)The increase in accounts payable is greater than the increase in inventory during the period.

B)The decrease in accounts payable is equal to the increase in inventory during the period.

C)The decrease in accounts payable is less than the decrease in inventory during the period.

D)The increase in accounts payable is equal to the decrease in inventory during the period.

A)The increase in accounts payable is greater than the increase in inventory during the period.

B)The decrease in accounts payable is equal to the increase in inventory during the period.

C)The decrease in accounts payable is less than the decrease in inventory during the period.

D)The increase in accounts payable is equal to the decrease in inventory during the period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

31

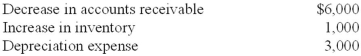

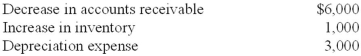

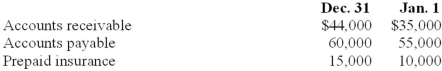

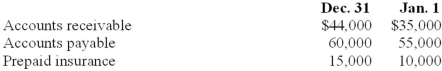

Dooling Corporation reported balances in the following accounts for the current year:  Cost of goods sold was $7,500. What was the amount of cash paid to suppliers?

Cost of goods sold was $7,500. What was the amount of cash paid to suppliers?

A)$7,000.

B)$7,200.

C)$7,300.

D)$7,500.

Cost of goods sold was $7,500. What was the amount of cash paid to suppliers?

Cost of goods sold was $7,500. What was the amount of cash paid to suppliers?A)$7,000.

B)$7,200.

C)$7,300.

D)$7,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

32

Cash paid to suppliers under the direct method is computed as:

A)Cost of goods sold plus a decrease in inventory and minus an increase in accounts payable.

B)Cost of goods sold plus an increase in inventory and minus an increase in accounts payable.

C)Cost of goods sold minus a decrease in inventory and plus an increase in accounts payable.

D)Cost of goods sold minus an increase in inventory and plus an increase in accounts payable.

A)Cost of goods sold plus a decrease in inventory and minus an increase in accounts payable.

B)Cost of goods sold plus an increase in inventory and minus an increase in accounts payable.

C)Cost of goods sold minus a decrease in inventory and plus an increase in accounts payable.

D)Cost of goods sold minus an increase in inventory and plus an increase in accounts payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

33

Using the direct method, cash received from customers is calculated as sales:

A)On account.

B)On account plus cash sales.

C)Plus an increase in accounts receivable.

D)Plus a decrease in accounts receivable.

A)On account.

B)On account plus cash sales.

C)Plus an increase in accounts receivable.

D)Plus a decrease in accounts receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

34

A firm reported ($ in millions) net cash inflows (outflows) as follows: operating $75, investing ($200), and financing $350. The beginning cash balance was $250. What was the ending cash balance?

A)$875.

B)$25.

C)$475.

D)$125.

A)$875.

B)$25.

C)$475.

D)$125.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

35

Pickering Company's prepaid insurance was $8,000 at December 31, 2012, and $10,000 at December 31, 2013. Pickering reported insurance expense of $15,000 on the 2013 income statement. What amount would be reported in the statement of cash flows as insurance paid using the direct method?

A)$13,000.

B)$17,000.

C)$15,000.

D)$23,000.

A)$13,000.

B)$17,000.

C)$15,000.

D)$23,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

36

If bond interest expense is $800,000, bond interest payable increased by $8,000 and bond discount decreased by $2,000, cash paid for bond interest is:

A)$790,000.

B)$784,000.

C)$806,000.

D)$910,000.

A)$790,000.

B)$784,000.

C)$806,000.

D)$910,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

37

During the year, cash increased by $300 million. Investing and financing activities created positive cash flow totaling $500 million. What were net cash flows from operating activities in the statement of cash flows?

A)Inflow of $300 million.

B)Outflow of $200 million.

C)Outflow of $300 million.

D)Inflow of $600 million.

A)Inflow of $300 million.

B)Outflow of $200 million.

C)Outflow of $300 million.

D)Inflow of $600 million.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

38

Cash equivalents have each of the following characteristics except:

A)Little risk of loss.

B)Highly liquid.

C)Maturity of at least three months.

D)Short-term.

A)Little risk of loss.

B)Highly liquid.

C)Maturity of at least three months.

D)Short-term.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

39

Bowers Corporation reported the following ($ in 000s) for the year:  Sales on account were $1,900 for the year. How much cash was collected from customers on account?

Sales on account were $1,900 for the year. How much cash was collected from customers on account?

A)$1,627.

B)$1,642.

C)$1,638.

D)$2,142.

Sales on account were $1,900 for the year. How much cash was collected from customers on account?

Sales on account were $1,900 for the year. How much cash was collected from customers on account?A)$1,627.

B)$1,642.

C)$1,638.

D)$2,142.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

40

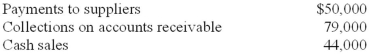

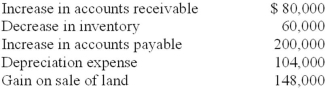

Lite Travel Company's accounting records include the following information:  What is the amount of net cash provided by operating activities indicated by the amounts provided?

What is the amount of net cash provided by operating activities indicated by the amounts provided?

A)$50,000.

B)$73,000.

C)$94,000.

D)$129,000.

What is the amount of net cash provided by operating activities indicated by the amounts provided?

What is the amount of net cash provided by operating activities indicated by the amounts provided?A)$50,000.

B)$73,000.

C)$94,000.

D)$129,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

41

A loss on the sale of machinery should be reported in the statement of cash flows as:

A)An adjustment to net income under the indirect method.

B)An operating activity under the direct method.

C)An investing activity cash outflow.

D)A noncash investing activity.

A)An adjustment to net income under the indirect method.

B)An operating activity under the direct method.

C)An investing activity cash outflow.

D)A noncash investing activity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

42

Which of the following is not reported as an adjustment to net income when using the indirect method of computing net cash flows from operating activities?

A)Cash dividends paid.

B)A change in accounts receivable.

C)Depreciation.

D)A change in a prepaid expense.

A)Cash dividends paid.

B)A change in accounts receivable.

C)Depreciation.

D)A change in a prepaid expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

43

A 10% stock dividend is reported in connection with a statement of cash flows as:

A)A financing activity.

B)An investing activity.

C)A noncash activity.

D)Not reported in the statement of cash flows.

A)A financing activity.

B)An investing activity.

C)A noncash activity.

D)Not reported in the statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

44

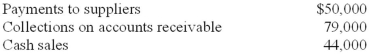

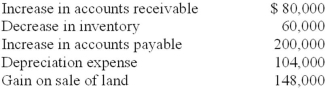

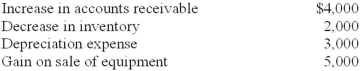

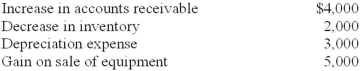

S Company reported net income for 2013 in the amount of $400,000. The company's financial statements also included the following:  What is net cash provided by operating activities under the indirect method?

What is net cash provided by operating activities under the indirect method?

A)$432,000.

B)$536,000.

C)$580,000.

D)$832,000.

What is net cash provided by operating activities under the indirect method?

What is net cash provided by operating activities under the indirect method?A)$432,000.

B)$536,000.

C)$580,000.

D)$832,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

45

Which of the following does not represent a cash flow relating to operating activities?

A)Cash dividends paid to stockholders.

B)Cash received from customers.

C)Interest paid to bondholders.

D)Cash paid for salaries.

A)Cash dividends paid to stockholders.

B)Cash received from customers.

C)Interest paid to bondholders.

D)Cash paid for salaries.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

46

Which of the following is reported as a deduction from net income when using the indirect method to determine net cash flows from operating activities?

A)Depreciation expense.

B)Amortization of a patent.

C)Amortization of premium on bonds payable.

D)Dividends declared.

A)Depreciation expense.

B)Amortization of a patent.

C)Amortization of premium on bonds payable.

D)Dividends declared.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

47

In its 2013 income statement, WME reported $440,000 for the cost of goods sold. WME paid inventory suppliers $380,000 in 2013, and its inventory balance decreased by $41,000 during the year. In its reconciliation schedule, WME should:

A)Show a $19,000 positive adjustment to net income under the indirect method for the increase in accounts payable.

B)Show a $19,000 positive adjustment to net income under the indirect method for the decrease in accounts payable.

C)Show a $19,000 negative adjustment to net income under the indirect method for the increase in accounts payable.

D)Show a $19,000 negative adjustment to net income under the indirect method for the decrease in accounts payable.

A)Show a $19,000 positive adjustment to net income under the indirect method for the increase in accounts payable.

B)Show a $19,000 positive adjustment to net income under the indirect method for the decrease in accounts payable.

C)Show a $19,000 negative adjustment to net income under the indirect method for the increase in accounts payable.

D)Show a $19,000 negative adjustment to net income under the indirect method for the decrease in accounts payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

48

How is the amortization of patents reported in a statement of cash flows that is prepared using the indirect method?

A)A decrease in cash flows from investing activities.

B)An increase in cash flows from investing activities.

C)A deduction from net income in arriving at cash flows from operations.

D)An addition to net income in arriving at cash flows from operations.

A)A decrease in cash flows from investing activities.

B)An increase in cash flows from investing activities.

C)A deduction from net income in arriving at cash flows from operations.

D)An addition to net income in arriving at cash flows from operations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

49

Which of the following is not true regarding the statement of cash flows?

A)The indirect method derives cash flows indirectly by starting with sales revenue and "working backwards" to convert that amount to a cash basis.

B)Noncash transactions sometimes are reported in conjunction with the statement.

C)Either the direct or the indirect method can be used to calculate and report the net cash increase or decrease from operating activities.

D)The statement of cash flows provides information about cash flows that the other statements either do not provide or provide only indirectly.

A)The indirect method derives cash flows indirectly by starting with sales revenue and "working backwards" to convert that amount to a cash basis.

B)Noncash transactions sometimes are reported in conjunction with the statement.

C)Either the direct or the indirect method can be used to calculate and report the net cash increase or decrease from operating activities.

D)The statement of cash flows provides information about cash flows that the other statements either do not provide or provide only indirectly.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

50

The amortization of bond discount is included in the statement of cash flows (indirect method) as:

A)A financing cash inflow.

B)An investing activity.

C)An addition to net income.

D)A deduction from net income.

A)A financing cash inflow.

B)An investing activity.

C)An addition to net income.

D)A deduction from net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

51

In its 2013 income statement, WME reported $58,000 for insurance expense. WME paid $72,000 in insurance premiums during 2013. In its reconciliation schedule, WME should:

A)Show a $14,000 positive adjustment to net income under the indirect method for the increase in prepaid insurance.

B)Show a $14,000 negative adjustment to net income under the indirect method for the decrease in prepaid insurance.

C)Show a $14,000 negative adjustment to net income under the indirect method for the increase in prepaid insurance.

D)Show a $14,000 positive adjustment to net income under the indirect method for the decrease in prepaid insurance.

A)Show a $14,000 positive adjustment to net income under the indirect method for the increase in prepaid insurance.

B)Show a $14,000 negative adjustment to net income under the indirect method for the decrease in prepaid insurance.

C)Show a $14,000 negative adjustment to net income under the indirect method for the increase in prepaid insurance.

D)Show a $14,000 positive adjustment to net income under the indirect method for the decrease in prepaid insurance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

52

In its 2013 income statement, WME reported a $40,000 loss on the sale of equipment. In its reconciliation schedule, WME should:

A)Report a $40,000 cash outflow for the direct method.

B)Show a $40,000 positive adjustment to net income under the indirect method.

C)Show a $40,000 negative adjustment to net income under the indirect method.

D)None of the above is correct.

A)Report a $40,000 cash outflow for the direct method.

B)Show a $40,000 positive adjustment to net income under the indirect method.

C)Show a $40,000 negative adjustment to net income under the indirect method.

D)None of the above is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

53

When preparing the statement of cash flows using the indirect method for determining net cash flows from operating activities, depreciation is added to net income because:

A)It was deducted as an expense on the income statement, but does not require cash.

B)It was deducted as an expense on the income statement and affects the amount of cash.

C)It is a significant portion of the year's expenses.

D)It represents a source or inflow of cash.

A)It was deducted as an expense on the income statement, but does not require cash.

B)It was deducted as an expense on the income statement and affects the amount of cash.

C)It is a significant portion of the year's expenses.

D)It represents a source or inflow of cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

54

Interest payments to creditors are reported in a statement of cash flows as:

A)An investing activity.

B)A borrowing activity.

C)A financing activity.

D)An operating activity.

A)An investing activity.

B)A borrowing activity.

C)A financing activity.

D)An operating activity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

55

An analyst compiled the following information for U Inc. for the year ended December 31, 2013: ▪ Net income was $1,700,000.

▪ Depreciation expense was $400,000.

▪ Interest paid was $200,000.

▪ Income taxes paid were $100,000.

▪ Common stock was sold for $200,000.

▪ Preferred stock (8% annual dividend) was sold at par value of $250,000.

▪ Common stock dividends of $50,000 were paid.

▪ Preferred stock dividends of $20,000 were paid.

▪ Equipment with a book value of $100,000 was sold for $200,000.

Using the indirect method, what was U Inc.'s net cash flow from operating activities for the year ended December 31, 2013?

A)$2,000,000.

B)$2,030,000.

C)$2,080,000.

D)$2,100,000.

▪ Depreciation expense was $400,000.

▪ Interest paid was $200,000.

▪ Income taxes paid were $100,000.

▪ Common stock was sold for $200,000.

▪ Preferred stock (8% annual dividend) was sold at par value of $250,000.

▪ Common stock dividends of $50,000 were paid.

▪ Preferred stock dividends of $20,000 were paid.

▪ Equipment with a book value of $100,000 was sold for $200,000.

Using the indirect method, what was U Inc.'s net cash flow from operating activities for the year ended December 31, 2013?

A)$2,000,000.

B)$2,030,000.

C)$2,080,000.

D)$2,100,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

56

In its 2013 income statement, WME reported $11,000 of interest expense on its outstanding bonds. During the year, WME paid its regular installments of $9,000 of interest in cash. In its reconciliation schedule, WME should:

A)Show a $2,000 positive adjustment to net income under the indirect method for the decrease in bond premium.

B)Show a $2,000 negative adjustment to net income under the indirect method for the decrease in bond premium.

C)Show a $2,000 positive adjustment to net income under the indirect method for the decrease in bond discount.

D)Show a $2,000 negative adjustment to net income under the indirect method for the decrease in bond discount.

A)Show a $2,000 positive adjustment to net income under the indirect method for the decrease in bond premium.

B)Show a $2,000 negative adjustment to net income under the indirect method for the decrease in bond premium.

C)Show a $2,000 positive adjustment to net income under the indirect method for the decrease in bond discount.

D)Show a $2,000 negative adjustment to net income under the indirect method for the decrease in bond discount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

57

Sneed Corporation reported balances in the following accounts for the current year:  Income tax expense was $230 for the year. What was the amount paid for taxes?

Income tax expense was $230 for the year. What was the amount paid for taxes?

A)$280.

B)$220.

C)$210.

D)$190.

Income tax expense was $230 for the year. What was the amount paid for taxes?

Income tax expense was $230 for the year. What was the amount paid for taxes?A)$280.

B)$220.

C)$210.

D)$190.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

58

On June 4, White Corporation issued $400 million of bonds for $386 million. During the same year, $1 million of the bond discount was amortized. In a statement of cash flows prepared by the indirect method, White Corporation should report:

A)A financing activity of $400 million.

B)An addition to net income of $1 million.

C)An investing activity of $386 million.

D)A deduction from net income of $1 million.

A)A financing activity of $400 million.

B)An addition to net income of $1 million.

C)An investing activity of $386 million.

D)A deduction from net income of $1 million.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

59

In its 2013 income statement, WME reported $695,000 for service revenue earned from membership fees. WME received $681,000 cash in advance from members during 2013. In its reconciliation schedule, WME should:

A)Show a $14,000 negative adjustment to net income under the indirect method for the increase in unearned revenue.

B)Show a $14,000 negative adjustment to net income under the indirect method for the decrease in unearned revenue.

C)Show a $14,000 positive adjustment to net income under the indirect method for the increase in unearned revenue.

D)Show a $14,000 positive adjustment to net income under the indirect method for the decrease in unearned revenue.

A)Show a $14,000 negative adjustment to net income under the indirect method for the increase in unearned revenue.

B)Show a $14,000 negative adjustment to net income under the indirect method for the decrease in unearned revenue.

C)Show a $14,000 positive adjustment to net income under the indirect method for the increase in unearned revenue.

D)Show a $14,000 positive adjustment to net income under the indirect method for the decrease in unearned revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

60

In determining cash flows from operating activities (indirect method), adjustments to net income should not include:

A)An addition for depreciation expense.

B)An addition for bond discount amortization.

C)An addition for a gain on sale of equipment.

D)An addition for patent amortization.

A)An addition for depreciation expense.

B)An addition for bond discount amortization.

C)An addition for a gain on sale of equipment.

D)An addition for patent amortization.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

61

Hemmer Company reported net income for 2013 in the amount of $40,000. The company's financial statements also included the following:  What is net cash provided by operating activities?

What is net cash provided by operating activities?

A)$38,000.

B)$43,000.

C)$35,000.

D)$48,000.

What is net cash provided by operating activities?

What is net cash provided by operating activities?A)$38,000.

B)$43,000.

C)$35,000.

D)$48,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

62

Which of the following is always reported as an outflow of cash?

A)The accrual of warranty expense.

B)The declaration of a cash dividend.

C)The purchase of equipment for cash.

D)Amortization expense.

A)The accrual of warranty expense.

B)The declaration of a cash dividend.

C)The purchase of equipment for cash.

D)Amortization expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

63

Hanson Company had the following account balances for 2013:  Hanson reported net income of $90,000 for 2013. Assuming no other changes in current account balances, what is the amount of net cash provided by operating activities for 2013 reported in the statement of cash flows?

Hanson reported net income of $90,000 for 2013. Assuming no other changes in current account balances, what is the amount of net cash provided by operating activities for 2013 reported in the statement of cash flows?

A)$70,000.

B)$80,000.

C)$100,000.

D)$110,000.

Hanson reported net income of $90,000 for 2013. Assuming no other changes in current account balances, what is the amount of net cash provided by operating activities for 2013 reported in the statement of cash flows?

Hanson reported net income of $90,000 for 2013. Assuming no other changes in current account balances, what is the amount of net cash provided by operating activities for 2013 reported in the statement of cash flows?A)$70,000.

B)$80,000.

C)$100,000.

D)$110,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

64

On December 31, 2013, Tiras Company reported net income of $50,000 and sales of $200,000. The company also reported beginning and ending accounts receivable at $20,000 and $25,000, respectively. Tiras will report cash collected from customers in its 2013 statement of cash flows (indirect method) in the amount of:

A)$0.

B)$245,000.

C)$205,000.

D)$195,000.

A)$0.

B)$245,000.

C)$205,000.

D)$195,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

65

Which of the following would be added to net income when determining cash flows from operating activities under the indirect method?

A)A gain on the sale of land.

B)An increase in prepaid expenses.

C)A decrease in accounts payable.

D)A decrease in accounts receivable.

A)A gain on the sale of land.

B)An increase in prepaid expenses.

C)A decrease in accounts payable.

D)A decrease in accounts receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

66

Which of the following would be an example of an investing activity on a statement of cash flows?

A)Sale of equipment.

B)Issuance of long-term bonds.

C)Receipt of investment revenue.

D)Conversion of a cash equivalent into cash.

A)Sale of equipment.

B)Issuance of long-term bonds.

C)Receipt of investment revenue.

D)Conversion of a cash equivalent into cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

67

Which of the following would be reported as a cash outflow from investing activities?

A)Issuance of bonds.

B)Purchase of land.

C)Payment of dividends.

D)Retirement of common stock.

A)Issuance of bonds.

B)Purchase of land.

C)Payment of dividends.

D)Retirement of common stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

68

Which of the following would not be a component of cash flows from investing activities?

A)Sale of land.

B)Purchase of securities.

C)Purchase of equipment.

D)Dividends paiD.Dividends paid is not a component of cash flow from investing; it is a component of cash flow from financing.The other items are all components of cash flow from investing.

A)Sale of land.

B)Purchase of securities.

C)Purchase of equipment.

D)Dividends paiD.Dividends paid is not a component of cash flow from investing; it is a component of cash flow from financing.The other items are all components of cash flow from investing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

69

Creble Company reported net income for 2013 in the amount of $40,000. The company's financial statements also included the following:  In the statement of cash flows what is net cash provided by operating activities under the indirect method?

In the statement of cash flows what is net cash provided by operating activities under the indirect method?

A)$36,000.

B)$41,000.

C)$40,000.

D)$38,000.

In the statement of cash flows what is net cash provided by operating activities under the indirect method?

In the statement of cash flows what is net cash provided by operating activities under the indirect method?A)$36,000.

B)$41,000.

C)$40,000.

D)$38,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

70

Red Manufacturing Company owns 40% of the outstanding common stock of Blue Supply Company. During 2013, Red received a $50 million cash dividend from Blue. What effect did this dividend have on Red's 2013 statement of cash flows?

A)Cash from operating activities increased.

B)Cash from investing activities increased.

C)Cash from financing activities increased.

D)No effect.

A)Cash from operating activities increased.

B)Cash from investing activities increased.

C)Cash from financing activities increased.

D)No effect.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

71

Charlene Company sold a printer with a cost of $68,000 and accumulated depreciation of $23,000 for $20,000 cash. This transaction would be reported as:

A)An operating activity.

B)An investing activity.

C)A financing activity.

D)None of the above is correct.

A)An operating activity.

B)An investing activity.

C)A financing activity.

D)None of the above is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

72

Moon Company owns 56 million shares of stock of Center Company classified as available for sale. During 2013, the fair value of those shares increased by $34 million. What effect did this increase have on Moon's 2013 statement of cash flows?

A)Cash from operating activities increased.

B)Cash from investing activities increased.

C)Cash from financing activities increased.

D)No effect.

A)Cash from operating activities increased.

B)Cash from investing activities increased.

C)Cash from financing activities increased.

D)No effect.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

73

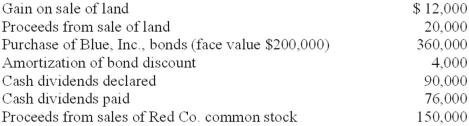

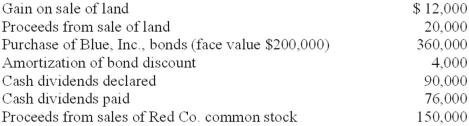

Selected information from Peridot Corporation's accounting records and financial statements for 2013 is as follows ($ in millions):  In its statement of cash flows, Peridot should report net cash outflows from investing activities of:

In its statement of cash flows, Peridot should report net cash outflows from investing activities of:

A)$26 million.

B)$46 million.

C)$72 million.

D)$78 million.

In its statement of cash flows, Peridot should report net cash outflows from investing activities of:

In its statement of cash flows, Peridot should report net cash outflows from investing activities of:A)$26 million.

B)$46 million.

C)$72 million.

D)$78 million.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

74

Which of the following is reported as an investing activity in the statement of cash flows?

A)The receipt of dividend revenue.

B)The payment of cash dividends.

C)The payment of interest on bonds.

D)The sale of machinery.

A)The receipt of dividend revenue.

B)The payment of cash dividends.

C)The payment of interest on bonds.

D)The sale of machinery.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

75

Payments to acquire bonds of other corporations should be classified on a statement of cash flows as:

A)A lending activity.

B)An operating activity.

C)A financing activity.

D)An investing activity.

A)A lending activity.

B)An operating activity.

C)A financing activity.

D)An investing activity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

76

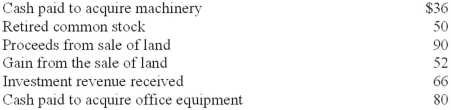

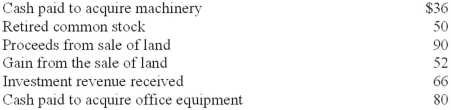

In preparing its cash flow statement for the year ended December 31, 2013, Red Co. gathered the following data:  In its December 31, 2013, statement of cash flows, what amount should Red report as net cash outflows from investing activities?

In its December 31, 2013, statement of cash flows, what amount should Red report as net cash outflows from investing activities?

A)$340,000.

B)$352,000.

C)$376,000.

D)$388,000.

In its December 31, 2013, statement of cash flows, what amount should Red report as net cash outflows from investing activities?

In its December 31, 2013, statement of cash flows, what amount should Red report as net cash outflows from investing activities?A)$340,000.

B)$352,000.

C)$376,000.

D)$388,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

77

A company reported interest expense of $540,000 for the year. Interest payable was $35,000 and $75,000 at the beginning and the end of the year, respectively. What was the amount of interest paid?

A)$580,000.

B)$615,000.

C)$500,000.

D)$575,000.

A)$580,000.

B)$615,000.

C)$500,000.

D)$575,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

78

Which of the following is reported as an investing activity in the statement of cash flows?

A)Sale of a subsidiary.

B)Issuance of a long-term promissory note.

C)Sale of treasury stock.

D)Purchase of highly liquid, short-term investments with excess cash.

A)Sale of a subsidiary.

B)Issuance of a long-term promissory note.

C)Sale of treasury stock.

D)Purchase of highly liquid, short-term investments with excess cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

79

Alpha Company had the following account balances for 2013:  Alpha reported net income of $210,000 for 2013. Assuming no other changes in current account balances, what is the amount of net cash provided by operating activities for 2013 reported in the statement of cash flows?

Alpha reported net income of $210,000 for 2013. Assuming no other changes in current account balances, what is the amount of net cash provided by operating activities for 2013 reported in the statement of cash flows?

A)$224,000.

B)$206,000.

C)$214,000.

D)$196,000.

Alpha reported net income of $210,000 for 2013. Assuming no other changes in current account balances, what is the amount of net cash provided by operating activities for 2013 reported in the statement of cash flows?

Alpha reported net income of $210,000 for 2013. Assuming no other changes in current account balances, what is the amount of net cash provided by operating activities for 2013 reported in the statement of cash flows?A)$224,000.

B)$206,000.

C)$214,000.

D)$196,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck

80

Hogan Company had the following account balances for 2013:  Hogan reported net income of $300,000 for 2013. Assuming no other changes in current account balances, what is the amount of net cash provided by operating activities for 2013 reported in the statement of cash flows?

Hogan reported net income of $300,000 for 2013. Assuming no other changes in current account balances, what is the amount of net cash provided by operating activities for 2013 reported in the statement of cash flows?

A)$291,000.

B)$290,000.

C)$281,000.

D)$301,000.

Hogan reported net income of $300,000 for 2013. Assuming no other changes in current account balances, what is the amount of net cash provided by operating activities for 2013 reported in the statement of cash flows?

Hogan reported net income of $300,000 for 2013. Assuming no other changes in current account balances, what is the amount of net cash provided by operating activities for 2013 reported in the statement of cash flows?A)$291,000.

B)$290,000.

C)$281,000.

D)$301,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 155 في هذه المجموعة.

فتح الحزمة

k this deck