Deck 2: Review of the Accounting Process

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

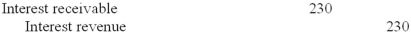

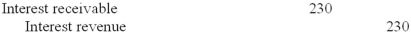

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

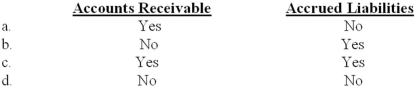

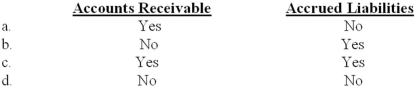

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/126

العب

ملء الشاشة (f)

Deck 2: Review of the Accounting Process

1

A reversing entry at the beginning of a period for salaries would include a debit to salaries expense.

False

2

The closing process brings all temporary accounts to a zero balance and updates the balance in the retained earnings account.

True

3

The adjusted trial balance contains only permanent accounts.

False

4

Owners' equity can be expressed as assets minus liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

5

Balance sheet accounts are referred to as temporary accounts because their balances are always changing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

6

Adjusting journal entries are required to comply with the realization and matching principles.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

7

The balance sheet can be considered a change or flow statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

8

After an unadjusted trial balance is prepared, the next step in the accounting processing cycle is the preparation of financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

9

The statement of cash flows summarizes transactions that caused cash to change during a reporting period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

10

XYZ Corporation receives $100,000 from investors for issuing them shares of its stock. XYZ's journal entry to record this transaction would include a:

A)Debit to investments.

B)Credit to retained earnings.

C)Credit to capital stock.

D)Credit to revenue.

A)Debit to investments.

B)Credit to retained earnings.

C)Credit to capital stock.

D)Credit to revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

11

Examples of external transactions include all of the following except:

A)Paying employees salaries.

B)Purchasing equipment.

C)Depreciating equipment.

D)Collecting a receivable.

A)Paying employees salaries.

B)Purchasing equipment.

C)Depreciating equipment.

D)Collecting a receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

12

The accounting equation can be stated as:

A)A + L - OE = 0.

B)A - L + OE = 0.

C)-A + L - OE = 0.

D)A - L - OE = 0.

A)A + L - OE = 0.

B)A - L + OE = 0.

C)-A + L - OE = 0.

D)A - L - OE = 0.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

13

The post-closing trial balance contains only permanent accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

14

The income statement summarizes the operating activity of a firm at a particular point in time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

15

Accruals occur when the cash flow precedes either revenue or expense recognition.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

16

Debits increase asset accounts and decrease liability accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

17

The sale of merchandise on account would be recorded in a sales journal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

18

The statement of shareholders' equity discloses the changes in the temporary shareholders' equity accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

19

The payment of cash to a supplier would be recorded in a purchases journal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

20

Examples of internal transactions include all of the following except:

A)Writing off an uncollectible account.

B)Recording the expiration of prepaid insurance.

C)Recording unpaid wages.

D)Paying wages to company employees.

A)Writing off an uncollectible account.

B)Recording the expiration of prepaid insurance.

C)Recording unpaid wages.

D)Paying wages to company employees.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

21

A sale on account would be recorded by:

A)Debiting revenue.

B)Crediting assets.

C)Crediting liabilities.

D)Debiting assets.

A)Debiting revenue.

B)Crediting assets.

C)Crediting liabilities.

D)Debiting assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

22

Cal Farms reported supplies expense of $2,000,000 this year. The supplies account decreased by $200,000 during the year to an ending balance of $400,000. What was the cost of supplies the Cal Farms purchased during the year?

A)$1,600,000.

B)$1,800,000.

C)$2,200,000.

D)$2,400,000.

A)$1,600,000.

B)$1,800,000.

C)$2,200,000.

D)$2,400,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

23

On December 31, 2012, Coolwear, Inc. had a balance in its prepaid insurance account of $48,400. During 2013, $86,000 was paid for insurance. At the end of 2013, after adjusting entries were recorded, the balance in the prepaid insurance account was 42,000. Insurance expense for 2013 would be:

A)$6,400.

B)$134,400.

C)$86,000.

D)$92,400.

A)$6,400.

B)$134,400.

C)$86,000.

D)$92,400.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

24

The adjusting entry required when amounts previously recorded as unearned revenues are earned includes:

A)A debit to a liability.

B)A debit to an asset.

C)A credit to a liability.

D)A credit to an asset.

A)A debit to a liability.

B)A debit to an asset.

C)A credit to a liability.

D)A credit to an asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

25

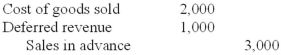

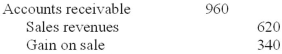

Ace Bonding Company purchased merchandise inventory on account. The inventory costs $2,000 and is expected to sell for $3,000. How should Ace record the purchase?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

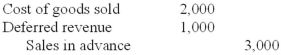

26

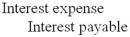

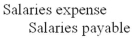

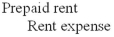

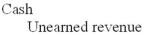

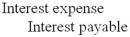

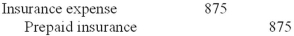

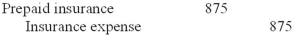

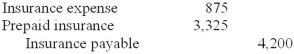

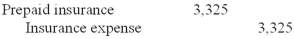

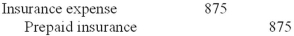

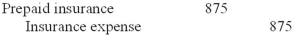

Which of the following is not an adjusting entry?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

27

When a magazine company collects cash for selling a subscription, it is an example of:

A)An accrued liability transaction.

B)An accrued receivable transaction.

C)A prepaid expense transaction.

D)An unearned revenue transaction.

A)An accrued liability transaction.

B)An accrued receivable transaction.

C)A prepaid expense transaction.

D)An unearned revenue transaction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

28

Which of the following accounts has a debit balance?

A)Accounts payable.

B)Accrued taxes.

C)Accumulated depreciation.

D)Advertising expense.

A)Accounts payable.

B)Accrued taxes.

C)Accumulated depreciation.

D)Advertising expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

29

Mary Parker Co. invested $15,000 in ABC Corporation and received capital stock in exchange. Mary Parker Co.'s journal entry to record this transaction would include a:

A)Debit to investments.

B)Credit to retained earnings.

C)Credit to capital stock.

D)Debit to expense.

A)Debit to investments.

B)Credit to retained earnings.

C)Credit to capital stock.

D)Debit to expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

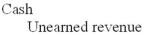

30

Somerset Leasing received $12,000 for 24 months rent in advance. How should Somerset record this transaction?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

31

On December 31, 2013, the end of Larry's Used Cars' first year of operations, the accounts receivable was $53,600. The company estimates that $1,200 of the year-end receivables will not be collected. Accounts receivable in the 2013 balance sheet will be valued at:

A)$53,600.

B)$54,800.

C)$52,400.

D)$1,200.

A)$53,600.

B)$54,800.

C)$52,400.

D)$1,200.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

32

Recording revenue that is earned, but not yet collected, is an example of:

A)A prepaid expense transaction.

B)An unearned revenue transaction.

C)An accrued liability transaction.

D)An accrued receivable transaction.

A)A prepaid expense transaction.

B)An unearned revenue transaction.

C)An accrued liability transaction.

D)An accrued receivable transaction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

33

An example of a contra account is:

A)Depreciation expense.

B)Accounts receivable.

C)Sales revenue.

D)Accumulated depreciation.

A)Depreciation expense.

B)Accounts receivable.

C)Sales revenue.

D)Accumulated depreciation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

34

Hughes Aircraft sold a four-passenger airplane for $380,000, receiving a $50,000 down payment and a 12% note for the balance. The journal entry to record this sale would include a:

A)Credit to cash.

B)Debit to cash discount.

C)Debit to note receivable.

D)Credit to note receivable.

A)Credit to cash.

B)Debit to cash discount.

C)Debit to note receivable.

D)Credit to note receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

35

Making insurance payments in advance is an example of:

A)An accrued receivable transaction.

B)An accrued liability transaction.

C)An unearned revenue transaction.

D)A prepaid expense transaction.

A)An accrued receivable transaction.

B)An accrued liability transaction.

C)An unearned revenue transaction.

D)A prepaid expense transaction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

36

Incurring an expense for advertising on account would be recorded by:

A)Debiting liabilities.

B)Crediting assets.

C)Debiting an expense.

D)Debiting assets.

A)Debiting liabilities.

B)Crediting assets.

C)Debiting an expense.

D)Debiting assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

37

Adjusting entries are primarily needed for:

A)Cash basis accounting.

B)Accrual accounting.

C)Current value accounting.

D)Manual accounting systems.

A)Cash basis accounting.

B)Accrual accounting.

C)Current value accounting.

D)Manual accounting systems.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

38

Accruals occur when cash flows:

A)Occur before expense recognition.

B)Occur after revenue or expense recognition.

C)Are uncertain.

D)May be substituted for goods or services.

A)Occur before expense recognition.

B)Occur after revenue or expense recognition.

C)Are uncertain.

D)May be substituted for goods or services.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

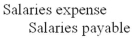

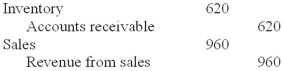

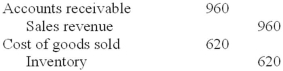

39

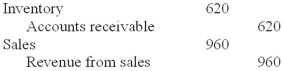

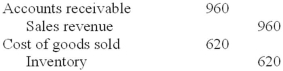

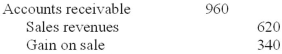

Davis Hardware Company uses a perpetual inventory system. How should Davis record the sale of merchandise, costing $620 and sold for $960 on account?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

40

Prepayments occur when:

A)Cash flow precedes expense recognition.

B)Sales are delayed pending credit approval.

C)Customers are unable to pay the full amount due when goods are delivered.

D)Manufactured goods await quality control inspections.

A)Cash flow precedes expense recognition.

B)Sales are delayed pending credit approval.

C)Customers are unable to pay the full amount due when goods are delivered.

D)Manufactured goods await quality control inspections.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

41

A future economic benefit owned or controlled by an entity is:

A)A revenue.

B)An asset.

C)A liability.

D)A contra asset until used.

A)A revenue.

B)An asset.

C)A liability.

D)A contra asset until used.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

42

On November 1, 2013, Tim's Toys borrows $30,000,000 at 9% to finance the holiday sales season. The note is for a six-month term and both principal and interest are payable at maturity. What is the balance of interest payable for the loan as of December 31, 2013?

A)$112,500.

B)$225,000.

C)$450,000.

D)$1,350,000.

A)$112,500.

B)$225,000.

C)$450,000.

D)$1,350,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

43

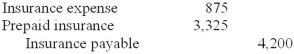

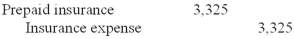

Yummy Foods purchased a two-year fire and extended coverage insurance policy on August 1, 2013, and charged the $4,200 premium to Insurance expense. At its December 31, 2013, year-end, Yummy Foods would record which of the following adjusting entries?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

44

Mama's Pizza Shoppe borrowed $8,000 at 9% interest on May 1, 2013, with principal and interest due on October 31, 2014. The company's fiscal year ends June 30, 2013. What adjusting entry is necessary on June 30, 2013?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

45

Dave's Duds reported cost of goods sold of $2,000,000 this year. The inventory account increased by $200,000 during the year to an ending balance of $400,000. What was the cost of merchandise that Dave's purchased during the year?

A)$1,600,000.

B)$1,800,000.

C)$2,200,000.

D)$2,400,000.

A)$1,600,000.

B)$1,800,000.

C)$2,200,000.

D)$2,400,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

46

On September 15, 2013, Oliver's Mortuary received a $6,000, nine-month note bearing interest at an annual rate of 10% from the estate of Jay Hendrix for services rendered. Oliver's has a December 31 year-end. What adjusting entry will the company record on December 31, 2013?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

47

Which of the following accounts has a credit balance?

A)Salary expense.

B)Accrued income taxes payable.

C)Land.

D)Prepaid rent.

A)Salary expense.

B)Accrued income taxes payable.

C)Land.

D)Prepaid rent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

48

In its first year of operations Best Corp. had income before tax of $500,000. Best made income tax payments totaling $210,000 during the year and has an income tax rate of 40%. What was Best's net income for the year?

A)$290,000.

B)$294,000.

C)$300,000.

D)$306,000.

A)$290,000.

B)$294,000.

C)$300,000.

D)$306,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

49

On September 1, 2013, Fortune Magazine sold 600 one-year subscriptions for $81 each. The total amount received was credited to unearned subscriptions revenue. What is the required adjusting entry at December 31, 2013?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

50

The balance in retained earnings at the end of the year is determined by retained earnings at the beginning of the year:

A)Plus revenues, minus liabilities.

B)Plus accruals, minus deferrals.

C)Plus net income, minus dividends.

D)Plus assets, minus liabilities.

A)Plus revenues, minus liabilities.

B)Plus accruals, minus deferrals.

C)Plus net income, minus dividends.

D)Plus assets, minus liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

51

In its first year of operations Acme Corp. had income before tax of $400,000. Acme made income tax payments totaling $150,000 during the year and has an income tax rate of 40%. What is the balance in income tax payable at the end of the year?

A)$160,000 credit.

B)$150,000 credit.

C)$10,000 credit.

D)$10,000 debit.

A)$160,000 credit.

B)$150,000 credit.

C)$10,000 credit.

D)$10,000 debit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

52

Permanent accounts would not include:

A)Interest expense.

B)Wages payable.

C)Prepaid rent.

D)Unearned revenues.

A)Interest expense.

B)Wages payable.

C)Prepaid rent.

D)Unearned revenues.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

53

Carolina Mills purchased $270,000 in supplies this year. The supplies account increased by $10,000 during the year to an ending balance of $66,000. What was supplies expense for Carolina Mills during the year?

A)$300,000.

B)$280,000.

C)$260,000.

D)$240,000.

A)$300,000.

B)$280,000.

C)$260,000.

D)$240,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

54

The adjusting entry required to record accrued expenses includes:

A)A credit to cash.

B)A debit to an asset.

C)A credit to an asset.

D)A credit to liability.

A)A credit to cash.

B)A debit to an asset.

C)A credit to an asset.

D)A credit to liability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

55

Eve's Apples opened business on January 1, 2013, and paid for two insurance policies effective that date. The liability policy was $36,000 for 18 months, and the crop damage policy was $12,000 for a two-year term. What is the balance in Eve's prepaid insurance as of December 31, 2013?

A)$9,000.

B)$18,000.

C)$30,000.

D)$48,000.

A)$9,000.

B)$18,000.

C)$30,000.

D)$48,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

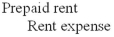

56

When a tenant makes an end-of-period adjusting entry credit to the "Prepaid rent" account:

A)(S)he usually debits cash.

B)(S)he usually debits an expense account.

C)(S)he debits a liability account.

D)(S)he does none of the above.

A)(S)he usually debits cash.

B)(S)he usually debits an expense account.

C)(S)he debits a liability account.

D)(S)he does none of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

57

When a business makes an end-of-period adjusting entry with a debit to supplies expense, the usual credit entry is made to:

A)Accounts payable.

B)Supplies.

C)Cash.

D)Retained earnings.

A)Accounts payable.

B)Supplies.

C)Cash.

D)Retained earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

58

The employees of Neat Clothes work Monday through Friday. Every other Friday the company issues payroll checks totaling $32,000. The current pay period ends on Friday, July 3. Neat Clothes is now preparing quarterly financial statements for the three months ended June 30. What is the adjusting entry to record accrued salaries at the end of June?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

59

Cost of goods sold is:

A)An asset account.

B)A revenue account.

C)An expense account.

D)A permanent equity account.

A)An asset account.

B)A revenue account.

C)An expense account.

D)A permanent equity account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

60

Fink Insurance collected premiums of $18,000,000 from its customers during the current year. The adjusted balance in the Unearned premiums account increased from $6 million to $8 million dollars during the year. What is Fink's revenue from earned insurance premiums for the current year?

A)$10,000,000.

B)$16,000,000.

C)$18,000,000.

D)$20,000,000.

A)$10,000,000.

B)$16,000,000.

C)$18,000,000.

D)$20,000,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

61

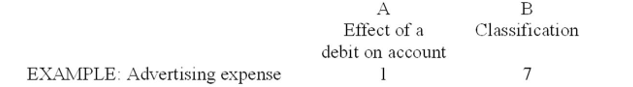

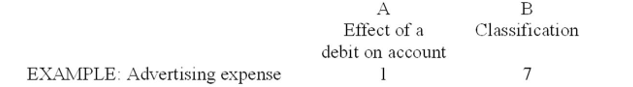

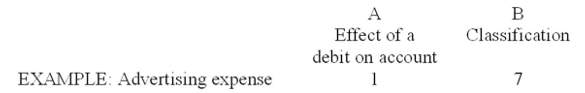

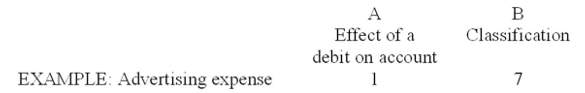

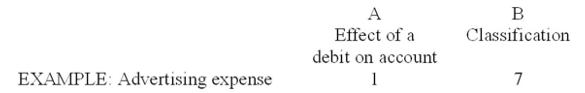

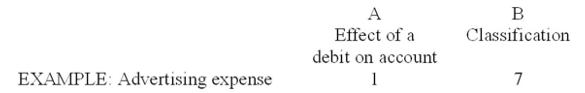

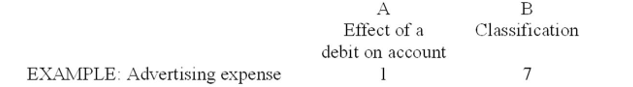

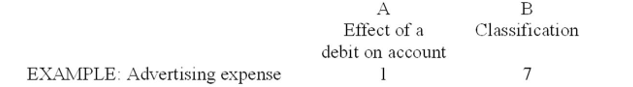

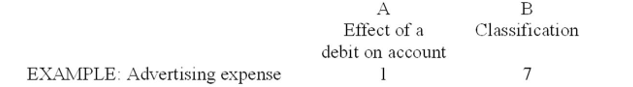

Below is a list of accounts in no particular order. Assume that all accounts have normal balances.

Required:

In column A, indicate whether a debit will:

1. Increase the account balance, or

2. Decrease the account balance.

In column B, classify each account according to the following scheme. For contra accounts, indicate the classification of the account to which it relates.

1. A current asset in the balance sheet.

2. A noncurrent asset in the balance sheet.

3. A current liability in the balance sheet.

4. A long-term liability in the balance sheet.

5. A permanent equity account in the balance sheet.

6. A revenue account in the income statement.

7. An expense account shown in the income statement.

8. Account does not appear in either the balance sheet or the income statement.

-Inventory

Required:

In column A, indicate whether a debit will:

1. Increase the account balance, or

2. Decrease the account balance.

In column B, classify each account according to the following scheme. For contra accounts, indicate the classification of the account to which it relates.

1. A current asset in the balance sheet.

2. A noncurrent asset in the balance sheet.

3. A current liability in the balance sheet.

4. A long-term liability in the balance sheet.

5. A permanent equity account in the balance sheet.

6. A revenue account in the income statement.

7. An expense account shown in the income statement.

8. Account does not appear in either the balance sheet or the income statement.

-Inventory

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

62

Compared to the accrual basis of accounting, the cash basis of accounting produces a higher amount of income by the net decrease during the accounting period of:

A)Option a

B)Option b

C)Option c

D)Option d

A)Option a

B)Option b

C)Option c

D)Option d

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

63

The Hamada Company sales for 2013 totaled $150,000 and purchases totaled $95,000. Selected January 1, 2013, balances were: accounts receivable, $18,000; inventory, $14,000; and accounts payable, $12,000. December 31, 2013, balances were: accounts receivable, $16,000; inventory, $15,000; and accounts payable, $13,000. Net cash flows from these activities were:

A)$45,000.

B)$55,000.

C)$58,000.

D)$74,000.

A)$45,000.

B)$55,000.

C)$58,000.

D)$74,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

64

Temporary accounts would not include:

A)Salaries payable.

B)Depreciation expense.

C)Supplies expense.

D)Cost of goods sold.

A)Salaries payable.

B)Depreciation expense.

C)Supplies expense.

D)Cost of goods sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

65

When the amount of interest receivable decreases during an accounting period:

A)Accrual-basis interest revenues exceed cash collections from borrowers.

B)Accrual-basis net income exceeds cash-basis net income.

C)Accrual-basis interest revenues are less than cash collections from borrowers.

D)Accrual-basis net income is less than cash-basis net income.

A)Accrual-basis interest revenues exceed cash collections from borrowers.

B)Accrual-basis net income exceeds cash-basis net income.

C)Accrual-basis interest revenues are less than cash collections from borrowers.

D)Accrual-basis net income is less than cash-basis net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

66

Below is a list of accounts in no particular order. Assume that all accounts have normal balances.

Required:

In column A, indicate whether a debit will:

1. Increase the account balance, or

2. Decrease the account balance.

In column B, classify each account according to the following scheme. For contra accounts, indicate the classification of the account to which it relates.

1. A current asset in the balance sheet.

2. A noncurrent asset in the balance sheet.

3. A current liability in the balance sheet.

4. A long-term liability in the balance sheet.

5. A permanent equity account in the balance sheet.

6. A revenue account in the income statement.

7. An expense account shown in the income statement.

8. Account does not appear in either the balance sheet or the income statement.

-Short-term notes payable

Required:

In column A, indicate whether a debit will:

1. Increase the account balance, or

2. Decrease the account balance.

In column B, classify each account according to the following scheme. For contra accounts, indicate the classification of the account to which it relates.

1. A current asset in the balance sheet.

2. A noncurrent asset in the balance sheet.

3. A current liability in the balance sheet.

4. A long-term liability in the balance sheet.

5. A permanent equity account in the balance sheet.

6. A revenue account in the income statement.

7. An expense account shown in the income statement.

8. Account does not appear in either the balance sheet or the income statement.

-Short-term notes payable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

67

Below is a list of accounts in no particular order. Assume that all accounts have normal balances.

Required:

In column A, indicate whether a debit will:

1. Increase the account balance, or

2. Decrease the account balance.

In column B, classify each account according to the following scheme. For contra accounts, indicate the classification of the account to which it relates.

1. A current asset in the balance sheet.

2. A noncurrent asset in the balance sheet.

3. A current liability in the balance sheet.

4. A long-term liability in the balance sheet.

5. A permanent equity account in the balance sheet.

6. A revenue account in the income statement.

7. An expense account shown in the income statement.

8. Account does not appear in either the balance sheet or the income statement.

-Cost of goods sold

Required:

In column A, indicate whether a debit will:

1. Increase the account balance, or

2. Decrease the account balance.

In column B, classify each account according to the following scheme. For contra accounts, indicate the classification of the account to which it relates.

1. A current asset in the balance sheet.

2. A noncurrent asset in the balance sheet.

3. A current liability in the balance sheet.

4. A long-term liability in the balance sheet.

5. A permanent equity account in the balance sheet.

6. A revenue account in the income statement.

7. An expense account shown in the income statement.

8. Account does not appear in either the balance sheet or the income statement.

-Cost of goods sold

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

68

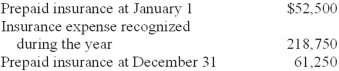

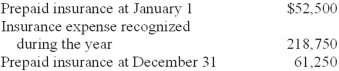

When Castle Corporation pays insurance premiums, the transaction is recorded as a debit to prepaid insurance. Additional information for the year ended December 31 is as follows:  What was the total amount cash paid by Castle for insurance premiums during the year?

What was the total amount cash paid by Castle for insurance premiums during the year?

A)$218,750

B)$166,250

C)$210,000

D)$227,500

What was the total amount cash paid by Castle for insurance premiums during the year?

What was the total amount cash paid by Castle for insurance premiums during the year?A)$218,750

B)$166,250

C)$210,000

D)$227,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

69

Below is a list of accounts in no particular order. Assume that all accounts have normal balances.

Required:

In column A, indicate whether a debit will:

1. Increase the account balance, or

2. Decrease the account balance.

In column B, classify each account according to the following scheme. For contra accounts, indicate the classification of the account to which it relates.

1. A current asset in the balance sheet.

2. A noncurrent asset in the balance sheet.

3. A current liability in the balance sheet.

4. A long-term liability in the balance sheet.

5. A permanent equity account in the balance sheet.

6. A revenue account in the income statement.

7. An expense account shown in the income statement.

8. Account does not appear in either the balance sheet or the income statement.

-Accounts receivable

Required:

In column A, indicate whether a debit will:

1. Increase the account balance, or

2. Decrease the account balance.

In column B, classify each account according to the following scheme. For contra accounts, indicate the classification of the account to which it relates.

1. A current asset in the balance sheet.

2. A noncurrent asset in the balance sheet.

3. A current liability in the balance sheet.

4. A long-term liability in the balance sheet.

5. A permanent equity account in the balance sheet.

6. A revenue account in the income statement.

7. An expense account shown in the income statement.

8. Account does not appear in either the balance sheet or the income statement.

-Accounts receivable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

70

The purpose of closing entries is to transfer:

A)Accounts receivable to retained earnings when an account is fully paid.

B)Balances in temporary accounts to a permanent account.

C)Inventory to cost of goods sold when merchandise is sold.

D)Assets and liabilities when operations are discontinued.

A)Accounts receivable to retained earnings when an account is fully paid.

B)Balances in temporary accounts to a permanent account.

C)Inventory to cost of goods sold when merchandise is sold.

D)Assets and liabilities when operations are discontinued.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

71

Pat's Custom Tuxedo Shop maintains its records on the cash basis. During this past year Pat's collected $42,000 in tailoring fees, and paid $14,000 in expenses. Depreciation expense totaled $2,000. Accounts receivable increased $1,500, supplies increased $4,000, and accrued liabilities increased $2,500. Pat's accrual basis net income was:

A)$18,000.

B)$34,000.

C)$23,000.

D)$29,000.

A)$18,000.

B)$34,000.

C)$23,000.

D)$29,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

72

When converting an income statement from a cash basis to an accrual basis, cash received for services:

A)Exceed service revenue.

B)May exceed or be less than service revenue.

C)Is less than service revenue.

D)Equals service revenue.

A)Exceed service revenue.

B)May exceed or be less than service revenue.

C)Is less than service revenue.

D)Equals service revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

73

When converting an income statement from a cash basis to an accrual basis, expenses:

A)Exceed cash payments to suppliers.

B)Equal cash payments to suppliers.

C)Are less than cash payments to suppliers.

D)May exceed or be less than cash payments to suppliers.

A)Exceed cash payments to suppliers.

B)Equal cash payments to suppliers.

C)Are less than cash payments to suppliers.

D)May exceed or be less than cash payments to suppliers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

74

Permanent accounts would not include:

A)Cost of goods sold.

B)Inventory.

C)Current liabilities.

D)Accumulated depreciation.

A)Cost of goods sold.

B)Inventory.

C)Current liabilities.

D)Accumulated depreciation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

75

When the amount of revenue collected in advance decreases during an accounting period:

A)Accrual-basis revenues exceed cash collections from customers.

B)Accrual-basis net income exceeds cash-basis net income.

C)Accrual-basis revenues are less than cash collections from customers.

D)Accrual-basis net income is less than cash-basis net income.

A)Accrual-basis revenues exceed cash collections from customers.

B)Accrual-basis net income exceeds cash-basis net income.

C)Accrual-basis revenues are less than cash collections from customers.

D)Accrual-basis net income is less than cash-basis net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

76

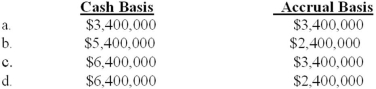

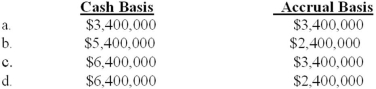

On June 1, Royal Corp. began operating a service company with an initial cash investment by shareholders of $2,000,000. The company provided $6,400,000 of services in June and received full payment in July. Royal also incurred expenses of $3,000,000 in June that were paid in August. During June, Royal paid its shareholders cash dividends of $1,000,000. What was the company's income before income taxes for the two months ended July 31 under the following methods of accounting?

A)Option a

B)Option b

C)Option c

D)Option d

A)Option a

B)Option b

C)Option c

D)Option d

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

77

Molly's Auto Detailers maintains its records on the cash basis. During 2013, Molly's collected $72,000 from customers and paid $21,000 in expenses. Depreciation expense of $5,000 would have been recorded on the accrual basis. Over the course of the year, accounts receivable increased $4,000, prepaid expenses decreased $2,000, and accrued liabilities decreased $1,000. Molly's accrual basis net income was:

A)$38,000.

B)$54,000.

C)$49,000.

D)$42,000.

A)$38,000.

B)$54,000.

C)$49,000.

D)$42,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

78

Below is a list of accounts in no particular order. Assume that all accounts have normal balances.

Required:

In column A, indicate whether a debit will:

1. Increase the account balance, or

2. Decrease the account balance.

In column B, classify each account according to the following scheme. For contra accounts, indicate the classification of the account to which it relates.

1. A current asset in the balance sheet.

2. A noncurrent asset in the balance sheet.

3. A current liability in the balance sheet.

4. A long-term liability in the balance sheet.

5. A permanent equity account in the balance sheet.

6. A revenue account in the income statement.

7. An expense account shown in the income statement.

8. Account does not appear in either the balance sheet or the income statement.

-Unearned revenues

Required:

In column A, indicate whether a debit will:

1. Increase the account balance, or

2. Decrease the account balance.

In column B, classify each account according to the following scheme. For contra accounts, indicate the classification of the account to which it relates.

1. A current asset in the balance sheet.

2. A noncurrent asset in the balance sheet.

3. A current liability in the balance sheet.

4. A long-term liability in the balance sheet.

5. A permanent equity account in the balance sheet.

6. A revenue account in the income statement.

7. An expense account shown in the income statement.

8. Account does not appear in either the balance sheet or the income statement.

-Unearned revenues

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

79

When converting an income statement from a cash basis to an accrual basis, which of the following is incorrect?

A)An adjustment for depreciation reduces net income.

B)A decrease in salaries payable decreases net income.

C)A reduction in prepaid expenses decreases net income.

D)An increase in accrued payables decreases net income.

A)An adjustment for depreciation reduces net income.

B)A decrease in salaries payable decreases net income.

C)A reduction in prepaid expenses decreases net income.

D)An increase in accrued payables decreases net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

80

Below is a list of accounts in no particular order. Assume that all accounts have normal balances.

Required:

In column A, indicate whether a debit will:

1. Increase the account balance, or

2. Decrease the account balance.

In column B, classify each account according to the following scheme. For contra accounts, indicate the classification of the account to which it relates.

1. A current asset in the balance sheet.

2. A noncurrent asset in the balance sheet.

3. A current liability in the balance sheet.

4. A long-term liability in the balance sheet.

5. A permanent equity account in the balance sheet.

6. A revenue account in the income statement.

7. An expense account shown in the income statement.

8. Account does not appear in either the balance sheet or the income statement.

-Buildings and equipment (B&E)

Required:

In column A, indicate whether a debit will:

1. Increase the account balance, or

2. Decrease the account balance.

In column B, classify each account according to the following scheme. For contra accounts, indicate the classification of the account to which it relates.

1. A current asset in the balance sheet.

2. A noncurrent asset in the balance sheet.

3. A current liability in the balance sheet.

4. A long-term liability in the balance sheet.

5. A permanent equity account in the balance sheet.

6. A revenue account in the income statement.

7. An expense account shown in the income statement.

8. Account does not appear in either the balance sheet or the income statement.

-Buildings and equipment (B&E)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck