Deck 15: Capital Budgeting and Strategic Investment Decisions

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/58

العب

ملء الشاشة (f)

Deck 15: Capital Budgeting and Strategic Investment Decisions

1

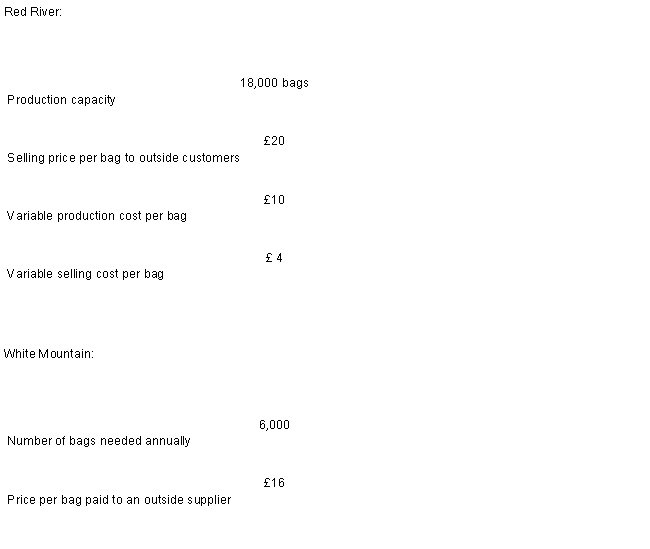

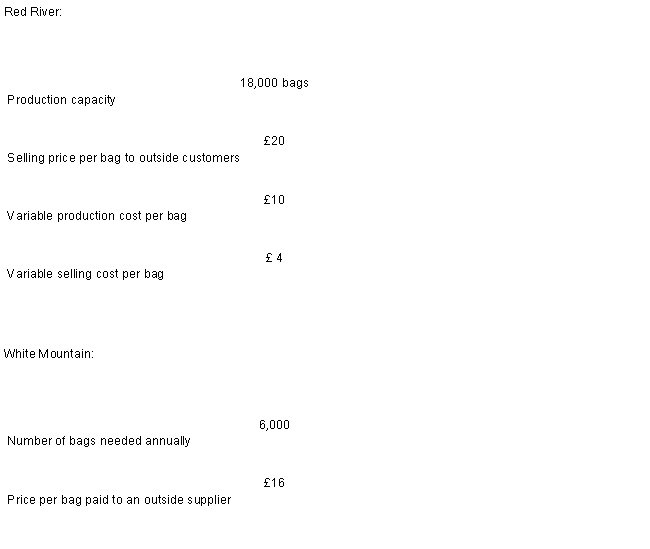

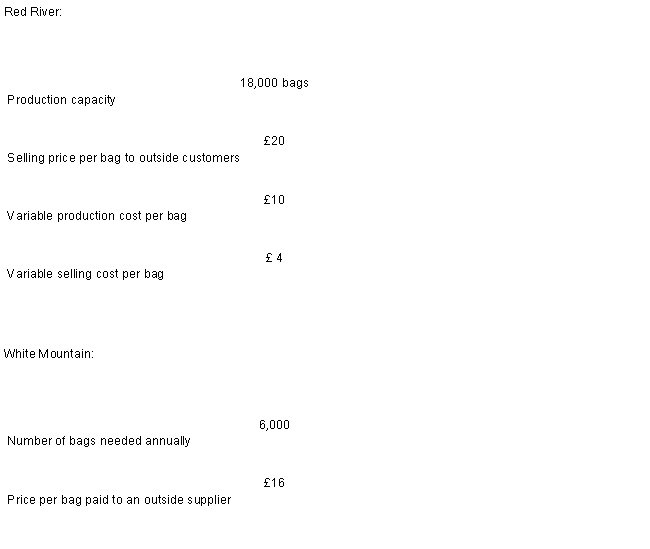

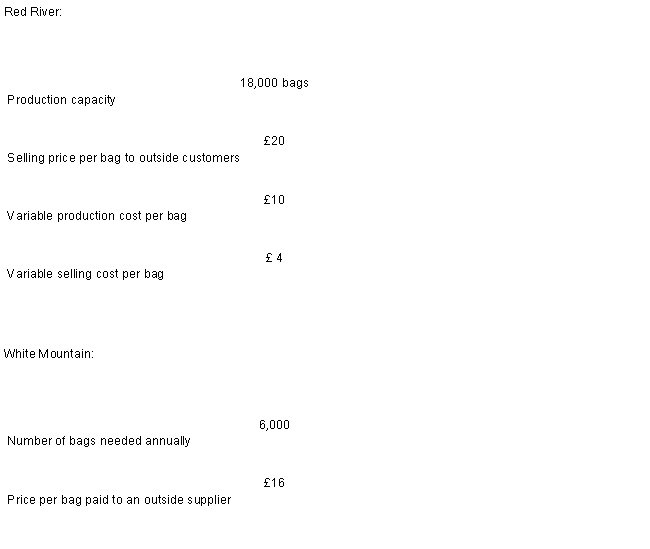

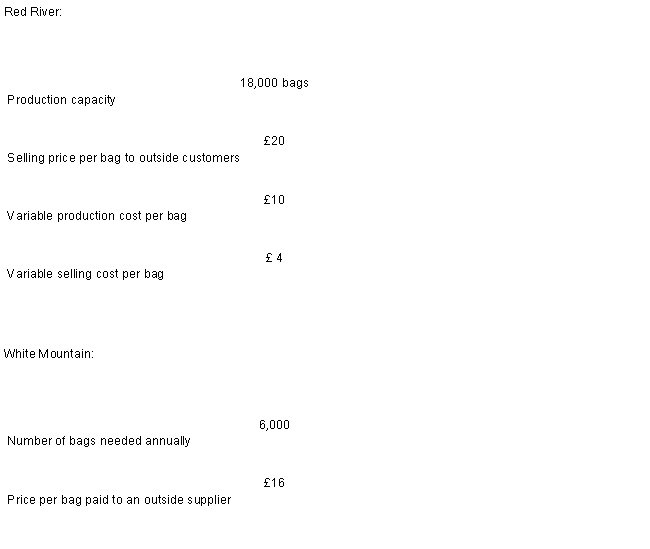

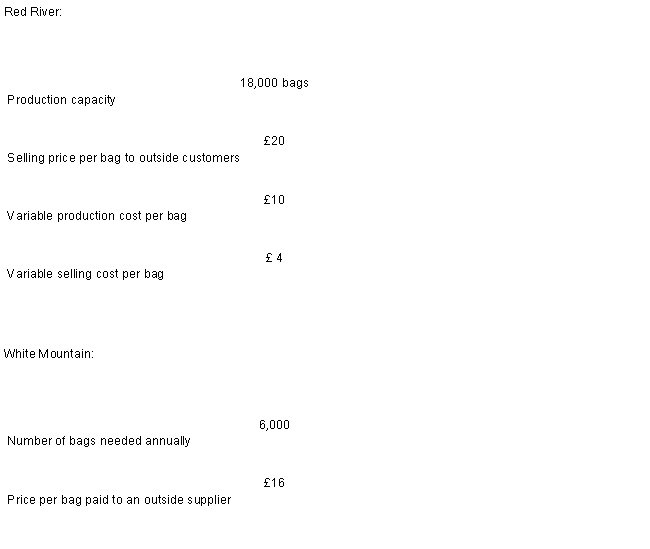

The Red River Division of Alto Company produces and sells bags of pottery clay that can either be sold to outside customers or transferred to the White Mountain Division of Alto Company. The following data are available from the last year:

By selling to the White Mountain Division, the Red River Division will avoid £3 per bag in selling costs.

-If Red River can sell 15,000 bags annually to outside customers, according to the formula in the text, what is the lowest acceptable transfer price from the viewpoint of the selling division

A)£20

B)£16

C)£11

D)£14

By selling to the White Mountain Division, the Red River Division will avoid £3 per bag in selling costs.

-If Red River can sell 15,000 bags annually to outside customers, according to the formula in the text, what is the lowest acceptable transfer price from the viewpoint of the selling division

A)£20

B)£16

C)£11

D)£14

£14

2

The Red River Division of Alto Company produces and sells bags of pottery clay that can either be sold to outside customers or transferred to the White Mountain Division of Alto Company. The following data are available from the last year:

By selling to the White Mountain Division, the Red River Division will avoid £3 per bag in selling costs.

-If Red River can sell only 10,000 bags annually to outside customers, according to the formula in the text, what is the lowest acceptable transfer price from the viewpoint of the selling division

A)£20

B)£16

C)£11

D)£14

By selling to the White Mountain Division, the Red River Division will avoid £3 per bag in selling costs.

-If Red River can sell only 10,000 bags annually to outside customers, according to the formula in the text, what is the lowest acceptable transfer price from the viewpoint of the selling division

A)£20

B)£16

C)£11

D)£14

£11

3

A transfer price is the price charged when one segment of a company provides goods or services to another segment of the company.

False

4

The CD Division of Sound Company makes and sells compact disk players (CDP) that can be sold it presently sells to outside customers. Budgeted costs next month for the CD Division are as follows:

MaxiSound, another division of Sound Company, would like to buy 1,000 of the CDPs from the CD Division. An outside supplier has offered to sell similar CDPs to MaxiSound for £170 each.

- Assume that CD Division's monthly production capacity is 2,800 units. If CD sells 1,000 CDPs to MaxiSound for £170 each, the monthly effect on the profits of CD Division will be a

A)£15,000 decrease

B)£42,000 decrease

C)£50,000 increase

D)no change

MaxiSound, another division of Sound Company, would like to buy 1,000 of the CDPs from the CD Division. An outside supplier has offered to sell similar CDPs to MaxiSound for £170 each.

- Assume that CD Division's monthly production capacity is 2,800 units. If CD sells 1,000 CDPs to MaxiSound for £170 each, the monthly effect on the profits of CD Division will be a

A)£15,000 decrease

B)£42,000 decrease

C)£50,000 increase

D)no change

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

5

Krenski Corporation has a Parts Division that does work for other Divisions in the company as well as for outside customers. The company's Equipment Division has asked the Parts Division to provide it with 10,000 special parts each year. The special parts would require £12.00 per unit in variable production costs.

The Equipment Division has a bid from an outside supplier for the special parts at £31.00 per unit. In order to have time and space to produce the special part, the Parts Division would have to cut back production of another part-the TW3 that it presently is producing. The TW3 sells for £35.00 per unit, and requires £13.00 per unit in variable production costs. Packaging and shipping costs of the TW3 are £3.00 per unit. Packaging and shipping costs for the new special part would be only £2.00 per unit. The Parts Division is now producing and selling 50,000 units of the TW3 each year. Production and sales of the TW3 would drop by 10% if the new special part is produced for the Equipment Division.

-The minimum transfer price for the Parts Division is

A)£23.50

B)£22

C)£10.50

D)£12

The Equipment Division has a bid from an outside supplier for the special parts at £31.00 per unit. In order to have time and space to produce the special part, the Parts Division would have to cut back production of another part-the TW3 that it presently is producing. The TW3 sells for £35.00 per unit, and requires £13.00 per unit in variable production costs. Packaging and shipping costs of the TW3 are £3.00 per unit. Packaging and shipping costs for the new special part would be only £2.00 per unit. The Parts Division is now producing and selling 50,000 units of the TW3 each year. Production and sales of the TW3 would drop by 10% if the new special part is produced for the Equipment Division.

-The minimum transfer price for the Parts Division is

A)£23.50

B)£22

C)£10.50

D)£12

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

6

Division X makes a part with the following characteristics:

Division Y of the same company would like to purchase 10,000 units each period from Division X. Division Y now purchases the part from an outside supplier at a price of £17 each.

- Suppose that Division X is operating at capacity and can sell all of its output to outside customers. If Division X sells the parts to Division Y at £17 per unit, the company as a whole will be

A)better off by £10,000 each period

B)worse off by £20,000 each period

C)worse off by £10,000 each period

D)there will be no change in the status of the company as a whole

Division Y of the same company would like to purchase 10,000 units each period from Division X. Division Y now purchases the part from an outside supplier at a price of £17 each.

- Suppose that Division X is operating at capacity and can sell all of its output to outside customers. If Division X sells the parts to Division Y at £17 per unit, the company as a whole will be

A)better off by £10,000 each period

B)worse off by £20,000 each period

C)worse off by £10,000 each period

D)there will be no change in the status of the company as a whole

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

7

Using the formula in the text, if the lowest acceptable transfer price to the selling division is £90 and the lost contribution margin per unit on outside sales is £40, then the variable cost per unit must be

A)£ 90

B)£ 40

C)£130

D)£ 50

A)£ 90

B)£ 40

C)£130

D)£ 50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

8

The CD Division of Sound Company makes and sells compact disk players (CDP) that can be sold it presently sells to outside customers. Budgeted costs next month for the CD Division are as follows:

MaxiSound, another division of Sound Company, would like to buy 1,000 of the CDPs from the CD Division. An outside supplier has offered to sell similar CDPs to MaxiSound for £170 each.

-Assume the CD Division's monthly production capacity is 4,000 units. If the CD Division sells 1,000 CDPs to MaxiSound for £170 each, the monthly effect on the profits of CD Division will be a

A)£65,000 increase.

B)£50,000 increase.

C)£185,000 increase.

D)£170,000 increase.

MaxiSound, another division of Sound Company, would like to buy 1,000 of the CDPs from the CD Division. An outside supplier has offered to sell similar CDPs to MaxiSound for £170 each.

-Assume the CD Division's monthly production capacity is 4,000 units. If the CD Division sells 1,000 CDPs to MaxiSound for £170 each, the monthly effect on the profits of CD Division will be a

A)£65,000 increase.

B)£50,000 increase.

C)£185,000 increase.

D)£170,000 increase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

9

Krenski Corporation has a Parts Division that does work for other Divisions in the company as well as for outside customers. The company's Equipment Division has asked the Parts Division to provide it with 10,000 special parts each year. The special parts would require £12.00 per unit in variable production costs.

The Equipment Division has a bid from an outside supplier for the special parts at £31.00 per unit. In order to have time and space to produce the special part, the Parts Division would have to cut back production of another part-the TW3 that it presently is producing. The TW3 sells for £35.00 per unit, and requires £13.00 per unit in variable production costs. Packaging and shipping costs of the TW3 are £3.00 per unit. Packaging and shipping costs for the new special part would be only £2.00 per unit. The Parts Division is now producing and selling 50,000 units of the TW3 each year. Production and sales of the TW3 would drop by 10% if the new special part is produced for the Equipment Division.

-

The minimum transfer price for the Equipment Division is

A)£31

B)£21

C)£1

D)£12

The Equipment Division has a bid from an outside supplier for the special parts at £31.00 per unit. In order to have time and space to produce the special part, the Parts Division would have to cut back production of another part-the TW3 that it presently is producing. The TW3 sells for £35.00 per unit, and requires £13.00 per unit in variable production costs. Packaging and shipping costs of the TW3 are £3.00 per unit. Packaging and shipping costs for the new special part would be only £2.00 per unit. The Parts Division is now producing and selling 50,000 units of the TW3 each year. Production and sales of the TW3 would drop by 10% if the new special part is produced for the Equipment Division.

-

The minimum transfer price for the Equipment Division is

A)£31

B)£21

C)£1

D)£12

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

10

The Red River Division of Alto Company produces and sells bags of pottery clay that can either be sold to outside customers or transferred to the White Mountain Division of Alto Company. The following data are available from the last year:

By selling to the White Mountain Division, the Red River Division will avoid £3 per bag in selling costs.

- What is the maximum transfer price the White Mountain Division should be willing to pay

A)£20

B)£16

C)£11

D)£14

By selling to the White Mountain Division, the Red River Division will avoid £3 per bag in selling costs.

- What is the maximum transfer price the White Mountain Division should be willing to pay

A)£20

B)£16

C)£11

D)£14

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

11

A negotiated transfer is usually imposed by the head office of a company

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

12

Krenski Corporation has a Parts Division that does work for other Divisions in the company as well as for outside customers. The company's Equipment Division has asked the Parts Division to provide it with 10,000 special parts each year. The special parts would require £12.00 per unit in variable production costs.

The Equipment Division has a bid from an outside supplier for the special parts at £31.00 per unit. In order to have time and space to produce the special part, the Parts Division would have to cut back production of another part-the TW3 that it presently is producing. The TW3 sells for £35.00 per unit, and requires £13.00 per unit in variable production costs. Packaging and shipping costs of the TW3 are £3.00 per unit. Packaging and shipping costs for the new special part would be only £2.00 per unit. The Parts Division is now producing and selling 50,000 units of the TW3 each year. Production and sales of the TW3 would drop by 10% if the new special part is produced for the Equipment Division.

-

The variable cost for the Parts Division is

A)£12

B)£2

C)£10

D)£14

The Equipment Division has a bid from an outside supplier for the special parts at £31.00 per unit. In order to have time and space to produce the special part, the Parts Division would have to cut back production of another part-the TW3 that it presently is producing. The TW3 sells for £35.00 per unit, and requires £13.00 per unit in variable production costs. Packaging and shipping costs of the TW3 are £3.00 per unit. Packaging and shipping costs for the new special part would be only £2.00 per unit. The Parts Division is now producing and selling 50,000 units of the TW3 each year. Production and sales of the TW3 would drop by 10% if the new special part is produced for the Equipment Division.

-

The variable cost for the Parts Division is

A)£12

B)£2

C)£10

D)£14

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

13

The Hogan Division of Reston Company makes and sells K7 motors that can either be sold to outside customers or transferred to the Jasper Division of Reston Company. The following data were supplied by the Hogan Division:

The Jasper Division is currently purchasing similar motors from an outside supplier at £110 each. Instead, the Jasper Division would like to buy 1,200 of the K7 motors from Hogan next month.

-The Hogan Division has proposed a transfer price of £105 per motor. Suppose sales of K7 motors to outside customers are expected to be 2,800 units next month. If Jasper acquires the 1,200 motors from Hogan rather than from the outside supplier, the effect on the monthly net operating income of the company as a whole will be

A)£6,000 decrease

B)£6,000 increase

C)£4,500 increase

D)£4,500 decrease

The Jasper Division is currently purchasing similar motors from an outside supplier at £110 each. Instead, the Jasper Division would like to buy 1,200 of the K7 motors from Hogan next month.

-The Hogan Division has proposed a transfer price of £105 per motor. Suppose sales of K7 motors to outside customers are expected to be 2,800 units next month. If Jasper acquires the 1,200 motors from Hogan rather than from the outside supplier, the effect on the monthly net operating income of the company as a whole will be

A)£6,000 decrease

B)£6,000 increase

C)£4,500 increase

D)£4,500 decrease

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

14

The Hogan Division of Reston Company makes and sells K7 motors that can either be sold to outside customers or transferred to the Jasper Division of Reston Company. The following data were supplied by the Hogan Division:

The Jasper Division is currently purchasing similar motors from an outside supplier at £110 each. Instead, the Jasper Division would like to buy 1,200 of the K7 motors from Hogan next month.

-The Hogan Division has proposed a transfer price of £105 per motor. Suppose there is ample idle capacity at the Hogan Division so that transfers to the Jasper Division do not cut into sales to outside customers. If the Jasper Division acquires the 1,200 motors from the Hogan Division rather than from the outside supplier, the effect on the monthly net operating income of the company as a whole will be

A)£36,000 increase

B)£42,000 increase

C)£48,000 increase

D)£12,000 decrease

The Jasper Division is currently purchasing similar motors from an outside supplier at £110 each. Instead, the Jasper Division would like to buy 1,200 of the K7 motors from Hogan next month.

-The Hogan Division has proposed a transfer price of £105 per motor. Suppose there is ample idle capacity at the Hogan Division so that transfers to the Jasper Division do not cut into sales to outside customers. If the Jasper Division acquires the 1,200 motors from the Hogan Division rather than from the outside supplier, the effect on the monthly net operating income of the company as a whole will be

A)£36,000 increase

B)£42,000 increase

C)£48,000 increase

D)£12,000 decrease

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

15

Suboptimisation occurs when managers do not act in the best interests of the company

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

16

Krenski Corporation has a Parts Division that does work for other Divisions in the company as well as for outside customers. The company's Equipment Division has asked the Parts Division to provide it with 10,000 special parts each year. The special parts would require £12.00 per unit in variable production costs.

The Equipment Division has a bid from an outside supplier for the special parts at £31.00 per unit. In order to have time and space to produce the special part, the Parts Division would have to cut back production of another part-the TW3 that it presently is producing. The TW3 sells for £35.00 per unit, and requires £13.00 per unit in variable production costs. Packaging and shipping costs of the TW3 are £3.00 per unit. Packaging and shipping costs for the new special part would be only £2.00 per unit. The Parts Division is now producing and selling 50,000 units of the TW3 each year. Production and sales of the TW3 would drop by 10% if the new special part is produced for the Equipment Division.

-

The opportunity cost for the Parts Division is

A)£9.50

B)£2

C)£10

D)£12

The Equipment Division has a bid from an outside supplier for the special parts at £31.00 per unit. In order to have time and space to produce the special part, the Parts Division would have to cut back production of another part-the TW3 that it presently is producing. The TW3 sells for £35.00 per unit, and requires £13.00 per unit in variable production costs. Packaging and shipping costs of the TW3 are £3.00 per unit. Packaging and shipping costs for the new special part would be only £2.00 per unit. The Parts Division is now producing and selling 50,000 units of the TW3 each year. Production and sales of the TW3 would drop by 10% if the new special part is produced for the Equipment Division.

-

The opportunity cost for the Parts Division is

A)£9.50

B)£2

C)£10

D)£12

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

17

A product's markup is the difference between the selling price and the overhead cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

18

Krenski Corporation has a Parts Division that does work for other Divisions in the company as well as for outside customers. The company's Equipment Division has asked the Parts Division to provide it with 10,000 special parts each year. The special parts would require £12.00 per unit in variable production costs.

The Equipment Division has a bid from an outside supplier for the special parts at £31.00 per unit. In order to have time and space to produce the special part, the Parts Division would have to cut back production of another part-the TW3 that it presently is producing. The TW3 sells for £35.00 per unit, and requires £13.00 per unit in variable production costs. Packaging and shipping costs of the TW3 are £3.00 per unit. Packaging and shipping costs for the new special part would be only £2.00 per unit. The Parts Division is now producing and selling 50,000 units of the TW3 each year. Production and sales of the TW3 would drop by 10% if the new special part is produced for the Equipment Division.

-From the point of view of the Parts Division, profits would increase if the transfer price is

A)Transfer price > Variable cost + Opportunity cost

B)Transfer price < Variable cost + Opportunity cost

C)Transfer price = Variable cost

D)Transfer price = Variable cost - Opportunity cost

The Equipment Division has a bid from an outside supplier for the special parts at £31.00 per unit. In order to have time and space to produce the special part, the Parts Division would have to cut back production of another part-the TW3 that it presently is producing. The TW3 sells for £35.00 per unit, and requires £13.00 per unit in variable production costs. Packaging and shipping costs of the TW3 are £3.00 per unit. Packaging and shipping costs for the new special part would be only £2.00 per unit. The Parts Division is now producing and selling 50,000 units of the TW3 each year. Production and sales of the TW3 would drop by 10% if the new special part is produced for the Equipment Division.

-From the point of view of the Parts Division, profits would increase if the transfer price is

A)Transfer price > Variable cost + Opportunity cost

B)Transfer price < Variable cost + Opportunity cost

C)Transfer price = Variable cost

D)Transfer price = Variable cost - Opportunity cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

19

The CD Division of Sound Company makes and sells compact disk players (CDP) that can be sold it presently sells to outside customers. Budgeted costs next month for the CD Division are as follows:

MaxiSound, another division of Sound Company, would like to buy 1,000 of the CDPs from the CD Division. An outside supplier has offered to sell similar CDPs to MaxiSound for £170 each.

- Assume that CD Division's monthly production capacity is 3,200 units and the MaxiSound Division will acquire the CDPs from the outside supplier if they are not available from the CD Division. If the CD Division sells 1,000 CDPs to MaxiSound for £170 each, the effect on the monthly profits of Sound Company as a whole will be a

A)£9,000 decrease.

B)£74,000 decrease.

C)£20,000 increase.

D)£11,000 increase.

MaxiSound, another division of Sound Company, would like to buy 1,000 of the CDPs from the CD Division. An outside supplier has offered to sell similar CDPs to MaxiSound for £170 each.

- Assume that CD Division's monthly production capacity is 3,200 units and the MaxiSound Division will acquire the CDPs from the outside supplier if they are not available from the CD Division. If the CD Division sells 1,000 CDPs to MaxiSound for £170 each, the effect on the monthly profits of Sound Company as a whole will be a

A)£9,000 decrease.

B)£74,000 decrease.

C)£20,000 increase.

D)£11,000 increase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

20

Division X makes a part with the following characteristics:

Division Y of the same company would like to purchase 10,000 units each period from Division X. Division Y now purchases the part from an outside supplier at a price of £17 each.

-

Suppose Division X has ample excess capacity to handle all of Division Y's needs without any increase in fixed costs and without cutting into sales to outside customers. If Division X refuses to accept the £17 price internally and Division Y continues to buy from the outside supplier, the company as a whole will be

A)worse off by £70,000 each period

B)better off by £10,000 each period

C)worse off by £60,000 each period

D)worse off by £20,000 each period

Division Y of the same company would like to purchase 10,000 units each period from Division X. Division Y now purchases the part from an outside supplier at a price of £17 each.

-

Suppose Division X has ample excess capacity to handle all of Division Y's needs without any increase in fixed costs and without cutting into sales to outside customers. If Division X refuses to accept the £17 price internally and Division Y continues to buy from the outside supplier, the company as a whole will be

A)worse off by £70,000 each period

B)better off by £10,000 each period

C)worse off by £60,000 each period

D)worse off by £20,000 each period

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

21

Division S of Goody Company makes a part with the following characteristics:

Division B, another division in the same company, presently is purchasing 10,000 units of a similar part each period from an outside supplier, but would like to start purchasing from Division S. Division B is now paying a price of £18 per unit to the outside supplier.

-Suppose that Division S has ample idle capacity to handle all of Division B's needs without any increase in fixed costs and without cutting into sales to outsiders. If Division S refuses to accept the £18 price from Division B, the company as a whole will be

A)better off by £20,000 each period

B)worse off by £60,000 each period

C)worse off by £30,000 each period

D)worse off by £20,000 each period

Division B, another division in the same company, presently is purchasing 10,000 units of a similar part each period from an outside supplier, but would like to start purchasing from Division S. Division B is now paying a price of £18 per unit to the outside supplier.

-Suppose that Division S has ample idle capacity to handle all of Division B's needs without any increase in fixed costs and without cutting into sales to outsiders. If Division S refuses to accept the £18 price from Division B, the company as a whole will be

A)better off by £20,000 each period

B)worse off by £60,000 each period

C)worse off by £30,000 each period

D)worse off by £20,000 each period

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

22

Fyodor Corporation has a Parts Division that does work for other Divisions in the company as well as for outside customers. The company's Machine Division has asked the Parts Division to provide it with 8,000 special parts each year. The special parts would require £19.00 per unit in variable production costs.

The Machine Division has a bid from an outside supplier for the special parts at £27.00 per unit. In order to have time and space to produce the special part, the Parts Division would have to cut back production of another part-the QR4 that it presently is producing. The QR4 sells for £34.00 per unit, and requires £18.00 per unit in variable production costs. Packaging and shipping costs of the QR4 are £2.00 per unit. Packaging and shipping costs for the new special part would be only £0.50 per unit. The Parts Division is now producing and selling 40,000 units of the QR4 each year. Production and sales of the QR4 would drop by 5% if the new special part is produced for the Machine Division.

-

The minimum transfer price for the Parts Division is

A)£23

B)£22

C)£19

D)£16

The Machine Division has a bid from an outside supplier for the special parts at £27.00 per unit. In order to have time and space to produce the special part, the Parts Division would have to cut back production of another part-the QR4 that it presently is producing. The QR4 sells for £34.00 per unit, and requires £18.00 per unit in variable production costs. Packaging and shipping costs of the QR4 are £2.00 per unit. Packaging and shipping costs for the new special part would be only £0.50 per unit. The Parts Division is now producing and selling 40,000 units of the QR4 each year. Production and sales of the QR4 would drop by 5% if the new special part is produced for the Machine Division.

-

The minimum transfer price for the Parts Division is

A)£23

B)£22

C)£19

D)£16

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

23

International transfer pricing is less complex than setting transfer prices between divisions in the same country

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

24

Division D has asked Division C of the same company to supply it with 4,000 units of part L763 this year to use in one of products. Division D has received a bid from an outside supplier for the parts at a price of £26.00 per unit. Division C has the capacity to produce 15,000 units of part L763 per year. Division C expects to sell 12,000 units of part L763 to outside customers this year at a price of £29.00 per unit. To fill the order from Division D, Division C would have to cut back its sales to outside customers. Division C produces part L763 at a variable cost of £20.00 per unit. The cost of packing and shipping the parts for outside customers is £1.00 per unit. These packing and shipping costs would not have to be incurred on sales of the parts to Division D.

-The minimum transfer price for Division D is

A)£23

B)£22

C)£19

D)£16

-The minimum transfer price for Division D is

A)£23

B)£22

C)£19

D)£16

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

25

The Pole Division of Hillyard Company produces poles that can be sold to outside customers or transferred to the Flag Division of Hillyard Company. Last year the Flag Division bought 50,000 poles from Pole at £2.50 each. The following data are available for last year's activities in the Pole Division:

In order to sell 50,000 poles to the Flag Division, the Pole Division must give up sales of 30,000 poles to outside customers. That is, the Pole Division could sell 380,000 poles each year to outside customers (rather than only 350,000 poles as shown above) if it were not making sales to the Flag Division. According to the formula in the text, what is the lowest acceptable transfer price from the viewpoint of the selling division

A)£2.50

B)£2.00

C)£2.60

D)£3.00

In order to sell 50,000 poles to the Flag Division, the Pole Division must give up sales of 30,000 poles to outside customers. That is, the Pole Division could sell 380,000 poles each year to outside customers (rather than only 350,000 poles as shown above) if it were not making sales to the Flag Division. According to the formula in the text, what is the lowest acceptable transfer price from the viewpoint of the selling division

A)£2.50

B)£2.00

C)£2.60

D)£3.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

26

Bounous Company has two divisions, Division X and Division Y. Division X has a production capacity of 6,000 units of a particular part per month. Division X sells 4,600 units of the part each month to outside customers at a contribution margin of £36 per unit. Division Y would like to buy 2,000 units of the part each month from Division X. In computing the lowest acceptable transfer price from the perspective of the selling division, the lost contribution margin per unit portion of the transfer price computation would be

A)£10.80

B)£36.00

C)£5.40

D)£25.20

A)£10.80

B)£36.00

C)£5.40

D)£25.20

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

27

Fyodor Corporation has a Parts Division that does work for other Divisions in the company as well as for outside customers. The company's Machine Division has asked the Parts Division to provide it with 8,000 special parts each year. The special parts would require £19.00 per unit in variable production costs.

The Machine Division has a bid from an outside supplier for the special parts at £27.00 per unit. In order to have time and space to produce the special part, the Parts Division would have to cut back production of another part-the QR4 that it presently is producing. The QR4 sells for £34.00 per unit, and requires £18.00 per unit in variable production costs. Packaging and shipping costs of the QR4 are £2.00 per unit. Packaging and shipping costs for the new special part would be only £0.50 per unit. The Parts Division is now producing and selling 40,000 units of the QR4 each year. Production and sales of the QR4 would drop by 5% if the new special part is produced for the Machine Division.

-

The minimum transfer price for the Machine Division is

A)£27

B)£28

C)£19

D)£17

The Machine Division has a bid from an outside supplier for the special parts at £27.00 per unit. In order to have time and space to produce the special part, the Parts Division would have to cut back production of another part-the QR4 that it presently is producing. The QR4 sells for £34.00 per unit, and requires £18.00 per unit in variable production costs. Packaging and shipping costs of the QR4 are £2.00 per unit. Packaging and shipping costs for the new special part would be only £0.50 per unit. The Parts Division is now producing and selling 40,000 units of the QR4 each year. Production and sales of the QR4 would drop by 5% if the new special part is produced for the Machine Division.

-

The minimum transfer price for the Machine Division is

A)£27

B)£28

C)£19

D)£17

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

28

Transfer prices are normally based on market prices

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

29

Division S of Goody Company makes a part with the following characteristics:

Division B, another division in the same company, presently is purchasing 10,000 units of a similar part each period from an outside supplier, but would like to start purchasing from Division S. Division B is now paying a price of £18 per unit to the outside supplier.

-Suppose that Division S can sell all that it can produce to outside customers at its regular selling price. If Division S sells to Division B at a price of £18 per unit, the company as a whole will be

A)worse off by £20,000 each period

B)worse off by £30,000 each period

C)worse off by £80,000 each period

D)there will be no change in the status of the company as a whole

Division B, another division in the same company, presently is purchasing 10,000 units of a similar part each period from an outside supplier, but would like to start purchasing from Division S. Division B is now paying a price of £18 per unit to the outside supplier.

-Suppose that Division S can sell all that it can produce to outside customers at its regular selling price. If Division S sells to Division B at a price of £18 per unit, the company as a whole will be

A)worse off by £20,000 each period

B)worse off by £30,000 each period

C)worse off by £80,000 each period

D)there will be no change in the status of the company as a whole

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

30

Cost based transfer prices are usually regarded as the best approach to setting a transfer price

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

31

If divisional autonomy is increased then profitability will improve.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

32

Suppose that last year an outside supplier would have been willing to provide the Flag Division with the basic poles at £2.10 each. If Flag had chosen to buy all of its poles from the outside supplier instead of the Pole Division, the change in net operating income for the company as a whole would have been

A)£45,000 increase

B)£20,000 decrease

C)£20,000 increase

D)£25,000 increase

A)£45,000 increase

B)£20,000 decrease

C)£20,000 increase

D)£25,000 increase

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

33

Division D has asked Division C of the same company to supply it with 4,000 units of part L763 this year to use in one of products. Division D has received a bid from an outside supplier for the parts at a price of £26.00 per unit. Division C has the capacity to produce 15,000 units of part L763 per year. Division C expects to sell 12,000 units of part L763 to outside customers this year at a price of £29.00 per unit. To fill the order from Division D, Division C would have to cut back its sales to outside customers. Division C produces part L763 at a variable cost of £20.00 per unit. The cost of packing and shipping the parts for outside customers is £1.00 per unit. These packing and shipping costs would not have to be incurred on sales of the parts to Division D.

-The optimal range of transfer prices is between

A)£22 to £26

B)£26- £28

C)£19-£22

D)£22-£36

-The optimal range of transfer prices is between

A)£22 to £26

B)£26- £28

C)£19-£22

D)£22-£36

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

34

Fyodor Corporation has a Parts Division that does work for other Divisions in the company as well as for outside customers. The company's Machine Division has asked the Parts Division to provide it with 8,000 special parts each year. The special parts would require £19.00 per unit in variable production costs.

The Machine Division has a bid from an outside supplier for the special parts at £27.00 per unit. In order to have time and space to produce the special part, the Parts Division would have to cut back production of another part-the QR4 that it presently is producing. The QR4 sells for £34.00 per unit, and requires £18.00 per unit in variable production costs. Packaging and shipping costs of the QR4 are £2.00 per unit. Packaging and shipping costs for the new special part would be only £0.50 per unit. The Parts Division is now producing and selling 40,000 units of the QR4 each year. Production and sales of the QR4 would drop by 5% if the new special part is produced for the Machine Division.

-From the point of view of the Parts Division, profits would increase if the transfer price is

A)Transfer price > Variable cost + Opportunity cost

B)Transfer price < Variable cost + Opportunity cost

C)Transfer price = Variable cost

D)Transfer price = Variable cost - Opportunity cost

The Machine Division has a bid from an outside supplier for the special parts at £27.00 per unit. In order to have time and space to produce the special part, the Parts Division would have to cut back production of another part-the QR4 that it presently is producing. The QR4 sells for £34.00 per unit, and requires £18.00 per unit in variable production costs. Packaging and shipping costs of the QR4 are £2.00 per unit. Packaging and shipping costs for the new special part would be only £0.50 per unit. The Parts Division is now producing and selling 40,000 units of the QR4 each year. Production and sales of the QR4 would drop by 5% if the new special part is produced for the Machine Division.

-From the point of view of the Parts Division, profits would increase if the transfer price is

A)Transfer price > Variable cost + Opportunity cost

B)Transfer price < Variable cost + Opportunity cost

C)Transfer price = Variable cost

D)Transfer price = Variable cost - Opportunity cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

35

Fyodor Corporation has a Parts Division that does work for other Divisions in the company as well as for outside customers. The company's Machine Division has asked the Parts Division to provide it with 8,000 special parts each year. The special parts would require £19.00 per unit in variable production costs.

The Machine Division has a bid from an outside supplier for the special parts at £27.00 per unit. In order to have time and space to produce the special part, the Parts Division would have to cut back production of another part-the QR4 that it presently is producing. The QR4 sells for £34.00 per unit, and requires £18.00 per unit in variable production costs. Packaging and shipping costs of the QR4 are £2.00 per unit. Packaging and shipping costs for the new special part would be only £0.50 per unit. The Parts Division is now producing and selling 40,000 units of the QR4 each year. Production and sales of the QR4 would drop by 5% if the new special part is produced for the Machine Division.

-The variable cost for the Parts Division is

A)£21

B)£2

C)£19

D)£19.50

The Machine Division has a bid from an outside supplier for the special parts at £27.00 per unit. In order to have time and space to produce the special part, the Parts Division would have to cut back production of another part-the QR4 that it presently is producing. The QR4 sells for £34.00 per unit, and requires £18.00 per unit in variable production costs. Packaging and shipping costs of the QR4 are £2.00 per unit. Packaging and shipping costs for the new special part would be only £0.50 per unit. The Parts Division is now producing and selling 40,000 units of the QR4 each year. Production and sales of the QR4 would drop by 5% if the new special part is produced for the Machine Division.

-The variable cost for the Parts Division is

A)£21

B)£2

C)£19

D)£19.50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

36

The price elasticity of demand measures the degree to which the volume of sales for a product or service is affected by a change in price

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

37

Fyodor Corporation has a Parts Division that does work for other Divisions in the company as well as for outside customers. The company's Machine Division has asked the Parts Division to provide it with 8,000 special parts each year. The special parts would require £19.00 per unit in variable production costs.

The Machine Division has a bid from an outside supplier for the special parts at £27.00 per unit. In order to have time and space to produce the special part, the Parts Division would have to cut back production of another part-the QR4 that it presently is producing. The QR4 sells for £34.00 per unit, and requires £18.00 per unit in variable production costs. Packaging and shipping costs of the QR4 are £2.00 per unit. Packaging and shipping costs for the new special part would be only £0.50 per unit. The Parts Division is now producing and selling 40,000 units of the QR4 each year. Production and sales of the QR4 would drop by 5% if the new special part is produced for the Machine Division.

-The opportunity cost for the Parts Division is

A)£9.50

B)£2.50

C)£3.50

D)£1

The Machine Division has a bid from an outside supplier for the special parts at £27.00 per unit. In order to have time and space to produce the special part, the Parts Division would have to cut back production of another part-the QR4 that it presently is producing. The QR4 sells for £34.00 per unit, and requires £18.00 per unit in variable production costs. Packaging and shipping costs of the QR4 are £2.00 per unit. Packaging and shipping costs for the new special part would be only £0.50 per unit. The Parts Division is now producing and selling 40,000 units of the QR4 each year. Production and sales of the QR4 would drop by 5% if the new special part is produced for the Machine Division.

-The opportunity cost for the Parts Division is

A)£9.50

B)£2.50

C)£3.50

D)£1

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

38

Target pricing is useful companies that have little control over market prices

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

39

Division D has asked Division C of the same company to supply it with 4,000 units of part L763 this year to use in one of products. Division D has received a bid from an outside supplier for the parts at a price of £26.00 per unit. Division C has the capacity to produce 15,000 units of part L763 per year. Division C expects to sell 12,000 units of part L763 to outside customers this year at a price of £29.00 per unit. To fill the order from Division D, Division C would have to cut back its sales to outside customers. Division C produces part L763 at a variable cost of £20.00 per unit. The cost of packing and shipping the parts for outside customers is £1.00 per unit. These packing and shipping costs would not have to be incurred on sales of the parts to DivisionD.

-

The minimum transfer price for Division C is

A)£27

B)£28

C)£26

D)£19

-

The minimum transfer price for Division C is

A)£27

B)£28

C)£26

D)£19

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

40

The North Division of Barter Company makes and sells a single product, which is a part used in manufacturing trucks. The annual production capacity is 35,000 units and the variable cost of each unit is £24. Presently the North Division sells 32,000 units per year to outside customers at £40 per unit. The South Division of Barter Company would like to buy 15,000 units a year from North to use in its production. There would be no savings in variable costs from transferring the units internally rather than selling them externally. The lowest acceptable transfer price from the standpoint of the North Division would be closest to

A)£36.80

B)£24.00

C)£32.00

D)£40.00

A)£36.80

B)£24.00

C)£32.00

D)£40.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

41

Time and Material pricing is NOT commonly used in one of the following

A)Repair shops

B)Accountants

C)Plumbers

D)Manufacturing

A)Repair shops

B)Accountants

C)Plumbers

D)Manufacturing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

42

Discuss the role of idle capacity in the setting of Transfer Prices.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

43

One of the advantages of the Absorption costing approach is

A)It is simple

B)It is safe

C)Customers need the forecast sales

D)Customers will pay whatever price is askeD.

A)It is simple

B)It is safe

C)Customers need the forecast sales

D)Customers will pay whatever price is askeD.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

44

The international aspects of Transfer Price Setting add nothing to the rules on how to set Transfer Prices. Discuss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

45

If a garage repairs your car and uses time and material pricing them you will always be charged the exact number of hours that they spend on you car.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

46

Discuss the advantages and the disadvantages of the various methods of pricing. Is there a best method?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

47

Explain what is meant by Revenue and Yield Management. In what industries is it typically used?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

48

Discuss the different Transfer Pricing methods. Is there a best method?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

49

Explain how prices tend to be set in service organizations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

50

Price Elasticity of demand plays no part in the setting of prices

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

51

Divisional Autonomy means that Head Office should never interfere in setting Transfer Prices or even give guidance. Discuss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

52

Llanelli employ target costing. The following rules relate to a new hand dryer

The likely price will be £200; expected sales, £100,000; investment to develop £1,000,000; Company requires 10% ROI. The target cost to manufacture, sell, distribute and service is

A)£16

B)£17

C)£18

D)£19

The likely price will be £200; expected sales, £100,000; investment to develop £1,000,000; Company requires 10% ROI. The target cost to manufacture, sell, distribute and service is

A)£16

B)£17

C)£18

D)£19

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

53

Selling and admin expenses re included as part of full absorption cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

54

Sueusueme Solicitors use time and material pricing. The following relates to job 14693.

Standard contract £200

Junior solicitor's time 4 hours @ £50 per hour

Senior Solicitor's time 1 hour @ £200 per hour

The billed amount would be

A)£1,000

B)£1,400

C)£600

D)£2,200

Standard contract £200

Junior solicitor's time 4 hours @ £50 per hour

Senior Solicitor's time 1 hour @ £200 per hour

The billed amount would be

A)£1,000

B)£1,400

C)£600

D)£2,200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

55

Target costing is used by many Japanese companies

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

56

One of the assumptions behind target costing is that

A)cost is irrelevant.

B)the product has already been developed.

C)The company already know the price that will be charged

D)The company has control over the pricing

A)cost is irrelevant.

B)the product has already been developed.

C)The company already know the price that will be charged

D)The company has control over the pricing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

57

Fixed Overheads are £40,000; Direct Materials per unit £6; Direct Labour per unit £2, Budgeted Production 10,000 units; Mark up is 25% on full absorption cost. The unit Selling Price is

A)£10

B)£11

C)£12

D)£13

A)£10

B)£11

C)£12

D)£13

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

58

Target costing is short term not strategic

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck