Deck 3: A Costing Framework and Cost Allocation

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/68

العب

ملء الشاشة (f)

Deck 3: A Costing Framework and Cost Allocation

1

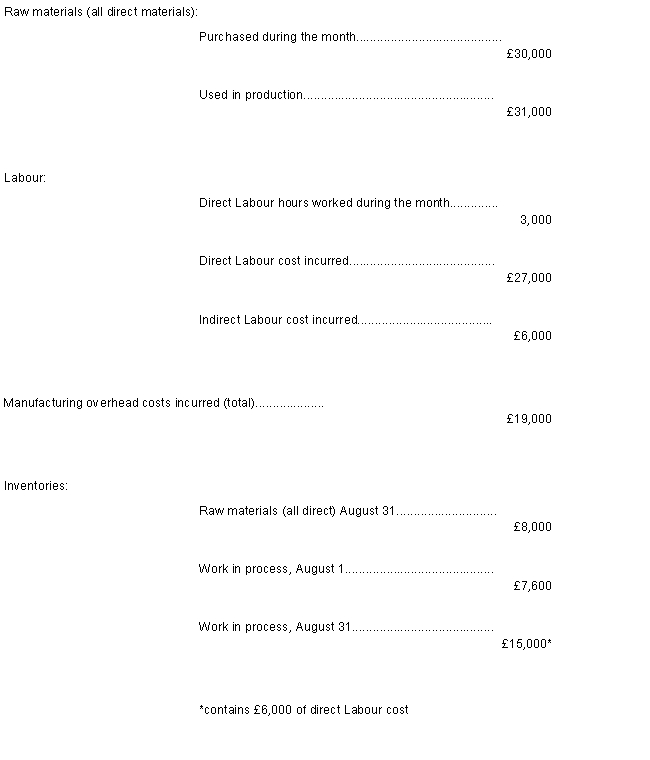

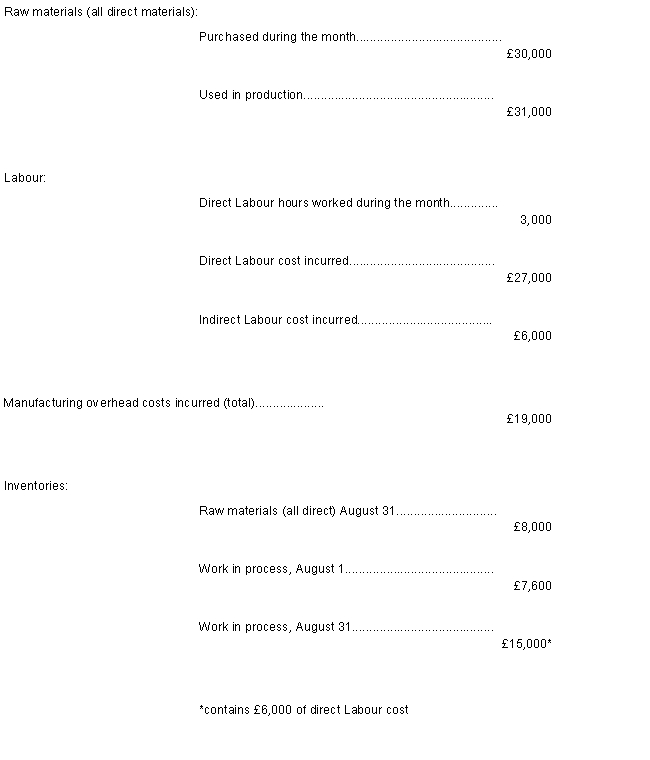

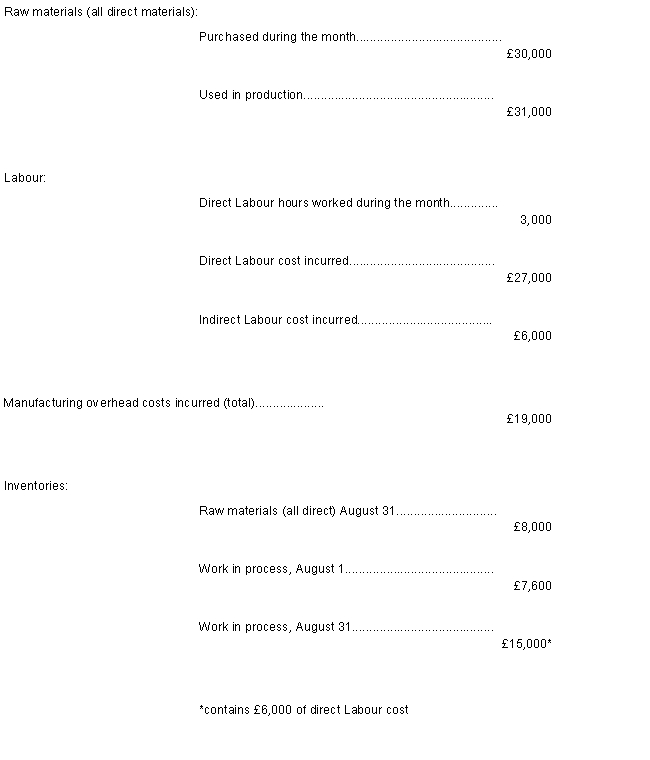

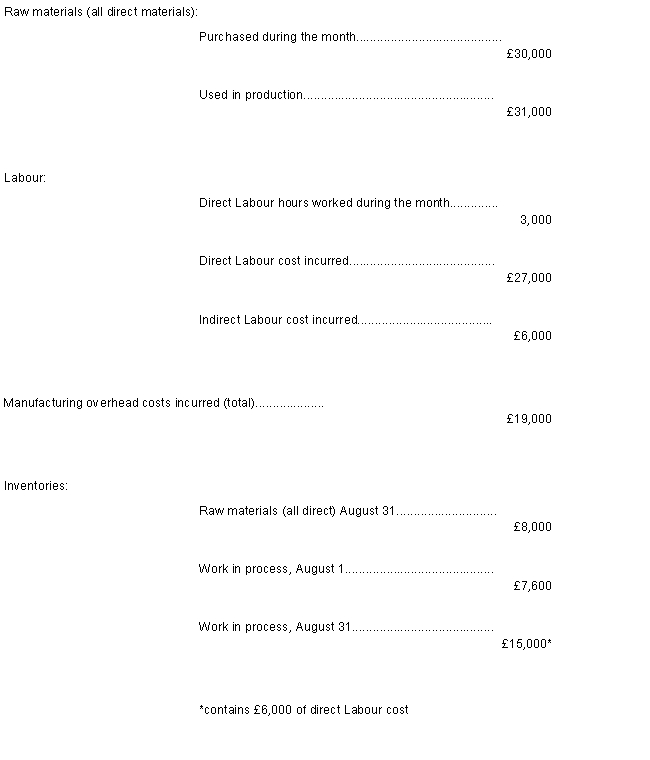

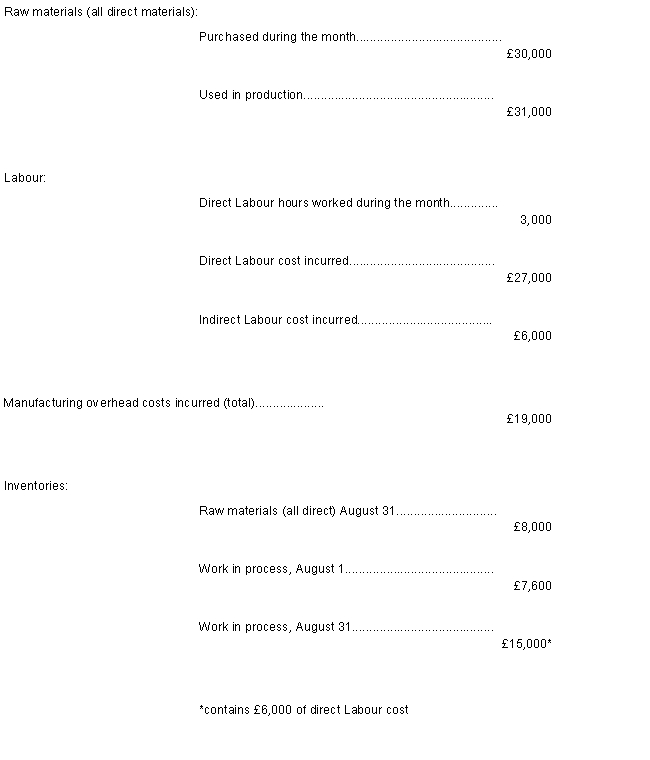

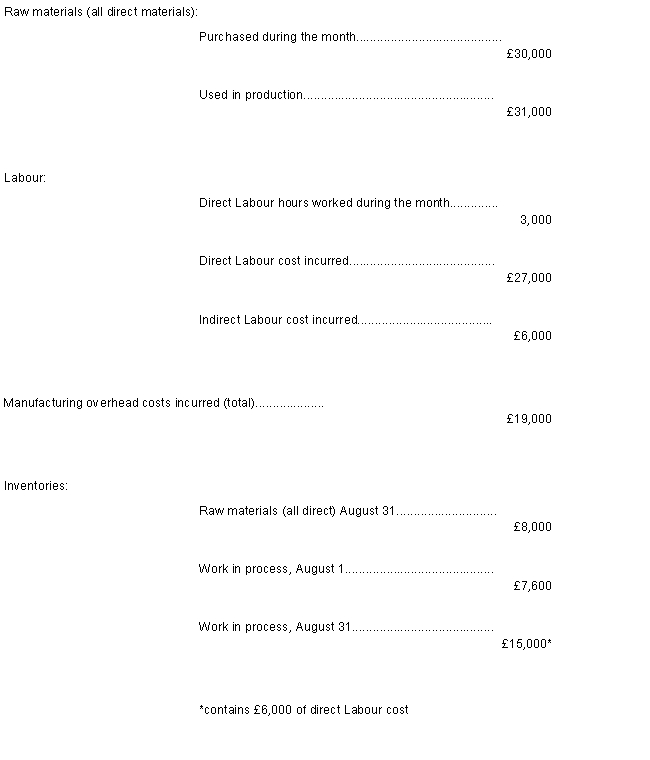

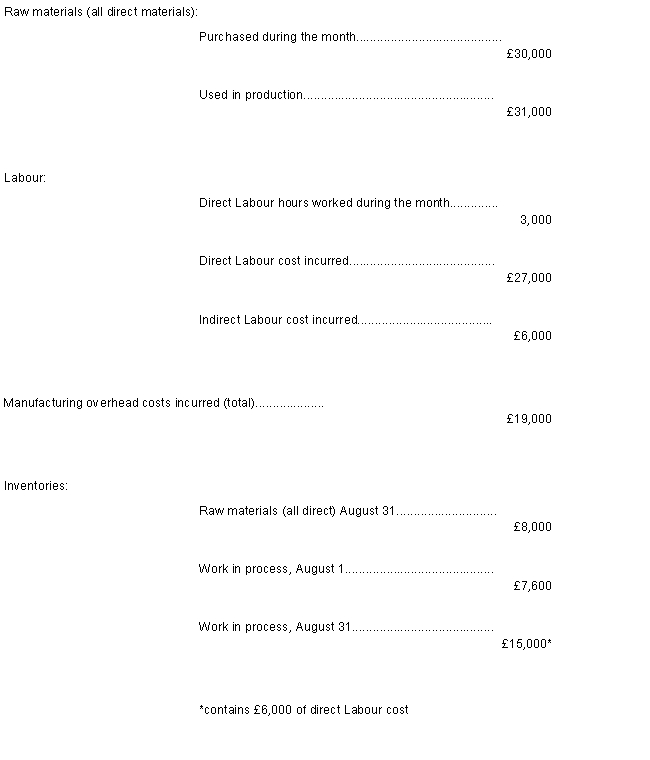

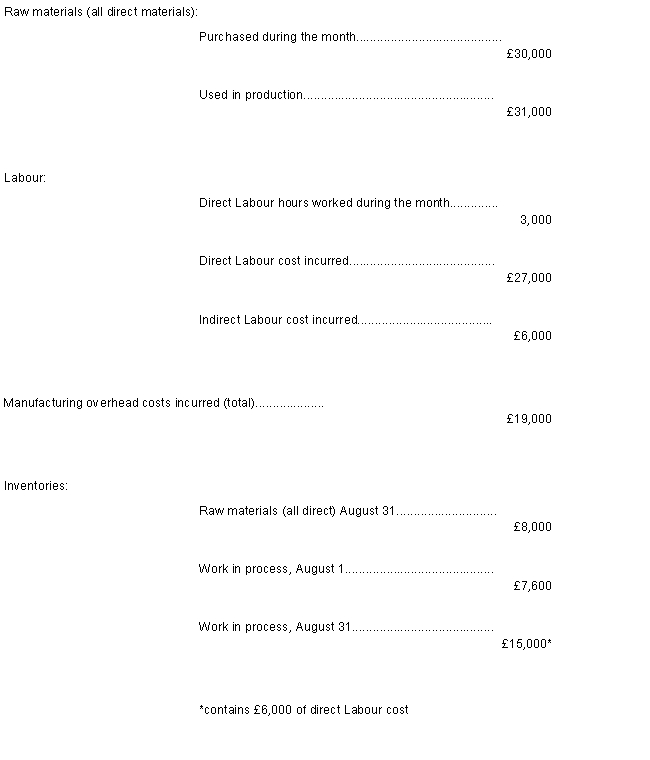

Loraine Company applies manufacturing overhead to jobs using a predetermined overhead rate of 70% of direct Labour cost. Any under- or overapplied overhead cost is closed to Cost of Goods Sold at the end of the month. During August, the following transactions were recorded by the company:

-The balance on August 1 in the Raw Materials Stock account was:

A)£4,500.

B)£7,000.

C)£9,000.

D)£11,500.

-The balance on August 1 in the Raw Materials Stock account was:

A)£4,500.

B)£7,000.

C)£9,000.

D)£11,500.

£9,000.

2

Newcastle Company's beginning and ending inventories for the month of January were as follows:

Production data for month follow:

Newcastle applies manufacturing overhead cost to jobs at the rate of 75% of direct labour cost incurred. This rate has been used for many years. The company does not close under- or overapplied manufacturing overhead to Cost of Goods Sold until the end of the year.

-

The management accountant wants to apply manufacturing overhead at a rate of 75% of direct labour. The managing director wants to know how this change will affect reported profit. (Assuming Newcastle applies manufacturing overhead cost to jobs at the rate of 70% of direct labour cost incurred). Newcastle Company's manufacturing overhead for January was:

A)overapplied by £5,500.

B)underapplied by £5,500.

C)overapplied by £12,000.

D)underapplied by £12,000.

Production data for month follow:

Newcastle applies manufacturing overhead cost to jobs at the rate of 75% of direct labour cost incurred. This rate has been used for many years. The company does not close under- or overapplied manufacturing overhead to Cost of Goods Sold until the end of the year.

-

The management accountant wants to apply manufacturing overhead at a rate of 75% of direct labour. The managing director wants to know how this change will affect reported profit. (Assuming Newcastle applies manufacturing overhead cost to jobs at the rate of 70% of direct labour cost incurred). Newcastle Company's manufacturing overhead for January was:

A)overapplied by £5,500.

B)underapplied by £5,500.

C)overapplied by £12,000.

D)underapplied by £12,000.

overapplied by £5,500.

3

Entry Effect on Cost ofGoods Sold

a.

b.

c.

d.

The operations of the Kerry Company resulted in underapplied overhead of £5,000. The entry to close out this balance to Cost of Goods Sold and the effect of the underapplied overhead on Cost of Goods Sold would be:

A)Option A

B)Option B

C)Option C

D)Option D

a.

b.

c.

d.

The operations of the Kerry Company resulted in underapplied overhead of £5,000. The entry to close out this balance to Cost of Goods Sold and the effect of the underapplied overhead on Cost of Goods Sold would be:

A)Option A

B)Option B

C)Option C

D)Option D

Option C

4

Newcastle Company's beginning and ending inventories for the month of January were as follows:

Production data for month follow:

Newcastle applies manufacturing overhead cost to jobs at the rate of 75% of direct labour cost incurred. This rate has been used for many years. The company does not close under- or overapplied manufacturing overhead to Cost of Goods Sold until the end of the year.

-

The management accountant wants to apply manufacturing overhead at a rate of 75% of direct labour. The managing director wants to know how this change will affect reported profit. (Assuming Newcastle applies manufacturing overhead cost to jobs at the rate of 75% of direct labour cost incurred). Newcastle Company's cost of goods manufactured for January was:

A)£499,000.

B)£497,000.

C)£490,250.

D)£527,250.

Production data for month follow:

Newcastle applies manufacturing overhead cost to jobs at the rate of 75% of direct labour cost incurred. This rate has been used for many years. The company does not close under- or overapplied manufacturing overhead to Cost of Goods Sold until the end of the year.

-

The management accountant wants to apply manufacturing overhead at a rate of 75% of direct labour. The managing director wants to know how this change will affect reported profit. (Assuming Newcastle applies manufacturing overhead cost to jobs at the rate of 75% of direct labour cost incurred). Newcastle Company's cost of goods manufactured for January was:

A)£499,000.

B)£497,000.

C)£490,250.

D)£527,250.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

5

Steele Company uses a predetermined overhead rate based on machine hours to apply manufacturing overhead to jobs. Steele Company has provided the following estimated costs for next year.

Steele estimates that 10,000 direct Labour hours and 16,000 machine hours will be worked during the year. The predetermined overhead rate per hour will be:

A)£4.25.

B)£8.00.

C)£9.00.

D)£10.25.

Steele estimates that 10,000 direct Labour hours and 16,000 machine hours will be worked during the year. The predetermined overhead rate per hour will be:

A)£4.25.

B)£8.00.

C)£9.00.

D)£10.25.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

6

Which of the following would probably be the least appropriate allocation base for allocating overhead in a highly automated manufacturer of specialty valves?

A)Machine-hours

B)Power consumption

C)Direct Labour-hours

D)Machine setups

A)Machine-hours

B)Power consumption

C)Direct Labour-hours

D)Machine setups

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

7

Karvel Corporation uses a predetermined overhead rate based on machine-hours to apply manufacturing overhead to jobs. For the month of August, Karvel estimated total manufacturing overhead costs at £300,000 and total machine-hours at 75,000 hours. Actual results for the period were manufacturing overhead costs of £290,000 and 75,000 machine-hours. As a result, Karvel would have

A)applied more overhead to Work in Process than the actual amount of overhead cost for the year.

B)applied less overhead to Work in Process than the actual amount of overhead cost for the year.

C)applied an amount of overhead to Work in Process that was equal to the actual amount of overhead.

D)found it necessary to recalculate the predetermined overhead rate.

A)applied more overhead to Work in Process than the actual amount of overhead cost for the year.

B)applied less overhead to Work in Process than the actual amount of overhead cost for the year.

C)applied an amount of overhead to Work in Process that was equal to the actual amount of overhead.

D)found it necessary to recalculate the predetermined overhead rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

8

Advertising costs should be charged to the Manufacturing Overhead account

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

9

Newcastle Company's beginning and ending inventories for the month of January were as follows:

Production data for month follow:

Newcastle applies manufacturing overhead cost to jobs at the rate of 75% of direct labour cost incurred. This rate has been used for many years. The company does not close under- or overapplied manufacturing overhead to Cost of Goods Sold until the end of the year.

-The management accountant wants to apply manufacturing overhead at a rate of 75% of direct labour. The managing director wants to know how this change will affect reported profit. (Assuming Newcastle applies manufacturing overhead cost to jobs at the rate of 70% of direct labour cost incurred). Newcastle Company's cost of goods manufactured for January was:

A)£499,000.

B)£497,000.

C)£490,000.

D)£516,500.

Production data for month follow:

Newcastle applies manufacturing overhead cost to jobs at the rate of 75% of direct labour cost incurred. This rate has been used for many years. The company does not close under- or overapplied manufacturing overhead to Cost of Goods Sold until the end of the year.

-The management accountant wants to apply manufacturing overhead at a rate of 75% of direct labour. The managing director wants to know how this change will affect reported profit. (Assuming Newcastle applies manufacturing overhead cost to jobs at the rate of 70% of direct labour cost incurred). Newcastle Company's cost of goods manufactured for January was:

A)£499,000.

B)£497,000.

C)£490,000.

D)£516,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

10

Newcastle Company's beginning and ending inventories for the month of January were as follows:

Production data for month follow:

Newcastle applies manufacturing overhead cost to jobs at the rate of 75% of direct labour cost incurred. This rate has been used for many years. The company does not close under- or overapplied manufacturing overhead to Cost of Goods Sold until the end of the year.

-The management accountant wants to apply manufacturing overhead at a rate of 75% of direct labour. The managing director wants to know how this change will affect reported profit. (Assuming Newcastle applies manufacturing overhead cost to jobs at the rate of 70% of direct labour cost incurred). Newcastle Company's total manufacturing cost for January was:

A)£522,000.

B)£527,500.

C)£463,000.

D)£465,000.

Production data for month follow:

Newcastle applies manufacturing overhead cost to jobs at the rate of 75% of direct labour cost incurred. This rate has been used for many years. The company does not close under- or overapplied manufacturing overhead to Cost of Goods Sold until the end of the year.

-The management accountant wants to apply manufacturing overhead at a rate of 75% of direct labour. The managing director wants to know how this change will affect reported profit. (Assuming Newcastle applies manufacturing overhead cost to jobs at the rate of 70% of direct labour cost incurred). Newcastle Company's total manufacturing cost for January was:

A)£522,000.

B)£527,500.

C)£463,000.

D)£465,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

11

Newcastle Company's beginning and ending inventories for the month of January were as follows:

Production data for month follow:

Newcastle applies manufacturing overhead cost to jobs at the rate of 75% of direct labour cost incurred. This rate has been used for many years. The company does not close under- or overapplied manufacturing overhead to Cost of Goods Sold until the end of the year.

-The management accountant wants to apply manufacturing overhead at a rate of 75% of direct labour. The managing director wants to know how this change will affect reported profit. (Assuming Newcastle applies manufacturing overhead cost to jobs at the rate of 75% of direct labour cost incurred). Newcastle Company's total manufacturing cost for January was:

A)£522,250.

B)£538,250.

C)£463,000.

D)£465,250.

Production data for month follow:

Newcastle applies manufacturing overhead cost to jobs at the rate of 75% of direct labour cost incurred. This rate has been used for many years. The company does not close under- or overapplied manufacturing overhead to Cost of Goods Sold until the end of the year.

-The management accountant wants to apply manufacturing overhead at a rate of 75% of direct labour. The managing director wants to know how this change will affect reported profit. (Assuming Newcastle applies manufacturing overhead cost to jobs at the rate of 75% of direct labour cost incurred). Newcastle Company's total manufacturing cost for January was:

A)£522,250.

B)£538,250.

C)£463,000.

D)£465,250.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

12

Loraine Company applies manufacturing overhead to jobs using a predetermined overhead rate of 70% of direct Labour cost. Any under- or overapplied overhead cost is closed to Cost of Goods Sold at the end of the month. During August, the following transactions were recorded by the company:

-The amount of direct materials cost in the August 31 Work in Process Stock account was:

A)£10,200.

B)£9,000.

C)£4,800.

D)£4,200.

-The amount of direct materials cost in the August 31 Work in Process Stock account was:

A)£10,200.

B)£9,000.

C)£4,800.

D)£4,200.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

13

Loraine Company applies manufacturing overhead to jobs using a predetermined overhead rate of 70% of direct Labour cost. Any under- or overapplied overhead cost is closed to Cost of Goods Sold at the end of the month. During August, the following transactions were recorded by the company:

-The Cost of Goods Manufactured for August was:

A)£69,600.

B)£69,500.

C)£76,900.

D)£84,500.

-The Cost of Goods Manufactured for August was:

A)£69,600.

B)£69,500.

C)£76,900.

D)£84,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

14

Newcastle Company's beginning and ending inventories for the month of January were as follows:

Production data for month follow:

Newcastle applies manufacturing overhead cost to jobs at the rate of 75% of direct labour cost incurred. This rate has been used for many years. The company does not close under- or overapplied manufacturing overhead to Cost of Goods Sold until the end of the year.

-The management accountant wants to apply manufacturing overhead at a rate of 75% of direct labour. The managing director wants to know how this change will affect reported profit.

(Assuming Newcastle applies manufacturing overhead cost to jobs at the rate of 75% of direct labour cost incurred). Newcastle Company's manufacturing overhead for January was:

A)overapplied by £16,250.

B)underapplied by £16,250.

C)overapplied by £12,000.

D)underapplied by £12,000.

Production data for month follow:

Newcastle applies manufacturing overhead cost to jobs at the rate of 75% of direct labour cost incurred. This rate has been used for many years. The company does not close under- or overapplied manufacturing overhead to Cost of Goods Sold until the end of the year.

-The management accountant wants to apply manufacturing overhead at a rate of 75% of direct labour. The managing director wants to know how this change will affect reported profit.

(Assuming Newcastle applies manufacturing overhead cost to jobs at the rate of 75% of direct labour cost incurred). Newcastle Company's manufacturing overhead for January was:

A)overapplied by £16,250.

B)underapplied by £16,250.

C)overapplied by £12,000.

D)underapplied by £12,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

15

Newcastle Company's beginning and ending inventories for the month of January were as follows:

Production data for month follow:

Newcastle applies manufacturing overhead cost to jobs at the rate of 75% of direct labour cost incurred. This rate has been used for many years. The company does not close under- or overapplied manufacturing overhead to Cost of Goods Sold until the end of the year.

-

The management accountant wants to apply manufacturing overhead at a rate of 75% of direct labour. The managing director wants to know how this change will affect reported profit. (Assuming Newcastle applies manufacturing overhead cost to jobs at the rate of 70% of direct labour cost incurred). Newcastle Company's Cost of Goods Sold for January was:

A)£512,000.

B)£518,500.

C)£522,000.

D)£496,000.

Production data for month follow:

Newcastle applies manufacturing overhead cost to jobs at the rate of 75% of direct labour cost incurred. This rate has been used for many years. The company does not close under- or overapplied manufacturing overhead to Cost of Goods Sold until the end of the year.

-

The management accountant wants to apply manufacturing overhead at a rate of 75% of direct labour. The managing director wants to know how this change will affect reported profit. (Assuming Newcastle applies manufacturing overhead cost to jobs at the rate of 70% of direct labour cost incurred). Newcastle Company's Cost of Goods Sold for January was:

A)£512,000.

B)£518,500.

C)£522,000.

D)£496,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

16

Newcastle Company's beginning and ending inventories for the month of January were as follows:

Production data for month follow:

Newcastle applies manufacturing overhead cost to jobs at the rate of 75% of direct labour cost incurred. This rate has been used for many years. The company does not close under- or overapplied manufacturing overhead to Cost of Goods Sold until the end of the year.

-The management accountant wants to apply manufacturing overhead at a rate of 75% of direct labour. The managing director wants to know how this change will affect reported profit. (Assuming Newcastle applies manufacturing overhead cost to jobs at the rate of 75% of direct labour cost incurred). Newcastle Company's Cost of Goods Sold for January was:

A)£512,000.

B)£529,250.

C)£522,000.

D)£496,000.

Production data for month follow:

Newcastle applies manufacturing overhead cost to jobs at the rate of 75% of direct labour cost incurred. This rate has been used for many years. The company does not close under- or overapplied manufacturing overhead to Cost of Goods Sold until the end of the year.

-The management accountant wants to apply manufacturing overhead at a rate of 75% of direct labour. The managing director wants to know how this change will affect reported profit. (Assuming Newcastle applies manufacturing overhead cost to jobs at the rate of 75% of direct labour cost incurred). Newcastle Company's Cost of Goods Sold for January was:

A)£512,000.

B)£529,250.

C)£522,000.

D)£496,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

17

The Bristol Company uses a job-order cost system. The following data were recorded for June:

Overhead is charged to production at 80% of direct materials cost. Jobs 235, 237, and 238 were completed during June and transferred to finished goods. Jobs 235 and 238 have been delivered to customers. Bristol's Work in Process Stock balance on June 30 was:

A)£4,100.

B)£3,940.

C)£3,300.

D)£9,450.

Overhead is charged to production at 80% of direct materials cost. Jobs 235, 237, and 238 were completed during June and transferred to finished goods. Jobs 235 and 238 have been delivered to customers. Bristol's Work in Process Stock balance on June 30 was:

A)£4,100.

B)£3,940.

C)£3,300.

D)£9,450.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

18

The Work in Process Stock account of a manufacturing firm shows a balance of £3,000 at the end of an accounting period. The job cost sheets of two uncompleted jobs show charges of £500 and £300 for materials, and charges of £400 and £600 for direct Labour. From this information, it appears that the company is using a predetermined overhead rate, as a percentage of direct Labour costs, of

A)83%

B)120%

C)40%

D)300%

A)83%

B)120%

C)40%

D)300%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

19

Paulson Company uses a predetermined overhead rate based on machine hours to apply manufacturing overhead to jobs. The company has provided the following estimated costs for next year:

Paulson estimated that 40,000 direct Labour hours and 20,000 machine hours would be worked during the year.

The predetermined overhead rate per machine hour will be:

A)£1.60.

B)£2.10.

C)£1.00.

D)£1.05.

Paulson estimated that 40,000 direct Labour hours and 20,000 machine hours would be worked during the year.

The predetermined overhead rate per machine hour will be:

A)£1.60.

B)£2.10.

C)£1.00.

D)£1.05.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

20

Loraine Company applies manufacturing overhead to jobs using a predetermined overhead rate of 70% of direct Labour cost. Any under- or overapplied overhead cost is closed to Cost of Goods Sold at the end of the month. During August, the following transactions were recorded by the company:

-The entry to dispose of the under- or overapplied overhead cost for the month would include:

A)a credit of £100 to Cost of Goods Sold.

B)a credit of £6,000 to Manufacturing Overhead.

C)a debit of £6,000 to Cost of Goods Sold.

D)A credit of £100 to the Manufacturing Overhead Account.

-The entry to dispose of the under- or overapplied overhead cost for the month would include:

A)a credit of £100 to Cost of Goods Sold.

B)a credit of £6,000 to Manufacturing Overhead.

C)a debit of £6,000 to Cost of Goods Sold.

D)A credit of £100 to the Manufacturing Overhead Account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

21

Job-order costing is used in those situations where units of a product are homogeneous, such as in the manufacture of sugar.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

22

Period costs are expensed as incurred, rather than going into the Work in Process account

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

23

The Bristol Company uses a job-order cost system. The following data were recorded for June:

In the previous question overhead is charged to production at 80% of direct materials cost. Jobs 235, 237, and 238 were completed during June and transferred to finished goods. Jobs 235 and 238 have been delivered to customers.

Assume that the company wants to recalculate the overhead rate and now wants to charge overhead to production at 75% of direct material cost. Bristol's Work in Process Stock balance on June 30 would change to:

A)£4,100.

B)£3,900.

C)£3,300.

D)£9,450.

In the previous question overhead is charged to production at 80% of direct materials cost. Jobs 235, 237, and 238 were completed during June and transferred to finished goods. Jobs 235 and 238 have been delivered to customers.

Assume that the company wants to recalculate the overhead rate and now wants to charge overhead to production at 75% of direct material cost. Bristol's Work in Process Stock balance on June 30 would change to:

A)£4,100.

B)£3,900.

C)£3,300.

D)£9,450.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

24

Galbraith Company applies overhead cost to jobs on the basis of 70% of direct Labour cost. If Job 201 shows £28,000 of manufacturing overhead applied, the direct Labour cost on the job was

A)£40,000.

B)£19,600.

C)£28,000.

D)£36,400.

A)£40,000.

B)£19,600.

C)£28,000.

D)£36,400.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

25

In a job order cost system, the use of indirect materials previously purchased is recorded as a decrease in

A)Raw Materials Stock.

B)Work in Process Stock.

C)Manufacturing Overhead.

D)Finished Goods Stock.

A)Raw Materials Stock.

B)Work in Process Stock.

C)Manufacturing Overhead.

D)Finished Goods Stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

26

The three cost categories appearing on a job cost sheet are: selling expense, manufacturing expense, and administrative expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

27

There are two acceptable methods for closing out any balance of under- or overapplied overhead. One method involves allocation, whereas the other closes any balance directly to

A)Finished Goods Stock.

B)Cost of Goods Sold.

C)Cost of Goods Manufactured.

D)Work in Process Stock.

A)Finished Goods Stock.

B)Cost of Goods Sold.

C)Cost of Goods Manufactured.

D)Work in Process Stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

28

Birk applies overhead to jobs at a predetermined rate of 80% of direct Labour cost. Job No. 5, the only job still in process on April 30, has been charged with direct Labour of £2,000. What was the amount of direct materials charged to Job No. 5

A)£3,000

B)£5,200

C)£8,800

D)£24,000

A)£3,000

B)£5,200

C)£8,800

D)£24,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

29

Snappy Company has a job-order cost system and uses a predetermined overhead rate based on direct Labour-hours to apply manufacturing overhead to jobs. Manufacturing overhead cost and direct Labour-hours were estimated at £100,000 and 40,000 hours, respectively, for the year. In July, Job #334 was completed at a cost of £5,000 in direct materials and £2,400 in direct Labour. The Labour rate is £6 per hour. By the end of the year, Snappy had worked a total of 45,000 direct Labour-hours and had incurred £110,250 actual manufacturing overhead cost.

-Snappy's manufacturing overhead for the year was:

A)£10,250 underapplied.

B)£12,500 overapplied.

C)£12,500 underapplied.

D)£2,250 overapplieD.

-Snappy's manufacturing overhead for the year was:

A)£10,250 underapplied.

B)£12,500 overapplied.

C)£12,500 underapplied.

D)£2,250 overapplieD.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

30

Snappy Company has a job-order cost system and uses a predetermined overhead rate based on direct Labour-hours to apply manufacturing overhead to jobs. Manufacturing overhead cost and direct Labour-hours were estimated at £100,000 and 40,000 hours, respectively, for the year. In July, Job #334 was completed at a cost of £5,000 in direct materials and £2,400 in direct Labour. The Labour rate is £6 per hour. By the end of the year, Snappy had worked a total of 45,000 direct Labour-hours and had incurred £110,250 actual manufacturing overhead cost.

-

If Job #334 contained 200 units, the unit cost on the completed job cost sheet would be:

A)£37.00.

B)£42.00.

C)£41.90.

D)£39.50.

-

If Job #334 contained 200 units, the unit cost on the completed job cost sheet would be:

A)£37.00.

B)£42.00.

C)£41.90.

D)£39.50.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

31

Precision Company data:

Precision Company used a predetermined overhead rate last year of £3 per direct Labour hour, based on an estimate of 24,000 direct Labour hours to be worked during the year.

The under- or overapplied overhead for the year was:

A)£3,000 underapplied.

B)£3,000 overapplied.

C)£12,000 underapplied.

D)£12,000 overapplieD.

Precision Company used a predetermined overhead rate last year of £3 per direct Labour hour, based on an estimate of 24,000 direct Labour hours to be worked during the year.

The under- or overapplied overhead for the year was:

A)£3,000 underapplied.

B)£3,000 overapplied.

C)£12,000 underapplied.

D)£12,000 overapplieD.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

32

Jameson Company uses a predetermined overhead rate based on direct Labour hours to apply manufacturing overhead to jobs. The company has provided the following estimated costs for the next year:

Jameson estimates that 24,000 direct Labour hours will be worked during the year. The predetermined overhead rate per hour will be:

A)£2.00

B)£2.79

C)£3.00

D)£4.00

Jameson estimates that 24,000 direct Labour hours will be worked during the year. The predetermined overhead rate per hour will be:

A)£2.00

B)£2.79

C)£3.00

D)£4.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

33

A proper journal entry to record issuing raw materials to be used on a job would be:

a.

b.

c.

d.

A)Option A

B)Option B

C)Option C

D)Option D

a.

b.

c.

d.

A)Option A

B)Option B

C)Option C

D)Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

34

Parsons Co. uses a predetermined overhead rate based on direct Labour hours to apply manufacturing overhead to jobs. Last year Parsons incurred £250,000 in actual manufacturing overhead cost. The Manufacturing Overhead account showed that overhead was overapplied in the amount of £12,000 for the year. If the predetermined overhead rate was £8.00 per direct Labour hour, how many hours were worked during the year

A)31,250 hours

B)30,250 hours

C)32,750 hours

D)29,750 hours

A)31,250 hours

B)30,250 hours

C)32,750 hours

D)29,750 hours

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

35

Axe applies overhead to jobs at a predetermined rate of 80% of direct Labour cost. Job No. 9, the only job still in process at the end of March, has been charged with direct Labour of £1,000. The amount of direct materials charged to Job No. 9 was

A)£12,000.

B)£ 4,400.

C)£ 2,600.

D)£ 1,500.

A)£12,000.

B)£ 4,400.

C)£ 2,600.

D)£ 1,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

36

During the month of March, Nale Co. used £300,000 of direct materials. At March 31, Nale's direct materials Stock was £50,000 more than it was at March 1. Direct material purchases during the month of March amounted to

A)£0.

B)£250,000.

C)£300,000.

D)£350,000.

A)£0.

B)£250,000.

C)£300,000.

D)£350,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

37

Top-management salaries should not go into the Manufacturing Overhead account

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

38

The manufacturing operation that would be most likely to use a job-order costing system is

A)toy manufacturing.

B)candy manufacturing.

C)crude oil refining.

D)shipbuilding.

A)toy manufacturing.

B)candy manufacturing.

C)crude oil refining.

D)shipbuilding.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

39

The Bristol Company uses a job-order cost system. The following data were recorded for June:

In the previous question overhead is charged to production at 80% of direct materials cost. Jobs 235, 237, and 238 were completed during June and transferred to finished goods. Jobs 235 and 238 have been delivered to customers.

Assume that the company wants to recalculate the overhead rate and now wants to charge overhead to production at 75% of direct material cost. Bristol Company's cost of goods sold for June would change to:

A)£15,520.

B)£10,170.

C)£ 9,625.

D)£14,640.

In the previous question overhead is charged to production at 80% of direct materials cost. Jobs 235, 237, and 238 were completed during June and transferred to finished goods. Jobs 235 and 238 have been delivered to customers.

Assume that the company wants to recalculate the overhead rate and now wants to charge overhead to production at 75% of direct material cost. Bristol Company's cost of goods sold for June would change to:

A)£15,520.

B)£10,170.

C)£ 9,625.

D)£14,640.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

40

The process of assigning overhead cost to jobs is known as overhead application

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

41

Compute the amount of direct materials used during August if £25,000 of raw materials were purchased during the month and the inventories were as follows:

A)£16,000

B)£19,000

C)£23,000

D)£27,000

A)£16,000

B)£19,000

C)£23,000

D)£27,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

42

An averaging process is used to compute unit product costs under which of the following costing method(s)

A)neither job-order nor process.

B)process but not job-order.

C)job-order but not process.

D)both job-order and process.

A)neither job-order nor process.

B)process but not job-order.

C)job-order but not process.

D)both job-order and process.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

43

Pinnini Co. uses a predetermined overhead rate based on direct Labour hours to apply manufacturing overhead to jobs. Last year, Pinnini Company incurred £225,000 in actual manufacturing overhead cost. The Manufacturing Overhead account showed that overhead was overapplied £14,500 for the year. If the predetermined overhead rate was £5.00 per direct Labour hour, how many hours did the company work during the year

A)45,000 hours

B)47,900 hours

C)42,100 hours

D)44,000 hours

A)45,000 hours

B)47,900 hours

C)42,100 hours

D)44,000 hours

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

44

Both job order and process costing systems use averaging to compute unit product costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

45

The use of predetermined overhead rates in a job order cost system makes it possible to estimate the total cost of a given job as soon as production is completed

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

46

The balance in the Work in Process account equals

A)the balance in the Finished Goods Stock account.

B)the balance in the Cost of Goods Sold account.

C)the balances on the job cost sheets of uncompleted jobs.

D)the balance in the Manufacturing Overhead account.

A)the balance in the Finished Goods Stock account.

B)the balance in the Cost of Goods Sold account.

C)the balances on the job cost sheets of uncompleted jobs.

D)the balance in the Manufacturing Overhead account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

47

The sum of all amounts transferred from the Work in Process account and into the Finished Goods account represents the Cost of Goods Manufactured for the period

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

48

Under- or overapplied overhead represents the difference between actual overhead costs and applied overhead costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

49

Nil Co. uses a predetermined overhead rate based on direct Labour cost to apply manufacturing overhead to jobs. For the year ended December 31, Nil's estimated manufacturing overhead was £600,000, based on an estimated volume of 50,000 direct Labour hours, at a direct Labour rate of £6.00 per hour. Actual manufacturing overhead amounted to £620,000, with actual direct Labour cost of £325,000. For the year, manufacturing overhead was

A)overapplied by £20,000.

B)underapplied by £22,000.

C)overapplied by £30,000.

D)underapplied by £30,000.

A)overapplied by £20,000.

B)underapplied by £22,000.

C)overapplied by £30,000.

D)underapplied by £30,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

50

The following journal entry would be made to apply overhead cost to jobs in a job-order costing system:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

51

Johansen Company uses a predetermined overhead rate based on direct Labour hours to apply manufacturing overhead to jobs. The company has provided the following estimated costs for the next year:

Johansen estimates that 20,000 direct Labour hours will be worked during the year. The predetermined overhead rate per hour will be:

A)£2.50.

B)£3.50.

C)£3.75.

D)£5.05.

Johansen estimates that 20,000 direct Labour hours will be worked during the year. The predetermined overhead rate per hour will be:

A)£2.50.

B)£3.50.

C)£3.75.

D)£5.05.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

52

In a job order cost system using predetermined manufacturing overhead rates, indirect materials issued into production usually are recorded as an increase in

A)Work in Process Stock.

B)Finished Goods Stock.

C)Raw Materials Stock.

D)Manufacturing OverheaD.

A)Work in Process Stock.

B)Finished Goods Stock.

C)Raw Materials Stock.

D)Manufacturing OverheaD.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

53

The cost of a completed job in a job-order costing system typically consists of the actual materials cost of the job, the actual Labour cost of the job, and the actual amount of manufacturing overhead cost of the job

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

54

Malcolm Company uses a predetermined overhead rate based on direct Labour hours to apply manufacturing overhead to jobs

The cost records for September will show:

On September 1, the estimates for the month were:

During September, the actual results were:

A)Overapplied overhead of £1,500.

B)Underapplied overhead of £1,500.

C)Overapplied overhead of £3,500.

D)Underapplied overhead of £3,500.

The cost records for September will show:

On September 1, the estimates for the month were:

During September, the actual results were:

A)Overapplied overhead of £1,500.

B)Underapplied overhead of £1,500.

C)Overapplied overhead of £3,500.

D)Underapplied overhead of £3,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

55

Kelson Company applies overhead to jobs on the basis of 60% of direct Labour cost. If Job 201 shows £27,000 of manufacturing overhead applied, the direct Labour cost on the job was

A)£16,200.

B)£27,000.

C)£37,800.

D)£45,000.

A)£16,200.

B)£27,000.

C)£37,800.

D)£45,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

56

In a job-order cost system, the application of manufacturing overhead usually would be recorded as a debit to

A)Cost of Goods Sold.

B)Work in Process Stock.

C)Manufacturing Overhead.

D)Finished Goods Stock.

A)Cost of Goods Sold.

B)Work in Process Stock.

C)Manufacturing Overhead.

D)Finished Goods Stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

57

In computing its predetermined overhead rate, Brady Company included its factory insurance cost twice. This error will result in

A)the ending balance of Finished Goods to be understated.

B)the credits to the Manufacturing Overhead account to be understated.

C)the Cost of Goods Manufactured to be overstated.

D)the Net Operating Income to be overstateD.

A)the ending balance of Finished Goods to be understated.

B)the credits to the Manufacturing Overhead account to be understated.

C)the Cost of Goods Manufactured to be overstated.

D)the Net Operating Income to be overstateD.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

58

Under a job-order cost system the Work in Process account is debited with the cost of materials purchased

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

59

Which of the following entries or sets of entries would record sales for the month of July of goods costing £119,000 for £200,000:

A.

b.

c.

d.

A)Option A

B)Option B

C)Option C

D)Option D

A.

b.

c.

d.

A)Option A

B)Option B

C)Option C

D)Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

60

The entire difference between the actual manufacturing overhead cost for a period and the applied manufacturing overhead cost is typically closed to the Work in Process account

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

61

Using the various documents used, outline how a job costing system works.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

62

Explain why sales can be a dangerous basis for allocating service department costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

63

Allocate the overheads from the two service dept to the others using the direct method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

64

The Donaldson Company uses a job-order cost system. The following data were recorded for July:

Overhead is applied to jobs at the rate of 80 percent of direct materials cost. Jobs 475, 477, and 478 were completed during July and transferred to finished goods. Jobs 475 and 478 have been delivered to the customer. Donaldson's Work in Process Stock balance on July 31 was:

A)£7,280.

B)£2,600.

C)£3,160.

D)£3,320.

Overhead is applied to jobs at the rate of 80 percent of direct materials cost. Jobs 475, 477, and 478 were completed during July and transferred to finished goods. Jobs 475 and 478 have been delivered to the customer. Donaldson's Work in Process Stock balance on July 31 was:

A)£7,280.

B)£2,600.

C)£3,160.

D)£3,320.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

65

Compare and Contrast the costing systems for Job Order and Product Process. Are they basically the same or different?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

66

Apportion the overheads from the two service dept to the others using the step method and the appropriate bases. Do the canteen first.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

67

The Collins Company uses predetermined overhead rates to apply manufacturing overhead to jobs. The predetermined overhead rate is based on Labour cost in Dept. A and on machine hours in Dept.B. At the beginning of the year, the company made the following estimates:

What predetermined overhead rates would be used in Dept A and Dept B, respectively?

A)71% and £4.00

B)140% and £4.00

C)140% and £4.80

D)71% and £4.80

What predetermined overhead rates would be used in Dept A and Dept B, respectively?

A)71% and £4.00

B)140% and £4.00

C)140% and £4.80

D)71% and £4.80

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

68

Now make the alternate assumption that the SP above for both firms is made using a mark up of 20%. What are the implications for both firms? You should look at all the possible scenarios.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck