Deck 2: Cost Concepts, Behaviour and Estimation

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/71

العب

ملء الشاشة (f)

Deck 2: Cost Concepts, Behaviour and Estimation

1

Noel Stewart bought a machine two years ago for £500. He must now replace the old machine by buying a new model 206 for £700 or a used model 204 for £650. Noel has decided to buy model 204.

Noel Stewart has estimated that the total fixed costs for his department are £10,000. He also estimated that his variable cost per unit is £10.

Noel Stewart bought some materials 2 years ago for £300. These materials have simply been left in stock as they were not needed. A new customer offers to buy a product that uses these materials. The conversion cost is £500 and the customer has offered to pay £650 for the product. Noel decides to accept the order.

-

In this decision, Noel would consider the sunk cost to be

A)£50.

B)£650.

C)£700.

D)£500.

Noel Stewart has estimated that the total fixed costs for his department are £10,000. He also estimated that his variable cost per unit is £10.

Noel Stewart bought some materials 2 years ago for £300. These materials have simply been left in stock as they were not needed. A new customer offers to buy a product that uses these materials. The conversion cost is £500 and the customer has offered to pay £650 for the product. Noel decides to accept the order.

-

In this decision, Noel would consider the sunk cost to be

A)£50.

B)£650.

C)£700.

D)£500.

£500.

2

Noel Stewart bought a machine two years ago for £500. He must now replace the old machine by buying a new model 206 for £700 or a used model 204 for £650. Noel has decided to buy model 204.

Noel Stewart has estimated that the total fixed costs for his department are £10,000. He also estimated that his variable cost per unit is £10.

Noel Stewart bought some materials 2 years ago for £300. These materials have simply been left in stock as they were not needed. A new customer offers to buy a product that uses these materials. The conversion cost is £500 and the customer has offered to pay £650 for the product. Noel decides to accept the order.

-

If Noel produced 10,000 units his fixed cost per unit would be:

A)£1.

B)£100.

C)£1,000.

D)£0.

Noel Stewart has estimated that the total fixed costs for his department are £10,000. He also estimated that his variable cost per unit is £10.

Noel Stewart bought some materials 2 years ago for £300. These materials have simply been left in stock as they were not needed. A new customer offers to buy a product that uses these materials. The conversion cost is £500 and the customer has offered to pay £650 for the product. Noel decides to accept the order.

-

If Noel produced 10,000 units his fixed cost per unit would be:

A)£1.

B)£100.

C)£1,000.

D)£0.

£1.

3

Noel Stewart bought a machine two years ago for £500. He must now replace the old machine by buying a new model 206 for £700 or a used model 204 for £650. Noel has decided to buy model 204.

Noel Stewart has estimated that the total fixed costs for his department are £10,000. He also estimated that his variable cost per unit is £10.

Noel Stewart bought some materials 2 years ago for £300. These materials have simply been left in stock as they were not needed. A new customer offers to buy a product that uses these materials. The conversion cost is £500 and the customer has offered to pay £650 for the product. Noel decides to accept the order.

-If Noel produced only one unit his fixed cost per unit would be:

A)£10,000.

B)£100.

C)£1,000.

D)£0.

Noel Stewart has estimated that the total fixed costs for his department are £10,000. He also estimated that his variable cost per unit is £10.

Noel Stewart bought some materials 2 years ago for £300. These materials have simply been left in stock as they were not needed. A new customer offers to buy a product that uses these materials. The conversion cost is £500 and the customer has offered to pay £650 for the product. Noel decides to accept the order.

-If Noel produced only one unit his fixed cost per unit would be:

A)£10,000.

B)£100.

C)£1,000.

D)£0.

£10,000.

4

The cost of factory machinery purchased last year is

A)an opportunity cost.

B)a differential cost.

C)a direct materials cost.

D)a sunk cost.

A)an opportunity cost.

B)a differential cost.

C)a direct materials cost.

D)a sunk cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

5

A direct cost is a cost that can be easily traced to the particular cost object under consideration.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

6

Noel Stewart bought a machine two years ago for £500. He must now replace the old machine by buying a new model 206 for £700 or a used model 204 for £650. Noel has decided to buy model 204.

Noel Stewart has estimated that the total fixed costs for his department are £10,000. He also estimated that his variable cost per unit is £10.

Noel Stewart bought some materials 2 years ago for £300. These materials have simply been left in stock as they were not needed. A new customer offers to buy a product that uses these materials. The conversion cost is £500 and the customer has offered to pay £650 for the product. Noel decides to accept the order.

-

If Noel produced 1,000 units his total cost would be:

A)£20,000.

B)£21,000.

C)£12,100.

D)£11,000.

Noel Stewart has estimated that the total fixed costs for his department are £10,000. He also estimated that his variable cost per unit is £10.

Noel Stewart bought some materials 2 years ago for £300. These materials have simply been left in stock as they were not needed. A new customer offers to buy a product that uses these materials. The conversion cost is £500 and the customer has offered to pay £650 for the product. Noel decides to accept the order.

-

If Noel produced 1,000 units his total cost would be:

A)£20,000.

B)£21,000.

C)£12,100.

D)£11,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

7

At a sales volume of 40,000 units, Lonnie Company's total fixed costs are £40,000 and total variable costs are £60,000.

The relevant range is 30,000 to 50,000 units.

-If Lonnie were to sell 50,000 units, the total expected cost per unit would be:

A)£2.20.

B)£2.30.

C)£2.50.

D)£2.00.

The relevant range is 30,000 to 50,000 units.

-If Lonnie were to sell 50,000 units, the total expected cost per unit would be:

A)£2.20.

B)£2.30.

C)£2.50.

D)£2.00.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

8

Noel Stewart bought a machine two years ago for £500. He must now replace the old machine by buying a new model 206 for £700 or a used model 204 for £650. Noel has decided to buy model 204.

Noel Stewart has estimated that the total fixed costs for his department are £10,000. He also estimated that his variable cost per unit is £10.

Noel Stewart bought some materials 2 years ago for £300. These materials have simply been left in stock as they were not needed. A new customer offers to buy a product that uses these materials. The conversion cost is £500 and the customer has offered to pay £650 for the product. Noel decides to accept the order.

-

If Noel produced 100 units his fixed cost per unit would be:

A)£10,000.

B)£100.

C)£1,000.

D)£0.

Noel Stewart has estimated that the total fixed costs for his department are £10,000. He also estimated that his variable cost per unit is £10.

Noel Stewart bought some materials 2 years ago for £300. These materials have simply been left in stock as they were not needed. A new customer offers to buy a product that uses these materials. The conversion cost is £500 and the customer has offered to pay £650 for the product. Noel decides to accept the order.

-

If Noel produced 100 units his fixed cost per unit would be:

A)£10,000.

B)£100.

C)£1,000.

D)£0.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

9

Which of the following costs would be included both as part of prime cost and as part of conversion cost

A)Direct materials.

B)Direct labour.

C)Manufacturing overhead.

D)None of these.

A)Direct materials.

B)Direct labour.

C)Manufacturing overhead.

D)None of these.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

10

Noel Stewart bought a machine two years ago for £500. He must now replace the old machine by buying a new model 206 for £700 or a used model 204 for £650. Noel has decided to buy model 204.

Noel Stewart has estimated that the total fixed costs for his department are £10,000. He also estimated that his variable cost per unit is £10.

Noel Stewart bought some materials 2 years ago for £300. These materials have simply been left in stock as they were not needed. A new customer offers to buy a product that uses these materials. The conversion cost is £500 and the customer has offered to pay £650 for the product. Noel decides to accept the order.

In making his decision, Noel would consider the differential cost to be

A)£50.

B)£200.

C)£150.

D)£500

Noel Stewart has estimated that the total fixed costs for his department are £10,000. He also estimated that his variable cost per unit is £10.

Noel Stewart bought some materials 2 years ago for £300. These materials have simply been left in stock as they were not needed. A new customer offers to buy a product that uses these materials. The conversion cost is £500 and the customer has offered to pay £650 for the product. Noel decides to accept the order.

In making his decision, Noel would consider the differential cost to be

A)£50.

B)£200.

C)£150.

D)£500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

11

Noel Stewart bought a machine two years ago for £500. He must now replace the old machine by buying a new model 206 for £700 or a used model 204 for £650. Noel has decided to buy model 204.

Noel Stewart has estimated that the total fixed costs for his department are £10,000. He also estimated that his variable cost per unit is £10.

Noel Stewart bought some materials 2 years ago for £300. These materials have simply been left in stock as they were not needed. A new customer offers to buy a product that uses these materials. The conversion cost is £500 and the customer has offered to pay £650 for the product. Noel decides to accept the order.

-

If Noel produced 100 units his total cost would be:

A)£10,010.

B)£11,000.

C)£11,100.

D)£1,000.

Noel Stewart has estimated that the total fixed costs for his department are £10,000. He also estimated that his variable cost per unit is £10.

Noel Stewart bought some materials 2 years ago for £300. These materials have simply been left in stock as they were not needed. A new customer offers to buy a product that uses these materials. The conversion cost is £500 and the customer has offered to pay £650 for the product. Noel decides to accept the order.

-

If Noel produced 100 units his total cost would be:

A)£10,010.

B)£11,000.

C)£11,100.

D)£1,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

12

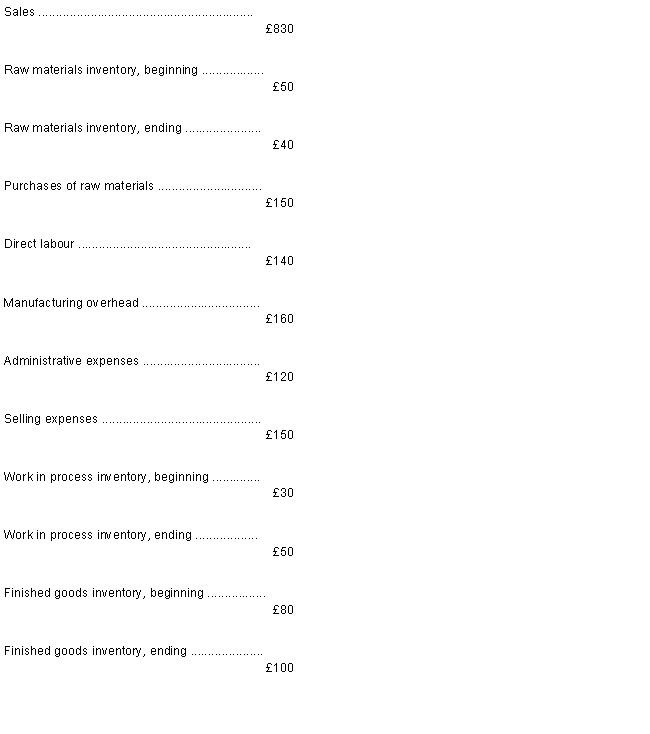

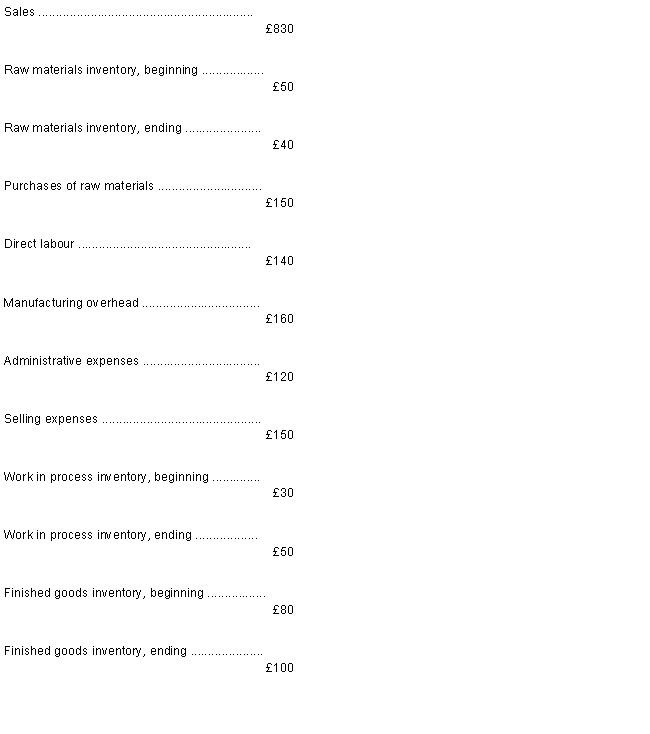

Morton Company's manufacturing costs last year were as follows:

Conversion cost was:

A)£400,000.

B)£480,000.

C)£530,000.

D)£830,000.

Conversion cost was:

A)£400,000.

B)£480,000.

C)£530,000.

D)£830,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

13

Noel Stewart bought a machine two years ago for £500. He must now replace the old machine by buying a new model 206 for £700 or a used model 204 for £650. Noel has decided to buy model 204.

Noel Stewart has estimated that the total fixed costs for his department are £10,000. He also estimated that his variable cost per unit is £10.

Noel Stewart bought some materials 2 years ago for £300. These materials have simply been left in stock as they were not needed. A new customer offers to buy a product that uses these materials. The conversion cost is £500 and the customer has offered to pay £650 for the product. Noel decides to accept the order.

-

In this decision the company is better off by:

A)£150.

B)£350.

C)£300.

D)£0.

Noel Stewart has estimated that the total fixed costs for his department are £10,000. He also estimated that his variable cost per unit is £10.

Noel Stewart bought some materials 2 years ago for £300. These materials have simply been left in stock as they were not needed. A new customer offers to buy a product that uses these materials. The conversion cost is £500 and the customer has offered to pay £650 for the product. Noel decides to accept the order.

-

In this decision the company is better off by:

A)£150.

B)£350.

C)£300.

D)£0.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

14

Noel Stewart bought a machine two years ago for £500. He must now replace the old machine by buying a new model 206 for £700 or a used model 204 for £650. Noel has decided to buy model 204.

Noel Stewart has estimated that the total fixed costs for his department are £10,000. He also estimated that his variable cost per unit is £10.

Noel Stewart bought some materials 2 years ago for £300. These materials have simply been left in stock as they were not needed. A new customer offers to buy a product that uses these materials. The conversion cost is £500 and the customer has offered to pay £650 for the product. Noel decides to accept the order.

-

In this decision, Noel would consider the relevant material cost to be:

A)£300.

B)£650.

C)£600.

D)£0.

Noel Stewart has estimated that the total fixed costs for his department are £10,000. He also estimated that his variable cost per unit is £10.

Noel Stewart bought some materials 2 years ago for £300. These materials have simply been left in stock as they were not needed. A new customer offers to buy a product that uses these materials. The conversion cost is £500 and the customer has offered to pay £650 for the product. Noel decides to accept the order.

-

In this decision, Noel would consider the relevant material cost to be:

A)£300.

B)£650.

C)£600.

D)£0.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

15

Noel Stewart bought a machine two years ago for £500. He must now replace the old machine by buying a new model 206 for £700 or a used model 204 for £650. Noel has decided to buy model 204.

Noel Stewart has estimated that the total fixed costs for his department are £10,000. He also estimated that his variable cost per unit is £10.

Noel Stewart bought some materials 2 years ago for £300. These materials have simply been left in stock as they were not needed. A new customer offers to buy a product that uses these materials. The conversion cost is £500 and the customer has offered to pay £650 for the product. Noel decides to accept the order.

-If Noel produced only one unit his total cost would be:

A)£10,010.

B)£10,000.

C)£10,100.

D)£10.

Noel Stewart has estimated that the total fixed costs for his department are £10,000. He also estimated that his variable cost per unit is £10.

Noel Stewart bought some materials 2 years ago for £300. These materials have simply been left in stock as they were not needed. A new customer offers to buy a product that uses these materials. The conversion cost is £500 and the customer has offered to pay £650 for the product. Noel decides to accept the order.

-If Noel produced only one unit his total cost would be:

A)£10,010.

B)£10,000.

C)£10,100.

D)£10.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

16

Noel Stewart bought a machine two years ago for £500. He must now replace the old machine by buying a new model 206 for £700 or a used model 204 for £650. Noel has decided to buy model 204.

Noel Stewart has estimated that the total fixed costs for his department are £10,000. He also estimated that his variable cost per unit is £10.

Noel Stewart bought some materials 2 years ago for £300. These materials have simply been left in stock as they were not needed. A new customer offers to buy a product that uses these materials. The conversion cost is £500 and the customer has offered to pay £650 for the product. Noel decides to accept the order.

-In this decision, Noel would consider the sunk cost to be:

A)£500.

B)£650.

C)£600.

D)£300.

Noel Stewart has estimated that the total fixed costs for his department are £10,000. He also estimated that his variable cost per unit is £10.

Noel Stewart bought some materials 2 years ago for £300. These materials have simply been left in stock as they were not needed. A new customer offers to buy a product that uses these materials. The conversion cost is £500 and the customer has offered to pay £650 for the product. Noel decides to accept the order.

-In this decision, Noel would consider the sunk cost to be:

A)£500.

B)£650.

C)£600.

D)£300.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

17

A department accepts a new order from a customer. It has already incurred £100 for design costs. It has also incurred costs of £200 for visits by sales staff. If the order is accepted a quality inspector will be transferred from another department. The inspector earns £20,000 per year. If the order is accepted there will be additional training costs of £700.

-

In this decision the differential costs for visits by staff are:

A)£0.

B)£100.

C)£200.

D)£300.

-

In this decision the differential costs for visits by staff are:

A)£0.

B)£100.

C)£200.

D)£300.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

18

At a sales volume of 40,000 units, Lonnie Company's total fixed costs are £40,000 and total variable costs are £60,000.

The relevant range is 30,000 to 50,000 units.

-If Lonnie were to sell 42,000 units, the total expected cost would be:

A)£105,000.

B)£100,000.

C)£103,000.

D)£102,000.

The relevant range is 30,000 to 50,000 units.

-If Lonnie were to sell 42,000 units, the total expected cost would be:

A)£105,000.

B)£100,000.

C)£103,000.

D)£102,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

19

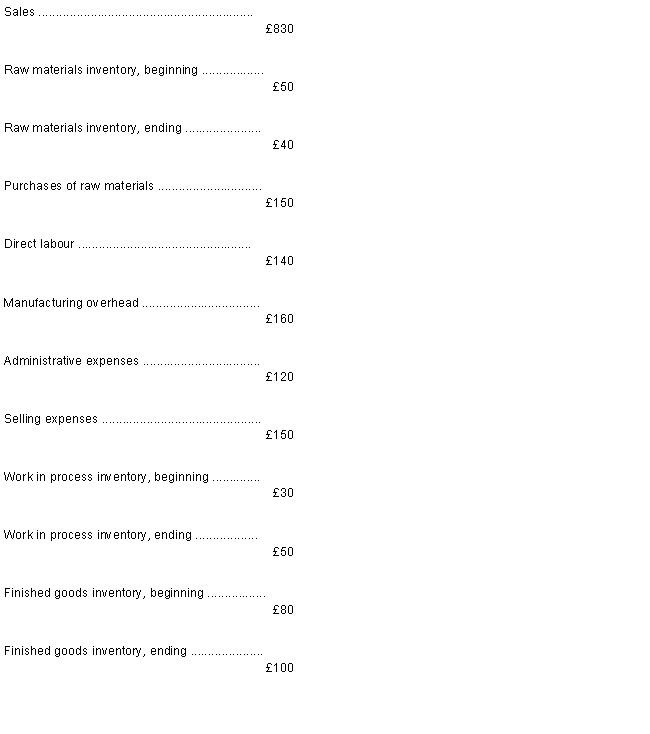

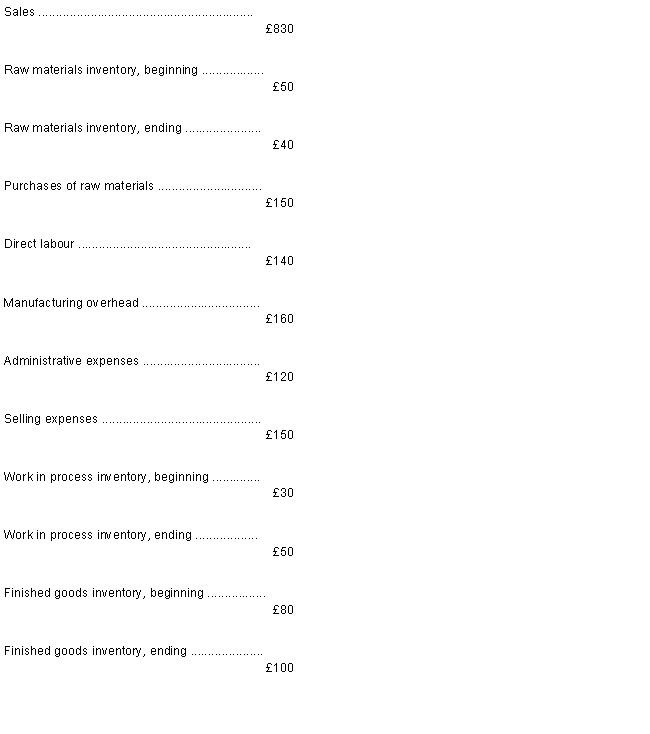

Data for Morton Co:

Prime cost was:

A)£300,000.

B)£380,000.

C)£700,000.

D)£830,000.

Prime cost was:

A)£300,000.

B)£380,000.

C)£700,000.

D)£830,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

20

Direct materials cost is a: I. Period Cost or II. Product Cost

A)Only I

B)Neither I nor II

C)Only II

D)Both I and II

A)Only I

B)Neither I nor II

C)Only II

D)Both I and II

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

21

In a manufacturing company, direct labour costs combined with direct materials costs are known as

A)period costs.

B)conversion costs.

C)prime costs.

D)opportunity cost.

A)period costs.

B)conversion costs.

C)prime costs.

D)opportunity cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

22

A department accepts a new order from a customer. It has already incurred £100 for design costs. It has also incurred costs of £200 for visits by sales staff. If the order is accepted a quality inspector will be transferred from another department. The inspector earns £20,000 per year. If the order is accepted there will be additional training costs of £700.

-

In this decision the differential design costs are:

A)£0.

B)£100.

C)£200.

D)£300.

-

In this decision the differential design costs are:

A)£0.

B)£100.

C)£200.

D)£300.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

23

Last month a manufacturing company had the following operating results:

What was the cost of goods manufactured for the month?

A)£429,000

B)£492,000

C)£442,000

D)£455,000

What was the cost of goods manufactured for the month?

A)£429,000

B)£492,000

C)£442,000

D)£455,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

24

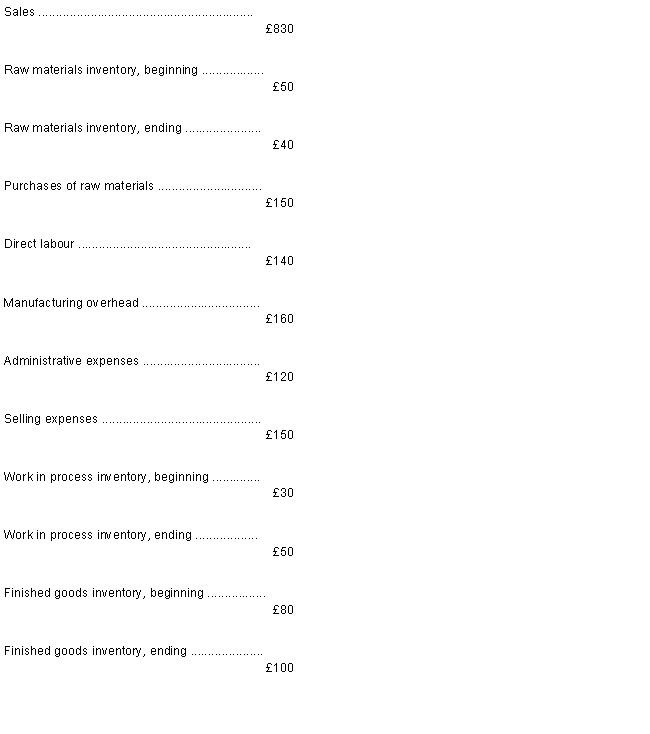

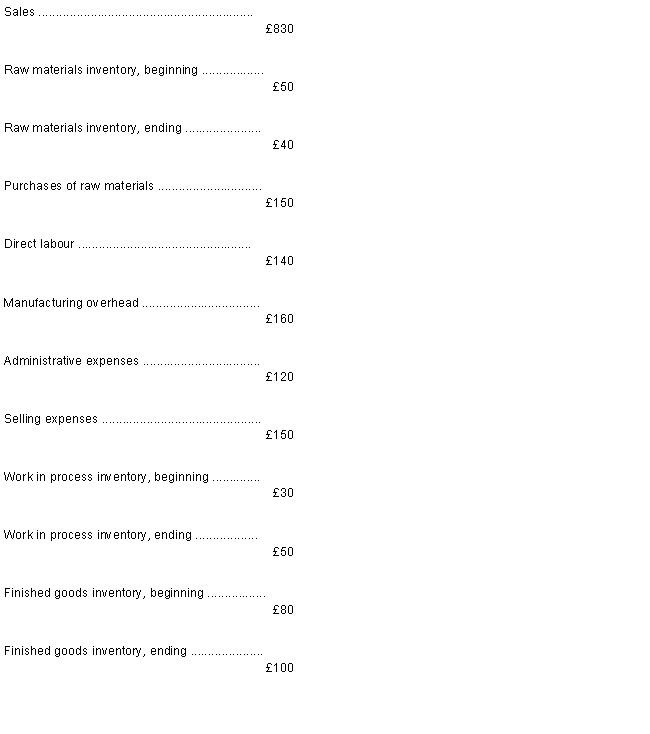

The following data (in thousands of pounds) have been taken from the accounting records of Karmint Corporation for the just completed year:

-The cost of goods manufactured (finished) for the year (in thousands of pounds) was:

A)£480.

B)£490.

C)£440.

D)£510.

-The cost of goods manufactured (finished) for the year (in thousands of pounds) was:

A)£480.

B)£490.

C)£440.

D)£510.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

25

The inventory of finished goods on hand at the end of a period would be considered an asset, but inventories of raw materials and work-in-process would not be considered assets until production is completed

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

26

During the month of May, Cassidy Manufacturers incurred £30,000, £40,000 and £20,000 of direct material, direct labour and manufacturing overhead costs respectively. If the cost of goods manufactured was £95,000 and the ending work in process inventory was £15,000, the beginning inventory of work in process must have been

A)£ 10,000.

B)£ 20,000.

C)£110,000.

D)£ 5,000.

A)£ 10,000.

B)£ 20,000.

C)£110,000.

D)£ 5,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

27

The three cost elements ordinarily included in the stock cost of a manufactured product are direct materials, direct labour, and marketing costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

28

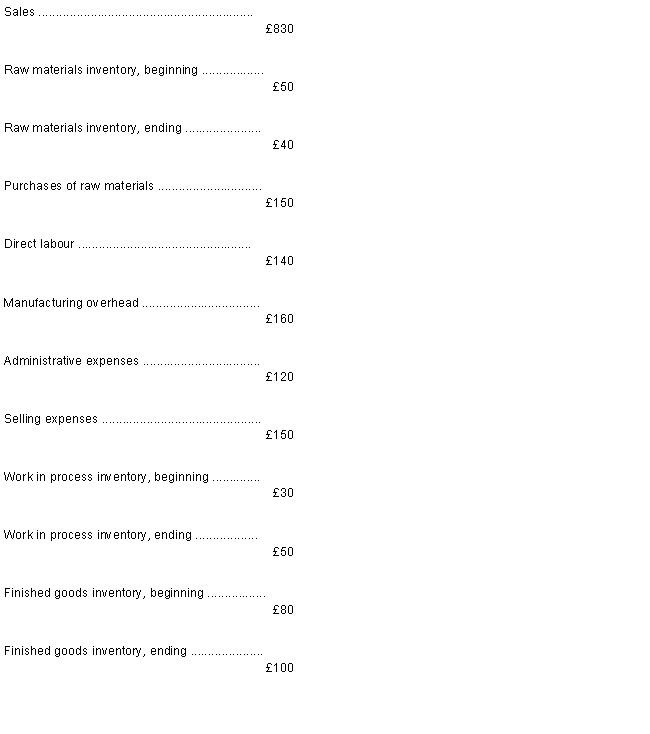

The following data (in thousands of pounds) have been taken from the accounting records of Karmint Corporation for the just completed year:

-The cost of goods sold for the year (in thousands of pounds) was

A)£540.

B)£420.

C)£460.

D)£520.

-The cost of goods sold for the year (in thousands of pounds) was

A)£540.

B)£420.

C)£460.

D)£520.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

29

Which of the following combinations of costs make up conversion cost

A)Direct materials cost and manufacturing overhead cost.

B)Direct labour cost and manufacturing overhead cost.

C)Marketing cost and administrative cost.

D)Direct materials costs and direct labour cost.

A)Direct materials cost and manufacturing overhead cost.

B)Direct labour cost and manufacturing overhead cost.

C)Marketing cost and administrative cost.

D)Direct materials costs and direct labour cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

30

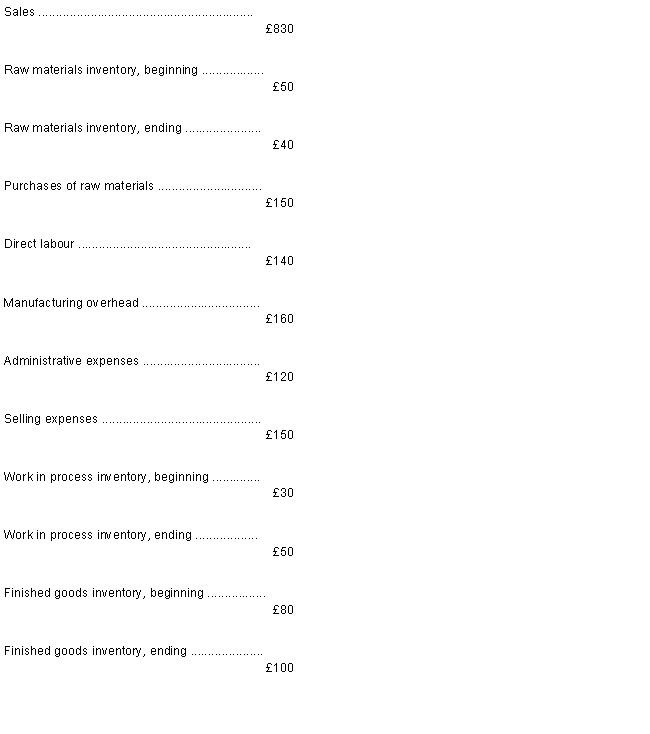

The following data (in thousands of pounds) have been taken from the accounting records of Karmint Corporation for the just completed year:

-

The net operating profit for the year (in thousands of pounds) was:

A)£140.

B)£170.

C)£110.

D)£410.

-

The net operating profit for the year (in thousands of pounds) was:

A)£140.

B)£170.

C)£110.

D)£410.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

31

In general only the differences between alternatives are relevant to decisions

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

32

A sunk cost is

A)a cost that may be saved by not adopting an alternative.

B)a cost that may be shifted to the future with little or no effect on current operations.

C)a cost that cannot be avoided because it has already been incurred.

D)a cost which does not entail any pound outlay but which is relevant to the decision-making process.

A)a cost that may be saved by not adopting an alternative.

B)a cost that may be shifted to the future with little or no effect on current operations.

C)a cost that cannot be avoided because it has already been incurred.

D)a cost which does not entail any pound outlay but which is relevant to the decision-making process.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

33

The following data (in thousands of pounds) have been taken from the accounting records of Karmint Corporation for the just completed year:

-The cost of the raw materials used in production during the year (in thousands of pounds) was:

A)£190.

B)£160.

C)£140.

D)£200.

-The cost of the raw materials used in production during the year (in thousands of pounds) was:

A)£190.

B)£160.

C)£140.

D)£200.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

34

In April direct labour was 70% percent of conversion cost. If the manufacturing overhead cost for the month was £42,000 and the direct materials cost was £28,000, the direct labour cost was

A)£98,000.

B)£65,333.

C)£18,000.

D)£12,000.

A)£98,000.

B)£65,333.

C)£18,000.

D)£12,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

35

Abburi Company's manufacturing overhead is 60% of its total conversion costs. If direct labour is £52,000 and if direct materials are £28,000, the manufacturing overhead is

A)£34,667.

B)£78,000.

C)£42,000.

D)£120,000.

A)£34,667.

B)£78,000.

C)£42,000.

D)£120,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

36

When volume or level of activity decreases, variable costs will

A)increase per unit.

B)increase in total.

C)decrease in total.

D)decrease per unit.

A)increase per unit.

B)increase in total.

C)decrease in total.

D)decrease per unit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

37

A department accepts a new order from a customer. It has already incurred £100 for design costs. It has also incurred costs of £200 for visits by sales staff. If the order is accepted a quality inspector will be transferred from another department. The inspector earns £20,000 per year. If the order is accepted there will be additional training costs of £700.

-In this decision the sunk costs are:

A)£20,000.

B)£100.

C)£200.

D)£300.

-In this decision the sunk costs are:

A)£20,000.

B)£100.

C)£200.

D)£300.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

38

Higgins Company's manufacturing overhead is 40% of its total conversion costs. If direct labour is £18,000 and if direct materials are £24,000, the manufacturing overhead is

A)£27,000.

B)£28,000.

C)£16,000.

D)£12,000.

A)£27,000.

B)£28,000.

C)£16,000.

D)£12,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

39

A department accepts a new order from a customer. It has already incurred £100 for design costs. It has also incurred costs of £200 for visits by sales staff. If the order is accepted a quality inspector will be transferred from another department. The inspector earns £20,000 per year. If the order is accepted there will be additional training costs of £700.

-In this decision the differential costs total:

A)£0.

B)£300.

C)£20,700.

D)£700.

-In this decision the differential costs total:

A)£0.

B)£300.

C)£20,700.

D)£700.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

40

A department accepts a new order from a customer. It has already incurred £100 for design costs. It has also incurred costs of £200 for visits by sales staff. If the order is accepted a quality inspector will be transferred from another department. The inspector earns £20,000 per year. If the order is accepted there will be additional training costs of £700.

-In this decision the differential costs for the inspector are:

A)£0.

B)£100.

C)£20,000.

D)£300.

-In this decision the differential costs for the inspector are:

A)£0.

B)£100.

C)£20,000.

D)£300.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

41

The following costs were incurred in June:

Conversion costs during the month totaled:

A)£133,000.

B)£73,000.

C)£65,000.

D)£64,000.

Conversion costs during the month totaled:

A)£133,000.

B)£73,000.

C)£65,000.

D)£64,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

42

Variable costs are costs that vary, in total, in direct proportion to changes in the volume or level of activity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

43

Commissions paid to salespersons are a variable selling expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

44

The cost of goods manufactured is computed by deducting the beginning inventory of work in process from the total manufacturing costs incurred during a given period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

45

Wages paid to the factory supply shop foreman are considered an example of: I. Direct Labour or II. Period Cost

A)Both I and II

B)Only I

C)Only II

D)Neither I nor II

A)Both I and II

B)Only I

C)Only II

D)Neither I nor II

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

46

The following costs were incurred in May:

Conversion costs during the month totaled:

A)£54,000.

B)£133,000.

C)£59,000.

D)£87,000.

Conversion costs during the month totaled:

A)£54,000.

B)£133,000.

C)£59,000.

D)£87,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

47

Gable Inc. is a merchandising company. Last month the company's merchandise purchases totaled £86,000. The company's beginning merchandise inventory was £15,000 and its ending merchandise inventory was £11,000. What was the company's cost of goods sold for the month

A)£86,000

B)£112,000

C)£82,000

D)£90,000

A)£86,000

B)£112,000

C)£82,000

D)£90,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

48

Which of the following statements is correct in describing manufacturing overhead costs

A)Manufacturing overhead when combined with direct material cost forms conversion cost.

B)Manufacturing overhead consists of all manufacturing cost except for prime cost.

C)Manufacturing overhead is a period cost.

D)Manufacturing overhead when combined with direct labour cost forms prime cost.

A)Manufacturing overhead when combined with direct material cost forms conversion cost.

B)Manufacturing overhead consists of all manufacturing cost except for prime cost.

C)Manufacturing overhead is a period cost.

D)Manufacturing overhead when combined with direct labour cost forms prime cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

49

All of the following can be differential costs except

A)variable costs.

B)sunk costs.

C)opportunity costs.

D)fixed costs.

A)variable costs.

B)sunk costs.

C)opportunity costs.

D)fixed costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

50

In June direct labour was 60% percent of conversion cost. If the manufacturing overhead cost for the month was £36,000 and the direct materials cost was £22,000, the direct labour cost was

A)£33,000.

B)£14,667.

C)£24,000.

D)£54,000.

A)£33,000.

B)£14,667.

C)£24,000.

D)£54,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

51

Like product costs, period costs are not necessarily treated as expenses in the period in which they are incurred

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

52

Depreciation on manufacturing equipment is a period cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

53

The cost of goods manufactured is included in the cost of goods available for sale in a manufacturing company

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

54

During April, the cost of goods manufactured was £74,000. The beginning finished goods inventory was £17,000 and the ending finished goods inventory was £14,000. What was the cost of goods sold for the month

A)£74,000

B)£71,000

C)£77,000

D)£105,000

A)£74,000

B)£71,000

C)£77,000

D)£105,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

55

The cost of goods that have been completed but are not yet sold are part of work in process inventory

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

56

Within the relevant range

A)variable cost per unit decreases as production decreases.

B)fixed cost per unit increases as production decreases.

C)fixed cost per unit decreases as production decreases.

D)variable cost per unit increases as production decreases.

A)variable cost per unit decreases as production decreases.

B)fixed cost per unit increases as production decreases.

C)fixed cost per unit decreases as production decreases.

D)variable cost per unit increases as production decreases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

57

All of the following costs would be found in a company's accounting records except:

A)sunk cost.

B)opportunity cost.

C)indirect costs.

D)direct costs.

A)sunk cost.

B)opportunity cost.

C)indirect costs.

D)direct costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

58

Which of the following would most likely be included as part of manufacturing overhead in the production of a wooden table

A)The amount paid to the individual who stains the table.

B)The commission paid to the salesperson who sold the table.

C)Rent of the factory.

D)The cost of the wood used in the table.

A)The amount paid to the individual who stains the table.

B)The commission paid to the salesperson who sold the table.

C)Rent of the factory.

D)The cost of the wood used in the table.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

59

The potential benefit that is given up when one alternative is selected over another is called a sunk cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

60

Direct labour combined with direct materials is known as prime cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

61

The variable portion of the cost of electricity for a manufacturing plant is a: I. Conversion Cost or II. Period Cost

A)Only I

B)Both I and II

C)Only II

D)Neither I nor II

A)Only I

B)Both I and II

C)Only II

D)Neither I nor II

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

62

Salaries and wages incurred in the factory would be product costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

63

Explain why in practice it is important to distinguish between period and product costs?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

64

Differential costs do not include fixed costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

65

Access the report by Fitzgerald, Johnston, Brignall, Silvestro and Voss (1991) mentioned on page 32 of Chapter 2. Discuss the differences that you see between costing for service industries and manufacturing. Give examples

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

66

The following costs were incurred in April:

Conversion costs during the month totalled:

A)£39,000.

B)£54,000.

C)£105,000.

D)£51,000.

Conversion costs during the month totalled:

A)£39,000.

B)£54,000.

C)£105,000.

D)£51,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

67

Define the following.

Prime cost, conversion cost & manufacturing overhead

Prime cost, conversion cost & manufacturing overhead

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

68

Gabriel Inc. is a merchandising company. Last month the company's merchandise purchases totaled £70,000. The company's beginning merchandise inventory was £15,000 and its ending merchandise inventory was £22,000. What was the company's cost of goods sold for the month

A)£63,000

B)£77,000

C)£107,000

D)£70,000

A)£63,000

B)£77,000

C)£107,000

D)£70,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

69

Define the following.

Product cost & period cost

Product cost & period cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

70

Define the following

Direct cost, indirect cost, variable cost, fixed cost,

Direct cost, indirect cost, variable cost, fixed cost,

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

71

During June, the cost of goods manufactured was £71,000. The beginning finished goods inventory was £18,000 and the ending finished goods inventory was £11,000. What was the cost of goods sold for the month

A)£64,000

B)£100,000

C)£71,000

D)£78,000

A)£64,000

B)£100,000

C)£71,000

D)£78,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck