Deck 14: Investments

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/44

العب

ملء الشاشة (f)

Deck 14: Investments

1

The statement of comprehensive income is a statement that includes net income plus investment by stockholders less payment of dividends.

False

2

When the investor has insignificant influence,the receipt of cash dividends is recorded as dividend revenue.

True

3

Under the equity method,the investor includes in net income its portion of the investee's net income.

True

4

Because the carrying value of bonds purchased at a premium increases over time,interest revenue will also increase each semi-annual interest period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

5

Because the carrying value of bonds purchased at a discount increases over time,interest revenue will also increase each semi-annual interest period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

6

When insignificant influence exists,the investment should be accounted for by the equity method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

7

The cash received from interest equals the face value of the investment in bonds times the stated interest rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

8

Investments are reported at fair value when a company has a significant influence over another company in which it invests.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

9

Companies with large expansion plans,called growth companies,prefer to reinvest earnings in the growth of the company rather than distribute earnings back to investors in the form of cash dividends.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

10

Consolidated financial statements combine the separate financial statements of the purchasing company and the acquired company into a single set of financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

11

When significant influence exists,the investment should be accounted for by the equity method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

12

When the investor has significant influence,the receipt of cash dividends is recorded as dividend revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

13

Gains and losses on the sale of equity investments are recorded in the income statement as part of net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

14

Investments are reported at fair value when a company has an insignificant influence over another company in which it invests.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

15

The statement of comprehensive income is a statement in which we report all changes in stockholders' equity other than investment by stockholders and payment of dividends.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

16

Bond investments are long-term assets that earn interest revenue,while bonds payable are long-term liabilities that incur interest expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

17

Seasonal refers to the revenue activities of a company varying based on the time (or season)of the year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

18

Interest revenue is calculated as the carrying value of the investment in bonds times the stated interest rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

19

Unrealized gains and losses from changes in the fair value of trading securities are reported as part of current net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

20

Unrealized gains and losses from changes in the fair value of available-for-sale securities are reported as part of current net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

21

Investments in equity securities for which the investor has insignificant influence over the investee are classified for reporting purposes under the fair value method in one of two categories.What are these two categories? How do we report unrealized holding gains and losses under each of these two categories?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

22

One of the primary reasons for investing in debt securities includes:

A)Receiving dividend payments.

B)Acquiring significant influence.

C)Earning interest revenue.

D)Deducting interest payments for tax purposes.

A)Receiving dividend payments.

B)Acquiring significant influence.

C)Earning interest revenue.

D)Deducting interest payments for tax purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

23

Sports Spectacular purchased 1,000 shares of stock in The Athletic Warehouse for $30 per share.The investment is properly classified as an available-for-sale security.By the end of the year,the stock price has increased to $32 per share.How would the change in stock price affect Sports Spectacular's net income?

A)Increase net income by $32,000.

B)Increase net income by $30,000.

C)Increase net income by $2,000.

D)No effect.

A)Increase net income by $32,000.

B)Increase net income by $30,000.

C)Increase net income by $2,000.

D)No effect.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

24

The equity method of accounting for investments in voting common stock is appropriate when:

A)The investor can significantly influence the investee.

B)The investor has voting control over the investee.

C)The investor intends to hold the common stock indefinitely.

D)The investor is assured of a continued supply of a valuable raw material.

A)The investor can significantly influence the investee.

B)The investor has voting control over the investee.

C)The investor intends to hold the common stock indefinitely.

D)The investor is assured of a continued supply of a valuable raw material.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

25

How can an investor benefit from an equity investment that does not pay dividends?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

26

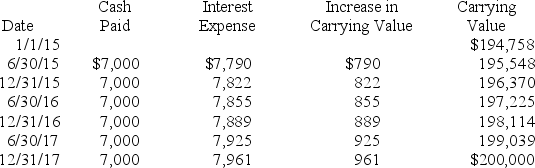

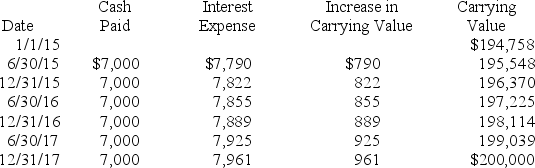

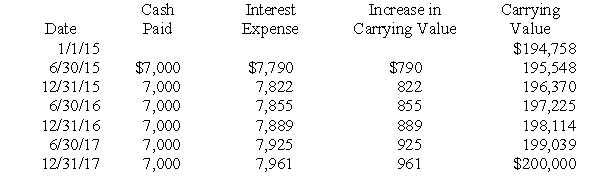

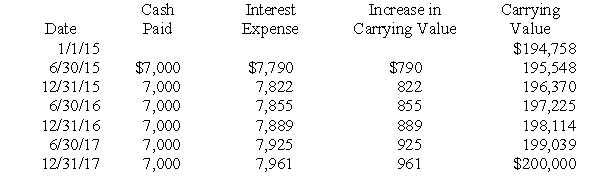

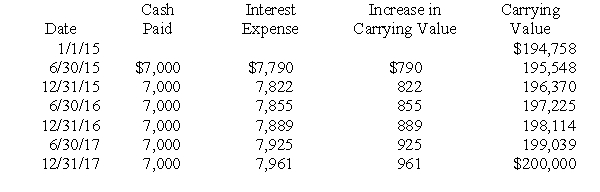

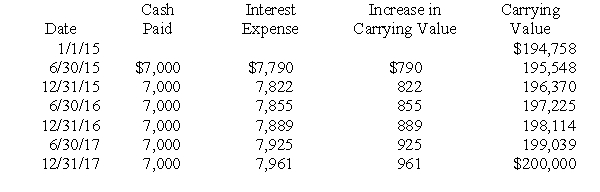

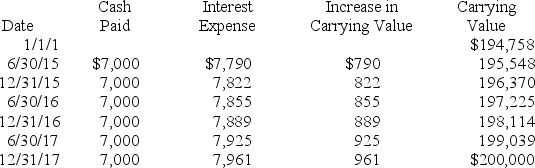

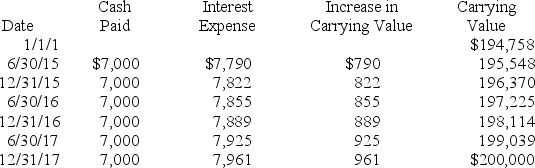

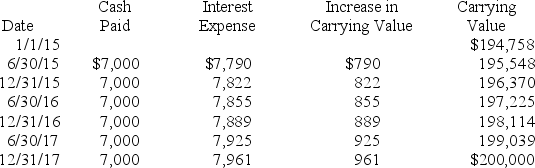

General Investment Co.(GIC)purchased bonds on January 1,2015.GIC's accountant has projected the following amortization schedule from purchase until maturity:  Recording the bond purchase would have what effect on the financial statements?

Recording the bond purchase would have what effect on the financial statements?

A)Increase assets.

B)Increase liabilities.

C)Increase assets and liabilities.

D)No effect on total assets and total liabilities.

Recording the bond purchase would have what effect on the financial statements?

Recording the bond purchase would have what effect on the financial statements?A)Increase assets.

B)Increase liabilities.

C)Increase assets and liabilities.

D)No effect on total assets and total liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

27

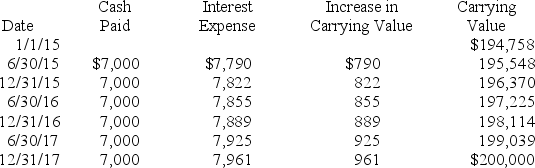

General Investment Co.(GIC)purchased bonds on January 1,2015.GIC's accountant has projected the following amortization schedule from purchase until maturity:  What is the annual market interest rate on the bonds?

What is the annual market interest rate on the bonds?

A)4%.

B)3.5%.

C)7%.

D)8%.

What is the annual market interest rate on the bonds?

What is the annual market interest rate on the bonds?A)4%.

B)3.5%.

C)7%.

D)8%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

28

Sports Spectacular purchased 1,000 shares of stock in The Athletic Warehouse for $30 per share.The investment is properly classified as a trading security.By the end of the year,the stock price has increased to $32 per share.How would the change in stock price affect Sports Spectacular's net income?

A)Increase net income by $32,000.

B)Increase net income by $30,000.

C)Increase net income by $2,000.

D)No effect.

A)Increase net income by $32,000.

B)Increase net income by $30,000.

C)Increase net income by $2,000.

D)No effect.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

29

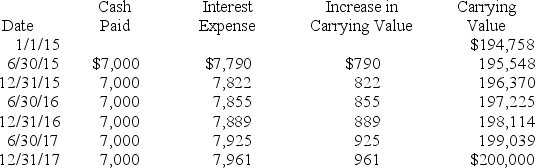

General Investment Co.(GIC)purchased bonds on January 1,2015.GIC's accountant has projected the following amortization schedule from purchase until maturity:  GIC purchased the bonds:

GIC purchased the bonds:

A)At par.

B)At a discount.

C)At a premium.

D)Cannot be determined from the given information.

GIC purchased the bonds:

GIC purchased the bonds:A)At par.

B)At a discount.

C)At a premium.

D)Cannot be determined from the given information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

30

General Investment Co.(GIC)purchased bonds on January 1,2015.GIC's accountant has projected the following amortization schedule from purchase until maturity:  GIC sells the bonds for $196,000 immediately after the interest payment on 12/31/15.What gain or loss,if any,would GIC record on this date?

GIC sells the bonds for $196,000 immediately after the interest payment on 12/31/15.What gain or loss,if any,would GIC record on this date?

A)No gain or loss.

B)$370 loss.

C)$4,000 loss.

D)$4,000 gain.

GIC sells the bonds for $196,000 immediately after the interest payment on 12/31/15.What gain or loss,if any,would GIC record on this date?

GIC sells the bonds for $196,000 immediately after the interest payment on 12/31/15.What gain or loss,if any,would GIC record on this date?A)No gain or loss.

B)$370 loss.

C)$4,000 loss.

D)$4,000 gain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

31

When using the equity method to account for an investment,cash dividends received by the investor from the investee should be recorded:

A)As a reduction in the Investments account.

B)As an increase in the Investments account.

C)As dividend income.

D)As a contra item to stockholders' equity.

A)As a reduction in the Investments account.

B)As an increase in the Investments account.

C)As dividend income.

D)As a contra item to stockholders' equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

32

Which of the following is true with regard to how to account for company A's investment in company B's common stock?

A)The fair value method is used when A owns more than 50% of B.

B)The equity method is used when A owns from 20% to 50% of B.

C)The consolidation method is used when A owns less than 20% of B.

D)All of the above are true.

A)The fair value method is used when A owns more than 50% of B.

B)The equity method is used when A owns from 20% to 50% of B.

C)The consolidation method is used when A owns less than 20% of B.

D)All of the above are true.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

33

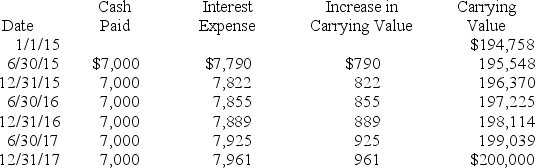

General Investment Co.(GIC)purchased bonds on January 1,2015.GIC's accountant has projected the following amortization schedule from purchase until maturity:  The investment in bonds has a maturity in:

The investment in bonds has a maturity in:

A)Two years.

B)Three years.

C)Six years.

D)Cannot be determined from the given information.

The investment in bonds has a maturity in:

The investment in bonds has a maturity in:A)Two years.

B)Three years.

C)Six years.

D)Cannot be determined from the given information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

34

General Investment Co.(GIC)purchased bonds on January 1,2015.GIC's accountant has projected the following amortization schedule from purchase until maturity:  GIC purchased the bonds for:

GIC purchased the bonds for:

A)$200,000.

B)$194,758.

C)$242,000.

D)Cannot be determined from the given information.

GIC purchased the bonds for:

GIC purchased the bonds for:A)$200,000.

B)$194,758.

C)$242,000.

D)Cannot be determined from the given information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

35

Which of the following investment securities held by Zoogle Inc.may be classified as held-to-maturity securities in its balance sheet?

A)Debt securities.

B)Equity securities.

C)Common stock.

D)All of these are correct.

A)Debt securities.

B)Equity securities.

C)Common stock.

D)All of these are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

36

Consolidated financial statements are prepared when one company has:

A)Accounted for the investment using the equity method.

B)Accounted for the investment as available-for-sale securities.

C)Control over another company.

D)None of these is correct.

A)Accounted for the investment using the equity method.

B)Accounted for the investment as available-for-sale securities.

C)Control over another company.

D)None of these is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

37

Sports Spectacular purchased 100,000 shares of stock in The Athletic Warehouse for $30 per share.The investment is properly recorded using the equity method.By the end of the year,the stock price has increased to $32 per share.How would the change in stock price affect Sports Spectacular's net income under the equity method?

A)Increase net income by $32,000.

B)Increase net income by $30,000.

C)Increase net income by $2,000.

D)No effect.

A)Increase net income by $32,000.

B)Increase net income by $30,000.

C)Increase net income by $2,000.

D)No effect.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

38

When the equity method of accounting for investments is used by the investor,the Investments account increases when:

A)A cash dividend is received from the investee.

B)The investee reports a net income for the year.

C)The investor records additional depreciation related to the investment.

D)The investee reports a net loss for the year.

A)A cash dividend is received from the investee.

B)The investee reports a net income for the year.

C)The investor records additional depreciation related to the investment.

D)The investee reports a net loss for the year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

39

Under what circumstances do we use the equity method to account for an investment in stock? Explain how we record dividends received from an investment in a company accounted for using the equity method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

40

One of the primary reasons for investing in equity securities includes:

A)Acquiring debt of competing companies.

B)Appreciation in the value of the stock.

C)Earning interest revenue.

D)Deducting dividend payments for tax purposes.

A)Acquiring debt of competing companies.

B)Appreciation in the value of the stock.

C)Earning interest revenue.

D)Deducting dividend payments for tax purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

41

Listed below are five terms followed by a list of phrases that describe or characterize the terms.Match each phrase with the best term placing the letter designating the term in the space provided.

a.Held-to-maturity securities

b.Trading securities

c.Available-for-sale securities

d.Equity method

e.Consolidation method

Phrases:

_____ This category is used only for debt securities.

_____ An investor owns 40% of the common voting shares in the company and can exercise significant influence.

_____ Common stock not held for immediate resale and the investor owns 2% of the outstanding shares.

_____ An investor owns over 50% of the common voting shares in the company.

_____ Common stock held for immediate resale.

a.Held-to-maturity securities

b.Trading securities

c.Available-for-sale securities

d.Equity method

e.Consolidation method

Phrases:

_____ This category is used only for debt securities.

_____ An investor owns 40% of the common voting shares in the company and can exercise significant influence.

_____ Common stock not held for immediate resale and the investor owns 2% of the outstanding shares.

_____ An investor owns over 50% of the common voting shares in the company.

_____ Common stock held for immediate resale.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

42

Investments in debt securities are classified for reporting purposes in one of three categories.List these three categories and explain which investments are included in each category.Also briefly describe how the reporting differs for each category.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

43

Listed below are five terms followed by a list of phrases that describe or characterize the terms.Match each phrase with the best term placing the letter designating the term in the space provided.

a.Held-to-maturity securities

b.Trading securities

c.Available-for-sale securities

d.Equity method

e.Consolidation method

Phrases:

_____ Used when an investor has controlling influence.

_____ This category is not used for equity investments.

_____ Used when an investor has insignificant influence and does not expect to sell in the near future.

_____ Used when an investor has significant,but not controlling influence.

_____ Used when an investor expects to sell in the near future.

a.Held-to-maturity securities

b.Trading securities

c.Available-for-sale securities

d.Equity method

e.Consolidation method

Phrases:

_____ Used when an investor has controlling influence.

_____ This category is not used for equity investments.

_____ Used when an investor has insignificant influence and does not expect to sell in the near future.

_____ Used when an investor has significant,but not controlling influence.

_____ Used when an investor expects to sell in the near future.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

44

Discuss the meaning of consolidated financial statements.When is it appropriate to consolidate financial statements of two companies?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck