Deck 13: Differential Analysis: The Key to Decision Making

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

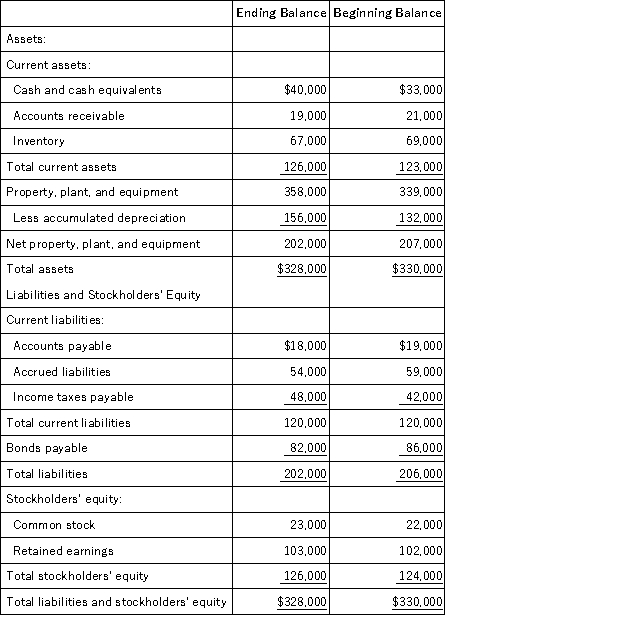

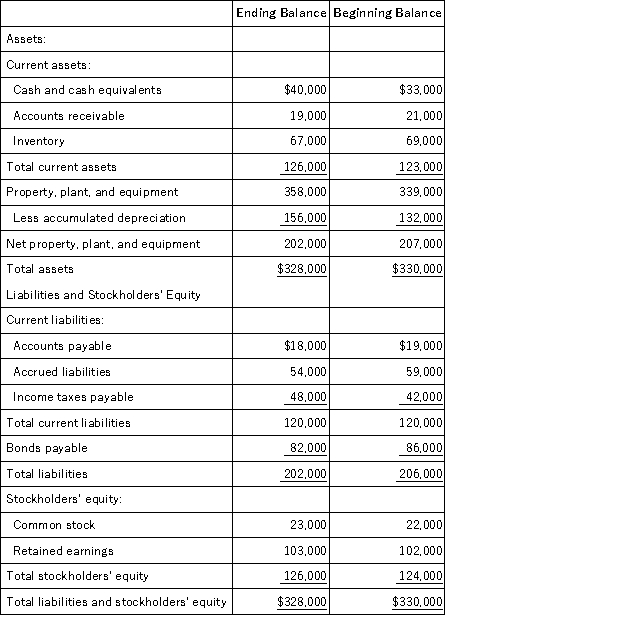

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

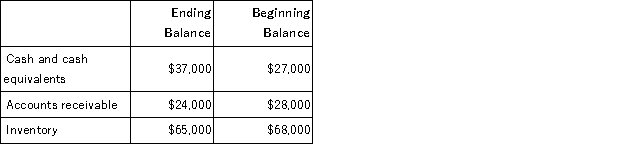

سؤال

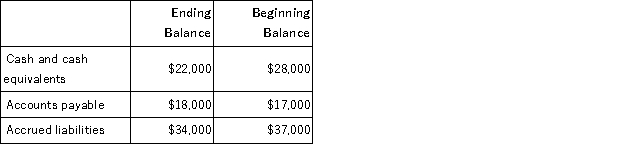

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

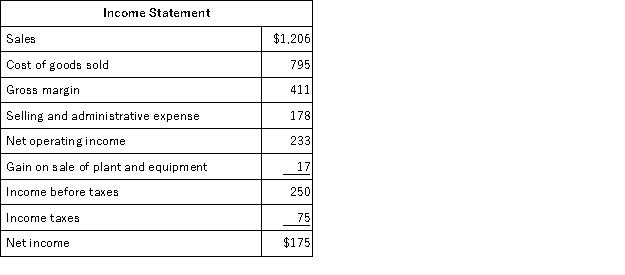

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

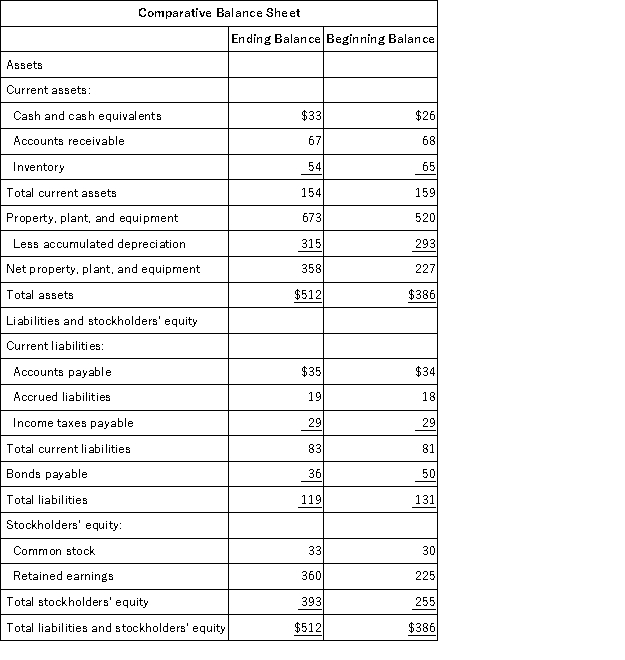

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/133

العب

ملء الشاشة (f)

Deck 13: Differential Analysis: The Key to Decision Making

1

Money received from issuing bonds payable would be included as part of a company's financing activities on the statement of cash flows.

True

2

When a company pays a supplier for inventory it has purchased,the cash outflow is recorded in the investing activities section of the statement of cash flows.

False

3

Collecting the principal on a loan to another company would be reported on the investing activities section of the statement of cash flows.

True

4

The collection of a loan made to a supplier would be treated as an investing activity on a statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

5

Paying wages and salaries to employees is classified as a cash outflow in the operating activities section of the statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

6

When a company pays cash to repurchase its own common stock,this is reported as a cash outflow in the financing activities section of the statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

7

In the statement of cash flows,collecting cash from customers is treated as a cash inflow in the financing activities section.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

8

Paying interest to lenders is classified as an operating activity on the statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

9

When computing the net cash provided by operating activities under the indirect method on the statement of cash flows,an increase in prepaid expenses would be added to net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

10

Cash payments to repay the principal amount of debt are reported as a cash outflow in the investing activities section of the statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

11

Insurance and utility expenses are considered operating activities on the statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

12

The statement of cash flows relies on a fundamental principle of double-entry bookkeeping;namely,the change in the cash balance must equal the change in total liabilities and stockholders' equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

13

Cash equivalents on the statement of cash flows consist of any investment that can be converted into cash within one year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

14

Buying property,plant,or equipment would be reported as a cash outflow on the investing activities section of the statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

15

Cash received from the sale of equipment the company had used in its own operations would be considered an operating activity on a statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

16

Paying taxes to governmental bodies is considered a cash outflow in the operating activities section on the statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

17

Dukas Corporation's net cash provided by operating activities was $218,000;its net income was $203,000;its capital expenditures were $146,000;and its cash dividends were $49,000.

Required:

Determine the company's free cash flow.

Required:

Determine the company's free cash flow.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

18

The net cash provided by operating activities on the statement of cash flows does not include any dividends paid to the company's own shareholders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

19

Investing activities on the statement of cash flows generate cash inflows and outflows related to borrowing from and repaying principal to creditors and completing transactions with the company's owners such as selling or repurchasing shares of common stocks and paying dividends.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

20

Under the indirect method of determining the net cash provided by operating activities on the statement of cash flows,a decrease in inventory would be added to net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

21

Under the indirect method of determining the net cash provided by operating activities on the statement of cash flows,an increase in accounts receivable would be subtracted from net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

22

Negative free cash flow suggests that the company generated enough cash flow from its operating activities to fund its capital expenditures and dividend payments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

23

In a statement of cash flows,a change in an income taxes payable account would be recorded in the:

A)operating activities section.

B)financing activities section.

C)investing activities section.

D)stockholders' equity section.

A)operating activities section.

B)financing activities section.

C)investing activities section.

D)stockholders' equity section.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

24

The amount of depreciation added to net income equals the sum of the debits to the Accumulated Depreciation account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

25

Which of the following would be considered a cash inflow in the financing activities section of the statement of cash flows?

A)Issuing bonds payable.

B)Receiving cash from customers.

C)Sale of equipment.

D)Collection of a loan made to another company.

A)Issuing bonds payable.

B)Receiving cash from customers.

C)Sale of equipment.

D)Collection of a loan made to another company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

26

Which of the following would be classified as a financing activity on the statement of cash flows?

A)Paying suppliers for inventory purchases.

B)Interest paid to lenders.

C)Lending money to another company.

D)Repurchasing capital stock from owners.

A)Paying suppliers for inventory purchases.

B)Interest paid to lenders.

C)Lending money to another company.

D)Repurchasing capital stock from owners.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

27

In a statement of cash flows,the sale of a long-term investment would ordinarily be classified as:

A)an operating activity.

B)a financing activity.

C)an investing activity.

D)a lending activity.

A)an operating activity.

B)a financing activity.

C)an investing activity.

D)a lending activity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

28

In a statement of cash flows,which of the following would be classified as an investing activity?

A)The sale of the company's own common stock for cash.

B)The sale of equipment.

C)Interest paid to a lender.

D)The issuance of bonds payable.

A)The sale of the company's own common stock for cash.

B)The sale of equipment.

C)Interest paid to a lender.

D)The issuance of bonds payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

29

Negative free cash flow does not automatically signal poor performance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

30

Which of the following items would not be classified as an operating activity on the statement of cash flows?

A)Cash received from customers.

B)Dividends paid to the company's own stockholders.

C)Payments to government agencies for taxes.

D)Cash paid to compensate employees.

A)Cash received from customers.

B)Dividends paid to the company's own stockholders.

C)Payments to government agencies for taxes.

D)Cash paid to compensate employees.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

31

Free cash flow decreases when a company issues common stock for cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

32

Which one of the following transactions should be classified as a financing activity on the statement of cash flows?

A)Purchase of equipment.

B)Purchase of the company's own stock.

C)Sale of a long-term investment.

D)Payment of interest to a lender.

A)Purchase of equipment.

B)Purchase of the company's own stock.

C)Sale of a long-term investment.

D)Payment of interest to a lender.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

33

Free cash flow is net cash provided by operating activities less capital expenditures.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

34

Under the indirect method of determining the net cash provided by operating activities on the statement of cash flows,an increase in property,plant,and equipment is subtracted from net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

35

In a statement of cash flows,issuing bonds payable affects the:

A)operating activities section.

B)financing activities section.

C)investing activities section.

D)free cash flow activities section.

A)operating activities section.

B)financing activities section.

C)investing activities section.

D)free cash flow activities section.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

36

Free cash flow will increase if a company increases its accounts payable balance by delaying payments to suppliers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

37

The direct method of preparing the statement of cash flows will show the same increase or decrease in cash as the indirect method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

38

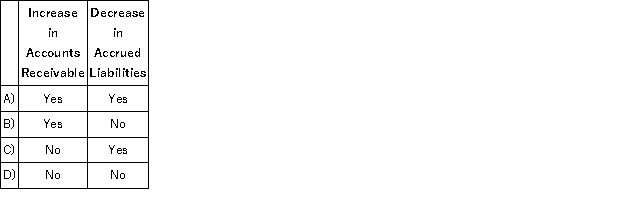

Tomlin Corporation prepares its statement of cash flows using the indirect method.Which of the following would be subtracted from net income in the operating activities section of the statement?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

39

Under the indirect method of determining the net cash provided by operating activities on the statement of cash flows,a loss on the sale of an asset would be added to net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

40

When computing the net cash provided by operating activities under the indirect method on the statement of cash flows,a decrease in common stock would be subtracted from net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

41

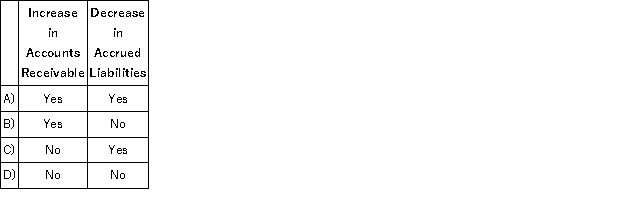

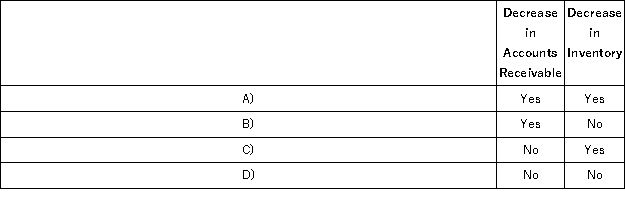

Shoshoni Corporation prepares its statement of cash flows using the indirect method.Which of the following would be added to net income in the operating activities section of the statement?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

42

When computing the net cash provided by operating activities using the indirect approach on the statement of cash flows,which item below would NOT be added to net income?

A)Depreciation.

B)Loss on the sale of an asset.

C)Decrease in accounts payable.

D)Decrease in prepaid expenses.

A)Depreciation.

B)Loss on the sale of an asset.

C)Decrease in accounts payable.

D)Decrease in prepaid expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

43

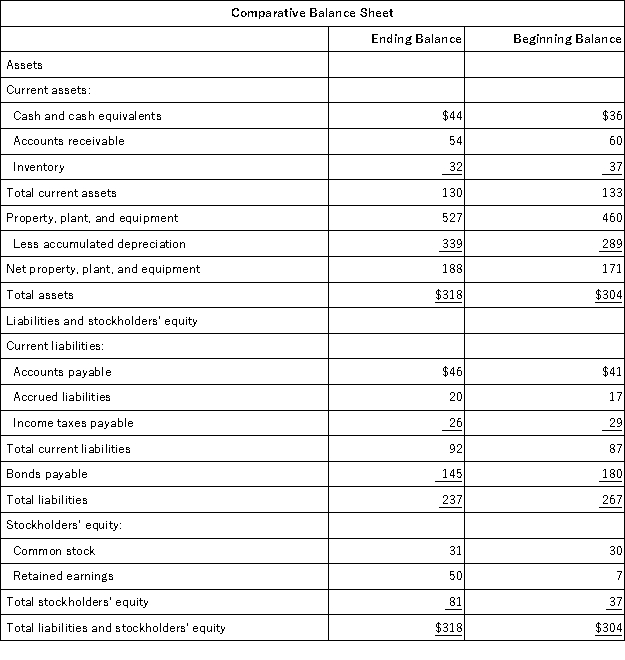

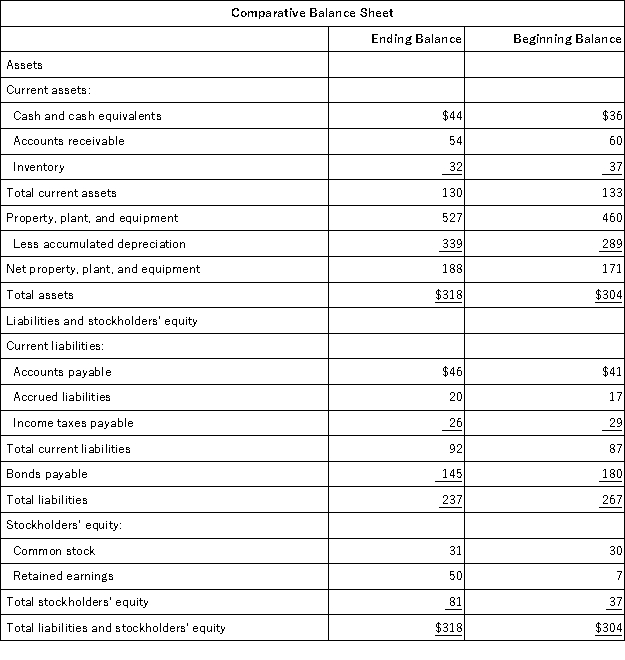

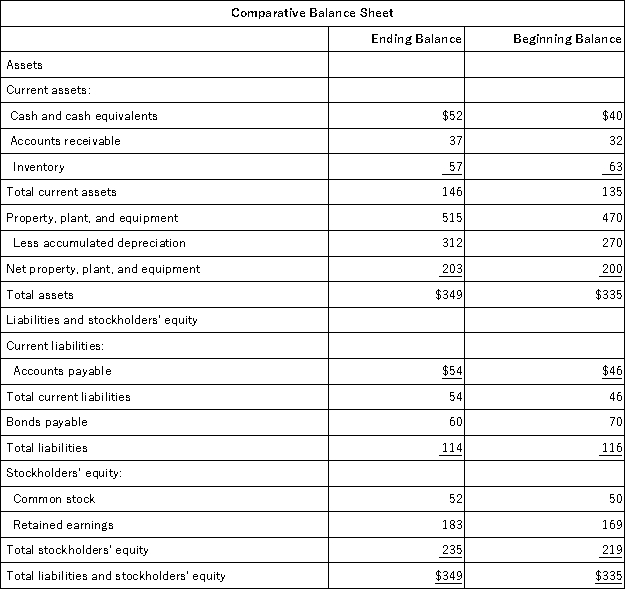

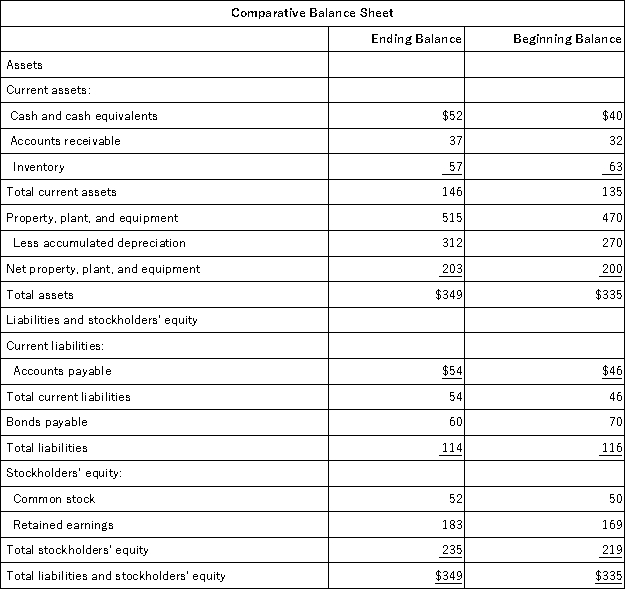

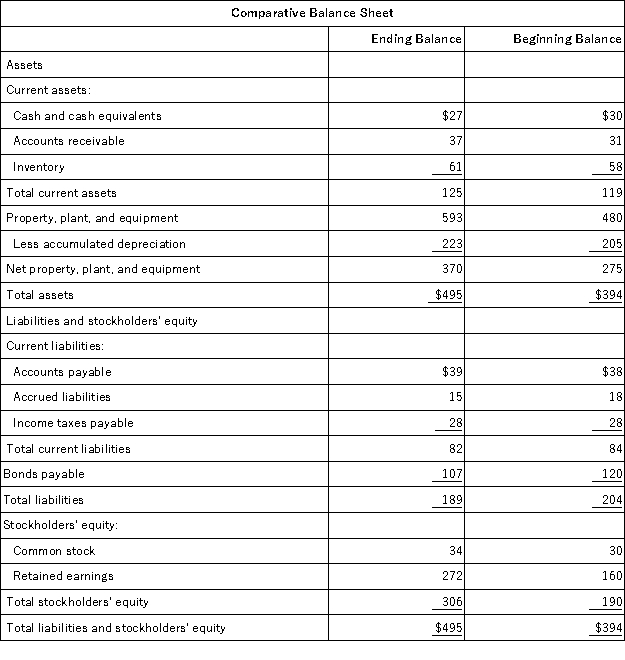

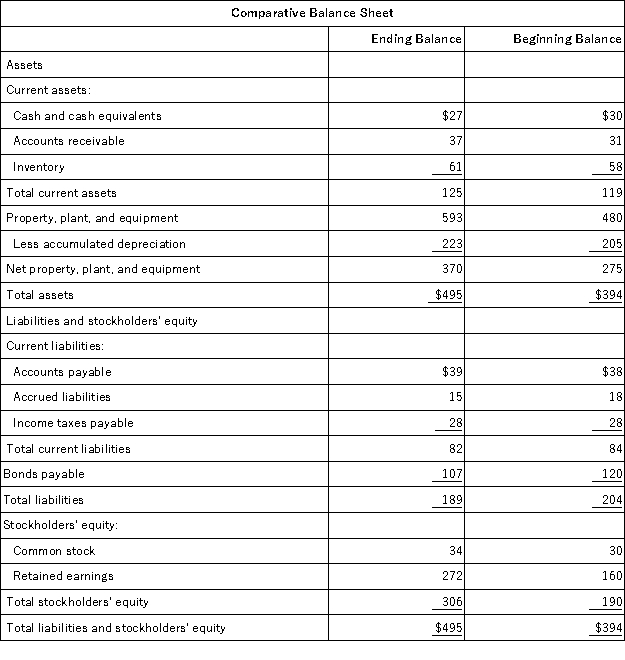

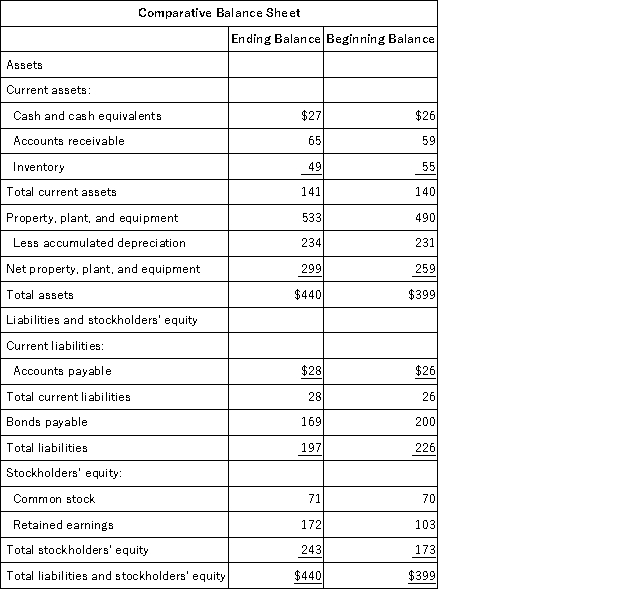

Kaeser Corporation's most recent balance sheet appears below:  The company's net income for the year was $52 and it did not sell or retire any property,plant,and equipment during the year.Cash dividends were $9.The net cash provided by (used in)investing activities for the year was:

The company's net income for the year was $52 and it did not sell or retire any property,plant,and equipment during the year.Cash dividends were $9.The net cash provided by (used in)investing activities for the year was:

A)$17

B)$67

C)($17)

D)($67)

The company's net income for the year was $52 and it did not sell or retire any property,plant,and equipment during the year.Cash dividends were $9.The net cash provided by (used in)investing activities for the year was:

The company's net income for the year was $52 and it did not sell or retire any property,plant,and equipment during the year.Cash dividends were $9.The net cash provided by (used in)investing activities for the year was:A)$17

B)$67

C)($17)

D)($67)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

44

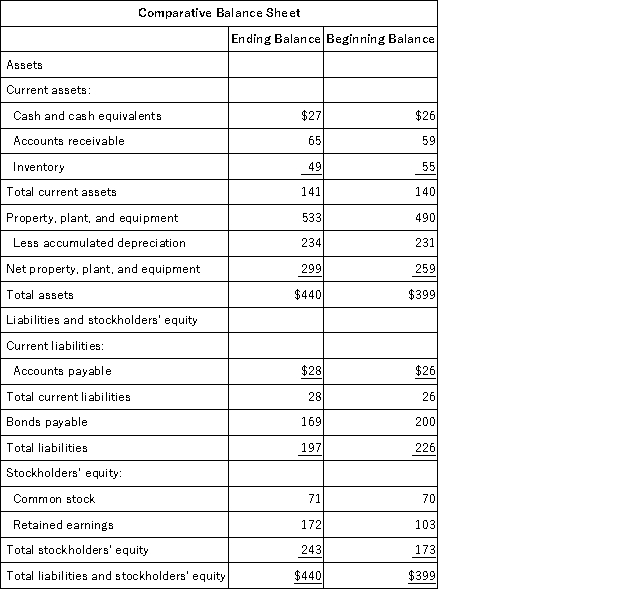

Sonier Corporation's most recent balance sheet appears below:  The net income for the year was $97.Cash dividends were $19.The company did not issue any bonds or repurchase any of its common stock during the year.The net cash provided by (used in)financing activities for the year was:

The net income for the year was $97.Cash dividends were $19.The company did not issue any bonds or repurchase any of its common stock during the year.The net cash provided by (used in)financing activities for the year was:

A)($43)

B)($19)

C)($25)

D)$1

The net income for the year was $97.Cash dividends were $19.The company did not issue any bonds or repurchase any of its common stock during the year.The net cash provided by (used in)financing activities for the year was:

The net income for the year was $97.Cash dividends were $19.The company did not issue any bonds or repurchase any of its common stock during the year.The net cash provided by (used in)financing activities for the year was:A)($43)

B)($19)

C)($25)

D)$1

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

45

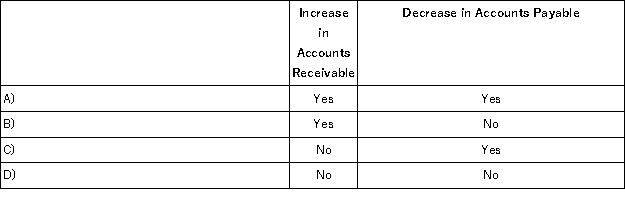

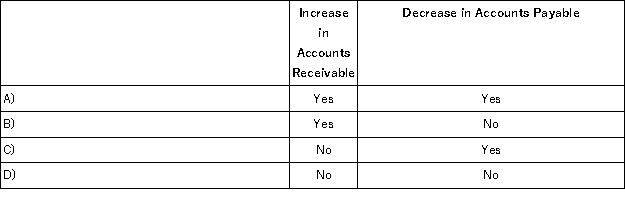

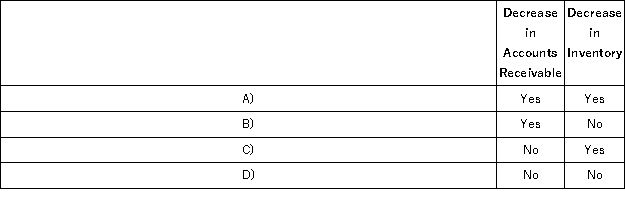

Adah Corporation prepares its statement of cash flows using the indirect method.Which of the following would be subtracted from net income in the operating activities section of the statement?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

46

Last year Burch Corporation's cash account decreased by $6,000.Net cash provided by investing activities was $13,000.Net cash used in financing activities was $30,000.On the statement of cash flows,the net cash flow provided by (used in)operating activities was:

A)($23,000)

B)($17,000)

C)($6,000)

D)$11,000

A)($23,000)

B)($17,000)

C)($6,000)

D)$11,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

47

An increase in accrued liabilities of $1,000 during a year would be shown on the company's statement of cash flows prepared under the indirect method as:

A)an addition to net income of $1,000 in order to arrive at net cash provided by operating activities.

B)a deduction from net income of $1,000 in order to arrive at net cash provided by operating activities.

C)a deduction of $1,000 under investing activities.

D)an addition of $1,000 under financing activities.

A)an addition to net income of $1,000 in order to arrive at net cash provided by operating activities.

B)a deduction from net income of $1,000 in order to arrive at net cash provided by operating activities.

C)a deduction of $1,000 under investing activities.

D)an addition of $1,000 under financing activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

48

Partin Corporation's cash and cash equivalents consist of cash and marketable securities.Last year the company's cash account increased by $31,000 and its marketable securities account decreased by $22,000.Cash provided by operating activities was $108,000.Net cash used in financing activities was $70,000.Based on this information,the net cash flow from investing activities on the statement of cash flows was:

A)a net $9,000 increase.

B)a net $29,000 decrease.

C)a net $38,000 increase.

D)a net $38,000 decrease.

A)a net $9,000 increase.

B)a net $29,000 decrease.

C)a net $38,000 increase.

D)a net $38,000 decrease.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

49

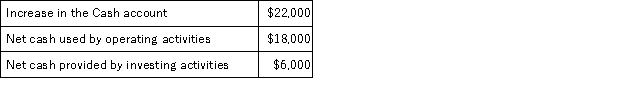

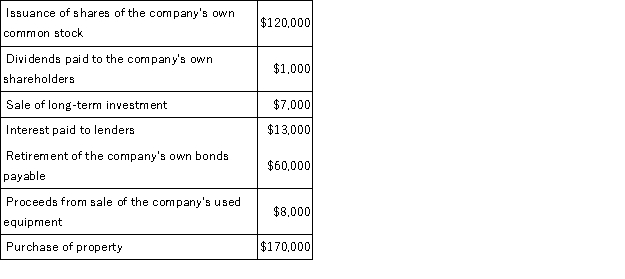

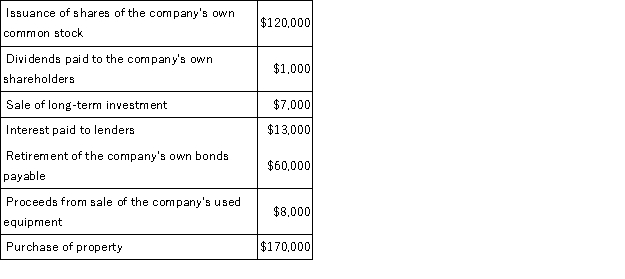

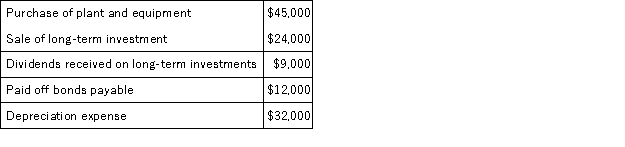

The Warrel Corporation reported the following data for last year:  Based solely on this information,the net cash provided (used)by financing activities on the statement of cash flows would be:

Based solely on this information,the net cash provided (used)by financing activities on the statement of cash flows would be:

A)$12,000

B)$34,000

C)($12,000)

D)($18,000)

Based solely on this information,the net cash provided (used)by financing activities on the statement of cash flows would be:

Based solely on this information,the net cash provided (used)by financing activities on the statement of cash flows would be:A)$12,000

B)$34,000

C)($12,000)

D)($18,000)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

50

Which of the following would be added to net income in the operating activities section of a statement of cash flows prepared using the indirect method?

A)a decrease in accounts receivable.

B)an increase in prepaid expenses.

C)an increase in accrued liabilities.

D)an increase in property,plant and equipment.

A)a decrease in accounts receivable.

B)an increase in prepaid expenses.

C)an increase in accrued liabilities.

D)an increase in property,plant and equipment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

51

An increase in the Inventory account of a company from $10,000 at the beginning of the year to $15,000 at the end of the year would be shown on the company's statement of cash flows prepared under the indirect method as:

A)an addition to net income of $5,000 in order to arrive at net cash provided by operating activities.

B)a deduction from net income of $5,000 in order to arrive at net cash provided by operating activities.

C)an addition to net income of $15,000 in order to arrive at net cash provided by operating activities.

D)a deduction from net income of $10,000 in order to arrive at net cash provided by operating activities.

A)an addition to net income of $5,000 in order to arrive at net cash provided by operating activities.

B)a deduction from net income of $5,000 in order to arrive at net cash provided by operating activities.

C)an addition to net income of $15,000 in order to arrive at net cash provided by operating activities.

D)a deduction from net income of $10,000 in order to arrive at net cash provided by operating activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

52

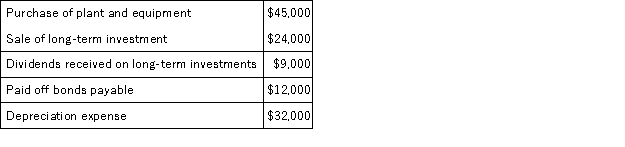

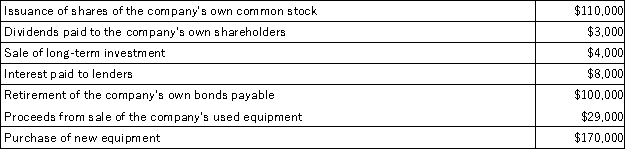

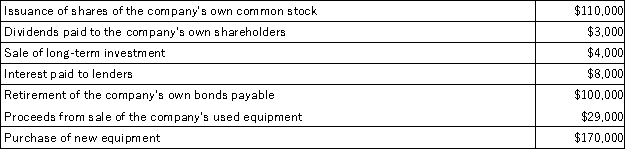

The following transactions occurred last year at Jolly Corporation:  Based solely on the above information,the net cash provided by financing activities for the year on the statement of cash flows would be:

Based solely on the above information,the net cash provided by financing activities for the year on the statement of cash flows would be:

A)$179,000

B)$59,000

C)($109,000)

D)$46,000

Based solely on the above information,the net cash provided by financing activities for the year on the statement of cash flows would be:

Based solely on the above information,the net cash provided by financing activities for the year on the statement of cash flows would be:A)$179,000

B)$59,000

C)($109,000)

D)$46,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

53

Tani Corporation's most recent balance sheet appears below:  The company's net income for the year was $18 and it did not sell or retire any property,plant,and equipment during the year.Cash dividends were $4.The net cash provided by (used in)investing activities for the year was:

The company's net income for the year was $18 and it did not sell or retire any property,plant,and equipment during the year.Cash dividends were $4.The net cash provided by (used in)investing activities for the year was:

A)($45)

B)$45

C)($3)

D)$3

The company's net income for the year was $18 and it did not sell or retire any property,plant,and equipment during the year.Cash dividends were $4.The net cash provided by (used in)investing activities for the year was:

The company's net income for the year was $18 and it did not sell or retire any property,plant,and equipment during the year.Cash dividends were $4.The net cash provided by (used in)investing activities for the year was:A)($45)

B)$45

C)($3)

D)$3

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

54

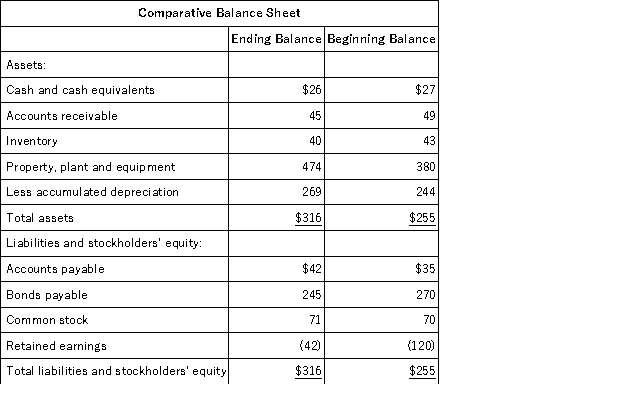

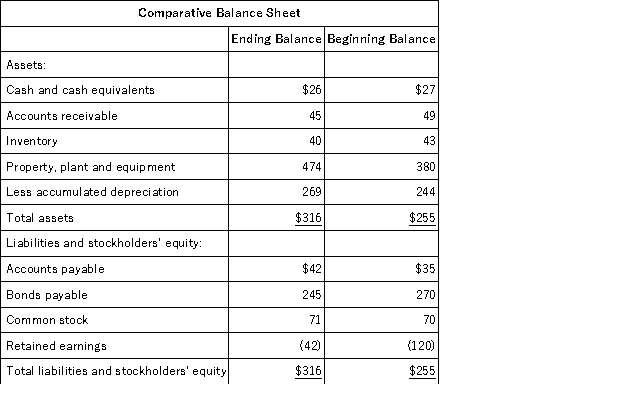

Klicker Corporation's most recent balance sheet appears below:  The company's net income for the year was $152 and it did not issue any bonds or repurchase any of its common stock during the year.Cash dividends were $40.The net cash provided by (used in)financing activities for the year was:

The company's net income for the year was $152 and it did not issue any bonds or repurchase any of its common stock during the year.Cash dividends were $40.The net cash provided by (used in)financing activities for the year was:

A)($49)

B)($40)

C)$4

D)($13)

The company's net income for the year was $152 and it did not issue any bonds or repurchase any of its common stock during the year.Cash dividends were $40.The net cash provided by (used in)financing activities for the year was:

The company's net income for the year was $152 and it did not issue any bonds or repurchase any of its common stock during the year.Cash dividends were $40.The net cash provided by (used in)financing activities for the year was:A)($49)

B)($40)

C)$4

D)($13)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

55

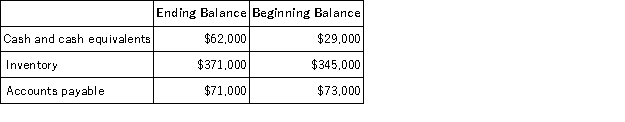

Excerpts from Aultman Corporation's comparative balance sheet appear below:  Which of the following is the correct treatment within the operating activities section of the statement of cash flows using the indirect method?

Which of the following is the correct treatment within the operating activities section of the statement of cash flows using the indirect method?

A)The change in Inventory is added to net income;The change in Accounts Payable is added to net income

B)The change in Inventory is added to net income;The change in Accounts Payable is subtracted from net income

C)The change in Inventory is subtracted from net income;The change in Accounts Payable is added to net income

D)The change in Inventory is subtracted from net income;The change in Accounts Payable is subtracted from net income

Which of the following is the correct treatment within the operating activities section of the statement of cash flows using the indirect method?

Which of the following is the correct treatment within the operating activities section of the statement of cash flows using the indirect method?A)The change in Inventory is added to net income;The change in Accounts Payable is added to net income

B)The change in Inventory is added to net income;The change in Accounts Payable is subtracted from net income

C)The change in Inventory is subtracted from net income;The change in Accounts Payable is added to net income

D)The change in Inventory is subtracted from net income;The change in Accounts Payable is subtracted from net income

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

56

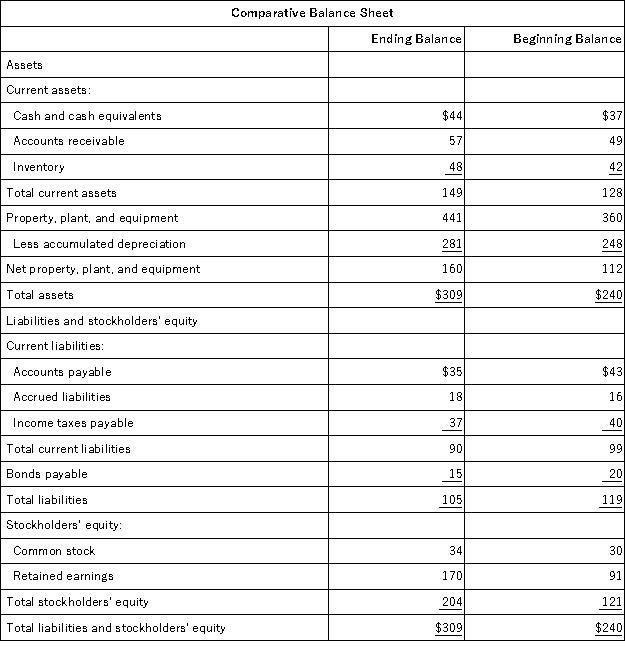

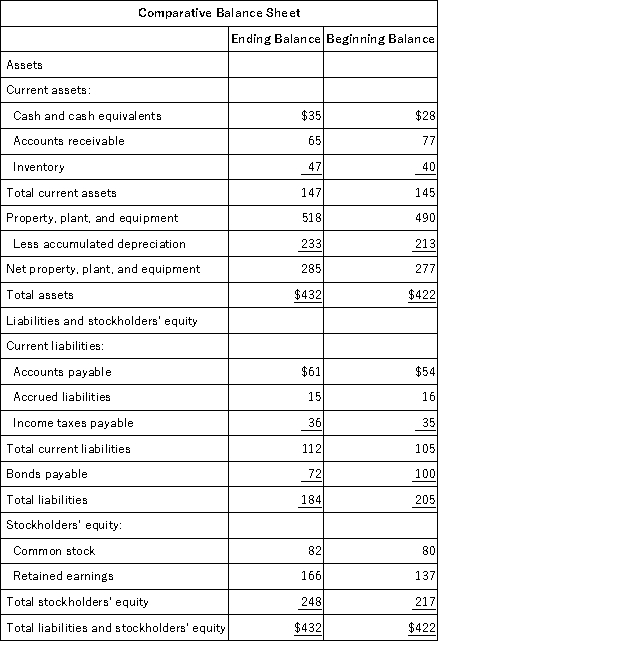

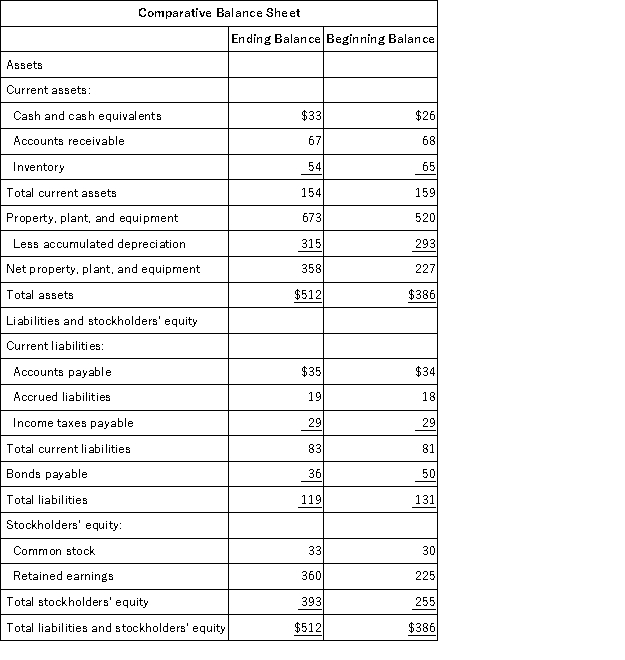

Marbry Corporation's balance sheet and income statement appear below:

Cash dividends were $21.The company did not issue any bonds or repurchase any of its own common stock during the year.The net cash provided by (used in)financing activities for the year was:

Cash dividends were $21.The company did not issue any bonds or repurchase any of its own common stock during the year.The net cash provided by (used in)financing activities for the year was:

A)$4

B)($22)

C)($5)

D)($21)

Cash dividends were $21.The company did not issue any bonds or repurchase any of its own common stock during the year.The net cash provided by (used in)financing activities for the year was:

Cash dividends were $21.The company did not issue any bonds or repurchase any of its own common stock during the year.The net cash provided by (used in)financing activities for the year was:A)$4

B)($22)

C)($5)

D)($21)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

57

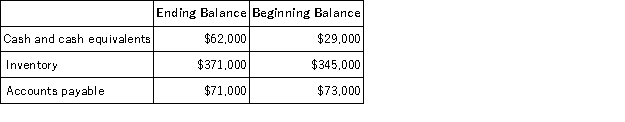

Excerpts from Neuwirth Corporation's comparative balance sheet appear below:  Which of the following is the correct treatment within the operating activities section of the statement of cash flows using the indirect method?

Which of the following is the correct treatment within the operating activities section of the statement of cash flows using the indirect method?

A)The change in Accounts Receivable is added to net income;The change in Inventory is added to net income

B)The change in Accounts Receivable is added to net income;The change in Inventory is subtracted from net income

C)The change in Accounts Receivable is subtracted from net income;The change in Inventory is subtracted from net income

D)The change in Accounts Receivable is subtracted from net income;The change in Inventory is added to net income

Which of the following is the correct treatment within the operating activities section of the statement of cash flows using the indirect method?

Which of the following is the correct treatment within the operating activities section of the statement of cash flows using the indirect method?A)The change in Accounts Receivable is added to net income;The change in Inventory is added to net income

B)The change in Accounts Receivable is added to net income;The change in Inventory is subtracted from net income

C)The change in Accounts Receivable is subtracted from net income;The change in Inventory is subtracted from net income

D)The change in Accounts Receivable is subtracted from net income;The change in Inventory is added to net income

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

58

Excerpts from Deblois Corporation's comparative balance sheet appear below:  Which of the following is the correct treatment within the operating activities section of the statement of cash flows using the indirect method?

Which of the following is the correct treatment within the operating activities section of the statement of cash flows using the indirect method?

A)The change in Accounts Payable is added to net income;The change in Accrued Liabilities is subtracted from net income

B)The change in Accounts Payable is added to net income;The change in Accrued Liabilities is added to net income

C)The change in Accounts Payable is subtracted from net income;The change in Accrued Liabilities is added to net income

D)The change in Accounts Payable is subtracted from net income;The change in Accrued Liabilities is subtracted from net income

Which of the following is the correct treatment within the operating activities section of the statement of cash flows using the indirect method?

Which of the following is the correct treatment within the operating activities section of the statement of cash flows using the indirect method?A)The change in Accounts Payable is added to net income;The change in Accrued Liabilities is subtracted from net income

B)The change in Accounts Payable is added to net income;The change in Accrued Liabilities is added to net income

C)The change in Accounts Payable is subtracted from net income;The change in Accrued Liabilities is added to net income

D)The change in Accounts Payable is subtracted from net income;The change in Accrued Liabilities is subtracted from net income

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

59

The following events occurred last year at Dorder Corporation:  Based on the above information,the cash provided (used)by investing activities for the year on the statement of cash flows would net to:

Based on the above information,the cash provided (used)by investing activities for the year on the statement of cash flows would net to:

A)($21,000)

B)($12,000)

C)($32,000)

D)($69,000)

Based on the above information,the cash provided (used)by investing activities for the year on the statement of cash flows would net to:

Based on the above information,the cash provided (used)by investing activities for the year on the statement of cash flows would net to:A)($21,000)

B)($12,000)

C)($32,000)

D)($69,000)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

60

An increase in accounts receivable of $1,000 over the course of a year would be shown on the company's statement of cash flows prepared under the indirect method as:

A)an addition to net income of $1,000 in order to arrive at net cash provided by operating activities.

B)a deduction from net income of $1,000 in order to arrive at net cash provided by operating activities.

C)an addition of $1,000 under financing activities.

D)a deduction of $1,000 under financing activities.

A)an addition to net income of $1,000 in order to arrive at net cash provided by operating activities.

B)a deduction from net income of $1,000 in order to arrive at net cash provided by operating activities.

C)an addition of $1,000 under financing activities.

D)a deduction of $1,000 under financing activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

61

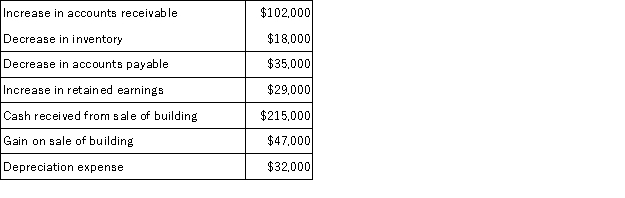

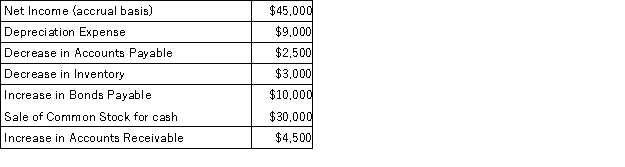

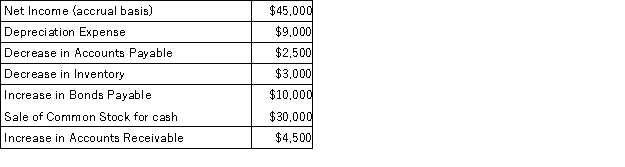

Majorn Auto Parts Store had net income of $81,000 for the year just ended.Majorn collected the following additional information to prepare its statement of cash flows for the year:  Majorn uses the indirect method to prepare its statement of cash flows.What is Majorn's net cash provided (used)by operating activities?

Majorn uses the indirect method to prepare its statement of cash flows.What is Majorn's net cash provided (used)by operating activities?

A)$41,000

B)($53,000)

C)$185,000

D)$279,000

Majorn uses the indirect method to prepare its statement of cash flows.What is Majorn's net cash provided (used)by operating activities?

Majorn uses the indirect method to prepare its statement of cash flows.What is Majorn's net cash provided (used)by operating activities?A)$41,000

B)($53,000)

C)$185,000

D)$279,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

62

Kaze Corporation's cash and cash equivalents consist of cash and marketable securities.Last year the company's cash account increased by $25,000 and its marketable securities account decreased by $15,000.Cash provided by operating activities was $38,000.Net cash provided by investing activities was $9,000.Based on this information,the net cash flow from financing activities on the statement of cash flows was:

A)a net $37,000 decrease.

B)a net $37,000 increase.

C)a net $47,000 decrease.

D)a net $47,000 increase.

A)a net $37,000 decrease.

B)a net $37,000 increase.

C)a net $47,000 decrease.

D)a net $47,000 increase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

63

Beacham Corporation's net cash provided by operating activities was $115;its net income was $95;its capital expenditures were $65;and its cash dividends were $17.The company's free cash flow was:

A)$292

B)$13

C)$33

D)$128

A)$292

B)$13

C)$33

D)$128

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

64

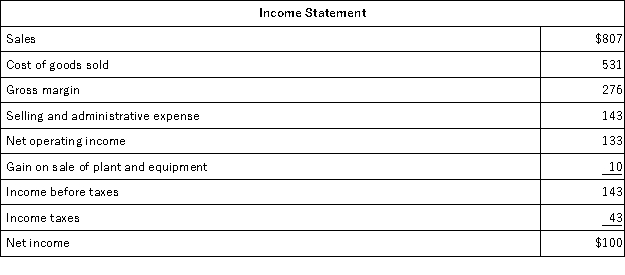

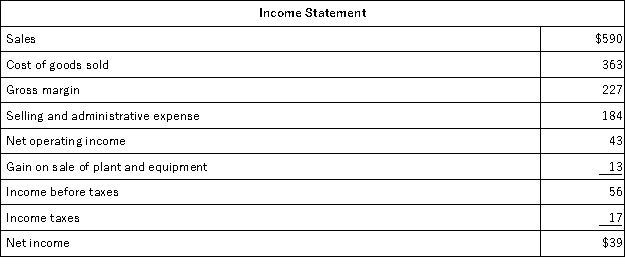

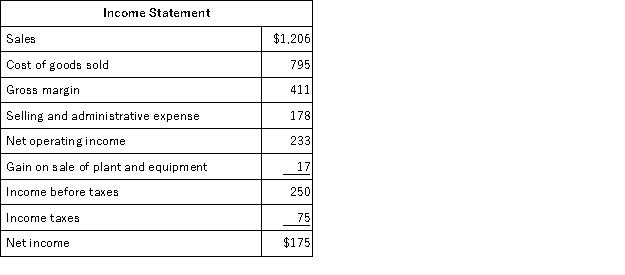

Degeare Corporation's balance sheet and income statement appear below:

Cash dividends were $10.The company sold equipment for $18 that was originally purchased for $10 and that had accumulated depreciation of $5.The net cash provided by (used in)operating activities for the year was:

Cash dividends were $10.The company sold equipment for $18 that was originally purchased for $10 and that had accumulated depreciation of $5.The net cash provided by (used in)operating activities for the year was:

A)$73

B)$76

C)$43

D)$63

Cash dividends were $10.The company sold equipment for $18 that was originally purchased for $10 and that had accumulated depreciation of $5.The net cash provided by (used in)operating activities for the year was:

Cash dividends were $10.The company sold equipment for $18 that was originally purchased for $10 and that had accumulated depreciation of $5.The net cash provided by (used in)operating activities for the year was:A)$73

B)$76

C)$43

D)$63

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

65

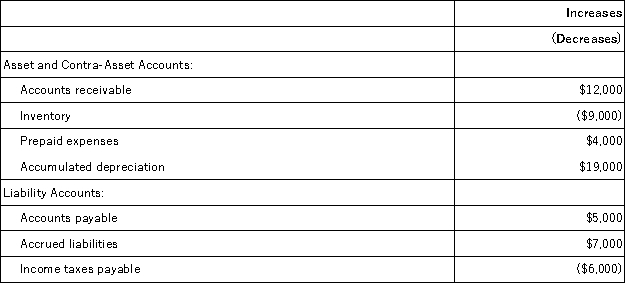

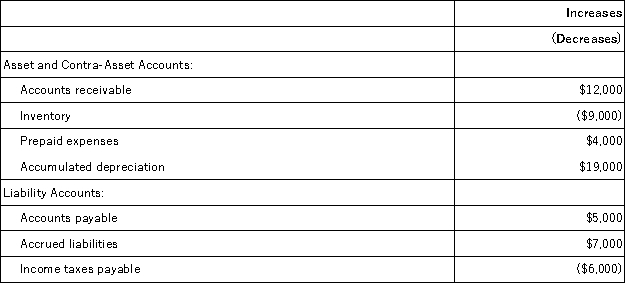

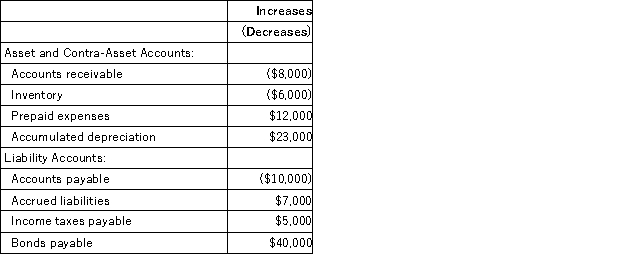

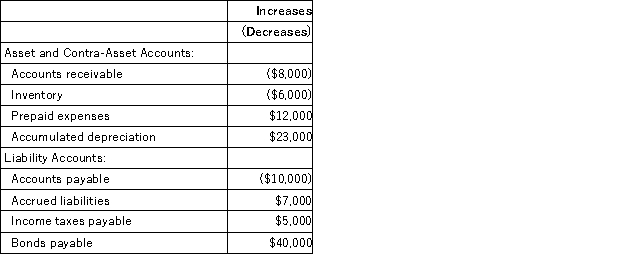

Norbury Corporation's net income last year was $34,000.The company did not sell or retire any property,plant,and equipment last year.Changes in selected balance sheet accounts for the year appear below:  Based solely on this information,the net cash provided by operating activities under the indirect method on the statement of cash flows would be:

Based solely on this information,the net cash provided by operating activities under the indirect method on the statement of cash flows would be:

A)$52,000

B)$66,000

C)$53,000

D)$16,000

Based solely on this information,the net cash provided by operating activities under the indirect method on the statement of cash flows would be:

Based solely on this information,the net cash provided by operating activities under the indirect method on the statement of cash flows would be:A)$52,000

B)$66,000

C)$53,000

D)$16,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

66

Carriveau Corporation's most recent balance sheet appears below:  Net income for the year was $172.Cash dividends were $35.The company did not sell or retire any property,plant,and equipment during the year.The net cash provided by (used in)operating activities for the year was:

Net income for the year was $172.Cash dividends were $35.The company did not sell or retire any property,plant,and equipment during the year.The net cash provided by (used in)operating activities for the year was:

A)$183

B)$246

C)($11)

D)$161

Net income for the year was $172.Cash dividends were $35.The company did not sell or retire any property,plant,and equipment during the year.The net cash provided by (used in)operating activities for the year was:

Net income for the year was $172.Cash dividends were $35.The company did not sell or retire any property,plant,and equipment during the year.The net cash provided by (used in)operating activities for the year was:A)$183

B)$246

C)($11)

D)$161

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

67

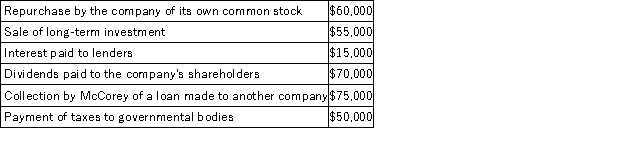

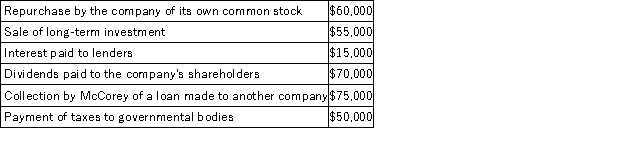

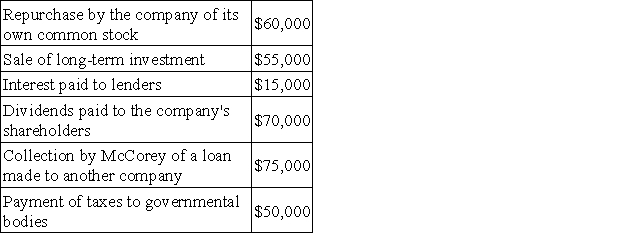

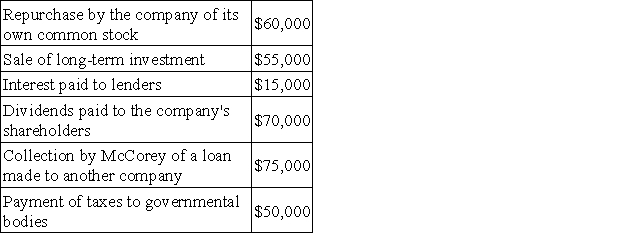

McCorey Corporation recorded the following events last year:  On the statement of cash flows,some of these events are classified as operating activities,some are classified as investing activities,and some are classified as financing activities. Based solely on the information above,the net cash provided by (used in)financing activities on the statement of cash flows would be:

On the statement of cash flows,some of these events are classified as operating activities,some are classified as investing activities,and some are classified as financing activities. Based solely on the information above,the net cash provided by (used in)financing activities on the statement of cash flows would be:

A)($70,000)

B)$70,000

C)($130,000)

D)$130,000

On the statement of cash flows,some of these events are classified as operating activities,some are classified as investing activities,and some are classified as financing activities. Based solely on the information above,the net cash provided by (used in)financing activities on the statement of cash flows would be:

On the statement of cash flows,some of these events are classified as operating activities,some are classified as investing activities,and some are classified as financing activities. Based solely on the information above,the net cash provided by (used in)financing activities on the statement of cash flows would be:A)($70,000)

B)$70,000

C)($130,000)

D)$130,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

68

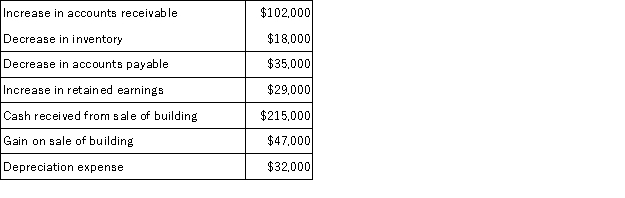

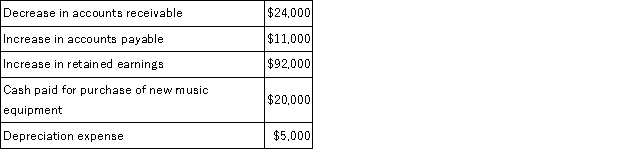

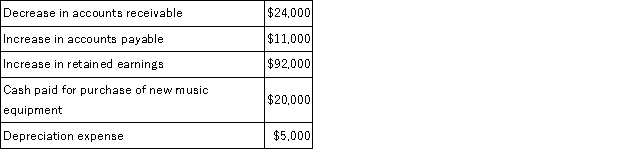

Klutz Dance Studio had net income of $167,000 for the year just ended.Klutz collected the following additional information to prepare its statement of cash flows for the year:  Klutz uses the indirect method to prepare its statement of cash flows.What is Klutz's net cash provided (used)by operating activities?

Klutz uses the indirect method to prepare its statement of cash flows.What is Klutz's net cash provided (used)by operating activities?

A)$95,000

B)$137,000

C)$185,000

D)$207,000

Klutz uses the indirect method to prepare its statement of cash flows.What is Klutz's net cash provided (used)by operating activities?

Klutz uses the indirect method to prepare its statement of cash flows.What is Klutz's net cash provided (used)by operating activities?A)$95,000

B)$137,000

C)$185,000

D)$207,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

69

McCorey Corporation recorded the following events last year:  On the statement of cash flows,some of these events are classified as operating activities,some are classified as investing activities,and some are classified as financing activities. Based solely on the information above,the net cash provided by (used in)investing activities on the statement of cash flows would be:

On the statement of cash flows,some of these events are classified as operating activities,some are classified as investing activities,and some are classified as financing activities. Based solely on the information above,the net cash provided by (used in)investing activities on the statement of cash flows would be:

A)$110,000

B)$55,000

C)$150,000

D)$130,000

On the statement of cash flows,some of these events are classified as operating activities,some are classified as investing activities,and some are classified as financing activities. Based solely on the information above,the net cash provided by (used in)investing activities on the statement of cash flows would be:

On the statement of cash flows,some of these events are classified as operating activities,some are classified as investing activities,and some are classified as financing activities. Based solely on the information above,the net cash provided by (used in)investing activities on the statement of cash flows would be:A)$110,000

B)$55,000

C)$150,000

D)$130,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

70

The following events occurred last year for the Cart Corporation:  Based solely on the above information,the net cash provided by financing activities for the year on the statement of cash flows was:

Based solely on the above information,the net cash provided by financing activities for the year on the statement of cash flows was:

A)$12,000

B)$24,000

C)$20,000

D)$49,000

Based solely on the above information,the net cash provided by financing activities for the year on the statement of cash flows was:

Based solely on the above information,the net cash provided by financing activities for the year on the statement of cash flows was:A)$12,000

B)$24,000

C)$20,000

D)$49,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

71

Suggett Corporation's net cash provided by operating activities was $34;its income taxes were $12;its capital expenditures were $24;and its cash dividends were $7.The company's free cash flow was:

A)($19)

B)$77

C)$3

D)$15

A)($19)

B)$77

C)$3

D)$15

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

72

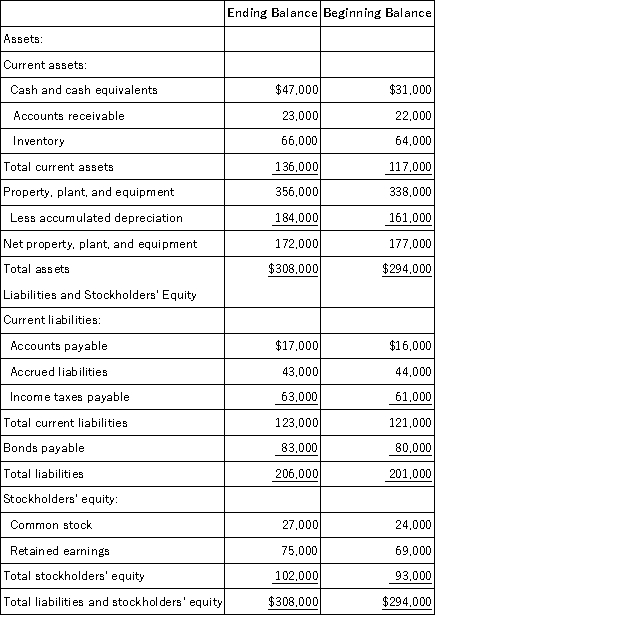

Illies Corporation's comparative balance sheet appears below:  The company did not dispose of any property,plant,and equipment during the year.Its net income for the year was $5,000 and its cash dividends were $4,000.The company did not issue any bonds payable or purchase any of its own common stock during the year.Its net cash provided by operating activities and net cash used in financing activities are:

The company did not dispose of any property,plant,and equipment during the year.Its net income for the year was $5,000 and its cash dividends were $4,000.The company did not issue any bonds payable or purchase any of its own common stock during the year.Its net cash provided by operating activities and net cash used in financing activities are:

A)net cash provided by operating activities,$33,000;net cash used in financing activities,$1,000

B)net cash provided by operating activities,$35,000;net cash used in financing activities,$7,000

C)net cash provided by operating activities,$33,000;net cash used in financing activities,$7,000

D)net cash provided by operating activities,$35,000;net cash used in financing activities,$1,000

The company did not dispose of any property,plant,and equipment during the year.Its net income for the year was $5,000 and its cash dividends were $4,000.The company did not issue any bonds payable or purchase any of its own common stock during the year.Its net cash provided by operating activities and net cash used in financing activities are:

The company did not dispose of any property,plant,and equipment during the year.Its net income for the year was $5,000 and its cash dividends were $4,000.The company did not issue any bonds payable or purchase any of its own common stock during the year.Its net cash provided by operating activities and net cash used in financing activities are:A)net cash provided by operating activities,$33,000;net cash used in financing activities,$1,000

B)net cash provided by operating activities,$35,000;net cash used in financing activities,$7,000

C)net cash provided by operating activities,$33,000;net cash used in financing activities,$7,000

D)net cash provided by operating activities,$35,000;net cash used in financing activities,$1,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

73

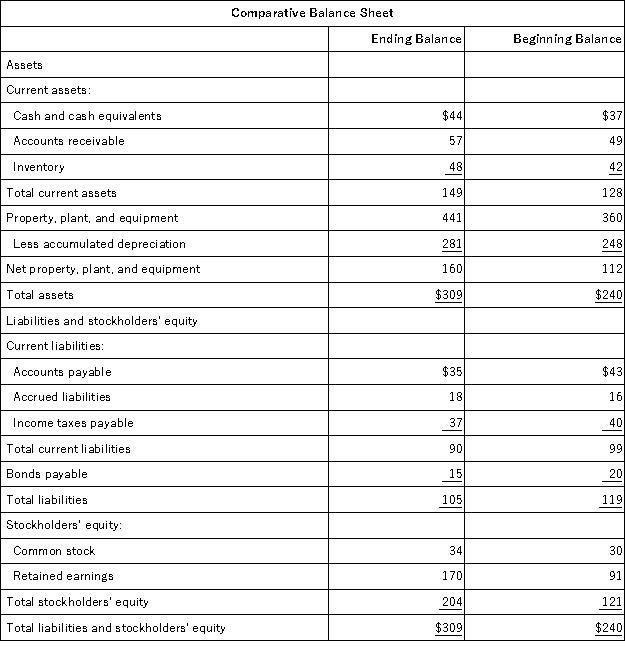

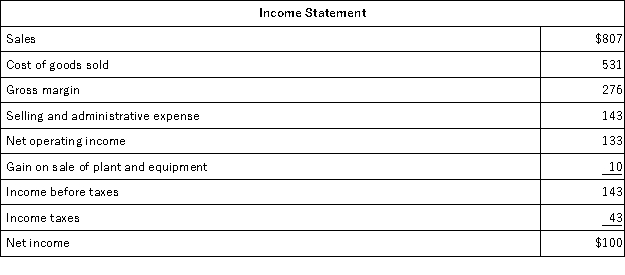

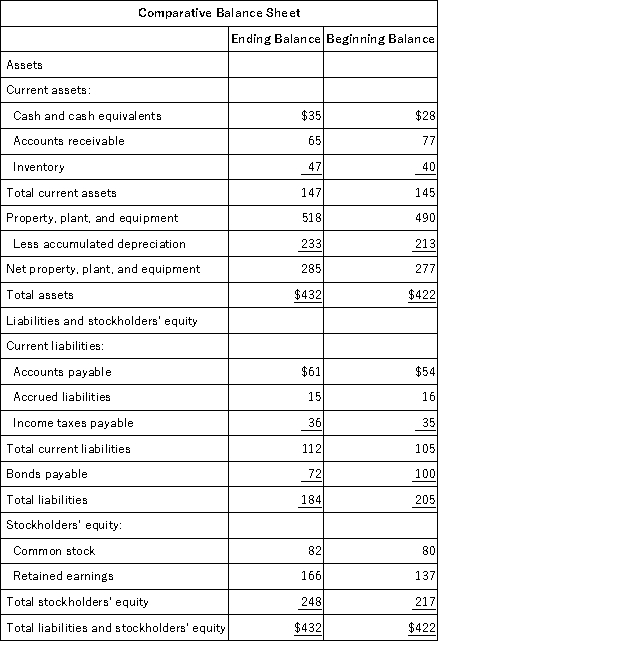

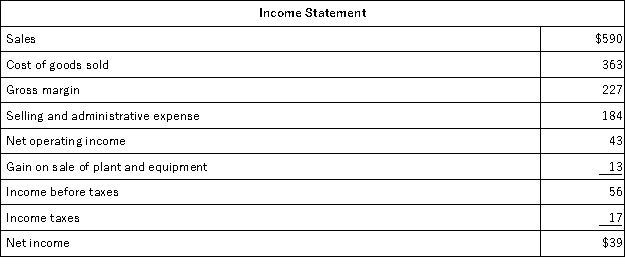

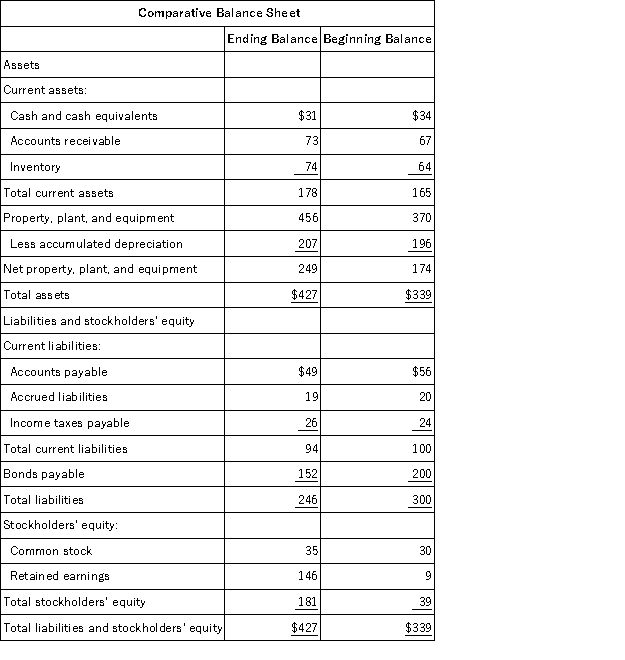

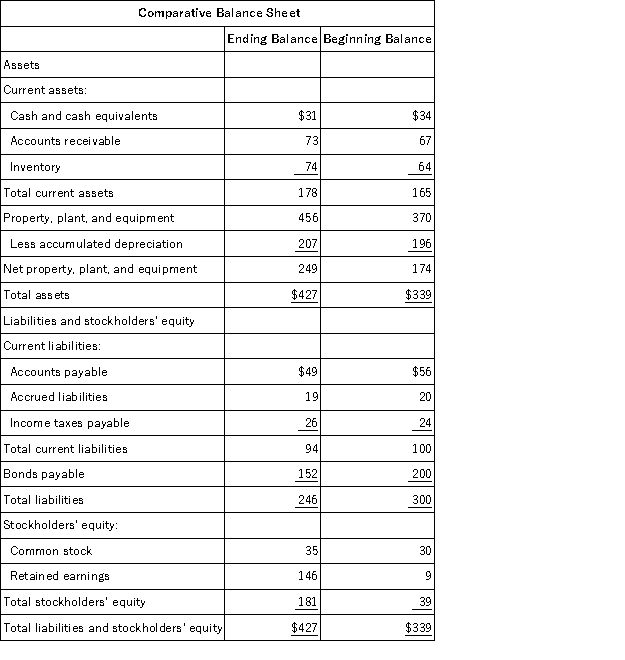

Autry Corporation's balance sheet and income statement appear below:

Cash dividends were $40.The company sold equipment for $19 that was originally purchased for $6 and that had accumulated depreciation of $4.The net cash provided by (used in)investing activities for the year was:

Cash dividends were $40.The company sold equipment for $19 that was originally purchased for $6 and that had accumulated depreciation of $4.The net cash provided by (used in)investing activities for the year was:

A)$19

B)$140

C)($159)

D)($140)

Cash dividends were $40.The company sold equipment for $19 that was originally purchased for $6 and that had accumulated depreciation of $4.The net cash provided by (used in)investing activities for the year was:

Cash dividends were $40.The company sold equipment for $19 that was originally purchased for $6 and that had accumulated depreciation of $4.The net cash provided by (used in)investing activities for the year was:A)$19

B)$140

C)($159)

D)($140)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

74

The data given below are from the accounting records of the Kuhn Corporation:  Based on this information,the net cash provided by operating activities using the indirect method would be:

Based on this information,the net cash provided by operating activities using the indirect method would be:

A)$55,000

B)$58,000

C)$50,000

D)$60,000

Based on this information,the net cash provided by operating activities using the indirect method would be:

Based on this information,the net cash provided by operating activities using the indirect method would be:A)$55,000

B)$58,000

C)$50,000

D)$60,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

75

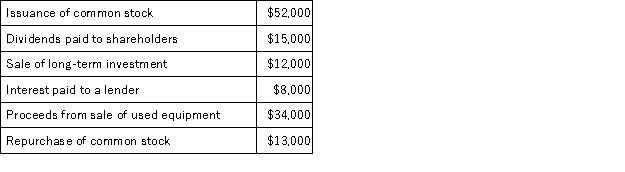

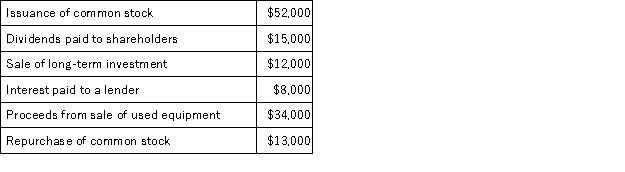

The following transactions occurred last year at Jogger Corporation:  Based solely on the above information,the net cash provided by financing activities for the year on the statement of cash flows would be:

Based solely on the above information,the net cash provided by financing activities for the year on the statement of cash flows would be:

A)$424,000

B)($138,000)

C)($1,000)

D)$7,000

Based solely on the above information,the net cash provided by financing activities for the year on the statement of cash flows would be:

Based solely on the above information,the net cash provided by financing activities for the year on the statement of cash flows would be:A)$424,000

B)($138,000)

C)($1,000)

D)$7,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

76

Morbeck Corporation's net income last year was $56,000.The company paid a cash dividend of $31,000 and did not sell or retire any property,plant,and equipment last year.Changes in selected balance sheet accounts for the year appear below:  Based solely on this information,the net cash provided by operating activities under the indirect method on the statement of cash flows would be:

Based solely on this information,the net cash provided by operating activities under the indirect method on the statement of cash flows would be:

A)$83,000

B)$102,000

C)$29,000

D)$79,000

Based solely on this information,the net cash provided by operating activities under the indirect method on the statement of cash flows would be:

Based solely on this information,the net cash provided by operating activities under the indirect method on the statement of cash flows would be:A)$83,000

B)$102,000

C)$29,000

D)$79,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

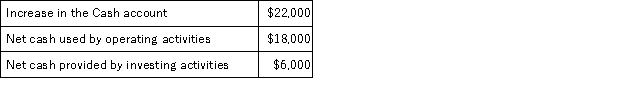

77

Furis Corporation's cash and cash equivalents consist of cash and marketable securities.Last year the company's cash account decreased by $12,000 and its marketable securities account increased by $19,000.Cash provided by operating activities was $18,000.Net cash used in financing activities was $12,000.Based on this information,the net cash flow from investing activities on the statement of cash flows was:

A)a net $12,000 decrease.

B)a net $1,000 increase.

C)a net $6,000 decrease.

D)a net $6,000 increase.

A)a net $12,000 decrease.

B)a net $1,000 increase.

C)a net $6,000 decrease.

D)a net $6,000 increase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

78

Birchett Corporation's most recent balance sheet appears below:  The company's net income for the year was $91 and it did not sell or retire any property,plant,and equipment during the year.Cash dividends were $22.The net cash provided by (used in)operating activities for the year was:

The company's net income for the year was $91 and it did not sell or retire any property,plant,and equipment during the year.Cash dividends were $22.The net cash provided by (used in)operating activities for the year was:

A)$86

B)$5

C)$96

D)$130

The company's net income for the year was $91 and it did not sell or retire any property,plant,and equipment during the year.Cash dividends were $22.The net cash provided by (used in)operating activities for the year was:

The company's net income for the year was $91 and it did not sell or retire any property,plant,and equipment during the year.Cash dividends were $22.The net cash provided by (used in)operating activities for the year was:A)$86

B)$5

C)$96

D)$130

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

79

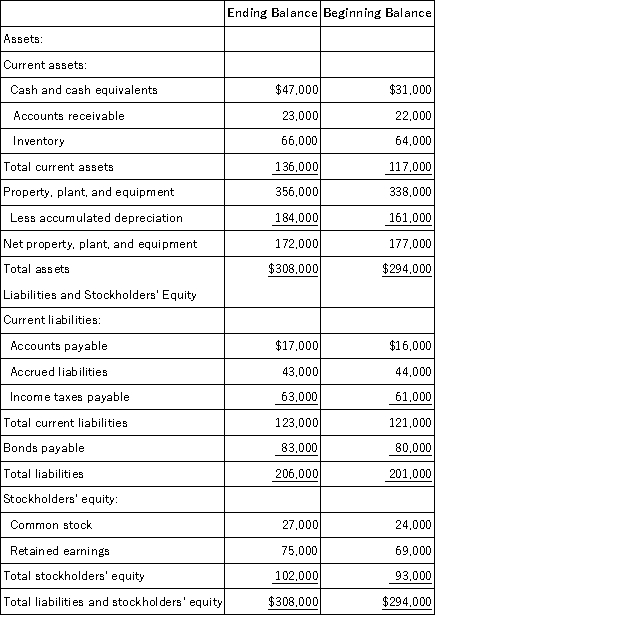

Swinger Corporation's comparative balance sheet appears below:  The company did not dispose of any property,plant,and equipment during the year.Its net income for the year was $10,000.The net cash provided by operating activities is:

The company did not dispose of any property,plant,and equipment during the year.Its net income for the year was $10,000.The net cash provided by operating activities is:

A)$32,000

B)$36,000

C)$34,000

D)$28,000

The company did not dispose of any property,plant,and equipment during the year.Its net income for the year was $10,000.The net cash provided by operating activities is:

The company did not dispose of any property,plant,and equipment during the year.Its net income for the year was $10,000.The net cash provided by operating activities is:A)$32,000

B)$36,000

C)$34,000

D)$28,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

80

Frankin Corporation's net cash provided by operating activities was $192;its capital expenditures were $154;and its cash dividends were $27.The company's free cash flow was:

A)$38

B)$373

C)$11

D)$165

A)$38

B)$373

C)$11

D)$165

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck