Deck 10: Flexible Budgets and Performance Analysis

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

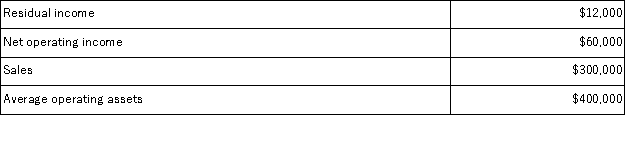

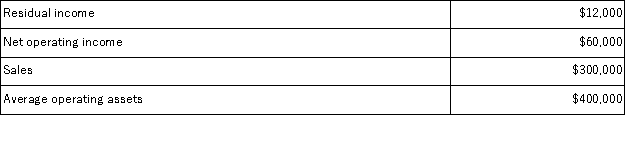

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

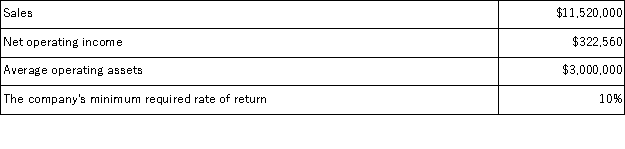

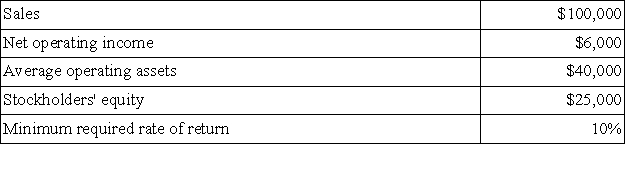

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

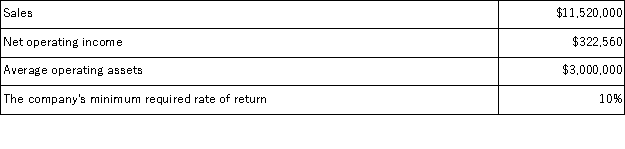

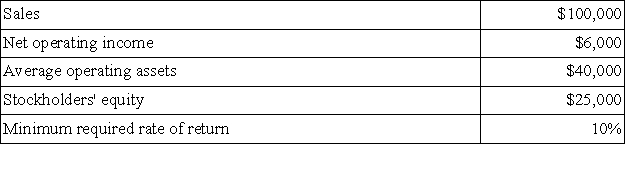

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/115

العب

ملء الشاشة (f)

Deck 10: Flexible Budgets and Performance Analysis

1

Land held for possible plant expansion would not be included as an operating asset when computing return on investment (ROI).

True

2

ROI and residual income are tools used to evaluate managerial performance in profit centers.

False

3

Queue time is considered value-added time.

False

4

Return on investment is superior to residual income as a means of measuring performance because it encourages managers to make investment decisions that are more consistent with the interests of the company as a whole.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

5

Margin equals net operating income divided by sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

6

Operating assets include cash,accounts receivable,and inventory but not any depreciable fixed assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

7

Wait time is considered non-value-added time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

8

Average operating assets is used in the numerator to compute turnover in an ROI analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

9

Residual income should not be used to evaluate a profit center.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

10

Suppose a company evaluates divisional performance using both ROI and residual income.The company's minimum required rate of return for the purposes of residual income calculations is 12%.If a division has a residual income of $6,000,then its ROI is greater than 12%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

11

Inspection Time is generally considered to be non-value-added time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

12

Net operating income is income after interest and taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

13

A manufacturing cycle efficiency (MCE)ratio close to 1.00 is desirable because this is the ratio of value-added time to throughput time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

14

A disadvantage of using ROI to evaluate performance is that it encourages the manager to reduce the investment in operating assets as well as increase net operating income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

15

Move time is considered value-added time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

16

All other things being the same,a decrease in average operating assets will decrease return on investment (ROI).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

17

Return on investment (ROI)equals margin multiplied by turnover.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

18

Residual income is the net operating income that an investment center earns above the minimum required return on the investment in fixed assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

19

When used in return on investment (ROI)calculations,operating assets do not include investments in land held for future use and investments in other companies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

20

Process Time is the only non-value-added component of Throughput Time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

21

A company that is seeking to increase ROI should attempt to decrease:

A)sales.

B)turnover.

C)margin.

D)average operating assets.

A)sales.

B)turnover.

C)margin.

D)average operating assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

22

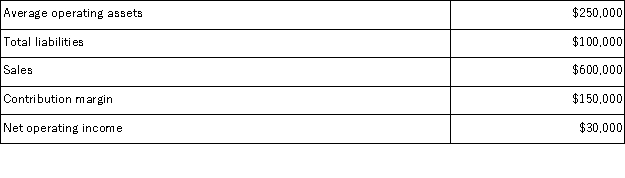

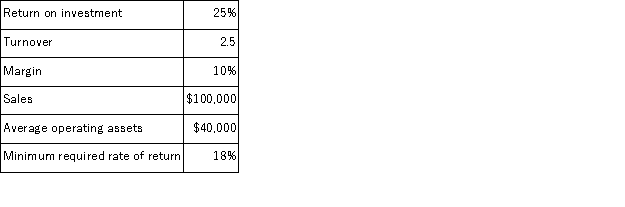

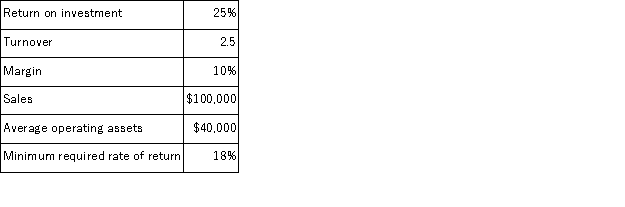

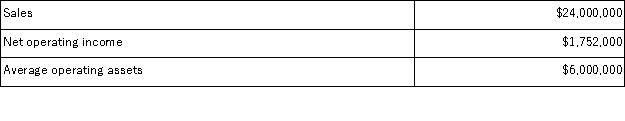

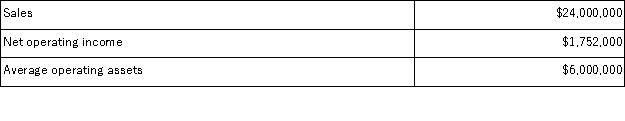

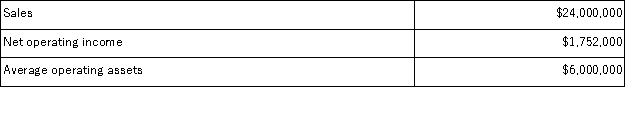

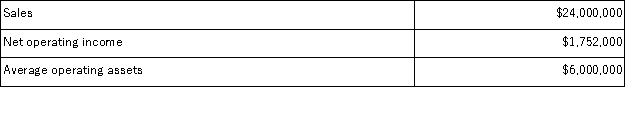

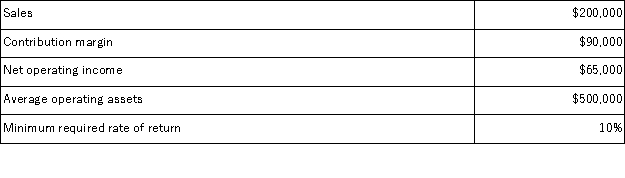

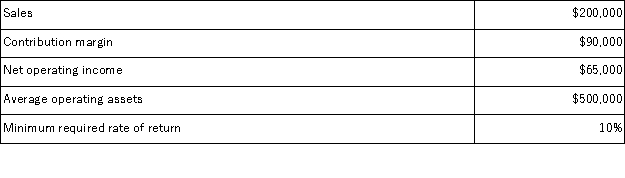

Given the following data:  Return on investment (ROI)would be:

Return on investment (ROI)would be:

A)5%

B)12%

C)25%

D)60%

Return on investment (ROI)would be:

Return on investment (ROI)would be:A)5%

B)12%

C)25%

D)60%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

23

All profit centers are responsibility centers,but not all responsibility centers are profit centers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

24

A cost center is not a responsibility center.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

25

Manufacturing Cycle Efficiency (MCE)is computed as:

A)Throughput Time ÷ Delivery Cycle Time.

B)Process Time ÷ Delivery Cycle Time.

C)Value-Added Time ÷ Throughput Time.

D)Value-Added Time ÷ Delivery-Cycle Time.

A)Throughput Time ÷ Delivery Cycle Time.

B)Process Time ÷ Delivery Cycle Time.

C)Value-Added Time ÷ Throughput Time.

D)Value-Added Time ÷ Delivery-Cycle Time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

26

Residual income:

A)is the return on investment (ROI)percentage multiplied by average operating assets.

B)is the net operating income earned above a certain minimum required return on sales.

C)is the net operating income earned above a certain minimum required return on average operating assets.

D)will always be greater than zero.

A)is the return on investment (ROI)percentage multiplied by average operating assets.

B)is the net operating income earned above a certain minimum required return on sales.

C)is the net operating income earned above a certain minimum required return on average operating assets.

D)will always be greater than zero.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

27

CS Company has a profit margin of 11%.Sales are $320,000,net operating income is $35,200,and average operating assets are $128,000.What is the company's return on investment (ROI)?

A)2.5

B)11%

C)27.5%

D)0.40

A)2.5

B)11%

C)27.5%

D)0.40

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

28

Because continuous improvement is very difficult,the emphasis in the balanced scorecard tends to be on meeting preset standards.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

29

Last year a company had sales of $400,000,a turnover of 2.4,and a return on investment of 36%.The company's net operating income for the year was:

A)$144,000

B)$120,000

C)$80,000

D)$60,000

A)$144,000

B)$120,000

C)$80,000

D)$60,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

30

A balanced scorecard should not contain any performance measures concerning customer satisfaction since the extent to which customers are satisfied is beyond the control of any manager in the company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

31

Throughput Time consists of:

A)Process Time.

B)Inspection Time and Move Time.

C)Process Time,Inspection Time,and Move Time.

D)Process Time,Inspection Time,Move Time,and Queue Time.

A)Process Time.

B)Inspection Time and Move Time.

C)Process Time,Inspection Time,and Move Time.

D)Process Time,Inspection Time,Move Time,and Queue Time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

32

Which of the following would be an argument for the use of net book value in the computation of operating assets in return on investment calculations?

A)It allows the manager to replace old,worn-out equipment with a minimum adverse impact on ROI.

B)It allows ROI to decrease over time as assets get older.

C)It is consistent with how plant and equipment items are reported on the balance sheet.

D)It eliminates both age of equipment and method of depreciation as factors in ROI computations.

A)It allows the manager to replace old,worn-out equipment with a minimum adverse impact on ROI.

B)It allows ROI to decrease over time as assets get older.

C)It is consistent with how plant and equipment items are reported on the balance sheet.

D)It eliminates both age of equipment and method of depreciation as factors in ROI computations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

33

Throughput time is the amount of time required to process raw materials into completed products.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

34

Contribution income statements are used to measure the performance of:

A)cost centers.

B)both cost centers and profit centers.

C)both cost centers and investment centers.

D)both profit centers and investment centers.

A)cost centers.

B)both cost centers and profit centers.

C)both cost centers and investment centers.

D)both profit centers and investment centers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

35

All other things being the same,which of the following would increase the residual income?

A)Decrease in average operating assets.

B)Decrease in sales.

C)Increase in minimum required return.

D)Decrease in net operating income.

A)Decrease in average operating assets.

B)Decrease in sales.

C)Increase in minimum required return.

D)Decrease in net operating income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

36

A profit center is responsible for generating revenue and for controlling costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

37

Managerial performance can be measured in many different ways including return on investment (ROI)and residual income.A good reason for using residual income instead of ROI is:

A)Residual income can be computed without having to measure operating assets.

B)Managers are more likely to accept projects that are beneficial to the company.

C)ROI does not take into account both turnover and margin.

D)A minimum rate of return does not have to be specified when the residual income approach is used.

A)Residual income can be computed without having to measure operating assets.

B)Managers are more likely to accept projects that are beneficial to the company.

C)ROI does not take into account both turnover and margin.

D)A minimum rate of return does not have to be specified when the residual income approach is used.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

38

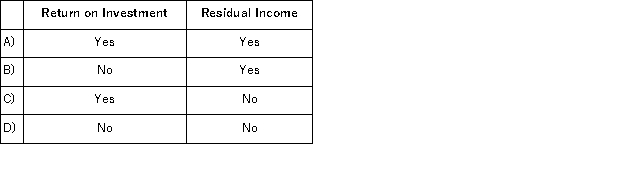

Which of the following performance measures will decrease if the minimum required rate of return increases?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

39

Net operating income is defined as:

A)net income plus interest and taxes.

B)sales minus variable expenses.

C)sales minus variable expenses and traceable fixed expenses.

D)contribution margin minus traceable and common fixed expenses.

A)net income plus interest and taxes.

B)sales minus variable expenses.

C)sales minus variable expenses and traceable fixed expenses.

D)contribution margin minus traceable and common fixed expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

40

Consider the following three conditions: I.An increase in sales

II)An increase in operating assets

III)A reduction in expenses

Which of the above conditions provide a way in which a manager can improve return on investment?

A)Only I

B)Only I and II

C)Only I and III

D)Only II and III

II)An increase in operating assets

III)A reduction in expenses

Which of the above conditions provide a way in which a manager can improve return on investment?

A)Only I

B)Only I and II

C)Only I and III

D)Only II and III

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

41

Chabot Company had the following results last year: net operating income,$2,160;turnover,5;and ROI 18%.Chabot Company's average operating assets were:

A)$300,000

B)$60,000

C)$10,800

D)$12,000

A)$300,000

B)$60,000

C)$10,800

D)$12,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

42

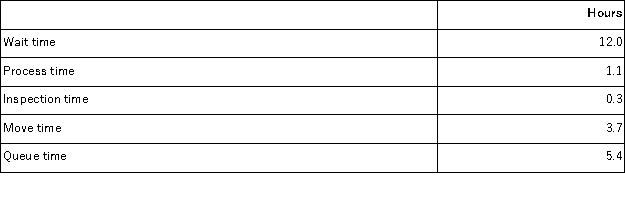

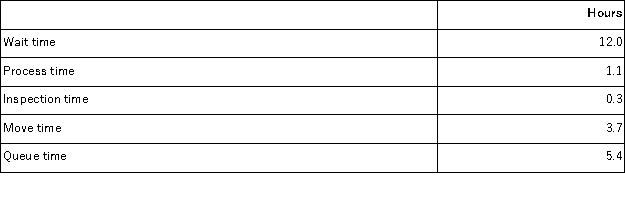

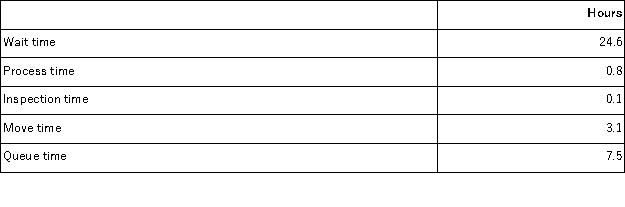

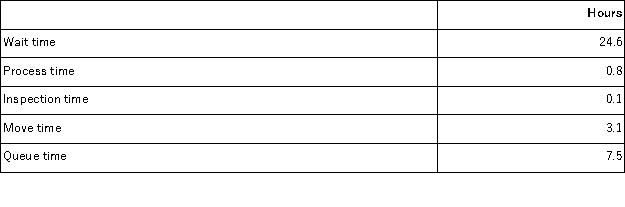

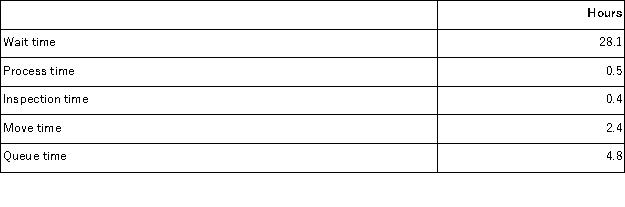

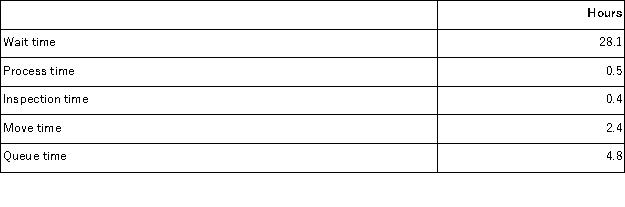

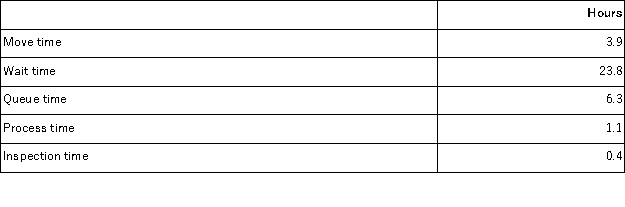

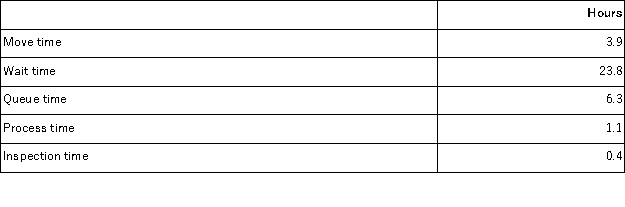

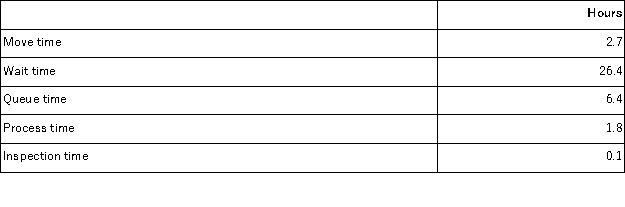

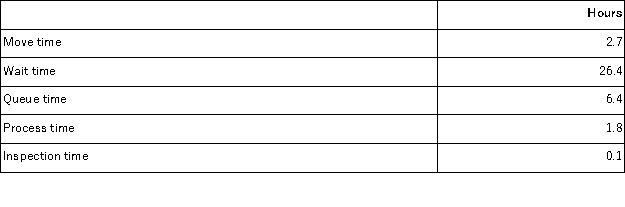

Brletich Corporation keeps careful track of the time required to fill orders.Data concerning a particular order appear below:  The delivery cycle time was:

The delivery cycle time was:

A)9.1 hours

B)21.1 hours

C)22.5 hours

D)3.7 hours

The delivery cycle time was:

The delivery cycle time was:A)9.1 hours

B)21.1 hours

C)22.5 hours

D)3.7 hours

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

43

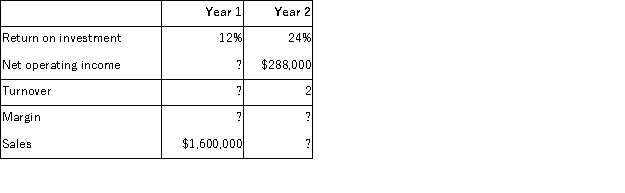

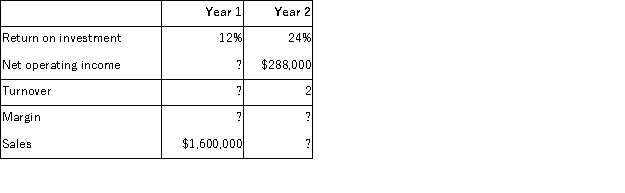

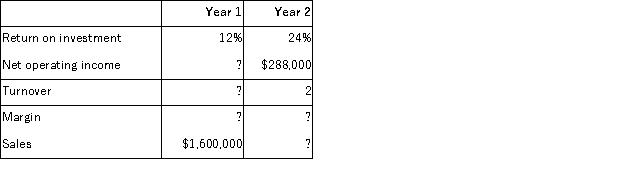

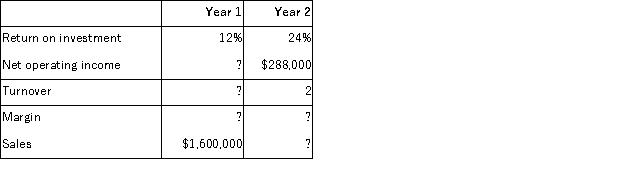

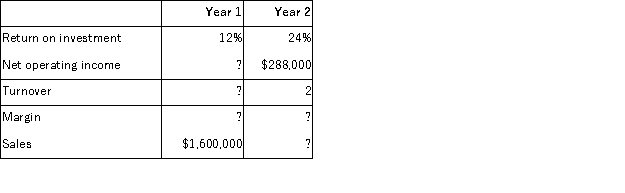

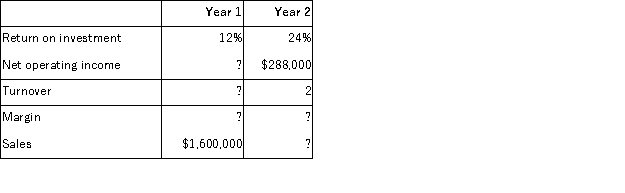

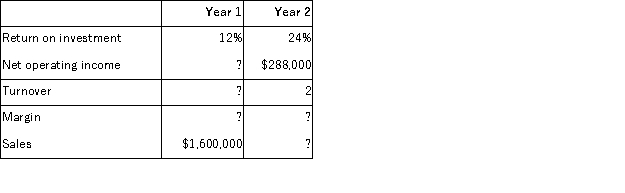

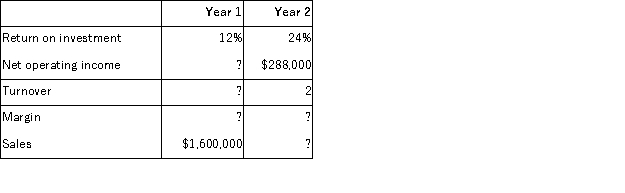

The Portland Division's operating data for the past two years is as follows:  The Portland Division's margin in Year 2 was 150% of the margin for Year 1. The turnover for Year 1 was:

The Portland Division's margin in Year 2 was 150% of the margin for Year 1. The turnover for Year 1 was:

A)10.00

B)2.00

C)1.50

D)3.20

The Portland Division's margin in Year 2 was 150% of the margin for Year 1. The turnover for Year 1 was:

The Portland Division's margin in Year 2 was 150% of the margin for Year 1. The turnover for Year 1 was:A)10.00

B)2.00

C)1.50

D)3.20

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

44

If operating income is $60,000,average operating assets are $240,000,and the minimum required rate of return is 20%,what is the residual income?

A)40%

B)25%

C)$12,000

D)$48,000

A)40%

B)25%

C)$12,000

D)$48,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

45

The following information relates to last year's operations at the Paper Division of Germane Corporation:  What was the Paper Division's net operating income last year?

What was the Paper Division's net operating income last year?

A)$24,300

B)$29,160

C)$145,800

D)$162,000

What was the Paper Division's net operating income last year?

What was the Paper Division's net operating income last year?A)$24,300

B)$29,160

C)$145,800

D)$162,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

46

The following information relates to last year's operations at the Bread Division of Rison Bakery Inc.:  What was the Bread Division's minimum required rate of return last year?

What was the Bread Division's minimum required rate of return last year?

A)12%

B)4%

C)15%

D)20%

What was the Bread Division's minimum required rate of return last year?

What was the Bread Division's minimum required rate of return last year?A)12%

B)4%

C)15%

D)20%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

47

For the past year,Allargando Company recorded sales of $500,000 and average operating assets of $250,000.What is the margin that Allargando Company needed to earn in order to achieve an ROI of 12%?

A)6.00%

B)12.00%

C)2.00%

D)8.33%

A)6.00%

B)12.00%

C)2.00%

D)8.33%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

48

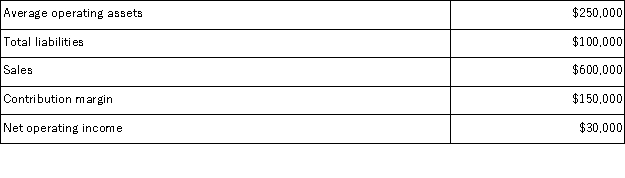

Given the following data:  The residual income would be:

The residual income would be:

A)$2,800

B)$0

C)$6,000

D)$8,000

The residual income would be:

The residual income would be:A)$2,800

B)$0

C)$6,000

D)$8,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

49

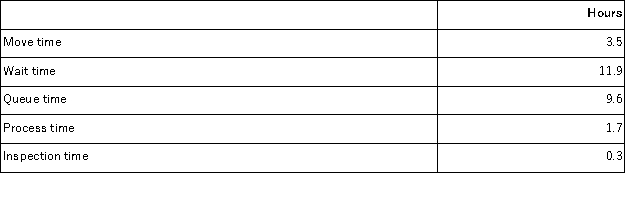

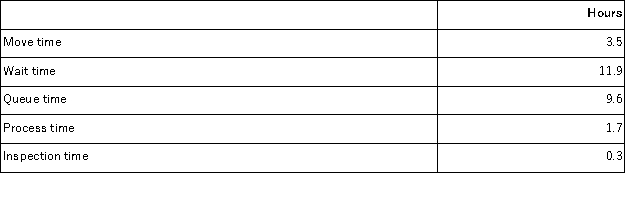

Ok Corporation keeps careful track of the time required to fill orders.Data concerning a particular order appear below:  The manufacturing cycle efficiency (MCE)was closest to:

The manufacturing cycle efficiency (MCE)was closest to:

A)0.47

B)0.02

C)0.07

D)0.12

The manufacturing cycle efficiency (MCE)was closest to:

The manufacturing cycle efficiency (MCE)was closest to:A)0.47

B)0.02

C)0.07

D)0.12

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

50

The Portland Division's operating data for the past two years is as follows:  The Portland Division's margin in Year 2 was 150% of the margin for Year 1. The net operating income for Year 1 was:

The Portland Division's margin in Year 2 was 150% of the margin for Year 1. The net operating income for Year 1 was:

A)$192,000

B)$128,000

C)$266,667

D)$208,000

The Portland Division's margin in Year 2 was 150% of the margin for Year 1. The net operating income for Year 1 was:

The Portland Division's margin in Year 2 was 150% of the margin for Year 1. The net operating income for Year 1 was:A)$192,000

B)$128,000

C)$266,667

D)$208,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

51

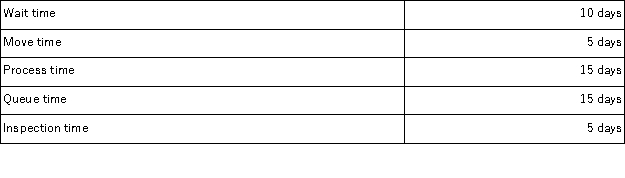

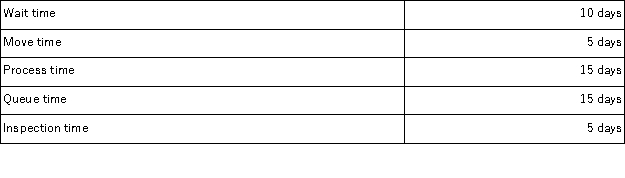

Nash Corporation manufactures and sells custom snowmobiles.From the time an order is placed till the time the snowmobile reaches the customer averages 50 days.This 50 days is spent as follows:  What is Nash's manufacturing cycle efficiency (MCE)for its snowmobiles?

What is Nash's manufacturing cycle efficiency (MCE)for its snowmobiles?

A)30.0%

B)37.5%

C)40.0%

D)60.0%

What is Nash's manufacturing cycle efficiency (MCE)for its snowmobiles?

What is Nash's manufacturing cycle efficiency (MCE)for its snowmobiles?A)30.0%

B)37.5%

C)40.0%

D)60.0%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

52

Mccubbin Corporation keeps careful track of the time required to fill orders.The times recorded for a particular order appear below:  The delivery cycle time was:

The delivery cycle time was:

A)25.0 hours

B)13.1 hours

C)27.0 hours

D)3.5 hours

The delivery cycle time was:

The delivery cycle time was:A)25.0 hours

B)13.1 hours

C)27.0 hours

D)3.5 hours

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

53

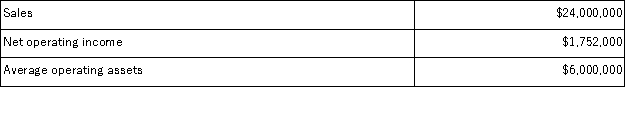

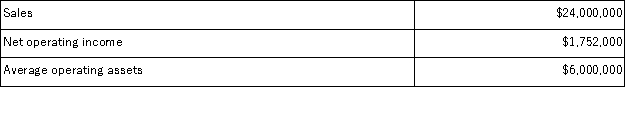

Aguilera Industries is a division of a major corporation.Data concerning the most recent year appears below:  The division's turnover is closest to:

The division's turnover is closest to:

A)3.10

B)13.70

C)4.00

D)0.29

The division's turnover is closest to:

The division's turnover is closest to:A)3.10

B)13.70

C)4.00

D)0.29

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

54

Koogle Corporation uses residual income to evaluate the performance of its divisions.The company's minimum required rate of return is 13%.In August,the Commercial Products Division had average operating assets of $530,000 and net operating income of $76,700.What was the Commercial Products Division's residual income in August?

A)-$9,971

B)-$7,800

C)$7,800

D)$9,971

A)-$9,971

B)-$7,800

C)$7,800

D)$9,971

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

55

Garde Corporation keeps careful track of the time required to fill orders.Data concerning a particular order appear below:  The throughput time was:

The throughput time was:

A)36.2 hours

B)8.1 hours

C)3.3 hours

D)32.9 hours

The throughput time was:

The throughput time was:A)36.2 hours

B)8.1 hours

C)3.3 hours

D)32.9 hours

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

56

Emerich Corporation keeps careful track of the time required to fill orders.The times recorded for a particular order appear below:  The manufacturing cycle efficiency (MCE)was closest to:

The manufacturing cycle efficiency (MCE)was closest to:

A)0.18

B)0.09

C)0.03

D)0.49

The manufacturing cycle efficiency (MCE)was closest to:

The manufacturing cycle efficiency (MCE)was closest to:A)0.18

B)0.09

C)0.03

D)0.49

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

57

In September,the Universal Solutions Division of Mcallister Corporation had average operating assets of $120,000 and net operating income of $12,800.The company uses residual income,with a minimum required rate of return of 12%,to evaluate the performance of its divisions.What was the Universal Solutions Division's residual income in September?

A)-$1,600

B)$1,600

C)-$1,536

D)$1,536

A)-$1,600

B)$1,600

C)-$1,536

D)$1,536

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

58

Aguilera Industries is a division of a major corporation.Data concerning the most recent year appears below:  The division's return on investment (ROI)is closest to:

The division's return on investment (ROI)is closest to:

A)2.1%

B)29.2%

C)22.6%

D)5.8%

The division's return on investment (ROI)is closest to:

The division's return on investment (ROI)is closest to:A)2.1%

B)29.2%

C)22.6%

D)5.8%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

59

Aguilera Industries is a division of a major corporation.Data concerning the most recent year appears below:  The division's margin is closest to:

The division's margin is closest to:

A)32.3%

B)25.0%

C)29.2%

D)7.3%

The division's margin is closest to:

The division's margin is closest to:A)32.3%

B)25.0%

C)29.2%

D)7.3%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

60

Fruchter Corporation keeps careful track of the time required to fill orders.The times recorded for a particular order appear below:  The throughput time was:

The throughput time was:

A)4.6 hours

B)32.8 hours

C)11.0 hours

D)37.4 hours

The throughput time was:

The throughput time was:A)4.6 hours

B)32.8 hours

C)11.0 hours

D)37.4 hours

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

61

Cabal Products is a division of a major corporation.Last year the division had total sales of $10,040,000,net operating income of $582,320,and average operating assets of $4,000,000.The company's minimum required rate of return is 14%. The division's return on investment (ROI)is closest to:

A)4.1%

B)14.6%

C)36.6%

D)0.9%

A)4.1%

B)14.6%

C)36.6%

D)0.9%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

62

The following information relates to the Quilt Division of TDS Corporation for last year:  What was the Quilt Division's return on investment (ROI)for last year?

What was the Quilt Division's return on investment (ROI)for last year?

A)13%

B)18%

C)40%

D)45%

What was the Quilt Division's return on investment (ROI)for last year?

What was the Quilt Division's return on investment (ROI)for last year?A)13%

B)18%

C)40%

D)45%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

63

Cabal Products is a division of a major corporation.Last year the division had total sales of $10,040,000,net operating income of $582,320,and average operating assets of $4,000,000.The company's minimum required rate of return is 14%. The division's margin is closest to:

A)5.8%

B)45.6%

C)14.6%

D)39.8%

A)5.8%

B)45.6%

C)14.6%

D)39.8%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

64

Last year the Uptown Division of Gorcen Enterprises had sales of $300,000 and a net operating income of $24,000.The average operating assets at Uptown last year amounted to $120,000. Last year at Uptown the return on investment was:

A)8%

B)12%

C)20%

D)40%

A)8%

B)12%

C)20%

D)40%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

65

Last year the Uptown Division of Gorcen Enterprises had sales of $300,000 and a net operating income of $24,000.The average operating assets at Uptown last year amounted to $120,000. Last year at Uptown the margin used to calculate ROI amounted to:

A)8%

B)12%

C)20%

D)40%

A)8%

B)12%

C)20%

D)40%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

66

The Portland Division's operating data for the past two years is as follows:  The Portland Division's margin in Year 2 was 150% of the margin for Year 1. The sales for Year 2 were:

The Portland Division's margin in Year 2 was 150% of the margin for Year 1. The sales for Year 2 were:

A)$750,000

B)$2,000,000

C)$3,846,154

D)$2,400,000

The Portland Division's margin in Year 2 was 150% of the margin for Year 1. The sales for Year 2 were:

The Portland Division's margin in Year 2 was 150% of the margin for Year 1. The sales for Year 2 were:A)$750,000

B)$2,000,000

C)$3,846,154

D)$2,400,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

67

The Portland Division's operating data for the past two years is as follows:  The Portland Division's margin in Year 2 was 150% of the margin for Year 1. The average operating assets for Year 2 were:

The Portland Division's margin in Year 2 was 150% of the margin for Year 1. The average operating assets for Year 2 were:

A)$750,000

B)$400,000

C)$1,200,000

D)$800,000

The Portland Division's margin in Year 2 was 150% of the margin for Year 1. The average operating assets for Year 2 were:

The Portland Division's margin in Year 2 was 150% of the margin for Year 1. The average operating assets for Year 2 were:A)$750,000

B)$400,000

C)$1,200,000

D)$800,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

68

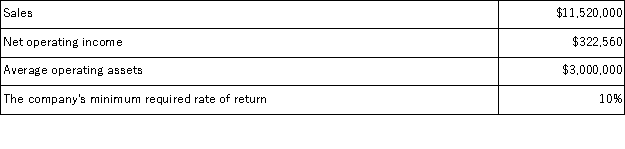

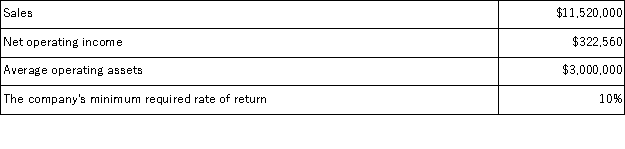

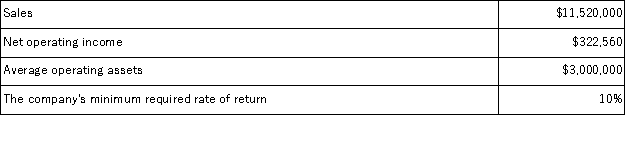

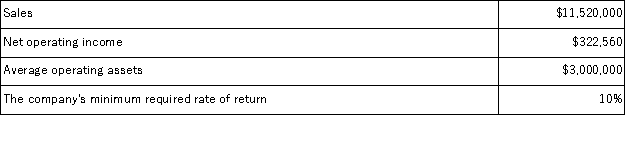

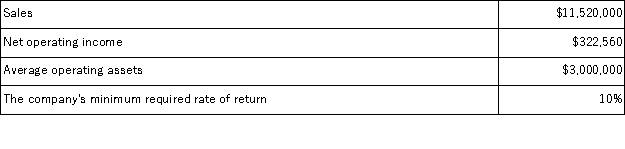

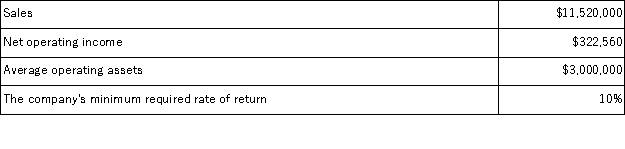

Daab Products is a division of a major corporation.The following data are for the most recent year of operations:  The division's turnover used to compute ROI is closest to:

The division's turnover used to compute ROI is closest to:

A)3.84

B)0.11

C)35.71

D)3.47

The division's turnover used to compute ROI is closest to:

The division's turnover used to compute ROI is closest to:A)3.84

B)0.11

C)35.71

D)3.47

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

69

Daab Products is a division of a major corporation.The following data are for the most recent year of operations:  The division's margin used to compute ROI is closest to:

The division's margin used to compute ROI is closest to:

A)2.8%

B)28.8%

C)10.8%

D)26.0%

The division's margin used to compute ROI is closest to:

The division's margin used to compute ROI is closest to:A)2.8%

B)28.8%

C)10.8%

D)26.0%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

70

Last year the Uptown Division of Gorcen Enterprises had sales of $300,000 and a net operating income of $24,000.The average operating assets at Uptown last year amounted to $120,000. At Uptown the turnover used to calculate ROI last year was:

A)0.4

B)2.5

C)3.2

D)5.0

A)0.4

B)2.5

C)3.2

D)5.0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

71

Cabal Products is a division of a major corporation.Last year the division had total sales of $10,040,000,net operating income of $582,320,and average operating assets of $4,000,000.The company's minimum required rate of return is 14%. The division's residual income is closest to:

A)$582,320

B)$22,320

C)($823,280)

D)$1,142,320

A)$582,320

B)$22,320

C)($823,280)

D)$1,142,320

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

72

Baad Industries is a division of a major corporation.Last year the division had total sales of $20,440,000,net operating income of $1,860,040,and average operating assets of $7,000,000. The division's turnover is closest to:

A)0.27

B)2.92

C)10.99

D)2.31

A)0.27

B)2.92

C)10.99

D)2.31

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

73

Baad Industries is a division of a major corporation.Last year the division had total sales of $20,440,000,net operating income of $1,860,040,and average operating assets of $7,000,000. The division's return on investment (ROI)is closest to:

A)21.0%

B)26.6%

C)6.8%

D)2.5%

A)21.0%

B)26.6%

C)6.8%

D)2.5%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

74

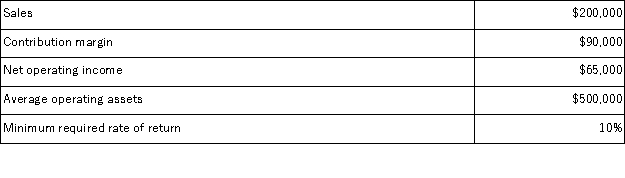

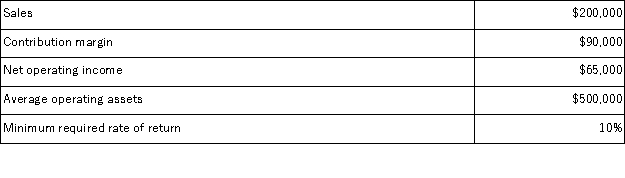

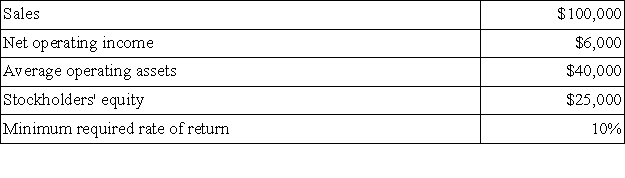

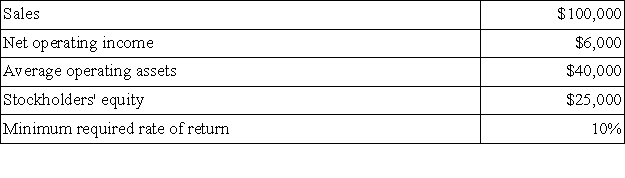

Brandon Inc. ,has provided the following data for last year's operations:  Brandon's return on investment (ROI)is:

Brandon's return on investment (ROI)is:

A)6%

B)10%

C)15%

D)24%

Brandon's return on investment (ROI)is:

Brandon's return on investment (ROI)is:A)6%

B)10%

C)15%

D)24%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

75

Cabal Products is a division of a major corporation.Last year the division had total sales of $10,040,000,net operating income of $582,320,and average operating assets of $4,000,000.The company's minimum required rate of return is 14%. The division's turnover is closest to:

A)2.19

B)17.24

C)0.15

D)2.51

A)2.19

B)17.24

C)0.15

D)2.51

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

76

Daab Products is a division of a major corporation.The following data are for the most recent year of operations:  The division's residual income is closest to:

The division's residual income is closest to:

A)$322,560

B)$622,560

C)($829,440)

D)$22,560

The division's residual income is closest to:

The division's residual income is closest to:A)$322,560

B)$622,560

C)($829,440)

D)$22,560

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

77

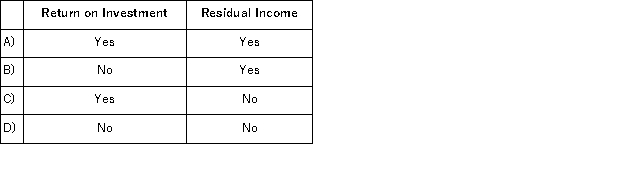

The following information relates to the Quilt Division of TDS Corporation for last year:  Assume that Quilt was being evaluated solely on the basis of residual income.Which of the following investment opportunities would Quilt want to invest in?

Assume that Quilt was being evaluated solely on the basis of residual income.Which of the following investment opportunities would Quilt want to invest in?

A)Option A

B)Option B

C)Option C

D)Option D

Assume that Quilt was being evaluated solely on the basis of residual income.Which of the following investment opportunities would Quilt want to invest in?

Assume that Quilt was being evaluated solely on the basis of residual income.Which of the following investment opportunities would Quilt want to invest in?

A)Option A

B)Option B

C)Option C

D)Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

78

Daab Products is a division of a major corporation.The following data are for the most recent year of operations:  The division's return on investment (ROI)is closest to:

The division's return on investment (ROI)is closest to:

A)10.8%

B)41.5%

C)0.3%

D)2.2%

The division's return on investment (ROI)is closest to:

The division's return on investment (ROI)is closest to:A)10.8%

B)41.5%

C)0.3%

D)2.2%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

79

Brandon Inc. ,has provided the following data for last year's operations:  Brandon's residual income is:

Brandon's residual income is:

A)$2,000

B)$4,000

C)$3,500

D)$2,500

Brandon's residual income is:

Brandon's residual income is:A)$2,000

B)$4,000

C)$3,500

D)$2,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

80

Baad Industries is a division of a major corporation.Last year the division had total sales of $20,440,000,net operating income of $1,860,040,and average operating assets of $7,000,000. The division's margin is closest to:

A)9.1%

B)34.2%

C)26.6%

D)43.3%

A)9.1%

B)34.2%

C)26.6%

D)43.3%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck