Deck 3: Job-Order Costing: Cost Flows and External Reporting

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/199

العب

ملء الشاشة (f)

Deck 3: Job-Order Costing: Cost Flows and External Reporting

1

If a company has a great deal of product diversity,activity-based costing will generally yield less accurate product costs than traditional methods based on direct labor or machine hours.

False

2

The challenge in designing an activity-based costing system is to identify a reasonably small number of activities that explain the bulk of the variation in overhead costs.

True

3

In activity-based costing,unit product costs computed for external financial reports include direct materials costs.

True

4

Facility-level costs can be traced on a cause-and-effect basis to individual products.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 199 في هذه المجموعة.

فتح الحزمة

k this deck

5

Activity rates in activity-based costing are computed by dividing costs from the first-stage cost assignments by the activity measure for each activity cost pool.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 199 في هذه المجموعة.

فتح الحزمة

k this deck

6

An activity measure in activity-based costing expresses how much of an activity is carried out and it is used as the allocation base for assigning overhead costs to departments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 199 في هذه المجموعة.

فتح الحزمة

k this deck

7

Direct labor is an appropriate allocation base for overhead when overhead costs and direct labor are highly correlated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 199 في هذه المجموعة.

فتح الحزمة

k this deck

8

A plantwide predetermined overhead rate based on direct labor-hours results in high overhead costs for products with a high direct labor-hour content and low overhead costs for products with a low direct labor-hour content.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 199 في هذه المجموعة.

فتح الحزمة

k this deck

9

When designing an activity-based costing system,accountants should be tasked with identifying the activities they think are important and that consume most of the resources in the organization.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 199 في هذه المجموعة.

فتح الحزمة

k this deck

10

In the second-stage allocation in activity-based costing,overhead costs are allocated from activity cost pools to products.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 199 في هذه المجموعة.

فتح الحزمة

k this deck

11

Activities consume resources.In activity-based costing an attempt is made to trace the costs of those activities directly to the products that cause them.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 199 في هذه المجموعة.

فتح الحزمة

k this deck

12

An activity rated is computed for each activity cost pool-not for each product.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 199 في هذه المجموعة.

فتح الحزمة

k this deck

13

Managing and sustaining product diversity requires many more overhead resources such as production schedulers and product design engineers.The costs of these resources have no obvious connection with direct labor.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 199 في هذه المجموعة.

فتح الحزمة

k this deck

14

The activity rates in activity-based costing are not intended to set targets for how quickly a task should be completed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 199 في هذه المجموعة.

فتح الحزمة

k this deck

15

Facility-level activities are activities that are carried out regardless of which products are produced,how many batches are run,or how many units are made.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 199 في هذه المجموعة.

فتح الحزمة

k this deck

16

An activity in activity-based costing is an event that causes the consumption of overhead resources.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 199 في هذه المجموعة.

فتح الحزمة

k this deck

17

Activity-based costing involves a two-stage allocation process in which overhead costs are first assigned to departments and then allocated to products using activity measures.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 199 في هذه المجموعة.

فتح الحزمة

k this deck

18

Batch-level activities are performed each time a batch of goods is processed.The cost of a batch-level activity is proportional to the number of units in the batch.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 199 في هذه المجموعة.

فتح الحزمة

k this deck

19

Companies use three common approaches to assign overhead costs to products-plantwide overhead rate,departmental overhead rates,and activity-based costing.The most accurate of these three approaches is departmental overhead rates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 199 في هذه المجموعة.

فتح الحزمة

k this deck

20

In general,activities and costs should be combined in an activity-based costing system only if they fall within the same level in the cost hierarchy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 199 في هذه المجموعة.

فتح الحزمة

k this deck

21

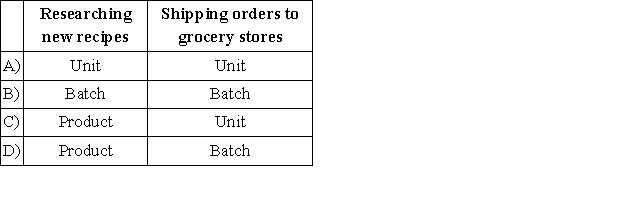

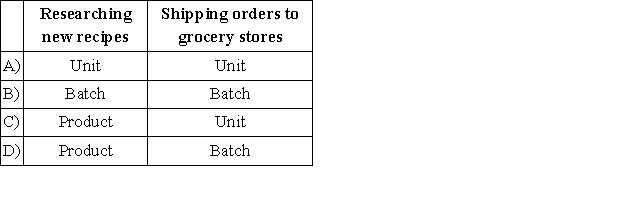

Would the following activities at a manufacturer of canned soup be best classified as unit-level,batch-level,product-level,or facility-level activities?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 199 في هذه المجموعة.

فتح الحزمة

k this deck

22

Which of the following would be classified as a product-level activity?

A)Setting up a machine for a standard product.

B)Operating a cafeteria for employees.

C)Personnel administration.

D)Testing a prototype for a new model.

A)Setting up a machine for a standard product.

B)Operating a cafeteria for employees.

C)Personnel administration.

D)Testing a prototype for a new model.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 199 في هذه المجموعة.

فتح الحزمة

k this deck

23

Setting up a machine to change from producing one product to another is an example of a:

A)Unit-level activity.

B)Batch-level activity.

C)Product-level activity.

D)Facility-level activity.

A)Unit-level activity.

B)Batch-level activity.

C)Product-level activity.

D)Facility-level activity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 199 في هذه المجموعة.

فتح الحزمة

k this deck

24

When a company changes from a traditional costing system to an activity-based costing system,the unit product costs of low-volume products typically change more than the unit product costs of high-volume products.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 199 في هذه المجموعة.

فتح الحزمة

k this deck

25

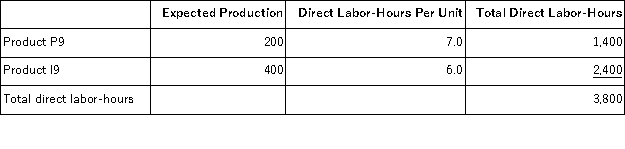

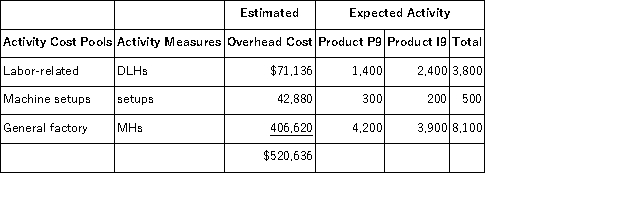

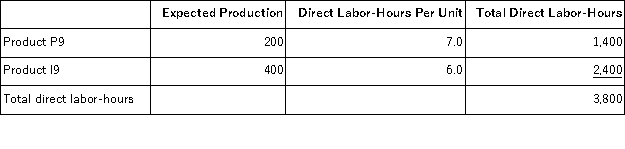

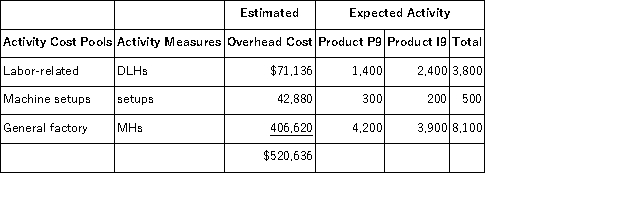

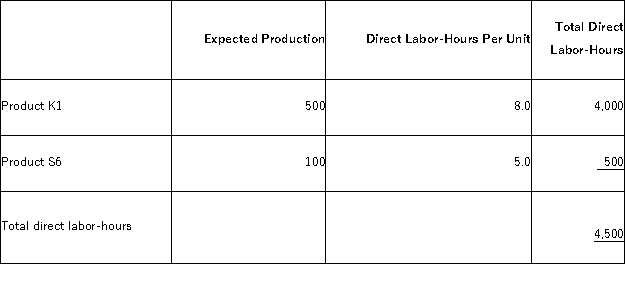

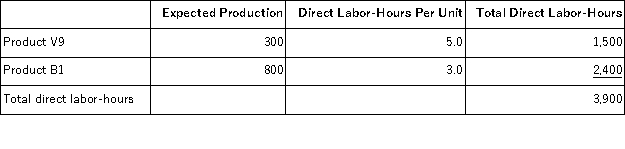

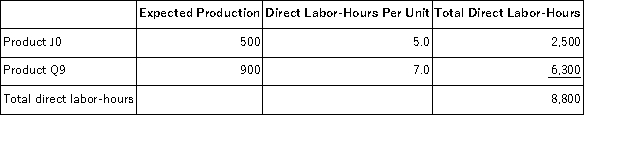

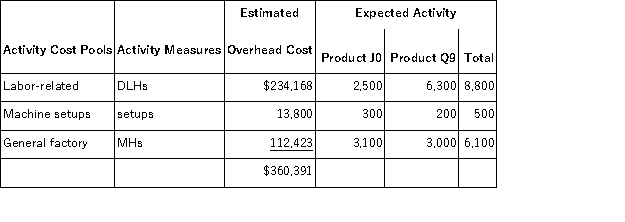

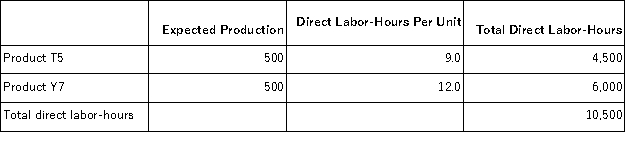

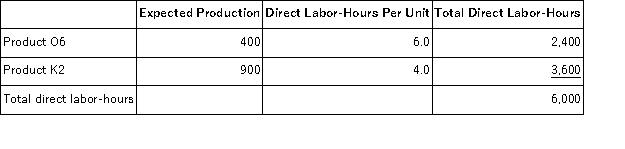

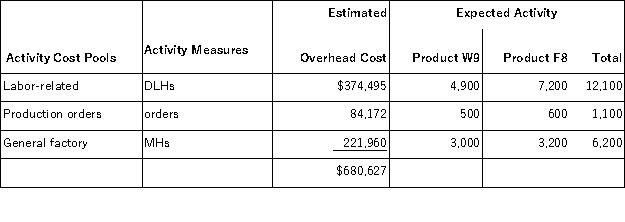

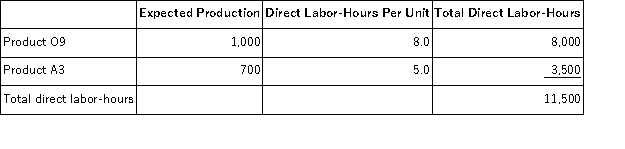

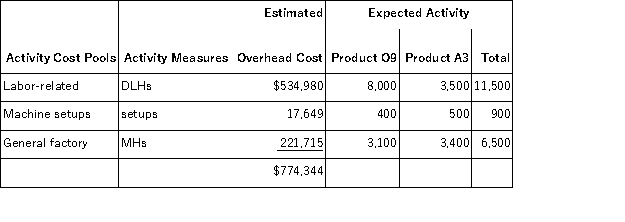

Tesh,Inc. ,manufactures and sells two products: Product P9 and Product I9.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs)required to produce that output appear below:  The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:

The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:  The activity rate for the Labor-Related activity cost pool under activity-based costing is closest to:

The activity rate for the Labor-Related activity cost pool under activity-based costing is closest to:

A)$214.40 per DLH

B)$1,041.27 per DLH

C)$142.93 per DLH

D)$18.72 per DLH

The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:

The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:  The activity rate for the Labor-Related activity cost pool under activity-based costing is closest to:

The activity rate for the Labor-Related activity cost pool under activity-based costing is closest to:A)$214.40 per DLH

B)$1,041.27 per DLH

C)$142.93 per DLH

D)$18.72 per DLH

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 199 في هذه المجموعة.

فتح الحزمة

k this deck

26

When switching from a traditional costing system to an activity-based costing system that contains some batch-level costs:

A)the unit product costs of both high and low volume products typically increase.

B)the unit product costs of both high and low volume products typically decrease.

C)the unit product costs of high volume products typically increase and the unit product costs of low volume products typically decrease.

D)the unit product costs of high volume products typically decrease and the unit product costs of low volume products typically increase.

A)the unit product costs of both high and low volume products typically increase.

B)the unit product costs of both high and low volume products typically decrease.

C)the unit product costs of high volume products typically increase and the unit product costs of low volume products typically decrease.

D)the unit product costs of high volume products typically decrease and the unit product costs of low volume products typically increase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 199 في هذه المجموعة.

فتح الحزمة

k this deck

27

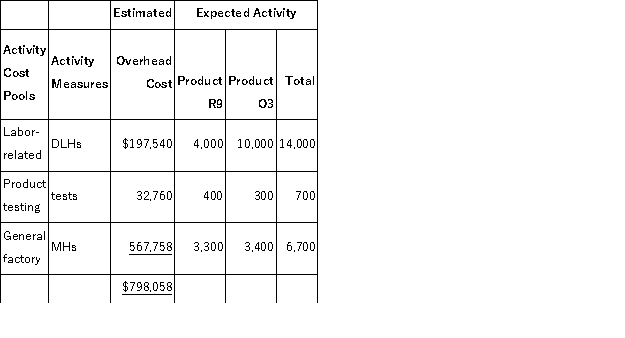

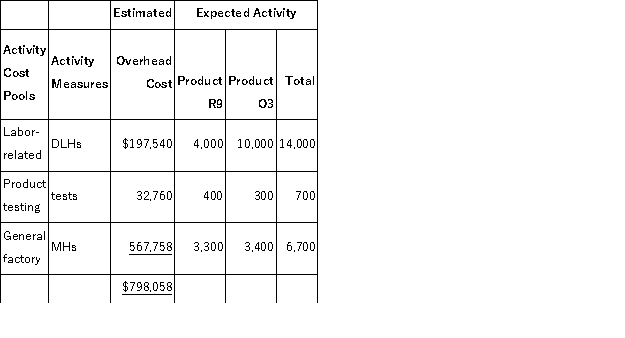

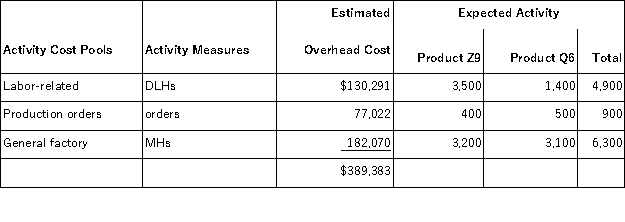

Pedrozo,Inc. ,manufactures and sells two products: Product R9 and Product O3.The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:  The activity rate for the Labor-Related activity cost pool under activity-based costing is closest to:

The activity rate for the Labor-Related activity cost pool under activity-based costing is closest to:

A)$81.90 per DLH

B)$1,140.08 per DLH

C)$14.11 per DLH

D)$109.20 per DLH

The activity rate for the Labor-Related activity cost pool under activity-based costing is closest to:

The activity rate for the Labor-Related activity cost pool under activity-based costing is closest to:A)$81.90 per DLH

B)$1,140.08 per DLH

C)$14.11 per DLH

D)$109.20 per DLH

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 199 في هذه المجموعة.

فتح الحزمة

k this deck

28

Material handling is an example of a:

A)Unit-level activity.

B)Batch-level activity.

C)Product-level activity.

D)Facility-level activity.

A)Unit-level activity.

B)Batch-level activity.

C)Product-level activity.

D)Facility-level activity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 199 في هذه المجموعة.

فتح الحزمة

k this deck

29

In activity-based costing,unit product costs computed for external financial reports include direct materials,direct labor,and only a part of manufacturing overhead costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 199 في هذه المجموعة.

فتح الحزمة

k this deck

30

When a company changes from a traditional cost system in which manufacturing overhead is applied based on direct labor-hours to an activity-based costing system in which there are batch-level and product-level costs,the unit product costs of high-volume products typically increase whereas the unit product costs of low-volume products typically decrease.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 199 في هذه المجموعة.

فتح الحزمة

k this deck

31

Assembling a product is an example of a:

A)Unit-level activity.

B)Batch-level activity.

C)Product-level activity.

D)Facility-level activity.

A)Unit-level activity.

B)Batch-level activity.

C)Product-level activity.

D)Facility-level activity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 199 في هذه المجموعة.

فتح الحزمة

k this deck

32

Which of the following would be classified as a product-level activity?

A)Setting up a machine for a batch of a standard product.

B)Operating a cafeteria for employees.

C)Running the Human Resource department.

D)Advertising a product.

A)Setting up a machine for a batch of a standard product.

B)Operating a cafeteria for employees.

C)Running the Human Resource department.

D)Advertising a product.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 199 في هذه المجموعة.

فتح الحزمة

k this deck

33

When a company changes from a traditional costing system to an activity-based costing system,costs will ordinarily shift from low-volume products to high-volume products when the activity-based costing system includes batch-level or product-level costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 199 في هذه المجموعة.

فتح الحزمة

k this deck

34

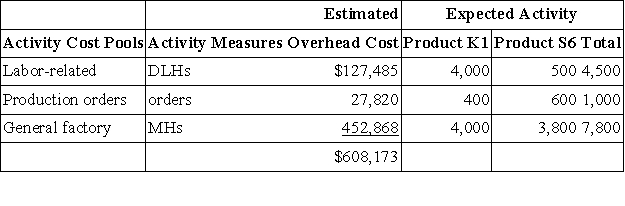

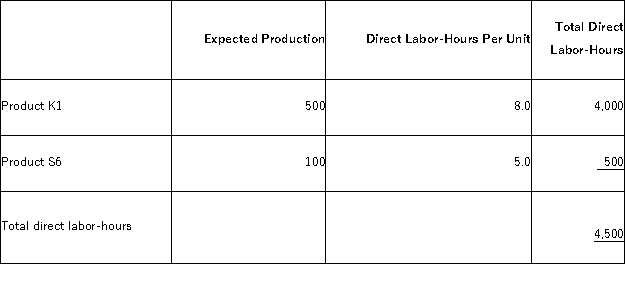

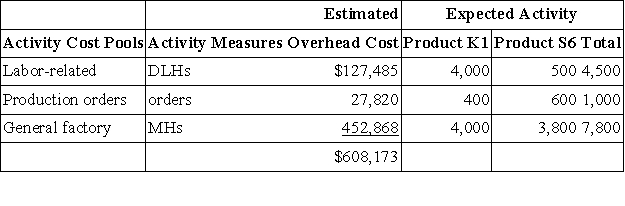

Marchan,Inc. ,manufactures and sells two products: Product K1 and Product S6.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs)required to produce that output appear below:  The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:

The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:  The activity rate for the General Factory activity cost pool under activity-based costing is closest to:

The activity rate for the General Factory activity cost pool under activity-based costing is closest to:

A)$45.73 per MH

B)$254.97 per MH

C)$135.15 per MH

D)$58.06 per MH

The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:

The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:  The activity rate for the General Factory activity cost pool under activity-based costing is closest to:

The activity rate for the General Factory activity cost pool under activity-based costing is closest to:A)$45.73 per MH

B)$254.97 per MH

C)$135.15 per MH

D)$58.06 per MH

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 199 في هذه المجموعة.

فتح الحزمة

k this deck

35

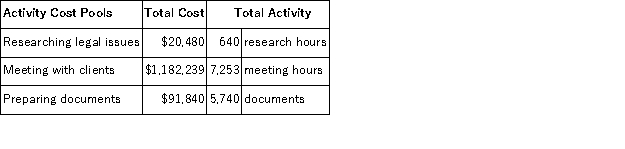

Data concerning three of the activity cost pools of Salcido LLC,a legal firm,have been provided below:  The activity rate for the Meeting With Clients activity cost pool is closest to:

The activity rate for the Meeting With Clients activity cost pool is closest to:

A)$95 per meeting hour

B)$61 per meeting hour

C)$163 per meeting hour

D)$1,182,239 per meeting hour

The activity rate for the Meeting With Clients activity cost pool is closest to:

The activity rate for the Meeting With Clients activity cost pool is closest to:A)$95 per meeting hour

B)$61 per meeting hour

C)$163 per meeting hour

D)$1,182,239 per meeting hour

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 199 في هذه المجموعة.

فتح الحزمة

k this deck

36

The plant manager's work is an example of a:

A)Unit-level activity.

B)Batch-level activity.

C)Product-level activity.

D)Facility-level activity.

A)Unit-level activity.

B)Batch-level activity.

C)Product-level activity.

D)Facility-level activity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 199 في هذه المجموعة.

فتح الحزمة

k this deck

37

Testing a prototype of a new product is an example of a:

A)Unit-level activity.

B)Batch-level activity.

C)Product-level activity.

D)Facility-level activity.

A)Unit-level activity.

B)Batch-level activity.

C)Product-level activity.

D)Facility-level activity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 199 في هذه المجموعة.

فتح الحزمة

k this deck

38

In activity-based costing,unit product costs computed for external financial reports do NOT include:

A)direct materials.

B)direct labor.

C)manufacturing overhead.

D)selling costs.

A)direct materials.

B)direct labor.

C)manufacturing overhead.

D)selling costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 199 في هذه المجموعة.

فتح الحزمة

k this deck

39

All other things the same,the unit product costs of high volume products will decrease and the unit product costs of low volume products will increase when switching from a traditional costing system to an activity-based costing system if:

A)the activity-based costing system uses direct labor-hours as a measure of activity for at least one activity cost pool.

B)the activity-based costing system includes at least one batch-level cost.

C)the activity-based costing system includes at least one unit-level cost.

D)the activity-based costing system uses machine-hours as a measure of activity for at least one activity cost pool.

A)the activity-based costing system uses direct labor-hours as a measure of activity for at least one activity cost pool.

B)the activity-based costing system includes at least one batch-level cost.

C)the activity-based costing system includes at least one unit-level cost.

D)the activity-based costing system uses machine-hours as a measure of activity for at least one activity cost pool.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 199 في هذه المجموعة.

فتح الحزمة

k this deck

40

In activity-based costing,the activity rate for an activity cost pool is computed by dividing the total overhead cost in the activity cost pool by:

A)the direct labor-hours required by the product.

B)the machine-hours required by the product.

C)the total activity for the activity cost pool.

D)the total direct labor-hours for the activity cost pool.

A)the direct labor-hours required by the product.

B)the machine-hours required by the product.

C)the total activity for the activity cost pool.

D)the total direct labor-hours for the activity cost pool.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 199 في هذه المجموعة.

فتح الحزمة

k this deck

41

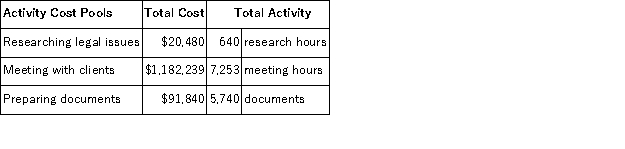

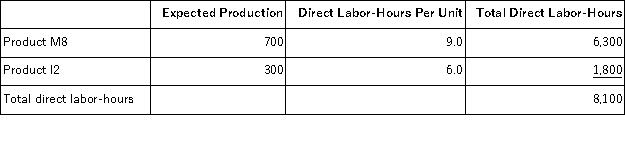

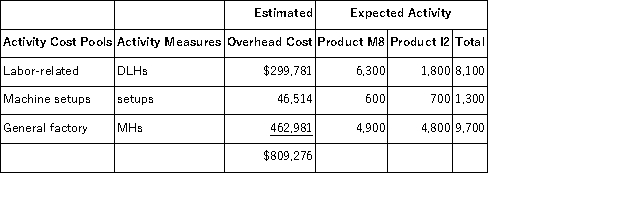

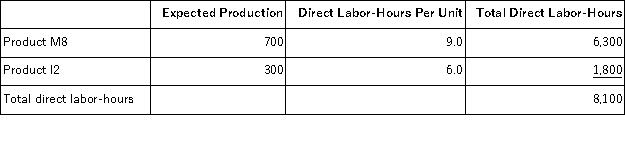

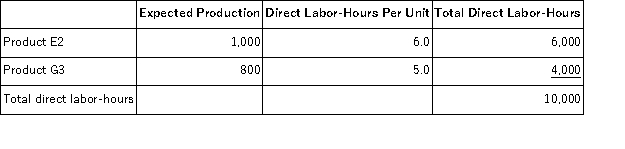

Karsten,Inc. ,manufactures and sells two products: Product M8 and Product I2.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs)required to produce that output appear below:  The direct labor rate is $21.20 per DLH.The direct materials cost per unit for each product is given below:

The direct labor rate is $21.20 per DLH.The direct materials cost per unit for each product is given below:  The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:

The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:  The unit product cost of Product I2 under activity-based costing is closest to:

The unit product cost of Product I2 under activity-based costing is closest to:

A)$1,133.78 per unit

B)$1,179.38 per unit

C)$1,439.33 per unit

D)$969.56 per unit

The direct labor rate is $21.20 per DLH.The direct materials cost per unit for each product is given below:

The direct labor rate is $21.20 per DLH.The direct materials cost per unit for each product is given below:  The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:

The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:  The unit product cost of Product I2 under activity-based costing is closest to:

The unit product cost of Product I2 under activity-based costing is closest to:A)$1,133.78 per unit

B)$1,179.38 per unit

C)$1,439.33 per unit

D)$969.56 per unit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 199 في هذه المجموعة.

فتح الحزمة

k this deck

42

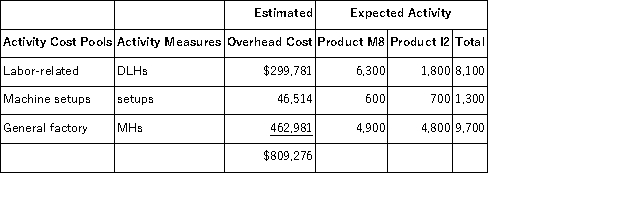

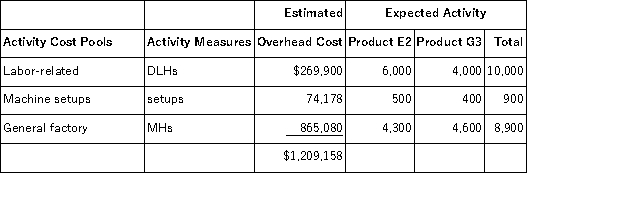

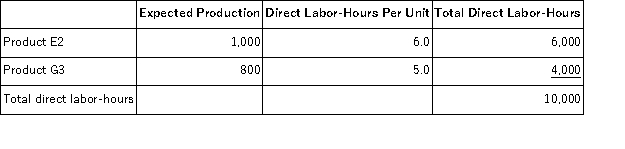

Fullard,Inc. ,manufactures and sells two products: Product E2 and Product G3.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs)required to produce that output appear below:  The company has an activity-based costing system with the following activity cost pools,activity measures,and expected activity:

The company has an activity-based costing system with the following activity cost pools,activity measures,and expected activity:  The total overhead applied to Product E2 under activity-based costing is closest to:

The total overhead applied to Product E2 under activity-based costing is closest to:

A)$671,750

B)$417,960

C)$621,110

D)$725,520

The company has an activity-based costing system with the following activity cost pools,activity measures,and expected activity:

The company has an activity-based costing system with the following activity cost pools,activity measures,and expected activity:  The total overhead applied to Product E2 under activity-based costing is closest to:

The total overhead applied to Product E2 under activity-based costing is closest to:A)$671,750

B)$417,960

C)$621,110

D)$725,520

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 199 في هذه المجموعة.

فتح الحزمة

k this deck

43

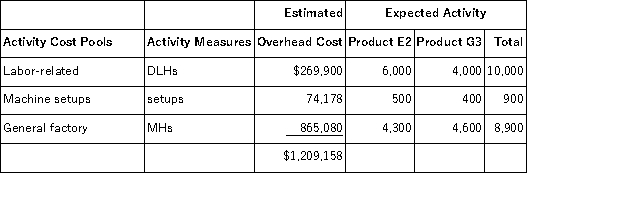

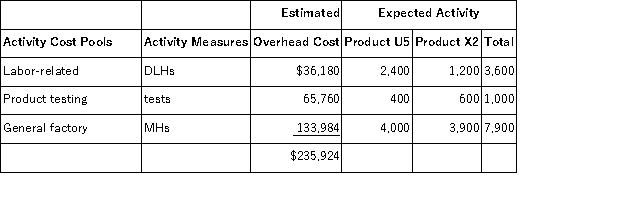

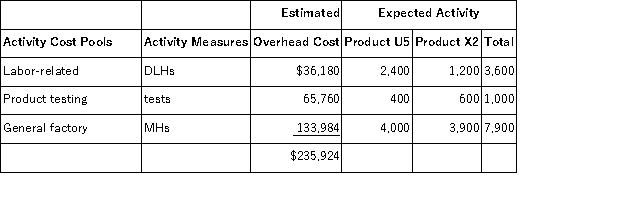

Nethery,Inc. ,manufactures and sells two products: Product U5 and Product X2.The company has an activity-based costing system with the following activity cost pools,activity measures,and expected activity:  The total overhead applied to Product U5 under activity-based costing is closest to:

The total overhead applied to Product U5 under activity-based costing is closest to:

A)$141,555

B)$67,839

C)$157,272

D)$118,264

The total overhead applied to Product U5 under activity-based costing is closest to:

The total overhead applied to Product U5 under activity-based costing is closest to:A)$141,555

B)$67,839

C)$157,272

D)$118,264

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 199 في هذه المجموعة.

فتح الحزمة

k this deck

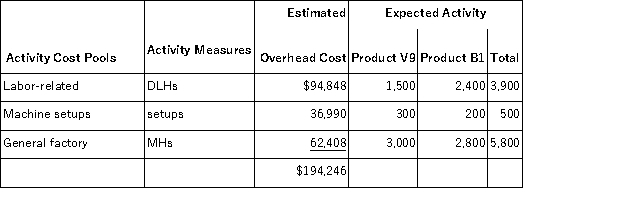

44

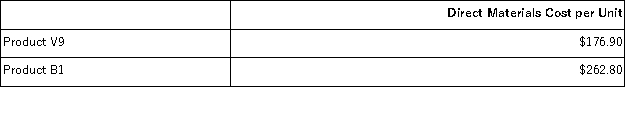

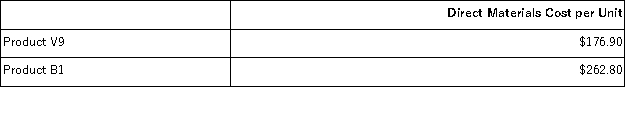

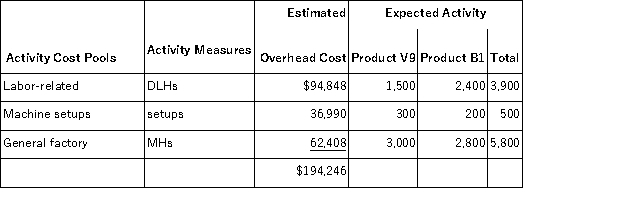

Sill,Inc. ,manufactures and sells two products: Product V9 and Product B1.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs)required to produce that output appear below:  The direct labor rate is $27.40 per DLH.The direct materials cost per unit for each product is given below:

The direct labor rate is $27.40 per DLH.The direct materials cost per unit for each product is given below:  The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:

The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:  The unit product cost of Product V9 under activity-based costing is closest to:

The unit product cost of Product V9 under activity-based costing is closest to:

A)$490.49 per unit

B)$421.50 per unit

C)$562.95 per unit

D)$617.08 per unit

The direct labor rate is $27.40 per DLH.The direct materials cost per unit for each product is given below:

The direct labor rate is $27.40 per DLH.The direct materials cost per unit for each product is given below:  The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:

The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:  The unit product cost of Product V9 under activity-based costing is closest to:

The unit product cost of Product V9 under activity-based costing is closest to:A)$490.49 per unit

B)$421.50 per unit

C)$562.95 per unit

D)$617.08 per unit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 199 في هذه المجموعة.

فتح الحزمة

k this deck

45

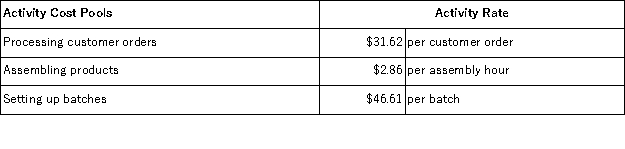

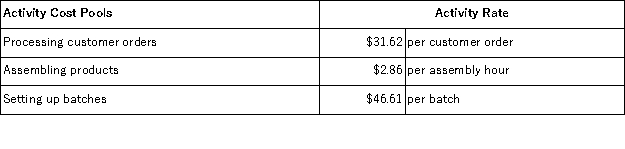

Activity rates from Lippard Corporation's activity-based costing system are listed below.The company uses the activity rates to assign overhead costs to products:  Last year,Product H50E involved 9 customer orders,666 assembly hours,and 77 batches.How much overhead cost would be assigned to Product H50E using the activity-based costing system?

Last year,Product H50E involved 9 customer orders,666 assembly hours,and 77 batches.How much overhead cost would be assigned to Product H50E using the activity-based costing system?

A)$60,979.68

B)$3,588.97

C)$5,778.31

D)$81.09

Last year,Product H50E involved 9 customer orders,666 assembly hours,and 77 batches.How much overhead cost would be assigned to Product H50E using the activity-based costing system?

Last year,Product H50E involved 9 customer orders,666 assembly hours,and 77 batches.How much overhead cost would be assigned to Product H50E using the activity-based costing system?A)$60,979.68

B)$3,588.97

C)$5,778.31

D)$81.09

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 199 في هذه المجموعة.

فتح الحزمة

k this deck

46

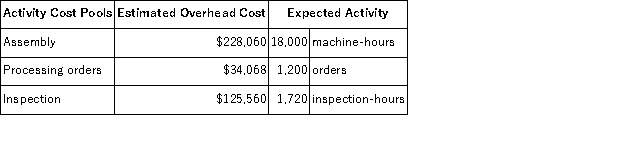

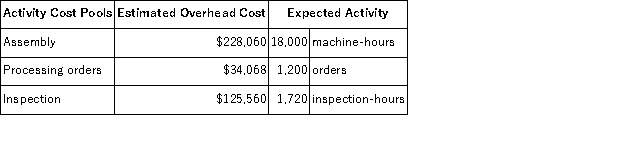

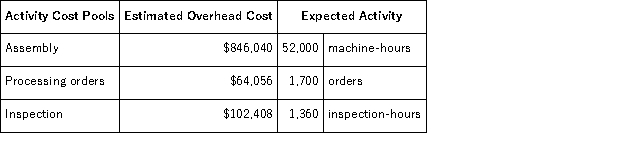

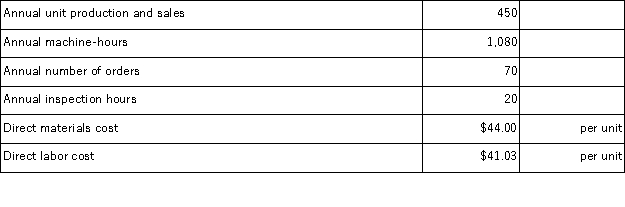

Dobles Corporation has provided the following data from its activity-based costing system:  The company makes 420 units of product D28K a year,requiring a total of 460 machine-hours,80 orders,and 10 inspection-hours per year.The product's direct materials cost is $48.96 per unit and its direct labor cost is $25.36 per unit. According to the activity-based costing system,the unit product cost of product D28K is closest to:

The company makes 420 units of product D28K a year,requiring a total of 460 machine-hours,80 orders,and 10 inspection-hours per year.The product's direct materials cost is $48.96 per unit and its direct labor cost is $25.36 per unit. According to the activity-based costing system,the unit product cost of product D28K is closest to:

A)$95.34 per unit

B)$93.60 per unit

C)$74.32 per unit

D)$89.93 per unit

The company makes 420 units of product D28K a year,requiring a total of 460 machine-hours,80 orders,and 10 inspection-hours per year.The product's direct materials cost is $48.96 per unit and its direct labor cost is $25.36 per unit. According to the activity-based costing system,the unit product cost of product D28K is closest to:

The company makes 420 units of product D28K a year,requiring a total of 460 machine-hours,80 orders,and 10 inspection-hours per year.The product's direct materials cost is $48.96 per unit and its direct labor cost is $25.36 per unit. According to the activity-based costing system,the unit product cost of product D28K is closest to:A)$95.34 per unit

B)$93.60 per unit

C)$74.32 per unit

D)$89.93 per unit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 199 في هذه المجموعة.

فتح الحزمة

k this deck

47

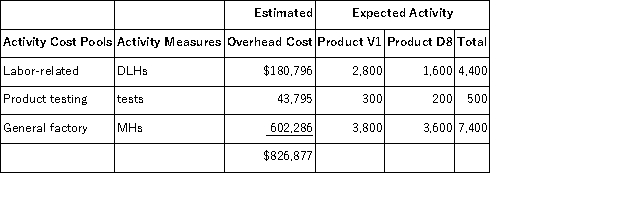

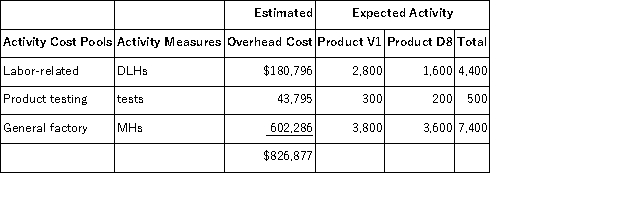

Kuperman,Inc. ,manufactures and sells two products: Product V1 and Product D8.The production of Product V1 is 400 units and of Product D8 is 200 units.The company has an activity-based costing system with the following activity cost pools,activity measures,and expected activity:  The overhead applied to each unit of Product V1 under activity-based costing is closest to:

The overhead applied to each unit of Product V1 under activity-based costing is closest to:

A)$773.21 per unit

B)$1,126.53 per unit

C)$1,315.51 per unit

D)$1,378.13 per unit

The overhead applied to each unit of Product V1 under activity-based costing is closest to:

The overhead applied to each unit of Product V1 under activity-based costing is closest to:A)$773.21 per unit

B)$1,126.53 per unit

C)$1,315.51 per unit

D)$1,378.13 per unit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 199 في هذه المجموعة.

فتح الحزمة

k this deck

48

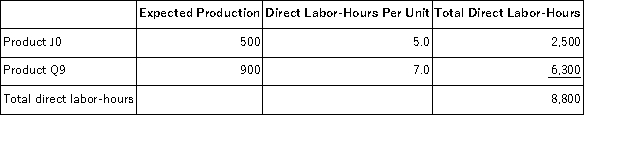

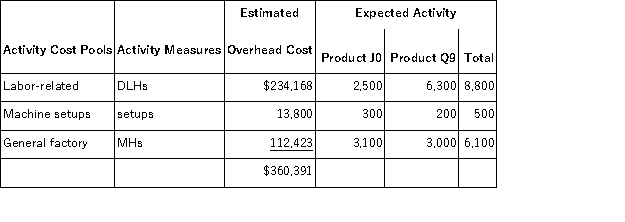

Wlodarczyk,Inc. ,manufactures and sells two products: Product J0 and Product Q9.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs)required to produce that output appear below:  The company has an activity-based costing system with the following activity cost pools,activity measures,and expected activity:

The company has an activity-based costing system with the following activity cost pools,activity measures,and expected activity:  The overhead applied to each unit of Product J0 under activity-based costing is closest to:

The overhead applied to each unit of Product J0 under activity-based costing is closest to:

A)$263.88 per unit

B)$114.27 per unit

C)$257.42 per unit

D)$204.75 per unit

The company has an activity-based costing system with the following activity cost pools,activity measures,and expected activity:

The company has an activity-based costing system with the following activity cost pools,activity measures,and expected activity:  The overhead applied to each unit of Product J0 under activity-based costing is closest to:

The overhead applied to each unit of Product J0 under activity-based costing is closest to:A)$263.88 per unit

B)$114.27 per unit

C)$257.42 per unit

D)$204.75 per unit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 199 في هذه المجموعة.

فتح الحزمة

k this deck

49

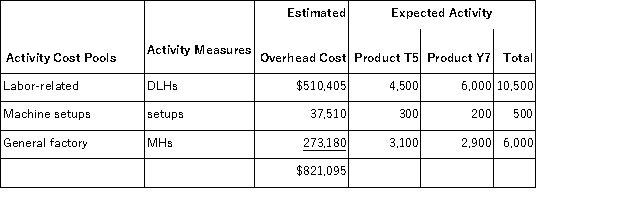

Gerula,Inc. ,manufactures and sells two products: Product Z9 and Product Q6.The company has an activity-based costing system with the following activity cost pools,activity measures,and expected activity:  The activity rate for the General Factory activity cost pool under activity-based costing is closest to:

The activity rate for the General Factory activity cost pool under activity-based costing is closest to:

A)$32.18 per MH

B)$93.07 per MH

C)$79.47 per MH

D)$28.90 per MH

The activity rate for the General Factory activity cost pool under activity-based costing is closest to:

The activity rate for the General Factory activity cost pool under activity-based costing is closest to:A)$32.18 per MH

B)$93.07 per MH

C)$79.47 per MH

D)$28.90 per MH

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 199 في هذه المجموعة.

فتح الحزمة

k this deck

50

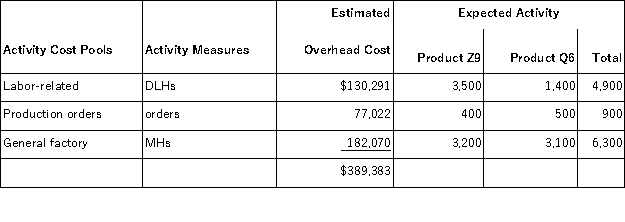

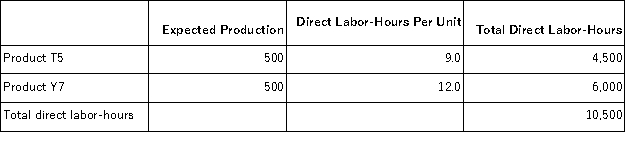

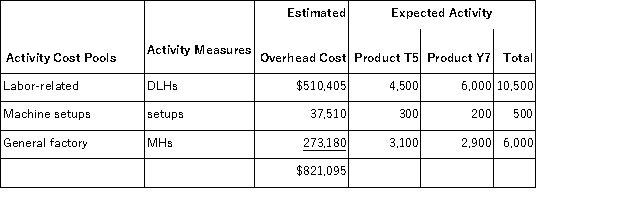

Randolph,Inc. ,manufactures and sells two products: Product T5 and Product Y7.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs)required to produce that output appear below:  The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:

The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:  The total overhead applied to Product Y7 under activity-based costing is closest to:

The total overhead applied to Product Y7 under activity-based costing is closest to:

A)$410,550

B)$132,035

C)$438,701

D)$469,200

The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:

The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:  The total overhead applied to Product Y7 under activity-based costing is closest to:

The total overhead applied to Product Y7 under activity-based costing is closest to:A)$410,550

B)$132,035

C)$438,701

D)$469,200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 199 في هذه المجموعة.

فتح الحزمة

k this deck

51

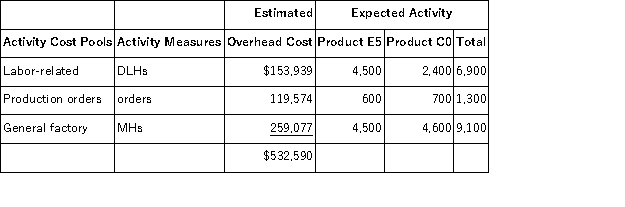

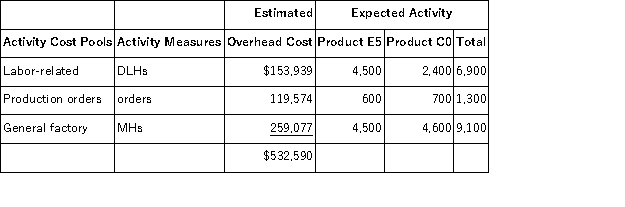

Onstad,Inc. ,manufactures and sells two products: Product E5 and Product C0.Expected production of Product E5 is 500 units and of Product C0 is 400 units.The company has an activity-based costing system with the following activity cost pools,activity measures,and expected activity:  The overhead applied to each unit of Product C0 under activity-based costing is closest to:

The overhead applied to each unit of Product C0 under activity-based costing is closest to:

A)$463.14 per unit

B)$591.77 per unit

C)$327.41 per unit

D)$622.23 per unit

The overhead applied to each unit of Product C0 under activity-based costing is closest to:

The overhead applied to each unit of Product C0 under activity-based costing is closest to:A)$463.14 per unit

B)$591.77 per unit

C)$327.41 per unit

D)$622.23 per unit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 199 في هذه المجموعة.

فتح الحزمة

k this deck

52

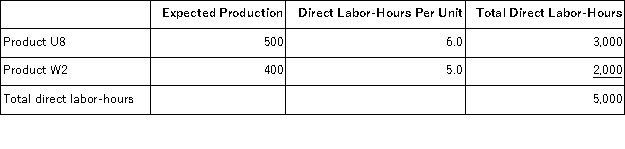

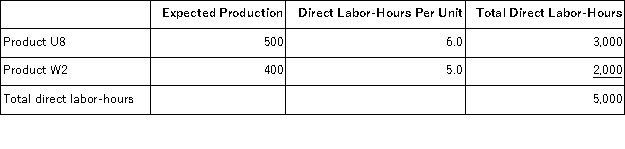

Crazier,Inc. ,manufactures and sells two products: Product U8 and Product W2.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs)required to produce that output appear below:  The direct labor rate is $22.10 per DLH.The direct materials cost per unit for each product is given below:

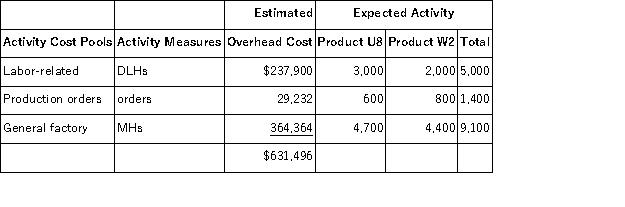

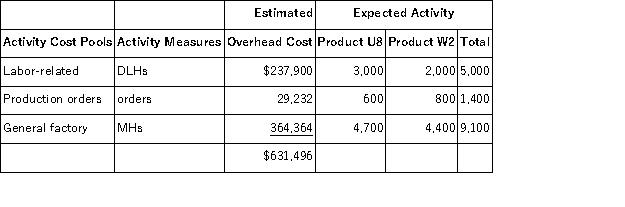

The direct labor rate is $22.10 per DLH.The direct materials cost per unit for each product is given below:  The company has an activity-based costing system with the following activity cost pools,activity measures,and expected activity:

The company has an activity-based costing system with the following activity cost pools,activity measures,and expected activity:  The unit product cost of Product U8 is closest to:

The unit product cost of Product U8 is closest to:

A)$995.06 per unit

B)$1,051.20 per unit

C)$980.31 per unit

D)$669.78 per unit

The direct labor rate is $22.10 per DLH.The direct materials cost per unit for each product is given below:

The direct labor rate is $22.10 per DLH.The direct materials cost per unit for each product is given below:  The company has an activity-based costing system with the following activity cost pools,activity measures,and expected activity:

The company has an activity-based costing system with the following activity cost pools,activity measures,and expected activity:  The unit product cost of Product U8 is closest to:

The unit product cost of Product U8 is closest to:A)$995.06 per unit

B)$1,051.20 per unit

C)$980.31 per unit

D)$669.78 per unit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 199 في هذه المجموعة.

فتح الحزمة

k this deck

53

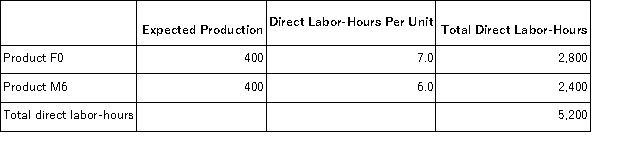

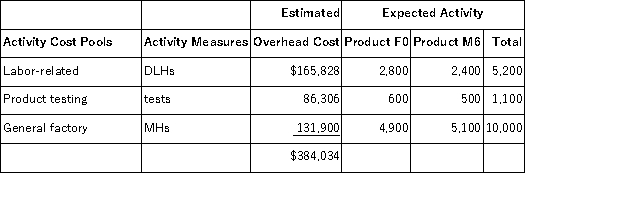

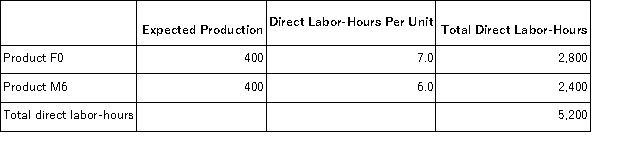

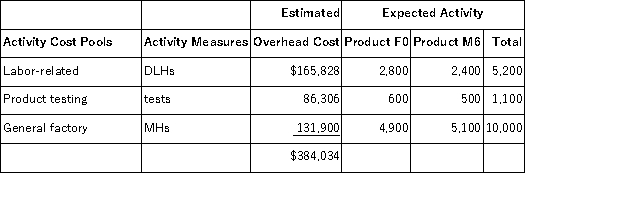

Drucker,Inc. ,manufactures and sells two products: Product F0 and Product M6.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs)required to produce that output appear below:  The company has an activity-based costing system with the following activity cost pools,activity measures,and expected activity:

The company has an activity-based costing system with the following activity cost pools,activity measures,and expected activity:  The overhead applied to each unit of Product M6 under activity-based costing is closest to:

The overhead applied to each unit of Product M6 under activity-based costing is closest to:

A)$443.10 per unit

B)$457.59 per unit

C)$480.04 per unit

D)$168.17 per unit

The company has an activity-based costing system with the following activity cost pools,activity measures,and expected activity:

The company has an activity-based costing system with the following activity cost pools,activity measures,and expected activity:  The overhead applied to each unit of Product M6 under activity-based costing is closest to:

The overhead applied to each unit of Product M6 under activity-based costing is closest to:A)$443.10 per unit

B)$457.59 per unit

C)$480.04 per unit

D)$168.17 per unit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 199 في هذه المجموعة.

فتح الحزمة

k this deck

54

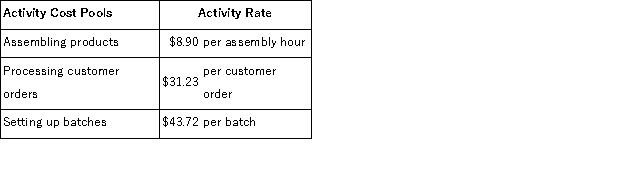

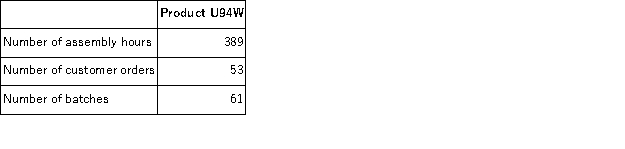

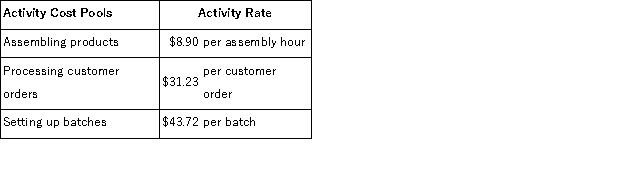

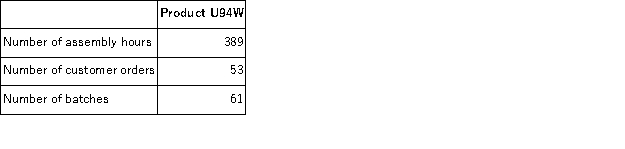

Hane Corporation uses the following activity rates from its activity-based costing to assign overhead costs to products:  Data for one of the company's products follow:

Data for one of the company's products follow:  How much overhead cost would be assigned to Product U94W using the activity-based costing system?

How much overhead cost would be assigned to Product U94W using the activity-based costing system?

A)$42,176.55

B)$83.85

C)$7,784.21

D)$2,666.92

Data for one of the company's products follow:

Data for one of the company's products follow:  How much overhead cost would be assigned to Product U94W using the activity-based costing system?

How much overhead cost would be assigned to Product U94W using the activity-based costing system?A)$42,176.55

B)$83.85

C)$7,784.21

D)$2,666.92

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 199 في هذه المجموعة.

فتح الحزمة

k this deck

55

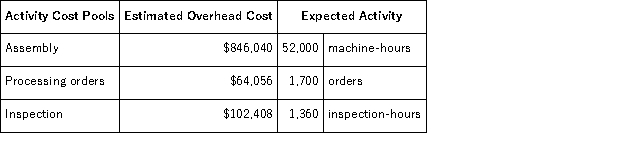

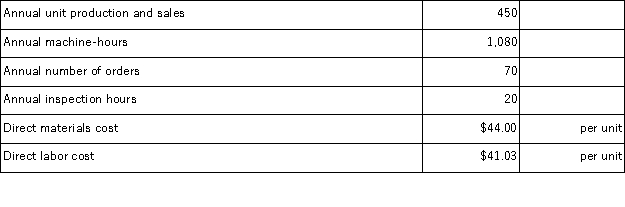

Paparo Corporation has provided the following data from its activity-based costing system:  Data concerning the company's product Q79Y appear below:

Data concerning the company's product Q79Y appear below:  According to the activity-based costing system,the unit product cost of product Q79Y is closest to:

According to the activity-based costing system,the unit product cost of product Q79Y is closest to:

A)$133.29 per unit

B)$85.03 per unit

C)$127.43 per unit

D)$129.94 per unit

Data concerning the company's product Q79Y appear below:

Data concerning the company's product Q79Y appear below:  According to the activity-based costing system,the unit product cost of product Q79Y is closest to:

According to the activity-based costing system,the unit product cost of product Q79Y is closest to:A)$133.29 per unit

B)$85.03 per unit

C)$127.43 per unit

D)$129.94 per unit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 199 في هذه المجموعة.

فتح الحزمة

k this deck

56

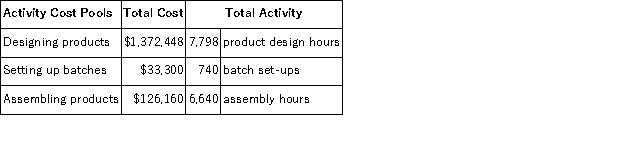

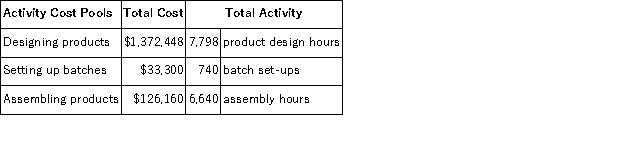

Millner Corporation has provided the following data from its activity-based costing accounting system:  The activity rate for the Designing Products activity cost pool is closest to:

The activity rate for the Designing Products activity cost pool is closest to:

A)$101 per product design hour

B)$1,372,448 per product design hour

C)$176 per product design hour

D)$57 per product design hour

The activity rate for the Designing Products activity cost pool is closest to:

The activity rate for the Designing Products activity cost pool is closest to:A)$101 per product design hour

B)$1,372,448 per product design hour

C)$176 per product design hour

D)$57 per product design hour

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 199 في هذه المجموعة.

فتح الحزمة

k this deck

57

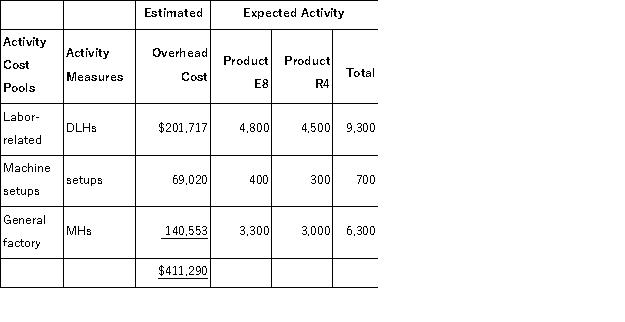

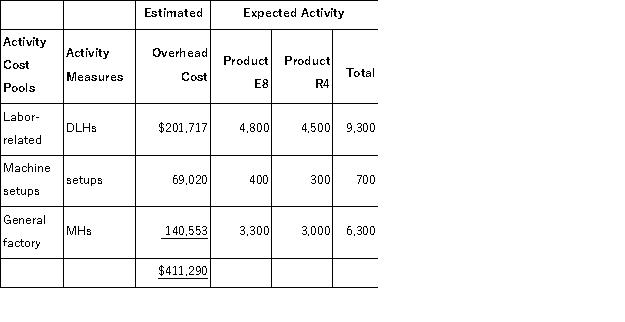

Bewig,Inc. ,manufactures and sells two products: Product E8 and Product R4.The company has an activity-based costing system with the following activity cost pools,activity measures,and expected activity:  The activity rate for the Machine Setups activity cost pool is closest to:

The activity rate for the Machine Setups activity cost pool is closest to:

A)$46.85 per setup

B)$98.60 per setup

C)$42.59 per setup

D)$65.28 per setup

The activity rate for the Machine Setups activity cost pool is closest to:

The activity rate for the Machine Setups activity cost pool is closest to:A)$46.85 per setup

B)$98.60 per setup

C)$42.59 per setup

D)$65.28 per setup

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 199 في هذه المجموعة.

فتح الحزمة

k this deck

58

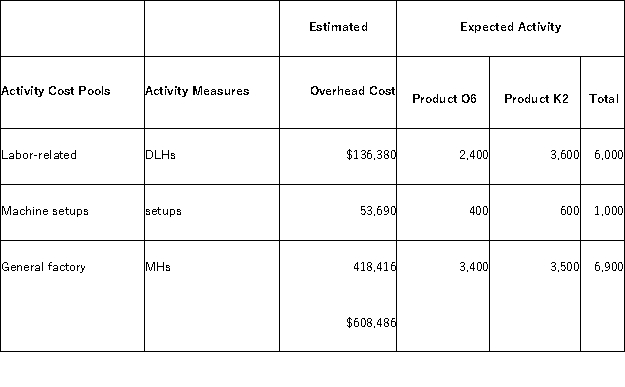

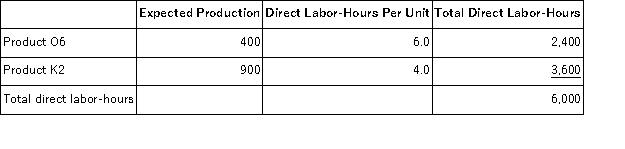

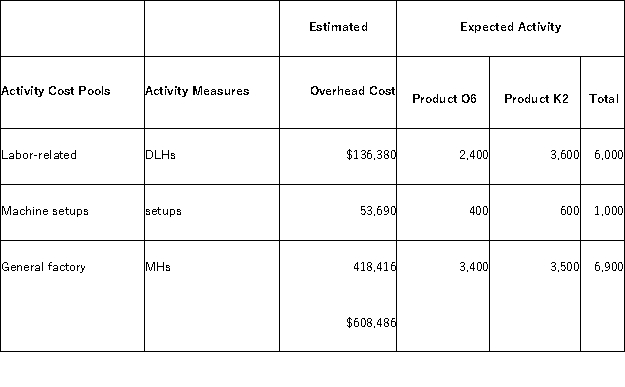

Scarff,Inc. ,manufactures and sells two products: Product O6 and Product K2.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs)required to produce that output appear below:  The direct labor rate is $23.20 per DLH.The direct materials cost per unit for each product is given below:

The direct labor rate is $23.20 per DLH.The direct materials cost per unit for each product is given below:  The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:

The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:

A)$88.19 per setup

B)$123.06 per setup

C)$119.55 per setup

D)$53.69 per setup

The direct labor rate is $23.20 per DLH.The direct materials cost per unit for each product is given below:

The direct labor rate is $23.20 per DLH.The direct materials cost per unit for each product is given below:  The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:

The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:

A)$88.19 per setup

B)$123.06 per setup

C)$119.55 per setup

D)$53.69 per setup

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 199 في هذه المجموعة.

فتح الحزمة

k this deck

59

Jeanlouis,Inc. ,manufactures and sells two products: Product D0 and Product D5.The company has an activity-based costing system with the following activity cost pools,activity measures,and expected activity:  The total overhead applied to Product D5 under activity-based costing is closest to:

The total overhead applied to Product D5 under activity-based costing is closest to:

A)$319,252

B)$125,286

C)$304,920

D)$273,240

The total overhead applied to Product D5 under activity-based costing is closest to:

The total overhead applied to Product D5 under activity-based costing is closest to:A)$319,252

B)$125,286

C)$304,920

D)$273,240

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 199 في هذه المجموعة.

فتح الحزمة

k this deck

60

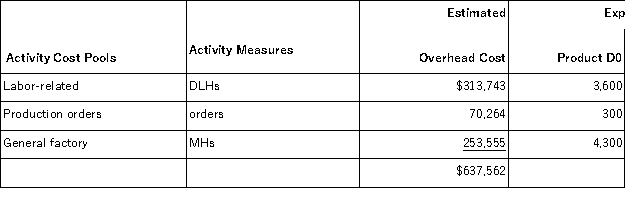

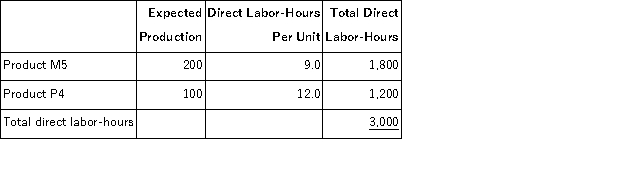

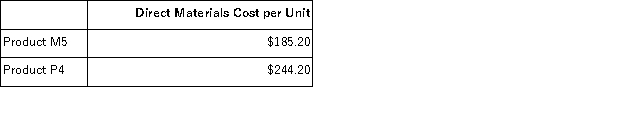

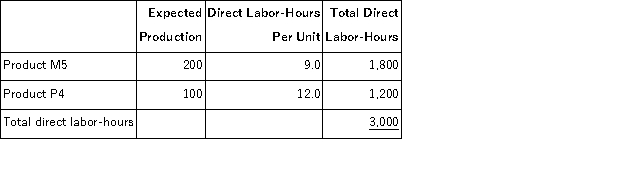

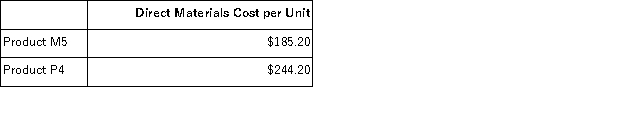

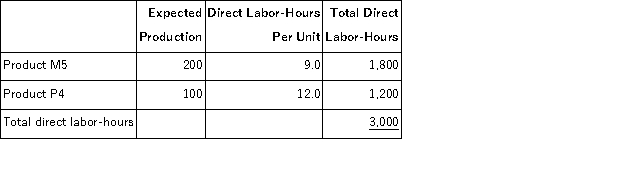

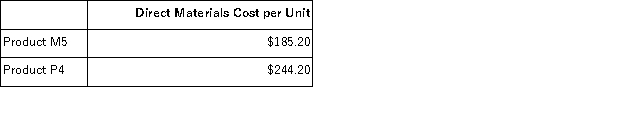

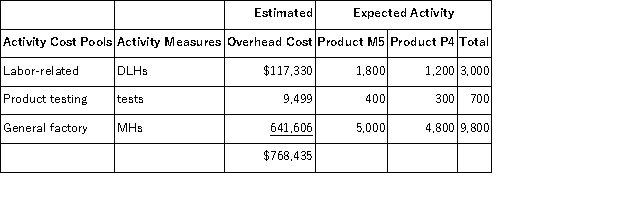

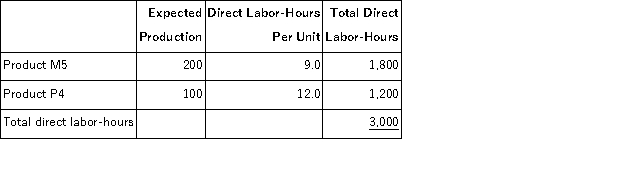

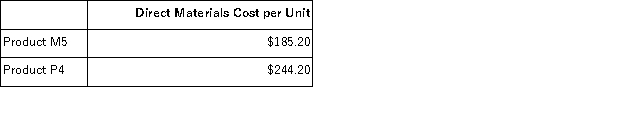

Whiteley,Inc. ,manufactures and sells two products: Product M5 and Product P4.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs)required to produce that output appear below:  The direct labor rate is $27.50 per DLH.The direct materials cost per unit for each product is given below:

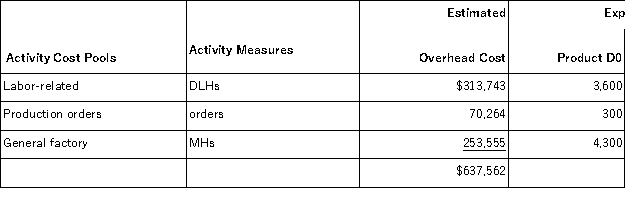

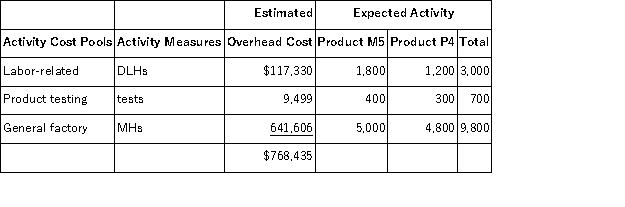

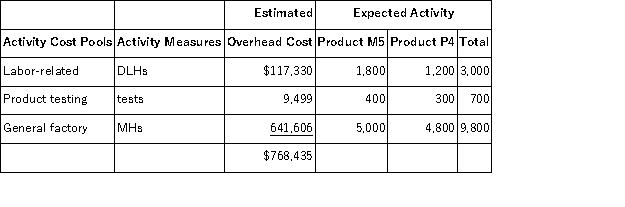

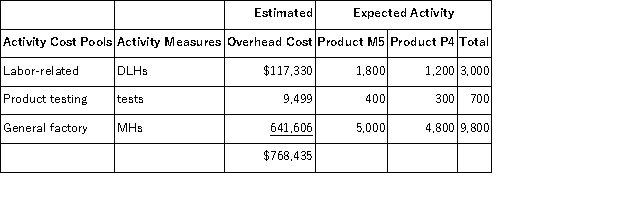

The direct labor rate is $27.50 per DLH.The direct materials cost per unit for each product is given below:  The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:

The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:  The unit product cost of Product P4 under activity-based costing is closest to:

The unit product cost of Product P4 under activity-based costing is closest to:

A)$3,716.76 per unit

B)$3,135.65 per unit

C)$4,226.79 per unit

D)$3,648.00 per unit

The direct labor rate is $27.50 per DLH.The direct materials cost per unit for each product is given below:

The direct labor rate is $27.50 per DLH.The direct materials cost per unit for each product is given below:  The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:

The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:  The unit product cost of Product P4 under activity-based costing is closest to:

The unit product cost of Product P4 under activity-based costing is closest to:A)$3,716.76 per unit

B)$3,135.65 per unit

C)$4,226.79 per unit

D)$3,648.00 per unit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 199 في هذه المجموعة.

فتح الحزمة

k this deck

61

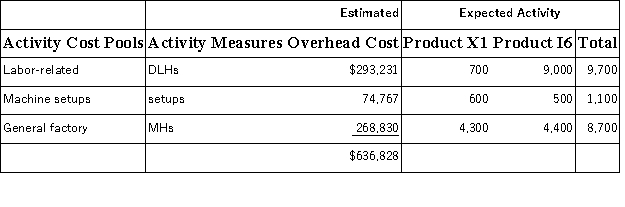

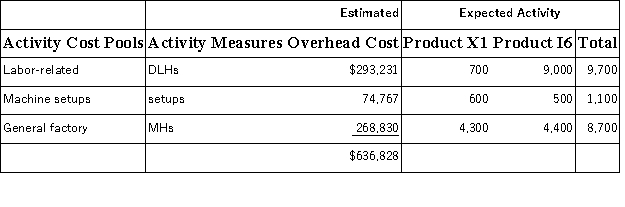

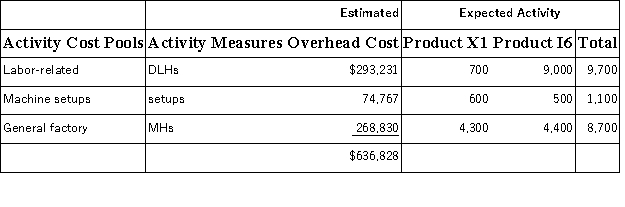

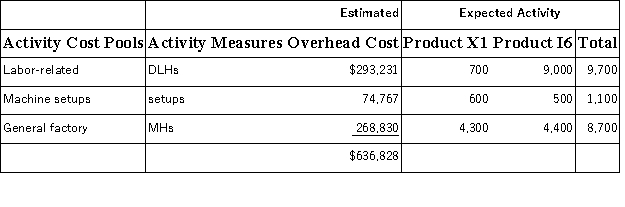

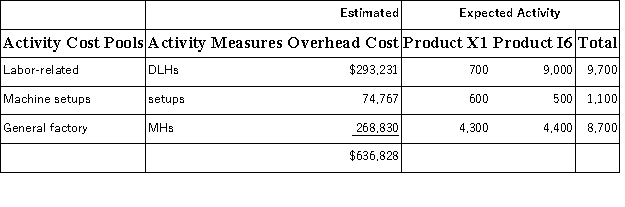

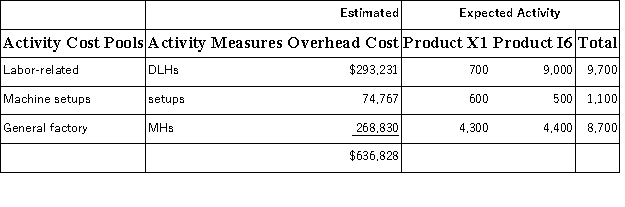

Schoeninger,Inc. ,manufactures and sells two products: Product X1 and Product I6.The company has an activity-based costing system with the following activity cost pools,activity measures,and expected activity:  The activity rate for the Machine Setups activity cost pool under activity-based costing is closest to:

The activity rate for the Machine Setups activity cost pool under activity-based costing is closest to:

A)$67.97 per setup

B)$62.52 per setup

C)$73.20 per setup

D)$61.10 per setup

The activity rate for the Machine Setups activity cost pool under activity-based costing is closest to:

The activity rate for the Machine Setups activity cost pool under activity-based costing is closest to:A)$67.97 per setup

B)$62.52 per setup

C)$73.20 per setup

D)$61.10 per setup

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 199 في هذه المجموعة.

فتح الحزمة

k this deck

62

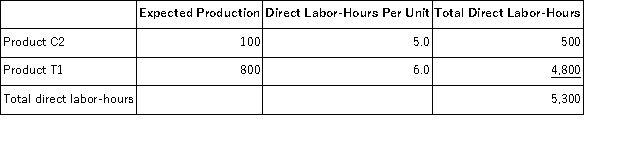

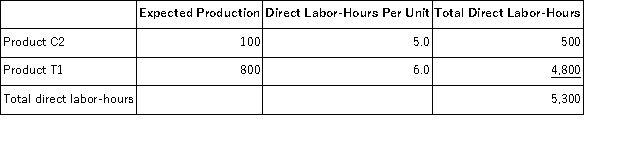

Avella,Inc. ,manufactures and sells two products: Product C2 and Product T1.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs)required to produce that output appear below:  The company's expected total manufacturing overhead is $775,080. If the company allocates all of its overhead based on direct labor-hours,the overhead assigned to each unit of Product T1 would be closest to:

The company's expected total manufacturing overhead is $775,080. If the company allocates all of its overhead based on direct labor-hours,the overhead assigned to each unit of Product T1 would be closest to:

A)$426.12 per unit

B)$393.90 per unit

C)$291.00 per unit

D)$877.44 per unit

The company's expected total manufacturing overhead is $775,080. If the company allocates all of its overhead based on direct labor-hours,the overhead assigned to each unit of Product T1 would be closest to:

The company's expected total manufacturing overhead is $775,080. If the company allocates all of its overhead based on direct labor-hours,the overhead assigned to each unit of Product T1 would be closest to:A)$426.12 per unit

B)$393.90 per unit

C)$291.00 per unit

D)$877.44 per unit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 199 في هذه المجموعة.

فتح الحزمة

k this deck

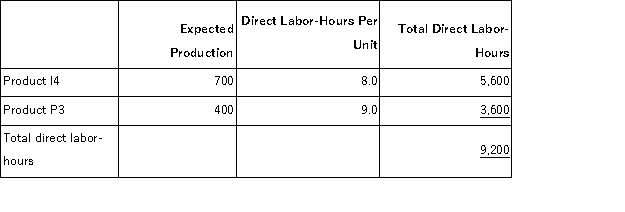

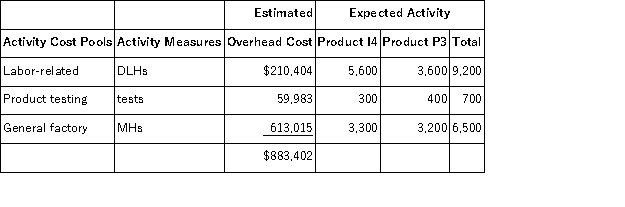

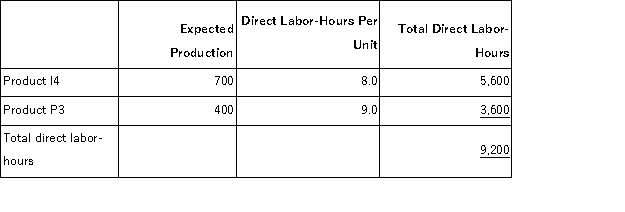

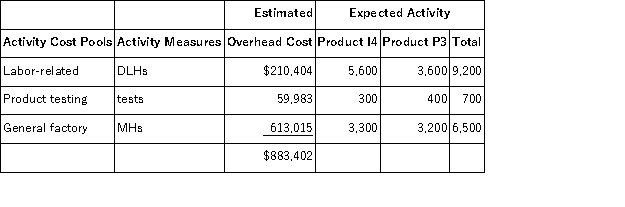

63

Sow,Inc. ,manufactures and sells two products: Product I4 and Product P3.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs)required to produce that output appear below:  The direct labor rate is $24.70 per DLH.The direct materials cost per unit for each product is given below:

The direct labor rate is $24.70 per DLH.The direct materials cost per unit for each product is given below:  The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:

The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:  The unit product cost of Product P3 under the company's traditional costing method in which all overhead is allocated on the basis of direct labor-hours is closest to:

The unit product cost of Product P3 under the company's traditional costing method in which all overhead is allocated on the basis of direct labor-hours is closest to:

A)$1,216.79 per unit

B)$1,139.21 per unit

C)$573.83 per unit

D)$1,232.18 per unit

The direct labor rate is $24.70 per DLH.The direct materials cost per unit for each product is given below:

The direct labor rate is $24.70 per DLH.The direct materials cost per unit for each product is given below:  The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:

The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:  The unit product cost of Product P3 under the company's traditional costing method in which all overhead is allocated on the basis of direct labor-hours is closest to:

The unit product cost of Product P3 under the company's traditional costing method in which all overhead is allocated on the basis of direct labor-hours is closest to:A)$1,216.79 per unit

B)$1,139.21 per unit

C)$573.83 per unit

D)$1,232.18 per unit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 199 في هذه المجموعة.

فتح الحزمة

k this deck

64

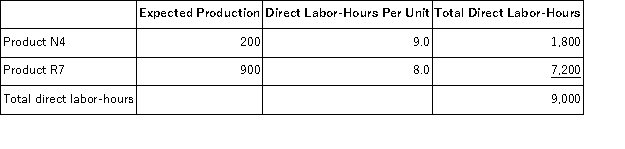

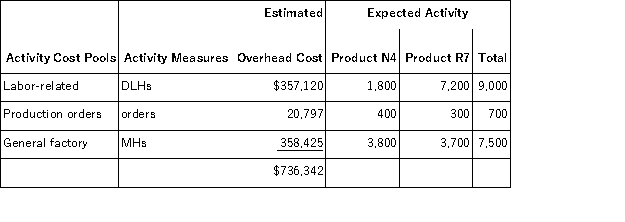

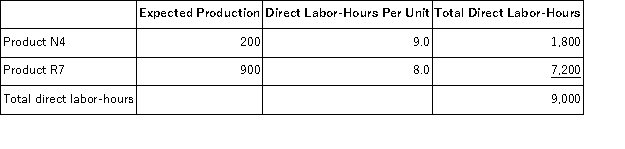

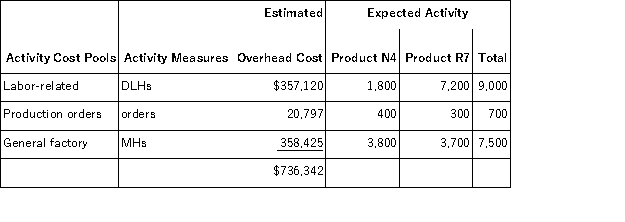

Diemer,Inc. ,manufactures and sells two products: Product N4 and Product R7.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs)required to produce that output appear below:  The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:

The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:  If the company allocates all of its overhead based on direct labor-hours using its traditional costing method,the predetermined overhead rate would be closest to:

If the company allocates all of its overhead based on direct labor-hours using its traditional costing method,the predetermined overhead rate would be closest to:

A)$39.68 per DLH

B)$81.82 per DLH

C)$29.71 per DLH

D)$47.79 per DLH

The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:

The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:  If the company allocates all of its overhead based on direct labor-hours using its traditional costing method,the predetermined overhead rate would be closest to:

If the company allocates all of its overhead based on direct labor-hours using its traditional costing method,the predetermined overhead rate would be closest to:A)$39.68 per DLH

B)$81.82 per DLH

C)$29.71 per DLH

D)$47.79 per DLH

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 199 في هذه المجموعة.

فتح الحزمة

k this deck

65

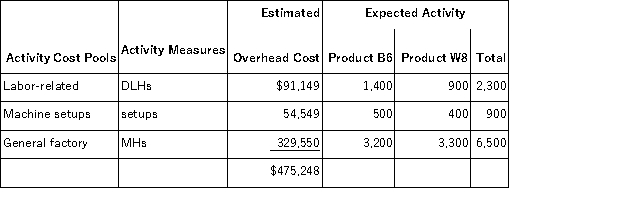

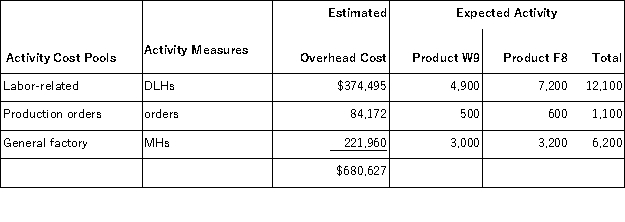

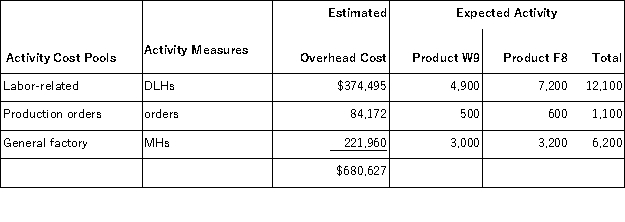

Filosa,Inc. ,manufactures and sells two products: Product W9 and Product F8.The company has an activity-based costing system with the following activity cost pools,activity measures,and expected activity:  The total overhead applied to Product F8 under activity-based costing is closest to:

The total overhead applied to Product F8 under activity-based costing is closest to:

A)$363,000

B)$114,560

C)$383,312

D)$405,000

The total overhead applied to Product F8 under activity-based costing is closest to:

The total overhead applied to Product F8 under activity-based costing is closest to:A)$363,000

B)$114,560

C)$383,312

D)$405,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 199 في هذه المجموعة.

فتح الحزمة

k this deck

66

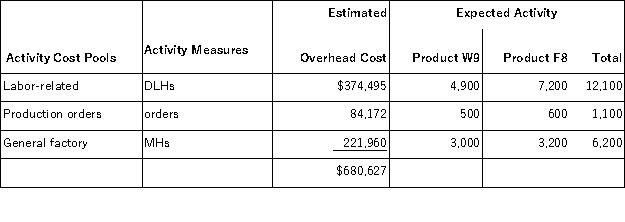

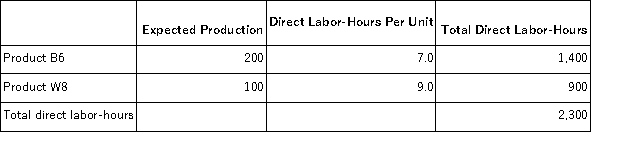

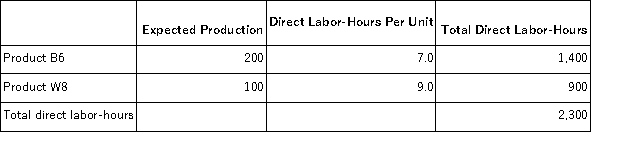

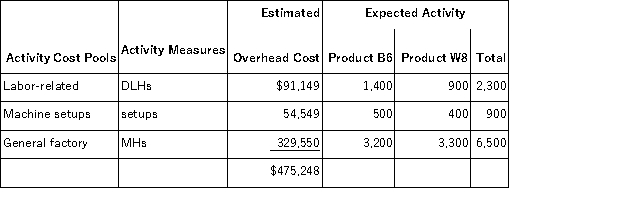

Boahn,Inc. ,manufactures and sells two products: Product B6 and Product W8.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs)required to produce that output appear below:  The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:

The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:  If the company allocates all of its overhead based on direct labor-hours using its traditional costing method,the overhead assigned to each unit of Product W8 would be closest to:

If the company allocates all of its overhead based on direct labor-hours using its traditional costing method,the overhead assigned to each unit of Product W8 would be closest to:

A)$1,859.67 per unit

B)$356.67 per unit

C)$545.49 per unit

D)$456.30 per unit

The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:

The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:  If the company allocates all of its overhead based on direct labor-hours using its traditional costing method,the overhead assigned to each unit of Product W8 would be closest to:

If the company allocates all of its overhead based on direct labor-hours using its traditional costing method,the overhead assigned to each unit of Product W8 would be closest to:A)$1,859.67 per unit

B)$356.67 per unit

C)$545.49 per unit

D)$456.30 per unit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 199 في هذه المجموعة.

فتح الحزمة

k this deck

67

Schoeninger,Inc. ,manufactures and sells two products: Product X1 and Product I6.The company has an activity-based costing system with the following activity cost pools,activity measures,and expected activity:  The activity rate for the General Factory activity cost pool under activity-based costing is closest to:

The activity rate for the General Factory activity cost pool under activity-based costing is closest to:

A)$30.90 per MH

B)$32.58 per MH

C)$65.65 per MH

D)$32.66 per MH

The activity rate for the General Factory activity cost pool under activity-based costing is closest to:

The activity rate for the General Factory activity cost pool under activity-based costing is closest to:A)$30.90 per MH

B)$32.58 per MH

C)$65.65 per MH

D)$32.66 per MH

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 199 في هذه المجموعة.

فتح الحزمة

k this deck

68

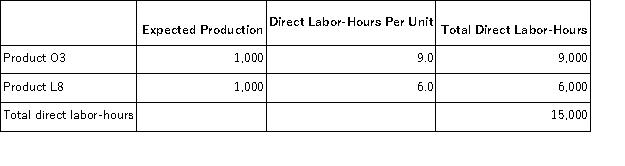

Sylvest,Inc. ,manufactures and sells two products: Product O3 and Product L8.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs)required to produce that output appear below:  The company's expected total manufacturing overhead is $913,376. If the company allocates all of its overhead based on direct labor-hours,the overhead assigned to each unit of Product O3 would be closest to:

The company's expected total manufacturing overhead is $913,376. If the company allocates all of its overhead based on direct labor-hours,the overhead assigned to each unit of Product O3 would be closest to:

A)$548.01 per unit

B)$441.00 per unit

C)$133.92 per unit

D)$342.00 per unit

The company's expected total manufacturing overhead is $913,376. If the company allocates all of its overhead based on direct labor-hours,the overhead assigned to each unit of Product O3 would be closest to:

The company's expected total manufacturing overhead is $913,376. If the company allocates all of its overhead based on direct labor-hours,the overhead assigned to each unit of Product O3 would be closest to:A)$548.01 per unit

B)$441.00 per unit

C)$133.92 per unit

D)$342.00 per unit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 199 في هذه المجموعة.

فتح الحزمة

k this deck

69

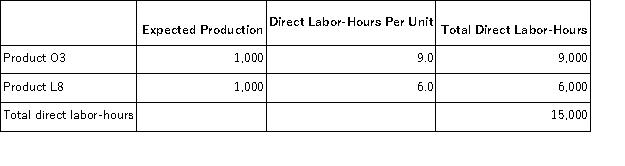

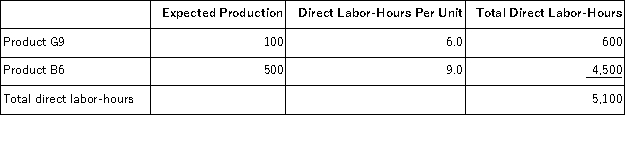

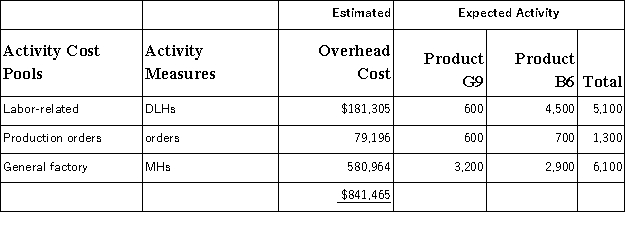

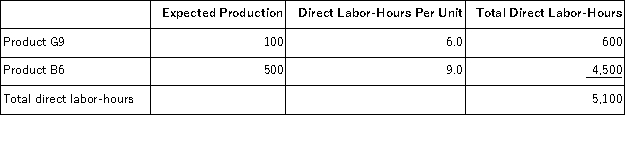

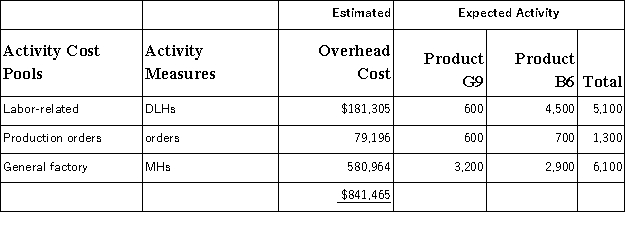

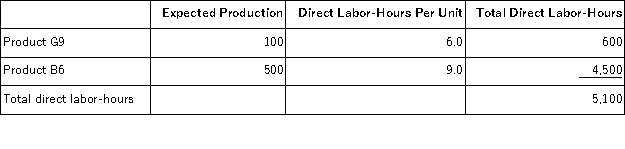

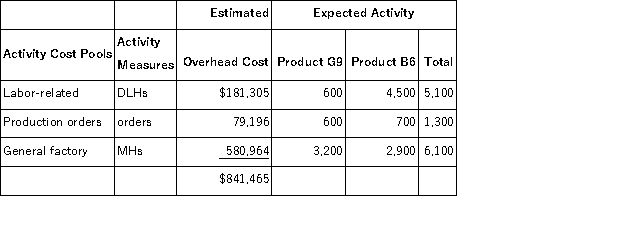

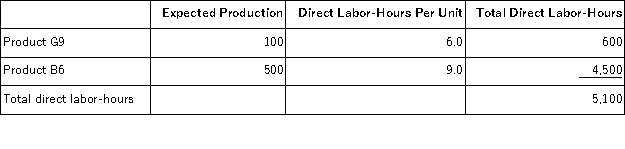

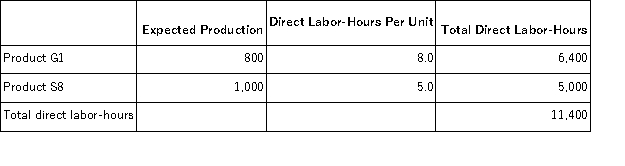

Bolerjack,Inc. ,manufactures and sells two products: Product G9 and Product B6.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs)required to produce that output appear below:  The direct labor rate is $16.50 per DLH.The direct materials cost per unit is $204.30 for Product G9 and $284.50 for Product B6. The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:

The direct labor rate is $16.50 per DLH.The direct materials cost per unit is $204.30 for Product G9 and $284.50 for Product B6. The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:  The unit product cost of Product G9 under activity-based costing is closest to:

The unit product cost of Product G9 under activity-based costing is closest to:

A)$1,705.74 per unit

B)$3,350.98 per unit

C)$1,293.24 per unit

D)$3,929.80 per unit

The direct labor rate is $16.50 per DLH.The direct materials cost per unit is $204.30 for Product G9 and $284.50 for Product B6. The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:

The direct labor rate is $16.50 per DLH.The direct materials cost per unit is $204.30 for Product G9 and $284.50 for Product B6. The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:  The unit product cost of Product G9 under activity-based costing is closest to:

The unit product cost of Product G9 under activity-based costing is closest to:A)$1,705.74 per unit

B)$3,350.98 per unit

C)$1,293.24 per unit

D)$3,929.80 per unit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 199 في هذه المجموعة.

فتح الحزمة

k this deck

70

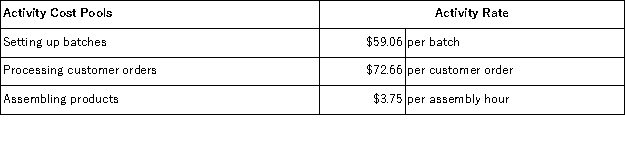

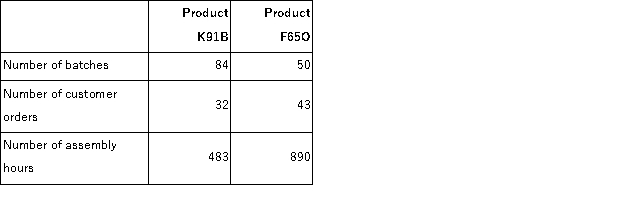

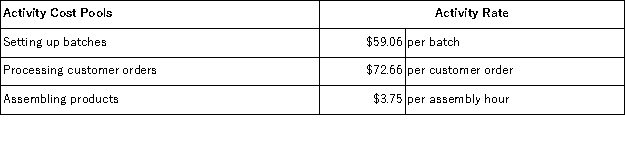

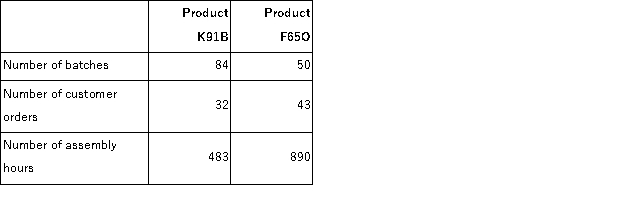

Gould Corporation uses the following activity rates from its activity-based costing to assign overhead costs to products:  Data concerning two products appear below:

Data concerning two products appear below:  How much overhead cost would be assigned to Product K91B using the activity-based costing system?

How much overhead cost would be assigned to Product K91B using the activity-based costing system?

A)$9,097.41

B)$81,146.53

C)$4,961.04

D)$135.47

Data concerning two products appear below:

Data concerning two products appear below:  How much overhead cost would be assigned to Product K91B using the activity-based costing system?

How much overhead cost would be assigned to Product K91B using the activity-based costing system?A)$9,097.41

B)$81,146.53

C)$4,961.04

D)$135.47

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 199 في هذه المجموعة.

فتح الحزمة

k this deck

71

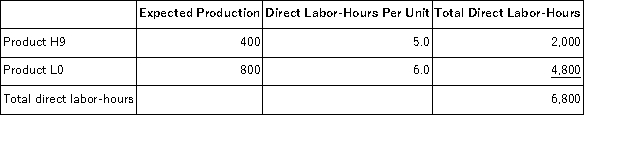

Finken,Inc. ,manufactures and sells two products: Product H9 and Product L0.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs)required to produce that output appear below:  The direct labor rate is $16.10 per DLH.The direct materials cost per unit is $256.40 for Product H9 and $125.00 for Product L0.The estimated total manufacturing overhead is $441,772. The unit product cost of Product L0 under the company's traditional costing method in which all overhead is allocated on the basis of direct labor-hours is closest to:

The direct labor rate is $16.10 per DLH.The direct materials cost per unit is $256.40 for Product H9 and $125.00 for Product L0.The estimated total manufacturing overhead is $441,772. The unit product cost of Product L0 under the company's traditional costing method in which all overhead is allocated on the basis of direct labor-hours is closest to:

A)$419.12 per unit

B)$611.42 per unit

C)$309.20 per unit

D)$686.24 per unit

The direct labor rate is $16.10 per DLH.The direct materials cost per unit is $256.40 for Product H9 and $125.00 for Product L0.The estimated total manufacturing overhead is $441,772. The unit product cost of Product L0 under the company's traditional costing method in which all overhead is allocated on the basis of direct labor-hours is closest to:

The direct labor rate is $16.10 per DLH.The direct materials cost per unit is $256.40 for Product H9 and $125.00 for Product L0.The estimated total manufacturing overhead is $441,772. The unit product cost of Product L0 under the company's traditional costing method in which all overhead is allocated on the basis of direct labor-hours is closest to:A)$419.12 per unit

B)$611.42 per unit

C)$309.20 per unit

D)$686.24 per unit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 199 في هذه المجموعة.

فتح الحزمة

k this deck

72

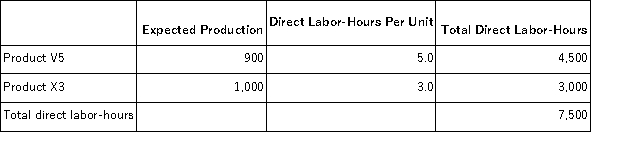

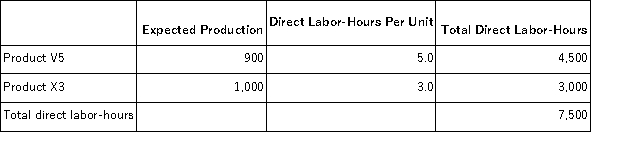

Trisdale,Inc. ,manufactures and sells two products: Product V5 and Product X3.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs)required to produce that output appear below:  The company's total manufacturing overhead is $372,695.If the company allocates all of its overhead based on direct labor-hours,the predetermined overhead rate would be closest to:

The company's total manufacturing overhead is $372,695.If the company allocates all of its overhead based on direct labor-hours,the predetermined overhead rate would be closest to:

A)$24.95 per DLH

B)$49.69 per DLH

C)$90.88 per DLH

D)$19.67 per DLH

The company's total manufacturing overhead is $372,695.If the company allocates all of its overhead based on direct labor-hours,the predetermined overhead rate would be closest to:

The company's total manufacturing overhead is $372,695.If the company allocates all of its overhead based on direct labor-hours,the predetermined overhead rate would be closest to:A)$24.95 per DLH

B)$49.69 per DLH

C)$90.88 per DLH

D)$19.67 per DLH

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 199 في هذه المجموعة.

فتح الحزمة

k this deck

73

Schoeninger,Inc. ,manufactures and sells two products: Product X1 and Product I6.The company has an activity-based costing system with the following activity cost pools,activity measures,and expected activity:  The activity rate for the Labor-Related activity cost pool under activity-based costing is closest to:

The activity rate for the Labor-Related activity cost pool under activity-based costing is closest to:

A)$149.53 per DLH

B)$30.23 per DLH

C)$578.93 per DLH

D)$124.61 per DLH

The activity rate for the Labor-Related activity cost pool under activity-based costing is closest to:

The activity rate for the Labor-Related activity cost pool under activity-based costing is closest to:A)$149.53 per DLH

B)$30.23 per DLH

C)$578.93 per DLH

D)$124.61 per DLH

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 199 في هذه المجموعة.

فتح الحزمة

k this deck

74

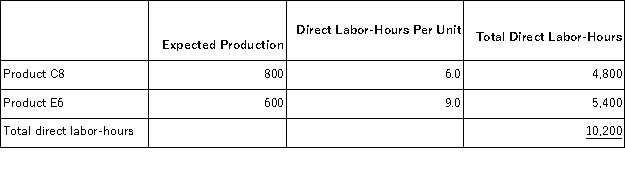

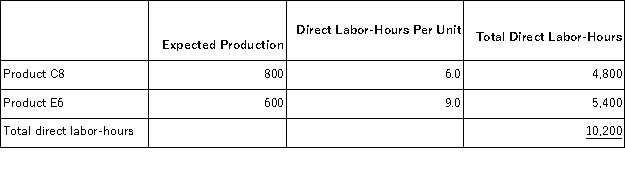

Cassano,Inc. ,manufactures and sells two products: Product C8 and Product E6.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs)required to produce that output appear below:  The direct labor rate is $19.80 per DLH.The direct materials cost per unit is $145.10 for Product C8 and $181.00 for Product E6.The estimated total manufacturing overhead is $671,598. The unit product cost of Product C8 under the company's traditional costing method in which all overhead is allocated on the basis of direct labor-hours is closest to:

The direct labor rate is $19.80 per DLH.The direct materials cost per unit is $145.10 for Product C8 and $181.00 for Product E6.The estimated total manufacturing overhead is $671,598. The unit product cost of Product C8 under the company's traditional costing method in which all overhead is allocated on the basis of direct labor-hours is closest to:

A)$658.94 per unit

B)$470.00 per unit

C)$666.56 per unit

D)$348.74 per unit

The direct labor rate is $19.80 per DLH.The direct materials cost per unit is $145.10 for Product C8 and $181.00 for Product E6.The estimated total manufacturing overhead is $671,598. The unit product cost of Product C8 under the company's traditional costing method in which all overhead is allocated on the basis of direct labor-hours is closest to:

The direct labor rate is $19.80 per DLH.The direct materials cost per unit is $145.10 for Product C8 and $181.00 for Product E6.The estimated total manufacturing overhead is $671,598. The unit product cost of Product C8 under the company's traditional costing method in which all overhead is allocated on the basis of direct labor-hours is closest to:A)$658.94 per unit

B)$470.00 per unit

C)$666.56 per unit

D)$348.74 per unit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 199 في هذه المجموعة.

فتح الحزمة

k this deck

75

Bolerjack,Inc. ,manufactures and sells two products: Product G9 and Product B6.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs)required to produce that output appear below:  The direct labor rate is $16.50 per DLH.The direct materials cost per unit is $204.30 for Product G9 and $284.50 for Product B6. The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:

The direct labor rate is $16.50 per DLH.The direct materials cost per unit is $204.30 for Product G9 and $284.50 for Product B6. The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:  The unit product cost of Product B6 under activity-based costing is closest to:

The unit product cost of Product B6 under activity-based costing is closest to:

A)$1,835.44 per unit

B)$1,917.91 per unit

C)$1,390.63 per unit

D)$985.39 per unit

The direct labor rate is $16.50 per DLH.The direct materials cost per unit is $204.30 for Product G9 and $284.50 for Product B6. The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:

The direct labor rate is $16.50 per DLH.The direct materials cost per unit is $204.30 for Product G9 and $284.50 for Product B6. The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:  The unit product cost of Product B6 under activity-based costing is closest to:

The unit product cost of Product B6 under activity-based costing is closest to:A)$1,835.44 per unit

B)$1,917.91 per unit

C)$1,390.63 per unit

D)$985.39 per unit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 199 في هذه المجموعة.

فتح الحزمة

k this deck

76

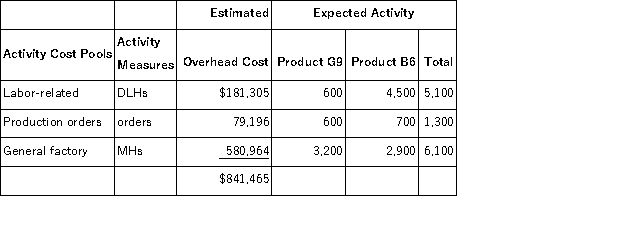

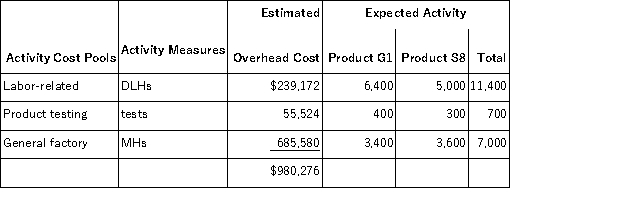

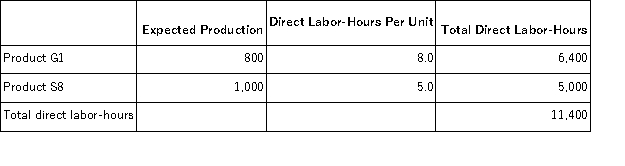

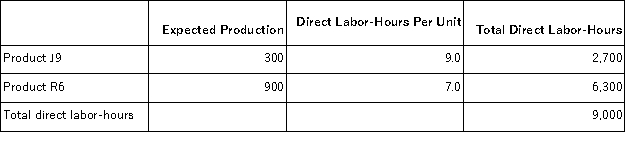

Molinas,Inc. ,manufactures and sells two products: Product G1 and Product S8.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs)required to produce that output appear below:  The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:

The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:  If the company allocates all of its overhead based on direct labor-hours using its traditional costing method,the predetermined overhead rate would be closest to:

If the company allocates all of its overhead based on direct labor-hours using its traditional costing method,the predetermined overhead rate would be closest to:

A)$85.99 per DLH

B)$20.98 per DLH

C)$97.94 per DLH

D)$79.32 per DLH

The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:

The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:  If the company allocates all of its overhead based on direct labor-hours using its traditional costing method,the predetermined overhead rate would be closest to:

If the company allocates all of its overhead based on direct labor-hours using its traditional costing method,the predetermined overhead rate would be closest to:A)$85.99 per DLH

B)$20.98 per DLH

C)$97.94 per DLH

D)$79.32 per DLH

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 199 في هذه المجموعة.

فتح الحزمة

k this deck

77

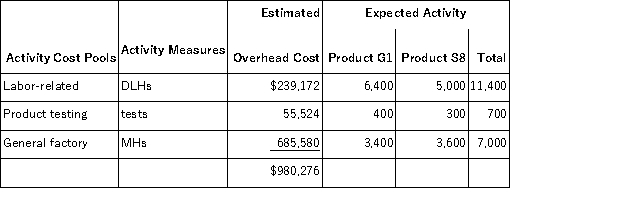

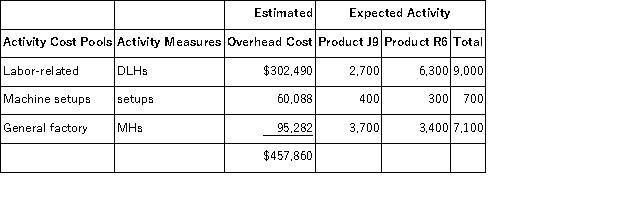

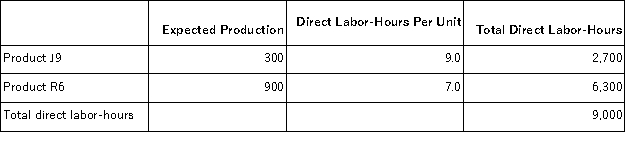

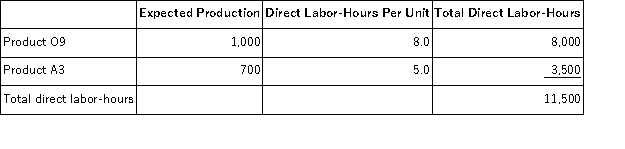

Lamon,Inc. ,manufactures and sells two products: Product J9 and Product R6.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs)required to produce that output appear below:  The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:

The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:  If the company allocates all of its overhead based on direct labor-hours using its traditional costing method,the overhead assigned to each unit of Product J9 would be closest to:

If the company allocates all of its overhead based on direct labor-hours using its traditional costing method,the overhead assigned to each unit of Product J9 would be closest to:

A)$120.78 per unit

B)$302.49 per unit

C)$457.83 per unit

D)$772.56 per unit

The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:

The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:  If the company allocates all of its overhead based on direct labor-hours using its traditional costing method,the overhead assigned to each unit of Product J9 would be closest to:

If the company allocates all of its overhead based on direct labor-hours using its traditional costing method,the overhead assigned to each unit of Product J9 would be closest to:A)$120.78 per unit

B)$302.49 per unit

C)$457.83 per unit

D)$772.56 per unit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 199 في هذه المجموعة.

فتح الحزمة

k this deck

78

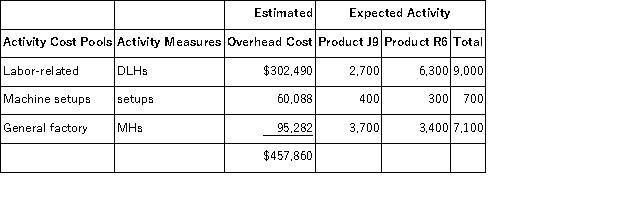

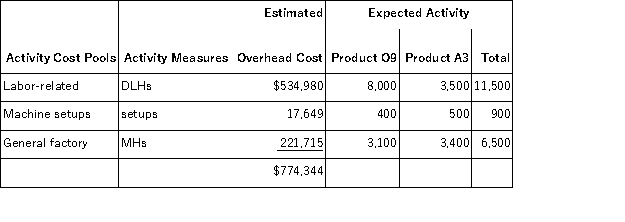

Abbe,Inc. ,manufactures and sells two products: Product O9 and Product A3.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs)required to produce that output appear below:  The direct labor rate is $24.40 per DLH.The direct materials cost per unit for each product is given below:

The direct labor rate is $24.40 per DLH.The direct materials cost per unit for each product is given below:  The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:

The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:  The unit product cost of Product O9 under the company's traditional costing method in which all overhead is allocated on the basis of direct labor-hours is closest to:

The unit product cost of Product O9 under the company's traditional costing method in which all overhead is allocated on the basis of direct labor-hours is closest to:

A)$544.48 per unit

B)$759.76 per unit

C)$660.48 per unit

D)$926.24 per unit

The direct labor rate is $24.40 per DLH.The direct materials cost per unit for each product is given below:

The direct labor rate is $24.40 per DLH.The direct materials cost per unit for each product is given below:  The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:

The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:  The unit product cost of Product O9 under the company's traditional costing method in which all overhead is allocated on the basis of direct labor-hours is closest to:

The unit product cost of Product O9 under the company's traditional costing method in which all overhead is allocated on the basis of direct labor-hours is closest to:A)$544.48 per unit

B)$759.76 per unit

C)$660.48 per unit

D)$926.24 per unit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 199 في هذه المجموعة.

فتح الحزمة

k this deck

79

Filosa,Inc. ,manufactures and sells two products: Product W9 and Product F8.The company has an activity-based costing system with the following activity cost pools,activity measures,and expected activity:  The total overhead applied to Product W9 under activity-based costing is closest to:

The total overhead applied to Product W9 under activity-based costing is closest to:

A)$297,315

B)$317,625

C)$107,401

D)$275,625

The total overhead applied to Product W9 under activity-based costing is closest to:

The total overhead applied to Product W9 under activity-based costing is closest to:A)$297,315

B)$317,625

C)$107,401

D)$275,625

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 199 في هذه المجموعة.

فتح الحزمة

k this deck

80

Whiteley,Inc. ,manufactures and sells two products: Product M5 and Product P4.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs)required to produce that output appear below:  The direct labor rate is $27.50 per DLH.The direct materials cost per unit for each product is given below:

The direct labor rate is $27.50 per DLH.The direct materials cost per unit for each product is given below:  The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:

The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:  The unit product cost of Product P4 under activity-based costing is closest to:

The unit product cost of Product P4 under activity-based costing is closest to:

A)$3,716.76 per unit

B)$3,135.65 per unit

C)$4,226.79 per unit

D)$3,648.00 per unit

The direct labor rate is $27.50 per DLH.The direct materials cost per unit for each product is given below:

The direct labor rate is $27.50 per DLH.The direct materials cost per unit for each product is given below:  The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:

The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:  The unit product cost of Product P4 under activity-based costing is closest to:

The unit product cost of Product P4 under activity-based costing is closest to:A)$3,716.76 per unit

B)$3,135.65 per unit

C)$4,226.79 per unit

D)$3,648.00 per unit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 199 في هذه المجموعة.

فتح الحزمة

k this deck