Deck 29: The Direct Method of Determining the Net Cash Provided by Operating Activities

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/48

العب

ملء الشاشة (f)

Deck 29: The Direct Method of Determining the Net Cash Provided by Operating Activities

1

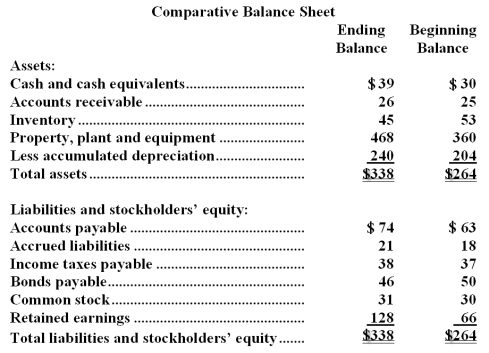

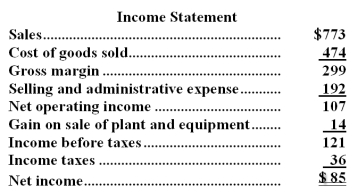

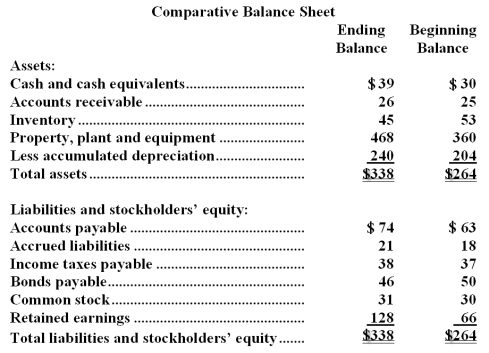

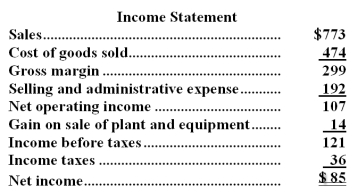

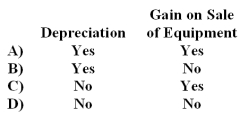

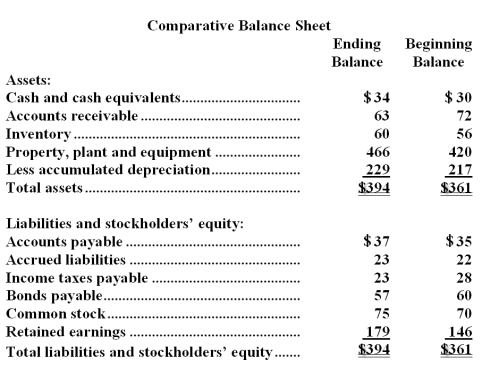

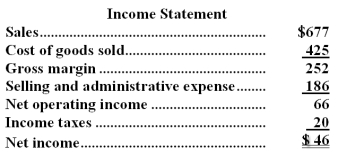

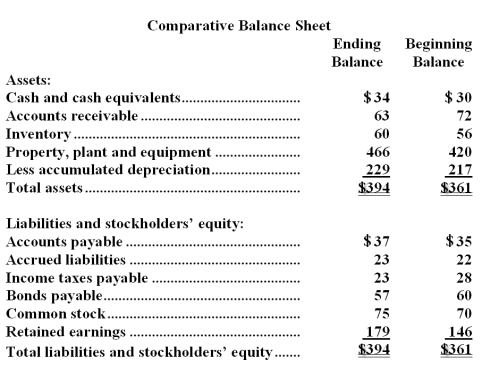

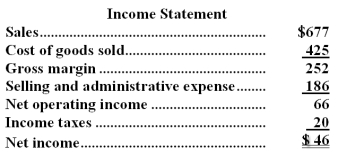

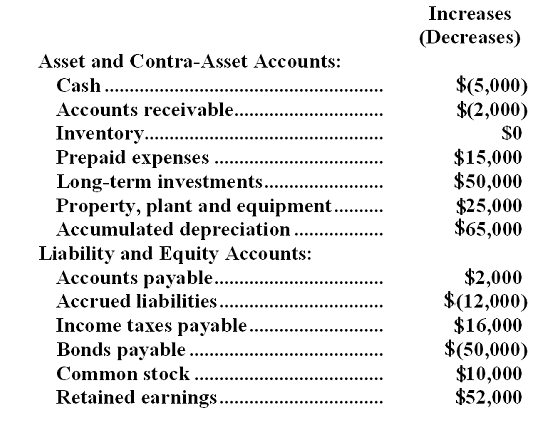

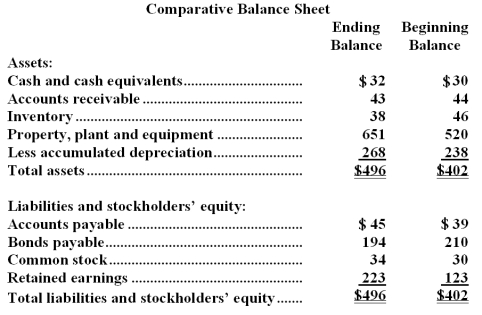

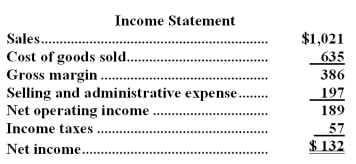

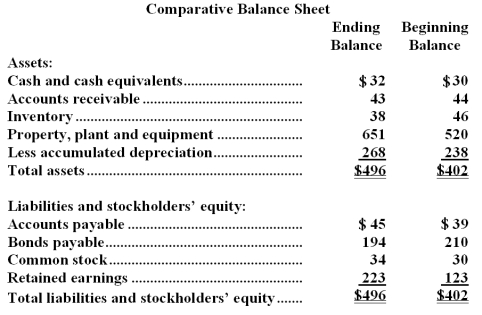

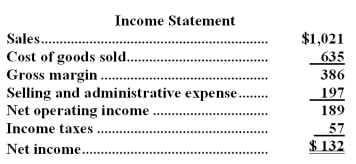

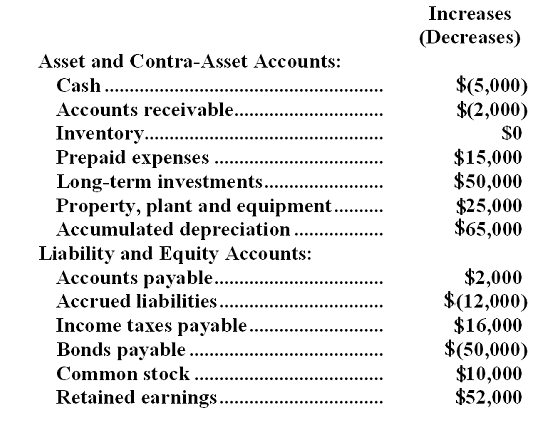

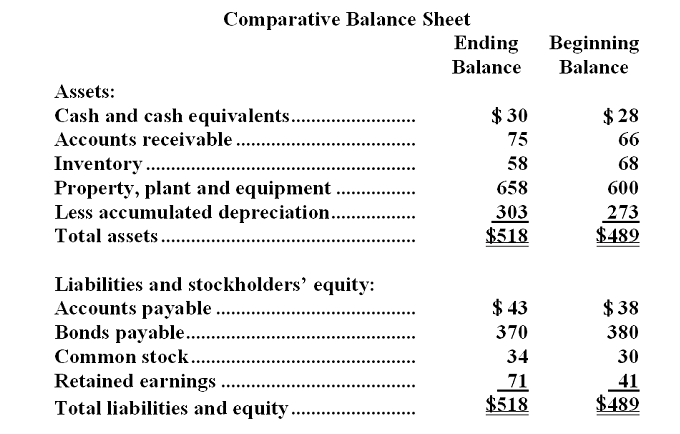

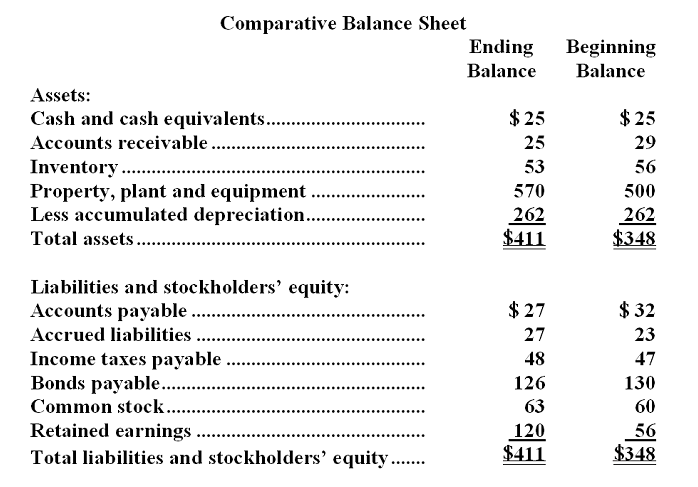

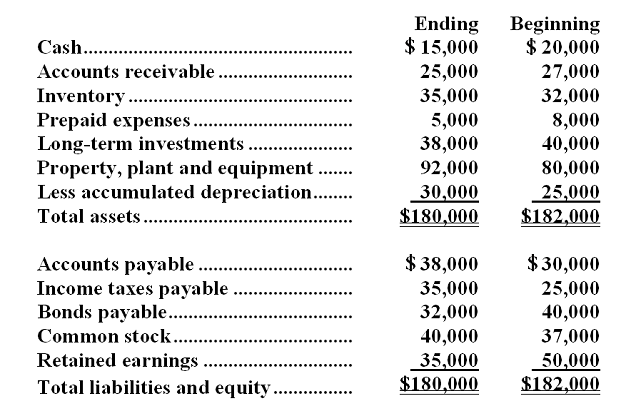

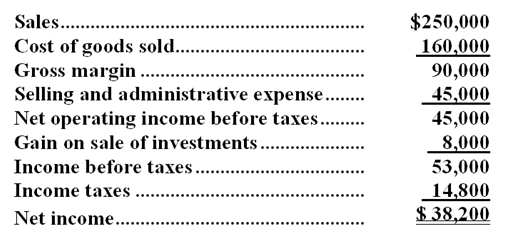

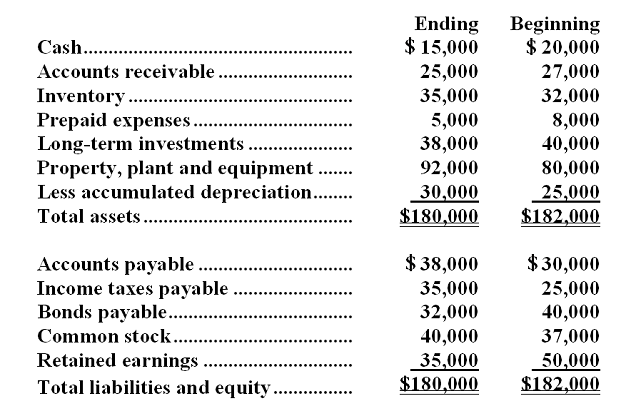

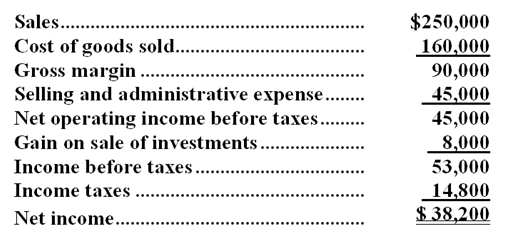

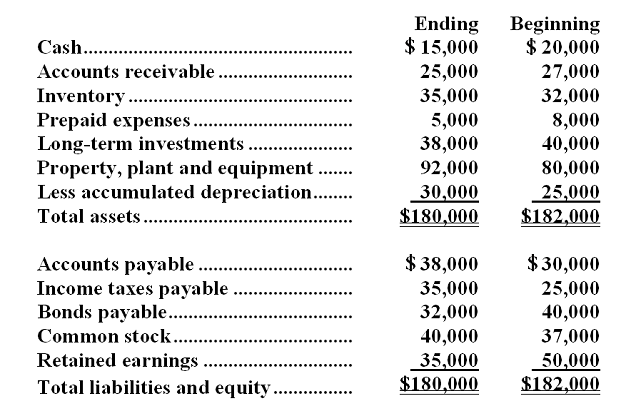

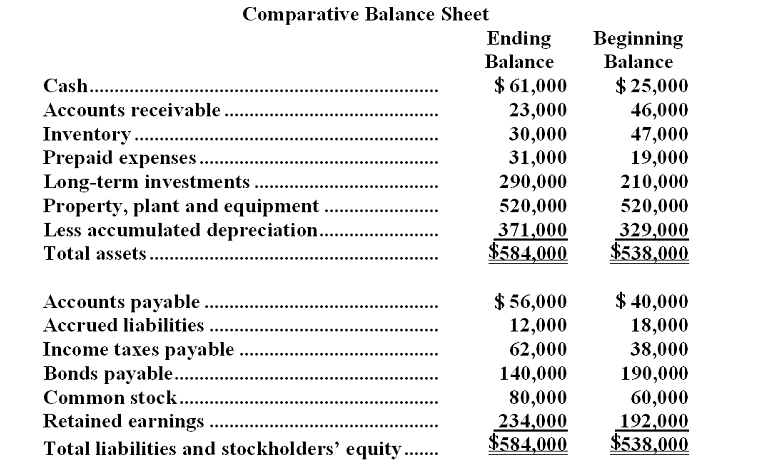

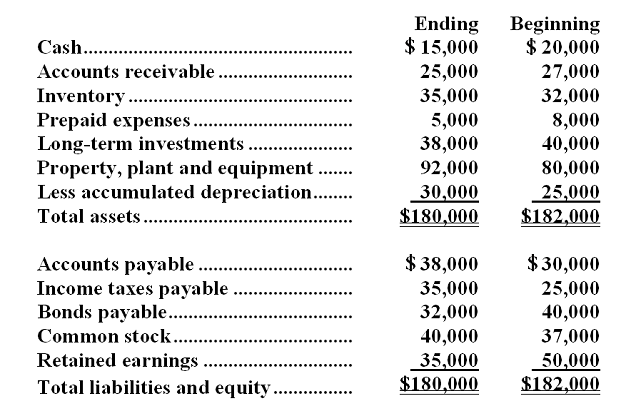

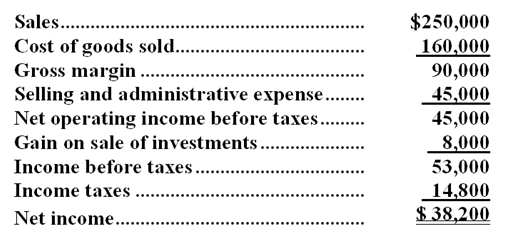

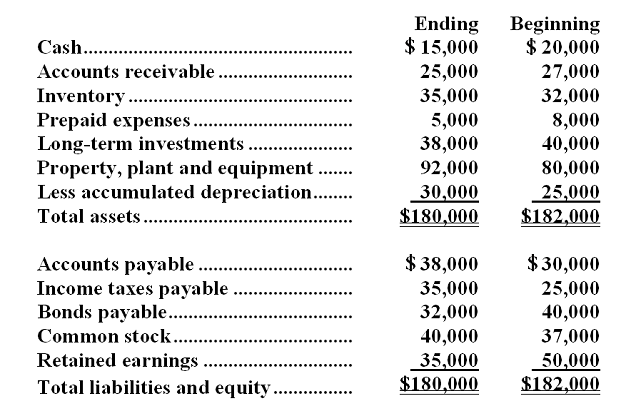

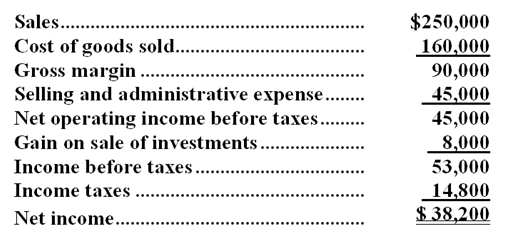

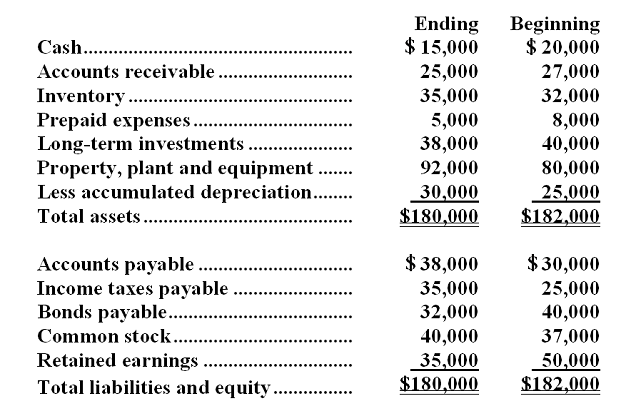

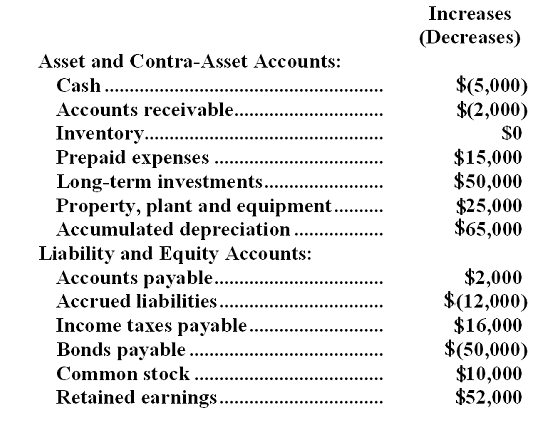

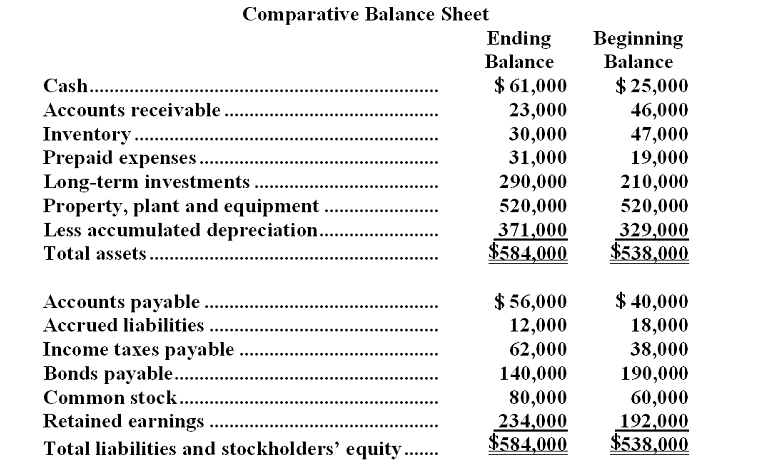

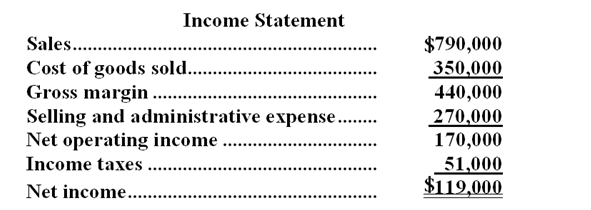

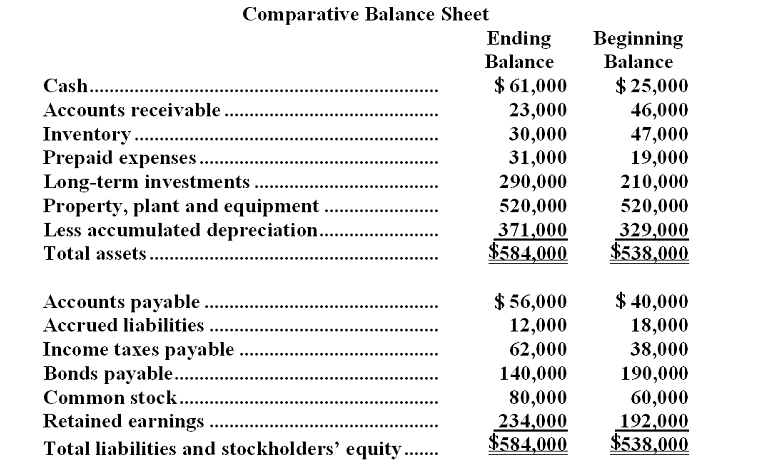

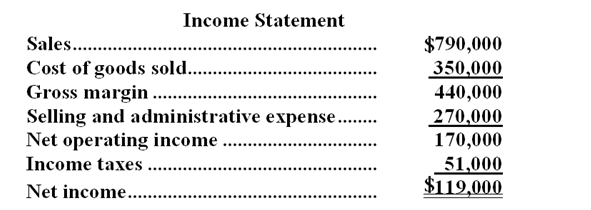

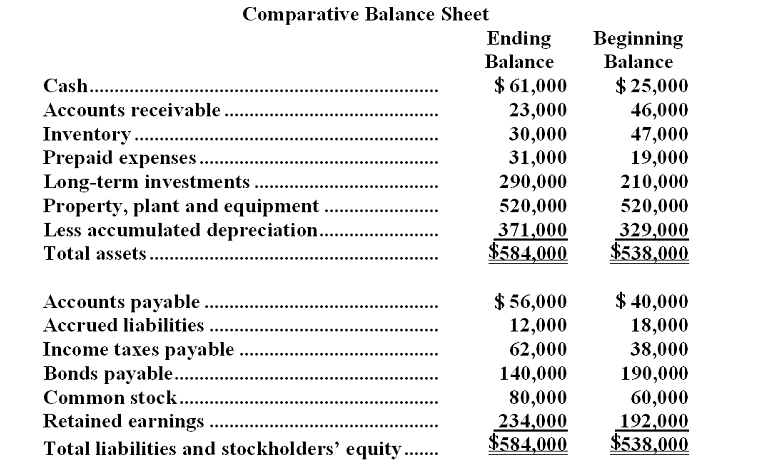

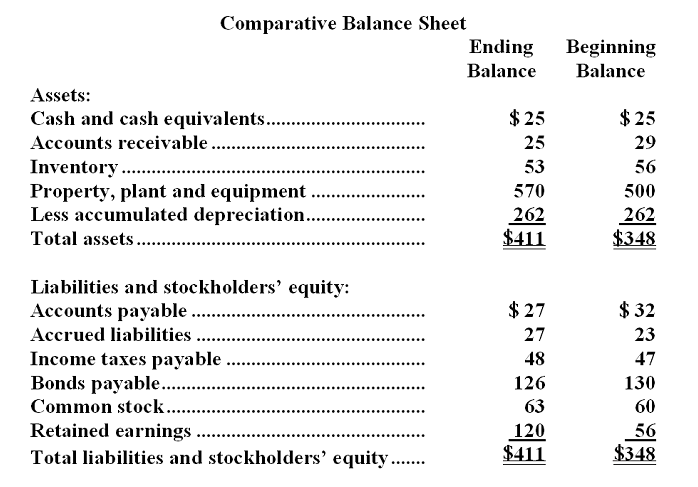

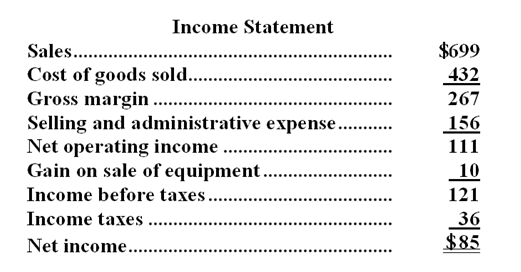

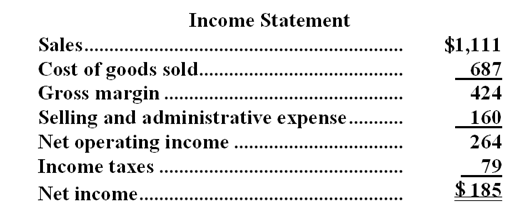

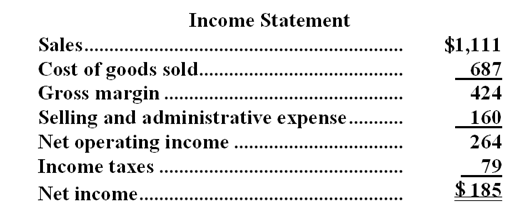

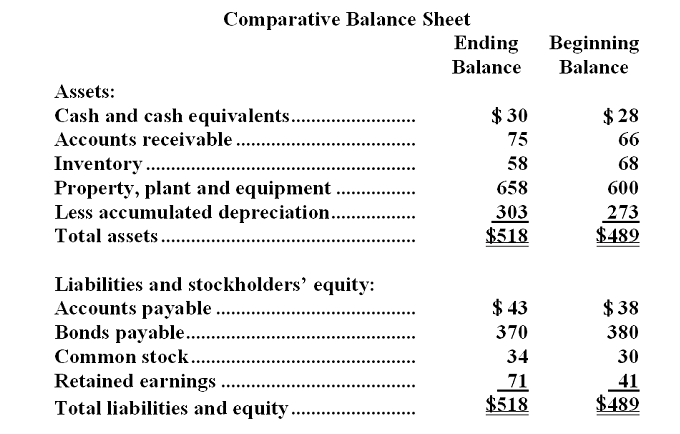

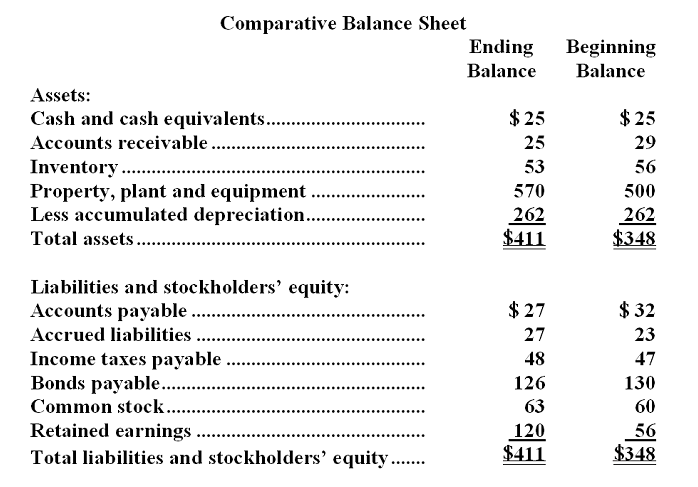

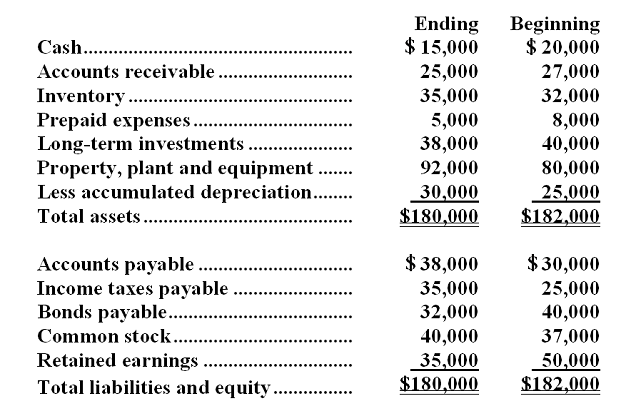

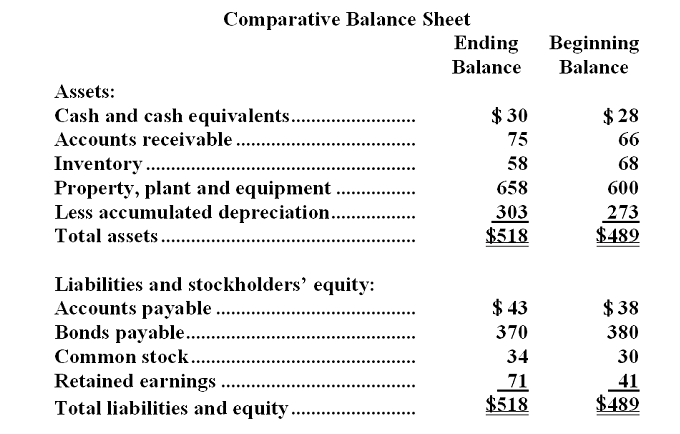

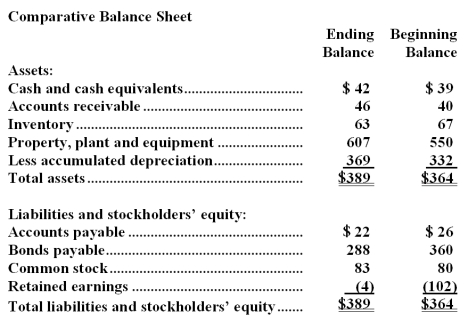

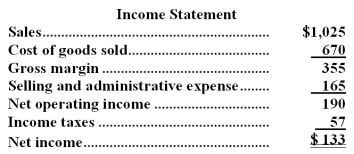

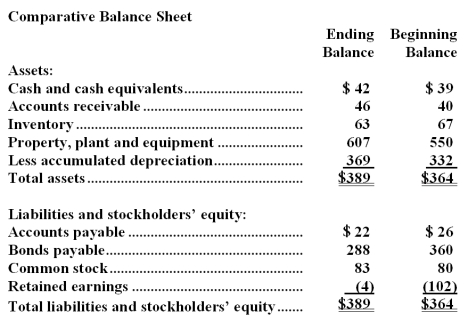

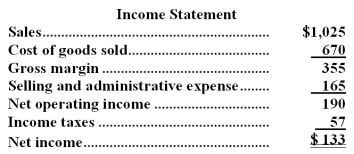

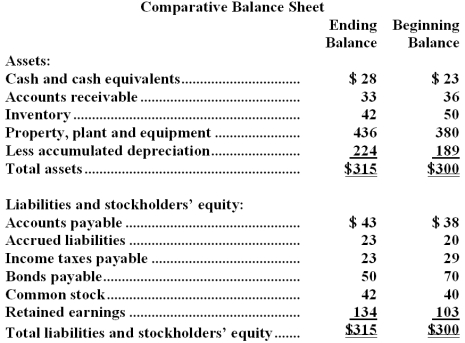

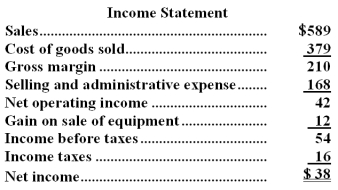

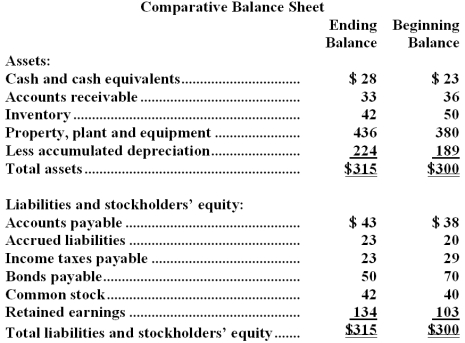

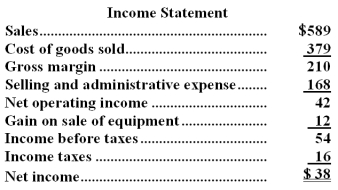

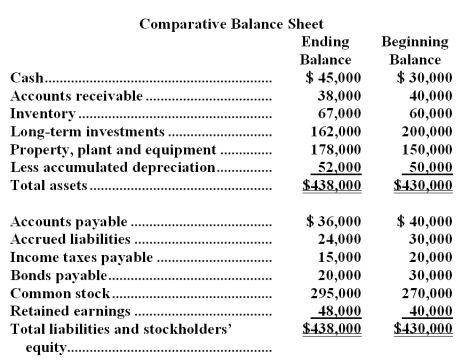

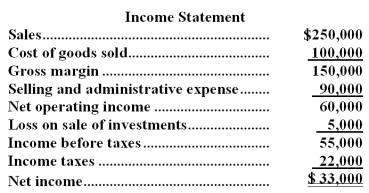

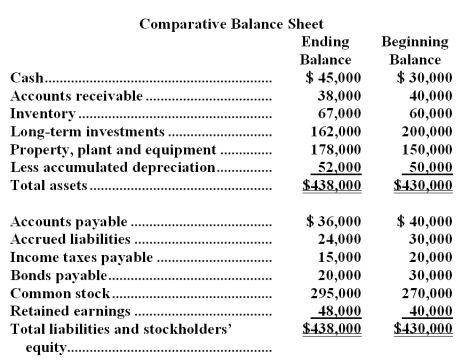

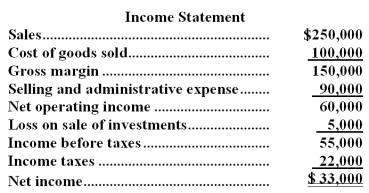

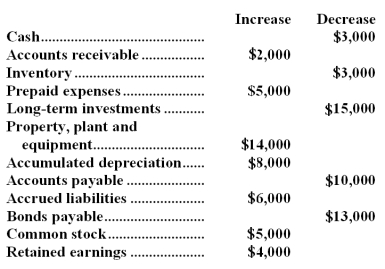

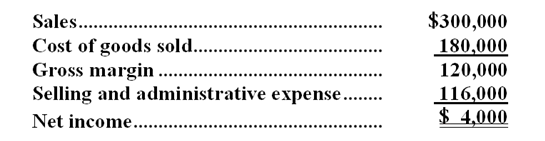

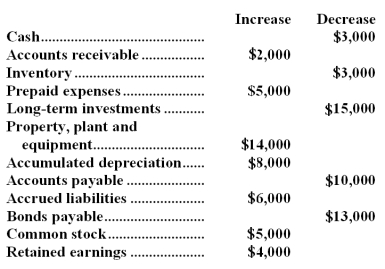

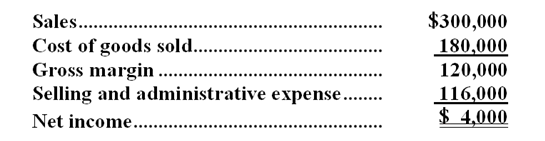

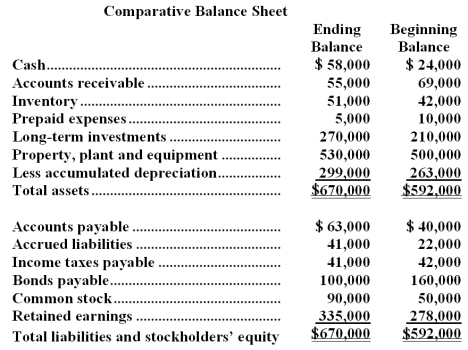

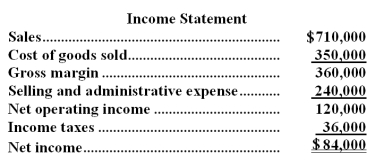

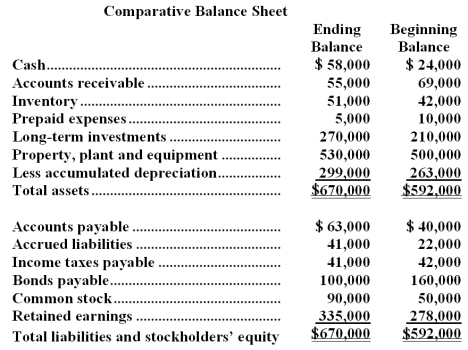

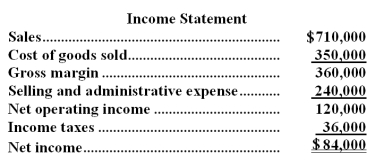

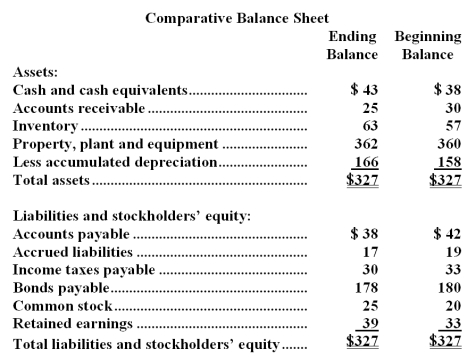

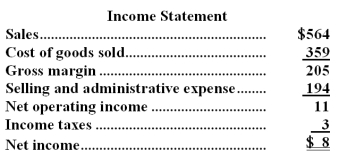

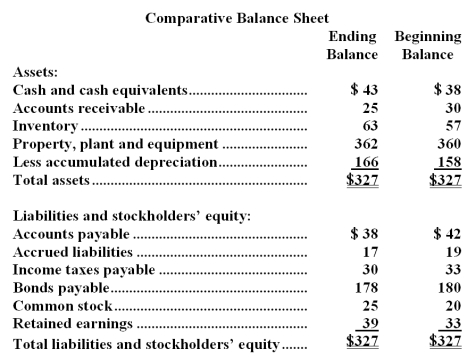

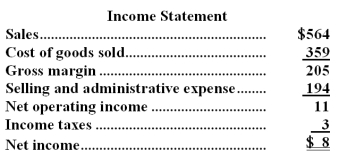

Baldock Corporation's balance sheet and income statement appear below:

Cash dividends were $23.The company sold equipment for $14 that was originally purchased for $10 and that had accumulated depreciation of $10.The net cash provided by (used in)operating activities for the year was:

Cash dividends were $23.The company sold equipment for $14 that was originally purchased for $10 and that had accumulated depreciation of $10.The net cash provided by (used in)operating activities for the year was:

A)$153

B)$162

C)$107

D)$139

Cash dividends were $23.The company sold equipment for $14 that was originally purchased for $10 and that had accumulated depreciation of $10.The net cash provided by (used in)operating activities for the year was:

Cash dividends were $23.The company sold equipment for $14 that was originally purchased for $10 and that had accumulated depreciation of $10.The net cash provided by (used in)operating activities for the year was:A)$153

B)$162

C)$107

D)$139

D

2

Under the direct method of determining the net cash provided by operating activities on the statement of cash flows,an increase in accounts payable would be added to cost of goods sold to convert cost of goods sold to a cash basis.

False

3

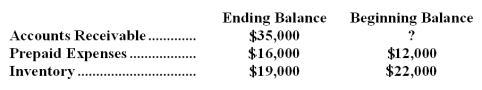

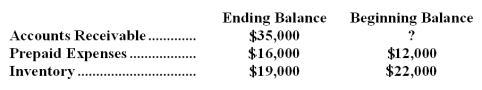

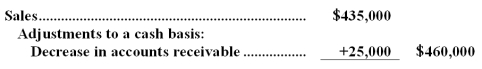

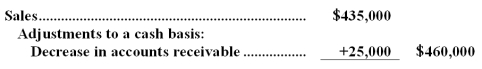

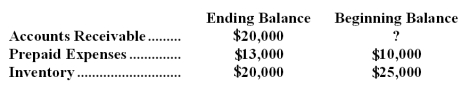

Carlton Company reported on its income statement sales for the year just ended of $435,000.Sales during the year adjusted to the cash basis on its statement of cash flows constructed using the direct method were $460,000.Carlton Company recorded the following account balances:  Based on this information,the balance in Accounts Receivable at the beginning of the year was:

Based on this information,the balance in Accounts Receivable at the beginning of the year was:

A)$60,000

B)$63,000

C)$59,000

D)$10,000

Based on this information,the balance in Accounts Receivable at the beginning of the year was:

Based on this information,the balance in Accounts Receivable at the beginning of the year was:A)$60,000

B)$63,000

C)$59,000

D)$10,000

A

Explanation: As shown below,a decrease in accounts receivable during the period would result in more cash being received during the period and cash sales being higher than accrual sales.If accounts receivable decreased by $25,000 during the period and the ending balance is $35,000,then the beginning balance must have been $60,000.

Explanation: As shown below,a decrease in accounts receivable during the period would result in more cash being received during the period and cash sales being higher than accrual sales.If accounts receivable decreased by $25,000 during the period and the ending balance is $35,000,then the beginning balance must have been $60,000.

4

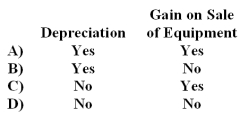

Olaf Corporation prepares its statement of cash flows using the direct method.The following items were listed on Olaf's income statement.Which of these items would also be listed in the operating activities section of Olaf's statement of cash flows?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

5

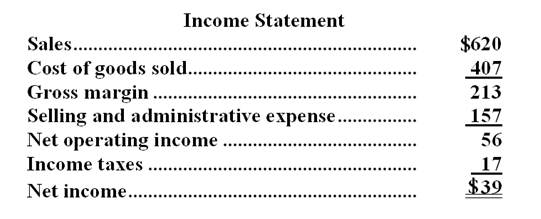

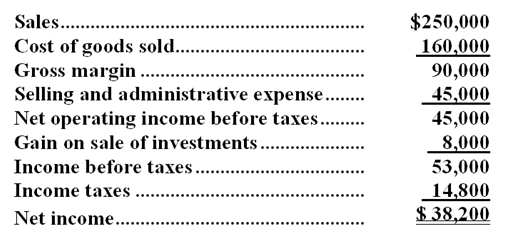

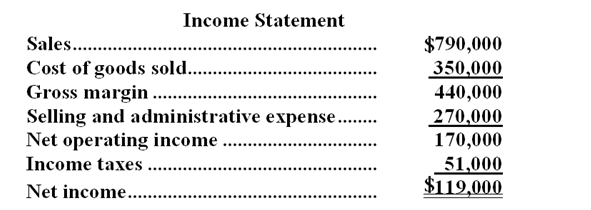

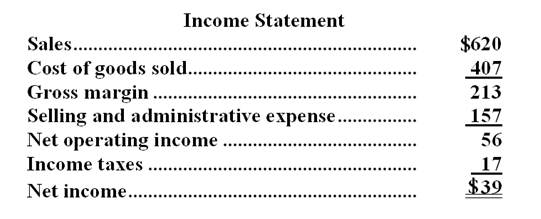

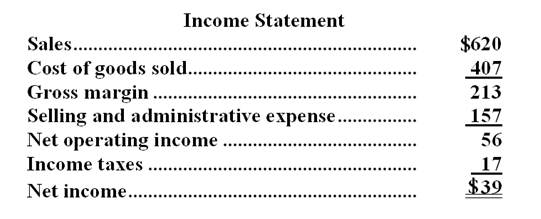

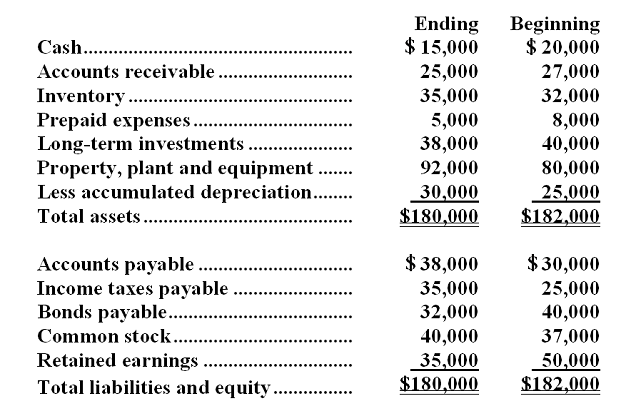

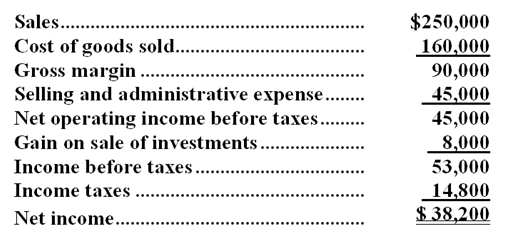

The most recent balance sheet and income statement of Woodside Corporation appear below:

Cash dividends were $13.The company did not retire or sell any property,plant,and equipment during the year.The net cash provided by (used in)operating activities for the year was:

Cash dividends were $13.The company did not retire or sell any property,plant,and equipment during the year.The net cash provided by (used in)operating activities for the year was:

A)$61

B)$31

C)$66

D)$15

Cash dividends were $13.The company did not retire or sell any property,plant,and equipment during the year.The net cash provided by (used in)operating activities for the year was:

Cash dividends were $13.The company did not retire or sell any property,plant,and equipment during the year.The net cash provided by (used in)operating activities for the year was:A)$61

B)$31

C)$66

D)$15

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

6

Sales reported on the income statement totaled $850,000.The beginning balance in accounts receivable was $90,000.The ending balance in accounts receivable was $160,000.Under the direct method of determining the net cash provided by operating activities on the statement of cash flows,sales adjusted to a cash basis are:

A)$780,000

B)$940,000

C)$860,000

D)$920,000

A)$780,000

B)$940,000

C)$860,000

D)$920,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

7

Wesi Corporation prepares its statement of cash flows using the direct method.Which of the following should Wesi classify as an operating activity on its statement?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

8

Under the direct method of determining the net cash provided by operating activities on the statement of cash flows,an increase in income taxes payable would be subtracted from income tax expense to convert income tax expense to a cash basis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

9

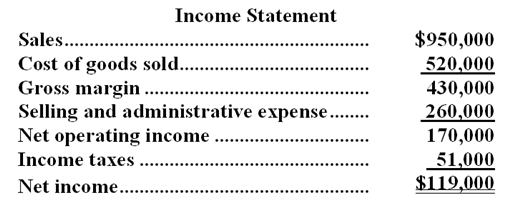

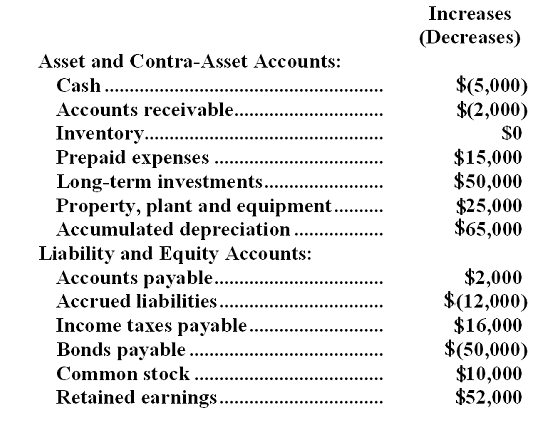

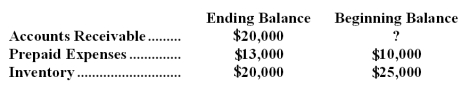

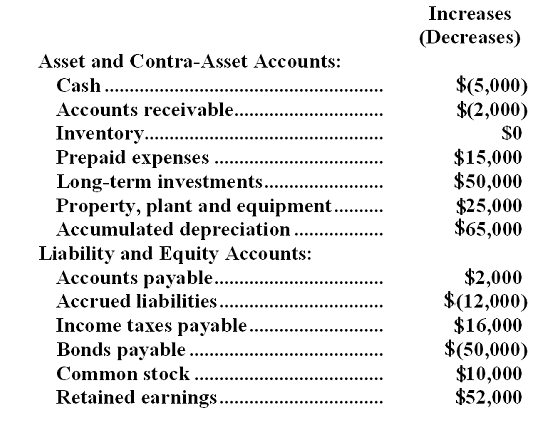

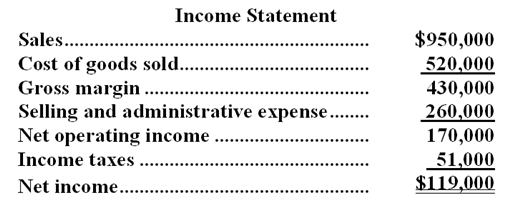

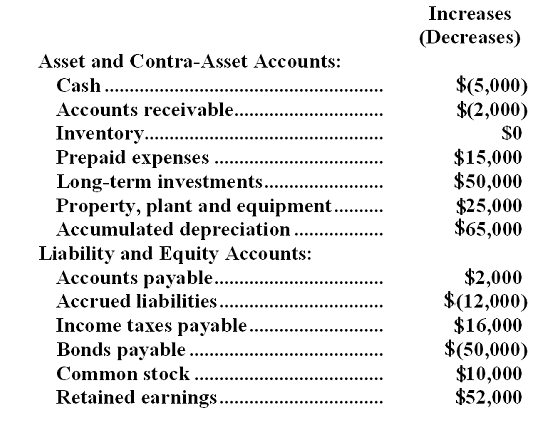

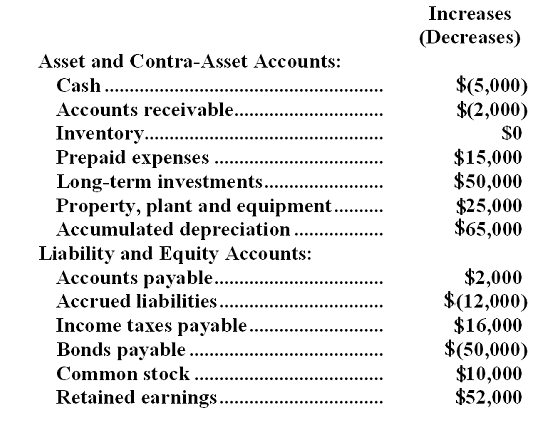

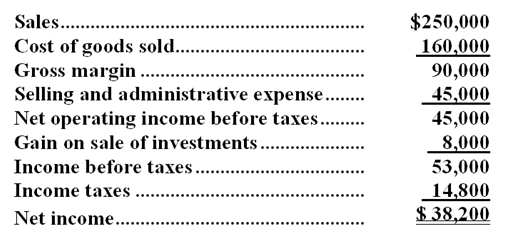

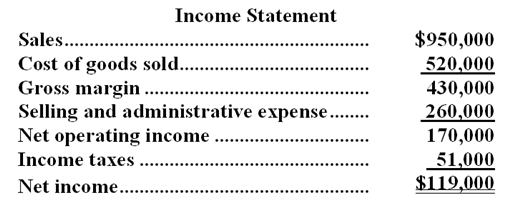

The changes in Tener Company's balance sheet account balances for last year appear below:  The company's income statement for the year appears below:

The company's income statement for the year appears below:  The company declared and paid $67,000 in cash dividends during the year. It did not dispose of any property, plant, and equipment during the year. The company uses the direct method to determine the net cash provided by operating activities.

The company declared and paid $67,000 in cash dividends during the year. It did not dispose of any property, plant, and equipment during the year. The company uses the direct method to determine the net cash provided by operating activities.

-On the statement of cash flows,the cost of goods sold adjusted to a cash basis would be:

A)$518,000

B)$520,000

C)$522,000

D)$516,000

The company's income statement for the year appears below:

The company's income statement for the year appears below:  The company declared and paid $67,000 in cash dividends during the year. It did not dispose of any property, plant, and equipment during the year. The company uses the direct method to determine the net cash provided by operating activities.

The company declared and paid $67,000 in cash dividends during the year. It did not dispose of any property, plant, and equipment during the year. The company uses the direct method to determine the net cash provided by operating activities.-On the statement of cash flows,the cost of goods sold adjusted to a cash basis would be:

A)$518,000

B)$520,000

C)$522,000

D)$516,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

10

Cridman Company's selling and administrative expenses for last year totaled $180,000.During the year the company's prepaid expense account balance decreased by $5,000 and accrued liabilities increased by $8,000.Depreciation for the year was $12,000.Based on this information,selling and administrative expenses adjusted to a cash basis under the direct method on the statement of cash flows would be:

A)$205,000

B)$181,000

C)$155,000

D)$179,000

A)$205,000

B)$181,000

C)$155,000

D)$179,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

11

Under the direct method of determining net cash provided by operating activities on the statement of cash flows,the net income figure is adjusted for changes in current assets and liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

12

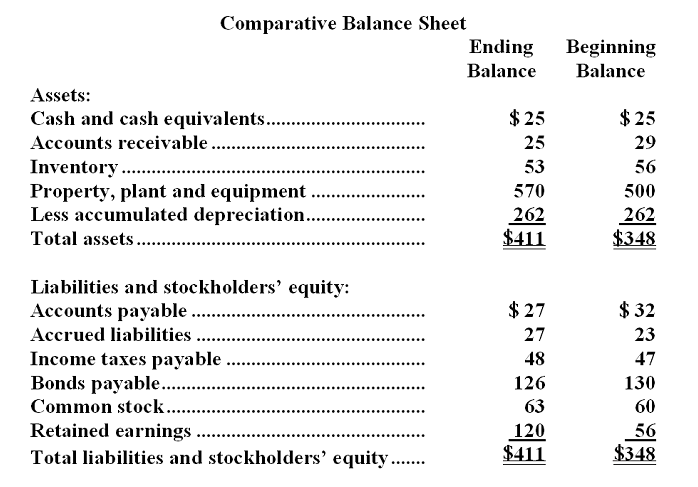

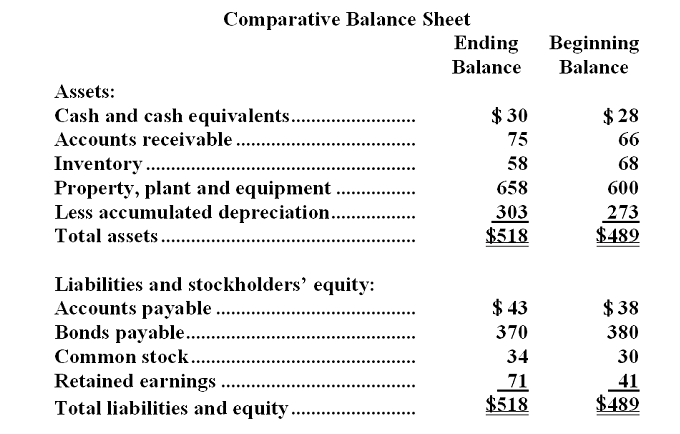

Prejean Corporation's most recent comparative balance sheet and income statement appear below:

Cash dividends were $32.The company did not retire or sell any property,plant,and equipment during the year.The net cash provided by (used in)operating activities for the year was:

Cash dividends were $32.The company did not retire or sell any property,plant,and equipment during the year.The net cash provided by (used in)operating activities for the year was:

A)$45

B)$87

C)$177

D)$189

Cash dividends were $32.The company did not retire or sell any property,plant,and equipment during the year.The net cash provided by (used in)operating activities for the year was:

Cash dividends were $32.The company did not retire or sell any property,plant,and equipment during the year.The net cash provided by (used in)operating activities for the year was:A)$45

B)$87

C)$177

D)$189

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

13

Bennett Company reported sales on its income statement last year of $345,000.On the company's statement of cash flows,sales adjusted to a cash basis were $337,000.(The company uses the direct method to determine the net cash provided by operating activities. )Bennett Company reported the following account balances on its comparative balance sheet:  Based on this information,the beginning Accounts Receivable balance was:

Based on this information,the beginning Accounts Receivable balance was:

A)$12,000

B)$17,000

C)$28,000

D)$14,000

Based on this information,the beginning Accounts Receivable balance was:

Based on this information,the beginning Accounts Receivable balance was:A)$12,000

B)$17,000

C)$28,000

D)$14,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

14

Severn Corporation prepares its statement of cash flows using the direct method.Last year,Severn reported Income Tax Expense of $27,000.At the beginning of last year,Severn had a $2,000 balance in the Income Taxes Payable account.At the end of last year,Severn had a $5,000 balance in the account.On its statement of cash flows for last year,what amount should Severn have shown for its Income Tax Expense adjusted to a cash basis (i.e. ,income taxes paid)?

A)$20,000

B)$22,000

C)$24,000

D)$30,000

A)$20,000

B)$22,000

C)$24,000

D)$30,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

15

If accounts receivable increase during a period,then the amount of cash collected from customers will be greater than the amount of sales reported on the income statement for the period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

16

The changes in Tener Company's balance sheet account balances for last year appear below:  The company's income statement for the year appears below:

The company's income statement for the year appears below:  The company declared and paid $67,000 in cash dividends during the year. It did not dispose of any property, plant, and equipment during the year. The company uses the direct method to determine the net cash provided by operating activities.

The company declared and paid $67,000 in cash dividends during the year. It did not dispose of any property, plant, and equipment during the year. The company uses the direct method to determine the net cash provided by operating activities.

-On the statement of cash flows,the selling and administrative expense adjusted to a cash basis would be:

A)$245,000

B)$222,000

C)$260,000

D)$298,000

The company's income statement for the year appears below:

The company's income statement for the year appears below:  The company declared and paid $67,000 in cash dividends during the year. It did not dispose of any property, plant, and equipment during the year. The company uses the direct method to determine the net cash provided by operating activities.

The company declared and paid $67,000 in cash dividends during the year. It did not dispose of any property, plant, and equipment during the year. The company uses the direct method to determine the net cash provided by operating activities.-On the statement of cash flows,the selling and administrative expense adjusted to a cash basis would be:

A)$245,000

B)$222,000

C)$260,000

D)$298,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

17

The changes in Tener Company's balance sheet account balances for last year appear below:  The company's income statement for the year appears below:

The company's income statement for the year appears below:  The company declared and paid $67,000 in cash dividends during the year. It did not dispose of any property, plant, and equipment during the year. The company uses the direct method to determine the net cash provided by operating activities.

The company declared and paid $67,000 in cash dividends during the year. It did not dispose of any property, plant, and equipment during the year. The company uses the direct method to determine the net cash provided by operating activities.

-On the statement of cash flows,the sales revenue adjusted to a cash basis would be:

A)$940,000

B)$948,000

C)$950,000

D)$952,000

The company's income statement for the year appears below:

The company's income statement for the year appears below:  The company declared and paid $67,000 in cash dividends during the year. It did not dispose of any property, plant, and equipment during the year. The company uses the direct method to determine the net cash provided by operating activities.

The company declared and paid $67,000 in cash dividends during the year. It did not dispose of any property, plant, and equipment during the year. The company uses the direct method to determine the net cash provided by operating activities.-On the statement of cash flows,the sales revenue adjusted to a cash basis would be:

A)$940,000

B)$948,000

C)$950,000

D)$952,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

18

Last year Cumber Company reported a cost of goods sold of $70,000.Inventories decreased by $12,000 during the year,and accounts payable increased by $8,000.The company uses the direct method to determine the net cash provided by operating activities on the statement of cash flows.The cost of goods sold adjusted to a cash basis would be:

A)$90,000

B)$62,000

C)$58,000

D)$50,000

A)$90,000

B)$62,000

C)$58,000

D)$50,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

19

During the year the balance in the Inventory account increased by $4,000.In order to adjust the company's net income to a cash basis using the direct method on the statement of cash flows,it would be necessary to:

A)subtract the $4,000 from the sales revenue reported on the income statement.

B)add the $4,000 to the sales revenue reported on the income statement.

C)subtract the $4,000 from the cost of goods sold reported on the income statement.

D)add the $4,000 to the cost of goods sold reported on the income statement.

A)subtract the $4,000 from the sales revenue reported on the income statement.

B)add the $4,000 to the sales revenue reported on the income statement.

C)subtract the $4,000 from the cost of goods sold reported on the income statement.

D)add the $4,000 to the cost of goods sold reported on the income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

20

Last year Lawsby Company reported sales of $120,000 on its income statement.During the year,accounts receivable increased by $10,000 and accounts payable increased by $15,000.The company uses the direct method to determine the net cash provided by operating activities on the statement of cash flows.The sales revenue adjusted to a cash basis for the year would be:

A)$105,000

B)$125,000

C)$110,000

D)$115,000

A)$105,000

B)$125,000

C)$110,000

D)$115,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

21

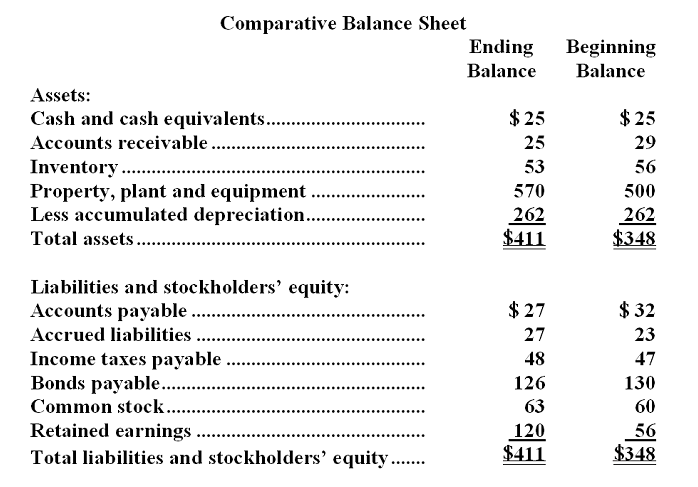

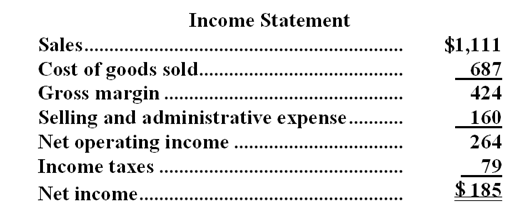

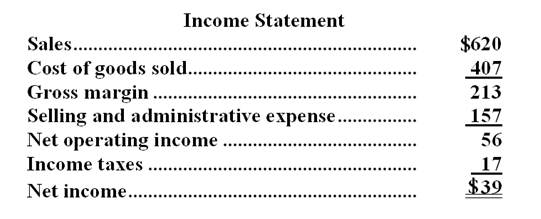

Kelln Corporation's most recent comparative balance sheet and income statement appear below:

The company paid a cash dividend and it did not dispose of any property, plant, and equipment. The company did not issue any bonds payable or repurchase any of its own common stock. The following questions pertain to the company's statement of cash flows.

The company paid a cash dividend and it did not dispose of any property, plant, and equipment. The company did not issue any bonds payable or repurchase any of its own common stock. The following questions pertain to the company's statement of cash flows.

-The net cash provided by (used in)operating activities for the year was:

A)$36

B)$3

C)$75

D)$56

The company paid a cash dividend and it did not dispose of any property, plant, and equipment. The company did not issue any bonds payable or repurchase any of its own common stock. The following questions pertain to the company's statement of cash flows.

The company paid a cash dividend and it did not dispose of any property, plant, and equipment. The company did not issue any bonds payable or repurchase any of its own common stock. The following questions pertain to the company's statement of cash flows.-The net cash provided by (used in)operating activities for the year was:

A)$36

B)$3

C)$75

D)$56

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

22

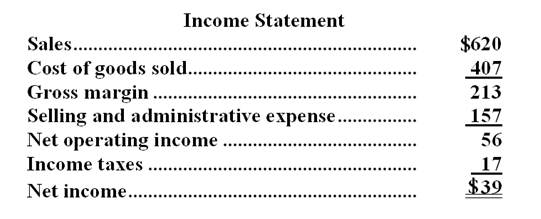

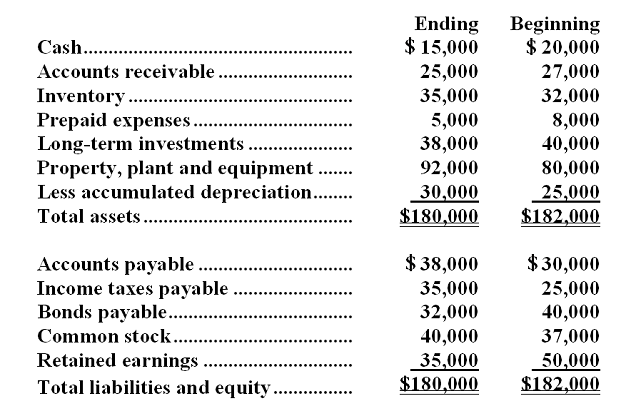

Fluck Corporation's balance sheet and income statement appear below:

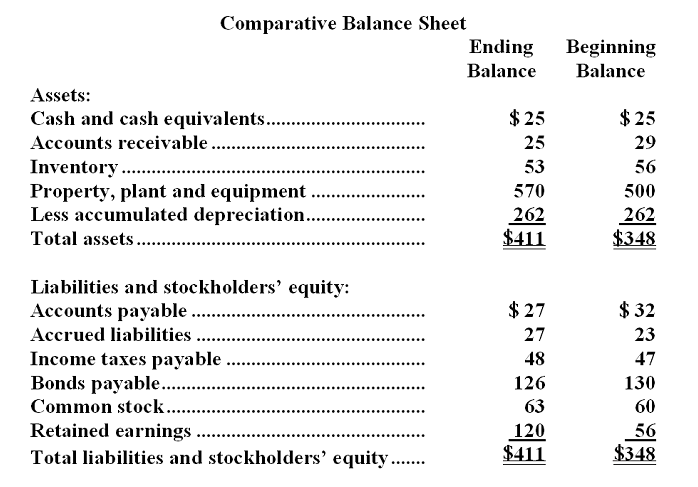

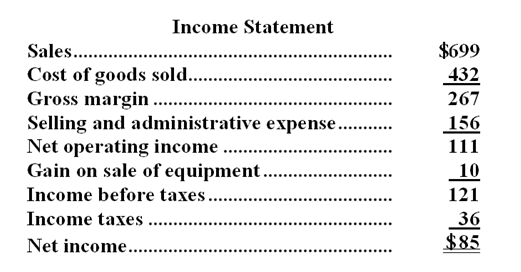

The company sold equipment for $12 that was originally purchased for $5 and that had accumulated depreciation of $3. The company paid a cash dividend and it did not issue any bonds payable or repurchase any of its own common stock.

The company sold equipment for $12 that was originally purchased for $5 and that had accumulated depreciation of $3. The company paid a cash dividend and it did not issue any bonds payable or repurchase any of its own common stock.

-The net cash provided by (used in)financing activities for the year was:

A)$3

B)$(4)

C)$(21)

D)$(22)

The company sold equipment for $12 that was originally purchased for $5 and that had accumulated depreciation of $3. The company paid a cash dividend and it did not issue any bonds payable or repurchase any of its own common stock.

The company sold equipment for $12 that was originally purchased for $5 and that had accumulated depreciation of $3. The company paid a cash dividend and it did not issue any bonds payable or repurchase any of its own common stock.-The net cash provided by (used in)financing activities for the year was:

A)$3

B)$(4)

C)$(21)

D)$(22)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

23

Last year, Nye Company reported on its income statement sales of $475,000 and cost of goods sold of $240,000. During the year, the balance in accounts receivable increased $40,000, the balance in accounts payable decreased $25,000, and the balance in inventory increased $10,000. The company uses the direct method to determine the net cash provided by operating activities on its statement of cash flows.

-Under the direct method,sales adjusted to a cash basis would be:

A)$435,000

B)$455,000

C)$515,000

D)$375,000

-Under the direct method,sales adjusted to a cash basis would be:

A)$435,000

B)$455,000

C)$515,000

D)$375,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

24

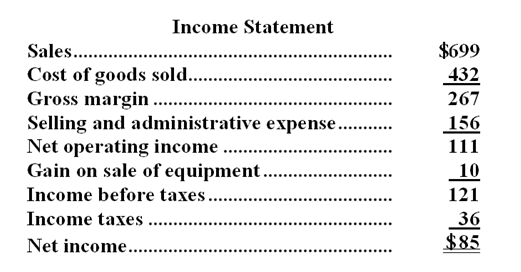

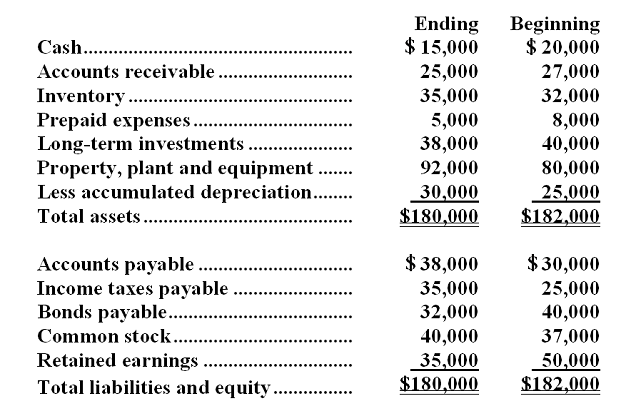

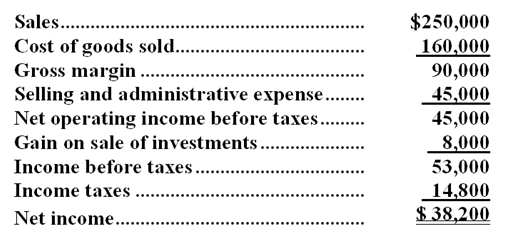

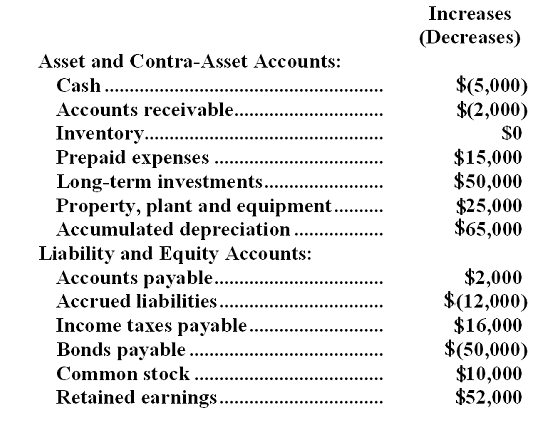

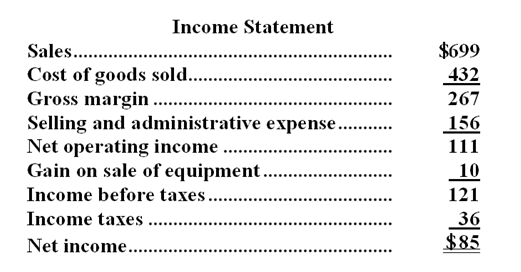

Alkine Company's comparative balance sheet appears below:  Alkine reported the following net income for the year:

Alkine reported the following net income for the year:  Dividends were declared and paid during the year. A gain of $8,000 was recorded on the sale of the long-term investments. The company did not purchase any long-term investments or dispose of any property, plant, and equipment during the year. It also did not issue any bonds payable or repurchase any of its own common stock.

Dividends were declared and paid during the year. A gain of $8,000 was recorded on the sale of the long-term investments. The company did not purchase any long-term investments or dispose of any property, plant, and equipment during the year. It also did not issue any bonds payable or repurchase any of its own common stock.

-The net cash provided (used)by investing activities would be:

A)$10,000

B)$(2,000)

C)$22,000

D)$1,000

Alkine reported the following net income for the year:

Alkine reported the following net income for the year:  Dividends were declared and paid during the year. A gain of $8,000 was recorded on the sale of the long-term investments. The company did not purchase any long-term investments or dispose of any property, plant, and equipment during the year. It also did not issue any bonds payable or repurchase any of its own common stock.

Dividends were declared and paid during the year. A gain of $8,000 was recorded on the sale of the long-term investments. The company did not purchase any long-term investments or dispose of any property, plant, and equipment during the year. It also did not issue any bonds payable or repurchase any of its own common stock.-The net cash provided (used)by investing activities would be:

A)$10,000

B)$(2,000)

C)$22,000

D)$1,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

25

Alkine Company's comparative balance sheet appears below:  Alkine reported the following net income for the year:

Alkine reported the following net income for the year:  Dividends were declared and paid during the year. A gain of $8,000 was recorded on the sale of the long-term investments. The company did not purchase any long-term investments or dispose of any property, plant, and equipment during the year. It also did not issue any bonds payable or repurchase any of its own common stock.

Dividends were declared and paid during the year. A gain of $8,000 was recorded on the sale of the long-term investments. The company did not purchase any long-term investments or dispose of any property, plant, and equipment during the year. It also did not issue any bonds payable or repurchase any of its own common stock.

-The net cash provided (used)by operating activities would be:

A)$45,200

B)$60,000

C)$37,200

D)$55,200

Alkine reported the following net income for the year:

Alkine reported the following net income for the year:  Dividends were declared and paid during the year. A gain of $8,000 was recorded on the sale of the long-term investments. The company did not purchase any long-term investments or dispose of any property, plant, and equipment during the year. It also did not issue any bonds payable or repurchase any of its own common stock.

Dividends were declared and paid during the year. A gain of $8,000 was recorded on the sale of the long-term investments. The company did not purchase any long-term investments or dispose of any property, plant, and equipment during the year. It also did not issue any bonds payable or repurchase any of its own common stock.-The net cash provided (used)by operating activities would be:

A)$45,200

B)$60,000

C)$37,200

D)$55,200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

26

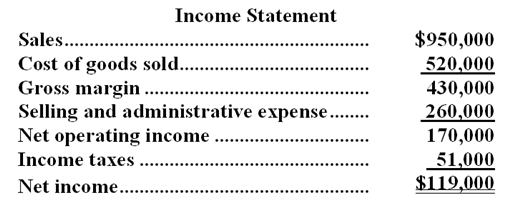

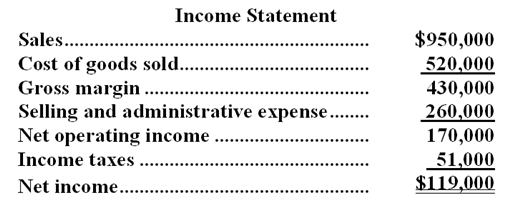

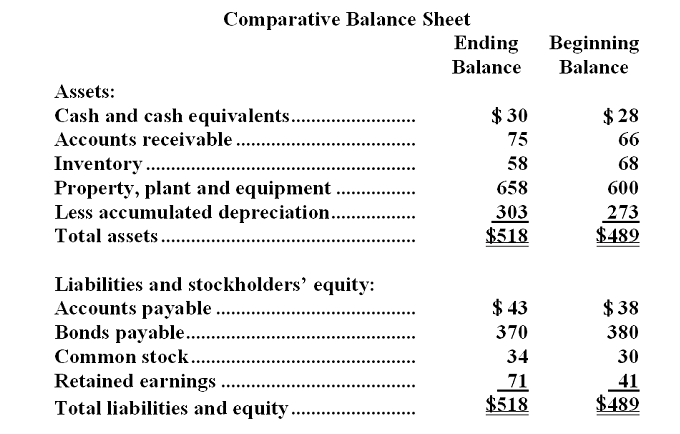

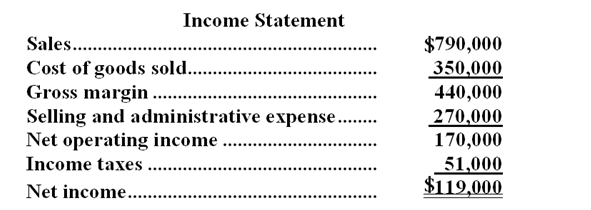

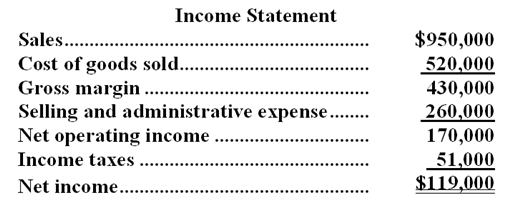

Van Aalst Company's comparative balance sheet and income statement for last year appear below:

The company declared and paid $77,000 in cash dividends during the year. It did not sell or retire any property, plant, and equipment during the year. The company uses the direct method to determine the net cash provided by operating activities.

The company declared and paid $77,000 in cash dividends during the year. It did not sell or retire any property, plant, and equipment during the year. The company uses the direct method to determine the net cash provided by operating activities.

-On the statement of cash flows,the income tax expense adjusted to a cash basis would be:

A)$27,000

B)$75,000

C)$51,000

D)$38,000

The company declared and paid $77,000 in cash dividends during the year. It did not sell or retire any property, plant, and equipment during the year. The company uses the direct method to determine the net cash provided by operating activities.

The company declared and paid $77,000 in cash dividends during the year. It did not sell or retire any property, plant, and equipment during the year. The company uses the direct method to determine the net cash provided by operating activities.-On the statement of cash flows,the income tax expense adjusted to a cash basis would be:

A)$27,000

B)$75,000

C)$51,000

D)$38,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

27

Alkine Company's comparative balance sheet appears below:  Alkine reported the following net income for the year:

Alkine reported the following net income for the year:  Dividends were declared and paid during the year. A gain of $8,000 was recorded on the sale of the long-term investments. The company did not purchase any long-term investments or dispose of any property, plant, and equipment during the year. It also did not issue any bonds payable or repurchase any of its own common stock.

Dividends were declared and paid during the year. A gain of $8,000 was recorded on the sale of the long-term investments. The company did not purchase any long-term investments or dispose of any property, plant, and equipment during the year. It also did not issue any bonds payable or repurchase any of its own common stock.

-Under the direct method,the sales adjusted to a cash basis would be:

A)$252,000

B)$244,000

C)$260,000

D)$250,000

Alkine reported the following net income for the year:

Alkine reported the following net income for the year:  Dividends were declared and paid during the year. A gain of $8,000 was recorded on the sale of the long-term investments. The company did not purchase any long-term investments or dispose of any property, plant, and equipment during the year. It also did not issue any bonds payable or repurchase any of its own common stock.

Dividends were declared and paid during the year. A gain of $8,000 was recorded on the sale of the long-term investments. The company did not purchase any long-term investments or dispose of any property, plant, and equipment during the year. It also did not issue any bonds payable or repurchase any of its own common stock.-Under the direct method,the sales adjusted to a cash basis would be:

A)$252,000

B)$244,000

C)$260,000

D)$250,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

28

Alkine Company's comparative balance sheet appears below:  Alkine reported the following net income for the year:

Alkine reported the following net income for the year:  Dividends were declared and paid during the year. A gain of $8,000 was recorded on the sale of the long-term investments. The company did not purchase any long-term investments or dispose of any property, plant, and equipment during the year. It also did not issue any bonds payable or repurchase any of its own common stock.

Dividends were declared and paid during the year. A gain of $8,000 was recorded on the sale of the long-term investments. The company did not purchase any long-term investments or dispose of any property, plant, and equipment during the year. It also did not issue any bonds payable or repurchase any of its own common stock.

-Under the direct method,the cost of goods sold adjusted to a cash basis would be:

A)$152,000

B)$160,000

C)$163,000

D)$155,000

Alkine reported the following net income for the year:

Alkine reported the following net income for the year:  Dividends were declared and paid during the year. A gain of $8,000 was recorded on the sale of the long-term investments. The company did not purchase any long-term investments or dispose of any property, plant, and equipment during the year. It also did not issue any bonds payable or repurchase any of its own common stock.

Dividends were declared and paid during the year. A gain of $8,000 was recorded on the sale of the long-term investments. The company did not purchase any long-term investments or dispose of any property, plant, and equipment during the year. It also did not issue any bonds payable or repurchase any of its own common stock.-Under the direct method,the cost of goods sold adjusted to a cash basis would be:

A)$152,000

B)$160,000

C)$163,000

D)$155,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

29

The changes in Tener Company's balance sheet account balances for last year appear below:  The company's income statement for the year appears below:

The company's income statement for the year appears below:  The company declared and paid $67,000 in cash dividends during the year. It did not dispose of any property, plant, and equipment during the year. The company uses the direct method to determine the net cash provided by operating activities.

The company declared and paid $67,000 in cash dividends during the year. It did not dispose of any property, plant, and equipment during the year. The company uses the direct method to determine the net cash provided by operating activities.

-On the statement of cash flows,the income tax expense adjusted to a cash basis would be:

A)$67,000

B)$42,000

C)$35,000

D)$51,000

The company's income statement for the year appears below:

The company's income statement for the year appears below:  The company declared and paid $67,000 in cash dividends during the year. It did not dispose of any property, plant, and equipment during the year. The company uses the direct method to determine the net cash provided by operating activities.

The company declared and paid $67,000 in cash dividends during the year. It did not dispose of any property, plant, and equipment during the year. The company uses the direct method to determine the net cash provided by operating activities.-On the statement of cash flows,the income tax expense adjusted to a cash basis would be:

A)$67,000

B)$42,000

C)$35,000

D)$51,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

30

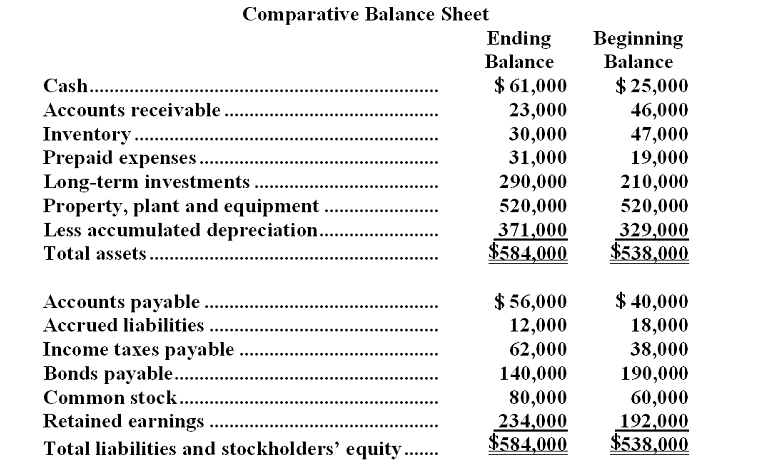

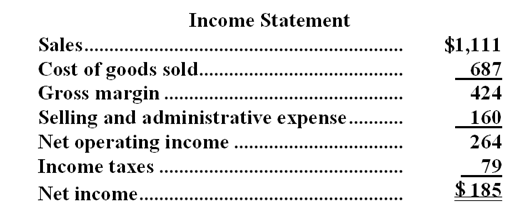

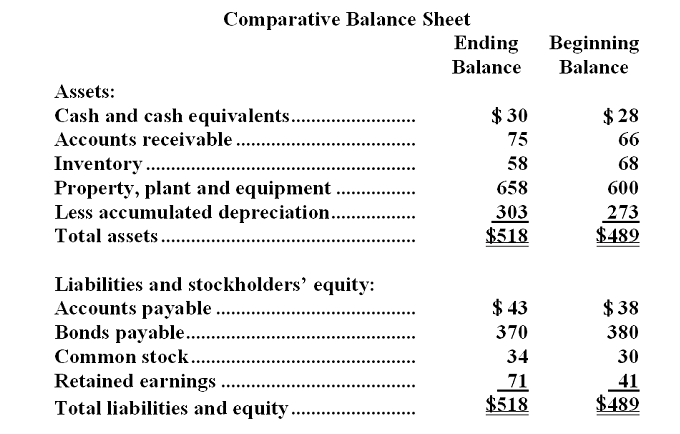

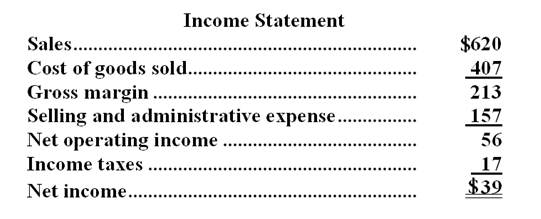

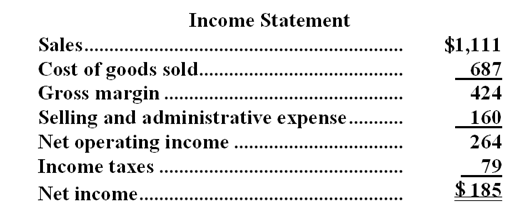

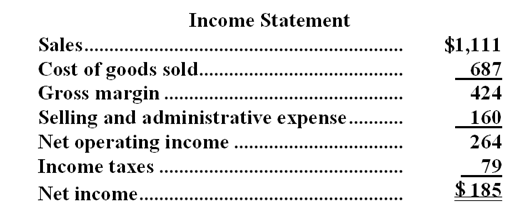

The most recent balance sheet and income statement of Marroquin Corporation appear below:

The company paid a cash dividend and it did not dispose of any property, plant, and equipment. The company did not issue any bonds payable or repurchase any of its own common stock. The following questions pertain to the company's statement of cash flows.

The company paid a cash dividend and it did not dispose of any property, plant, and equipment. The company did not issue any bonds payable or repurchase any of its own common stock. The following questions pertain to the company's statement of cash flows.

-The net cash provided by (used in)operating activities for the year was:

A)$264

B)$149

C)$221

D)$36

The company paid a cash dividend and it did not dispose of any property, plant, and equipment. The company did not issue any bonds payable or repurchase any of its own common stock. The following questions pertain to the company's statement of cash flows.

The company paid a cash dividend and it did not dispose of any property, plant, and equipment. The company did not issue any bonds payable or repurchase any of its own common stock. The following questions pertain to the company's statement of cash flows.-The net cash provided by (used in)operating activities for the year was:

A)$264

B)$149

C)$221

D)$36

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

31

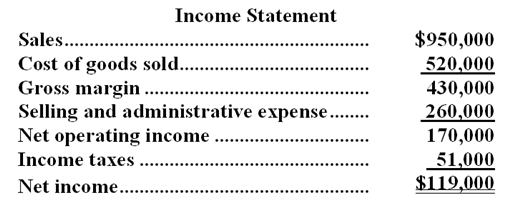

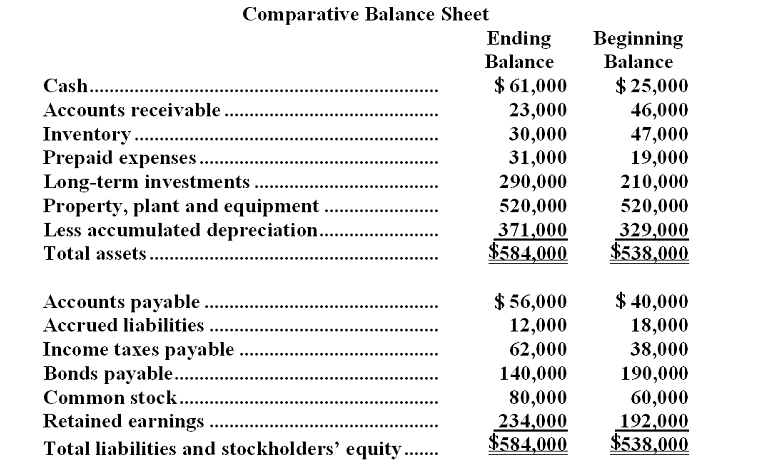

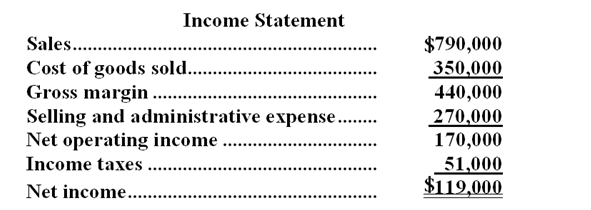

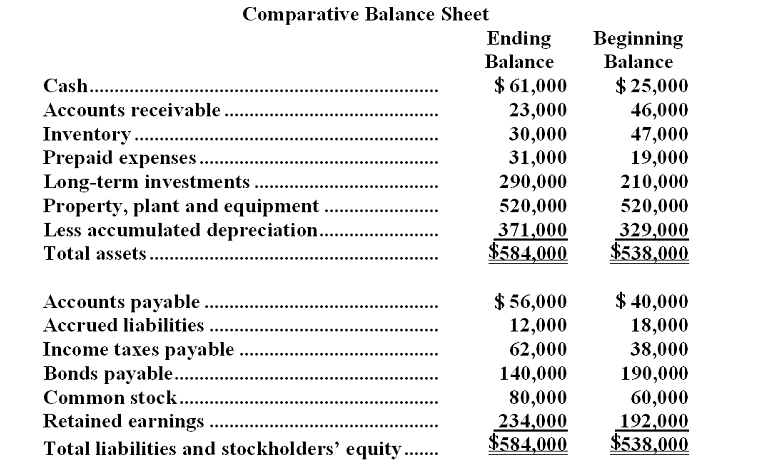

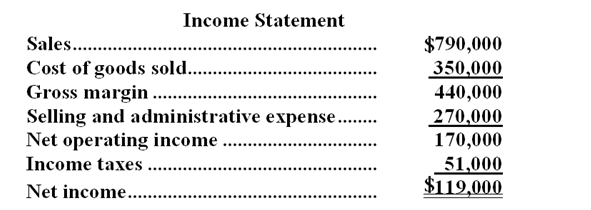

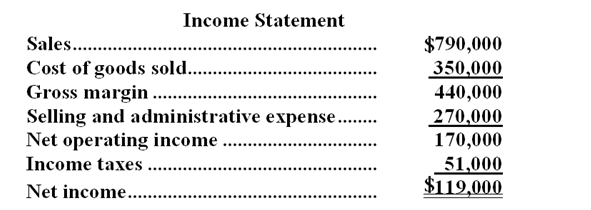

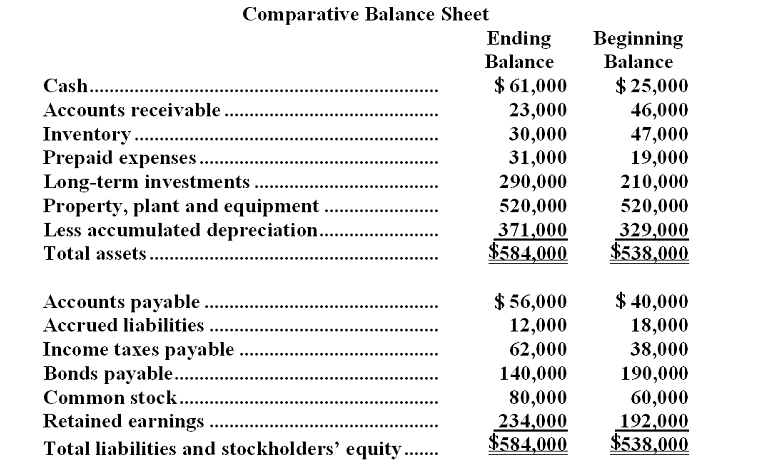

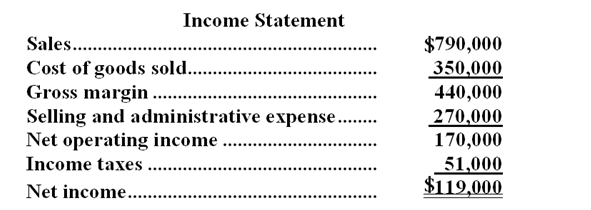

Van Aalst Company's comparative balance sheet and income statement for last year appear below:

The company declared and paid $77,000 in cash dividends during the year. It did not sell or retire any property, plant, and equipment during the year. The company uses the direct method to determine the net cash provided by operating activities.

The company declared and paid $77,000 in cash dividends during the year. It did not sell or retire any property, plant, and equipment during the year. The company uses the direct method to determine the net cash provided by operating activities.

-On the statement of cash flows,the cost of goods sold adjusted to a cash basis would be:

A)$350,000

B)$383,000

C)$317,000

D)$334,000

The company declared and paid $77,000 in cash dividends during the year. It did not sell or retire any property, plant, and equipment during the year. The company uses the direct method to determine the net cash provided by operating activities.

The company declared and paid $77,000 in cash dividends during the year. It did not sell or retire any property, plant, and equipment during the year. The company uses the direct method to determine the net cash provided by operating activities.-On the statement of cash flows,the cost of goods sold adjusted to a cash basis would be:

A)$350,000

B)$383,000

C)$317,000

D)$334,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

32

Van Aalst Company's comparative balance sheet and income statement for last year appear below:

The company declared and paid $77,000 in cash dividends during the year. It did not sell or retire any property, plant, and equipment during the year. The company uses the direct method to determine the net cash provided by operating activities.

The company declared and paid $77,000 in cash dividends during the year. It did not sell or retire any property, plant, and equipment during the year. The company uses the direct method to determine the net cash provided by operating activities.

-On the statement of cash flows,the selling and administrative expense adjusted to a cash basis would be:

A)$270,000

B)$246,000

C)$294,000

D)$288,000

The company declared and paid $77,000 in cash dividends during the year. It did not sell or retire any property, plant, and equipment during the year. The company uses the direct method to determine the net cash provided by operating activities.

The company declared and paid $77,000 in cash dividends during the year. It did not sell or retire any property, plant, and equipment during the year. The company uses the direct method to determine the net cash provided by operating activities.-On the statement of cash flows,the selling and administrative expense adjusted to a cash basis would be:

A)$270,000

B)$246,000

C)$294,000

D)$288,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

33

Van Aalst Company's comparative balance sheet and income statement for last year appear below:

The company declared and paid $77,000 in cash dividends during the year. It did not sell or retire any property, plant, and equipment during the year. The company uses the direct method to determine the net cash provided by operating activities.

The company declared and paid $77,000 in cash dividends during the year. It did not sell or retire any property, plant, and equipment during the year. The company uses the direct method to determine the net cash provided by operating activities.

-On the statement of cash flows,the sales revenue adjusted to a cash basis would be:

A)$796,000

B)$767,000

C)$790,000

D)$813,000

The company declared and paid $77,000 in cash dividends during the year. It did not sell or retire any property, plant, and equipment during the year. The company uses the direct method to determine the net cash provided by operating activities.

The company declared and paid $77,000 in cash dividends during the year. It did not sell or retire any property, plant, and equipment during the year. The company uses the direct method to determine the net cash provided by operating activities.-On the statement of cash flows,the sales revenue adjusted to a cash basis would be:

A)$796,000

B)$767,000

C)$790,000

D)$813,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

34

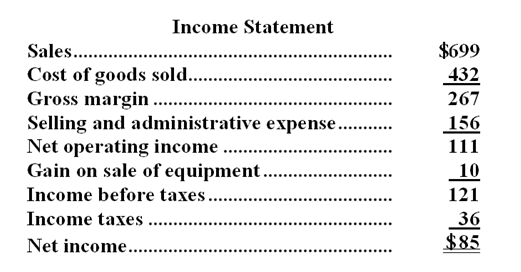

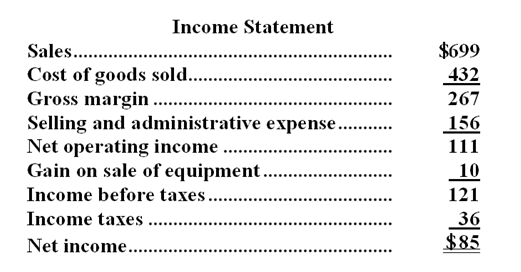

Fluck Corporation's balance sheet and income statement appear below:

The company sold equipment for $12 that was originally purchased for $5 and that had accumulated depreciation of $3. The company paid a cash dividend and it did not issue any bonds payable or repurchase any of its own common stock.

The company sold equipment for $12 that was originally purchased for $5 and that had accumulated depreciation of $3. The company paid a cash dividend and it did not issue any bonds payable or repurchase any of its own common stock.

-The net cash provided by (used in)investing activities for the year was:

A)$12

B)$(63)

C)$63

D)$(75)

The company sold equipment for $12 that was originally purchased for $5 and that had accumulated depreciation of $3. The company paid a cash dividend and it did not issue any bonds payable or repurchase any of its own common stock.

The company sold equipment for $12 that was originally purchased for $5 and that had accumulated depreciation of $3. The company paid a cash dividend and it did not issue any bonds payable or repurchase any of its own common stock.-The net cash provided by (used in)investing activities for the year was:

A)$12

B)$(63)

C)$63

D)$(75)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

35

Last year, Nye Company reported on its income statement sales of $475,000 and cost of goods sold of $240,000. During the year, the balance in accounts receivable increased $40,000, the balance in accounts payable decreased $25,000, and the balance in inventory increased $10,000. The company uses the direct method to determine the net cash provided by operating activities on its statement of cash flows.

-Under the direct method,cost of goods sold adjusted to a cash basis would be:

A)$225,000

B)$205,000

C)$275,000

D)$255,000

-Under the direct method,cost of goods sold adjusted to a cash basis would be:

A)$225,000

B)$205,000

C)$275,000

D)$255,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

36

The most recent balance sheet and income statement of Marroquin Corporation appear below:

The company paid a cash dividend and it did not dispose of any property, plant, and equipment. The company did not issue any bonds payable or repurchase any of its own common stock. The following questions pertain to the company's statement of cash flows.

The company paid a cash dividend and it did not dispose of any property, plant, and equipment. The company did not issue any bonds payable or repurchase any of its own common stock. The following questions pertain to the company's statement of cash flows.

-The net cash provided by (used in)investing activities for the year was:

A)$130

B)$(130)

C)$(155)

D)$155

The company paid a cash dividend and it did not dispose of any property, plant, and equipment. The company did not issue any bonds payable or repurchase any of its own common stock. The following questions pertain to the company's statement of cash flows.

The company paid a cash dividend and it did not dispose of any property, plant, and equipment. The company did not issue any bonds payable or repurchase any of its own common stock. The following questions pertain to the company's statement of cash flows.-The net cash provided by (used in)investing activities for the year was:

A)$130

B)$(130)

C)$(155)

D)$155

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

37

Kelln Corporation's most recent comparative balance sheet and income statement appear below:

The company paid a cash dividend and it did not dispose of any property, plant, and equipment. The company did not issue any bonds payable or repurchase any of its own common stock. The following questions pertain to the company's statement of cash flows.

The company paid a cash dividend and it did not dispose of any property, plant, and equipment. The company did not issue any bonds payable or repurchase any of its own common stock. The following questions pertain to the company's statement of cash flows.

-The net cash provided by (used in)investing activities for the year was:

A)$(28)

B)$(58)

C)$28

D)$58

The company paid a cash dividend and it did not dispose of any property, plant, and equipment. The company did not issue any bonds payable or repurchase any of its own common stock. The following questions pertain to the company's statement of cash flows.

The company paid a cash dividend and it did not dispose of any property, plant, and equipment. The company did not issue any bonds payable or repurchase any of its own common stock. The following questions pertain to the company's statement of cash flows.-The net cash provided by (used in)investing activities for the year was:

A)$(28)

B)$(58)

C)$28

D)$58

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

38

Fluck Corporation's balance sheet and income statement appear below:

The company sold equipment for $12 that was originally purchased for $5 and that had accumulated depreciation of $3. The company paid a cash dividend and it did not issue any bonds payable or repurchase any of its own common stock.

The company sold equipment for $12 that was originally purchased for $5 and that had accumulated depreciation of $3. The company paid a cash dividend and it did not issue any bonds payable or repurchase any of its own common stock.

-The net cash provided by (used in)operating activities for the year was:

A)$106

B)$85

C)$95

D)$111

The company sold equipment for $12 that was originally purchased for $5 and that had accumulated depreciation of $3. The company paid a cash dividend and it did not issue any bonds payable or repurchase any of its own common stock.

The company sold equipment for $12 that was originally purchased for $5 and that had accumulated depreciation of $3. The company paid a cash dividend and it did not issue any bonds payable or repurchase any of its own common stock.-The net cash provided by (used in)operating activities for the year was:

A)$106

B)$85

C)$95

D)$111

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

39

Alkine Company's comparative balance sheet appears below:  Alkine reported the following net income for the year:

Alkine reported the following net income for the year:  Dividends were declared and paid during the year. A gain of $8,000 was recorded on the sale of the long-term investments. The company did not purchase any long-term investments or dispose of any property, plant, and equipment during the year. It also did not issue any bonds payable or repurchase any of its own common stock.

Dividends were declared and paid during the year. A gain of $8,000 was recorded on the sale of the long-term investments. The company did not purchase any long-term investments or dispose of any property, plant, and equipment during the year. It also did not issue any bonds payable or repurchase any of its own common stock.

-The net cash provided (used)by financing activities would be:

A)$3,000

B)$(5,000)

C)$(58,200)

D)$(61,200)

Alkine reported the following net income for the year:

Alkine reported the following net income for the year:  Dividends were declared and paid during the year. A gain of $8,000 was recorded on the sale of the long-term investments. The company did not purchase any long-term investments or dispose of any property, plant, and equipment during the year. It also did not issue any bonds payable or repurchase any of its own common stock.

Dividends were declared and paid during the year. A gain of $8,000 was recorded on the sale of the long-term investments. The company did not purchase any long-term investments or dispose of any property, plant, and equipment during the year. It also did not issue any bonds payable or repurchase any of its own common stock.-The net cash provided (used)by financing activities would be:

A)$3,000

B)$(5,000)

C)$(58,200)

D)$(61,200)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

40

Kelln Corporation's most recent comparative balance sheet and income statement appear below:

The company paid a cash dividend and it did not dispose of any property, plant, and equipment. The company did not issue any bonds payable or repurchase any of its own common stock. The following questions pertain to the company's statement of cash flows.

The company paid a cash dividend and it did not dispose of any property, plant, and equipment. The company did not issue any bonds payable or repurchase any of its own common stock. The following questions pertain to the company's statement of cash flows.

-The net cash provided by (used in)financing activities for the year was:

A)$(15)

B)$4

C)$(9)

D)$(10)

The company paid a cash dividend and it did not dispose of any property, plant, and equipment. The company did not issue any bonds payable or repurchase any of its own common stock. The following questions pertain to the company's statement of cash flows.

The company paid a cash dividend and it did not dispose of any property, plant, and equipment. The company did not issue any bonds payable or repurchase any of its own common stock. The following questions pertain to the company's statement of cash flows.-The net cash provided by (used in)financing activities for the year was:

A)$(15)

B)$4

C)$(9)

D)$(10)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

41

The most recent balance sheet and income statement of Marroquin Corporation appear below:

The company paid a cash dividend and it did not dispose of any property, plant, and equipment. The company did not issue any bonds payable or repurchase any of its own common stock. The following questions pertain to the company's statement of cash flows.

The company paid a cash dividend and it did not dispose of any property, plant, and equipment. The company did not issue any bonds payable or repurchase any of its own common stock. The following questions pertain to the company's statement of cash flows.

-The net cash provided by (used in)financing activities for the year was:

A)$3

B)$(65)

C)$(24)

D)$(44)

The company paid a cash dividend and it did not dispose of any property, plant, and equipment. The company did not issue any bonds payable or repurchase any of its own common stock. The following questions pertain to the company's statement of cash flows.

The company paid a cash dividend and it did not dispose of any property, plant, and equipment. The company did not issue any bonds payable or repurchase any of its own common stock. The following questions pertain to the company's statement of cash flows.-The net cash provided by (used in)financing activities for the year was:

A)$3

B)$(65)

C)$(24)

D)$(44)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

42

Kren Corporation's balance sheet and income statement appear below:

Cash dividends were $35.The company did not dispose of any property,plant,and equipment during the year.

Cash dividends were $35.The company did not dispose of any property,plant,and equipment during the year.

Required:

Prepare the operating activities section of the statement of cash flows in good form using the direct method.

Cash dividends were $35.The company did not dispose of any property,plant,and equipment during the year.

Cash dividends were $35.The company did not dispose of any property,plant,and equipment during the year.Required:

Prepare the operating activities section of the statement of cash flows in good form using the direct method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

43

Sawyer Corporation's balance sheet and income statement appear below:

Cash dividends were $7.The company sold equipment for $13 that was originally purchased for $3 and that had accumulated depreciation of $2.

Cash dividends were $7.The company sold equipment for $13 that was originally purchased for $3 and that had accumulated depreciation of $2.

Required:

Using the direct method,determine the net cash provided by operating activities.

Cash dividends were $7.The company sold equipment for $13 that was originally purchased for $3 and that had accumulated depreciation of $2.

Cash dividends were $7.The company sold equipment for $13 that was originally purchased for $3 and that had accumulated depreciation of $2.Required:

Using the direct method,determine the net cash provided by operating activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

44

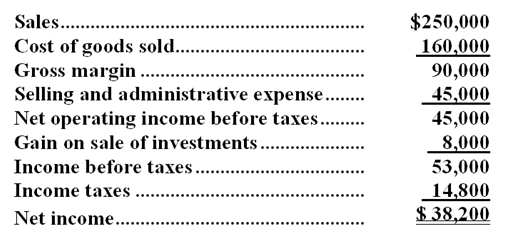

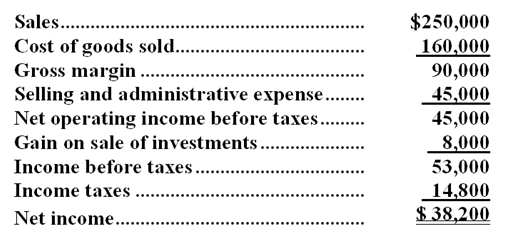

Cavett Company's comparative balance sheet and income statement for last year appear below:

The following additional information is available for the year:

The following additional information is available for the year:

* During the year,the company sold long-term investments with a cost of $38,000 when purchased for $33,000 in cash.

* All sales were on credit.

* The company paid a cash dividend of $25,000.

* The company did not dispose of any property,plant,and equipment,issue any bonds payable,or repurchase any of its own common stock during the year.

Required:

a.Using the direct method,determine the net cash provided by operating activities for the year.

b.Using the indirect method,determine the net cash provided by operating activities for the year.

c.Using the net cash provided by operating activities figure from either part a or b,prepare a statement of cash flows for the year.

The following additional information is available for the year:

The following additional information is available for the year:* During the year,the company sold long-term investments with a cost of $38,000 when purchased for $33,000 in cash.

* All sales were on credit.

* The company paid a cash dividend of $25,000.

* The company did not dispose of any property,plant,and equipment,issue any bonds payable,or repurchase any of its own common stock during the year.

Required:

a.Using the direct method,determine the net cash provided by operating activities for the year.

b.Using the indirect method,determine the net cash provided by operating activities for the year.

c.Using the net cash provided by operating activities figure from either part a or b,prepare a statement of cash flows for the year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

45

The changes in each balance sheet account for Bryan Company during the year just completed are as follows:  Bryan Company's income statement for the year just ended shows the following:

Bryan Company's income statement for the year just ended shows the following:

The company did not dispose of any property,plant,and equipment,buy any long-term investments,issue any bonds payable,or repurchase any of its own common stock during the year.Bryan Company uses the direct method to construct its statement of cash flows.

Required:

a.Determine the sales adjusted to the cash basis.

b.Determine the cost of goods sold adjusted to the cash basis.

c.Determine the selling and administrative expenses adjusted to a cash basis.

d.Determine the net cash provided (used)by operating activities.

e.Determine the net cash provided (used)by investing activities.

f.Determine the net cash provided (used)by financing activities.

Bryan Company's income statement for the year just ended shows the following:

Bryan Company's income statement for the year just ended shows the following:

The company did not dispose of any property,plant,and equipment,buy any long-term investments,issue any bonds payable,or repurchase any of its own common stock during the year.Bryan Company uses the direct method to construct its statement of cash flows.

Required:

a.Determine the sales adjusted to the cash basis.

b.Determine the cost of goods sold adjusted to the cash basis.

c.Determine the selling and administrative expenses adjusted to a cash basis.

d.Determine the net cash provided (used)by operating activities.

e.Determine the net cash provided (used)by investing activities.

f.Determine the net cash provided (used)by financing activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

46

Carston Company's comparative balance sheet and income statement for last year appear below:

The company declared and paid $27,000 in cash dividends during the year.It did not dispose of any property,plant,and equipment during the year.

The company declared and paid $27,000 in cash dividends during the year.It did not dispose of any property,plant,and equipment during the year.

Required:

Construct in good form the operating activities section of the company's statement of cash flows for the year using the direct method.

The company declared and paid $27,000 in cash dividends during the year.It did not dispose of any property,plant,and equipment during the year.

The company declared and paid $27,000 in cash dividends during the year.It did not dispose of any property,plant,and equipment during the year.Required:

Construct in good form the operating activities section of the company's statement of cash flows for the year using the direct method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

47

Milton Corporation's balance sheet and income statement appear below:

Cash dividends were $2.The company did not dispose of any property,plant,and equipment during the year.

Cash dividends were $2.The company did not dispose of any property,plant,and equipment during the year.

Required:

Prepare the operating activities section of the statement of cash flows using the direct method.

Cash dividends were $2.The company did not dispose of any property,plant,and equipment during the year.

Cash dividends were $2.The company did not dispose of any property,plant,and equipment during the year.Required:

Prepare the operating activities section of the statement of cash flows using the direct method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

48

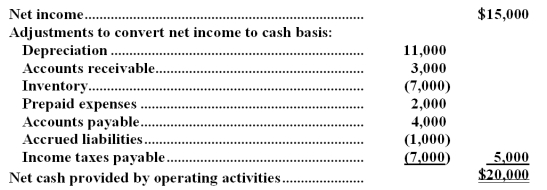

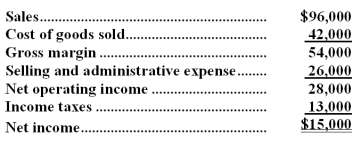

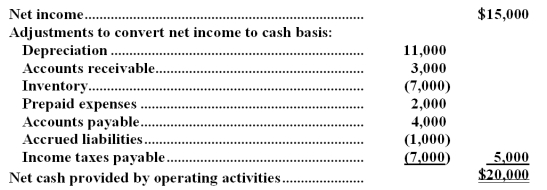

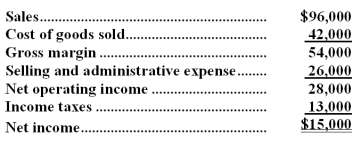

The following information is taken from the operating activities section of the statement of cash flows for the Parks Company for the year just ended:  The following information is taken from the company's income statement for the year just ended:

The following information is taken from the company's income statement for the year just ended:  Required:

Required:

a.For each of the adjustments to convert net income to the cash basis,indicate whether the account increased or decreased.

b.Determine the net cash provided by operating activities using the direct method.You need not prepare the formal operating activities section of the statement of cash flows but you should show the adjustments that must be made to sales,expenses,and so forth and the cash flow balances of sales,expenses,etc.

The following information is taken from the company's income statement for the year just ended:

The following information is taken from the company's income statement for the year just ended:  Required:

Required:a.For each of the adjustments to convert net income to the cash basis,indicate whether the account increased or decreased.

b.Determine the net cash provided by operating activities using the direct method.You need not prepare the formal operating activities section of the statement of cash flows but you should show the adjustments that must be made to sales,expenses,and so forth and the cash flow balances of sales,expenses,etc.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck