Deck 13: Statement of Cash Flows

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

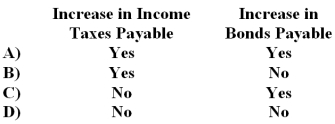

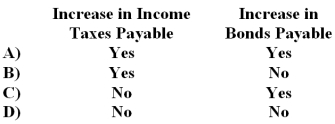

سؤال

سؤال

سؤال

سؤال

سؤال

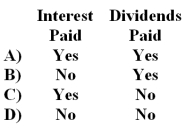

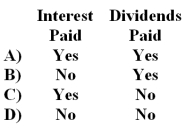

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

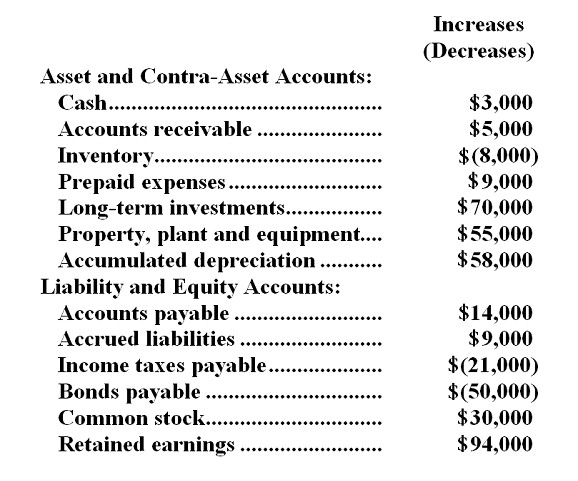

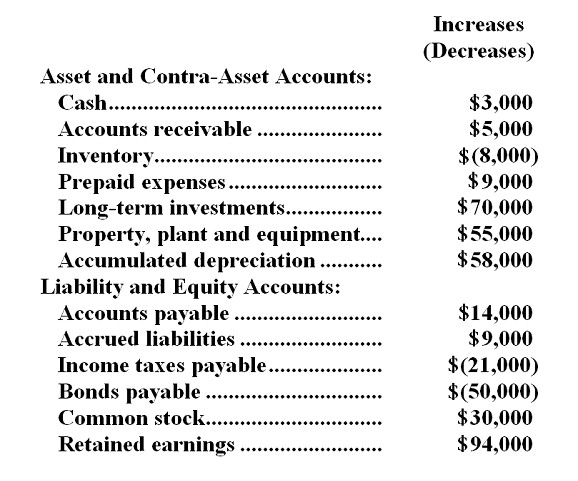

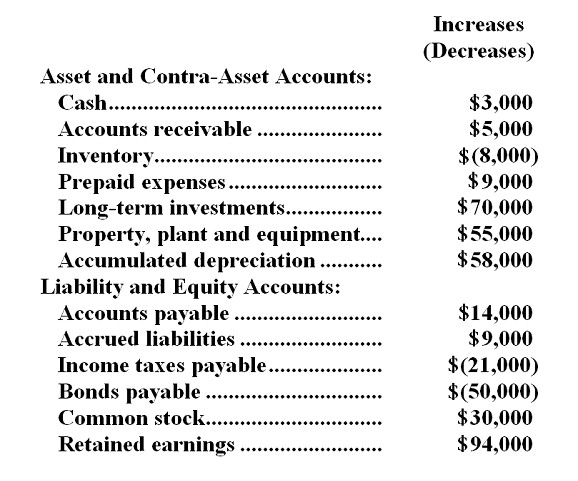

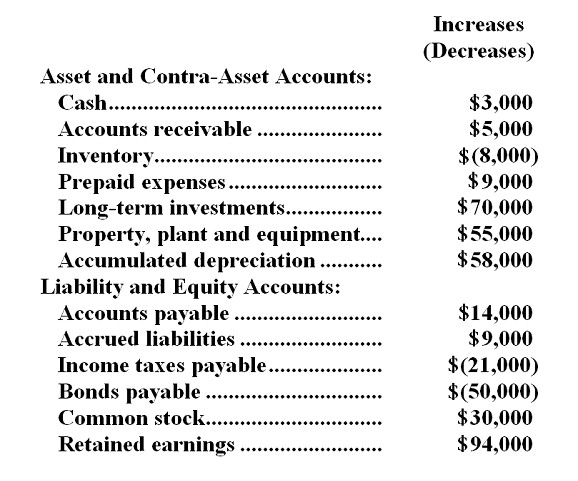

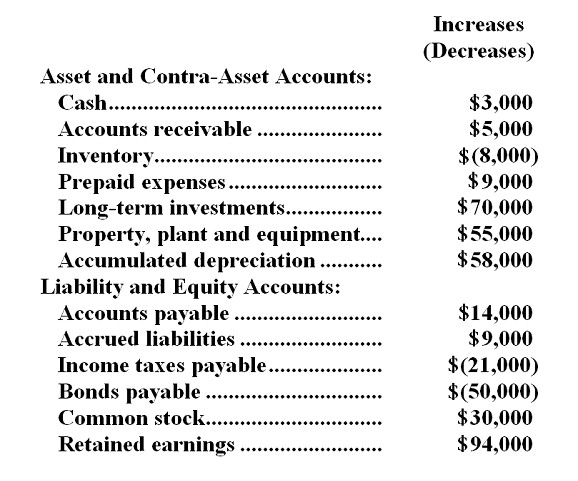

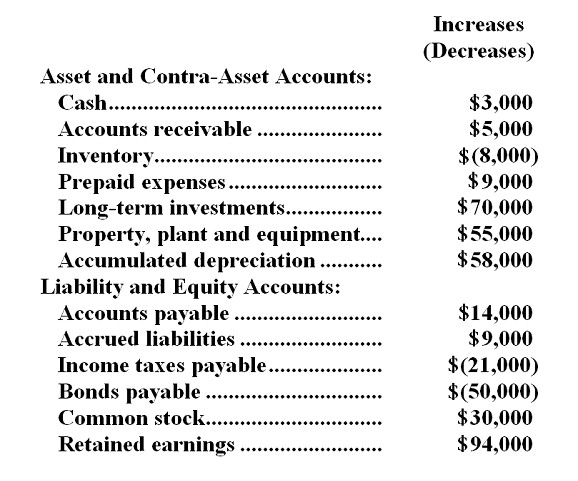

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

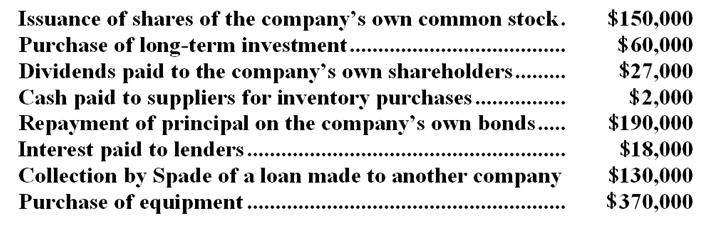

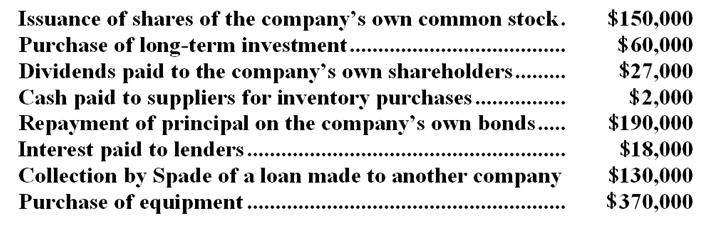

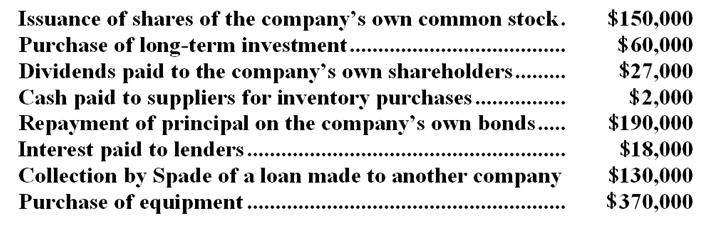

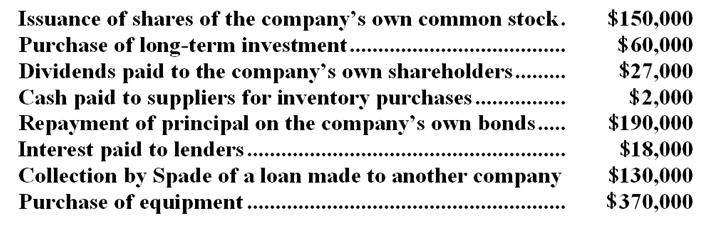

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/108

العب

ملء الشاشة (f)

Deck 13: Statement of Cash Flows

1

Free cash flow increases when a company issues common stock for cash.

False

2

The change in the cash balance must equal the changes in all other balance sheet accounts besides cash.

True

3

For contra-asset accounts,debits are added to the beginning balance on the statement of cash flows.

False

4

For asset accounts,credits are added to the beginning balance on the statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

5

Under the indirect method of determining the net cash provided by operating activities on the statement of cash flows,a decrease in accounts receivable is added to net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

6

For liability accounts,debits are added to the beginning balance on the statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

7

The investing and financing sections of the statement of cash flows record net cash flows rather than gross cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

8

Cash payments to retire bonds payable are reported as a cash outflow in the financing activities section of the statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

9

A gain on the sale of equipment would be included as part of a company's financing activities on the statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

10

A newly formed company with enormous growth prospects would be expected to have negative free cash flow during its start-up phase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

11

Negative free cash flow suggests that the company did not generate enough cash flow from its operating activities to fund its capital expenditures and dividend payments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

12

The sale of a long-term investment for cash would be classified as an investing activity in the statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

13

Paying cash to retire bonds payable would be considered a financing activity on the statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

14

When a company issues common stock in exchange for cash,the cash inflow is recorded in the investing activities section of the statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

15

Under the indirect method of determining the net cash provided by operating activities on the statement of cash flows,an increase in inventory is subtracted from net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

16

A company can increase its net cash flow by increasing the depreciation expense it records during the period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

17

A company can have a net loss and still generate a positive net cash provided by operating activities in its statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

18

For stockholders' equity accounts,credits are added to the beginning balance on the statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

19

Paying taxes to governmental bodies is considered an operating activity on the statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

20

Free cash flow is net cash provided by operating activities less dividends.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

21

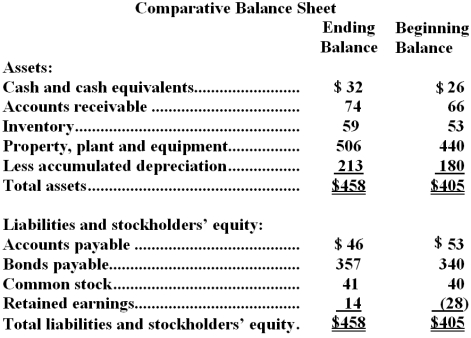

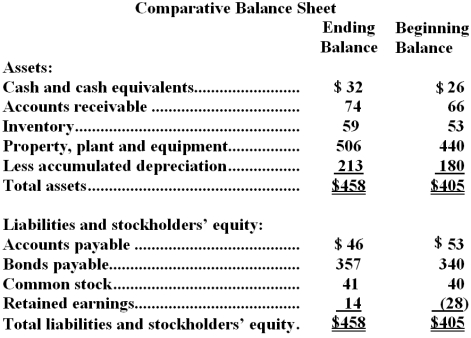

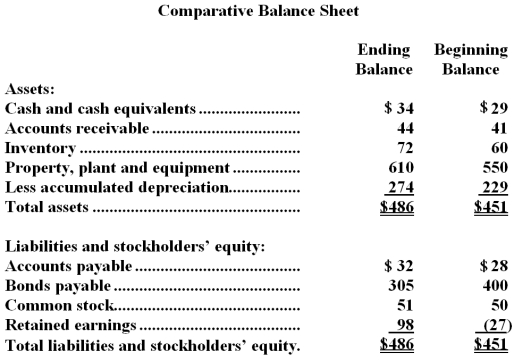

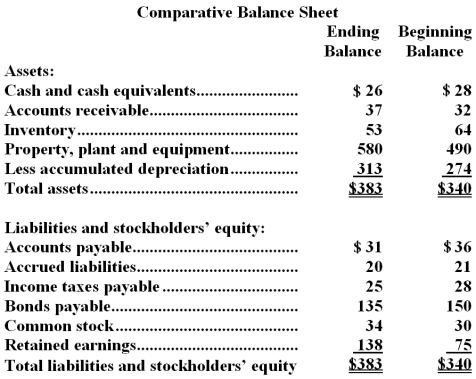

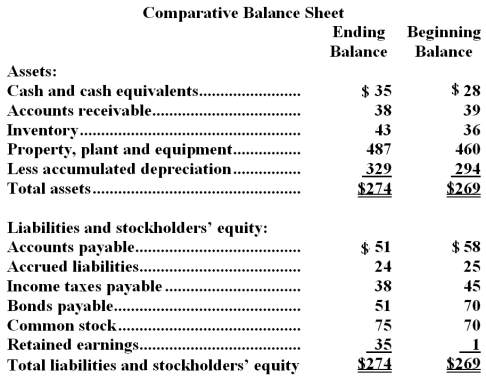

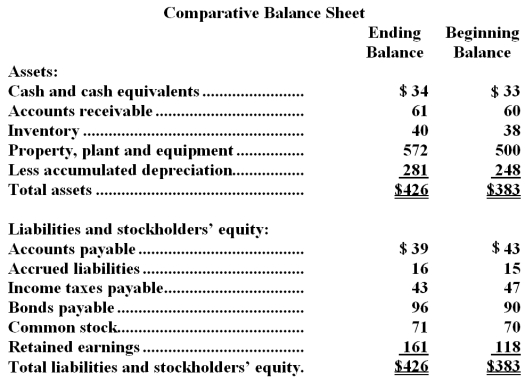

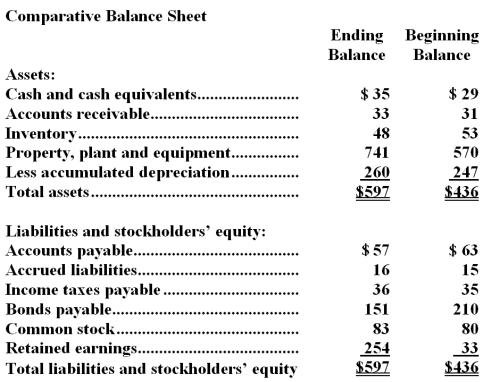

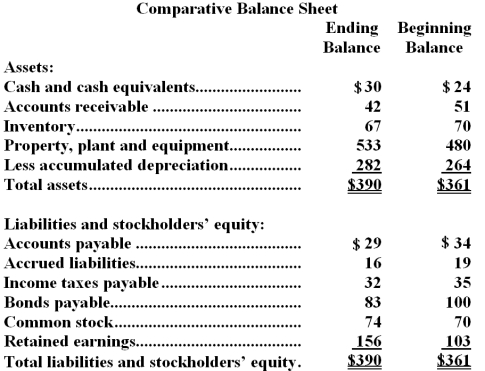

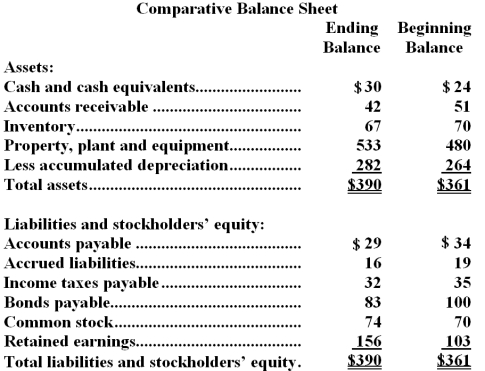

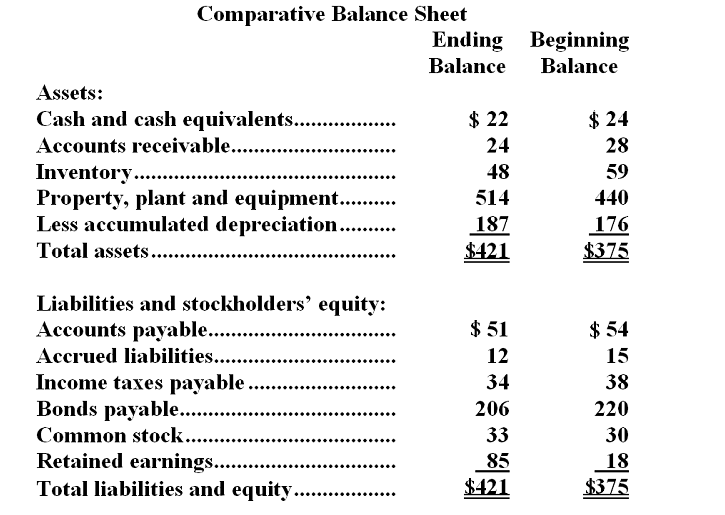

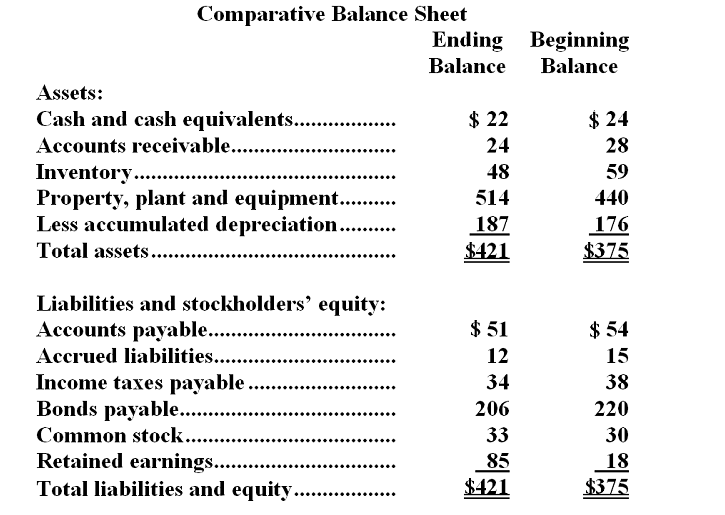

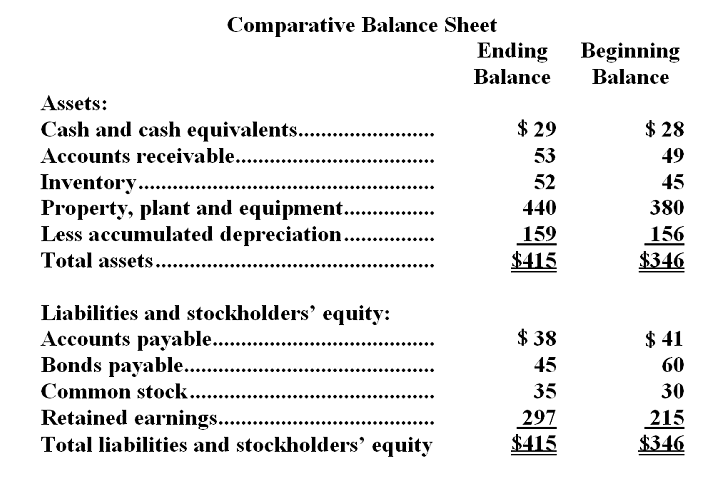

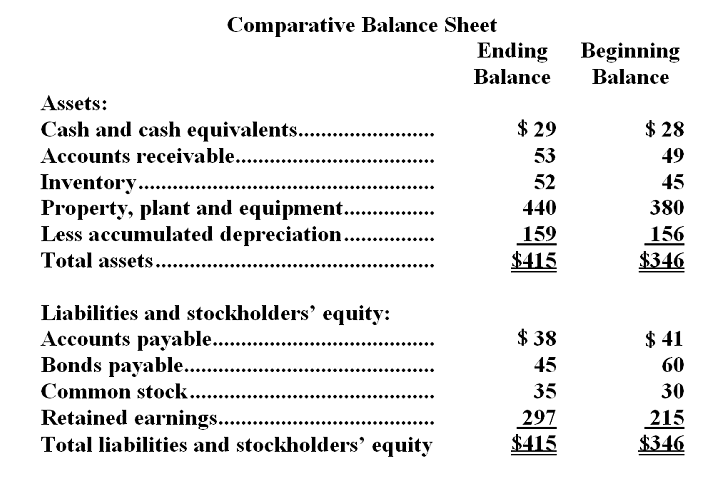

Newburn Corporation's most recent balance sheet appears below:  The company's net income for the year was $53 and it did not sell or retire any property,plant,and equipment during the year.Cash dividends were $11.The net cash provided by (used in)investing activities for the year was:

The company's net income for the year was $53 and it did not sell or retire any property,plant,and equipment during the year.Cash dividends were $11.The net cash provided by (used in)investing activities for the year was:

A)$(33)

B)$33

C)$(66)

D)$66

The company's net income for the year was $53 and it did not sell or retire any property,plant,and equipment during the year.Cash dividends were $11.The net cash provided by (used in)investing activities for the year was:

The company's net income for the year was $53 and it did not sell or retire any property,plant,and equipment during the year.Cash dividends were $11.The net cash provided by (used in)investing activities for the year was:A)$(33)

B)$33

C)$(66)

D)$66

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

22

Under the indirect method of determining net cash provided by operating activities on the statement of cash flows,which of the following would be subtracted from net income?

A)A decrease in accounts receivable.

B)An increase in accrued liabilities.

C)A decrease in accounts payable.

D)An increase in dividend payments to stockholders.

A)A decrease in accounts receivable.

B)An increase in accrued liabilities.

C)A decrease in accounts payable.

D)An increase in dividend payments to stockholders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

23

The sale of equipment at a gain would be shown on the statement of cash flows prepared under the indirect method in which of the following manners?

A)Cash received would be shown under Investing Activities and the gain would be subtracted from net income.

B)Cash received would be shown under Investing Activities and the gain would be added to net income.

C)Cash received would be shown under Investing Activities and the gain would not appear on the statement of cash flows.

D)Cash received would be shown as an adjustment to net income and the gain would not appear on the statement of cash flows.

A)Cash received would be shown under Investing Activities and the gain would be subtracted from net income.

B)Cash received would be shown under Investing Activities and the gain would be added to net income.

C)Cash received would be shown under Investing Activities and the gain would not appear on the statement of cash flows.

D)Cash received would be shown as an adjustment to net income and the gain would not appear on the statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

24

An increase in the Prepaid Expenses account of $1,000 over the course of a year would be shown on the company's statement of cash flows prepared under the indirect method as:

A)an addition to net income of $1,000 in order to arrive at net cash provided by operating activities.

B)a deduction from net income of $1,000 in order to arrive at net cash provided by operating activities.

C)an addition of $1,000 under financing activities.

D)a deduction of $1,000 under financing activities.

A)an addition to net income of $1,000 in order to arrive at net cash provided by operating activities.

B)a deduction from net income of $1,000 in order to arrive at net cash provided by operating activities.

C)an addition of $1,000 under financing activities.

D)a deduction of $1,000 under financing activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

25

Last year Burford Company's cash account decreased by $19,000.Net cash used in investing activities was $9,000.Net cash provided by financing activities was $16,000.On the statement of cash flows,the net cash flow provided by (used in)operating activities was:

A)$(19,000)

B)$(26,000)

C)$(12,000)

D)$7,000

A)$(19,000)

B)$(26,000)

C)$(12,000)

D)$7,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

26

If Thomson Company did not issue any bonds payable during the year and its bonds payable account decreased by $200,000 over the course of a year,then this amount would be shown on the company's statement of cash flows prepared under the indirect method as:

A)a cash inflow of $200,000 under investing activities.

B)a cash outflow of $200,000 under investing activities.

C)a cash inflow of $200,000 under financing activities.

D)a cash outflow of $200,000 under financing activities.

A)a cash inflow of $200,000 under investing activities.

B)a cash outflow of $200,000 under investing activities.

C)a cash inflow of $200,000 under financing activities.

D)a cash outflow of $200,000 under financing activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

27

In a statement of cash flows,which of the following would be classified as an operating activity?

A)The purchase of equipment.

B)Dividends paid to the company's own common stockholders.

C)Tax payments to governmental bodies.

D)The cash paid to retire bonds payable.

A)The purchase of equipment.

B)Dividends paid to the company's own common stockholders.

C)Tax payments to governmental bodies.

D)The cash paid to retire bonds payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

28

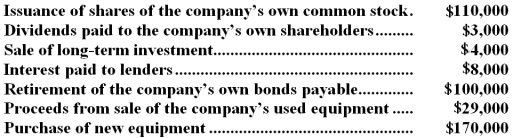

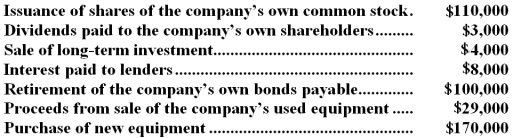

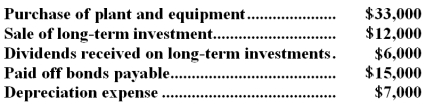

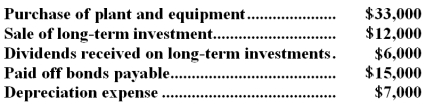

The following transactions occurred last year at Jogger Company:  Based solely on the above information,the net cash provided by financing activities for the year on the statement of cash flows would be:

Based solely on the above information,the net cash provided by financing activities for the year on the statement of cash flows would be:

A)$424,000

B)$(138,000)

C)$(1,000)

D)$7,000

Based solely on the above information,the net cash provided by financing activities for the year on the statement of cash flows would be:

Based solely on the above information,the net cash provided by financing activities for the year on the statement of cash flows would be:A)$424,000

B)$(138,000)

C)$(1,000)

D)$7,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

29

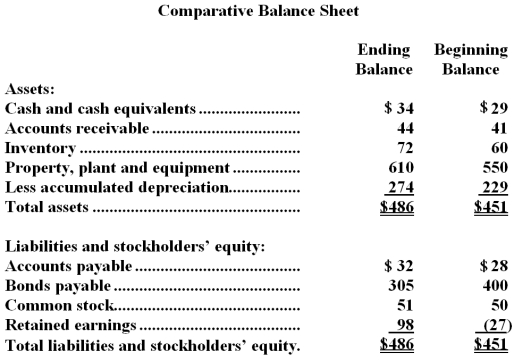

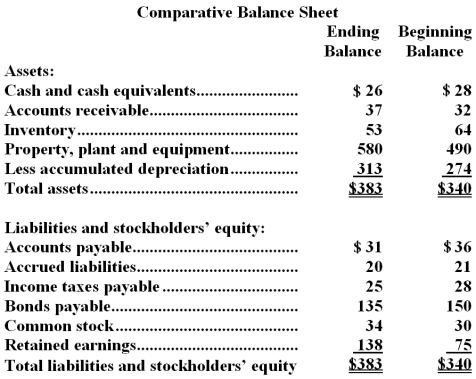

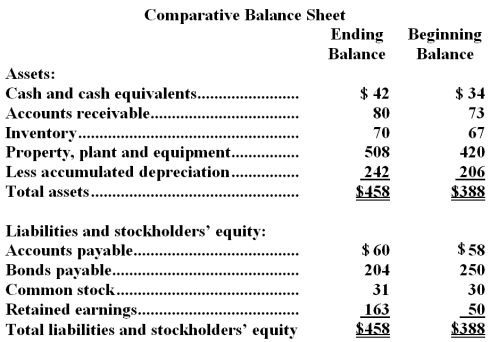

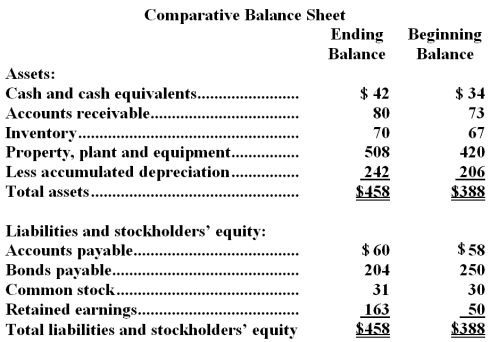

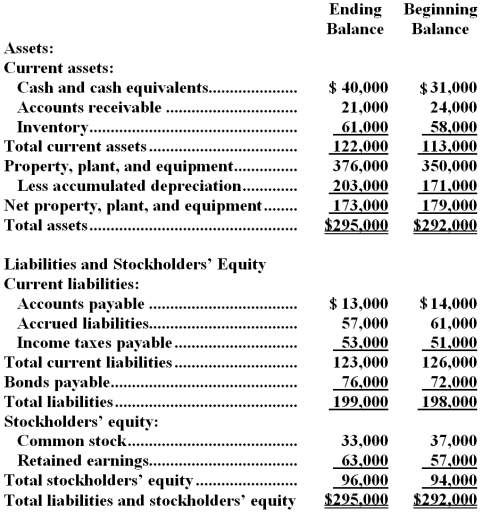

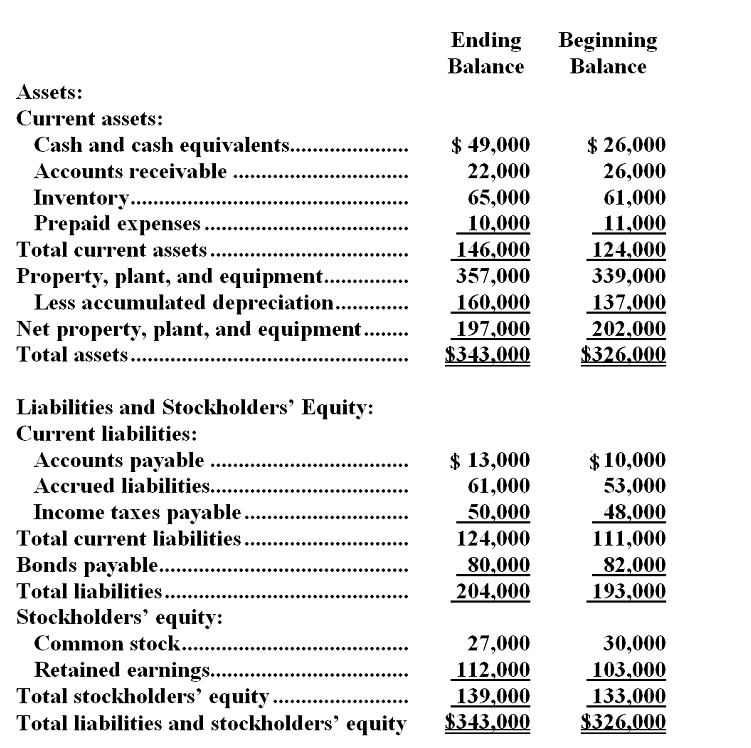

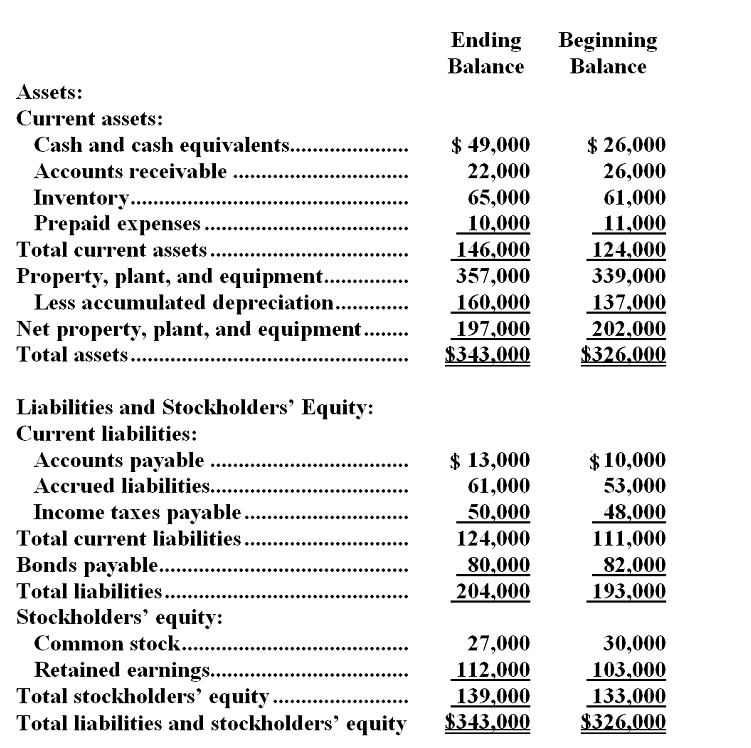

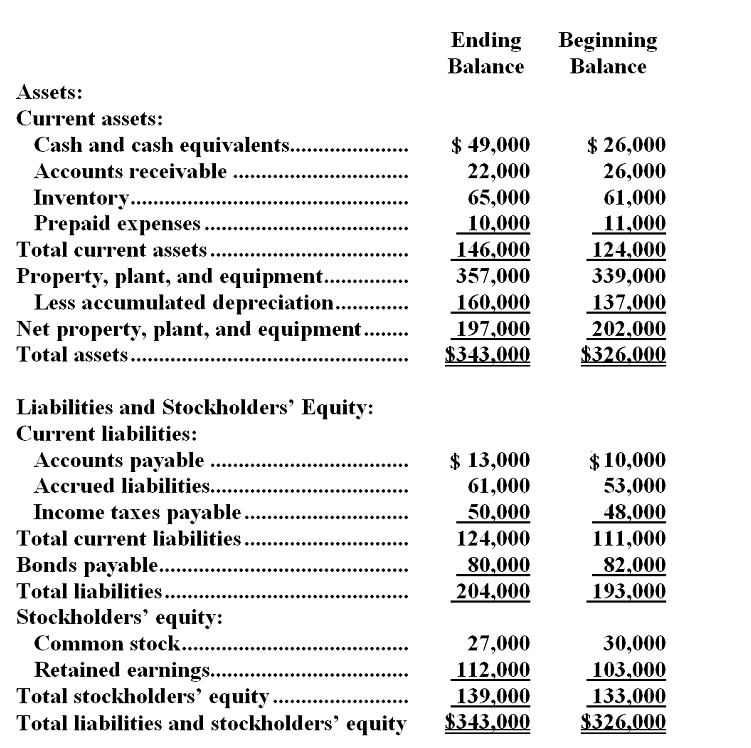

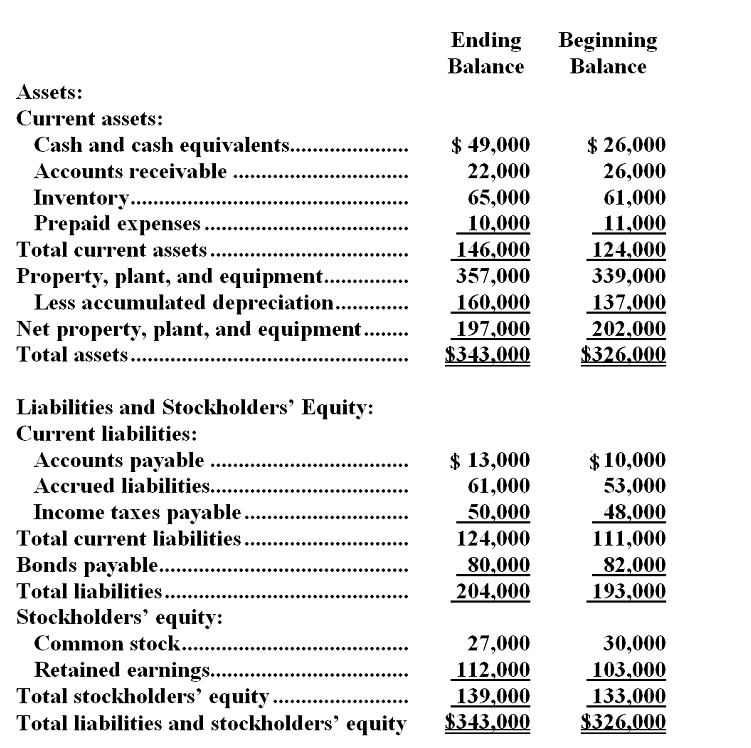

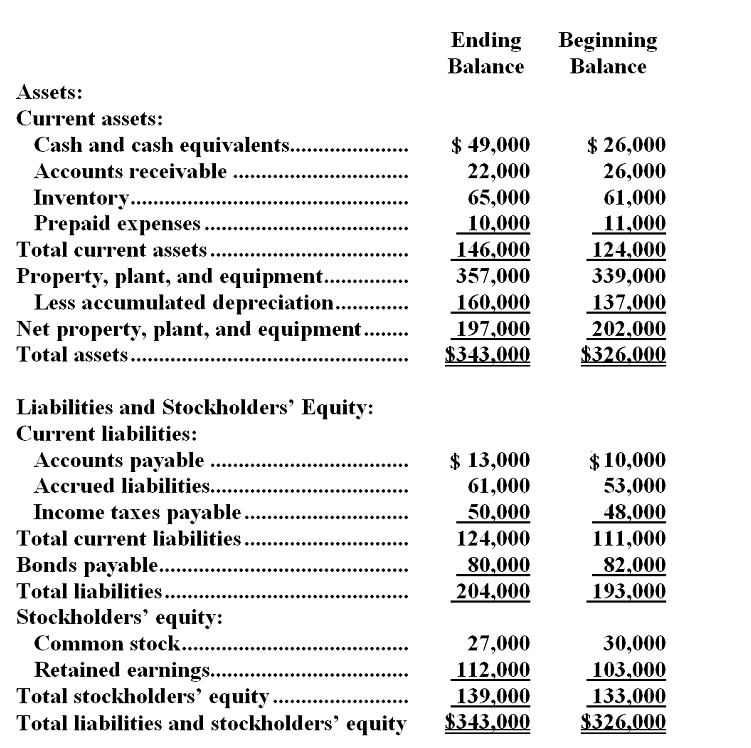

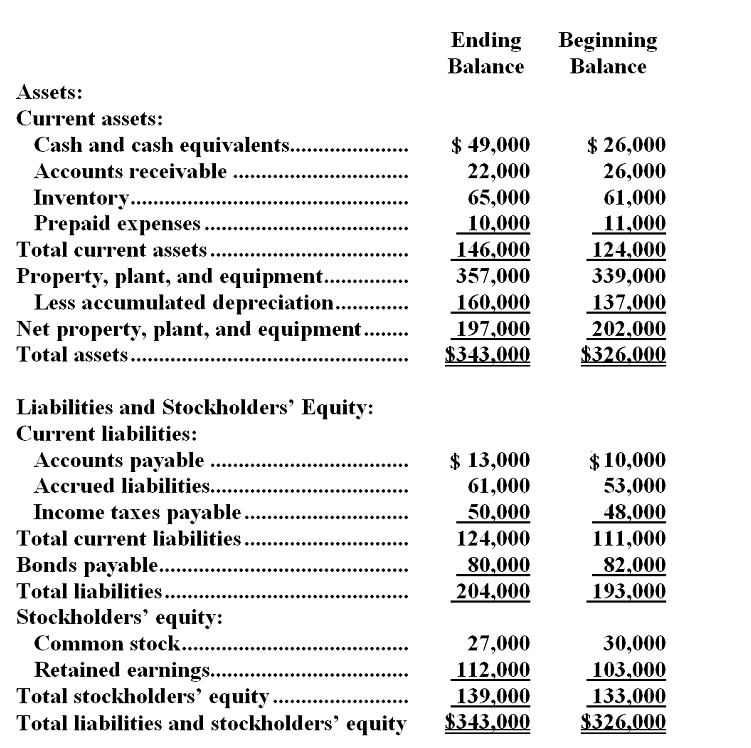

Lueckenhoff Corporation's most recent balance sheet appears below:  The company's net income for the year was $153 and it did not sell or retire any property,plant,and equipment during the year.Cash dividends were $28.The net cash provided by (used in)operating activities for the year was:

The company's net income for the year was $153 and it did not sell or retire any property,plant,and equipment during the year.Cash dividends were $28.The net cash provided by (used in)operating activities for the year was:

A)$34

B)$187

C)$119

D)$219

The company's net income for the year was $153 and it did not sell or retire any property,plant,and equipment during the year.Cash dividends were $28.The net cash provided by (used in)operating activities for the year was:

The company's net income for the year was $153 and it did not sell or retire any property,plant,and equipment during the year.Cash dividends were $28.The net cash provided by (used in)operating activities for the year was:A)$34

B)$187

C)$119

D)$219

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

30

Which of the following would be considered a cash outflow in the investing activities section of the statement of cash flows?

A)Dividends paid to the company's own stockholders.

B)Payment of interest to a lender.

C)Purchase of equipment.

D)Retirement of bonds payable.

A)Dividends paid to the company's own stockholders.

B)Payment of interest to a lender.

C)Purchase of equipment.

D)Retirement of bonds payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

31

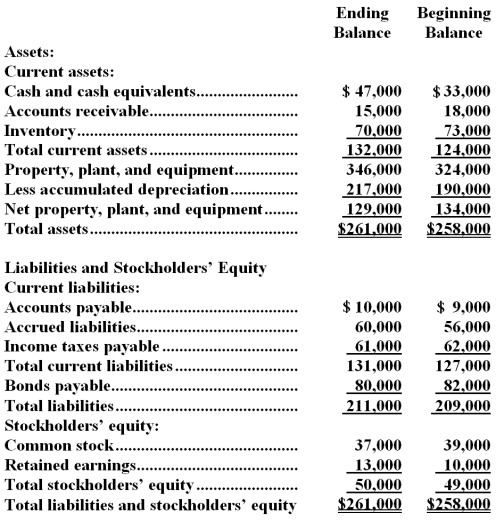

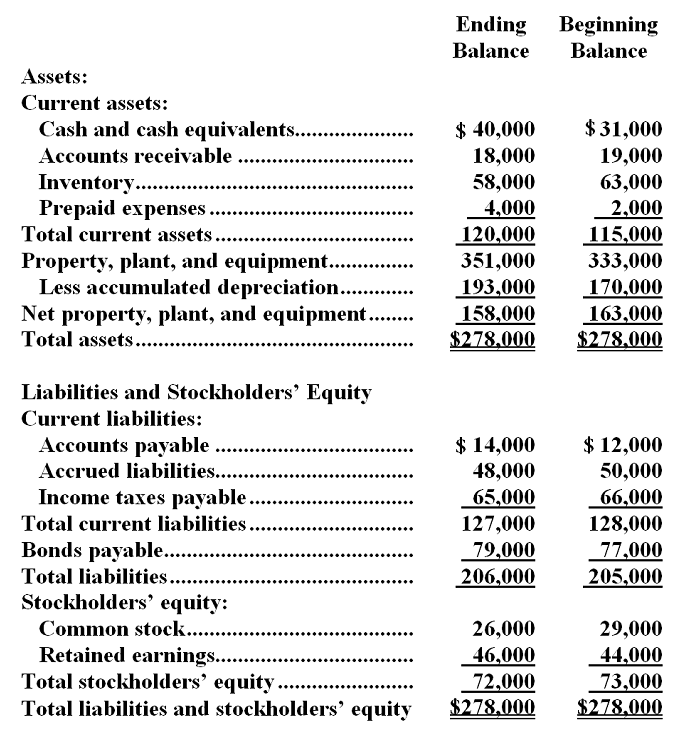

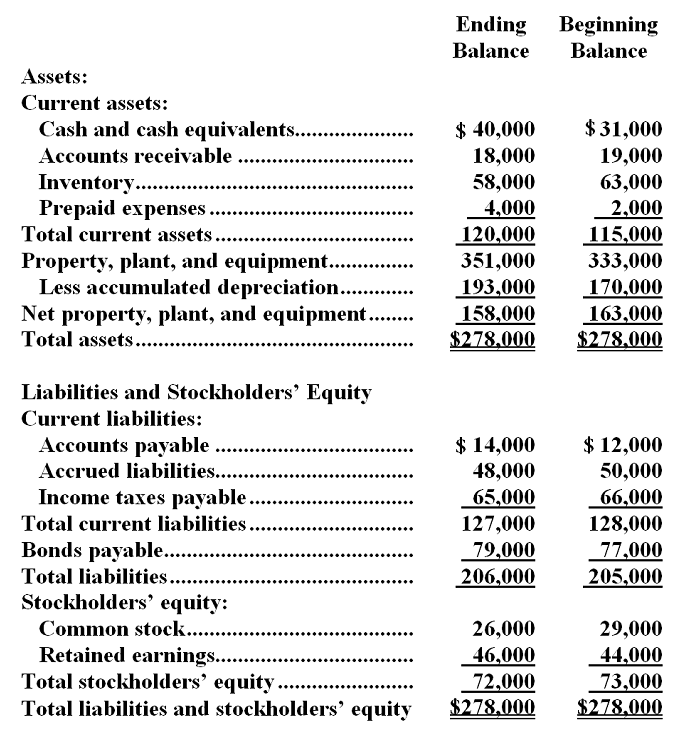

Waldrop Corporation's comparative balance sheet appears below:  The company did not dispose of any property,plant,and equipment during the year.Its net income for the year was $4,000.The net cash provided by operating activities is:

The company did not dispose of any property,plant,and equipment during the year.Its net income for the year was $4,000.The net cash provided by operating activities is:

A)$35,000

B)$14,000

C)$41,000

D)$43,000

The company did not dispose of any property,plant,and equipment during the year.Its net income for the year was $4,000.The net cash provided by operating activities is:

The company did not dispose of any property,plant,and equipment during the year.Its net income for the year was $4,000.The net cash provided by operating activities is:A)$35,000

B)$14,000

C)$41,000

D)$43,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

32

Which of the following would be classified as a financing activity on the statement of cash flows?

A)Interest paid to a lender.

B)Dividends paid to the company's common stockholders.

C)Cash paid to acquire a long-term investment.

D)Cash received from a loan that was made to another company.

A)Interest paid to a lender.

B)Dividends paid to the company's common stockholders.

C)Cash paid to acquire a long-term investment.

D)Cash received from a loan that was made to another company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

33

Gary Corporation prepares its statement of cash flows using the indirect method.Which of the following would be subtracted from net income in the operating activities section of the statement?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

34

In a statement of cash flows,receipts from sales of property,plant,and equipment should be classified as a(n):

A)Operating activity.

B)Financing activity.

C)Investing activity.

D)Selling activity.

A)Operating activity.

B)Financing activity.

C)Investing activity.

D)Selling activity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

35

The statement of cash flows:

A)serves as a replacement for the income statement and balance sheet.

B)explains the change in the cash balance at one point in time.

C)explains the change in the cash balance for one period of time.

D)both A and B above.

A)serves as a replacement for the income statement and balance sheet.

B)explains the change in the cash balance at one point in time.

C)explains the change in the cash balance for one period of time.

D)both A and B above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

36

A company that had a $500 decrease in accounts receivable during a period would do which of the following on its statement of cash flows prepared using the indirect method?

A)Add the $500 to net income in order to arrive at net cash provided by operating activities.

B)Subtract the $500 from net income in order to arrive at net cash provided by operating activities.

C)Add the $500 to the net cash provided by investing activities.

D)Add the $500 to the net cash provided by financing activities.

A)Add the $500 to net income in order to arrive at net cash provided by operating activities.

B)Subtract the $500 from net income in order to arrive at net cash provided by operating activities.

C)Add the $500 to the net cash provided by investing activities.

D)Add the $500 to the net cash provided by financing activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

37

In a statement of cash flows,all of the following would be classified as financing activities except:

A)the collection of cash related to a loan made to another entity.

B)the payment of a cash dividend on the company's own common stock.

C)the cash paid to retire bonds payable.

D)the sale of the company's own common stock for cash.

A)the collection of cash related to a loan made to another entity.

B)the payment of a cash dividend on the company's own common stock.

C)the cash paid to retire bonds payable.

D)the sale of the company's own common stock for cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

38

Which of the following should be classified as a financing activity on a statement of cash flows?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

39

Which of the following would be added to net income in the operating activities section of a statement of cash flows prepared using the indirect method?

A)an increase in accounts receivable.

B)an increase in accounts payable.

C)an increase in common stock.

D)an increase in bonds payable.

A)an increase in accounts receivable.

B)an increase in accounts payable.

C)an increase in common stock.

D)an increase in bonds payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

40

Maze Company's cash and cash equivalents consist of cash and marketable securities.Last year the company's cash account increased by $24,000 and its marketable securities account decreased by $16,000.Cash provided by operating activities was $40,000.Net cash used in financing activities was $39,000.Based on this information,the net cash flow from investing activities on the statement of cash flows was:

A)a net $9,000 increase.

B)a net $23,000 increase.

C)a net $39,000 increase.

D)a net $7,000 increase.

A)a net $9,000 increase.

B)a net $23,000 increase.

C)a net $39,000 increase.

D)a net $7,000 increase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

41

Gorovitz Corporation's most recent balance sheet appears below:  The company's net income for the year was $86 and it did not issue any bonds or repurchase any of its common stock during the year.Cash dividends were $23.The net cash provided by (used in)financing activities for the year was:

The company's net income for the year was $86 and it did not issue any bonds or repurchase any of its common stock during the year.Cash dividends were $23.The net cash provided by (used in)financing activities for the year was:

A)$4

B)$(15)

C)$(23)

D)$(34)

The company's net income for the year was $86 and it did not issue any bonds or repurchase any of its common stock during the year.Cash dividends were $23.The net cash provided by (used in)financing activities for the year was:

The company's net income for the year was $86 and it did not issue any bonds or repurchase any of its common stock during the year.Cash dividends were $23.The net cash provided by (used in)financing activities for the year was:A)$4

B)$(15)

C)$(23)

D)$(34)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

42

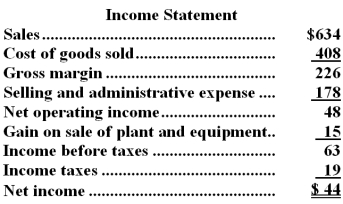

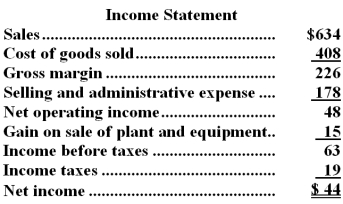

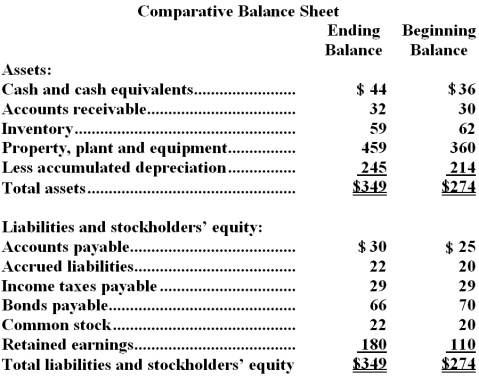

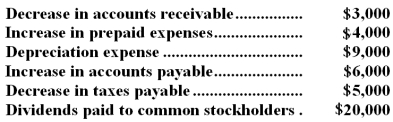

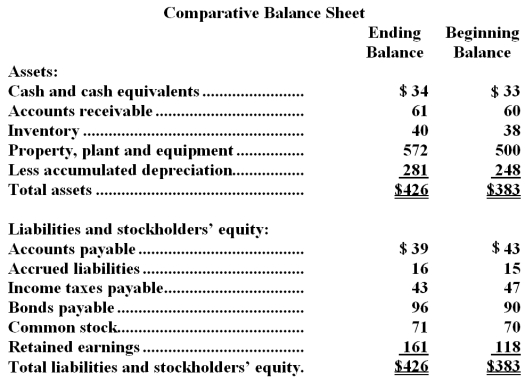

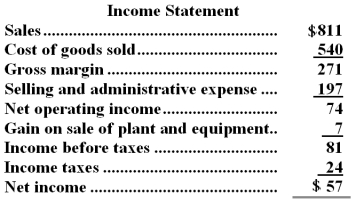

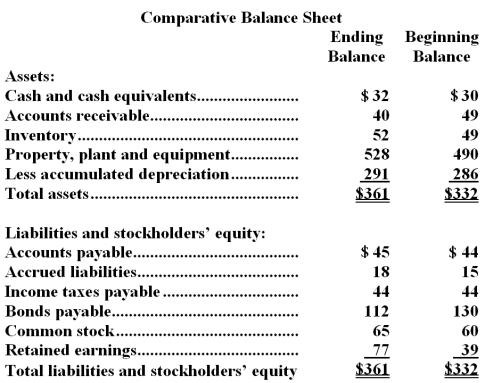

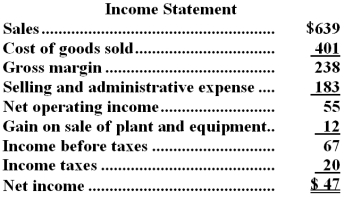

Hanzely Corporation's balance sheet and income statement appear below:

Cash dividends were $10.The company sold equipment for $17 that was originally purchased for $11 and that had accumulated depreciation of $9.The net cash provided by (used in)operating activities for the year was:

Cash dividends were $10.The company sold equipment for $17 that was originally purchased for $11 and that had accumulated depreciation of $9.The net cash provided by (used in)operating activities for the year was:

A)$67

B)$62

C)$52

D)$48

Cash dividends were $10.The company sold equipment for $17 that was originally purchased for $11 and that had accumulated depreciation of $9.The net cash provided by (used in)operating activities for the year was:

Cash dividends were $10.The company sold equipment for $17 that was originally purchased for $11 and that had accumulated depreciation of $9.The net cash provided by (used in)operating activities for the year was:A)$67

B)$62

C)$52

D)$48

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

43

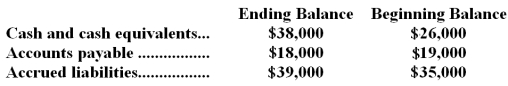

Excerpts from Harris Corporation's comparative balance sheet appear below:  Which of the following is the correct treatment within the operating activities section of the statement of cash flows using the indirect method?

Which of the following is the correct treatment within the operating activities section of the statement of cash flows using the indirect method?

A)The change in Accounts Payable is added to net income;The change in Accrued Liabilities is subtracted from net income

B)The change in Accounts Payable is added to net income;The change in Accrued Liabilities is added to net income

C)The change in Accounts Payable is subtracted from net income;The change in Accrued Liabilities is added to net income

D)The change in Accounts Payable is subtracted from net income;The change in Accrued Liabilities is subtracted from net income

Which of the following is the correct treatment within the operating activities section of the statement of cash flows using the indirect method?

Which of the following is the correct treatment within the operating activities section of the statement of cash flows using the indirect method?A)The change in Accounts Payable is added to net income;The change in Accrued Liabilities is subtracted from net income

B)The change in Accounts Payable is added to net income;The change in Accrued Liabilities is added to net income

C)The change in Accounts Payable is subtracted from net income;The change in Accrued Liabilities is added to net income

D)The change in Accounts Payable is subtracted from net income;The change in Accrued Liabilities is subtracted from net income

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

44

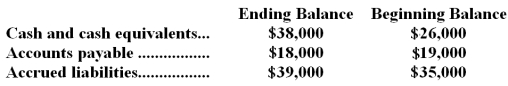

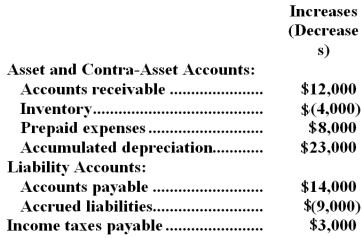

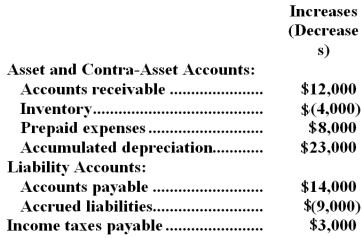

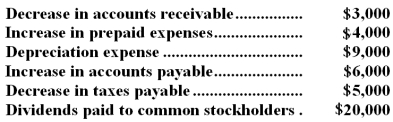

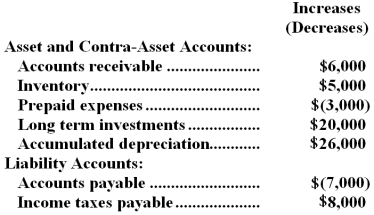

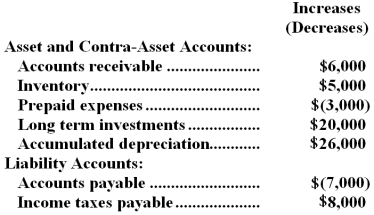

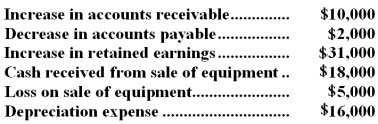

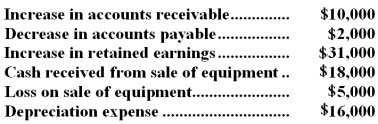

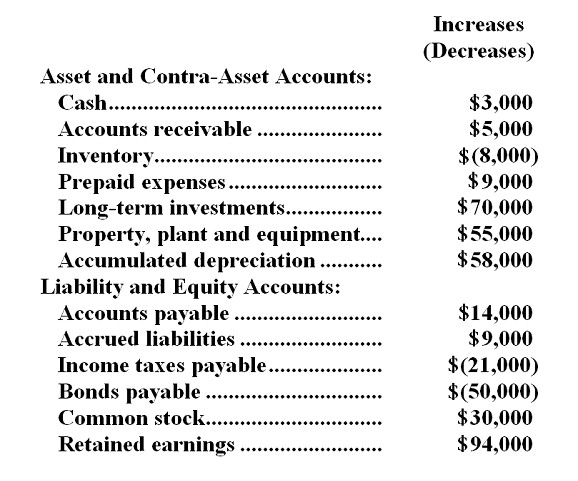

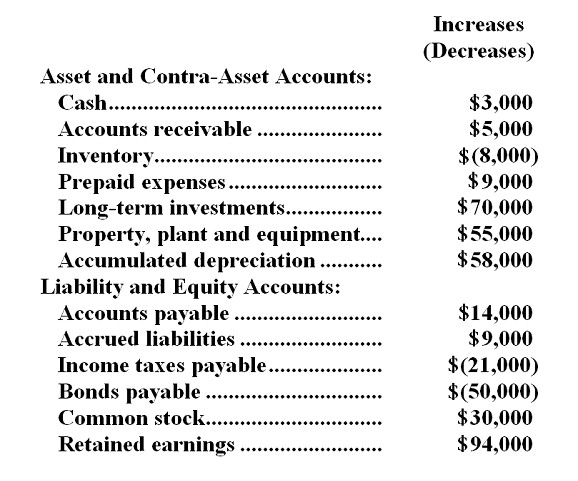

Nordquist Company's net income last year was $33,000.The company did not sell or retire any property,plant,and equipment last year.Changes in selected balance sheet accounts for the year appear below:  Based solely on this information,the net cash provided by operating activities under the indirect method on the statement of cash flows would be:

Based solely on this information,the net cash provided by operating activities under the indirect method on the statement of cash flows would be:

A)$80,000

B)$18,000

C)$48,000

D)$56,000

Based solely on this information,the net cash provided by operating activities under the indirect method on the statement of cash flows would be:

Based solely on this information,the net cash provided by operating activities under the indirect method on the statement of cash flows would be:A)$80,000

B)$18,000

C)$48,000

D)$56,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

45

Moren Corporation's net cash provided by operating activities was $95;its net income was $71;its capital expenditures were $70;and its cash dividends were $18.The company's free cash flow was:

A)$254

B)$78

C)$7

D)-$17

A)$254

B)$78

C)$7

D)-$17

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

46

Gayles Corporation's most recent balance sheet appears below:  The net income for the year was $144.Cash dividends were $31.The company did not issue any bonds or repurchase any of its common stock during the year.The net cash provided by (used in)financing activities for the year was:

The net income for the year was $144.Cash dividends were $31.The company did not issue any bonds or repurchase any of its common stock during the year.The net cash provided by (used in)financing activities for the year was:

A)$(46)

B)$(31)

C)$1

D)$(76)

The net income for the year was $144.Cash dividends were $31.The company did not issue any bonds or repurchase any of its common stock during the year.The net cash provided by (used in)financing activities for the year was:

The net income for the year was $144.Cash dividends were $31.The company did not issue any bonds or repurchase any of its common stock during the year.The net cash provided by (used in)financing activities for the year was:A)$(46)

B)$(31)

C)$1

D)$(76)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

47

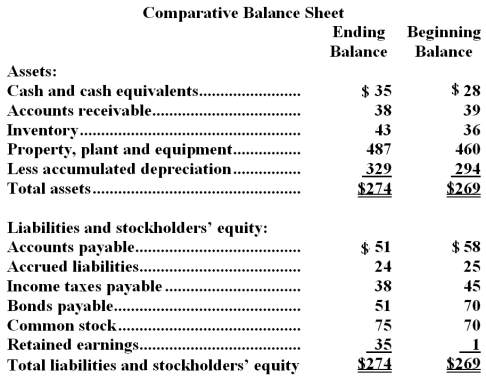

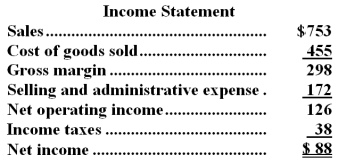

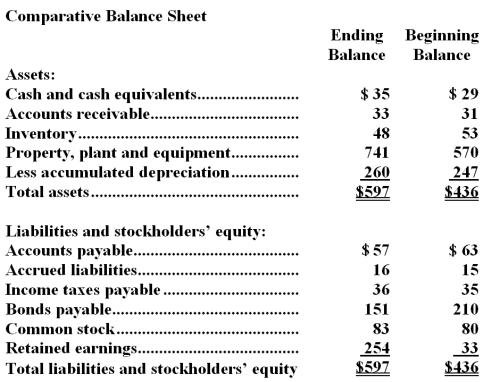

The most recent balance sheet and income statement of Swanigan Corporation appear below:

Cash dividends were $18.The company did not sell or retire any property,plant,and equipment during the year.The net cash provided by (used in)operating activities for the year was:

Cash dividends were $18.The company did not sell or retire any property,plant,and equipment during the year.The net cash provided by (used in)operating activities for the year was:

A)$127

B)$39

C)$49

D)$126

Cash dividends were $18.The company did not sell or retire any property,plant,and equipment during the year.The net cash provided by (used in)operating activities for the year was:

Cash dividends were $18.The company did not sell or retire any property,plant,and equipment during the year.The net cash provided by (used in)operating activities for the year was:A)$127

B)$39

C)$49

D)$126

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

48

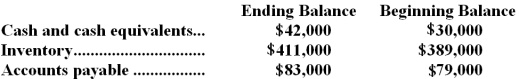

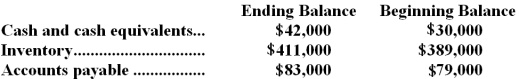

Kahn Company is a merchandiser that reported net income of $90,000.Additional information follows:  Based on this information,under the indirect method the cash provided by operating activities on the statement of cash flows would be:

Based on this information,under the indirect method the cash provided by operating activities on the statement of cash flows would be:

A)$90,000.

B)$99,000.

C)$81,000.

D)$79,000.

Based on this information,under the indirect method the cash provided by operating activities on the statement of cash flows would be:

Based on this information,under the indirect method the cash provided by operating activities on the statement of cash flows would be:A)$90,000.

B)$99,000.

C)$81,000.

D)$79,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

49

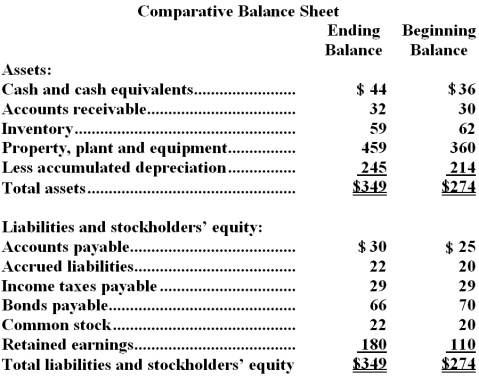

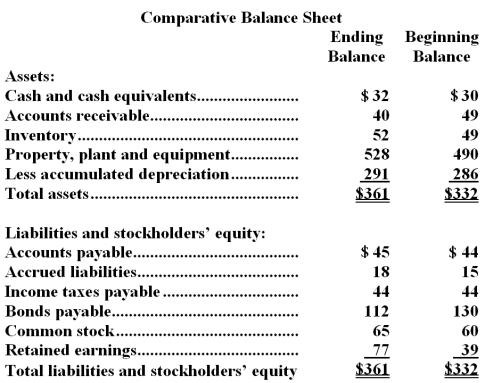

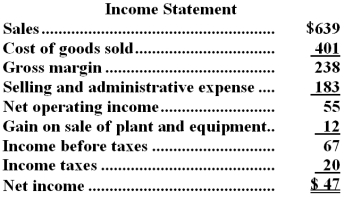

Dooling Corporation's balance sheet and income statement appear below:

Cash dividends were $14.The company sold equipment for $15 that was originally purchased for $11 and that had accumulated depreciation of $3.The net cash provided by (used in)investing activities for the year was:

Cash dividends were $14.The company sold equipment for $15 that was originally purchased for $11 and that had accumulated depreciation of $3.The net cash provided by (used in)investing activities for the year was:

A)$(83)

B)$68

C)$15

D)$(68)

Cash dividends were $14.The company sold equipment for $15 that was originally purchased for $11 and that had accumulated depreciation of $3.The net cash provided by (used in)investing activities for the year was:

Cash dividends were $14.The company sold equipment for $15 that was originally purchased for $11 and that had accumulated depreciation of $3.The net cash provided by (used in)investing activities for the year was:A)$(83)

B)$68

C)$15

D)$(68)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

50

Lemar Corporation's net cash provided by operating activities was $70;its income taxes were $13;its capital expenditures were $67;and its cash dividends were $5.The company's free cash flow was:

A)$155

B)-$59

C)$11

D)-$2

A)$155

B)-$59

C)$11

D)-$2

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

51

Boole Corporation's net cash provided by operating activities was $112;its capital expenditures were $76;and its cash dividends were $31.The company's free cash flow was:

A)$36

B)$81

C)$219

D)$5

A)$36

B)$81

C)$219

D)$5

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

52

The following events occurred last year at Dewhurst Company:  Based on the above information,the cash provided (used)by investing activities for the year on the statement of cash flows would net to:

Based on the above information,the cash provided (used)by investing activities for the year on the statement of cash flows would net to:

A)$(21,000)

B)$(15,000)

C)$(7,000)

D)$(37,000)

Based on the above information,the cash provided (used)by investing activities for the year on the statement of cash flows would net to:

Based on the above information,the cash provided (used)by investing activities for the year on the statement of cash flows would net to:A)$(21,000)

B)$(15,000)

C)$(7,000)

D)$(37,000)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

53

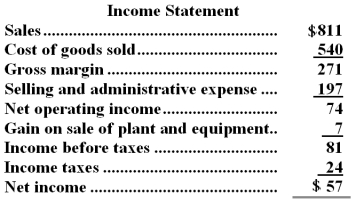

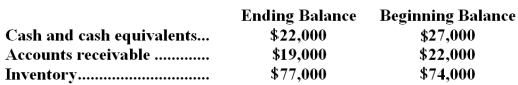

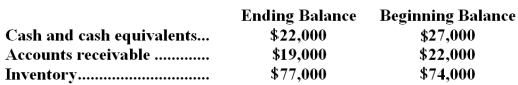

More Company's net income last year was $37,000.The company paid a cash dividend of $2,000 and did not sell or retire any property,plant,and equipment last year.Changes in selected balance sheet accounts for the year appear below:  Based solely on this information,the net cash provided by operating activities under the indirect method on the statement of cash flows would be:

Based solely on this information,the net cash provided by operating activities under the indirect method on the statement of cash flows would be:

A)$63,000

B)$32,000

C)$18,000

D)$56,000

Based solely on this information,the net cash provided by operating activities under the indirect method on the statement of cash flows would be:

Based solely on this information,the net cash provided by operating activities under the indirect method on the statement of cash flows would be:A)$63,000

B)$32,000

C)$18,000

D)$56,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

54

Excerpts from Dibello Corporation's comparative balance sheet appear below:  Which of the following is the correct treatment within the operating activities section of the statement of cash flows using the indirect method?

Which of the following is the correct treatment within the operating activities section of the statement of cash flows using the indirect method?

A)The change in Accounts Receivable is added to net income;The change in Inventory is added to net income

B)The change in Accounts Receivable is added to net income;The change in Inventory is subtracted from net income

C)The change in Accounts Receivable is subtracted from net income;The change in Inventory is subtracted from net income

D)The change in Accounts Receivable is subtracted from net income;The change in Inventory is added to net income

Which of the following is the correct treatment within the operating activities section of the statement of cash flows using the indirect method?

Which of the following is the correct treatment within the operating activities section of the statement of cash flows using the indirect method?A)The change in Accounts Receivable is added to net income;The change in Inventory is added to net income

B)The change in Accounts Receivable is added to net income;The change in Inventory is subtracted from net income

C)The change in Accounts Receivable is subtracted from net income;The change in Inventory is subtracted from net income

D)The change in Accounts Receivable is subtracted from net income;The change in Inventory is added to net income

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

55

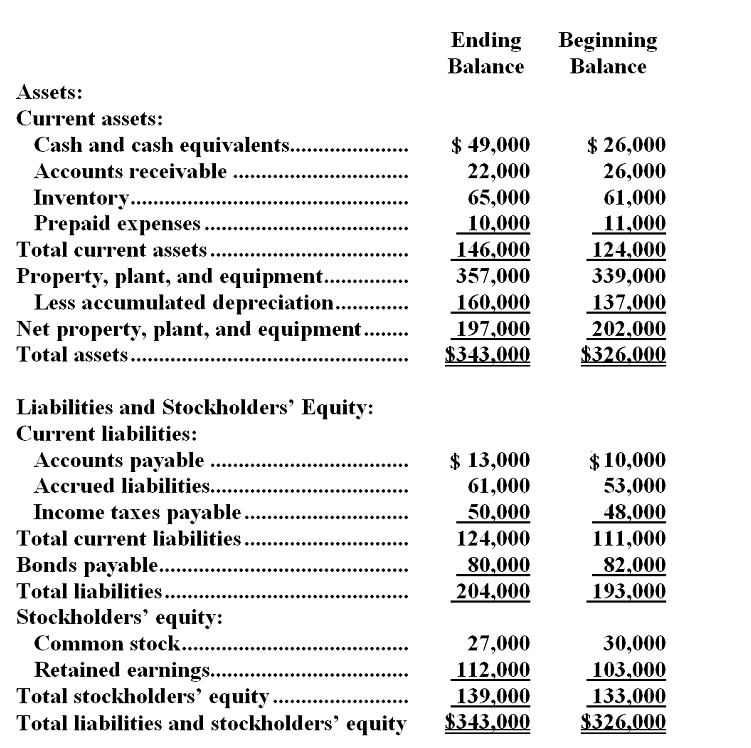

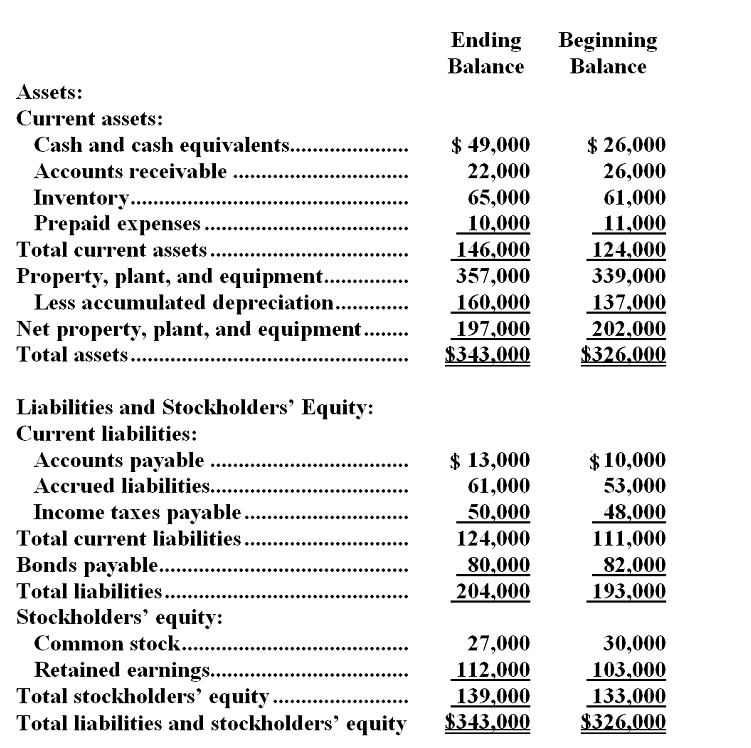

Cezar Corporation's comparative balance sheet appears below:  The company did not dispose of any property,plant,and equipment during the year.Its net income for the year was $10,000 and its cash dividends were $4,000.The company did not retire any bonds payable or issue any common stock during the year.Its net cash provided by operating activities and net cash used in financing activities are:

The company did not dispose of any property,plant,and equipment during the year.Its net income for the year was $10,000 and its cash dividends were $4,000.The company did not retire any bonds payable or issue any common stock during the year.Its net cash provided by operating activities and net cash used in financing activities are:

A)net cash provided by operating activities,$35,000;net cash used in financing activities,$8,000

B)net cash provided by operating activities,$35,000;net cash used in financing activities,$4,000

C)net cash provided by operating activities,$39,000;net cash used in financing activities,$8,000

D)net cash provided by operating activities,$39,000;net cash used in financing activities,$4,000

The company did not dispose of any property,plant,and equipment during the year.Its net income for the year was $10,000 and its cash dividends were $4,000.The company did not retire any bonds payable or issue any common stock during the year.Its net cash provided by operating activities and net cash used in financing activities are:

The company did not dispose of any property,plant,and equipment during the year.Its net income for the year was $10,000 and its cash dividends were $4,000.The company did not retire any bonds payable or issue any common stock during the year.Its net cash provided by operating activities and net cash used in financing activities are:A)net cash provided by operating activities,$35,000;net cash used in financing activities,$8,000

B)net cash provided by operating activities,$35,000;net cash used in financing activities,$4,000

C)net cash provided by operating activities,$39,000;net cash used in financing activities,$8,000

D)net cash provided by operating activities,$39,000;net cash used in financing activities,$4,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

56

Schleich Corporation's most recent balance sheet appears below:  Net income for the year was $274.Cash dividends were $53.The company did not sell or retire any property,plant,and equipment during the year.The net cash provided by (used in)operating activities for the year was:

Net income for the year was $274.Cash dividends were $53.The company did not sell or retire any property,plant,and equipment during the year.The net cash provided by (used in)operating activities for the year was:

A)$286

B)$262

C)$391

D)$12

Net income for the year was $274.Cash dividends were $53.The company did not sell or retire any property,plant,and equipment during the year.The net cash provided by (used in)operating activities for the year was:

Net income for the year was $274.Cash dividends were $53.The company did not sell or retire any property,plant,and equipment during the year.The net cash provided by (used in)operating activities for the year was:A)$286

B)$262

C)$391

D)$12

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

57

Frizz Hair Salon had net income of $93,000 for the year just ended.Frizz collected the following additional information to prepare its statement of cash flows for the year:  Frizz uses the indirect method to prepare its statement of cash flows.What is Frizz's net cash provided (used)by operating activities?

Frizz uses the indirect method to prepare its statement of cash flows.What is Frizz's net cash provided (used)by operating activities?

A)$92,000

B)$102,000

C)$120,000

D)$126,000

Frizz uses the indirect method to prepare its statement of cash flows.What is Frizz's net cash provided (used)by operating activities?

Frizz uses the indirect method to prepare its statement of cash flows.What is Frizz's net cash provided (used)by operating activities?A)$92,000

B)$102,000

C)$120,000

D)$126,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

58

Excerpts from Raimo Corporation's comparative balance sheet appear below:  Which of the following is the correct treatment within the operating activities section of the statement of cash flows using the indirect method?

Which of the following is the correct treatment within the operating activities section of the statement of cash flows using the indirect method?

A)The change in Inventory is added to net income;The change in Accounts Payable is added to net income

B)The change in Inventory is added to net income;The change in Accounts Payable is subtracted from net income

C)The change in Inventory is subtracted from net income;The change in Accounts Payable is added to net income

D)The change in Inventory is subtracted from net income;The change in Accounts Payable is subtracted from net income

Which of the following is the correct treatment within the operating activities section of the statement of cash flows using the indirect method?

Which of the following is the correct treatment within the operating activities section of the statement of cash flows using the indirect method?A)The change in Inventory is added to net income;The change in Accounts Payable is added to net income

B)The change in Inventory is added to net income;The change in Accounts Payable is subtracted from net income

C)The change in Inventory is subtracted from net income;The change in Accounts Payable is added to net income

D)The change in Inventory is subtracted from net income;The change in Accounts Payable is subtracted from net income

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

59

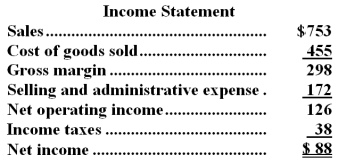

Mccloe Corporation's balance sheet and income statement appear below:

Cash dividends were $9.The company did not issue any bonds or repurchase any of its own common stock during the year.The net cash provided by (used in)financing activities for the year was:

Cash dividends were $9.The company did not issue any bonds or repurchase any of its own common stock during the year.The net cash provided by (used in)financing activities for the year was:

A)$5

B)$(22)

C)$(18)

D)$(9)

Cash dividends were $9.The company did not issue any bonds or repurchase any of its own common stock during the year.The net cash provided by (used in)financing activities for the year was:

Cash dividends were $9.The company did not issue any bonds or repurchase any of its own common stock during the year.The net cash provided by (used in)financing activities for the year was:A)$5

B)$(22)

C)$(18)

D)$(9)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

60

Cannedy Corporation's most recent balance sheet appears below:  The company's net income for the year was $74 and it did not sell or retire any property,plant,and equipment during the year.Cash dividends were $21.The net cash provided by (used in)investing activities for the year was:

The company's net income for the year was $74 and it did not sell or retire any property,plant,and equipment during the year.Cash dividends were $21.The net cash provided by (used in)investing activities for the year was:

A)$(53)

B)$35

C)$(35)

D)$53

The company's net income for the year was $74 and it did not sell or retire any property,plant,and equipment during the year.Cash dividends were $21.The net cash provided by (used in)investing activities for the year was:

The company's net income for the year was $74 and it did not sell or retire any property,plant,and equipment during the year.Cash dividends were $21.The net cash provided by (used in)investing activities for the year was:A)$(53)

B)$35

C)$(35)

D)$53

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

61

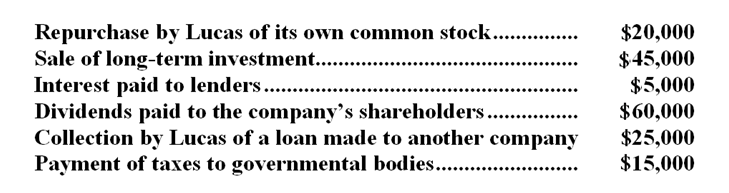

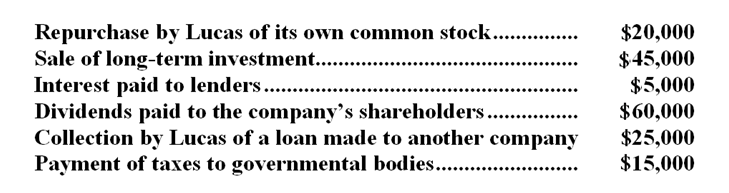

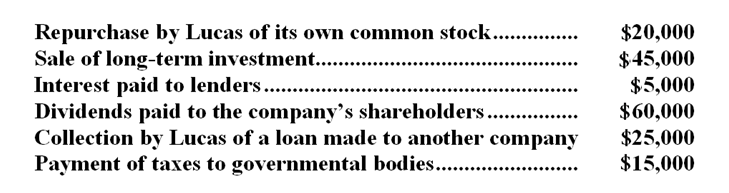

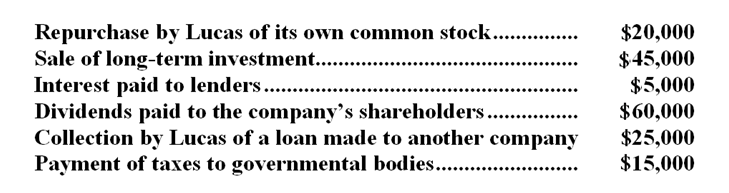

Lucas Company recorded the following events last year:  On the statement of cash flows, some of these events are classified as operating activities, some are classified as investing activities, and some are classified as financing activities.

On the statement of cash flows, some of these events are classified as operating activities, some are classified as investing activities, and some are classified as financing activities.

-Based solely on the information above,the net cash provided by (used in)investing activities on the statement of cash flows would be:

A)$(5,000)

B)$10,000

C)$70,000

D)$(30,000)

On the statement of cash flows, some of these events are classified as operating activities, some are classified as investing activities, and some are classified as financing activities.

On the statement of cash flows, some of these events are classified as operating activities, some are classified as investing activities, and some are classified as financing activities.-Based solely on the information above,the net cash provided by (used in)investing activities on the statement of cash flows would be:

A)$(5,000)

B)$10,000

C)$70,000

D)$(30,000)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

62

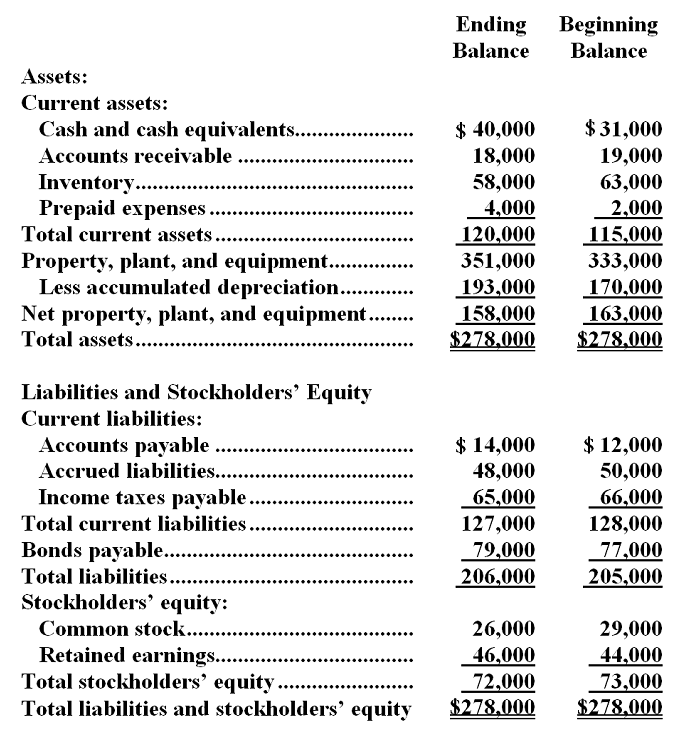

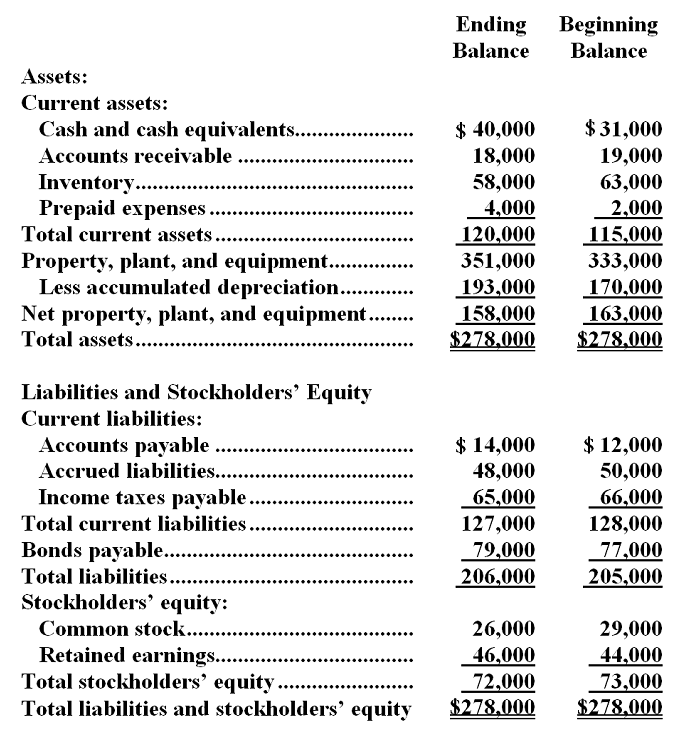

Hocking Corporation's comparative balance sheet appears below:  The company's net income (loss) for the year was $10,000 and its cash dividends were $1,000. It did not sell or retire any property, plant, and equipment during the year. The company uses the indirect method to determine the net cash provided by operating activities

The company's net income (loss) for the year was $10,000 and its cash dividends were $1,000. It did not sell or retire any property, plant, and equipment during the year. The company uses the indirect method to determine the net cash provided by operating activities

-Which of the following is correct regarding the operating activities section of the statement of cash flows?

A)The change in Accounts Payable will be added to net income;The change in Accrued Liabilities will be subtracted from net income

B)The change in Accounts Payable will be subtracted from net income;The change in Accrued Liabilities will be added to net income

C)The change in Accounts Payable will be subtracted from net income;The change in Accrued Liabilities will be subtracted from net income

D)The change in Accounts Payable will be added to net income;The change in Accrued Liabilities will be added to net income

The company's net income (loss) for the year was $10,000 and its cash dividends were $1,000. It did not sell or retire any property, plant, and equipment during the year. The company uses the indirect method to determine the net cash provided by operating activities

The company's net income (loss) for the year was $10,000 and its cash dividends were $1,000. It did not sell or retire any property, plant, and equipment during the year. The company uses the indirect method to determine the net cash provided by operating activities-Which of the following is correct regarding the operating activities section of the statement of cash flows?

A)The change in Accounts Payable will be added to net income;The change in Accrued Liabilities will be subtracted from net income

B)The change in Accounts Payable will be subtracted from net income;The change in Accrued Liabilities will be added to net income

C)The change in Accounts Payable will be subtracted from net income;The change in Accrued Liabilities will be subtracted from net income

D)The change in Accounts Payable will be added to net income;The change in Accrued Liabilities will be added to net income

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

63

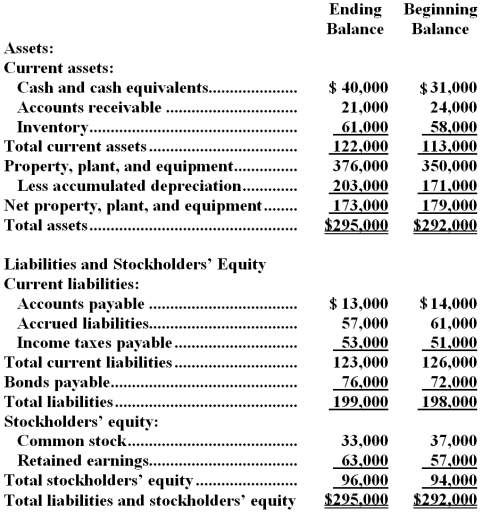

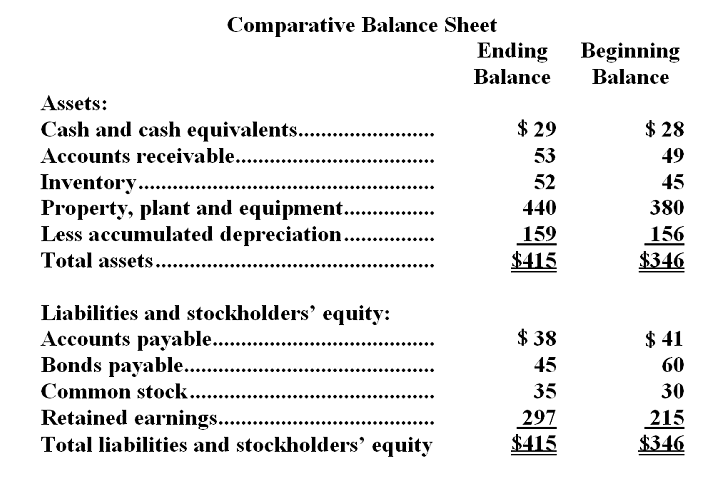

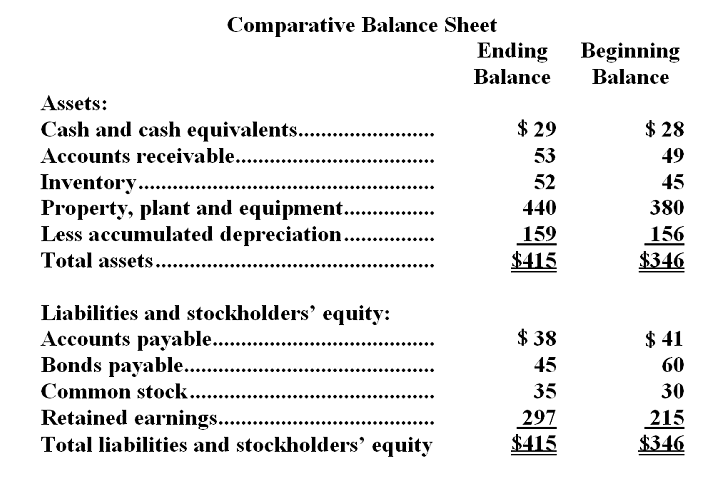

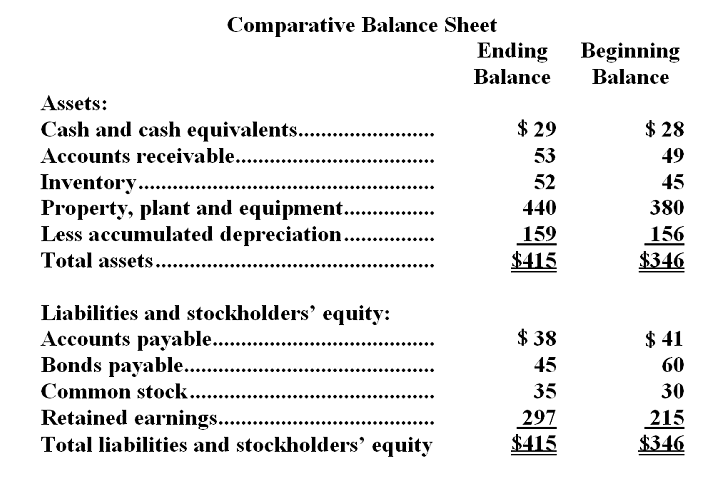

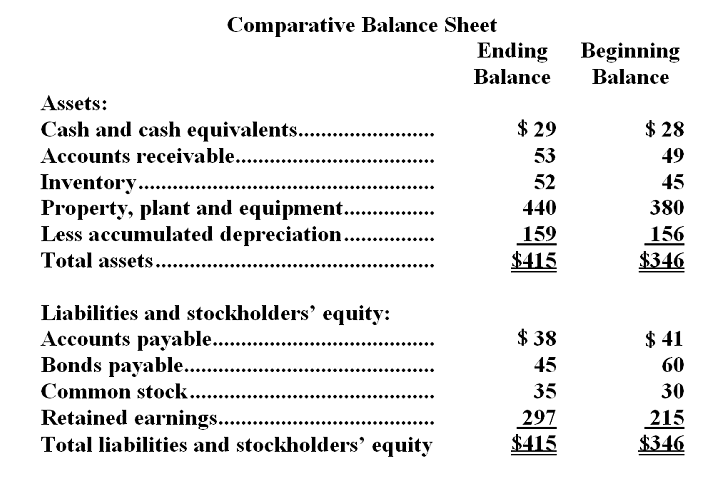

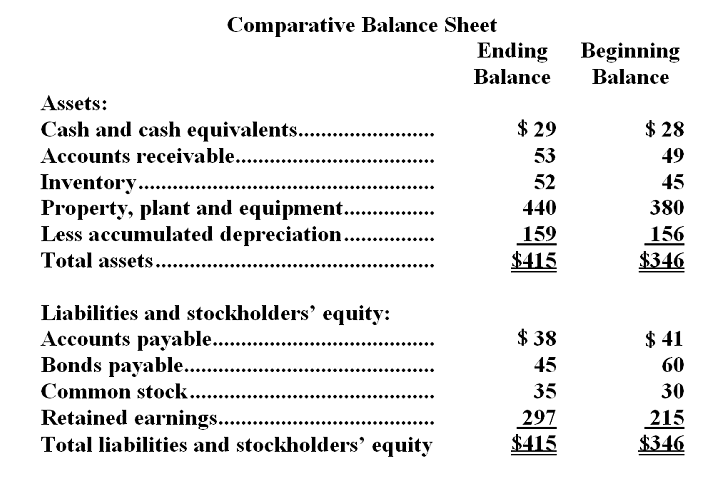

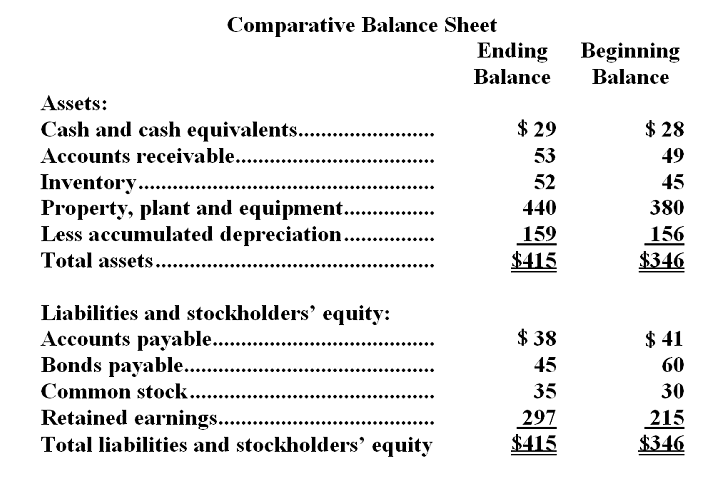

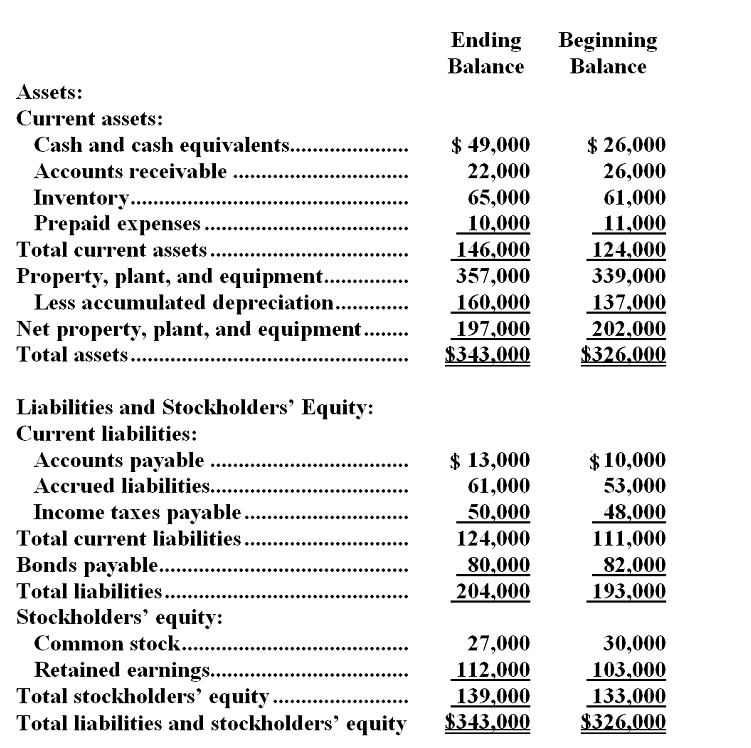

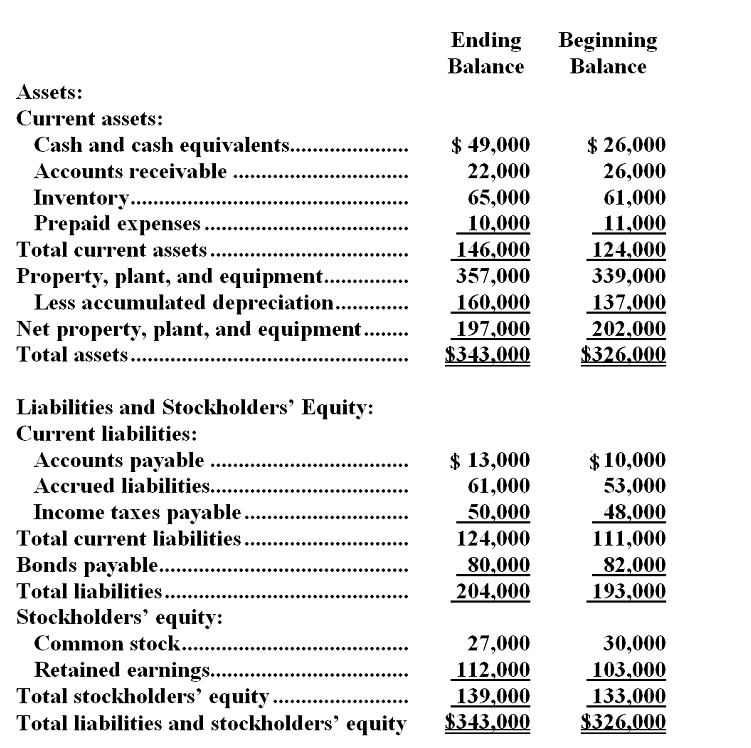

Threets Corporation's most recent comparative balance sheet appears below:  The company's net income for the year was $109 and it paid a cash dividend. It did not dispose of any property, plant, and equipment during the year. The company did not issue any bonds payable or repurchase any of its own common stock.

The company's net income for the year was $109 and it paid a cash dividend. It did not dispose of any property, plant, and equipment during the year. The company did not issue any bonds payable or repurchase any of its own common stock.

-The net cash provided by (used in)financing activities for the year was:

A)$(37)

B)$5

C)$(15)

D)$(27)

The company's net income for the year was $109 and it paid a cash dividend. It did not dispose of any property, plant, and equipment during the year. The company did not issue any bonds payable or repurchase any of its own common stock.

The company's net income for the year was $109 and it paid a cash dividend. It did not dispose of any property, plant, and equipment during the year. The company did not issue any bonds payable or repurchase any of its own common stock.-The net cash provided by (used in)financing activities for the year was:

A)$(37)

B)$5

C)$(15)

D)$(27)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

64

Binnie Corporation's most recent balance sheet appears below:  Net income for the year was $83. Cash dividends were $16. The company did not dispose of any property, plant, and equipment. It did not issue any bonds payable or repurchase any of its own common stock. The following questions pertain to the company's statement of cash flows.

Net income for the year was $83. Cash dividends were $16. The company did not dispose of any property, plant, and equipment. It did not issue any bonds payable or repurchase any of its own common stock. The following questions pertain to the company's statement of cash flows.

-The net cash provided by (used in)operating activities for the year was:

A)$99

B)$67

C)$16

D)$119

Net income for the year was $83. Cash dividends were $16. The company did not dispose of any property, plant, and equipment. It did not issue any bonds payable or repurchase any of its own common stock. The following questions pertain to the company's statement of cash flows.

Net income for the year was $83. Cash dividends were $16. The company did not dispose of any property, plant, and equipment. It did not issue any bonds payable or repurchase any of its own common stock. The following questions pertain to the company's statement of cash flows.-The net cash provided by (used in)operating activities for the year was:

A)$99

B)$67

C)$16

D)$119

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

65

Hocking Corporation's comparative balance sheet appears below:  The company's net income (loss) for the year was $10,000 and its cash dividends were $1,000. It did not sell or retire any property, plant, and equipment during the year. The company uses the indirect method to determine the net cash provided by operating activities

The company's net income (loss) for the year was $10,000 and its cash dividends were $1,000. It did not sell or retire any property, plant, and equipment during the year. The company uses the indirect method to determine the net cash provided by operating activities

-The company's net cash used in investing activities is:

A)$5,000

B)$18,000

C)$27,000

D)$41,000

The company's net income (loss) for the year was $10,000 and its cash dividends were $1,000. It did not sell or retire any property, plant, and equipment during the year. The company uses the indirect method to determine the net cash provided by operating activities

The company's net income (loss) for the year was $10,000 and its cash dividends were $1,000. It did not sell or retire any property, plant, and equipment during the year. The company uses the indirect method to determine the net cash provided by operating activities-The company's net cash used in investing activities is:

A)$5,000

B)$18,000

C)$27,000

D)$41,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

66

Lucas Company recorded the following events last year:  On the statement of cash flows, some of these events are classified as operating activities, some are classified as investing activities, and some are classified as financing activities.

On the statement of cash flows, some of these events are classified as operating activities, some are classified as investing activities, and some are classified as financing activities.

-Based solely on the information above,the net cash provided by (used in)financing activities on the statement of cash flows would be:

A)$85,000

B)$(80,000)

C)$(145,000)

D)$170,000

On the statement of cash flows, some of these events are classified as operating activities, some are classified as investing activities, and some are classified as financing activities.

On the statement of cash flows, some of these events are classified as operating activities, some are classified as investing activities, and some are classified as financing activities.-Based solely on the information above,the net cash provided by (used in)financing activities on the statement of cash flows would be:

A)$85,000

B)$(80,000)

C)$(145,000)

D)$170,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

67

Threets Corporation's most recent comparative balance sheet appears below:  The company's net income for the year was $109 and it paid a cash dividend. It did not dispose of any property, plant, and equipment during the year. The company did not issue any bonds payable or repurchase any of its own common stock.

The company's net income for the year was $109 and it paid a cash dividend. It did not dispose of any property, plant, and equipment during the year. The company did not issue any bonds payable or repurchase any of its own common stock.

-The net cash provided by (used in)investing activities for the year was:

A)$(60)

B)$(57)

C)$57

D)$60

The company's net income for the year was $109 and it paid a cash dividend. It did not dispose of any property, plant, and equipment during the year. The company did not issue any bonds payable or repurchase any of its own common stock.

The company's net income for the year was $109 and it paid a cash dividend. It did not dispose of any property, plant, and equipment during the year. The company did not issue any bonds payable or repurchase any of its own common stock.-The net cash provided by (used in)investing activities for the year was:

A)$(60)

B)$(57)

C)$57

D)$60

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

68

Megna Company's net income last year was $143,000. Changes in the company's balance sheet accounts for the year appear below:  The company paid a cash dividend and it did not dispose of any long-term investments or property, plant, and equipment. The company did not issue any bonds payable or repurchase any of its own common stock. The following questions pertain to the company's statement of cash flows.

The company paid a cash dividend and it did not dispose of any long-term investments or property, plant, and equipment. The company did not issue any bonds payable or repurchase any of its own common stock. The following questions pertain to the company's statement of cash flows.

-The net cash provided by (used in)operating activities last year was:

A)$143,000

B)$201,000

C)$139,000

D)$197,000

The company paid a cash dividend and it did not dispose of any long-term investments or property, plant, and equipment. The company did not issue any bonds payable or repurchase any of its own common stock. The following questions pertain to the company's statement of cash flows.

The company paid a cash dividend and it did not dispose of any long-term investments or property, plant, and equipment. The company did not issue any bonds payable or repurchase any of its own common stock. The following questions pertain to the company's statement of cash flows.-The net cash provided by (used in)operating activities last year was:

A)$143,000

B)$201,000

C)$139,000

D)$197,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

69

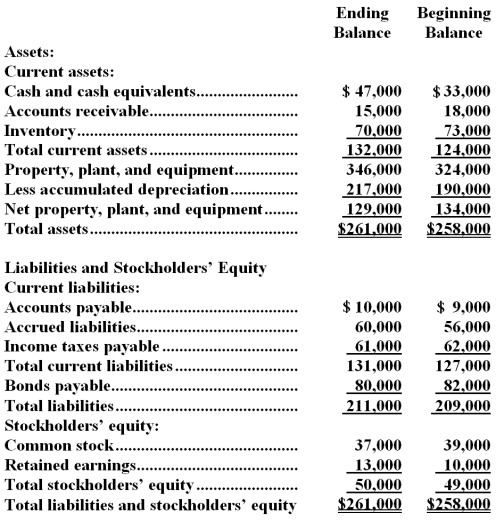

Colosi Corporation's comparative balance sheet appears below:  The company's net income (loss) for the year was $3,000 and its cash dividends were $1,000. It did not sell or retire any property, plant, and equipment during the year.

The company's net income (loss) for the year was $3,000 and its cash dividends were $1,000. It did not sell or retire any property, plant, and equipment during the year.

-The company's net cash provided by operating activities is:

A)$27,000

B)$29,000

C)$31,000

D)$6,000

The company's net income (loss) for the year was $3,000 and its cash dividends were $1,000. It did not sell or retire any property, plant, and equipment during the year.

The company's net income (loss) for the year was $3,000 and its cash dividends were $1,000. It did not sell or retire any property, plant, and equipment during the year.-The company's net cash provided by operating activities is:

A)$27,000

B)$29,000

C)$31,000

D)$6,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

70

Megna Company's net income last year was $143,000. Changes in the company's balance sheet accounts for the year appear below:  The company paid a cash dividend and it did not dispose of any long-term investments or property, plant, and equipment. The company did not issue any bonds payable or repurchase any of its own common stock. The following questions pertain to the company's statement of cash flows.

The company paid a cash dividend and it did not dispose of any long-term investments or property, plant, and equipment. The company did not issue any bonds payable or repurchase any of its own common stock. The following questions pertain to the company's statement of cash flows.

-The net cash provided by (used in)financing activities last year was:

A)$20,000

B)$(20,000)

C)$69,000

D)$(69,000)

The company paid a cash dividend and it did not dispose of any long-term investments or property, plant, and equipment. The company did not issue any bonds payable or repurchase any of its own common stock. The following questions pertain to the company's statement of cash flows.

The company paid a cash dividend and it did not dispose of any long-term investments or property, plant, and equipment. The company did not issue any bonds payable or repurchase any of its own common stock. The following questions pertain to the company's statement of cash flows.-The net cash provided by (used in)financing activities last year was:

A)$20,000

B)$(20,000)

C)$69,000

D)$(69,000)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

71

Megna Company's net income last year was $143,000. Changes in the company's balance sheet accounts for the year appear below:  The company paid a cash dividend and it did not dispose of any long-term investments or property, plant, and equipment. The company did not issue any bonds payable or repurchase any of its own common stock. The following questions pertain to the company's statement of cash flows.

The company paid a cash dividend and it did not dispose of any long-term investments or property, plant, and equipment. The company did not issue any bonds payable or repurchase any of its own common stock. The following questions pertain to the company's statement of cash flows.

-The net cash provided by (used in)investing activities last year was:

A)$(95,000)

B)$95,000

C)$(125,000)

D)$125,000

The company paid a cash dividend and it did not dispose of any long-term investments or property, plant, and equipment. The company did not issue any bonds payable or repurchase any of its own common stock. The following questions pertain to the company's statement of cash flows.

The company paid a cash dividend and it did not dispose of any long-term investments or property, plant, and equipment. The company did not issue any bonds payable or repurchase any of its own common stock. The following questions pertain to the company's statement of cash flows.-The net cash provided by (used in)investing activities last year was:

A)$(95,000)

B)$95,000

C)$(125,000)

D)$125,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

72

Hocking Corporation's comparative balance sheet appears below:  The company's net income (loss) for the year was $10,000 and its cash dividends were $1,000. It did not sell or retire any property, plant, and equipment during the year. The company uses the indirect method to determine the net cash provided by operating activities

The company's net income (loss) for the year was $10,000 and its cash dividends were $1,000. It did not sell or retire any property, plant, and equipment during the year. The company uses the indirect method to determine the net cash provided by operating activities

-The company's net cash provided by operating activities is:

A)$47,000

B)$51,000

C)$43,000

D)$24,000

The company's net income (loss) for the year was $10,000 and its cash dividends were $1,000. It did not sell or retire any property, plant, and equipment during the year. The company uses the indirect method to determine the net cash provided by operating activities

The company's net income (loss) for the year was $10,000 and its cash dividends were $1,000. It did not sell or retire any property, plant, and equipment during the year. The company uses the indirect method to determine the net cash provided by operating activities-The company's net cash provided by operating activities is:

A)$47,000

B)$51,000

C)$43,000

D)$24,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

73

Threets Corporation's most recent comparative balance sheet appears below:  The company's net income for the year was $109 and it paid a cash dividend. It did not dispose of any property, plant, and equipment during the year. The company did not issue any bonds payable or repurchase any of its own common stock.

The company's net income for the year was $109 and it paid a cash dividend. It did not dispose of any property, plant, and equipment during the year. The company did not issue any bonds payable or repurchase any of its own common stock.

-The free cash flow for the year was:

A)$38

B)$71

C)$285

D)$11

The company's net income for the year was $109 and it paid a cash dividend. It did not dispose of any property, plant, and equipment during the year. The company did not issue any bonds payable or repurchase any of its own common stock.

The company's net income for the year was $109 and it paid a cash dividend. It did not dispose of any property, plant, and equipment during the year. The company did not issue any bonds payable or repurchase any of its own common stock.-The free cash flow for the year was:

A)$38

B)$71

C)$285

D)$11

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

74

Hocking Corporation's comparative balance sheet appears below:  The company's net income (loss) for the year was $10,000 and its cash dividends were $1,000. It did not sell or retire any property, plant, and equipment during the year. The company uses the indirect method to determine the net cash provided by operating activities

The company's net income (loss) for the year was $10,000 and its cash dividends were $1,000. It did not sell or retire any property, plant, and equipment during the year. The company uses the indirect method to determine the net cash provided by operating activities

-Which of the following is correct regarding the operating activities section of the statement of cash flows?

A)The change in Accounts Receivable will be subtracted from net income;The change in Inventory will be added to net income

B)The change in Accounts Receivable will be added to net income;The change in Inventory will be subtracted from net income

C)The change in Accounts Receivable will be added to net income;The change in Inventory will be added to net income

D)The change in Accounts Receivable will be subtracted from net income;The change in Inventory will be subtracted from net income

The company's net income (loss) for the year was $10,000 and its cash dividends were $1,000. It did not sell or retire any property, plant, and equipment during the year. The company uses the indirect method to determine the net cash provided by operating activities

The company's net income (loss) for the year was $10,000 and its cash dividends were $1,000. It did not sell or retire any property, plant, and equipment during the year. The company uses the indirect method to determine the net cash provided by operating activities-Which of the following is correct regarding the operating activities section of the statement of cash flows?

A)The change in Accounts Receivable will be subtracted from net income;The change in Inventory will be added to net income

B)The change in Accounts Receivable will be added to net income;The change in Inventory will be subtracted from net income

C)The change in Accounts Receivable will be added to net income;The change in Inventory will be added to net income

D)The change in Accounts Receivable will be subtracted from net income;The change in Inventory will be subtracted from net income

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

75

Threets Corporation's most recent comparative balance sheet appears below:  The company's net income for the year was $109 and it paid a cash dividend. It did not dispose of any property, plant, and equipment during the year. The company did not issue any bonds payable or repurchase any of its own common stock.

The company's net income for the year was $109 and it paid a cash dividend. It did not dispose of any property, plant, and equipment during the year. The company did not issue any bonds payable or repurchase any of its own common stock.

-The net cash provided by (used in)operating activities for the year was:

A)$120

B)$98

C)$(11)

D)$156

The company's net income for the year was $109 and it paid a cash dividend. It did not dispose of any property, plant, and equipment during the year. The company did not issue any bonds payable or repurchase any of its own common stock.

The company's net income for the year was $109 and it paid a cash dividend. It did not dispose of any property, plant, and equipment during the year. The company did not issue any bonds payable or repurchase any of its own common stock.-The net cash provided by (used in)operating activities for the year was:

A)$120

B)$98

C)$(11)

D)$156

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

76

Spade Company recorded the following events last year: On the statement of cash flows, some of these events are classified as operating activities, some are classified as investing activities, and some are classified as financing activities.

On the statement of cash flows, some of these events are classified as operating activities, some are classified as investing activities, and some are classified as financing activities.

-Based solely on the information above,the net cash provided by (used in)investing activities on the statement of cash flows would be:

A)$(947,000)

B)$(430,000)

C)$(300,000)

D)$(620,000)

On the statement of cash flows, some of these events are classified as operating activities, some are classified as investing activities, and some are classified as financing activities.

On the statement of cash flows, some of these events are classified as operating activities, some are classified as investing activities, and some are classified as financing activities.-Based solely on the information above,the net cash provided by (used in)investing activities on the statement of cash flows would be:

A)$(947,000)

B)$(430,000)

C)$(300,000)

D)$(620,000)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

77

Spade Company recorded the following events last year: On the statement of cash flows, some of these events are classified as operating activities, some are classified as investing activities, and some are classified as financing activities.

On the statement of cash flows, some of these events are classified as operating activities, some are classified as investing activities, and some are classified as financing activities.

-Based solely on the information above,the net cash provided by (used in)financing activities on the statement of cash flows would be:

A)$41,000

B)$(85,000)

C)$947,000

D)$(67,000)

On the statement of cash flows, some of these events are classified as operating activities, some are classified as investing activities, and some are classified as financing activities.

On the statement of cash flows, some of these events are classified as operating activities, some are classified as investing activities, and some are classified as financing activities.-Based solely on the information above,the net cash provided by (used in)financing activities on the statement of cash flows would be:

A)$41,000

B)$(85,000)

C)$947,000

D)$(67,000)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

78

Colosi Corporation's comparative balance sheet appears below:  The company's net income (loss) for the year was $3,000 and its cash dividends were $1,000. It did not sell or retire any property, plant, and equipment during the year.

The company's net income (loss) for the year was $3,000 and its cash dividends were $1,000. It did not sell or retire any property, plant, and equipment during the year.

-The company's net cash used in investing activities is:

A)$41,000

B)$5,000

C)$9,000

D)$18,000

The company's net income (loss) for the year was $3,000 and its cash dividends were $1,000. It did not sell or retire any property, plant, and equipment during the year.

The company's net income (loss) for the year was $3,000 and its cash dividends were $1,000. It did not sell or retire any property, plant, and equipment during the year.-The company's net cash used in investing activities is:

A)$41,000

B)$5,000

C)$9,000

D)$18,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

79

Hocking Corporation's comparative balance sheet appears below:  The company's net income (loss) for the year was $10,000 and its cash dividends were $1,000. It did not sell or retire any property, plant, and equipment during the year. The company uses the indirect method to determine the net cash provided by operating activities

The company's net income (loss) for the year was $10,000 and its cash dividends were $1,000. It did not sell or retire any property, plant, and equipment during the year. The company uses the indirect method to determine the net cash provided by operating activities

-Which of the following is correct regarding the operating activities section of the statement of cash flows?

A)The change in Prepaid Expenses will be added to net income;The change in Income Taxes Payable will be subtracted from net income

B)The change in Prepaid Expenses will be subtracted from net income;The change in Income Taxes Payable will be subtracted from net income

C)The change in Prepaid Expenses will be subtracted from net income;The change in Income Taxes Payable will be added to net income

D)The change in Prepaid Expenses will be added to net income;The change in Income Taxes Payable will be added to net income

The company's net income (loss) for the year was $10,000 and its cash dividends were $1,000. It did not sell or retire any property, plant, and equipment during the year. The company uses the indirect method to determine the net cash provided by operating activities

The company's net income (loss) for the year was $10,000 and its cash dividends were $1,000. It did not sell or retire any property, plant, and equipment during the year. The company uses the indirect method to determine the net cash provided by operating activities-Which of the following is correct regarding the operating activities section of the statement of cash flows?

A)The change in Prepaid Expenses will be added to net income;The change in Income Taxes Payable will be subtracted from net income

B)The change in Prepaid Expenses will be subtracted from net income;The change in Income Taxes Payable will be subtracted from net income

C)The change in Prepaid Expenses will be subtracted from net income;The change in Income Taxes Payable will be added to net income

D)The change in Prepaid Expenses will be added to net income;The change in Income Taxes Payable will be added to net income

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

80

Megna Company's net income last year was $143,000. Changes in the company's balance sheet accounts for the year appear below:  The company paid a cash dividend and it did not dispose of any long-term investments or property, plant, and equipment. The company did not issue any bonds payable or repurchase any of its own common stock. The following questions pertain to the company's statement of cash flows.

The company paid a cash dividend and it did not dispose of any long-term investments or property, plant, and equipment. The company did not issue any bonds payable or repurchase any of its own common stock. The following questions pertain to the company's statement of cash flows.

-The free cash flow for the year was:

A)$142,000

B)$148,000

C)$301,000

D)$93,000

The company paid a cash dividend and it did not dispose of any long-term investments or property, plant, and equipment. The company did not issue any bonds payable or repurchase any of its own common stock. The following questions pertain to the company's statement of cash flows.

The company paid a cash dividend and it did not dispose of any long-term investments or property, plant, and equipment. The company did not issue any bonds payable or repurchase any of its own common stock. The following questions pertain to the company's statement of cash flows.-The free cash flow for the year was:

A)$142,000

B)$148,000

C)$301,000

D)$93,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck