Deck 10: Performance Measurement in Decentralized Organizations

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

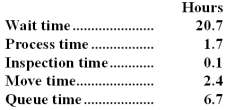

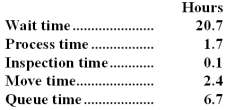

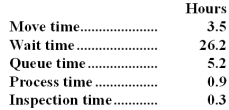

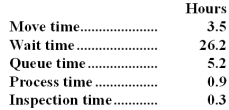

سؤال

سؤال

سؤال

سؤال

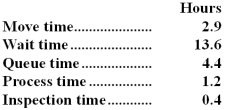

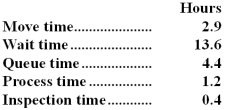

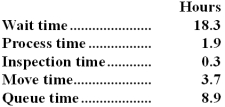

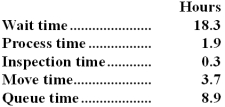

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

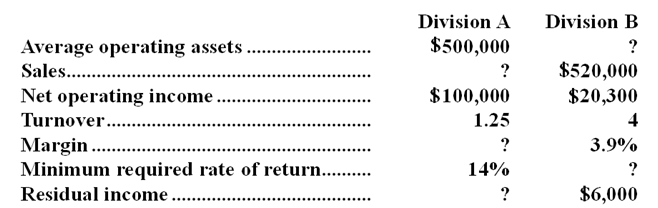

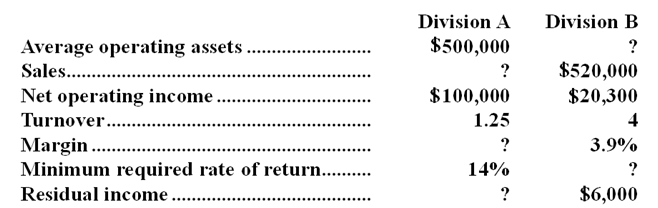

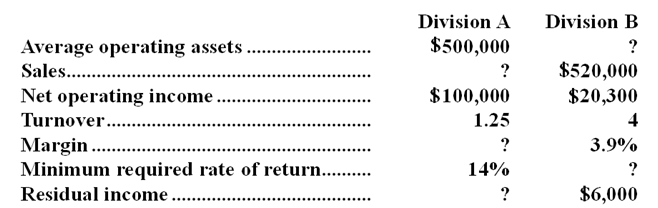

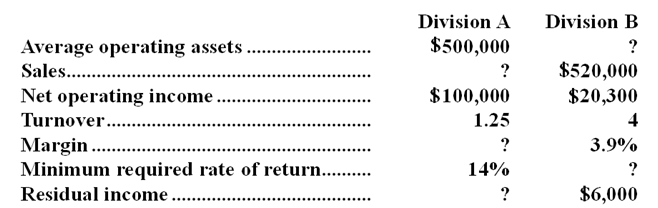

سؤال

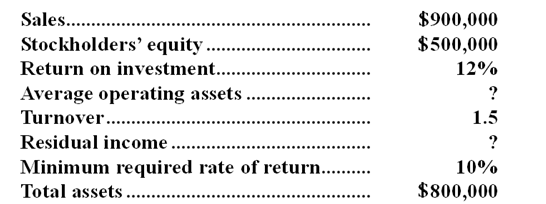

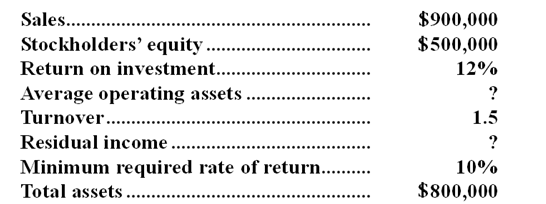

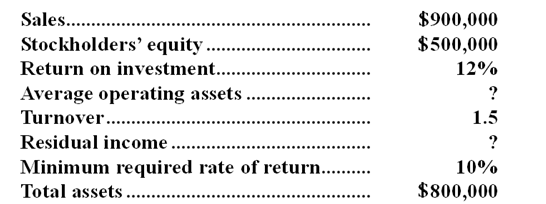

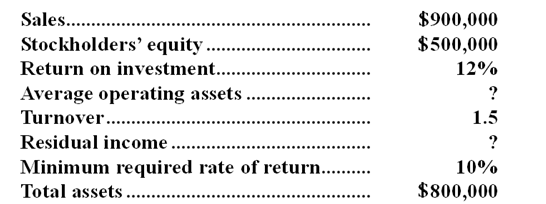

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/93

العب

ملء الشاشة (f)

Deck 10: Performance Measurement in Decentralized Organizations

1

Which of the following three statements are correct?

I.A profit center has control over both cost and revenue.

II.An investment center has control over invested funds,but not over costs and revenue.

III.A cost center has no control over sales.

A)Only I

B)Only II

C)Only I and III

D)Only I and II

I.A profit center has control over both cost and revenue.

II.An investment center has control over invested funds,but not over costs and revenue.

III.A cost center has no control over sales.

A)Only I

B)Only II

C)Only I and III

D)Only I and II

Only I and III

2

Turnover is computed by dividing average operating assets into:

A)invested capital.

B)total assets.

C)net operating income.

D)sales.

A)invested capital.

B)total assets.

C)net operating income.

D)sales.

D

3

Consider a company that has only variable costs.All other things the same,an increase in unit sales will result in no change in the return on investment.

False

4

In computing the margin in a ROI analysis,which of the following is used?

A)Sales in the denominator

B)Net operating income in the denominator

C)Average operating assets in the denominator

D)Residual income in the denominator

A)Sales in the denominator

B)Net operating income in the denominator

C)Average operating assets in the denominator

D)Residual income in the denominator

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

5

Managers of cost centers are evaluated according to the profits which their departments are able to generate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

6

If expenses exceed revenues in a department,then it would be considered a cost center.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

7

Residual income is a better measure for performance evaluation of an investment center manager than return on investment because:

A)the problems associated with measuring the asset base are eliminated.

B)desirable investment decisions will not be rejected by divisions that already have a high ROI.

C)only the gross book value of assets needs to be calculated.

D)returns do not increase as assets are depreciated.

A)the problems associated with measuring the asset base are eliminated.

B)desirable investment decisions will not be rejected by divisions that already have a high ROI.

C)only the gross book value of assets needs to be calculated.

D)returns do not increase as assets are depreciated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

8

A balanced scorecard should contain every performance measure that can be expected to influence a company's profits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

9

Residual income equals average operating assets multiplied by the difference between the return on investment and the minimum required rate of return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

10

Residual income should not be used to evaluate a cost center.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

11

Which of the following is not an operating asset?

A)Cash

B)Inventory

C)Plant equipment

D)Common stock

A)Cash

B)Inventory

C)Plant equipment

D)Common stock

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

12

The performance measures on a balanced scorecard tend to fall into four groups: financial measures,customer measures,internal business process measures,and external business process measures.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

13

The use of return on investment as a performance measure may lead managers to make decisions that are not in the best interests of the company as a whole.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

14

In determining the dollar amount to use for operating assets in the return on investment (ROI)calculation,companies will generally use either net book value or gross cost of the assets.Which of the following is an argument for the use of net book value rather than gross cost?

A)It is consistent with how assets are reported on the balance sheet.

B)It eliminates the depreciation method as a factor in ROI calculations.

C)It encourages the replacement of old,worn-out equipment.

D)All of the above.

A)It is consistent with how assets are reported on the balance sheet.

B)It eliminates the depreciation method as a factor in ROI calculations.

C)It encourages the replacement of old,worn-out equipment.

D)All of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

15

Residual income is the net operating income that an investment center earns above the minimum required return on the investment in operating assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

16

Which of the following will not result in an increase in the residual income,assuming other factors remain constant?

A)An increase in sales.

B)An increase in the minimum required rate of return.

C)A decrease in expenses.

D)A decrease in operating assets.

A)An increase in sales.

B)An increase in the minimum required rate of return.

C)A decrease in expenses.

D)A decrease in operating assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

17

All other things the same,which of the following would increase residual income?

A)Increase in average operating assets.

B)Decrease in average operating assets.

C)Increase in minimum required return.

D)Decrease in net operating income.

A)Increase in average operating assets.

B)Decrease in average operating assets.

C)Increase in minimum required return.

D)Decrease in net operating income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

18

Which of the following statements provide(s)an argument in favor of including only a plant's net book value rather than gross book value as part of operating assets in the ROI computation?

I.Net book value is consistent with how plant and equipment items are reported on a balance sheet.

II.Net book value is consistent with the computation of net operating income,which includes depreciation as an operating expense.

III.Net book value allows ROI to decrease over time as assets get older.

A)Only I.

B)Only III.

C)Only I and II.

D)Only I and III.

I.Net book value is consistent with how plant and equipment items are reported on a balance sheet.

II.Net book value is consistent with the computation of net operating income,which includes depreciation as an operating expense.

III.Net book value allows ROI to decrease over time as assets get older.

A)Only I.

B)Only III.

C)Only I and II.

D)Only I and III.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

19

Residual income is superior to return on investment as a means of measuring performance because it encourages managers to make investment decisions that are more consistent with the interests of the company as a whole.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

20

The performance measures on an individual's scorecard should not be overly influenced by actions taken by others in the company or by events that are outside of the individual's control.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

21

The division's turnover is closest to:

A)20.00

B)4.35

C)0.22

D)3.57

A)20.00

B)4.35

C)0.22

D)3.57

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

22

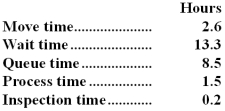

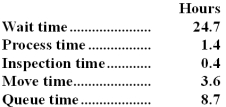

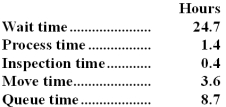

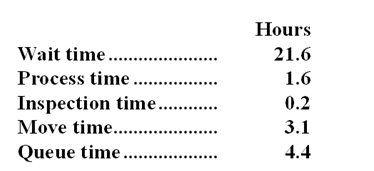

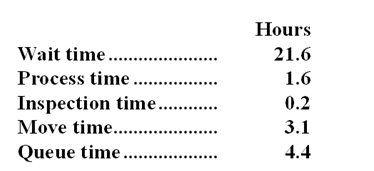

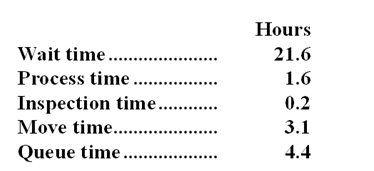

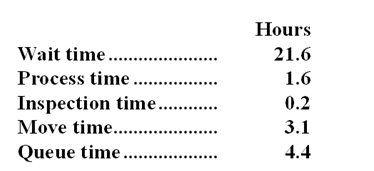

Mordue Corporation keeps careful track of the time required to fill orders.Data concerning a particular order appear below:  The manufacturing cycle efficiency (MCE)was closest to:

The manufacturing cycle efficiency (MCE)was closest to:

A)0.15

B)0.53

C)0.05

D)0.16

The manufacturing cycle efficiency (MCE)was closest to:

The manufacturing cycle efficiency (MCE)was closest to:A)0.15

B)0.53

C)0.05

D)0.16

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

23

Reed Company's sales last year totaled $150,000 and its return on investment (ROI)was 12%.If the company's turnover was 3,then its net operating income for the year must have been:

A)$6,000

B)$2,000

C)$18,000

D)it is impossible to determine from the data given.

A)$6,000

B)$2,000

C)$18,000

D)it is impossible to determine from the data given.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

24

Last year a company had stockholder's equity of $160,000,net operating income of $16,000 and sales of $100,000.The turnover was 0.5.The return on investment (ROI)was:

A)10%

B)9%

C)8%

D)7%

A)10%

B)9%

C)8%

D)7%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

25

The division's margin is closest to:

A)21.8%

B)5.0%

C)23.0%

D)28.0%

A)21.8%

B)5.0%

C)23.0%

D)28.0%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

26

Hoster Corporation keeps careful track of the time required to fill orders.The times recorded for a particular order appear below:  The throughput time was:

The throughput time was:

A)8.9 hours

B)18 hours

C)4.5 hours

D)22.5 hours

The throughput time was:

The throughput time was:A)8.9 hours

B)18 hours

C)4.5 hours

D)22.5 hours

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

27

Niemiec Corporation keeps careful track of the time required to fill orders.The times recorded for a particular order appear below:  The manufacturing cycle efficiency (MCE)was closest to:

The manufacturing cycle efficiency (MCE)was closest to:

A)0.20

B)0.06

C)0.12

D)0.96

The manufacturing cycle efficiency (MCE)was closest to:

The manufacturing cycle efficiency (MCE)was closest to:A)0.20

B)0.06

C)0.12

D)0.96

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

28

The division's return on investment (ROI)is closest to:

A)4.1%

B)21.75%

C)17.9%

D)1.1%

A)4.1%

B)21.75%

C)17.9%

D)1.1%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

29

In August,the Universal Solutions Division of Jugan Corporation had average operating assets of $670,000 and net operating income of $77,500.The company uses residual income,with a minimum required rate of return of 12%,to evaluate the performance of its divisions.What was the Universal Solutions Division's residual income in August?

A)$2,900

B)-$2,900

C)-$9,300

D)$9,300

A)$2,900

B)-$2,900

C)-$9,300

D)$9,300

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

30

Division B had an ROI last year of 15%.The division's minimum required rate of return is 10%.If the division's average operating assets last year were $450,000,then the division's residual income for last year was:

A)$67,500

B)$22,500

C)$37,500

D)$45,000

A)$67,500

B)$22,500

C)$37,500

D)$45,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

31

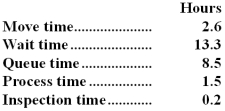

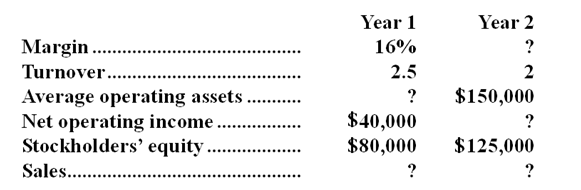

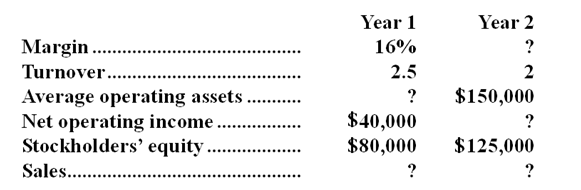

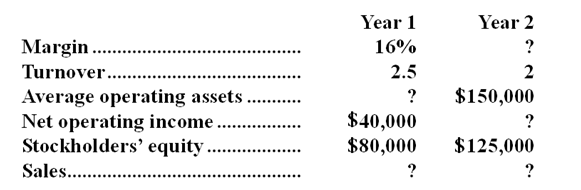

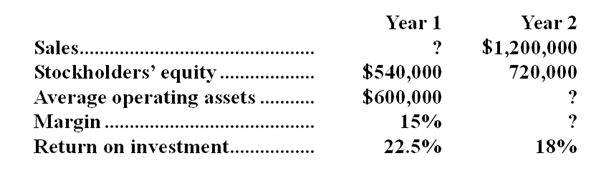

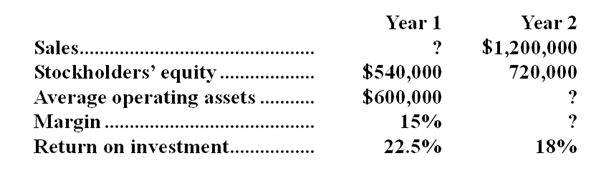

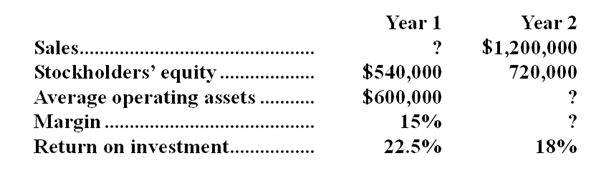

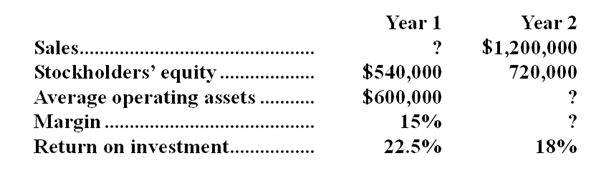

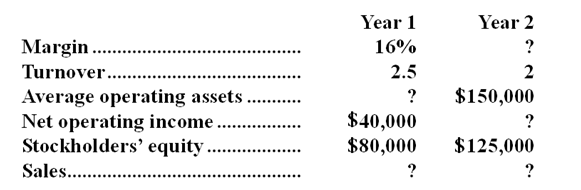

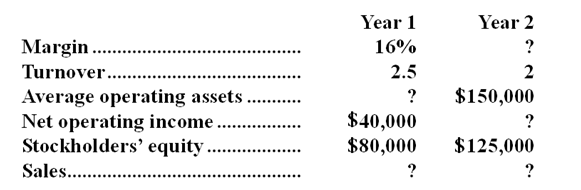

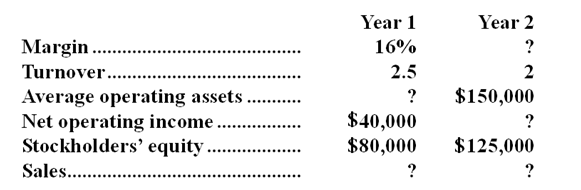

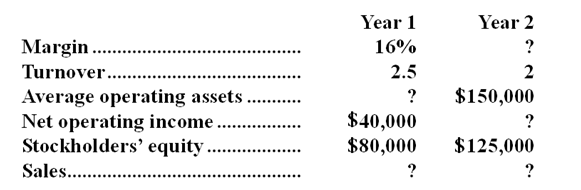

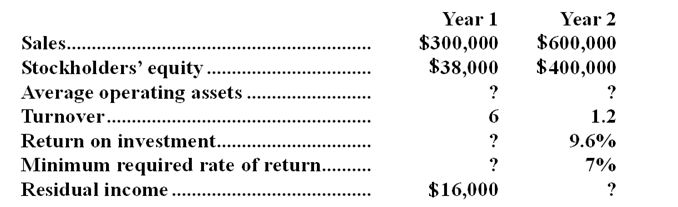

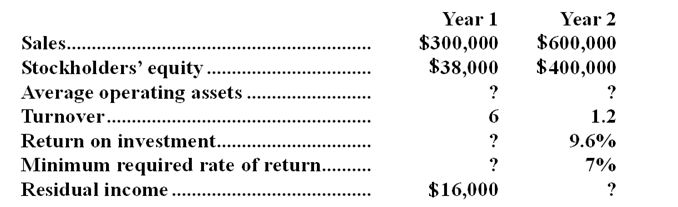

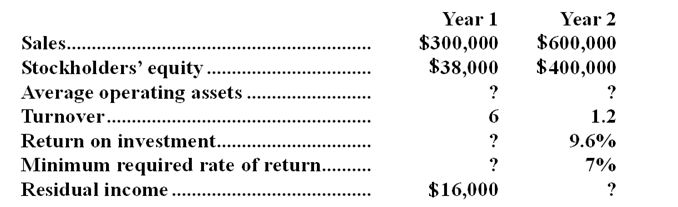

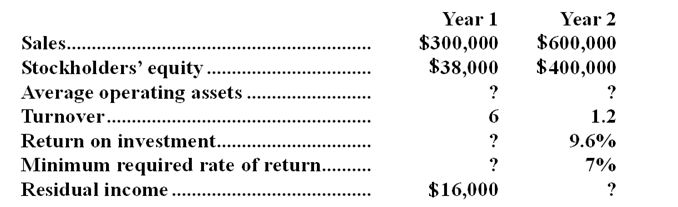

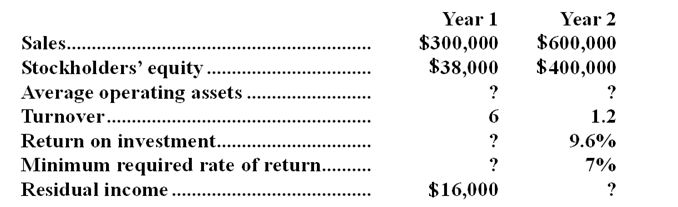

The Reed Division reports the following operating data for the past two years:  The return on investment at Reed was exactly the same in Year 1 and Year 2.

The return on investment at Reed was exactly the same in Year 1 and Year 2.

-The margin in Year 2 was:

A)48%

B)32%

C)20%

D)10%

The return on investment at Reed was exactly the same in Year 1 and Year 2.

The return on investment at Reed was exactly the same in Year 1 and Year 2.-The margin in Year 2 was:

A)48%

B)32%

C)20%

D)10%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

32

Garnick Corporation keeps careful track of the time required to fill orders.The times recorded for a particular order appear below:  The delivery cycle time was:

The delivery cycle time was:

A)3.5 hours

B)8.7 hours

C)34.9 hours

D)36.1 hours

The delivery cycle time was:

The delivery cycle time was:A)3.5 hours

B)8.7 hours

C)34.9 hours

D)36.1 hours

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

33

A company's current net operating income is $16,800 and its average operating assets are $80,000.The company's required rate of return is 18%.A new project being considered would require an investment of $15,000 and would generate annual net operating income of $3,000.What is the residual income of the new project?

A)20.8%

B)20%

C)($150)

D)$300

A)20.8%

B)20%

C)($150)

D)$300

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

34

Average operating assets are $110,000 and net operating income is $23,100.The company invests $25,000 in new assets for a project that will increase net operating income by $4,750.What is the return on investment (ROI)of the new project?

A)21%

B)19%

C)18.5%

D)20%

A)21%

B)19%

C)18.5%

D)20%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

35

Soderquist Corporation uses residual income to evaluate the performance of its divisions.The company's minimum required rate of return is 11%.In April,the Commercial Products Division had average operating assets of $100,000 and net operating income of $9,400.What was the Commercial Products Division's residual income in April?

A)-$1,600

B)$1,600

C)$1,034

D)-$1,034

A)-$1,600

B)$1,600

C)$1,034

D)-$1,034

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

36

Botelho Corporation keeps careful track of the time required to fill orders.Data concerning a particular order appear below:  The delivery cycle time was:

The delivery cycle time was:

A)33.1 hours

B)3.7 hours

C)12.6 hours

D)30.9 hours

The delivery cycle time was:

The delivery cycle time was:A)33.1 hours

B)3.7 hours

C)12.6 hours

D)30.9 hours

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

37

The purpose of the Data Processing Department of Falena Corporation is to assist the various departments of the corporation with their information needs free of charge.The Data Processing Department would best be evaluated as a:

A)cost center.

B)revenue center.

C)profit center.

D)investment center.

A)cost center.

B)revenue center.

C)profit center.

D)investment center.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

38

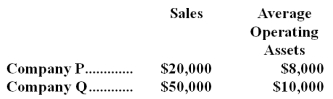

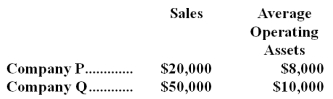

Sales and average operating assets for Company P and Company Q are given below:  What is the margin that each company will have to earn in order to generate a return on investment of 20%?

What is the margin that each company will have to earn in order to generate a return on investment of 20%?

A)12% and 16%

B)50% and 100%

C)8% and 4%

D)2.5% and 5%

What is the margin that each company will have to earn in order to generate a return on investment of 20%?

What is the margin that each company will have to earn in order to generate a return on investment of 20%?A)12% and 16%

B)50% and 100%

C)8% and 4%

D)2.5% and 5%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

39

The Reed Division reports the following operating data for the past two years:  The return on investment at Reed was exactly the same in Year 1 and Year 2.

The return on investment at Reed was exactly the same in Year 1 and Year 2.

-Sales in Year 2 amounted to:

A)$250,000

B)$300,000

C)$325,000

D)$350,000

The return on investment at Reed was exactly the same in Year 1 and Year 2.

The return on investment at Reed was exactly the same in Year 1 and Year 2.-Sales in Year 2 amounted to:

A)$250,000

B)$300,000

C)$325,000

D)$350,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

40

Galanis Corporation keeps careful track of the time required to fill orders.Data concerning a particular order appear below:  The throughput time was:

The throughput time was:

A)38.8 hours

B)33.4 hours

C)14.1 hours

D)5.4 hours

The throughput time was:

The throughput time was:A)38.8 hours

B)33.4 hours

C)14.1 hours

D)5.4 hours

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

41

The West Division of Shekarchi Corporation had average operating assets of $620,000 and net operating income of $80,100 in March. The minimum required rate of return for performance evaluation purposes is 14%.

-What was the West Division's residual income in March?

A)-$6,700

B)$6,700

C)-$11,214

D)$11,214

-What was the West Division's residual income in March?

A)-$6,700

B)$6,700

C)-$11,214

D)$11,214

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

42

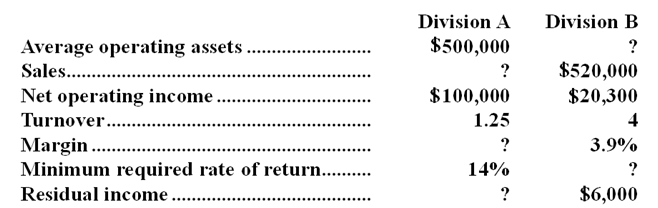

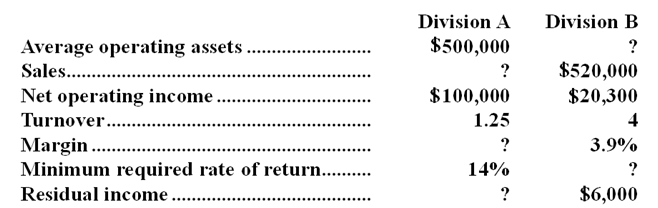

Estes Company has assembled the following data for its divisions for the past year:

-Division B's average operating assets is:

A)$81,200

B)$2,080,000

C)$1,333,333

D)$130,000

-Division B's average operating assets is:

A)$81,200

B)$2,080,000

C)$1,333,333

D)$130,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

43

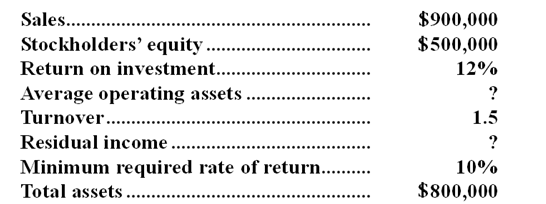

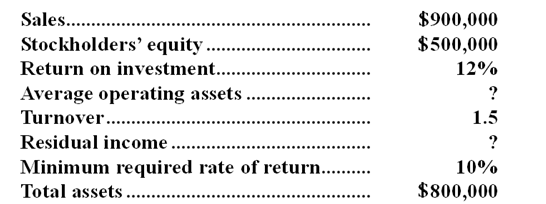

Operating data from Tindall Company for last year follows:

-The average operating assets amounted to:

A)$600,000

B)$400,000

C)$500,000

D)$800,000

-The average operating assets amounted to:

A)$600,000

B)$400,000

C)$500,000

D)$800,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

44

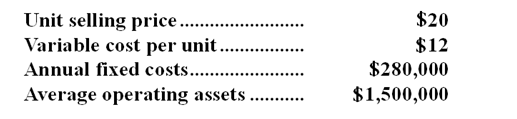

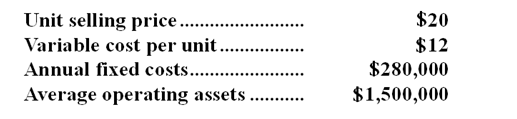

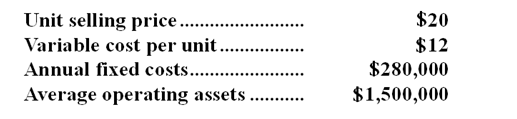

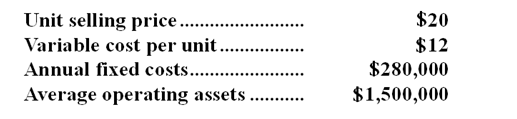

The following data are available for the South Division of Redride Products, Inc. and the single product it makes:

-How many units must South sell each year to have an ROI of 16%?

A)240,000

B)1,300,000

C)52,000

D)65,000

-How many units must South sell each year to have an ROI of 16%?

A)240,000

B)1,300,000

C)52,000

D)65,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

45

Operating data from Tindall Company for last year follows:

-The margin used in ROI calculations was closest to:

A)18.00%

B)8.00%

C)6.67%

D)15.00%

-The margin used in ROI calculations was closest to:

A)18.00%

B)8.00%

C)6.67%

D)15.00%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

46

Beall Industries is a division of a major corporation. Last year the division had total sales of $20,160,000, net operating income of $1,592,640, and average operating assets of $8,000,000.

-The division's return on investment (ROI)is closest to:

A)19.9%

B)16.6%

C)1.6%

D)5.7%

-The division's return on investment (ROI)is closest to:

A)19.9%

B)16.6%

C)1.6%

D)5.7%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

47

Beall Industries is a division of a major corporation. Last year the division had total sales of $20,160,000, net operating income of $1,592,640, and average operating assets of $8,000,000.

-The division's turnover is closest to:

A)2.52

B)2.10

C)0.20

D)12.66

-The division's turnover is closest to:

A)2.52

B)2.10

C)0.20

D)12.66

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

48

Beall Industries is a division of a major corporation. Last year the division had total sales of $20,160,000, net operating income of $1,592,640, and average operating assets of $8,000,000.

-The division's margin is closest to:

A)39.7%

B)47.6%

C)7.9%

D)19.9%

-The division's margin is closest to:

A)39.7%

B)47.6%

C)7.9%

D)19.9%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

49

The West Division of Shekarchi Corporation had average operating assets of $620,000 and net operating income of $80,100 in March. The minimum required rate of return for performance evaluation purposes is 14%.

-What was the West Division's minimum required return in March?

A)$80,100

B)$86,800

C)$11,214

D)$98,014

-What was the West Division's minimum required return in March?

A)$80,100

B)$86,800

C)$11,214

D)$98,014

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

50

Estes Company has assembled the following data for its divisions for the past year:

-Division A's residual income is:

A)$20,000

B)$30,000

C)$35,000

D)$45,000

-Division A's residual income is:

A)$20,000

B)$30,000

C)$35,000

D)$45,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

51

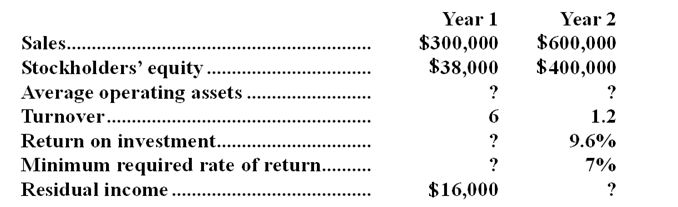

The Baily Division recorded operating data as follows for the past two years:  Baily Division's turnover was exactly the same in both Year 1 and Year 2.

Baily Division's turnover was exactly the same in both Year 1 and Year 2.

-The margin in Year 2 was:

A)18.75%

B)27.00%

C)22.50%

D)12.00%

Baily Division's turnover was exactly the same in both Year 1 and Year 2.

Baily Division's turnover was exactly the same in both Year 1 and Year 2.-The margin in Year 2 was:

A)18.75%

B)27.00%

C)22.50%

D)12.00%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

52

The Baily Division recorded operating data as follows for the past two years:  Baily Division's turnover was exactly the same in both Year 1 and Year 2.

Baily Division's turnover was exactly the same in both Year 1 and Year 2.

-The net operating income in Year 1 was:

A)$90,000

B)$135,000

C)$140,000

D)$150,000

Baily Division's turnover was exactly the same in both Year 1 and Year 2.

Baily Division's turnover was exactly the same in both Year 1 and Year 2.-The net operating income in Year 1 was:

A)$90,000

B)$135,000

C)$140,000

D)$150,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

53

Operating data from Tindall Company for last year follows:

-The residual income was:

A)$18,000

B)$10,000

C)$12,000

D)$16,000

-The residual income was:

A)$18,000

B)$10,000

C)$12,000

D)$16,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

54

Estes Company has assembled the following data for its divisions for the past year:

-Division A's sales are:

A)$400,000

B)$625,000

C)$125,000

D)$200,000

-Division A's sales are:

A)$400,000

B)$625,000

C)$125,000

D)$200,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

55

The Reed Division reports the following operating data for the past two years:  The return on investment at Reed was exactly the same in Year 1 and Year 2.

The return on investment at Reed was exactly the same in Year 1 and Year 2.

-Net operating income in Year 2 amounted to:

A)$60,000

B)$50,000

C)$40,000

D)$35,000

The return on investment at Reed was exactly the same in Year 1 and Year 2.

The return on investment at Reed was exactly the same in Year 1 and Year 2.-Net operating income in Year 2 amounted to:

A)$60,000

B)$50,000

C)$40,000

D)$35,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

56

The Consumer Products Division of Weiter Corporation had average operating assets of $570,000 and net operating income of $65,100 in March. The minimum required rate of return for performance evaluation purposes is 12%.

-What was the Consumer Products Division's minimum required return in March?

A)$7,812

B)$76,212

C)$68,400

D)$65,100

-What was the Consumer Products Division's minimum required return in March?

A)$7,812

B)$76,212

C)$68,400

D)$65,100

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

57

The Baily Division recorded operating data as follows for the past two years:  Baily Division's turnover was exactly the same in both Year 1 and Year 2.

Baily Division's turnover was exactly the same in both Year 1 and Year 2.

-The average operating assets in Year 2 were:

A)$720,000

B)$750,000

C)$800,000

D)$900,000

Baily Division's turnover was exactly the same in both Year 1 and Year 2.

Baily Division's turnover was exactly the same in both Year 1 and Year 2.-The average operating assets in Year 2 were:

A)$720,000

B)$750,000

C)$800,000

D)$900,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

58

The Reed Division reports the following operating data for the past two years:  The return on investment at Reed was exactly the same in Year 1 and Year 2.

The return on investment at Reed was exactly the same in Year 1 and Year 2.

-Average operating assets in Year 1 were:

A)$160,000

B)$150,000

C)$125,000

D)$100,000

The return on investment at Reed was exactly the same in Year 1 and Year 2.

The return on investment at Reed was exactly the same in Year 1 and Year 2.-Average operating assets in Year 1 were:

A)$160,000

B)$150,000

C)$125,000

D)$100,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

59

The Baily Division recorded operating data as follows for the past two years:  Baily Division's turnover was exactly the same in both Year 1 and Year 2.

Baily Division's turnover was exactly the same in both Year 1 and Year 2.

-Sales in Year 1 amounted to:

A)$400,000

B)$900,000

C)$750,000

D)$1,200,000

Baily Division's turnover was exactly the same in both Year 1 and Year 2.

Baily Division's turnover was exactly the same in both Year 1 and Year 2.-Sales in Year 1 amounted to:

A)$400,000

B)$900,000

C)$750,000

D)$1,200,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

60

The Consumer Products Division of Weiter Corporation had average operating assets of $570,000 and net operating income of $65,100 in March. The minimum required rate of return for performance evaluation purposes is 12%.

-What was the Consumer Products Division's residual income in March?

A)-$3,300

B)$3,300

C)-$7,812

D)$7,812

-What was the Consumer Products Division's residual income in March?

A)-$3,300

B)$3,300

C)-$7,812

D)$7,812

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

61

The following data are available for the South Division of Redride Products, Inc. and the single product it makes:

-If South wants a residual income of $50,000 and the minimum required rate of return is 10%,the annual turnover will have to be:

A)0.32

B)0.80

C)1.25

D)1.50

-If South wants a residual income of $50,000 and the minimum required rate of return is 10%,the annual turnover will have to be:

A)0.32

B)0.80

C)1.25

D)1.50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

62

Chace Products is a division of a major corporation. Last year the division had total sales of $21,300,000, net operating income of $575,100, and average operating assets of $5,000,000. The company's minimum required rate of return is 12%.

-The division's turnover is closest to:

A)3.82

B)4.26

C)0.12

D)37.04

-The division's turnover is closest to:

A)3.82

B)4.26

C)0.12

D)37.04

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

63

Chace Products is a division of a major corporation. Last year the division had total sales of $21,300,000, net operating income of $575,100, and average operating assets of $5,000,000. The company's minimum required rate of return is 12%.

-The division's return on investment (ROI)is closest to:

A)49.0%

B)11.5%

C)0.3%

D)2.2%

-The division's return on investment (ROI)is closest to:

A)49.0%

B)11.5%

C)0.3%

D)2.2%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

64

Chace Products is a division of a major corporation. Last year the division had total sales of $21,300,000, net operating income of $575,100, and average operating assets of $5,000,000. The company's minimum required rate of return is 12%.

-The delivery cycle time was:

A)29.1 hours

B)30.6 hours

C)8 hours

D)2.7 hours

-The delivery cycle time was:

A)29.1 hours

B)30.6 hours

C)8 hours

D)2.7 hours

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

65

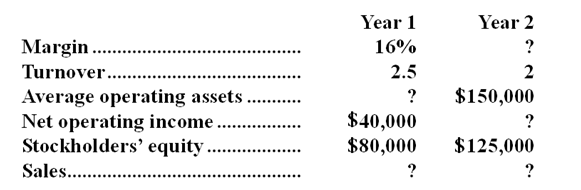

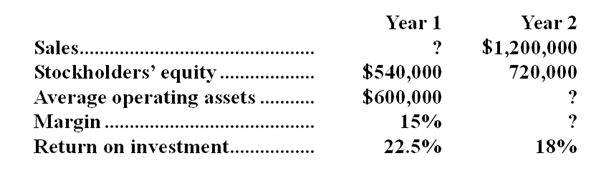

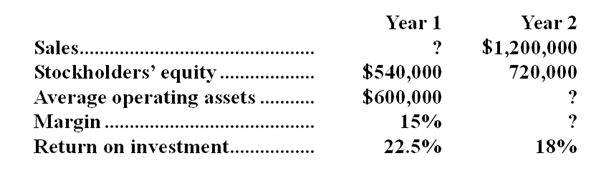

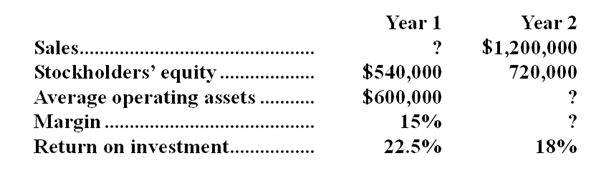

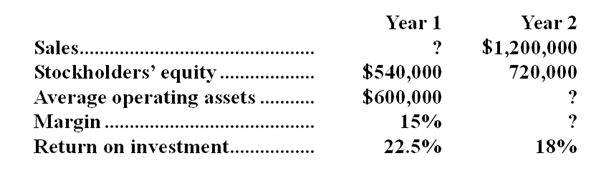

The following data pertain to the Whalen Division of Northern Industries.  The margin at Whalen was exactly the same in Year 2 as it was in Year 1.

The margin at Whalen was exactly the same in Year 2 as it was in Year 1.

-The average operating assets for Year 2 amounted to:

A)$400,000

B)$800,000

C)$600,000

D)$500,000

The margin at Whalen was exactly the same in Year 2 as it was in Year 1.

The margin at Whalen was exactly the same in Year 2 as it was in Year 1.-The average operating assets for Year 2 amounted to:

A)$400,000

B)$800,000

C)$600,000

D)$500,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

66

Chace Products is a division of a major corporation. Last year the division had total sales of $21,300,000, net operating income of $575,100, and average operating assets of $5,000,000. The company's minimum required rate of return is 12%.

-The division's residual income is closest to:

A)$575,100

B)$1,175,100

C)$(1,980,900)

D)$(24,900)

-The division's residual income is closest to:

A)$575,100

B)$1,175,100

C)$(1,980,900)

D)$(24,900)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

67

Saffer Corporation keeps careful track of the time required to fill orders. Data concerning a particular order appear below:

-The throughput time was:

A)9.3 hours

B)4.9 hours

C)30.9 hours

D)26 hours

-The throughput time was:

A)9.3 hours

B)4.9 hours

C)30.9 hours

D)26 hours

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

68

Hart Manufacturing operates an automated steel fabrication process. For one operation, Hart has found that 45% of the total throughput (manufacturing cycle) time is spent on non-value-added activities. Delivery cycle time is 12 hours, waiting time during the production process is 3 hours, queue time prior to starting the production process is 2 hours, and inspection time is 1.2 hours.

-The manufacturing cycle efficiency (MCE)for this operation is:

A)55%

B)45%

C)6.6 hours

D)5.4 hours

-The manufacturing cycle efficiency (MCE)for this operation is:

A)55%

B)45%

C)6.6 hours

D)5.4 hours

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

69

Saffer Corporation keeps careful track of the time required to fill orders. Data concerning a particular order appear below:

-The manufacturing cycle efficiency (MCE)was closest to:

A)0.17

B)0.05

C)0.43

D)0.19

-The manufacturing cycle efficiency (MCE)was closest to:

A)0.17

B)0.05

C)0.43

D)0.19

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

70

Hart Manufacturing operates an automated steel fabrication process. For one operation, Hart has found that 45% of the total throughput (manufacturing cycle) time is spent on non-value-added activities. Delivery cycle time is 12 hours, waiting time during the production process is 3 hours, queue time prior to starting the production process is 2 hours, and inspection time is 1.2 hours.

-What is the move time recorded for the operation?

A)1.5 hours

B)6.5 hours

C)5.8 hours

D)0.85 hours

-What is the move time recorded for the operation?

A)1.5 hours

B)6.5 hours

C)5.8 hours

D)0.85 hours

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

71

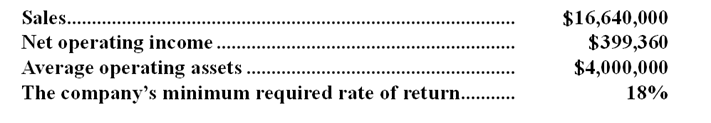

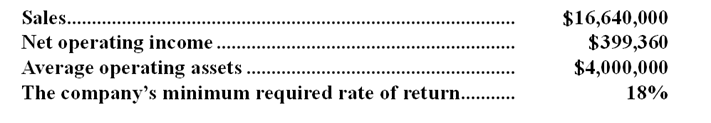

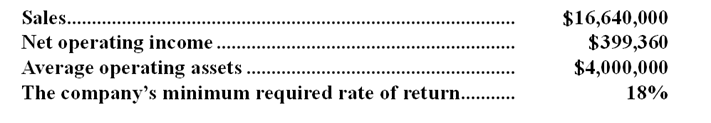

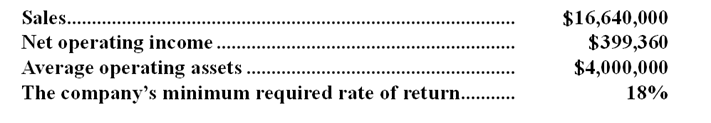

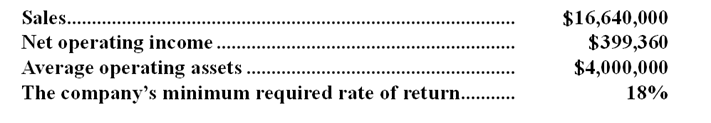

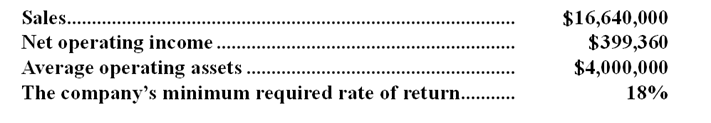

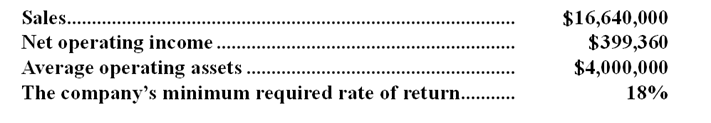

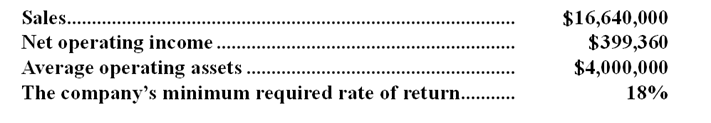

Dickonson Products is a division of a major corporation. The following data are for the last year of operations:

-The division's residual income is closest to:

A)$(320,640)

B)$1,119,360

C)$399,360

D)$(2,595,840)

-The division's residual income is closest to:

A)$(320,640)

B)$1,119,360

C)$399,360

D)$(2,595,840)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

72

Dickonson Products is a division of a major corporation. The following data are for the last year of operations:

-The division's turnover is closest to:

A)3.78

B)41.67

C)4.16

D)0.10

-The division's turnover is closest to:

A)3.78

B)41.67

C)4.16

D)0.10

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

73

Dickonson Products is a division of a major corporation. The following data are for the last year of operations:

-The division's margin is closest to:

A)26.4%

B)10.0%

C)2.4%

D)24.0%

-The division's margin is closest to:

A)26.4%

B)10.0%

C)2.4%

D)24.0%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

74

Chace Products is a division of a major corporation. Last year the division had total sales of $21,300,000, net operating income of $575,100, and average operating assets of $5,000,000. The company's minimum required rate of return is 12%.

-The division's margin is closest to:

A)26.2%

B)23.5%

C)2.7%

D)11.5%

-The division's margin is closest to:

A)26.2%

B)23.5%

C)2.7%

D)11.5%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

75

Chace Products is a division of a major corporation. Last year the division had total sales of $21,300,000, net operating income of $575,100, and average operating assets of $5,000,000. The company's minimum required rate of return is 12%.

-The throughput time was:

A)4.2 hours

B)9.5 hours

C)30.6 hours

D)26.4 hours

-The throughput time was:

A)4.2 hours

B)9.5 hours

C)30.6 hours

D)26.4 hours

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

76

The following data pertain to the Whalen Division of Northern Industries.  The margin at Whalen was exactly the same in Year 2 as it was in Year 1.

The margin at Whalen was exactly the same in Year 2 as it was in Year 1.

-The minimum required rate of return in Year 1 was:

A)18%

B)17%

C)16%

D)15%

The margin at Whalen was exactly the same in Year 2 as it was in Year 1.

The margin at Whalen was exactly the same in Year 2 as it was in Year 1.-The minimum required rate of return in Year 1 was:

A)18%

B)17%

C)16%

D)15%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

77

Dickonson Products is a division of a major corporation. The following data are for the last year of operations:

-The division's return on investment (ROI)is closest to:

A)0.2%

B)41.6%

C)10.0%

D)1.9%

-The division's return on investment (ROI)is closest to:

A)0.2%

B)41.6%

C)10.0%

D)1.9%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

78

The following data pertain to the Whalen Division of Northern Industries.  The margin at Whalen was exactly the same in Year 2 as it was in Year 1.

The margin at Whalen was exactly the same in Year 2 as it was in Year 1.

-The return on investment in Year 1 was:

A)48.00%

B)32.50%

C)7.58%

D)1.92%

The margin at Whalen was exactly the same in Year 2 as it was in Year 1.

The margin at Whalen was exactly the same in Year 2 as it was in Year 1.-The return on investment in Year 1 was:

A)48.00%

B)32.50%

C)7.58%

D)1.92%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

79

Chace Products is a division of a major corporation. Last year the division had total sales of $21,300,000, net operating income of $575,100, and average operating assets of $5,000,000. The company's minimum required rate of return is 12%.

-The manufacturing cycle efficiency (MCE)was closest to:

A)0.15

B)0.05

C)0.45

D)0.18

-The manufacturing cycle efficiency (MCE)was closest to:

A)0.15

B)0.05

C)0.45

D)0.18

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

80

Hart Manufacturing operates an automated steel fabrication process. For one operation, Hart has found that 45% of the total throughput (manufacturing cycle) time is spent on non-value-added activities. Delivery cycle time is 12 hours, waiting time during the production process is 3 hours, queue time prior to starting the production process is 2 hours, and inspection time is 1.2 hours.

-What is the throughput (manufacturing cycle)time for the operation?

A)12.0 hours

B)9.0 hours

C)10.0 hours

D)5.8 hours

-What is the throughput (manufacturing cycle)time for the operation?

A)12.0 hours

B)9.0 hours

C)10.0 hours

D)5.8 hours

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck