Deck 2: Statement of Cash Flows

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/56

العب

ملء الشاشة (f)

Deck 2: Statement of Cash Flows

1

Sales reported on the income statement totaled $750,000.The beginning balance in accounts receivable was $70,000.The ending balance in accounts receivable was $80,000.Under the direct method of determining the net cash provided by operating activities on the statement of cash flows,sales adjusted to a cash basis are:

A)$760,000

B)$740,000

C)$680,000

D)$830,000

A)$760,000

B)$740,000

C)$680,000

D)$830,000

B

2

Last year Cumberland Corporation reported a cost of goods sold of $120,000.Inventories increased by $35,000 during the year,and accounts payable increased by $20,000.The company uses the direct method to determine the net cash provided by operating activities on the statement of cash flows.The cost of goods sold adjusted to a cash basis would be:

A)$135,000

B)$100,000

C)$155,000

D)$105,000

A)$135,000

B)$100,000

C)$155,000

D)$105,000

A

3

The ending balance of accounts receivable was $69,000.Sales,adjusted to a cash basis using the direct method on the statement of cash flows,were $354,000.Sales reported on the income statement were $378,000.Based on this information,the beginning balance in accounts receivable was:

A)$93,000

B)$24,000

C)$94,000

D)$45,000

A)$93,000

B)$24,000

C)$94,000

D)$45,000

$45,000

4

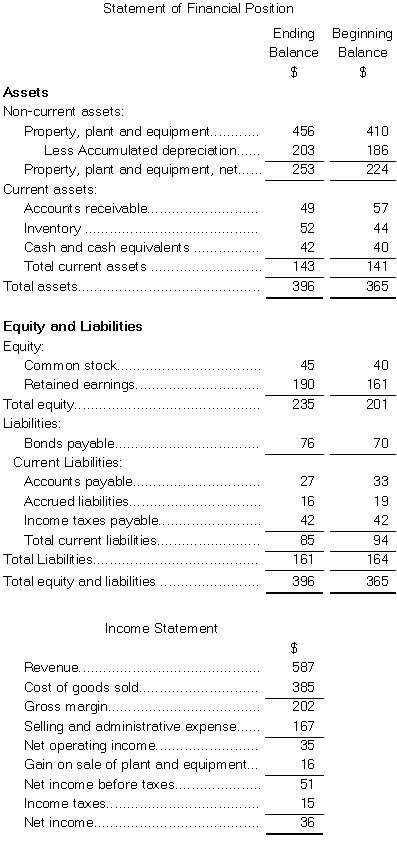

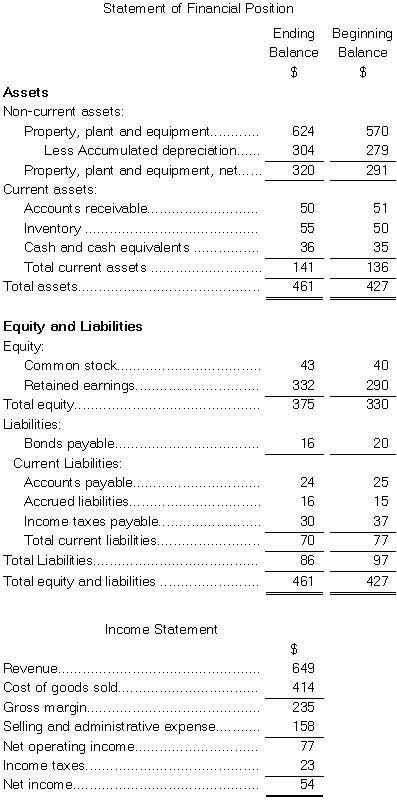

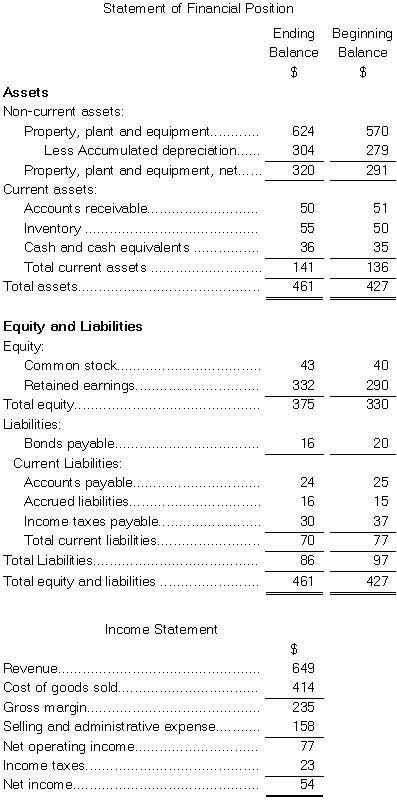

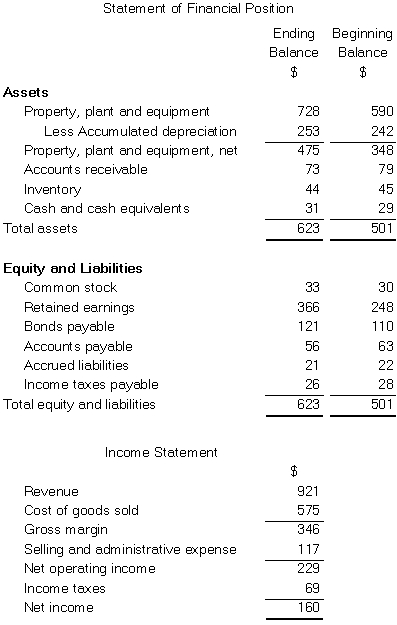

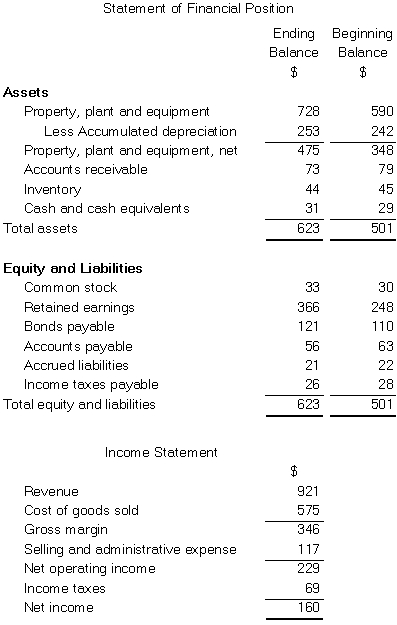

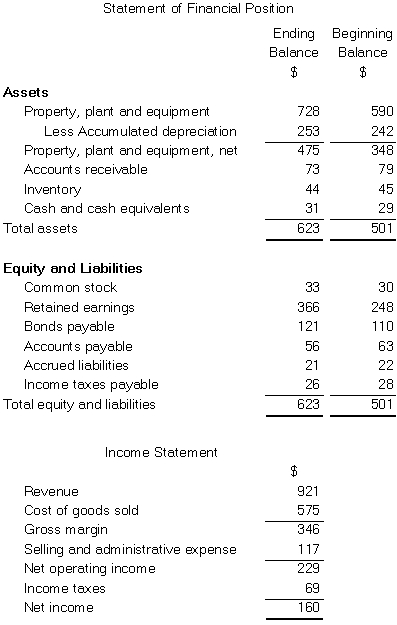

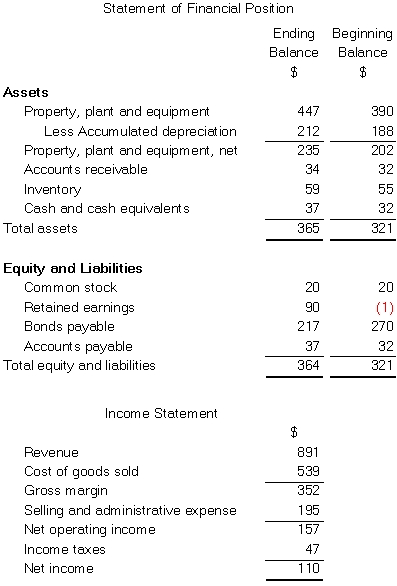

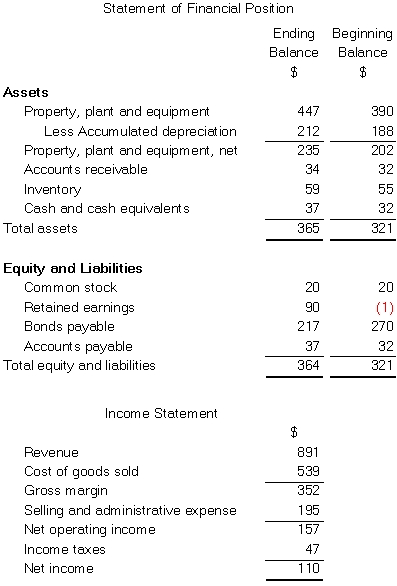

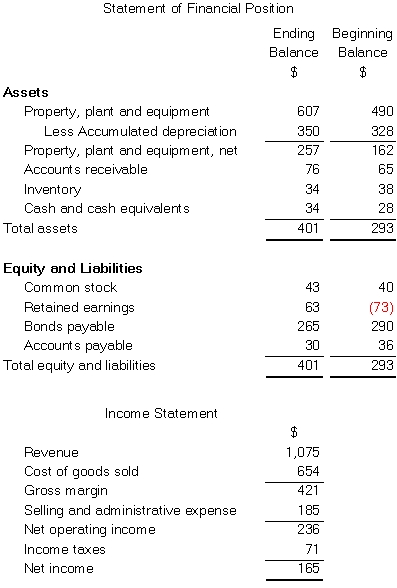

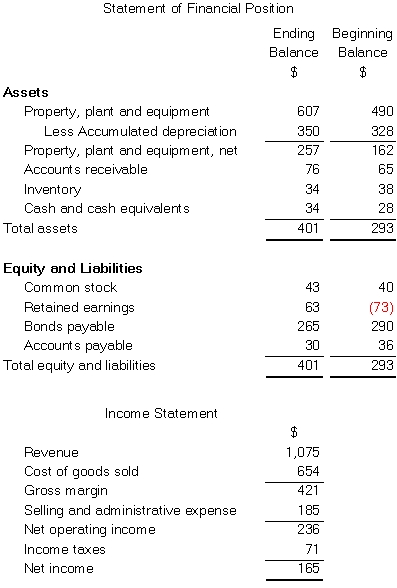

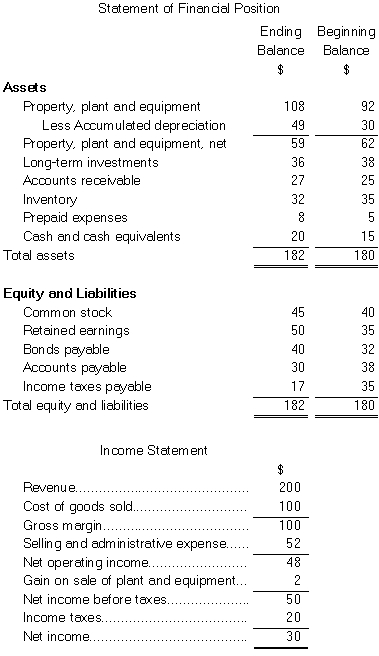

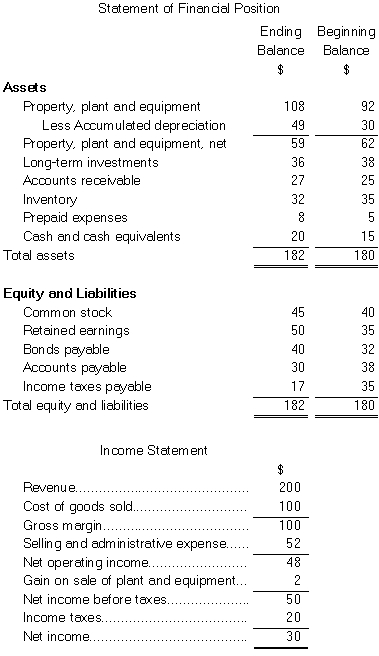

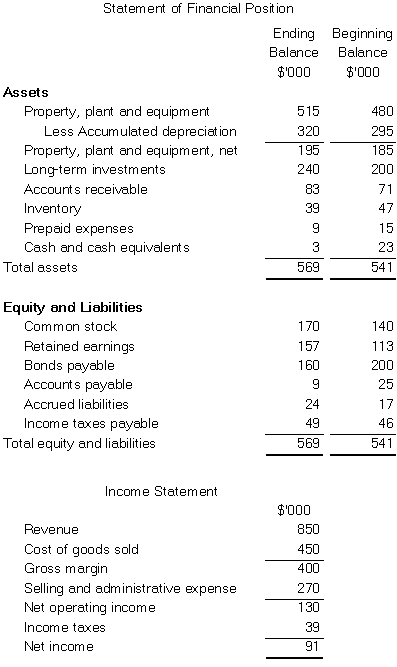

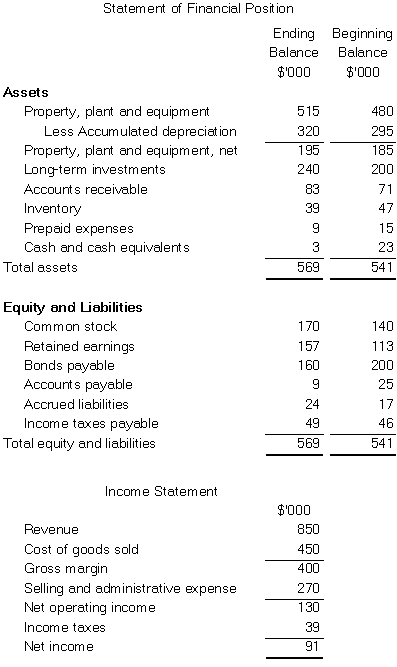

Dorris Corporation's statement of financial position and income statement appear below: Cash dividends were $7.The company sold equipment for $18 that was originally purchased for $8 and that had accumulated depreciation of $6.The net cash provided by (used in)operating activities for the year was:

A)$34

B)$35

C)$50

D)$41

A)$34

B)$35

C)$50

D)$41

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

5

Last year Lawn Corporation reported sales of $115,000 on its income statement.During the year,accounts receivable decreased by $10,000 and accounts payable increased by $15,000.The company uses the direct method to determine the net cash provided by operating activities on the statement of cash flows.The sales revenue adjusted to a cash basis for the year would be:

A)$125,000

B)$90,000

C)$140,000

D)$100,000

A)$125,000

B)$90,000

C)$140,000

D)$100,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

6

During the year the balance in the Prepaid Expenses account increased by $6,000.In order to adjust the company's net income to a cash basis using the direct method on the statement of cash flows,it would be necessary to:

A)subtract the $6,000 from the selling and administrative expenses reported on the income statement.

B)add the $6,000 to the selling and administrative expenses reported on the income statement.

C)subtract the $6,000 from the cost of goods sold reported on the income statement.

D)add the $6,000 to the cost of goods sold reported on the income statement.

A)subtract the $6,000 from the selling and administrative expenses reported on the income statement.

B)add the $6,000 to the selling and administrative expenses reported on the income statement.

C)subtract the $6,000 from the cost of goods sold reported on the income statement.

D)add the $6,000 to the cost of goods sold reported on the income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

7

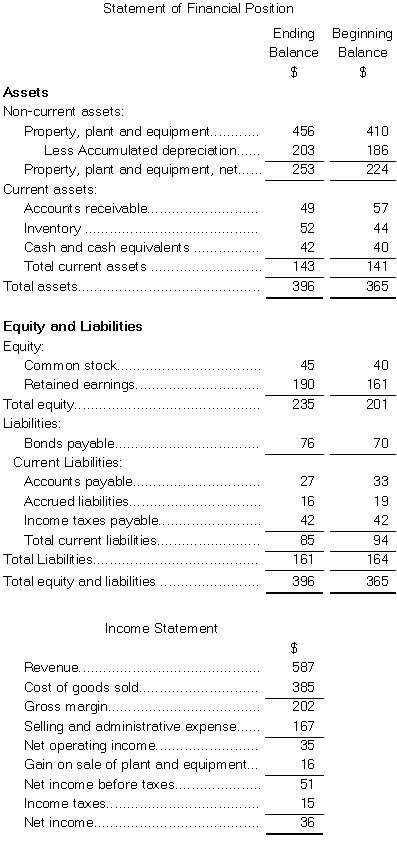

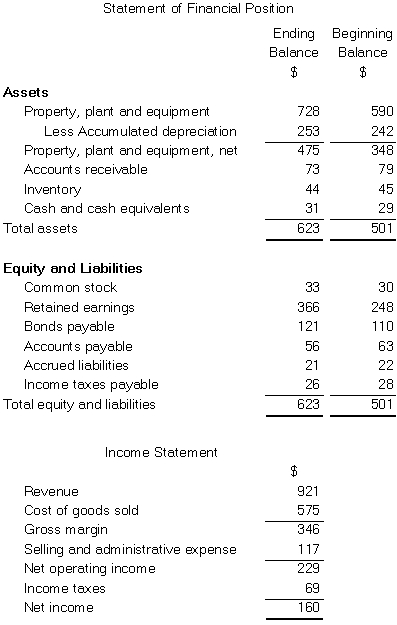

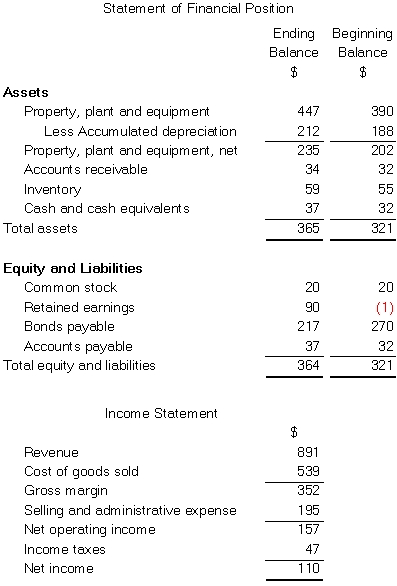

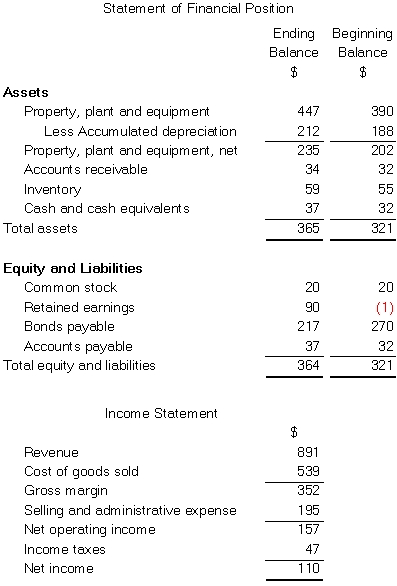

Brew Corporation's most recent comparative statement of financial position and income statement appear below: Cash dividends were $37.The company did not retire or sell any property,plant,and equipment during the year.The net cash provided by (used in)operating activities for the year was:

A)$185

B)$51

C)$83

D)$191

A)$185

B)$51

C)$83

D)$191

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

8

Wister Corporation had net sales of $462,000 for the just completed year.Shown below are the beginning and ending balances of various Wister accounts: Wister prepares its statement of cash flows using the direct method.On its statement of cash flows,what amount should Wister show for its net sales adjusted to a cash basis (i.e. ,cash received from sales)?

A)$488,000

B)$436,000

C)$462,000

D)$445,000

A)$488,000

B)$436,000

C)$462,000

D)$445,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

9

Kuma,Inc.had cost of goods sold of $106,000 for the just completed year.Shown below are the beginning and ending balances of various Kuma accounts: Kuma prepares its statement of cash flows using the direct method.On its statement of cash flows,what amount should Kuma show for its cost of goods sold adjusted to a cash basis (i.e. ,cash paid to suppliers)?

A)$100,000

B)$96,000

C)$102,000

D)$116,000

A)$100,000

B)$96,000

C)$102,000

D)$116,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

10

Evita Corporation prepares its statement of cash flows using the indirect method.Evita's statement showed "Net cash provided by operating activities" of $46,000.Under the direct method,this number would have been:

A)$0.

B)$46,000.

C)greater than $46,000.

D)less than $46,000 but greater than $0.

A)$0.

B)$46,000.

C)greater than $46,000.

D)less than $46,000 but greater than $0.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

11

During the year the balance in the Accounts Receivable account increased by $6,000.In order to adjust the company's net income to a cash basis using the direct method on the statement of cash flows,it would be necessary to:

A)subtract the $6,000 from the sales revenue reported on the income statement.

B)add the $6,000 to the sales revenue reported on the income statement.

C)subtract the $6,000 from the cost of goods sold reported on the income statement.

D)add the $6,000 to the cost of goods sold reported on the income statement.

A)subtract the $6,000 from the sales revenue reported on the income statement.

B)add the $6,000 to the sales revenue reported on the income statement.

C)subtract the $6,000 from the cost of goods sold reported on the income statement.

D)add the $6,000 to the cost of goods sold reported on the income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

12

If accounts receivable increase during a period,then the amount of cash collected from customers will be less than the amount of sales reported on the income statement for the period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

13

Reven Corporation prepares its statement of cash flows using the direct method.Last year,Reven reported Income Tax Expense of $25,000.At the beginning of last year,Reven had a $5,000 balance in the Income Taxes Payable account.At the end of last year,Reven had a $9,000 balance in the account.On its statement of cash flows for last year,what amount should Reven have shown for its Income Tax Expense adjusted to a cash basis (i.e. ,income taxes paid)?

A)$29,000

B)$21,000

C)$25,000

D)$4,000

A)$29,000

B)$21,000

C)$25,000

D)$4,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

14

Under the direct method of determining the net cash provided by operating activities on the statement of cash flows,one step in adjusting selling and administrative expenses from an accrual to a cash basis is to subtract any increase in prepaid expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

15

Cridberg Corporation's selling and administrative expenses for last year totaled $260,000.During the year the company's prepaid expense account balance increased by $18,000 and accrued liabilities decreased by $12,000.Depreciation for the year was $25,000.Based on this information,selling and administrative expenses adjusted to a cash basis under the direct method on the statement of cash flows would be:

A)$255,000

B)$315,000

C)$205,000

D)$265,000

A)$255,000

B)$315,000

C)$205,000

D)$265,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

16

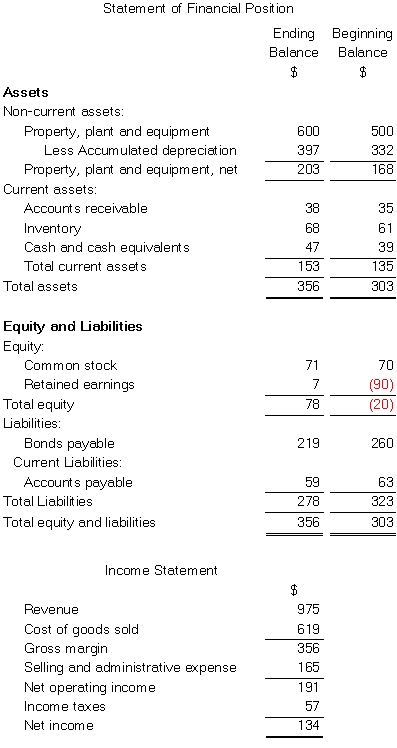

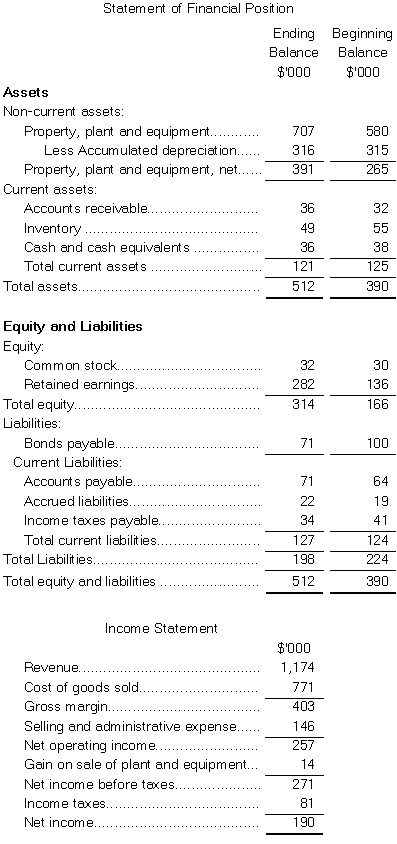

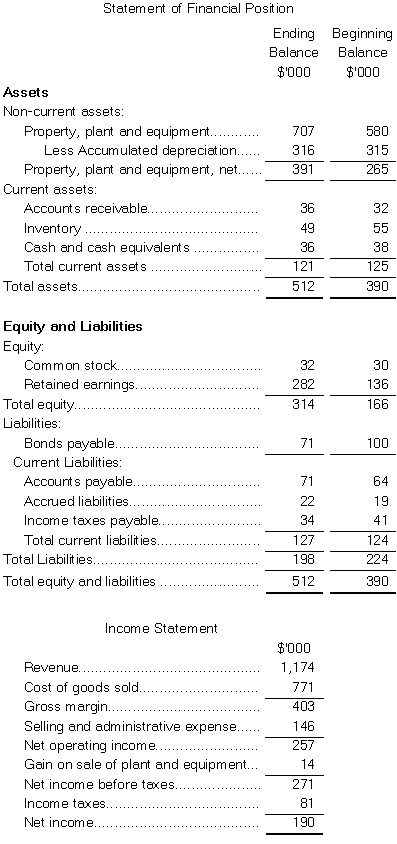

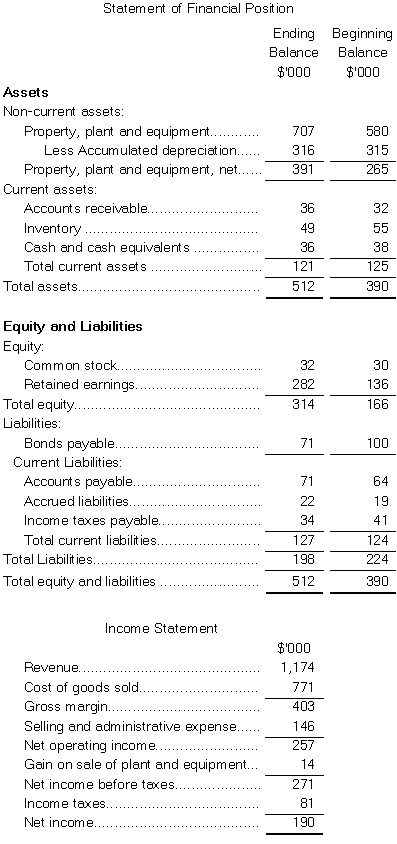

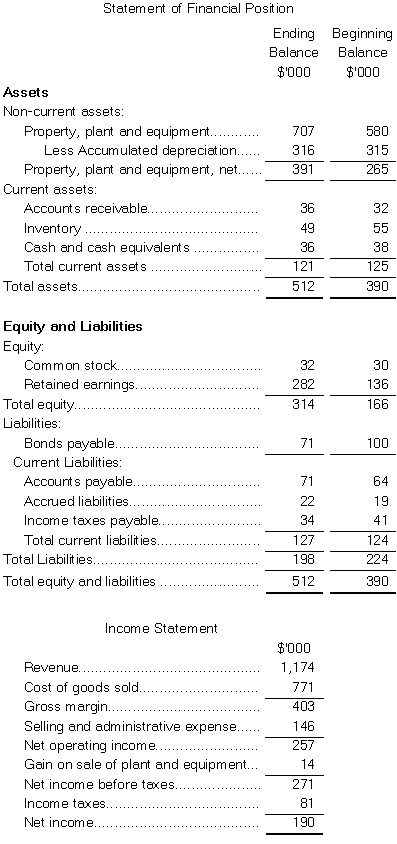

The most recent statement of financial position and income statement of Dallavalle Corporation appear below: Cash dividends were $12.The company did not retire or sell any property,plant,and equipment during the year.The net cash provided by (used in)operating activities for the year was:

A)$77

B)$68

C)$40

D)$14

A)$77

B)$68

C)$40

D)$14

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

17

Under the direct method of determining the net cash provided by operating activities on the statement of cash flows,an increase in accounts receivable would be added to sales revenue to convert revenue to a cash basis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

18

Crossland Corporation reported sales on its income statement of $435,000.On the statement of cash flows,which used the direct method,sales adjusted to a cash basis were $455,000.Crossland Corporation reported the following account balances on its statement of financial position for the year: Based on this information,the beginning balance in accounts receivable was:

A)$50,000

B)$40,000

C)$30,000

D)$20,000

A)$50,000

B)$40,000

C)$30,000

D)$20,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

19

LFM Corporation reported cost of goods sold on its income statement of $15,000.The following account balances appeared on the company's comparative statement of financial position for the same year: The company uses the direct method to determine the net cash provided by operating activities.The cost of goods sold,adjusted to a cash basis,on the company's statement of cash flows for the year would be:

A)$14,000

B)$16,000

C)$10,000

D)$15,000

A)$14,000

B)$16,000

C)$10,000

D)$15,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

20

Under the direct method of determining the net cash provided by operating activities on the statement of cash flows,a decrease in prepaid expenses would be added to selling and administrative expenses to convert selling and administrative expenses to a cash basis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

21

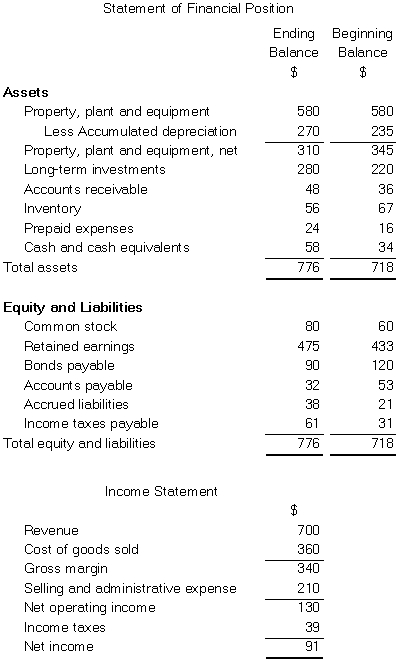

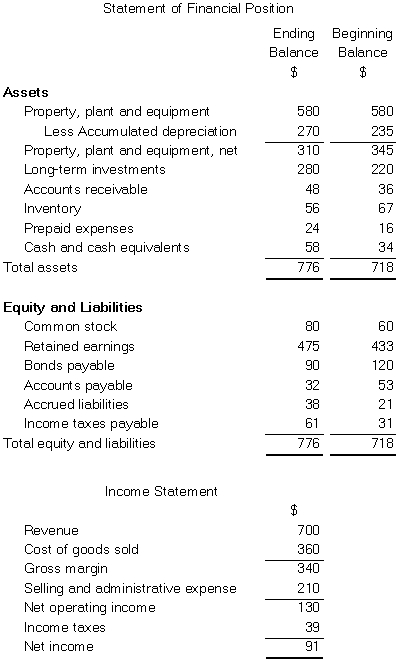

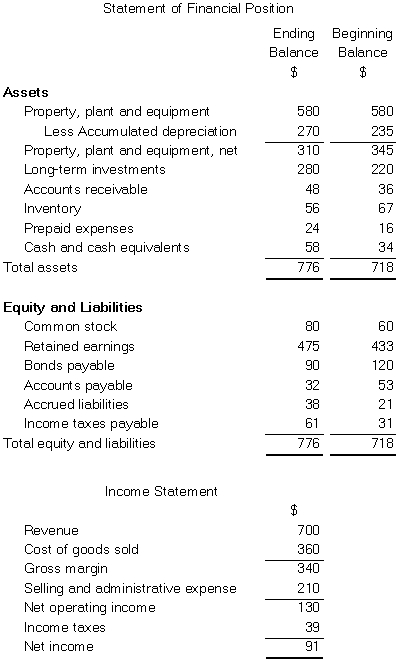

Shimko Corporation's most recent comparative statement of financial position and income statement appear below:

The company paid a cash dividend of $19 and it did not dispose of any property,plant,and equipment.The company did not issue any bonds payable or repurchase any of its own common stock.The following questions pertain to the company's statement of cash flows.

The net cash provided by (used in)operating activities for the year was:

A)$23

B)$133

C)$157

D)$87

The company paid a cash dividend of $19 and it did not dispose of any property,plant,and equipment.The company did not issue any bonds payable or repurchase any of its own common stock.The following questions pertain to the company's statement of cash flows.

The net cash provided by (used in)operating activities for the year was:

A)$23

B)$133

C)$157

D)$87

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

22

The most recent statement of financial position and income statement of Oldaker Corporation appear below:

The company paid a cash dividend of $42 and it did not dispose of any property,plant,and equipment.The company did not retire any bonds payable or repurchase any of its own common stock.The following questions pertain to the company's statement of cash flows.

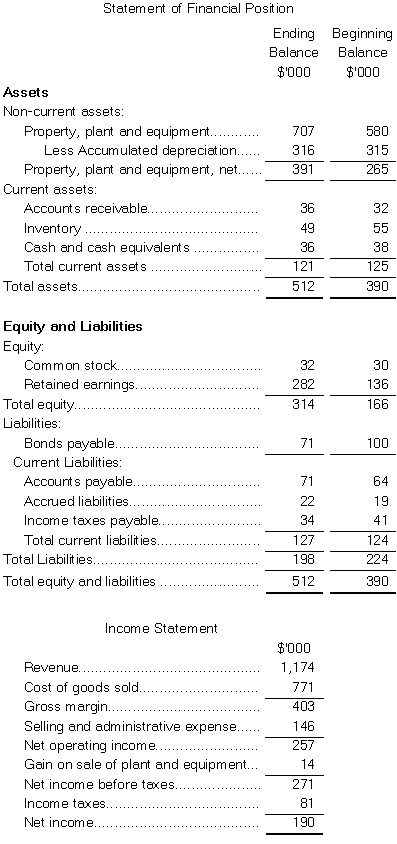

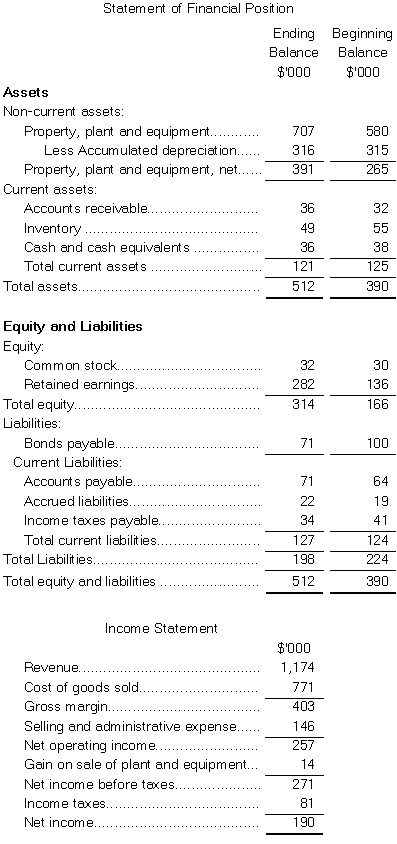

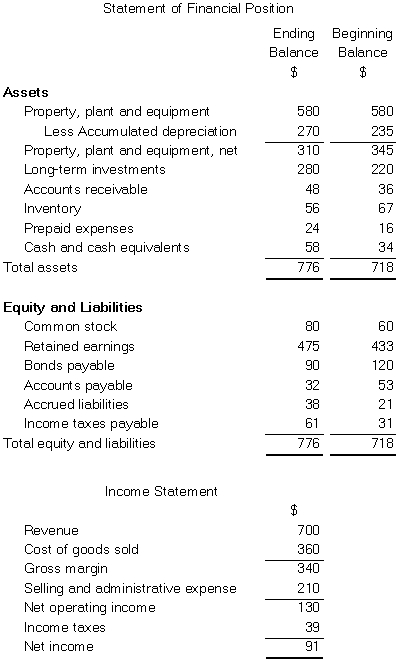

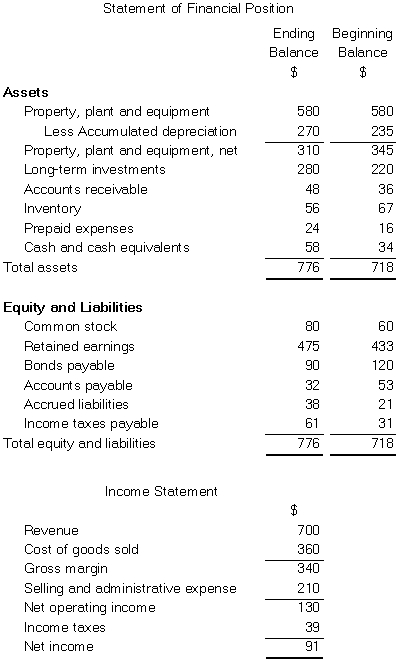

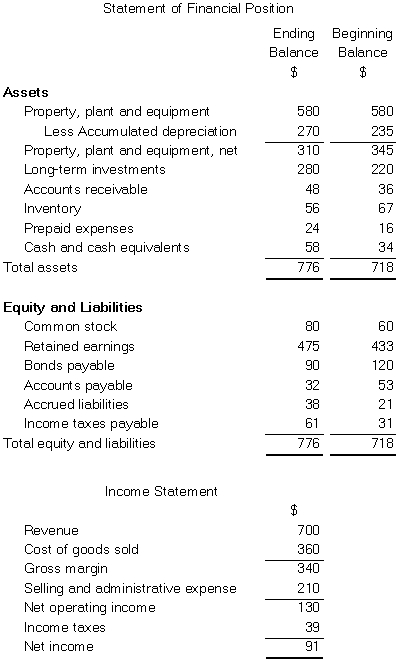

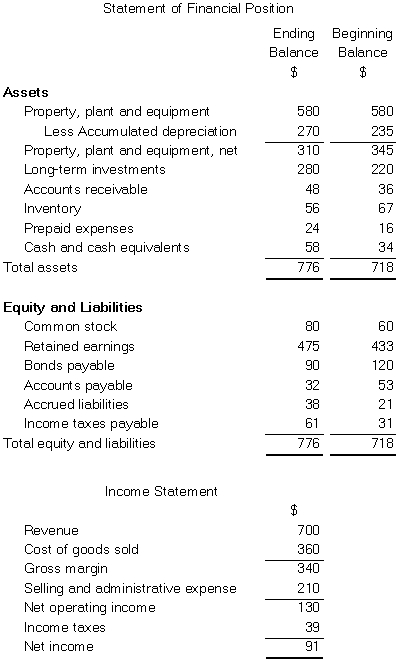

The net cash provided by (used in)investing activities for the year was:

A)$(127)

B)$(138)

C)$138

D)$127

The company paid a cash dividend of $42 and it did not dispose of any property,plant,and equipment.The company did not retire any bonds payable or repurchase any of its own common stock.The following questions pertain to the company's statement of cash flows.

The net cash provided by (used in)investing activities for the year was:

A)$(127)

B)$(138)

C)$138

D)$127

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

23

The change in each of Kendall Corporation's statement of financial position accounts last year follows:

Kendall Corporation's income statement for the year was:

There were no sales or retirements of property,plant,and equipment and no dividends paid during the year.The company pays no income taxes and it did not purchase any long-term investments,issue any bonds payable,or repurchase any of its own common stock.The net cash provided by operating activities on the statement of cash flows is determined using the direct method.

-The net cash provided (used)by investing activities would be:

A)$15,000

B)$(10,000)

C)$(8,000)

D)$5,000

Kendall Corporation's income statement for the year was:

There were no sales or retirements of property,plant,and equipment and no dividends paid during the year.The company pays no income taxes and it did not purchase any long-term investments,issue any bonds payable,or repurchase any of its own common stock.The net cash provided by operating activities on the statement of cash flows is determined using the direct method.

-The net cash provided (used)by investing activities would be:

A)$15,000

B)$(10,000)

C)$(8,000)

D)$5,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

24

The change in each of Kendall Corporation's statement of financial position accounts last year follows:

Kendall Corporation's income statement for the year was:

There were no sales or retirements of property,plant,and equipment and no dividends paid during the year.The company pays no income taxes and it did not purchase any long-term investments,issue any bonds payable,or repurchase any of its own common stock.The net cash provided by operating activities on the statement of cash flows is determined using the direct method.

-The net cash provided (used)by financing activities would be:

A)$(8,000)

B)$(13,000)

C)$20,000

D)$(3,000)

Kendall Corporation's income statement for the year was:

There were no sales or retirements of property,plant,and equipment and no dividends paid during the year.The company pays no income taxes and it did not purchase any long-term investments,issue any bonds payable,or repurchase any of its own common stock.The net cash provided by operating activities on the statement of cash flows is determined using the direct method.

-The net cash provided (used)by financing activities would be:

A)$(8,000)

B)$(13,000)

C)$20,000

D)$(3,000)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

25

The change in each of Kendall Corporation's statement of financial position accounts last year follows:

Kendall Corporation's income statement for the year was:

There were no sales or retirements of property,plant,and equipment and no dividends paid during the year.The company pays no income taxes and it did not purchase any long-term investments,issue any bonds payable,or repurchase any of its own common stock.The net cash provided by operating activities on the statement of cash flows is determined using the direct method.

-The selling and administrative expense adjusted to a cash basis would be:

A)$120,000

B)$106,000

C)$110,000

D)$112,000

Kendall Corporation's income statement for the year was:

There were no sales or retirements of property,plant,and equipment and no dividends paid during the year.The company pays no income taxes and it did not purchase any long-term investments,issue any bonds payable,or repurchase any of its own common stock.The net cash provided by operating activities on the statement of cash flows is determined using the direct method.

-The selling and administrative expense adjusted to a cash basis would be:

A)$120,000

B)$106,000

C)$110,000

D)$112,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

26

Learning Objective: 1

Kilduff Corporation's statement of financial position and income statement appear below:

The company sold equipment for $19 that was originally purchased for $10 and that had accumulated depreciation of $5.The company paid a cash dividend of $44 and it did not issue any bonds payable or repurchase any of its own common stock.

The net cash provided by (used in)investing activities for the year was:

A)$19

B)$(118)

C)$(137)

D)$118

Kilduff Corporation's statement of financial position and income statement appear below:

The company sold equipment for $19 that was originally purchased for $10 and that had accumulated depreciation of $5.The company paid a cash dividend of $44 and it did not issue any bonds payable or repurchase any of its own common stock.

The net cash provided by (used in)investing activities for the year was:

A)$19

B)$(118)

C)$(137)

D)$118

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

27

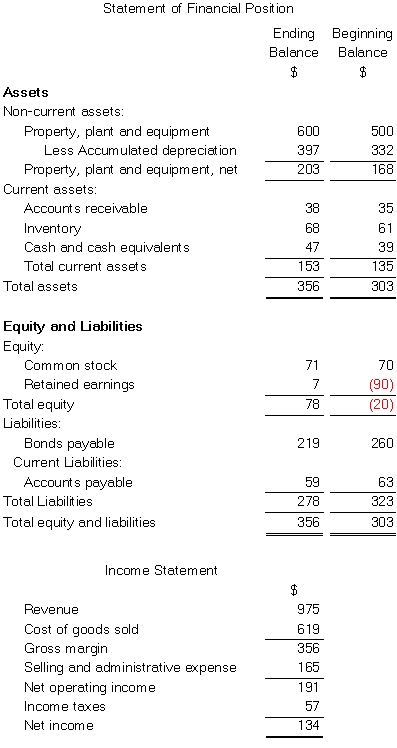

The most recent statement of financial position and income statement of Oldaker Corporation appear below:

The company paid a cash dividend of $42 and it did not dispose of any property,plant,and equipment.The company did not retire any bonds payable or repurchase any of its own common stock.The following questions pertain to the company's statement of cash flows.

The net cash provided by (used in)operating activities for the year was:

A)$168

B)$8

C)$152

D)$229

The company paid a cash dividend of $42 and it did not dispose of any property,plant,and equipment.The company did not retire any bonds payable or repurchase any of its own common stock.The following questions pertain to the company's statement of cash flows.

The net cash provided by (used in)operating activities for the year was:

A)$168

B)$8

C)$152

D)$229

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

28

Learning Objective: 1

Kilduff Corporation's statement of financial position and income statement appear below:

The company sold equipment for $19 that was originally purchased for $10 and that had accumulated depreciation of $5.The company paid a cash dividend of $44 and it did not issue any bonds payable or repurchase any of its own common stock.

The net cash provided by (used in)financing activities for the year was:

A)$(44)

B)$(71)

C)$2

D)$(29)

Kilduff Corporation's statement of financial position and income statement appear below:

The company sold equipment for $19 that was originally purchased for $10 and that had accumulated depreciation of $5.The company paid a cash dividend of $44 and it did not issue any bonds payable or repurchase any of its own common stock.

The net cash provided by (used in)financing activities for the year was:

A)$(44)

B)$(71)

C)$2

D)$(29)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

29

The change in each of Kendall Corporation's statement of financial position accounts last year follows:

Kendall Corporation's income statement for the year was:

There were no sales or retirements of property,plant,and equipment and no dividends paid during the year.The company pays no income taxes and it did not purchase any long-term investments,issue any bonds payable,or repurchase any of its own common stock.The net cash provided by operating activities on the statement of cash flows is determined using the direct method.

-Using the direct method,the cost of goods sold adjusted to a cash basis would be:

A)$180,000

B)$174,000

C)$177,000

D)$186,000

Kendall Corporation's income statement for the year was:

There were no sales or retirements of property,plant,and equipment and no dividends paid during the year.The company pays no income taxes and it did not purchase any long-term investments,issue any bonds payable,or repurchase any of its own common stock.The net cash provided by operating activities on the statement of cash flows is determined using the direct method.

-Using the direct method,the cost of goods sold adjusted to a cash basis would be:

A)$180,000

B)$174,000

C)$177,000

D)$186,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

30

The changes in Northrup Corporation's statement of financial position account balances for last year appear below:

The company's income statement for the year appears below:

The company declared and paid $28,000 in cash dividends during the year.It did not dispose of any property,plant,and equipment during the year.The company uses the direct method to determine the net cash provided by operating activities.

-On the statement of cash flows,the cost of goods sold adjusted to a cash basis would be:

A)$546,000

B)$536,000

C)$544,000

D)$540,000

The company's income statement for the year appears below:

The company declared and paid $28,000 in cash dividends during the year.It did not dispose of any property,plant,and equipment during the year.The company uses the direct method to determine the net cash provided by operating activities.

-On the statement of cash flows,the cost of goods sold adjusted to a cash basis would be:

A)$546,000

B)$536,000

C)$544,000

D)$540,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

31

Last year Marton Corporation reported a cost of goods sold of $720,000 on its income statement.The following additional data were taken from the company's comparative statement of financial position for the year: The company uses the direct method to determine the net cash provided by operating activities on the statement of cash flows.The cost of goods sold adjusted to a cash basis would be:

A)$740,000

B)$767,000

C)$747,000

D)$673,000

A)$740,000

B)$767,000

C)$747,000

D)$673,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

32

The changes in Northrup Corporation's statement of financial position account balances for last year appear below:

The company's income statement for the year appears below:

The company declared and paid $28,000 in cash dividends during the year.It did not dispose of any property,plant,and equipment during the year.The company uses the direct method to determine the net cash provided by operating activities.

-On the statement of cash flows,the income tax expense adjusted to a cash basis would be:

A)$47,000

B)$39,000

C)$31,000

D)$49,000

The company's income statement for the year appears below:

The company declared and paid $28,000 in cash dividends during the year.It did not dispose of any property,plant,and equipment during the year.The company uses the direct method to determine the net cash provided by operating activities.

-On the statement of cash flows,the income tax expense adjusted to a cash basis would be:

A)$47,000

B)$39,000

C)$31,000

D)$49,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

33

Shimko Corporation's most recent comparative statement of financial position and income statement appear below:

The company paid a cash dividend of $19 and it did not dispose of any property,plant,and equipment.The company did not issue any bonds payable or repurchase any of its own common stock.The following questions pertain to the company's statement of cash flows.

The net cash provided by (used in)financing activities for the year was:

A)$(19)

B)$(53)

C)$1

D)$(71)

The company paid a cash dividend of $19 and it did not dispose of any property,plant,and equipment.The company did not issue any bonds payable or repurchase any of its own common stock.The following questions pertain to the company's statement of cash flows.

The net cash provided by (used in)financing activities for the year was:

A)$(19)

B)$(53)

C)$1

D)$(71)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

34

Learning Objective: 1

The net cash provided by (used in)financing activities for the year was:

A)$(42)

B)$3

C)$11

D)$(28)

The net cash provided by (used in)financing activities for the year was:

A)$(42)

B)$3

C)$11

D)$(28)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

35

Learning Objective: 1

Kilduff Corporation's statement of financial position and income statement appear below:

The company sold equipment for $19 that was originally purchased for $10 and that had accumulated depreciation of $5.The company paid a cash dividend of $44 and it did not issue any bonds payable or repurchase any of its own common stock.

The net cash provided by (used in)operating activities for the year was:

A)$187

B)$231

C)$257

D)$201

Kilduff Corporation's statement of financial position and income statement appear below:

The company sold equipment for $19 that was originally purchased for $10 and that had accumulated depreciation of $5.The company paid a cash dividend of $44 and it did not issue any bonds payable or repurchase any of its own common stock.

The net cash provided by (used in)operating activities for the year was:

A)$187

B)$231

C)$257

D)$201

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

36

Shimko Corporation's most recent comparative statement of financial position and income statement appear below:

The company paid a cash dividend of $19 and it did not dispose of any property,plant,and equipment.The company did not issue any bonds payable or repurchase any of its own common stock.The following questions pertain to the company's statement of cash flows.

The net cash provided by (used in)investing activities for the year was:

A)$57

B)$(57)

C)$33

D)$(33)

The company paid a cash dividend of $19 and it did not dispose of any property,plant,and equipment.The company did not issue any bonds payable or repurchase any of its own common stock.The following questions pertain to the company's statement of cash flows.

The net cash provided by (used in)investing activities for the year was:

A)$57

B)$(57)

C)$33

D)$(33)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

37

The change in each of Kendall Corporation's statement of financial position accounts last year follows:

Kendall Corporation's income statement for the year was:

There were no sales or retirements of property,plant,and equipment and no dividends paid during the year.The company pays no income taxes and it did not purchase any long-term investments,issue any bonds payable,or repurchase any of its own common stock.The net cash provided by operating activities on the statement of cash flows is determined using the direct method.

-Using the direct method,sales adjusted to a cash basis would be:

A)$300,000

B)$302,000

C)$298,000

D)$305,000

Kendall Corporation's income statement for the year was:

There were no sales or retirements of property,plant,and equipment and no dividends paid during the year.The company pays no income taxes and it did not purchase any long-term investments,issue any bonds payable,or repurchase any of its own common stock.The net cash provided by operating activities on the statement of cash flows is determined using the direct method.

-Using the direct method,sales adjusted to a cash basis would be:

A)$300,000

B)$302,000

C)$298,000

D)$305,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

38

Last year Anderson Corporation reported a cost of goods sold of $100,000.The company's inventory at the beginning of the year was $11,000,and its inventory at the end of the year was $19,000.The prepaid expense account increased by $2,000 between the beginning and end of the year,and the accounts payable account decreased by $4,000.Cost of goods sold adjusted to the cash basis under the direct method would be:

A)$94,000

B)$106,000

C)$112,000

D)$110,000

A)$94,000

B)$106,000

C)$112,000

D)$110,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

39

The changes in Northrup Corporation's statement of financial position account balances for last year appear below:

The company's income statement for the year appears below:

The company declared and paid $28,000 in cash dividends during the year.It did not dispose of any property,plant,and equipment during the year.The company uses the direct method to determine the net cash provided by operating activities.

-On the statement of cash flows,the selling and administrative expense adjusted to a cash basis would be:

A)$304,000

B)$384,000

C)$310,000

D)$236,000

The company's income statement for the year appears below:

The company declared and paid $28,000 in cash dividends during the year.It did not dispose of any property,plant,and equipment during the year.The company uses the direct method to determine the net cash provided by operating activities.

-On the statement of cash flows,the selling and administrative expense adjusted to a cash basis would be:

A)$304,000

B)$384,000

C)$310,000

D)$236,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

40

The changes in Northrup Corporation's statement of financial position account balances for last year appear below:

The company's income statement for the year appears below:

The company declared and paid $28,000 in cash dividends during the year.It did not dispose of any property,plant,and equipment during the year.The company uses the direct method to determine the net cash provided by operating activities.

-On the statement of cash flows,the sales adjusted to a cash basis would be:

A)$976,000

B)$982,000

C)$984,000

D)$980,000

The company's income statement for the year appears below:

The company declared and paid $28,000 in cash dividends during the year.It did not dispose of any property,plant,and equipment during the year.The company uses the direct method to determine the net cash provided by operating activities.

-On the statement of cash flows,the sales adjusted to a cash basis would be:

A)$976,000

B)$982,000

C)$984,000

D)$980,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

41

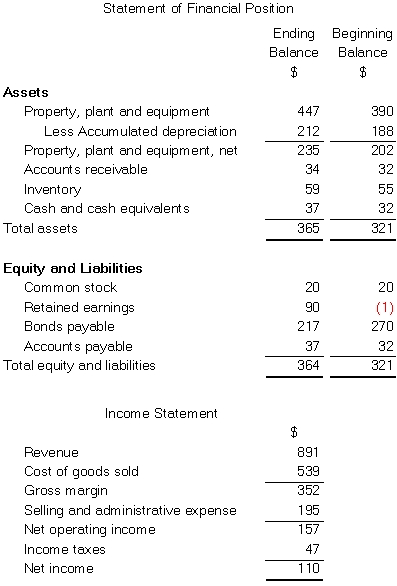

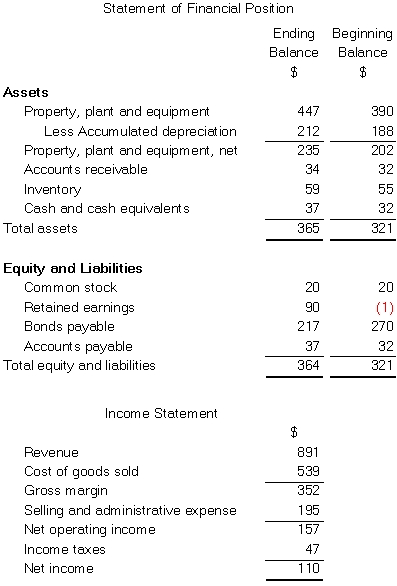

Maloney Corporation's statement of financial position and income statement appear below:

Cash dividends were $42.The company did not dispose of any property,plant,and equipment during the year.

Required:

Prepare the operating activities section of the statement of cash flows using the direct method.

Cash dividends were $42.The company did not dispose of any property,plant,and equipment during the year.

Required:

Prepare the operating activities section of the statement of cash flows using the direct method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

42

Van Beeber Corporation's comparative statement of financial position and income statement for last year appear below:

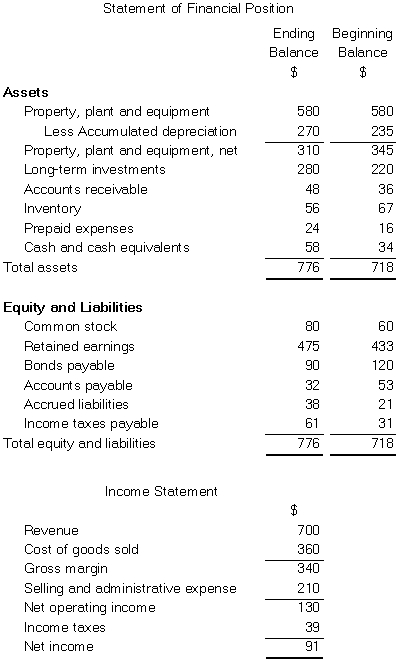

The company declared and paid $49,000 in cash dividends during the year.It did not sell or retire any property,plant,and equipment during the year.The company uses the direct method to determine the net cash provided by operating activities.

On the statement of cash flows,the selling and administrative expense adjusted to a cash basis would be:

A)$201,000

B)$166,000

C)$254,000

D)$210,000

The company declared and paid $49,000 in cash dividends during the year.It did not sell or retire any property,plant,and equipment during the year.The company uses the direct method to determine the net cash provided by operating activities.

On the statement of cash flows,the selling and administrative expense adjusted to a cash basis would be:

A)$201,000

B)$166,000

C)$254,000

D)$210,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

43

Digby Corporation's statement of financial position and income statement appear below:

Cash dividends were $29.The company did not dispose of any property,plant,and equipment during the year.

Required:

Prepare the operating activities section of the statement of cash flows in good form using the direct method.

Cash dividends were $29.The company did not dispose of any property,plant,and equipment during the year.

Required:

Prepare the operating activities section of the statement of cash flows in good form using the direct method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

44

Van Beeber Corporation's comparative statement of financial position and income statement for last year appear below:

The company declared and paid $49,000 in cash dividends during the year.It did not sell or retire any property,plant,and equipment during the year.The company uses the direct method to determine the net cash provided by operating activities.

On the statement of cash flows,the sales adjusted to a cash basis would be:

A)$700,000

B)$688,000

C)$677,000

D)$712,000

The company declared and paid $49,000 in cash dividends during the year.It did not sell or retire any property,plant,and equipment during the year.The company uses the direct method to determine the net cash provided by operating activities.

On the statement of cash flows,the sales adjusted to a cash basis would be:

A)$700,000

B)$688,000

C)$677,000

D)$712,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

45

Carson Corporation's comparative statement of financial position and income statement for last year appear below:

Carson did not dispose of any property,plant,and equipment during the year.It constructs its statement of cash flows using the direct method.

Required:

Using the direct method,prepare in good form the operating activities section of the statement of cash flows.

Carson did not dispose of any property,plant,and equipment during the year.It constructs its statement of cash flows using the direct method.

Required:

Using the direct method,prepare in good form the operating activities section of the statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

46

The changes in each statement of financial position account for Carver Corporation during the year just completed are as follows:

Carver Corporation's income statement for the year just ended shows the following:

The company did not dispose of any property,plant,and equipment,buy any long-term investments,issue any bonds payable,or repurchase any of its own common stock during the year.Carver Corporation uses the direct method to construct its statement of cash flows.

Required:

a.Determine the sales adjusted to the cash basis.

b.Determine the cost of goods sold adjusted to the cash basis.

c.Determine the selling and administrative expenses adjusted to a cash basis.

d.Determine the net cash provided (used)by operating activities.

e.Determine the net cash provided (used)by investing activities.

f.Determine the net cash provided (used)by financing activities.

Carver Corporation's income statement for the year just ended shows the following:

The company did not dispose of any property,plant,and equipment,buy any long-term investments,issue any bonds payable,or repurchase any of its own common stock during the year.Carver Corporation uses the direct method to construct its statement of cash flows.

Required:

a.Determine the sales adjusted to the cash basis.

b.Determine the cost of goods sold adjusted to the cash basis.

c.Determine the selling and administrative expenses adjusted to a cash basis.

d.Determine the net cash provided (used)by operating activities.

e.Determine the net cash provided (used)by investing activities.

f.Determine the net cash provided (used)by financing activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

47

Van Beeber Corporation's comparative statement of financial position and income statement for last year appear below:

The company declared and paid $49,000 in cash dividends during the year.It did not sell or retire any property,plant,and equipment during the year.The company uses the direct method to determine the net cash provided by operating activities.

On the statement of cash flows,the cost of goods sold adjusted to a cash basis would be:

A)$360,000

B)$350,000

C)$370,000

D)$381,000

The company declared and paid $49,000 in cash dividends during the year.It did not sell or retire any property,plant,and equipment during the year.The company uses the direct method to determine the net cash provided by operating activities.

On the statement of cash flows,the cost of goods sold adjusted to a cash basis would be:

A)$360,000

B)$350,000

C)$370,000

D)$381,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

48

Carr Corporation's comparative statement of financial position and income statement for last year appear below:

The company declared and paid $47,000 in cash dividends during the year.It did not dispose of any property,plant,and equipment during the year.

Required:

Construct in good form the operating activities section of the company's statement of cash flows for the year using the direct method.

The company declared and paid $47,000 in cash dividends during the year.It did not dispose of any property,plant,and equipment during the year.

Required:

Construct in good form the operating activities section of the company's statement of cash flows for the year using the direct method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

49

Last year,Knox Corporation reported on its income statement sales of $375,000 and cost of goods sold of $140,000.During the year,the balance in accounts receivable increased $30,000,the balance in accounts payable decreased $25,000,and the balance in inventory increased $10,000.The company uses the direct method to determine the net cash provided by operating activities on its statement of cash flows.

Under the direct method,cost of goods sold adjusted to a cash basis would be:

A)$105,000

B)$125,000

C)$175,000

D)$155,000

Under the direct method,cost of goods sold adjusted to a cash basis would be:

A)$105,000

B)$125,000

C)$175,000

D)$155,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

50

Hayward Corporation had net sales of $610,000 and cost of goods sold of $360,000 for the just completed year.Shown below are the beginning and ending balances for the year of various accounts:

The company prepares its statement of cash flows using the direct method.

-On its statement of cash flows,what amount should Howard show for its net sales adjusted to a cash basis (i.e. ,cash received from sales)?

A)$616,000

B)$623,000

C)$625,000

D)$595,000

The company prepares its statement of cash flows using the direct method.

-On its statement of cash flows,what amount should Howard show for its net sales adjusted to a cash basis (i.e. ,cash received from sales)?

A)$616,000

B)$623,000

C)$625,000

D)$595,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

51

Freeport Corporation's income statement for last year appears below:

The beginning and ending balances for last year are available for the following selected accounts (the company did not dispose of any property,plant,and equipment during the year):

Required:

Using the direct method,prepare in good form the operating activities section of the statement of cash flows.

The beginning and ending balances for last year are available for the following selected accounts (the company did not dispose of any property,plant,and equipment during the year):

Required:

Using the direct method,prepare in good form the operating activities section of the statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

52

Harkey Corporation's statement of financial position and income statement appear below:

Cash dividends were $29.The company sold equipment for $15 that was originally purchased for $6 and that had accumulated depreciation of $2.

Required:

Using the direct method,determine the net cash provided by operating activities.

Cash dividends were $29.The company sold equipment for $15 that was originally purchased for $6 and that had accumulated depreciation of $2.

Required:

Using the direct method,determine the net cash provided by operating activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

53

Last year,Knox Corporation reported on its income statement sales of $375,000 and cost of goods sold of $140,000.During the year,the balance in accounts receivable increased $30,000,the balance in accounts payable decreased $25,000,and the balance in inventory increased $10,000.The company uses the direct method to determine the net cash provided by operating activities on its statement of cash flows.

Under the direct method,sales adjusted to a cash basis would be:

A)$295,000

B)$345,000

C)$405,000

D)$355,000

Under the direct method,sales adjusted to a cash basis would be:

A)$295,000

B)$345,000

C)$405,000

D)$355,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

54

Comparative statement of financial position and the income statement for Ellis Corporation are presented below:

The following additional information is available for the year:

* During the year,the company sold long-term investments for $35,500 that had been purchased for $38,000.

* The company did not sell any property,plant,and equipment during the year or repurchase any of its own common stock.

* All sales were on credit.

* The company paid a cash dividend of $25,000.

* The company paid cash to retire $15,000 of bonds payable.

Required:

a.Using the indirect method,determine the net cash provided by operating activities.

b.Using the direct method,determine the net cash provided by operating activities.

c.Using the net cash provided by operating activities amount from either part a or b,prepare a statement of cash flows.

The following additional information is available for the year:

* During the year,the company sold long-term investments for $35,500 that had been purchased for $38,000.

* The company did not sell any property,plant,and equipment during the year or repurchase any of its own common stock.

* All sales were on credit.

* The company paid a cash dividend of $25,000.

* The company paid cash to retire $15,000 of bonds payable.

Required:

a.Using the indirect method,determine the net cash provided by operating activities.

b.Using the direct method,determine the net cash provided by operating activities.

c.Using the net cash provided by operating activities amount from either part a or b,prepare a statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

55

Van Beeber Corporation's comparative statement of financial position and income statement for last year appear below:

The company declared and paid $49,000 in cash dividends during the year.It did not sell or retire any property,plant,and equipment during the year.The company uses the direct method to determine the net cash provided by operating activities.

On the statement of cash flows,the income tax expense adjusted to a cash basis would be:

A)$39,000

B)$69,000

C)$9,000

D)$25,000

The company declared and paid $49,000 in cash dividends during the year.It did not sell or retire any property,plant,and equipment during the year.The company uses the direct method to determine the net cash provided by operating activities.

On the statement of cash flows,the income tax expense adjusted to a cash basis would be:

A)$39,000

B)$69,000

C)$9,000

D)$25,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

56

Hayward Corporation had net sales of $610,000 and cost of goods sold of $360,000 for the just completed year.Shown below are the beginning and ending balances for the year of various accounts:

The company prepares its statement of cash flows using the direct method.

-On its statement of cash flows,what amount should Howard show for its cost of goods sold adjusted to a cash basis (i.e. ,cash paid to suppliers)?

A)$345,000

B)$366,000

C)$379,000

D)$373,000

The company prepares its statement of cash flows using the direct method.

-On its statement of cash flows,what amount should Howard show for its cost of goods sold adjusted to a cash basis (i.e. ,cash paid to suppliers)?

A)$345,000

B)$366,000

C)$379,000

D)$373,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck