Deck 22: Money and Inflation

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/149

العب

ملء الشاشة (f)

Deck 22: Money and Inflation

1

One of the most important principles of macroeconomics is that excessive decreases in the supply of money cause inflation.

False

2

An individual who claims she is making a lot of money is using the word money according to the definition of the word used in economics.

False

3

Barter represents a great technological improvement over coins.

False

4

Money is always a good store of value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

5

Under a barter system,

A)there is a single medium of exchange.

B)an efficient banking system is necessary.

C)money is exchanged for goods after reaching an agreed-upon price.

D)any good can be used as a medium of exchange.

E)the coincidence of wants is not a major problem.

A)there is a single medium of exchange.

B)an efficient banking system is necessary.

C)money is exchanged for goods after reaching an agreed-upon price.

D)any good can be used as a medium of exchange.

E)the coincidence of wants is not a major problem.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

6

When you put your spare change into your child's piggy bank,money is serving as a

A)store of value.

B)unit of account and store of value.

C)medium of exchange and unit of account.

D)medium of exchange.

E)unit of account.

A)store of value.

B)unit of account and store of value.

C)medium of exchange and unit of account.

D)medium of exchange.

E)unit of account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

7

When something is generally accepted as a means of payment,such as grain in many traditional societies,we say that this represents

A)money as a medium of exchange.

B)money as a store of value.

C)money as a unit of wealth.

D)an inflationary danger.

E)a government opportunity for social control.

A)money as a medium of exchange.

B)money as a store of value.

C)money as a unit of wealth.

D)an inflationary danger.

E)a government opportunity for social control.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

8

Historians trace the origins of money to the very origins of civilization.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

9

If gold is being used for money,an increase in the supply of gold will cause

A)a decrease in the money supply.

B)the price of all other goods to fall.

C)the price of gold to increase.

D)an increase in the price of all other goods.

E)nothing to happen to inflation.

A)a decrease in the money supply.

B)the price of all other goods to fall.

C)the price of gold to increase.

D)an increase in the price of all other goods.

E)nothing to happen to inflation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

10

If inflation is high,the local currency may not be the most efficient unit of account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

11

The functions of money do not include

A)a unit of account.

B)a medium of exchange..

C)a store of value.

D)an exchange of purchasing power.

E)any of these.

A)a unit of account.

B)a medium of exchange..

C)a store of value.

D)an exchange of purchasing power.

E)any of these.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

12

Which of the following is true about barter?

A)Barter is more efficient than using coins.

B)The disadvantage of barter is that it requires a rare double coincidence of wants.

C)Barter is the main form of exchange in most developed countries today.

D)All of the above

E)None of the above

A)Barter is more efficient than using coins.

B)The disadvantage of barter is that it requires a rare double coincidence of wants.

C)Barter is the main form of exchange in most developed countries today.

D)All of the above

E)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

13

Money is the fraction of wealth used for transaction purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

14

Suppose that transactions are conducted in pesos and prices are quoted in dollars.In this case the dollar functions primarily as a

A)store of value.

B)unit of account and store of value.

C)medium of exchange.

D)unit of account.

E)medium of exchange and store of value.

A)store of value.

B)unit of account and store of value.

C)medium of exchange.

D)unit of account.

E)medium of exchange and store of value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

15

Before you buy your new car,you visit four local dealerships and collect information on the prices and features of the cars.In this case,you are using money as a

A)unit of account.

B)store of value and unit of account.

C)store of value and medium of exchange.

D)store of value.

E)medium of exchange.

A)unit of account.

B)store of value and unit of account.

C)store of value and medium of exchange.

D)store of value.

E)medium of exchange.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

16

Suppose that transactions are conducted in pesos and prices are quoted in dollars.In this case the peso is used primarily as a

A)medium of exchange and unit of account.

B)unit of account.

C)medium of exchange.

D)unit of account and store of value.

E)store of value.

A)medium of exchange and unit of account.

B)unit of account.

C)medium of exchange.

D)unit of account and store of value.

E)store of value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

17

Only money can serve as a store of value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

18

Which of the following is true?

A)Historians trace the origins of money to cities such as Babylon,more than 5,000 years ago.

B)After World War I,the government of Germany printed too much money and correspondingly made the price of everything rise by millions of percentage points.

C)In 2009,high inflation occurred in Zimbabwe as a result of its government printing too little money.

D)In 2008 and 2009,the government of the United States dealt with a financial crisis by raising the supply of money.

E)All of these are true.

A)Historians trace the origins of money to cities such as Babylon,more than 5,000 years ago.

B)After World War I,the government of Germany printed too much money and correspondingly made the price of everything rise by millions of percentage points.

C)In 2009,high inflation occurred in Zimbabwe as a result of its government printing too little money.

D)In 2008 and 2009,the government of the United States dealt with a financial crisis by raising the supply of money.

E)All of these are true.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

19

To economists,money

A)means the same thing as income.

B)functions as a medium of exchange.

C)means the same thing as wealth.

D)All of these

E)means the same thing as earnings.

A)means the same thing as income.

B)functions as a medium of exchange.

C)means the same thing as wealth.

D)All of these

E)means the same thing as earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

20

Which of the following monetary terms,which originally meant one-third of an ounce of silver,was invented thousands of years ago?

A)Peso

B)Dollar

C)Shekel

D)Euro

E)Yen

A)Peso

B)Dollar

C)Shekel

D)Euro

E)Yen

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

21

M2 includes

A)M1 plus government bonds.

B)M1 plus U.S.government securities.

C)M1 plus savings accounts and small time deposits.

D)M1 plus term Eurodollar deposits.

E)M1 minus savings accounts.

A)M1 plus government bonds.

B)M1 plus U.S.government securities.

C)M1 plus savings accounts and small time deposits.

D)M1 plus term Eurodollar deposits.

E)M1 minus savings accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

22

The sum of all currency (coin and paper money)coupled with all bank deposits is known by economists as

A)convertible currency.

B)foreign exchange.

C)the money supply.

D)cash and marketable securities.

E)None of these

A)convertible currency.

B)foreign exchange.

C)the money supply.

D)cash and marketable securities.

E)None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

23

M1 consists of

A)paper money only.

B)currency plus checking deposits only.

C)currency plus checking deposits plus travelers' checks plus savings deposits only.

D)currency only.

E)currency plus checking deposits plus travelers' checks only.

A)paper money only.

B)currency plus checking deposits only.

C)currency plus checking deposits plus travelers' checks plus savings deposits only.

D)currency only.

E)currency plus checking deposits plus travelers' checks only.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

24

Throughout history,metallic coins have been the most common form of commodity money.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

25

Throughout history,the most common form of commodity money has been

A)cattle.

B)salt.

C)metallic coins.

D)shells.

E)stones.

A)cattle.

B)salt.

C)metallic coins.

D)shells.

E)stones.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

26

The gold standard

A)is no longer observed in the United States.

B)imposes a limit on the amount of paper money in circulation.

C)All of these

D)means that the price of gold in terms of paper money is fixed by the government.

E)was devised as a means of controlling inflation.

A)is no longer observed in the United States.

B)imposes a limit on the amount of paper money in circulation.

C)All of these

D)means that the price of gold in terms of paper money is fixed by the government.

E)was devised as a means of controlling inflation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

27

Which of the following is the most common form of money?

A)Commodity money

B)Currency

C)Paper money

D)Coins

E)Checking deposits

A)Commodity money

B)Currency

C)Paper money

D)Coins

E)Checking deposits

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

28

Currency includes only

A)coins and paper money.

B)coins,paper money,and checking deposits.

C)paper money.

D)greenbacks.

E)coins.

A)coins and paper money.

B)coins,paper money,and checking deposits.

C)paper money.

D)greenbacks.

E)coins.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

29

An economy that uses commodity money will not experience inflation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

30

Which of the following would not be counted as part of M1?

A)Paper money

B)Demand deposits

C)Savings deposits

D)Travelers' checks

E)Currency

A)Paper money

B)Demand deposits

C)Savings deposits

D)Travelers' checks

E)Currency

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

31

The most efficient form of money is checking accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

32

As a measure of money,M1 emphasizes the use of money as

A)an illiquid asset.

B)a unit of account.

C)a standard of deferred payment.

D)a medium of exchange.

E)a store of value.

A)an illiquid asset.

B)a unit of account.

C)a standard of deferred payment.

D)a medium of exchange.

E)a store of value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

33

What percentage of M2 is currency?

A)50 percent

B)30 percent

C)10 percent

D)100 percent

E)75 percent

A)50 percent

B)30 percent

C)10 percent

D)100 percent

E)75 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

34

Governments supply virtually all the coin and paper money that is used as a medium of exchange in an economy.Economists refer to coin and paper money together as

A)currency.

B)convertible cash.

C)total checking deposits.

D)base money.

E)None of these

A)currency.

B)convertible cash.

C)total checking deposits.

D)base money.

E)None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

35

The United States has never been on a gold standard.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

36

What percentage of M1 is currency?

A)50 percent

B)10 percent

C)75 percent

D)100 percent

E)30 percent

A)50 percent

B)10 percent

C)75 percent

D)100 percent

E)30 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

37

Paper money

A)is a less efficient form of money than checking deposits.

B)is as efficient a form of money as coins.

C)is the most efficient form of money.

D)must be linked by law to the supply of gold.

E)is an efficient form of money only if it is backed by a precious commodity.

A)is a less efficient form of money than checking deposits.

B)is as efficient a form of money as coins.

C)is the most efficient form of money.

D)must be linked by law to the supply of gold.

E)is an efficient form of money only if it is backed by a precious commodity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

38

Starting in the mid-twentieth century,paper money began to be used widely and supplemented or replaced coins as a form of money.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

39

Which of the following is money?

A)All of these

B)Checks in the checkbook

C)Checking deposits

D)ATM cards

E)Credit cards

A)All of these

B)Checks in the checkbook

C)Checking deposits

D)ATM cards

E)Credit cards

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

40

The U.S.dollar is not backed by any precious metal or commodity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

41

The central bank of the United States of America is commonly known as the Fed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

42

The "Fed" is the nickname for

A)Congress.

B)the presidency.

C)the Federal Reserve System.

D)the federal government.

E)the United States Treasury.

A)Congress.

B)the presidency.

C)the Federal Reserve System.

D)the federal government.

E)the United States Treasury.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

43

The chairman of the Board of Governors of the Federal Reserve since 2006 is

A)Paul O'Neal.

B)Irving Fisher.

C)Ben Bernanke.

D)Ted Kennedy.

E)Paul Volcker.

A)Paul O'Neal.

B)Irving Fisher.

C)Ben Bernanke.

D)Ted Kennedy.

E)Paul Volcker.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

44

The Federal Reserve

A)controls the supply of money according to the gold standard.

B)exists primarily to be the bank of the federal government.

C)is another name for the U.S.Treasury.

D)serves as a bank to other banks.

E)exists only to control the supply of currency in the economy.

A)controls the supply of money according to the gold standard.

B)exists primarily to be the bank of the federal government.

C)is another name for the U.S.Treasury.

D)serves as a bank to other banks.

E)exists only to control the supply of currency in the economy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

45

Financial intermediaries exist primarily because

A)they are part of the U.S.Treasury.

B)they are part of the Federal Reserve System.

C)of historical accident.

D)they can make a profit.

E)of federal mandates.

A)they are part of the U.S.Treasury.

B)they are part of the Federal Reserve System.

C)of historical accident.

D)they can make a profit.

E)of federal mandates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

46

Although there has been a reported increase in counterfeit money,it is estimated to currently account for

A)less than 1 percent of genuine currency.

B)between 1 and 2 percent of genuine currency.

C)between 2 and 5 percent of genuine currency.

D)between 5 and 10 percent of genuine currency.

E)more than 10 percent of genuine currency,but less than 50 percent.

A)less than 1 percent of genuine currency.

B)between 1 and 2 percent of genuine currency.

C)between 2 and 5 percent of genuine currency.

D)between 5 and 10 percent of genuine currency.

E)more than 10 percent of genuine currency,but less than 50 percent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

47

The chair of the Board of Governors of the Federal Reserve is

A)appointed by the president and confirmed by the Senate,the appointment can be renewed for additional terms.

B)appointed by the president and confirmed by the Senate,and the appointment cannot be renewed for additional terms.

C)elected by Congress and serves a 7-year term.

D)elected by Congress and serves a 4-year term.

E)elected by Congress and serves a 10-year term.

A)appointed by the president and confirmed by the Senate,the appointment can be renewed for additional terms.

B)appointed by the president and confirmed by the Senate,and the appointment cannot be renewed for additional terms.

C)elected by Congress and serves a 7-year term.

D)elected by Congress and serves a 4-year term.

E)elected by Congress and serves a 10-year term.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

48

The Board of Governors of the Federal Reserve is

A)appointed by the president and confirmed by the Senate,and each governor serves a 14-year term.

B)elected by Congress,and each governor serves a 10-year term.

C)elected by Congress,and each governor serves a 4-year term.

D)elected by Congress,and each governor serves a 7-year term.

E)appointed by the president and confirmed by the Senate,and each governor serves a 7-year term.

A)appointed by the president and confirmed by the Senate,and each governor serves a 14-year term.

B)elected by Congress,and each governor serves a 10-year term.

C)elected by Congress,and each governor serves a 4-year term.

D)elected by Congress,and each governor serves a 7-year term.

E)appointed by the president and confirmed by the Senate,and each governor serves a 7-year term.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

49

Items in M1 are more liquid than items in M2.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

50

One of the main reasons the U.S.Treasury is redesigning dollar bills (such as the $10,$20,and $50 denominated bills)is so that they are more difficult to counterfeit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

51

The Federal Reserve System is divided into how many districts?

A)12

B)7

C)50

D)2

E)6

A)12

B)7

C)50

D)2

E)6

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

52

Banks are referred to as intermediaries because they

A)are part of the money supply process.

B)earn a profit.

C)charge interest on a loan.

D)channel funds from depositors to borrowers.

E)provide a way for people to save their money.

A)are part of the money supply process.

B)earn a profit.

C)charge interest on a loan.

D)channel funds from depositors to borrowers.

E)provide a way for people to save their money.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

53

Which of the following is true?

A)None of these

B)Commercial banks are the only legal type of financial intermediary.

C)Banks are prohibited by law from earning a profit.

D)It is customary to pay a higher interest rate on a loan than you would receive on your savings account from the same bank.

E)A bank earns a profit by lending at a lower rate than it pays its depositors.

A)None of these

B)Commercial banks are the only legal type of financial intermediary.

C)Banks are prohibited by law from earning a profit.

D)It is customary to pay a higher interest rate on a loan than you would receive on your savings account from the same bank.

E)A bank earns a profit by lending at a lower rate than it pays its depositors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

54

A commercial bank is

A)a Federal Reserve bank.

B)part of the federal government.

C)part of the U.S.Treasury.

D)a financial intermediary.

E)a nonprofit organization.

A)a Federal Reserve bank.

B)part of the federal government.

C)part of the U.S.Treasury.

D)a financial intermediary.

E)a nonprofit organization.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

55

Time deposits require the depositor to keep the money at the bank for a certain amount of time or else lose interest.They are therefore not as liquid as checking deposits,but it is normally possible to withdraw funds from them.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

56

The money supply is the sum of the currency in circulation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

57

Is money the same as income? Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

58

For a bank to make a profit,the interest rate on its deposit liabilities must be higher than the interest rate on its loan receipts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

59

The central bank of the United States is known as the

A)Bundesbank.

B)Fed.

C)Bank of America.

D)First National Bank.

E)Department of the Treasury.

A)Bundesbank.

B)Fed.

C)Bank of America.

D)First National Bank.

E)Department of the Treasury.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

60

If a country's currency is on a gold standard,does that mean there can be no inflation? Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

61

If the Fed wants to decrease the amount of deposits that banks hold,it can

A)buy government bonds in an open market operation.

B)sell government bonds in an open market operation.

C)force banks by decree to do so.

D)sell domestic deposits to foreign investors.

E)None of these

A)buy government bonds in an open market operation.

B)sell government bonds in an open market operation.

C)force banks by decree to do so.

D)sell domestic deposits to foreign investors.

E)None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

62

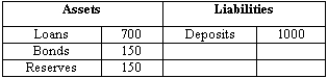

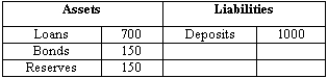

Exhibit 22-1

The data in Exhibit 22-1 shows the balance sheet (in millions of dollars)for Bank INF.Assuming the bank's reserves are what is required by law,the required reserve ratio is

A)85 percent.

B)15 percent.

C)70 percent.

D)30 percent.

E)5 percent.

The data in Exhibit 22-1 shows the balance sheet (in millions of dollars)for Bank INF.Assuming the bank's reserves are what is required by law,the required reserve ratio is

A)85 percent.

B)15 percent.

C)70 percent.

D)30 percent.

E)5 percent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

63

All members of the Federal Reserve Board of Governors are appointed by the president and confirmed by the Senate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

64

Deposits are an asset for the bank because the bank can use the deposits to generate a profit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

65

Reserves are another name for commercial bank deposits at the Fed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

66

The Federal Reserve system is divided into 52 districts,1 for each state,plus 1 for Washington,D.C.,and 1 for Puerto Rico.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

67

The voting members of the FOMC are

A)the governors of the Federal Reserve Board and the president of the United States.

B)the governors of the Federal Reserve Board and the president of the New York Fed.

C)the governors of the Federal Reserve Board and 5 of the 12 Federal Reserve district bank presidents.

D)the governors of the Federal Reserve Board and the 12 Federal Reserve district bank presidents.

E)the governors of the Federal Reserve Board,5 of the 12 Federal Reserve district bank presidents,and the secretary of the Treasury.

A)the governors of the Federal Reserve Board and the president of the United States.

B)the governors of the Federal Reserve Board and the president of the New York Fed.

C)the governors of the Federal Reserve Board and 5 of the 12 Federal Reserve district bank presidents.

D)the governors of the Federal Reserve Board and the 12 Federal Reserve district bank presidents.

E)the governors of the Federal Reserve Board,5 of the 12 Federal Reserve district bank presidents,and the secretary of the Treasury.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

68

If the Fed's actions cause a bank's reserves to increase,we know the bank will have an incentive to convert the new reserves into loans and bonds because

A)of government regulation.

B)reserves are taxed by the federal government.

C)of moral suasion.

D)reserves don't earn interest.

E)the Fed will take the reserves back if they are not used.

A)of government regulation.

B)reserves are taxed by the federal government.

C)of moral suasion.

D)reserves don't earn interest.

E)the Fed will take the reserves back if they are not used.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

69

If the Fed purchases $15 million worth of government bonds from Bank Zip,initially

A)the amount of Bank Zip's deposits at the Fed will decrease by $15 million.

B)the amount of Bank Zip's deposits at the Fed will increase by $15 million.

C)nothing will happen to Bank Zip's balance sheet.

D)the amount of funds deposited at Bank Zip will increase by $15 million.

E)the amount of funds deposited at Bank Zip will decrease by $15 million.

A)the amount of Bank Zip's deposits at the Fed will decrease by $15 million.

B)the amount of Bank Zip's deposits at the Fed will increase by $15 million.

C)nothing will happen to Bank Zip's balance sheet.

D)the amount of funds deposited at Bank Zip will increase by $15 million.

E)the amount of funds deposited at Bank Zip will decrease by $15 million.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

70

Suppose a bank's deposit liabilities increase by $10 million.If the required reserve ratio is 20 percent,bank reserves will increase by

A)Not enough information is given.

B)$2 million.

C)$8 million.

D)$1 million.

E)$10 million.

A)Not enough information is given.

B)$2 million.

C)$8 million.

D)$1 million.

E)$10 million.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

71

If the Fed sells $15 million worth of government bonds to Bank Zip,then initially

A)the amount of deposits held by Bank Zip will increase by $15 million.

B)the amount of reserves held by Bank Zip will decrease by $15 million.

C)the amount of bonds held by Bank Zip will decrease by $15 million.

D)the amount of deposits held by Bank Zip will decrease by $15 million.

E)the amount of reserves held by Bank Zip will increase by $15 million.

A)the amount of deposits held by Bank Zip will increase by $15 million.

B)the amount of reserves held by Bank Zip will decrease by $15 million.

C)the amount of bonds held by Bank Zip will decrease by $15 million.

D)the amount of deposits held by Bank Zip will decrease by $15 million.

E)the amount of reserves held by Bank Zip will increase by $15 million.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

72

Open market operations refer to the buying or selling of bonds by the central bank.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

73

The Federal Reserve serves as a financial intermediary only for other financial intermediaries.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

74

The FOMC implements monetary policy after obtaining the approval of the president.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

75

The buying and selling of government bonds by the central bank is known as

A)government bond barter.

B)fiscal policy.

C)open market operations.

D)banking equivalency.

E)None of these

A)government bond barter.

B)fiscal policy.

C)open market operations.

D)banking equivalency.

E)None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

76

To increase bank reserves,the Fed will

A)sell bonds to banks.

B)buy bonds from banks.

C)sell bonds to the government.

D)buy bonds from the government.

E)sell bonds to the public.

A)sell bonds to banks.

B)buy bonds from banks.

C)sell bonds to the government.

D)buy bonds from the government.

E)sell bonds to the public.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

77

The Federal Reserve system is a government agency.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

78

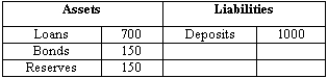

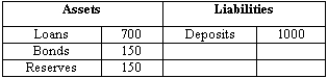

Exhibit 22-1

According to the data in Exhibit 22-1,the amount of deposits Bank INF holds at the Fed equals

A)$150 million.

B)$1000 million.

C)$850 million.

D)$50 million.

E)$25 million.

According to the data in Exhibit 22-1,the amount of deposits Bank INF holds at the Fed equals

A)$150 million.

B)$1000 million.

C)$850 million.

D)$50 million.

E)$25 million.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

79

The reserve ratio can be larger or smaller than the required reserve ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

80

Which of the following are a liability for a bank?

A)Reserves

B)Bonds

C)Loans

D)Deposits

E)Treasury securities

A)Reserves

B)Bonds

C)Loans

D)Deposits

E)Treasury securities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck