Deck 5: The Accounting Cycle: Reporting Financial Results

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/111

العب

ملء الشاشة (f)

Deck 5: The Accounting Cycle: Reporting Financial Results

1

At year-end,all equity accounts must be closed.

False

2

Publicly owned companies are typically managed by their stockholders.

False

3

Real accounts can only be closed at the end of the year with a single compound entry.

False

4

A current asset must be capable of being converted into cash within a relatively short period of time,usually less than five years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

5

The report form of the balance sheet lists liabilities and owners' equity below assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

6

Closing entries do not affect the cash account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

7

IFRS 1 requires that management and auditors should depart from compliance with GAAP if it is necessary to achieve a fair presentation when reporting financial results.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

8

The income summary account appears on the statement of retained earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

9

Most disclosures appear within the body of the financial statements; however,a few disclosures may also appear in the notes that accompany the financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

10

The Financial Accounting Standards Board (FASB)maintains and periodically updates a well-defined list of disclosure items that companies must include in their annual reports.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

11

A revenue account is closed by debiting Income Summary and crediting Service Revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

12

The balance sheet is prepared first because if it balances,all the accounting information is correct and can be used to prepare the other financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

13

A company's annual report includes comparative statements for several years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

14

The income statement,statement of retained earnings,and the statement of cash flows can all be prepared directly from the adjusted trial balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

15

The Dividends account is closed directly to retained earnings at year-end.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

16

Accountants refer to the period of time from October 1 - December 31 as "busy season."

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

17

Publicly owned companies must file their audited financial statements and detailed supporting schedules with the Financial Accounting Standards Board.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

18

Companies need not disclose information that may have a damaging effect on the business,such as product liability lawsuits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

19

After all the closing entries have been posted,the Income Summary account has a zero balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

20

Dividends declared are an expense and reduce net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

21

Working capital equals current assets divided by current liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

22

Return on equity is a commonly used measure of a company's profitability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

23

Measures of profitability tell us how quickly current assets can be converted into profits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

24

Interim financial statements usually report on a period of time less than one year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

25

The Retained Earnings statement is based upon which of the following relationships?

A)Retained Earnings - Net Income - Dividends.

B)Retained Earnings - Net Income + Dividends.

C)Retained Earnings + Net Income + Dividends.

D)Retained Earnings + Net Income - Dividends.

A)Retained Earnings - Net Income - Dividends.

B)Retained Earnings - Net Income + Dividends.

C)Retained Earnings + Net Income + Dividends.

D)Retained Earnings + Net Income - Dividends.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

26

The return on equity ratio equals net income divided by common stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

27

The normal order in which the financial statements are prepared is:

A)Balance sheet,income statement,statement of retained earnings.

B)Income statement,statement of retained earnings,balance sheet.

C)Income tax return,income statement,balance sheet.

D)Income statement,statement of cash flows,balance sheet.

A)Balance sheet,income statement,statement of retained earnings.

B)Income statement,statement of retained earnings,balance sheet.

C)Income tax return,income statement,balance sheet.

D)Income statement,statement of cash flows,balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

28

An after-closing trial balance consists only of asset,liability,and owners' equity accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

29

The adjusted trial balance contains income statement accounts and balance sheet accounts,while the after-closing trial balance will only have balance sheet accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

30

The current ratio is a measure of short-term debt paying ability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

31

The current ratio is a measure of liquidity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

32

Publicly traded companies must file audited financial statements with the:

A)AICPA.

B)IRS.

C)SEC.

D)AAA.

A)AICPA.

B)IRS.

C)SEC.

D)AAA.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

33

An annual report filed with the Securities and Exchange Commission must include a section called "Management Discussion and Analysis" (MD&A).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

34

An annual report

A)Must be audited by the IRS.

B)Is delivered to stockholders and the public on the last day of the fiscal year.

C)Includes comparative financial statements for several years.

D)Must be filed with the SEC by all companies in the United States.

A)Must be audited by the IRS.

B)Is delivered to stockholders and the public on the last day of the fiscal year.

C)Includes comparative financial statements for several years.

D)Must be filed with the SEC by all companies in the United States.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

35

The purpose of the after-closing trial balance is to give assurance that the accounts are in balance and ready for the new accounting period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

36

Of the following,which is not an alternative title for the income statement?

A)Earnings statement.

B)Statement of Operations.

C)Profit and Loss Statement.

D)Statement of Financial Position.

A)Earnings statement.

B)Statement of Operations.

C)Profit and Loss Statement.

D)Statement of Financial Position.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

37

The current ratio equals current assets plus current liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

38

Publicly owned companies are:

A)Managed and owned by the government.

B)Must be not-for-profit companies.

C)Usually listed on a stock exchange.

D)Not permitted to be owned by individuals.

A)Managed and owned by the government.

B)Must be not-for-profit companies.

C)Usually listed on a stock exchange.

D)Not permitted to be owned by individuals.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

39

The net income percentage can be measured by dividing net income by total assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

40

Which of the following financial statements is usually prepared last?

A)Income statement.

B)Statement of retained earnings.

C)Income tax return.

D)Balance sheet.

A)Income statement.

B)Statement of retained earnings.

C)Income tax return.

D)Balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

41

Closing entries would be prepared before:

A)Financial statements are prepared.

B)The after-closing trial balance.

C)An adjusted trial balance.

D)Adjusting entries.

A)Financial statements are prepared.

B)The after-closing trial balance.

C)An adjusted trial balance.

D)Adjusting entries.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

42

The concept of adequate disclosure requires a company to inform financial statement users of each of the following,except:

A)The accounting methods in use.

B)The due dates of major liabilities.

C)Destruction of a large portion of the company's inventory on January 20,three weeks after the balance sheet date,but prior to issuance of the financial statements.

D)Income projections for the next five years based upon anticipated market share of a new product; the new product was introduced a few days before the balance sheet date.

A)The accounting methods in use.

B)The due dates of major liabilities.

C)Destruction of a large portion of the company's inventory on January 20,three weeks after the balance sheet date,but prior to issuance of the financial statements.

D)Income projections for the next five years based upon anticipated market share of a new product; the new product was introduced a few days before the balance sheet date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

43

During the closing process:

A)All income statement accounts are credited to income summary.

B)All income statement accounts are debited to income summary.

C)All revenue accounts are credited and expense accounts are debited.

D)All revenue accounts are debited and expense accounts are credited.

A)All income statement accounts are credited to income summary.

B)All income statement accounts are debited to income summary.

C)All revenue accounts are credited and expense accounts are debited.

D)All revenue accounts are debited and expense accounts are credited.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

44

The closing entry for an expense account would consist of a:

A)Debit to Income Summary and a credit to the expense account.

B)Debit to the expense account and a credit to Income Summary.

C)Credit to Retained Earnings and a debit to the expense account.

D)Credit to Revenue and a debit to the expense account.

A)Debit to Income Summary and a credit to the expense account.

B)Debit to the expense account and a credit to Income Summary.

C)Credit to Retained Earnings and a debit to the expense account.

D)Credit to Revenue and a debit to the expense account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

45

Declaring a dividend will:

A)Increase net income.

B)Decrease net income.

C)Not change net income.

D)Increase the net worth of a company.

A)Increase net income.

B)Decrease net income.

C)Not change net income.

D)Increase the net worth of a company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

46

The Income Summary account has debits of $85,000 and credits of $75,000.The company had which of the following:

A)Net income of $10,000.

B)Net income of $160,000.

C)Net loss of $10,000.

D)Net loss of $160,000.

A)Net income of $10,000.

B)Net income of $160,000.

C)Net loss of $10,000.

D)Net loss of $160,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

47

The balance in Income Summary:

A)Should equal retained earnings.

B)Will always be equal to the increase in retained earnings.

C)Will equal net income less dividends.

D)Will equal net income or net loss.

A)Should equal retained earnings.

B)Will always be equal to the increase in retained earnings.

C)Will equal net income less dividends.

D)Will equal net income or net loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

48

All of the following statements are true regarding the Income Statement except?

A)The Income Statement may also be called the Earnings Statement.

B)The measurement of income is not absolutely accurate or precise due to assumptions and estimates.

C)The Income Statement only includes those events that have been evidenced by actual business transactions.

D)The net income (or net loss)appears at the bottom of the Income Statement and also in the company's year-end balance sheet.

A)The Income Statement may also be called the Earnings Statement.

B)The measurement of income is not absolutely accurate or precise due to assumptions and estimates.

C)The Income Statement only includes those events that have been evidenced by actual business transactions.

D)The net income (or net loss)appears at the bottom of the Income Statement and also in the company's year-end balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

49

The concept of adequate disclosure:

A)Demands a "good faith effort" by management.

B)Grants users of the financial statements access to a company's accounting records.

C)Does not apply to events occurring after the balance sheet date.

D)Specifies which accounting methods must be used in a company's financial statements.

A)Demands a "good faith effort" by management.

B)Grants users of the financial statements access to a company's accounting records.

C)Does not apply to events occurring after the balance sheet date.

D)Specifies which accounting methods must be used in a company's financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

50

Dividends will have what effect upon retained earnings?

A)Increase.

B)Decrease.

C)No effect.

D)Depends upon if there is income or loss.

A)Increase.

B)Decrease.

C)No effect.

D)Depends upon if there is income or loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

51

Assets are considered current assets if they are cash or will usually be converted into cash:

A)Within a month or less.

B)Within 3 months.

C)Within a year or less.

D)Within 6 months or less.

A)Within a month or less.

B)Within 3 months.

C)Within a year or less.

D)Within 6 months or less.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

52

Net income from the Income Statement appears on:

A)The Balance Sheet.

B)The Retained Earnings Statement.

C)Neither the Balance Sheet nor the Retained Earnings Statement.

D)Both the Balance Sheet and the Retained Earnings Statement.

A)The Balance Sheet.

B)The Retained Earnings Statement.

C)Neither the Balance Sheet nor the Retained Earnings Statement.

D)Both the Balance Sheet and the Retained Earnings Statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

53

The dividends account should be:

A)Closed to income summary.

B)Closed to retained earnings.

C)Closed only if there is a profit.

D)Not closed at all.

A)Closed to income summary.

B)Closed to retained earnings.

C)Closed only if there is a profit.

D)Not closed at all.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

54

The adequacy of a company's disclosure is based on:

A)Laws established by Congress.

B)IRS rules and FASB requirements.

C)A combination of official rules,tradition,and professional judgment.

D)The needs of stockholders and creditors.

A)Laws established by Congress.

B)IRS rules and FASB requirements.

C)A combination of official rules,tradition,and professional judgment.

D)The needs of stockholders and creditors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

55

In the notes to financial statements,adequate disclosure would typically not include:

A)The accounting methods in use.

B)Lawsuits pending against the business.

C)Customers that account for 10 percent or more of the company's revenues.

D)The optimism of the CFO regarding future profits.

A)The accounting methods in use.

B)Lawsuits pending against the business.

C)Customers that account for 10 percent or more of the company's revenues.

D)The optimism of the CFO regarding future profits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

56

A debit balance in the income summary account indicates:

A)An error was made.

B)A Net Profit.

C)A Net Loss.

D)That revenues were greater than expenses.

A)An error was made.

B)A Net Profit.

C)A Net Loss.

D)That revenues were greater than expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

57

Dividends declared:

A)Reduce retained earnings.

B)Increase retained earnings.

C)Reduce net income.

D)Increase net income.

A)Reduce retained earnings.

B)Increase retained earnings.

C)Reduce net income.

D)Increase net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

58

A statement of retained earnings shows:

A)The changes in the Cash account occurring during the accounting period.

B)The revenue,expense,and dividends of the period.

C)The types of assets which have been purchased with the earnings retained during the accounting period.

D)The changes in the Retained Earnings account occurring during the accounting period.

A)The changes in the Cash account occurring during the accounting period.

B)The revenue,expense,and dividends of the period.

C)The types of assets which have been purchased with the earnings retained during the accounting period.

D)The changes in the Retained Earnings account occurring during the accounting period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

59

If Income Summary has a net credit balance,it signifies:

A)A net loss.

B)Net income.

C)A reduction of net worth.

D)Dividends have been declared.

A)A net loss.

B)Net income.

C)A reduction of net worth.

D)Dividends have been declared.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

60

Retained Earnings at the end of a period:

A)Is equal to the balance in the Retained Earnings account in the adjusted trial balance at the end of a period.

B)Is determined in the Statement of Retained Earnings.

C)Is equal to Retained Earnings at the beginning of the period,minus net income (or plus net loss)for the period.

D)Appears in the Income Statement for the period.

A)Is equal to the balance in the Retained Earnings account in the adjusted trial balance at the end of a period.

B)Is determined in the Statement of Retained Earnings.

C)Is equal to Retained Earnings at the beginning of the period,minus net income (or plus net loss)for the period.

D)Appears in the Income Statement for the period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

61

Closing entries should be made:

A)Every year.

B)Only when an entity goes out of business.

C)Only if there is a profit.

D)Only if there is a loss.

A)Every year.

B)Only when an entity goes out of business.

C)Only if there is a profit.

D)Only if there is a loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

62

After preparing the financial statements for the current year,the accountant for Exquisite Gems closed the Dividends account at year-end by debiting Income Summary and crediting the Dividends account.What is the effect of this entry on current-year net income and the balance in the Retained Earnings account at year-end?

A)Net income is overstated and the balance in the Retained Earnings account is correct.

B)Net income is correct and the balance in the Retained Earnings account is overstated.

C)Net income is understated and the balance in the Retained Earnings account is correct.

D)Net income is understated and the balance in the Retained Earnings account is overstated.

A)Net income is overstated and the balance in the Retained Earnings account is correct.

B)Net income is correct and the balance in the Retained Earnings account is overstated.

C)Net income is understated and the balance in the Retained Earnings account is correct.

D)Net income is understated and the balance in the Retained Earnings account is overstated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

63

Closing entries never involve posting a credit to the:

A)Income Summary account.

B)Accumulated Depreciation account.

C)Dividends account.

D)Depreciation Expense account.

A)Income Summary account.

B)Accumulated Depreciation account.

C)Dividends account.

D)Depreciation Expense account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

64

Which of the following accounts will be closed to Income Summary?

A)Prepaid Expenses.

B)Unearned Revenue.

C)Dividends.

D)Depreciation Expense.

A)Prepaid Expenses.

B)Unearned Revenue.

C)Dividends.

D)Depreciation Expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

65

Return on equity is calculated by:

A)Dividing net income by total revenue.

B)Dividing net income by average stockholders' equity.

C)Dividing net income by working capital.

D)Dividing dividends by stockholders' equity.

A)Dividing net income by total revenue.

B)Dividing net income by average stockholders' equity.

C)Dividing net income by working capital.

D)Dividing dividends by stockholders' equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

66

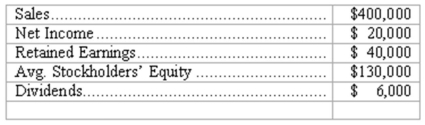

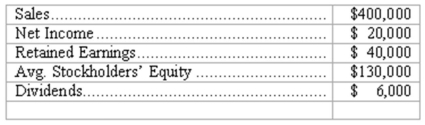

The following information is available:  What is the return on equity? (round to the nearest number)

What is the return on equity? (round to the nearest number)

A)5%.

B)20%.

C)25%.

D)15%.

What is the return on equity? (round to the nearest number)

What is the return on equity? (round to the nearest number)A)5%.

B)20%.

C)25%.

D)15%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

67

If sales are $540,000,expenses are $440,000 and dividends are $50,000,Income Summary:

A)Will have a credit balance of $50,000.

B)Will have a debit balance of $50,000.

C)Will have a debit balance of $100,000.

D)Will have a credit balance of $100,000.

A)Will have a credit balance of $50,000.

B)Will have a debit balance of $50,000.

C)Will have a debit balance of $100,000.

D)Will have a credit balance of $100,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

68

Which account appears on the After-Closing Trial Balance?

A)Service Revenue.

B)Unearned Revenue.

C)Dividends.

D)Retained Earnings,Beginning of Year.

A)Service Revenue.

B)Unearned Revenue.

C)Dividends.

D)Retained Earnings,Beginning of Year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

69

If current assets are $110,000 and current liabilities are $50,000,working capital will be:

A)45.5%.

B)2:2.

C)$60,000.

D)$160,000.

A)45.5%.

B)2:2.

C)$60,000.

D)$160,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

70

Income Summary appears on which financial statement:

A)Income statement.

B)Balance sheet.

C)Retained Earnings statement.

D)Income summary does not appear on any financial statement.

A)Income statement.

B)Balance sheet.

C)Retained Earnings statement.

D)Income summary does not appear on any financial statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

71

Which account will appear on an After-Closing Trial Balance?

A)Dividends.

B)Prepaid Expenses.

C)Retained Earnings,at the beginning of the period.

D)Sales.

A)Dividends.

B)Prepaid Expenses.

C)Retained Earnings,at the beginning of the period.

D)Sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

72

Return on equity measures:

A)Solvency.

B)Profitability.

C)Leverage.

D)Both solvency and leverage.

A)Solvency.

B)Profitability.

C)Leverage.

D)Both solvency and leverage.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

73

If a business closes its accounts only at year-end:

A)Financial statements are prepared only at year-end.

B)Adjusting entries are made only at year-end.

C)Revenue and expense accounts reflect year-to-date amounts throughout the year.

D)Monthly and quarterly financial statements cannot be prepared.

A)Financial statements are prepared only at year-end.

B)Adjusting entries are made only at year-end.

C)Revenue and expense accounts reflect year-to-date amounts throughout the year.

D)Monthly and quarterly financial statements cannot be prepared.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

74

Which of the following accounts should not be closed?

A)Expenses and revenues.

B)Dividends.

C)Income summary.

D)Accumulated depreciation.

A)Expenses and revenues.

B)Dividends.

C)Income summary.

D)Accumulated depreciation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

75

Which account will not appear on an After-Closing Trial Balance?

A)Dividends.

B)Prepaid Expenses.

C)Unearned Revenue.

D)Retained Earnings,at the end of the period.

A)Dividends.

B)Prepaid Expenses.

C)Unearned Revenue.

D)Retained Earnings,at the end of the period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

76

If current assets are $90,000 and current liabilities are $70,000,the current ratio will be:

A)77%.

B)$20,000.

C)1.3.

D)$160,000.

A)77%.

B)$20,000.

C)1.3.

D)$160,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

77

The purpose of making closing entries is to:

A)Prepare revenue and expense accounts for the recording of the next period's revenue and expenses.

B)Enable the accountant to transfer the balances from all permanent accounts to the Income Summary account.

C)Establish new balances in the balance sheet accounts.

D)Reduce the number of expense accounts.

A)Prepare revenue and expense accounts for the recording of the next period's revenue and expenses.

B)Enable the accountant to transfer the balances from all permanent accounts to the Income Summary account.

C)Establish new balances in the balance sheet accounts.

D)Reduce the number of expense accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

78

When closing the accounts at the end of the period,which of the following is closed directly into the Retained Earnings account?

A)Depreciation Expense.

B)Accumulated Depreciation.

C)Revenue and liability accounts.

D)The Income Summary account.

A)Depreciation Expense.

B)Accumulated Depreciation.

C)Revenue and liability accounts.

D)The Income Summary account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

79

Which of the following account titles would not be debited in the process of preparing closing entries for Andrew's Auto Shop?

A)Income Summary.

B)Fees Earned.

C)Dividends.

D)Retained Earnings.

A)Income Summary.

B)Fees Earned.

C)Dividends.

D)Retained Earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck

80

If sales are $270,000,expenses are $220,000 and dividends are $30,000,Income Summary:

A)Will have a credit balance of $50,000.

B)Will have a debit balance of $50,000.

C)Will have a debit balance of $20,000.

D)Will have a credit balance of $20,000.

A)Will have a credit balance of $50,000.

B)Will have a debit balance of $50,000.

C)Will have a debit balance of $20,000.

D)Will have a credit balance of $20,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 111 في هذه المجموعة.

فتح الحزمة

k this deck