Deck 16: Reporting and Analyzing Partnerships

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/168

العب

ملء الشاشة (f)

Deck 16: Reporting and Analyzing Partnerships

1

The equity section of the balance sheet of a partnership usually shows the separate capital account balances of each partner.

True

2

Mutual agency means each partner can commit or bind the partnership to any contract within the scope of the partnership business.

True

3

When partners invest in a partnership, their capital accounts are debited for the amount invested.

False

4

Even if partners devote their time and services to their partnership, their salaries are not expenses on the income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

5

Salary allowances are reported as salaries expense on a partnership income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

6

Partners' withdrawals are debited to their separate withdrawals accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

7

In closing the accounts at the end of a period, the partners' capital accounts are credited for their share of the partnership net income or debited for their share of the partnership loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

8

A partnership is an incorporated association of two or more people to pursue a business for profit as co-owners.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

9

The statement of changes in partners' equity shows the beginning balance in retained earnings, plus investments, less withdrawals, plus the income (or less the loss) and the ending balance in retained earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

10

A partnership has a limited life.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

11

Partner return on equity can be used by each partner to help decide whether additional investment or withdrawal of resources is best for that partner.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

12

A partnership may allocate salary allowances to the partners reflecting the relative value of services provided.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

13

Limited liability partnerships are designed to protect innocent partners from malpractice or negligence claims resulting from the acts of another partner.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

14

The withdrawals account of each partner is closed to retained earnings at the end of the accounting period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

15

Feldt is a partner in Feldt & Dodson Company. Feldt's share of the partnership income is $18,600 and her average partnership equity is $155,000. Her partner return on equity equals 8.33.

Partner Return on Equity = Partnership Income/Average Partnership Equity

Partner Return on Equity = $18,600/$155,000 = 0.12 = 12%

Partner Return on Equity = Partnership Income/Average Partnership Equity

Partner Return on Equity = $18,600/$155,000 = 0.12 = 12%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

16

Partners can invest assets but not liabilities into a partnership.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

17

In the absence of a partnership agreement, the law says that income of a partnership will be shared equally by the partners.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

18

In a limited partnership the general partner has unlimited liability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

19

Accounting procedures for both C corporations and S corporations are the same in all aspects.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

20

Partners in a partnership are taxed on the partnership income, not the amounts they withdraw from the partnership.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

21

When a partnership is liquidated, its business is ended.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

22

A capital deficiency can arise from liquidation losses, excessive withdrawals before liquidation, or recurring losses in prior periods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

23

A partnership agreement:

A)Is not binding unless it is in writing.

B)Is the same as a limited liability partnership.

C)Is binding even if it is not in writing.

D)Does not generally address the issue of the rights and duties of the partners.

E)Is also called the articles of incorporation.

A)Is not binding unless it is in writing.

B)Is the same as a limited liability partnership.

C)Is binding even if it is not in writing.

D)Does not generally address the issue of the rights and duties of the partners.

E)Is also called the articles of incorporation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

24

A capital deficiency exists when at least one partner has a debit balance in his or her capital account at the point of final cash distribution during liquidation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

25

If at the time of partnership liquidation, a partner has a $5,000 capital deficiency and pays the partnership $5,000 out of personal assets to cover the deficiency, then that partner is entitled to share in the final distribution of cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

26

When a partner leaves a partnership, the present partnership ends, but the business can still continue to operate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

27

If the partners agree on a formula to share income and say nothing about losses, then the losses are shared using the same formula.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

28

Admitting a partner by accepting assets is a personal transaction between one or more current partners and the new partner.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

29

Advantages of a partnership include:

A)Limited life.

B)Mutual agency.

C)Unlimited liability.

D)Co-ownership of property.

E)Voluntary association.

A)Limited life.

B)Mutual agency.

C)Unlimited liability.

D)Co-ownership of property.

E)Voluntary association.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

30

Current partners usually require any new partner to pay a bonus for the privilege of joining when the current value of a partnership is greater than the recorded amounts of equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

31

When a partner leaves a partnership, the withdrawing partner is entitled to a bonus if the recorded equity is overstated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

32

A partnership that has two classes of partners, general and limited, where the limited partners have no personal liability beyond the amounts they invest in the partnership, and no active role in the partnership, except as specified in the partnership agreement is a:

A)Mutual agency partnership.

B)Limited partnership.

C)Limited liability partnership.

D)General partnership.

E)Limited liability company.

A)Mutual agency partnership.

B)Limited partnership.

C)Limited liability partnership.

D)General partnership.

E)Limited liability company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

33

If a partner is unable to cover a deficiency and the other partners absorb the deficiency, then the partner with the deficiency is thus relieved of all liability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

34

When a partner leaves a partnership, the present partnership ends.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

35

To buy into an existing partnership, the new partner must contribute cash to the partnership.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

36

Mutual agency means

A)Creditors can apply their claims to partners' personal assets.

B)Partners are taxed on partnership withdrawals.

C)All partners must agree before the partnership can act.

D)The partnership has a limited life.

E)A partner can commit or bind the partnership in any contract within the scope of the partnership business.

A)Creditors can apply their claims to partners' personal assets.

B)Partners are taxed on partnership withdrawals.

C)All partners must agree before the partnership can act.

D)The partnership has a limited life.

E)A partner can commit or bind the partnership in any contract within the scope of the partnership business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

37

An unincorporated association of two or more persons to pursue a business for profit as co-owners is a:

A)Partnership.

B)Proprietorship.

C)Contractual company.

D)Mutual agency.

E)Voluntary organization.

A)Partnership.

B)Proprietorship.

C)Contractual company.

D)Mutual agency.

E)Voluntary organization.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

38

Assets invested by a partner into a partnership become the property of the business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

39

Assume that the M & L partnership agreement gave March 60% and Ludwig 40% of partnership income and losses. The partnership lost $27,000 in the current period. This implies that March's share of the loss equals $16,200, and Ludwig's share equals $10,800.

March's Share of Loss = Net Loss * Allocation Percentage

March's Share of Loss = $27,000 * 60% = $16,200

Ludwig's Share of Loss = Net Loss * Allocation Percentage

Ludwig's Share of Loss = $27,000 * 40% = $10,800

March's Share of Loss = Net Loss * Allocation Percentage

March's Share of Loss = $27,000 * 60% = $16,200

Ludwig's Share of Loss = Net Loss * Allocation Percentage

Ludwig's Share of Loss = $27,000 * 40% = $10,800

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

40

A partnership designed to protect innocent partners from malpractice or negligence claims resulting from acts of another partner is a(n):

A)Partnership.

B)Limited partnership.

C)Limited liability partnership.

D)General partnership.

E)Unlimited liability company.

A)Partnership.

B)Limited partnership.

C)Limited liability partnership.

D)General partnership.

E)Unlimited liability company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

41

Wheadon, Davis, and Singer formed a partnership with Wheadon contributing $60,000, Davis contributing $50,000 and Singer contributing $40,000. Their partnership agreement called for the income (loss) division to be based on the ratio of capital investments. If the partnership had income of $75,000 for its first year of operation, what amount of income (rounded to the nearest thousand) would be credited to Singer's capital account?

A)$20,000.

B)$25,000.

C)$30,000.

D)$40,000.

E)$75,000.

A)$20,000.

B)$25,000.

C)$30,000.

D)$40,000.

E)$75,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

42

Partnership accounting does not:

A)Use a capital account for each partner.

B)Use a withdrawals account for each partner.

C)Allocate net income to each partner according to the partnership agreement.

D)Allocate net loss to each partner according to the partnership agreement.

E)Tax the business entity.

A)Use a capital account for each partner.

B)Use a withdrawals account for each partner.

C)Allocate net income to each partner according to the partnership agreement.

D)Allocate net loss to each partner according to the partnership agreement.

E)Tax the business entity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

43

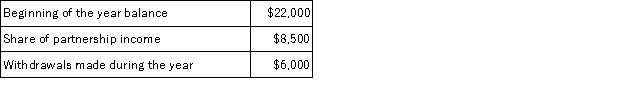

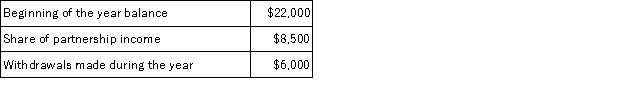

The following information is available regarding Grace Smit's capital account in Enterprise Consulting Group, a general partnership, for a recent year:  What is Smit's partner return on equity during the year in question?

What is Smit's partner return on equity during the year in question?

A)36.6%

B)34.7%

C)10.8%

D)11.4%

E)55.7%

What is Smit's partner return on equity during the year in question?

What is Smit's partner return on equity during the year in question?A)36.6%

B)34.7%

C)10.8%

D)11.4%

E)55.7%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

44

In a partnership agreement, if the partners agreed to an interest allowance of 10% annually on each partner's investment, the interest allowance:

A)Is ignored when earnings are not sufficient to pay interest.

B)Can make up for unequal capital contributions.

C)Is an expense of the business.

D)Must be paid because the partnership contract has unlimited life.

E)Legally becomes a liability of the general partner.

A)Is ignored when earnings are not sufficient to pay interest.

B)Can make up for unequal capital contributions.

C)Is an expense of the business.

D)Must be paid because the partnership contract has unlimited life.

E)Legally becomes a liability of the general partner.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

45

Wheadon, Davis, and Singer formed a partnership with Wheadon contributing $60,000, Davis contributing $50,000 and Singer contributing $40,000. Their partnership agreement called for the income (loss) division to be based on the ratio of capital investments. If the partnership had income of $75,000 for its first year of operation, what amount of income (rounded to the nearest thousand) would be credited to Wheadon's capital account?

A)$20,000.

B)$25,000.

C)$30,000.

D)$40,000.

E)$75,000.

A)$20,000.

B)$25,000.

C)$30,000.

D)$40,000.

E)$75,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

46

Maxwell and Smart are forming a partnership. Maxwell is investing a building that has a market value of $180,000. However, the building carries a $56,000 mortgage that will be assumed by the partnership. Smart is investing $120,000 cash. The balance of Maxwell's Capital account will be:

A)$180,000.

B)$124,000.

C)$56,000.

D)$64,000.

E)$60,000.

A)$180,000.

B)$124,000.

C)$56,000.

D)$64,000.

E)$60,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

47

R. Stetson contributed $14,000 in cash plus office equipment valued at $7,000 to the SJ Partnership. The journal entry to record the transaction for the partnership is:

A)Debit Cash $14,000; debit Office Equipment $7,000; credit R.Stetson, Capital $21,000.

B)Debit Cash $14,000; debit Office Equipment $7,000; credit SJ Partnership, Capital $21,000.

C)Debit SJ Partnership $21,000; credit R.Stetson, Capital $21,000.

D)Debit R.Stetson, Capital $21,000; credit SJ Partnership, Capital $21,000.

E)Debit Cash $14,000; debit Office Equipment $7,000; credit Common Stock $21,000.

A)Debit Cash $14,000; debit Office Equipment $7,000; credit R.Stetson, Capital $21,000.

B)Debit Cash $14,000; debit Office Equipment $7,000; credit SJ Partnership, Capital $21,000.

C)Debit SJ Partnership $21,000; credit R.Stetson, Capital $21,000.

D)Debit R.Stetson, Capital $21,000; credit SJ Partnership, Capital $21,000.

E)Debit Cash $14,000; debit Office Equipment $7,000; credit Common Stock $21,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

48

T. Andrews contributed $14,000 to the T & B Partnership. The journal entry to record the transaction for the partnership is:

A)Debit Cash $14,000; credit T & B Partnership, Capital $14,000.

B)Debit Cash $14,000; credit T.Andrews, Capital $14,000.

C)Debit T & B Partnership $14,000; credit T.Andrews, Capital $14,000.

D)Debit T.Andrews, Capital $14,000; credit T & B Partnership, Capital $14,000.

E)Debit Cash $14,000; credit Common Stock $14,000.

A)Debit Cash $14,000; credit T & B Partnership, Capital $14,000.

B)Debit Cash $14,000; credit T.Andrews, Capital $14,000.

C)Debit T & B Partnership $14,000; credit T.Andrews, Capital $14,000.

D)Debit T.Andrews, Capital $14,000; credit T & B Partnership, Capital $14,000.

E)Debit Cash $14,000; credit Common Stock $14,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

49

A partnership in which all partners have mutual agency and unlimited liability is called:

A)Limited partnership.

B)Limited liability partnership.

C)General partnership.

D)S corporation.

E)Limited liability company.

A)Limited partnership.

B)Limited liability partnership.

C)General partnership.

D)S corporation.

E)Limited liability company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

50

The withdrawals account of each partner is:

A)Closed to that partner's capital account with a credit.

B)Closed to that partner's capital account with a debit.

C)A permanent account that is not closed.

D)Credited with that partner's share of net income.

E)Debited with that partner's share of net loss.

A)Closed to that partner's capital account with a credit.

B)Closed to that partner's capital account with a debit.

C)A permanent account that is not closed.

D)Credited with that partner's share of net income.

E)Debited with that partner's share of net loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

51

In the absence of a partnership agreement, the law says that income (and loss) should be allocated based on:

A)A fractional basis.

B)The ratio of capital investments.

C)Salary allowances.

D)Equal shares.

E)Interest allowances.

A)A fractional basis.

B)The ratio of capital investments.

C)Salary allowances.

D)Equal shares.

E)Interest allowances.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

52

Design Services is organized as a limited partnership, with Miko Toori as one of its partners. Miko's capital account began the year with a balance of $35,000. During the year, Miko's share of the partnership income was $7,500, and Miko received $4,000 in distributions from the partnership. What is Miko's partner return on equity?

A)10.2%

B)22.7%

C)19.5%

D)20.4%

E)21.4%

A)10.2%

B)22.7%

C)19.5%

D)20.4%

E)21.4%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

53

Pat and Nicole formed Here & There as a limited liability company. Unless the member owners elect to be treated otherwise, the Internal Revenue Service will tax the LLC as:

A)An S corporation.

B)A C corporation.

C)A non-taxable entity.

D)A joint venture.

E)A partnership.

A)An S corporation.

B)A C corporation.

C)A non-taxable entity.

D)A joint venture.

E)A partnership.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

54

Forman and Berry are forming a partnership. Forman will invest a building that currently is being used by another business owned by Forman. The building has a market value of $80,000. Also, the partnership will assume responsibility for a $20,000 note secured by a mortgage on that building. Berry will invest $50,000 cash. For the partnership, the amounts to be recorded for the building and for Forman's Capital account are:

A)Building, $80,000 and Forman, Capital, $80,000.

B)Building, $60,000 and Forman, Capital, $60,000.

C)Building, $60,000 and Forman, Capital, $50,000.

D)Building, $80,000 and Forman, Capital, $60,000.

E)Building, $60,000 and Forman, Capital, $80,000.

A)Building, $80,000 and Forman, Capital, $80,000.

B)Building, $60,000 and Forman, Capital, $60,000.

C)Building, $60,000 and Forman, Capital, $50,000.

D)Building, $80,000 and Forman, Capital, $60,000.

E)Building, $60,000 and Forman, Capital, $80,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

55

Partners' withdrawals of assets are:

A)Credited to their withdrawals accounts.

B)Debited to their withdrawals accounts.

C)Credited to their retained earnings.

D)Debited to their retained earnings.

E)Debited to their asset accounts.

A)Credited to their withdrawals accounts.

B)Debited to their withdrawals accounts.

C)Credited to their retained earnings.

D)Debited to their retained earnings.

E)Debited to their asset accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

56

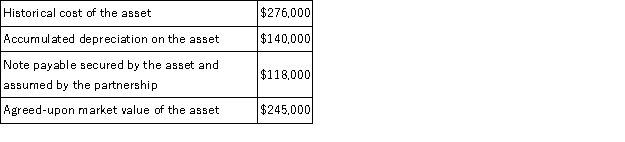

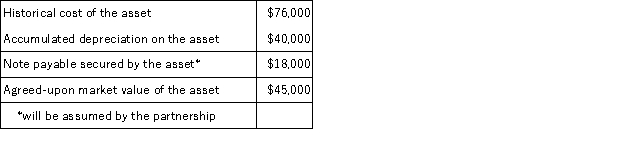

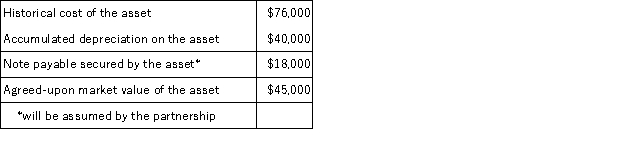

Dalworth and Minor have decided to form a partnership. Minor is going to contribute a depreciable asset to the partnership as her equity contribution to the partnership. The following information regarding the asset to be contributed by Minor is available:  Based on this information, Minor's beginning equity balance in the partnership will be:

Based on this information, Minor's beginning equity balance in the partnership will be:

A)$276,000

B)$158,000

C)$136,000

D)$127,000

E)$18,000

Based on this information, Minor's beginning equity balance in the partnership will be:

Based on this information, Minor's beginning equity balance in the partnership will be:A)$276,000

B)$158,000

C)$136,000

D)$127,000

E)$18,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

57

Partnership accounting is the same as accounting for:

A)A sole proprietorship.

B)A corporation.

C)A sole proprietorship, except that separate capital and withdrawal accounts are kept for each partner.

D)An S corporation.

E)A corporation, except that retained earnings is used to keep track of partners' withdrawals.

A)A sole proprietorship.

B)A corporation.

C)A sole proprietorship, except that separate capital and withdrawal accounts are kept for each partner.

D)An S corporation.

E)A corporation, except that retained earnings is used to keep track of partners' withdrawals.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

58

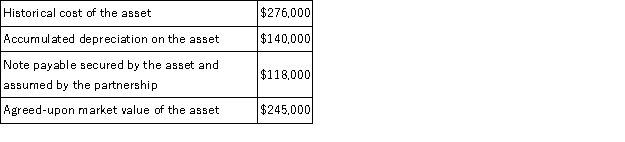

Harvey and Quick have decided to form a partnership. Harvey is going to contribute a depreciable asset to the partnership as his equity contribution to the partnership. The following information regarding the asset to be contributed by Harvey is available:  Based on this information, Harvey's beginning equity balance in the partnership will be:

Based on this information, Harvey's beginning equity balance in the partnership will be:

A)$76,000

B)$36,000

C)$18,000

D)$27,000

E)$45,000

Based on this information, Harvey's beginning equity balance in the partnership will be:

Based on this information, Harvey's beginning equity balance in the partnership will be:A)$76,000

B)$36,000

C)$18,000

D)$27,000

E)$45,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

59

Mutual agency implies that each partner in a partnership is a fully authorized agent of the partnership. Which of the following statements is correct regarding the authority of a partner to bind the partnership in dealings with third parties?

A)The partner's authority must be derived from the partnership agreement.

B)The partner's authority may be effectively limited by a formal resolution of the other partners, even if third parties are not aware of that limitation.

C)Only a partner with a majority interest in a partnership has the authority to represent the partnership to third parties.

D)A partner has authority to deal with third parties on the behalf of the other partners only if he has written permission to do so.

E)A partner may be able to legally bind the partnership to actions even if the other partners are unaware of his actions.

A)The partner's authority must be derived from the partnership agreement.

B)The partner's authority may be effectively limited by a formal resolution of the other partners, even if third parties are not aware of that limitation.

C)Only a partner with a majority interest in a partnership has the authority to represent the partnership to third parties.

D)A partner has authority to deal with third parties on the behalf of the other partners only if he has written permission to do so.

E)A partner may be able to legally bind the partnership to actions even if the other partners are unaware of his actions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

60

Carter Pearson is a partner in Event Promoters. His beginning partnership capital balance for the current year is $55,000, and his ending partnership capital balance for the current year is $62,000. His share of this year's partnership income was $6,250. What is his partner return on equity?

A)5.34%

B)8.93%

C)10.08%

D)11.36%

E)10.68%

A)5.34%

B)8.93%

C)10.08%

D)11.36%

E)10.68%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

61

Wright, Bell, and Edison are partners and share income in a 2:5:3 ratio. The partnership's capital balances are as follows: Wright, $33,000, Bell $27,000 and Edison $40,000. Edison decides to withdraw from the partnership, and the partners agree not to revalue the assets upon Edison's retirement. The journal entry to record Edison's June 1 withdrawal from the partnership if Edison is paid $40,000 for his equity is:

A)Debit Edison, Capital $40,000; credit Cash $40,000.

B)Debit Wright, Capital $20,000; Debit Bell, Capital $20,000; credit Cash $40,000.

C)Debit Wright, Capital $20,000; Debit Bell, Capital $20,000; credit Edison, Capital $40,000.

D)Debit Edison, Capital $40,000; credit Wright, Capital $20,000; credit Bell, Capital $20,000.

E)Debit Cash $40,000; credit Edison, Capital $40,000.

A)Debit Edison, Capital $40,000; credit Cash $40,000.

B)Debit Wright, Capital $20,000; Debit Bell, Capital $20,000; credit Cash $40,000.

C)Debit Wright, Capital $20,000; Debit Bell, Capital $20,000; credit Edison, Capital $40,000.

D)Debit Edison, Capital $40,000; credit Wright, Capital $20,000; credit Bell, Capital $20,000.

E)Debit Cash $40,000; credit Edison, Capital $40,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

62

Olivia Greer is a partner in Made for You. An analysis of Greer's capital account indicates that during the most recent year, she withdrew $30,000 from the partnership. Her share of the partnership's net loss was $16,000 and she made an additional equity contribution of $10,000. Her capital account ended the year at $150,000. What was her capital balance at the beginning of the year?

A)$154,000

B)$170,000

C)$180,000

D)$186,000

E)$196,000

A)$154,000

B)$170,000

C)$180,000

D)$186,000

E)$196,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

63

Hewlett and Martin are partners. Hewlett's capital balance in the partnership is $64,000, and Martin's capital balance $67,000. Hewlett and Martin have agreed to share equally in income or loss. The existing partners agree to accept Black with a 20% interest. Black will invest $35,000 in the partnership. The bonus that is granted to Hewlett and Martin equals:

A)$900 each.

B)$1,500 each.

C)$600 each.

D)600 to Hewlett; $900 to Martin.

E)$0, because Hewlett and Martin actually grant a bonus to Black.

A)$900 each.

B)$1,500 each.

C)$600 each.

D)600 to Hewlett; $900 to Martin.

E)$0, because Hewlett and Martin actually grant a bonus to Black.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

64

When a partnership is liquidated:

A)Noncash assets are distributed to partners.

B)Any gain or loss on liquidation is allocated to the partner with the highest capital account balance.

C)Liabilities are paid or settled.

D)Any remaining cash is distributed to the partners equally.

E)The business may continue to operate.

A)Noncash assets are distributed to partners.

B)Any gain or loss on liquidation is allocated to the partner with the highest capital account balance.

C)Liabilities are paid or settled.

D)Any remaining cash is distributed to the partners equally.

E)The business may continue to operate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

65

When a partner is added to a partnership:

A)The previous partnership ends.

B)The underlying business operations end.

C)The underlying business operations must close and then re-open.

D)The partnership must continue.

E)The partnership equity always increases.

A)The previous partnership ends.

B)The underlying business operations end.

C)The underlying business operations must close and then re-open.

D)The partnership must continue.

E)The partnership equity always increases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

66

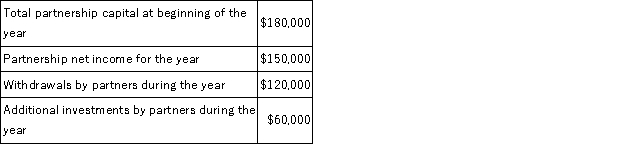

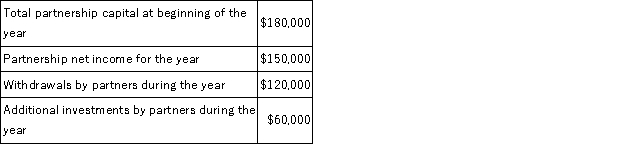

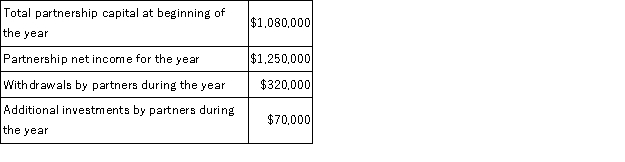

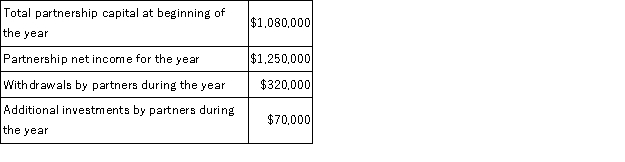

The following information is available on TGR Enterprises, a partnership, for the most recent fiscal year:  There are three partners in TGR Enterprises: Tracey, Gregory and Rodgers. At the end of the year, the partners' capital accounts were in the ratio of 2:1:2, respectively, based on their proportionate investments and withdrawals. Compute the ending capital balances of the three partners.

There are three partners in TGR Enterprises: Tracey, Gregory and Rodgers. At the end of the year, the partners' capital accounts were in the ratio of 2:1:2, respectively, based on their proportionate investments and withdrawals. Compute the ending capital balances of the three partners.

A)Tracey = $108,000; Gregory = $54,000; Rodgers = $108,000.

B)Tracey = $90,000; Gregory = $90,000; Rodgers = $90,000.

C)Tracey = $204,000; Gregory = $102,000; Rodgers = $204,000.

D)Tracey = $84,000; Gregory = $102,000; Rodgers = $84,000.

E)Tracey = $60,000; Gregory = $30,000; Rodgers = $60,000.

There are three partners in TGR Enterprises: Tracey, Gregory and Rodgers. At the end of the year, the partners' capital accounts were in the ratio of 2:1:2, respectively, based on their proportionate investments and withdrawals. Compute the ending capital balances of the three partners.

There are three partners in TGR Enterprises: Tracey, Gregory and Rodgers. At the end of the year, the partners' capital accounts were in the ratio of 2:1:2, respectively, based on their proportionate investments and withdrawals. Compute the ending capital balances of the three partners.A)Tracey = $108,000; Gregory = $54,000; Rodgers = $108,000.

B)Tracey = $90,000; Gregory = $90,000; Rodgers = $90,000.

C)Tracey = $204,000; Gregory = $102,000; Rodgers = $204,000.

D)Tracey = $84,000; Gregory = $102,000; Rodgers = $84,000.

E)Tracey = $60,000; Gregory = $30,000; Rodgers = $60,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

67

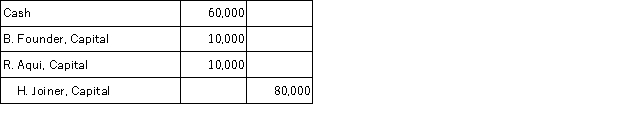

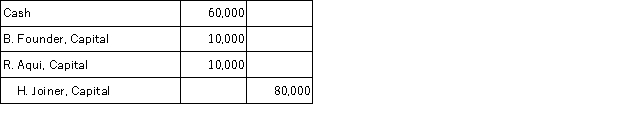

A partnership recorded the following journal entry:  This entry reflects:

This entry reflects:

A)Acceptance of a new partner who invests $60,000 and receives a $20,000 bonus.

B)Withdrawal of a partner who pays a $10,000 bonus to each of the other partners.

C)Addition of a partner who pays a bonus to each of the other partners.

D)Additional investment into the partnership by Founder and Aqui.

E)Withdrawal of $10,000 each by Founder and Aqui upon the admission of a new partner.

This entry reflects:

This entry reflects:A)Acceptance of a new partner who invests $60,000 and receives a $20,000 bonus.

B)Withdrawal of a partner who pays a $10,000 bonus to each of the other partners.

C)Addition of a partner who pays a bonus to each of the other partners.

D)Additional investment into the partnership by Founder and Aqui.

E)Withdrawal of $10,000 each by Founder and Aqui upon the admission of a new partner.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

68

The partnership agreement for Wilson, Pickett & Nelson, a general partnership, provided that profits be shared between the partners in the ratio of their financial contributions to the partnership. Wilson contributed $100,000, Pickett contributed $50,000 and Nelson contributed $50,000. In the partnership's first year of operation, it incurred a loss of $110,000. What amount of the partnership's loss, rounded to the nearest dollar, should be absorbed by Nelson?

A)$50,000

B)$27,500

C)$36,667

D)$0

E)$40,000

A)$50,000

B)$27,500

C)$36,667

D)$0

E)$40,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

69

Christie and Jergens formed a partnership with capital contributions of $300,000 and $400,000, respectively. Their partnership agreement calls for Christie to receive a $60,000 per year salary. Also, each partner is to receive an interest allowance equal to 10% of a partner's beginning capital investments. The remaining income or loss is to be divided equally. If the net income for the current year is $135,000, then Christie and Jergens's respective shares are:

A)$67,500; $67,500.

B)$92,500; $42,500.

C)$57,857; $77,143.

D)$90,000; $40,000.

E)$35,000; $100,000.

A)$67,500; $67,500.

B)$92,500; $42,500.

C)$57,857; $77,143.

D)$90,000; $40,000.

E)$35,000; $100,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

70

The following information is available on PDC Enterprises, a partnership, for the most recent fiscal year:  There are three partners in TGR Enterprises: Pearson, Darling and Cathay. At the end of the year, based on their proportionate investments and withdrawals, the partners' capital accounts were in the ratio of 2:2:1, respectively. Compute the ending capital balances of Cathay.

There are three partners in TGR Enterprises: Pearson, Darling and Cathay. At the end of the year, based on their proportionate investments and withdrawals, the partners' capital accounts were in the ratio of 2:2:1, respectively. Compute the ending capital balances of Cathay.

A)$466,000.

B)$402,000.

C)$416,000.

D)$544,000.

E)$388,000.

There are three partners in TGR Enterprises: Pearson, Darling and Cathay. At the end of the year, based on their proportionate investments and withdrawals, the partners' capital accounts were in the ratio of 2:2:1, respectively. Compute the ending capital balances of Cathay.

There are three partners in TGR Enterprises: Pearson, Darling and Cathay. At the end of the year, based on their proportionate investments and withdrawals, the partners' capital accounts were in the ratio of 2:2:1, respectively. Compute the ending capital balances of Cathay.A)$466,000.

B)$402,000.

C)$416,000.

D)$544,000.

E)$388,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

71

Zheng invested $100,000 and Murray invested $200,000 in a partnership. They agreed to share incomes and losses by allowing a $60,000 per year salary allowance to Zheng and a $40,000 per year salary allowance to Murray, plus an interest allowance on the partners' beginning-year capital investments at 10%, with the balance to be shared equally. Under this agreement, the shares of the partners when the partnership earns $105,000 in income are:

A)$52,500 to Zheng; $52,500 to Murray.

B)$35,000 to Zheng; $70,000 to Murray.

C)$57,500 to Zheng; $47,500 to Murray.

D)$42,500 to Zheng; $62,500 to Murray.

E)$70,000 to Zheng; $60,000 to Murray.

A)$52,500 to Zheng; $52,500 to Murray.

B)$35,000 to Zheng; $70,000 to Murray.

C)$57,500 to Zheng; $47,500 to Murray.

D)$42,500 to Zheng; $62,500 to Murray.

E)$70,000 to Zheng; $60,000 to Murray.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

72

Hewlett and Martin are partners. Hewlett's capital balance in the partnership is $64,000, and Martin's capital balance $61,000. Hewlett and Martin have agreed to share equally in income or loss. Hewlett and Martin agree to accept Black with a 25% interest. Black will invest $35,000 in the partnership. The bonus that is granted to Black equals:

A)$5,000.

B)$2,500.

C)$6,667.

D)$3,333.

E)$0, because Black must actually grant a bonus to Hewlett and Martin.

A)$5,000.

B)$2,500.

C)$6,667.

D)$3,333.

E)$0, because Black must actually grant a bonus to Hewlett and Martin.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

73

Masters, Hardy, and Rowen are dissolving their partnership. Their partnership agreement allocates income and losses equally among the partners. The current period's ending capital account balances are Masters, $15,000; Hardy, $15,000; Rowen, $30,000. After all the assets are sold and liabilities are paid, but before any contributions to cover any deficiencies, there is $54,000 in cash to be distributed. The general journal entry to record the final distribution would be:

A)Debit Masters, Capital $18,000; debit Hardy, Capital $18,000; debit Rowen, Capital $18,000; credit Cash $54,000.

B)Debit Masters, Capital $13,500; debit Hardy, Capital $13,500; debit Rowen, Capital $27,000; credit Cash $54,000.

C)Debit Masters, Capital $15,000; debit Hardy, Capital $15,000; debit Rowen, Capital $30,000; credit Gain from Liquidation $6,000; credit Cash $54,000.

D)Debit Cash $54,000; credit Rowen, Capital $13,500; credit Masters, Capital $13,500; credit Hardy, Capital $27,000.

E)Debit Masters, Capital $15,000; debit Hardy, Capital $15,000; debit Rowen, Capital $30,000; credit Retained Earnings $6000; credit Cash $54,000.

A)Debit Masters, Capital $18,000; debit Hardy, Capital $18,000; debit Rowen, Capital $18,000; credit Cash $54,000.

B)Debit Masters, Capital $13,500; debit Hardy, Capital $13,500; debit Rowen, Capital $27,000; credit Cash $54,000.

C)Debit Masters, Capital $15,000; debit Hardy, Capital $15,000; debit Rowen, Capital $30,000; credit Gain from Liquidation $6,000; credit Cash $54,000.

D)Debit Cash $54,000; credit Rowen, Capital $13,500; credit Masters, Capital $13,500; credit Hardy, Capital $27,000.

E)Debit Masters, Capital $15,000; debit Hardy, Capital $15,000; debit Rowen, Capital $30,000; credit Retained Earnings $6000; credit Cash $54,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

74

Farmer and Taylor formed a partnership with capital contributions of $200,000 and $250,000, respectively. Their partnership agreement calls for Farmer to receive a $70,000 per year salary. The remaining income or loss is to be divided equally. If the net income for the current year is $135,000, then Farmer and Taylor's respective shares are:

A)$67,500; $67,500.

B)$130,000; $5,000.

C)$106,140; $28,860.

D)$90,000; $45,000.

E)$102,500; $32,500.

A)$67,500; $67,500.

B)$130,000; $5,000.

C)$106,140; $28,860.

D)$90,000; $45,000.

E)$102,500; $32,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

75

A bonus may be paid in all of the following situations except:

A)By a new partner when the current value of a partnership is greater than the recorded amounts of equity.

B)By a withdrawing partner to remaining partners if the recorded value of the equity is overstated.

C)To a new partner with exceptional talents.

D)By remaining partners to a withdrawing partner if the recorded equity is understated.

E)By an existing partner to him or herself when in need of personal cash flow.

A)By a new partner when the current value of a partnership is greater than the recorded amounts of equity.

B)By a withdrawing partner to remaining partners if the recorded value of the equity is overstated.

C)To a new partner with exceptional talents.

D)By remaining partners to a withdrawing partner if the recorded equity is understated.

E)By an existing partner to him or herself when in need of personal cash flow.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

76

Wright, Bell, and Edison are partners and share income in a 2:5:3 ratio. The partnership's capital balances are as follows: Wright, $33,000, Bell $27,000 and Edison $40,000. Edison decides to withdraw from the partnership, and the partners agree not to revalue the assets upon Edison's retirement. The journal entry to record Edison's June 1 withdrawal from the partnership if Edison sells his interest to Whitney for $45,000 after the other two partners approve Whitney as partner is:

A)Debit Edison, Capital $45,000; credit Whitney, Capital $45,000.

B)Debit Edison, Capital $40,000; credit Cash $40,000.

C)Debit Edison, Capital $40,000; debit Wright, Capital $2,500; debit Bell, Capital $2,500; credit Whitney, Capital $45,000.

D)Debit Edison, Capital $40,000; credit Whitney, Capital $40,000.

E)Debit Edison, Capital $40,000; debit Cash $5,000; credit Whitney, Capital $45,000.

A)Debit Edison, Capital $45,000; credit Whitney, Capital $45,000.

B)Debit Edison, Capital $40,000; credit Cash $40,000.

C)Debit Edison, Capital $40,000; debit Wright, Capital $2,500; debit Bell, Capital $2,500; credit Whitney, Capital $45,000.

D)Debit Edison, Capital $40,000; credit Whitney, Capital $40,000.

E)Debit Edison, Capital $40,000; debit Cash $5,000; credit Whitney, Capital $45,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

77

A partner can withdraw from a partnership by any of the following means except:

A)Selling his/her interest to another person for cash.

B)Selling his/her interest to another person in exchange for assets.

C)Receiving cash from the partnership in the amount of his/her interest.

D)Receiving assets from the partnership in the amount of his/her interest.

E)Close the business and liquidate the assets under the mutual agency principle.

A)Selling his/her interest to another person for cash.

B)Selling his/her interest to another person in exchange for assets.

C)Receiving cash from the partnership in the amount of his/her interest.

D)Receiving assets from the partnership in the amount of his/her interest.

E)Close the business and liquidate the assets under the mutual agency principle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

78

Masters, Hardy, and Rowen are dissolving their partnership. Their partnership agreement allocates income and losses equally among the partners. The current period's ending capital account balances are Masters, $15,000; Hardy, $15,000; Rowen, $(2,000). After all the assets are sold and liabilities are paid, but before any contributions to cover any deficiencies, there is $28,000 in cash to be distributed. Rowen pays $2,000 to cover the deficiency in his account. The general journal entry to record the final distribution would be:

A)Debit Masters, Capital $15,000; debit Hardy, Capital $15,000; credit Cash $30,000.

B)Debit Masters, Capital $14,000; debit Hardy, Capital $14,000; credit Cash $28,000.

C)Debit Masters, Capital $15,000; debit Hardy, Capital $15,000; credit Rowen, Capital $2,000; credit Cash $28,000.

D)Debit Cash $28,000; debit Rowen, Capital $2,000; credit Masters, Capital $15,000; credit Hardy, Capital $15,000.

E)Debit Masters, Capital $9,334; debit Hardy, Capital $9,333; debit Rowen, Capital $9,333; credit Cash $28,000.

A)Debit Masters, Capital $15,000; debit Hardy, Capital $15,000; credit Cash $30,000.

B)Debit Masters, Capital $14,000; debit Hardy, Capital $14,000; credit Cash $28,000.

C)Debit Masters, Capital $15,000; debit Hardy, Capital $15,000; credit Rowen, Capital $2,000; credit Cash $28,000.

D)Debit Cash $28,000; debit Rowen, Capital $2,000; credit Masters, Capital $15,000; credit Hardy, Capital $15,000.

E)Debit Masters, Capital $9,334; debit Hardy, Capital $9,333; debit Rowen, Capital $9,333; credit Cash $28,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

79

Which of the following statements is true?

A)Partners are employees of the partnership.

B)Salaries to partners are expenses on the partnership income statement.

C)Salary allowances usually reflect the relative value of services provided by partners.

D)Salary allowances are expenses.

E)Interest allowances are expenses.

A)Partners are employees of the partnership.

B)Salaries to partners are expenses on the partnership income statement.

C)Salary allowances usually reflect the relative value of services provided by partners.

D)Salary allowances are expenses.

E)Interest allowances are expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

80

Brown invested $200,000 and Freeman invested $150,000 in a partnership. They agreed to an interest allowance on the partners' beginning-year capital investments at 10%, with the balance to be shared equally. Under this agreement, the shares of the partners when the partnership earns $205,000 in income are:

A)$102,500 to Brown; $102,500 to Freeman.

B)$117,143 to Brown; $87,857 to Freeman.

C)$122,500 to Brown; $82,500 to Freeman.

D)$105,000 to Brown; $100,000 to Freeman.

E)$112,750 to Brown; $92,250 to Freeman.

A)$102,500 to Brown; $102,500 to Freeman.

B)$117,143 to Brown; $87,857 to Freeman.

C)$122,500 to Brown; $82,500 to Freeman.

D)$105,000 to Brown; $100,000 to Freeman.

E)$112,750 to Brown; $92,250 to Freeman.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck