Deck 14: Applying Present and Future Values

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/76

العب

ملء الشاشة (f)

Deck 14: Applying Present and Future Values

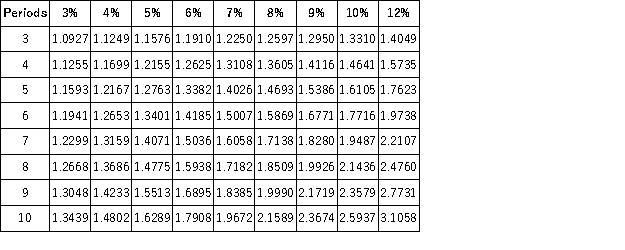

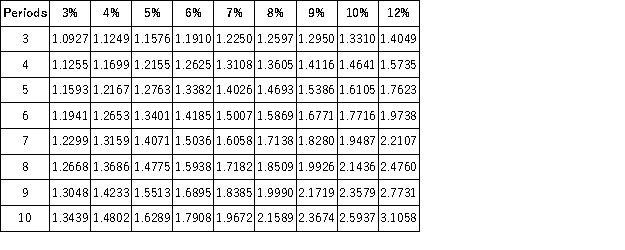

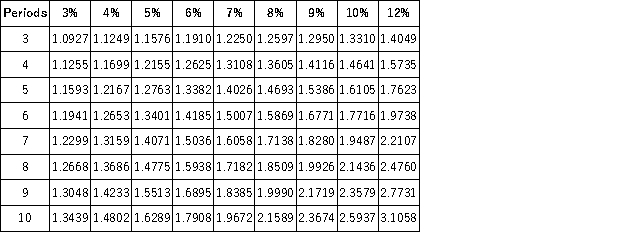

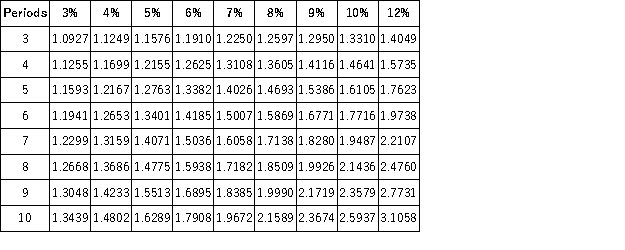

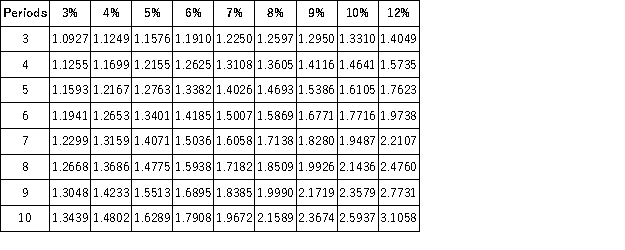

1

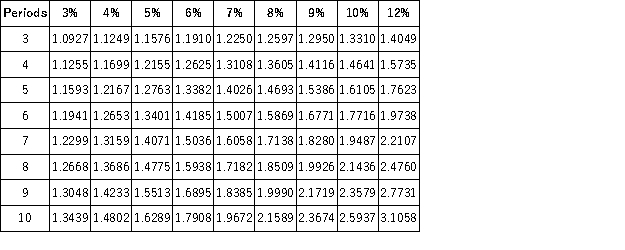

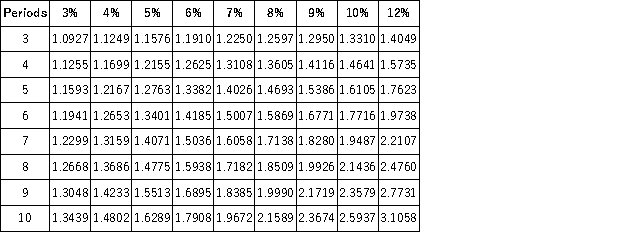

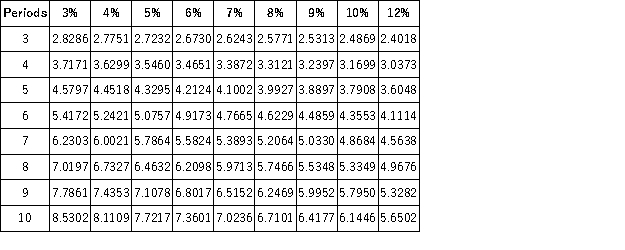

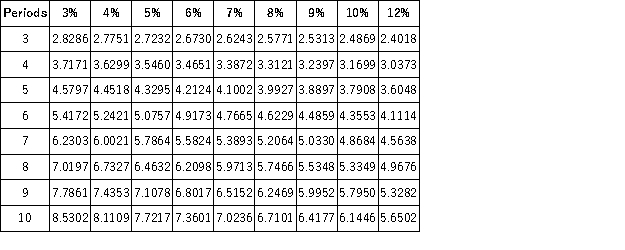

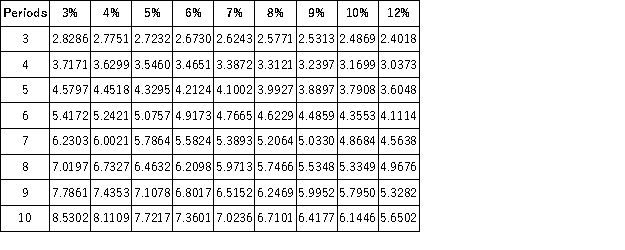

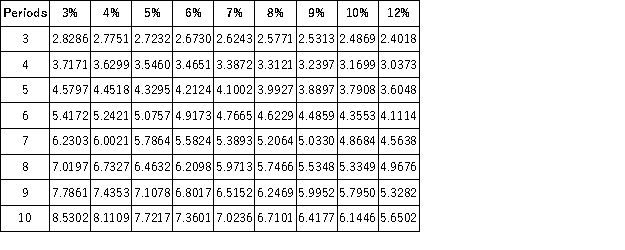

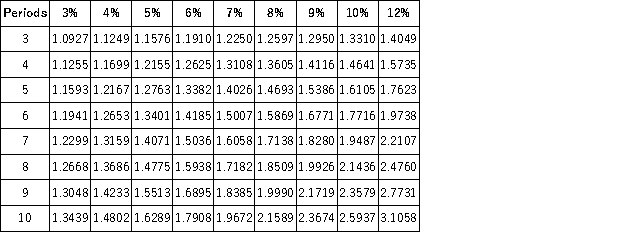

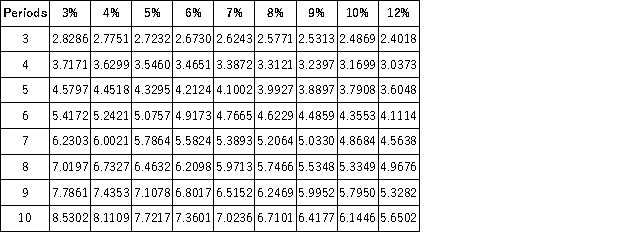

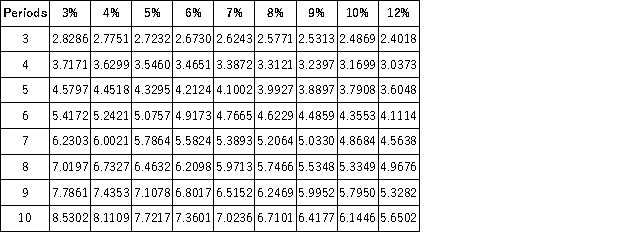

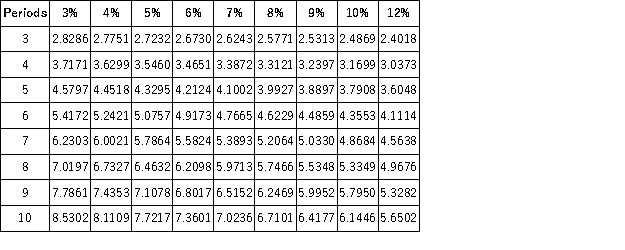

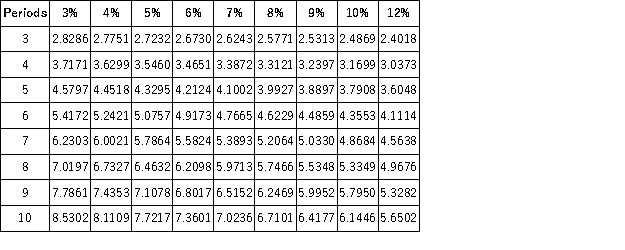

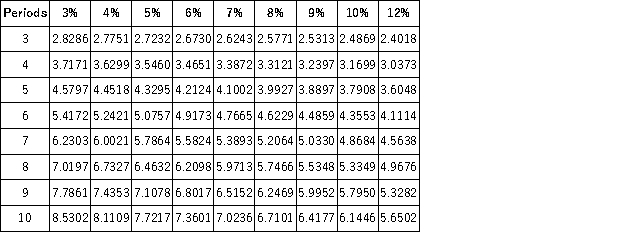

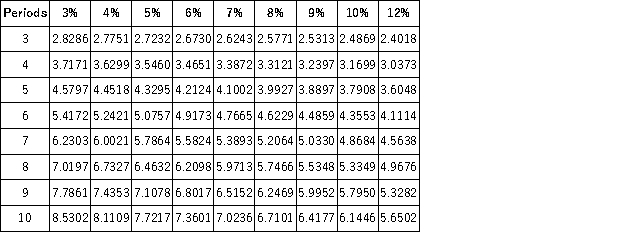

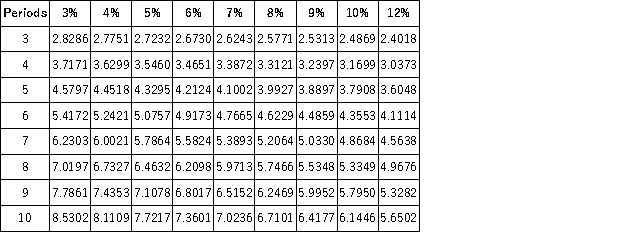

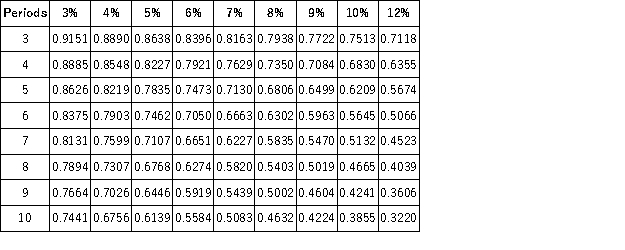

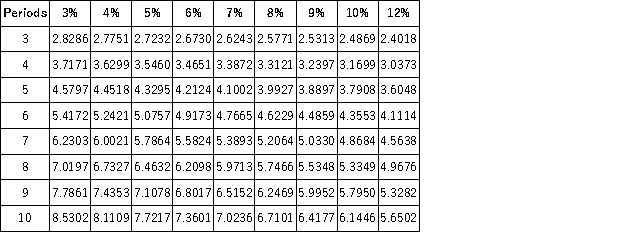

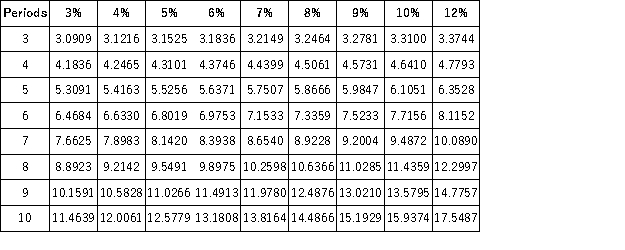

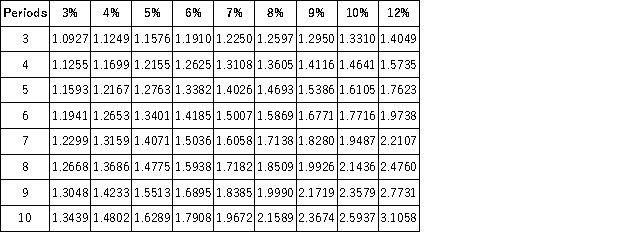

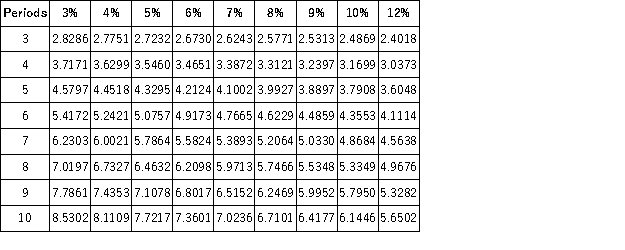

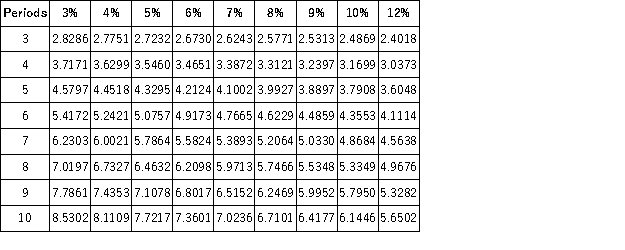

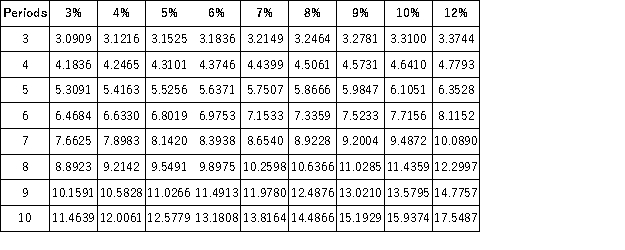

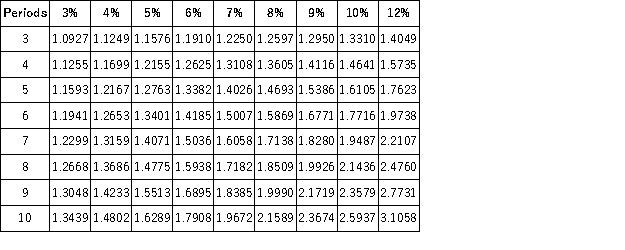

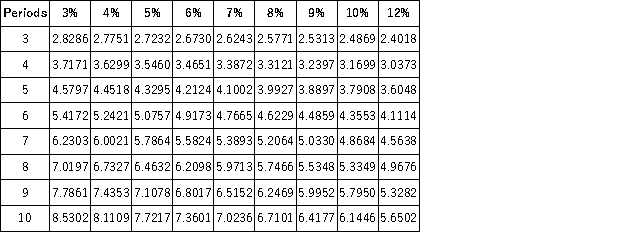

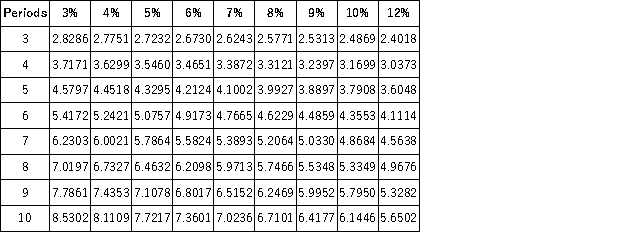

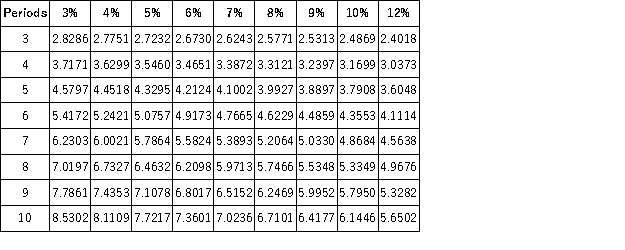

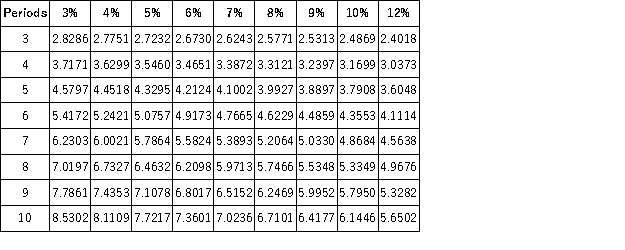

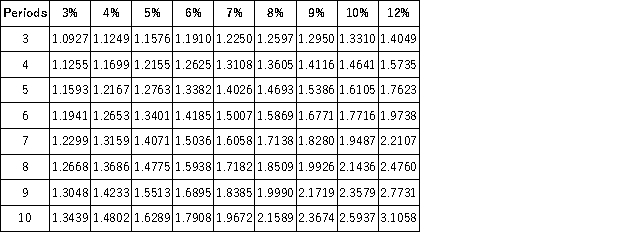

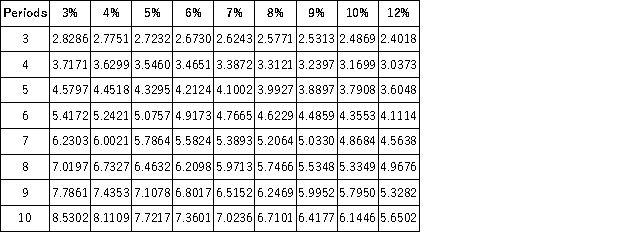

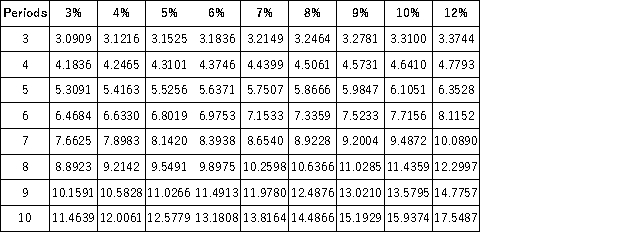

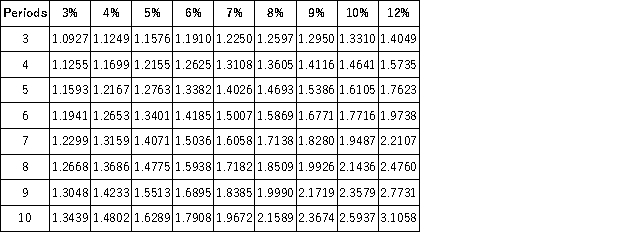

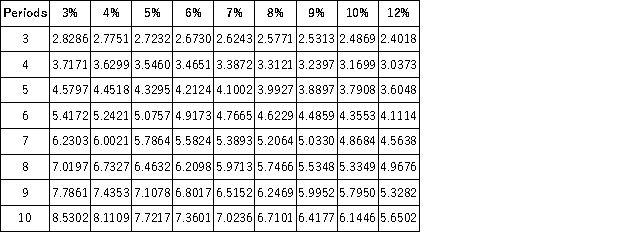

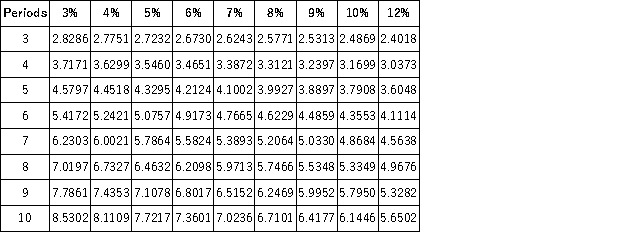

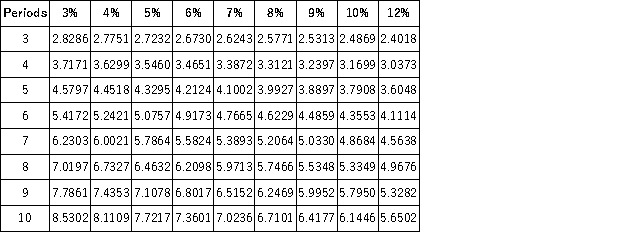

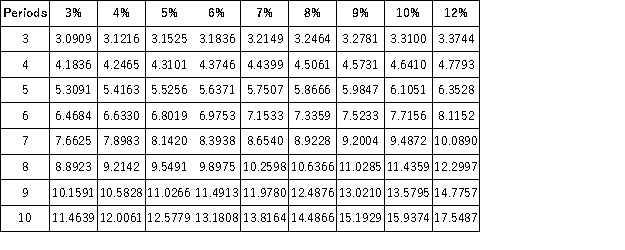

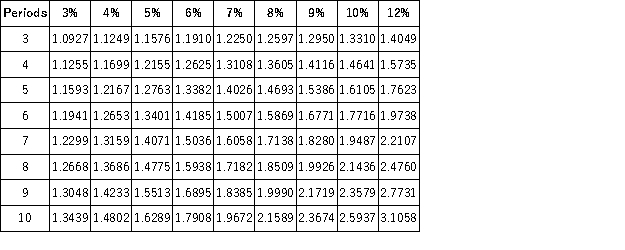

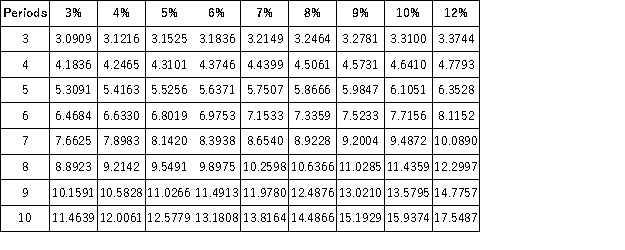

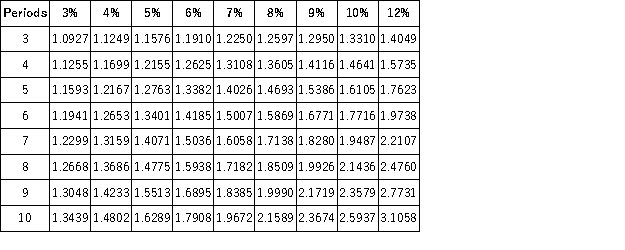

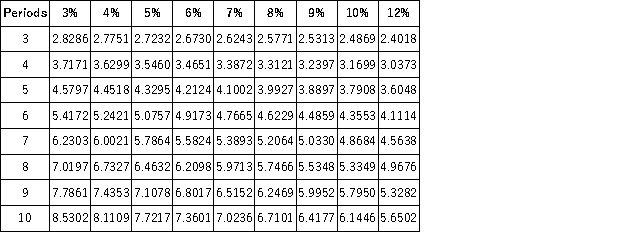

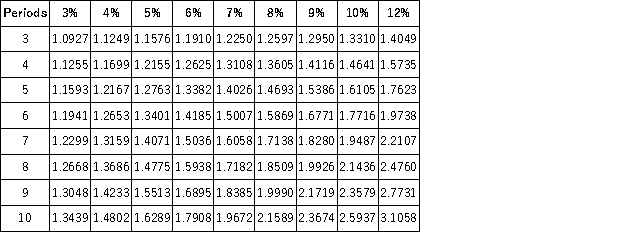

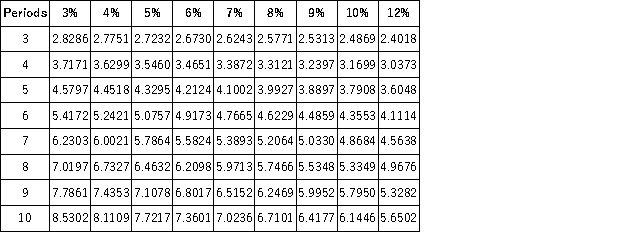

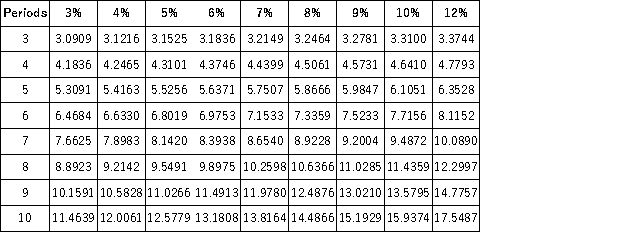

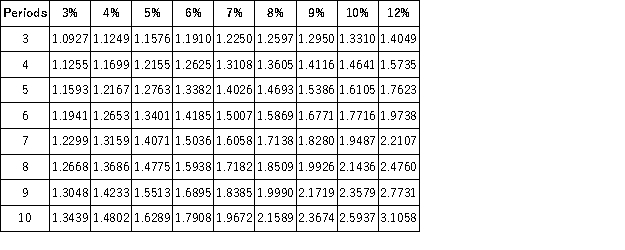

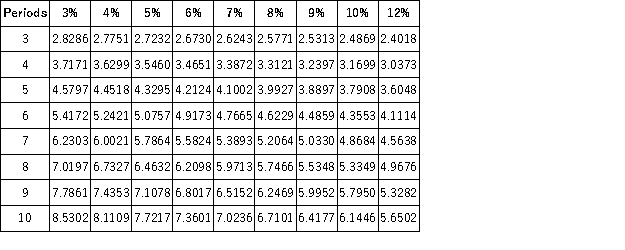

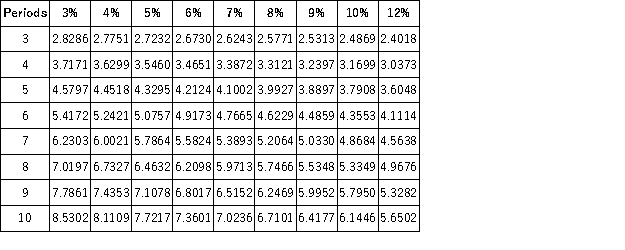

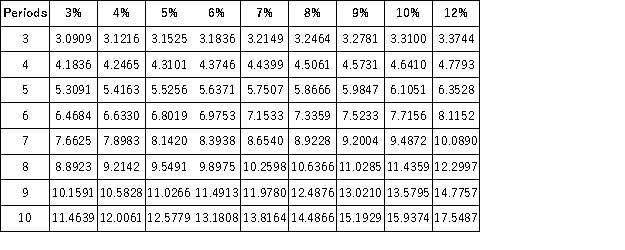

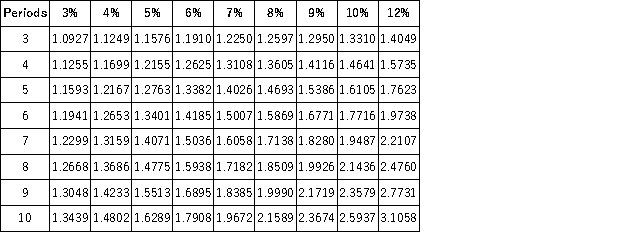

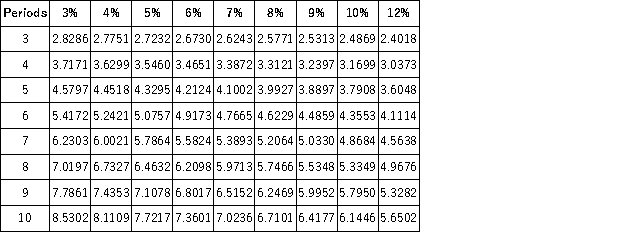

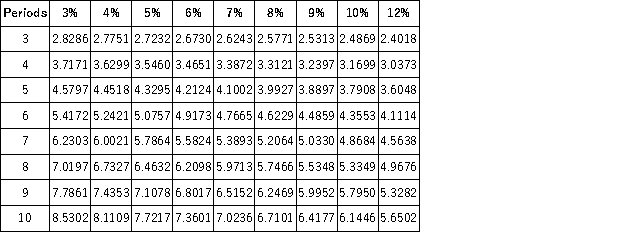

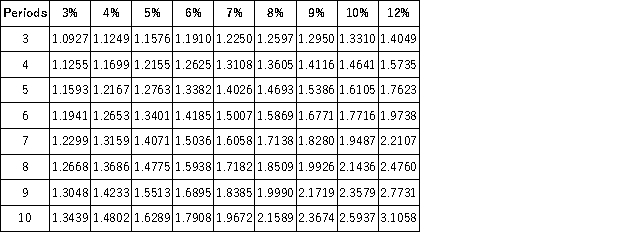

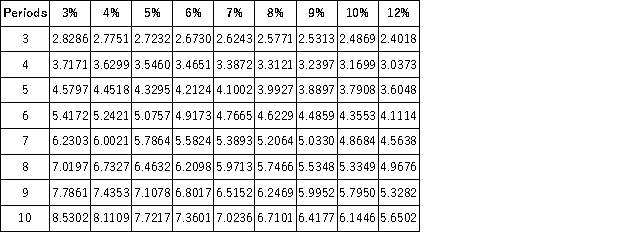

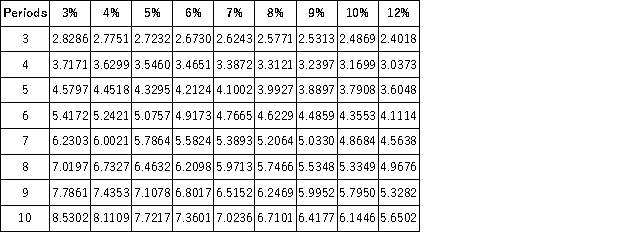

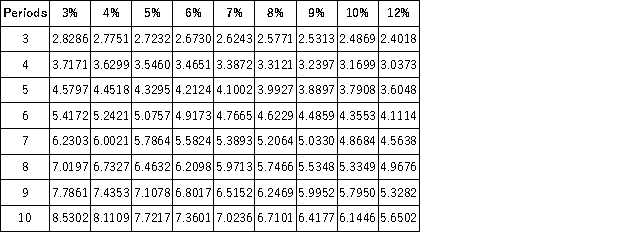

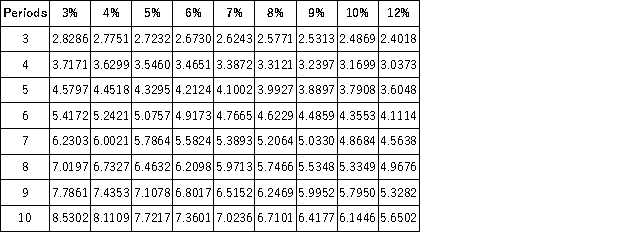

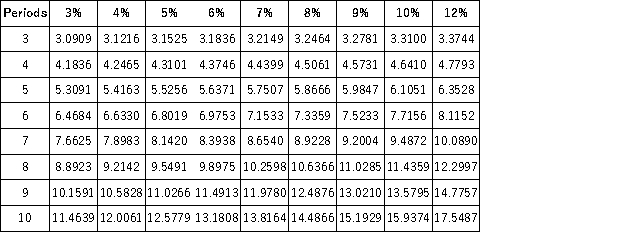

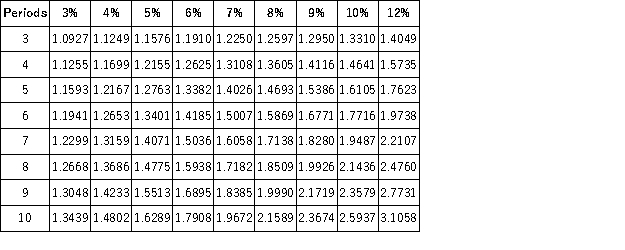

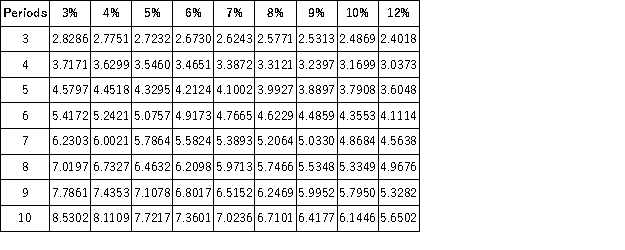

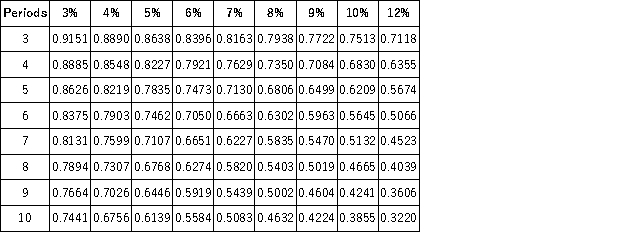

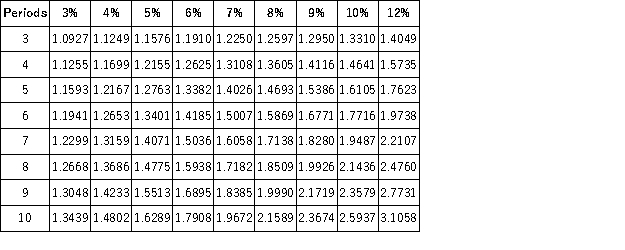

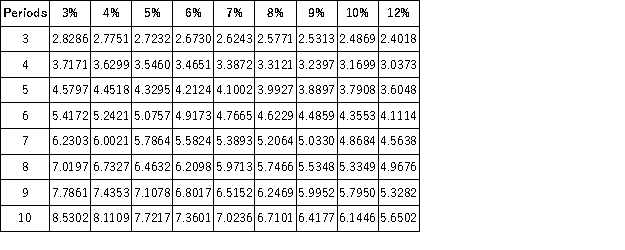

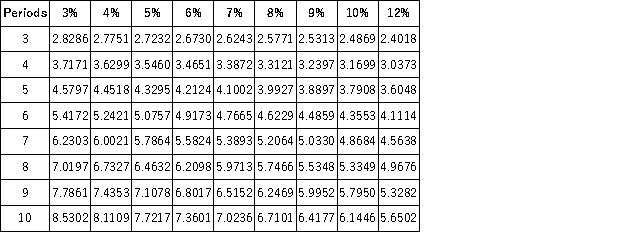

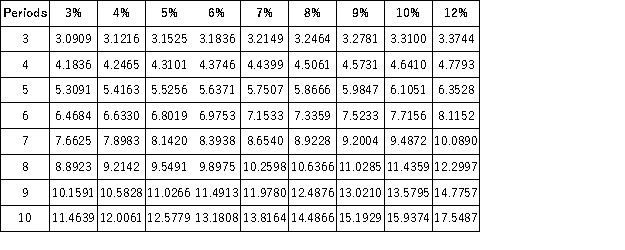

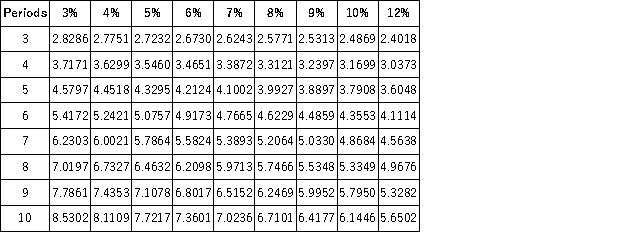

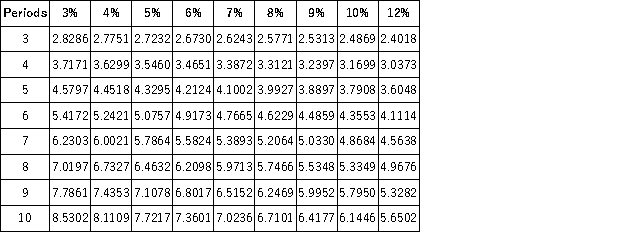

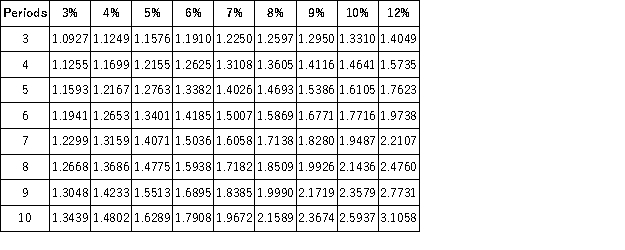

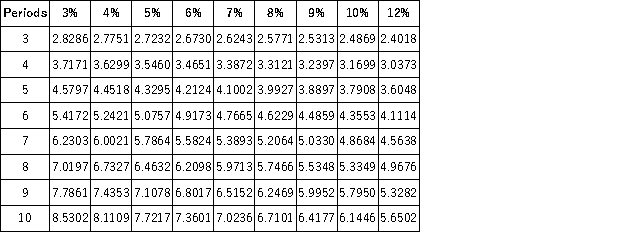

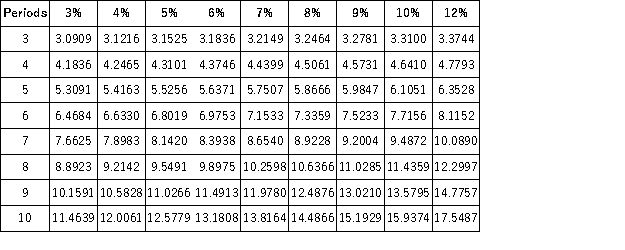

Present Value of 1  Future Value of 1

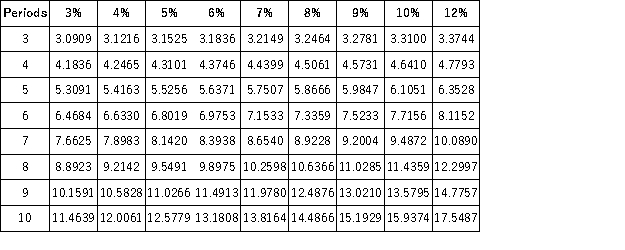

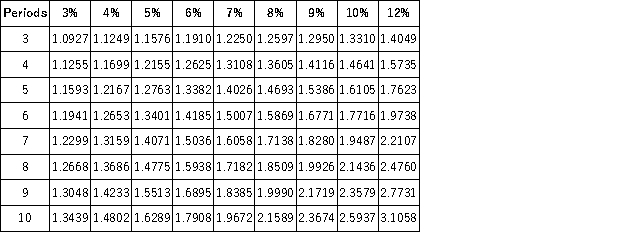

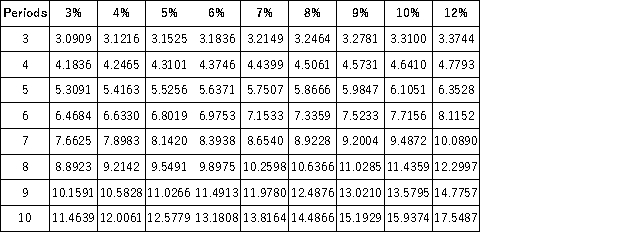

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

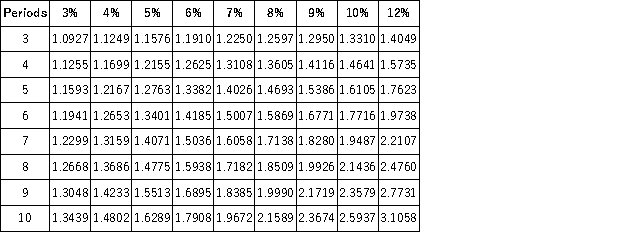

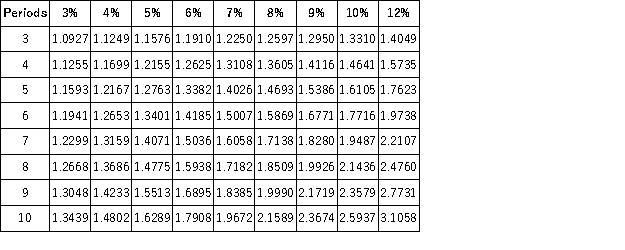

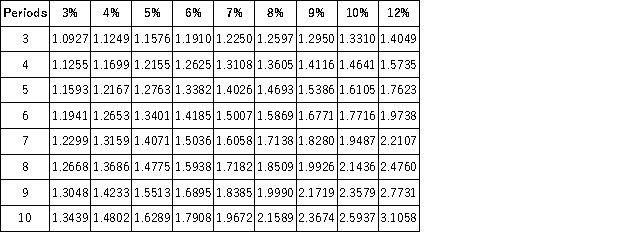

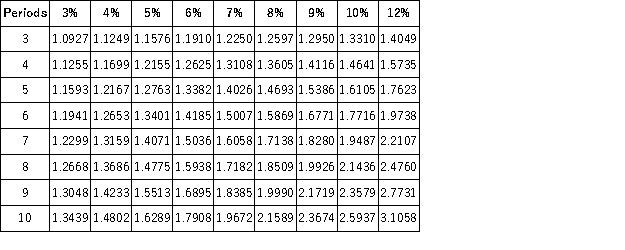

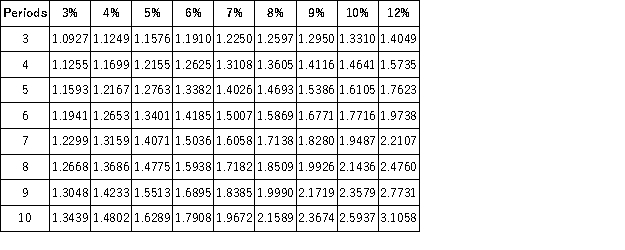

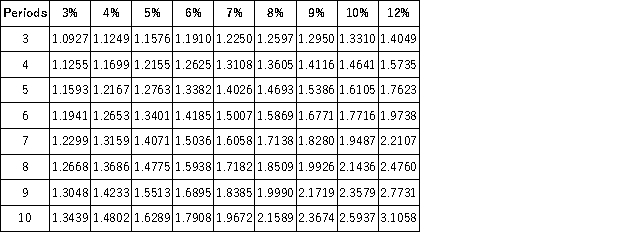

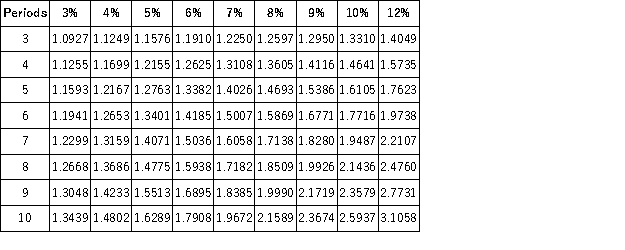

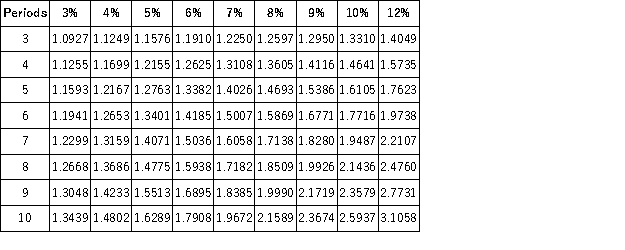

Future Value of an Annuity of 1  At an annual interest rate of 8% compounded annually, $5,300 will accumulate to a total of $7,210.65 in 5 years.

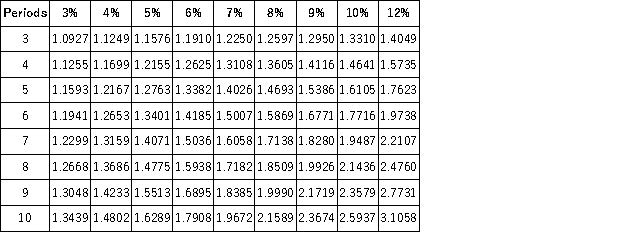

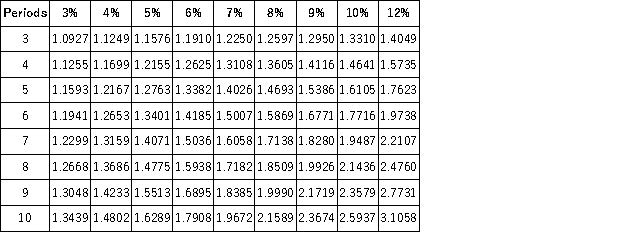

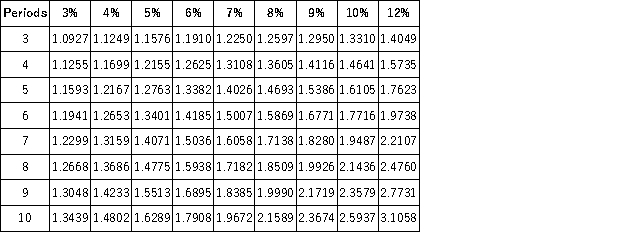

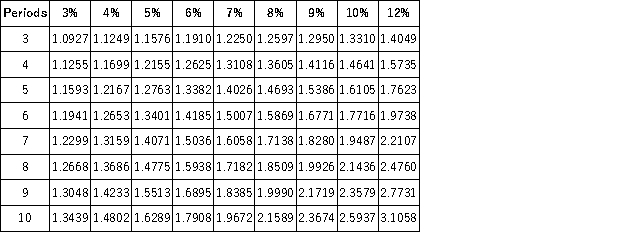

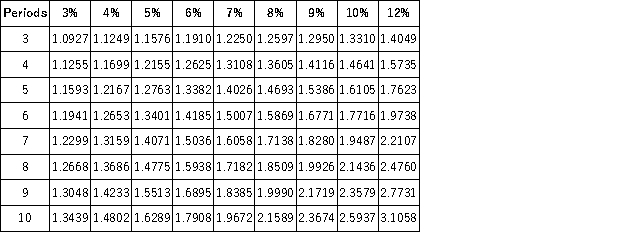

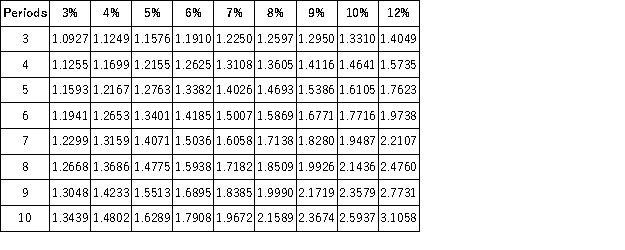

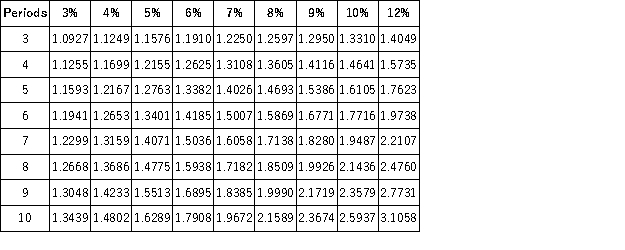

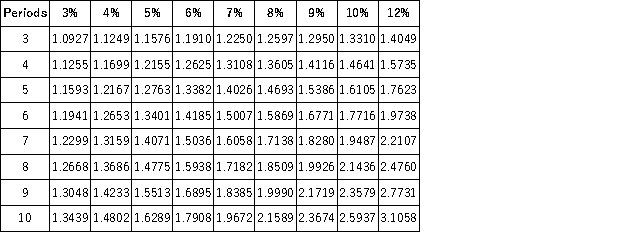

At an annual interest rate of 8% compounded annually, $5,300 will accumulate to a total of $7,210.65 in 5 years.

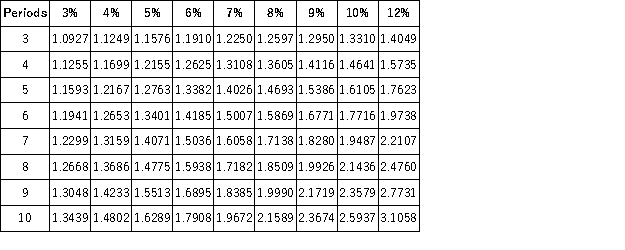

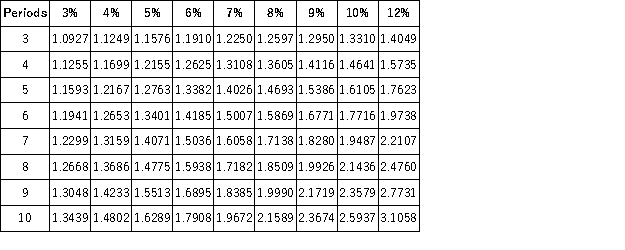

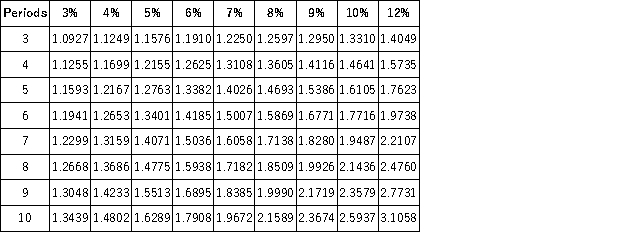

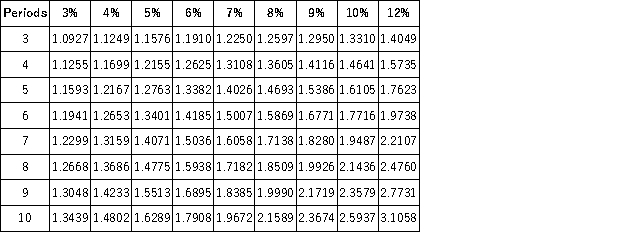

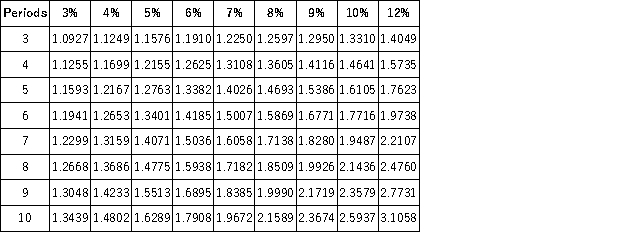

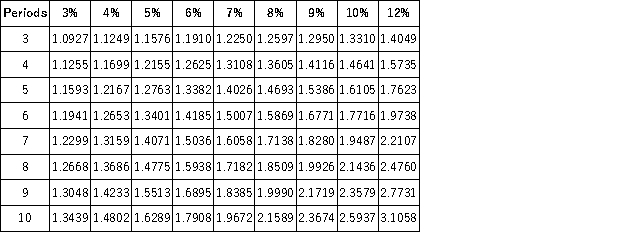

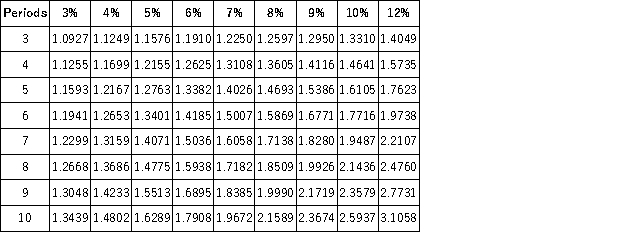

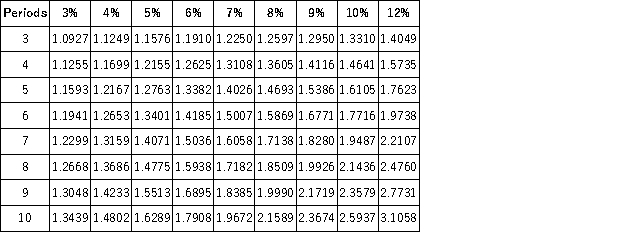

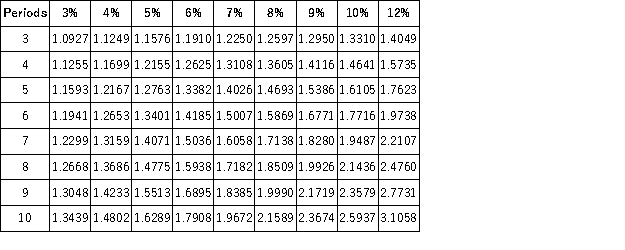

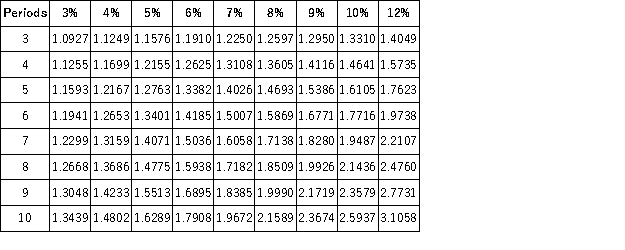

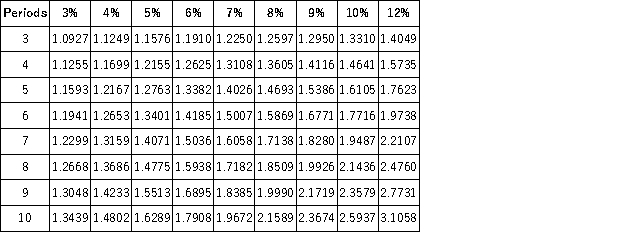

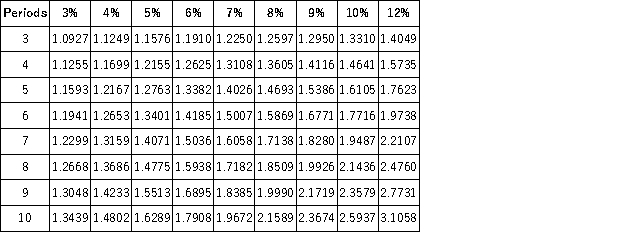

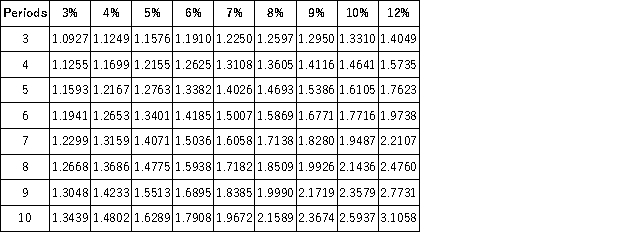

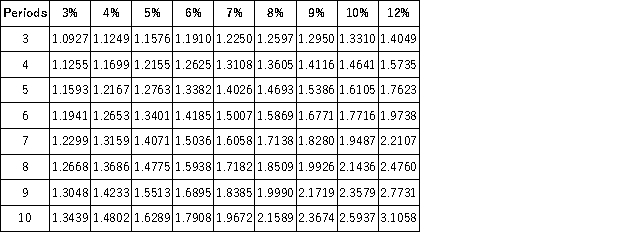

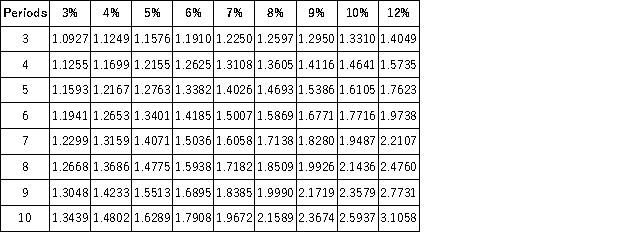

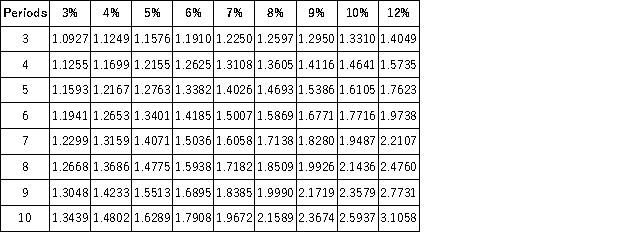

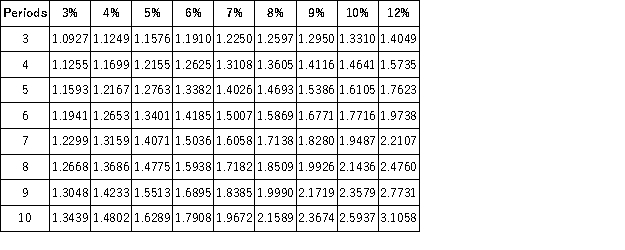

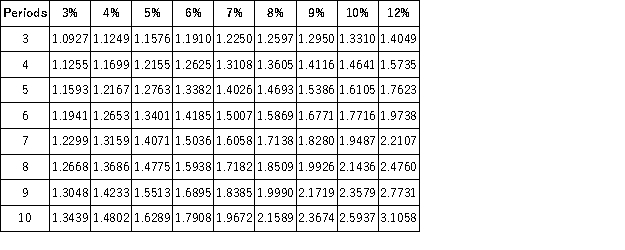

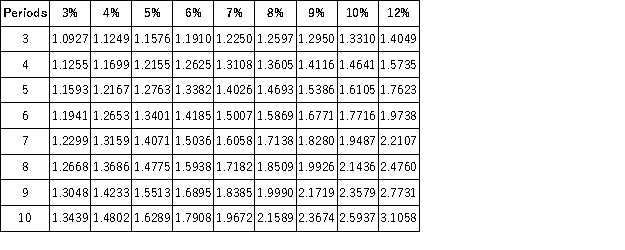

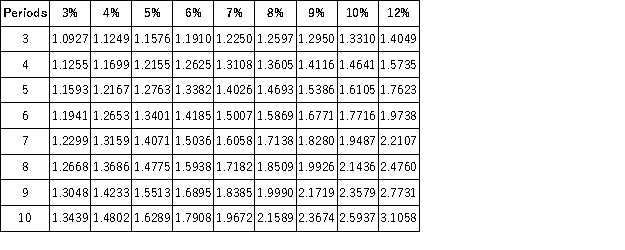

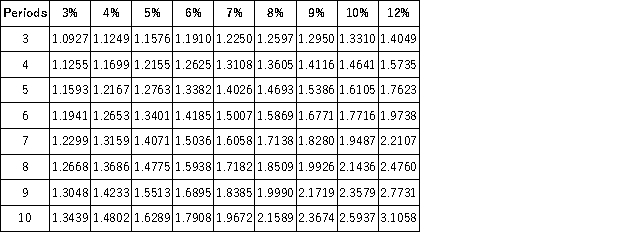

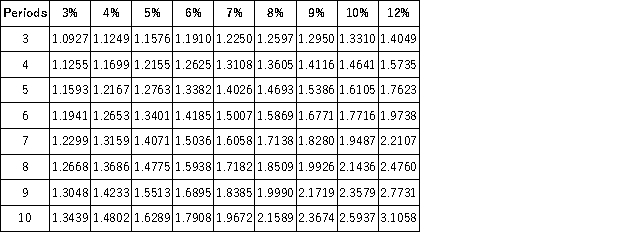

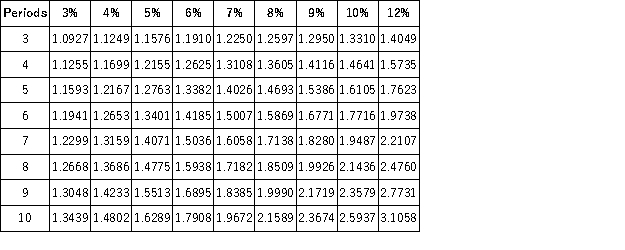

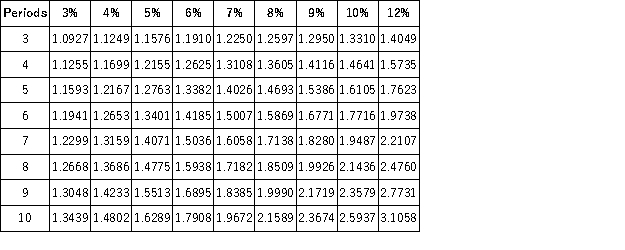

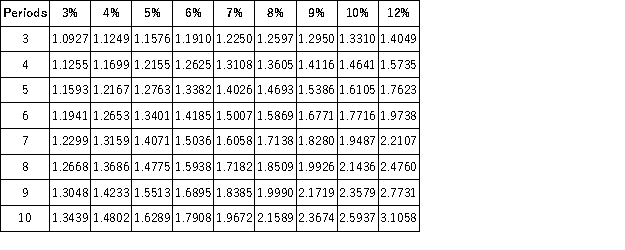

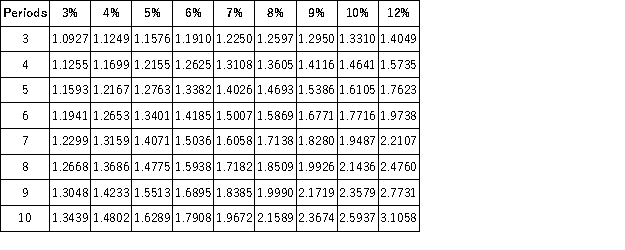

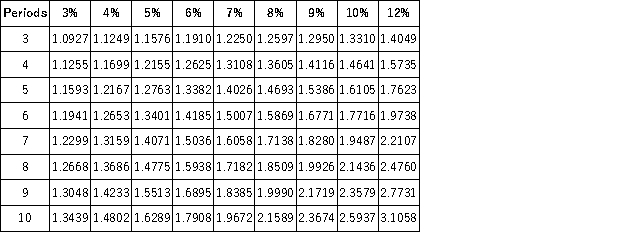

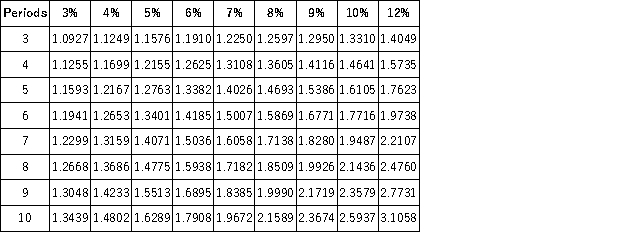

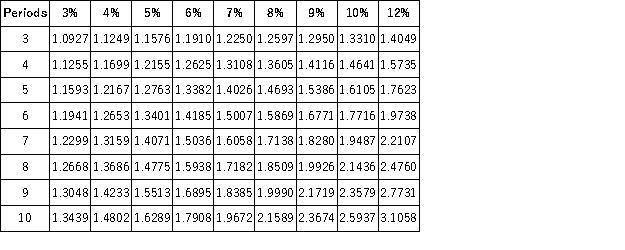

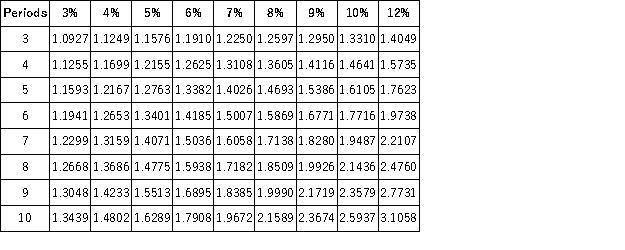

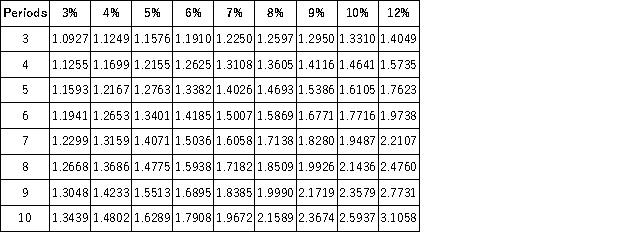

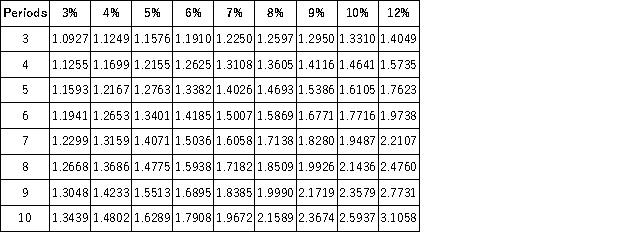

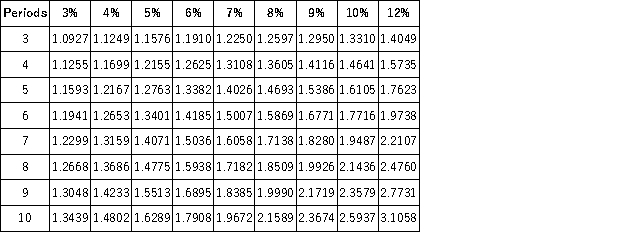

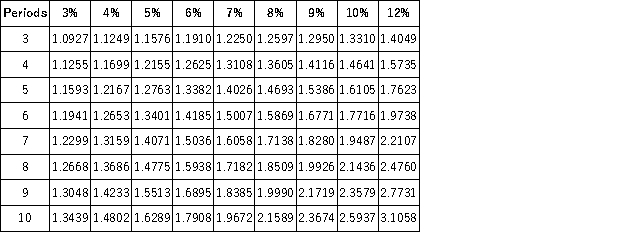

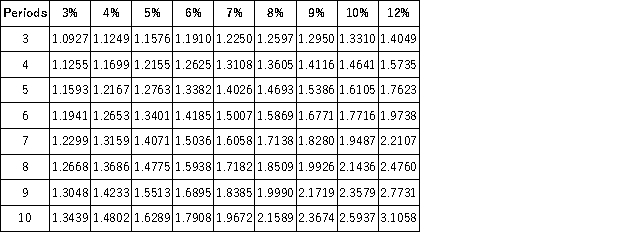

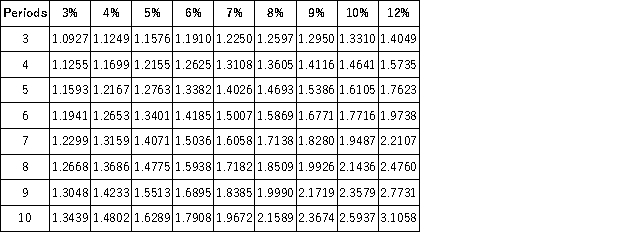

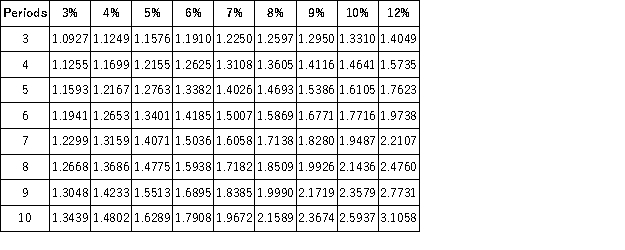

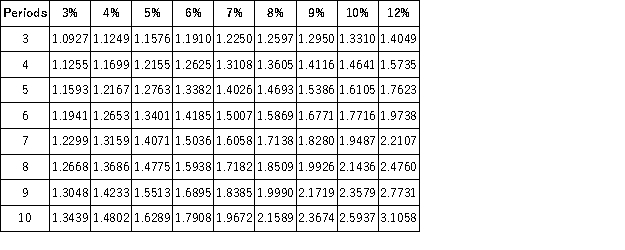

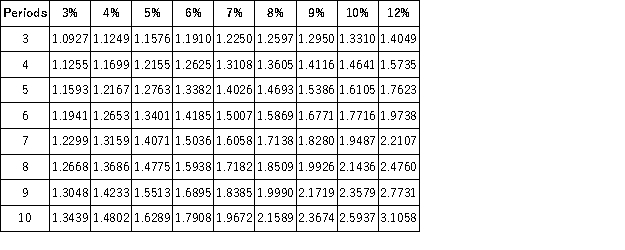

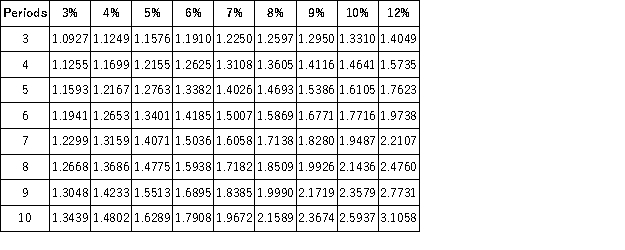

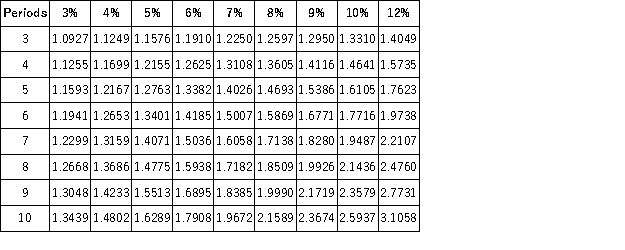

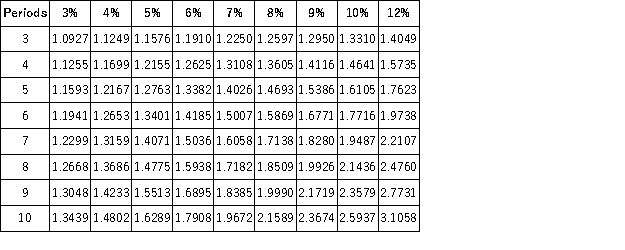

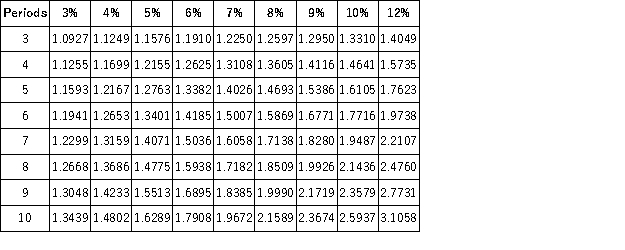

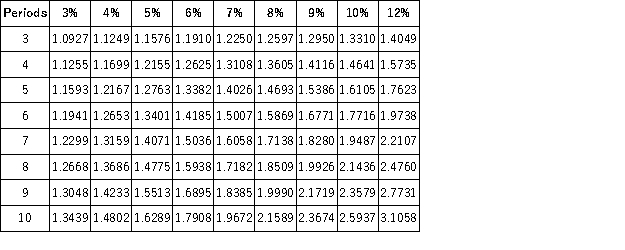

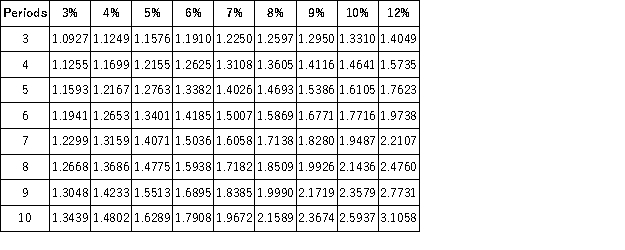

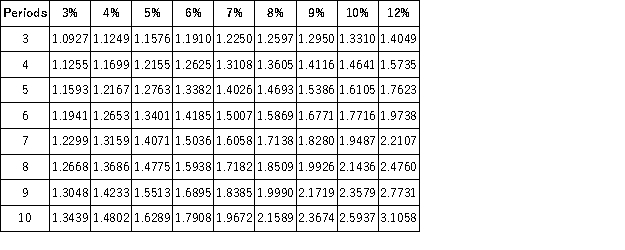

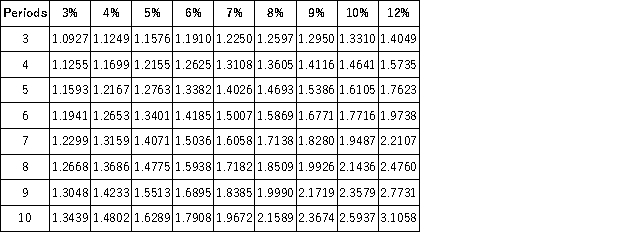

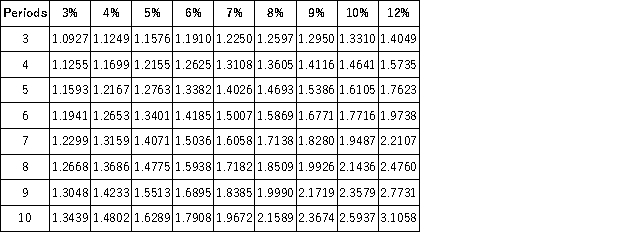

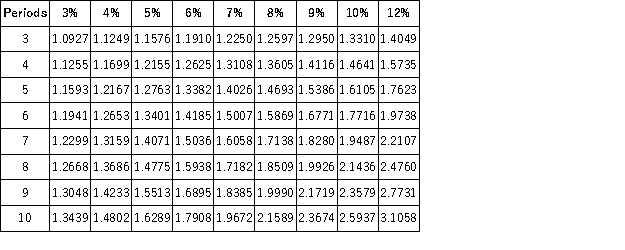

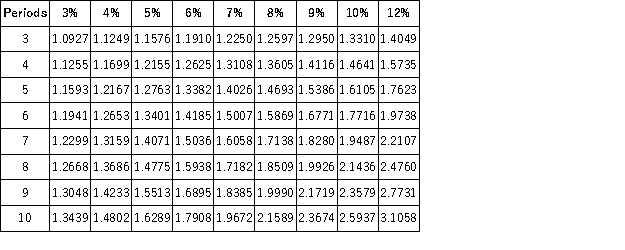

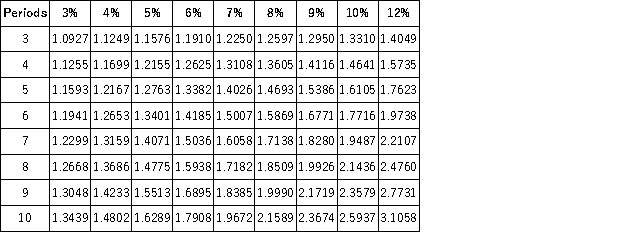

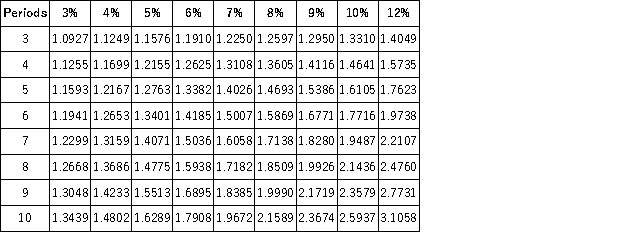

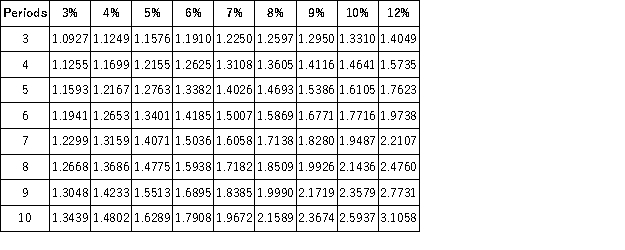

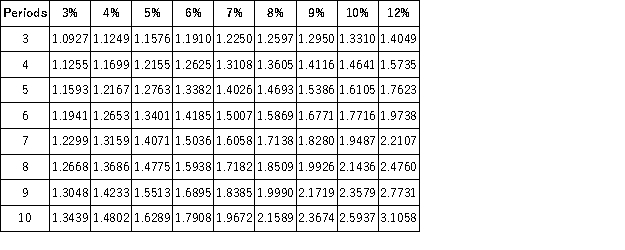

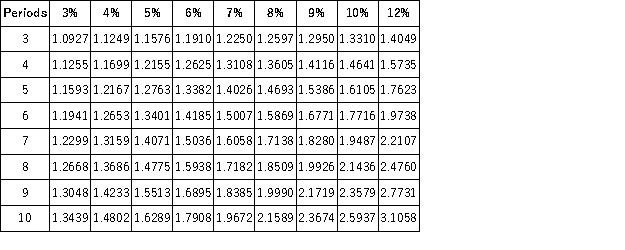

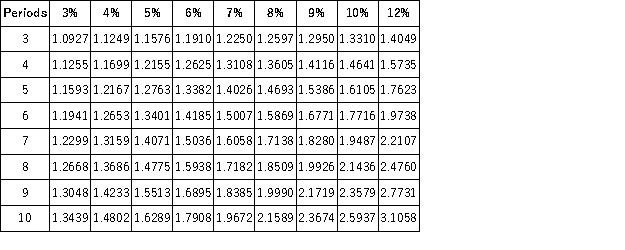

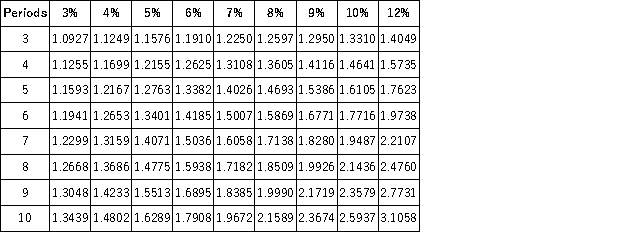

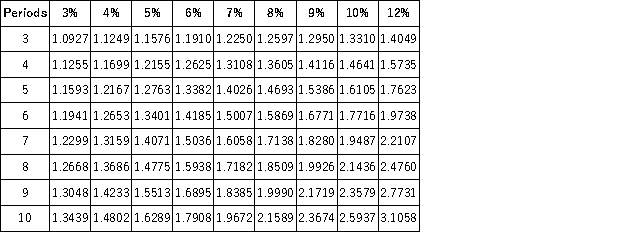

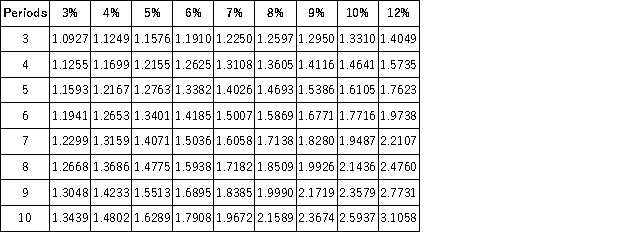

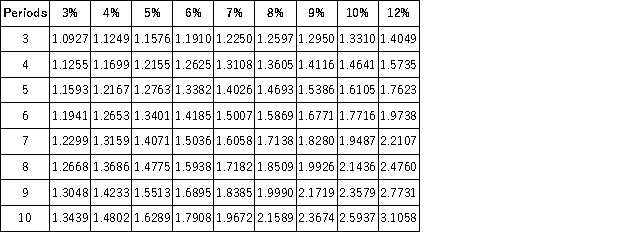

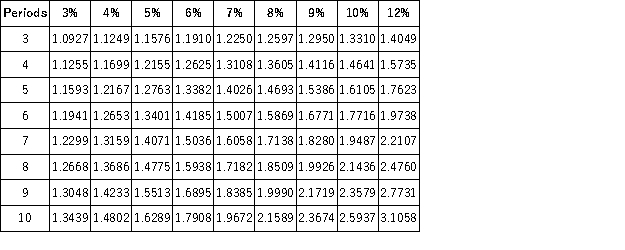

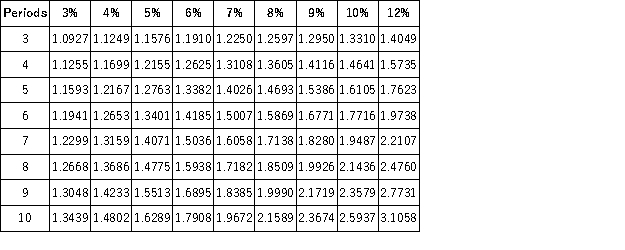

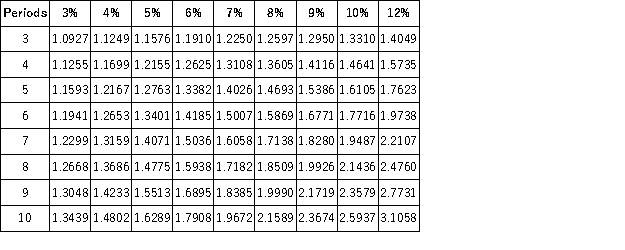

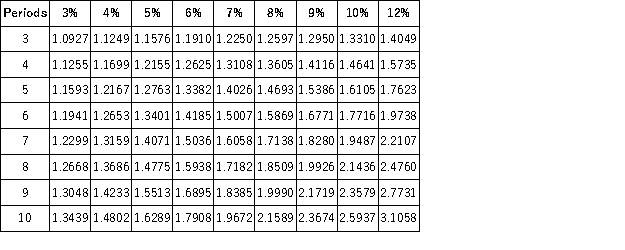

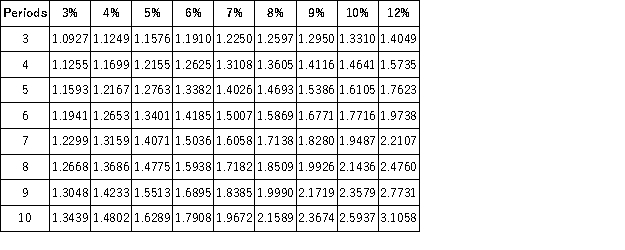

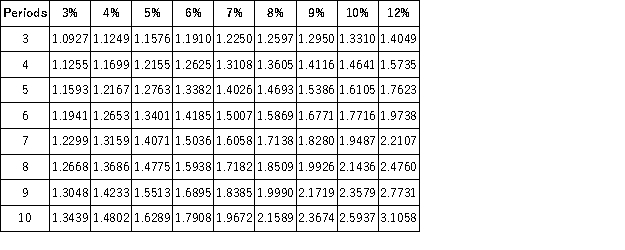

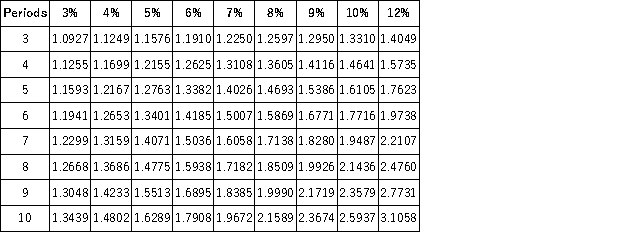

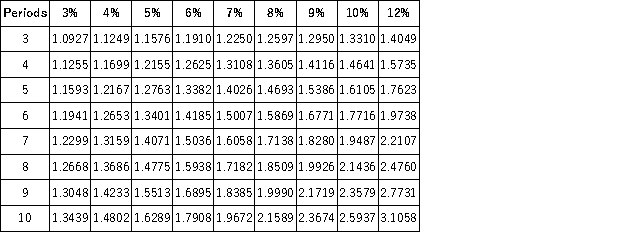

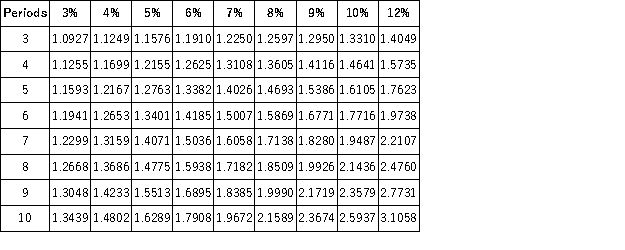

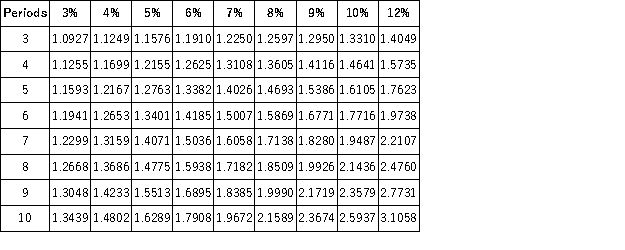

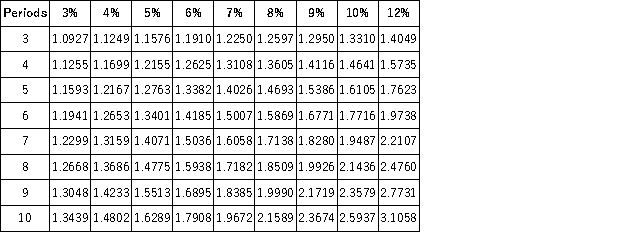

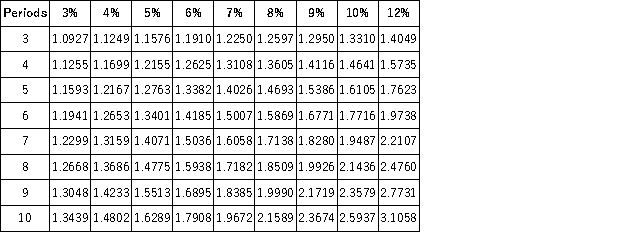

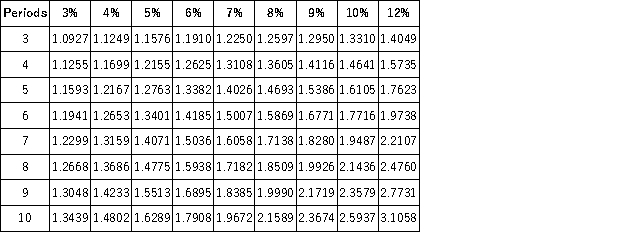

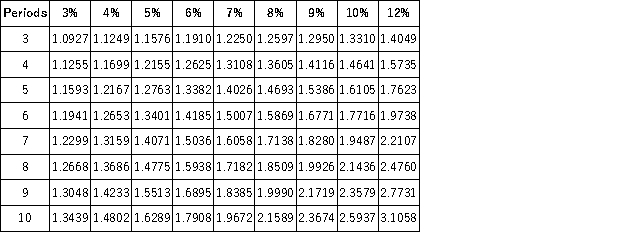

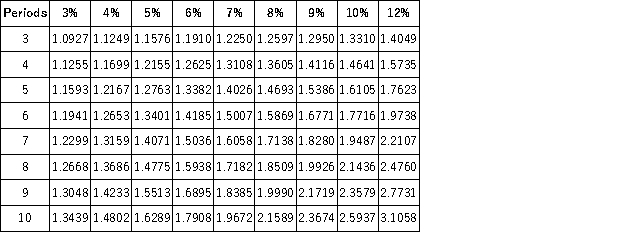

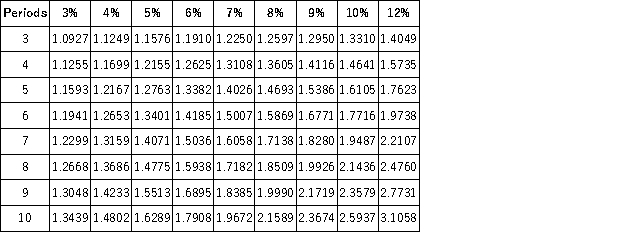

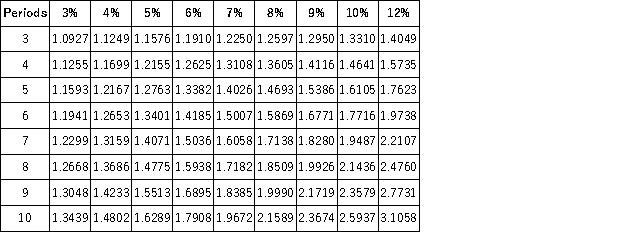

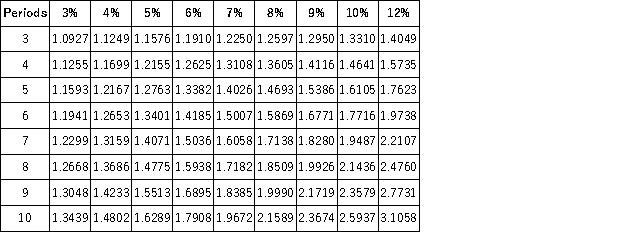

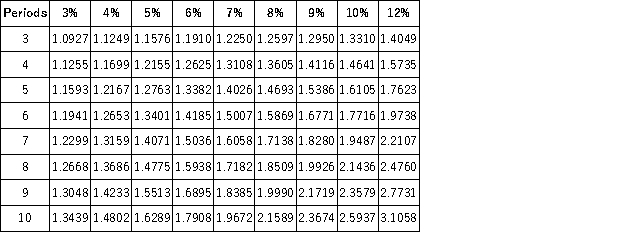

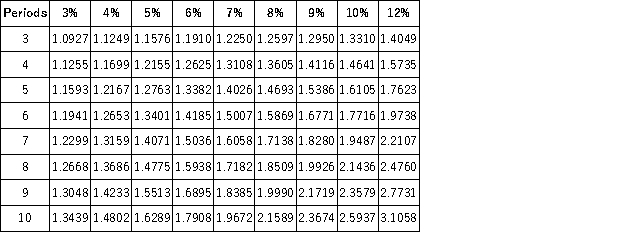

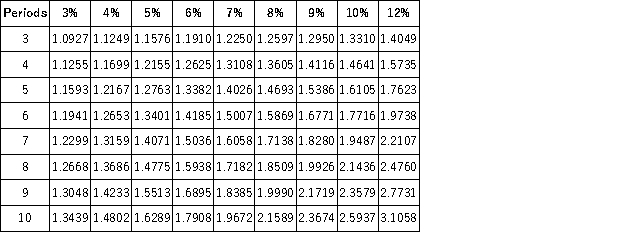

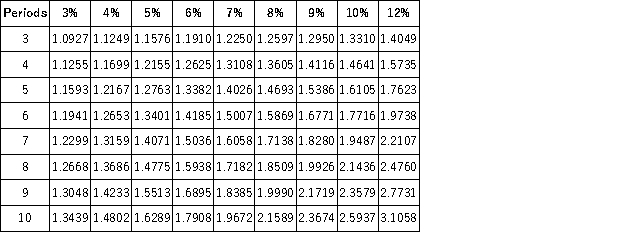

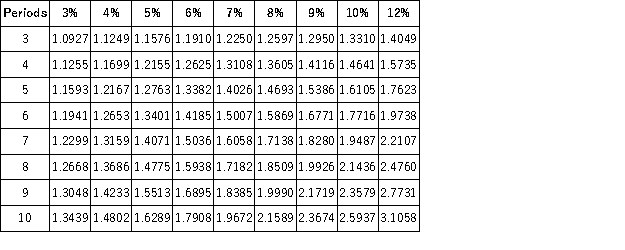

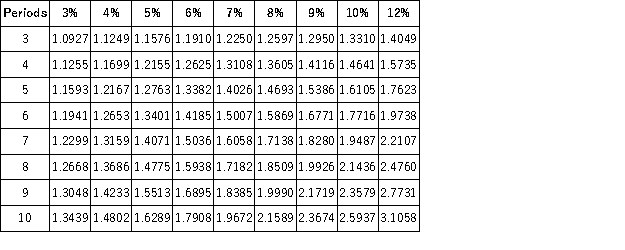

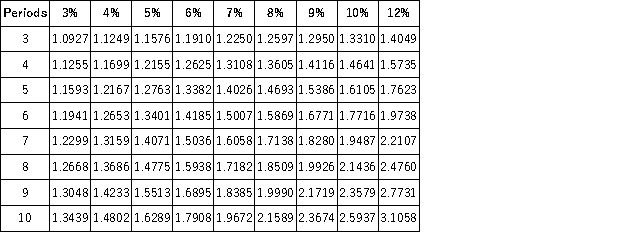

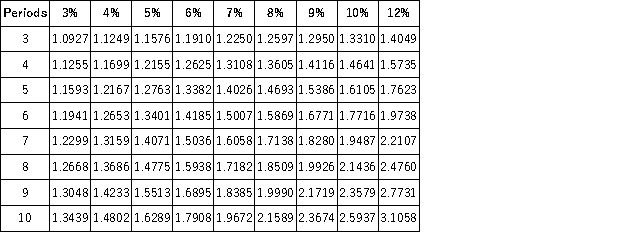

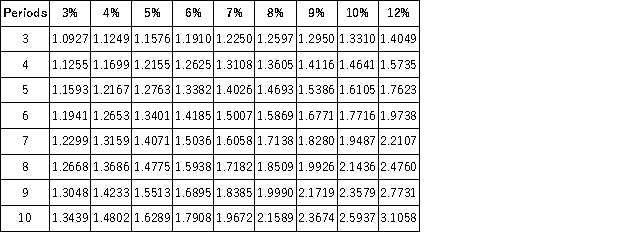

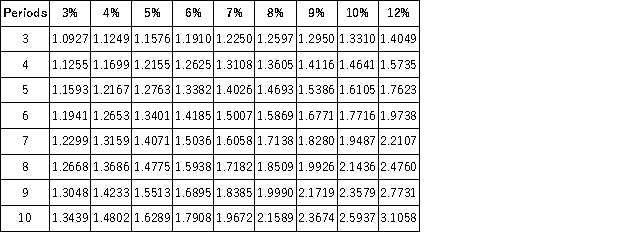

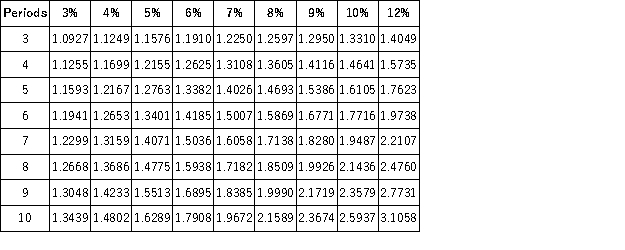

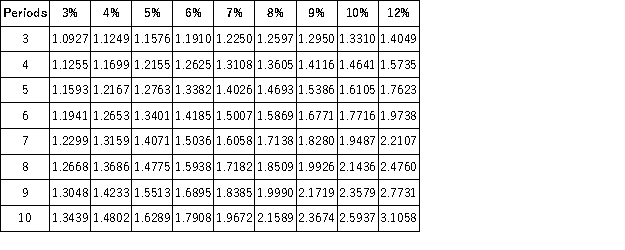

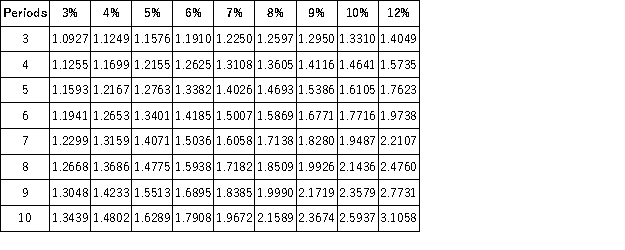

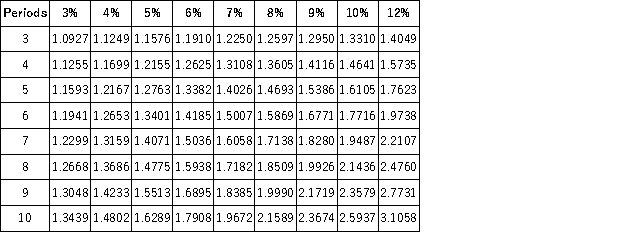

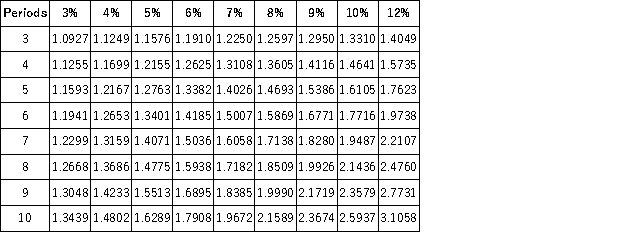

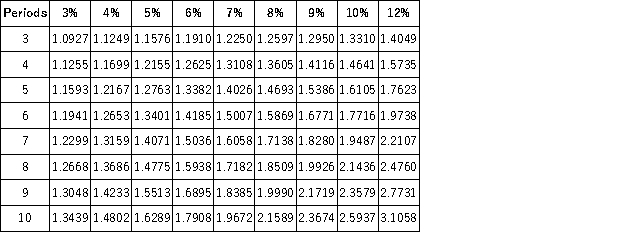

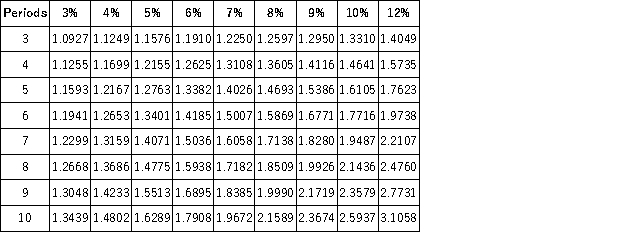

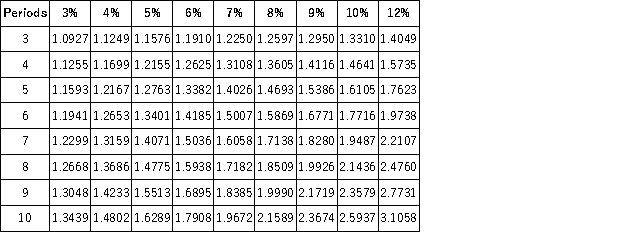

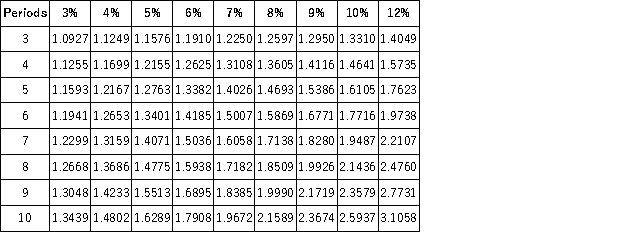

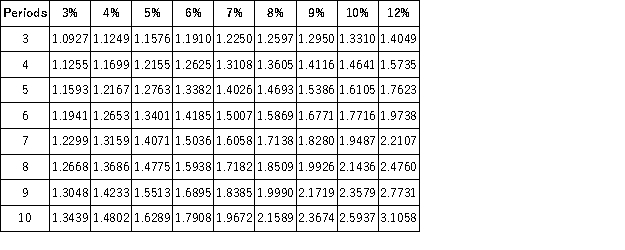

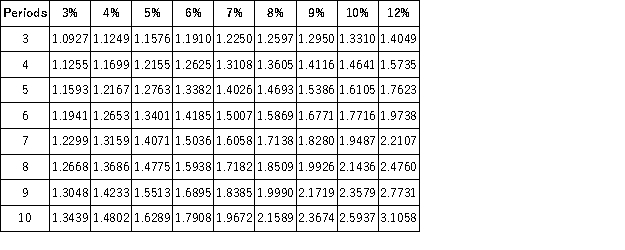

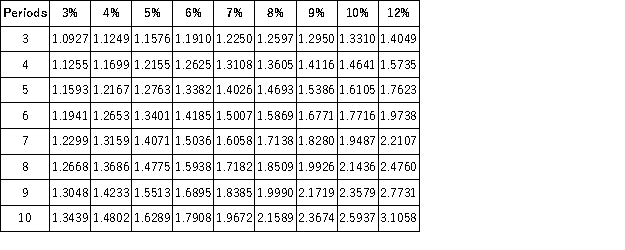

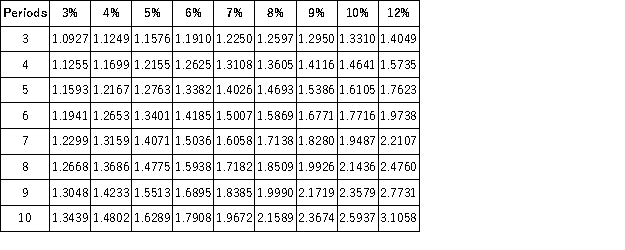

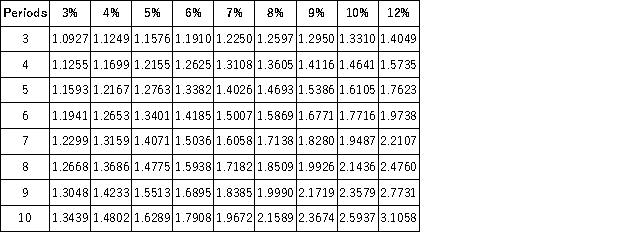

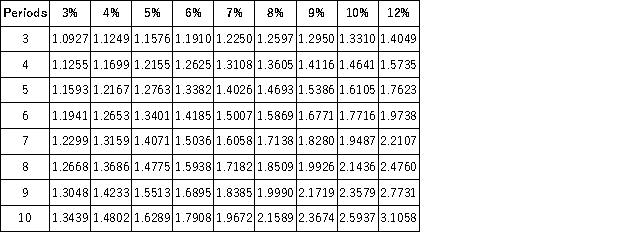

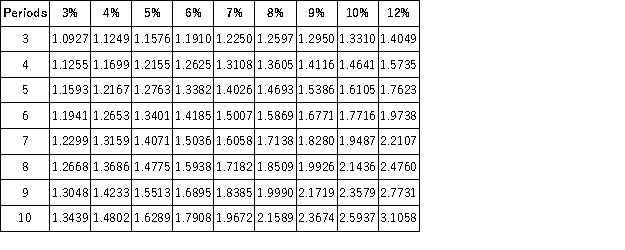

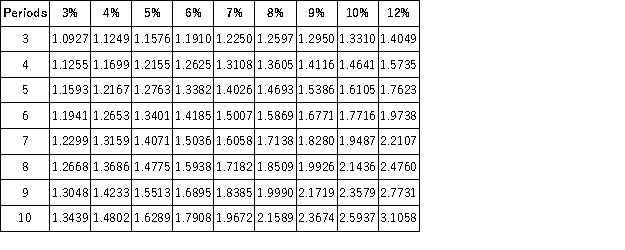

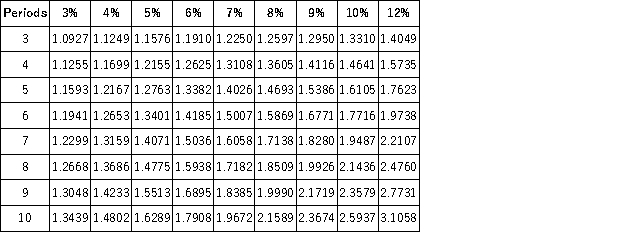

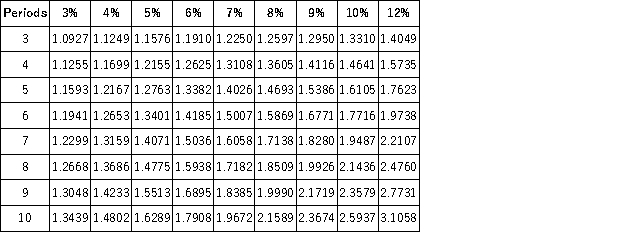

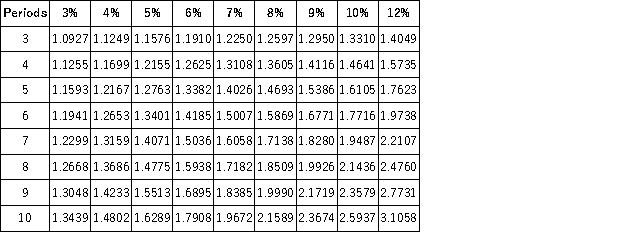

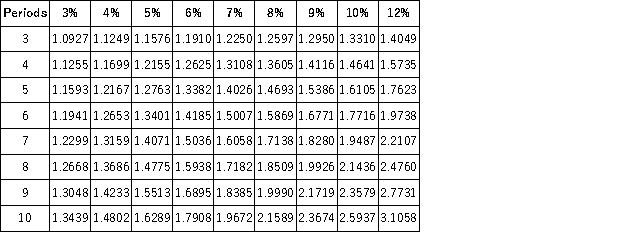

FV Factor = Future Value/Present Value

FV Factor = $7,210.65/$5,300 = 1.3605

1.3605 is the future value of $1 factor for 4 periods at 8%

Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  At an annual interest rate of 8% compounded annually, $5,300 will accumulate to a total of $7,210.65 in 5 years.

At an annual interest rate of 8% compounded annually, $5,300 will accumulate to a total of $7,210.65 in 5 years.FV Factor = Future Value/Present Value

FV Factor = $7,210.65/$5,300 = 1.3605

1.3605 is the future value of $1 factor for 4 periods at 8%

False

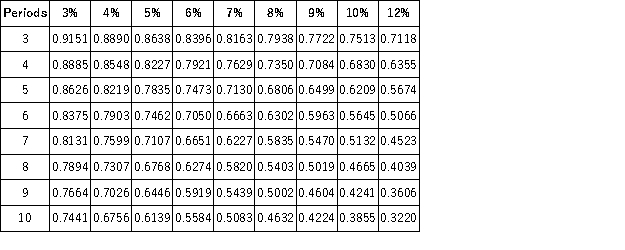

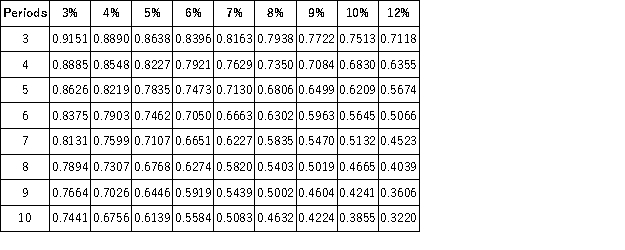

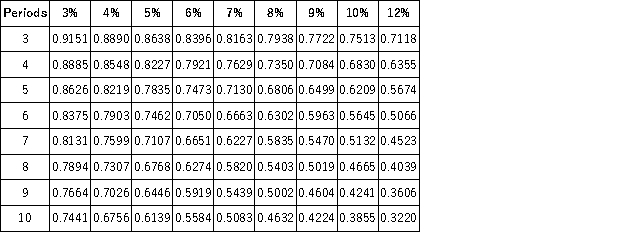

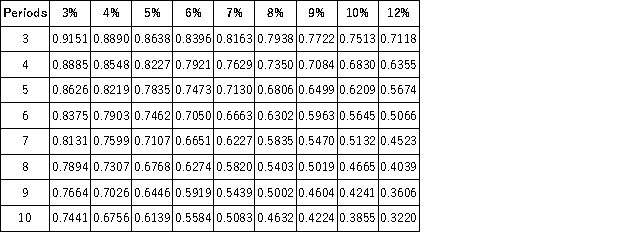

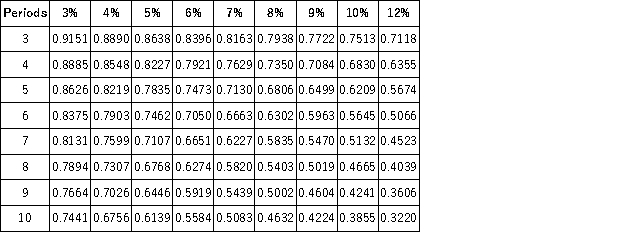

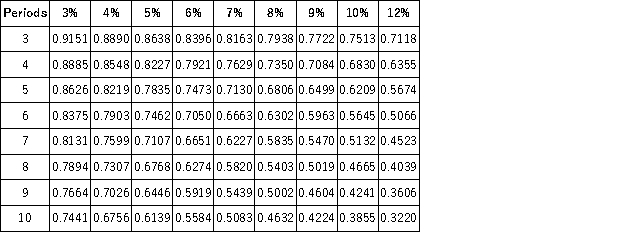

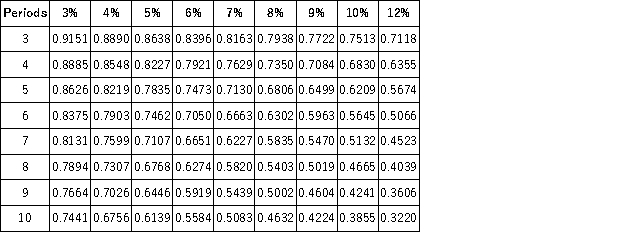

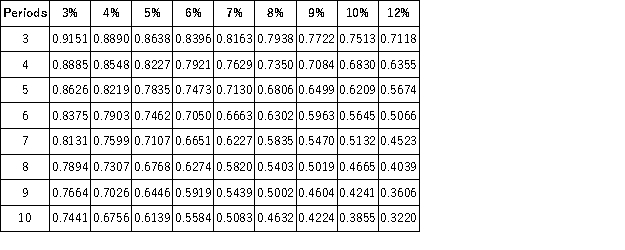

2

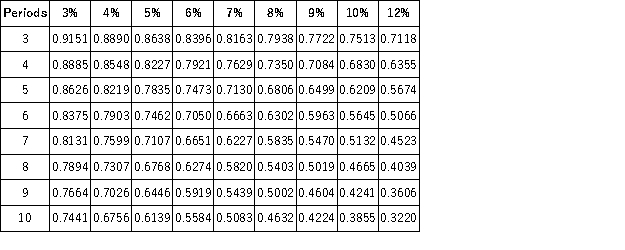

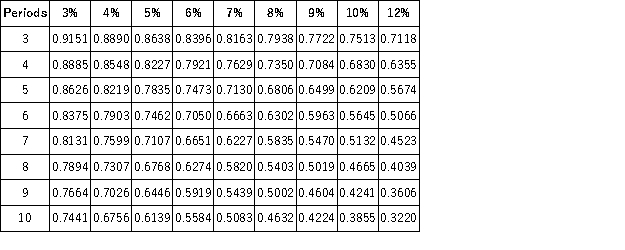

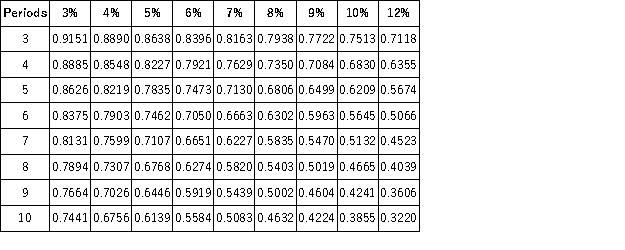

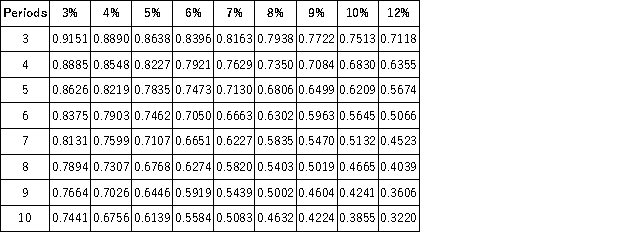

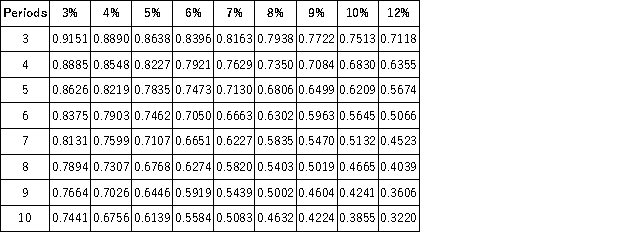

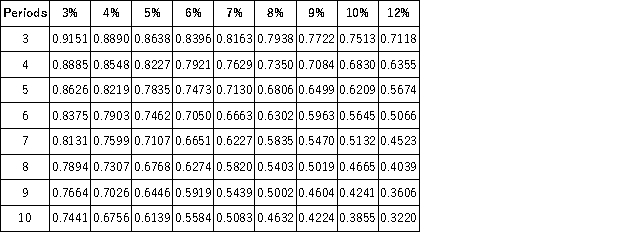

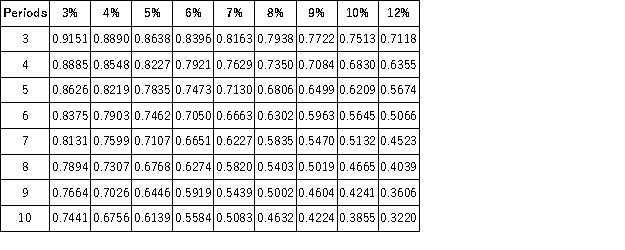

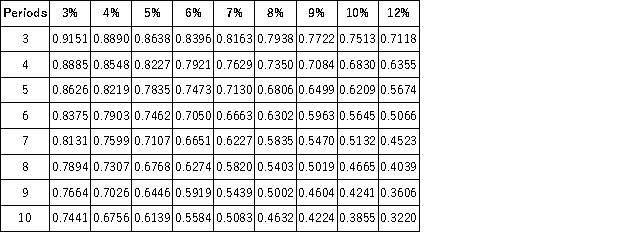

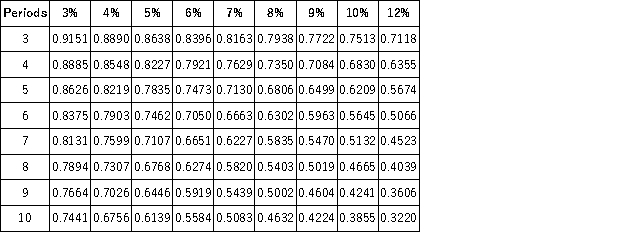

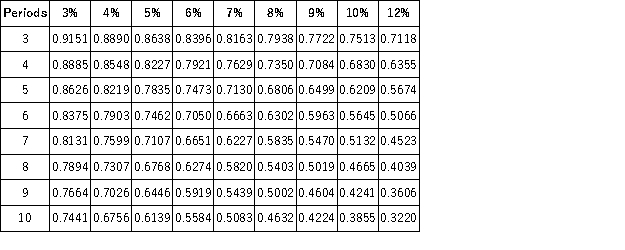

Present Value of 1  Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

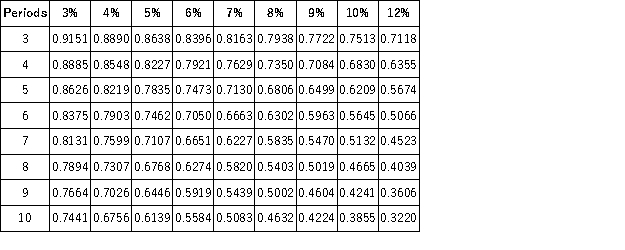

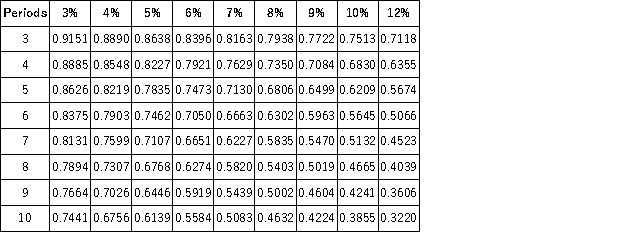

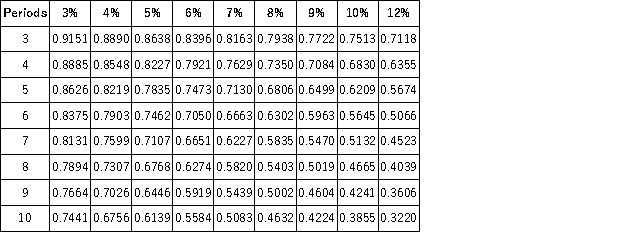

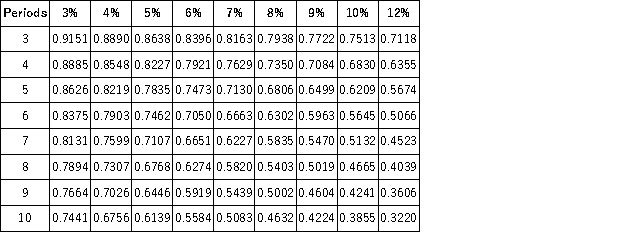

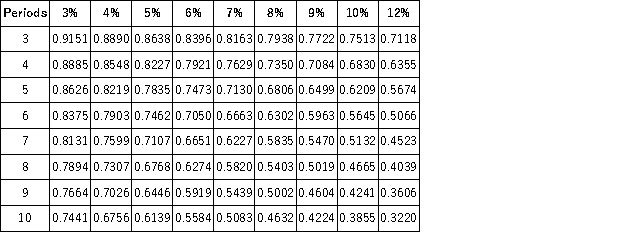

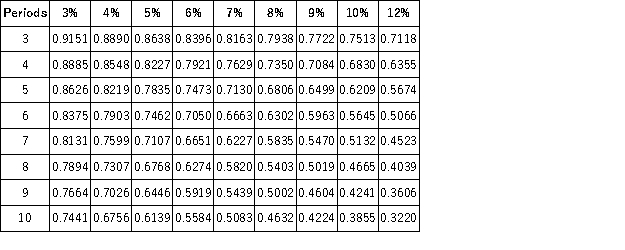

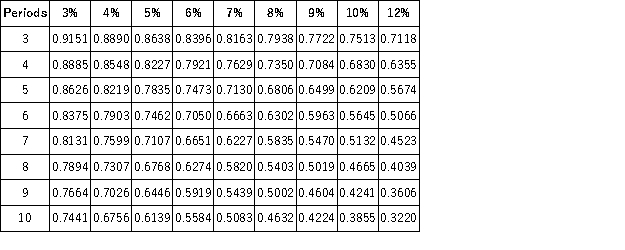

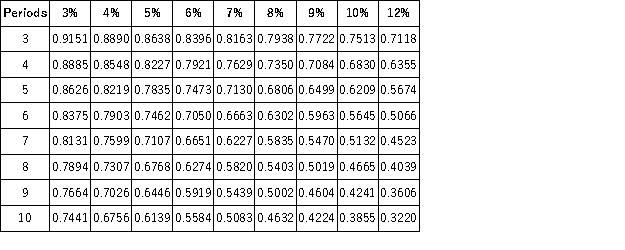

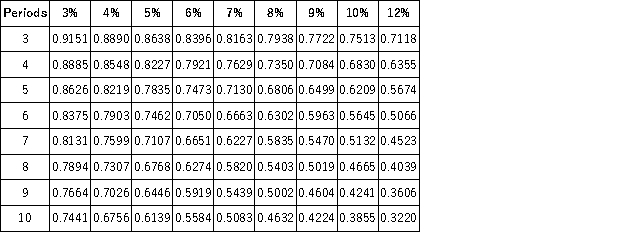

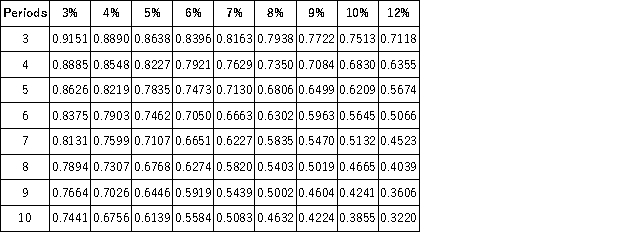

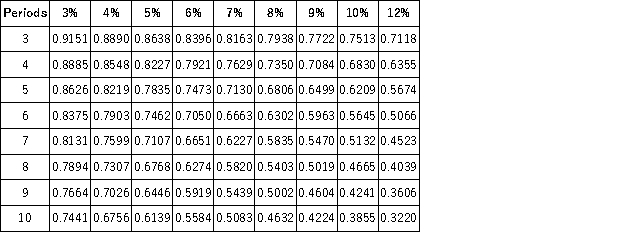

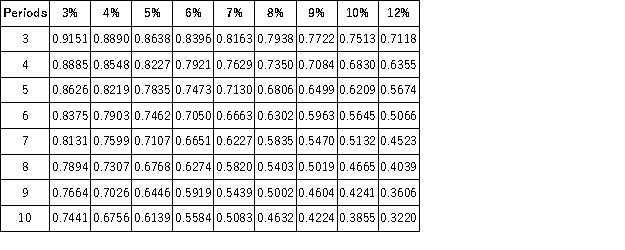

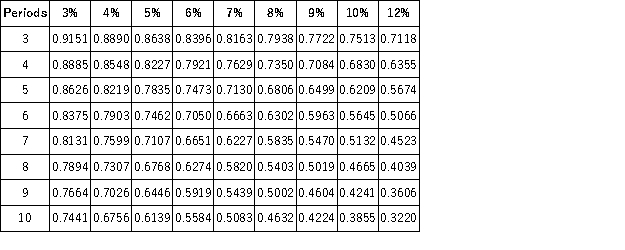

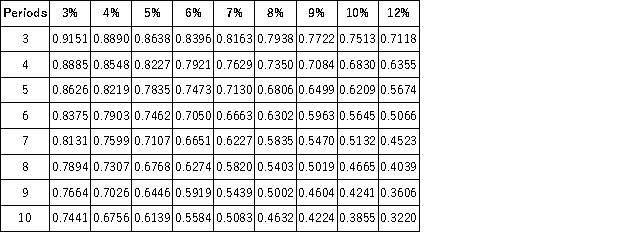

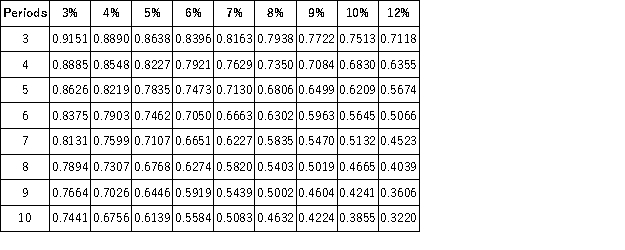

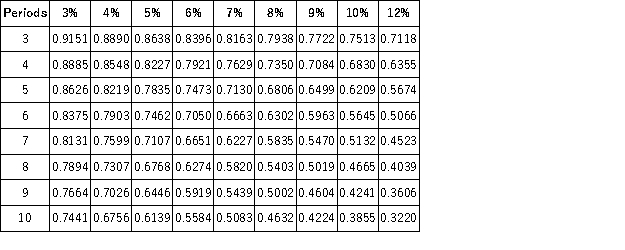

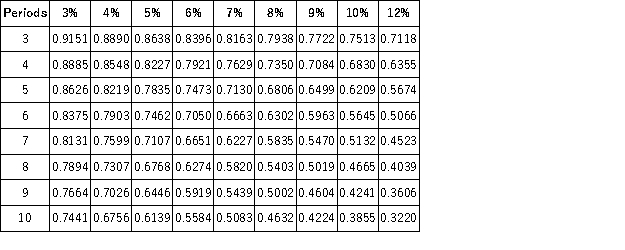

Future Value of an Annuity of 1  The present value of $2,000 to be received nine years from today at 8% interest compounded annually is $1,000.

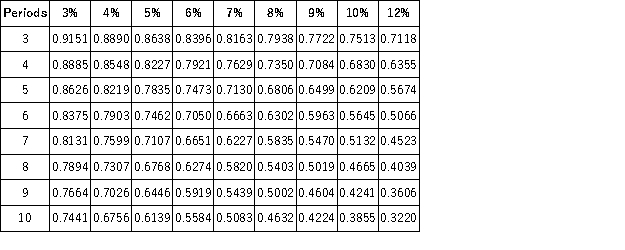

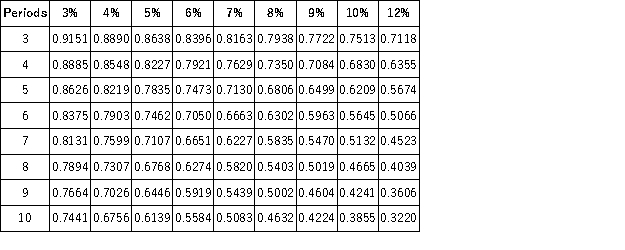

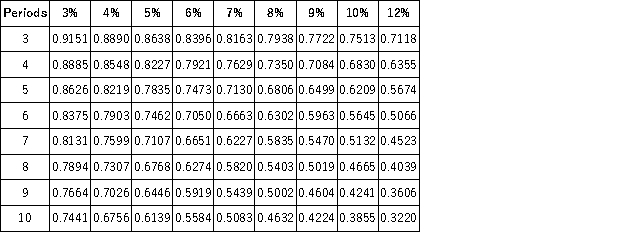

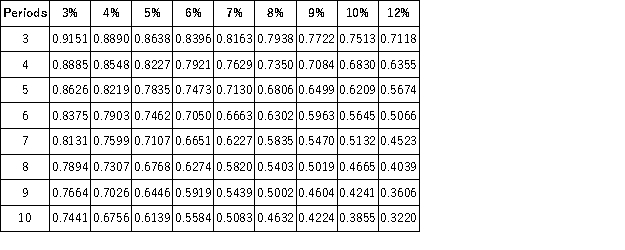

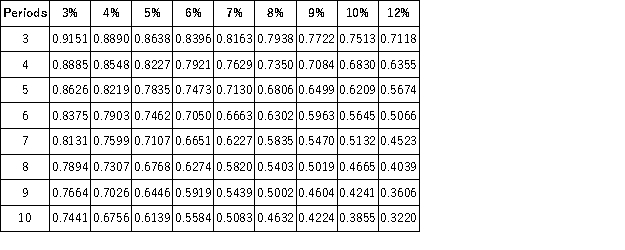

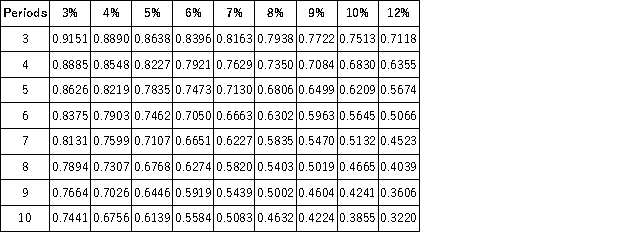

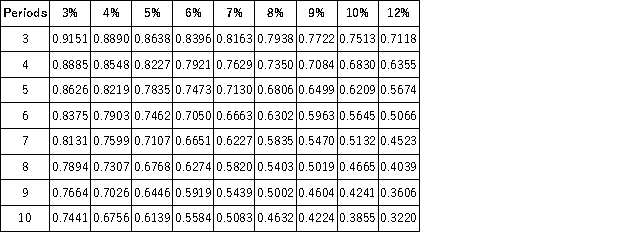

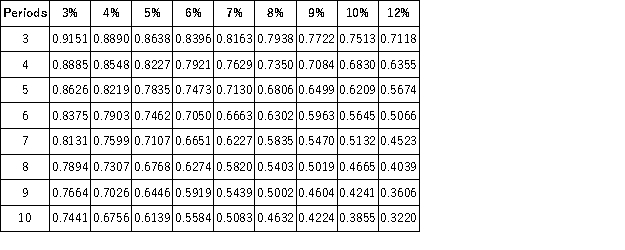

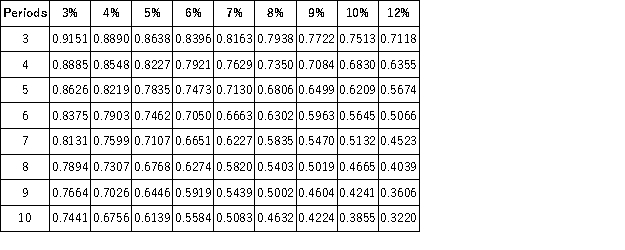

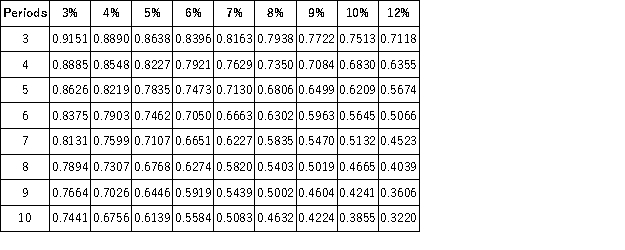

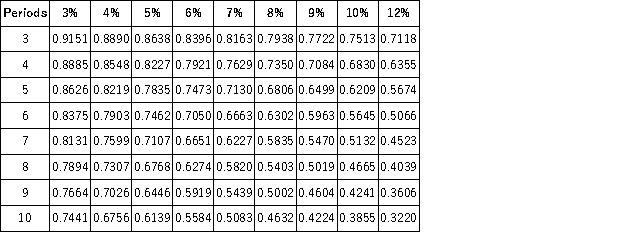

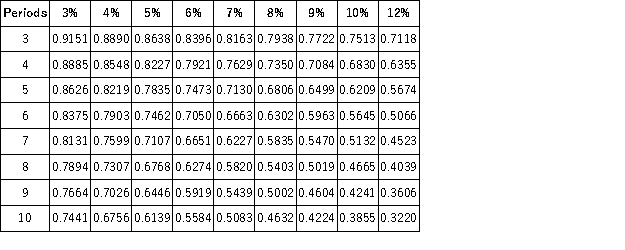

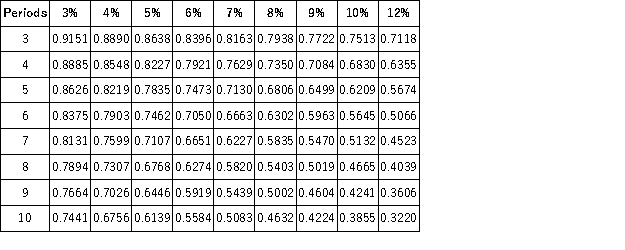

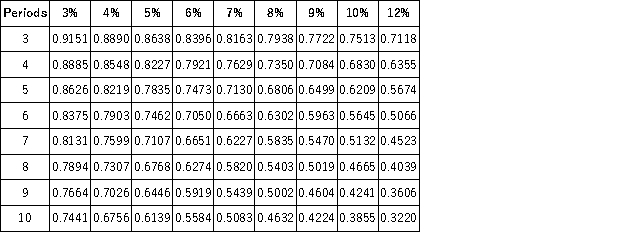

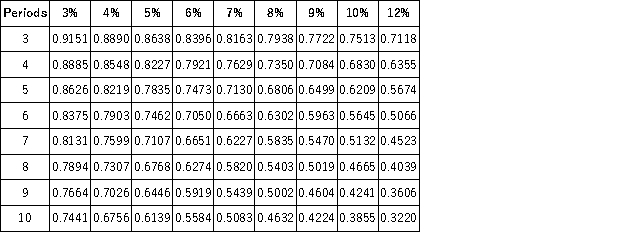

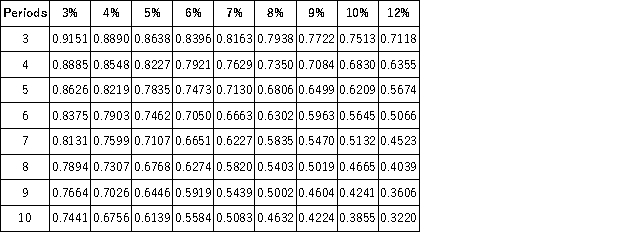

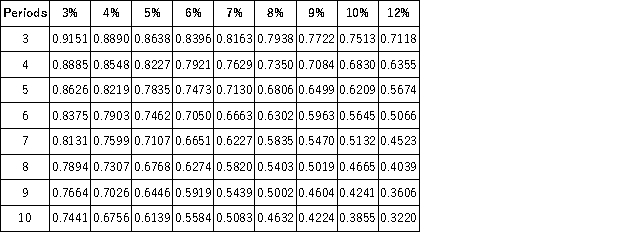

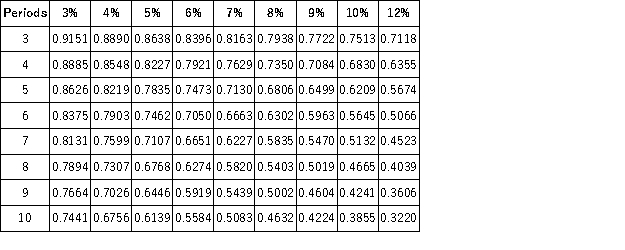

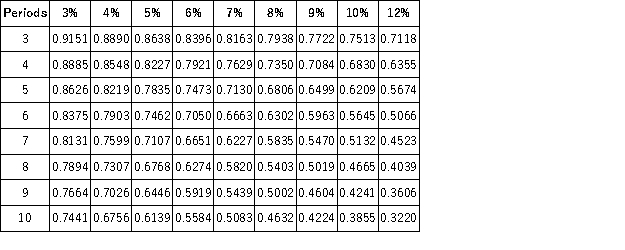

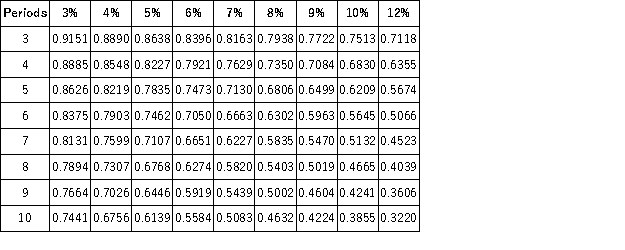

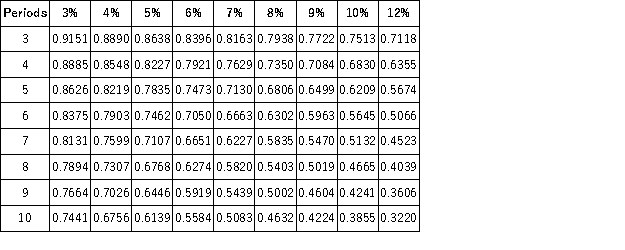

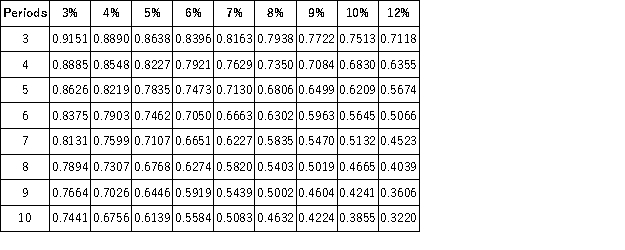

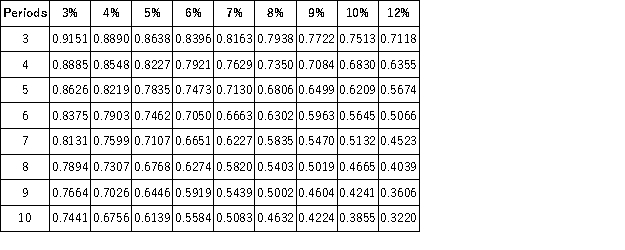

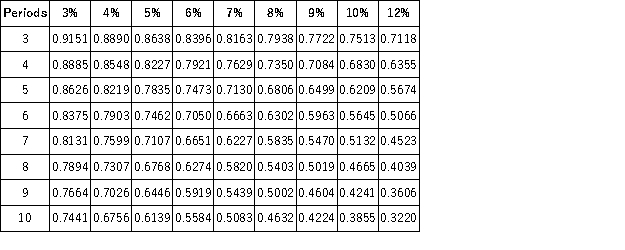

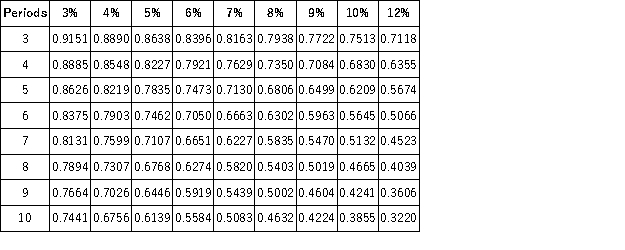

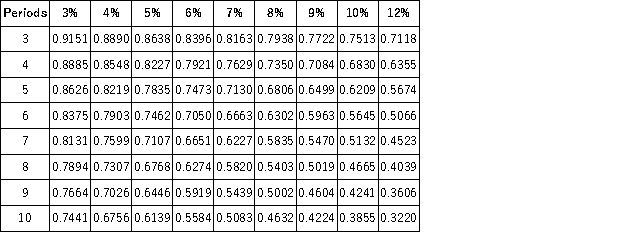

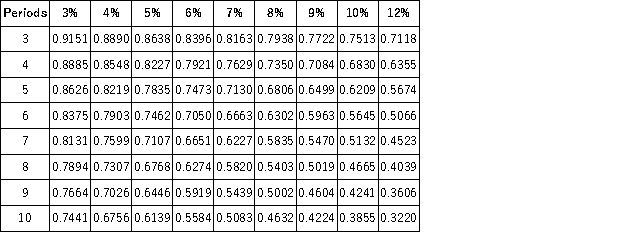

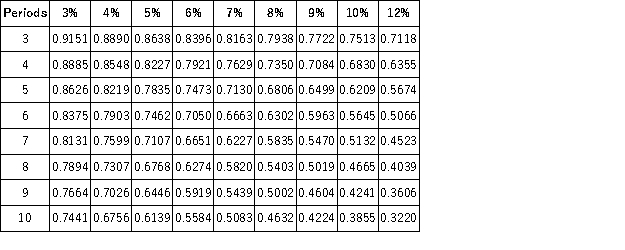

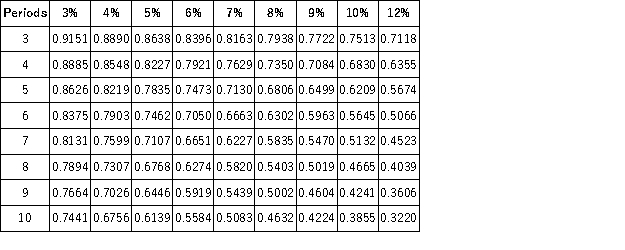

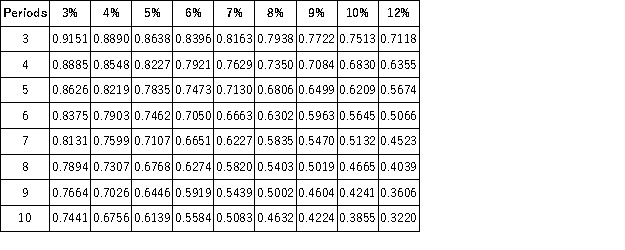

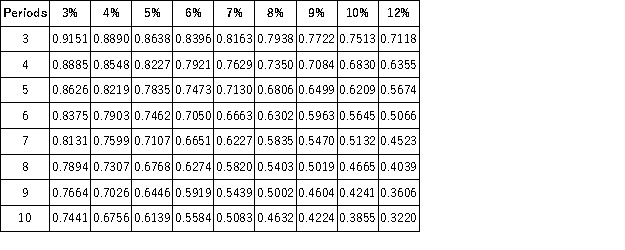

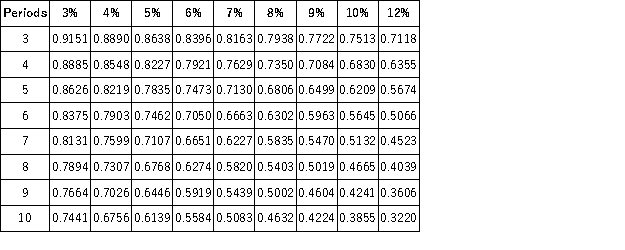

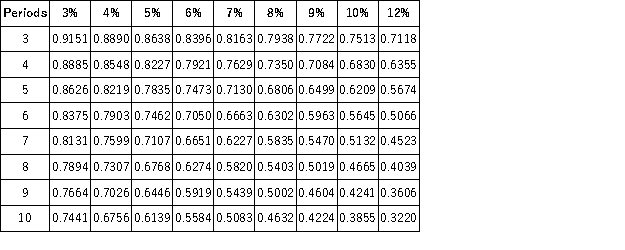

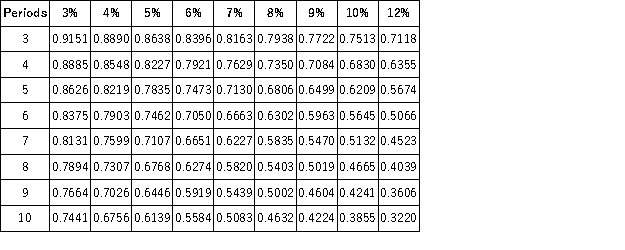

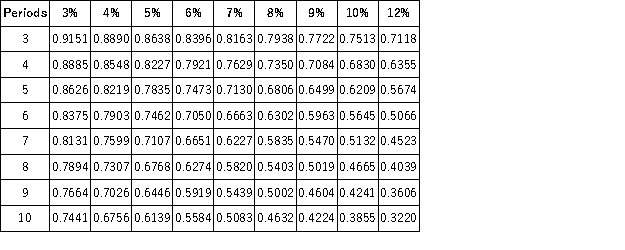

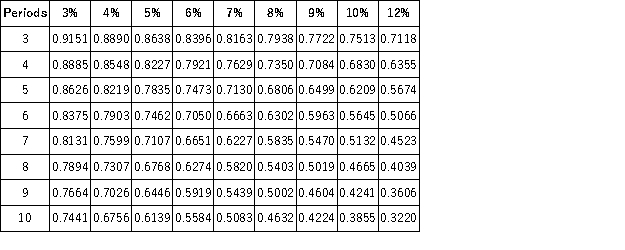

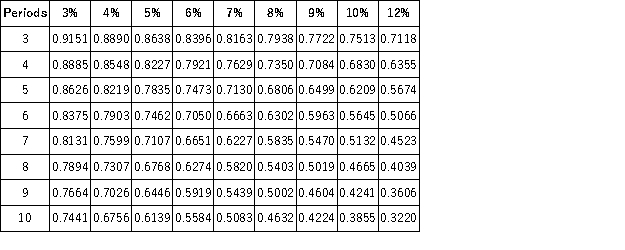

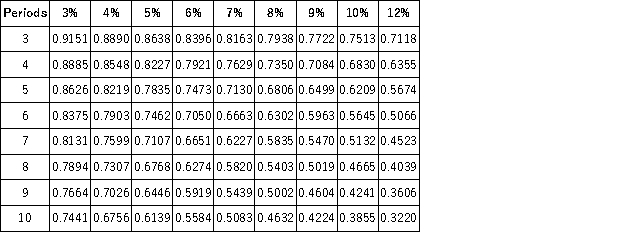

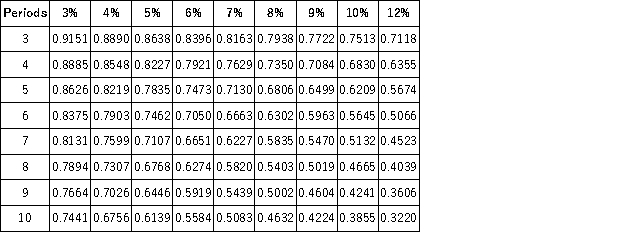

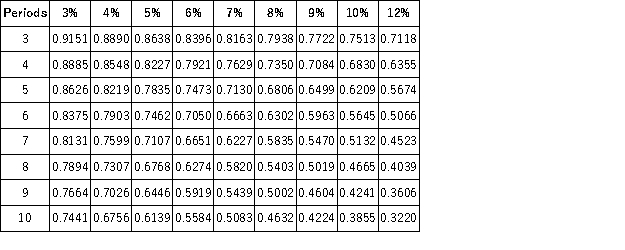

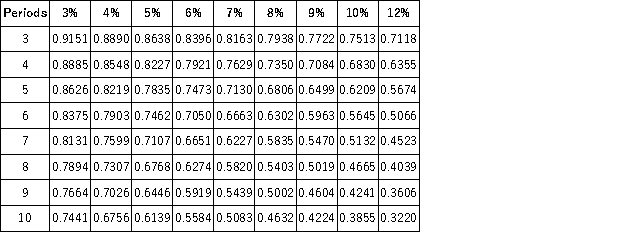

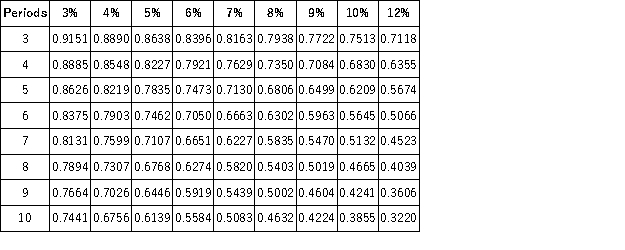

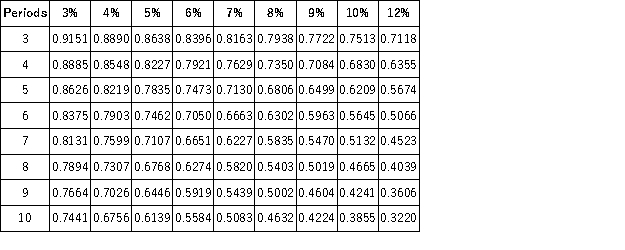

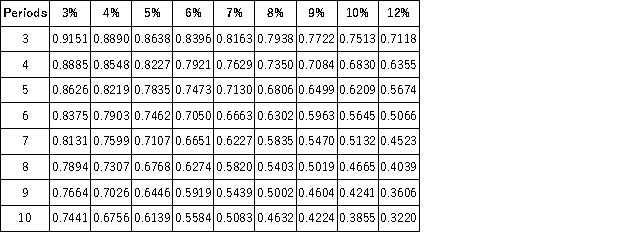

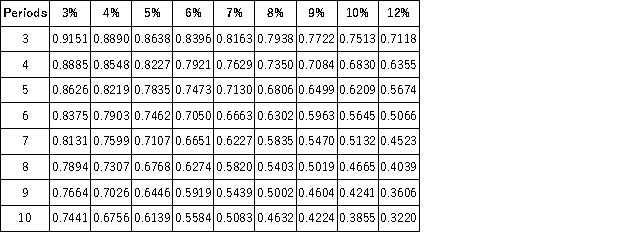

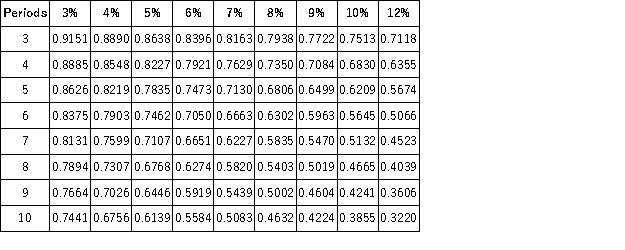

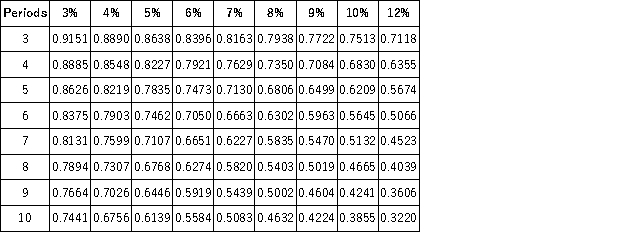

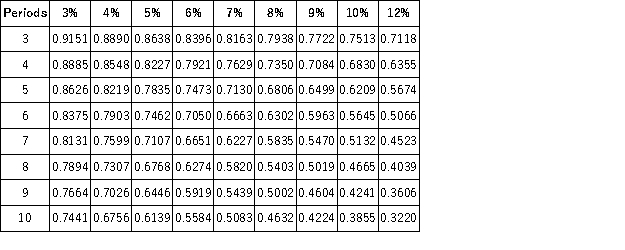

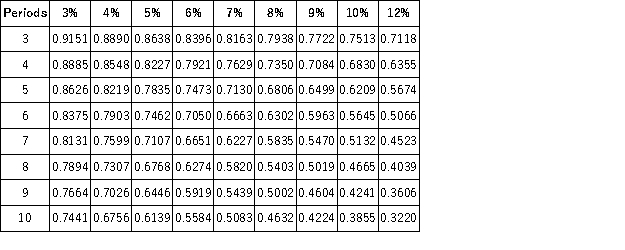

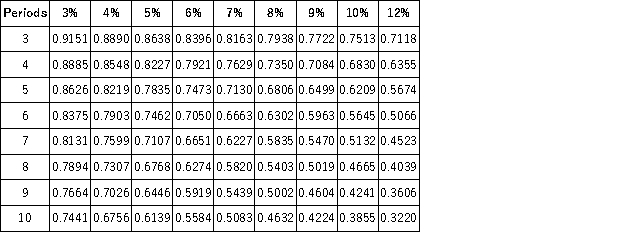

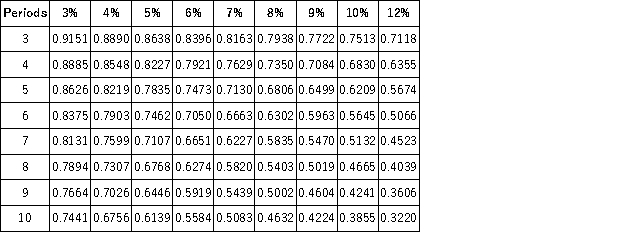

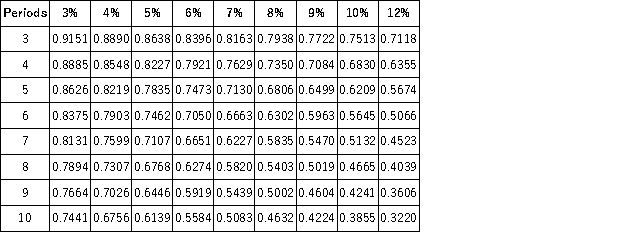

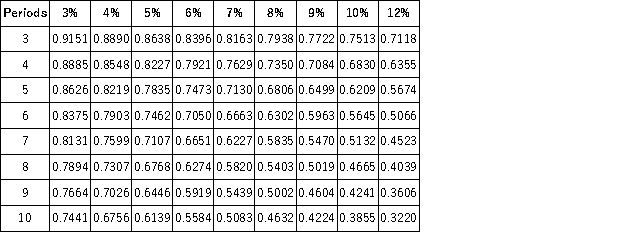

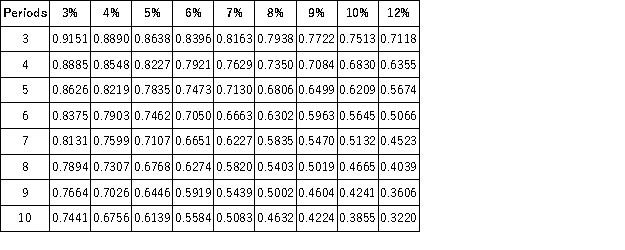

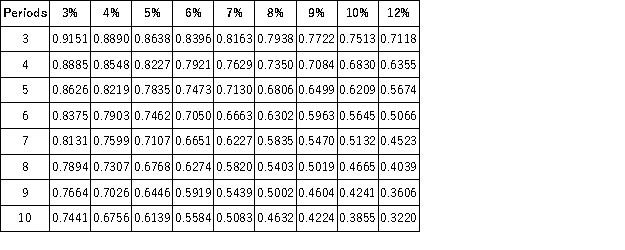

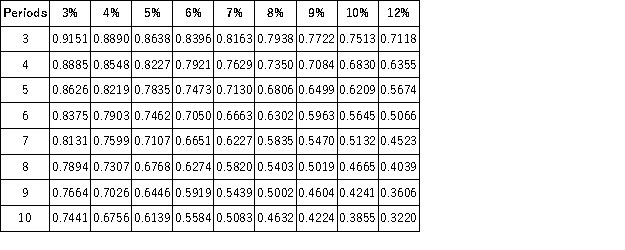

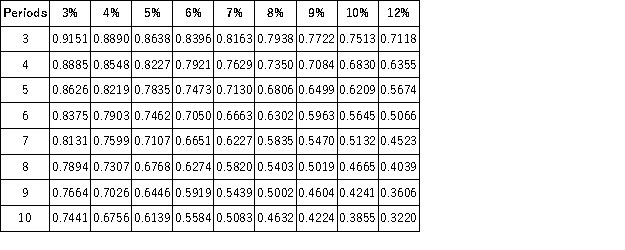

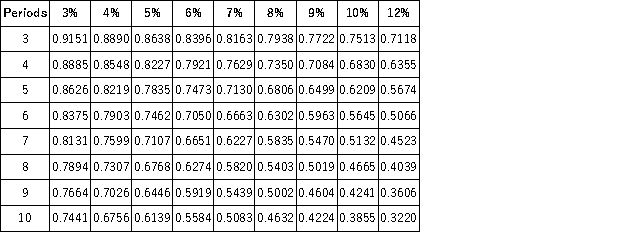

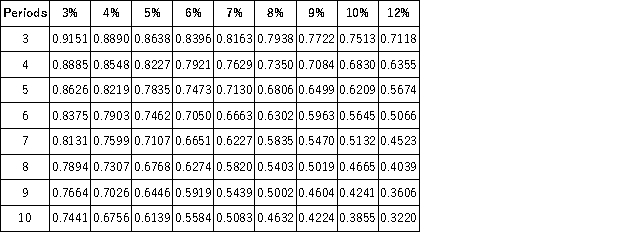

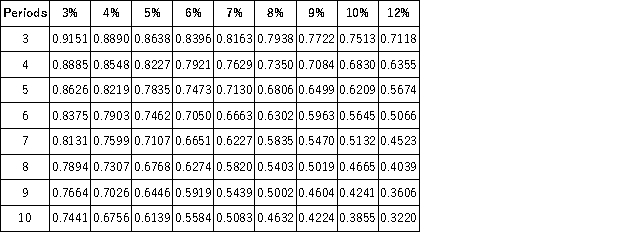

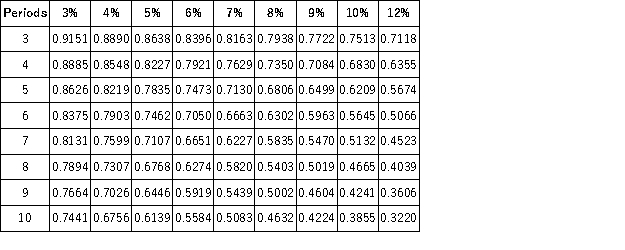

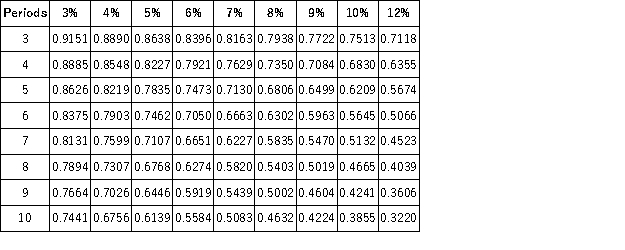

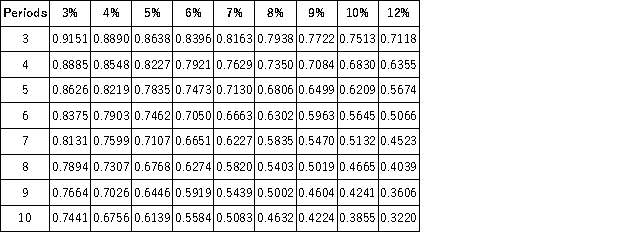

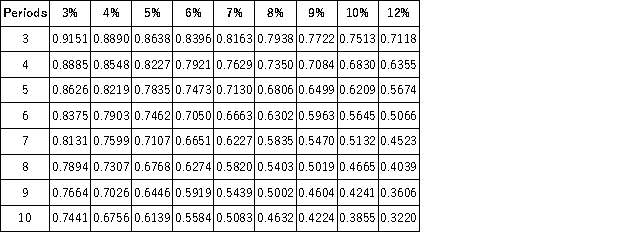

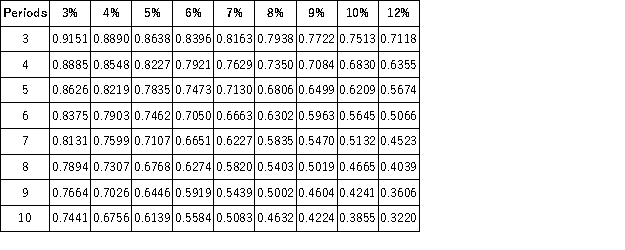

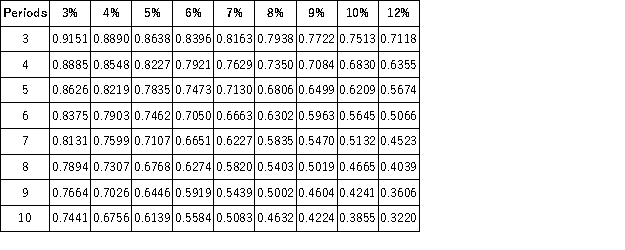

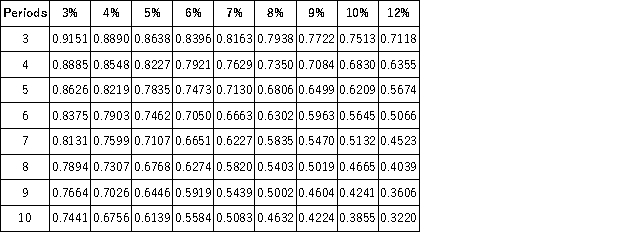

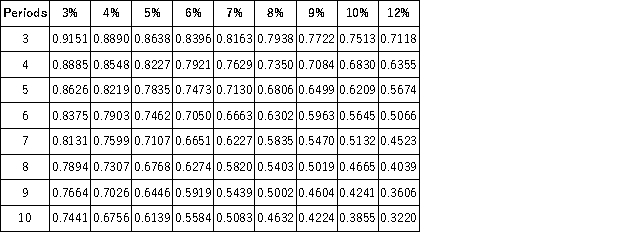

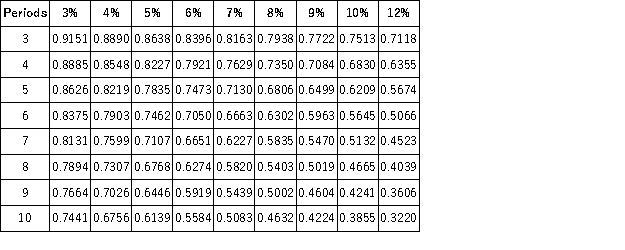

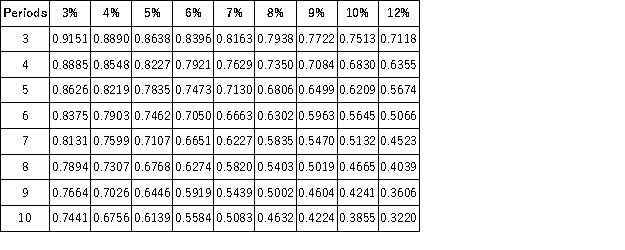

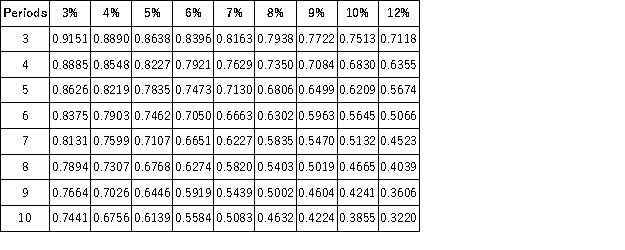

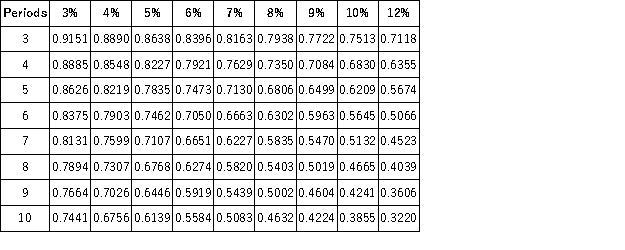

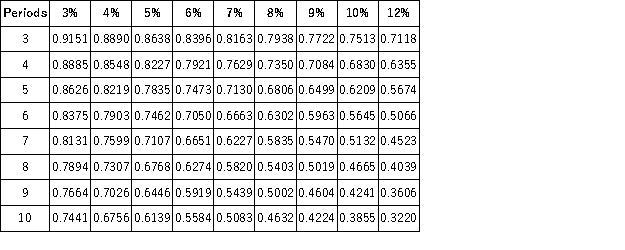

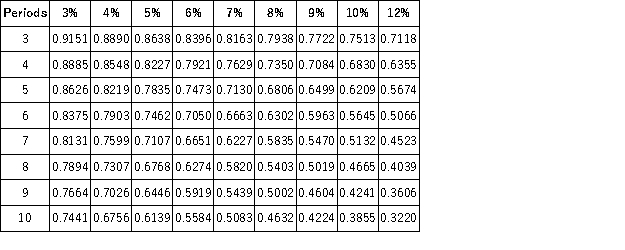

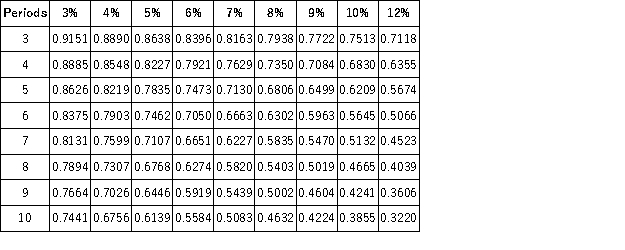

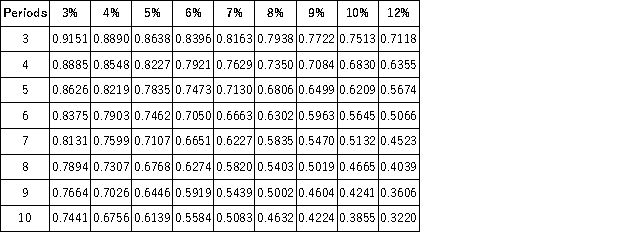

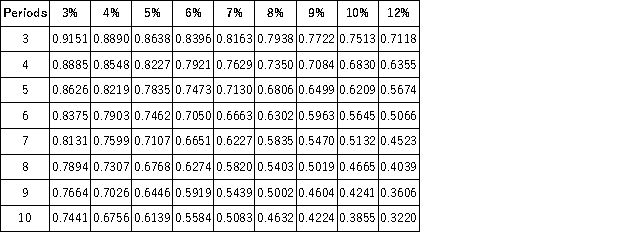

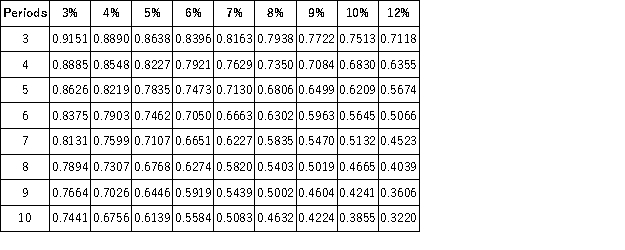

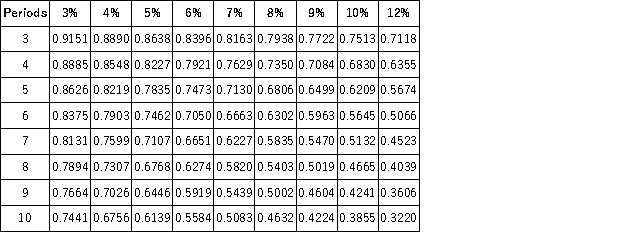

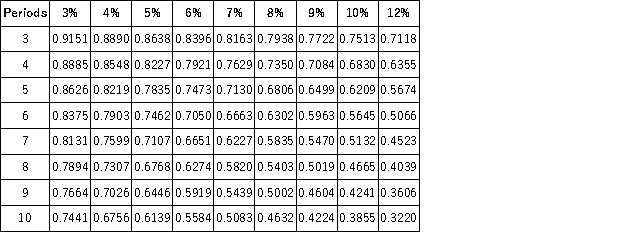

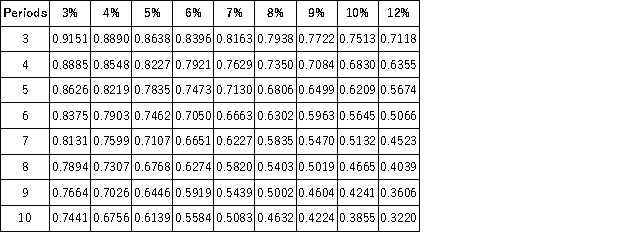

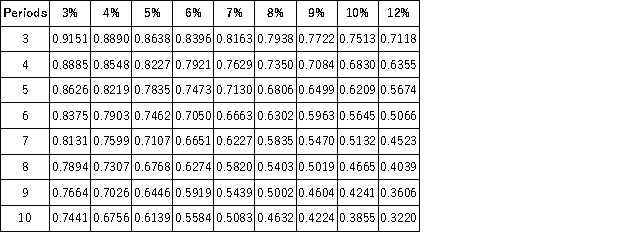

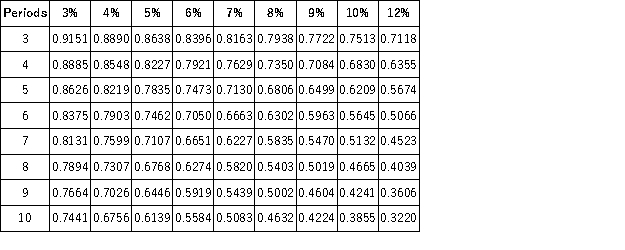

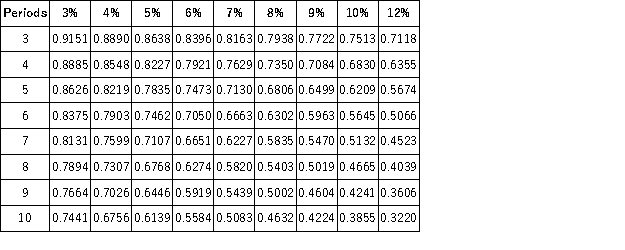

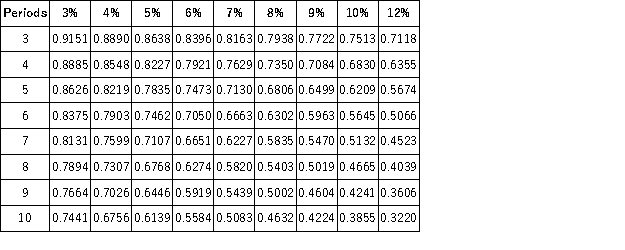

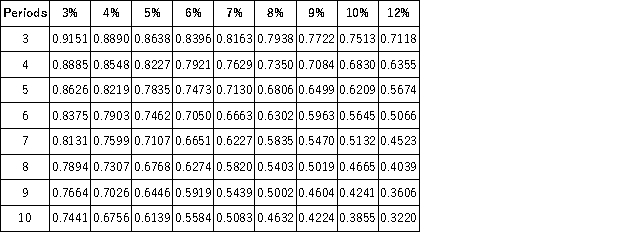

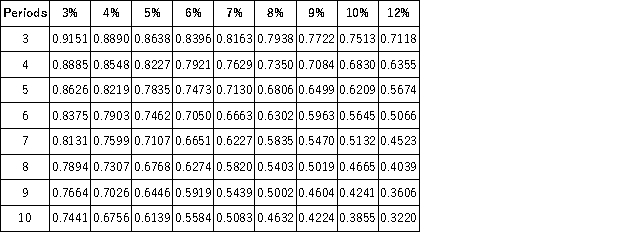

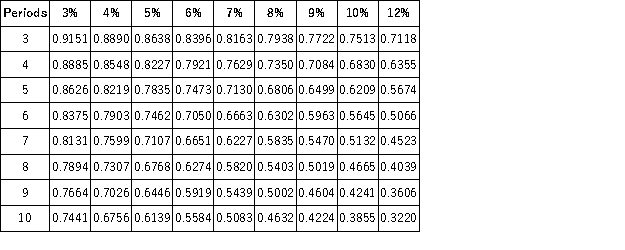

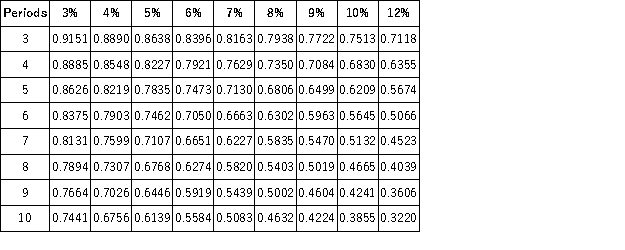

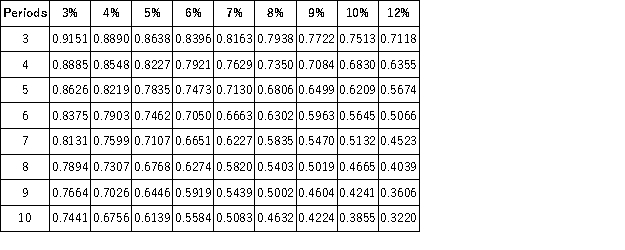

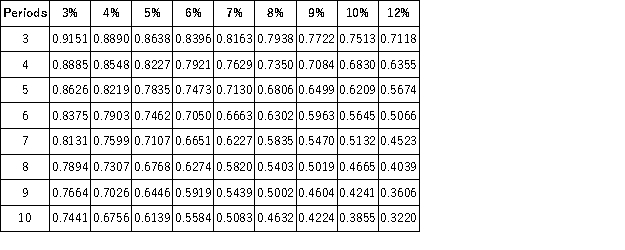

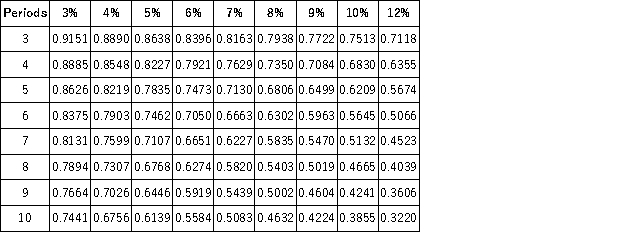

The present value of $2,000 to be received nine years from today at 8% interest compounded annually is $1,000.

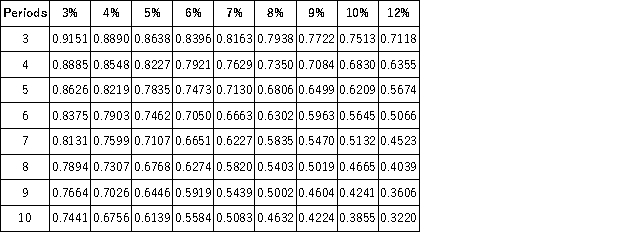

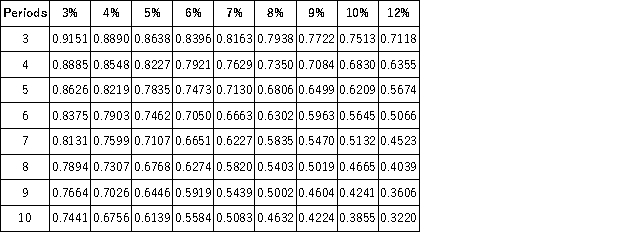

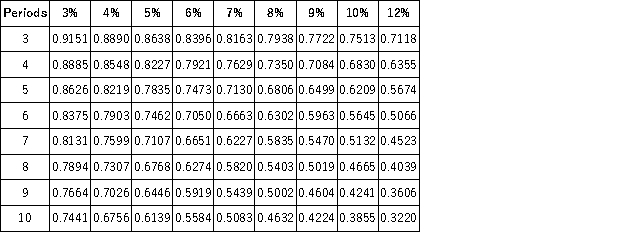

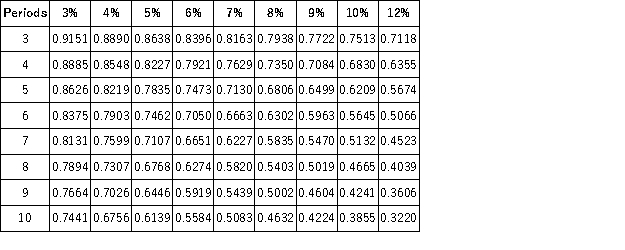

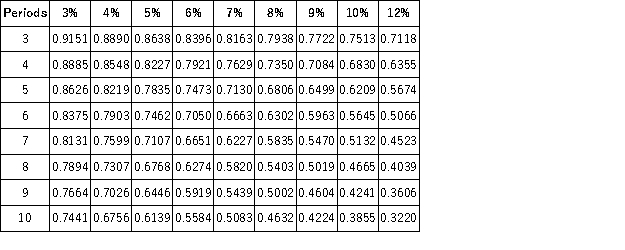

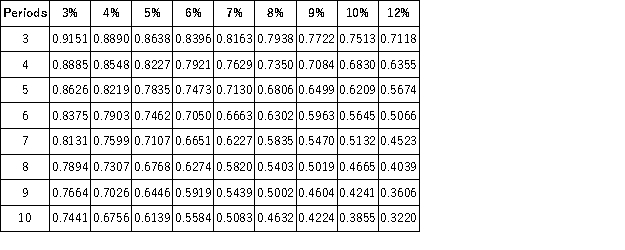

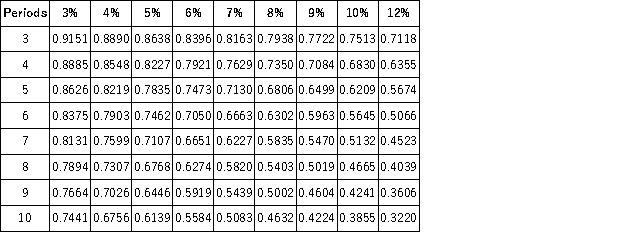

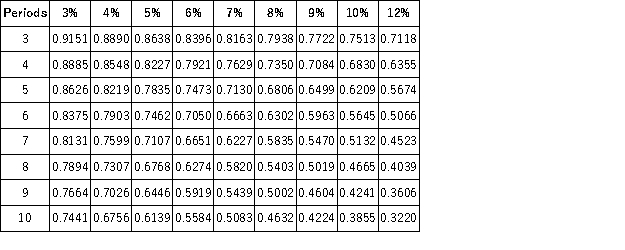

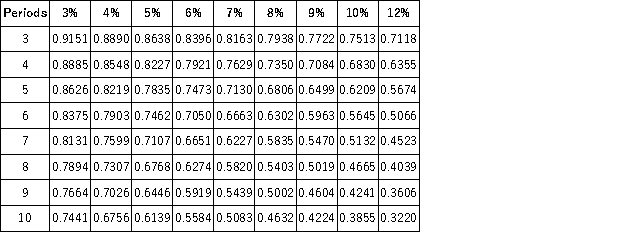

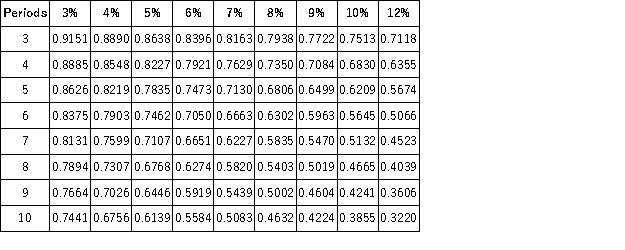

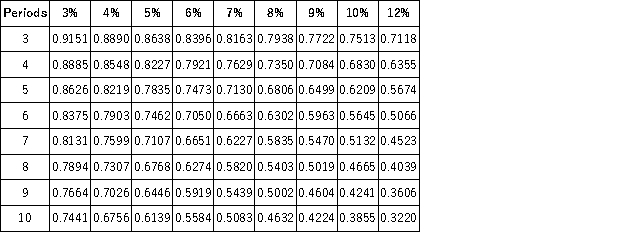

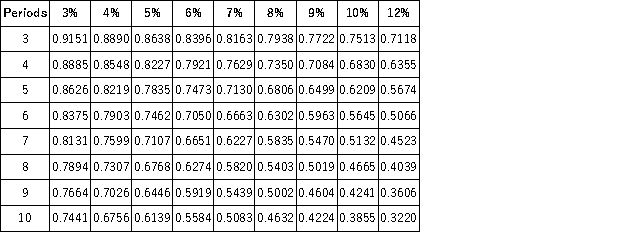

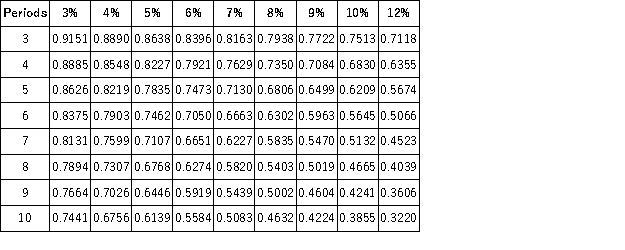

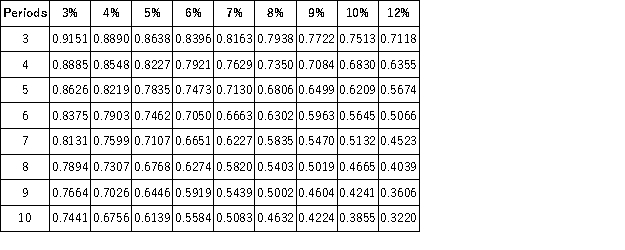

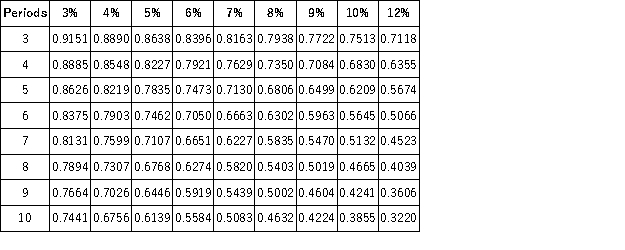

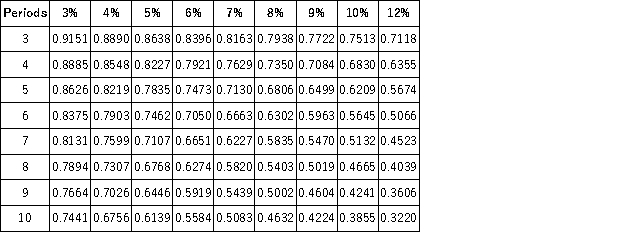

Present Value = Future Value * Interest Factor for 9 years @8%

Present Value = $2,000 * 0.5002 = $1,000

Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  The present value of $2,000 to be received nine years from today at 8% interest compounded annually is $1,000.

The present value of $2,000 to be received nine years from today at 8% interest compounded annually is $1,000.Present Value = Future Value * Interest Factor for 9 years @8%

Present Value = $2,000 * 0.5002 = $1,000

True

3

Present Value of 1  Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  The future value of an ordinary annuity is the accumulated value of each annuity payment excluding interest as of the date of the final payment.

The future value of an ordinary annuity is the accumulated value of each annuity payment excluding interest as of the date of the final payment.

Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  The future value of an ordinary annuity is the accumulated value of each annuity payment excluding interest as of the date of the final payment.

The future value of an ordinary annuity is the accumulated value of each annuity payment excluding interest as of the date of the final payment.False

4

Present Value of 1  Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  The number of periods in a present value calculation may only be expressed in years.

The number of periods in a present value calculation may only be expressed in years.

Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  The number of periods in a present value calculation may only be expressed in years.

The number of periods in a present value calculation may only be expressed in years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

5

Present Value of 1  Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  Interest is the borrower's payment to the owner of an asset for its use.

Interest is the borrower's payment to the owner of an asset for its use.

Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  Interest is the borrower's payment to the owner of an asset for its use.

Interest is the borrower's payment to the owner of an asset for its use.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

6

Present Value of 1  Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

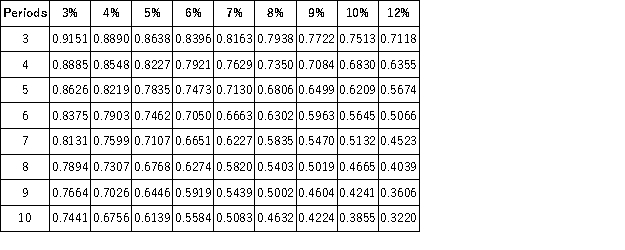

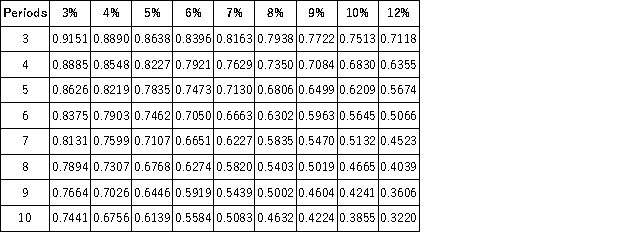

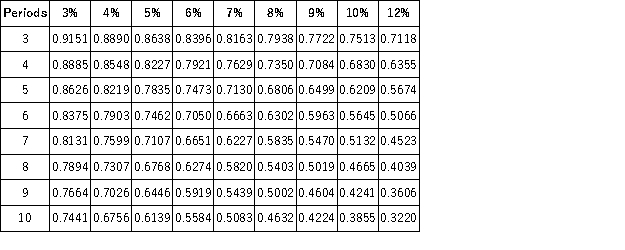

Future Value of an Annuity of 1  The present value factor for determining the present value of $6,300 to be received three years from today at 10% interest compounded semiannually is 0.7462.

The present value factor for determining the present value of $6,300 to be received three years from today at 10% interest compounded semiannually is 0.7462.

n = 6 semiannual periods, i = 5% semiannual interest rate; from the PV of $1 table the factor is 0.7462

Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  The present value factor for determining the present value of $6,300 to be received three years from today at 10% interest compounded semiannually is 0.7462.

The present value factor for determining the present value of $6,300 to be received three years from today at 10% interest compounded semiannually is 0.7462.n = 6 semiannual periods, i = 5% semiannual interest rate; from the PV of $1 table the factor is 0.7462

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

7

Present Value of 1  Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

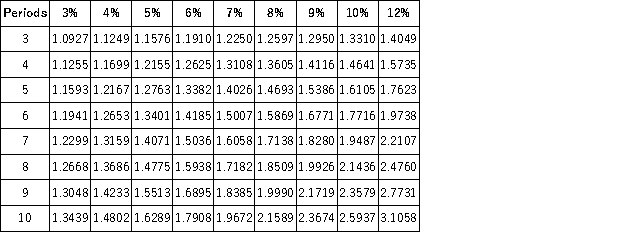

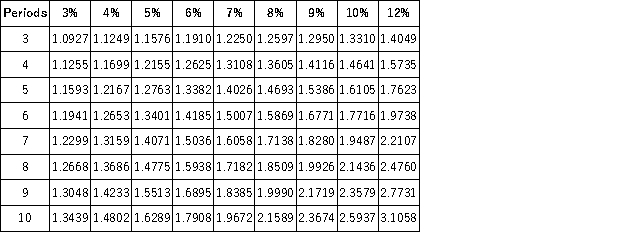

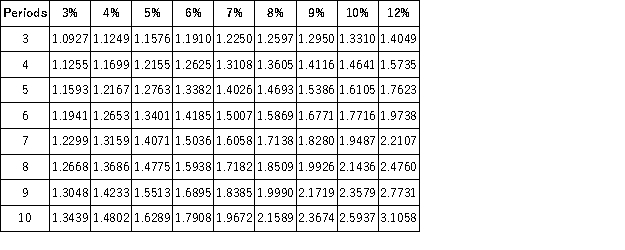

Future Value of an Annuity of 1  The future value of $100 compounded semiannually for 3 years at 12% equals $140.49.

The future value of $100 compounded semiannually for 3 years at 12% equals $140.49.

Future Value = Present Value * Interest Factor

FV of 1 factor for n = 6 and i = 6% = 1.4185

Future Value = $100 * 1.4185 = $141.85

Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  The future value of $100 compounded semiannually for 3 years at 12% equals $140.49.

The future value of $100 compounded semiannually for 3 years at 12% equals $140.49.Future Value = Present Value * Interest Factor

FV of 1 factor for n = 6 and i = 6% = 1.4185

Future Value = $100 * 1.4185 = $141.85

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

8

Present Value of 1  Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  Sandra has a savings account that has accumulated to $50,000. She started with $28,225, and earned interest at 10% compounded annually. It took her five years to accumulate the $50,000.

Sandra has a savings account that has accumulated to $50,000. She started with $28,225, and earned interest at 10% compounded annually. It took her five years to accumulate the $50,000.

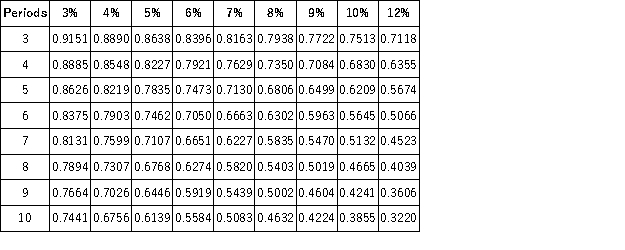

PV Factor = Present Value/Future Value

PV Factor = $28,225/$50,000 = 0.5645

0.5645 is the present value of 1 factor for 6 periods at 10%

Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  Sandra has a savings account that has accumulated to $50,000. She started with $28,225, and earned interest at 10% compounded annually. It took her five years to accumulate the $50,000.

Sandra has a savings account that has accumulated to $50,000. She started with $28,225, and earned interest at 10% compounded annually. It took her five years to accumulate the $50,000.PV Factor = Present Value/Future Value

PV Factor = $28,225/$50,000 = 0.5645

0.5645 is the present value of 1 factor for 6 periods at 10%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

9

Present Value of 1  Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  An interest rate is also called a discount rate.

An interest rate is also called a discount rate.

Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  An interest rate is also called a discount rate.

An interest rate is also called a discount rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

10

Present Value of 1  Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  The present value of 1 formula is often useful when a borrowed asset must be repaid in full at a later date and the borrower wants to know the worth of the asset at the future date.

The present value of 1 formula is often useful when a borrowed asset must be repaid in full at a later date and the borrower wants to know the worth of the asset at the future date.

Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  The present value of 1 formula is often useful when a borrowed asset must be repaid in full at a later date and the borrower wants to know the worth of the asset at the future date.

The present value of 1 formula is often useful when a borrowed asset must be repaid in full at a later date and the borrower wants to know the worth of the asset at the future date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

11

Present Value of 1  Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  From the perspective of an account holder, a savings account is a liability with interest.

From the perspective of an account holder, a savings account is a liability with interest.

Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  From the perspective of an account holder, a savings account is a liability with interest.

From the perspective of an account holder, a savings account is a liability with interest.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

12

Present Value of 1  Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  An annuity is a series of equal payments occurring at equal intervals.

An annuity is a series of equal payments occurring at equal intervals.

Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  An annuity is a series of equal payments occurring at equal intervals.

An annuity is a series of equal payments occurring at equal intervals.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

13

Present Value of 1  Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  The number of periods in a future value calculation may only be expressed in years.

The number of periods in a future value calculation may only be expressed in years.

Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  The number of periods in a future value calculation may only be expressed in years.

The number of periods in a future value calculation may only be expressed in years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

14

Present Value of 1  Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  Future value can be found if the interest rate (i), the number of periods (n), and the present value (p) are known.

Future value can be found if the interest rate (i), the number of periods (n), and the present value (p) are known.

Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  Future value can be found if the interest rate (i), the number of periods (n), and the present value (p) are known.

Future value can be found if the interest rate (i), the number of periods (n), and the present value (p) are known.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

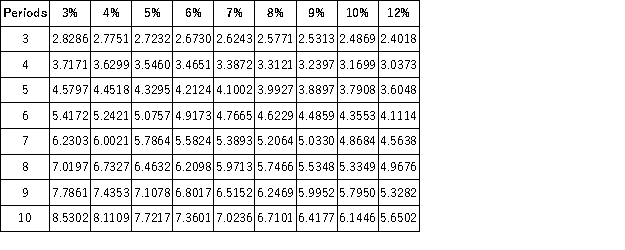

15

Present Value of 1  Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

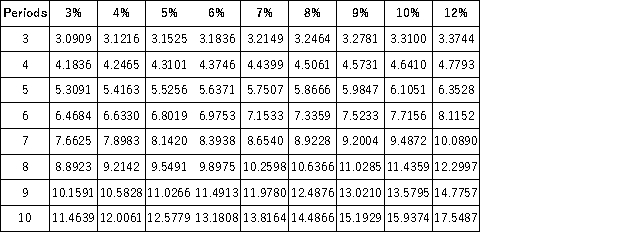

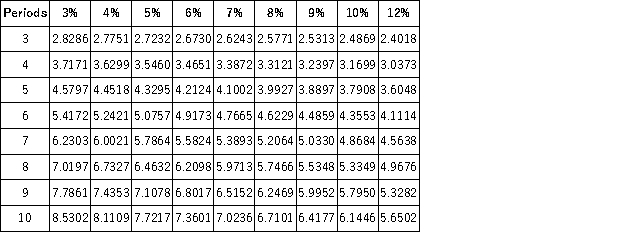

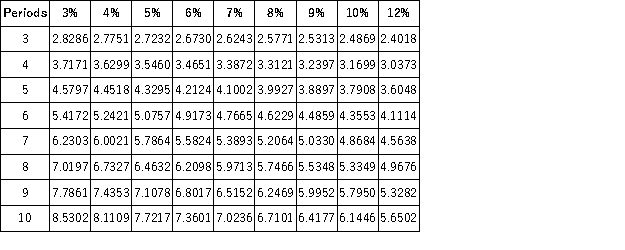

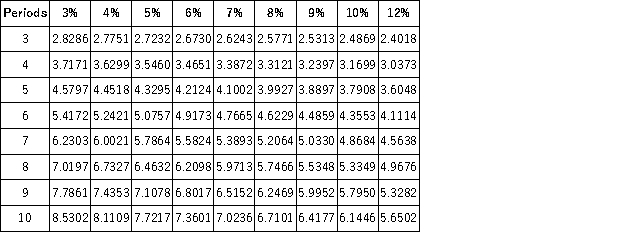

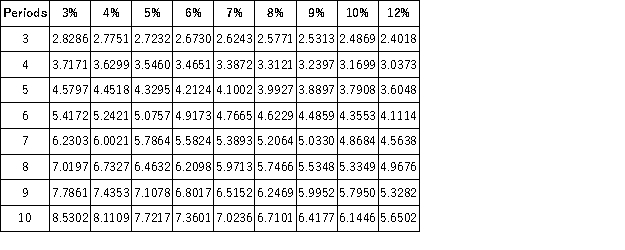

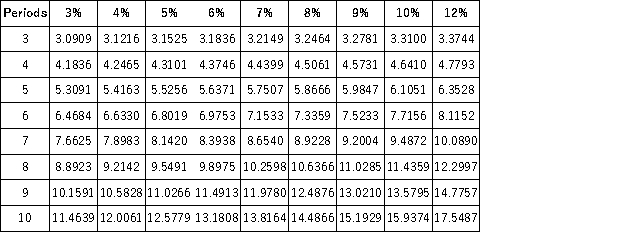

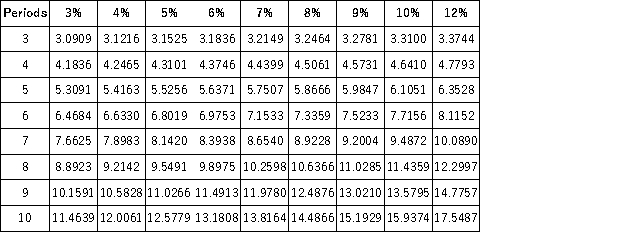

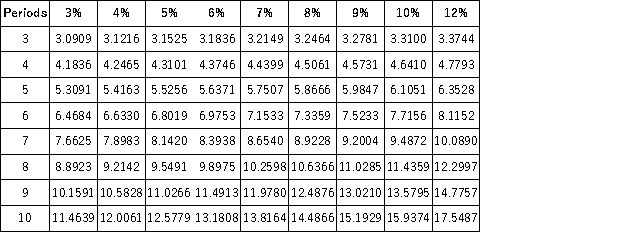

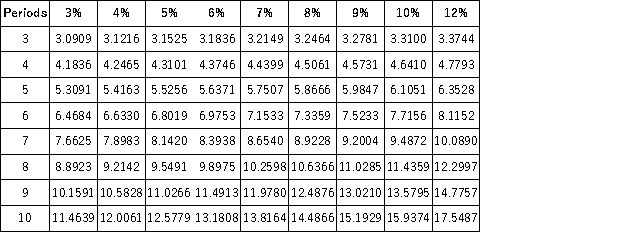

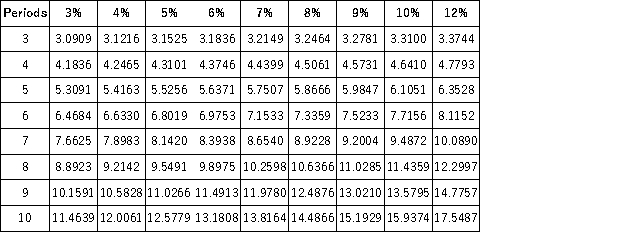

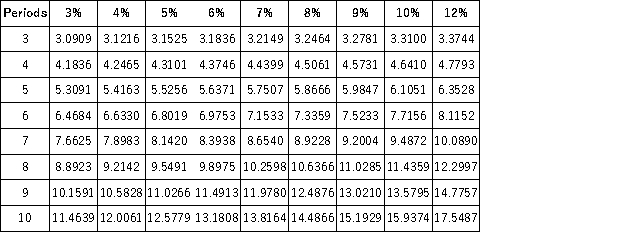

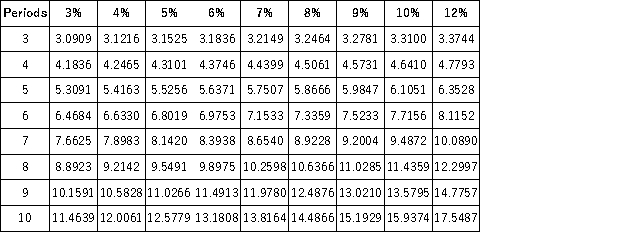

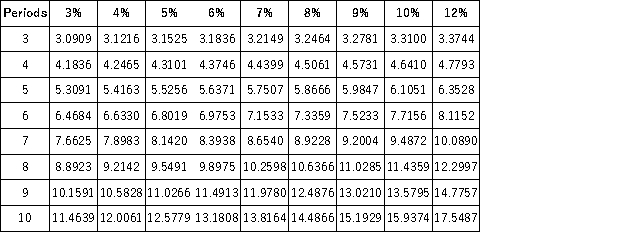

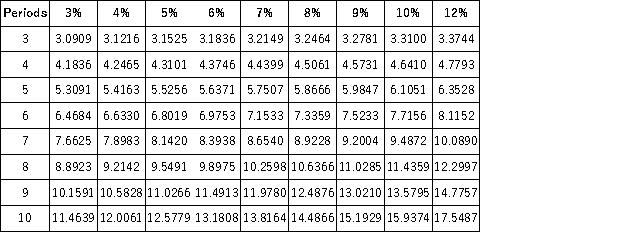

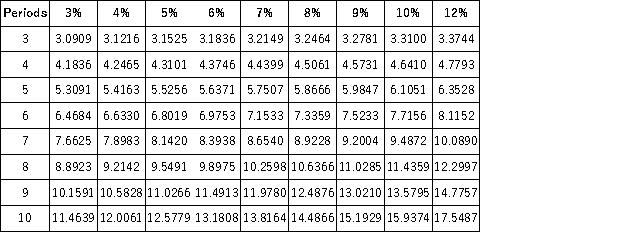

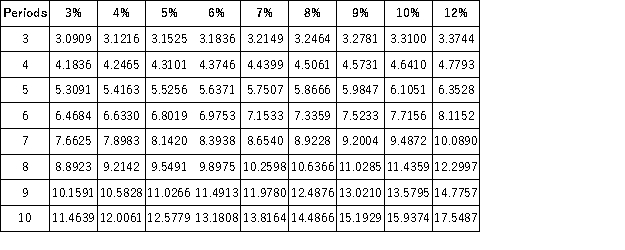

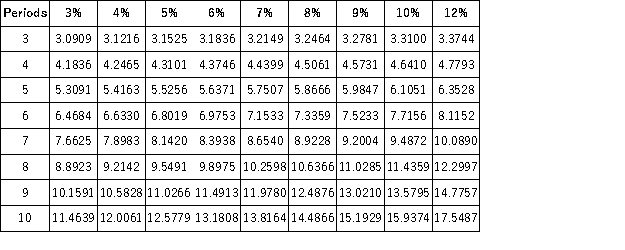

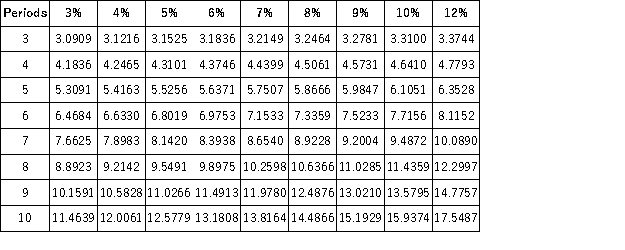

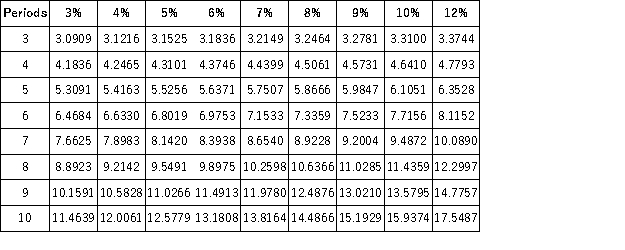

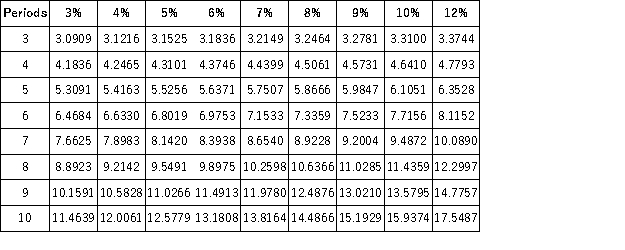

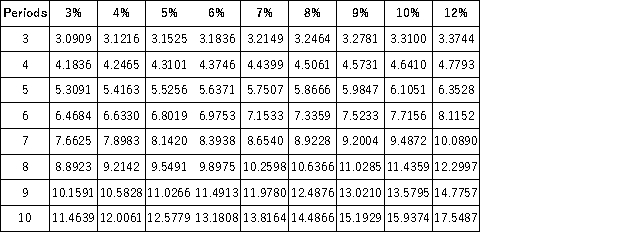

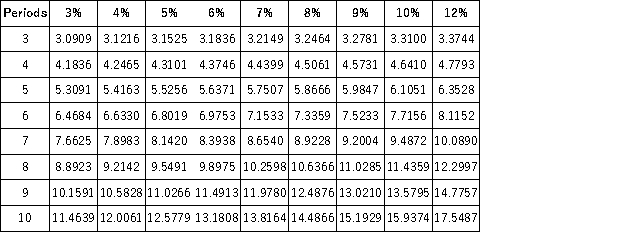

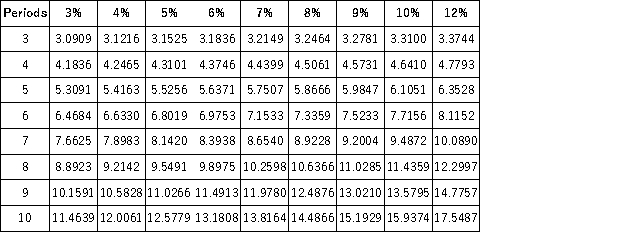

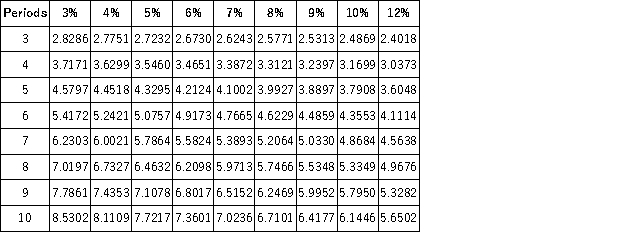

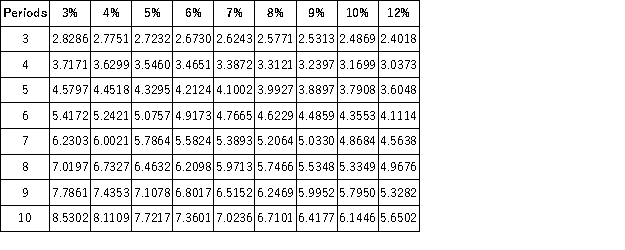

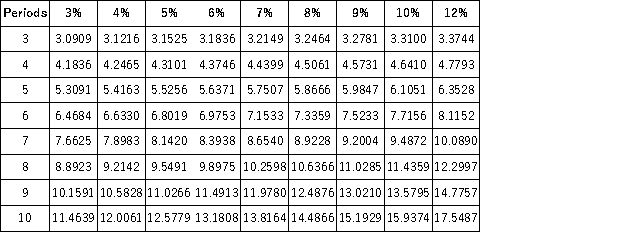

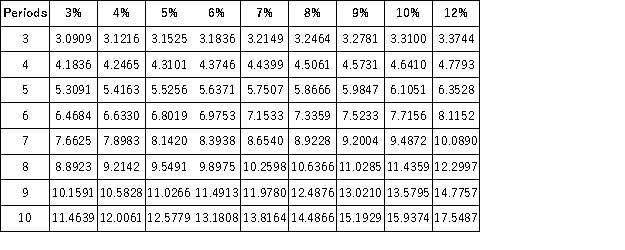

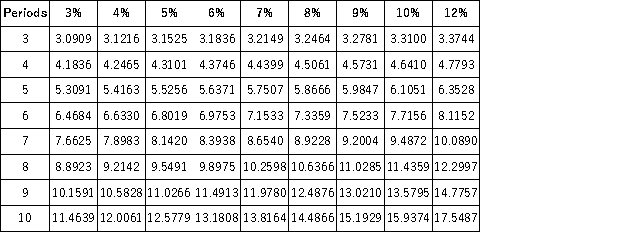

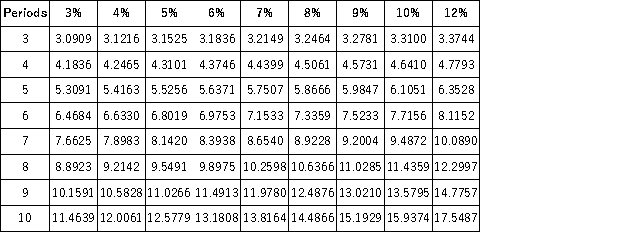

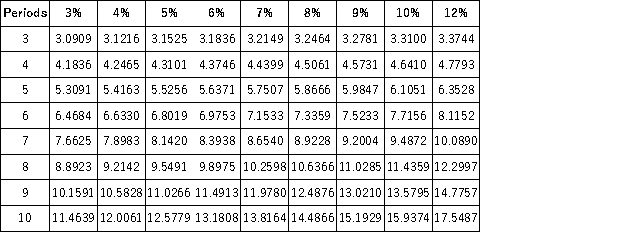

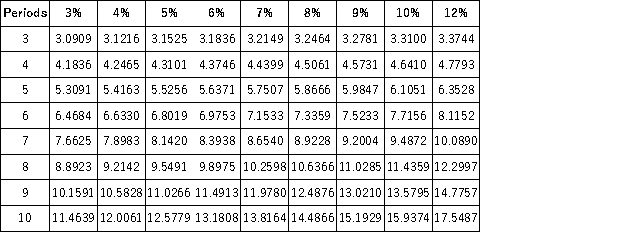

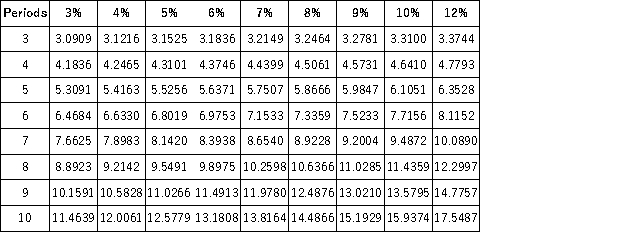

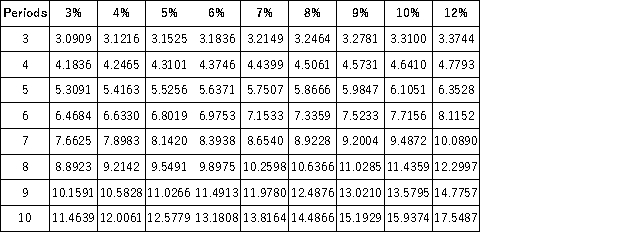

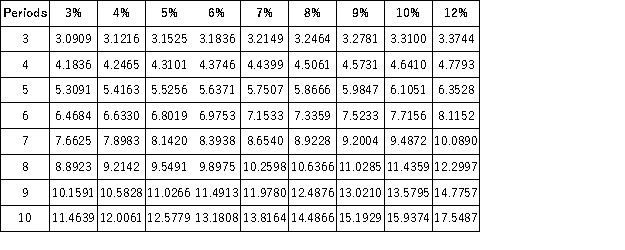

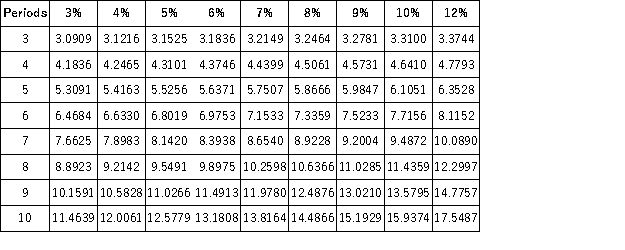

Future Value of an Annuity of 1  With deposits of $5,000 at the end of each year, you will have accumulated $38,578 at the end of the sixth year if the annual rate of interest is 10%.

With deposits of $5,000 at the end of each year, you will have accumulated $38,578 at the end of the sixth year if the annual rate of interest is 10%.

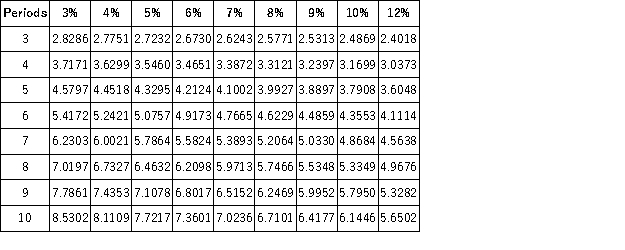

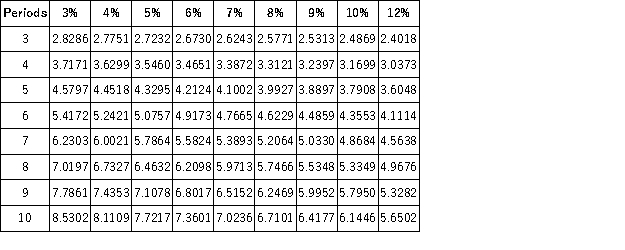

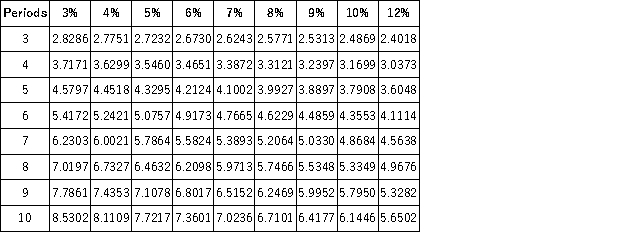

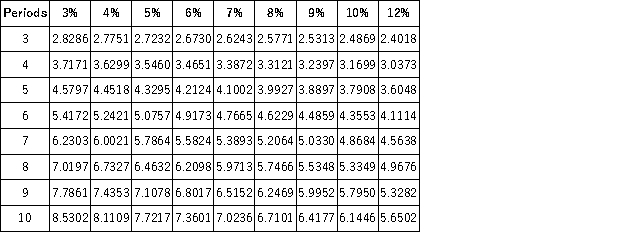

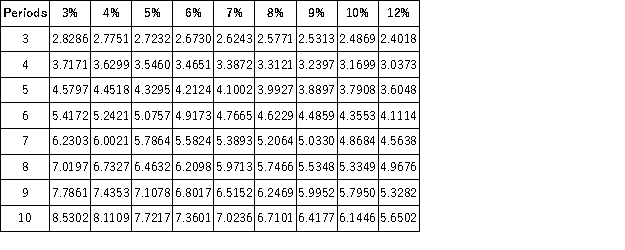

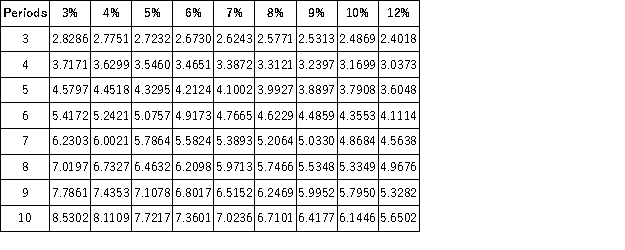

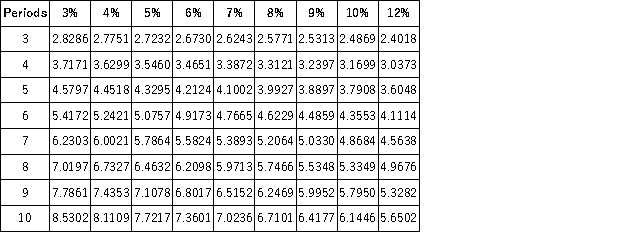

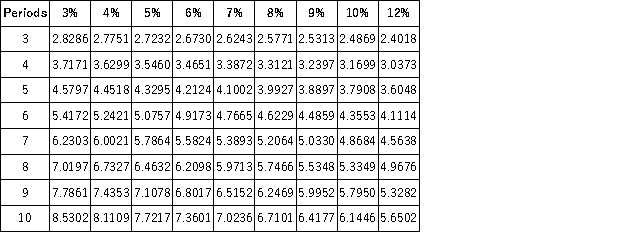

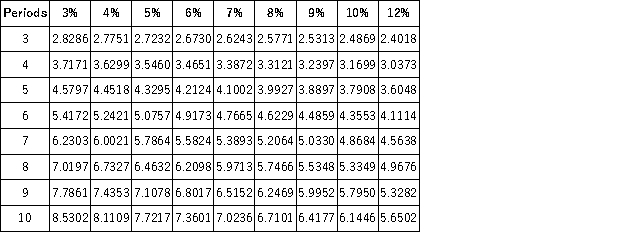

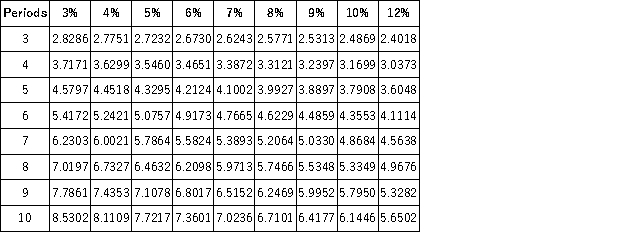

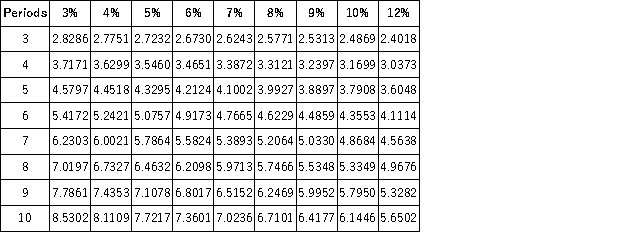

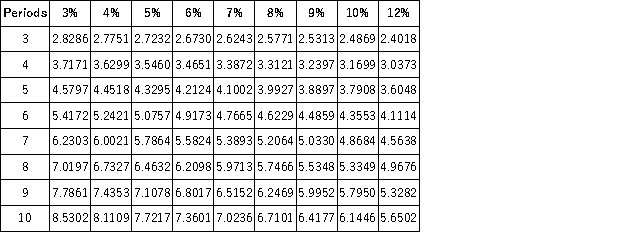

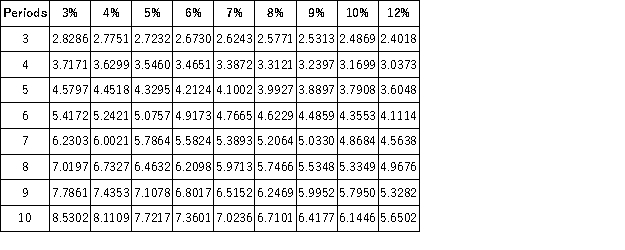

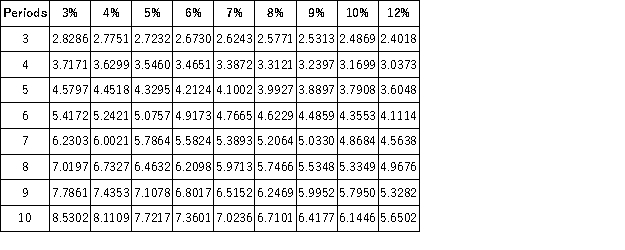

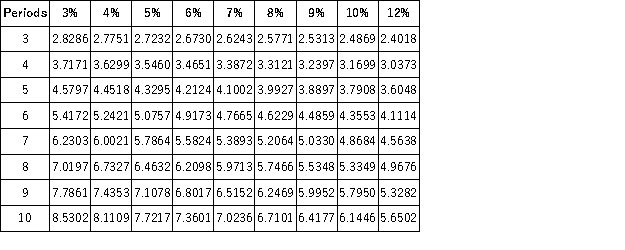

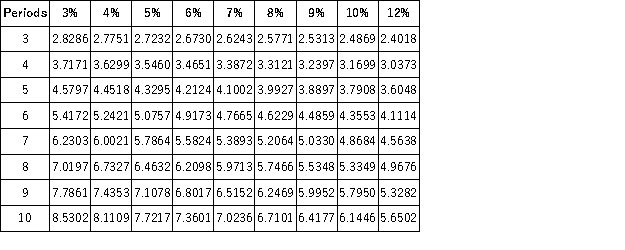

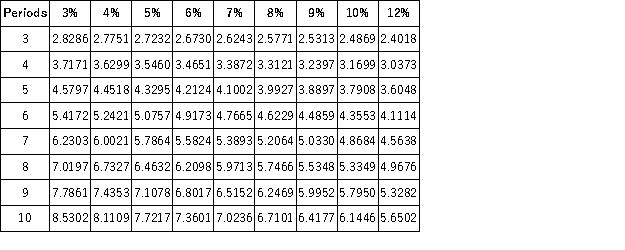

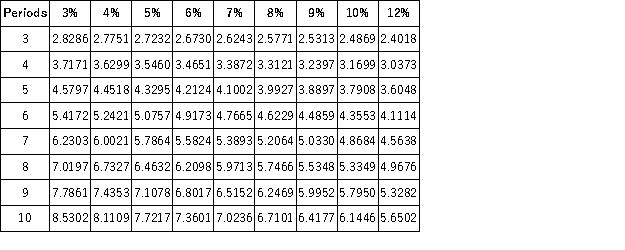

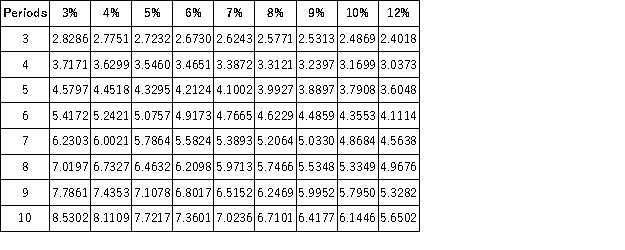

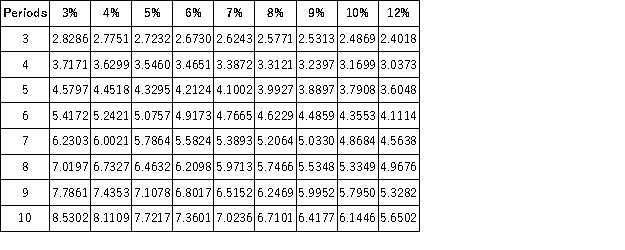

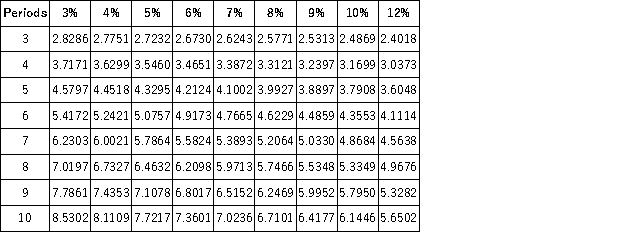

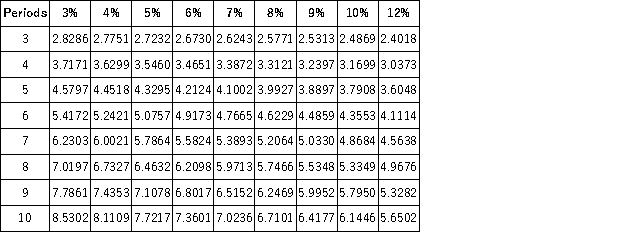

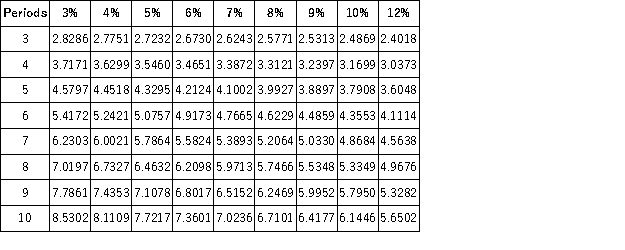

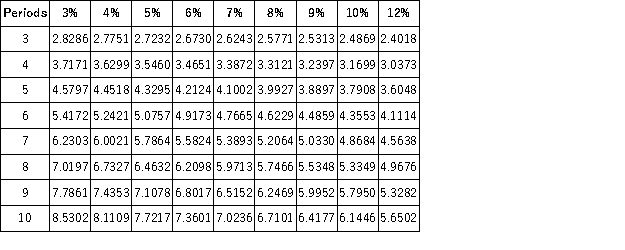

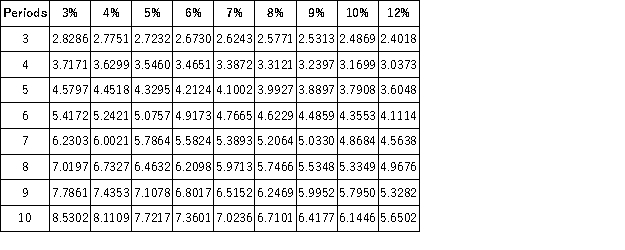

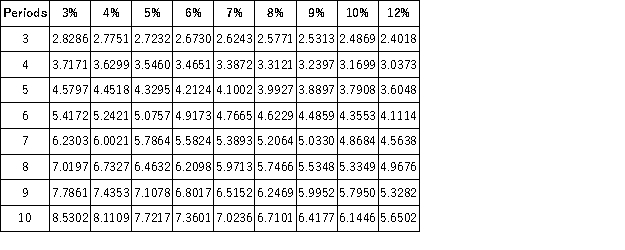

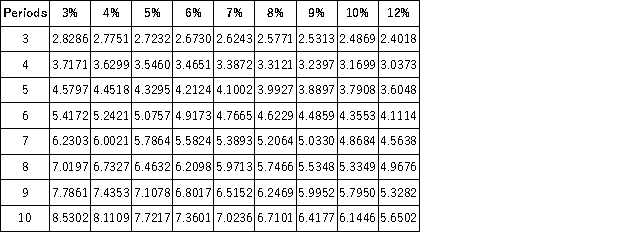

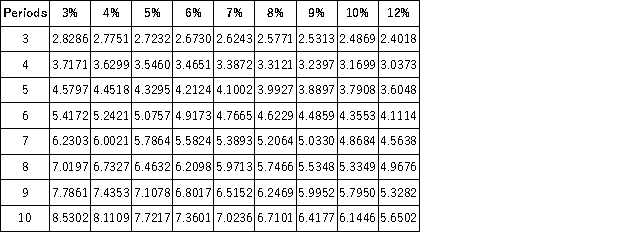

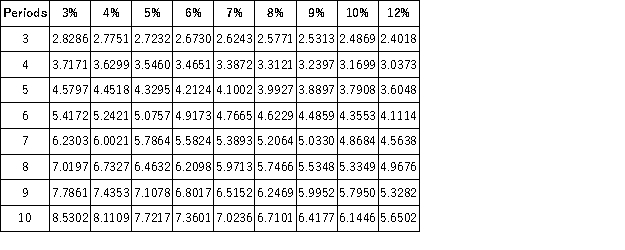

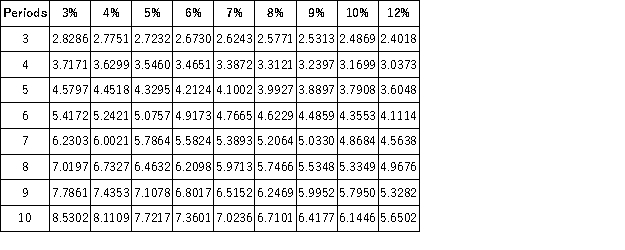

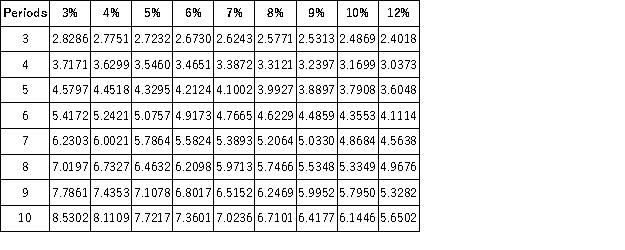

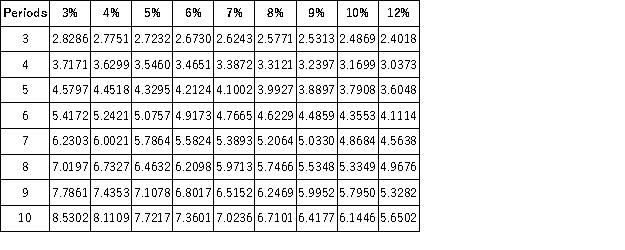

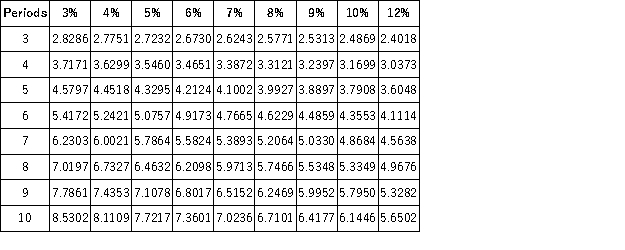

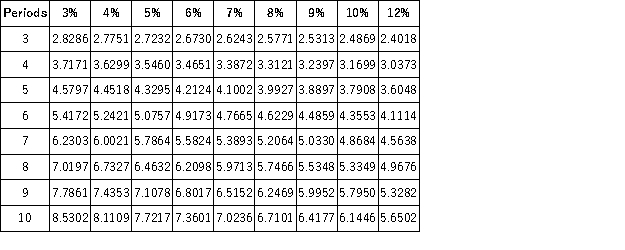

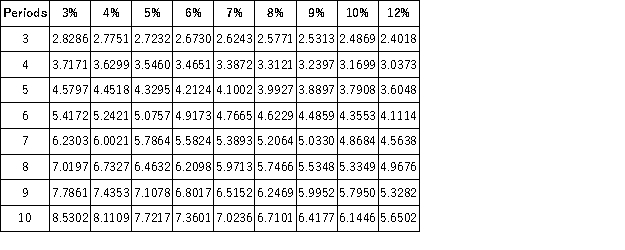

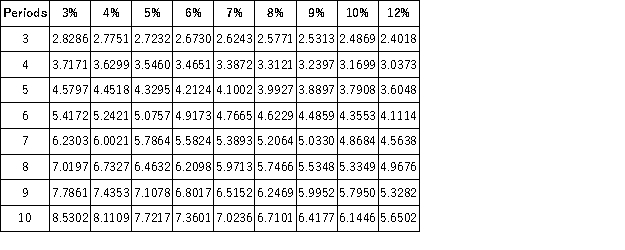

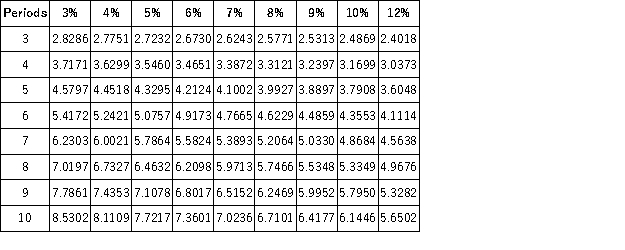

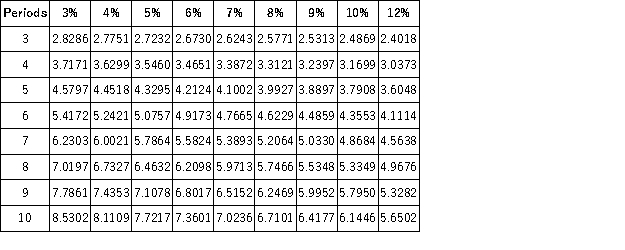

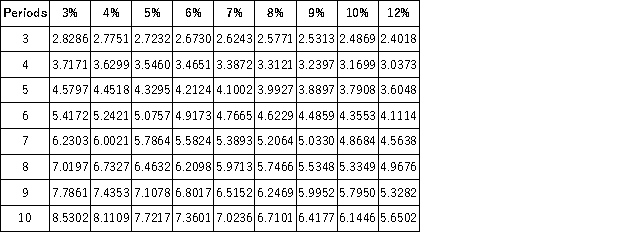

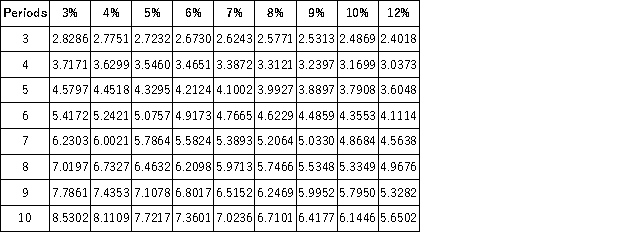

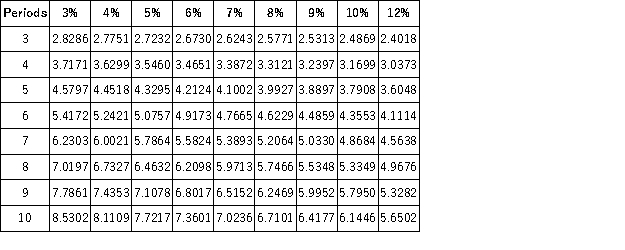

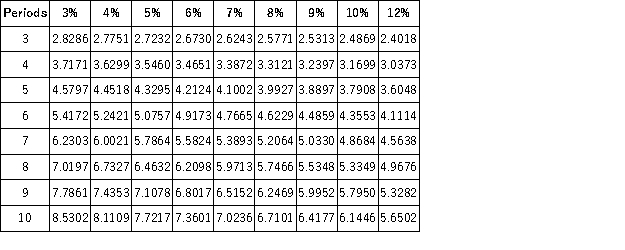

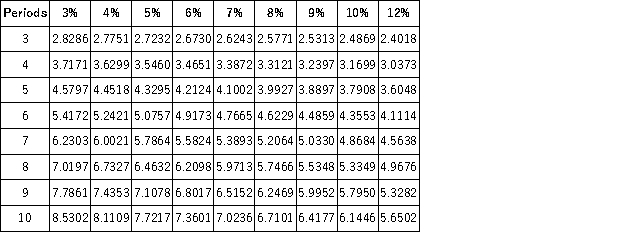

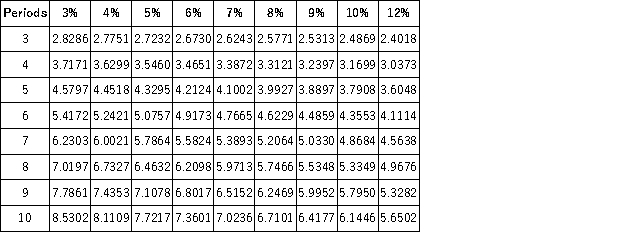

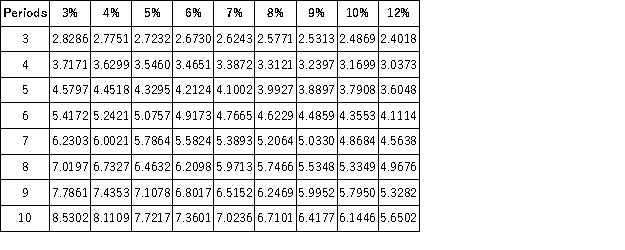

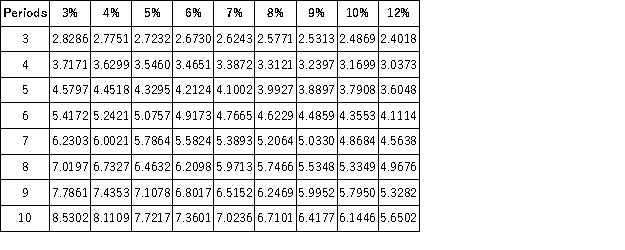

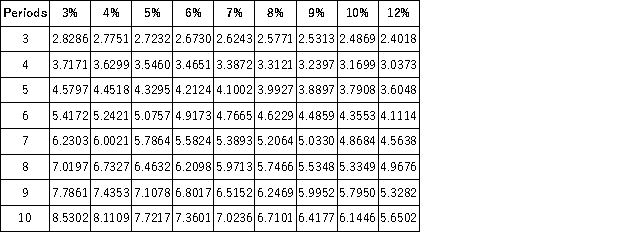

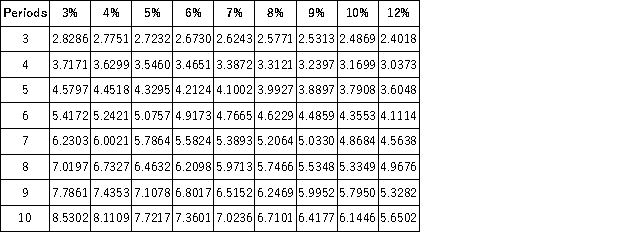

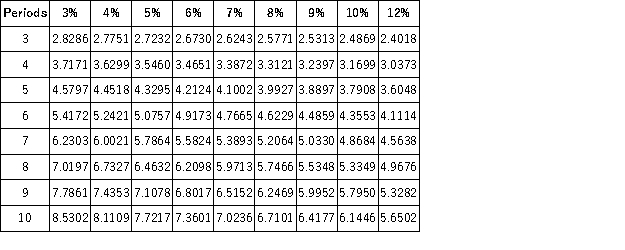

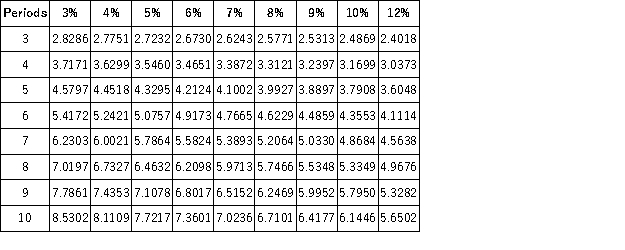

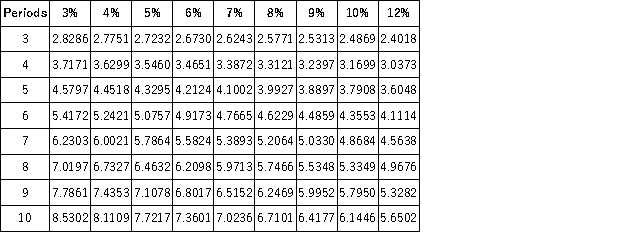

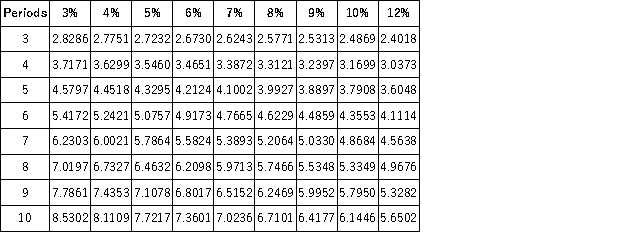

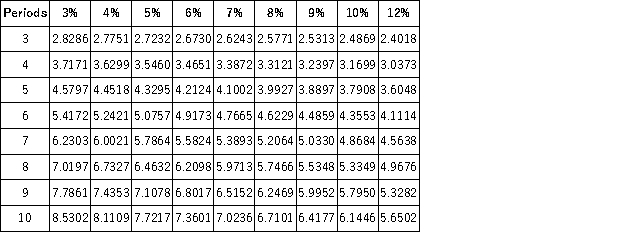

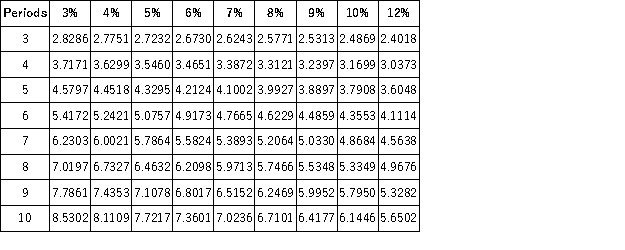

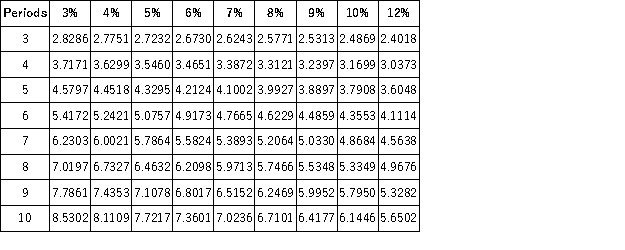

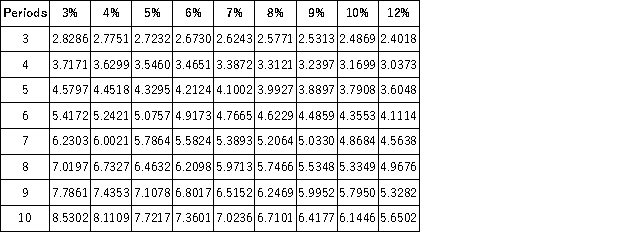

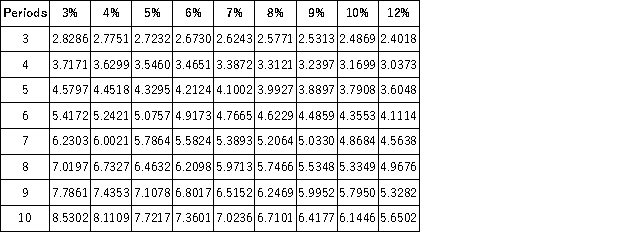

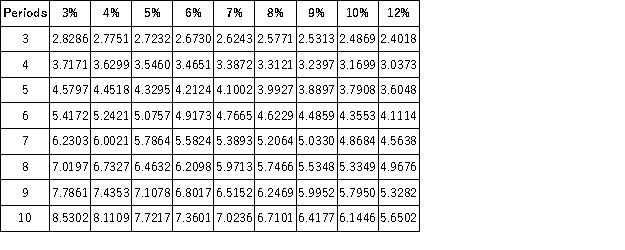

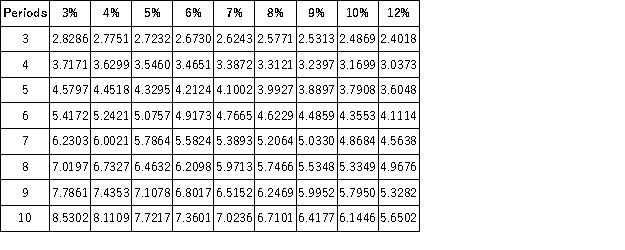

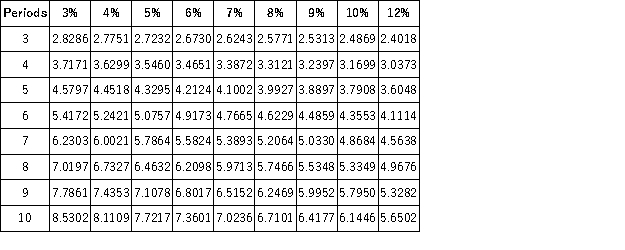

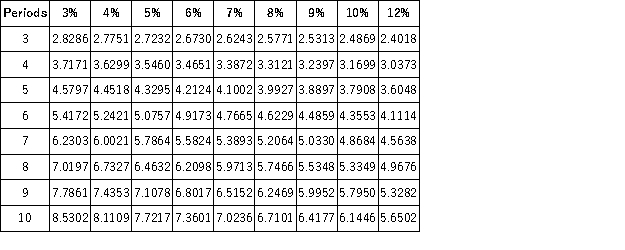

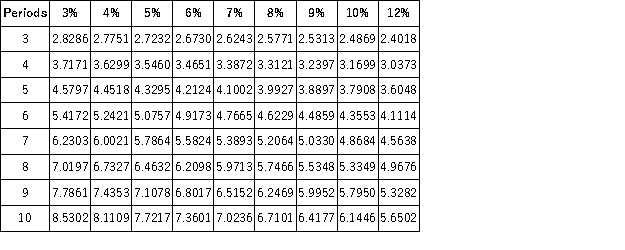

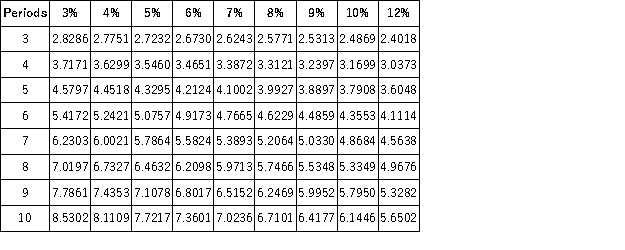

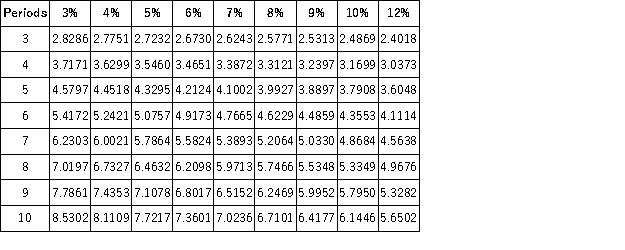

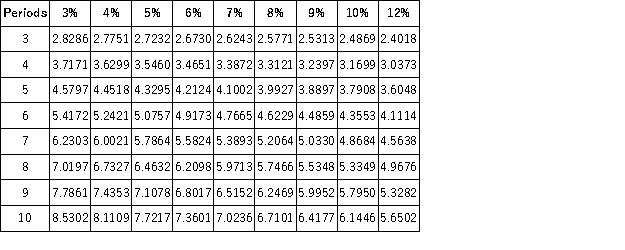

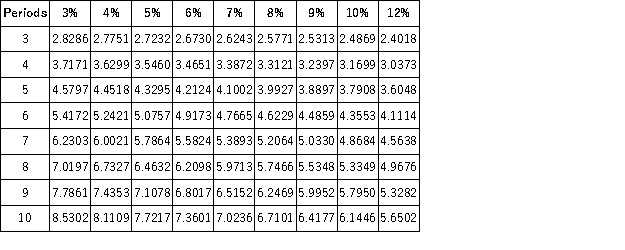

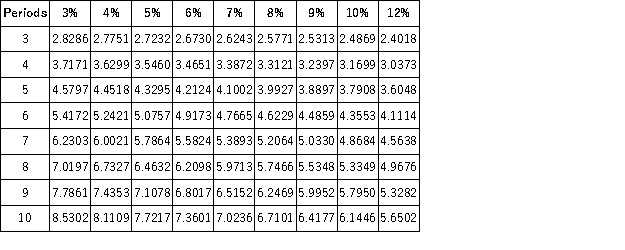

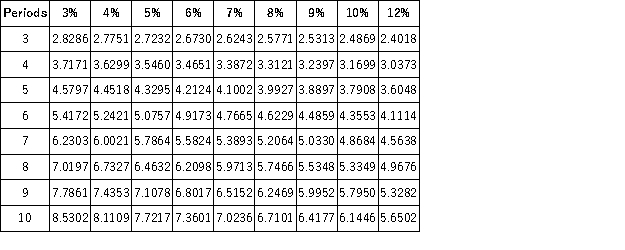

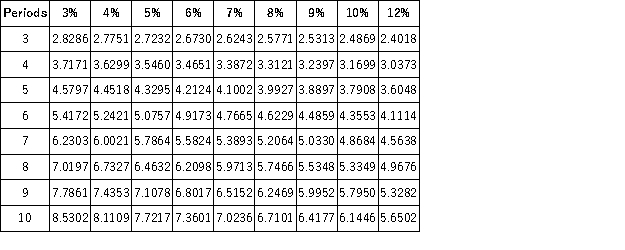

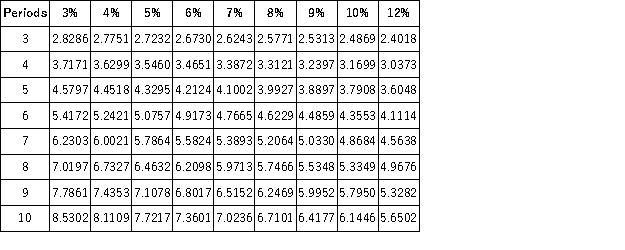

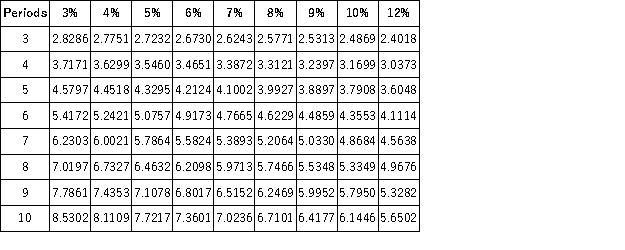

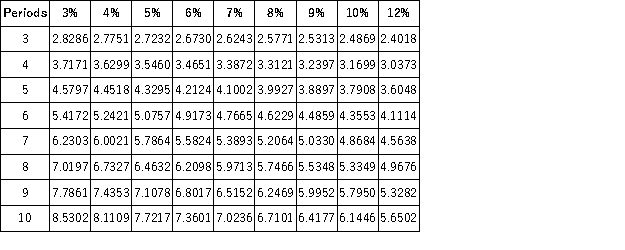

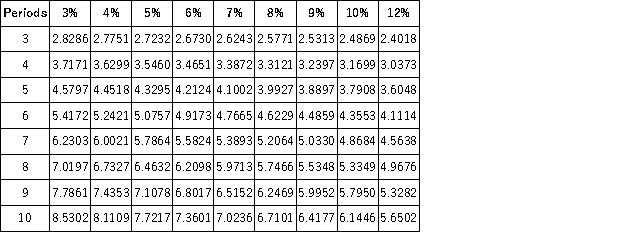

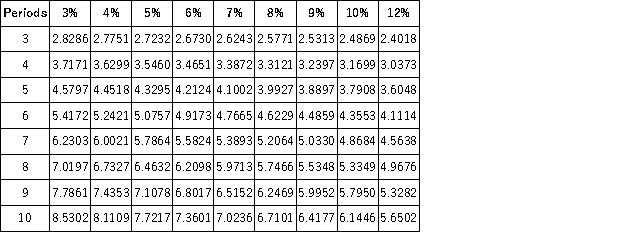

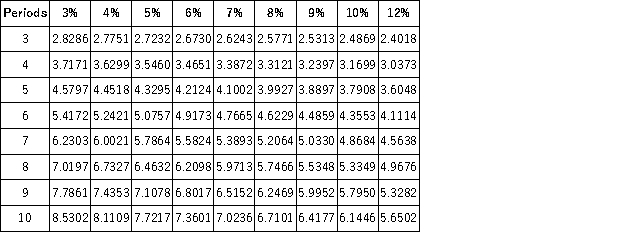

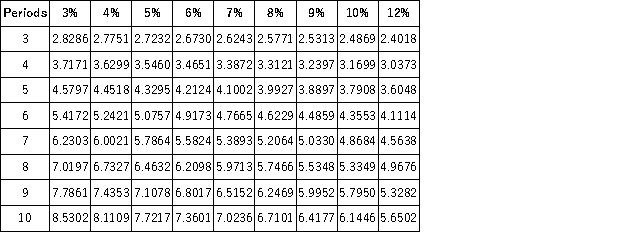

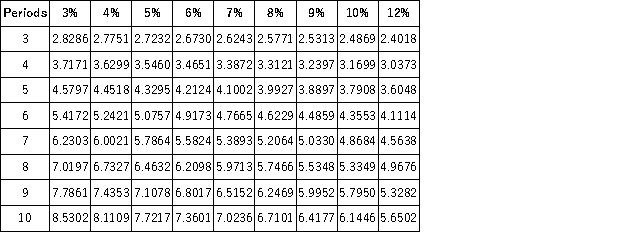

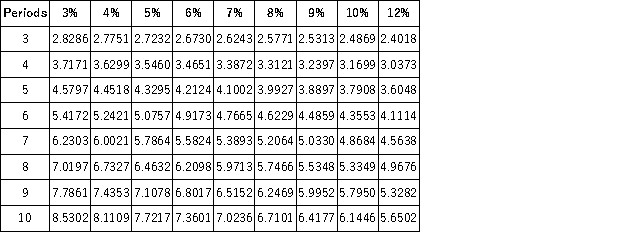

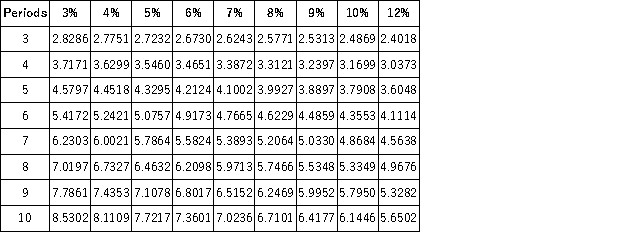

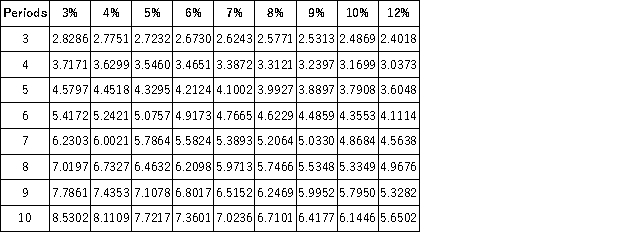

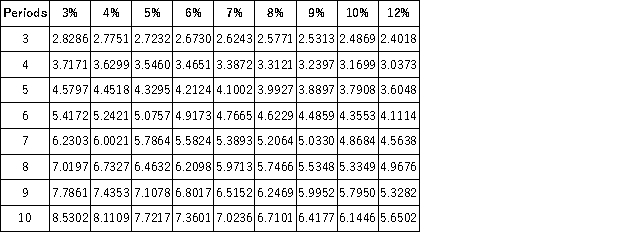

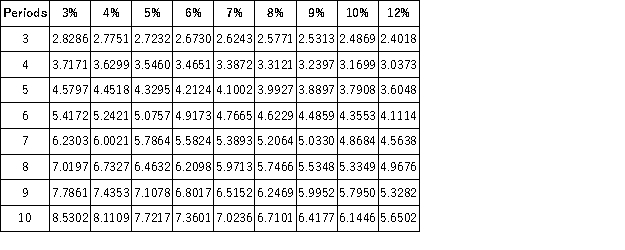

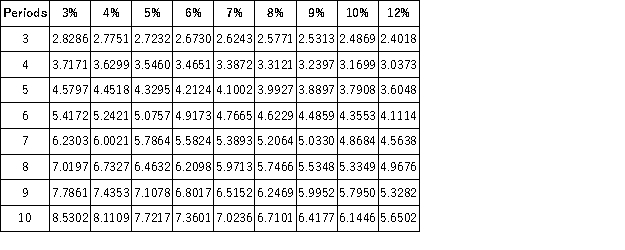

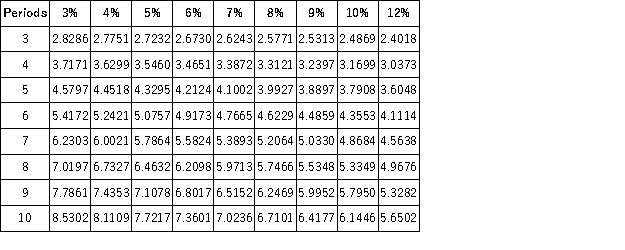

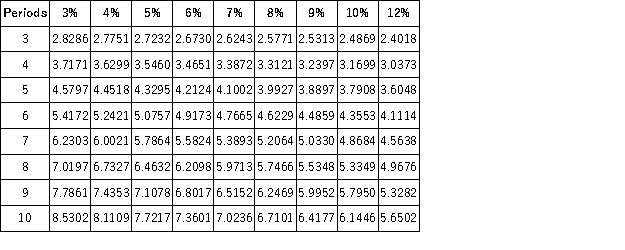

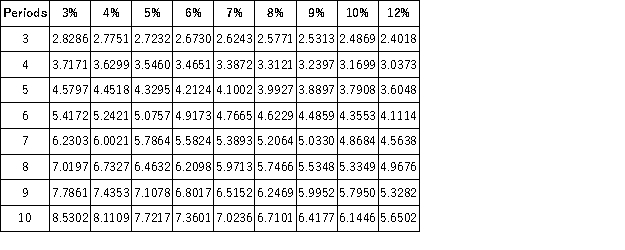

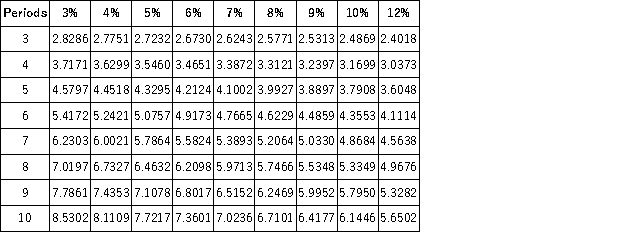

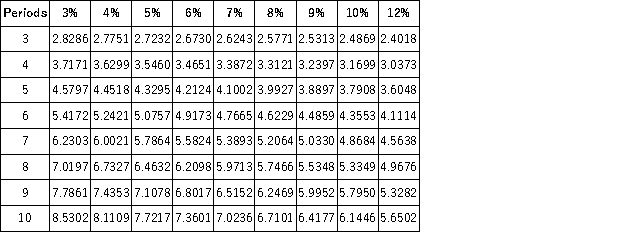

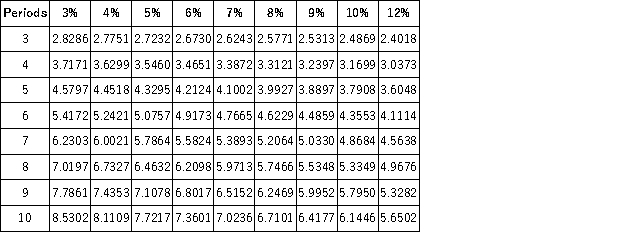

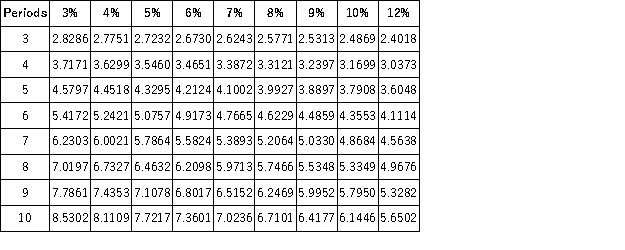

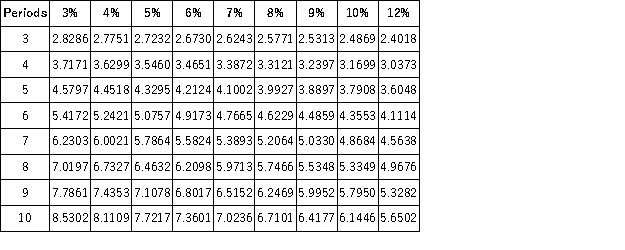

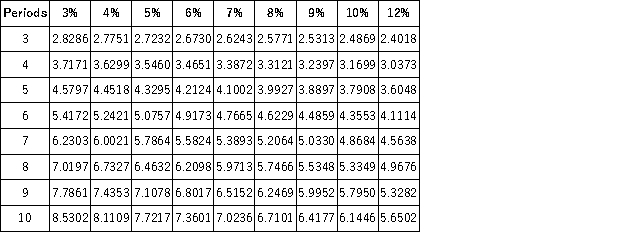

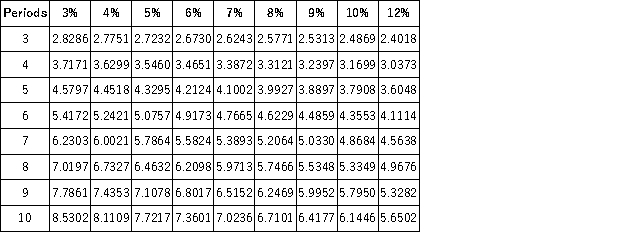

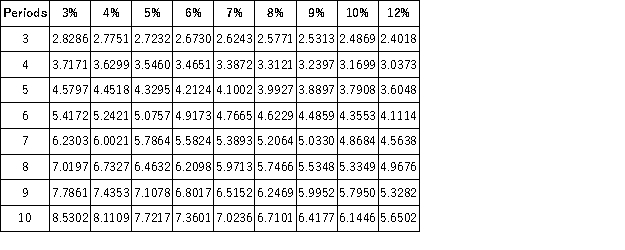

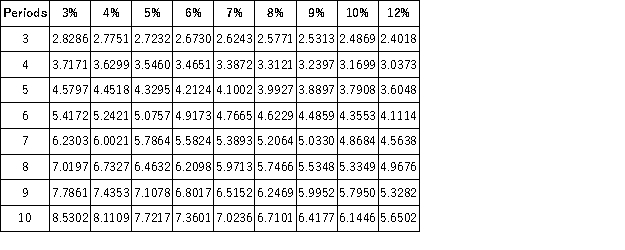

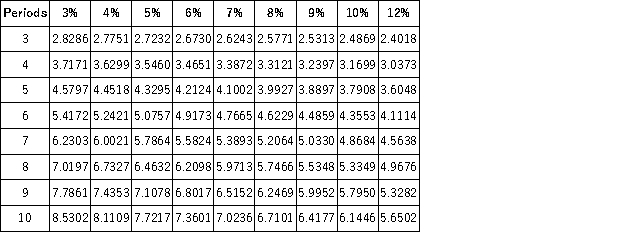

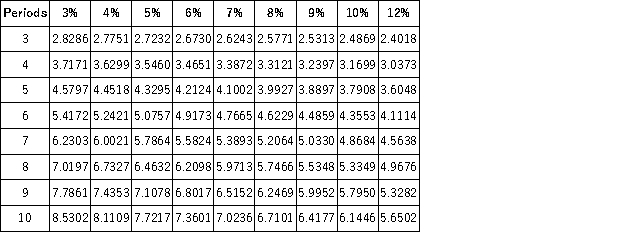

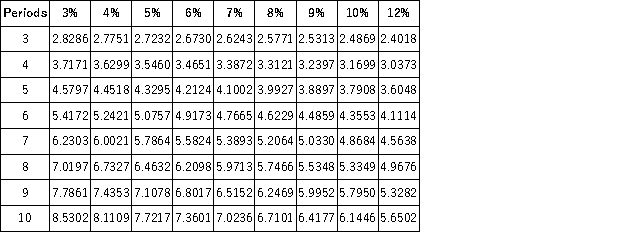

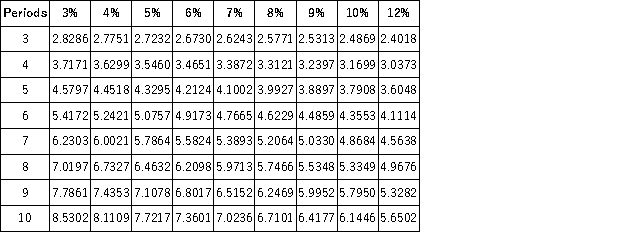

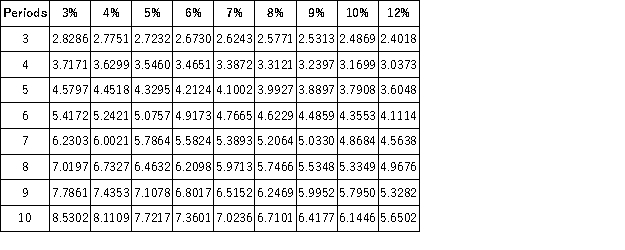

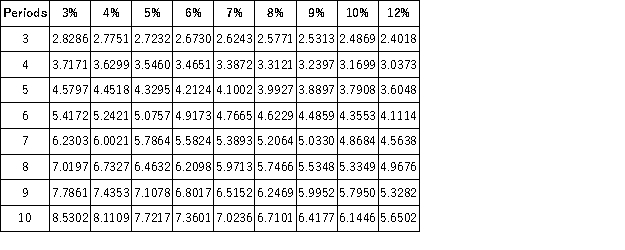

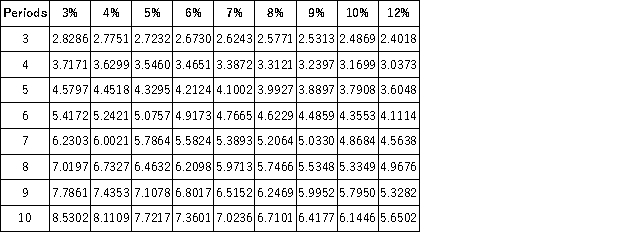

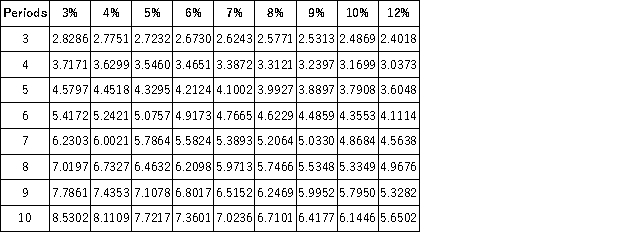

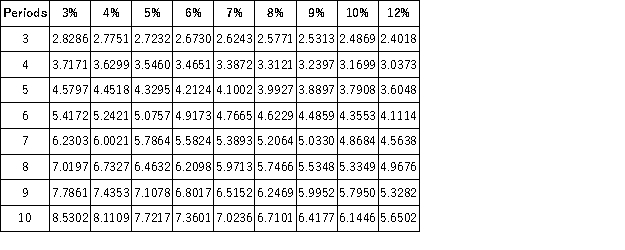

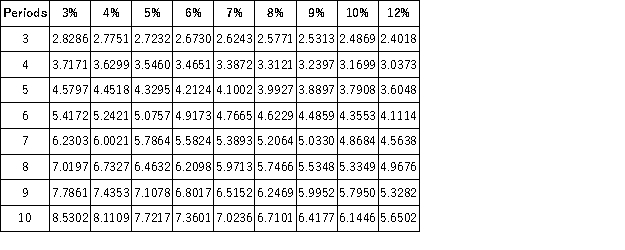

7.7156 is the FV factor on the Future Value of an Annuity table; n = 6; i = 10%

Future Value of an Annuity = Annuity * FV Factor

Future Value of an Annuity = $5,000 * 7.7156 = $38,578

Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  With deposits of $5,000 at the end of each year, you will have accumulated $38,578 at the end of the sixth year if the annual rate of interest is 10%.

With deposits of $5,000 at the end of each year, you will have accumulated $38,578 at the end of the sixth year if the annual rate of interest is 10%.7.7156 is the FV factor on the Future Value of an Annuity table; n = 6; i = 10%

Future Value of an Annuity = Annuity * FV Factor

Future Value of an Annuity = $5,000 * 7.7156 = $38,578

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

16

Present Value of 1  Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

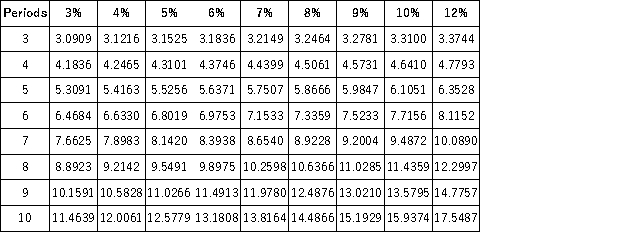

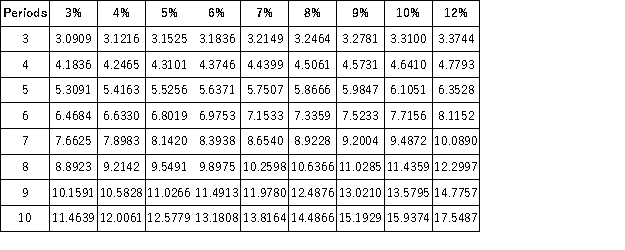

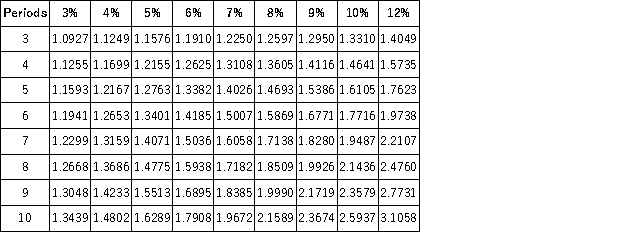

Future Value of an Annuity of 1  The present value of $5,000 per year for three years at 12% compounded annually is $12,009.

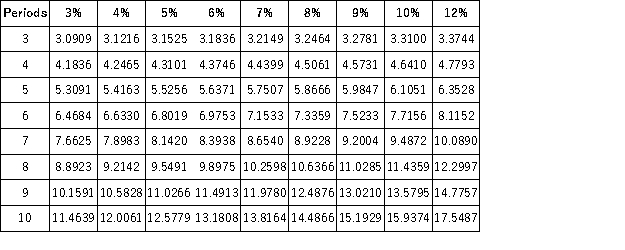

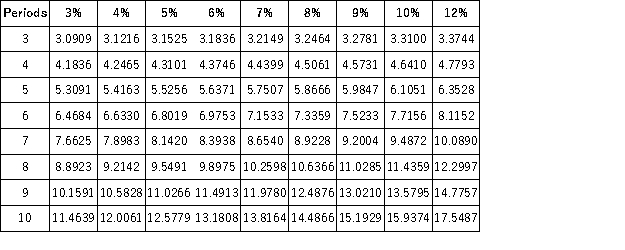

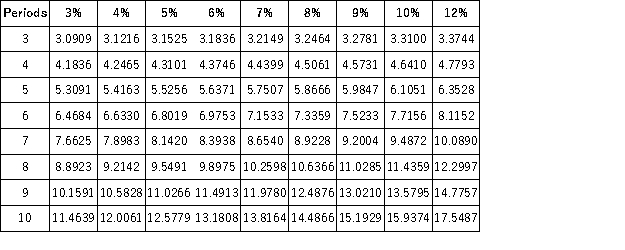

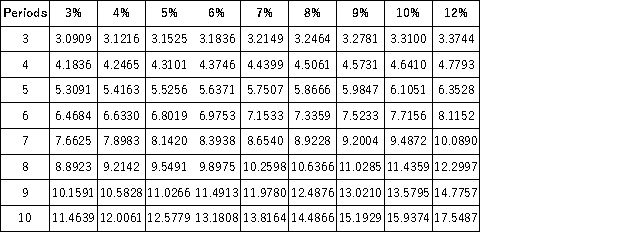

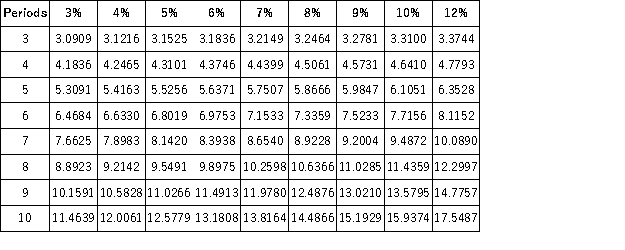

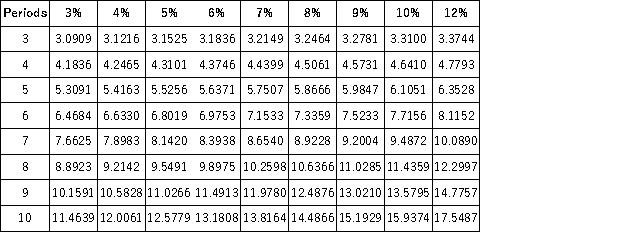

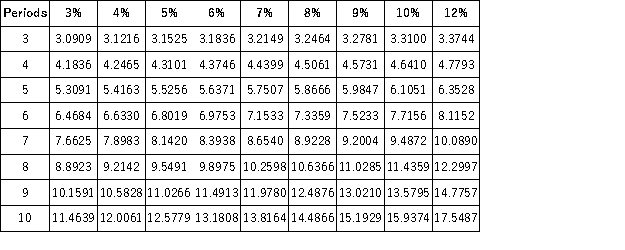

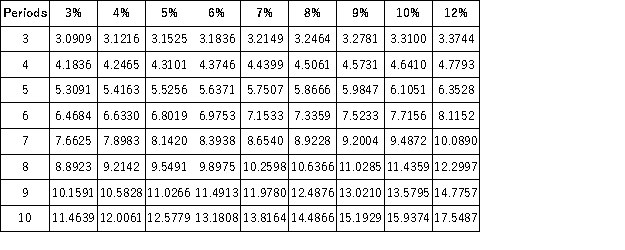

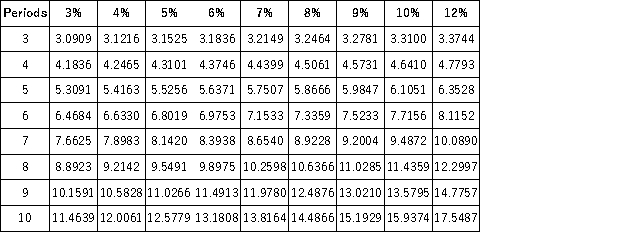

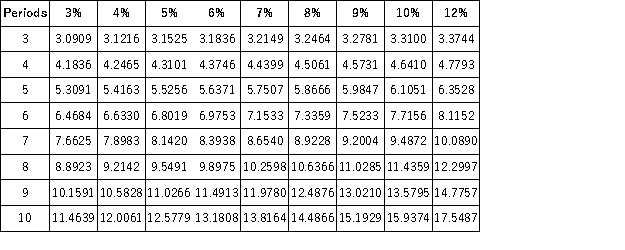

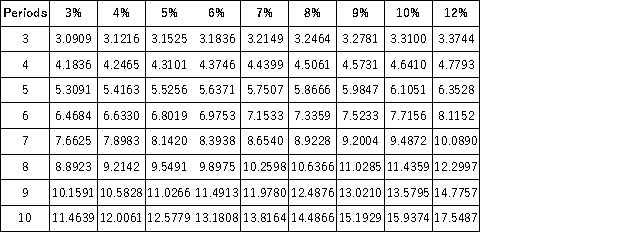

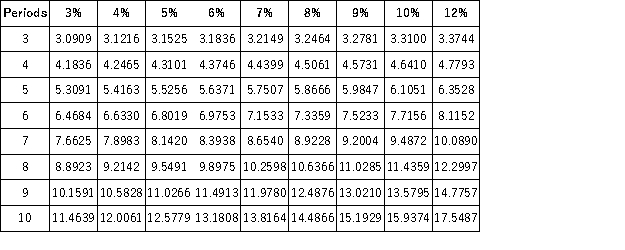

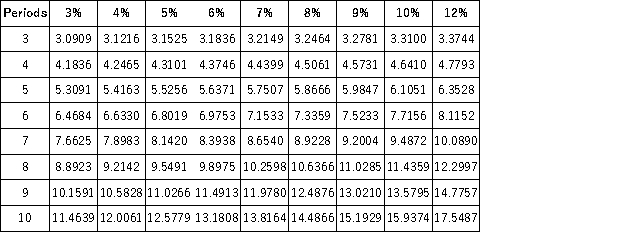

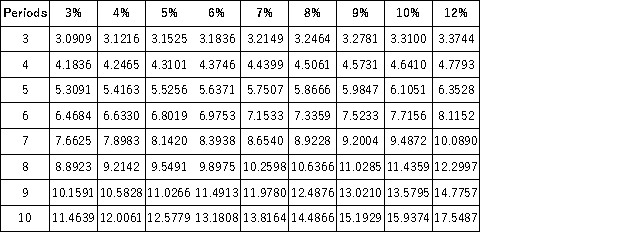

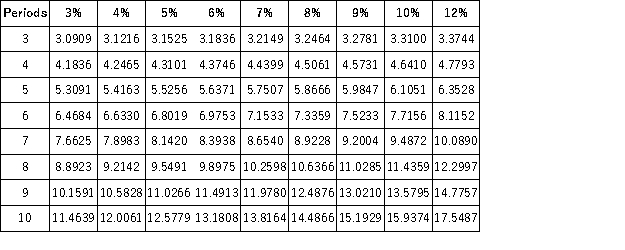

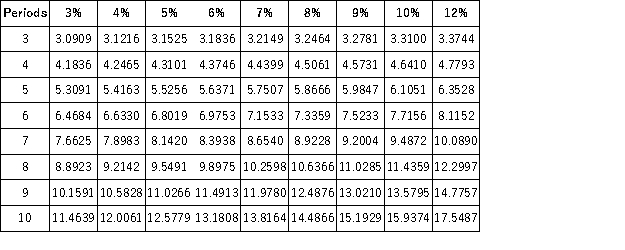

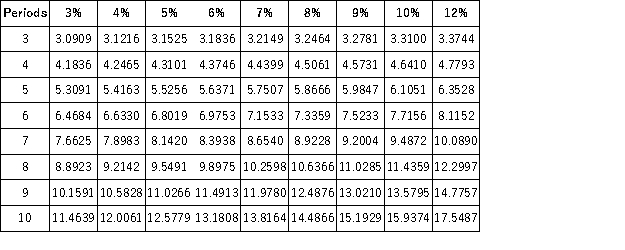

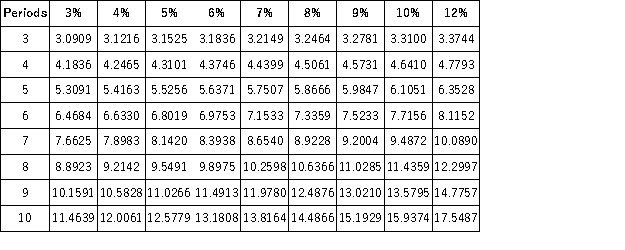

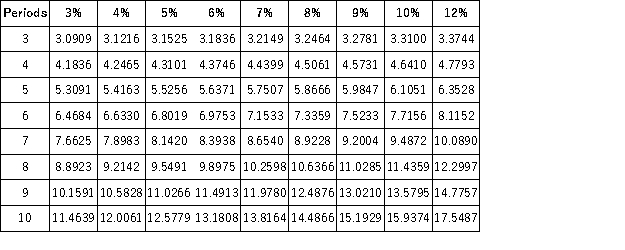

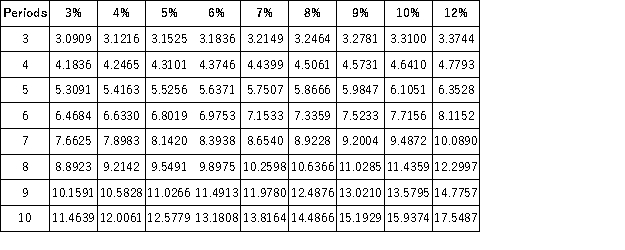

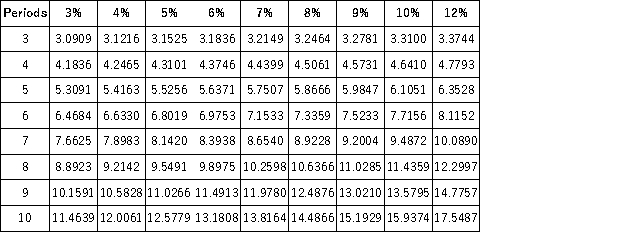

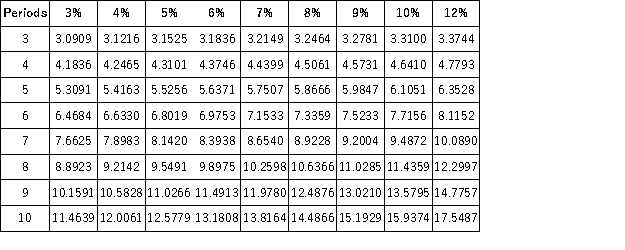

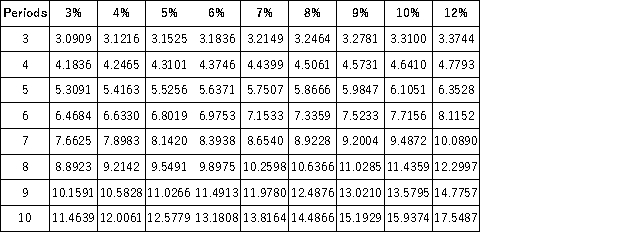

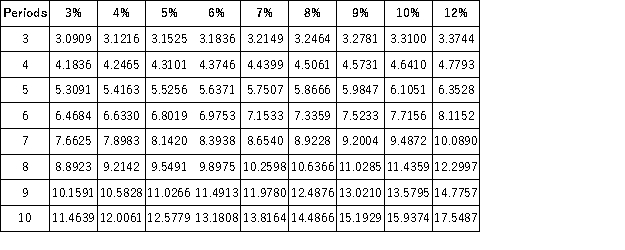

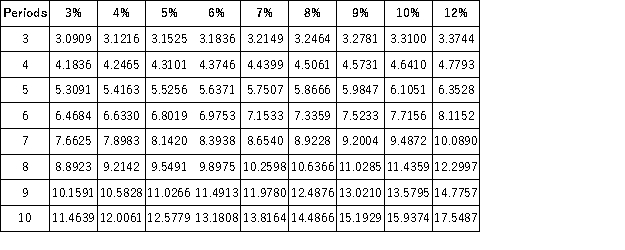

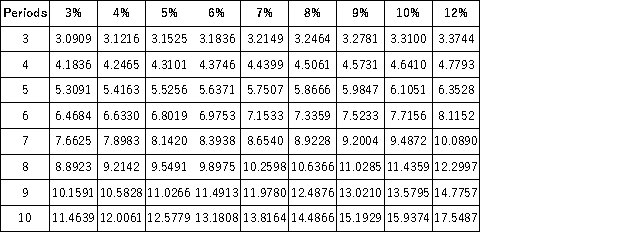

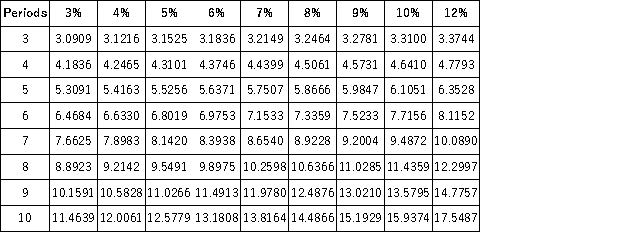

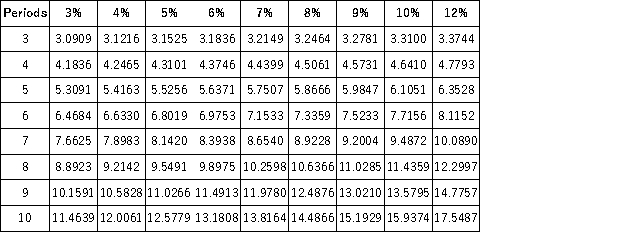

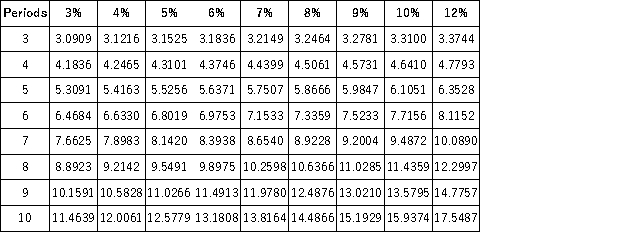

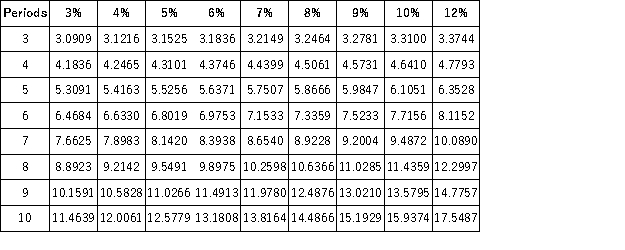

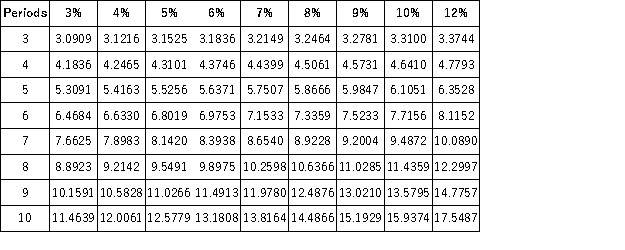

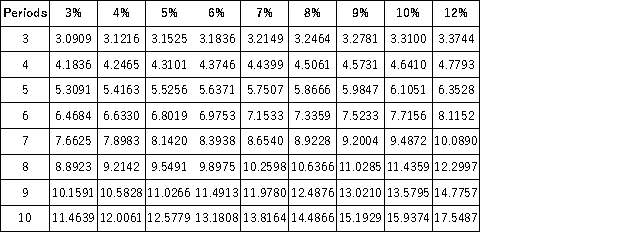

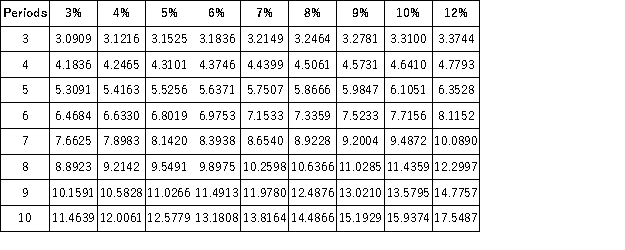

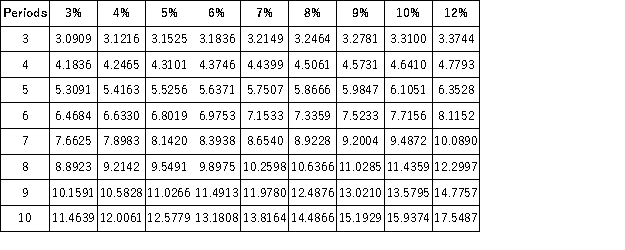

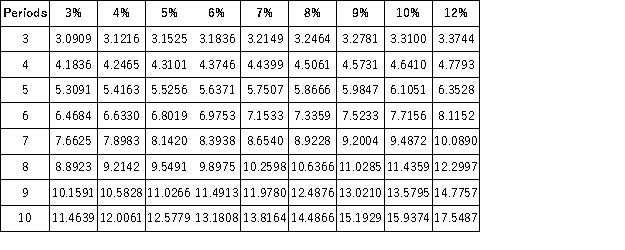

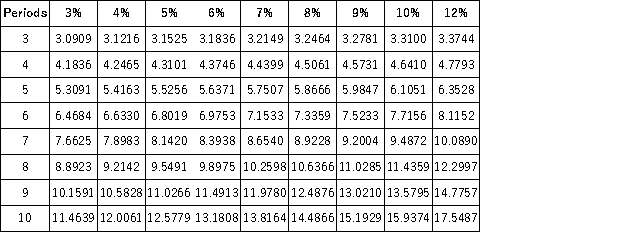

The present value of $5,000 per year for three years at 12% compounded annually is $12,009.

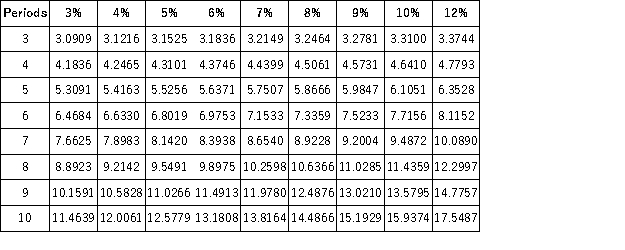

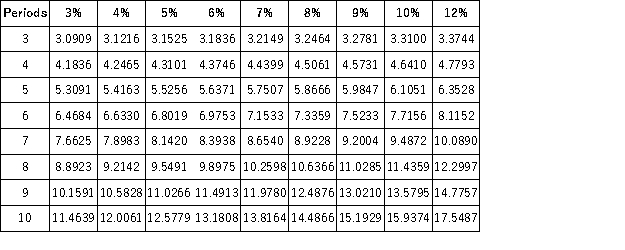

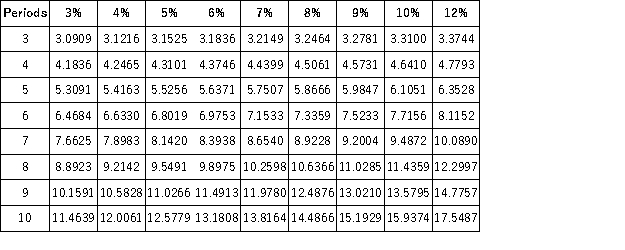

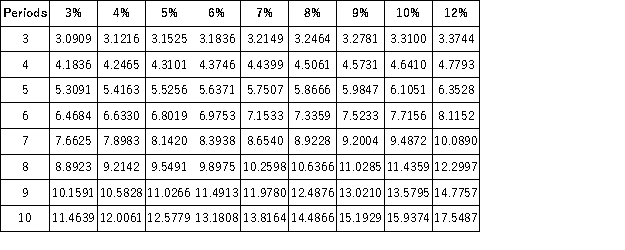

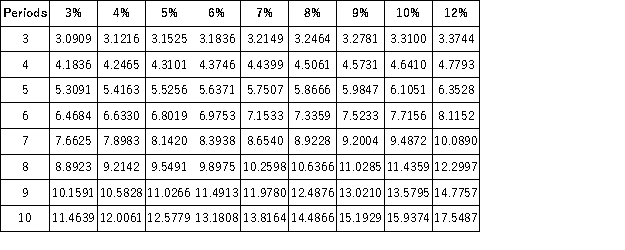

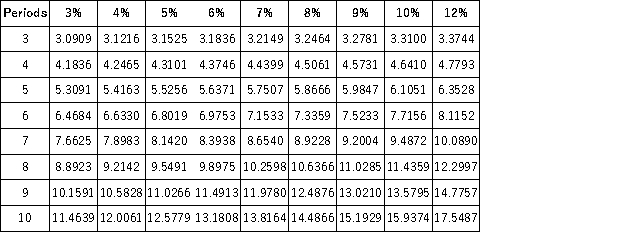

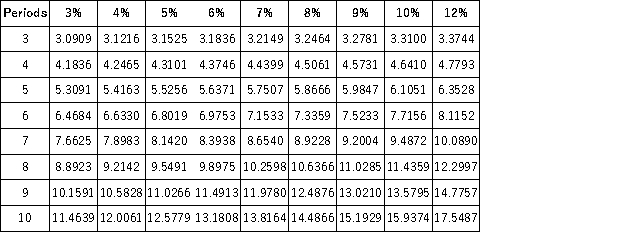

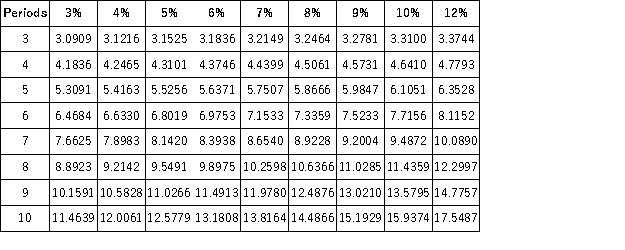

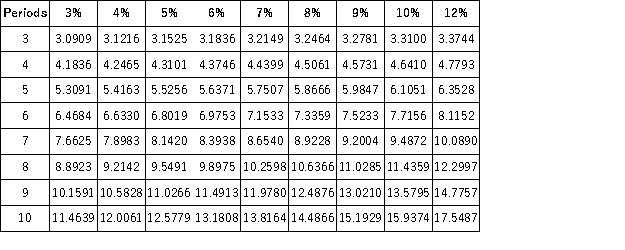

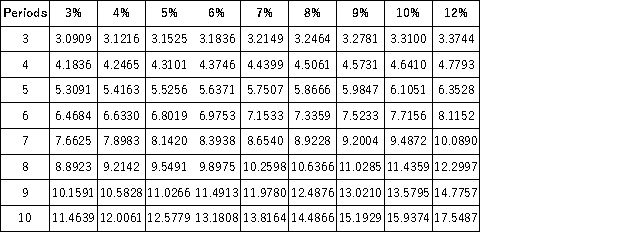

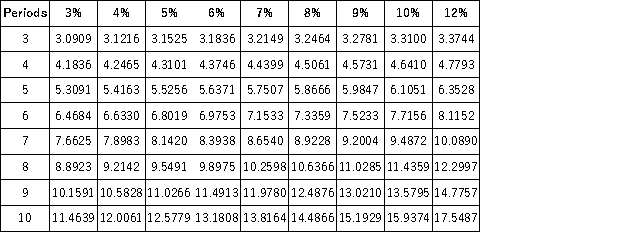

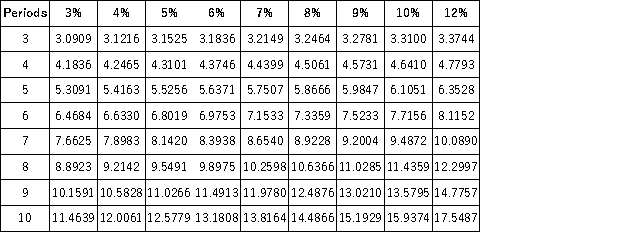

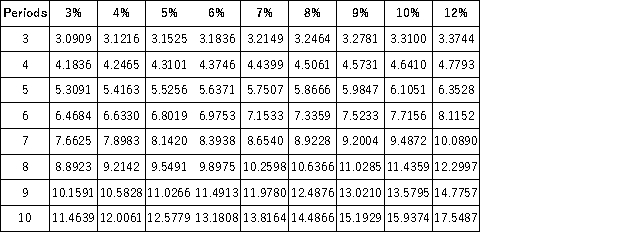

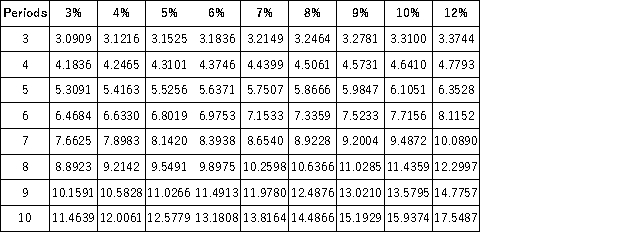

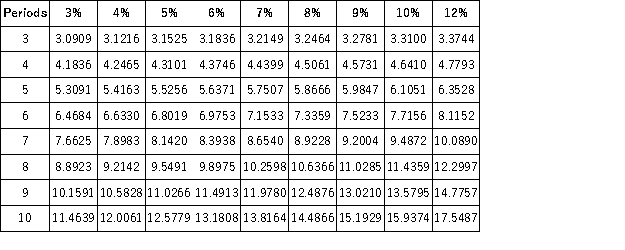

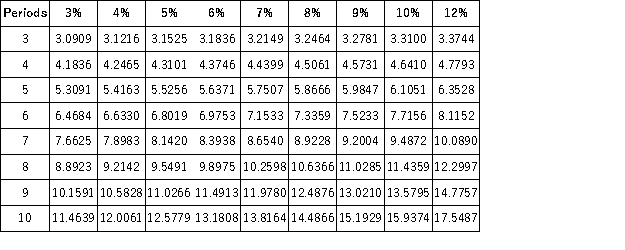

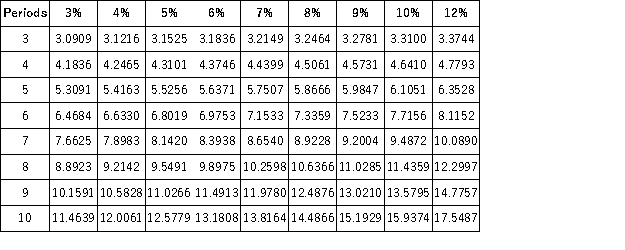

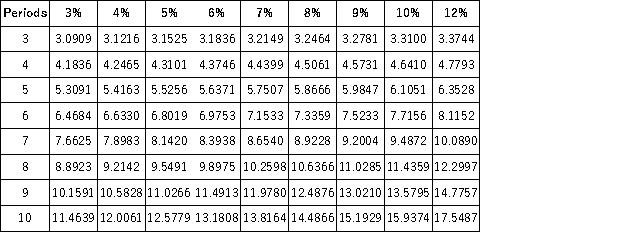

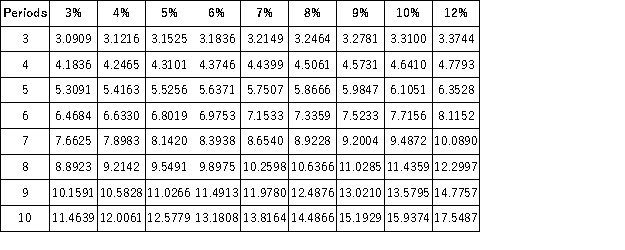

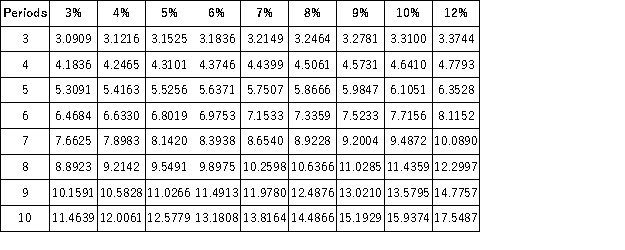

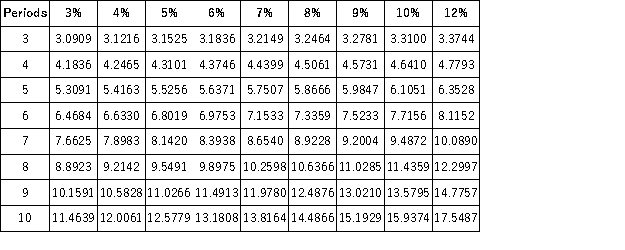

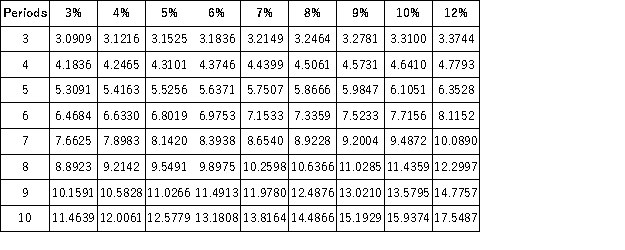

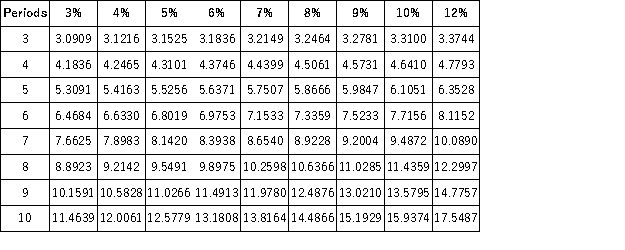

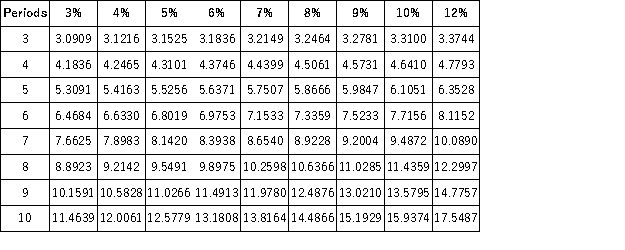

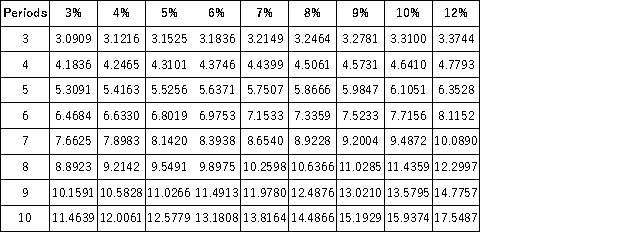

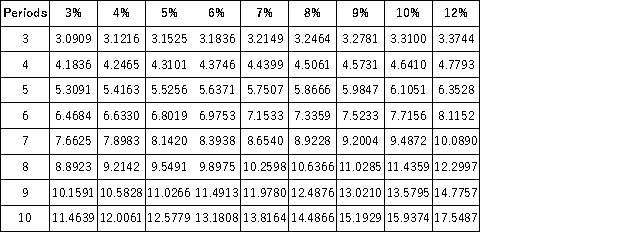

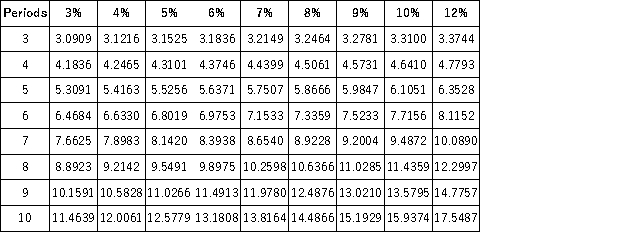

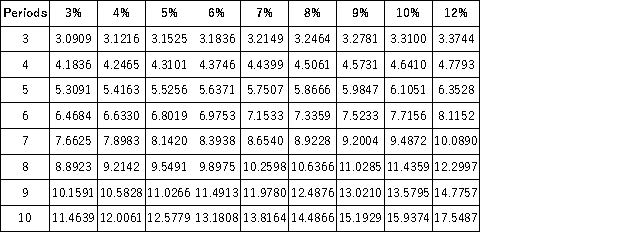

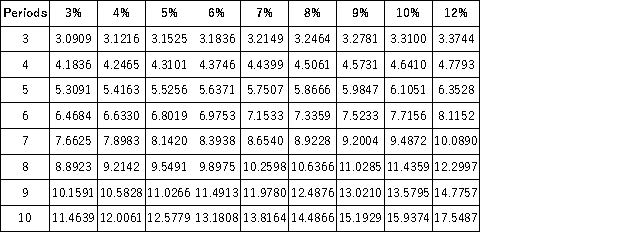

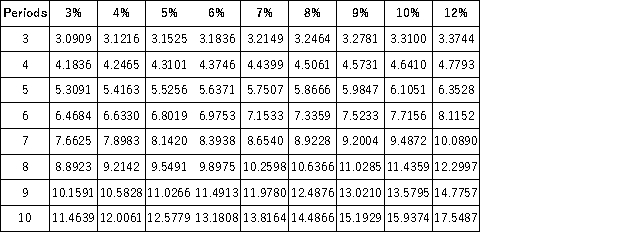

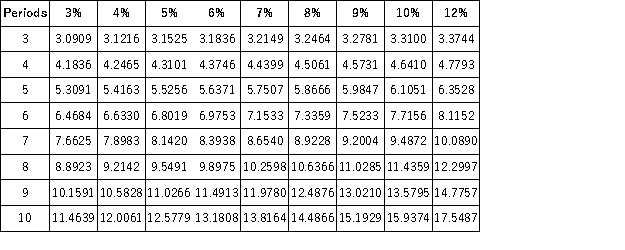

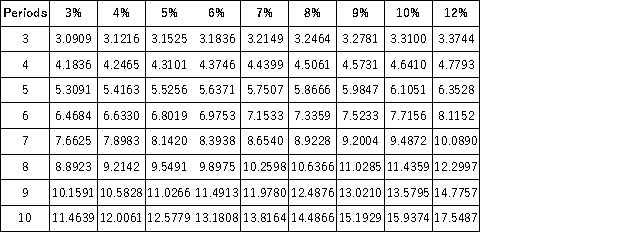

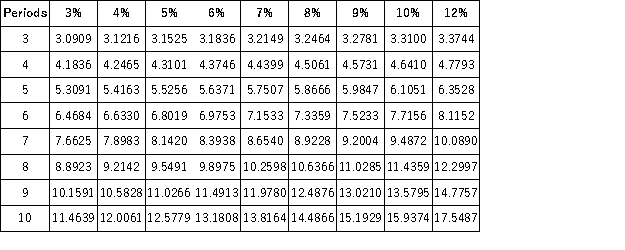

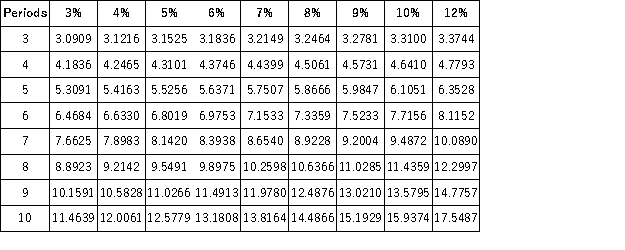

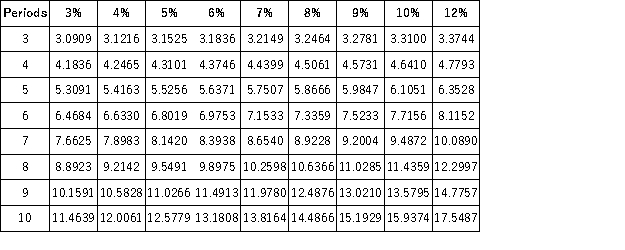

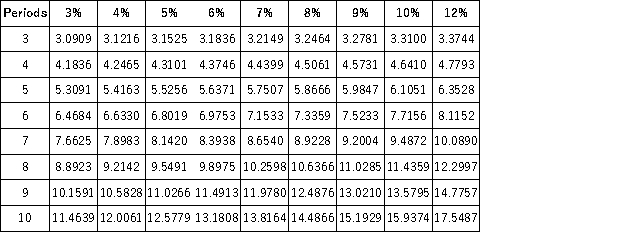

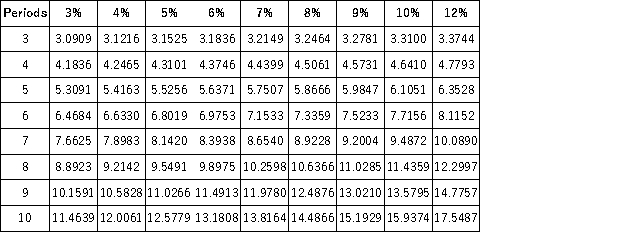

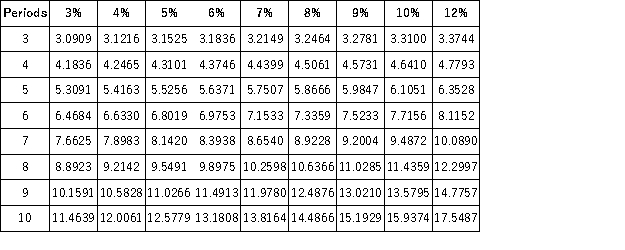

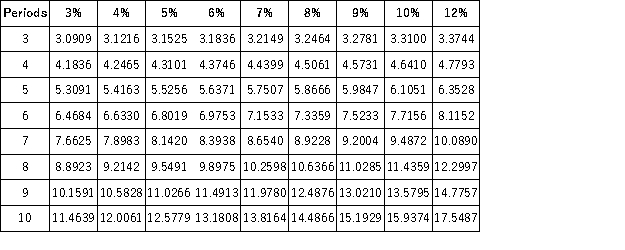

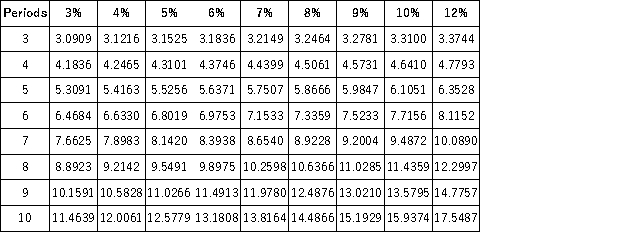

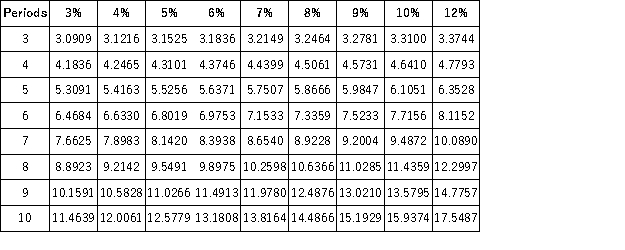

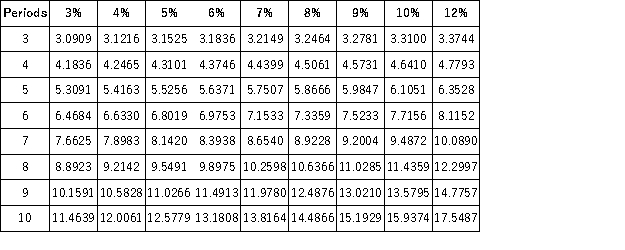

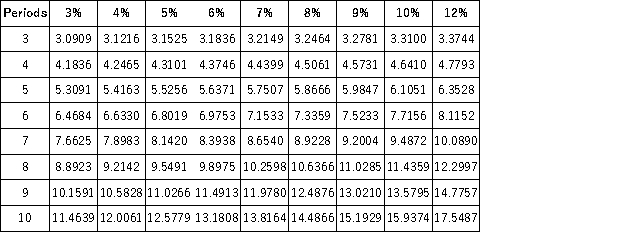

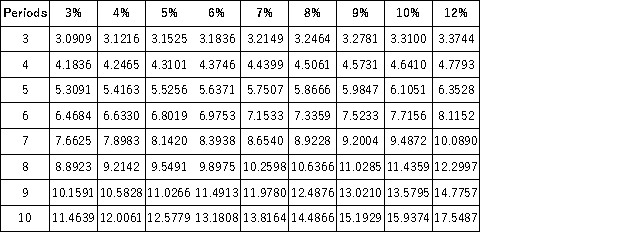

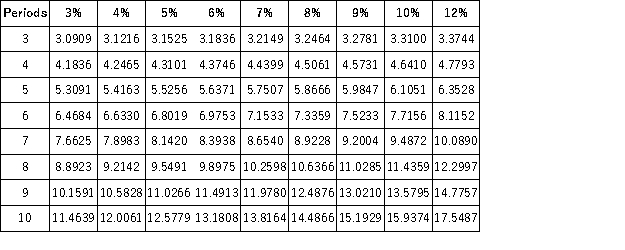

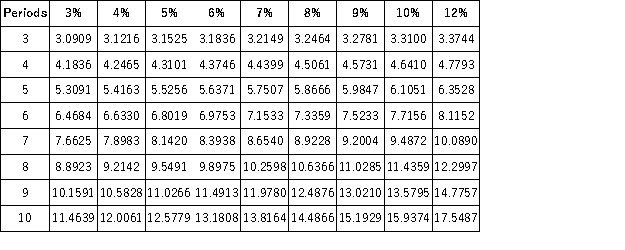

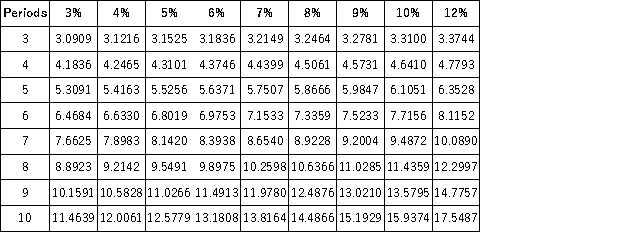

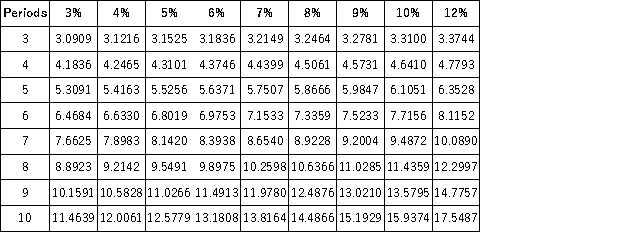

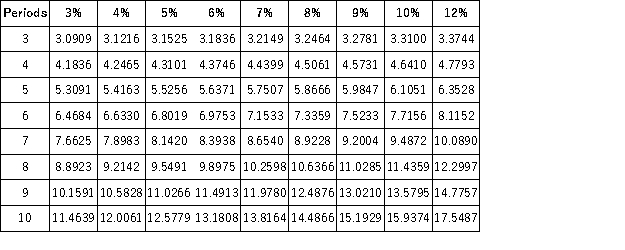

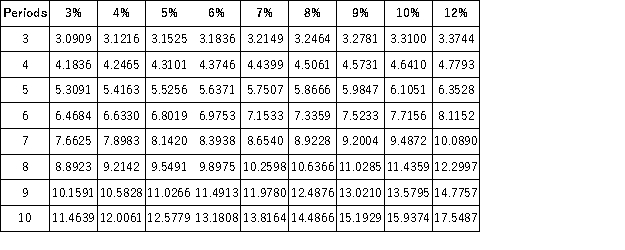

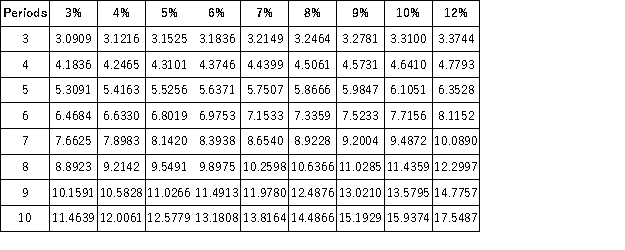

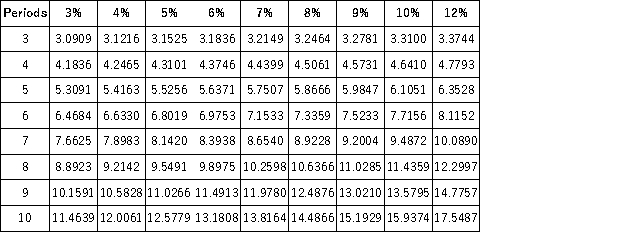

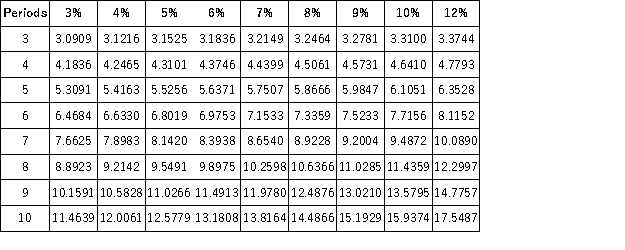

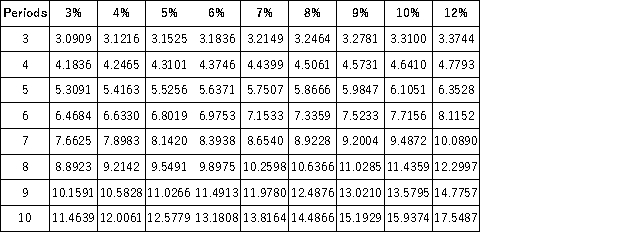

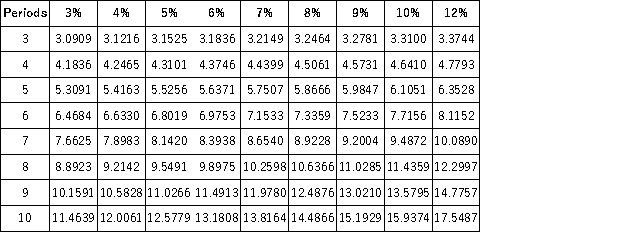

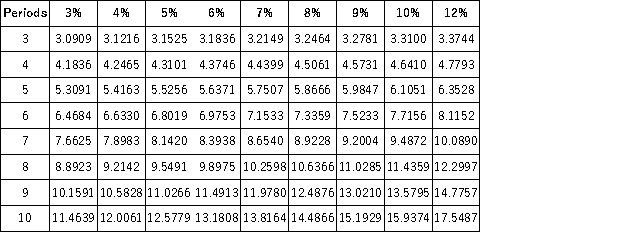

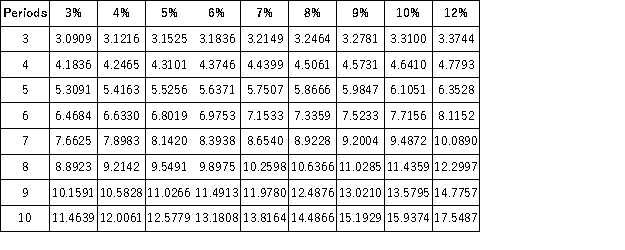

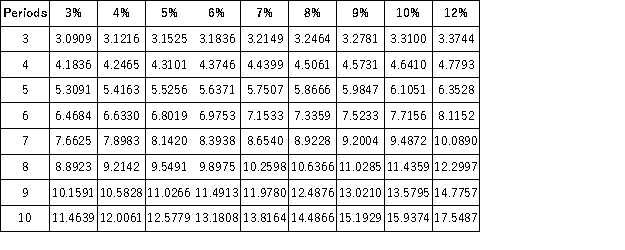

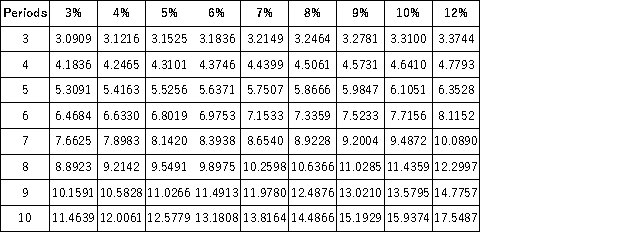

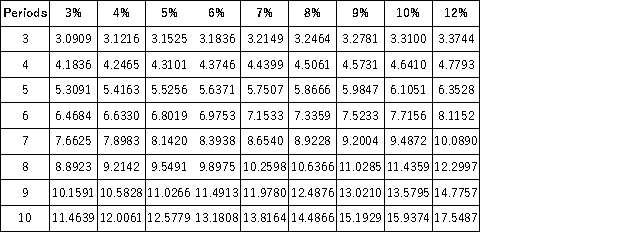

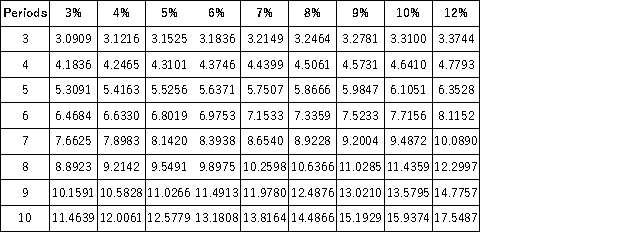

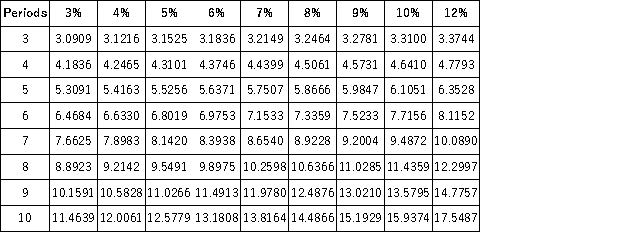

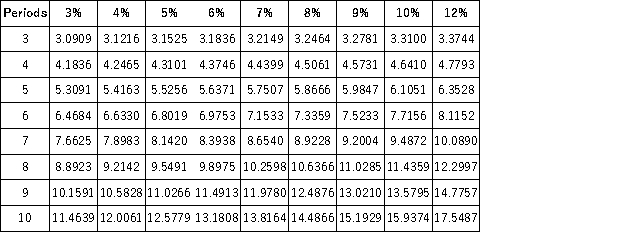

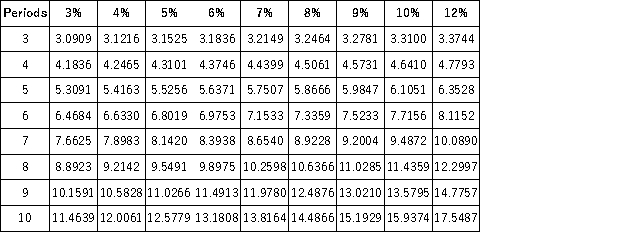

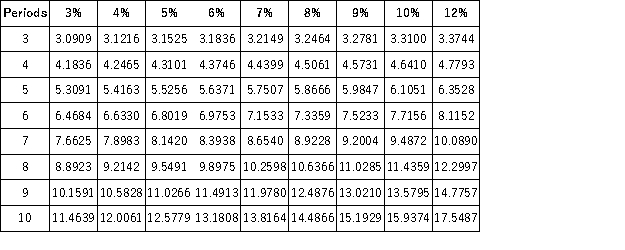

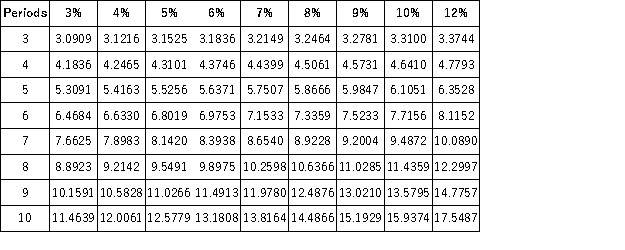

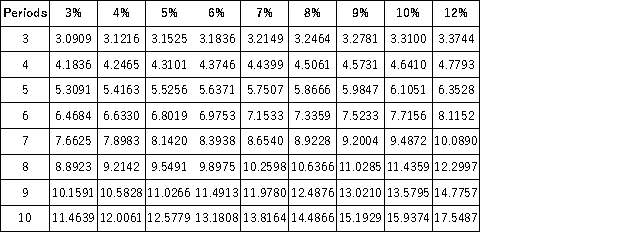

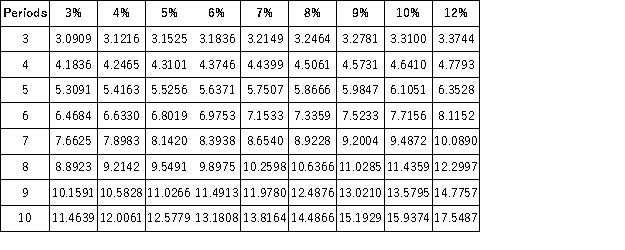

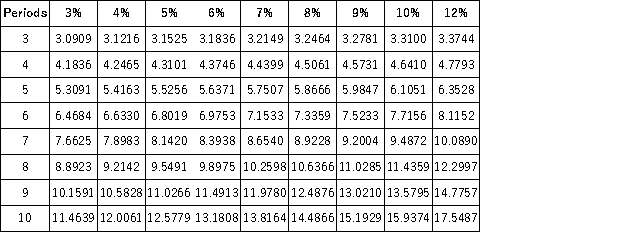

2.4018 is the PV factor on the Present Value of an Annuity table; n = 3; i = 12%

Present Value of an Annuity = Annuity * PV Factor

Present Value of an Annuity = $5,000 * 2.4018 = $12,009

Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  The present value of $5,000 per year for three years at 12% compounded annually is $12,009.

The present value of $5,000 per year for three years at 12% compounded annually is $12,009.2.4018 is the PV factor on the Present Value of an Annuity table; n = 3; i = 12%

Present Value of an Annuity = Annuity * PV Factor

Present Value of an Annuity = $5,000 * 2.4018 = $12,009

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

17

Present Value of 1  Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  A series of equal payments made or received at the end of each period is an ordinary annuity.

A series of equal payments made or received at the end of each period is an ordinary annuity.

Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  A series of equal payments made or received at the end of each period is an ordinary annuity.

A series of equal payments made or received at the end of each period is an ordinary annuity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

18

Present Value of 1  Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  Present and future value computations enable companies to measure or estimate the interest component of holding assets or liabilities over time.

Present and future value computations enable companies to measure or estimate the interest component of holding assets or liabilities over time.

Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  Present and future value computations enable companies to measure or estimate the interest component of holding assets or liabilities over time.

Present and future value computations enable companies to measure or estimate the interest component of holding assets or liabilities over time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

19

Present Value of 1  Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  In a present value or future value table, the length of one time period may be interpreted as one year, one month, or any other length of time.

In a present value or future value table, the length of one time period may be interpreted as one year, one month, or any other length of time.

Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  In a present value or future value table, the length of one time period may be interpreted as one year, one month, or any other length of time.

In a present value or future value table, the length of one time period may be interpreted as one year, one month, or any other length of time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

20

Present Value of 1  Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  The present value of an annuity table can be used to determine the value today of a series of payments to be received in the future.

The present value of an annuity table can be used to determine the value today of a series of payments to be received in the future.

Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  The present value of an annuity table can be used to determine the value today of a series of payments to be received in the future.

The present value of an annuity table can be used to determine the value today of a series of payments to be received in the future.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

21

Present Value of 1  Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  A company expects to invest $5,000 today at 12% annual interest and plans to receive $15,529 at the end of the investment period. How many years will elapse before the company accumulates the $15,529?

A company expects to invest $5,000 today at 12% annual interest and plans to receive $15,529 at the end of the investment period. How many years will elapse before the company accumulates the $15,529?

A)0.322 years

B)3.1058 years

C)5 years

D)8 years

E)10 years

Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  A company expects to invest $5,000 today at 12% annual interest and plans to receive $15,529 at the end of the investment period. How many years will elapse before the company accumulates the $15,529?

A company expects to invest $5,000 today at 12% annual interest and plans to receive $15,529 at the end of the investment period. How many years will elapse before the company accumulates the $15,529?A)0.322 years

B)3.1058 years

C)5 years

D)8 years

E)10 years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

22

Present Value of 1  Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  Which interest rate column would you use from a present value or future value table for 8% interest compounded quarterly?

Which interest rate column would you use from a present value or future value table for 8% interest compounded quarterly?

A)12%

B)6%

C)3%

D)2%

E)1%

Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  Which interest rate column would you use from a present value or future value table for 8% interest compounded quarterly?

Which interest rate column would you use from a present value or future value table for 8% interest compounded quarterly?A)12%

B)6%

C)3%

D)2%

E)1%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

23

Present Value of 1  Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  A company is considering investing in a project that is expected to return $350,000 four years from now. How much is the company willing to pay for this investment if the company requires a 12% return compounded annually?

A company is considering investing in a project that is expected to return $350,000 four years from now. How much is the company willing to pay for this investment if the company requires a 12% return compounded annually?

A)$55,606

B)$137,681

C)$222,425

D)$265,764

E)$350,000

Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  A company is considering investing in a project that is expected to return $350,000 four years from now. How much is the company willing to pay for this investment if the company requires a 12% return compounded annually?

A company is considering investing in a project that is expected to return $350,000 four years from now. How much is the company willing to pay for this investment if the company requires a 12% return compounded annually?A)$55,606

B)$137,681

C)$222,425

D)$265,764

E)$350,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

24

Present Value of 1  Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  Marshall has received an inheritance and wants to invest a sum of money today that will yield $5,000 at the end of each of the next 10 years. Assuming he can earn an interest rate of 5% compounded annually, how much of his inheritance must he invest today?

Marshall has received an inheritance and wants to invest a sum of money today that will yield $5,000 at the end of each of the next 10 years. Assuming he can earn an interest rate of 5% compounded annually, how much of his inheritance must he invest today?

A)$50,000.00

B)$47,500.00

C)$45,125.00

D)$38,608.50

E)$100,000.00

Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  Marshall has received an inheritance and wants to invest a sum of money today that will yield $5,000 at the end of each of the next 10 years. Assuming he can earn an interest rate of 5% compounded annually, how much of his inheritance must he invest today?

Marshall has received an inheritance and wants to invest a sum of money today that will yield $5,000 at the end of each of the next 10 years. Assuming he can earn an interest rate of 5% compounded annually, how much of his inheritance must he invest today?A)$50,000.00

B)$47,500.00

C)$45,125.00

D)$38,608.50

E)$100,000.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

25

Present Value of 1  Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  Keisha has $3,500 now and plans on investing it in a fund that will pay her 12% interest compounded quarterly. How much will Keisha have accumulated after 2 years?

Keisha has $3,500 now and plans on investing it in a fund that will pay her 12% interest compounded quarterly. How much will Keisha have accumulated after 2 years?

A)$4,433.80

B)$4,340.00

C)$4,390.40

D)$3,920.00

E)$3,500.00

Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  Keisha has $3,500 now and plans on investing it in a fund that will pay her 12% interest compounded quarterly. How much will Keisha have accumulated after 2 years?

Keisha has $3,500 now and plans on investing it in a fund that will pay her 12% interest compounded quarterly. How much will Keisha have accumulated after 2 years?A)$4,433.80

B)$4,340.00

C)$4,390.40

D)$3,920.00

E)$3,500.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

26

Present Value of 1  Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  What amount can you borrow if you can make six future quarterly payments of $4,000 at a 12% annual rate of interest?

What amount can you borrow if you can make six future quarterly payments of $4,000 at a 12% annual rate of interest?

A)$24,838.00

B)$21,668.80

C)$31,049.00

D)$40,000.00

E)$44,800.00

Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  What amount can you borrow if you can make six future quarterly payments of $4,000 at a 12% annual rate of interest?

What amount can you borrow if you can make six future quarterly payments of $4,000 at a 12% annual rate of interest?A)$24,838.00

B)$21,668.80

C)$31,049.00

D)$40,000.00

E)$44,800.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

27

Present Value of 1  Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  If we want to know the value of present-day assets at a future date, we can use:

If we want to know the value of present-day assets at a future date, we can use:

A)Present value computations.

B)Annuity computations.

C)Interest computations.

D)Future value computations.

E)Earnings computations.

Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  If we want to know the value of present-day assets at a future date, we can use:

If we want to know the value of present-day assets at a future date, we can use:A)Present value computations.

B)Annuity computations.

C)Interest computations.

D)Future value computations.

E)Earnings computations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

28

Present Value of 1  Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  Jessica received a gift of $7,500 at the time of her high school graduation. She invests it in an account that yields 10% compounded semi-annually. What will the value of Jessica's investment be at the end of 5 years?

Jessica received a gift of $7,500 at the time of her high school graduation. She invests it in an account that yields 10% compounded semi-annually. What will the value of Jessica's investment be at the end of 5 years?

A)$8,250.00

B)$11,250.00

C)$12,216.75

D)$9,375.00

E)$10,500.00

Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  Jessica received a gift of $7,500 at the time of her high school graduation. She invests it in an account that yields 10% compounded semi-annually. What will the value of Jessica's investment be at the end of 5 years?

Jessica received a gift of $7,500 at the time of her high school graduation. She invests it in an account that yields 10% compounded semi-annually. What will the value of Jessica's investment be at the end of 5 years?A)$8,250.00

B)$11,250.00

C)$12,216.75

D)$9,375.00

E)$10,500.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

29

Present Value of 1  Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  Jason has a loan that requires a single payment of $4,000 at the end of 3 years. The loan's interest rate is 6%, compounded semiannually. How much did Jason borrow?

Jason has a loan that requires a single payment of $4,000 at the end of 3 years. The loan's interest rate is 6%, compounded semiannually. How much did Jason borrow?

A)$3,358.40

B)$4,000.00

C)$3,660.40

D)$4,776.40

E)$3,350.00

Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  Jason has a loan that requires a single payment of $4,000 at the end of 3 years. The loan's interest rate is 6%, compounded semiannually. How much did Jason borrow?

Jason has a loan that requires a single payment of $4,000 at the end of 3 years. The loan's interest rate is 6%, compounded semiannually. How much did Jason borrow?A)$3,358.40

B)$4,000.00

C)$3,660.40

D)$4,776.40

E)$3,350.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

30

Present Value of 1  Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  An individual is planning to set-up an education fund for her daughter. She plans to invest $7,000 annually at the end of each year. She expects to withdraw money from the fund at the end of 9 years and expects to earn an annual return of 8%. What will be the total value of the fund at the end of 9 years?

An individual is planning to set-up an education fund for her daughter. She plans to invest $7,000 annually at the end of each year. She expects to withdraw money from the fund at the end of 9 years and expects to earn an annual return of 8%. What will be the total value of the fund at the end of 9 years?

A)$87,413

B)$68,040

C)$50,400

D)$126,000

E)$45,360

Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  An individual is planning to set-up an education fund for her daughter. She plans to invest $7,000 annually at the end of each year. She expects to withdraw money from the fund at the end of 9 years and expects to earn an annual return of 8%. What will be the total value of the fund at the end of 9 years?

An individual is planning to set-up an education fund for her daughter. She plans to invest $7,000 annually at the end of each year. She expects to withdraw money from the fund at the end of 9 years and expects to earn an annual return of 8%. What will be the total value of the fund at the end of 9 years?A)$87,413

B)$68,040

C)$50,400

D)$126,000

E)$45,360

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

31

Present Value of 1  Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  What amount can you borrow if you can make seven future semiannual payments of $4,000 at an 8% annual rate of interest?

What amount can you borrow if you can make seven future semiannual payments of $4,000 at an 8% annual rate of interest?

A)$28,000.00

B)$25,760.00

C)$31,049.00

D)$24,008.40

E)$35,691.20

Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  What amount can you borrow if you can make seven future semiannual payments of $4,000 at an 8% annual rate of interest?

What amount can you borrow if you can make seven future semiannual payments of $4,000 at an 8% annual rate of interest?A)$28,000.00

B)$25,760.00

C)$31,049.00

D)$24,008.40

E)$35,691.20

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

32

Present Value of 1  Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  How long will it take an investment of $25,000 at 6% compounded annually to accumulate to a total of $35,462.50?

How long will it take an investment of $25,000 at 6% compounded annually to accumulate to a total of $35,462.50?

A)4 years

B)5 years

C)6 years

D)2 years

E)10 years

Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  How long will it take an investment of $25,000 at 6% compounded annually to accumulate to a total of $35,462.50?

How long will it take an investment of $25,000 at 6% compounded annually to accumulate to a total of $35,462.50?A)4 years

B)5 years

C)6 years

D)2 years

E)10 years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

33

Present Value of 1  Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  What interest rate is required to accumulate $6,802.50 in four years from an investment of $5,000?

What interest rate is required to accumulate $6,802.50 in four years from an investment of $5,000?

A)5%

B)8%

C)10%

D)12%

E)15%

Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  What interest rate is required to accumulate $6,802.50 in four years from an investment of $5,000?

What interest rate is required to accumulate $6,802.50 in four years from an investment of $5,000?A)5%

B)8%

C)10%

D)12%

E)15%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

34

Present Value of 1  Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  Interest may be defined as:

Interest may be defined as:

A)Time.

B)A borrower's payment to the owner of an asset for its use.

C)The future value of a present amount.

D)Always a liability.

E)Always an asset.

Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  Interest may be defined as:

Interest may be defined as:A)Time.

B)A borrower's payment to the owner of an asset for its use.

C)The future value of a present amount.

D)Always a liability.

E)Always an asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

35

Present Value of 1  Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  Cody invests $1,800 per year from his summer wages at a 4% annual interest rate. He plans to take a European vacation at the end of 4 years when he graduates from college. How much will he have available to spend on his vacation?

Cody invests $1,800 per year from his summer wages at a 4% annual interest rate. He plans to take a European vacation at the end of 4 years when he graduates from college. How much will he have available to spend on his vacation?

A)$7,787.52

B)$7,488.00

C)$6,912.00

D)$7,200.00

E)$7,643.70

Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  Cody invests $1,800 per year from his summer wages at a 4% annual interest rate. He plans to take a European vacation at the end of 4 years when he graduates from college. How much will he have available to spend on his vacation?

Cody invests $1,800 per year from his summer wages at a 4% annual interest rate. He plans to take a European vacation at the end of 4 years when he graduates from college. How much will he have available to spend on his vacation?A)$7,787.52

B)$7,488.00

C)$6,912.00

D)$7,200.00

E)$7,643.70

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

36

Present Value of 1  Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  Marc Lewis expects an investment of $25,000 to return $6,595 annually. His investment is earning 10% per year. How many annual payments will he receive?

Marc Lewis expects an investment of $25,000 to return $6,595 annually. His investment is earning 10% per year. How many annual payments will he receive?

A)Five payments

B)Six payments

C)Four payments

D)Three payments

E)More than six payments

Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  Marc Lewis expects an investment of $25,000 to return $6,595 annually. His investment is earning 10% per year. How many annual payments will he receive?

Marc Lewis expects an investment of $25,000 to return $6,595 annually. His investment is earning 10% per year. How many annual payments will he receive?A)Five payments

B)Six payments

C)Four payments

D)Three payments

E)More than six payments

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

37

Present Value of 1  Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  Patricia wants to invest a sum of money today that will yield $10,000 at the end of 6 years. Assuming she can earn an interest rate of 6% compounded annually, how much must she invest today?

Patricia wants to invest a sum of money today that will yield $10,000 at the end of 6 years. Assuming she can earn an interest rate of 6% compounded annually, how much must she invest today?

A)$7,050

B)$9,400

C)$6,000

D)$8,836

E)$8,306

Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  Patricia wants to invest a sum of money today that will yield $10,000 at the end of 6 years. Assuming she can earn an interest rate of 6% compounded annually, how much must she invest today?

Patricia wants to invest a sum of money today that will yield $10,000 at the end of 6 years. Assuming she can earn an interest rate of 6% compounded annually, how much must she invest today?A)$7,050

B)$9,400

C)$6,000

D)$8,836

E)$8,306

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

38

Present Value of 1  Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  A company is considering an investment that will return $22,000 at the end of each semiannual period for 4 years. If the company requires an annual return of 10%, what is the maximum amount it is willing to pay for this investment?

A company is considering an investment that will return $22,000 at the end of each semiannual period for 4 years. If the company requires an annual return of 10%, what is the maximum amount it is willing to pay for this investment?

A)Not more than $69,738

B)Not more than $139,476

C)Not more than $88,000

D)Not more than $142,190

E)Not more than $176,000

Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  A company is considering an investment that will return $22,000 at the end of each semiannual period for 4 years. If the company requires an annual return of 10%, what is the maximum amount it is willing to pay for this investment?

A company is considering an investment that will return $22,000 at the end of each semiannual period for 4 years. If the company requires an annual return of 10%, what is the maximum amount it is willing to pay for this investment?A)Not more than $69,738

B)Not more than $139,476

C)Not more than $88,000

D)Not more than $142,190

E)Not more than $176,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

39

Present Value of 1  Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  Russell Company has acquired a building with a loan that requires payments of $20,000 every six months for 5 years. The annual interest rate on the loan is 12%. What is the present value of the building?

Russell Company has acquired a building with a loan that requires payments of $20,000 every six months for 5 years. The annual interest rate on the loan is 12%. What is the present value of the building?

A)$72,096

B)$113,004

C)$147,202

D)$86,590

E)$200,000

Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  Russell Company has acquired a building with a loan that requires payments of $20,000 every six months for 5 years. The annual interest rate on the loan is 12%. What is the present value of the building?

Russell Company has acquired a building with a loan that requires payments of $20,000 every six months for 5 years. The annual interest rate on the loan is 12%. What is the present value of the building?A)$72,096

B)$113,004

C)$147,202

D)$86,590

E)$200,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

40

Present Value of 1  Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  An individual is planning to set-up an education fund for his grandchildren. He plans to invest $10,000 annually at the end of each year. He expects to withdraw money from the fund at the end of 10 years and expects to earn an annual return of 8%. What will be the total value of the fund at the end of 10 years?

An individual is planning to set-up an education fund for his grandchildren. He plans to invest $10,000 annually at the end of each year. He expects to withdraw money from the fund at the end of 10 years and expects to earn an annual return of 8%. What will be the total value of the fund at the end of 10 years?

A)$46,320

B)$67,107

C)$100,000

D)$144,866

E)$215,890

Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  An individual is planning to set-up an education fund for his grandchildren. He plans to invest $10,000 annually at the end of each year. He expects to withdraw money from the fund at the end of 10 years and expects to earn an annual return of 8%. What will be the total value of the fund at the end of 10 years?

An individual is planning to set-up an education fund for his grandchildren. He plans to invest $10,000 annually at the end of each year. He expects to withdraw money from the fund at the end of 10 years and expects to earn an annual return of 8%. What will be the total value of the fund at the end of 10 years?A)$46,320

B)$67,107

C)$100,000

D)$144,866

E)$215,890

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

41

Present Value of 1  Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  Sheryl Frasier has won the Indiana state lottery when the jackpot was $9 million. She has chosen to take the prize winnings as $1 million per year over the next nine years. Using a 7% annual interest rate, determine the present value of the $1 million annuity Sheryl will receive.

Sheryl Frasier has won the Indiana state lottery when the jackpot was $9 million. She has chosen to take the prize winnings as $1 million per year over the next nine years. Using a 7% annual interest rate, determine the present value of the $1 million annuity Sheryl will receive.

A)$9,000,000

B)$8,370,000

C)$6,515,200

D)$5,670,000

E)$4,895,100

Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  Sheryl Frasier has won the Indiana state lottery when the jackpot was $9 million. She has chosen to take the prize winnings as $1 million per year over the next nine years. Using a 7% annual interest rate, determine the present value of the $1 million annuity Sheryl will receive.

Sheryl Frasier has won the Indiana state lottery when the jackpot was $9 million. She has chosen to take the prize winnings as $1 million per year over the next nine years. Using a 7% annual interest rate, determine the present value of the $1 million annuity Sheryl will receive.A)$9,000,000

B)$8,370,000

C)$6,515,200

D)$5,670,000

E)$4,895,100

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

42

Present Value of 1  Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  A company has $50,000 today to invest in a fund that will earn 7% compounded annually. How much will the fund contain at the end of 8 years?

A company has $50,000 today to invest in a fund that will earn 7% compounded annually. How much will the fund contain at the end of 8 years?

Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  A company has $50,000 today to invest in a fund that will earn 7% compounded annually. How much will the fund contain at the end of 8 years?

A company has $50,000 today to invest in a fund that will earn 7% compounded annually. How much will the fund contain at the end of 8 years?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

43

Present Value of 1  Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  A company has $46,000 today to invest in a fund that will earn 4% compounded annually. How much will the fund contain at the end of 6 years?

A company has $46,000 today to invest in a fund that will earn 4% compounded annually. How much will the fund contain at the end of 6 years?

Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  A company has $46,000 today to invest in a fund that will earn 4% compounded annually. How much will the fund contain at the end of 6 years?

A company has $46,000 today to invest in a fund that will earn 4% compounded annually. How much will the fund contain at the end of 6 years?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

44

Present Value of 1  Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  A company is creating a fund today by depositing $65,763. The fund will grow to $90,000 after 8 years. What annual interest rate is the company earning on the fund?

A company is creating a fund today by depositing $65,763. The fund will grow to $90,000 after 8 years. What annual interest rate is the company earning on the fund?

Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  A company is creating a fund today by depositing $65,763. The fund will grow to $90,000 after 8 years. What annual interest rate is the company earning on the fund?

A company is creating a fund today by depositing $65,763. The fund will grow to $90,000 after 8 years. What annual interest rate is the company earning on the fund?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

45

Present Value of 1  Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  Dave wants to retire now but isn't at the eligible retirement age to draw his pension. He has some investment savings and wants to be able to take out $25,000 at the end of each of the next 5 years. His investment pays an average of 6% annual interest. What is the present value of the funds that Dave will be drawing from his investment account?

Dave wants to retire now but isn't at the eligible retirement age to draw his pension. He has some investment savings and wants to be able to take out $25,000 at the end of each of the next 5 years. His investment pays an average of 6% annual interest. What is the present value of the funds that Dave will be drawing from his investment account?

A)$125,000.00

B)$117,500.00

C)$41,666.67

D)$93,412.50

E)$105,310.00

Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  Dave wants to retire now but isn't at the eligible retirement age to draw his pension. He has some investment savings and wants to be able to take out $25,000 at the end of each of the next 5 years. His investment pays an average of 6% annual interest. What is the present value of the funds that Dave will be drawing from his investment account?

Dave wants to retire now but isn't at the eligible retirement age to draw his pension. He has some investment savings and wants to be able to take out $25,000 at the end of each of the next 5 years. His investment pays an average of 6% annual interest. What is the present value of the funds that Dave will be drawing from his investment account?A)$125,000.00

B)$117,500.00

C)$41,666.67

D)$93,412.50

E)$105,310.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

46

Present Value of 1  Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  A company needs to have $150,000 in 5 years, and will create a fund to insure that the $150,000 will be available. If it can earn a 6% return compounded annually, how much must the company invest in the fund today to equal the $150,000 at the end of 5 years?

A company needs to have $150,000 in 5 years, and will create a fund to insure that the $150,000 will be available. If it can earn a 6% return compounded annually, how much must the company invest in the fund today to equal the $150,000 at the end of 5 years?

Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  A company needs to have $150,000 in 5 years, and will create a fund to insure that the $150,000 will be available. If it can earn a 6% return compounded annually, how much must the company invest in the fund today to equal the $150,000 at the end of 5 years?

A company needs to have $150,000 in 5 years, and will create a fund to insure that the $150,000 will be available. If it can earn a 6% return compounded annually, how much must the company invest in the fund today to equal the $150,000 at the end of 5 years?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

47

Present Value of 1  Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  A company has $46,000 today to invest in a fund that will earn 4% compounded annually. How much will the fund contain at the end of 6 years?

A company has $46,000 today to invest in a fund that will earn 4% compounded annually. How much will the fund contain at the end of 6 years?

A)$58,204

B)$47,840

C)$58,075

D)$57,040

E)$62,582

Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  A company has $46,000 today to invest in a fund that will earn 4% compounded annually. How much will the fund contain at the end of 6 years?

A company has $46,000 today to invest in a fund that will earn 4% compounded annually. How much will the fund contain at the end of 6 years?A)$58,204

B)$47,840

C)$58,075

D)$57,040

E)$62,582

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

48

Present Value of 1  Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  A company needs to have $150,000 in 5 years, and will create a fund to insure that the $150,000 will be available. If it can earn a 6% return compounded annually, how much must the company invest in the fund today to equal the $150,000 at the end of 5 years?

A company needs to have $150,000 in 5 years, and will create a fund to insure that the $150,000 will be available. If it can earn a 6% return compounded annually, how much must the company invest in the fund today to equal the $150,000 at the end of 5 years?

A)$141,000

B)$112,095

C)$100,000

D)$111,615

E)$105,000

Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  A company needs to have $150,000 in 5 years, and will create a fund to insure that the $150,000 will be available. If it can earn a 6% return compounded annually, how much must the company invest in the fund today to equal the $150,000 at the end of 5 years?

A company needs to have $150,000 in 5 years, and will create a fund to insure that the $150,000 will be available. If it can earn a 6% return compounded annually, how much must the company invest in the fund today to equal the $150,000 at the end of 5 years?A)$141,000

B)$112,095

C)$100,000

D)$111,615

E)$105,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

49

Present Value of 1  Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  Jackson has a loan that requires a $17,000 lump sum payment at the end of four years. The interest rate on the loan is 5%, compounded annually. How much did Jackson borrow today?

Jackson has a loan that requires a $17,000 lump sum payment at the end of four years. The interest rate on the loan is 5%, compounded annually. How much did Jackson borrow today?

A)$16,150

B)$13,600

C)$11,504

D)$13,986

E)$15,343

Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  Jackson has a loan that requires a $17,000 lump sum payment at the end of four years. The interest rate on the loan is 5%, compounded annually. How much did Jackson borrow today?

Jackson has a loan that requires a $17,000 lump sum payment at the end of four years. The interest rate on the loan is 5%, compounded annually. How much did Jackson borrow today?A)$16,150

B)$13,600

C)$11,504

D)$13,986

E)$15,343

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

50

Present Value of 1  Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  A company needs to have $200,000 in 4 years, and will create a fund to insure that amount will be available. If it can earn a 7% return compounded annually, how much must the company invest in the fund today to equal the $200,000 at the end of 4 years?

A company needs to have $200,000 in 4 years, and will create a fund to insure that amount will be available. If it can earn a 7% return compounded annually, how much must the company invest in the fund today to equal the $200,000 at the end of 4 years?

Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  A company needs to have $200,000 in 4 years, and will create a fund to insure that amount will be available. If it can earn a 7% return compounded annually, how much must the company invest in the fund today to equal the $200,000 at the end of 4 years?

A company needs to have $200,000 in 4 years, and will create a fund to insure that amount will be available. If it can earn a 7% return compounded annually, how much must the company invest in the fund today to equal the $200,000 at the end of 4 years?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

51

Present Value of 1  Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  A company is setting aside $21,354 today, and wishes to have $30,000 at the end of three years for a down payment on a piece of property. What interest rate must the company earn?

A company is setting aside $21,354 today, and wishes to have $30,000 at the end of three years for a down payment on a piece of property. What interest rate must the company earn?

Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  A company is setting aside $21,354 today, and wishes to have $30,000 at the end of three years for a down payment on a piece of property. What interest rate must the company earn?

A company is setting aside $21,354 today, and wishes to have $30,000 at the end of three years for a down payment on a piece of property. What interest rate must the company earn?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

52

Present Value of 1  Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  A company needs to have $150,000 in 5 years, and will create a fund to insure that the $150,000 will be available. If it can earn a 6% return compounded semiannually, how much must the company invest in the fund today to equal the $150,000 at the end of 5 years?

A company needs to have $150,000 in 5 years, and will create a fund to insure that the $150,000 will be available. If it can earn a 6% return compounded semiannually, how much must the company invest in the fund today to equal the $150,000 at the end of 5 years?

A)$141,000

B)$112,095

C)$100,000

D)$111,615

E)$105,000

Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  A company needs to have $150,000 in 5 years, and will create a fund to insure that the $150,000 will be available. If it can earn a 6% return compounded semiannually, how much must the company invest in the fund today to equal the $150,000 at the end of 5 years?

A company needs to have $150,000 in 5 years, and will create a fund to insure that the $150,000 will be available. If it can earn a 6% return compounded semiannually, how much must the company invest in the fund today to equal the $150,000 at the end of 5 years?A)$141,000

B)$112,095

C)$100,000

D)$111,615

E)$105,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

53

Present Value of 1  Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  Jackson has a loan that requires a $17,000 lump sum payment at the end of four years. The interest rate on the loan is 5%, compounded annually. How much did Jackson borrow today?

Jackson has a loan that requires a $17,000 lump sum payment at the end of four years. The interest rate on the loan is 5%, compounded annually. How much did Jackson borrow today?

Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  Jackson has a loan that requires a $17,000 lump sum payment at the end of four years. The interest rate on the loan is 5%, compounded annually. How much did Jackson borrow today?

Jackson has a loan that requires a $17,000 lump sum payment at the end of four years. The interest rate on the loan is 5%, compounded annually. How much did Jackson borrow today?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

54

Present Value of 1  Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  The Masterson family is setting up a vacation fund, and they plan on depositing $1,000 per quarter in an investment that will pay 12% annual interest. What amount will they have available for their vacation at the end of 2 years?

The Masterson family is setting up a vacation fund, and they plan on depositing $1,000 per quarter in an investment that will pay 12% annual interest. What amount will they have available for their vacation at the end of 2 years?

A)$8,000.00

B)$8,960.00

C)$8,892.30

D)$8,240.00

E)$8,487.20

Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  The Masterson family is setting up a vacation fund, and they plan on depositing $1,000 per quarter in an investment that will pay 12% annual interest. What amount will they have available for their vacation at the end of 2 years?

The Masterson family is setting up a vacation fund, and they plan on depositing $1,000 per quarter in an investment that will pay 12% annual interest. What amount will they have available for their vacation at the end of 2 years?A)$8,000.00

B)$8,960.00

C)$8,892.30

D)$8,240.00

E)$8,487.20

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

55

Present Value of 1  Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  Garcia Brass Fixtures is planning on replacing one of its machines in five years by making a one-time deposit of $20,000 today and four yearly contributions of $5,000 beginning at the end of year 1. The deposits will earn 10% interest. How much money will Garcia have accumulated at the end of five years to replace the machine?

Garcia Brass Fixtures is planning on replacing one of its machines in five years by making a one-time deposit of $20,000 today and four yearly contributions of $5,000 beginning at the end of year 1. The deposits will earn 10% interest. How much money will Garcia have accumulated at the end of five years to replace the machine?

Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  Garcia Brass Fixtures is planning on replacing one of its machines in five years by making a one-time deposit of $20,000 today and four yearly contributions of $5,000 beginning at the end of year 1. The deposits will earn 10% interest. How much money will Garcia have accumulated at the end of five years to replace the machine?

Garcia Brass Fixtures is planning on replacing one of its machines in five years by making a one-time deposit of $20,000 today and four yearly contributions of $5,000 beginning at the end of year 1. The deposits will earn 10% interest. How much money will Garcia have accumulated at the end of five years to replace the machine?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

56

Present Value of 1  Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  Mason Company has acquired a machine from a dealer that requires a single payment of $45,000 at the end of five years. This transaction includes interest at 8%, compounded semiannually. What is the value of the machine today?

Mason Company has acquired a machine from a dealer that requires a single payment of $45,000 at the end of five years. This transaction includes interest at 8%, compounded semiannually. What is the value of the machine today?

Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  Mason Company has acquired a machine from a dealer that requires a single payment of $45,000 at the end of five years. This transaction includes interest at 8%, compounded semiannually. What is the value of the machine today?

Mason Company has acquired a machine from a dealer that requires a single payment of $45,000 at the end of five years. This transaction includes interest at 8%, compounded semiannually. What is the value of the machine today?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

57

Present Value of 1  Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  Protocol Company has acquired equipment from a dealer that requires equal payments of $12,000 at the end of the next five years. This transaction includes interest at 9%, compounded annually. What is the value of the machine today?

Protocol Company has acquired equipment from a dealer that requires equal payments of $12,000 at the end of the next five years. This transaction includes interest at 9%, compounded annually. What is the value of the machine today?

Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  Protocol Company has acquired equipment from a dealer that requires equal payments of $12,000 at the end of the next five years. This transaction includes interest at 9%, compounded annually. What is the value of the machine today?

Protocol Company has acquired equipment from a dealer that requires equal payments of $12,000 at the end of the next five years. This transaction includes interest at 9%, compounded annually. What is the value of the machine today?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

58

Present Value of 1  Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  Kelsey has a loan that requires a $25,000 lump sum payment at the end of three years. The interest rate on the loan is 5%, compounded annually. How much did Kelsey borrow today?

Kelsey has a loan that requires a $25,000 lump sum payment at the end of three years. The interest rate on the loan is 5%, compounded annually. How much did Kelsey borrow today?

Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  Kelsey has a loan that requires a $25,000 lump sum payment at the end of three years. The interest rate on the loan is 5%, compounded annually. How much did Kelsey borrow today?

Kelsey has a loan that requires a $25,000 lump sum payment at the end of three years. The interest rate on the loan is 5%, compounded annually. How much did Kelsey borrow today?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

59

Present Value of 1  Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  Trey has $105,000 now. He has a loan of $175,000 that he must pay at the end of 5 years. He can invest his $105,000 at 10% interest compounded semiannually. Will Trey have enough to pay his loan at the end of the 5 years? If not, by how much will he be short?

Trey has $105,000 now. He has a loan of $175,000 that he must pay at the end of 5 years. He can invest his $105,000 at 10% interest compounded semiannually. Will Trey have enough to pay his loan at the end of the 5 years? If not, by how much will he be short?

Future Value of 1

Future Value of 1  Present Value of an Annuity of 1

Present Value of an Annuity of 1  Future Value of an Annuity of 1