Deck 7: Property, Plant and Equipment

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/24

العب

ملء الشاشة (f)

Deck 7: Property, Plant and Equipment

1

Outline the two situations where an asset revaluation surplus may be transferred to retained earnings.

The first situation is where the associated non-current asset is derecognised (that is,removed from the statement of financial position).In this case the whole or part of the surplus may be transferred.The second situation is where an asset is being used up over its useful life,a proportion of the revaluation surplus,in relation to the depreciation on the asset,may be transferred to retained earnings.

2

A change in accounting policy from the revaluation model to the cost model requires a retrospective adjustment to the:

A)revenue in the profit and loss statement

B)expenses in the profit and loss statement

C)opening balance of retained earnings

D)other comprehensive income.

A)revenue in the profit and loss statement

B)expenses in the profit and loss statement

C)opening balance of retained earnings

D)other comprehensive income.

C

3

Revaluations under AASB 116 Property,Plant and Equipment apply to:

A)all assets on an individual basis

B)individual current assets only

C)individual non-current assets only

D)assets on a class-by-class basis.

A)all assets on an individual basis

B)individual current assets only

C)individual non-current assets only

D)assets on a class-by-class basis.

D

4

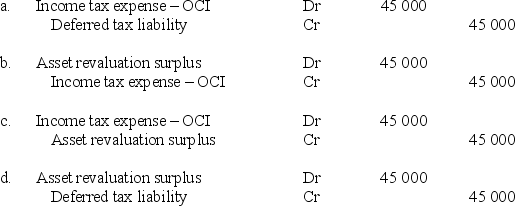

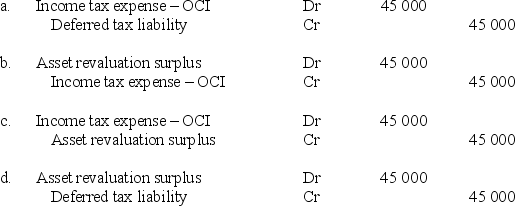

The net effect of the journal entries to adjust for the tax effect of the revaluation at 30 June 2012 is:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

5

Wilson Limited applied the straight-line method of depreciation to its non-current assets.The cost of the buildings was $640 000 the depreciable amount is $560 000 the residual value is $40 000 and the useful life is 8 years.The annual depreciation charge is:

A)$80 000

B)$75 000

C)$70 000

D)$65 000.

A)$80 000

B)$75 000

C)$70 000

D)$65 000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

6

Property,plant and equipment are assets that:

A)are expected to be used up within the current financial period

B)are held for resale within the current period

C)are physical in nature

D)have a remaining productive life of less than one financial year.

A)are expected to be used up within the current financial period

B)are held for resale within the current period

C)are physical in nature

D)have a remaining productive life of less than one financial year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

7

When an asset is sold the resulting gain or loss is:

A)reported in other comprehensive income,normally on a gross basis

B)reported in other comprehensive income,normally on a net basis

C)reported in current period profit or loss,normally on a gross basis

D)reported in current period profit or loss,normally on a net basis

A)reported in other comprehensive income,normally on a gross basis

B)reported in other comprehensive income,normally on a net basis

C)reported in current period profit or loss,normally on a gross basis

D)reported in current period profit or loss,normally on a net basis

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

8

Speculator Limited acquired a parcel of land for $50 000.This amount is also the tax base of the land.Two years after acquisition date the building was revalued to $80 000.The tax rate is 30%.The appropriate journal entry to recognise the net effect of the revaluation is:

A)DR Gain on revaluation - OCI $30 000 CR Asset revaluation surplus $30 000

B)DR Land $21 000 DR Income tax expense - OCI $ 9 000

CR Asset revaluation surplus $30 000

C)DR Land $30 000 CR Deferred tax liability $ 9 000

CR Asset revaluation surplus $21 000

D)DR Gain on revaluation - OCI $30 000 CR Income tax expense - OCI $9 000

CR Asset revaluation surplus $21 000

A)DR Gain on revaluation - OCI $30 000 CR Asset revaluation surplus $30 000

B)DR Land $21 000 DR Income tax expense - OCI $ 9 000

CR Asset revaluation surplus $30 000

C)DR Land $30 000 CR Deferred tax liability $ 9 000

CR Asset revaluation surplus $21 000

D)DR Gain on revaluation - OCI $30 000 CR Income tax expense - OCI $9 000

CR Asset revaluation surplus $21 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

9

Troubadour Limited had an existing revaluation surplus in respect to an item of Plant that had been derecognised.An appropriate journal entry to transfer the surplus to retained earnings would include:

A)DR Gain on revaluation - OCI

B)CR Asset revaluation surplus

C)DR Retained earnings

D)CR Retained earnings.

A)DR Gain on revaluation - OCI

B)CR Asset revaluation surplus

C)DR Retained earnings

D)CR Retained earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

10

After an asset has been initially recognised at cost it may be measured using the following measurement method:

A)liquidation value

B)accrual

C)revaluation

D)realisable value.

A)liquidation value

B)accrual

C)revaluation

D)realisable value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

11

Under the cost model,after initial recognition of a Property,plant and equipment asset the item must be carried at its:

A)residual value

B)cost less accumulated depreciation and less accumulated impairment losses

C)initial cost

D)net present value.

A)residual value

B)cost less accumulated depreciation and less accumulated impairment losses

C)initial cost

D)net present value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

12

Jackson Limited acquired a bundle of assets for a cash consideration of $200 000.The fair values of the assets on date of acquisition was as follows: Building $132 000,Furniture $88 000.The appropriate journal entry to record this acquisition is:

A)DR Property,plant and equipment $200 000 CR Cash $200 000

B)DR Property,plant and equipment $220 000 CR Cash $220 000

C)DR Building $120 000 DR Furniture $ 80 000

CR Cash $200 000

D)DR Building $132 000 DR Furniture $ 88 000

CR Cash $220 000

A)DR Property,plant and equipment $200 000 CR Cash $200 000

B)DR Property,plant and equipment $220 000 CR Cash $220 000

C)DR Building $120 000 DR Furniture $ 80 000

CR Cash $200 000

D)DR Building $132 000 DR Furniture $ 88 000

CR Cash $220 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

13

Which of the following statements is not correct in relation to disclosure of property,plant & equipment balances?

A)Paragraph 79 of AASB 116 contains disclosure that are encouraged,but not required in relation to property,plant & equipment.

B)An entity must disclose the useful life estimates for each class of assets.

C)A summary of movements in the revaluation surplus is required to be disclosed.

D)Information on assets carried at revalued amounts must be disclosed on an individual asset basis.

A)Paragraph 79 of AASB 116 contains disclosure that are encouraged,but not required in relation to property,plant & equipment.

B)An entity must disclose the useful life estimates for each class of assets.

C)A summary of movements in the revaluation surplus is required to be disclosed.

D)Information on assets carried at revalued amounts must be disclosed on an individual asset basis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

14

Replicator Limited acquired an item of Plant with an expected useful life of 5 years.Expected total production output over this period was: Year 1,35 000 units; Year 2,30 000 units; Year 3,18 000 units; Year 4,12 000 units; Year 5,5000 units.The asset cost $ 100 000 and associated installation costs amounted to $20 000 and residual value is $5 000.The amount of depreciation charged in the first year is:

A)$40 250

B)$42 000

C)$35 000

D)$33 250.

A)$40 250

B)$42 000

C)$35 000

D)$33 250.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

15

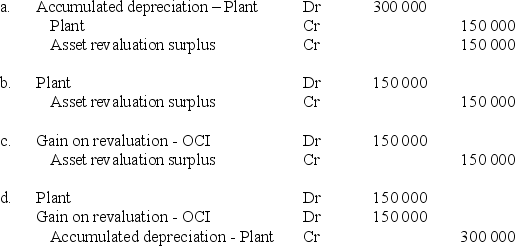

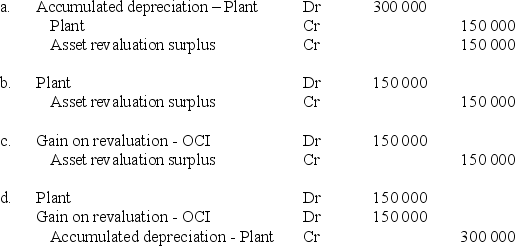

The net effect of the journal entries necessary to record the revaluation of plant at 30 June 2012 in accordance with AASB 116 Property,Plant and Equipment is:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

16

When a company recognises a depreciation credit resulting from a review of the estimated residual value of a depreciable asset,the depreciation debit should be recognised in accumulated depreciation and the depreciation credit should be recognised:

A)in the opening balance of retained earnings

B)in the current period depreciation expense

C)directly in the depreciable asset account

D)as a gain in the current period.

A)in the opening balance of retained earnings

B)in the current period depreciation expense

C)directly in the depreciable asset account

D)as a gain in the current period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

17

When using the revaluation model:

A)ongoing record keeping costs are generally lower than if the cost model were used.

B)the values reported will provide more relevant information to users of the financial statements.

C)depreciation costs will generally be lower than under the cost model.

D)the entities financial statements will be consistent with USGAAP requirements.

A)ongoing record keeping costs are generally lower than if the cost model were used.

B)the values reported will provide more relevant information to users of the financial statements.

C)depreciation costs will generally be lower than under the cost model.

D)the entities financial statements will be consistent with USGAAP requirements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

18

Property,plant and equipment includes items that are:

A)intangible

B)held for resale

C)expected to be used up during the current period

D)held for rental to others.

A)intangible

B)held for resale

C)expected to be used up during the current period

D)held for rental to others.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

19

The cost of property,plant and equipment is only recognised as an asset if it is probable that the future economic benefits will flow to the entity and if:

A)the cost can be reliably measured

B)the asset has been fully paid for in cash

C)the asset has been received by the purchaser

D)it is a tangible asset.

A)the cost can be reliably measured

B)the asset has been fully paid for in cash

C)the asset has been received by the purchaser

D)it is a tangible asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

20

A non-current Property,plant and equipment asset is depreciated using the straight-line method.The asset was revalued upwards after four years of use.There is no change in the remaining useful life of six years or to the residual value.Which of the following relationships reflects the effect of the revaluation on the prospective depreciation of the asset?

Depreciation Annual depreciation

Rate Expense

A)Same Higher

B)Same Same

C)Higher Higher

D)Higher Same

Depreciation Annual depreciation

Rate Expense

A)Same Higher

B)Same Same

C)Higher Higher

D)Higher Same

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

21

Explain how an entity determines the useful life of an asset for the purpose of calculating a periodic depreciation charge.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

22

Provide a definition of 'residual value' of an asset,and explain the nature of residual value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

23

Discuss the notion that depreciation is a process of allocation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

24

Distinguish between the accounting treatment for a revaluation increment and a revaluation decrement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck