Deck 32: Income Taxes in Capital Budgeting Decisions

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/33

العب

ملء الشاشة (f)

Deck 32: Income Taxes in Capital Budgeting Decisions

1

In a net present value analysis of an equipment upgrade using a 30% tax rate, what amount of cash savings would have the same present value as a $168,000 depreciation deduction?

A) $35,280

B) $50,400

C) $72,000

D) $117,600

A) $35,280

B) $50,400

C) $72,000

D) $117,600

C

2

A company anticipates a depreciation deduction of $30,000 in year 2 of a project. The company's tax rate is 30% and its discount rate is 10%. The present value of the depreciation tax shield resulting from this deduction is closest to:

A) $9,000

B) $17,355

C) $7,438

D) $21,000

A) $9,000

B) $17,355

C) $7,438

D) $21,000

C

3

If a company operates at a profit, the after-tax cost of a tax-deductible cash expense is determined by multiplying the cash expense by one minus the tax rate.

True

4

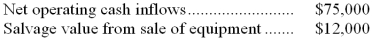

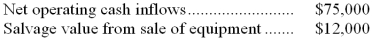

Uzzle Corporation uses a discount rate of 10% and has a tax rate of 30%. The following cash flows occur in the last year of an 8-year equipment selection investment project:

The assumed salvage value was zero when the depreciation deductions were computed for tax purposes. The total after-tax present value of the cash flows above is closest to:

A) $12,189

B) $24,518

C) $26,199

D) $28,440

The assumed salvage value was zero when the depreciation deductions were computed for tax purposes. The total after-tax present value of the cash flows above is closest to:

A) $12,189

B) $24,518

C) $26,199

D) $28,440

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

5

All of Schnider Company's sales and expenses last year were for cash. The tax rate was 30%. If the net cash inflow (after taxes) last year was $18,900, and if the total gross cash sales were $75,000, then the total cash expenses before taxes must have been:

A) $27,000

B) $48,000

C) $52,000

D) $37,000

A) $27,000

B) $48,000

C) $52,000

D) $37,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

6

Last year a firm had taxable cash receipts of $800,000 and the tax rate was 30%. The after-tax net cash inflow from these receipts was:

A) $800,000

B) $640,000

C) $560,000

D) $240,000

A) $800,000

B) $640,000

C) $560,000

D) $240,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

7

In a plant expansion capital budgeting decision, which of the following amounts would be affected by a change in the tax rate?

A) the present value of the cash inflows from increased sales.

B) the present value of the tax savings from the depreciation tax shield.

C) the present value of the cost of building repairs needed in Year 8 of the project.

D) all of these.

A) the present value of the cash inflows from increased sales.

B) the present value of the tax savings from the depreciation tax shield.

C) the present value of the cost of building repairs needed in Year 8 of the project.

D) all of these.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

8

A company anticipates a taxable cash expense of $50,000 in year 2 of a project. The company's tax rate is 30% and its discount rate is 14%. The present value of this future cash flow is closest to:

A) $(26,931)

B) $(11,542)

C) $(15,000)

D) $(35,000)

A) $(26,931)

B) $(11,542)

C) $(15,000)

D) $(35,000)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

9

Eyring Industries has a truck purchased seven years ago at a cost of $6,000. At the time of purchase, the ultimate salvage value was estimated at $500, but salvage value was ignored in depreciation deductions. The truck is now fully depreciated. Assuming a tax rate of 40%, if the truck is sold for $500, the after-tax cash inflow for capital budgeting purposes will be:

A) $500

B) $300

C) $200

D) $100

A) $500

B) $300

C) $200

D) $100

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

10

Kane Company is in the process of purchasing a new machine for its production line. It is near the end of the year, and the machine is being offered at a special discount if purchased before the end of the year. Kane has determined that the depreciation deduction for tax purposes on the new machine for the year of purchase would be $13,000. The tax rate is 30%. If Kane purchases the machine and reports a positive net operating income for the year, then the tax savings from the deprecation tax shield related to this machine for the year of purchase would be:

A) $3,900

B) $9,100

C) $13,000

D) $0

A) $3,900

B) $9,100

C) $13,000

D) $0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

11

Which of the following would decrease the net present value of a project?

A) A decrease in the income tax rate.

B) A decrease in the initial investment.

C) An increase in the useful life of the project.

D) An increase in the discount rate.

A) A decrease in the income tax rate.

B) A decrease in the initial investment.

C) An increase in the useful life of the project.

D) An increase in the discount rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

12

A company needs an increase in working capital of $30,000 in a project that will last 2 years. The company's tax rate is 30% and its discount rate is 14%. The present value of the release of the working capital at the end of the project is closest to:

A) $16,159

B) $9,000

C) $21,000

D) $23,084

A) $16,159

B) $9,000

C) $21,000

D) $23,084

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

13

The calculation of the net present value of an investment project requires that the depreciation tax shield be included at:

A) the amount of the depreciation with no adjustment for taxes.

B) the amount of the depreciation times one minus the tax rate.

C) the amount of the depreciation times the tax rate.

D) zero, since depreciation is not relevant to the calculation of net present value.

A) the amount of the depreciation with no adjustment for taxes.

B) the amount of the depreciation times one minus the tax rate.

C) the amount of the depreciation times the tax rate.

D) zero, since depreciation is not relevant to the calculation of net present value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

14

To determine the effect of income taxes on a project, multiply the net present value of the project by one minus the tax rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

15

Aardvik Corporation is considering renting a new building at an annual rent of $10,000. At a tax rate of 40%, the after-tax cost of the proposed rent would be:

A) $4,000

B) $6,000

C) $10,000

D) $5,000

A) $4,000

B) $6,000

C) $10,000

D) $5,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

16

If a company is operating at a profit, all cash inflows associated with an investment project should be multiplied by one minus the tax rate to be placed on an after-tax basis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

17

An investment of $180,000 made now will yield an annual net after-tax cash operating inflow of $24,000 for each of the next ten years. The tax rate is 40%. The annual net before-tax cash operating inflow is:

A) $60,000

B) $14,400

C) $9,600

D) $40,000

A) $60,000

B) $14,400

C) $9,600

D) $40,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

18

A company anticipates a taxable cash receipt of $20,000 in year 4 of a project. The company's tax rate is 30% and its discount rate is 14%. The present value of this future cash flow is closest to:

A) $14,000

B) $6,000

C) $3,552

D) $8,289

A) $14,000

B) $6,000

C) $3,552

D) $8,289

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

19

Suppose a machine that costs $80,000 has a useful life of 10 years. Also suppose that depreciation on the machine is $8,000 for tax purposes in year 4. The tax rate is 40%. The tax savings from the depreciation tax shield in year 4 would be:

A) $4,800 inflow

B) $3,200 inflow

C) $4,800 outflow

D) $3,200 outflow

A) $4,800 inflow

B) $3,200 inflow

C) $4,800 outflow

D) $3,200 outflow

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

20

Brownell Inc. currently has annual cash revenues of $240,000 and annual expenses of $185,000. The expenses are all cash except for $35,000 of depreciation. The company is considering the purchase of a new mixing machine costing $120,000 that would increase cash revenues to $290,000 and expenses (including depreciation) to $205,000 in year two. The new machine would increase depreciation expense to $50,000 per year. The company's tax rate is 40%. Brownell's incremental after-tax cash flow from the new mixing machine in year two would be:

A) $33,000

B) $24,000

C) $30,000

D) $18,000

A) $33,000

B) $24,000

C) $30,000

D) $18,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

21

Demirjian Inc. is considering an investment project that would require an initial investment of $290,000 and that would last for 8 years. The annual cash receipts from the project would be $189,000 and the annual cash expenses would be $85,000. The equipment used in the project could be sold at the end of the project for a salvage value of $29,000. The company's tax rate is 30%. For tax purposes, the entire initial investment will be depreciated over 7 years without any reduction for salvage value. The company uses a discount rate of 13%.

The net present value of the project is closest to:

A) $121,972

B) $114,339

C) $59,367

D) $67,000

The net present value of the project is closest to:

A) $121,972

B) $114,339

C) $59,367

D) $67,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

22

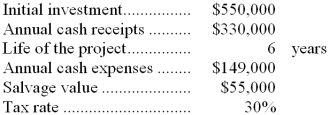

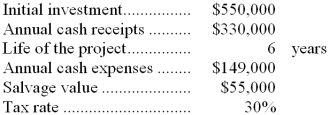

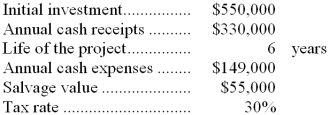

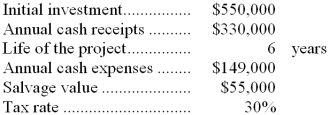

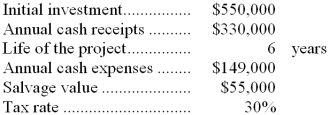

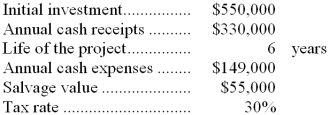

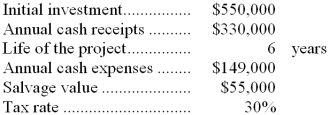

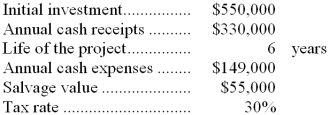

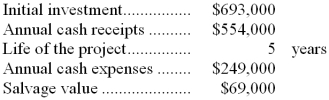

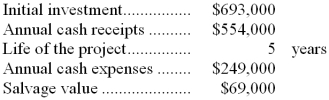

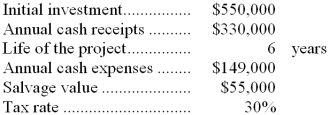

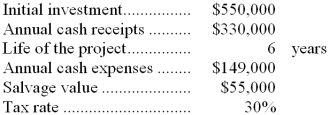

Wable Inc. has provided the following data to be used in evaluating a proposed investment project:  For tax purposes, the entire initial investment without any reduction for salvage value will be depreciated over 5 years. The company uses a discount rate of 16%.

For tax purposes, the entire initial investment without any reduction for salvage value will be depreciated over 5 years. The company uses a discount rate of 16%.

When computing the net present value of the project, what are the annual after-tax cash expenses?

A) $94,000

B) $193,700

C) $44,700

D) $104,300

For tax purposes, the entire initial investment without any reduction for salvage value will be depreciated over 5 years. The company uses a discount rate of 16%.

For tax purposes, the entire initial investment without any reduction for salvage value will be depreciated over 5 years. The company uses a discount rate of 16%.When computing the net present value of the project, what are the annual after-tax cash expenses?

A) $94,000

B) $193,700

C) $44,700

D) $104,300

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

23

Wable Inc. has provided the following data to be used in evaluating a proposed investment project:  For tax purposes, the entire initial investment without any reduction for salvage value will be depreciated over 5 years. The company uses a discount rate of 16%.

For tax purposes, the entire initial investment without any reduction for salvage value will be depreciated over 5 years. The company uses a discount rate of 16%.

The net present value of the project is closest to:

A) $24,931

B) -$67,326

C) -$83,111

D) $40,716

For tax purposes, the entire initial investment without any reduction for salvage value will be depreciated over 5 years. The company uses a discount rate of 16%.

For tax purposes, the entire initial investment without any reduction for salvage value will be depreciated over 5 years. The company uses a discount rate of 16%.The net present value of the project is closest to:

A) $24,931

B) -$67,326

C) -$83,111

D) $40,716

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

24

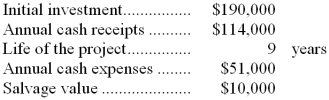

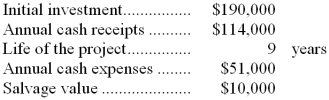

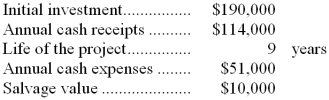

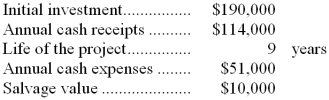

Littau Inc. has provided the following data concerning an investment project that has been proposed:  The company's tax rate is 30%. For tax purposes, the entire initial investment will be depreciated over 7 years without any reduction for salvage value. The company uses a discount rate of 19%.

The company's tax rate is 30%. For tax purposes, the entire initial investment will be depreciated over 7 years without any reduction for salvage value. The company uses a discount rate of 19%.

When computing the net present value of the project, what is the after-tax cash flow from the salvage value in the final year?

A) $0

B) $3,000

C) $10,000

D) $7,000

The company's tax rate is 30%. For tax purposes, the entire initial investment will be depreciated over 7 years without any reduction for salvage value. The company uses a discount rate of 19%.

The company's tax rate is 30%. For tax purposes, the entire initial investment will be depreciated over 7 years without any reduction for salvage value. The company uses a discount rate of 19%.When computing the net present value of the project, what is the after-tax cash flow from the salvage value in the final year?

A) $0

B) $3,000

C) $10,000

D) $7,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

25

Demirjian Inc. is considering an investment project that would require an initial investment of $290,000 and that would last for 8 years. The annual cash receipts from the project would be $189,000 and the annual cash expenses would be $85,000. The equipment used in the project could be sold at the end of the project for a salvage value of $29,000. The company's tax rate is 30%. For tax purposes, the entire initial investment will be depreciated over 7 years without any reduction for salvage value. The company uses a discount rate of 13%.

When computing the net present value of the project, what are the annual after-tax cash receipts?

A) $56,700

B) $104,000

C) $132,300

D) $147,571

When computing the net present value of the project, what are the annual after-tax cash receipts?

A) $56,700

B) $104,000

C) $132,300

D) $147,571

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

26

Wable Inc. has provided the following data to be used in evaluating a proposed investment project:  For tax purposes, the entire initial investment without any reduction for salvage value will be depreciated over 5 years. The company uses a discount rate of 16%.

For tax purposes, the entire initial investment without any reduction for salvage value will be depreciated over 5 years. The company uses a discount rate of 16%.

When computing the net present value of the project, what is the annual amount of the depreciation tax shield? In other words, by how much does the depreciation deduction reduce taxes each year in which the depreciation deduction is taken?

A) $27,500

B) $77,000

C) $33,000

D) $64,167

For tax purposes, the entire initial investment without any reduction for salvage value will be depreciated over 5 years. The company uses a discount rate of 16%.

For tax purposes, the entire initial investment without any reduction for salvage value will be depreciated over 5 years. The company uses a discount rate of 16%.When computing the net present value of the project, what is the annual amount of the depreciation tax shield? In other words, by how much does the depreciation deduction reduce taxes each year in which the depreciation deduction is taken?

A) $27,500

B) $77,000

C) $33,000

D) $64,167

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

27

Management is considering purchasing an asset for $30,000 that would have a useful life of 5 years and no salvage value. For tax purposes, the entire original cost of the asset would be depreciated over 5 years using the straight-line method. The asset would generate annual net cash inflows of $18,000 throughout its useful life. The project would require additional working capital of $8,000, which would be released at the end of the project. The company's tax rate is 30% and its discount rate is 14%.

Required:

What is the net present value of the asset?

Required:

What is the net present value of the asset?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

28

Wable Inc. has provided the following data to be used in evaluating a proposed investment project:  For tax purposes, the entire initial investment without any reduction for salvage value will be depreciated over 5 years. The company uses a discount rate of 16%.

For tax purposes, the entire initial investment without any reduction for salvage value will be depreciated over 5 years. The company uses a discount rate of 16%.

When computing the net present value of the project, what are the annual after-tax cash receipts?

A) $165,000

B) $231,000

C) $99,000

D) $57,750

For tax purposes, the entire initial investment without any reduction for salvage value will be depreciated over 5 years. The company uses a discount rate of 16%.

For tax purposes, the entire initial investment without any reduction for salvage value will be depreciated over 5 years. The company uses a discount rate of 16%.When computing the net present value of the project, what are the annual after-tax cash receipts?

A) $165,000

B) $231,000

C) $99,000

D) $57,750

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

29

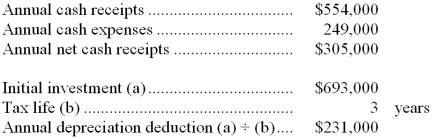

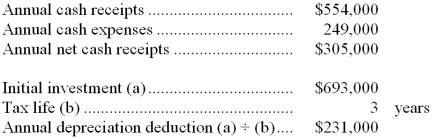

Salomone Inc. has provided the following data concerning a proposed investment project:

The company's tax rate is 30%. For tax purposes, the entire initial investment without any reduction for salvage value will be depreciated over 3 years. The company uses a discount rate of 13%.

Required:

Compute the net present value of the project.

The company's tax rate is 30%. For tax purposes, the entire initial investment without any reduction for salvage value will be depreciated over 3 years. The company uses a discount rate of 13%.

Required:

Compute the net present value of the project.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

30

A company is considering purchasing an asset for $50,000 that would have a useful life of 8 years and would have a salvage value of $7,000. For tax purposes, the entire original cost of the asset would be depreciated over 8 years using the straight-line method and the salvage value would be ignored. The asset would generate annual net cash inflows of $18,000 throughout its useful life. The project would require additional working capital of $2,000, which would be released at the end of the project. The company's tax rate is 30% and its discount rate is 15%.

Required:

What is the net present value of the asset?

Required:

What is the net present value of the asset?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

31

Littau Inc. has provided the following data concerning an investment project that has been proposed:  The company's tax rate is 30%. For tax purposes, the entire initial investment will be depreciated over 7 years without any reduction for salvage value. The company uses a discount rate of 19%.

The company's tax rate is 30%. For tax purposes, the entire initial investment will be depreciated over 7 years without any reduction for salvage value. The company uses a discount rate of 19%.

The net present value of the project is closest to:

A) -$4,949

B) $25,780

C) $23,766

D) -$6,412

The company's tax rate is 30%. For tax purposes, the entire initial investment will be depreciated over 7 years without any reduction for salvage value. The company uses a discount rate of 19%.

The company's tax rate is 30%. For tax purposes, the entire initial investment will be depreciated over 7 years without any reduction for salvage value. The company uses a discount rate of 19%.The net present value of the project is closest to:

A) -$4,949

B) $25,780

C) $23,766

D) -$6,412

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

32

Bauerkemper Inc. is considering a project that would require an initial investment of $924,000 and would have a useful life of 7 years. The annual cash receipts would be $693,000 and the annual cash expenses would be $347,000. The salvage value of the assets used in the project would be $92,000. The company's tax rate is 30%. For tax purposes, the entire initial investment without any reduction for salvage value will be depreciated over 5 years. The company uses a discount rate of 17%.

Required:

Compute the net present value of the project.

Required:

Compute the net present value of the project.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

33

Wable Inc. has provided the following data to be used in evaluating a proposed investment project:  For tax purposes, the entire initial investment without any reduction for salvage value will be depreciated over 5 years. The company uses a discount rate of 16%.

For tax purposes, the entire initial investment without any reduction for salvage value will be depreciated over 5 years. The company uses a discount rate of 16%.

When computing the net present value of the project, what is the after-tax cash flow from the salvage value in the final year?

A) $55,000

B) $38,500

C) $16,500

D) $0

For tax purposes, the entire initial investment without any reduction for salvage value will be depreciated over 5 years. The company uses a discount rate of 16%.

For tax purposes, the entire initial investment without any reduction for salvage value will be depreciated over 5 years. The company uses a discount rate of 16%.When computing the net present value of the project, what is the after-tax cash flow from the salvage value in the final year?

A) $55,000

B) $38,500

C) $16,500

D) $0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck