Deck 23: Service Department Allocations

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/51

العب

ملء الشاشة (f)

Deck 23: Service Department Allocations

1

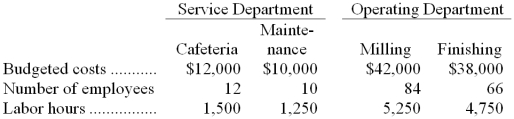

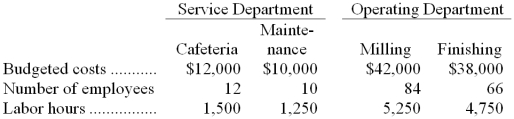

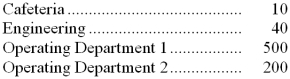

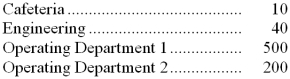

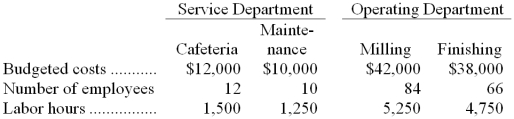

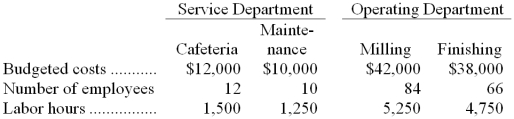

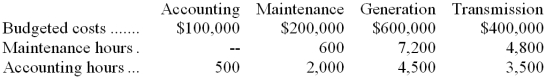

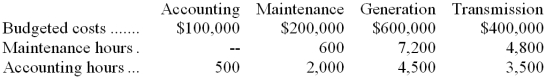

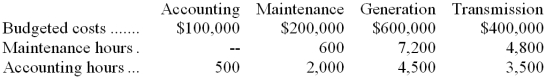

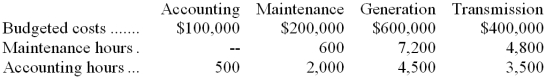

The James Company has four departments with data as follows:

Cafeteria costs are allocated on the basis of number of employees. If the step-down method is used with costs of the Cafeteria allocated first, the amount of cost allocated from the Cafeteria to Maintenance would be:

A) $0

B) $625

C) $698

D) $750

Cafeteria costs are allocated on the basis of number of employees. If the step-down method is used with costs of the Cafeteria allocated first, the amount of cost allocated from the Cafeteria to Maintenance would be:

A) $0

B) $625

C) $698

D) $750

D

2

Reciprocal service department costs are:

A) allocated to producing departments under the direct method but not allocated to producing departments at all under the step-down method.

B) allocated to producing departments under the step-down method but not allocated to producing departments at all under the direct method.

C) not allocated to producing departments under either the direct or the step-down methods.

D) allocated to producing departments under both the direct and step-down methods.

A) allocated to producing departments under the direct method but not allocated to producing departments at all under the step-down method.

B) allocated to producing departments under the step-down method but not allocated to producing departments at all under the direct method.

C) not allocated to producing departments under either the direct or the step-down methods.

D) allocated to producing departments under both the direct and step-down methods.

D

3

If personnel department expenses are allocated on the basis of the number of employees in various departments, then the number of employees in the personnel department itself must be included in the allocation base when the step-down method is used.

False

4

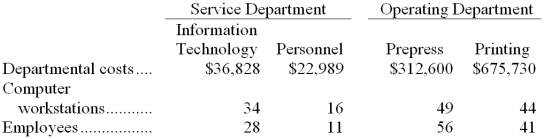

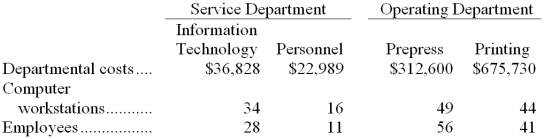

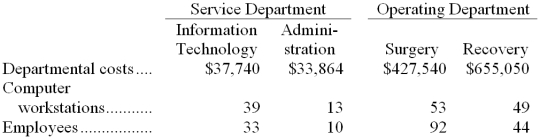

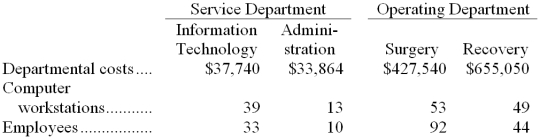

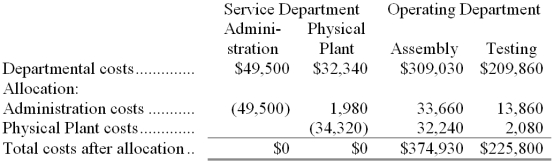

The direct method is used by Hoeffner Publishing, Inc., to allocate service department costs to operating departments. The company has two service departments, Information Technology and Personnel, and two operating departments, Prepress and Printing.

Information Technology Department costs are allocated on the basis of computer workstations and Personnel Department costs are allocated on the basis of employees. The total Prepress Department cost after service department allocations is closest to:

A) $345,276

B) $342,428

C) $334,685

D) $339,455

Information Technology Department costs are allocated on the basis of computer workstations and Personnel Department costs are allocated on the basis of employees. The total Prepress Department cost after service department allocations is closest to:

A) $345,276

B) $342,428

C) $334,685

D) $339,455

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

5

Parker Company has two service departments, cafeteria and engineering, and two operating departments. The number of employees in each department is given below:

The costs of the Cafeteria are allocated to other departments on the basis of the number of employees in the departments. If these costs are budgeted at $69,375, the amount of cost allocated to Engineering under the direct method would be:

A) $0

B) $3,700

C) $3,750

D) $17,344

The costs of the Cafeteria are allocated to other departments on the basis of the number of employees in the departments. If these costs are budgeted at $69,375, the amount of cost allocated to Engineering under the direct method would be:

A) $0

B) $3,700

C) $3,750

D) $17,344

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

6

When would the direct method and the step-down method of service department cost allocation result in identical allocations being made to the operating departments?

A) when there is only one service department

B) when all of the costs in the service departments are fixed costs

C) when there is an equal amount of service departments and operating departments

D) both A and B above

A) when there is only one service department

B) when all of the costs in the service departments are fixed costs

C) when there is an equal amount of service departments and operating departments

D) both A and B above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

7

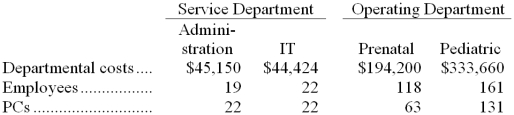

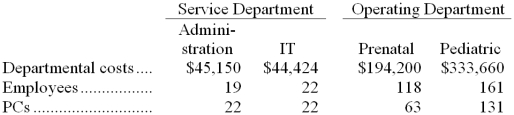

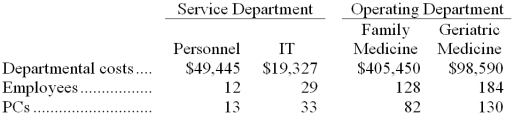

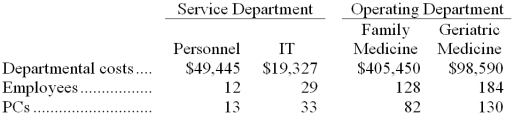

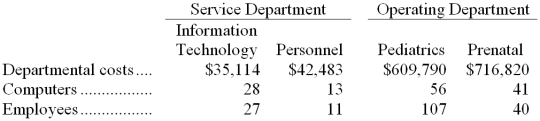

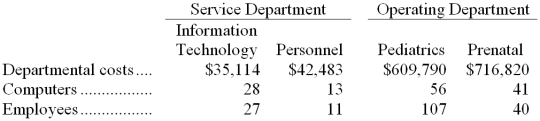

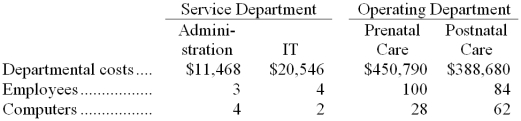

Wiedenheft Children's Clinic allocates service department costs to operating departments using the step-down method. The clinic has two service departments, Administration and Information Technology (IT), and two operating departments, Prenatal and Pediatric. Data concerning those departments follow:

Administration costs are allocated first on the basis of employees and IT costs are allocated second on the basis of PCs. The total Pediatric Department cost after allocations is closest to:

A) $390,036

B) $380,828

C) $389,712

D) $365,886

Administration costs are allocated first on the basis of employees and IT costs are allocated second on the basis of PCs. The total Pediatric Department cost after allocations is closest to:

A) $390,036

B) $380,828

C) $389,712

D) $365,886

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

8

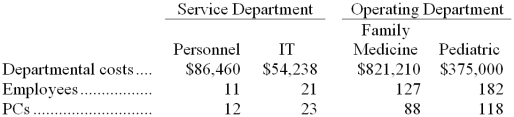

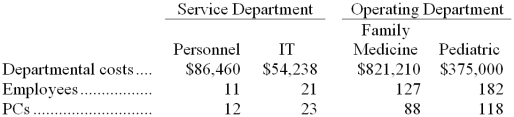

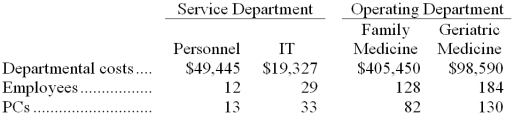

Ranft Clinic uses the step-down method to allocate service department costs to operating departments. The clinic has two service departments, Personnel and Information Technology (IT), and two operating departments, Family Medicine and Pediatric. Data concerning those departments follow:

Personnel costs are allocated first on the basis of employees and IT costs are allocated second on the basis of PCs. The total Pediatric Department cost after allocations is closest to:

A) $456,993

B) $456,904

C) $409,220

D) $447,702

Personnel costs are allocated first on the basis of employees and IT costs are allocated second on the basis of PCs. The total Pediatric Department cost after allocations is closest to:

A) $456,993

B) $456,904

C) $409,220

D) $447,702

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

9

The direct method has the disadvantage that it may leave some service department costs unallocated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

10

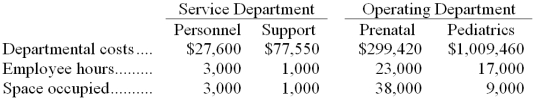

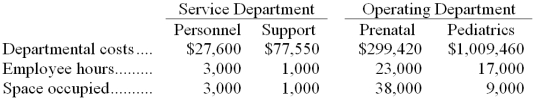

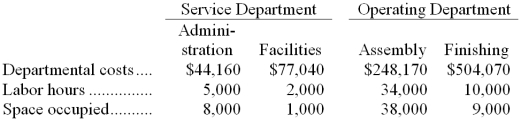

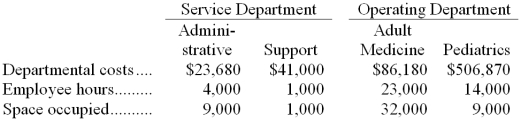

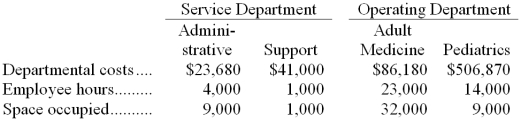

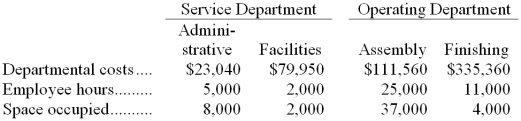

Hypes Clinic uses the direct method to allocate service department costs to operating departments. The clinic has two service departments, Personnel and Support, and two operating departments, Prenatal and Pediatrics.

Personnel Department costs are allocated on the basis of employee hours and Support Department costs are allocated on the basis of space occupied in square feet. The total Pediatrics Department cost after the allocations of service department costs is closest to:

A) $1,036,914

B) $1,036,040

C) $1,024,310

D) $1,033,809

Personnel Department costs are allocated on the basis of employee hours and Support Department costs are allocated on the basis of space occupied in square feet. The total Pediatrics Department cost after the allocations of service department costs is closest to:

A) $1,036,914

B) $1,036,040

C) $1,024,310

D) $1,033,809

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

11

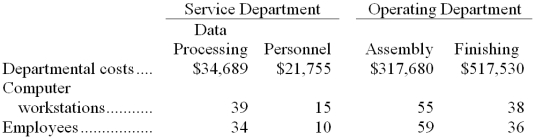

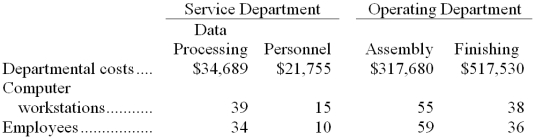

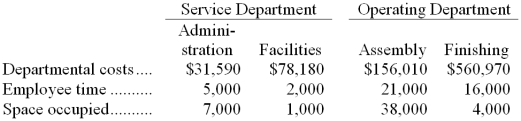

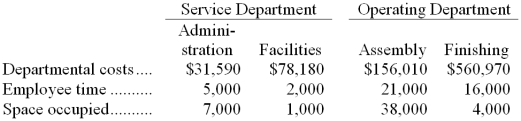

Hopp Corporation uses the direct method to allocate service department costs to operating departments. The company has two service departments, Data Processing and Personnel, and two operating departments, Assembly and Finishing.

Data Processing Department costs are allocated on the basis of computer workstations and Personnel Department costs are allocated on the basis of employees. The total amount of Data Processing Department cost allocated to the two operating departments is closest to:

A) $29,871

B) $82,720

C) $34,689

D) $21,946

Data Processing Department costs are allocated on the basis of computer workstations and Personnel Department costs are allocated on the basis of employees. The total amount of Data Processing Department cost allocated to the two operating departments is closest to:

A) $29,871

B) $82,720

C) $34,689

D) $21,946

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

12

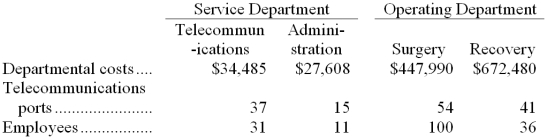

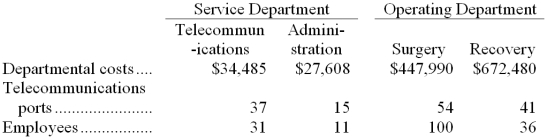

Kormos Surgical Hospital uses the direct method to allocate service department costs to operating departments. The hospital has two service departments, Telecommunications and Administration, and two operating departments, Surgery and Recovery.

Telecommunications Department costs are allocated on the basis of the number of telecommunications ports in departments and Administration Department costs are allocated on the basis of employees. The total Surgery Department cost after service department allocations is closest to:

A) $485,219

B) $481,451

C) $476,168

D) $487,892

Telecommunications Department costs are allocated on the basis of the number of telecommunications ports in departments and Administration Department costs are allocated on the basis of employees. The total Surgery Department cost after service department allocations is closest to:

A) $485,219

B) $481,451

C) $476,168

D) $487,892

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

13

In both the direct and step-down methods of allocating service department costs, any amount of the allocation base that is attributable to the service department whose cost is being allocated is ignored.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

14

The James Company has four departments with data as follows:

Maintenance Department costs are allocated on the basis of labor hours. The amount of cost allocated to Milling from Maintenance under the direct method would be:

A) $5,600

B) $6,720

C) $5,250

D) $5,700

Maintenance Department costs are allocated on the basis of labor hours. The amount of cost allocated to Milling from Maintenance under the direct method would be:

A) $5,600

B) $6,720

C) $5,250

D) $5,700

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

15

The step-down method requires that an order of allocation is established before service department costs can be allocated to operating departments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

16

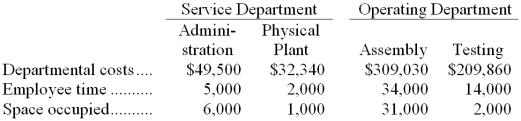

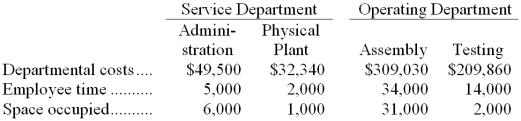

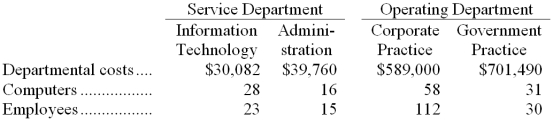

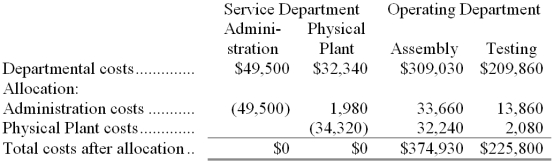

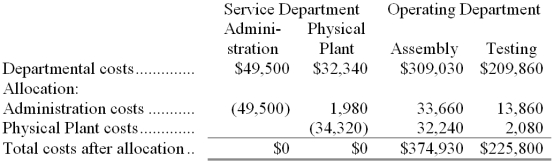

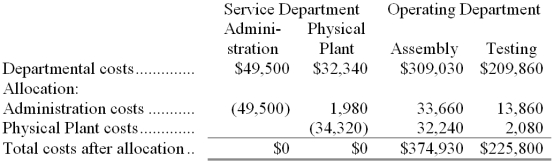

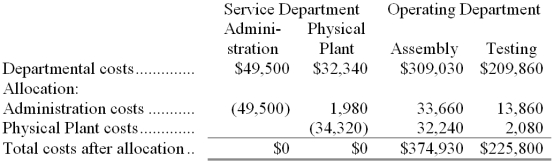

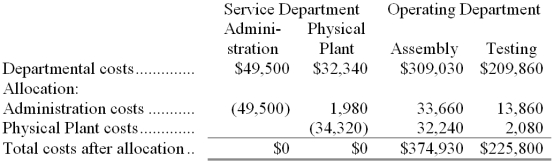

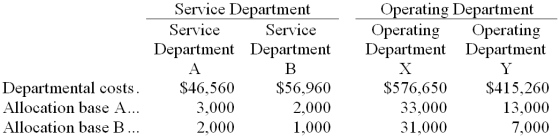

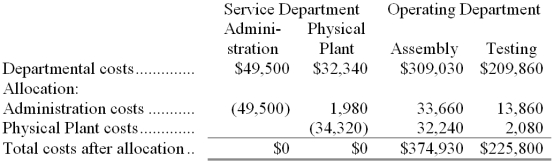

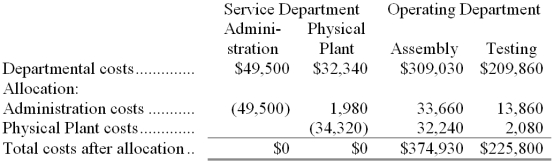

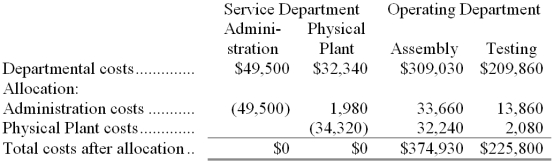

Lisby, Inc., allocates service department costs to operating departments using the step-down method. The company has two service departments, Administration and Physical Plant, and two operating departments, Assembly and Testing. Data concerning those departments follow:

Administration Department costs are allocated first on the basis of employee time and Physical Plant Department costs are allocated second on the basis of space occupied. The total Testing Department cost after allocations is closest to:

A) $226,258

B) $225,800

C) $211,940

D) $224,077

Administration Department costs are allocated first on the basis of employee time and Physical Plant Department costs are allocated second on the basis of space occupied. The total Testing Department cost after allocations is closest to:

A) $226,258

B) $225,800

C) $211,940

D) $224,077

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

17

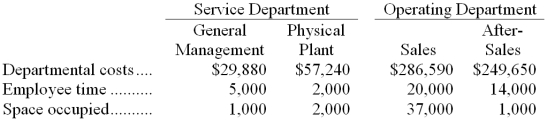

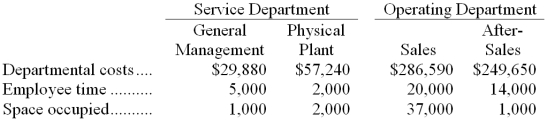

Wisneski Corporation uses the step-down method to allocate service department costs to operating departments. The company has two service departments, General Management and Physical Plant, and two operating departments, Sales and After-Sales. Data concerning those departments follow:

General Management Department costs are allocated first on the basis of employee time and Physical Plant Department costs are allocated second on the basis of space occupied. The total After-Sales Department cost after allocations is closest to:

A) $251,200

B) $261,249

C) $263,460

D) $262,820

General Management Department costs are allocated first on the basis of employee time and Physical Plant Department costs are allocated second on the basis of space occupied. The total After-Sales Department cost after allocations is closest to:

A) $251,200

B) $261,249

C) $263,460

D) $262,820

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

18

Letter Corporation has two service departments (A and B) that provide service to each other and to two operating departments (X and Y). A provides 20% of its service to B, 30% of its service to X, and 50% of its service to Y. B provides 10% of its service to A, 45% of its service to X, and 45% of its service to Y. Operating costs in A are $300,000. Operating costs in B are $180,000. Cost allocations are made starting with department A. No distinction is made between variable and fixed costs.

If service department costs are allocated using the step-down method, what is the total amount of service cost that will be allocated to Y?

A) $231,000

B) $240,000

C) $258,000

D) $270,000

If service department costs are allocated using the step-down method, what is the total amount of service cost that will be allocated to Y?

A) $231,000

B) $240,000

C) $258,000

D) $270,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

19

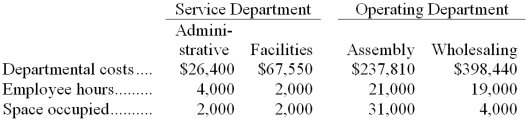

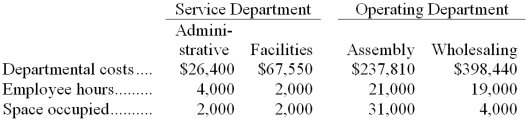

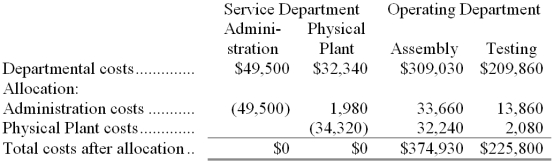

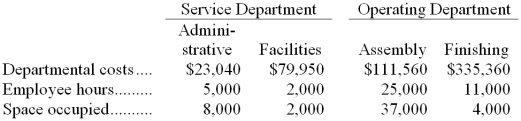

Nolin Corporation uses the direct method to allocate service department costs to operating departments. The company has two service departments, Administrative and Facilities, and two operating departments, Assembly and Wholesaling.

Administrative costs are allocated on the basis of employee hours and Facilities costs are allocated on the basis of space occupied. The total Wholesaling Department cost after the allocations of service department costs is closest to:

A) $418,700

B) $406,160

C) $416,273

D) $418,390

Administrative costs are allocated on the basis of employee hours and Facilities costs are allocated on the basis of space occupied. The total Wholesaling Department cost after the allocations of service department costs is closest to:

A) $418,700

B) $406,160

C) $416,273

D) $418,390

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

20

Letter Corporation has two service departments (A and B) that provide service to each other and to two operating departments (X and Y). A provides 20% of its service to B, 30% of its service to X, and 50% of its service to Y. B provides 10% of its service to A, 45% of its service to X, and 45% of its service to Y. Operating costs in A are $300,000. Operating costs in B are $180,000. Cost allocations are made starting with department A. No distinction is made between variable and fixed costs.

If service department costs are allocated using the direct method, what is the total amount of service cost that will be allocated to X?

A) $172,000

B) $180,000

C) $198,000

D) $202,500

If service department costs are allocated using the direct method, what is the total amount of service cost that will be allocated to X?

A) $172,000

B) $180,000

C) $198,000

D) $202,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

21

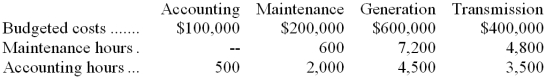

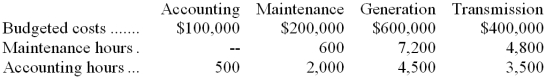

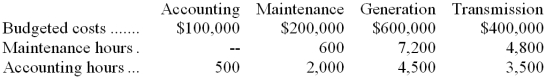

The Mohawk-Hudson Company is an electric utility which has two service departments, Accounting and Maintenance. It has two operating departments, Generation and Transmission. The company does not distinguish between fixed and variable service department costs. Maintenance Department costs are allocated on the basis of maintenance hours. Accounting Department costs are allocated to operating departments on the basis of accounting hours of service provided. Budgeted costs and other data for the coming year are as follows:  The step-down method is used to allocate service department costs, with the accounting department being allocated first.

The step-down method is used to allocate service department costs, with the accounting department being allocated first.

The amount of Maintenance Department cost allocated to the Generation Department would be:

A) $132,000

B) $123,750

C) $150,685

D) $140,000

The step-down method is used to allocate service department costs, with the accounting department being allocated first.

The step-down method is used to allocate service department costs, with the accounting department being allocated first.The amount of Maintenance Department cost allocated to the Generation Department would be:

A) $132,000

B) $123,750

C) $150,685

D) $140,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

22

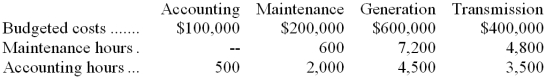

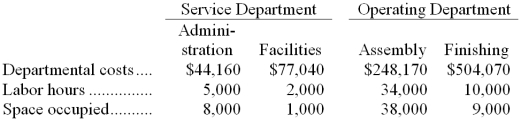

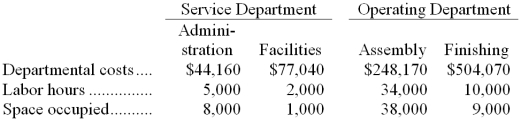

Quezaire Corporation, a manufacturer, uses the step-down method to allocate service department costs to operating departments. The company has two service departments, Administration and Facilities, and two operating departments, Assembly and Finishing. Data concerning those departments follow:  Administration Department costs are allocated first on the basis of labor hours and Facilities Department costs are allocated second on the basis of space occupied.

Administration Department costs are allocated first on the basis of labor hours and Facilities Department costs are allocated second on the basis of space occupied.

In the first step of the allocation, the amount of Administration Department cost allocated to the Assembly Department is closest to:

A) $32,640

B) $14,569

C) $34,124

D) $29,440

Administration Department costs are allocated first on the basis of labor hours and Facilities Department costs are allocated second on the basis of space occupied.

Administration Department costs are allocated first on the basis of labor hours and Facilities Department costs are allocated second on the basis of space occupied.In the first step of the allocation, the amount of Administration Department cost allocated to the Assembly Department is closest to:

A) $32,640

B) $14,569

C) $34,124

D) $29,440

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

23

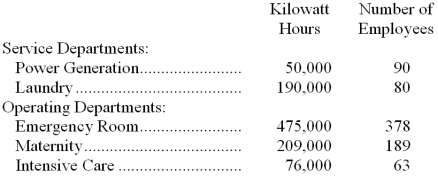

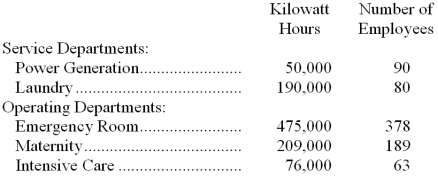

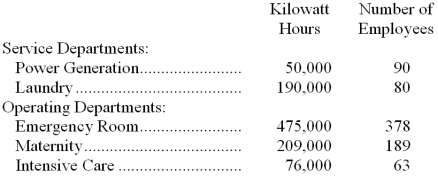

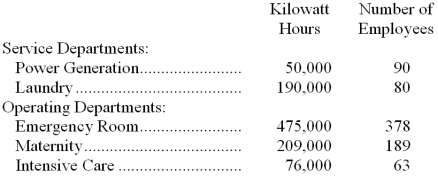

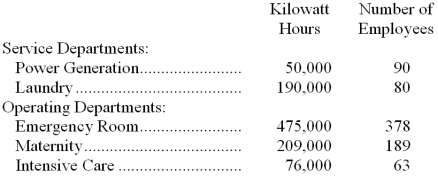

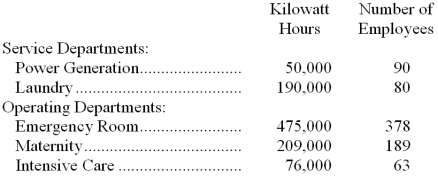

Zoopsia Hospital has two service departments and three operating departments. Selected information on the five departments for last year is as follows:  Zoopsia allocates Power Generation cost first on the basis of kilowatt hours. Zoopsia then allocates Laundry cost on the basis of the number of employees. Operating costs in Power Generation for last year were $250,000. Operating costs in Laundry for last year were $60,000. No distinction is made between variable and fixed costs.

Zoopsia allocates Power Generation cost first on the basis of kilowatt hours. Zoopsia then allocates Laundry cost on the basis of the number of employees. Operating costs in Power Generation for last year were $250,000. Operating costs in Laundry for last year were $60,000. No distinction is made between variable and fixed costs.

If service department costs are allocated using the step-down method, how much service cost will remain in the Power Generation department after allocation?

A) $0

B) $6,750

C) $12,375

D) $12,500

Zoopsia allocates Power Generation cost first on the basis of kilowatt hours. Zoopsia then allocates Laundry cost on the basis of the number of employees. Operating costs in Power Generation for last year were $250,000. Operating costs in Laundry for last year were $60,000. No distinction is made between variable and fixed costs.

Zoopsia allocates Power Generation cost first on the basis of kilowatt hours. Zoopsia then allocates Laundry cost on the basis of the number of employees. Operating costs in Power Generation for last year were $250,000. Operating costs in Laundry for last year were $60,000. No distinction is made between variable and fixed costs.If service department costs are allocated using the step-down method, how much service cost will remain in the Power Generation department after allocation?

A) $0

B) $6,750

C) $12,375

D) $12,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

24

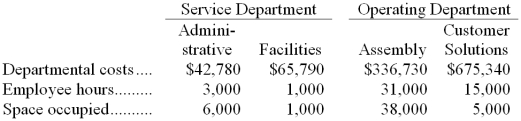

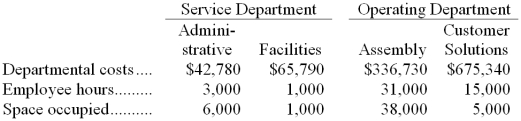

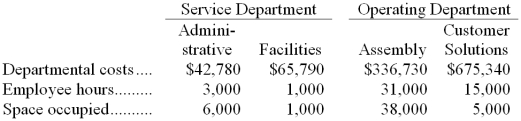

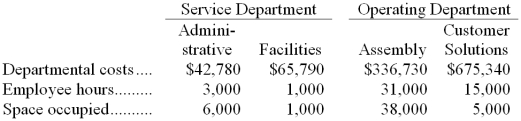

Franca Corporation has two service departments, Administrative and Facilities, and two operating departments, Assembly and Customer Feedbacks.  The company uses the direct method to allocate service department costs to operating departments. Administrative costs are allocated on the basis of employee hours and Facilities costs are allocated on the basis of space occupied.

The company uses the direct method to allocate service department costs to operating departments. Administrative costs are allocated on the basis of employee hours and Facilities costs are allocated on the basis of space occupied.

The total Customer solutions Department cost after the allocations of service department costs is closest to:

A) $696,940

B) $682,990

C) $694,753

D) $697,172

The company uses the direct method to allocate service department costs to operating departments. Administrative costs are allocated on the basis of employee hours and Facilities costs are allocated on the basis of space occupied.

The company uses the direct method to allocate service department costs to operating departments. Administrative costs are allocated on the basis of employee hours and Facilities costs are allocated on the basis of space occupied.The total Customer solutions Department cost after the allocations of service department costs is closest to:

A) $696,940

B) $682,990

C) $694,753

D) $697,172

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

25

Zoopsia Hospital has two service departments and three operating departments. Selected information on the five departments for last year is as follows:  Zoopsia allocates Power Generation cost first on the basis of kilowatt hours. Zoopsia then allocates Laundry cost on the basis of the number of employees. Operating costs in Power Generation for last year were $250,000. Operating costs in Laundry for last year were $60,000. No distinction is made between variable and fixed costs.

Zoopsia allocates Power Generation cost first on the basis of kilowatt hours. Zoopsia then allocates Laundry cost on the basis of the number of employees. Operating costs in Power Generation for last year were $250,000. Operating costs in Laundry for last year were $60,000. No distinction is made between variable and fixed costs.

If service department costs are allocated using the step-down method, what is the total amount of service cost that will be allocated to Maternity?

A) $66,425

B) $73,000

C) $84,500

D) $88,000

Zoopsia allocates Power Generation cost first on the basis of kilowatt hours. Zoopsia then allocates Laundry cost on the basis of the number of employees. Operating costs in Power Generation for last year were $250,000. Operating costs in Laundry for last year were $60,000. No distinction is made between variable and fixed costs.

Zoopsia allocates Power Generation cost first on the basis of kilowatt hours. Zoopsia then allocates Laundry cost on the basis of the number of employees. Operating costs in Power Generation for last year were $250,000. Operating costs in Laundry for last year were $60,000. No distinction is made between variable and fixed costs.If service department costs are allocated using the step-down method, what is the total amount of service cost that will be allocated to Maternity?

A) $66,425

B) $73,000

C) $84,500

D) $88,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

26

Quezaire Corporation, a manufacturer, uses the step-down method to allocate service department costs to operating departments. The company has two service departments, Administration and Facilities, and two operating departments, Assembly and Finishing. Data concerning those departments follow:  Administration Department costs are allocated first on the basis of labor hours and Facilities Department costs are allocated second on the basis of space occupied.

Administration Department costs are allocated first on the basis of labor hours and Facilities Department costs are allocated second on the basis of space occupied.

The total Finishing Department cost after allocations is closest to:

A) $528,859

B) $525,110

C) $528,790

D) $519,190

Administration Department costs are allocated first on the basis of labor hours and Facilities Department costs are allocated second on the basis of space occupied.

Administration Department costs are allocated first on the basis of labor hours and Facilities Department costs are allocated second on the basis of space occupied.The total Finishing Department cost after allocations is closest to:

A) $528,859

B) $525,110

C) $528,790

D) $519,190

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

27

The Mohawk-Hudson Company is an electric utility which has two service departments, Accounting and Maintenance. It has two operating departments, Generation and Transmission. The company does not distinguish between fixed and variable service department costs. Maintenance Department costs are allocated on the basis of maintenance hours. Accounting Department costs are allocated to operating departments on the basis of accounting hours of service provided. Budgeted costs and other data for the coming year are as follows:  The step-down method is used to allocate service department costs, with the accounting department being allocated first.

The step-down method is used to allocate service department costs, with the accounting department being allocated first.

The amount of Maintenance Department cost allocated to the Accounting Department would be:

A) $0

B) $69,315

C) $75,000

D) $88,000

The step-down method is used to allocate service department costs, with the accounting department being allocated first.

The step-down method is used to allocate service department costs, with the accounting department being allocated first.The amount of Maintenance Department cost allocated to the Accounting Department would be:

A) $0

B) $69,315

C) $75,000

D) $88,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

28

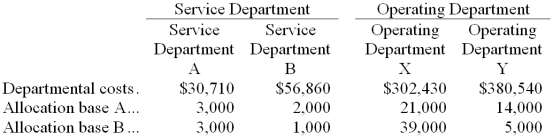

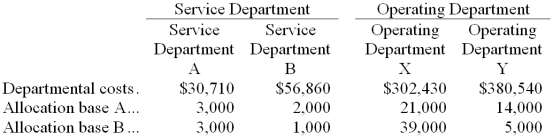

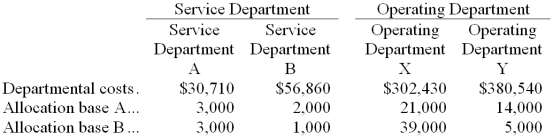

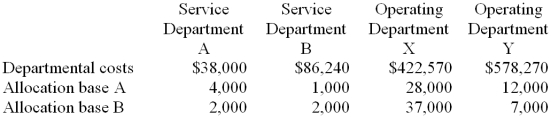

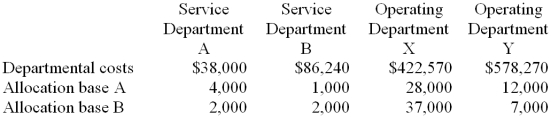

Karnofski Corporation uses the step-down method to allocate service department costs to operating departments. The company has two service departments, Service Department A and Service Department B, and two operating departments, Operating Department X and Operating Department Y. Data concerning those departments follow:  Service Department A costs are allocated first on the basis of allocation base A and Service Department B costs are allocated second on the basis of allocation base B.

Service Department A costs are allocated first on the basis of allocation base A and Service Department B costs are allocated second on the basis of allocation base B.

The total Operating Department Y cost after allocations is closest to:

A) $398,810

B) $397,211

C) $399,285

D) $387,190

Service Department A costs are allocated first on the basis of allocation base A and Service Department B costs are allocated second on the basis of allocation base B.

Service Department A costs are allocated first on the basis of allocation base A and Service Department B costs are allocated second on the basis of allocation base B.The total Operating Department Y cost after allocations is closest to:

A) $398,810

B) $397,211

C) $399,285

D) $387,190

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

29

The Mohawk-Hudson Company is an electric utility which has two service departments, Accounting and Maintenance. It has two operating departments, Generation and Transmission. The company does not distinguish between fixed and variable service department costs. Maintenance Department costs are allocated on the basis of maintenance hours. Accounting Department costs are allocated to operating departments on the basis of accounting hours of service provided. Budgeted costs and other data for the coming year are as follows:  The step-down method is used to allocate service department costs, with the accounting department being allocated first.

The step-down method is used to allocate service department costs, with the accounting department being allocated first.

The amount of accounting department costs allocated to the Maintenance Department would be:

A) $0

B) $20,000

C) $19,048

D) $18,000

The step-down method is used to allocate service department costs, with the accounting department being allocated first.

The step-down method is used to allocate service department costs, with the accounting department being allocated first.The amount of accounting department costs allocated to the Maintenance Department would be:

A) $0

B) $20,000

C) $19,048

D) $18,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

30

Zoopsia Hospital has two service departments and three operating departments. Selected information on the five departments for last year is as follows:  Zoopsia allocates Power Generation cost first on the basis of kilowatt hours. Zoopsia then allocates Laundry cost on the basis of the number of employees. Operating costs in Power Generation for last year were $250,000. Operating costs in Laundry for last year were $60,000. No distinction is made between variable and fixed costs.

Zoopsia allocates Power Generation cost first on the basis of kilowatt hours. Zoopsia then allocates Laundry cost on the basis of the number of employees. Operating costs in Power Generation for last year were $250,000. Operating costs in Laundry for last year were $60,000. No distinction is made between variable and fixed costs.

If service department costs are allocated using the direct method, what is the total amount of service cost that would be allocated to the Emergency Room?

A) $147,100

B) $161,000

C) $182,750

D) $192,250

Zoopsia allocates Power Generation cost first on the basis of kilowatt hours. Zoopsia then allocates Laundry cost on the basis of the number of employees. Operating costs in Power Generation for last year were $250,000. Operating costs in Laundry for last year were $60,000. No distinction is made between variable and fixed costs.

Zoopsia allocates Power Generation cost first on the basis of kilowatt hours. Zoopsia then allocates Laundry cost on the basis of the number of employees. Operating costs in Power Generation for last year were $250,000. Operating costs in Laundry for last year were $60,000. No distinction is made between variable and fixed costs.If service department costs are allocated using the direct method, what is the total amount of service cost that would be allocated to the Emergency Room?

A) $147,100

B) $161,000

C) $182,750

D) $192,250

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

31

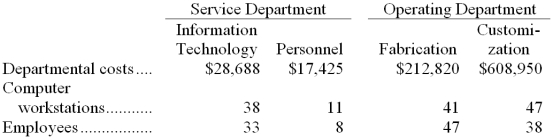

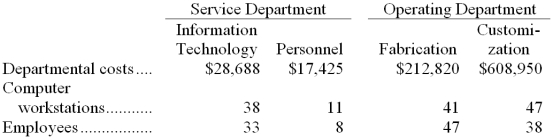

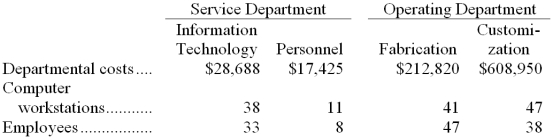

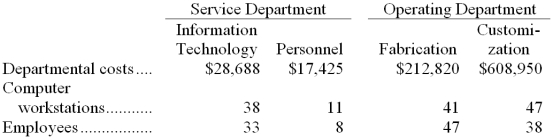

Weisenborn Corporation uses the direct method to allocate service department costs to operating departments. The company has two service departments, Information Technology and Personnel, and two operating departments, Fabrication and Customization.  Information Technology Department costs are allocated on the basis of computer workstations and Personnel Department costs are allocated on the basis of employees.

Information Technology Department costs are allocated on the basis of computer workstations and Personnel Department costs are allocated on the basis of employees.

The total Fabrication Department cost after service department allocations is closest to:

A) $235,821

B) $227,905

C) $234,336

D) $231,641

Information Technology Department costs are allocated on the basis of computer workstations and Personnel Department costs are allocated on the basis of employees.

Information Technology Department costs are allocated on the basis of computer workstations and Personnel Department costs are allocated on the basis of employees.The total Fabrication Department cost after service department allocations is closest to:

A) $235,821

B) $227,905

C) $234,336

D) $231,641

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

32

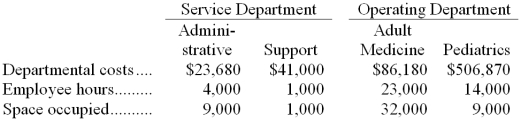

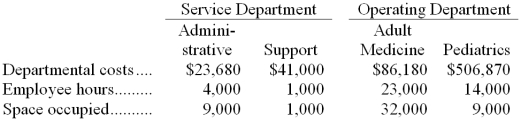

Silguero Clinic has two service departments, Administrative and Support, and two operating departments, Adult Medicine and Pediatrics.  The clinic uses the direct method to allocate service department costs to operating departments. Administrative Department costs are allocated on the basis of employee hours and Support Department costs are allocated on the basis of space occupied in square feet.

The clinic uses the direct method to allocate service department costs to operating departments. Administrative Department costs are allocated on the basis of employee hours and Support Department costs are allocated on the basis of space occupied in square feet.

The total Pediatrics Department cost after the allocations of service department costs is closest to:

A) $521,999

B) $524,830

C) $515,870

D) $525,825

The clinic uses the direct method to allocate service department costs to operating departments. Administrative Department costs are allocated on the basis of employee hours and Support Department costs are allocated on the basis of space occupied in square feet.

The clinic uses the direct method to allocate service department costs to operating departments. Administrative Department costs are allocated on the basis of employee hours and Support Department costs are allocated on the basis of space occupied in square feet.The total Pediatrics Department cost after the allocations of service department costs is closest to:

A) $521,999

B) $524,830

C) $515,870

D) $525,825

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

33

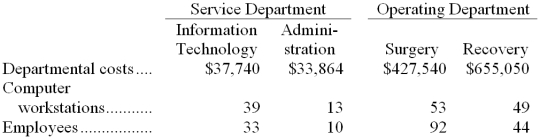

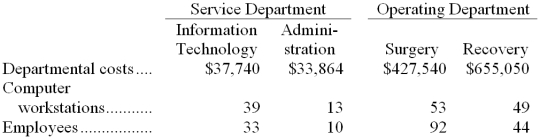

Holmon Surgical Hospital uses the direct method to allocate service department costs to operating departments. The hospital has two service departments, Information Technology and Administration, and two operating departments, Surgery and Recovery.  Information Technology Department costs are allocated on the basis of computer workstations and Administration Department costs are allocated on the basis of employees.

Information Technology Department costs are allocated on the basis of computer workstations and Administration Department costs are allocated on the basis of employees.

The total amount of Information Technology Department cost allocated to the two operating departments is closest to:

A) $37,740

B) $24,997

C) $98,705

D) $33,474

Information Technology Department costs are allocated on the basis of computer workstations and Administration Department costs are allocated on the basis of employees.

Information Technology Department costs are allocated on the basis of computer workstations and Administration Department costs are allocated on the basis of employees.The total amount of Information Technology Department cost allocated to the two operating departments is closest to:

A) $37,740

B) $24,997

C) $98,705

D) $33,474

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

34

The Mohawk-Hudson Company is an electric utility which has two service departments, Accounting and Maintenance. It has two operating departments, Generation and Transmission. The company does not distinguish between fixed and variable service department costs. Maintenance Department costs are allocated on the basis of maintenance hours. Accounting Department costs are allocated to operating departments on the basis of accounting hours of service provided. Budgeted costs and other data for the coming year are as follows:  The step-down method is used to allocate service department costs, with the accounting department being allocated first.

The step-down method is used to allocate service department costs, with the accounting department being allocated first.

The amount of Accounting Department costs allocated to the Generation Department would be:

A) $42,857

B) $57,143

C) $38,000

D) $45,000

The step-down method is used to allocate service department costs, with the accounting department being allocated first.

The step-down method is used to allocate service department costs, with the accounting department being allocated first.The amount of Accounting Department costs allocated to the Generation Department would be:

A) $42,857

B) $57,143

C) $38,000

D) $45,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

35

Silguero Clinic has two service departments, Administrative and Support, and two operating departments, Adult Medicine and Pediatrics.  The clinic uses the direct method to allocate service department costs to operating departments. Administrative Department costs are allocated on the basis of employee hours and Support Department costs are allocated on the basis of space occupied in square feet.

The clinic uses the direct method to allocate service department costs to operating departments. Administrative Department costs are allocated on the basis of employee hours and Support Department costs are allocated on the basis of space occupied in square feet.

The total amount of Administrative Department cost allocated to the Adult Medicine Department is closest to:

A) $18,482

B) $14,333

C) $12,968

D) $14,720

The clinic uses the direct method to allocate service department costs to operating departments. Administrative Department costs are allocated on the basis of employee hours and Support Department costs are allocated on the basis of space occupied in square feet.

The clinic uses the direct method to allocate service department costs to operating departments. Administrative Department costs are allocated on the basis of employee hours and Support Department costs are allocated on the basis of space occupied in square feet.The total amount of Administrative Department cost allocated to the Adult Medicine Department is closest to:

A) $18,482

B) $14,333

C) $12,968

D) $14,720

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

36

Holmon Surgical Hospital uses the direct method to allocate service department costs to operating departments. The hospital has two service departments, Information Technology and Administration, and two operating departments, Surgery and Recovery.  Information Technology Department costs are allocated on the basis of computer workstations and Administration Department costs are allocated on the basis of employees.

Information Technology Department costs are allocated on the basis of computer workstations and Administration Department costs are allocated on the basis of employees.

The total Surgery Department cost after service department allocations is closest to:

A) $463,368

B) $457,933

C) $470,058

D) $467,841

Information Technology Department costs are allocated on the basis of computer workstations and Administration Department costs are allocated on the basis of employees.

Information Technology Department costs are allocated on the basis of computer workstations and Administration Department costs are allocated on the basis of employees.The total Surgery Department cost after service department allocations is closest to:

A) $463,368

B) $457,933

C) $470,058

D) $467,841

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

37

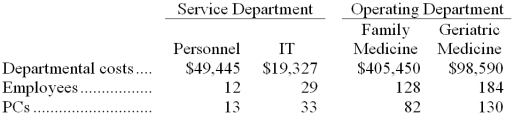

Clopton Clinic uses the step-down method to allocate service department costs to operating departments. The clinic has two service departments, Personnel and Information Technology (IT), and two operating departments, Family Medicine and Geriatric Medicine. Data concerning those departments follow:  Personnel costs are allocated first on the basis of employees and IT costs are allocated second on the basis of PCs.

Personnel costs are allocated first on the basis of employees and IT costs are allocated second on the basis of PCs.

In the first step of the allocation, the amount of Personnel Department cost allocated to the Family Medicine Department is closest to:

A) $20,285

B) $17,929

C) $18,560

D) $39,774

Personnel costs are allocated first on the basis of employees and IT costs are allocated second on the basis of PCs.

Personnel costs are allocated first on the basis of employees and IT costs are allocated second on the basis of PCs.In the first step of the allocation, the amount of Personnel Department cost allocated to the Family Medicine Department is closest to:

A) $20,285

B) $17,929

C) $18,560

D) $39,774

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

38

Karnofski Corporation uses the step-down method to allocate service department costs to operating departments. The company has two service departments, Service Department A and Service Department B, and two operating departments, Operating Department X and Operating Department Y. Data concerning those departments follow:  Service Department A costs are allocated first on the basis of allocation base A and Service Department B costs are allocated second on the basis of allocation base B.

Service Department A costs are allocated first on the basis of allocation base A and Service Department B costs are allocated second on the basis of allocation base B.

In the first step of the allocation, the amount of Service Department A cost allocated to the Operating Department X is closest to:

A) $13,599

B) $18,426

C) $16,123

D) $17,430

Service Department A costs are allocated first on the basis of allocation base A and Service Department B costs are allocated second on the basis of allocation base B.

Service Department A costs are allocated first on the basis of allocation base A and Service Department B costs are allocated second on the basis of allocation base B.In the first step of the allocation, the amount of Service Department A cost allocated to the Operating Department X is closest to:

A) $13,599

B) $18,426

C) $16,123

D) $17,430

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

39

Weisenborn Corporation uses the direct method to allocate service department costs to operating departments. The company has two service departments, Information Technology and Personnel, and two operating departments, Fabrication and Customization.  Information Technology Department costs are allocated on the basis of computer workstations and Personnel Department costs are allocated on the basis of employees.

Information Technology Department costs are allocated on the basis of computer workstations and Personnel Department costs are allocated on the basis of employees.

The total amount of Information Technology Department cost allocated to the two operating departments is closest to:

A) $28,688

B) $66,435

C) $18,427

D) $25,500

Information Technology Department costs are allocated on the basis of computer workstations and Personnel Department costs are allocated on the basis of employees.

Information Technology Department costs are allocated on the basis of computer workstations and Personnel Department costs are allocated on the basis of employees.The total amount of Information Technology Department cost allocated to the two operating departments is closest to:

A) $28,688

B) $66,435

C) $18,427

D) $25,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

40

Franca Corporation has two service departments, Administrative and Facilities, and two operating departments, Assembly and Customer Feedbacks.  The company uses the direct method to allocate service department costs to operating departments. Administrative costs are allocated on the basis of employee hours and Facilities costs are allocated on the basis of space occupied.

The company uses the direct method to allocate service department costs to operating departments. Administrative costs are allocated on the basis of employee hours and Facilities costs are allocated on the basis of space occupied.

The total amount of Administrative Department cost allocated to the Assembly Department is closest to:

A) $37,806

B) $28,217

C) $28,830

D) $26,524

The company uses the direct method to allocate service department costs to operating departments. Administrative costs are allocated on the basis of employee hours and Facilities costs are allocated on the basis of space occupied.

The company uses the direct method to allocate service department costs to operating departments. Administrative costs are allocated on the basis of employee hours and Facilities costs are allocated on the basis of space occupied.The total amount of Administrative Department cost allocated to the Assembly Department is closest to:

A) $37,806

B) $28,217

C) $28,830

D) $26,524

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

41

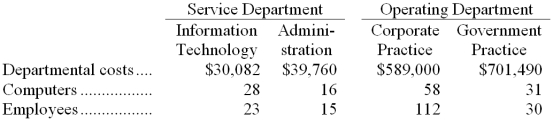

Goffinet Consultancy uses the direct method to allocate its service department costs to its operating departments. The company has two service departments, Information Technology and Administration, and two operating departments, Corporate Practice and Government Practice. Data concerning those departments follow:

Information Technology Department costs are allocated on the basis of computers and Administration Department costs are allocated on the basis of employees.

Required:

Allocate the service department costs to the operating departments using the direct method.

Information Technology Department costs are allocated on the basis of computers and Administration Department costs are allocated on the basis of employees.

Required:

Allocate the service department costs to the operating departments using the direct method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

42

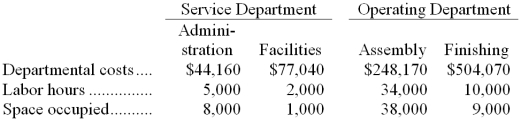

Finkler Legal Services, LLC, uses the step-down method to allocate service department costs to operating departments. The firm has two service departments, Personnel and Information Technology (IT), and two operating departments, Family Law and Corporate Law. Data concerning those departments follow:  Personnel costs are allocated first on the basis of employees and IT costs are allocated second on the basis of PCs.

Personnel costs are allocated first on the basis of employees and IT costs are allocated second on the basis of PCs.

Maclennan Corporation uses the direct method to allocate service department costs to operating departments. The company has two service departments, Administrative and Facilities, and two operating departments, Assembly and Finishing.

Administrative Department costs are allocated on the basis of employee hours and Facilities Department costs are allocated on the basis of space occupied.

Required:

Allocate the service department costs to the operating departments using the direct method.

Personnel costs are allocated first on the basis of employees and IT costs are allocated second on the basis of PCs.

Personnel costs are allocated first on the basis of employees and IT costs are allocated second on the basis of PCs.Maclennan Corporation uses the direct method to allocate service department costs to operating departments. The company has two service departments, Administrative and Facilities, and two operating departments, Assembly and Finishing.

Administrative Department costs are allocated on the basis of employee hours and Facilities Department costs are allocated on the basis of space occupied.

Required:

Allocate the service department costs to the operating departments using the direct method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

43

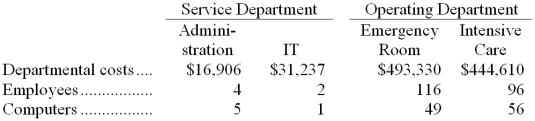

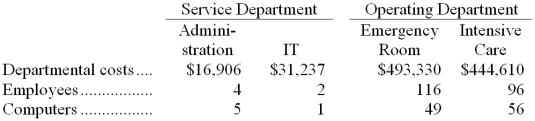

Aderholt Emergency Care Hospital uses the step-down method to allocate service department costs to operating departments. The hospital has two service departments, Administration and Information Technology (IT), and two operating departments, Emergency Room and Intensive Care.

Administration Department costs are allocated first on the basis of employees and IT Department costs are allocated second on the basis of computers.

Required:

Allocate the service department costs to the operating departments using the step-down method.

Administration Department costs are allocated first on the basis of employees and IT Department costs are allocated second on the basis of computers.

Required:

Allocate the service department costs to the operating departments using the step-down method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

44

Clopton Clinic uses the step-down method to allocate service department costs to operating departments. The clinic has two service departments, Personnel and Information Technology (IT), and two operating departments, Family Medicine and Geriatric Medicine. Data concerning those departments follow:  Personnel costs are allocated first on the basis of employees and IT costs are allocated second on the basis of PCs.

Personnel costs are allocated first on the basis of employees and IT costs are allocated second on the basis of PCs.

The total Geriatric Medicine Department cost after allocations is closest to:

A) $113,020

B) $134,101

C) $139,700

D) $139,601

Personnel costs are allocated first on the basis of employees and IT costs are allocated second on the basis of PCs.

Personnel costs are allocated first on the basis of employees and IT costs are allocated second on the basis of PCs.The total Geriatric Medicine Department cost after allocations is closest to:

A) $113,020

B) $134,101

C) $139,700

D) $139,601

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

45

Finkler Legal Services, LLC, uses the step-down method to allocate service department costs to operating departments. The firm has two service departments, Personnel and Information Technology (IT), and two operating departments, Family Law and Corporate Law. Data concerning those departments follow:  Personnel costs are allocated first on the basis of employees and IT costs are allocated second on the basis of PCs.

Personnel costs are allocated first on the basis of employees and IT costs are allocated second on the basis of PCs.

In the first step of the allocation, the amount of Personnel Department cost allocated to the Family Law Department is closest to:

A) $30,752

B) $32,837

C) $45,636

D) $29,177

Personnel costs are allocated first on the basis of employees and IT costs are allocated second on the basis of PCs.

Personnel costs are allocated first on the basis of employees and IT costs are allocated second on the basis of PCs.In the first step of the allocation, the amount of Personnel Department cost allocated to the Family Law Department is closest to:

A) $30,752

B) $32,837

C) $45,636

D) $29,177

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

46

Taketa Corporation uses the step-down method to allocate service department costs to operating departments. The company has two service departments, Administration and Facilities, and two operating departments, Assembly and Finishing.

Administration Department costs are allocated first on the basis of employee time and Facilities Department costs are allocated second on the basis of space occupied.

Required:

Allocate the service department costs to the operating departments using the step-down method.

Administration Department costs are allocated first on the basis of employee time and Facilities Department costs are allocated second on the basis of space occupied.

Required:

Allocate the service department costs to the operating departments using the step-down method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

47

Finkler Legal Services, LLC, uses the step-down method to allocate service department costs to operating departments. The firm has two service departments, Personnel and Information Technology (IT), and two operating departments, Family Law and Corporate Law. Data concerning those departments follow:  Personnel costs are allocated first on the basis of employees and IT costs are allocated second on the basis of PCs.

Personnel costs are allocated first on the basis of employees and IT costs are allocated second on the basis of PCs.

The total Corporate Law Department cost after allocations is closest to:

A) $389,318

B) $380,375

C) $346,910

D) $388,872

Personnel costs are allocated first on the basis of employees and IT costs are allocated second on the basis of PCs.

Personnel costs are allocated first on the basis of employees and IT costs are allocated second on the basis of PCs.The total Corporate Law Department cost after allocations is closest to:

A) $389,318

B) $380,375

C) $346,910

D) $388,872

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

48

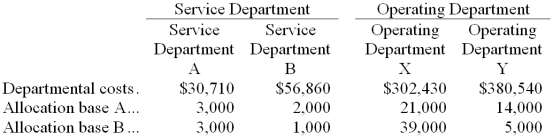

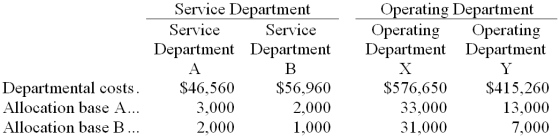

Costillo Corporation has two service departments, Service Department A and Service Department B, and two operating departments, Operating Department X and Operating Department Y.

The company uses the step-down method to allocate service department costs to operating departments. Service Department A costs are allocated first on the basis of allocation base A and Service Department B costs are allocated second on the basis of allocation base

B.

Required:

Allocate the service department costs to the operating departments using the step-down method.

The company uses the step-down method to allocate service department costs to operating departments. Service Department A costs are allocated first on the basis of allocation base A and Service Department B costs are allocated second on the basis of allocation base

B.

Required:

Allocate the service department costs to the operating departments using the step-down method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

49

Finkler Legal Services, LLC, uses the step-down method to allocate service department costs to operating departments. The firm has two service departments, Personnel and Information Technology (IT), and two operating departments, Family Law and Corporate Law. Data concerning those departments follow:  Personnel costs are allocated first on the basis of employees and IT costs are allocated second on the basis of PCs.

Personnel costs are allocated first on the basis of employees and IT costs are allocated second on the basis of PCs.

The direct method is used by Rastorfer Clinic to allocate its service department costs to its operating departments. Data concerning those departments follow:

Information Technology costs are allocated on the basis of computers and Personnel costs are allocated on the basis of employees.

Required:

Allocate the service department costs to the operating departments using the direct method.

Personnel costs are allocated first on the basis of employees and IT costs are allocated second on the basis of PCs.

Personnel costs are allocated first on the basis of employees and IT costs are allocated second on the basis of PCs.The direct method is used by Rastorfer Clinic to allocate its service department costs to its operating departments. Data concerning those departments follow:

Information Technology costs are allocated on the basis of computers and Personnel costs are allocated on the basis of employees.

Required:

Allocate the service department costs to the operating departments using the direct method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

50

Finkler Legal Services, LLC, uses the step-down method to allocate service department costs to operating departments. The firm has two service departments, Personnel and Information Technology (IT), and two operating departments, Family Law and Corporate Law. Data concerning those departments follow:  Personnel costs are allocated first on the basis of employees and IT costs are allocated second on the basis of PCs.

Personnel costs are allocated first on the basis of employees and IT costs are allocated second on the basis of PCs.

Hodgin Corporation uses the direct method to allocate its two service department costs to its two operating departments. Data concerning those departments follow:

B.

Required:

Allocate the service department costs to the operating departments using the direct method.

Service Department A costs are allocated on the basis of allocation base A and Service Department B costs are allocated on the basis of allocation base

Personnel costs are allocated first on the basis of employees and IT costs are allocated second on the basis of PCs.

Personnel costs are allocated first on the basis of employees and IT costs are allocated second on the basis of PCs.Hodgin Corporation uses the direct method to allocate its two service department costs to its two operating departments. Data concerning those departments follow:

B.

Required:

Allocate the service department costs to the operating departments using the direct method.

Service Department A costs are allocated on the basis of allocation base A and Service Department B costs are allocated on the basis of allocation base

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

51

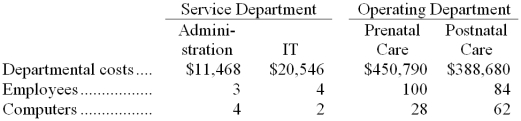

Ziebol Natal Clinic uses the step-down method to allocate service department costs to operating departments. The clinic has two service departments, Administration and Information Technology (IT), and two operating departments, Prenatal Care and Postnatal Care.

Administration Department costs are allocated first on the basis of employees and IT Department costs are allocated second on the basis of computers.

Required:

Allocate the service department costs to the operating departments using the step-down method.

Administration Department costs are allocated first on the basis of employees and IT Department costs are allocated second on the basis of computers.

Required:

Allocate the service department costs to the operating departments using the step-down method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck