Deck 15: How Well Am I Doing Statement of Cash Flows

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

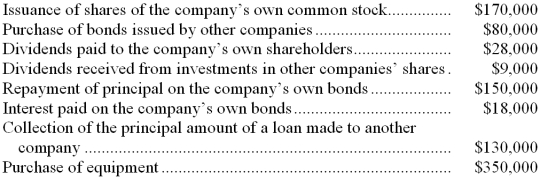

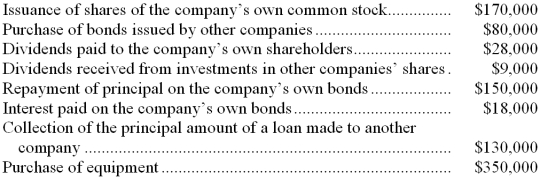

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

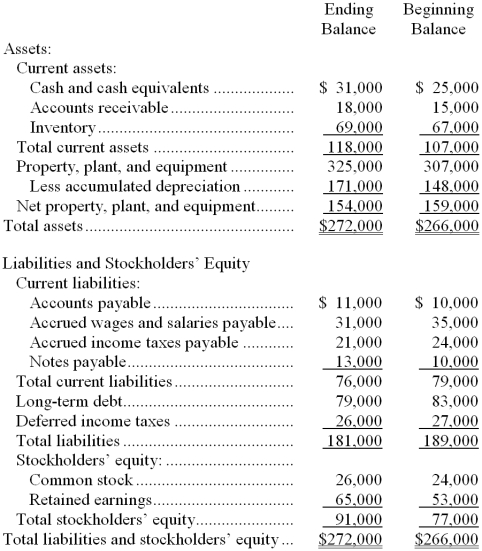

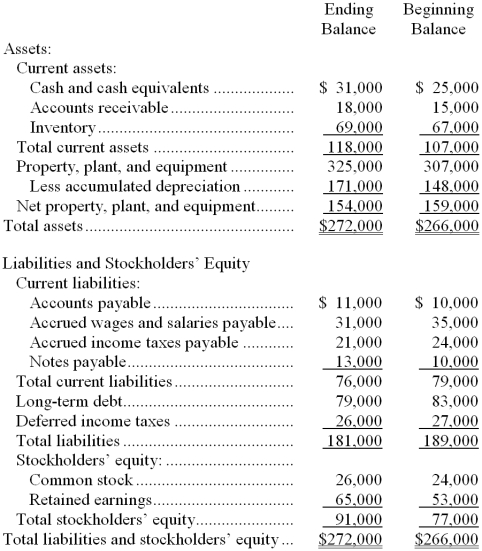

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/103

العب

ملء الشاشة (f)

Deck 15: How Well Am I Doing Statement of Cash Flows

1

Positive free cash flow suggests that the company did not generate enough cash flow from its operating activities to fund its capital expenditures and dividend payments.

False

2

For purposes of preparing a the statement of cash flows, cash equivalents consist of short-term, highly liquid investments such as treasury bills, commercial paper, and money market funds that are made solely for the purpose of generating a return on funds that are temporarily idle.

True

3

A newly formed company with enormous growth prospects would be expected to have positive free cash flow during its start-up phase.

False

4

In the statement of cash flows, increases in a company's capital stock accounts are treated as a "use" rather than as a "source" of cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

5

An increase in the accumulated depreciation account of $50,000 over the course of a year would be shown on the company's statement of cash flows prepared under the indirect method as:

A) an addition to net income of $50,000 in order to arrive at net cash provided by operating activities.

B) a deduction from net income of $50,000 in order to arrive at net cash provided by operating activities.

C) an addition of $50,000 under investing activities.

D) a deduction of $50,000 under investing activities.

A) an addition to net income of $50,000 in order to arrive at net cash provided by operating activities.

B) a deduction from net income of $50,000 in order to arrive at net cash provided by operating activities.

C) an addition of $50,000 under investing activities.

D) a deduction of $50,000 under investing activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

6

When computing the net cash provided by operating activities under the indirect method on the statement of cash flows, a decrease in common stock would be added to net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

7

When using the indirect method to prepare the statement of cash flows, depreciation should be presented as a(n):

A) cash flow from investing activities.

B) cash flow from financing activities.

C) deduction from net income.

D) addition to net income.

A) cash flow from investing activities.

B) cash flow from financing activities.

C) deduction from net income.

D) addition to net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

8

Transactions that involve acquiring or disposing of noncurrent assets are generally classified as investing activities on the statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

9

A change in deferred taxes is considered to be an investing activity on the statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

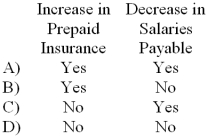

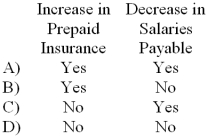

10

Drusilla Corporation prepares its statement of cash flows using the indirect method. Which of the following would be deducted from net income in the operating activities section of the statement?

A) Choice A

B) Choice B

C) Choice C

D) Choice D

A) Choice A

B) Choice B

C) Choice C

D) Choice D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

11

Free cash flow is net cash provided by operating activities less capital expenditures and dividends.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

12

The issuance of a stock dividend will appear in the financing activities section of the statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

13

Which of the following would be considered a "use" of cash for purpose of constructing a statement of cash flows?

A) selling the company's own common stock to investors.

B) issuing long-term debt.

C) purchasing equipment.

D) amortizing a patent.

A) selling the company's own common stock to investors.

B) issuing long-term debt.

C) purchasing equipment.

D) amortizing a patent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

14

Under the indirect method of determining the net cash provided by operating activities on the statement of cash flows, increases in current assets such as prepaid expenses are subtracted from net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

15

In a statement of cash flows, a change in prepaid expenses would be classified as:

A) an operating activity.

B) a financing activity.

C) an investing activity.

D) a noncash item that need not appear on the statement of cash flows.

A) an operating activity.

B) a financing activity.

C) an investing activity.

D) a noncash item that need not appear on the statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

16

Negative free cash flow invariably signals poor performance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

17

Which of the following would be considered a "use" of cash for purposes of constructing a statement of cash flows?

A) an increase in accounts payable.

B) an increase in prepaid expenses.

C) an increase in accrued liabilities.

D) an increase in accumulated depreciation.

A) an increase in accounts payable.

B) an increase in prepaid expenses.

C) an increase in accrued liabilities.

D) an increase in accumulated depreciation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

18

Activities such as the purchase of inventory on account should be included as part of a company's financing activities on the statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

19

When a company prepares its statement of cash flows under the indirect method, an increase in depreciation expense will also increase the net cash provided by operating activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

20

For external reporting purposes, the FASB recommends the indirect method of determining the net cash provided by operating activities on the statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

21

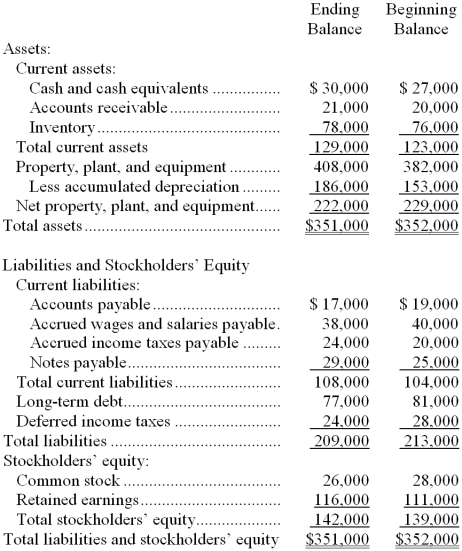

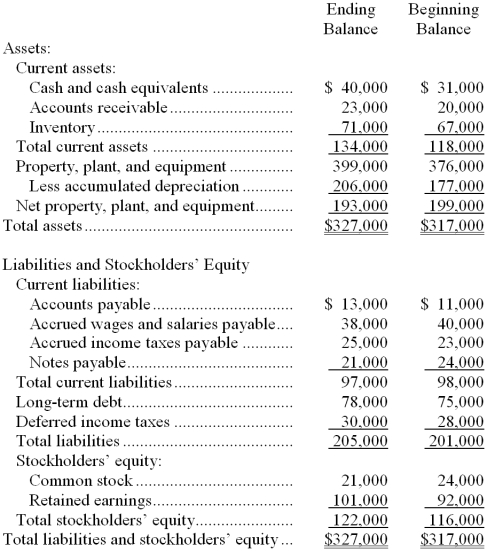

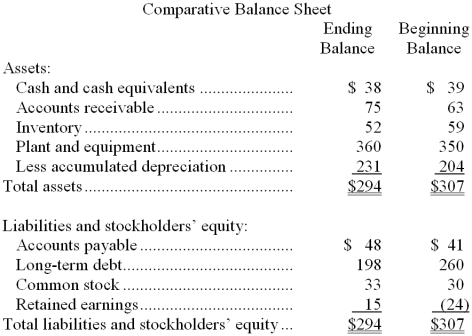

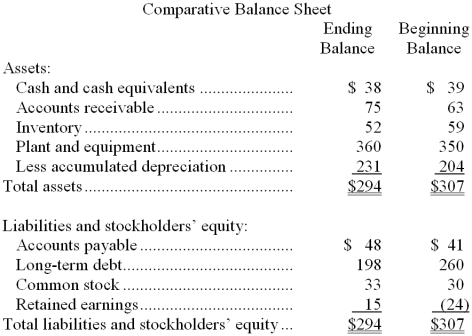

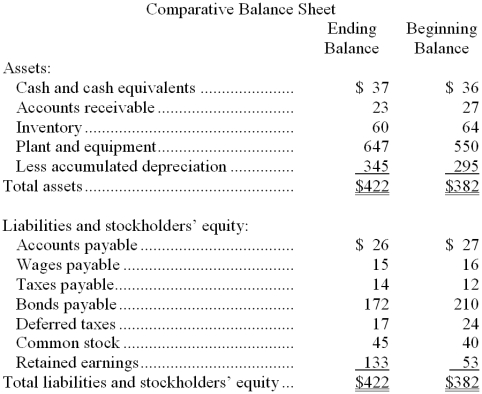

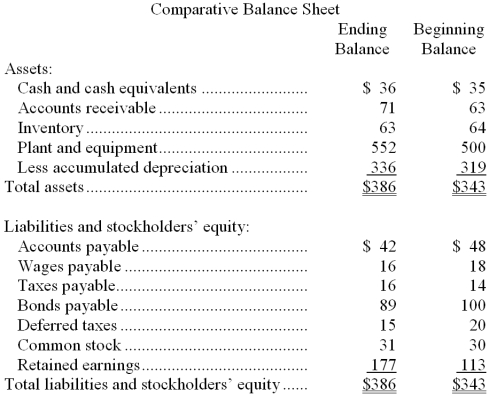

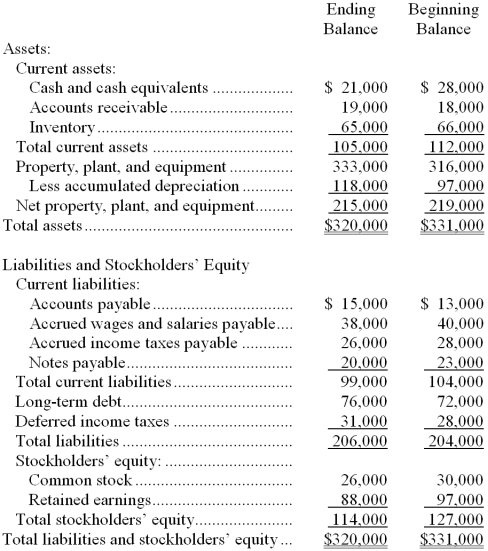

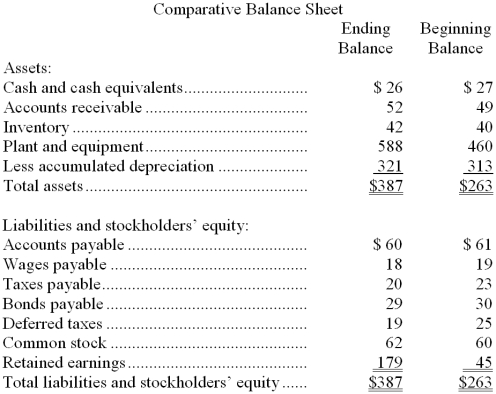

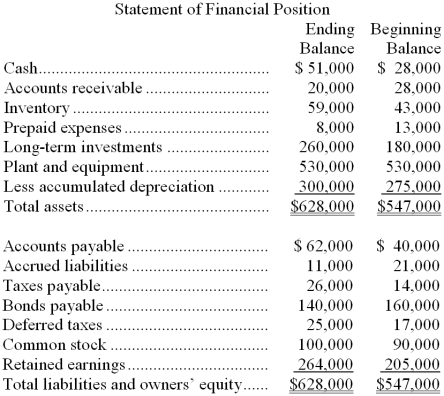

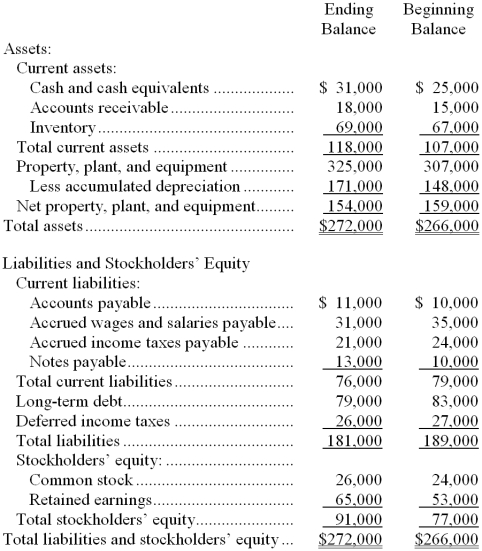

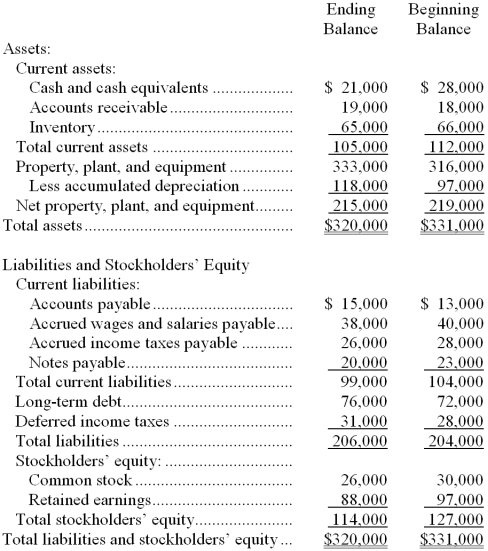

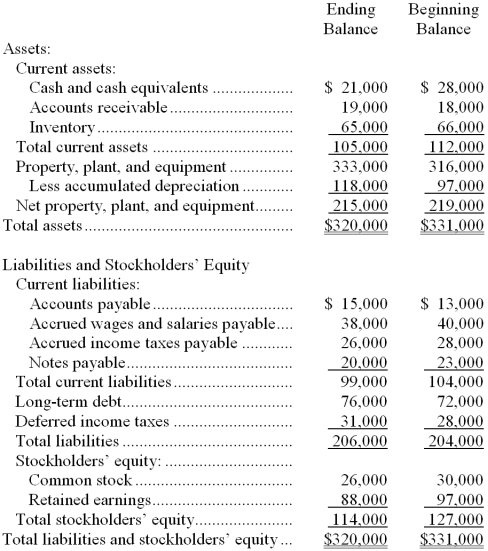

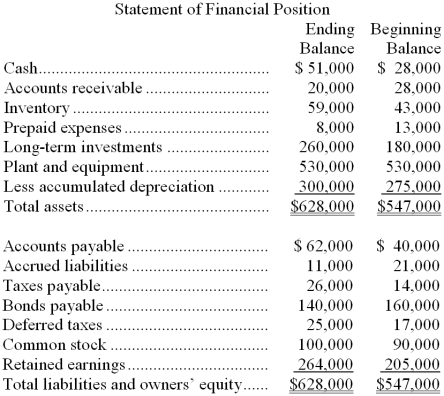

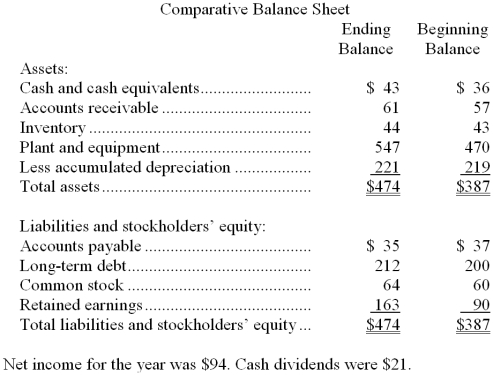

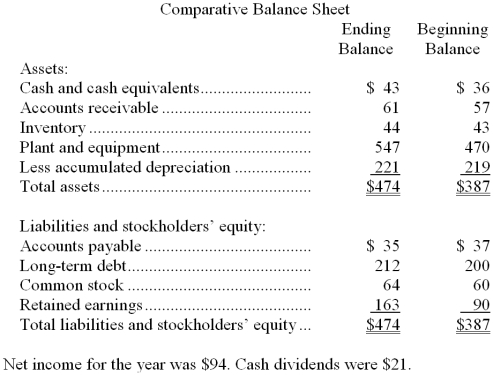

Strei Corporation's comparative balance sheet appears below:

The company's net income (loss) for the year was ($6,000) and its cash dividends were $4,000. The total dollar amount of all of the items that would be classified as sources when compiling a simplified statement of cash flows is:

A) $4,000

B) $38,000

C) $34,000

D) $28,000

The company's net income (loss) for the year was ($6,000) and its cash dividends were $4,000. The total dollar amount of all of the items that would be classified as sources when compiling a simplified statement of cash flows is:

A) $4,000

B) $38,000

C) $34,000

D) $28,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

22

Which of the following should be classified as an investing activity on a statement of cash flows?

A) cash used to purchase land.

B) cash collected on a loan made to a supplier.

C) cash received from the sale of a stock investment.

D) both A and C above

E) all of these

A) cash used to purchase land.

B) cash collected on a loan made to a supplier.

C) cash received from the sale of a stock investment.

D) both A and C above

E) all of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

23

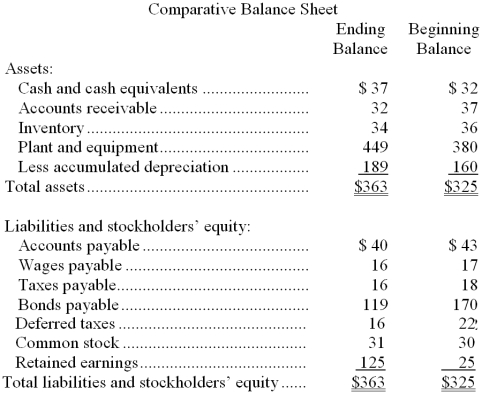

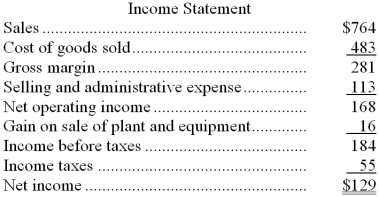

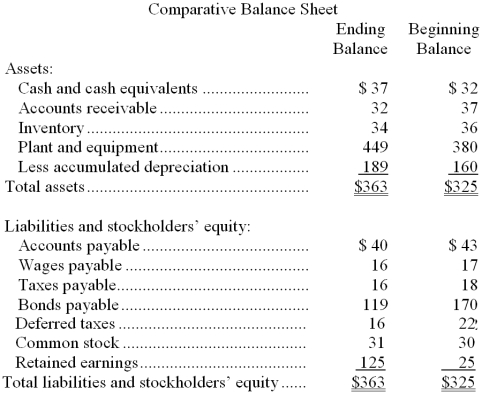

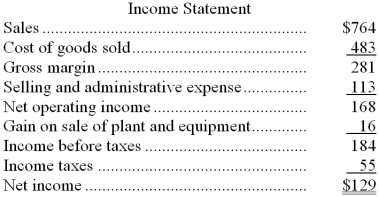

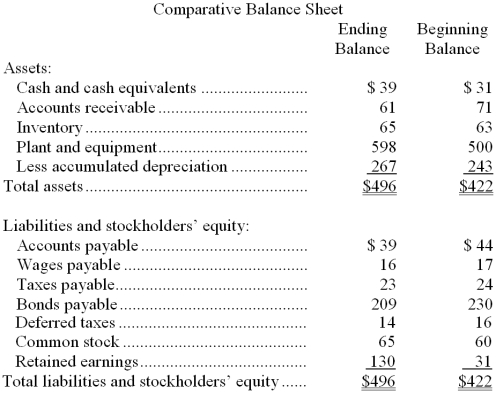

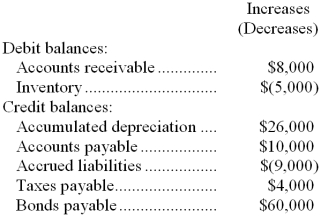

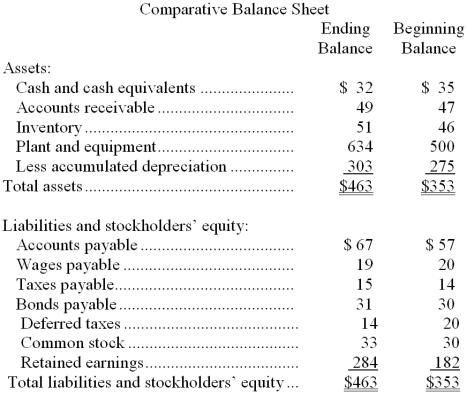

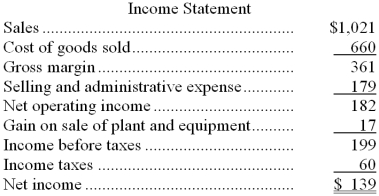

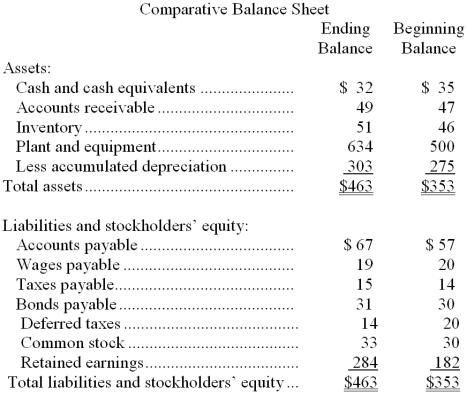

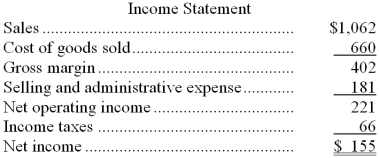

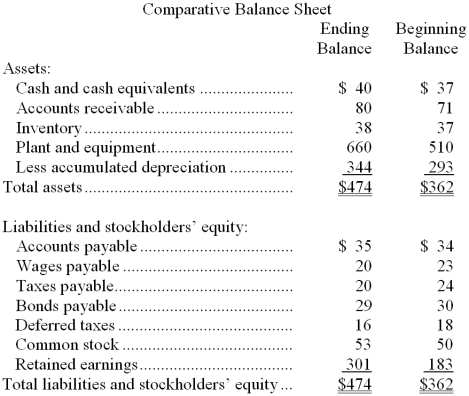

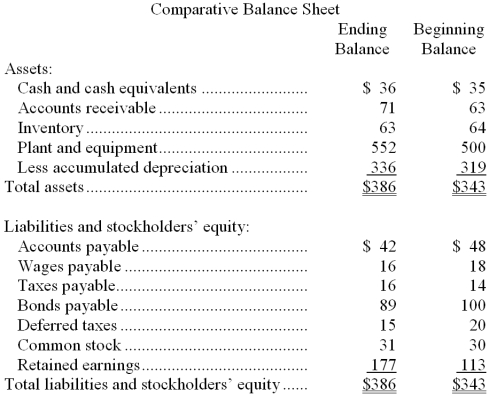

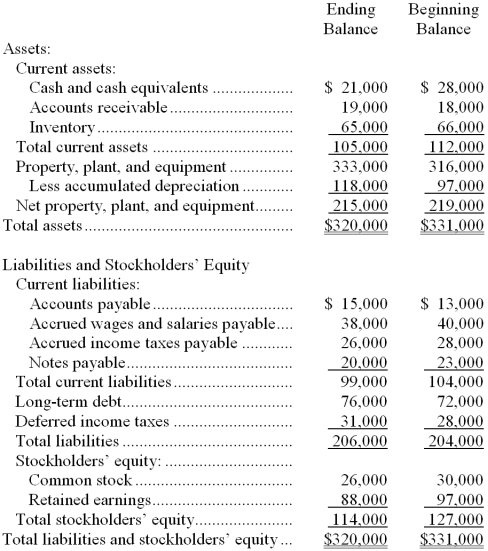

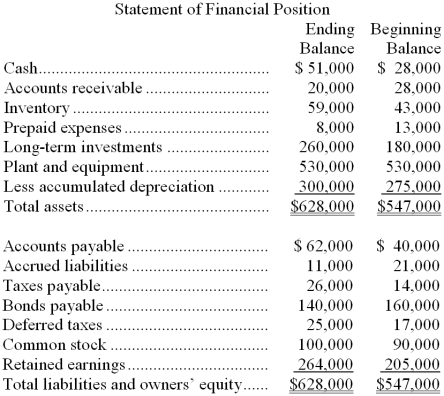

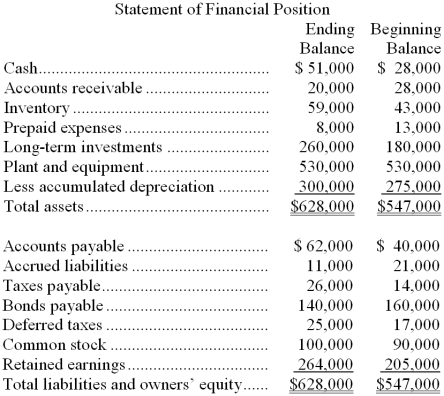

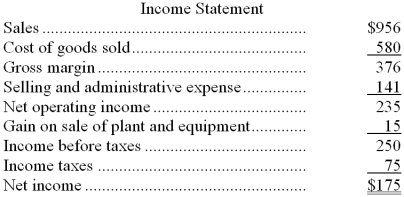

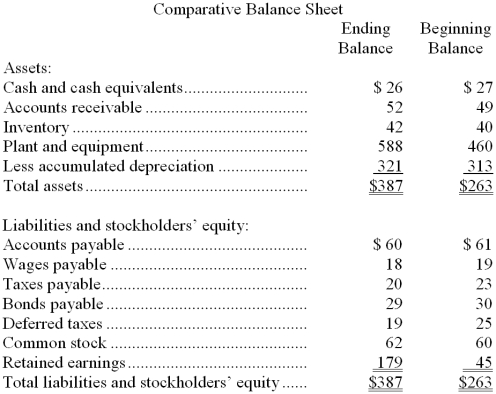

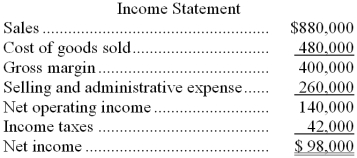

Postma Corporation's balance sheet and income statement appear below:

Cash dividends were $29. The company sold equipment for $19 that was originally purchased for $14 and that had accumulated depreciation of $11. The net cash provided by (used by) operations for the year was:

A) $177

B) $148

C) $164

D) $168

Cash dividends were $29. The company sold equipment for $19 that was originally purchased for $14 and that had accumulated depreciation of $11. The net cash provided by (used by) operations for the year was:

A) $177

B) $148

C) $164

D) $168

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

24

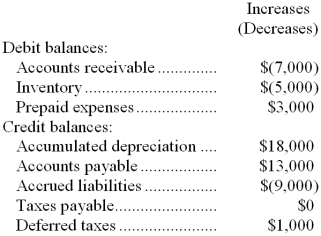

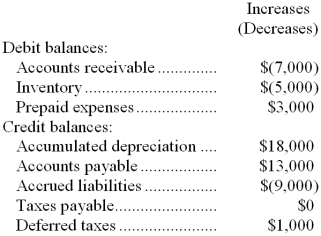

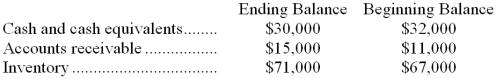

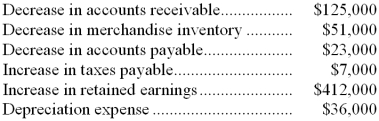

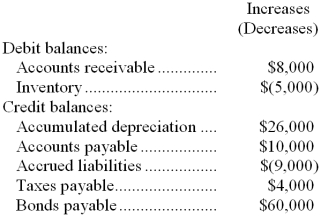

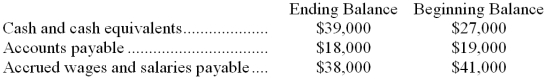

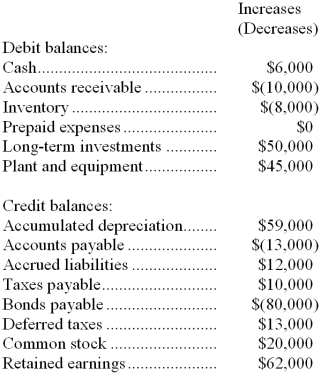

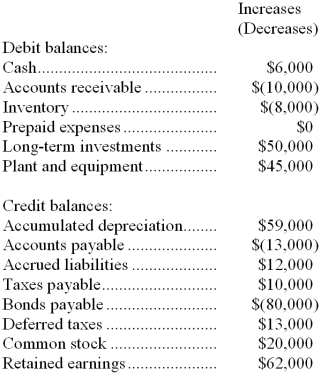

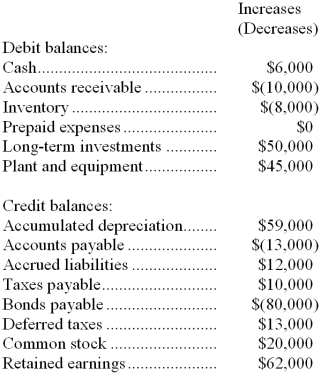

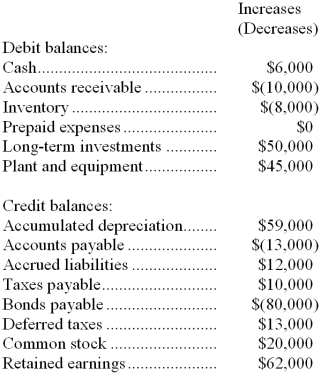

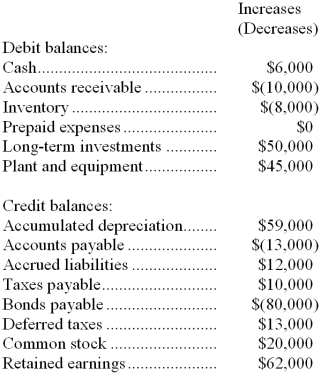

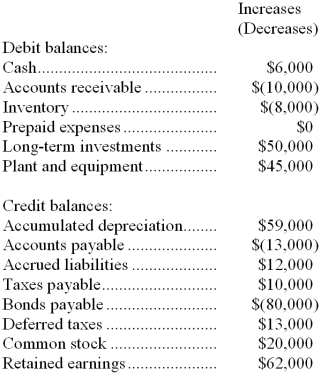

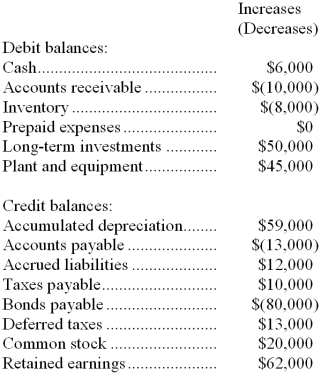

Nordstrand Company's net income last year was $36,000. Changes in selected balance sheet accounts for the year appear below:

Based solely on this information, the net cash provided by operations under the indirect method on the statement of cash flows would be:

A) $4,000

B) $68,000

C) $50,000

D) $54,000

Based solely on this information, the net cash provided by operations under the indirect method on the statement of cash flows would be:

A) $4,000

B) $68,000

C) $50,000

D) $54,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

25

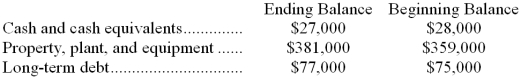

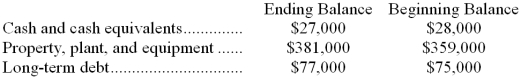

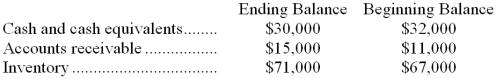

Excerpts from Niederhauser Corporation's comparative balance sheet appear below:

Which of the following classifications of changes in balance sheet accounts as sources and uses is correct?

A) The change in Property, Plant, and Equipment is a source; The change in Long-Term Debt is a source

B) The change in Property, Plant, and Equipment is a use; The change in Long-Term Debt is a use

C) The change in Property, Plant, and Equipment is a source; The change in Long-Term Debt is a use

D) The change in Property, Plant, and Equipment is a use; The change in Long-Term Debt is a source

Which of the following classifications of changes in balance sheet accounts as sources and uses is correct?

A) The change in Property, Plant, and Equipment is a source; The change in Long-Term Debt is a source

B) The change in Property, Plant, and Equipment is a use; The change in Long-Term Debt is a use

C) The change in Property, Plant, and Equipment is a source; The change in Long-Term Debt is a use

D) The change in Property, Plant, and Equipment is a use; The change in Long-Term Debt is a source

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

26

In the preparation of a statement of cash flows all of the following would be classified as investing activities except:

A) collection of a loan from a subsidiary.

B) purchase of a patent from an inventor.

C) sale of plant assets.

D) dividends received on stock held as an investment.

A) collection of a loan from a subsidiary.

B) purchase of a patent from an inventor.

C) sale of plant assets.

D) dividends received on stock held as an investment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

27

Demagistris Corporation's balance sheet and income statement appear below:

Cash dividends were $22. The company sold equipment for $14 that was originally purchased for $6 and that had accumulated depreciation of $4. The net cash provided by (used by) financing activities for the year was:

A) ($21)

B) ($22)

C) $5

D) ($38)

Cash dividends were $22. The company sold equipment for $14 that was originally purchased for $6 and that had accumulated depreciation of $4. The net cash provided by (used by) financing activities for the year was:

A) ($21)

B) ($22)

C) $5

D) ($38)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

28

The statement of cash flows:

A) serves as a replacement for the income statement and balance sheet.

B) shows the sources and uses of cash at one point in time.

C) shows the sources and uses of cash for one period of time.

D) is both A and B above.

A) serves as a replacement for the income statement and balance sheet.

B) shows the sources and uses of cash at one point in time.

C) shows the sources and uses of cash for one period of time.

D) is both A and B above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

29

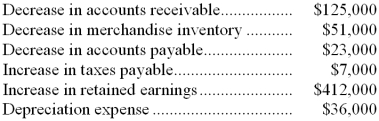

Excerpts from Blackner Corporation's comparative balance sheet appear below:

Which of the following classifications of changes in balance sheet accounts as sources and uses is correct?

A) The change in Accounts Receivable is a source; The change in Inventory is a source

B) The change in Accounts Receivable is a use; The change in Inventory is a use

C) The change in Accounts Receivable is a use; The change in Inventory is a source

D) The change in Accounts Receivable is a source; The change in Inventory is a use

Which of the following classifications of changes in balance sheet accounts as sources and uses is correct?

A) The change in Accounts Receivable is a source; The change in Inventory is a source

B) The change in Accounts Receivable is a use; The change in Inventory is a use

C) The change in Accounts Receivable is a use; The change in Inventory is a source

D) The change in Accounts Receivable is a source; The change in Inventory is a use

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

30

Which of the following would be classified as a financing activity on the statement of cash flows?

A) Interest paid on bonds issued by the reporting company.

B) Dividends paid to shareholders of the company on the company's common stock.

C) Interest received on investments in another company's bonds.

D) Dividends received on investments in another company's common stock.

A) Interest paid on bonds issued by the reporting company.

B) Dividends paid to shareholders of the company on the company's common stock.

C) Interest received on investments in another company's bonds.

D) Dividends received on investments in another company's common stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

31

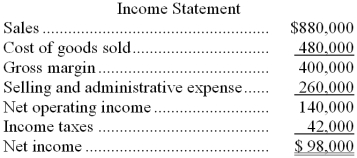

Orebic Department Store had net income of $642,000 for the year just ended. Orebic collected the following additional information to prepare its statement of cash flows for the year:

Orebic uses the indirect method to prepare its statement of cash flows. What is Orebic's net cash provided (used) by operating activities?

A) $518,000

B) $588,000

C) $838,000

D) $870,000

Orebic uses the indirect method to prepare its statement of cash flows. What is Orebic's net cash provided (used) by operating activities?

A) $518,000

B) $588,000

C) $838,000

D) $870,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

32

Moravec Company's net income last year was $46,000 and cash dividends declared and paid to the company's stockholders totaled $18,000. Changes in selected balance sheet accounts for the year appear below:

Based solely on this information, the net cash provided by operations under the indirect method on the statement of cash flows would be:

A) $126,000

B) $74,000

C) $72,000

D) $18,000

Based solely on this information, the net cash provided by operations under the indirect method on the statement of cash flows would be:

A) $126,000

B) $74,000

C) $72,000

D) $18,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

33

In a statement of cash flows, a change in the inventories account would be classified as:

A) an operating activity.

B) a financing activity.

C) an investing activity.

D) a noncash item that need not appear on the statement of cash flows.

A) an operating activity.

B) a financing activity.

C) an investing activity.

D) a noncash item that need not appear on the statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

34

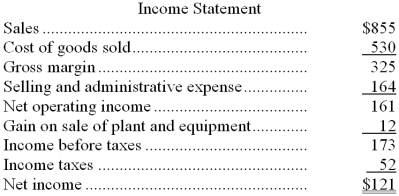

Ebner Corporation's balance sheet and income statement appear below:

Cash dividends were $37. The company sold equipment for $18 that was originally purchased for $10 and that had accumulated depreciation of $9. The net cash provided by (used by) investing activities for the year was:

A) $126

B) $18

C) ($144)

D) ($126)

Cash dividends were $37. The company sold equipment for $18 that was originally purchased for $10 and that had accumulated depreciation of $9. The net cash provided by (used by) investing activities for the year was:

A) $126

B) $18

C) ($144)

D) ($126)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

35

An increase in the plant and equipment account of $100,000 over the course of a year would be shown on the company's statement of cash flows prepared under the indirect method as:

A) an addition to net income of $100,000 in order to arrive at net cash provided by operating activities.

B) a deduction from net income of $100,000 in order to arrive at net cash provided by operating activities.

C) an addition of $100,000 under investing activities.

D) a deduction of $100,000 under investing activities.

A) an addition to net income of $100,000 in order to arrive at net cash provided by operating activities.

B) a deduction from net income of $100,000 in order to arrive at net cash provided by operating activities.

C) an addition of $100,000 under investing activities.

D) a deduction of $100,000 under investing activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

36

An increase in the bonds payable account of $200,000 over the course of a year would be shown on the company's statement of cash flows prepared under the indirect method as:

A) an addition of $200,000 under investing activities.

B) a deduction of $200,000 under investing activities.

C) an addition of $200,000 under financing activities.

D) a deduction of $200,000 under financing activities.

A) an addition of $200,000 under investing activities.

B) a deduction of $200,000 under investing activities.

C) an addition of $200,000 under financing activities.

D) a deduction of $200,000 under financing activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

37

Which of the following should be classified as a financing activity on a statement of cash flows?

A) direct exchange transactions involving common stock.

B) interest paid on a long-term notes payable.

C) a loan made to a long time supplier of component parts.

D) both A and C above

E) none of these

A) direct exchange transactions involving common stock.

B) interest paid on a long-term notes payable.

C) a loan made to a long time supplier of component parts.

D) both A and C above

E) none of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

38

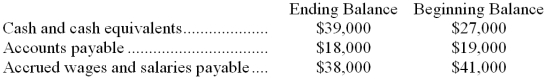

Excerpts from Welshans Corporation's comparative balance sheet appear below:

Which of the following classifications of changes in balance sheet accounts as sources and uses is correct?

A) The change in Accounts Payable is a use; The change in Accrued Wages and Salaries payable is a source

B) The change in Accounts Payable is a source; The change in Accrued Wages and Salaries payable is a source

C) The change in Accounts Payable is a source; The change in Accrued Wages and Salaries payable is a use

D) The change in Accounts Payable is a use; The change in Accrued Wages and Salaries payable is a use

Which of the following classifications of changes in balance sheet accounts as sources and uses is correct?

A) The change in Accounts Payable is a use; The change in Accrued Wages and Salaries payable is a source

B) The change in Accounts Payable is a source; The change in Accrued Wages and Salaries payable is a source

C) The change in Accounts Payable is a source; The change in Accrued Wages and Salaries payable is a use

D) The change in Accounts Payable is a use; The change in Accrued Wages and Salaries payable is a use

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

39

In the preparation of a statement of cash flows, all of the following would be classified as financing activities except:

A) the conversion of the company's own preferred stock into common stock.

B) the declaration and payment of a cash dividend on the company's own common stock.

C) the repayment of principal on a mortgage.

D) the sale of the company's own preferred stock for cash.

A) the conversion of the company's own preferred stock into common stock.

B) the declaration and payment of a cash dividend on the company's own common stock.

C) the repayment of principal on a mortgage.

D) the sale of the company's own preferred stock for cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

40

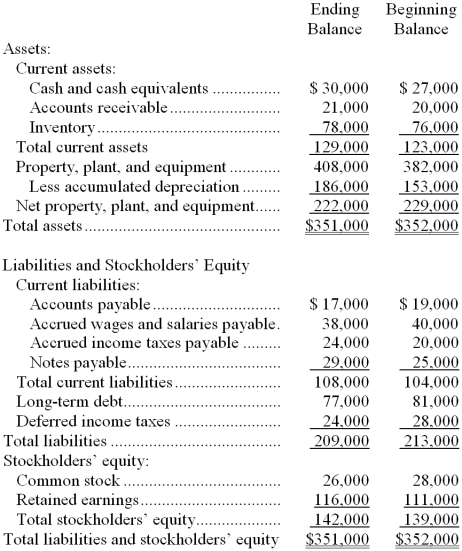

Spiro Corporation's comparative balance sheet appears below:

The company's net income (loss) for the year was $7,000 and its cash dividends were $2,000. The total dollar amount of all of the items that would be classified as uses when compiling a simplified statement of cash flows is:

A) $43,000

B) $45,000

C) $48,000

D) $3,000

The company's net income (loss) for the year was $7,000 and its cash dividends were $2,000. The total dollar amount of all of the items that would be classified as uses when compiling a simplified statement of cash flows is:

A) $43,000

B) $45,000

C) $48,000

D) $3,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

41

Last year Marmin Company sold equipment with a net book value of $120,000 for $160,000 in cash. This equipment was originally purchased for $230,000. What will be the net effect of this transaction on the net cash provided by investing activities on last year's statement of cash flows?

A) A net deduction of $40,000 from cash.

B) A net addition of $40,000 to cash.

C) A net deduction of $70,000 from cash.

D) A net addition of $70,000 to cash.

A) A net deduction of $40,000 from cash.

B) A net addition of $40,000 to cash.

C) A net deduction of $70,000 from cash.

D) A net addition of $70,000 to cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

42

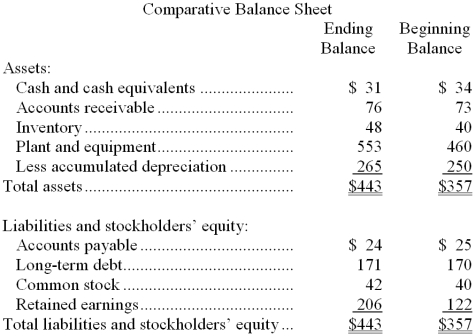

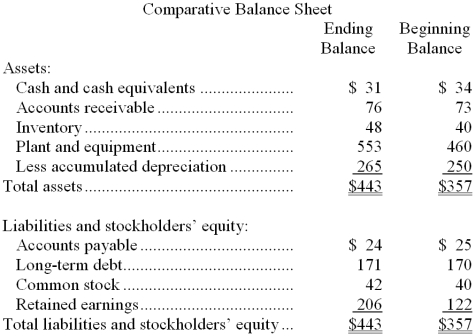

Spettel Corporation's comparative balance sheet appears below:  The company's net income (loss) for the year was $11,000 and its cash dividends were $2,000.

The company's net income (loss) for the year was $11,000 and its cash dividends were $2,000.

The total dollar amount of all of the items that would be classified as uses when compiling a simplified statement of cash flows is:

A) $38,000

B) $40,000

C) $9,000

D) $49,000

The company's net income (loss) for the year was $11,000 and its cash dividends were $2,000.

The company's net income (loss) for the year was $11,000 and its cash dividends were $2,000.The total dollar amount of all of the items that would be classified as uses when compiling a simplified statement of cash flows is:

A) $38,000

B) $40,000

C) $9,000

D) $49,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

43

Spettel Corporation's comparative balance sheet appears below:  The company's net income (loss) for the year was $11,000 and its cash dividends were $2,000.

The company's net income (loss) for the year was $11,000 and its cash dividends were $2,000.

Which of the following classifications of changes in balance sheet accounts as sources and uses is correct?

A) The change in Accounts Payable is a use; The change in Accrued Wages and Salaries payable is a use

B) The change in Accounts Payable is a source; The change in Accrued Wages and Salaries payable is a use

C) The change in Accounts Payable is a source; The change in Accrued Wages and Salaries payable is a source

D) The change in Accounts Payable is a use; The change in Accrued Wages and Salaries payable is a source

The company's net income (loss) for the year was $11,000 and its cash dividends were $2,000.

The company's net income (loss) for the year was $11,000 and its cash dividends were $2,000.Which of the following classifications of changes in balance sheet accounts as sources and uses is correct?

A) The change in Accounts Payable is a use; The change in Accrued Wages and Salaries payable is a use

B) The change in Accounts Payable is a source; The change in Accrued Wages and Salaries payable is a use

C) The change in Accounts Payable is a source; The change in Accrued Wages and Salaries payable is a source

D) The change in Accounts Payable is a use; The change in Accrued Wages and Salaries payable is a source

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

44

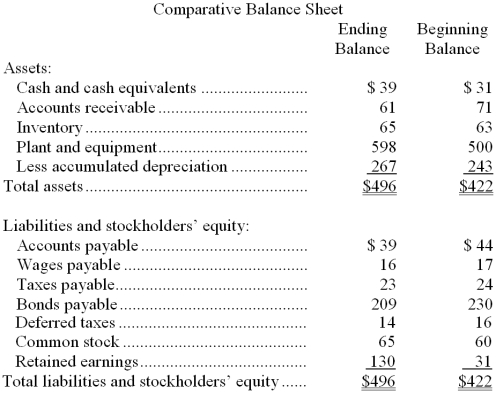

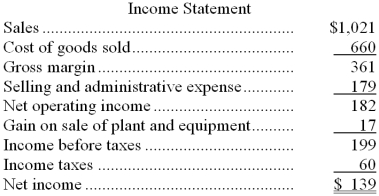

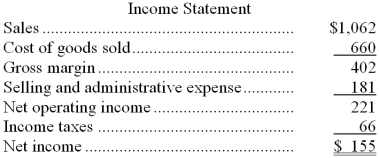

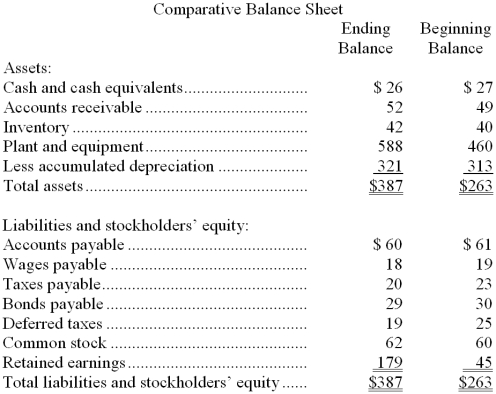

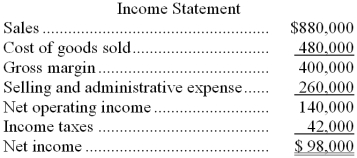

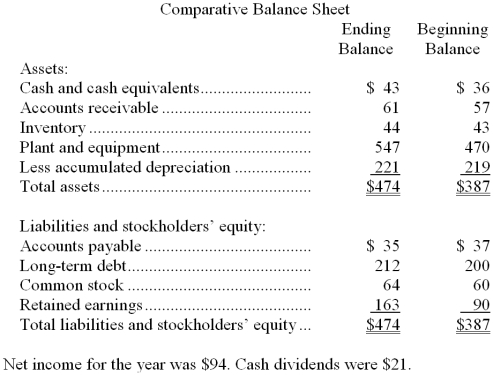

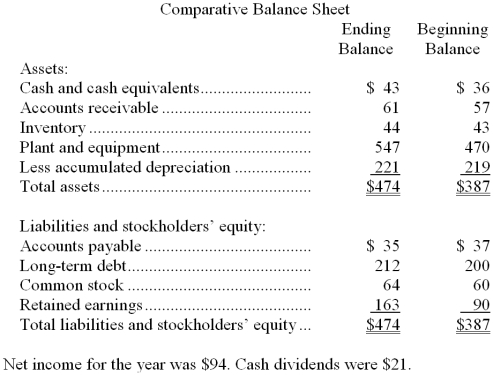

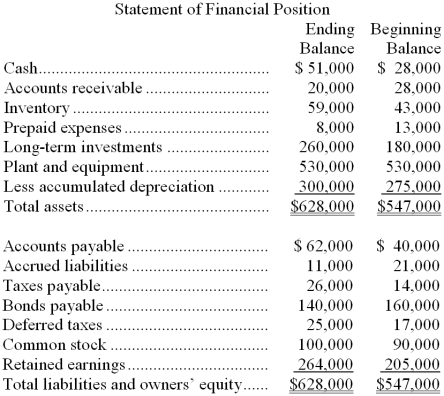

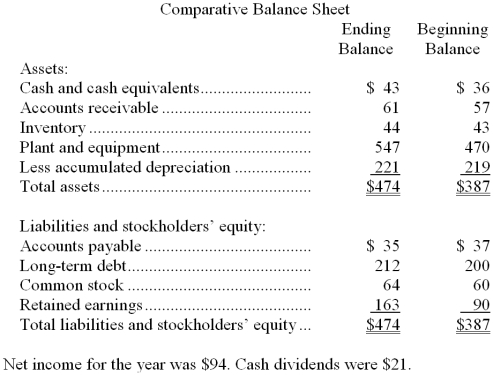

The most recent balance sheet and income statement of Schneekloth Corporation appear below:

Cash dividends were $37. The net cash provided by (used by) operations for the year was:

A) $221

B) $188

C) $33

D) $122

Cash dividends were $37. The net cash provided by (used by) operations for the year was:

A) $221

B) $188

C) $33

D) $122

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

45

Hamblet Corporation's net cash provided by operating activities was $130; its net income was $94; its capital expenditures were $116; and its cash dividends were $19. The company's free cash flow was:

A) $89

B) -$41

C) $359

D) -$5

A) $89

B) -$41

C) $359

D) -$5

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

46

Spettel Corporation's comparative balance sheet appears below:  The company's net income (loss) for the year was $11,000 and its cash dividends were $2,000.

The company's net income (loss) for the year was $11,000 and its cash dividends were $2,000.

Which of the following classifications of changes in balance sheet accounts as sources and uses is correct?

A) The change in Accounts Receivable is a use; The change in Inventory is a use

B) The change in Accounts Receivable is a use; The change in Inventory is a source

C) The change in Accounts Receivable is a source; The change in Inventory is a source

D) The change in Accounts Receivable is a source; The change in Inventory is a use

The company's net income (loss) for the year was $11,000 and its cash dividends were $2,000.

The company's net income (loss) for the year was $11,000 and its cash dividends were $2,000.Which of the following classifications of changes in balance sheet accounts as sources and uses is correct?

A) The change in Accounts Receivable is a use; The change in Inventory is a use

B) The change in Accounts Receivable is a use; The change in Inventory is a source

C) The change in Accounts Receivable is a source; The change in Inventory is a source

D) The change in Accounts Receivable is a source; The change in Inventory is a use

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

47

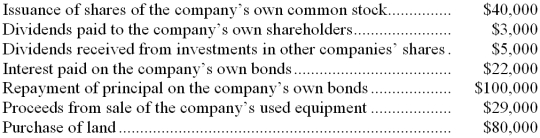

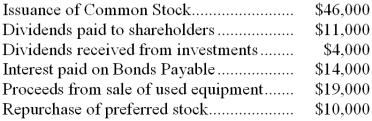

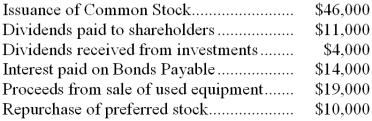

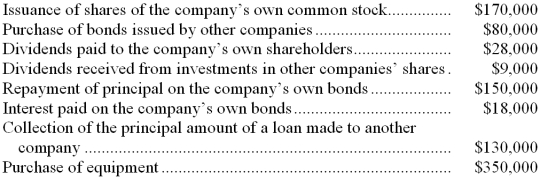

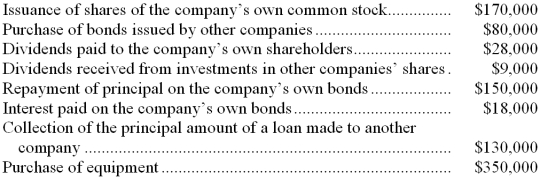

The following transactions occurred last year at Jowlson Company:

Based solely on the above information, the net cash provided by financing activities for the year on the statement of cash flows would be:

A) $(131,000)

B) $279,000

C) $(63,000)

D) $(85,000)

Based solely on the above information, the net cash provided by financing activities for the year on the statement of cash flows would be:

A) $(131,000)

B) $279,000

C) $(63,000)

D) $(85,000)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

48

Spettel Corporation's comparative balance sheet appears below:  The company's net income (loss) for the year was $11,000 and its cash dividends were $2,000.

The company's net income (loss) for the year was $11,000 and its cash dividends were $2,000.

Which of the following classifications of changes in balance sheet accounts as sources and uses is correct?

A) The change in Property, Plant, and Equipment is a source; The change in Long-Term Debt is a source

B) The change in Property, Plant, and Equipment is a use; The change in Long-Term Debt is a source

C) The change in Property, Plant, and Equipment is a source; The change in Long-Term Debt is a use

D) The change in Property, Plant, and Equipment is a use; The change in Long-Term Debt is a use

The company's net income (loss) for the year was $11,000 and its cash dividends were $2,000.

The company's net income (loss) for the year was $11,000 and its cash dividends were $2,000.Which of the following classifications of changes in balance sheet accounts as sources and uses is correct?

A) The change in Property, Plant, and Equipment is a source; The change in Long-Term Debt is a source

B) The change in Property, Plant, and Equipment is a use; The change in Long-Term Debt is a source

C) The change in Property, Plant, and Equipment is a source; The change in Long-Term Debt is a use

D) The change in Property, Plant, and Equipment is a use; The change in Long-Term Debt is a use

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

49

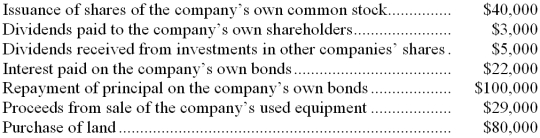

The following events occurred last year for the Cashback Company:

Based solely on the above information, the net cash provided by financing activities for the year on the statement of cash flows was:

A) $44,000

B) $48,000

C) $25,000

D) $15,000

Based solely on the above information, the net cash provided by financing activities for the year on the statement of cash flows was:

A) $44,000

B) $48,000

C) $25,000

D) $15,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

50

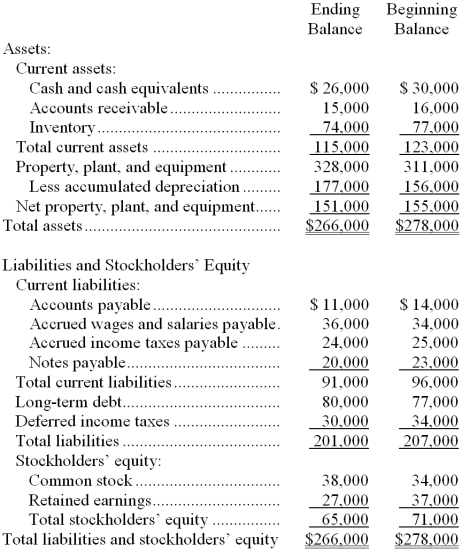

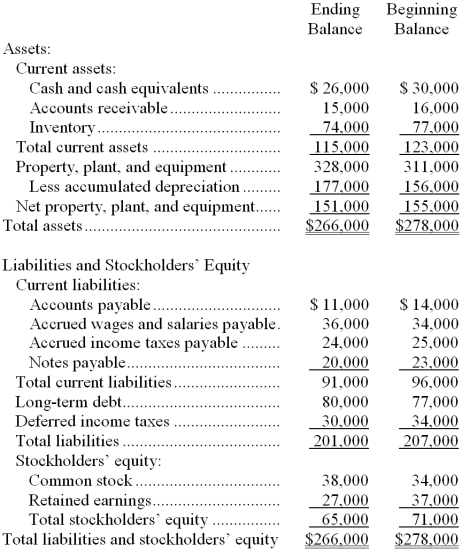

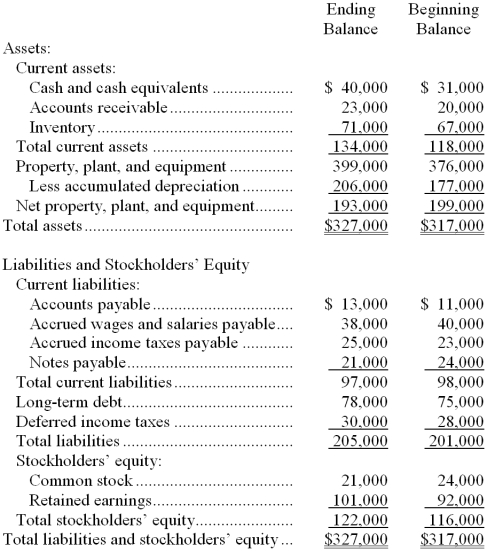

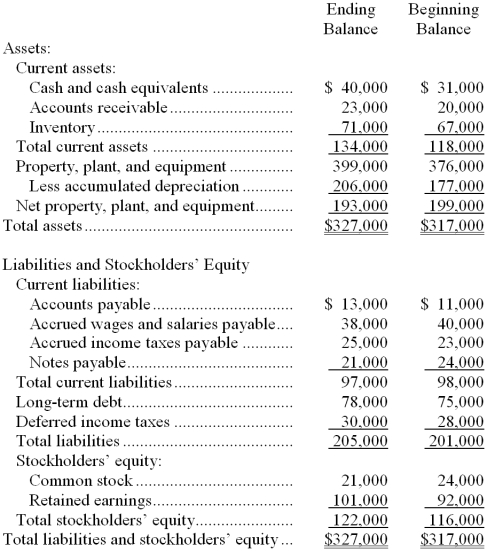

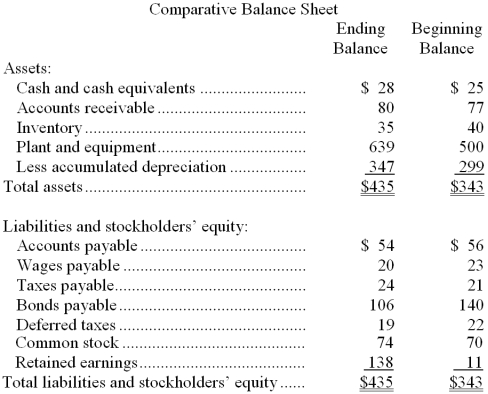

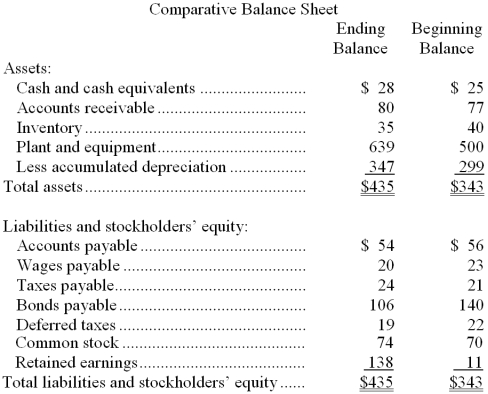

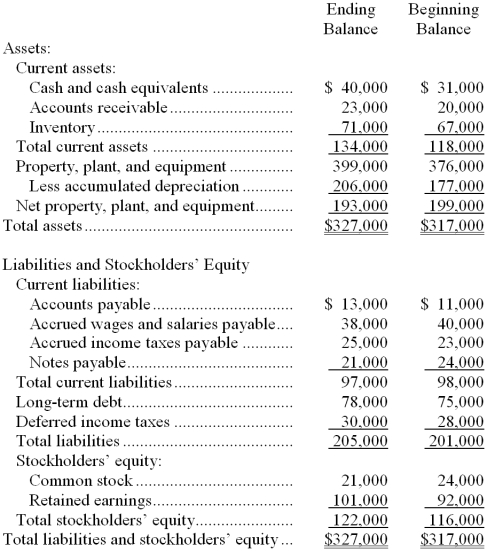

Kania Corporation's most recent balance sheet appears below:

The net income for the year was $171. Cash dividends were $44. The net cash provided by (used by) investing activities for the year was:

A) ($91)

B) ($139)

C) $91

D) $139

The net income for the year was $171. Cash dividends were $44. The net cash provided by (used by) investing activities for the year was:

A) ($91)

B) ($139)

C) $91

D) $139

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

51

Last year Burbach Company's cash account increased by $10,000. Net cash provided by investing activities was $16,000. Net cash used in financing activities was $34,000. On the statement of cash flows, the net cash flow provided by (used in) operating activities was:

A) $28,000

B) $(8,000)

C) $10,000

D) $(18,000)

A) $28,000

B) $(8,000)

C) $10,000

D) $(18,000)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

52

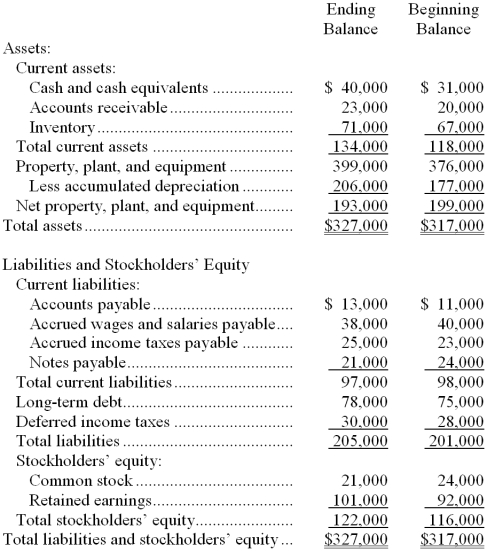

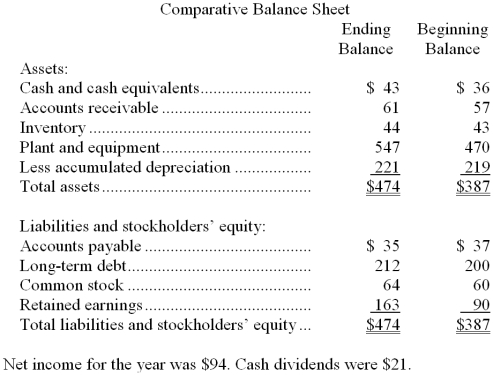

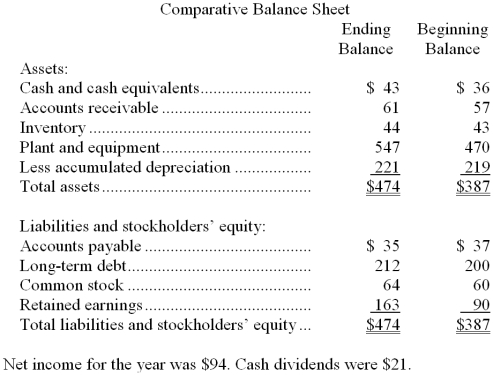

Hudgens Corporation's most recent balance sheet appears below:

The net income for the year was $49. Cash dividends were $10. The net cash provided by (used by) operations for the year was:

A) $70

B) $78

C) $20

D) $29

The net income for the year was $49. Cash dividends were $10. The net cash provided by (used by) operations for the year was:

A) $70

B) $78

C) $20

D) $29

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

53

Grboyan Corporation's most recent balance sheet appears below:

The net income for the year was $116. Cash dividends were $32. The net cash provided by (used by) investing activities for the year was:

A) $93

B) ($93)

C) $78

D) ($78)

The net income for the year was $116. Cash dividends were $32. The net cash provided by (used by) investing activities for the year was:

A) $93

B) ($93)

C) $78

D) ($78)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

54

Hanemann Corporation's most recent balance sheet appears below:

The net income for the year was $103. Cash dividends were $23. The net cash provided by (used by) financing activities for the year was:

A) ($56)

B) ($38)

C) ($23)

D) $5

The net income for the year was $103. Cash dividends were $23. The net cash provided by (used by) financing activities for the year was:

A) ($56)

B) ($38)

C) ($23)

D) $5

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

55

Andreoli Corporation's most recent balance sheet appears below:

The net income for the year was $189. Cash dividends were $47. The net cash provided by (used by) financing activities for the year was:

A) $4

B) ($80)

C) ($47)

D) ($123)

The net income for the year was $189. Cash dividends were $47. The net cash provided by (used by) financing activities for the year was:

A) $4

B) ($80)

C) ($47)

D) ($123)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

56

Foxworthy Corporation's most recent balance sheet appears below:

Net income for the year was $79. Cash dividends were $15. The net cash provided by (used by) operations for the year was:

A) $80

B) $78

C) ($1)

D) $113

Net income for the year was $79. Cash dividends were $15. The net cash provided by (used by) operations for the year was:

A) $80

B) $78

C) ($1)

D) $113

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

57

Ferron Corporation's net cash provided by operating activities was $81; its income taxes were $36; its capital expenditures were $34; and its cash dividends were $15. The company's free cash flow was:

A) $68

B) $32

C) -$13

D) $166

A) $68

B) $32

C) -$13

D) $166

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

58

Spettel Corporation's comparative balance sheet appears below:  The company's net income (loss) for the year was $11,000 and its cash dividends were $2,000.

The company's net income (loss) for the year was $11,000 and its cash dividends were $2,000.

The total dollar amount of all of the items that would be classified as sources when compiling a simplified statement of cash flows is:

A) $9,000

B) $38,000

C) $40,000

D) $49,000

The company's net income (loss) for the year was $11,000 and its cash dividends were $2,000.

The company's net income (loss) for the year was $11,000 and its cash dividends were $2,000.The total dollar amount of all of the items that would be classified as sources when compiling a simplified statement of cash flows is:

A) $9,000

B) $38,000

C) $40,000

D) $49,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

59

Grading Company's cash and cash equivalents consist of cash and marketable securities. Last year the company's cash account decreased by $14,000 and its marketable securities account increased by $18,000. Cash provided by operating activities was $21,000. Net cash used for financing activities was $22,000. Based on this information, the net cash flow from investing activities on the statement of cash flows was:

A) a net $13,000 decrease.

B) a net $1,000 increase.

C) a net $3,000 decrease.

D) a net $5,000 increase.

A) a net $13,000 decrease.

B) a net $1,000 increase.

C) a net $3,000 decrease.

D) a net $5,000 increase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

60

Hutchings Corporation's net cash provided by operating activities was $124; its capital expenditures were $54; and its cash dividends were $33. The company's free cash flow was:

A) $70

B) $91

C) $211

D) $37

A) $70

B) $91

C) $211

D) $37

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

61

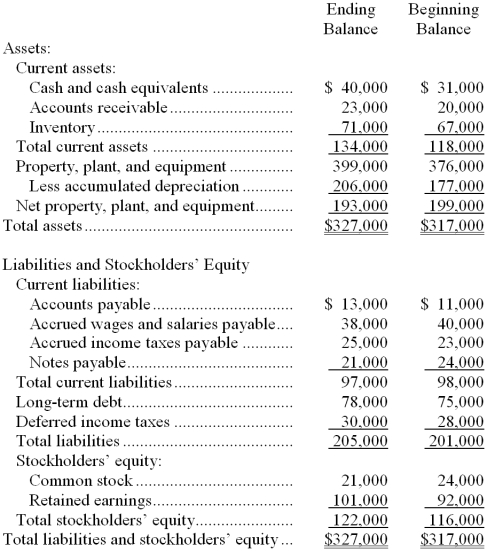

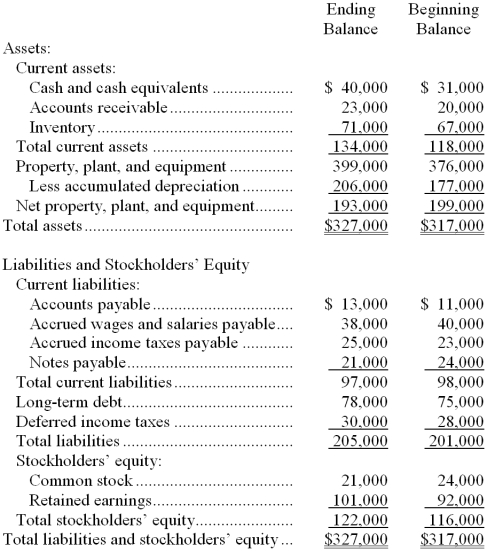

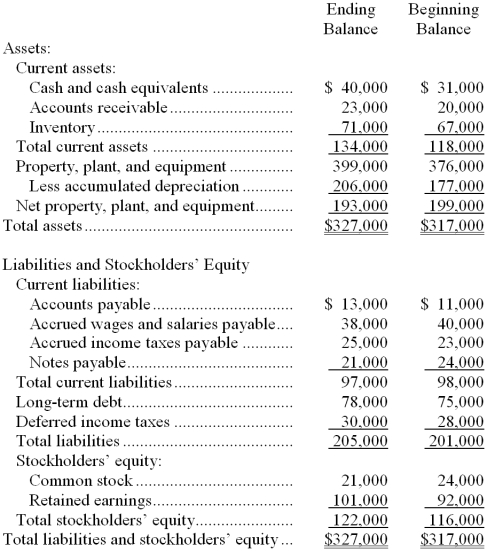

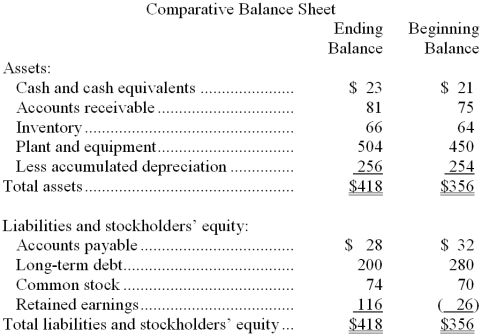

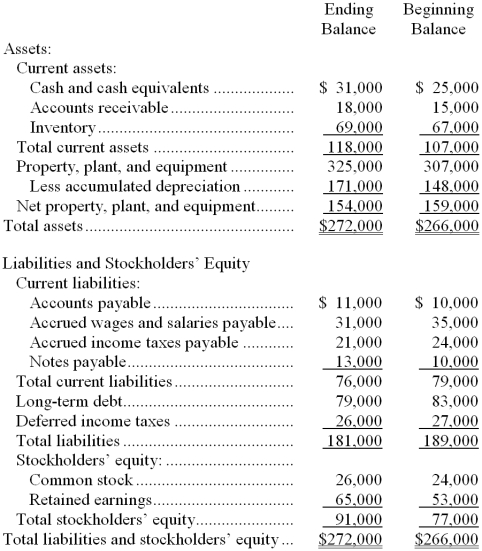

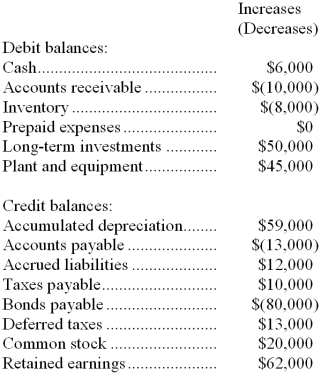

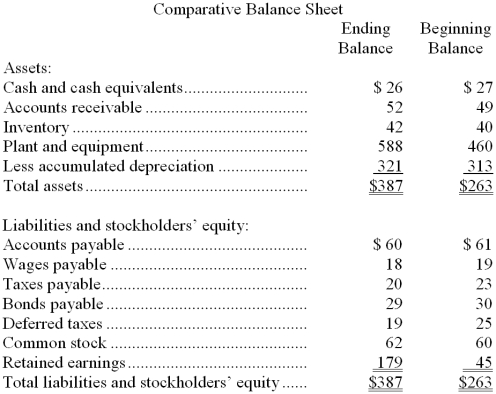

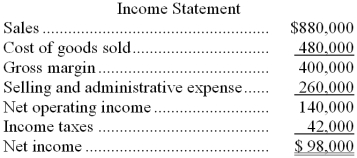

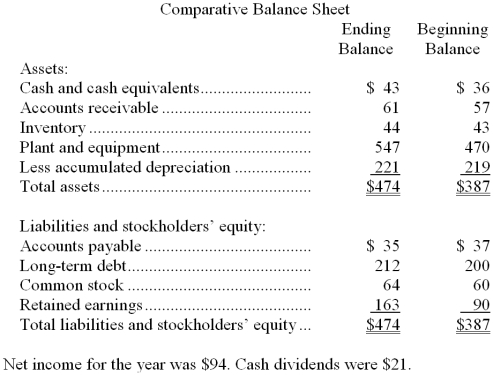

The most recent comparative balance sheet of Benefield Corporation appears below:

Which of the following classifications of changes in balance sheet accounts as sources and uses is correct?

A) The change in Accounts Receivable is a source; The change in Inventory is a use

B) The change in Accounts Receivable is a source; The change in Inventory is a source

C) The change in Accounts Receivable is a use; The change in Inventory is a use

D) The change in Accounts Receivable is a use; The change in Inventory is a source

Which of the following classifications of changes in balance sheet accounts as sources and uses is correct?

A) The change in Accounts Receivable is a source; The change in Inventory is a use

B) The change in Accounts Receivable is a source; The change in Inventory is a source

C) The change in Accounts Receivable is a use; The change in Inventory is a use

D) The change in Accounts Receivable is a use; The change in Inventory is a source

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

62

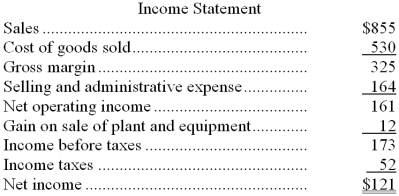

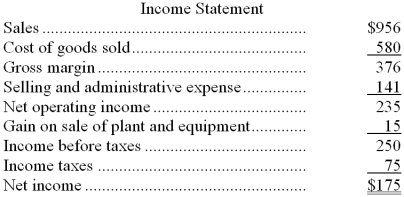

Burgett Corporation's balance sheet and income statement appear below:

Cash dividends were $41. The company sold equipment for $15 that was originally purchased for $4 and that had accumulated depreciation of $4.

Cash dividends were $41. The company sold equipment for $15 that was originally purchased for $4 and that had accumulated depreciation of $4.

The net cash provided by (used by) operations for the year was:

A) $235

B) $171

C) $156

D) $197

Cash dividends were $41. The company sold equipment for $15 that was originally purchased for $4 and that had accumulated depreciation of $4.

Cash dividends were $41. The company sold equipment for $15 that was originally purchased for $4 and that had accumulated depreciation of $4.The net cash provided by (used by) operations for the year was:

A) $235

B) $171

C) $156

D) $197

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

63

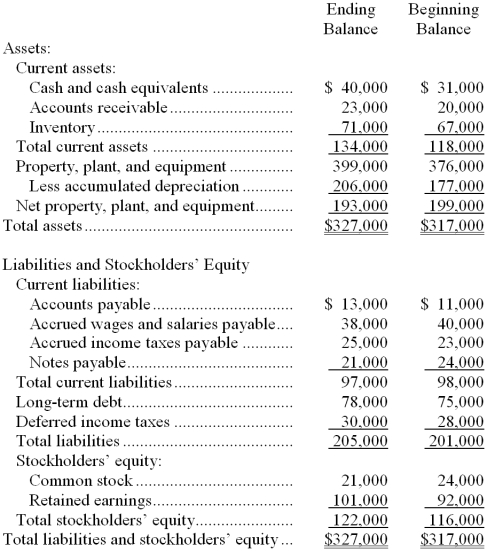

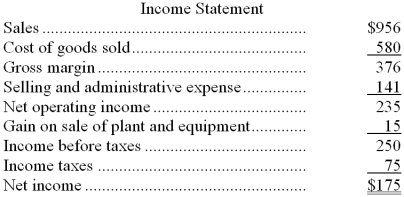

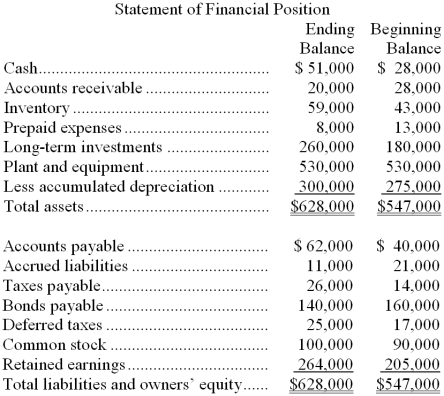

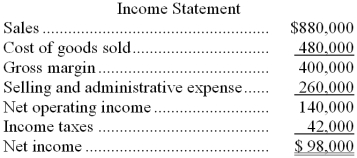

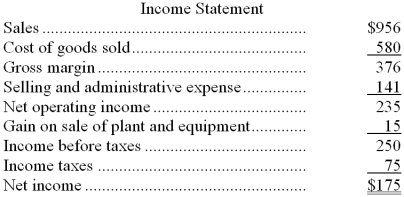

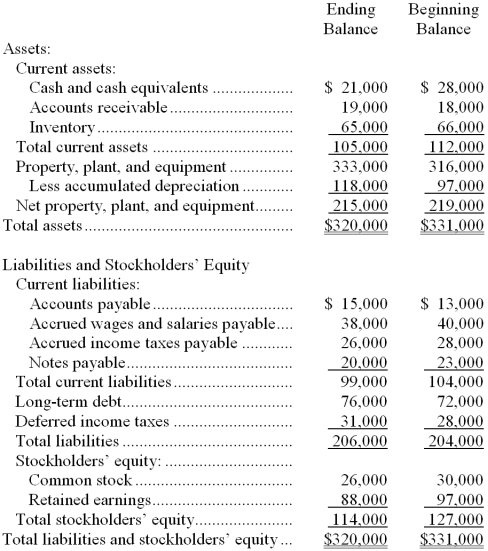

Wander Company's comparative balance sheet and income statement for last year appear below:

The company declared and paid $39,000 in cash dividends during the year. The following questions pertain to the company's statement of cash flows.

The company declared and paid $39,000 in cash dividends during the year. The following questions pertain to the company's statement of cash flows.

The net cash provided by (used in) operating activities last year was:

A) $44,000

B) $152,000

C) $123,000

D) $98,000

The company declared and paid $39,000 in cash dividends during the year. The following questions pertain to the company's statement of cash flows.

The company declared and paid $39,000 in cash dividends during the year. The following questions pertain to the company's statement of cash flows.The net cash provided by (used in) operating activities last year was:

A) $44,000

B) $152,000

C) $123,000

D) $98,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

64

Spanner Company recorded the following events last year:  On the statement of cash flows, some of these events are classified as operating activities, some are classified as investing activities, and some are classified as financing activities.

On the statement of cash flows, some of these events are classified as operating activities, some are classified as investing activities, and some are classified as financing activities.

Based solely on the information above, the net cash provided by (used in) financing activities on the statement of cash flows would be:

A) $(26,000)

B) $(8,000)

C) $89,000

D) $935,000

On the statement of cash flows, some of these events are classified as operating activities, some are classified as investing activities, and some are classified as financing activities.

On the statement of cash flows, some of these events are classified as operating activities, some are classified as investing activities, and some are classified as financing activities.Based solely on the information above, the net cash provided by (used in) financing activities on the statement of cash flows would be:

A) $(26,000)

B) $(8,000)

C) $89,000

D) $935,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

65

Kassebaum Corporation's comparative balance sheet appears below:  The company's net income (loss) for the year was $13,000 and its cash dividends were $1,000.

The company's net income (loss) for the year was $13,000 and its cash dividends were $1,000.

The total dollar amount of all of the items that would be classified as sources when compiling a simplified statement of cash flows is:

A) $6,000

B) $35,000

C) $36,000

D) $42,000

The company's net income (loss) for the year was $13,000 and its cash dividends were $1,000.

The company's net income (loss) for the year was $13,000 and its cash dividends were $1,000.The total dollar amount of all of the items that would be classified as sources when compiling a simplified statement of cash flows is:

A) $6,000

B) $35,000

C) $36,000

D) $42,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

66

Wander Company's comparative balance sheet and income statement for last year appear below:

The company declared and paid $39,000 in cash dividends during the year. The following questions pertain to the company's statement of cash flows.

The company declared and paid $39,000 in cash dividends during the year. The following questions pertain to the company's statement of cash flows.

The net cash provided by (used in) financing activities last year was:

A) $10,000

B) $(10,000)

C) $49,000

D) $(49,000)

The company declared and paid $39,000 in cash dividends during the year. The following questions pertain to the company's statement of cash flows.

The company declared and paid $39,000 in cash dividends during the year. The following questions pertain to the company's statement of cash flows.The net cash provided by (used in) financing activities last year was:

A) $10,000

B) $(10,000)

C) $49,000

D) $(49,000)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

67

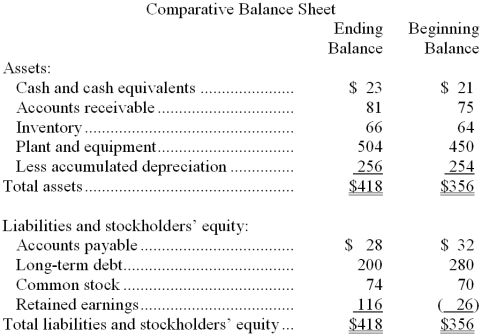

Lindgren Corporation's most recent comparative balance sheet appears below:

The net cash provided by (used by) investing activities for the year was:

A) $77

B) ($77)

C) $75

D) ($75)

The net cash provided by (used by) investing activities for the year was:

A) $77

B) ($77)

C) $75

D) ($75)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

68

Spanner Company recorded the following events last year:  On the statement of cash flows, some of these events are classified as operating activities, some are classified as investing activities, and some are classified as financing activities.

On the statement of cash flows, some of these events are classified as operating activities, some are classified as investing activities, and some are classified as financing activities.

Based solely on the information above, the net cash provided by (used in) investing activities on the statement of cash flows would be:

A) $(430,000)

B) $(935,000)

C) $(580,000)

D) $(300,000)

On the statement of cash flows, some of these events are classified as operating activities, some are classified as investing activities, and some are classified as financing activities.

On the statement of cash flows, some of these events are classified as operating activities, some are classified as investing activities, and some are classified as financing activities.Based solely on the information above, the net cash provided by (used in) investing activities on the statement of cash flows would be:

A) $(430,000)

B) $(935,000)

C) $(580,000)

D) $(300,000)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

69

Kassebaum Corporation's comparative balance sheet appears below:  The company's net income (loss) for the year was $13,000 and its cash dividends were $1,000.

The company's net income (loss) for the year was $13,000 and its cash dividends were $1,000.

The total dollar amount of all of the items that would be classified as uses when compiling a simplified statement of cash flows is:

A) $42,000

B) $35,000

C) $6,000

D) $36,000

The company's net income (loss) for the year was $13,000 and its cash dividends were $1,000.

The company's net income (loss) for the year was $13,000 and its cash dividends were $1,000.The total dollar amount of all of the items that would be classified as uses when compiling a simplified statement of cash flows is:

A) $42,000

B) $35,000

C) $6,000

D) $36,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

70

The most recent comparative balance sheet of Benefield Corporation appears below:

Which of the following classifications of changes in balance sheet accounts as sources and uses is correct?

A) The change in Accounts Payable is a use; The change in Accrued Wages and Salaries payable is a source

B) The change in Accounts Payable is a source; The change in Accrued Wages and Salaries payable is a use

C) The change in Accounts Payable is a source; The change in Accrued Wages and Salaries payable is a source

D) The change in Accounts Payable is a use; The change in Accrued Wages and Salaries payable is a use

Which of the following classifications of changes in balance sheet accounts as sources and uses is correct?

A) The change in Accounts Payable is a use; The change in Accrued Wages and Salaries payable is a source

B) The change in Accounts Payable is a source; The change in Accrued Wages and Salaries payable is a use

C) The change in Accounts Payable is a source; The change in Accrued Wages and Salaries payable is a source

D) The change in Accounts Payable is a use; The change in Accrued Wages and Salaries payable is a use

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

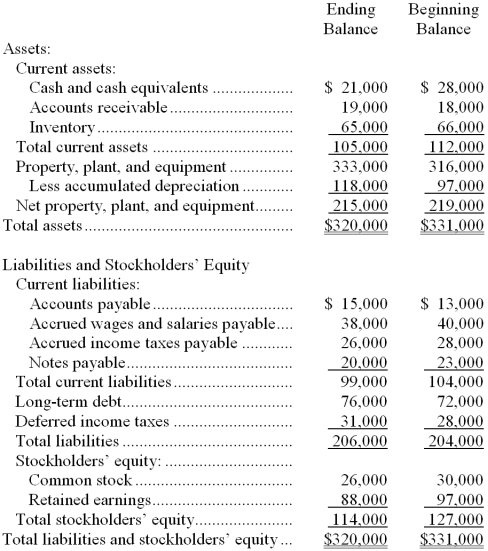

71

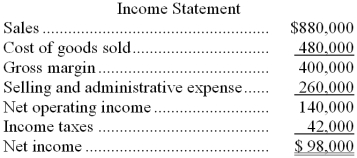

Megenity Company's net income last year was $194,000. Changes in the company's balance sheet accounts for the year appear below:  The company declared and paid cash dividends of $132,000 last year. The following questions pertain to the company's statement of cash flows.

The company declared and paid cash dividends of $132,000 last year. The following questions pertain to the company's statement of cash flows.

The net cash provided by (used in) financing activities last year was:

A) $60,000

B) $(60,000)

C) $192,000

D) $(192,000)

The company declared and paid cash dividends of $132,000 last year. The following questions pertain to the company's statement of cash flows.

The company declared and paid cash dividends of $132,000 last year. The following questions pertain to the company's statement of cash flows.The net cash provided by (used in) financing activities last year was:

A) $60,000

B) $(60,000)

C) $192,000

D) $(192,000)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

72

Megenity Company's net income last year was $194,000. Changes in the company's balance sheet accounts for the year appear below:  The company declared and paid cash dividends of $132,000 last year. The following questions pertain to the company's statement of cash flows.

The company declared and paid cash dividends of $132,000 last year. The following questions pertain to the company's statement of cash flows.

The net cash provided by (used in) operating activities last year was:

A) $194,000

B) $253,000

C) $234,000

D) $293,000

The company declared and paid cash dividends of $132,000 last year. The following questions pertain to the company's statement of cash flows.

The company declared and paid cash dividends of $132,000 last year. The following questions pertain to the company's statement of cash flows.The net cash provided by (used in) operating activities last year was:

A) $194,000

B) $253,000

C) $234,000

D) $293,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

73

Burgett Corporation's balance sheet and income statement appear below:

Cash dividends were $41. The company sold equipment for $15 that was originally purchased for $4 and that had accumulated depreciation of $4.

Cash dividends were $41. The company sold equipment for $15 that was originally purchased for $4 and that had accumulated depreciation of $4.

The net cash provided by (used by) investing activities for the year was:

A) ($132)

B) ($117)

C) $117

D) $15

Cash dividends were $41. The company sold equipment for $15 that was originally purchased for $4 and that had accumulated depreciation of $4.

Cash dividends were $41. The company sold equipment for $15 that was originally purchased for $4 and that had accumulated depreciation of $4.The net cash provided by (used by) investing activities for the year was:

A) ($132)

B) ($117)

C) $117

D) $15

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

74

The most recent comparative balance sheet of Benefield Corporation appears below:

Which of the following classifications of changes in balance sheet accounts as sources and uses is correct?

A) The change in Property, Plant, and Equipment is a source; The change in Long-Term Debt is a use

B) The change in Property, Plant, and Equipment is a use; The change in Long-Term Debt is a source

C) The change in Property, Plant, and Equipment is a source; The change in Long-Term Debt is a source

D) The change in Property, Plant, and Equipment is a use; The change in Long-Term Debt is a use

Which of the following classifications of changes in balance sheet accounts as sources and uses is correct?

A) The change in Property, Plant, and Equipment is a source; The change in Long-Term Debt is a use

B) The change in Property, Plant, and Equipment is a use; The change in Long-Term Debt is a source

C) The change in Property, Plant, and Equipment is a source; The change in Long-Term Debt is a source

D) The change in Property, Plant, and Equipment is a use; The change in Long-Term Debt is a use

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

75

Wander Company's comparative balance sheet and income statement for last year appear below:

The company declared and paid $39,000 in cash dividends during the year. The following questions pertain to the company's statement of cash flows.

The company declared and paid $39,000 in cash dividends during the year. The following questions pertain to the company's statement of cash flows.

The net cash provided by (used in) investing activities last year was:

A) $80,000

B) $(80,000)

C) $70,000

D) $(70,000)

The company declared and paid $39,000 in cash dividends during the year. The following questions pertain to the company's statement of cash flows.

The company declared and paid $39,000 in cash dividends during the year. The following questions pertain to the company's statement of cash flows.The net cash provided by (used in) investing activities last year was:

A) $80,000

B) $(80,000)

C) $70,000

D) $(70,000)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

76

Megenity Company's net income last year was $194,000. Changes in the company's balance sheet accounts for the year appear below:  The company declared and paid cash dividends of $132,000 last year. The following questions pertain to the company's statement of cash flows.

The company declared and paid cash dividends of $132,000 last year. The following questions pertain to the company's statement of cash flows.

No plant and equipment was disposed of during the year. The free cash flow for the year was:

A) $248,000

B) $116,000

C) $161,000

D) $470,000

The company declared and paid cash dividends of $132,000 last year. The following questions pertain to the company's statement of cash flows.

The company declared and paid cash dividends of $132,000 last year. The following questions pertain to the company's statement of cash flows.No plant and equipment was disposed of during the year. The free cash flow for the year was:

A) $248,000

B) $116,000

C) $161,000

D) $470,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

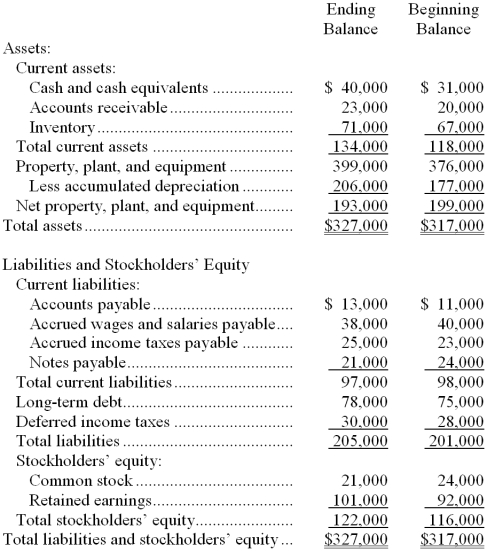

77

Lindgren Corporation's most recent comparative balance sheet appears below:

The net cash provided by (used by) operations for the year was:

A) $134

B) ($5)

C) $99

D) $89

The net cash provided by (used by) operations for the year was:

A) $134

B) ($5)

C) $99

D) $89

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

78

Lindgren Corporation's most recent comparative balance sheet appears below:

No plant and equipment was disposed of during the year. The free cash flow for the year was:

A) $68

B) $15

C) ($9)

D) $6

No plant and equipment was disposed of during the year. The free cash flow for the year was:

A) $68

B) $15

C) ($9)

D) $6

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

79

Megenity Company's net income last year was $194,000. Changes in the company's balance sheet accounts for the year appear below:  The company declared and paid cash dividends of $132,000 last year. The following questions pertain to the company's statement of cash flows.

The company declared and paid cash dividends of $132,000 last year. The following questions pertain to the company's statement of cash flows.

The net cash provided by (used in) investing activities last year was:

A) $(75,000)

B) $75,000

C) $(95,000)

D) $95,000

The company declared and paid cash dividends of $132,000 last year. The following questions pertain to the company's statement of cash flows.

The company declared and paid cash dividends of $132,000 last year. The following questions pertain to the company's statement of cash flows.The net cash provided by (used in) investing activities last year was:

A) $(75,000)

B) $75,000

C) $(95,000)

D) $95,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

80

Lindgren Corporation's most recent comparative balance sheet appears below:

The net cash provided by (used by) financing activities for the year was:

A) ($5)

B) ($21)

C) $4

D) $12

The net cash provided by (used by) financing activities for the year was:

A) ($5)

B) ($21)

C) $4

D) $12

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck