Deck 7: Financial Instruments

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/30

العب

ملء الشاشة (f)

Deck 7: Financial Instruments

1

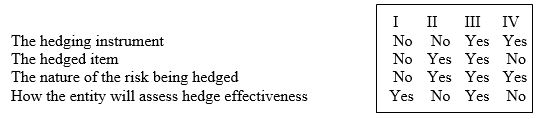

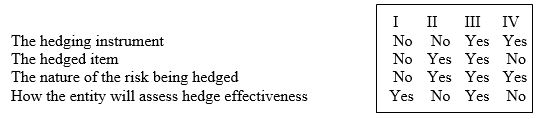

The formal documentation of a hedging relationship must include identification of:

A) I;

B) II;

C) III;

D) IV.

A) I;

B) II;

C) III;

D) IV.

C

2

Company A issued convertible notes 3 years ago and accounted for them as a compound financial instrument. Complete the following:

At the end of the three year period the portion of the XXX component that relates to the notes which have been converted XXX.

A) equity, is transferred to profit & loss

B) liability, remains as a liability

C) liability, is transferred to equity

D) liability, is transferred to profit & loss

At the end of the three year period the portion of the XXX component that relates to the notes which have been converted XXX.

A) equity, is transferred to profit & loss

B) liability, remains as a liability

C) liability, is transferred to equity

D) liability, is transferred to profit & loss

C

3

Which of the following is NOT a condition for hedge accounting to be applied?

A) There must be formal designation and documentation of the hedging relationship at the inception of the hedge.

B) The effectiveness of the hedge must be able to be reliably measured.

C) The hedge must be expected to be effective

D) For cash flow hedges, the forecast transaction must be highly probable.

A) There must be formal designation and documentation of the hedging relationship at the inception of the hedge.

B) The effectiveness of the hedge must be able to be reliably measured.

C) The hedge must be expected to be effective

D) For cash flow hedges, the forecast transaction must be highly probable.

C

4

When first issued, IAS 39 was:

A) More rule-based than other AASB standards

B) Less rule-based than other AASB standards

C) Wider in scope that other AASB standards

D) Narrower in scope that other AASB standards

A) More rule-based than other AASB standards

B) Less rule-based than other AASB standards

C) Wider in scope that other AASB standards

D) Narrower in scope that other AASB standards

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

5

To be regarded as 'highly effective' in achieving offsetting changes in fair value or cash flows, actual hedge results must be in the range:

A) 70% - 100%;

B) 80% - 125%;

C) 90% - 100%;

D) 20% - 50%.

A) 70% - 100%;

B) 80% - 125%;

C) 90% - 100%;

D) 20% - 50%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

6

Which of the following events provide objective evidence that a financial asset has been impaired:

I A default in interest payments.

II The borrower enters into bankruptcy.

III Significant financial difficulty of the issuer.

IV The downgrade of an entity's credit rating.

A) I, II and III only;

B) II, III and IV only;

C) I, III and IV only;

D) II and IV only.

I A default in interest payments.

II The borrower enters into bankruptcy.

III Significant financial difficulty of the issuer.

IV The downgrade of an entity's credit rating.

A) I, II and III only;

B) II, III and IV only;

C) I, III and IV only;

D) II and IV only.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

7

According to IAS 32 Financial Instruments: Presentation, which of the following items would be regarded as a financial liability?

A) ordinary shares held in another entity;

B) a contract that is a non-derivative for which the entity is obliged to deliver a variable number of its own equity instruments;

C) a contractual right to exchange under potentially favourable conditions, an option to purchase shares below the market price;

D) the right of a depositor to obtain cash from a financial institution with which it has deposited cash.

A) ordinary shares held in another entity;

B) a contract that is a non-derivative for which the entity is obliged to deliver a variable number of its own equity instruments;

C) a contractual right to exchange under potentially favourable conditions, an option to purchase shares below the market price;

D) the right of a depositor to obtain cash from a financial institution with which it has deposited cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

8

The degree to which changes in the fair value or cash flows of a hedge item that are attributable to a hedge risk are offset by the changes in the fair value or cash flows of a hedging instrument, describes:

A) transaction exposure;

B) hedge ineffectiveness;

C) hedge effectiveness;

D) transaction variability.

A) transaction exposure;

B) hedge ineffectiveness;

C) hedge effectiveness;

D) transaction variability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

9

Which of the following items is classified as a financial asset?

A) ordinary shares of the issuer;

B) loans payable (owed by the borrower);

C) accounts receivable;

D) inventory.

A) ordinary shares of the issuer;

B) loans payable (owed by the borrower);

C) accounts receivable;

D) inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

10

When accounting for a cash flow hedge, IAS 39 Financial Instruments: Recognition and Measurement, requires that hedge ineffectiveness is:

A) recorded in profit or loss;

B) separately recorded in equity;

C) recorded separately as a financial liability;

D) capitalised as a deferred asset.

A) recorded in profit or loss;

B) separately recorded in equity;

C) recorded separately as a financial liability;

D) capitalised as a deferred asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

11

All of the following would be regarded as financial instruments except:

A) bank overdraft;

B) notes payable;

C) cash;

D) equipment.

A) bank overdraft;

B) notes payable;

C) cash;

D) equipment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

12

Under IAS 39 Financial Instruments: Recognition and Measurement, when a fair value hedge instrument expires it:

A) must be transferred within equity to retained earnings;

B) remains permanently in equity;

C) must be discontinued retrospectively;

D) must be discontinued prospectively.

A) must be transferred within equity to retained earnings;

B) remains permanently in equity;

C) must be discontinued retrospectively;

D) must be discontinued prospectively.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

13

Which of the following is NOT an example of a derivative financial instrument?

A) A forward exchange contract

B) A commercial bill contract

C) A futures contract

D) An option contract

A) A forward exchange contract

B) A commercial bill contract

C) A futures contract

D) An option contract

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

14

Company A has convertible notes on issue. These notes are convertible to ordinary shares of the Company after 3 years. The distributions made to the note holders by Company A are classified by Company A as follows:

A) interest expense.

B) dividends distributed.

C) a portion representing interest expense and a portion representing dividends distributed

D) indeterminable based on the information provided.

A) interest expense.

B) dividends distributed.

C) a portion representing interest expense and a portion representing dividends distributed

D) indeterminable based on the information provided.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

15

Whitnall Limited lost $150 on a hedging instrument and had a corresponding gain on the hedged item of $100. The effectiveness range for the associated transactions is:

A) 100% - 150%;

B) 20% - 30%;

C) 0% - 15%;

D) 66% - 150%.

A) 100% - 150%;

B) 20% - 30%;

C) 0% - 15%;

D) 66% - 150%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

16

Which of the following are regarded as financial instruments:

I Deposits held by a financial institution;

II Ordinary shares;

III Raw materials inventories;

IV Property, plant and equipment.

V Accounts receivable and accounts payable.

A) I, II, IV and V only;

B) II, III and IV only;

C) I, II and V only;

D) I, IV and V only.

I Deposits held by a financial institution;

II Ordinary shares;

III Raw materials inventories;

IV Property, plant and equipment.

V Accounts receivable and accounts payable.

A) I, II, IV and V only;

B) II, III and IV only;

C) I, II and V only;

D) I, IV and V only.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

17

Which of the following categories of financial instruments is NOT subsequently measured at amortised cost?

A) Held-to-maturity investments

B) Loans and receivables

C) Other financial liabilities

D) Available-for-sale financial assets

A) Held-to-maturity investments

B) Loans and receivables

C) Other financial liabilities

D) Available-for-sale financial assets

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

18

The definition of a derivative requires which of the following characteristics to be met?

I its value must change in response to a change in an underlying variable such as a specified interest rate, price or foreign exchange rate.

II it must be settled on a net basis

III it must require no initial net investment or an additional net investment that is smaller than would be required for other types of contracts with similar responses to changes in market factors.

IV it is to be settled at a future date

A) I, II and III

B) I, III and IV

C) I, II and IV

D) II, III and IV

I its value must change in response to a change in an underlying variable such as a specified interest rate, price or foreign exchange rate.

II it must be settled on a net basis

III it must require no initial net investment or an additional net investment that is smaller than would be required for other types of contracts with similar responses to changes in market factors.

IV it is to be settled at a future date

A) I, II and III

B) I, III and IV

C) I, II and IV

D) II, III and IV

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

19

Company A issues preference shares to Company B, the terms of which entitle party B to redeem the preference shares for cash if Company A's revenues fall below a specified level. From Company A's perspective the preference shares are:

A) an equity instrument

B) a financial liability

C) a compound financial instrument

D) a financial asset

A) an equity instrument

B) a financial liability

C) a compound financial instrument

D) a financial asset

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

20

IAS 39 Financial Instruments: Recognition and Measurement, requires that 'Held-to- maturity' investments be initially measured at:

A) fair value;

B) fair value plus transaction costs;

C) discounted future cash outflows;

D) discounted future net cash flows.

A) fair value;

B) fair value plus transaction costs;

C) discounted future cash outflows;

D) discounted future net cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

21

IAS 39 requires that on initial recognition, financial assets and liabilities be measured at:

A) historic cost;

B) fair value;

C) lower of cost or market;

D) net present value.

A) historic cost;

B) fair value;

C) lower of cost or market;

D) net present value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

22

Which of the following is within the scope of IAS 39?

A) a lease obligation to which IAS 17 applies

B) a lease renewal option within a lease agreement

C) a contract for contingent consideration payable in a business combination covered by IFRS 3

D) a share option issued under an employee share scheme which is covered by IFRS 2.

A) a lease obligation to which IAS 17 applies

B) a lease renewal option within a lease agreement

C) a contract for contingent consideration payable in a business combination covered by IFRS 3

D) a share option issued under an employee share scheme which is covered by IFRS 2.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

23

Callas Corporation Limited buys an option that entitles it to purchase 2000 shares in Maria Limited at $5 per share at any time in the next 3 months. The derivative financial instrument in this transaction is the:

A) shares in Callas Corporation Limited;

B) shares in Maria Limited;

C) price of the shares in Maria Limited after 3 months have elapsed;

D) option priced at $5.

A) shares in Callas Corporation Limited;

B) shares in Maria Limited;

C) price of the shares in Maria Limited after 3 months have elapsed;

D) option priced at $5.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

24

When an entity has a legally enforceable right to set off the recognised amounts of a financial asset and financial liability and it intends to settle on a net basis, it:

A) can write off both the asset and the liability;

B) may offset the financial asset and liability;

C) is not entitled to offset the asset and liability;

D) need not present the asset, the liability or the net amount in its financial statements.

A) can write off both the asset and the liability;

B) may offset the financial asset and liability;

C) is not entitled to offset the asset and liability;

D) need not present the asset, the liability or the net amount in its financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

25

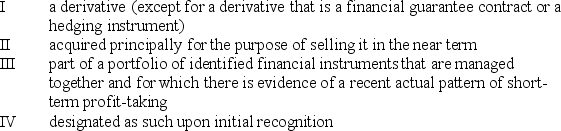

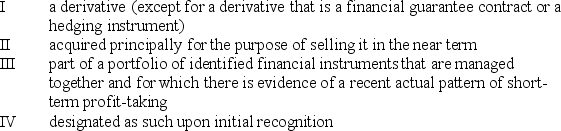

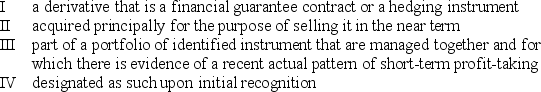

A financial liability classified as fair value through profit and loss must be:

A) I, II and III

B) I, III and IV

C) I, II and IV

D) II, III and IV

A) I, II and III

B) I, III and IV

C) I, II and IV

D) II, III and IV

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

26

The risk that one party to a financial instrument will fail to discharge an obligation and cause the other party to incur a financial loss is referred to as:

A) interest rate risk;

B) liquidity risk;

C) market risk;

D) credit risk.

A) interest rate risk;

B) liquidity risk;

C) market risk;

D) credit risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

27

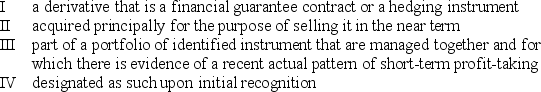

A financial asset classified as fair value through profit and loss (FVTPL) must be:

A) I, II and III

B) I, III and IV

C) I, II and IV

D) II, III and IV

A) I, II and III

B) I, III and IV

C) I, II and IV

D) II, III and IV

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

28

Which of the following is excluded from the scope of IAS 39?

A) a lease renewal option within a lease agreement.

B) a contract for contingent consideration receivable in a business combination covered by IFRS 3

C) an investment in a controlled entity accounted for at cost in the investor's separate consolidated financial statements.

D) Loan commitments that cannot be settled in cash or another financial instrument.

A) a lease renewal option within a lease agreement.

B) a contract for contingent consideration receivable in a business combination covered by IFRS 3

C) an investment in a controlled entity accounted for at cost in the investor's separate consolidated financial statements.

D) Loan commitments that cannot be settled in cash or another financial instrument.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

29

The appropriate accounting treatment for incremental costs directly attributable to an equity transaction that would otherwise have been avoided is to:

A) deduct from equity, net of tax;

B) add to equity, net of tax;

C) expense in the period incurred;

D) defer as a contingent asset.

A) deduct from equity, net of tax;

B) add to equity, net of tax;

C) expense in the period incurred;

D) defer as a contingent asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

30

The classification of a financial instrument on the Statement of Financial Position of an entity is governed by the principle of:

A) legal form;

B) net present value;

C) substance over form;

D) forfeiture.

A) legal form;

B) net present value;

C) substance over form;

D) forfeiture.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck