Deck 6: Income Taxes

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/28

العب

ملء الشاشة (f)

Deck 6: Income Taxes

1

Generally, when considering the differences between the accounting treatment and the income tax treatment of a particular item the accounting treatment is based on:

A) cash flows

B) cash flows adjusted for depreciation charges

C) accrual accounting and is subject to the requirements of accounting standards

D) the income tax legislation.

A) cash flows

B) cash flows adjusted for depreciation charges

C) accrual accounting and is subject to the requirements of accounting standards

D) the income tax legislation.

C

2

Balchin Limited had the following deferred tax balances at reporting date:

Deferred tax assets $12 000

Deferred tax liabilities $30 000

Effective from the first day of the next financial period, the company rate of income tax was reduced from 40% to 30%. The adjustment to income tax expense to recognise the impact of the tax rate change is:

A) DR $6000

B) DR $4500

C) CR $6000

D) CR $4500.

Deferred tax assets $12 000

Deferred tax liabilities $30 000

Effective from the first day of the next financial period, the company rate of income tax was reduced from 40% to 30%. The adjustment to income tax expense to recognise the impact of the tax rate change is:

A) DR $6000

B) DR $4500

C) CR $6000

D) CR $4500.

D

3

Use the information below to answer questions 12 and 13.

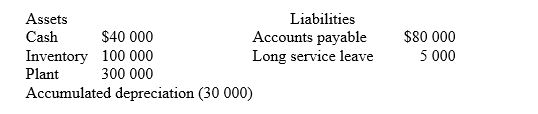

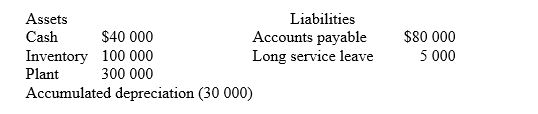

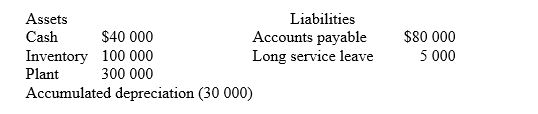

A company commenced business on 1 July 2012. On 30 June 2013, an extract of the statement of financial position prepared for internal purposes, but excluding the effect of income tax, disclosed the following information:

Additional information:

1. The plant was acquired on 1 July 2012. Depreciation for accounting purposes was 10% (straight-line method), while 15% (straight-line) was used for tax purposes.

2. The tax rate is 30%.

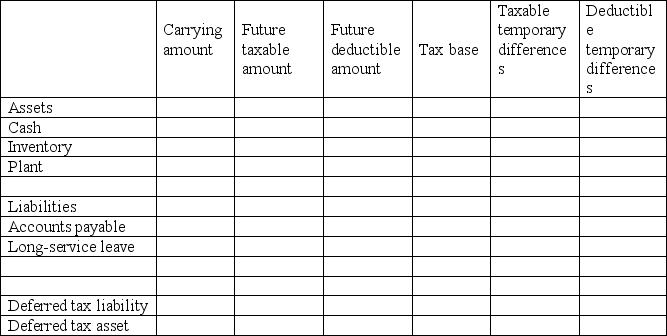

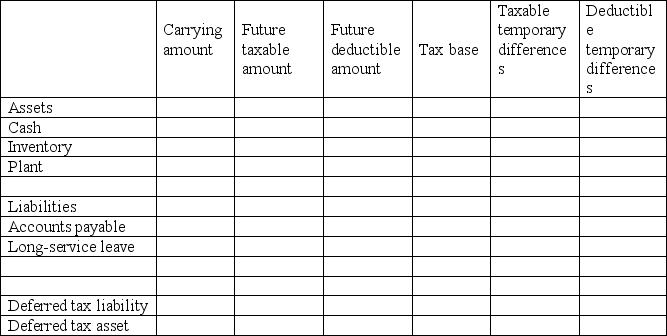

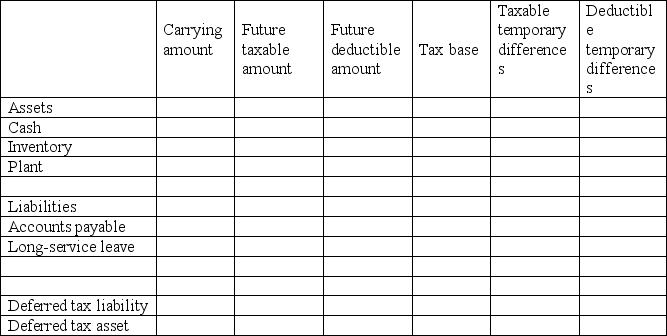

Using the following worksheet, determine the deferred tax asset and deferred tax liability.

The deferred tax asset is:

A) $1500

B) $4500

C) $5000

D) $25 500.

A company commenced business on 1 July 2012. On 30 June 2013, an extract of the statement of financial position prepared for internal purposes, but excluding the effect of income tax, disclosed the following information:

Additional information:

1. The plant was acquired on 1 July 2012. Depreciation for accounting purposes was 10% (straight-line method), while 15% (straight-line) was used for tax purposes.

2. The tax rate is 30%.

Using the following worksheet, determine the deferred tax asset and deferred tax liability.

The deferred tax asset is:

A) $1500

B) $4500

C) $5000

D) $25 500.

A

4

On 1 April 2013, the company rate of income tax was changed from 35% to 30%. At the previous reporting date (30 June 2012) Montgomery Limited had the following tax balances:

Deferred tax assets $26 250

Deferred tax liabilities $21 000

What is the impact of the tax rate change on income tax expense?

A) increase $750

B) decrease $750

C) increase $875

D) decrease $875.

Deferred tax assets $26 250

Deferred tax liabilities $21 000

What is the impact of the tax rate change on income tax expense?

A) increase $750

B) decrease $750

C) increase $875

D) decrease $875.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

5

A taxable temporary difference is expected to lead to the payment of:

A) more tax in the future and gives rise to a deferred tax asset

B) less tax in the future and gives rise to a deferred tax asset

C) more tax in the future and gives rise to a deferred tax liability

D) less tax in the future and gives rise to a deferred tax liability.

A) more tax in the future and gives rise to a deferred tax asset

B) less tax in the future and gives rise to a deferred tax asset

C) more tax in the future and gives rise to a deferred tax liability

D) less tax in the future and gives rise to a deferred tax liability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

6

Tax losses can be viewed as providing:

A) taxable temporary differences, and therefore a current tax liability

B) taxable temporary differences, and therefore a current tax refund

C) deductible temporary differences, and therefore a deferred tax asset

D) deductible temporary differences, and therefore deferred tax liabilities.

A) taxable temporary differences, and therefore a current tax liability

B) taxable temporary differences, and therefore a current tax refund

C) deductible temporary differences, and therefore a deferred tax asset

D) deductible temporary differences, and therefore deferred tax liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

7

Differences between the carrying amounts of an entity's net assets determined under accounting standards and accrual accounting, and the tax bases of those net assets determined under the Income Tax Assessment Act, are described as:

A) temporary differences

B) permanent differences

C) tax losses

D) the current income tax liability.

A) temporary differences

B) permanent differences

C) tax losses

D) the current income tax liability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

8

CTT Limited has an asset which cost $300 and against which depreciation of $100 has accumulated. The accumulated depreciation for tax purposes is $180 and the company tax rate is 30%. The tax base of this asset is:

A) $120

B) $220

C) $80

D) $20

A) $120

B) $220

C) $80

D) $20

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

9

In jurisdictions where the impairment of goodwill is not tax deductible, IAS 12 Income Taxes:

A) does not permit the application of deferred tax accounting to goodwill

B) allows the recognition of a deferred tax item in relation to goodwill

C) requires that any deferred tax items in relation to goodwill be recognised directly in equity

D) requires that any deferred tax items for goodwill be capitalised in the carrying amount of goodwill.

A) does not permit the application of deferred tax accounting to goodwill

B) allows the recognition of a deferred tax item in relation to goodwill

C) requires that any deferred tax items in relation to goodwill be recognised directly in equity

D) requires that any deferred tax items for goodwill be capitalised in the carrying amount of goodwill.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

10

The following information relates to Godfrey Limited for the year ended 30 June 2014.

Accounting profit before income tax (after all expenses have been included) $300 000

Fines and penalties (not tax deductible) 20 000

Depreciation of plant (accounting) 40 000

Depreciation of plant (tax) 100 000

Long-service leave expense (not a tax deduction until the leave is paid) 8 000

Income tax rate 30%

On the basis of this information the current tax liability is:

A) $74 400

B) $78 000

C) $80 400

D) $99 600.

Accounting profit before income tax (after all expenses have been included) $300 000

Fines and penalties (not tax deductible) 20 000

Depreciation of plant (accounting) 40 000

Depreciation of plant (tax) 100 000

Long-service leave expense (not a tax deduction until the leave is paid) 8 000

Income tax rate 30%

On the basis of this information the current tax liability is:

A) $74 400

B) $78 000

C) $80 400

D) $99 600.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

11

The tax expense related to profit or loss of the period is required to be presented:

A) on the face of the statement of financial position

B) on the face of the statement of profit or loss and other comprehensive income

C) in the statement of cash flows

D) in the statement of changes in equity.

A) on the face of the statement of financial position

B) on the face of the statement of profit or loss and other comprehensive income

C) in the statement of cash flows

D) in the statement of changes in equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

12

Malarky Limited accrued $30 000 for employees' long service leave in the year ended 30 June 2013. This item will not be tax deductible until it is paid in approximately 10 years' time. If the company tax rate is 30% Malarky Limited must record the following tax effect as a balance date adjustment:

A) debit Deferred tax asset $9000

B) debit Deferred tax liability $9000

C) credit Deferred tax asset $9000

D) credit Deferred tax liability $9000.

A) debit Deferred tax asset $9000

B) debit Deferred tax liability $9000

C) credit Deferred tax asset $9000

D) credit Deferred tax liability $9000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

13

D'Silva Limited has a product warranty liability amounting to $10 000. The product warranty costs are not tax deductible until paid out to customers. The company tax rate is 30%. The company has:

A) a deductible temporary difference of $10 000

B) an taxable temporary difference of $10 000

C) a tax base of $10 000

D) a future deductible amount of $0.

A) a deductible temporary difference of $10 000

B) an taxable temporary difference of $10 000

C) a tax base of $10 000

D) a future deductible amount of $0.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

14

Deferred tax accounting adjustments are recorded at what point in time?

A) As each transaction arises or is incurred

B) As the cash flows from each transaction occur

C) At the end of each month

D) At balance date.

A) As each transaction arises or is incurred

B) As the cash flows from each transaction occur

C) At the end of each month

D) At balance date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

15

Unless a company has a legal right of set-off, IAS 12 Income Taxes, requires disclosure of all of the following information for deferred tax statement of financial position items:

I The amount of deferred tax assets recognised.

II The amount of the deferred tax liabilities recognised.

III The net amount of the deferred tax assets and liabilities recognised.

IV The amount of the deferred tax asset relating to tax losses.

A) I, II and IV only

B) I, II and III only

C) III and IV only

D) IV only.

I The amount of deferred tax assets recognised.

II The amount of the deferred tax liabilities recognised.

III The net amount of the deferred tax assets and liabilities recognised.

IV The amount of the deferred tax asset relating to tax losses.

A) I, II and IV only

B) I, II and III only

C) III and IV only

D) IV only.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

16

The following information was extracted from the financial records of Pamakari Limited: Equipment purchased on 1 July 2014 for $100 000 (accounting depreciation 10% straight line tax depreciation 20% straight line). If the company tax rate is 30%, the deferred tax item that will be recorded by Pamakari Limited at 30 June 2015 is:

A) debit Deferred tax asset $3000

B) credit Deferred tax asset $3000

C) debit Deferred tax liability $3000

D) credit Deferred tax liability $3000.

A) debit Deferred tax asset $3000

B) credit Deferred tax asset $3000

C) debit Deferred tax liability $3000

D) credit Deferred tax liability $3000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

17

Use the information below to answer questions 12 and 13.

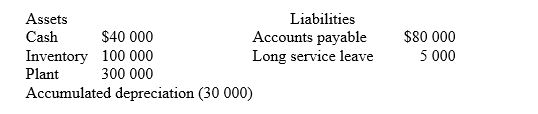

A company commenced business on 1 July 2012. On 30 June 2013, an extract of the statement of financial position prepared for internal purposes, but excluding the effect of income tax, disclosed the following information:

Additional information:

1. The plant was acquired on 1 July 2012. Depreciation for accounting purposes was 10% (straight-line method), while 15% (straight-line) was used for tax purposes.

2. The tax rate is 30%.

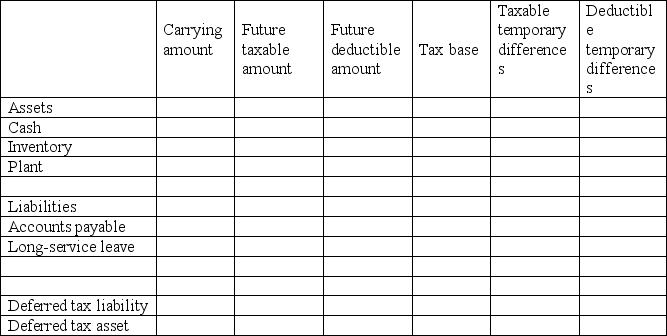

Using the following worksheet, determine the deferred tax asset and deferred tax liability.

The deferred tax liability is:

A) $1500

B) $4500

C) $15 000

D) $34 500.

A company commenced business on 1 July 2012. On 30 June 2013, an extract of the statement of financial position prepared for internal purposes, but excluding the effect of income tax, disclosed the following information:

Additional information:

1. The plant was acquired on 1 July 2012. Depreciation for accounting purposes was 10% (straight-line method), while 15% (straight-line) was used for tax purposes.

2. The tax rate is 30%.

Using the following worksheet, determine the deferred tax asset and deferred tax liability.

The deferred tax liability is:

A) $1500

B) $4500

C) $15 000

D) $34 500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

18

Under IAS 12 Incomes Taxes, deferred tax assets and liabilities are measured at the tax rates that:

A) applied at the beginning of the reporting period

B) at the end of the reporting period

C) at the rates that prevail at the reporting date

D) are expected to apply when the asset is realised or the liability is settled.

A) applied at the beginning of the reporting period

B) at the end of the reporting period

C) at the rates that prevail at the reporting date

D) are expected to apply when the asset is realised or the liability is settled.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

19

During the year ended 30 June 2013 Barry Ltd, pays quarterly tax instalments as follows:

$4000 on 28 October 2012

$11 000 on 28 February 2013

$12 000 on 28 April 2013

On 30 June 2013, Barry Ltd determines its total current tax liability for the year to be $33 000.

The final tax instalment for the year will be:

A) a refund of $2000.

B) a payment of $6000

C) a payment of $12 000

D) a payment of $33 000.

$4000 on 28 October 2012

$11 000 on 28 February 2013

$12 000 on 28 April 2013

On 30 June 2013, Barry Ltd determines its total current tax liability for the year to be $33 000.

The final tax instalment for the year will be:

A) a refund of $2000.

B) a payment of $6000

C) a payment of $12 000

D) a payment of $33 000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

20

A deductible temporary difference is expected to lead to the payment of:

A) more tax in the future and gives rise to a deferred tax asset

B) less tax in the future and gives rise to a deferred tax asset

C) more tax in the future and gives rise to a deferred tax liability

D) less tax in the future and gives rise to a deferred tax liability.

A) more tax in the future and gives rise to a deferred tax asset

B) less tax in the future and gives rise to a deferred tax asset

C) more tax in the future and gives rise to a deferred tax liability

D) less tax in the future and gives rise to a deferred tax liability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

21

If a taxation authority amends a company's assessment, the company should:

A) Debit income tax expense if more tax needs to be paid

B) Credit income tax expense if less tax needs to be paid

C) Analyse the reason for the adjustment and consider whether both current and deferred tax are affected

D) Treat the adjustment as a prior period adjustment.

A) Debit income tax expense if more tax needs to be paid

B) Credit income tax expense if less tax needs to be paid

C) Analyse the reason for the adjustment and consider whether both current and deferred tax are affected

D) Treat the adjustment as a prior period adjustment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

22

Which of the following disclosures are optional under IAS 12?

A) the major components of income tax expense

B) the aggregate current tax or deferred tax that arises relating to items that are charged or credited directly to equity

C) the amount of deductible temporary differences and unused tax losses, for which no deferred tax asset is recognised in the statement of financial position

D) a numerical reconciliation between the average effective tax rate and the applicable tax rate, disclosing also the basis of calculating the applicable tax rate.

A) the major components of income tax expense

B) the aggregate current tax or deferred tax that arises relating to items that are charged or credited directly to equity

C) the amount of deductible temporary differences and unused tax losses, for which no deferred tax asset is recognised in the statement of financial position

D) a numerical reconciliation between the average effective tax rate and the applicable tax rate, disclosing also the basis of calculating the applicable tax rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

23

Carry-forward tax losses create:

A) a deductible temporary difference and therefore a deferred tax asset in that the company will pay more tax on future taxable profits

B) a taxable temporary difference and therefore a deferred tax asset in that the company will pay less tax on future taxable profits

C) a deductible temporary difference and therefore a deferred tax liability in that the company will pay more tax on future taxable profits

D) a deductible temporary difference and therefore a deferred tax asset in that the company will pay less tax on future taxable profits.

A) a deductible temporary difference and therefore a deferred tax asset in that the company will pay more tax on future taxable profits

B) a taxable temporary difference and therefore a deferred tax asset in that the company will pay less tax on future taxable profits

C) a deductible temporary difference and therefore a deferred tax liability in that the company will pay more tax on future taxable profits

D) a deductible temporary difference and therefore a deferred tax asset in that the company will pay less tax on future taxable profits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

24

The tax effect method of accounting for a company's income tax is based on an assumption that:

A) income tax expense is equal to income tax payable

B) an accounting balance sheet and a tax balance sheet are the same

C) a tax balance sheet is prepared according to accounting standards

D) income tax expense is not equal to current tax liability.

A) income tax expense is equal to income tax payable

B) an accounting balance sheet and a tax balance sheet are the same

C) a tax balance sheet is prepared according to accounting standards

D) income tax expense is not equal to current tax liability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

25

Beta Limited has an accounting profit before tax of $200 000. All of the following items have been included in the accounting profit: depreciation of equipment $30 000 (tax deductible depreciation is $20 000); entertainment expenses $15 000 (non-deductible for tax purposes); Long service leave expense provided $6000 (no employee took long service leave during the year). The tax rate is 30%. The amount of current tax liability is:

A) $81 300

B) $50 700

C) $69 300

D) $38 700.

A) $81 300

B) $50 700

C) $69 300

D) $38 700.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

26

ABC Limited has an asset with a carrying value of $50 000. The tax base of this asset is $40 000. The tax rate is 30%. As a result, which of the following deferred tax items does Roland Limited have?

A) A deferred tax asset of $10 000.

B) A deferred tax liability of $3000.

C) A deferred tax liability of $10 000;

D) A deferred tax asset of $3000;

A) A deferred tax asset of $10 000.

B) A deferred tax liability of $3000.

C) A deferred tax liability of $10 000;

D) A deferred tax asset of $3000;

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

27

To the extent that tax payable exists and has NOT yet been paid a company will recognise:

A) current tax asset

B) non-current asset

C) non-current liability

D) current tax liability.

A) current tax asset

B) non-current asset

C) non-current liability

D) current tax liability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

28

According to IAS 12, current tax for current and prior periods shall, to the extent unpaid, be recognised as a:

A) Note to the financial statements

B) Contingent liability

C) Liability

D) Expense

A) Note to the financial statements

B) Contingent liability

C) Liability

D) Expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck