Deck 27: Consolidation: Other Issues

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/29

العب

ملء الشاشة (f)

Deck 27: Consolidation: Other Issues

1

X Limited has a 70% ownership interest in Y Limited. Y Limited has a 60% ownership interest in Z Limited. X Limited has an indirect ownership interest in Z Limited of:

A) zero;

B) 42%;

C) 60%;

D) 70%.

A) zero;

B) 42%;

C) 60%;

D) 70%.

B

2

John Limited has an ownership interest of 80% in a subsidiary Jack Limited. Jack Limited owns 60% of Jill Limited. At acquisition date the retained earnings of Jill Limited were

$100 000. At consolidation date the retained earnings of Jill Limited were $220 000. The indirect non-controlling interest in the retained earnings of Jill Limited is calculated as:

A) $0;

B) $12 000;

C) $14 400;

D) $26 400.

$100 000. At consolidation date the retained earnings of Jill Limited were $220 000. The indirect non-controlling interest in the retained earnings of Jill Limited is calculated as:

A) $0;

B) $12 000;

C) $14 400;

D) $26 400.

C

3

Klang Limited has a direct ownership interest of 90% in Liao Limited. Liao Limited has a direct ownership interest of 70% in Meng Limited. The indirect non-controlling interest in Meng Limited is:

A) 70%;

B) 63%;

C) 30%;

D) 7%.

A) 70%;

B) 63%;

C) 30%;

D) 7%.

D

4

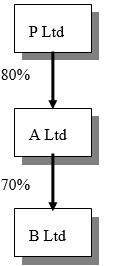

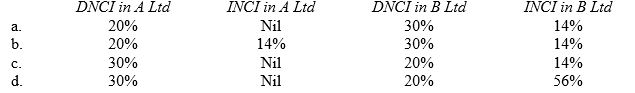

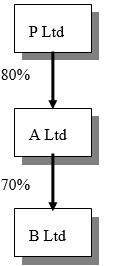

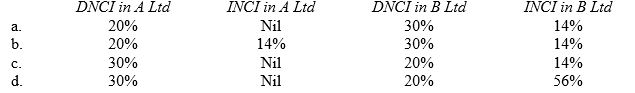

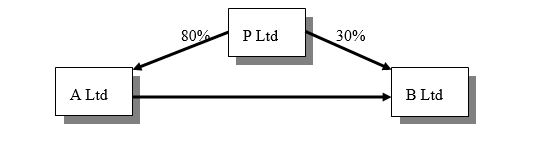

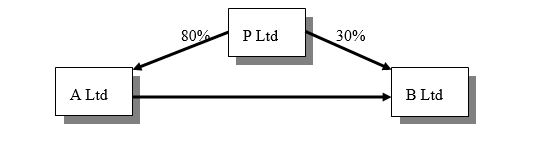

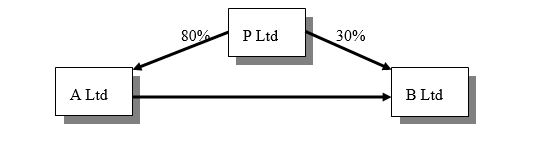

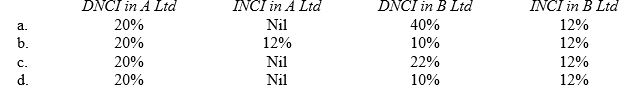

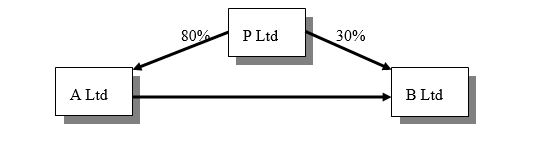

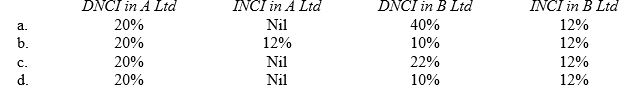

Consider the following group structure:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

5

Use the information below to answer questions 4 and 5

Consider the following group structure.

The INCI in B Ltd is the same group of shareholders as the:

A) DNCI in B Ltd;

B) INCI in A Ltd;

C) DNCI in A Ltd;

D) shareholders in P Ltd.

Consider the following group structure.

The INCI in B Ltd is the same group of shareholders as the:

A) DNCI in B Ltd;

B) INCI in A Ltd;

C) DNCI in A Ltd;

D) shareholders in P Ltd.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

6

The pre-acquisition entry for the Hayward group in order to consolidate a 60% interest in a subsidiary contained the following debits. Retained earnings $3000, Share capital $6000, General Reserve $1200, BCVR $600. The interest in equity attributable to the direct non-controlling interest is:

A) $6800;

B) $7200;

C) $10 800;

D) $18 000.

A) $6800;

B) $7200;

C) $10 800;

D) $18 000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

7

Tribulation Limited has an ownership interest of 80% in a subsidiary Trouble Limited. Trouble owns 60% of Strife Limited. Since acquisition date the retained earnings of Strife Limited have increased from $80 000 to $130 000. The direct non-controlling interest in the retained earnings of Strife is:

A) $0;

B) $20 000;

C) $32 000;

D) $52 000.

A) $0;

B) $20 000;

C) $32 000;

D) $52 000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

8

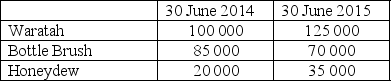

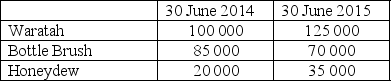

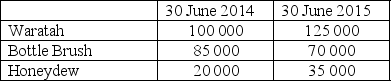

The effect of the interest paid by Bottle Brush to Waratah on the NCI of Bottle Brush for the year ended 30 June 2015 is:

A) NIL

B) increase in NCI of $1120

C) increase in NCI of $1600

D) increase in NCI of $2800

A) NIL

B) increase in NCI of $1120

C) increase in NCI of $1600

D) increase in NCI of $2800

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

9

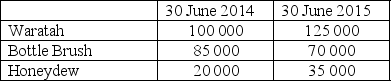

The following information relates to questions 17 to 21

Waratah Ltd acquired a 60% ownership interest in Bottle Brush Ltd on 30 June 2013. On the same day, Bottle Brush Ltd acquired a 70% ownership interest in Honeydew Ltd.

The following interentity transactions have taken place between the entities in the group during the years ended 30 June 2014 and 30 June 2015:

On 1 July 2013 Bottle Brush sold an item of plant to Honeydew for a profit of $20 000. The remaining useful life of the plant at the date of transfer was 4 years.

On 1 September 2013, Honeydew paid a dividend of $70 000 from profits earned since 30 June 2013.

Waratah lent $50 000 to Bottle Brush on 1 January 2014. Interest charged on the loan for the year ended 30 June 2014 was $2000 and for the year ended 30 June 2015 was $4000.

On 31 May 2014 Honeydew sold inventory to Waratah for $15,000. Profit earned on the sale was $5000. Waratah sold the inventory to external parties on 1 August 2014.

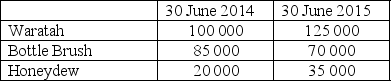

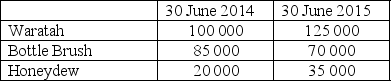

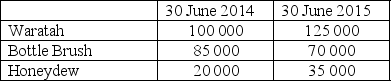

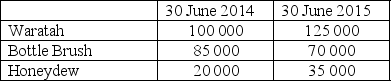

Details of profits earned by entities within the group for the years ended 30 June 2014 and 30 June 2015 are:

The tax rate is 30%.

-The NCI share of profit in Honeydew for the year ended 30 June 2015 is:

A) $9 450

B) $11 550

C) $18 270

D) $22 330

Waratah Ltd acquired a 60% ownership interest in Bottle Brush Ltd on 30 June 2013. On the same day, Bottle Brush Ltd acquired a 70% ownership interest in Honeydew Ltd.

The following interentity transactions have taken place between the entities in the group during the years ended 30 June 2014 and 30 June 2015:

On 1 July 2013 Bottle Brush sold an item of plant to Honeydew for a profit of $20 000. The remaining useful life of the plant at the date of transfer was 4 years.

On 1 September 2013, Honeydew paid a dividend of $70 000 from profits earned since 30 June 2013.

Waratah lent $50 000 to Bottle Brush on 1 January 2014. Interest charged on the loan for the year ended 30 June 2014 was $2000 and for the year ended 30 June 2015 was $4000.

On 31 May 2014 Honeydew sold inventory to Waratah for $15,000. Profit earned on the sale was $5000. Waratah sold the inventory to external parties on 1 August 2014.

Details of profits earned by entities within the group for the years ended 30 June 2014 and 30 June 2015 are:

The tax rate is 30%.

-The NCI share of profit in Honeydew for the year ended 30 June 2015 is:

A) $9 450

B) $11 550

C) $18 270

D) $22 330

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

10

The Noor group prepared the following acquisition date entry in order to consolidate a 70% indirect interest in a subsidiary. Retained earnings $35 000, Share capital $70 000, BCVR $21 000. The amount attributable to the indirect non-controlling interest is:

A) $0;

B) $54 000;

C) $126 000;

D) $180 000.

A) $0;

B) $54 000;

C) $126 000;

D) $180 000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

11

The indirect non-controlling interest, in a group that has a multiple subsidiary structure, is entitled to:

A) a proportionate share of post-acquisition equity only;

B) a proportionate share of pre-acquisition equity only;

C) no share of post acquisition equity;

D) no share of either pre acquisition or post acquisition equity.

A) a proportionate share of post-acquisition equity only;

B) a proportionate share of pre-acquisition equity only;

C) no share of post acquisition equity;

D) no share of either pre acquisition or post acquisition equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

12

When calculating the indirect non-controlling interest share of equity, consolidation adjustments are needed to:

A) remove unrealised profits or losses from intragroup transactions;

B) recognise profits made on intragroup services;

C) eliminate intragroup advances;

D) partially eliminate profits on intragroup services.

A) remove unrealised profits or losses from intragroup transactions;

B) recognise profits made on intragroup services;

C) eliminate intragroup advances;

D) partially eliminate profits on intragroup services.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

13

In a multiple subsidiary structure the direct non-controlling interest is entitled to a proportionate share of:

A) pre-acquisition equity only;

B) pre and post-acquisition amounts of equity;

C) post-acquisition amounts of equity only;

D) post-acquisition balance of retained earnings only.

A) pre-acquisition equity only;

B) pre and post-acquisition amounts of equity;

C) post-acquisition amounts of equity only;

D) post-acquisition balance of retained earnings only.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

14

A Limited has a 60% ownership interest in B Limited. B Limited has a 70% ownership interest in C Limited. As a result of these ownership interests, there is an indirect ownership interest in C Limited of:

A) 60%;

B) 42%;

C) 40%;

D) 18%.

A) 60%;

B) 42%;

C) 40%;

D) 18%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

15

The following information relates to questions 17 to 21

Waratah Ltd acquired a 60% ownership interest in Bottle Brush Ltd on 30 June 2013. On the same day, Bottle Brush Ltd acquired a 70% ownership interest in Honeydew Ltd.

The following interentity transactions have taken place between the entities in the group during the years ended 30 June 2014 and 30 June 2015:

On 1 July 2013 Bottle Brush sold an item of plant to Honeydew for a profit of $20 000. The remaining useful life of the plant at the date of transfer was 4 years.

On 1 September 2013, Honeydew paid a dividend of $70 000 from profits earned since 30 June 2013.

Waratah lent $50 000 to Bottle Brush on 1 January 2014. Interest charged on the loan for the year ended 30 June 2014 was $2000 and for the year ended 30 June 2015 was $4000.

On 31 May 2014 Honeydew sold inventory to Waratah for $15,000. Profit earned on the sale was $5000. Waratah sold the inventory to external parties on 1 August 2014.

Details of profits earned by entities within the group for the years ended 30 June 2014 and 30 June 2015 are:

The tax rate is 30%.

-The NCI share of profit in Bottle Brush for the year ended 30 June 2015 is:

A) $21 000

B) $23 800

C) $26 600

D) $29 400

Waratah Ltd acquired a 60% ownership interest in Bottle Brush Ltd on 30 June 2013. On the same day, Bottle Brush Ltd acquired a 70% ownership interest in Honeydew Ltd.

The following interentity transactions have taken place between the entities in the group during the years ended 30 June 2014 and 30 June 2015:

On 1 July 2013 Bottle Brush sold an item of plant to Honeydew for a profit of $20 000. The remaining useful life of the plant at the date of transfer was 4 years.

On 1 September 2013, Honeydew paid a dividend of $70 000 from profits earned since 30 June 2013.

Waratah lent $50 000 to Bottle Brush on 1 January 2014. Interest charged on the loan for the year ended 30 June 2014 was $2000 and for the year ended 30 June 2015 was $4000.

On 31 May 2014 Honeydew sold inventory to Waratah for $15,000. Profit earned on the sale was $5000. Waratah sold the inventory to external parties on 1 August 2014.

Details of profits earned by entities within the group for the years ended 30 June 2014 and 30 June 2015 are:

The tax rate is 30%.

-The NCI share of profit in Bottle Brush for the year ended 30 June 2015 is:

A) $21 000

B) $23 800

C) $26 600

D) $29 400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

16

The following information relates to questions 17 to 21

Waratah Ltd acquired a 60% ownership interest in Bottle Brush Ltd on 30 June 2013. On the same day, Bottle Brush Ltd acquired a 70% ownership interest in Honeydew Ltd.

The following interentity transactions have taken place between the entities in the group during the years ended 30 June 2014 and 30 June 2015:

On 1 July 2013 Bottle Brush sold an item of plant to Honeydew for a profit of $20 000. The remaining useful life of the plant at the date of transfer was 4 years.

On 1 September 2013, Honeydew paid a dividend of $70 000 from profits earned since 30 June 2013.

Waratah lent $50 000 to Bottle Brush on 1 January 2014. Interest charged on the loan for the year ended 30 June 2014 was $2000 and for the year ended 30 June 2015 was $4000.

On 31 May 2014 Honeydew sold inventory to Waratah for $15,000. Profit earned on the sale was $5000. Waratah sold the inventory to external parties on 1 August 2014.

Details of profits earned by entities within the group for the years ended 30 June 2014 and 30 June 2015 are:

The tax rate is 30%.

-The NCI share of profit in Honeydew for the year ended 30 June 2014 is:

A) $4 950

B) $6 000

C) $9 570

D) $11 600

Waratah Ltd acquired a 60% ownership interest in Bottle Brush Ltd on 30 June 2013. On the same day, Bottle Brush Ltd acquired a 70% ownership interest in Honeydew Ltd.

The following interentity transactions have taken place between the entities in the group during the years ended 30 June 2014 and 30 June 2015:

On 1 July 2013 Bottle Brush sold an item of plant to Honeydew for a profit of $20 000. The remaining useful life of the plant at the date of transfer was 4 years.

On 1 September 2013, Honeydew paid a dividend of $70 000 from profits earned since 30 June 2013.

Waratah lent $50 000 to Bottle Brush on 1 January 2014. Interest charged on the loan for the year ended 30 June 2014 was $2000 and for the year ended 30 June 2015 was $4000.

On 31 May 2014 Honeydew sold inventory to Waratah for $15,000. Profit earned on the sale was $5000. Waratah sold the inventory to external parties on 1 August 2014.

Details of profits earned by entities within the group for the years ended 30 June 2014 and 30 June 2015 are:

The tax rate is 30%.

-The NCI share of profit in Honeydew for the year ended 30 June 2014 is:

A) $4 950

B) $6 000

C) $9 570

D) $11 600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

17

Use the information below to answer questions 4 and 5

Consider the following group structure.

The direct non-controlling interest (DNCI) and indirect non-controlling interest (INCI) are:

Consider the following group structure.

The direct non-controlling interest (DNCI) and indirect non-controlling interest (INCI) are:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

18

When preparing consolidation adjustment entries to effect a consolidation of a multiple subsidiary structure intragroup transactions:

A) are not eliminated;

B) are partially eliminated to the extent of the ownership interest of the parent entity to each transaction;

C) are ignored as it is impractical to attempt to determine the size of the ownership interest relating to each transaction;

D) are eliminated in full;

A) are not eliminated;

B) are partially eliminated to the extent of the ownership interest of the parent entity to each transaction;

C) are ignored as it is impractical to attempt to determine the size of the ownership interest relating to each transaction;

D) are eliminated in full;

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

19

The following information relates to questions 17 to 21

Waratah Ltd acquired a 60% ownership interest in Bottle Brush Ltd on 30 June 2013. On the same day, Bottle Brush Ltd acquired a 70% ownership interest in Honeydew Ltd.

The following interentity transactions have taken place between the entities in the group during the years ended 30 June 2014 and 30 June 2015:

On 1 July 2013 Bottle Brush sold an item of plant to Honeydew for a profit of $20 000. The remaining useful life of the plant at the date of transfer was 4 years.

On 1 September 2013, Honeydew paid a dividend of $70 000 from profits earned since 30 June 2013.

Waratah lent $50 000 to Bottle Brush on 1 January 2014. Interest charged on the loan for the year ended 30 June 2014 was $2000 and for the year ended 30 June 2015 was $4000.

On 31 May 2014 Honeydew sold inventory to Waratah for $15,000. Profit earned on the sale was $5000. Waratah sold the inventory to external parties on 1 August 2014.

Details of profits earned by entities within the group for the years ended 30 June 2014 and 30 June 2015 are:

The tax rate is 30%.

-The NCI share of profit in Bottle Brush for the year ended 30 June 2014 is:

A) $10 200

B) $13 000

C) $13 800

D) $29 800

Waratah Ltd acquired a 60% ownership interest in Bottle Brush Ltd on 30 June 2013. On the same day, Bottle Brush Ltd acquired a 70% ownership interest in Honeydew Ltd.

The following interentity transactions have taken place between the entities in the group during the years ended 30 June 2014 and 30 June 2015:

On 1 July 2013 Bottle Brush sold an item of plant to Honeydew for a profit of $20 000. The remaining useful life of the plant at the date of transfer was 4 years.

On 1 September 2013, Honeydew paid a dividend of $70 000 from profits earned since 30 June 2013.

Waratah lent $50 000 to Bottle Brush on 1 January 2014. Interest charged on the loan for the year ended 30 June 2014 was $2000 and for the year ended 30 June 2015 was $4000.

On 31 May 2014 Honeydew sold inventory to Waratah for $15,000. Profit earned on the sale was $5000. Waratah sold the inventory to external parties on 1 August 2014.

Details of profits earned by entities within the group for the years ended 30 June 2014 and 30 June 2015 are:

The tax rate is 30%.

-The NCI share of profit in Bottle Brush for the year ended 30 June 2014 is:

A) $10 200

B) $13 000

C) $13 800

D) $29 800

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

20

An ownership structure in which Orange Limited acquires shares in Pear Limited before Pear Limited acquires shares in Quince Limited is known as:

A) an aggregate acquisition;

B) a sequential acquisition;

C) a multiple acquisition;

D) a compounding acquisition.

A) an aggregate acquisition;

B) a sequential acquisition;

C) a multiple acquisition;

D) a compounding acquisition.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

21

Which of the following cannot result in a loss of control by a parent over a subsidiary?

A) the parent sells some of the shares in the subsidiary;

B) there is a change in the dispersion in the holding of shares by entities comprising the NCI;

C) a receiver is appointed to manage the affairs of the parent;

D) the subsidiary becomes subject to the control of an administrator.

A) the parent sells some of the shares in the subsidiary;

B) there is a change in the dispersion in the holding of shares by entities comprising the NCI;

C) a receiver is appointed to manage the affairs of the parent;

D) the subsidiary becomes subject to the control of an administrator.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

22

Where a parent acquires additional shares in a subsidiary subsequent to obtaining control the change is accounted for:

A) in current year profit or loss;

B) as an equity transaction;

C) as an increase in the investment account;

D) as an adjustment to goodwill.

A) in current year profit or loss;

B) as an equity transaction;

C) as an increase in the investment account;

D) as an adjustment to goodwill.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

23

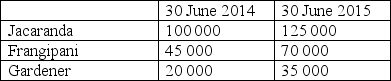

The following information relates to questions 22 to 24

Jacaranda Limited acquired a 75% ownership interest in Frangipani Limited on 30 June 2014. On the same day, Frangipani Limited acquired a 60% ownership interest in Gardener Limited. The following interentity transactions have taken place between the entities in the group during the years ended 30 June 2014 and 30 June 2015:

On 1 July 2013 Gardener sold an item of plant to Jacaranda for a profit of $25 000. The remaining useful life of the plant at the date of transfer was 2 years.

On 1 September 2013, Gardener paid a dividend of $100 000 from profits earned prior to 30 June 2013.

Jacaranda lent $500 000 to Gardener on 1 January 2014. Interest charged on the loan for the year ended 30 June 2014 was $20 000 and for the year ended 30 June 2015 was $40 000.

On 31 May 2014 Frangipani sold inventory to Gardener for $15 000. Profit earned on the sale was $1500. Gardener sold the inventory to external parties on 1 August 2014.

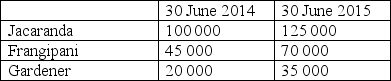

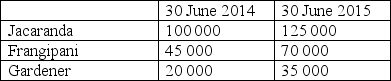

Details of profits earned by entities within the group for the years ended 30 June 2014 and 30 June 2015 are:

The tax rate is 30%.

The tax rate is 30%.

The NCI share of profit in the Frangipani group for the year ended 30 June 2014 is:

A) $14 812.50

B) $15 487.50

C) $17 175.00

D) $21 987.50

Jacaranda Limited acquired a 75% ownership interest in Frangipani Limited on 30 June 2014. On the same day, Frangipani Limited acquired a 60% ownership interest in Gardener Limited. The following interentity transactions have taken place between the entities in the group during the years ended 30 June 2014 and 30 June 2015:

On 1 July 2013 Gardener sold an item of plant to Jacaranda for a profit of $25 000. The remaining useful life of the plant at the date of transfer was 2 years.

On 1 September 2013, Gardener paid a dividend of $100 000 from profits earned prior to 30 June 2013.

Jacaranda lent $500 000 to Gardener on 1 January 2014. Interest charged on the loan for the year ended 30 June 2014 was $20 000 and for the year ended 30 June 2015 was $40 000.

On 31 May 2014 Frangipani sold inventory to Gardener for $15 000. Profit earned on the sale was $1500. Gardener sold the inventory to external parties on 1 August 2014.

Details of profits earned by entities within the group for the years ended 30 June 2014 and 30 June 2015 are:

The tax rate is 30%.

The tax rate is 30%.The NCI share of profit in the Frangipani group for the year ended 30 June 2014 is:

A) $14 812.50

B) $15 487.50

C) $17 175.00

D) $21 987.50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

24

Gamma Limited acquired shares in Delta Limited. At the time of this acquisition Delta Limited already held shares in Epsilon Limited. This form of acquisition of an indirect ownership interest, by Gamma Limited in Epsilon Limited, is known as:

A) an indirect business combination;

B) an indirect acquisition;

C) a non-sequential acquisition;

D) an unorthodox acquisition.

A) an indirect business combination;

B) an indirect acquisition;

C) a non-sequential acquisition;

D) an unorthodox acquisition.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

25

The following information relates to questions 26 and 27

On 1 July 2012 Yamba Ltd acquired a 60% interest in Zombi Ltd for $42,000. At that date the net assets of Zombi comprised $30,000 share capital and $23,000 retained earnings. All assets were recorded at their fair values, with the exception of an item of land, whose carrying amount was $10,000 less than its fair value.

On 1 July 2013 Xtreme Ltd acquired a 50% interest in Yamba Ltd for $65,000.

At that date the net assets of Yamba Ltd comprised $50,000 share capital and $60,000 retained earnings. All assets were recorded at their fair values, with the exception of Yamba Ltd's investment in Zombi Ltd, which had a fair value of $54,000.

During the twelve months to 30 June 2013 the retained earnings of Zombi Ltd had increased to $30,000. In addition the fair value of the land had increased by a further $10,000.

The Xtreme Group accounts for goodwill under the partial method.

The total goodwill in the Xtreme Group at 30 June 2013 is:

A) $3,600

B) $4,000

C) $6,000

D) $13,600

On 1 July 2012 Yamba Ltd acquired a 60% interest in Zombi Ltd for $42,000. At that date the net assets of Zombi comprised $30,000 share capital and $23,000 retained earnings. All assets were recorded at their fair values, with the exception of an item of land, whose carrying amount was $10,000 less than its fair value.

On 1 July 2013 Xtreme Ltd acquired a 50% interest in Yamba Ltd for $65,000.

At that date the net assets of Yamba Ltd comprised $50,000 share capital and $60,000 retained earnings. All assets were recorded at their fair values, with the exception of Yamba Ltd's investment in Zombi Ltd, which had a fair value of $54,000.

During the twelve months to 30 June 2013 the retained earnings of Zombi Ltd had increased to $30,000. In addition the fair value of the land had increased by a further $10,000.

The Xtreme Group accounts for goodwill under the partial method.

The total goodwill in the Xtreme Group at 30 June 2013 is:

A) $3,600

B) $4,000

C) $6,000

D) $13,600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

26

Mutual shareholdings exist when:

A) a parent owns shares in a subsidiary;

B) a subsidiary owns shares in a parent only;

C) a parent owns shares in a subsidiary and in a joint venture;

D) a parent and a subsidiary own shares in each other.

A) a parent owns shares in a subsidiary;

B) a subsidiary owns shares in a parent only;

C) a parent owns shares in a subsidiary and in a joint venture;

D) a parent and a subsidiary own shares in each other.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

27

The following information relates to questions 26 and 27

On 1 July 2012 Yamba Ltd acquired a 60% interest in Zombi Ltd for $42,000. At that date the net assets of Zombi comprised $30,000 share capital and $23,000 retained earnings. All assets were recorded at their fair values, with the exception of an item of land, whose carrying amount was $10,000 less than its fair value.

On 1 July 2013 Xtreme Ltd acquired a 50% interest in Yamba Ltd for $65,000.

At that date the net assets of Yamba Ltd comprised $50,000 share capital and $60,000 retained earnings. All assets were recorded at their fair values, with the exception of Yamba Ltd's investment in Zombi Ltd, which had a fair value of $54,000.

During the twelve months to 30 June 2013 the retained earnings of Zombi Ltd had increased to $30,000. In addition the fair value of the land had increased by a further $10,000.

The Xtreme Group accounts for goodwill under the partial method.

The consolidation elimination entry to eliminate Xtreme Ltd's investment in Yamba Ltd at 30 June 2013 will require a credit against the "Investment in Yamba" account of $65,000 and a debit against the Business Combination Valuation Reserve of:

A) $4,000

B) $6,000

C) $10,000

D) $12,000

On 1 July 2012 Yamba Ltd acquired a 60% interest in Zombi Ltd for $42,000. At that date the net assets of Zombi comprised $30,000 share capital and $23,000 retained earnings. All assets were recorded at their fair values, with the exception of an item of land, whose carrying amount was $10,000 less than its fair value.

On 1 July 2013 Xtreme Ltd acquired a 50% interest in Yamba Ltd for $65,000.

At that date the net assets of Yamba Ltd comprised $50,000 share capital and $60,000 retained earnings. All assets were recorded at their fair values, with the exception of Yamba Ltd's investment in Zombi Ltd, which had a fair value of $54,000.

During the twelve months to 30 June 2013 the retained earnings of Zombi Ltd had increased to $30,000. In addition the fair value of the land had increased by a further $10,000.

The Xtreme Group accounts for goodwill under the partial method.

The consolidation elimination entry to eliminate Xtreme Ltd's investment in Yamba Ltd at 30 June 2013 will require a credit against the "Investment in Yamba" account of $65,000 and a debit against the Business Combination Valuation Reserve of:

A) $4,000

B) $6,000

C) $10,000

D) $12,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

28

The effect of the dividend paid by Gardener to Frangipani on the NCI of Gardener for the year ended 30 June 2014 is:

A) NIL

B) $15 000

C) $40 000

D) $55 000

A) NIL

B) $15 000

C) $40 000

D) $55 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

29

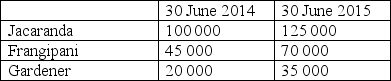

The following information relates to questions 22 to 24

Jacaranda Limited acquired a 75% ownership interest in Frangipani Limited on 30 June 2014. On the same day, Frangipani Limited acquired a 60% ownership interest in Gardener Limited. The following interentity transactions have taken place between the entities in the group during the years ended 30 June 2014 and 30 June 2015:

On 1 July 2013 Gardener sold an item of plant to Jacaranda for a profit of $25 000. The remaining useful life of the plant at the date of transfer was 2 years.

On 1 September 2013, Gardener paid a dividend of $100 000 from profits earned prior to 30 June 2013.

Jacaranda lent $500 000 to Gardener on 1 January 2014. Interest charged on the loan for the year ended 30 June 2014 was $20 000 and for the year ended 30 June 2015 was $40 000.

On 31 May 2014 Frangipani sold inventory to Gardener for $15 000. Profit earned on the sale was $1500. Gardener sold the inventory to external parties on 1 August 2014.

Details of profits earned by entities within the group for the years ended 30 June 2014 and 30 June 2015 are:

The tax rate is 30%.

The tax rate is 30%.

The NCI share of profit in Gardener for the year ended 30 June 2015 is:

A) $19 250.00

B) $24 062.50

C) $33 500.00

D) $46 062.50

Jacaranda Limited acquired a 75% ownership interest in Frangipani Limited on 30 June 2014. On the same day, Frangipani Limited acquired a 60% ownership interest in Gardener Limited. The following interentity transactions have taken place between the entities in the group during the years ended 30 June 2014 and 30 June 2015:

On 1 July 2013 Gardener sold an item of plant to Jacaranda for a profit of $25 000. The remaining useful life of the plant at the date of transfer was 2 years.

On 1 September 2013, Gardener paid a dividend of $100 000 from profits earned prior to 30 June 2013.

Jacaranda lent $500 000 to Gardener on 1 January 2014. Interest charged on the loan for the year ended 30 June 2014 was $20 000 and for the year ended 30 June 2015 was $40 000.

On 31 May 2014 Frangipani sold inventory to Gardener for $15 000. Profit earned on the sale was $1500. Gardener sold the inventory to external parties on 1 August 2014.

Details of profits earned by entities within the group for the years ended 30 June 2014 and 30 June 2015 are:

The tax rate is 30%.

The tax rate is 30%.The NCI share of profit in Gardener for the year ended 30 June 2015 is:

A) $19 250.00

B) $24 062.50

C) $33 500.00

D) $46 062.50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck